Understanding the Historic US Tariff on Advanced AI Semiconductors

In January 2025, the Trump administration formalized what many in the tech industry saw coming from miles away: a 25% tariff on advanced AI semiconductors bound for China. The move wasn't a surprise to anyone following the political winds, but its implications for global chip manufacturing, artificial intelligence development, and US-China relations run deeper than the headline numbers suggest.

Let's be clear about what actually happened. President Trump signed a proclamation imposing a quarter tariff on certain semiconductors—specifically advanced AI chips like Nvidia's H200—that are manufactured outside the United States and then pass through US territory before being exported to customers elsewhere. This is a targeted play. It's not a blanket ban. It's not a complete shutdown of semiconductor sales to China. It's a tax on the transaction, collected when chips leave American soil.

For Nvidia, the timing created an unusual situation. The company had just received approval from the Department of Commerce in December 2024 to begin selling H200 chips to vetted customers in China. Then, weeks later, a tariff landed on those exact chips. On the surface, this looks contradictory. Why approve sales and then tax them? The answer reveals something interesting about how modern US policy actually works: it's about control and calibration, not prohibition.

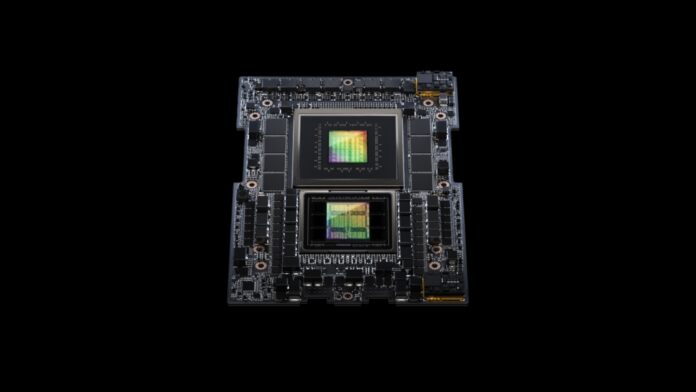

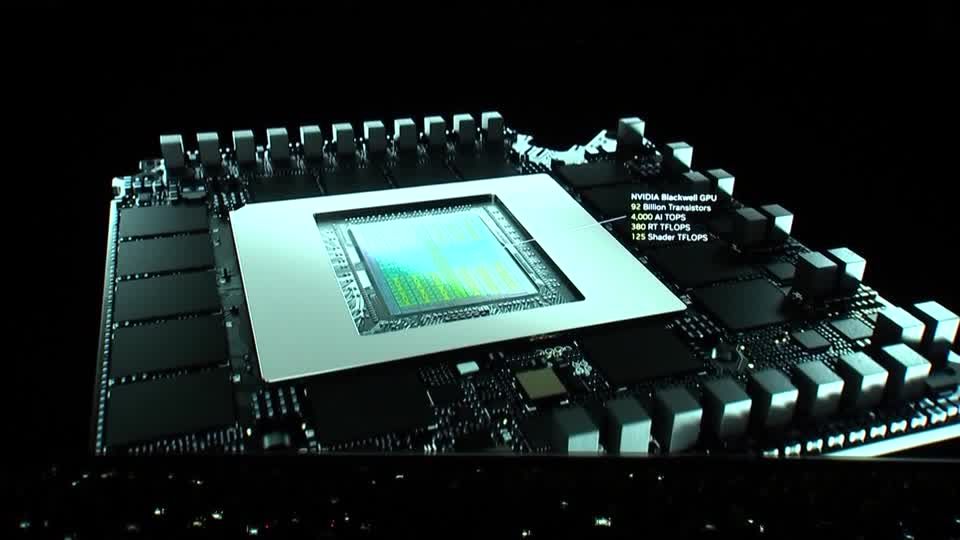

The H200 isn't just another chip. It's one of the most powerful AI accelerators ever manufactured. Each unit can perform massive computations needed for training large language models, running complex simulations, and processing enormous datasets. For Chinese companies racing to build domestic AI capabilities, access to these chips represents a competitive lifeline. Block them completely, and you push China toward accelerating its own chip development. Tax them, and you create friction while still allowing some commerce.

Nvidia's public response was telling. The company didn't complain. Instead, an official spokesperson said the company "applauds" the decision because it "allows America's chip industry to compete to support high-paying jobs and manufacturing in America." This framing matters. Nvidia isn't fighting the tariff; it's embracing the broader narrative about American chip manufacturing and competitiveness. Translation: the company understands the political reality and is positioning itself as part of the solution, not the problem.

But here's where things get complicated. Demand for H200s is already crushing Nvidia's production capacity. Chinese companies were reportedly rushing to place orders before any restrictions tightened. A 25% tariff doesn't kill that demand. It just makes the chips more expensive for Chinese buyers. And when you're talking about cutting-edge AI infrastructure that costs millions per deployment, a 25% premium might be irritating, but it won't stop decision-making at major corporations and research institutions.

The real story here isn't about Nvidia specifically. It's about America's relationship with its own semiconductor supply chain, the global competition for AI dominance, and the mechanics of modern trade policy.

The Strategic Context Behind the Tariff Decision

Tariffs don't happen in a vacuum. This move was years in the making, rooted in a fundamental recognition that US economic and national security depend on advanced semiconductor manufacturing staying competitive and accessible.

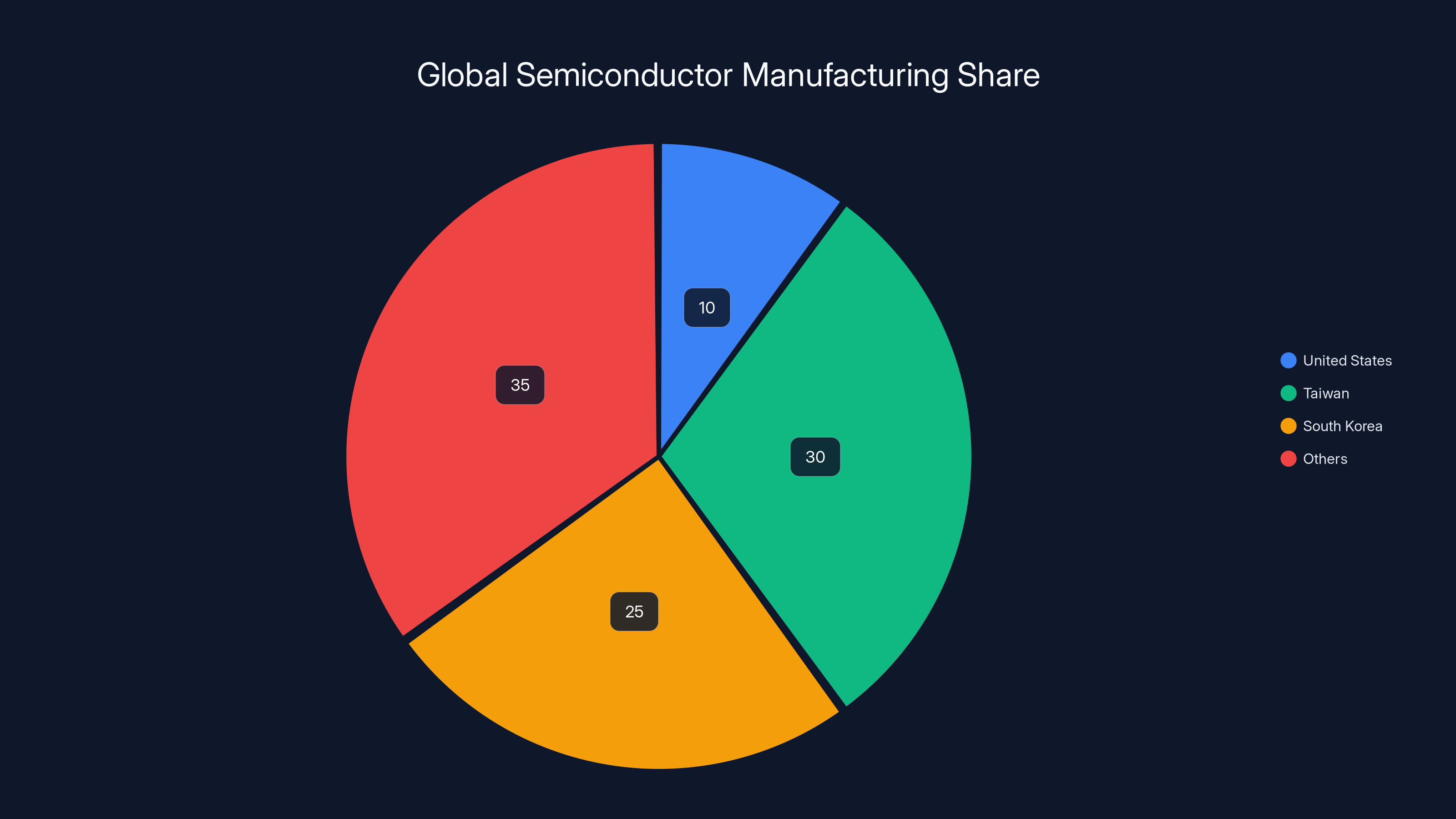

Consider the starting point: the United States currently manufactures only about 10% of the semiconductor chips it actually needs. That's a staggering dependency on foreign supply chains. Taiwan manufactures the most advanced chips. South Korea produces memory chips at scale. The US? The US designs chips brilliantly and handles cutting-edge fabrication in places like Arizona, but the base capacity isn't there. That vulnerability became crystal clear during the global chip shortage of 2021-2023, when supply chain disruptions cascaded through every industry from automobiles to consumer electronics.

