Memory Chip Tariffs 2025: How 100% Duties Will Hit Your PC & Phone

TL; DR

- The threat is real: US government considering 100% tariffs on memory chip imports as leverage to force manufacturing domestically

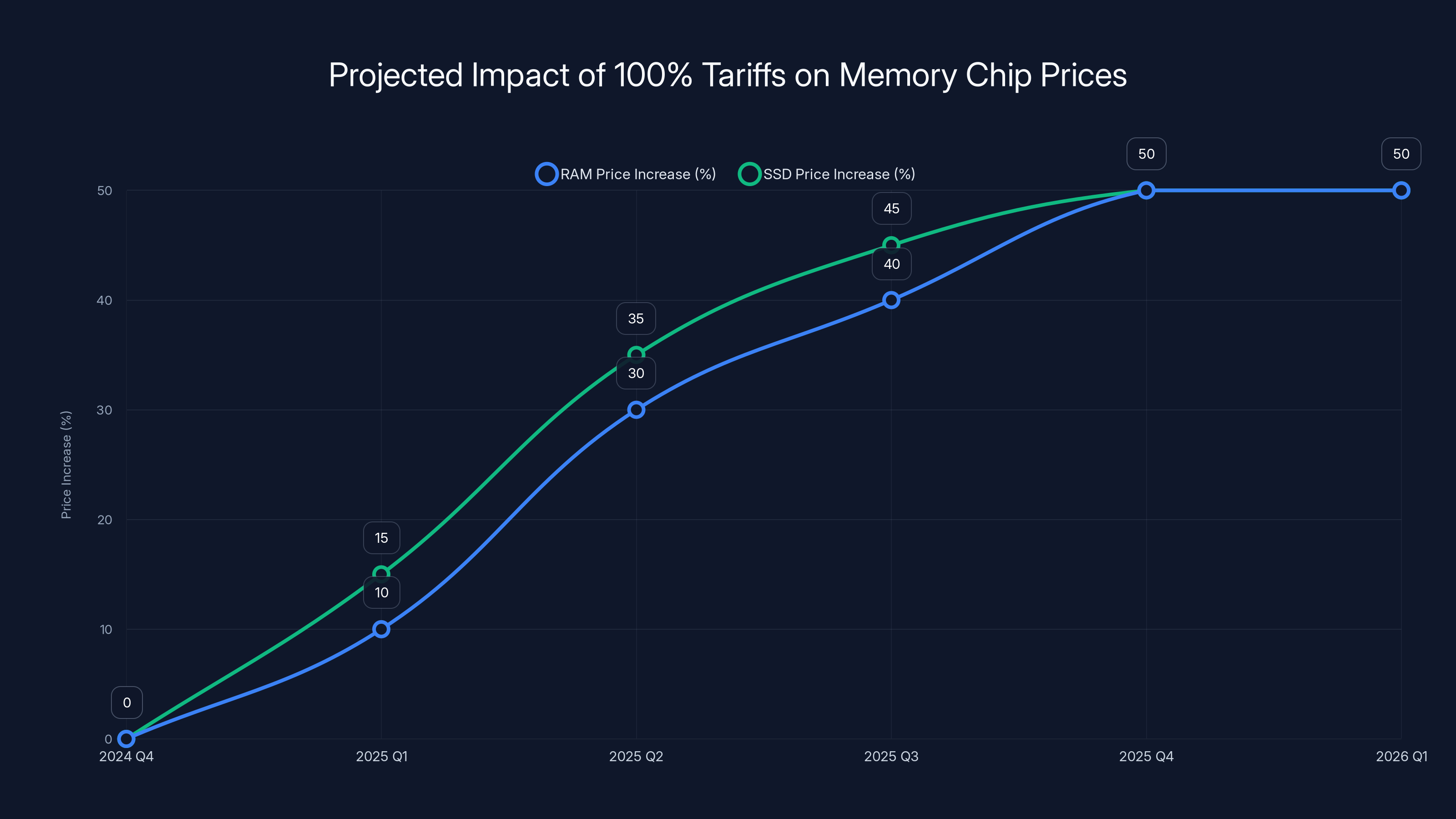

- Price impact: RAM and SSD costs could jump 30-50% or more if tariffs pass, affecting every PC, laptop, and phone buyer

- Timeline matters: Any tariff implementation likely happens in Q1-Q2 2025, with price increases flowing through consumer products by mid-year

- Who's vulnerable: Budget PC builders, laptop buyers, and consumers buying phones face the biggest hit; enterprise customers have negotiating power

- Your options now: Buy before tariffs hit, consider alternative storage solutions, or wait for domestic manufacturing to scale (unlikely before 2026)

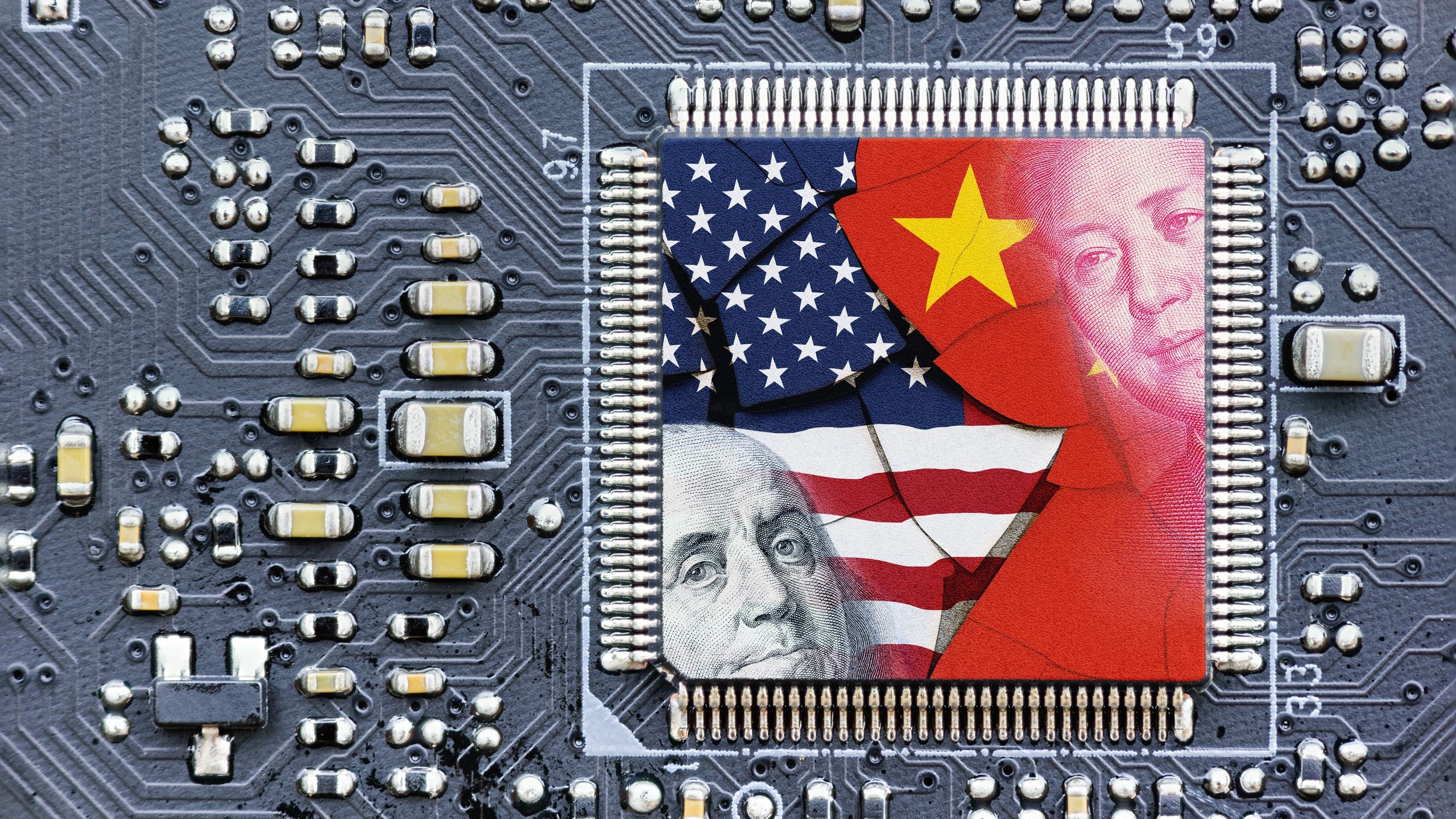

Let's talk about something that sounds boring but will absolutely wreck your wallet if it happens: memory chip tariffs. The US government is seriously considering slapping 100% import duties on RAM and storage chips. That's not a typo. That's double the cost on the parts that make your computer actually work.

I know what you're thinking. "Why would they do that?" The answer is vintage American trade policy: force companies to build factories here instead of in Asia. It's leverage. Blunt, expensive leverage that falls directly on your shoulder.

Here's the thing though. This isn't hypothetical anymore. The Trump administration has publicly discussed these tariffs as a strategic tool to reshape the semiconductor industry. Companies like Samsung, SK Hynix, and Micron are watching closely. And honestly, they're probably sweating.

