India's Audacious $200 Billion AI Bet: A Deep Dive Into Asia's Emerging Computing Powerhouse

India just made a move that caught the tech world's attention. Not with a press release buried in regulatory filings, but with a bold declaration: we want $200 billion in AI infrastructure investment by 2028, and we're willing to reshape our entire policy framework to get it. According to TechCrunch, this ambitious target is part of India's strategic plan to become a global leader in AI infrastructure.

When you step back and think about what that number means, it's staggering. We're talking about building AI computational capacity at a scale most countries wouldn't even attempt. But here's the thing that makes this interesting: India isn't betting on hope. It's betting on leverage.

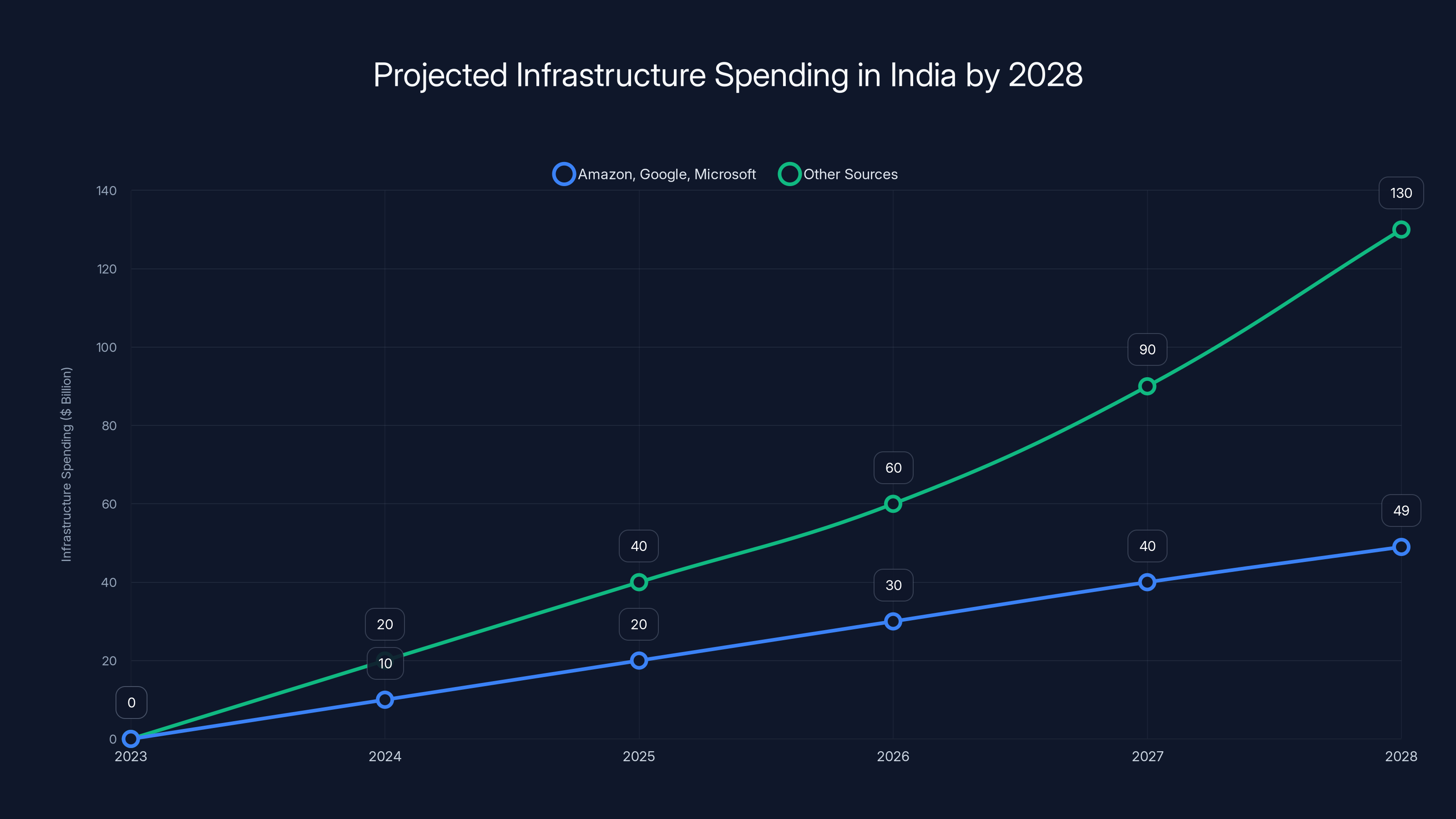

The country already has a foundation. Amazon, Google, and Microsoft have collectively committed about $70 billion to expand AI and cloud infrastructure across India. That's not chump change. That's the kind of vote of confidence that tells other investors the game isn't theoretical—it's already moving. The government is now running straight at that momentum, trying to compress what took other nations a decade into maybe 18 months.

But this isn't just about throwing compute power at the problem. India's approach is far more sophisticated. It's about creating an entire ecosystem where global AI companies see India as the natural place to build, where startups have access to compute they couldn't afford elsewhere, and where the regulatory environment isn't an obstacle but an advantage.

This article breaks down what India is actually doing, why it matters globally, what challenges it faces, and what success or failure looks like. Because whether India pulls this off will matter to pretty much everyone building AI today.

TL; DR

- **India targets 70B already committed by big tech companies like Amazon, Google, and Microsoft.

- 20,000 new GPUs are being added to the India AI Mission, expanding shared compute capacity from 38,000 to 58,000 units, making AI accessible to startups that couldn't afford it otherwise.

- Tax incentives and policy changes are the real differentiators, including 20-year startup classification extensions and ₹100 billion ($1.1B) government-backed venture funding.