That's where the Infrastructure Investment and Jobs Act came in. In 2021, Congress allocated $52 billion specifically to incentivize semiconductor manufacturing inside the United States. The goal was explicit: bring chip production home, reduce dependency on foreign suppliers, and ensure US companies have reliable access to advanced semiconductors. The CHIPS Act worked. Companies like Intel, Samsung, and TSMC committed billions to building fabs in the US. But there's a catch that politicians don't always emphasize: these plants take years to build and even longer to reach full capacity. Meanwhile, demand for advanced chips—especially AI chips—is exploding globally.

The tariff on H200s heading to China isn't just about China. It's about protecting the US semiconductor ecosystem during a vulnerable transition period. The argument goes like this: if Chinese companies can easily and cheaply buy the world's most advanced AI chips from Nvidia, they won't invest as heavily in building their own. If they don't invest in building their own, they'll eventually become more dependent on imports. That dependency could theoretically give the US leverage. But if they do invest and eventually succeed, they'll have world-class AI capabilities independent of US companies.

It's a lose-lose calculation for US policymakers. Block the sales entirely, and you accelerate Chinese domestic chip development out of necessity. Allow unlimited sales, and you're enabling potential competitors to build AI capabilities faster. Tax the sales, and you create a middle path: some commerce continues, American manufacturing gets protected, and the friction of the tariff incentivizes Chinese investment in domestic alternatives while still being survivable economically.

The other chips included in the tariff—like AMD's MI325X—tell us this isn't just about Nvidia. The proclamation targets a category: advanced AI semiconductors manufactured outside the US and destined for re-export. That means any company producing these chips outside America would face the same 25% tax when shipping through US territory to China. This is intentional. It's saying to the entire global semiconductor industry: if you want to profit from the US market and US design ecosystem, you need to start manufacturing here.

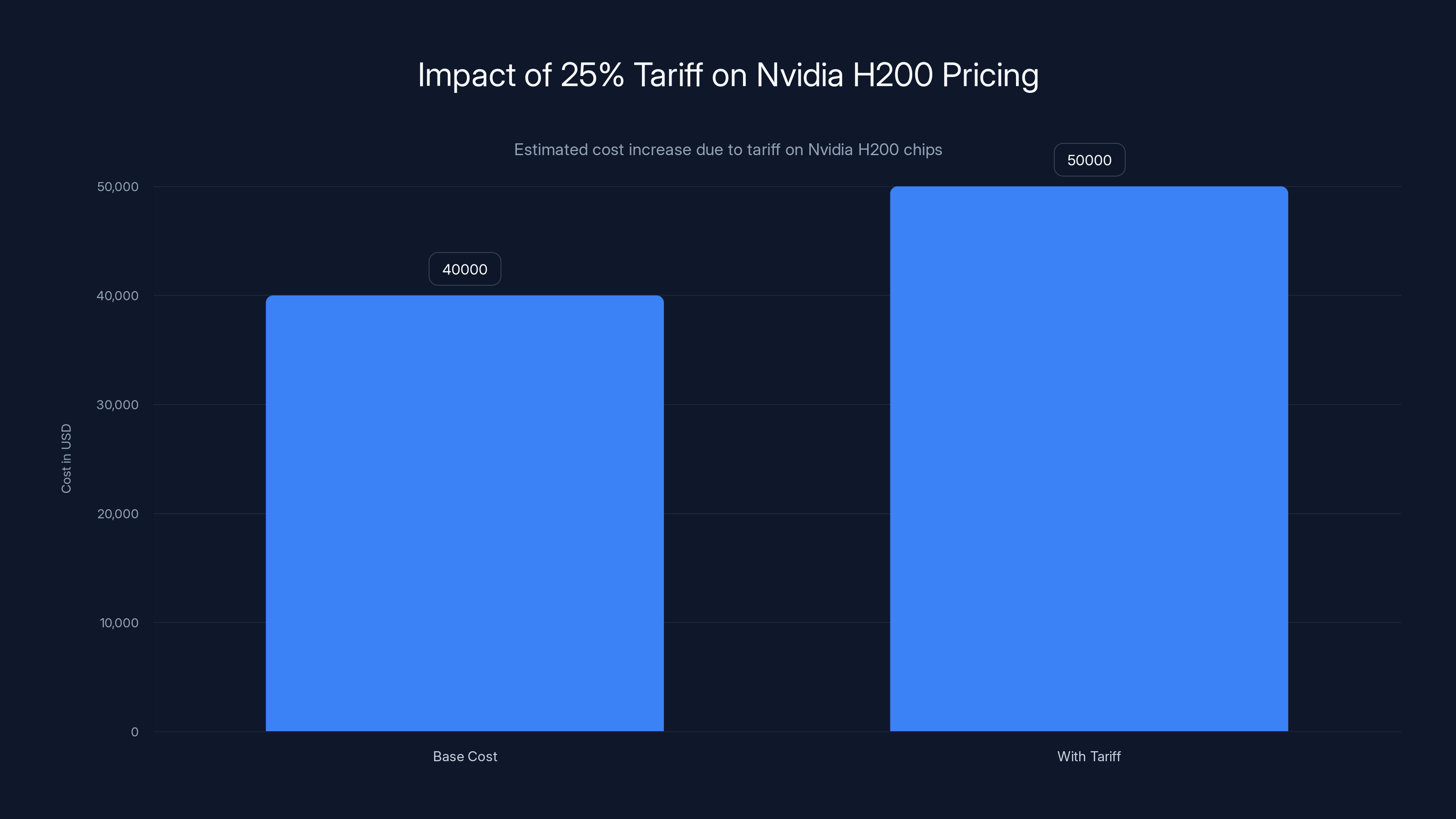

The 25% tariff increases the cost of an Nvidia H200 unit from

How the 25% Tariff Actually Works in Practice

Understanding how a tariff actually functions in the modern supply chain is more interesting than it sounds, because it reveals why Nvidia wasn't devastated by this news.

First, the mechanics. A tariff is a tax levied on goods crossing a border. In this case, when Nvidia ships H200s from its manufacturing partner (currently Samsung in South Korea) through US ports or distribution centers before they reach Chinese customers, the 25% tariff applies. The tariff is calculated on the value of the chips at the time of export.

Who pays it? Technically, the exporter—in this case, Nvidia or whoever's handling logistics. But economically, that cost gets priced into the customer's bill. Chinese companies buying H200s through vetted channels (approved by the Department of Commerce) will pay 25% more than they would if the tariff didn't exist.

Now here's the practical part. That 25% increases the cost of an H200 system significantly. An H200 costs roughly

But demand is already so strong that Chinese companies are willing to absorb it. One report suggested Nvidia was considering ramping up production specifically because of early orders from Chinese companies hoping to beat the tariff. That tells you something important: the tariff affects pricing and margins, but it doesn't kill the market. It just makes it more expensive.

There's also the question of how the tariff is enforced. The proclamation specifically exempts chips imported into the US for research, defense, or commercial use within America. So if a US company like Google or Microsoft wants to buy H200s for their own data centers, they're not paying the tariff. That exemption is important because it protects US companies' ability to access the latest chips without the tax friction applied to exports.

Another wrinkle: chips manufactured in the US are completely exempt. If Nvidia could manufacture H200s domestically at scale, those chips exported to China would face no tariff at all. This creates a direct incentive. Build US fabs, avoid the tariff. The economics might not work out immediately, but the policy nudges in that direction. It's industrial policy disguised as trade policy.

The tariff also only applies to semiconductors actually destined for China. If a chip goes through US ports but is ultimately bound for Europe or Japan or Southeast Asia, no tariff applies. That's a critical detail because it prevents companies from finding creative workarounds by rerouting shipments. The customs code for the destination matters.