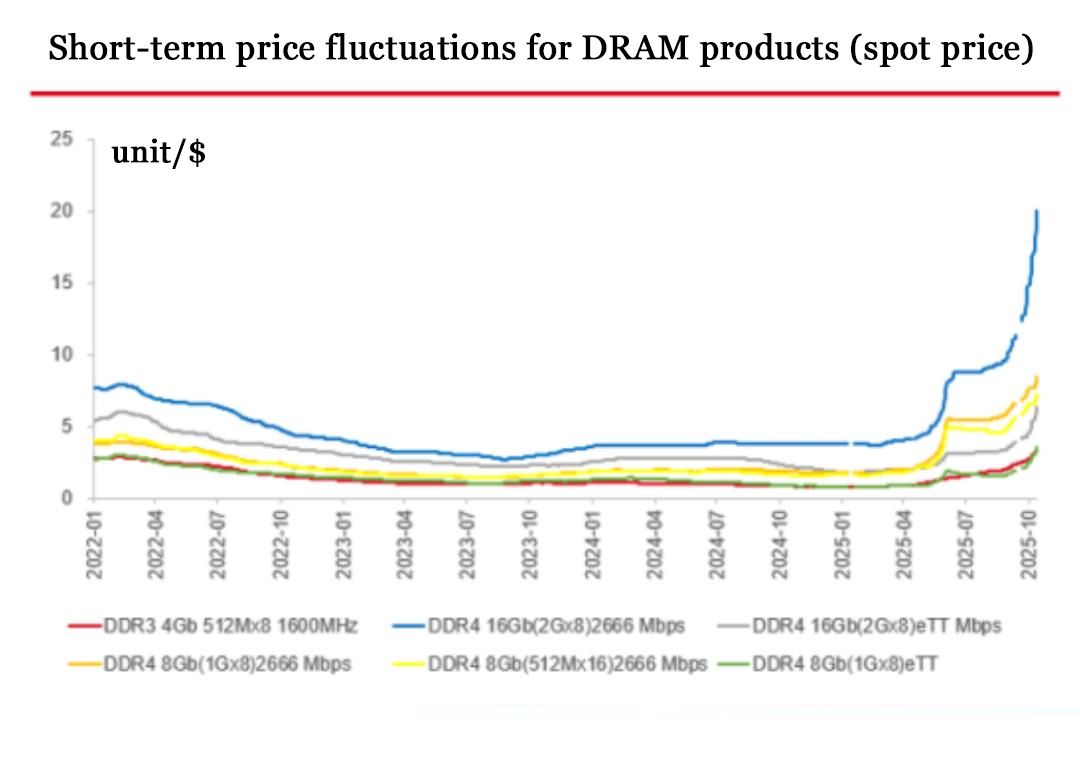

The memory chip industry is already stressed. We're coming off a brutal surplus period where chip makers flooded the market and crashed prices. Now they're finally recovering profitability. A 100% tariff would flip that script completely. Suddenly, imported chips become so expensive that either companies absorb massive losses or consumers pay through the nose.

What makes this particularly nasty is that there's no real alternative. Memory chips aren't like other products where you can switch suppliers easily. Samsung makes around 19% of the world's DRAM. SK Hynix makes another 27%. Micron, the only major US manufacturer, makes about 8%. The math is terrible. Even if Micron doubled production overnight, they couldn't cover the shortfall. And they won't double production overnight. Building a fabrication plant takes years and billions of dollars.

So what happens when supply can't meet demand and prices skyrocket? Exactly what you'd expect. PC builders bail. Laptop manufacturers suffer. Your phone gets more expensive. And the companies hit hardest are the ones operating on thin margins: the budget-conscious brands, the startups, the regions with less bargaining power.

This article breaks down exactly how bad this could get, who gets hit hardest, and what you can actually do about it. Some of it's not great news. But some of it is actionable if you move now.

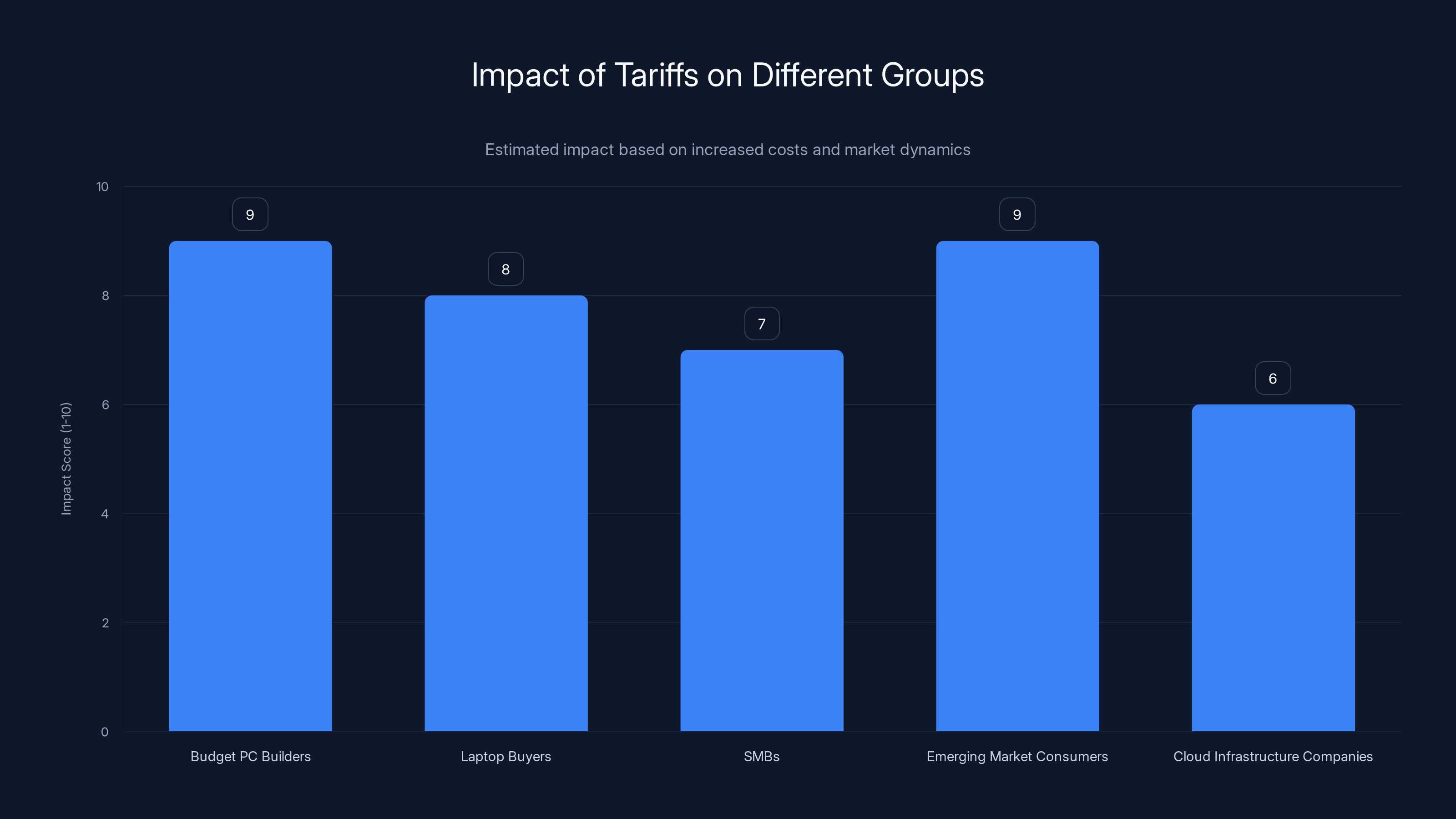

Budget PC builders and emerging market consumers are hit hardest by tariffs due to their price sensitivity, with an estimated impact score of 9 out of 10. (Estimated data)

Understanding the US Memory Chip Tariff Threat

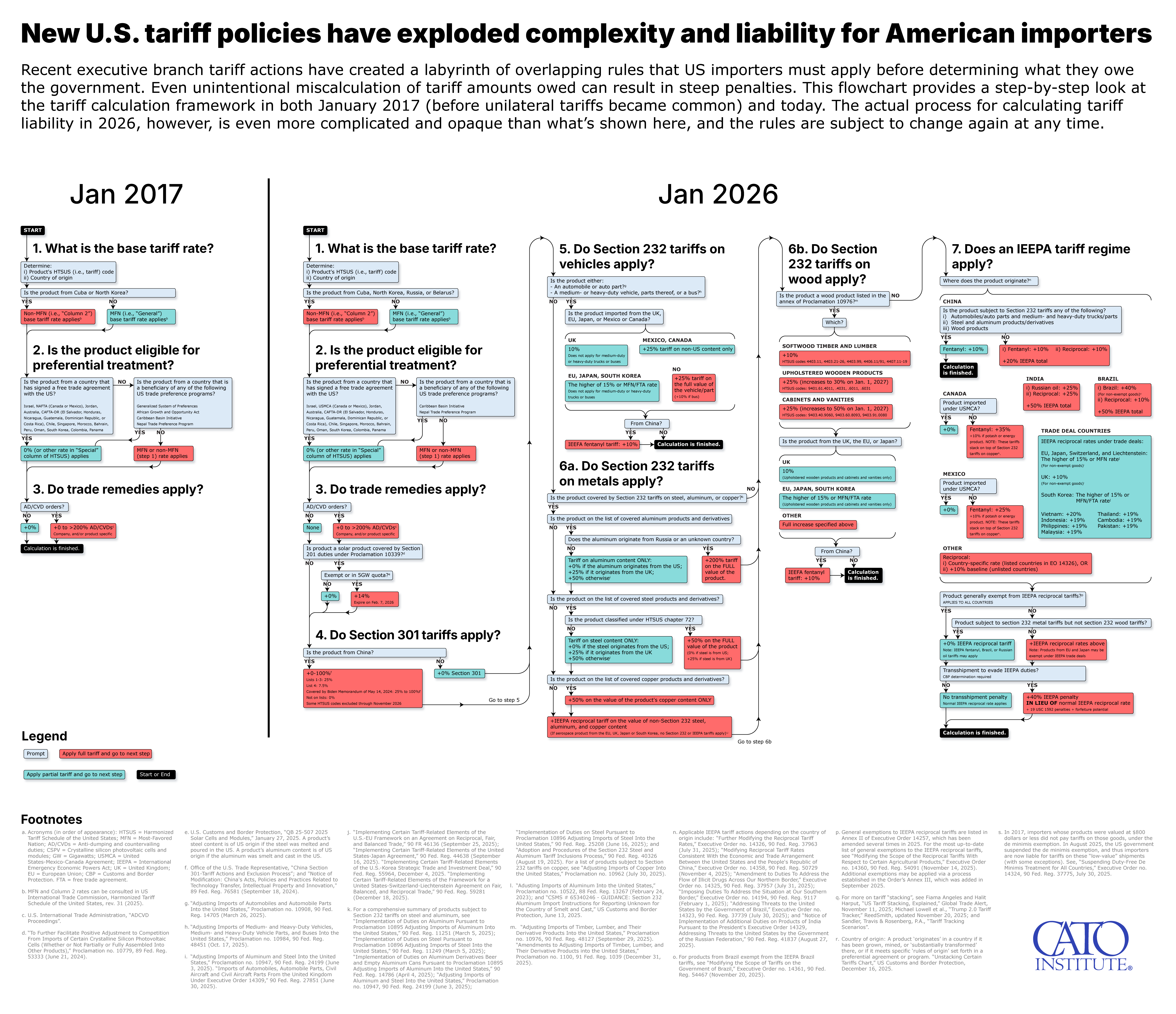

The US government isn't threatening tariffs on memory chips because they woke up angry one morning. This is strategic industrial policy with specific goals. Understanding what's actually happening matters because it changes how you should react.