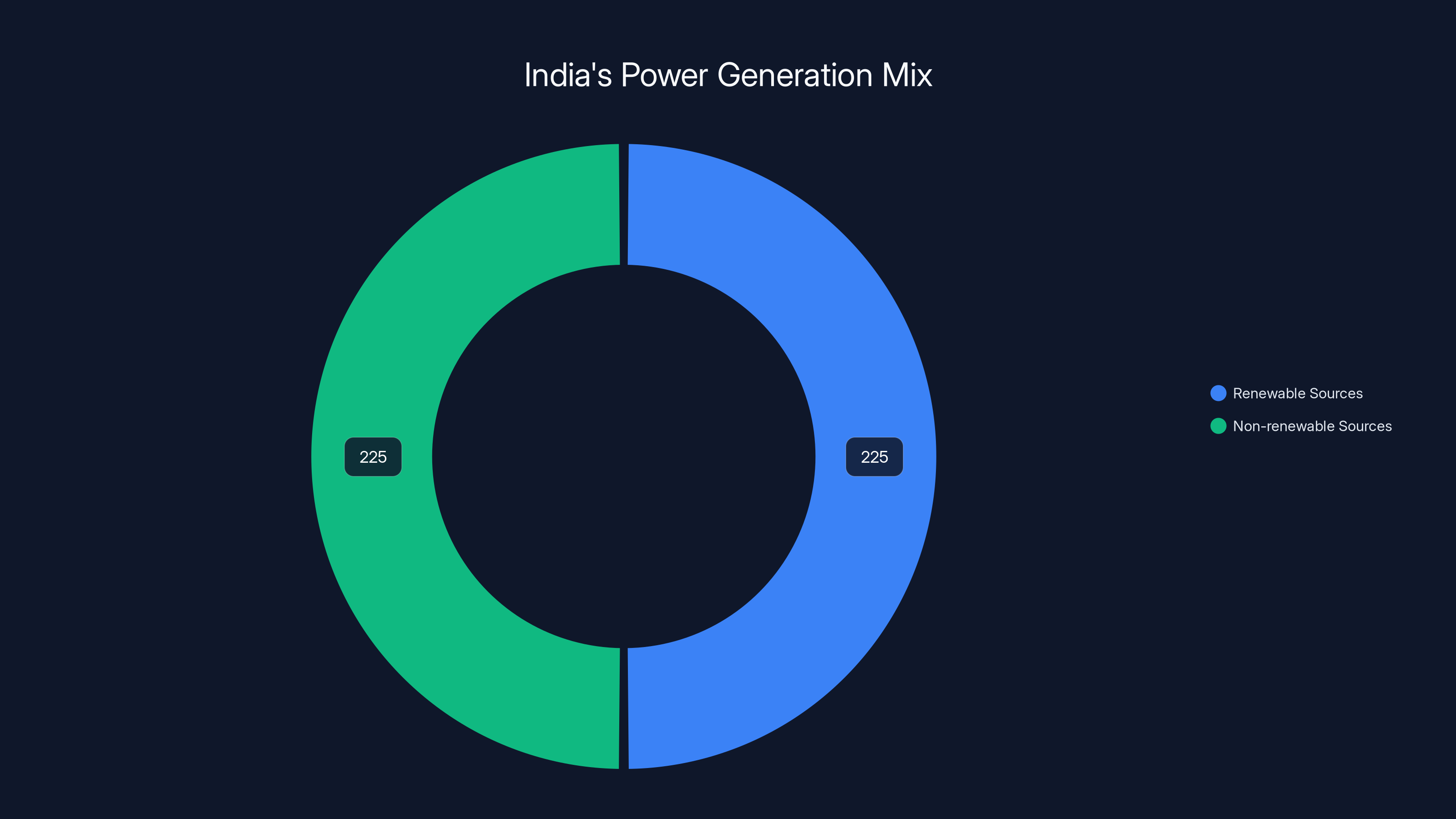

- Infrastructure challenges are real but surmountable, with power and water constraints forcing India to lean into renewable energy advantages (50%+ of installed capacity).

- The global implications are massive: if India succeeds, it shifts AI compute economics, reduces costs, and fundamentally changes which countries can host AI workloads.

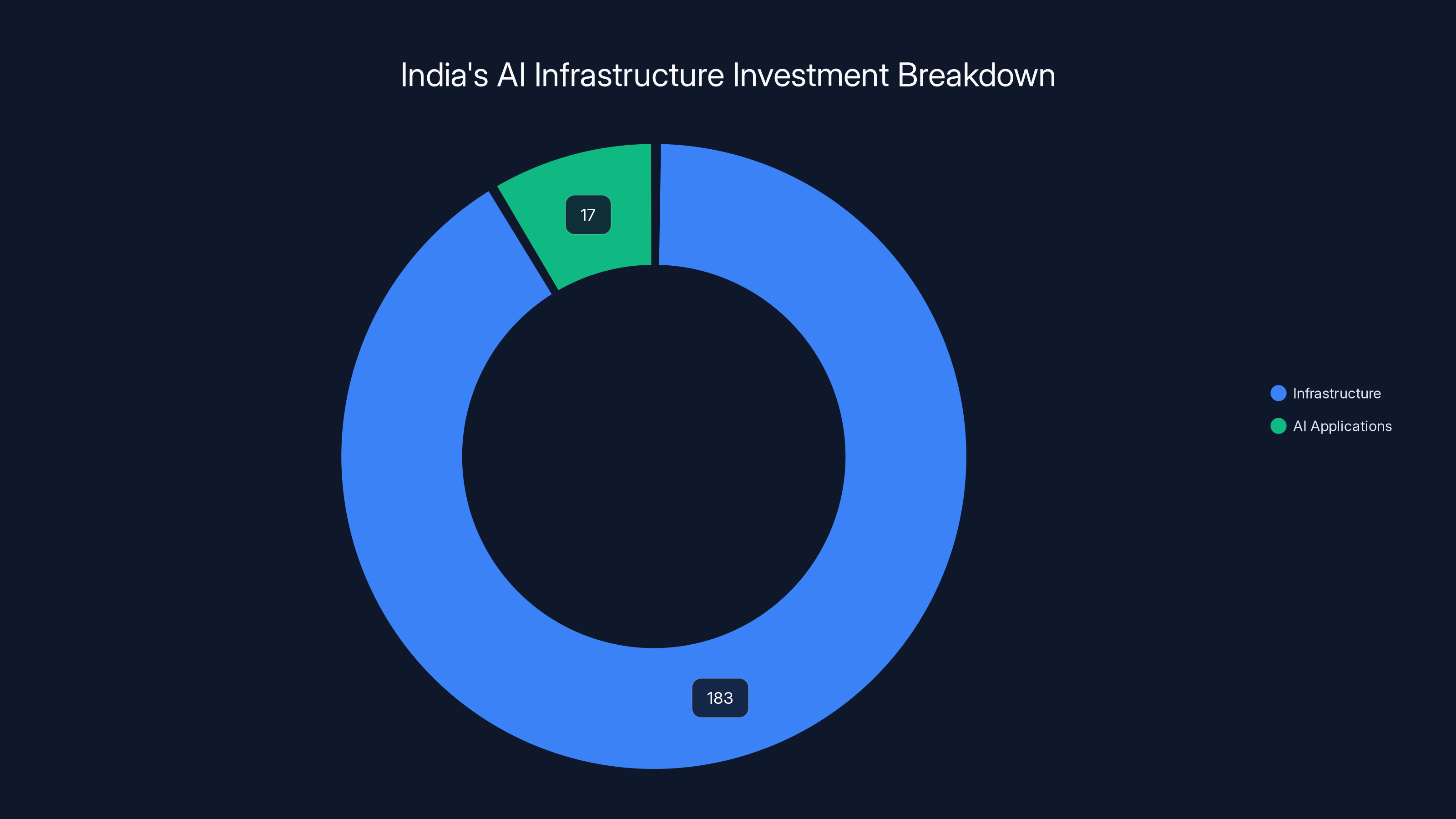

The majority of India's AI investment,

The Foundation: How India Got Here

India didn't wake up one morning and decide to hunt for $200 billion. This is the result of years of watching the world build AI infrastructure and realizing something crucial: whoever controls compute capacity controls the future of AI.

Let's be honest about India's position a few years ago. When Chat GPT launched, India was a consumer of AI, not a builder of it. The infrastructure was elsewhere. The talent was distributed globally. The regulatory framework treated tech as something to be cautious about rather than encouraged.

That changed gradually, then all at once. First came the realization that India had something valuable: a massive pool of engineers willing to work on hard problems, a booming startup ecosystem, and crucially, a government that was starting to see tech as strategic.

Then came the big tech commitments. In 2023 and 2024, Amazon, Google, and Microsoft announced billions in infrastructure spending across India. These weren't charity projects. They were calculating that India offered something unique: cost advantages, regulatory predictability (improving), and access to talent. The companies weren't betting on India out of goodwill. They were betting on its economics.

But here's where India's government saw an opening. Those $70 billion in commitments weren't the ceiling—they were the starting point. What if the government could sweeten the deal? Not with subsidies (though there's some of that), but with fundamentally different thinking about how AI infrastructure gets built and who gets access to it.

India's IT Minister Ashwini Vaishnaw started talking about shared compute capacity. Instead of each company building its own data centers in isolation, what if there was a pool of GPUs that researchers, startups, and smaller companies could access? That's not a revolutionary idea, but it's not standard practice in global AI either.

This is where the India AI Mission comes in. It wasn't a flashy announcement. It was practical infrastructure thinking. By 2024, the program had deployed 38,000 GPUs. That's about 1.5% of the global installed base of high-end GPUs, but it's meaningful. For context, a single A100 GPU costs roughly $15,000. Thirty-eight thousand of them represents over half a billion dollars in hardware value.

The government's plan to add 20,000 more GPUs in the coming weeks (bringing the total to 58,000) isn't just about numbers. It's about signaling. It's saying to the world: we understand that compute is the fundamental constraint on AI progress right now, and we're removing that constraint for anyone willing to build here.