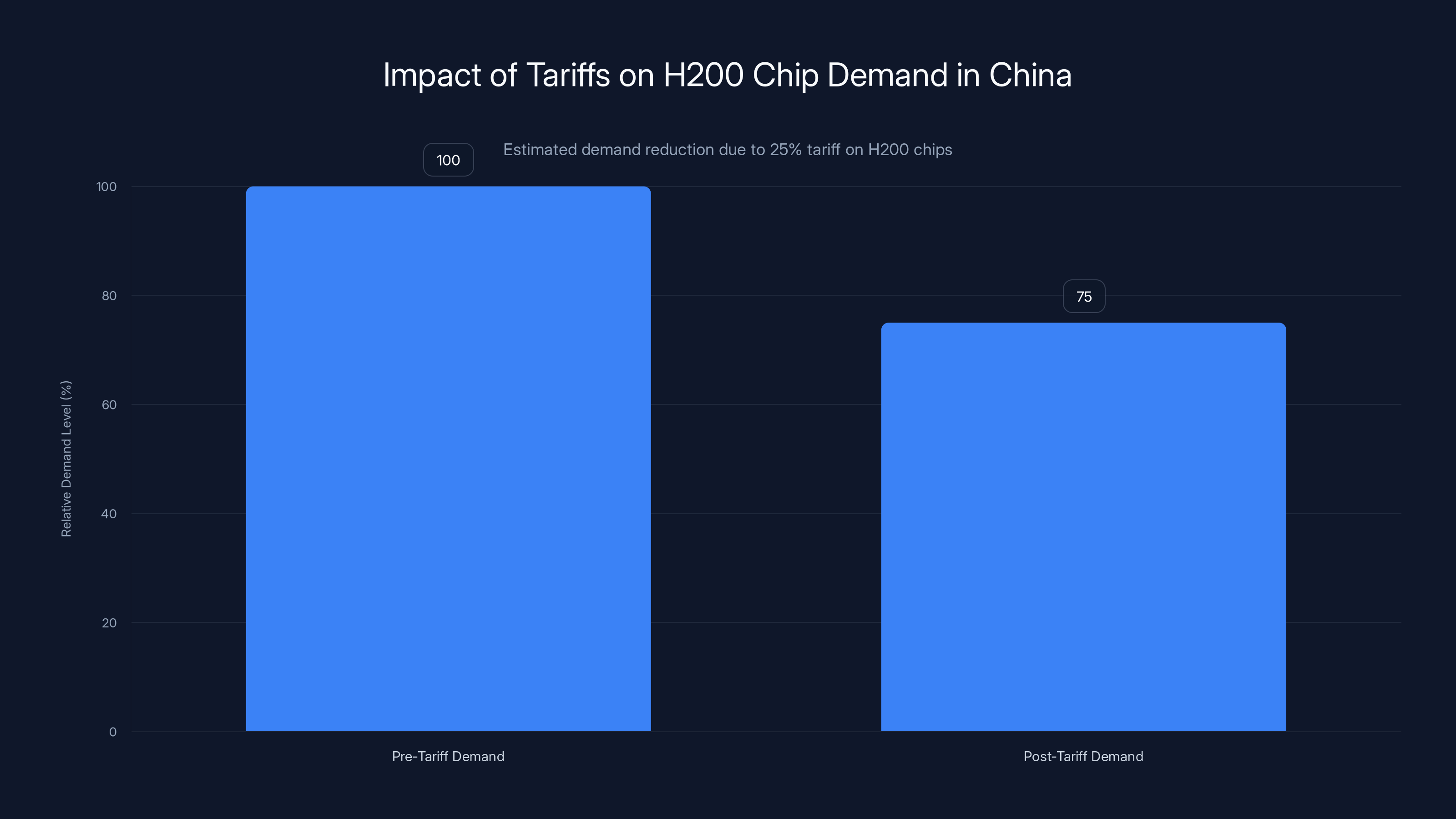

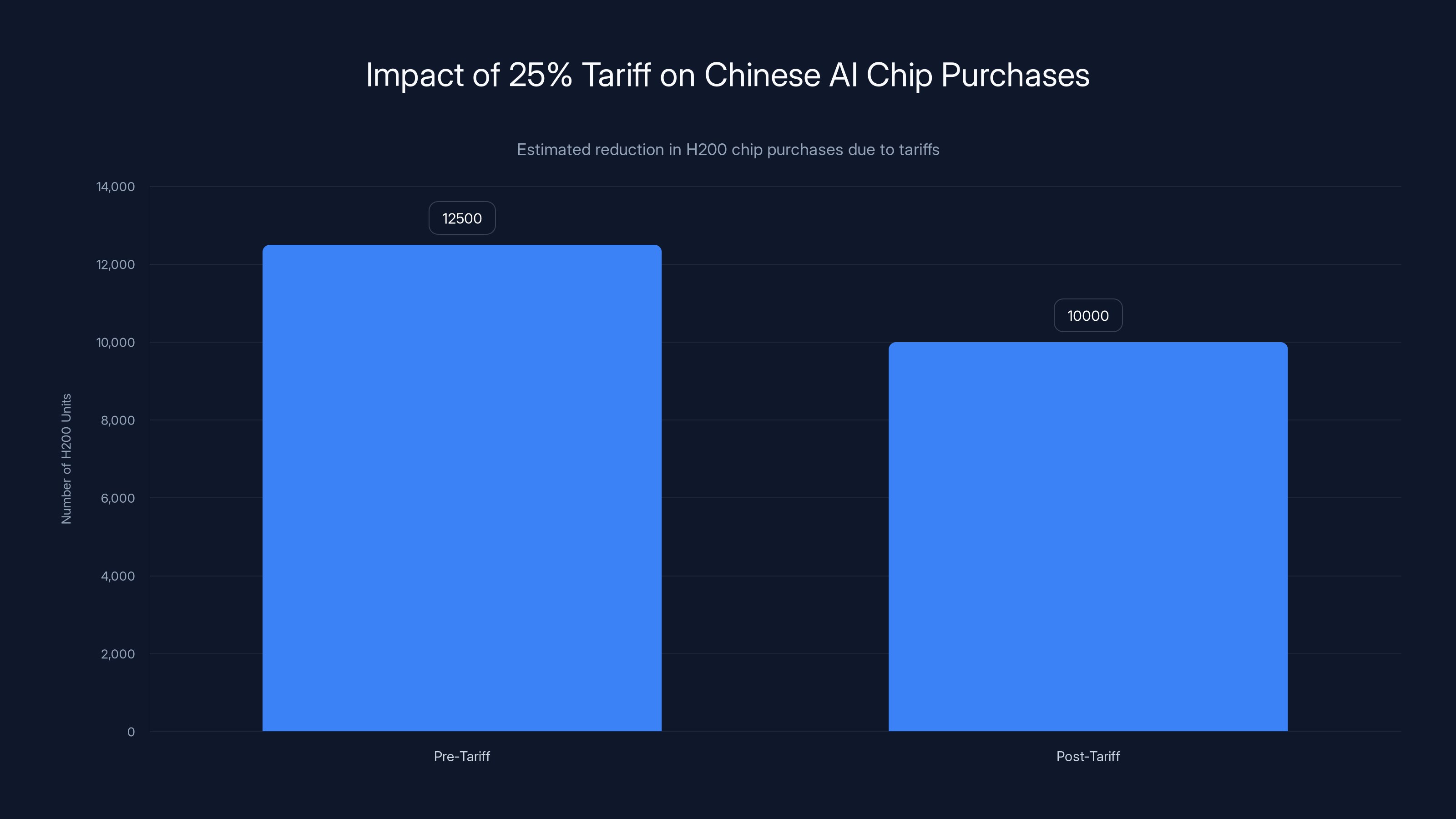

Estimated data suggests that a 25% tariff might reduce demand for H200 chips by 20-30%, but not eliminate it entirely, as Chinese companies prioritize capability over cost.

The Nvidia Paradox: Why the Company Cheered Its Own Tariff

When a major company celebrates a tariff that directly affects its products, something interesting is happening below the surface. Nvidia's response—genuine praise for the Trump administration's decision—wasn't just corporate diplomacy. It reflected real strategic thinking.