For decades, the US has watched its semiconductor manufacturing base shrink. In 1990, America produced about 37% of the world's chips. By 2020, that number had collapsed to 12%. Meanwhile, South Korea, Taiwan, and Japan became the dominant players. This bothers policymakers for a lot of reasons: national security, supply chain resilience, job creation, trade deficits.

Memory chips are the obvious target. They're a commodity product, which means margins are thin and companies are price-sensitive. If you can make imported chips expensive enough, companies will build factories domestically instead. That's the theory anyway.

The 100% tariff proposal is the nuclear option. It's saying to chip makers: "Your Asian-made RAM is going to cost twice as much. Either accept losing the US market entirely, or build factories here." For context, current tariffs on semiconductors are around 0-2.5%. A jump to 100% would be unprecedented in modern trade policy.

Why memory chips specifically? Because they're essential and difficult to substitute. Every PC needs RAM. Every device needs storage. You can't just decide to stop using them. That makes them perfect leverage. Companies will feel real pain and have real incentive to shift production.

The timing also matters. The Trump administration has been clear that tariffs are coming, but implementation details are still fuzzy. Most analyses suggest Q1 or Q2 of 2025 as likely launch windows. That's soon enough to cause real disruption but far enough away that companies might still have time to adjust.

Here's what makes this different from previous trade threats: this one might actually happen. The political will is there. The justification is plausible (national security, manufacturing jobs). And there's precedent for aggressive tariffs on strategic sectors. So you can't just assume this will blow over like previous threats have.

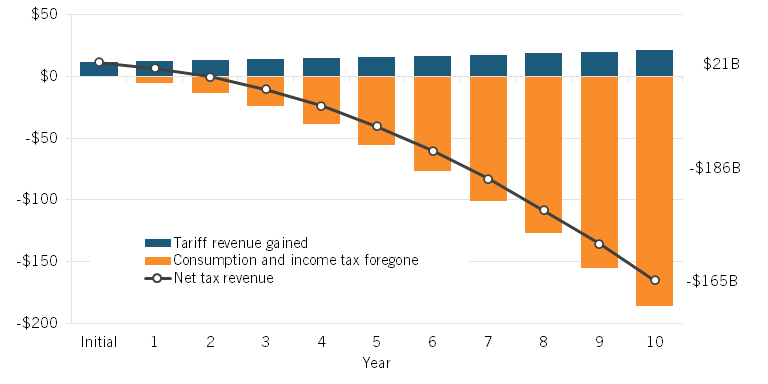

Estimated data shows a significant price increase for DDR5 RAM and 1TB NVMe SSDs due to a 100% tariff, with RAM potentially increasing by

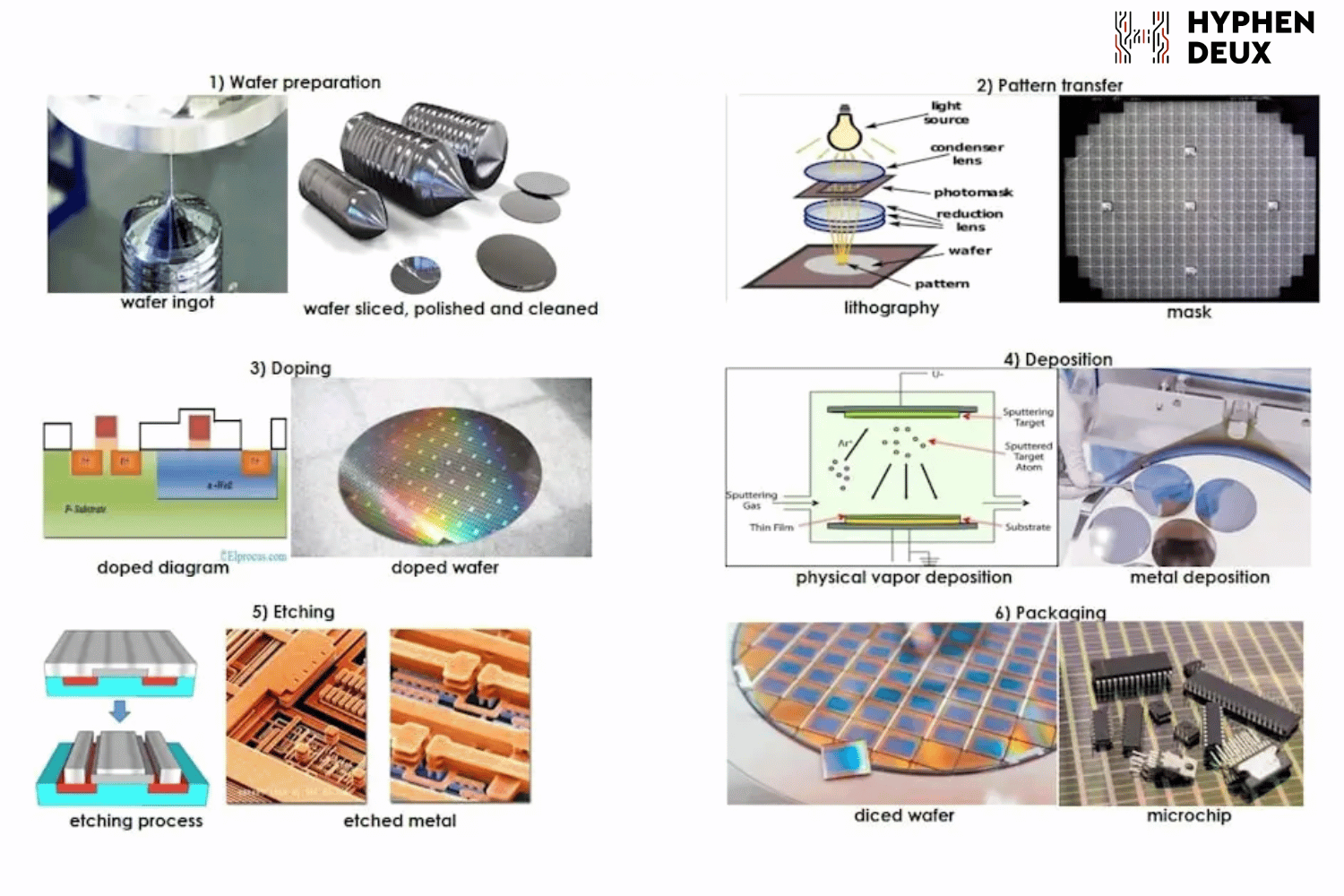

How Memory Chip Manufacturing Actually Works

To understand why tariffs on memory chips hit so differently than tariffs on other products, you need to understand how the industry actually works. It's not like shoes or furniture where a country can spin up manufacturing relatively quickly. Memory chip fabrication is brutally complex.

Building a modern semiconductor fabrication plant (a "fab") is one of the most capital-intensive industries on Earth. A single cutting-edge facility costs $10-15 billion. It takes 4-6 years to build from groundbreaking to production. And you need extraordinary precision: we're talking about etching features measured in nanometers. One speck of dust can ruin a chip.

Then there's the talent problem. These facilities need thousands of highly specialized engineers, technicians, and process specialists. That workforce doesn't exist in abundance in the US. The expertise is concentrated in South Korea, Taiwan, and Japan. Building fabs here means either relocating foreign talent or training Americans from scratch, which takes years.

Geographically, memory chip production is insanely concentrated. Samsung's primary DRAM manufacturing is in South Korea. SK Hynix operates facilities in South Korea and China. Micron does manufacture in the US (Idaho and Utah), but also in Taiwan and Singapore. If you look at the actual global supply chain, it's a fragile web. One facility going down impacts worldwide supply.

The specific technology matters too. DRAM and NAND flash have different manufacturing requirements. A fab optimized for DRAM can't just switch to NAND. So you're not building "a memory fab"—you're building specific fabs for specific products.

Micron's existing US facilities are valuable but not sufficient. They manufacture cutting-edge chips, but they're running at maximum capacity already. Adding domestic production capacity means building new fabs from zero. Even if the government threw money at the problem, you're looking at 2026-2027 before new capacity comes online in significant volumes. That's a 2-3 year gap where tariffs would be in effect but no domestic alternative exists.

So here's the paradox: the tariff is supposed to force domestic manufacturing, but you can't build that manufacturing fast enough to avoid the tariff's harm. For at least a couple years, you'd have high prices with no supply relief.

The Global Memory Chip Supply Chain

Memory chips don't come from one country or even one region. The supply chain is genuinely global, and that's important because tariffs on US imports would create immediate shortages unless other supply routes absorbed the demand.