Why does this matter? Because access to compute has become the new gatekeeper for AI development. A startup in Silicon Valley can't just build an AI company anymore without thinking about compute costs. Training even a modest language model can cost millions. Running inference at scale is expensive. Most startups die before they get to ask "is our model good?" because they're buried under infrastructure costs.

India is trying to change that equation. If you can get GPU access at scale for a fraction of what it costs elsewhere, suddenly lots of AI ideas become economically viable. That creates a downstream effect: more experimentation, more failures, more successes. The startups that emerge from that environment are battle-hardened by having to be efficient.

India's power generation capacity is composed of over 50% renewable sources, providing a cleaner energy mix compared to many developed countries. However, the intermittent nature of renewables poses challenges for consistent power supply to data centers.

The Investment Breakdown: Where's the Money Actually Going?

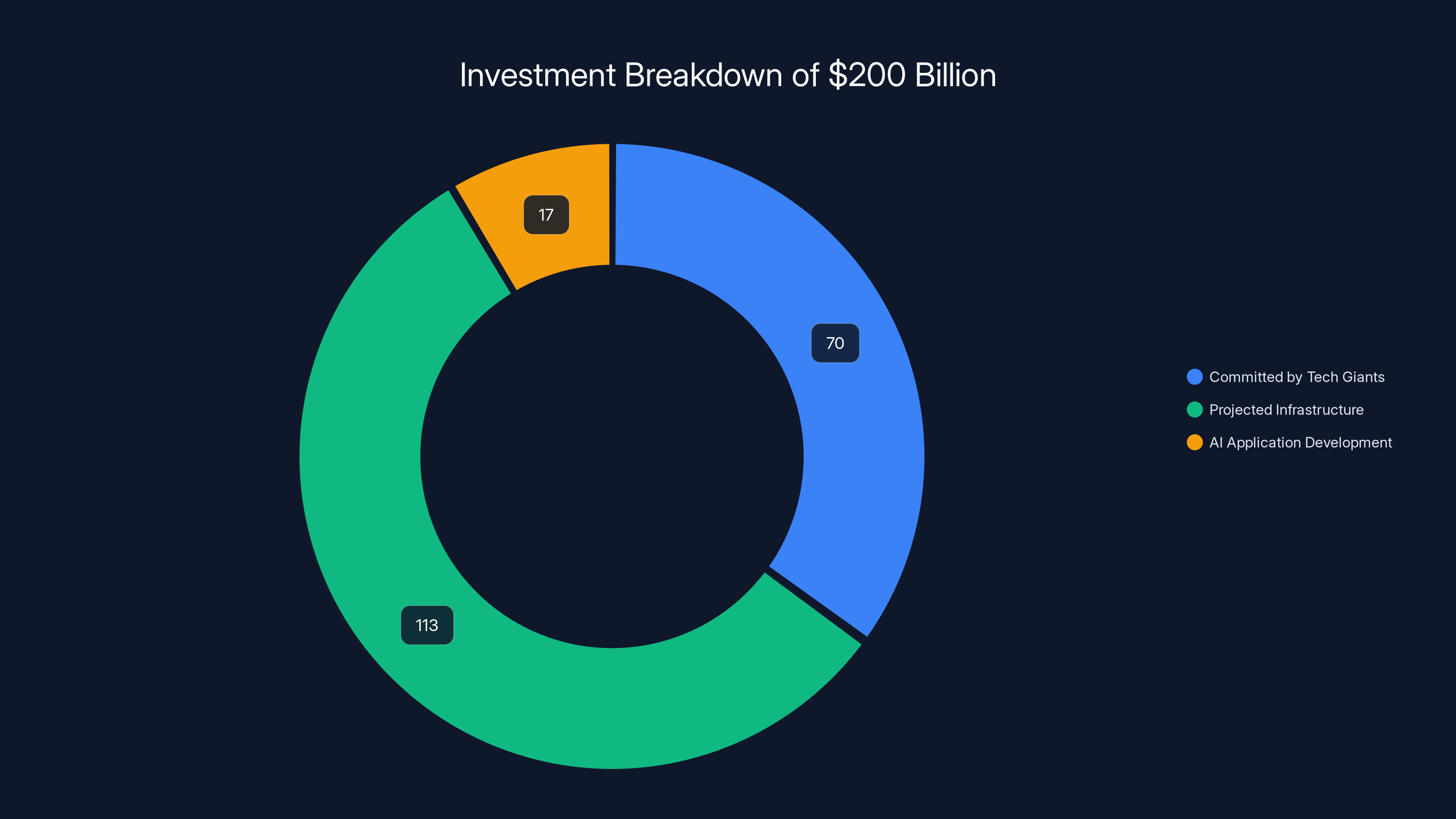

Here's a question nobody asked clearly in the initial announcements: what does that $200 billion actually represent?

Vaishnaw was specific about this, though it got buried in the headlines. The $200 billion isn't coming from one source or flowing into one bucket. It's a mix.

About $70 billion is already committed by Amazon, Google, and Microsoft. That's real money, signed checks, projects already underway. These companies are building data centers, laying fiber, establishing regional hubs. It's infrastructure spending tied to their own services and products. Google's investing in data centers to run their own AI models and serve their cloud customers. Same with Amazon and Microsoft. This isn't altruism. It's business.

The remaining $130 billion is the speculative part. It's the government's projection of what additional investment will flow into India if it executes on its promises. Some of this will come from other tech companies. Apple, Meta, and others will eventually need AI infrastructure in India to serve the region's market (which is massive—1.4 billion people, growing smartphone adoption, increasing AI consumption). Some will come from specialized infrastructure companies. Some from sovereign wealth funds and private equity looking for infrastructure plays.

But here's the nuance that gets lost: not all of that

This distinction matters because it shows the government is thinking beyond just "we want more GPUs." It's thinking about moving up the value chain. Anyone can build a data center if you have capital and land. But building the AI applications that run on top of that infrastructure? That's where the real value sits long-term.

Let's think about what

For comparison, the entire annual cloud infrastructure spending globally is around

What does

Will they actually hit that? Probably not to the dollar. But hitting 70-80% of that target would still be transformative.

The Shared Compute Strategy: Democratizing GPU Access

Here's the part of India's strategy that doesn't get enough credit: the India AI Mission's shared compute model.

Most AI infrastructure is proprietary. AWS builds data centers for AWS customers. Google Cloud builds for Google Cloud customers. Microsoft builds for Azure. That's the model. You want compute, you go to one of these companies, you pay their rates, you get their terms.

India's approach is different. They're building public infrastructure. Think of it like public highways instead of toll roads.

The India AI Mission operates on the principle that access to compute is becoming essential infrastructure, like electricity or internet. If you leave it purely to private companies, you get unequal access. Some companies can afford whatever it costs. Others can't. Startups and researchers get priced out.

So the government built a shared pool. Thirty-eight thousand GPUs, distributed across institutions, available to Indian researchers, startups, and companies. You can apply for access. The costs are subsidized. Not free, but much cheaper than commercial rates.

Adding 20,000 more GPUs takes the total to 58,000. That's a 52% increase in available capacity. For a startup ecosystem that's been GPU-starved, that's significant.

Let's think about what this means practically. A researcher at a startup wants to fine-tune a language model. Normally, they'd go to a cloud provider, spin up some GPUs, maybe spend $2,000-5,000 for a week of training. That's after they've already spent months building the model, training it on smaller hardware, proving the concept. A lot of startups don't even get to that step because they know what the costs look like.

With the India AI Mission, that same researcher can apply for shared compute access. Maybe they get 8 GPUs for a month, heavily subsidized or free if it's research. Same training job? Might cost $200. Suddenly, the math changes. Now experimentation is possible. Now you can iterate faster.

Vaishnaw was explicit about this being a differentiation strategy. He talked about the government seeing VCs commit funds for deep-tech startups, for big applications, for cutting-edge model research. That doesn't happen without access. The VCs are looking at India's GPU supply and seeing an advantage: lower infrastructure costs mean better unit economics, which means the startups they fund are more likely to succeed, which means better returns.

