Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]

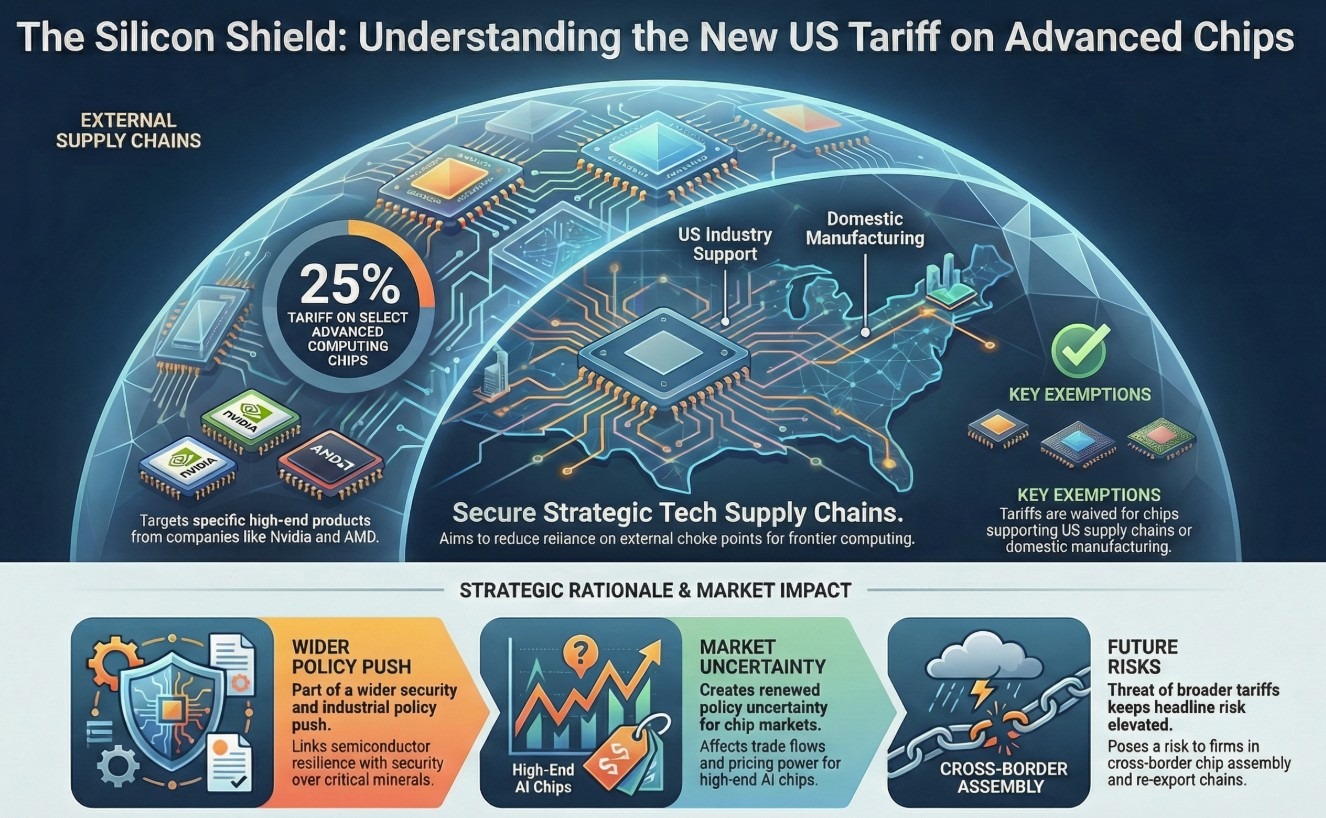

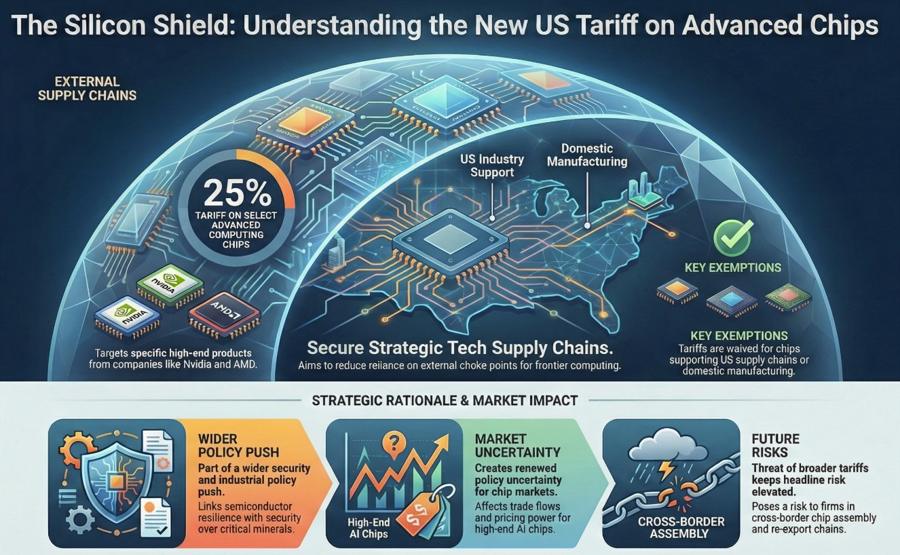

When President Trump signed the proclamation imposing a 25 percent tariff on advanced computing chips, it sent shockwaves through the technology industry. But here's the thing—the actual impact is far more nuanced than the headline suggests. The tariff specifically targets chips imported for re-export, not those destined for domestic use or data centers. That distinction matters enormously for understanding what this policy really means for companies, consumers, and the future of artificial intelligence development.