Let's break down who makes what. Samsung and SK Hynix together control nearly 50% of the global DRAM market. Both are South Korean companies with major manufacturing in South Korea. Samsung also makes NAND flash. SK Hynix makes both DRAM and NAND. Micron, the American company, makes about 8% of global DRAM and a decent chunk of NAND. Intel used to be huge in memory but exited the business. That's a critical point: the US doesn't have backup capacity to replace Korean manufacturing.

For NAND flash specifically, the picture is slightly different. Samsung leads with about 20% market share. SK Hynix has about 20%. Micron has about 12%. Then you've got Kioxia (Japan), Western Digital (US, but they outsource manufacturing), and various Chinese manufacturers. The distribution is less concentrated than DRAM, which matters because it means NAND might absorb tariffs slightly better through supplier diversity.

Now, here's what actually happens if tariffs hit. Companies have options, and they'll pursue them. First, they could shift to non-US markets. Samsung can sell to European, Asian, and other buyers without US tariffs. Those customers will compete harder for supply, which drives global prices up. Second, they could use existing US manufacturing capacity (mostly Micron) at premium prices. Third, they could invest heavily in building new US capacity, but that takes years. Fourth, they could pass costs to consumers immediately.

In reality, it's probably a combination of all four. Some production would shift away from the US market. Micron's existing capacity would get squeezed. Some new investment would probably happen (especially if the government offers subsidies, which they're considering). And prices would go up everywhere because the global semiconductor market is interconnected.

There's also a secondary supply chain consideration. It's not just chips. It's memory modules, storage devices, complete systems. A tariff on raw chips might get negotiated, but the tariff on finished products assembled from those chips is another question. Does a US company building SSDs overseas pay tariffs when they import those drives? Does a company assembling PCs in Mexico get hit when they use foreign chips? These details matter enormously and haven't been fully clarified.