This is where India's public infrastructure play becomes a multiplier. The government's investing in GPUs, but that investment is triggering private investment that dwarfs the public spending.

There's a secondary benefit too. Shared infrastructure means knowledge transfer. When a startup is running its workloads on public infrastructure alongside university researchers and other startups, there's cross-pollination. People learn from each other. Techniques spread faster. The whole ecosystem gets smarter.

Now, executing this at scale is hard. Managing 58,000 GPUs, keeping them operational, dealing with scheduling and resource allocation, handling the support for thousands of users—that's a massive operational challenge. Cloud providers have spent decades building the systems to do this reliably. Can India's government-backed institutions do it as well? That's an open question.

The

The Tax and Policy Arsenal: Making India Irresistible

Compute capacity alone isn't enough to shift global AI infrastructure investment. Money flows to where the returns are best. India's government knows this. So they're not just building infrastructure. They're fundamentally changing the economics through policy.

First, the tax side. India introduced long-term tax relief for export-oriented cloud services. This is crucial. If a company based in India is providing cloud services to customers globally, they get favorable tax treatment. Why does this matter? Because it changes the return on investment for infrastructure spending. If you're Google deciding where to build your next data center, tax policy matters. India offering 5, 10, or 15 years of tax breaks on cloud service revenue significantly improves the IRR on that investment. Over a decade, that could mean hundreds of millions in tax savings for a large infrastructure deployment.

Second, the venture capital apparatus. India created a ₹100 billion ($1.1 billion) government-backed venture program specifically targeting deep-tech and AI. This isn't a one-time allocation. This is saying "we're systematically going to fund high-risk AI companies for the next several years." For VCs trying to decide where to base an AI fund, this matters. There's now public capital supplementing private capital. That means they can take bigger risks, fund more startups, keep more capital deployed. Some VCs will base operations in India just to access this program.

Third, the startup classification framework. India extended the period for which companies qualify as "startups" to 20 years, and raised the revenue threshold for startup-specific benefits to ₹3 billion (about $33 million). This sounds bureaucratic, but it's brilliant policy. Why? Because most AI companies are going to be deep in R&D, burning capital, not making revenue for their first 5-10 years. Qualifying as a startup gets you tax breaks, compliance relief, access to capital. Extending that qualification window to 20 years means an AI company can get these benefits throughout its critical scaling phase. You're solving for the actual timeline of AI company development, not imposing a generic timeline.

Fourth, the emerging policy work on data localization and data governance. India is being thoughtful about requiring certain types of data to stay within the country, which incentivizes companies to build local infrastructure rather than piping everything to the US. This is sensitive—data localization can be protectionist—but it's also strategically smart. If you're a global company processing Indian citizen data, you now have a business case to build infrastructure in India. The compute capacity we talked about earlier becomes more valuable because there's regulatory pressure pushing demand toward it.

Taken together, these policies create what economists call a "pull system" rather than a "push system." The government isn't subsidizing companies to build in India. It's creating conditions where companies want to build in India because it makes economic sense. Tax breaks alone don't do that. Shared compute alone doesn't do that. But the combination—compute access, capital, favorable tax treatment, regulatory alignment, and political commitment—that creates momentum.

One more policy thing worth noting: India's government is signaling stability. The tax breaks aren't one-year programs that might disappear. They're framed as long-term commitments. Vaishnaw talking about a "second phase" of the AI Mission suggests this isn't a flash-in-the-pan initiative. Companies making billion-dollar infrastructure bets need to believe the policy environment will still be favorable five years from now. India's government is doing the work to credibly signal that belief.

The Competitive Landscape: How India Stacks Against Other Regions

India's play isn't happening in a vacuum. Other countries and regions are making similar moves, though with different approaches.

The United States remains the dominant player in AI infrastructure. The vast majority of training compute happens in the US. Major cloud providers (AWS, Azure, Google Cloud) have massive US presence. There's capital, talent, and regulatory clarity. The US has a moat. But moats erode. Costs keep rising. Land for data centers gets scarcer. Power costs climb. Those dynamics create opportunity for challengers.

Europe is trying a different approach. They're investing heavily in sovereign infrastructure through initiatives like the European High-Performance Computing Joint Undertaking. Europe's bet is on building a non-US-dependent compute ecosystem. It's a strategic/geopolitical play, not purely economic. Europe's also imposing stricter AI regulation, which creates friction for building and deploying AI, but it also creates a market advantage for companies that navigate those rules well. The cost/compute tradeoff is worse in Europe than India, but the regulatory certainty for some use cases is better.

China is doing state-directed AI infrastructure buildout at massive scale, though with less international participation because of sanctions and geopolitical tension. China's advantage is deployment velocity (their government can move faster) and massive domestic market pull. China's disadvantage is isolation from global AI talent and capital markets.

Middle Eastern countries, particularly the UAE and Saudi Arabia, are making noise about AI infrastructure plays, backed by sovereign wealth fund money. They're less about compute democratization and more about pure infrastructure play to attract global companies. It's a capital-intensity competition, and Middle Eastern countries have capital.

India's positioning is interesting because it tries to split the difference. It's got some of China's deployment speed (government support, policy direction) without China's isolation. It's got more geographic diversity than the Middle East, and more accessible capital markets than Europe. It's cheaper than the US but with better governance signals than some cheaper alternatives.

But here's the honest assessment: India's still behind on several dimensions. The US has more experience operating hyperscale infrastructure. Europe has more developed power/cooling infrastructure in some regions. The Middle East has more capital per capita. China has more deployment speed. What India has is an opportunity to be cheaper AND capable, which is rare.

One more dynamic worth noting: for most AI companies, the ideal strategy isn't "build in one region." It's build in multiple regions. You want redundancy. You want to serve customers in multiple geographies with local compute. So India doesn't have to "win" against the US or other regions. Companies can build in the US AND India AND Europe. India just needs to be attractive enough that it gets a meaningful slice of global infrastructure spending.