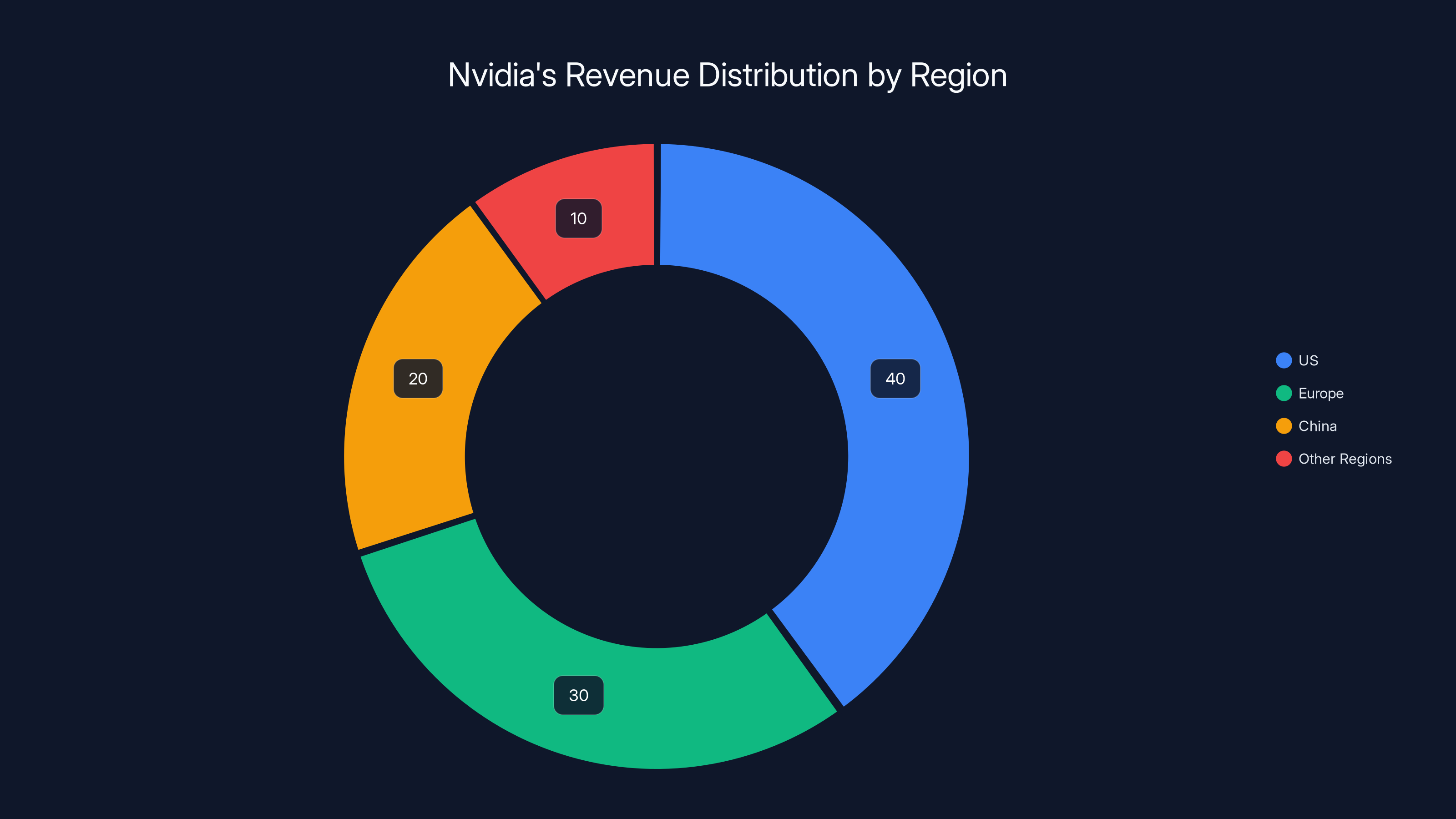

Here's the calculation from Nvidia's perspective. The company sells AI chips globally. China is a major market, but it's not the only market. In fact, most of Nvidia's revenue comes from the US, Europe, and other regions where companies and governments are aggressively investing in AI infrastructure. The US government itself is a massive customer. Biden administration infrastructure spending included billions allocated for AI and computing resources, and that trend is accelerating under Trump.

Nvidia also understands something fundamental about competition. The most dangerous competitor isn't China right now—it's AMD. AMD's MI325X is directly competing with H200s in the market for advanced AI accelerators. If Nvidia fights tariffs and is perceived as trying to help Chinese AI companies, it might face political backlash in the US and Europe. Political backlash translates to government contracts lost, research partnerships abandoned, and regulatory scrutiny.

Instead, Nvidia positioned itself as the American company. The company cooperated with government restrictions. It praised the tariff as good for American manufacturing. It emphasized that it works with vetted Chinese customers only, implying it's doing the work the government wants. The result? Nvidia gained political credibility while maintaining access to the high-value Chinese market—just at higher prices and lower volumes.

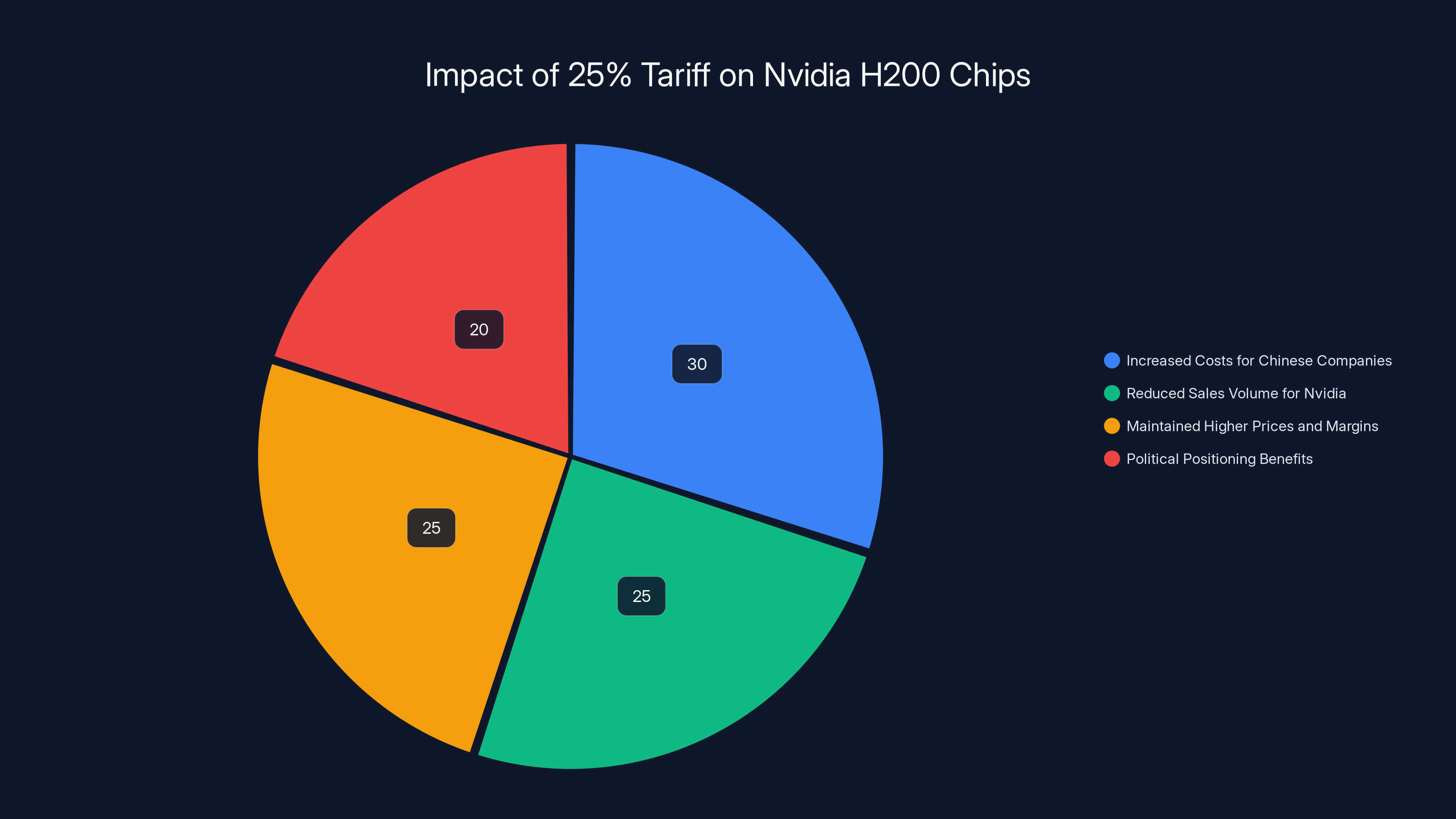

There's also a volume-versus-margin question. The 25% tariff increases chip prices but likely reduces the number of chips Chinese companies will buy. Fewer units sold at higher margin might generate similar revenue to more units at lower margin. Nvidia's manufacturing capacity is already constrained. If demand exceeds supply anyway, Nvidia prefers selling fewer chips at higher prices with better margins. The tariff helps create that scenario.

Beyond the immediate economics, the tariff creates another advantage: it slows down Chinese AI companies' ability to train massive models. Every dollar a Chinese company spends on tariffs is a dollar not spent on expanding data centers or training new models. Over time, that friction accumulates. If Chinese companies can only afford to buy half the chips they'd ideally want, their AI development slows compared to what it might have been. That's a win for US companies trying to maintain dominance in AI research and deployment.

Nvidia's public stance also pre-empts future political pressure. By praising the tariff now, the company makes it harder for politicians to later demand even harsher restrictions. The message is clear: Nvidia is already aligned with national security concerns. Pushing for stricter measures would just harm an American company that's already cooperating.

It's a sophisticated play, and it reveals how modern trade policy actually works at the company level. When you're powerful enough, you can almost shape the policy environment to your advantage while appearing to submit to government authority.

The Demand Realities: Why Chinese Companies Will Still Buy

Tariffs only matter if they actually suppress demand. In the case of H200s destined for China, the evidence suggests they won't—at least not substantially.

The context is crucial. Chinese AI companies are in a race. Every quarter without access to the latest chips is a quarter their American and European competitors are pulling further ahead. Open AI, Anthropic, Google, Microsoft—these companies have uninterrupted access to the most advanced Nvidia chips at competitive prices. They're training massive models, launching new products, and establishing market dominance in AI applications.