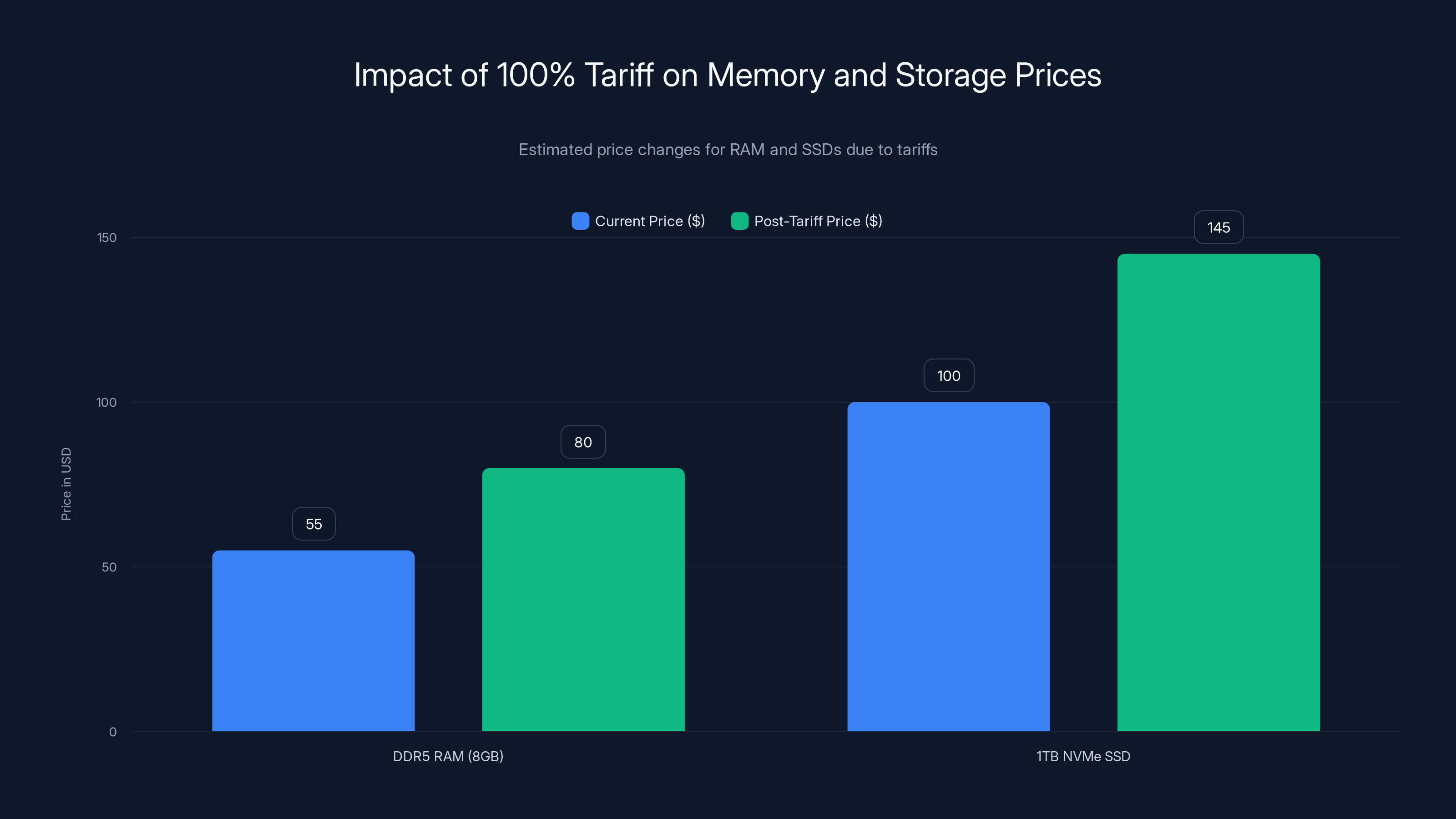

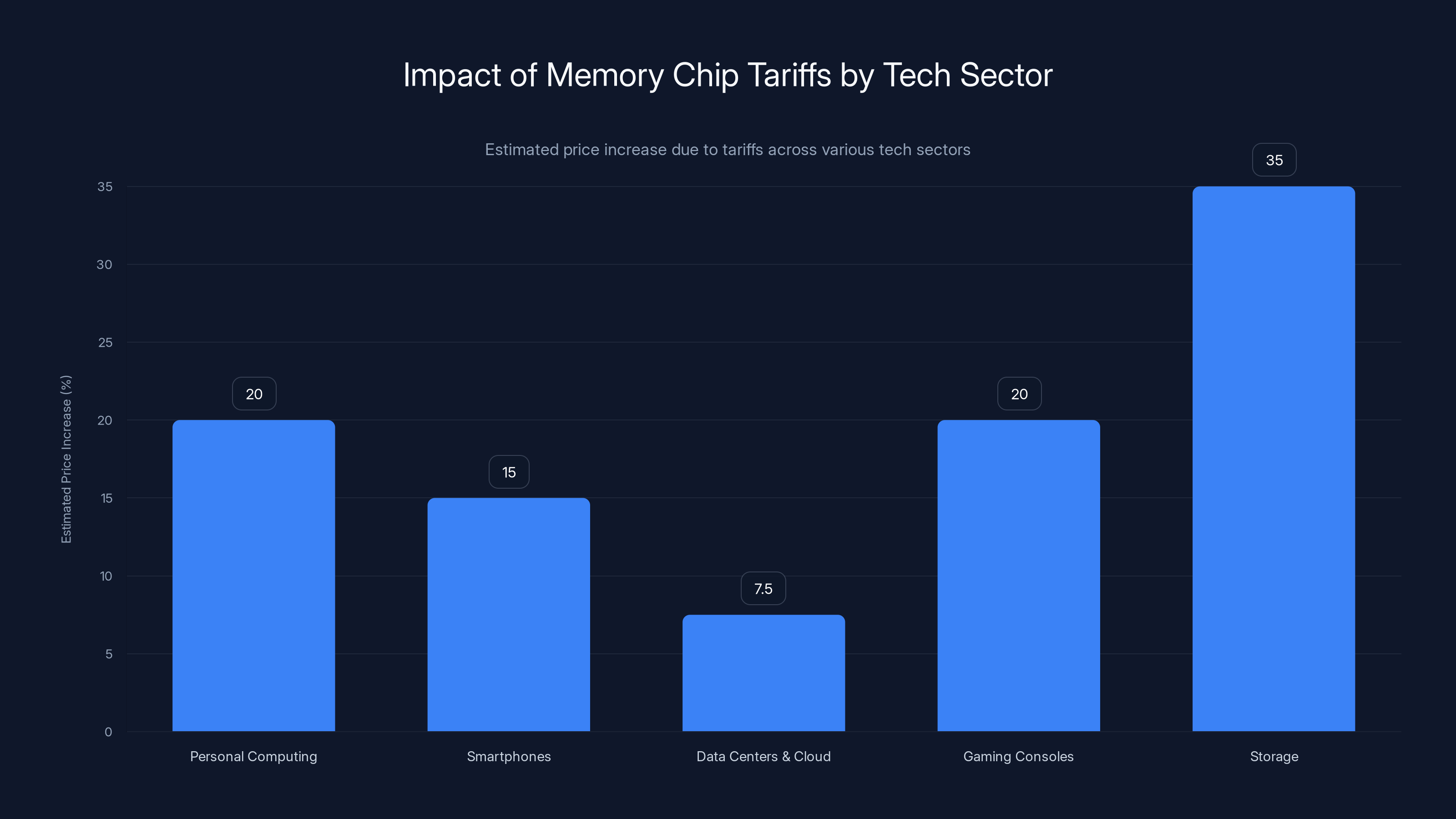

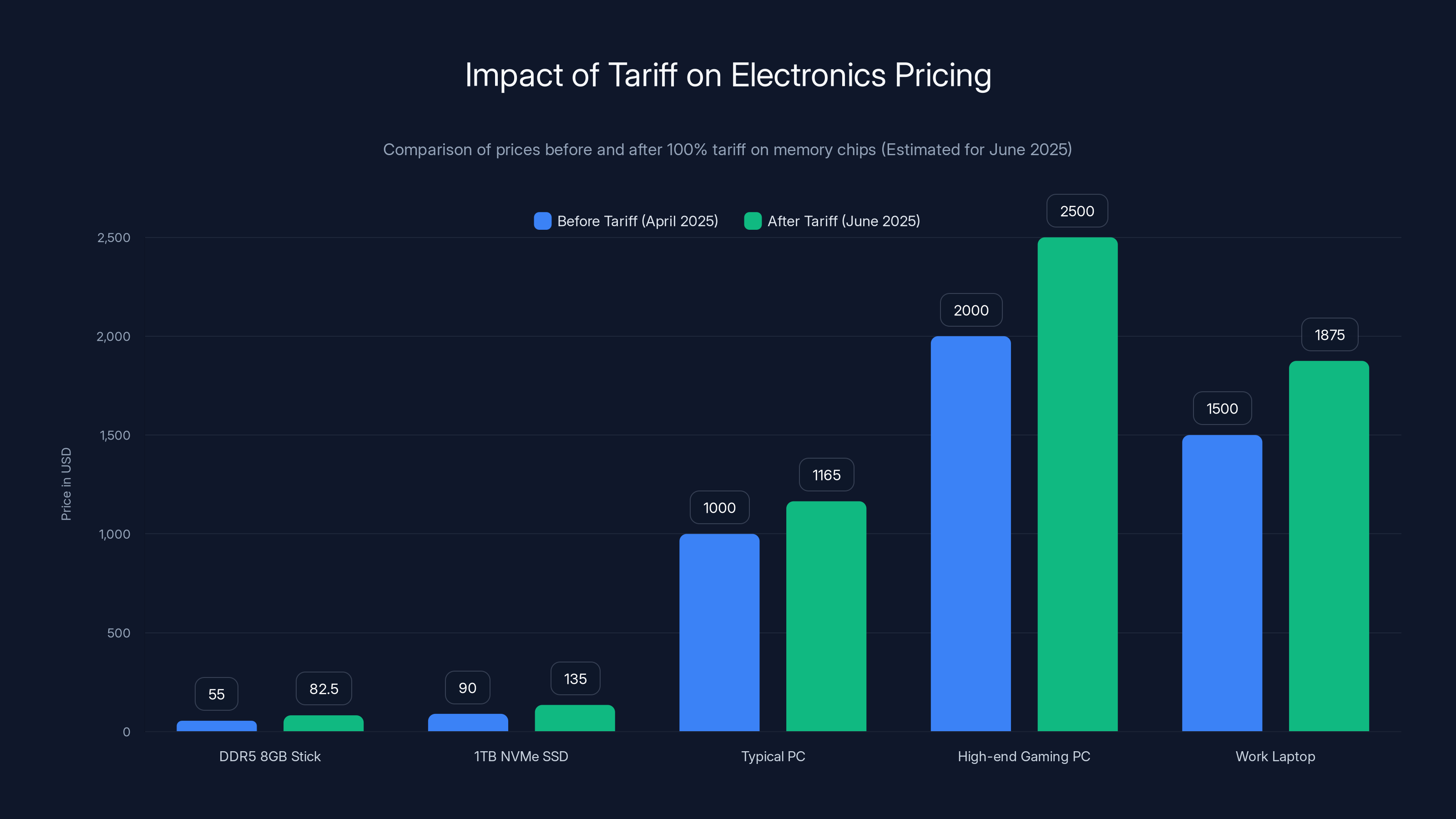

Estimated data shows storage and personal computing sectors face the highest price increases due to memory chip tariffs, with storage costs potentially rising by 35%.

Price Impact: What You'll Actually Pay

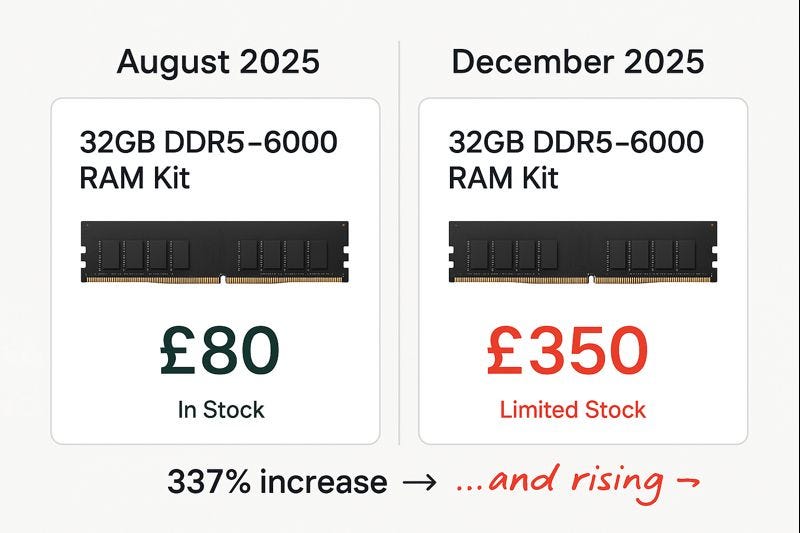

Now let's get specific about what this means for your wallet. A 100% tariff on memory chips wouldn't necessarily mean your RAM costs double. But it probably means it goes up a lot.

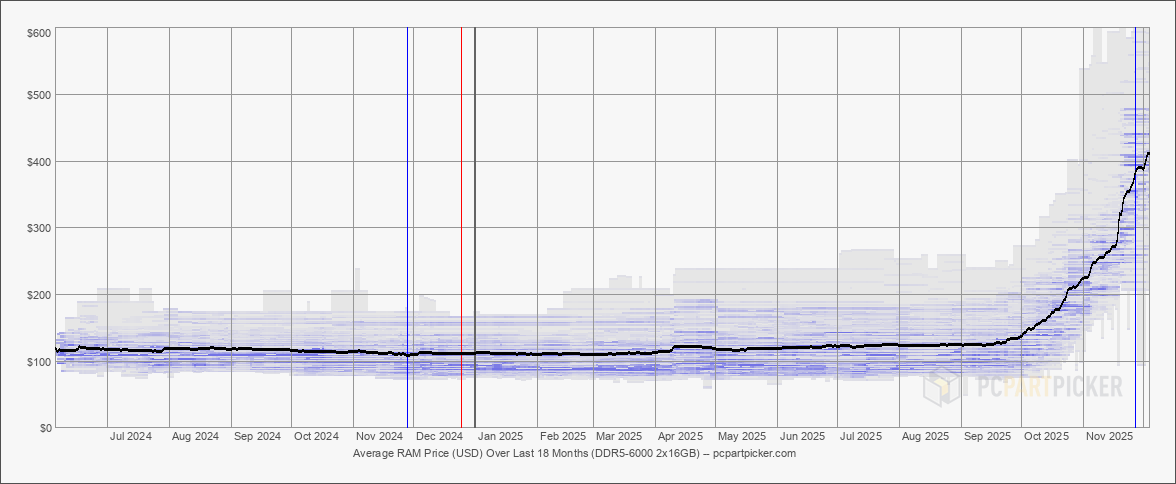

Current pricing for memory is already stabilizing after a brutal 2023-2024 surplus. DDR5 RAM is running around

For NAND flash, the math is similar. A 1TB NVMe SSD currently costs

But here's where it gets complicated. Not all of the tariff cost gets passed to consumers immediately. Companies have incentives to absorb some of the hit because price-sensitive consumers will just wait or switch to competitors. So maybe manufacturers eat 10-20% of the tariff impact and consumers see 80-90% of it.

For PC builders, this is a multiplication problem. A mid-range PC today might cost

For laptop manufacturers, it's worse because they buy in huge volumes and operate on thin margins. Dell, Lenovo, HP might each buy millions of RAM modules per year. A tariff-driven price spike hits them immediately and forces them to choose between absorbing losses or raising consumer prices. They'll raise prices.

Phones are interesting because they have less exposed memory (most phones have 8GB of RAM, which is cheaper per unit), but those volumes are enormous. Apple sells 200+ million iPhones per year. If every unit needs

Enterprise customers are in a different position. A company buying 10,000 servers with terabytes of storage can negotiate. They have leverage. They might get exemptions or special deals. Small companies buying off-the-shelf consumer parts? They're stuck paying whatever the market price becomes.

The timeline for these price increases matters too. Retail prices might jump within weeks of tariff implementation. Wholesale prices for manufacturers could go up immediately. But there's a lag before those flow through to finished products. Expect consumer prices to start noticeably rising within 60-90 days of any tariff announcement that seems likely to pass.

Who Gets Hit Hardest

Tariffs don't distribute pain evenly. Some groups will suffer significantly more than others, and understanding where you fall in that spectrum matters.

Budget PC Builders and Gamers: These people are price-sensitive by definition. A 40% increase in memory costs makes their target build either impossible or forces them to compromise on specs. Worst-case scenario, they delay purchases waiting for prices to stabilize. That's probably years. Best case, they pay more and get less performance than they would have.

Laptop Buyers: Laptops have thin margins already. Dell, Lenovo, and Asus profit margins on consumer laptops are often 5-10%. A tariff-driven cost increase of $100+ per unit could eliminate profitability entirely. They'll raise prices, which means fewer people buying, or they'll cut features to maintain pricing. Neither is good for consumers.

Small and Medium Businesses: SMBs don't have the purchasing power to negotiate special deals. They'll pay whatever the market price is. If they need to upgrade 20 employees' laptops and suddenly each one costs

Emerging Market Consumers: People in India, Southeast Asia, and other price-sensitive regions often buy budget tech. A tariff that pushes prices up 40-50% might price them out entirely. This actually could shift market dynamics toward Chinese manufacturers who have more flexible supply chains and less reliance on US markets.