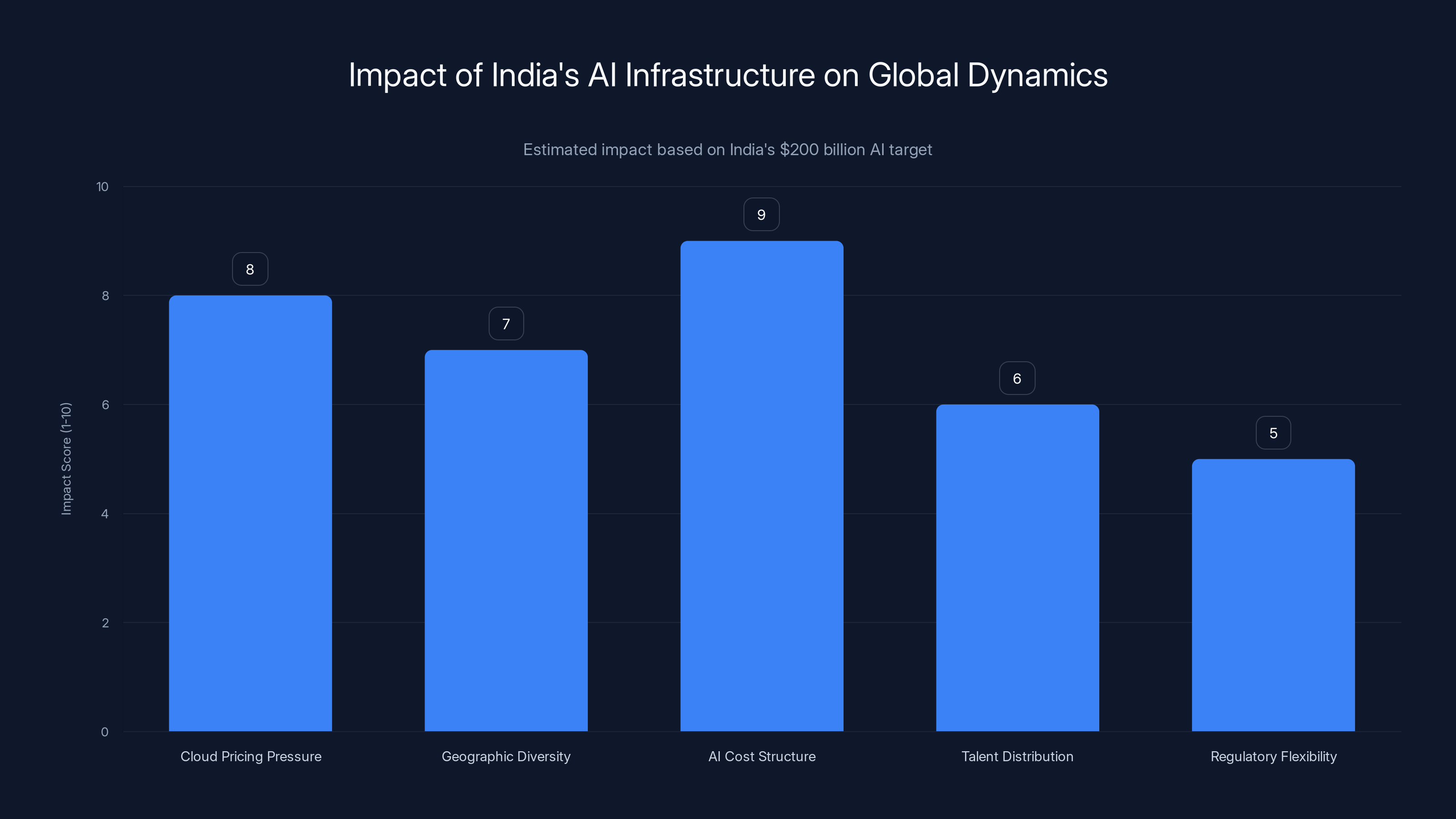

India's AI infrastructure could significantly lower cloud pricing, enhance geographic diversity, and reduce AI operational costs, with moderate effects on talent distribution and regulatory flexibility. (Estimated data)

Infrastructure Challenges: The Constraints Nobody Wants to Talk About

Here's where the conversation usually gets optimistic without being realistic. India's plan is ambitious, but ambitious plans run into reality. Let's talk about the constraints.

Power: The Elephant in the Room

Data centers consume massive amounts of electricity. A large hyperscale data center might draw 50-100 megawatts of power, continuously. That's the power consumption of a small city. If you're scaling to $200 billion in infrastructure, you're talking about needing tens of gigawatts of reliable, consistent, sustainable power.

India's power situation is complicated. The country has growing electricity supply—about 450 gigawatts of installed capacity currently, and growing. But India's also a developing country where electricity demand is surging alongside economic growth. There's also the reality that much of India's power infrastructure is aging and needs modernization.

Vaishnaw did acknowledge this explicitly. He pointed to India's energy mix as an advantage. More than 50% of installed generation capacity comes from renewable sources (solar, wind, hydro). That's higher than many developed countries. For a company concerned about AI's environmental impact, building in a country with clean power is an advantage.

But here's the catch: renewables are intermittent. Solar power varies throughout the day. Wind varies with weather. Data centers need consistent power. So India would need to pair renewable generation with battery storage or backup generation. That's technically feasible but capital-intensive and operationally complex.

Alternatively, India could build data centers in regions with more stable power supplies (maybe near hydroelectric dams). But that constrains where you can build, which constrains how much infrastructure you can actually deploy.

This is solvable, but it's not a trivial problem. And it's not something the government can just announce its way through. It requires real capital investment in power infrastructure.

Water: A Secondary but Real Constraint

Data centers need water for cooling. Not potable water, but lots of it. A large data center might use millions of gallons of water daily for cooling systems.

India has water challenges in many regions. Some areas face seasonal scarcity. Others face groundwater depletion. Climate change is making seasonal patterns less predictable.

Vaishnaw mentioned this constraint too, which is good—he's not hiding from it. But the solution is still somewhat vague. Using recycled water? Possible, but you need infrastructure for that. Locating data centers in regions with abundant water? Possible, but you're constrained geographically.

Unlike power, where renewables offer a locally-beneficial option, water is trickier. You can't just generate more water. You can only use what you have more efficiently or transport it (expensive) from elsewhere.

This constraint is real enough that it likely will determine where India can actually build data centers. The most likely scenarios: data centers go near hydroelectric facilities where water's abundant and power's clean, or they go in coastal regions where desalination is possible. Both options limit total buildable capacity versus the theoretical maximum.

Land: Less Obvious but Important

Hyperscale data centers are physically large. A single facility might occupy 100+ acres. If you're building hundreds of data centers, you need thousands of acres.

India has land, obviously, but not all land is suitable. You need:

- Access to power infrastructure (or room to build it)

- Access to fiber/network infrastructure (or room to build it)

- Reasonable climate (not requiring excessive cooling)

- Stable ground conditions

- Proximity to existing cities/talent (for staffing)

- Regulatory environment (local government approval)

Finding sites that meet all these criteria at scale is harder than it sounds. The best sites get taken quickly. As you move to less ideal sites, capital efficiency drops.

India's government is aware of this and has probably started identifying suitable regions. But execution—actually acquiring land, getting permits, installing infrastructure—takes time. Compressing years of development into 18 months is ambitious at best.

Operational Expertise: The Often-Forgotten Factor

Building data centers is one thing. Operating them reliably is another. A 99.99% uptime SLA sounds achievable, but it means you can only have 52 minutes of downtime per year. Across thousands of systems. That requires people who know what they're doing.

Amazon, Google, and Microsoft have been operating data centers for 15+ years. They've got playbooks, systems, and talent. India's government-backed infrastructure providers are newer to the game. They'll improve, but there's a learning curve.

This is solvable—they can hire experienced operators, partner with global companies, send people for training. But it's a real constraint on how fast they can scale quality infrastructure.

The Startup Ecosystem Angle: Why This Matters Beyond Just Compute

Here's something that doesn't always get discussed in infrastructure pieces: the government's strategy is explicitly about ecosystem effects.

Vaishnaw mentioned specifically that VCs are committing funds for deep-tech startups, big applications, and cutting-edge model research. That's not accidental. It's the goal.

Why? Because compute alone doesn't drive economic value. You need applications built on top of that compute. You need people experimenting, building, failing, iterating. That's where startups come in.

India's startup ecosystem has historically been strongest in software services (outsourcing, IT consulting) and consumer internet (e-commerce, digital payments). It's been weaker in deep-tech and frontier AI because those require compute, capital, and tolerance for failure at a scale India hasn't historically had.

By providing cheap compute and capital, India's government is trying to shift that. They want the next generation of deep-tech founders to build in India because they can afford to. They want the next major AI application company to be founded in Bangalore, not San Francisco.

Is that likely to happen? Maybe not at scale. But even small success here is valuable. If India produces 10 significant AI application startups in the next three years (versus maybe 2-3 currently), that's a meaningful shift.

There's also a multiplier effect. Successful startups attract talent. Talent attracts more startups. More startups attract VCs. VCs attract companies. Pretty soon you've got a self-reinforcing ecosystem. That's not guaranteed, but it's the growth path the government is trying to create.

One thing worth noting: India already has a cultural advantage here. There's a very strong engineering tradition, particularly in certain cities (Bangalore, Hyderabad, Mumbai). Indian engineers have worked at every major tech company, often in leadership roles. So the human capital exists. The question is whether the economic incentives are strong enough to keep people building in India rather than moving to the US or elsewhere.

The government's policies are explicitly trying to answer that question. Better capital availability, lower infrastructure costs, favorable tax treatment—all of that moves the needle on whether a founder stays or leaves.

By 2028, Amazon, Google, and Microsoft are projected to contribute

The $17 Billion AI Applications Layer: Beyond Infrastructure

Earlier we glossed over this, but it's worth deeper attention: the $17 billion projected investment into AI applications and deep-tech.