Chinese companies can't do that if they're locked out of advanced chips. They have a few options: wait for domestic alternatives (which exist but lag behind Nvidia in raw performance), buy older chips (which are available but less capable), or pay the tariff and buy the latest technology. For any serious AI company in China, paying a 25% premium beats waiting years for a domestic chip that might never reach the performance level of an H200.

Demand for H200s specifically is crushing. Nvidia was reportedly considering increasing production runs because of early order rushes from China. That's not hypothetical. That's actual data showing customers were lining up to buy before tariffs took effect. Would a 25% price increase eliminate that demand entirely? Almost certainly not. It might reduce it by 20-30%, but it's unlikely to drop to zero.

The companies buying these chips aren't price-sensitive in the way a consumer might be. A Chinese data center operator considering building an AI infrastructure investment worth billions is making decisions based on capability, not the absolute dollar amount. If an H200 is 30% more capable than the next-best alternative, and you're spending $500 million on infrastructure, a 25% tariff-driven price increase is a relevant cost factor, but it's not a deal-killer.

There's also timing to consider. Chinese companies that buy now—with the tariff already applied—lock in their orders. If they wait, they're gambling that tariffs might go down or that domestic alternatives might suddenly become viable. That's risky in an environment where the US government is clearly moving toward more restrictions, not fewer. The rational move for a risk-averse company is to buy now and absorb the cost.

One more demand factor: the "approved customer" list maintained by the Department of Commerce. Not every Chinese company can buy H200s. Only vetted customers can make purchases through official channels. This creates a scarcity dynamic. The smaller the approved buyer pool, the more intense competition is among those approved buyers to secure chips. That concentration of demand among fewer competitors actually increases the likelihood that approved buyers will pay the tariff rather than go without.

The 25% tariff reduces the number of H200 chips that can be purchased within a $500 million budget from 12,500 to 10,000 units. Estimated data.

China's Response and the Emerging Regulatory Framework

China doesn't just absorb American tariffs passively. The Chinese government is actively strategizing how to respond, and those responses will shape the entire global semiconductor landscape over the next few years.

According to reporting from regional sources, the Chinese central government is drafting new rules and guidelines for how much foreign semiconductor equipment domestic companies can purchase. This is novel. Historically, China had adversity toward chip imports—meaning it restricted them. Now, the government is apparently considering allowing more imports under a controlled system. That's a shift.

The logic is pragmatic. China wants to boost domestic semiconductor manufacturing, but not so aggressively that it cripples domestic AI development in the meantime. Chinese companies need access to advanced chips to train models and build AI products. If those companies can't access advanced chips, they fall further behind global competitors. The government faces a balancing act: encourage domestic chip development while allowing some foreign chip imports to maintain competitiveness.

A regulated import system might look like this: Chinese companies can import foreign AI chips up to a certain threshold, but need government approval for larger purchases. This allows some access to advanced technology while limiting the total quantity flowing into the country. It also gives the government visibility into what Chinese companies are building and what their compute needs actually are.

That regulatory framework matters for Nvidia and other chip makers because it introduces another layer of friction beyond US tariffs. You're not just paying the American tariff. You're also navigating Chinese import regulations that might require government approval, delay shipments, or cap total purchasing volume. For Nvidia customers in China, the effective constraint isn't just the price increase from tariffs—it's also regulatory uncertainty.

China is also accelerating investment in domestic alternatives. Huawei's Half Toone chips, Alibaba's custom accelerators, and various smaller efforts are progressing. None of them match H200 performance yet, but the gap is narrowing. A government that's simultaneously allowing some foreign chip imports while investing billions in domestic alternatives is hedging its bets. If the domestic chips succeed, great—dependency on foreign suppliers decreases. If they don't, the country still has some access to advanced technology.

There's also the geopolitical leverage angle. When China allows AI chip imports under a regulatory system, it creates a dependency relationship. US policymakers become concerned that tightening restrictions will hurt American companies' revenue and China's government becomes concerned that tightening restrictions will hurt American companies' leverage over China. It's the classic dynamic of trade creating mutual interests.

The question is whether that mutual interest survives the broader US-China competition for AI dominance. So far, the answer seems to be yes, but with conditions. The US allows sales to vetted customers through specific channels. China allows imports under government oversight. Both countries maintain the ability to tighten restrictions if political conditions change.

Global Supply Chain Implications and Manufacturing Shifts

A tariff on semiconductors doesn't just affect the immediate transaction between a chip maker and a Chinese customer. It ripples through the entire global supply chain, affecting where chips are manufactured, how they're transported, and where companies decide to invest in future capacity.

Currently, most advanced semiconductors—including Nvidia's chips—are manufactured in Taiwan or South Korea. TSMC in Taiwan manufactures Nvidia chips. Samsung in South Korea does as well. Nvidia, like most fabless chip design companies, doesn't own manufacturing facilities. It licenses production capacity from foundries.

The H200-specific tariff creates an incentive for Nvidia to explore alternative manufacturing locations. What if Nvidia negotiated with TSMC's Arizona fab or worked with other US-based manufacturers to produce H200s on American soil? If manufacturing happened in the US, the tariff would disappear. That's the policy intent.

But there's a timing problem. Building or expanding fab capacity takes years. TSMC's Arizona facility is under construction and won't reach full volume production until 2026 or later. Intel is building new fabs in multiple states but faces technology challenges. Samsung is building a plant in Texas but is similarly years away from full production. The infrastructure to manufacture advanced chips domestically at scale doesn't exist yet. It's being built, but it's not ready.

In the meantime, the tariff creates a temporary advantage for any chip maker who can access non-US manufacturing capacity that isn't subject to the tariff. AMD, for instance, manufactures MI325X chips through different foundry partners. Depending on the routing and specific manufacturing location, they might face different tariff treatment. That complexity is actually a problem because it means the tariff might not achieve its stated goal of incentivizing US manufacturing—it might instead just create incentives for clever supply chain rerouting.

The broader implication is that US policy is pushing the global semiconductor industry toward more geographically diversified manufacturing. Companies are being incentivized to build capacity in multiple countries to avoid concentrating production in locations that might face future tariffs. That's actually good for resilience in some ways—no single geopolitical event can cut off global chip supply if manufacturing is distributed. But it's also more expensive and less efficient than concentrated manufacturing.

For companies already planning fab expansions, tariffs don't change the decision much—those decisions are based on long-term trends. But for companies on the fence about where to locate new capacity, tariffs tip the scale toward the US. Over the next decade, expect more semiconductor manufacturing capacity in America. How much more, and whether it'll be enough to meet domestic demand, is an open question.

The 25% tariff on Nvidia H200 chips affects various stakeholders differently, with increased costs for Chinese companies and reduced sales volume for Nvidia being the most significant impacts. Estimated data.

National Security Arguments Underlying the Tariff

The Trump administration's proclamation explicitly tied the tariff to national security. The language in the official proclamation stated clearly: "The United States currently fully manufactures only approximately 10% of the chips it requires, making it heavily reliant on foreign supply chains. This dependence on foreign supply chains is a significant economic and national security risk."

That's not hyperbole. It's a real concern that's been building for years. During the COVID-19 pandemic and the subsequent supply chain crisis, it became painfully obvious how vulnerable advanced economies are when they depend on other countries for critical infrastructure components. Semiconductors are the foundation of modern military technology, communication systems, financial infrastructure, and pretty much every other critical system.

If a major geopolitical event disrupted TSMC's production in Taiwan, the global economic impact would be catastrophic. Every company depending on chips from TSMC would face constraints. That includes US defense contractors, tech companies, and critical infrastructure operators. From a national security perspective, that level of dependency is unacceptable.

The solution isn't to achieve complete self-sufficiency—that's economically impractical. The solution is to diversify sources and maintain enough domestic capacity to handle crisis situations. That's what the CHIPS Act and policies like this tariff are trying to accomplish.

The specific focus on chips destined for China adds another security layer. Advanced AI chips can accelerate military AI applications. They can improve surveillance systems, enable better command and control systems, and accelerate weapons development. If China has unrestricted access to the world's most advanced chips, it can build AI capabilities faster. That's a strategic problem from the US perspective.

The tariff is calculated to be restrictive enough to slow Chinese AI development without cutting it off entirely. Complete restriction would risk triggering Chinese retaliation against US companies or accelerating Chinese efforts to achieve chip independence. A managed friction approach—allowing some sales at higher cost—is more strategically sophisticated.

National security also plays into the "approved customers" framework. Not every Chinese company can buy H200s. Only companies vetted by the Department of Commerce can make purchases. That vetting process includes assessing whether the customer might divert chips toward military or surveillance applications. The theory is that approved customers are unlikely to do that. In practice, verifying who actually uses imported chips after delivery is nearly impossible, but the framework at least creates a procedural speed bump.