Cloud Infrastructure Companies: This is less obvious but important. AWS, Azure, Google Cloud all need massive amounts of memory and storage for their data centers. Tariffs on imported chips could force them to source from Micron (US) at higher costs, raising cloud computing prices. If AWS raises prices, that ripples through every SaaS company that uses AWS. So effectively, SMBs using cloud services pay the tariff too.

Apple, Google, Microsoft: These companies have negotiating power and can potentially secure exemptions or long-term contracts at preferential rates. They'll still pay more, but they won't pay the same percentage increase that smaller competitors do. That actually hurts competition because smaller manufacturers get hit harder.

Micron: This is weird. Micron is the "victim" the tariff is supposed to help. But here's the thing: Micron already sells basically everything they make. Adding a tariff that raises competitive prices actually hurts them because they lose the ability to sell more volume. They just might make slightly higher profit per unit. But if the goal is to expand US manufacturing, higher per-unit profit alone isn't enough motive. They need volume growth, which requires new capacity, which requires long-term demand certainty. A tariff creates uncertainty, so it's unclear whether Micron actually benefits.

Enterprise customers with serious bargaining power might actually benefit if they can negotiate fixed-price long-term contracts before tariffs hit. They're probably already doing that.

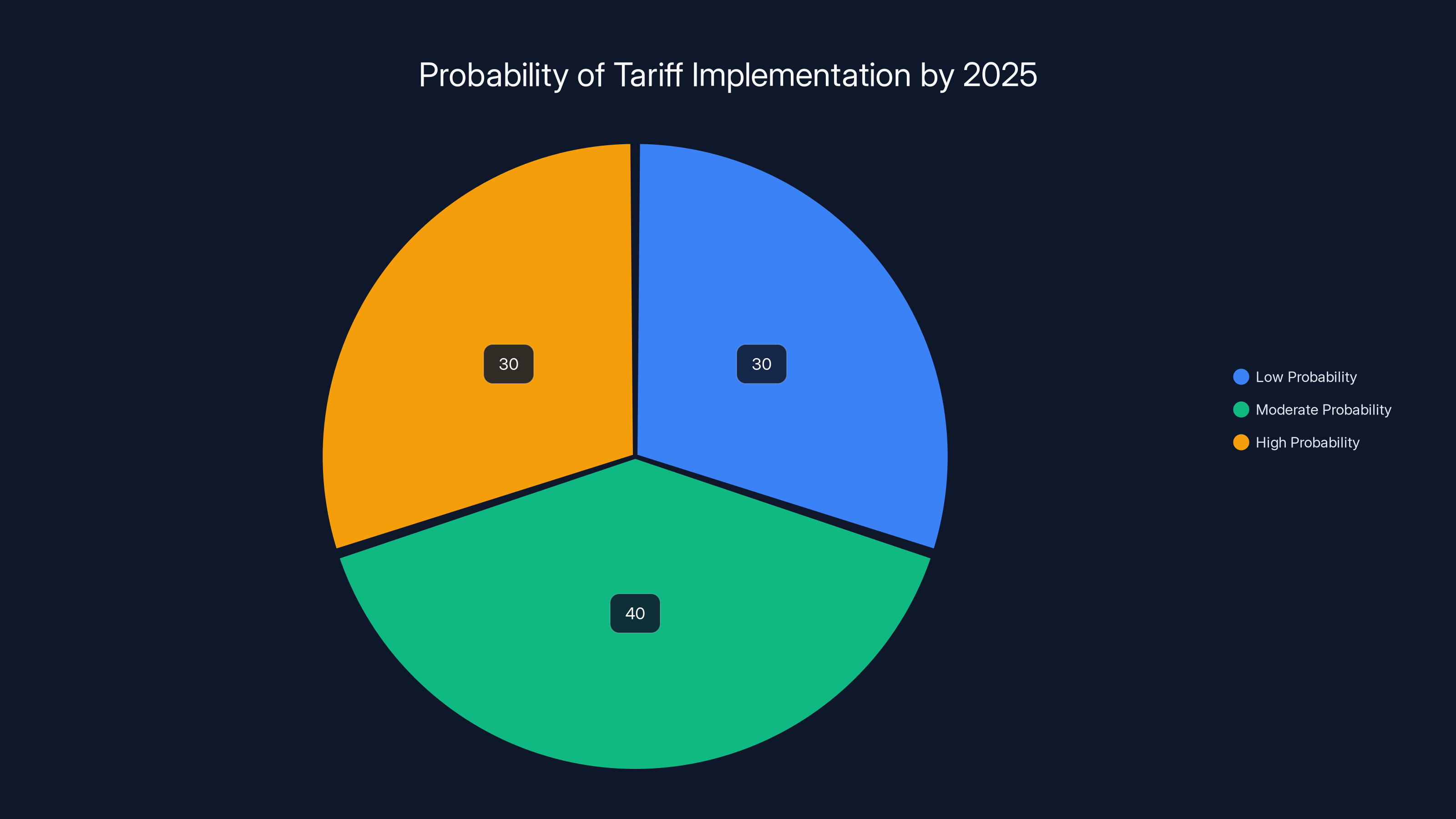

Estimated data suggests a 30-70% probability of some form of tariff implementation by the end of 2025, with moderate probability being the most likely scenario.

Timeline: When Tariffs Might Actually Hit

This is important because timing changes whether you can do anything about it. Let's be specific about what the actual timeline probably looks like.

Q1 2025: This is when new administration policies start rolling out. If tariffs are coming, official announcements and draft proposals would likely appear here. But announcements don't mean immediate implementation. There's usually a comment period where companies and trade groups complain. That process takes weeks.

Q2 2025: If the tariff actually seems likely (not just proposed), that's when prices might start rising in anticipation. Futures markets for memory chips would price in the risk. Retailers might start buying aggressively to build inventory before tariffs hit. Manufacturers would accelerate orders and try to lock in pre-tariff pricing.

Q3 2025: If tariffs actually go into effect (biggest if), that's when real prices jump. Retail pricing would follow within 2-4 weeks. This is when you'd see the 30-50% jumps we've been discussing.

2026 and beyond: This is when any domestic manufacturing expansion might start actually producing chips at scale. Even aggressive timelines put new US fabrication capacity at 2026-2027. Until then, tariffs just mean higher prices with no supply relief.

The wildcard is political pressure. Congress could block tariffs. Courts could challenge them. Trade negotiations could result in exemptions or delayed implementation. The actual timeline might slip left or right by months depending on how these factors play out.

Here's the honest truth though: uncertainty is already baking into the market. Memory chip makers are probably already adjusting production plans and pricing strategies. The damage is happening in slow motion right now. Even if tariffs never actually pass, the disruption they're causing is real.

For you as a consumer, the practical timeline is: act now if you need upgrades (Q4 2024 and early Q1 2025), hold your decision if you can wait (hoping tariffs get blocked or delayed), or delay purchases intentionally (betting that this whole thing falls through and prices come back down).

Obviously, the third option is a gamble. If tariffs don't happen, you've just wasted your time. If they do happen, you've missed the price window. Most risk-averse approach is option one: upgrade now if you need it at all.

Domestic Manufacturing Reality Check

Let's talk about the actual rationale for these tariffs: forcing domestic manufacturing expansion. This is where the policy gets sticky because the reality doesn't match the intent.

Micron is the only significant US memory manufacturer. They have existing facilities in Boise, Idaho and Lehi, Utah. These plants are state-of-the-art but running at maximum capacity. Micron also has joint ventures and partnerships in Taiwan and Singapore. The company isn't short on capacity globally; they're focused on optimizing efficiency and profitability, not expanding volume.

For Micron to significantly increase US production, they'd need to build new fabs. We're talking $10-15 billion per facility. That's an enormous capital commitment that requires confidence in long-term demand and profitability. A tariff creates demand certainty in the US market, sure. But it also creates uncertainty everywhere else because tariffs might trigger retaliatory tariffs, disrupting global trade.

Would the government help fund this? Possibly. The CHIPS Act provides subsidies for semiconductor manufacturing in the US. But it's competitive—companies have to apply and justify the spending. There's no automatic "build in America and get free money" deal.

Here's the bigger problem though: even if Micron started building new US fabs today and fast-tracked construction, you're not getting significant volume until 2027 at the earliest. That's a 2+ year gap where tariffs are in effect but no new supply actually materializes. So the tariff goal of "increasing domestic supply" would actually be harmed by its own implementation.

Also, Samsung and SK Hynix could build US facilities too. Samsung is actually investing in US semiconductor manufacturing, though it's mostly cutting-edge logic chips (for AI/processing), not memory. If you made the tariff attractive enough, Samsung might build DRAM or NAND capacity in the US. But that requires going through the CHIPS Act, needing government approval, long planning cycles, and honestly, Seoul's not thrilled about shifting production to the US.

So the idealistic version of this policy (tariffs force companies to build US manufacturing, we get new jobs and industrial capacity) runs into practical reality really quickly. More likely scenario: tariffs cause prices to spike for 2-3 years, some token new investment happens in US manufacturing, most supply still comes from Asia, and prices gradually stabilize at a higher level once the tariff shock wears off.

For consumers and businesses, that's just pain with no upside.

Projected data shows RAM and SSD prices could increase by 30-50% by mid-2025 due to potential 100% tariffs. Estimated data.

What Actually Happens to Prices

Let me be concrete about this because "prices will go up" is abstract. Let's walk through an actual scenario with real numbers.

Scenario: A 100% tariff on imported memory chips takes effect May 1, 2025. Samsung and SK Hynix both immediately reduce US shipments and raise prices to remaining buyers. Micron's existing capacity gets snapped up quickly. Within 4-6 weeks, retail prices start adjusting.