Vaishnaw was explicit that the government expects not just infrastructure investment, but application investment. That's different from most national infrastructure plays, which focus on the pipes and highways and let market forces figure out what flows through them.

India's government is explicitly trying to shape what gets built on top of the infrastructure. They're signaling that they want:

- Big applications solving real problems

- Research into cutting-edge models

- Deep-tech companies building novel solutions

That $17 billion isn't just going to be private capital. Some of it will flow through the ₹100 billion venture fund. Government's using capital allocation as a way to guide ecosystem development.

What kinds of applications might be built? Given India's context and comparative advantages, reasonable guesses:

Agricultural AI: India has 900+ million people, many dependent on agriculture. AI for crop prediction, irrigation optimization, pest detection—these solve real problems and reduce waste. A company building this could operate globally but would naturally develop in India.

Healthcare AI: India has massive healthcare infrastructure gaps and a large population needing care. AI for diagnostic assistance, drug discovery, patient monitoring—applications built for India's context would have global relevance.

Manufacturing AI: India's industrial base is growing. Optimization, quality control, predictive maintenance—these are valuable globally and India has the manufacturing context.

Finance and Digital Payments: India already leads in some digital payment technologies. AI applied to risk assessment, fraud detection, and financial inclusion could drive huge value.

Language and Localization: India has 22 official languages plus hundreds of others. AI for translation, transcription, and localized services is naturally valuable here and globally.

The government's not going to pick winners and losers explicitly, but the capital structure of the venture fund will implicitly guide investment toward these areas. That's not necessarily bad policy—it's just acknowledging that markets don't always solve for problems that matter most to a nation.

Global Competitive Dynamics: What This Means for AI Elsewhere

If India executes on even 60-70% of its $200 billion target, it changes the global AI economics significantly.

First, pricing pressure on cloud providers. AWS, Azure, and Google Cloud set their pricing based on costs plus market power. If India's offering cheaper compute through its shared infrastructure, it creates a price floor. Companies like Amazon and Google will need to compete. They'll either lower prices (margin compression) or improve services (cost increase). Either way, it's a shift in the dynamics that have made cloud providers incredibly profitable.

Second, geographic diversity of AI. Right now, AI is too concentrated in the US. Most training happens here. Most deployment happens here. That's a single point of failure at a geopolitical level. If India becomes a meaningful alternative, it distributes risk. Companies can train models in India, deploy in Asia using India's infrastructure, use the US for other markets. That's healthier for global AI.

Third, cost structure of AI companies. If compute gets 30-50% cheaper (which is plausible if India's infrastructure is used at scale), it changes which AI business models are viable. Companies that are currently too expensive to operate become viable. Smaller teams can do things that previously required larger teams. That's generally good for innovation.

Fourth, talent distribution. Right now, top AI talent concentrates in the US and (to a lesser extent) China and Europe. If India becomes a serious center for AI infrastructure and startups, it creates opportunities for talent to build great things without leaving. That probably keeps more Indian talent in India (where they'd stay anyway) but might also attract talent from other regions.

Fifth, regulatory arbitrage and fragmentation. Different countries are adopting different AI regulations. If you can build in one country, deploy in another, that's valuable flexibility for companies navigating the regulatory landscape. India's relatively business-friendly approach to AI could make it attractive for companies building applications that face stricter regulation elsewhere.

None of this displaces the US as the center of global AI. But it does mean the US is no longer the only game in town. That's a significant shift.

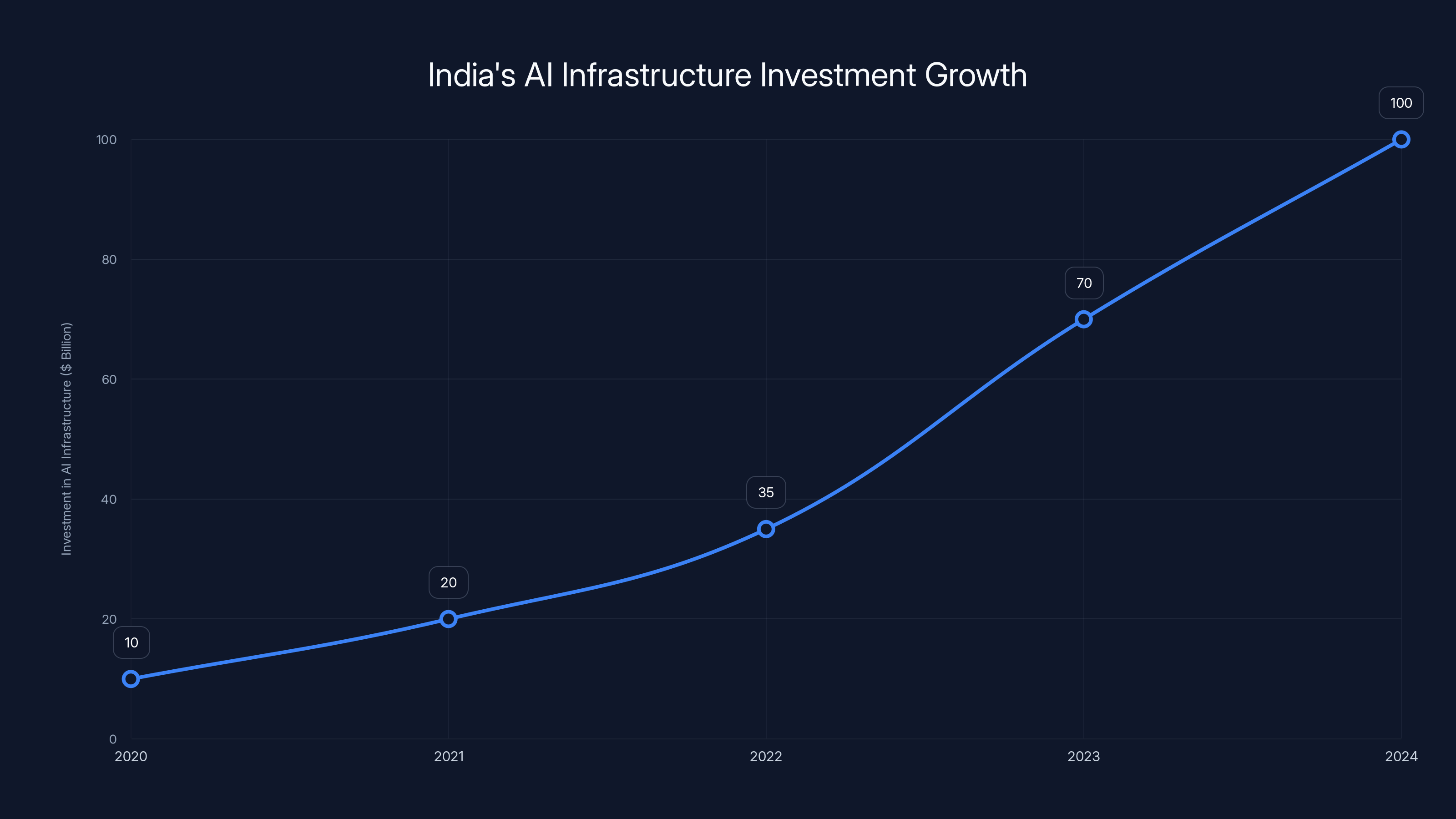

India's AI infrastructure investments have grown significantly, from

Timeline Realities: Can India Actually Deliver by 2028?

Here's the thing that separates ambitious plans from actual execution: timelines.

India's government is saying $200 billion by 2028. That's roughly 3 years from now. Let's think about whether that's realistic.

The

The remaining $130 billion from other sources—that's where timeline risk gets real. For that to materialize, India needs to:

- Demonstrate the shared compute infrastructure works reliably (6-12 months)

- Show that startups are actually thriving on that infrastructure (12-18 months)

- Attract major companies to commit infrastructure spending (18-24 months)

- Get those companies to actually deploy the infrastructure (24-36 months)

Conditionally, it's doable. But each step depends on the previous one working. If shared compute turns out to be operationally problematic, the whole edifice wobbles.