The Competitive Dynamics with AMD and Other Chip Makers

While Nvidia dominates the market for AI accelerators, it's not completely uncontested. AMD's MI325X chips are the closest competitor. The 25% tariff applies to AMD chips too, which might seem like a wash—everyone faces the same tariff. But competitive dynamics are more nuanced.

Nvidia has market momentum. The company got to market with advanced AI chips first. Every major cloud provider and many enterprises already have infrastructure built around Nvidia chips. Switching to AMD chips requires rewriting software, retesting infrastructure, and often replacing physical hardware. That switching cost is substantial.

The tariff actually benefits Nvidia relative to AMD in some ways. Nvidia's strong market position means it can pass the tariff cost to customers more easily. AMD, trying to gain market share, might absorb more of the tariff cost to stay competitive on pricing. That hurts AMD's margins while Nvidia maintains profitability.

For Chinese customers specifically, they've already been dealing with US restrictions on Nvidia chips for years. Intel's latest generation chips faced similar restrictions. Chinese companies have learned to work around restrictions through approved channels or by developing alternatives. AMD chips facing the same tariff aren't necessarily more attractive—they're just another restricted option.

Other chip makers—Intel, smaller fabless design companies, startups building specialized AI chips—are watching closely. The tariff framework signals that the US government is willing to use trade policy to shape semiconductor markets. Companies have to factor that into their manufacturing location decisions.

One interesting wrinkle: companies that can route manufacturing through countries not named China and not facing tariffs might gain advantage. If a company manufactures AI chips in, say, Taiwan or South Korea but ships them to a non-China destination, no tariff applies. That creates complexity in global competition because the tariff's impact depends on destination country, not just the chip's capabilities.

Estimated data shows Nvidia's major revenue comes from the US and Europe, with China being a significant but smaller market.

The Role of Department of Commerce in Vetting and Approval

Implementing a tariff requires government machinery, but implementing selective tariffs—taxing some sales to some customers but not others—requires even more complex bureaucracy. The Department of Commerce became the gatekeeper for which Chinese companies can access H200s.

The vetting process isn't public, so we don't know exactly what criteria the Commerce Department uses to approve customers. In theory, it's assessing whether a customer might divert chips toward prohibited applications like military use or surveillance. In practice, that assessment is difficult to make with certainty.

What we do know is that Nvidia worked with the Commerce Department to identify approved customers before chips started shipping in December 2024. That coordination tells us something important: the tariff wasn't a surprise to Nvidia. The company expected some form of restriction. The Commerce Department worked with the company to structure a framework that allows some sales while maintaining control.

The vetting system also creates ongoing dependencies. Chinese companies approved to buy chips gain competitive advantages over companies that aren't approved. That creates incentives for unapproved companies to work with the government to get on the approved list. It's a form of leverage. Want access to US technology? Play along with the government's strategic vision.

Over time, the Commerce Department's role will likely expand. If restrictions tighten, they'll be the agency implementing those tightening measures. If restrictions loosen, the Department will likely be involved in that negotiation. The department has become a key player in US semiconductor geopolitics.

One concern with this approach is that it creates uncertainty for customers. A Chinese company approved today might face restrictions tomorrow if political conditions change. That uncertainty makes planning difficult. Companies can't confidently forecast their chip supply chains when government approval could be revoked. The Commerce Department maintains significant discretion, and that discretion creates risk.

Foreigners also can't be certain that approved status is permanent. The original announcement in December 2024 that the Commerce Department would allow H200 sales to vetted customers seemed like a permanent change in policy. Then the tariff arrived weeks later. Now, Chinese companies have to assume that further restrictions might come with little notice. That uncertainty is actually part of the policy design—it discourages reliance on foreign chips by making that reliance feel unstable.

Economic Impact Modeling: Cost to Chinese AI Development

Let's get specific about what the 25% tariff actually costs the Chinese AI industry in aggregate terms.

Estimating the total value of H200 imports to China is difficult without official trade data, but we can make educated guesses. If major Chinese AI companies and cloud providers each order thousands of H200s—and there's evidence they're trying to—we might be talking about tens of thousands of units annually. At roughly $40,000 wholesale per chip, that's hundreds of millions of dollars in tariff costs.

But the impact extends beyond the direct tariff. When chips become more expensive, customers buy fewer of them. A Chinese company budgeting

In AI development, more compute matters enormously. A company with 20% less compute capacity trains models 20% more slowly, assuming similar architectures and datasets. That translates to slower product development cycles, delayed launches, and reduced ability to experiment with novel approaches. Over a year, that compounds to significant competitive disadvantage.

Calculating the actual cost to Chinese AI companies:

If we assume 50,000 H200 units flow to China annually at $40,000 per chip:

That's in the ballpark of what major Chinese cloud providers spend on total infrastructure annually. It's not a trivial cost, but it's not crushing either. For context, it represents roughly 2-3% of the total AI infrastructure spending across all Chinese companies combined.

Where the real impact concentrates is among smaller companies and startups that can't absorb tariff costs as easily. A startup with a

The tariff's long-term impact depends on whether Chinese domestic chip alternatives improve fast enough. If domestic chips reach 80% of H200 performance within 2-3 years, the tariff's impact is temporary. If it takes 5+ years, the impact compounds significantly as US companies pull further ahead in AI capabilities.

Estimated data shows the US manufactures only 10% of its semiconductor needs, highlighting its dependency on foreign supply chains, primarily Taiwan and South Korea.

The CHIPS Act Connection and US Manufacturing Timelines

The tariff can't be fully understood without the context of the CHIPS Act—the $52 billion industrial policy investment the US government made to incentivize semiconductor manufacturing domestically.

The CHIPS Act was passed in 2022 with bipartisan support. The investment allocated funds for: TSMC's Arizona fab expansion, Intel's multiple new facilities, Samsung's Texas plant, and various other projects. The goal was explicit: bring chip manufacturing back to America and reduce dependency on foreign suppliers.

Here's the timeline problem. TSMC's Arizona plant started construction in 2021. It's still not producing at volume in 2025. Intel is expanding capacity at multiple locations but has faced technical challenges. Samsung's Texas facility is under construction. These plants won't reach meaningful production capacity until 2026-2027 at earliest.

Meanwhile, demand for advanced chips is growing every quarter. AI infrastructure is expanding. Data centers are being built globally. The demand is outpacing domestic US manufacturing capacity. That creates a gap. Policymakers recognize the gap and are using tariffs to manage it—slowing non-US demand while domestic capacity comes online.

The tariff is essentially a temporary measure to protect the emerging US semiconductor manufacturing base while it scales up. Once domestic capacity is sufficient, tariffs might become less necessary. But that's years away.

The CHIPS Act is also supporting research into next-generation chip technologies. Memory chips, processors, specialized AI accelerators—there's federal funding for development across the board. The goal is not just to manufacture existing chips domestically but to ensure future technological leadership stays in the US.

The tariff works in concert with the CHIPS Act. The Act provides the incentives and funding for manufacturers to build capacity here. The tariff creates the economic friction that makes that capacity valuable. Without the tariff, a new fab in Arizona might struggle to compete with established manufacturers elsewhere. With the tariff, that fab becomes economically attractive.