Before tariff (April 2025 pricing):

- DDR5 8GB stick: $55

- 1TB NVMe SSD: $90

- Typical PC (with 32GB RAM + 1TB SSD): $1,000

After tariff hits (June 2025 pricing):

- DDR5 8GB stick: $80-85 (+45-55%)

- 1TB NVMe SSD: $130-140 (+45-55%)

- Typical PC: $1,150-1,180 (+15-18%)

Notice the PC price doesn't increase 45-55%. It's closer to 15-18%. That's because memory is a portion of total cost, not all of it. Labor, chassis, power supply, motherboard, CPU, cooling, cables—none of that gets hit by a memory tariff.

But wait, let's add a complication. If tariffs also hit other components (which is being discussed), the percentage increases. If they hit:

- CPUs (processors)

- Storage controllers

- Other semiconductor components

Then suddenly the PC price increase could be 25-35%, not 15-18%. Now we're talking real money.

For a high-end gaming PC currently priced at

What about enterprise? A company buying servers with massive storage and memory gets hit harder in absolute dollars. A high-end server might have

The supply/demand dynamics could create even worse scenarios. If prices spike dramatically, companies might hoard inventory, creating artificial shortages that drive prices even higher. Retailers might place larger orders expecting continued increases. That hoarding behavior could disrupt the entire supply chain.

Opposite scenario: Companies delay purchases waiting for prices to stabilize, killing demand temporarily. Chip makers then have less volume to sell but higher per-unit prices. They might actually prefer this to a volume war because margins improve. Eventually, demand picks back up at the new higher price level.

Either way, you're paying more. The question is just how much more and for how long.

Industry Impact by Sector

Memory chip tariffs don't affect the entire tech industry equally. Some sectors get hit harder than others, and understanding the breakdown matters if you work in tech or have investments.

Personal Computing (Desktops & Laptops): This sector is most exposed. PC makers already operate on thin margins (5-15% depending on the manufacturer). A tariff-driven cost increase is impossible to absorb without cutting prices, so they'll pass it to consumers. Expect budget PC prices to jump 15-25%. Gaming PCs and workstations might see smaller percentage increases because they already have fat margins. But overall, this sector suffers.

Smartphones: Phone makers have enormous bargaining power. Apple, Samsung, and Google can negotiate pre-tariff pricing or even secure exemptions. They'll absorb some tariff cost to maintain market position but pass most of it to consumers. Expect flagship phones to jump

Data Centers & Cloud: AWS, Microsoft Azure, Google Cloud all need huge amounts of memory for their infrastructure. A 40-50% increase in chip costs hits them directly. They can't negotiate their way out because even Micron has limited capacity. Cloud pricing likely goes up 5-10% across the board. That ripples through every SaaS company using cloud services.

Gaming Consoles: PS5, Xbox Series X, Nintendo Switch all need memory. New console versions are unlikely in the next 2-3 years, so existing inventory is what matters. But once new generations launch, tariffs could drive up prices significantly. A

Storage (External Drives, USB, SD Cards): Everything needs NAND flash. External hard drive prices will go up 30-40%. USB drives, SD cards, everything with flash memory gets more expensive. These are lower-margin products, so manufacturers pass most of the cost to consumers.

AI Hardware: This is interesting. AI accelerators, GPUs, and training equipment often have custom memory configurations. Tariffs could hit this sector hard because companies can't easily substitute or negotiate around custom memory requirements. This could slow AI infrastructure expansion, which would actually have broader economic impacts.

Semiconductors for Other Uses: Tariffs are specifically targeting "memory" chips (DRAM and NAND), not all semiconductors. Logic chips (processors), analog chips, and specialized semiconductors might not be directly hit. But if the tariff regime expands—which is possible—those get affected too. Companies operating in those spaces are probably paying attention and making contingency plans.

Small electronics companies that rely on cheap commodity chips for products like smart home devices, IoT sensors, and basic consumer electronics get squeezed hard. Their entire margin disappears. Many might just exit the market or raise prices so much that demand collapses.

Estimated data shows significant price increases due to tariffs, with memory products seeing the largest hikes. PCs and laptops experience smaller percentage increases due to diversified component costs.

Global Trade Retaliation Risks

Here's something important that doesn't get enough attention: other countries will retaliate. Tariffs don't exist in a vacuum.

South Korea and Japan export massive amounts of technology to the US. Memory chips are South Korea's most valuable export category. A 100% US tariff doesn't just affect South Korean companies; it affects South Korea's entire economy. You think they'll sit quietly?

Most likely response: retaliatory tariffs on American tech exports. That could hit:

- Intel processors (US company, but manufactured globally)

- Qualcomm chips (US design, Korean manufacturing)

- Microsoft software licenses

- Apple iPhones and devices

- American agricultural products

- American machinery and industrial equipment

Once retaliation starts, it escalates. The US responds to South Korean retaliation. South Korea responds to the US response. Within months, you have a full-blown trade war that disrupts global supply chains.

In a real trade war scenario, everyone loses. Memory chip prices spike. Electronics of all types become more expensive. Companies hedge by buying from multiple suppliers, creating artificial shortages. The entire global supply chain becomes less efficient.

There's also political pressure from allies. Japan, South Korea, and Europe are all US allies. But their economies are deeply integrated with semiconductors. The European Union might even implement tariffs on US goods in solidarity with South Korea. That sounds weird, but trade blocs do work together on retaliatory tariffs.

The Trump administration is probably aware of this and calculating whether the disruption is worth the perceived benefit. Their thinking might be: "Yes, it's painful short-term, but reshoring manufacturing is strategically valuable." Other governments might think: "No, the pain is too much." That's the actual debate happening behind closed doors.

For consumers, retaliation risk means things could get worse than just memory price increases. It could spiral into broader inflation, supply chain disruptions, and economic uncertainty. That's why smart companies are already planning around this.

What Companies Are Actually Doing

If you want to know how serious the tariff threat is, look at what companies are actually doing. Words are cheap; actions matter.

Memory Manufacturers: Samsung, SK Hynix, and Micron are all making strategic adjustments. Samsung is accelerating investment in advanced chip research to maintain technological leadership if tariffs disrupt sales. SK Hynix is quietly exploring expansion of existing US partnerships. Micron is probably expanding its US production planning but cautiously because they don't want to commit billions if tariffs don't actually pass.

PC Makers: Dell, HP, and Lenovo are buying more inventory than normal right now. They're trying to lock in pre-tariff pricing and build supply cushions. If tariffs don't happen, they've overbuilt inventory. If tariffs do happen, they've protected themselves. It's insurance.

Apple: Apple is incredibly protective about supply chain details, but reports suggest they're diversifying suppliers and potentially locking in long-term pricing agreements. Apple has the financial power to outbid competitors for memory, so tariffs might actually help them by hurting smaller competitors harder.

Cloud Companies: AWS, Azure, and Google Cloud are probably consolidating their server designs to use Micron memory preferentially. They're building relationships with Micron's team to secure allocation. They might even negotiate tariff exemptions directly with the government as "critical infrastructure."

Chinese Manufacturers: This is a huge wildcard. Chinese phone makers like Xiaomi, Oppo, and Vivo might gain advantage if they're not hit by retaliatory tariffs and can source from Southeast Asian suppliers more easily. They could actually gain market share from Western brands that get more expensive.

Smaller Tech Companies: Startups and smaller manufacturers are basically helpless. They can't negotiate. They can't build inventory effectively. They can't lock in supply agreements. They're likely just screwed if tariffs pass. Some will raise prices and lose customers. Others will just exit the market.

Government Relations Teams: Every major tech company has expanded their government affairs budgets. They're lobbying. They're trying to secure exemptions, delay implementation, or lobby for subsidies to offset tariff costs. It's a real arms race of influence right now.

The fact that companies are already making contingency plans suggests the tariff threat is genuinely credible in their view. If they thought it was just political theater, they wouldn't invest resources in preparation.

Strategic Buying: Should You Buy Now or Wait?

This is the practical question everyone wants answered. Should you upgrade your PC, buy that new laptop, or replace your phone now before tariffs hit? Or should you wait?

Honest answer: it depends on three things.

First: Do you actually need the upgrade? If your current device works fine, waiting is wise. You might avoid tariffs entirely, and prices will eventually stabilize at whatever the new equilibrium is. But if your device is failing or limiting your work, buy now. The productivity benefit of an upgrade outweighs potential future savings.

Second: What's your timeline confidence? If you believe tariffs are 80%+ likely to happen in Q2 2025, buy now. If you think it's 50/50, it's closer call. If you think tariffs have less than 30% chance, you can probably wait. The math of risk-adjusted pricing depends heavily on your confidence in tariff probability.

Third: What's your financial situation? If money is tight, wait. If you can afford to buy now and absorb the cost, do it. The tariff-driven price increase is real, but it's spread over time. Paying a tiny bit more in Q3 2025 versus paying today is mathematically different than waiting forever.

Here's a rough framework:

Buy Now If:

- You need an upgrade and can afford it

- You're a gamer or professional who benefits from latest specs

- You're buying something that gets outdated quickly (like flagship phones)

- You have high confidence tariffs will pass

Wait If:

- Your current device works fine

- You can afford to wait 6-12 months

- You're skeptical tariffs will actually pass

- You're budget-conscious and price-sensitive

Strategic Alternatives:

- Buy used or refurbished devices now (they avoid tariffs because they're already made)

- Buy international versions of products if you travel (some countries might not have tariffs)

- Consider products with less memory (budget smartphones, basic laptops) that have lower tariff exposure

- Invest in upgradeable components (like external storage) that you can swap rather than buying new systems

One more thing: if you're a business, stop procrastinating. Get a budget approved now for Q1 2025 equipment purchases. Once tariffs hit and prices spike, your procurement process probably breaks because no one budgeted for 40% cost increases. Act now.

Long-Term Industry Restructuring

Beyond the immediate price pain, tariffs could fundamentally restructure the memory chip industry. We're talking multi-year changes that would cascade through the entire tech sector.