Also, there's execution risk on the government side. Policies are good, but implementation matters. Will the tax breaks actually be applied as promised? Will the venture fund actually deploy capital on reasonable terms? Will permits actually be processed quickly? These are questions of bureaucratic execution, and India's government, while improving, doesn't have a perfect track record.

Then there's the force-of-nature risk. What if a major drought hits and water for cooling becomes genuinely scarce? What if there's political instability that spooks foreign investors? What if US policy shifts to restrict India's access to advanced chips or technology? These aren't predictions—they're just reminders that timelines are hostage to things outside anyone's control.

Realistic assessment: India will likely deploy

If we're being honest, that doesn't matter that much to India's success. They don't need to hit the exact number. They need to hit enough to establish themselves as a serious alternative to the US and Europe, to create a thriving startup ecosystem, and to develop institutional competency in operating AI infrastructure. If they do that, the $200 billion becomes more of a Phase 2 goal.

The Second Phase: What Comes After 2028

Vaishnaw mentioned a second phase of the AI Mission, with stronger focus on research and development, innovation, and wider diffusion of AI tools.

This is interesting because it suggests the government is thinking in cycles. First cycle: build the infrastructure, attract investment, get the ecosystem going. Second cycle: deepen the technology, help more people access AI, build defensibility.

What might this look like? Some possibilities:

Open-Source Model Development: India funding research into large language models and other foundation models that are open-sourced or licensed on favorable terms. This creates technological IP in India and gives other countries an alternative to US-based models.

AI Education and Training: Government-backed programs to train the next generation of AI researchers and engineers, keeping talent in India or bringing diaspora back.

Industry-Specific AI Deployment: Helping specific industries (agriculture, healthcare, manufacturing) adopt AI solutions, creating economic value while building use case experience.

Chip Development: Potentially funding research into AI-optimized chips, reducing dependence on US chip makers like NVIDIA for this crucial input.

Regulatory Excellence: Developing India as a test ground for responsible AI practices, creating a reputation for safe, reliable AI infrastructure and applications.

The second phase sounds more ambitious, actually. Because it's not just about building infrastructure—it's about building capability and defensibility. If India can develop its own models, its own chips, its own research, it becomes significantly harder for other countries to pressure India out of the AI game through sanctions or restrictions.

The Role of Private Companies: Amazon, Google, Microsoft, and Others

Let's be clear: India's $200 billion play doesn't happen without private companies. The government is facilitating, but companies are executing.

Amazon, Google, and Microsoft have the most to gain from India infrastructure expansion. They serve Indian customers (population of 1.4 billion, growing digital adoption). They need capacity for the region. They benefit from lower costs. They get favorable regulatory treatment. For them, investing in India is purely rational.

But what about other companies? Why would a company like Anthropic (one of the AI labs at the AI Impact Summit) commit to building infrastructure in India?

Several reasons:

-

Cost arbitrage: Training models is cheaper in India, which means better unit economics for their API business.

-

Diversification: Not putting all eggs in US infrastructure reduces geopolitical risk and regulatory risk.

-

Market expansion: India's market for AI is growing, and having local infrastructure helps serve it faster.

-

Policy incentives: The government's tax breaks and capital programs make the investment more attractive financially.

-

Competitive dynamics: If competitors are building in India, staying out means losing ground.

When Vaishnaw talked about VCs committing funds for deep-tech, he was noticing this dynamic. The companies showing up at the AI Impact Summit weren't doing PR. They were evaluating real opportunities.

The question is whether those evaluations turn into actual commitments. That takes months or years of planning, negotiation, and due diligence. The government can't force it. But it can create conditions where it makes sense.

Risk Factors: What Could Actually Go Wrong

We've talked about structural challenges. Let's talk about actual failure modes.

Infrastructure Deployment Failures: Shared compute infrastructure turns out to have unacceptable uptime or performance issues. Startups get burned because their workloads fail. They leave. The whole ecosystem stalls.

Capital Deployment Failures: The venture fund invests in mediocre startups that don't go anywhere. Or it gets politically captured and invests in pet projects that don't work. Capital gets wasted, reputation suffers, future capital dries up.

Regulatory Whiplash: The government introduces new regulations that hurt the companies it's trying to attract. Tax breaks get reversed for political reasons. Investors lose confidence.

US Policy Restrictions: The US restricts India's access to advanced chips, cutting off a key input for data center buildout.

Brain Drain Acceleration: AI talent continues to leave India faster than it arrives, limiting local development of applications and expertise.

Macroeconomic Stress: India's currency weakens, inflation rises, or broader economic problems make infrastructure investment less attractive.

Climate Events: Water scarcity becomes genuinely acute, power generation is disrupted, or other climate impacts force data center shutdowns.

Any of these could derail the plan. Are they likely? On any individual one, probably not. But on at least one happening in a 3-year timeframe? More likely than not. The question is whether India's government is resilient enough to adapt when things go sideways.

The Long-term Vision: What Does Success Actually Look Like?

Let's step back from the $200 billion number and ask: what's India actually trying to achieve?

I think there are several layers:

Layer 1: Economic: Attract foreign investment, create jobs, develop a world-class infrastructure industry. This is the straightforward development economics play.

Layer 2: Strategic: Reduce dependence on other countries for AI infrastructure and services. Build technological capability that gives India leverage in negotiations with other powers.

Layer 3: Demographic: Leverage India's demographic dividend (young population, growing workforce) to build talent advantage in AI. Keep talented engineers in India instead of losing them to the US.

Layer 4: Inclusive: Make AI accessible to more people and companies than the current model allows. Reduce inequality in who gets to participate in the AI economy.

If India achieves all of these, it's a fundamental shift. It goes from being a consumer of other countries' AI to being a producer and exporter. It goes from being an outsourcing destination to being an innovation destination.

That's ambitious. It might not happen. But the fact that India's government is explicitly trying is noteworthy.

What does it mean for the rest of the world? Probably good things, actually. More computing capacity means better AI economics. More geographic diversity in AI infrastructure means less concentration of power. More countries participating in the AI race means more ideas, more perspectives, more resilience to single-point-of-failure risks.

The worst outcome would be if India's push failed and deterred other countries from trying similar things. The best outcome is India succeeds well enough to inspire similar efforts elsewhere, and we end up with a more distributed, resilient, innovative AI infrastructure ecosystem globally.

Lessons for Other Developing Economies

India's play isn't just about India. Other countries are watching.

What makes India's approach replicable, and what makes it unique?

Replicable aspects:

- Policy incentives and tax breaks don't require huge capital upfront

- Shared public infrastructure can be copied

- Venture capital programs are well-established tools

- Startup-friendly regulatory changes are achievable

Unique to India:

- Market size (1.4 billion people creates its own demand)

- Engineering talent (deep ecosystem of trained engineers)

- English-speaking population (simplifies global business)

- Existing relationships with major tech companies

- Government willingness to take risk on infrastructure

Other developing countries might try similar plays. Vietnam, Indonesia, Brazil, Mexico, Nigeria all have elements of what India has. But replicating all of them at the same time is hard. Vietnam's got talent but smaller market. Brazil's got market but weaker engineering ecosystem. Nigeria's got growth but less infrastructure maturity.

India's advantage is it has enough of everything. It's not the best on any single dimension, but it's good enough on all of them. That's underrated in competitive strategy.

The Role of Regulation and AI Safety

One thing India's government was relatively quiet about: AI regulation and safety.

Globally, there's increasing demand for AI regulation. The EU passed AI Act. The US is working on executive orders and legislation. China's got its own regulatory framework.

India hasn't moved as aggressively. The government is focused on attracting investment, which means not creating regulatory friction.

But here's the thing: India's approach to light regulation is actually a feature for some companies. If you're building AI applications and you're worried about regulatory burden, India looks more attractive than the EU or some US jurisdictions.