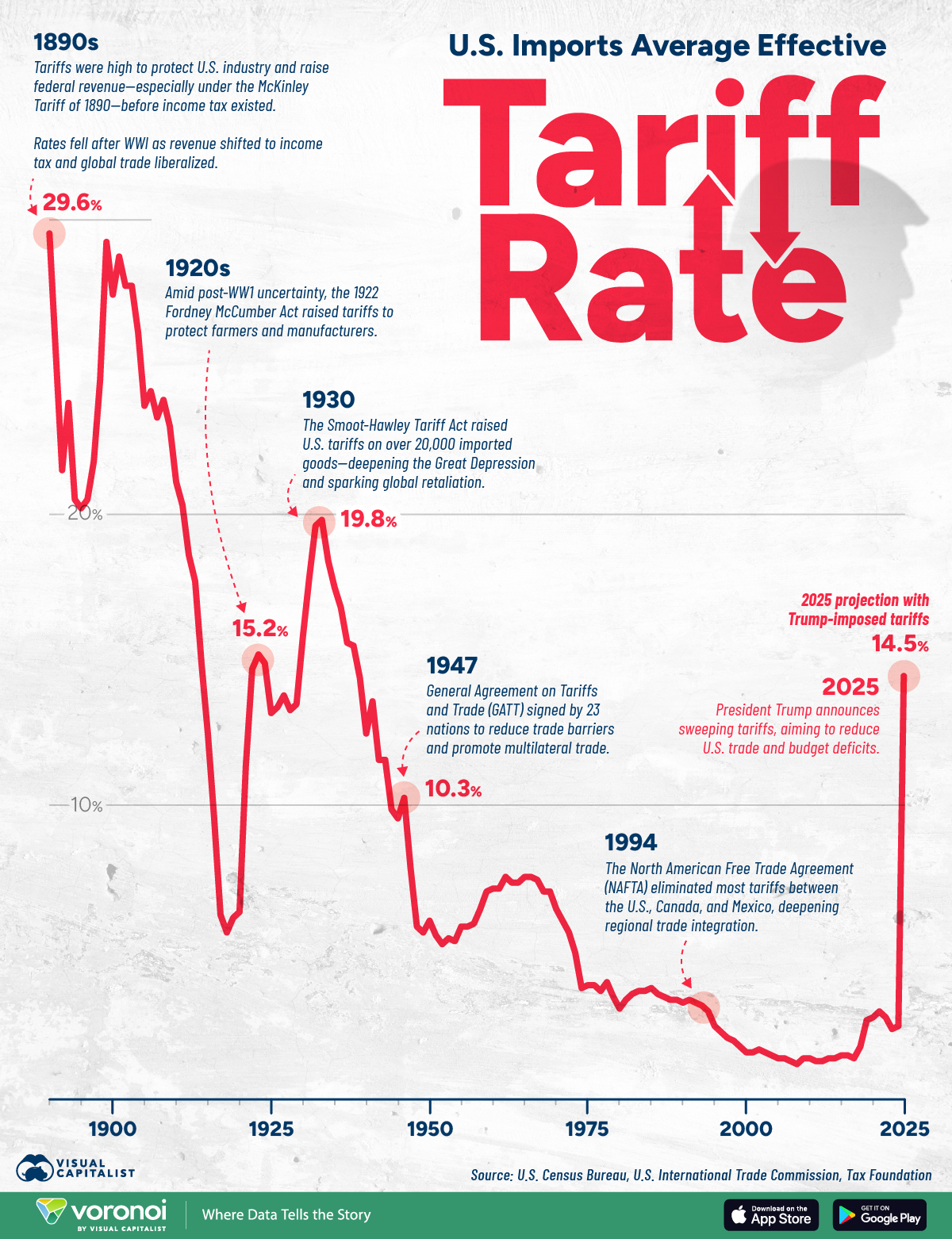

Precedent and Historical Context: Previous Tariff Policies

The Trump administration's tariff on AI semiconductors isn't unprecedented, but it's more targeted and strategic than most previous tech tariffs.

Historically, the US has used tariffs on semiconductors as a blunt instrument. In the 1980s, the US imposed tariffs on Japanese semiconductor imports to protect American chip makers from competition. The result was complex: tariffs hurt American computer companies that needed affordable chips. It protected some chip manufacturers but harmed others. The lesson was that broad-based tech tariffs create winners and losers, and the economic impact is hard to predict.

More recently, the Trump administration's first term (2017-2021) imposed tariffs on various Chinese goods, including some electronics. Those tariffs were broad and created significant economic friction. They also prompted retaliation from China and other trading partners.

The current tariff on H200s is different in character. It's narrowly targeted at a specific product category. It's designed to allow some commerce while creating friction. It includes exceptions for domestic use. It works with a vetting system to maintain some access to Chinese customers. That's more sophisticated policy design than the earlier broad tariffs.

Historically, targeted tariffs work better than broad ones. But they also require more government machinery to implement and create opportunities for gaming or workarounds. A company might try to reclassify chips to avoid tariffs or route shipments through intermediate countries. The Commerce Department has to be vigilant.

One historical lesson: tariffs tend to persist longer than intended. Governments impose them as temporary measures but find political reasons to keep them even after the original justification changes. Once a tariff exists, companies lobby to keep it to protect their interests. That political economy could apply here too. The 25% tariff might be intended as temporary, but once chip manufacturers have invested in US capacity and lobby for protection, the tariff could become permanent.

Future Restrictions and Escalation Scenarios

The current 25% tariff probably isn't the final word on US semiconductor policy toward China. Multiple escalation scenarios are plausible.

Scenario 1: Expansion to More Chip Categories The current tariff targets advanced AI semiconductors. Future proclamations could expand to include other advanced chip categories—high-performance processors, advanced memory chips, graphics processors. Each expansion would apply the same tariff logic to a broader range of products. That would increase total costs for Chinese companies but also create more manufacturing incentives in the US.

Scenario 2: Higher Tariff Rates The 25% rate was chosen to be restrictive but not catastrophic. Policymakers could raise it to 35% or 50% if they deem current restrictions insufficient. That would create much more painful economics for Chinese customers and potentially force a shift to domestic alternatives faster.

Scenario 3: Destination Controls Instead of Origin Controls Currently, the tariff is applied based on where chips are headed—if China is the destination, tariff applies. Future policy might instead control which countries can manufacture certain chips at all, regardless of destination. That would be more restrictive but harder to implement globally.

Scenario 4: Supply Chain Restrictions Beyond tariffs, the US could restrict the sale of chip manufacturing equipment to certain countries. If China can't buy advanced lithography equipment from companies like ASML, it becomes much harder for Chinese companies to build competitive domestic chips. This approach directly targets the capability for future domestic competition.

Scenario 5: Negotiated Reduction If China agrees to certain conditions—limiting surveillance applications of AI, restricting military use of advanced chips, investing in something the US wants—tariffs could be reduced as a bargaining chip. Trade policy becomes the negotiation tool.

Which scenario actually happens depends on several factors: how effective the current tariff is at slowing Chinese AI development, whether domestic US chip manufacturing comes online as planned, the overall state of US-China relations, and political dynamics in the US government. We're in the early innings of what could be a long competition over semiconductor policy.

Industry Reactions and Lobbying Dynamics

Nvidia's public praise for the tariff was genuine from a strategic standpoint, but it doesn't represent uniform industry opinion. Other stakeholders have more complicated positions.

Companies that use AI chips—cloud providers, software companies, hardware startups—have more ambiguous positions. They benefit from competition among chip makers, which keeps prices lower. A tariff that protects Nvidia from Chinese competition could lead to higher prices for everyone else. These companies mostly stay quiet publicly because opposing the tariff means opposing the Trump administration's national security narrative, which is politically dangerous.

AMD faces a complex situation. The company is a US manufacturer and design company, so tariffs align with its interests in theory. But in practice, AMD benefits from competing with Nvidia globally. If tariffs reduce overall demand in China, AMD sells fewer chips even if its relative market position improves. AMD has been quiet about the tariff.

Fab operators—TSMC, Samsung, Intel—have divergent interests. TSMC has the most capacity constraints and most to gain from a tariff that reduces global competition. Samsung is trying to gain market share and might prefer lower tariffs. Intel is trying to recover market position and supports policies that protect domestic manufacturing.

Smaller chip design startups care enormously about this policy. A startup building specialized AI chips has no manufacturing capacity of its own. It depends on fabless design and outside foundry partnerships. Tariffs affect their customers' willingness to pay for new designs. Some startups oppose tariffs quietly while appearing to support national security.

Government relations teams at tech companies are lobbying actively behind the scenes. The public position is usually "we support the government's strategy," but private lobbying focuses on exemptions, grandfathering, timeline extensions, and favorable interpretations of the policy.

Washington's revolving door means many of these lobbyists have personal relationships with Commerce Department officials and congressional staffers. The policy details—which chips qualify for tariffs, which exceptions apply, how the vetting process works—are all negotiated in these back-channel conversations.

Long-Term Implications for Global AI Competition

The tariff on H200s is a tactical move, but the strategic implication is that the US is intentionally slowing Chinese AI development. The goal appears to be to maintain American dominance in AI while domestic manufacturing capacity comes online.

For Chinese companies, the implication is clear: don't rely on imported chips. Invest in domestic alternatives. The government is creating an economic environment that incentivizes that investment.

For global AI development broadly, the implication is that AI capabilities won't be evenly distributed. Companies with easy access to advanced chips will develop faster and build better models. That creates long-term competitive advantages. If the US can maintain exclusive or preferential access to the most advanced chips for longer than China can, American AI companies will build better models and more innovative applications.

The counterargument is that AI development isn't purely driven by chip access. Brilliant researchers and good algorithms matter too. China has both. Even with restricted chip access, Chinese AI companies will eventually build competitive systems. The tariff just slows that timeline.

Globally, the tariff sets a precedent that semiconductor supply can be weaponized. Other countries watching this might conclude they need to develop domestic chip manufacturing capacity too. The tariff potentially accelerates a global shift toward more geographically distributed chip manufacturing, which is resilient but less efficient.

For companies headquartered in small countries without chip manufacturing capacity, the policy is worrying. How do they access advanced technology if every major chip maker faces tariffs or restrictions in key markets? The answer is they become more dependent on government relationships or they invest in locating manufacturing. Either way, the global semiconductor industry becomes more fragmented and more geopolitical.

The Road Ahead: What to Watch

Several developments will signal how this tariff policy evolves:

Domestic Fab Progress: Monitor how quickly TSMC's Arizona facility, Intel's new plants, and Samsung's Texas plant reach meaningful production volumes. If they ramp faster than expected, policymakers might feel confident raising tariffs further. If they lag, tariffs might need to stay moderate to avoid handicapping US companies' competitiveness.