Possible Outcome 1: Regionalization of Supply Chains: Instead of a global memory chip market, you get regional markets. US companies source from Micron (or new US manufacturers). European companies source from European/allies. Asia sources from South Korea and Taiwan. This fragmentation is inefficient and expensive, but it might become the new reality.

Possible Outcome 2: Consolidation: Smaller chip makers get squeezed out. Memory becomes a 2-3 player game (Samsung, SK Hynix, maybe Micron if they expand). Consolidation reduces competition and stabilizes prices at higher levels.

Possible Outcome 3: Technology Shift: Companies invest heavily in alternative memory technologies (3D NAND, DDR6, emerging architectures) that don't compete with current tariffs. If tariffs target specific types of memory, companies pivot to different types. This actually could accelerate innovation, though unintentionally.

Possible Outcome 4: American Manufacturing Expansion: If tariffs persist and the government provides subsidies, US memory manufacturing actually does expand significantly by 2027-2028. This would create real manufacturing jobs and increase US tech independence. But it requires sustained tariffs, which means sustained high prices for years. The public might not tolerate that.

Possible Outcome 5: Chinese Dominance: Chinese manufacturers face lower tariff exposure and can source chips from Southeast Asian suppliers. If the policy is poorly designed, it actually helps Chinese companies gain market share. This could backfire on the stated goal of "America first" manufacturing.

Long-term, the structure of the tech industry depends on how this tariff situation plays out. If it's temporary theater, nothing changes. If it's real and sustained, the entire supply chain gets restructured. Companies are probably planning for multiple scenarios right now, hedging their bets.

What You Should Actually Do Right Now

Enough analysis. Here's actionable advice you can implement today.

For Consumers:

-

Assess your needs: Does your device still work? If yes, you can wait. If no, you need to act.

-

Set a timeline: Decide if you can realistically make a purchase in the next 8 weeks. If yes, do it now. If no, you're waiting anyway so no point stressing.

-

Check current prices: Know what things cost today. If you wait, you can compare future prices to today's baseline and make informed decisions.

-

Consider alternatives: Refurbished devices, previous-generation models, and lower-spec options all avoid maximum tariff exposure. You might be happier with a cheaper device anyway.

-

Lock in deals: Black Friday and holiday sales are coming up. Maximum discounts combined with current pricing might be optimal buying window.

For Business Decision-Makers:

-

Get budget approval NOW: Work with finance to approve Q1 2025 capital purchases before tariff implementation. Prices will spike in mid-2025. You want purchasing power locked in before that.

-

Diversify suppliers: Don't rely on single vendor. Having relationships with Micron, Samsung, and SK Hynix gives you flexibility if one gets constrained.

-

Negotiate long-term contracts: Lock in pricing for 12-24 months if possible. Fixed pricing protects against tariff shocks.

-

Plan supply chain buffers: Build larger inventory of critical components. Higher holding costs now might be cheaper than emergency procurement later.

-

Monitor policy changes: Subscribe to US Trade Representative announcements and industry newsletters. You need early warning of actual tariff implementation.

For Everyone:

-

Don't panic-buy: Hoarding components helps no one and makes shortages worse. Buy strategically, not emotionally.

-

Stay informed: This situation is fluid. New information emerges constantly. Understand the basics so you can make good decisions as new facts come out.

-

Expect uncertainty: Whether tariffs happen or not, expect some level of supply chain disruption and price volatility over the next 6-12 months. That's just the reality now.

-

Think long-term: Whatever you buy now will serve you for 3-5 years in most cases. A device you buy now at current prices is probably cheaper over its lifetime than buying post-tariff even if tariffs create initial supply issues and gradual price stability later.

The Bigger Picture: Why This Matters

Here's the thing that's easy to lose in all the price discussion: this tariff threat isn't really about memory chips. It's about industrial policy, trade strategy, and how the US wants to compete in the future.

The US has legitimate concerns about chip manufacturing concentration. Taiwan, South Korea, and Japan collectively control most of the world's production. That's a genuine supply chain risk, especially during geopolitical tensions. If China invades Taiwan, the world's chip supply becomes a crisis. The US wanting to reduce dependence on Asian manufacturing isn't crazy; it's reasonable strategic thinking.

But the execution matters enormously. Using tariffs to force domestic manufacturing is a blunt instrument. It creates pain now for potential benefit years from now. Companies need certainty to invest billions. Tariffs create uncertainty. That's the paradox.

A better approach (theoretically) would be to subsidize domestic manufacturing directly through the CHIPS Act without tariffs. Make it economically rational for companies to build in the US. Give them incentives, not punishment. That's what some policymakers would prefer.

But the current administration apparently believes tariffs are necessary as leverage. They're saying "build here or accept losing the world's largest consumer market." That's credible leverage for a $2 trillion market, but it costs consumers a lot.

This matters because it sets precedent. If memory chip tariffs work, tariff policy becomes the go-to tool for industrial reshaping. That's good for politically connected industries and bad for consumers. It's also probably inflationary across the entire economy.

For tech enthusiasts and workers in the industry, the tariff threat represents a fundamental shift in how supply chains will work. Global optimization is being replaced by regional resilience, even if it's less efficient. That's a permanent structural change with long-term implications.

FAQ

What exactly is a 100% tariff on memory chips?

A 100% tariff means the import tax is equal to the product's base price. So a

Will 100% tariffs actually be implemented?

It's uncertain but credible. The Trump administration has publicly discussed these tariffs as policy. Whether they actually pass depends on political pressure, industry lobbying, court challenges, and trade negotiations. Estimates range from 30-70% probability of some form of tariff implementation by end of 2025.

How long would tariffs stay in place?

If implemented, they could stay for years unless they're negotiated away or repealed by future administrations. Most analysts expect at least 2-3 years if they go into effect. That's enough time for some supply chain restructuring but not enough to completely shift manufacturing.

Can I buy memory chips without tariffs?

Once tariffs are implemented, they apply to all imports into the US. If you're in the US, you're probably paying the tariff directly or indirectly. If you're internationally, you might avoid them if the product isn't shipped through the US. But global markets are interconnected, so tariffs in one region affect prices elsewhere.

Will domestic chip manufacturing actually expand?

Probably, but slowly. Tariffs create incentive, but building fabs takes 4-6 years and costs $10-15 billion. Even aggressive timelines put new meaningful capacity at 2026-2027. So tariff pain comes before supply relief.

Are other countries planning similar tariffs?

EU leadership has mentioned potential reciprocal tariffs but haven't committed. China has extensive tariff threats in response to US actions. India and others are watching. A full trade war scenario is possible but not certain.

What about used devices or imports from other countries?

Used devices manufactured before tariffs are unaffected by new tariffs. Importing from other countries might avoid some tariffs, but international shipping becomes expensive and complicated. It's not a practical workaround for most consumers.

Will memory prices ever come back down after tariffs?

Yes, eventually. But the new price level might be permanently higher because the tariff changes the economics permanently. Expect prices to spike 40-50% short-term, potentially stabilize at 20-30% higher long-term, and only drop back to pre-tariff levels if tariffs are removed and supply increases significantly.

Should I upgrade my device now or wait?

Depends on whether you actually need it. If your device works fine, waiting is less risky. If it's failing or limiting your work, buying now avoids paying tariff-inflated prices. Timeline confidence in tariff probability should influence your decision.

How will tariffs affect cloud services like AWS and Azure?

Cloud providers will pay higher costs for memory and storage hardware. They'll likely raise prices for cloud services across the board. That ripples through every company using cloud services, so indirect impact is broad.

Final Word

Memory chip tariffs represent a genuine economic risk, not just speculative fear. The threat is real, the probability is meaningful, and the impact would be significant. But it's not catastrophic and it's not inevitable.

The most likely outcome is that tariffs get implemented in some form in mid-2025, prices spike 30-50% for memory and storage, that pain gradually distributes through PC and device pricing by late 2025, and then things stabilize at a new higher price level while some domestic manufacturing capacity starts coming online in 2026-2027.

That's bad for consumers, fine for profitable companies with negotiating power, and rough for smaller manufacturers. But it's manageable if you understand it and plan accordingly.

If you need upgrades, do it now or very early Q1 2025. If you don't need upgrades, you can wait comfortably. Either way, understand the situation, make informed decisions, and stop worrying. Tariff policy is set by people who are also guessing about outcomes.

What matters is that you make decisions based on your actual needs and your actual financial situation, not on panic or speculation. The rest will work itself out, and $50-100 price differences won't matter as much in retrospect as whether you made a rational decision with the information available to you.

That's the real takeaway: stay informed, stay rational, act when you have good reason to act, and don't lose sleep over tariff policy you can't control.

Key Takeaways

- US government considering 100% tariffs on memory chips as leverage to force domestic manufacturing by 2025-2026

- Memory chip tariffs could raise RAM prices 30-50% and SSD prices 40-50%, impacting every consumer PC and phone

- South Korea's Samsung and SK Hynix dominate memory production with 47% combined market share; US Micron has only 8% capacity

- Budget PC builders, laptop buyers, and cloud infrastructure face highest economic impact from tariff implementation

- Domestic manufacturing cannot scale fast enough to replace imports during tariff period; expect 2-3 year price premium before new capacity comes online

Related Articles

- Micron's AI Memory Pivot: What It Means for Consumers and PC Builders [2025]

- Taiwan's $250B US Semiconductor Investment: What It Means [2026]

- US 25% Tariff on Nvidia H200 AI Chips to China [2025]

- Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]

- Nvidia RTX 5000 GPU Shortage & RAM Crisis Explained [2025]

- PC Prices Set to Soar in 2026: RAM Shortage & AI Demand Explained [2025]

![Memory Chip Tariffs 2025: How 100% Duties Will Hit Your PC & Phone [2025]](https://tryrunable.com/blog/memory-chip-tariffs-2025-how-100-duties-will-hit-your-pc-pho/image-1-1768936403320.png)