Is that a risk? Maybe. It could mean irresponsible AI companies locate in India to avoid regulation elsewhere. Or it could mean the space gets to innovate faster without regulatory barriers that may be premature.

Most likely, India will develop a middle-ground regulatory approach. Not as strict as EU, not as loose as some other countries. They're probably watching global developments and will introduce regulation that's business-friendly but addresses the main safety/ethics concerns.

The government did mention setting up institutes for AI research, which often have implicit mandates to think about safety and ethics. So there's awareness of the issue, just not the same emphasis as on infrastructure and investment.

Workforce and Talent Implications

All this infrastructure and investment means nothing without people to operate it, build on it, and improve it.

India has advantages here. It has the world's largest pool of English-speaking engineers. It has a strong tradition of technical education. It has a young population entering the workforce.

But there are also challenges.

The best Indian AI engineers can make more money in Silicon Valley than in India. They have to choose between financial maximization and staying home. Some will choose to stay for non-financial reasons (family, culture, quality of life), but not all.

India's government is trying to address this with tax breaks and capital programs, but these are indirect tools. They don't directly increase salaries at startups.

Maybe the most important factor is just that India's ecosystem becomes interesting enough that people want to be part of it. Success attracts talent. Failure repels it. If the first wave of AI startups built on India's infrastructure succeed, more engineers will want to join subsequent waves. That's how ecosystems compound.

There's also upskilling. India has computer science graduates, but training an engineer to build deep-tech is different from training them to build software services. India's government would be smart to invest heavily in specialized AI training programs, partnerships with universities, and import of talent (offering visa incentives to AI experts globally).

FAQ

What is India's AI infrastructure investment goal?

India's government is targeting

How many GPUs will India have deployed by 2028?

India's India AI Mission currently has 38,000 GPUs deployed, with plans to add 20,000 more in the coming weeks for a total of 58,000. While the government hasn't specified total GPU targets for 2028, the $200 billion infrastructure investment would likely result in several million additional GPU deployments when considering both shared public infrastructure and private company buildouts, potentially doubling or tripling the current global GPU capacity.

What tax benefits does India offer for AI companies and infrastructure providers?

India has introduced long-term tax relief for export-oriented cloud services, effectively providing multi-year tax breaks on revenue from cloud services provided globally. Additionally, the government created a ₹100 billion ($1.1 billion) government-backed venture program targeting deep-tech and AI. The government also extended the startup classification period to 20 years and raised the revenue threshold to ₹3 billion, allowing AI companies to maintain startup tax benefits throughout their scaling phase.

Why is shared compute infrastructure important for India's AI strategy?

Shared compute infrastructure democratizes access to GPUs, which are expensive and a major constraint on AI development. Instead of each company building isolated infrastructure, India's approach allows startups, researchers, and smaller companies to access GPUs at subsidized rates through the India AI Mission. This reduces the barrier to entry for AI experimentation, encourages more innovation and startup formation, and creates a more resilient ecosystem where knowledge spreads across participants.

What are the main infrastructure challenges India faces in scaling AI compute?

Three primary challenges stand out. Power: data centers consume massive amounts of electricity, and while India's 50%+ renewable energy percentage is favorable, integrating intermittent renewables with continuous data center demand requires battery storage or backup generation. Water: data centers need millions of gallons daily for cooling, and parts of India face water scarcity challenges. Land and logistics: finding suitable sites with access to power, fiber, and proper infrastructure, plus securing permits and handling implementation, all take time and money.

How does India's approach compare to other countries' AI infrastructure strategies?

India's model combines elements of different approaches: it emphasizes shared public infrastructure like some European initiatives, uses government venture capital like China, and targets cost competitiveness like Middle Eastern investors, but it focuses more on ecosystem development and startup support than most competitors. The US has more established infrastructure expertise, Europe has stricter regulations but good governance signals, China has faster deployment speed, and the Middle East has more capital, but India uniquely combines cheap compute with capital support, relatively business-friendly regulation, and a massive domestic market pull.

Will India actually hit its $200 billion investment target by 2028?

Realistic assessment suggests India will likely deploy

What types of AI applications is India most likely to develop?

Given India's context and advantages, likely focus areas include: agricultural AI (crop prediction, irrigation optimization for a nation of 900+ million agriculturalists), healthcare AI (diagnostic assistance and patient monitoring for a population with infrastructure gaps), manufacturing AI (optimization for India's growing industrial base), and digital finance and payments AI (building on India's existing strength in digital payment innovation). The government's venture capital programs will probably implicitly guide investment toward these areas through capital allocation.

How will India's AI infrastructure play affect global AI costs and competition?

If successfully deployed, India's infrastructure would introduce pricing pressure on cloud providers like AWS and Azure, likely pushing down compute costs globally. It would create geographic diversity in AI infrastructure, reducing single-country dependence and geopolitical risk. It would make more AI business models economically viable (since cheaper compute enables new use cases), potentially accelerate AI adoption and innovation, and distribute AI development across more countries rather than concentrating it in the US. These dynamics would likely be net positive for global AI development but would compress margins for current cloud infrastructure providers.

The Bottom Line

India's bid for $200 billion in AI infrastructure investment by 2028 isn't just about money or technology. It's a strategic play to shift where the world builds AI. It's ambitious, execution-intensive, and faces real constraints. But it's also grounded in practical policy, backed by existing corporate commitment, and aligned with India's fundamental economic interests.

The interesting thing about India's approach is that it's not trying to beat the US at its own game. It's not trying to become Silicon Valley or build the most advanced chips or develop the most capable models. Instead, it's trying to become the place where AI infrastructure is most efficient, where compute is most accessible, and where the ecosystem most strongly supports both infrastructure companies and AI startups.

If India pulls this off—and that's a non-trivial if—it changes how the world thinks about AI infrastructure. Suddenly geography matters less. Cost structure matters more. Distributed systems become more viable. That's good for global AI development.

If India struggles, it's probably still okay for global AI, because the US and Europe have enough capacity. But it would mean a missed opportunity for India to shape its own economic future and participate in one of the defining technology shifts of the era.

The next two years will be telling. Watch whether the shared compute infrastructure actually gets deployed and used at scale. Watch whether VCs actually start funding more deep-tech startups. Watch whether water and power constraints become dealbreakers or manageable challenges. Watch whether India's government actually delivers on its policy promises.

Those aren't theoretical metrics. They're the real indicators of whether India's AI infrastructure play is real or aspirational. And they'll determine whether that $200 billion number looks like prescient forecasting or optimistic overreach in a few years.

Key Takeaways

- India targets 70B already committed by major tech companies and remaining $130B projected from additional sources.

- The IndiaAI Mission's shared GPU infrastructure is being expanded from 38,000 to 58,000+ units immediately, with far larger deployments planned, democratizing compute access for startups.

- Tax incentives (long-term relief for cloud services), venture capital ($1.1B government fund), and extended startup classifications create powerful economic pull for AI company formation.

- Infrastructure challenges around power, water, and land are real but surmountable given India's renewable energy advantages and geographic opportunities.

- Success would fundamentally shift global AI economics, introducing pricing pressure on cloud providers, distributing compute capacity geographically, and enabling new AI business models to become viable.

Related Articles

- Adani's $100B AI Data Center Bet: India's Infrastructure Play [2025]

- India's $1.1B State-Backed VC Fund: Deep-Tech Boom [2025]

- Intel On Demand Failure: Why Pay-As-You-Go Hardware Never Worked [2025]

- Mysterious Bot Traffic From China Explained [2025]

- EU Data Centers & AI Readiness: The Infrastructure Crisis [2025]

- Anthropic's Data Center Power Pledge: AI's Energy Crisis [2025]

![India's $200B AI Infrastructure Push: What's Really Happening [2025]](https://tryrunable.com/blog/india-s-200b-ai-infrastructure-push-what-s-really-happening-/image-1-1771339054592.jpg)