Chinese Domestic Alternatives: Watch whether Chinese chip companies successfully develop alternatives that approach H200 performance. If Huawei or others succeed, the tariff becomes less important because Chinese companies have local options. If they fail, tariffs remain crucial for slowing Chinese AI development.

Global Negotiations: Track whether the US attempts to negotiate semiconductor policies with other countries or whether China retaliates with its own tariffs on US products. The next phase might be negotiated compromises or escalating trade tensions.

Supply Chain Innovation: Monitor whether companies find creative ways around tariffs—rerouting through intermediate countries, reclassifying products, or using alternative suppliers. The Commerce Department will likely close loopholes if they emerge.

Technology Development: Advanced AI chips aren't standing still. Nvidia is developing H300 and future generations. AMD is improving MI series chips. ASML's lithography equipment keeps improving. If next-generation chips face even tighter restrictions, the competitive dynamics shift.

The 25% tariff on H200s is just the opening move in what's likely to be a multi-year competition over semiconductor supply and AI dominance. The immediate impact is manageable for most players, but the strategic intent is clear: the US is using policy to reshape the global semiconductor landscape and maintain technological advantage in AI.

FAQ

What is the 25% tariff on Nvidia H200 chips?

The tariff is a 25% tax imposed by the Trump administration on advanced AI semiconductors, including Nvidia's H200 chips, that are manufactured outside the United States and then exported through US territory to China. The policy was formalized in January 2025 through a presidential proclamation and specifically targets chips destined for Chinese customers, though they must be approved by the Department of Commerce.

How did the tariff get implemented so quickly after H200 sales were approved?

The H200 approval from the Department of Commerce in December 2024 allowed sales to vetted customers, but that approval didn't preclude additional trade policy measures. The Trump administration designed the tariff to work alongside the approval framework—allowing some commerce through approved channels while adding a 25% cost through tariffs. This gave policymakers a way to maintain some business opportunity for Nvidia while still restricting Chinese access and protecting US strategic interests.

Why did Nvidia publicly support the tariff if it directly reduces their sales to China?

Nvidia's support reflects strategic positioning rather than immediate business interest. The company understood that opposing the tariff would be politically damaging and could invite even harsher restrictions. By supporting the tariff, Nvidia positioned itself as patriotic and aligned with US national security interests, which protects against future political pressure. Additionally, the tariff helps Nvidia maintain higher prices and margins on remaining sales, and it reduces competition from Chinese companies that can't afford expensive imported chips. The company calculated that political credibility and market protection were worth the reduced volume in China.

Will the 25% tariff actually reduce Chinese companies' ability to develop AI?

Yes, but not catastrophically. The tariff increases costs for Chinese companies without making H200s completely inaccessible to approved customers. Companies will buy fewer chips and develop more slowly than if the tariff didn't exist, but determined organizations will still make purchases. The real impact depends on how quickly Chinese domestic chip alternatives improve and whether policymakers increase tariff rates or restrictions in the future. A 25% one-time cost adjustment probably delays Chinese AI development by months, not years.

What happens to American companies that want to buy H200s—do they pay the tariff?

No. The tariff specifically exempts chips imported into the United States for domestic research, defense, or commercial use. US companies and government agencies can buy H200s without paying the tariff, giving American organizations a significant cost advantage over Chinese competitors. This creates an incentive for companies to locate AI development and deployment in the United States rather than other countries.

Could other countries retaliate against US semiconductor tariffs?

Yes, retaliation is possible and even likely. China could impose tariffs on US tech products, software, or other exports. Other countries that manufacture semiconductors might challenge the tariff through trade dispute mechanisms. However, the US framed the tariff as a national security measure, which gives it more legal protection under international trade rules. Additionally, most other countries benefit from US policies that slow Chinese competitiveness, so support for retaliation might be limited.

Will the CHIPS Act investments in US chip manufacturing make these tariffs unnecessary?

Eventually, yes, but not for several years. Current CHIPS Act investments won't result in meaningful volume production until 2026-2027. Until then, the US remains dependent on foreign chip manufacturing. The tariff is designed to manage that dependency period by restricting demand while domestic capacity comes online. Once US manufacturing reaches sufficient scale, tariffs might become less necessary for achieving the same policy goals.

What's the timeline for Chinese domestic chip alternatives to compete with H200?

That's uncertain, but likely 3-5 years minimum. Companies like Huawei are working on competitive chips, but they're currently 1-2 generations behind Nvidia in performance. Closing that gap requires solving difficult engineering challenges, securing manufacturing capacity, and debugging production processes. It can be done, but it takes time and significant investment. The tariff accelerates Chinese investment in these alternatives by making foreign chips expensive, but that doesn't speed up the actual technical development cycle.

How does the tariff affect semiconductor prices globally?

The tariff's global impact is limited because it only applies to chips destined for China that pass through US territory. Most other countries aren't affected by the tariff directly. However, the tariff could indirectly affect global prices if it reduces total demand significantly—less overall demand might reduce pressure on prices globally. Alternatively, if US companies gain more market share due to Chinese restriction, competition might decrease and US chip prices could rise.

Conclusion

The 25% tariff on Nvidia's H200 advanced AI semiconductors headed to China represents far more than a simple trade policy decision. It's a calculated move in a long-term strategic competition between the world's two largest economies over technological dominance in artificial intelligence.

Understanding what actually happened requires looking beyond headlines. The Trump administration didn't ban H200 sales to China. It allowed them to continue through approved channels while adding a 25% tax. Nvidia didn't lose market access. It lost some margin and volume but maintained strategic positioning. The policy achieved complexity where many expected simplicity.

The tariff works because it's well-calibrated to its purpose. It's restrictive enough to slow Chinese AI development—a 25% cost increase in a capital-intensive industry creates real friction. It's not so restrictive that it triggers full retaliation or completely shut down commerce. It works with a vetting system to maintain some visibility into how chips are being used. It creates an incentive for US manufacturing without requiring complete self-sufficiency.

For China, the policy signals a harder line on technology transfer. The country won't be locked out of advanced chips entirely, but it will face ongoing restrictions and higher costs. Chinese companies need to accelerate domestic chip development and make peace with slower AI progress than their American counterparts can achieve.

For the global technology industry, the tariff confirms that semiconductors are permanently politicized. Companies can't treat chip supply as a pure market phenomenon anymore. Geography matters. Government relationships matter. Sourcing decisions have geopolitical implications. Supply chains need to be resilient across multiple countries because any single location can become subject to sudden restrictions.

For the United States, the tariff is part of a broader strategy to maintain technological leadership while building domestic manufacturing capacity. The strategy makes sense because semiconductor manufacturing is genuinely critical infrastructure. But it also creates costs—higher prices for some customers, reduced competition, slower innovation in some areas. Policymakers are making a conscious trade-off of short-term efficiency for long-term resilience and strategic autonomy.

The 25% tariff probably isn't the final measure. It's likely the opening of an escalating series of restrictions and counter-restrictions as US-China competition over semiconductors intensifies. How that competition plays out over the next 3-5 years will determine not just who leads in AI capabilities, but how global technology supply chains are structured for decades to come.

The policy is sophisticated, carefully calculated, and strategically sound. Whether it achieves its long-term goals depends on execution—whether domestic US manufacturing comes online as planned, whether Chinese alternatives develop faster than expected, and whether global political conditions hold steady enough to maintain the policy framework. Those are open questions, and the answers will shape the technology landscape for years ahead.

Key Takeaways

- The 25% tariff targets advanced AI chips like H200 manufactured overseas and exported through US territory to China, allowing some sales through approved channels while adding significant cost friction

- Nvidia paradoxically supports the tariff because it protects company margins, reduces competition from Chinese AI companies, and positions Nvidia as patriotic—potentially avoiding harsher future restrictions

- The tariff is calibrated to slow Chinese AI development without completely blocking access, reducing Chinese chip purchases by estimated 20-30% while generating roughly $500 million annually in tariff revenue

- CHIPS Act investments in domestic US chip manufacturing won't produce meaningful capacity until 2026-2027, meaning tariffs bridge a gap while domestic fabs come online and domestic capabilities improve

- Global semiconductor supply chains will increasingly fragment geographically as tariffs and restrictions make companies value resilience over efficiency, accelerating distributed manufacturing investment worldwide

Related Articles

- Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]

- Samsung AI Chip Boom Drives Record $13.8B Profits [2025]

- AMD at CES 2026: Lisa Su's AI Revolution & Ryzen Announcements [2026]

- Intel Core Ultra Series 3 Panther Lake at CES 2026 [Complete Guide]

- How Big Tech Surrendered to Trump's Trade War [2025]

- Wikipedia AI Licensing Deals: How Big Tech Is Paying for Knowledge [2025]

![US 25% Tariff on Nvidia H200 AI Chips to China [2025]](https://tryrunable.com/blog/us-25-tariff-on-nvidia-h200-ai-chips-to-china-2025/image-1-1768496832603.jpg)