This isn't just another trade policy. It's a calculated move in what's becoming an increasingly complex semiconductor geopolitical landscape. The White House specifically named AMD MI325X and NVIDIA H200 as prime targets, signaling that this administration views advanced chip exports as leverage in broader tech negotiations. Trump himself suggested he could have imposed a 100 percent tariff but chose a middle ground, creating both immediate concern and a window for negotiation.

The semiconductor industry has become ground zero for U.S. economic and national security policy. Advanced chips power everything from artificial intelligence systems to military applications, and the administration clearly recognizes their strategic importance. Over the next decade, expect semiconductor tariffs to remain a recurring policy tool, regardless of which administration holds office.

Let's dive into what this tariff actually means, who it impacts most, and what the broader implications are for the tech ecosystem we all depend on.

Understanding the 25% Advanced Chip Tariff

The proclamation that Trump signed creates a specific tax on advanced computing chips when they're imported into the United States for the explicit purpose of being re-exported to other countries. This is the critical distinction most coverage misses. The tariff doesn't apply to chips imported and used domestically—either in products manufactured in America or in U.S.-based data centers. That's a massive carve-out that fundamentally shapes who bears the burden of this policy.

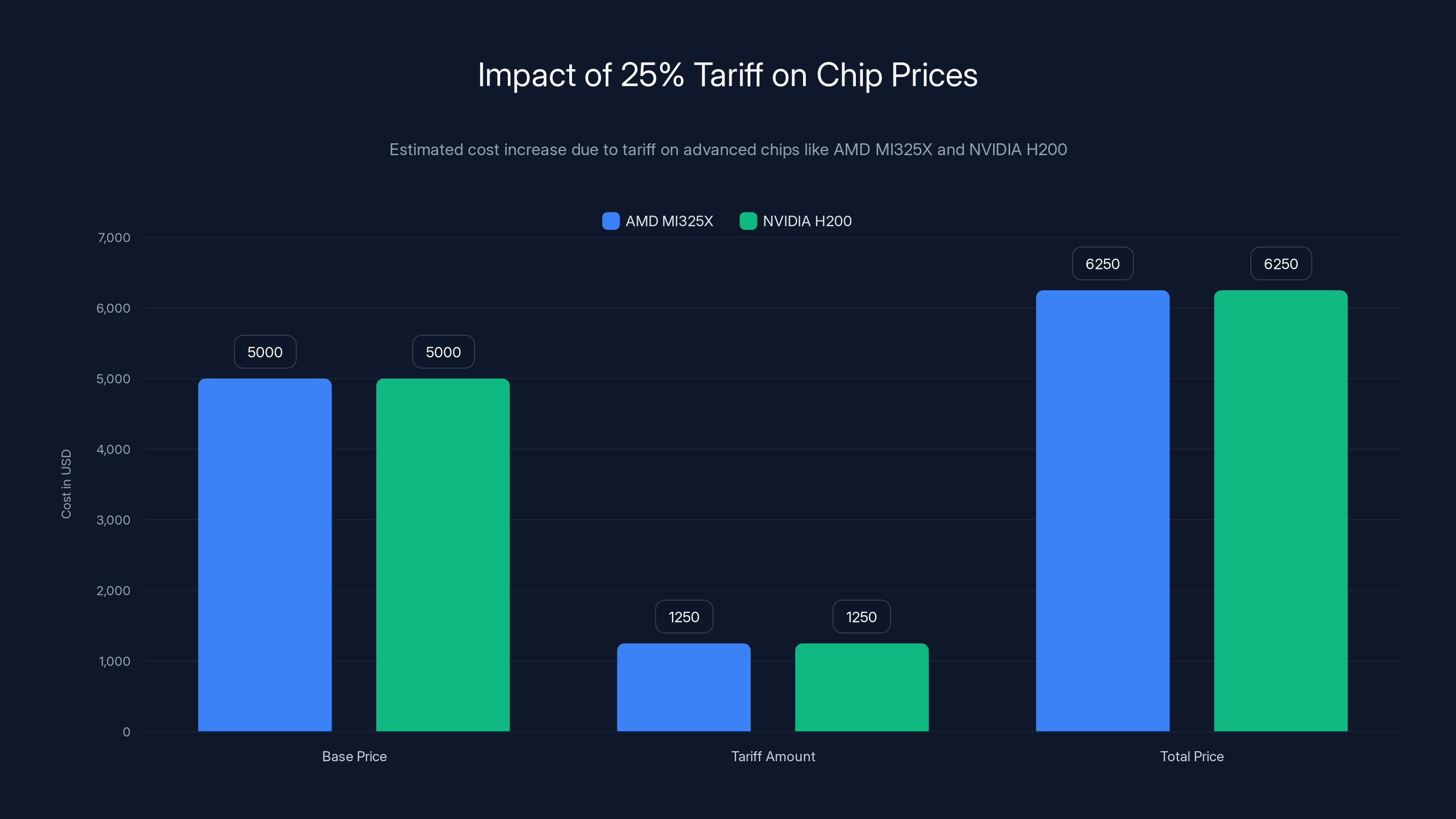

In practical terms, the 25 percent figure represents a significant cost increase for companies relying on re-export of high-end semiconductors. If you're importing a

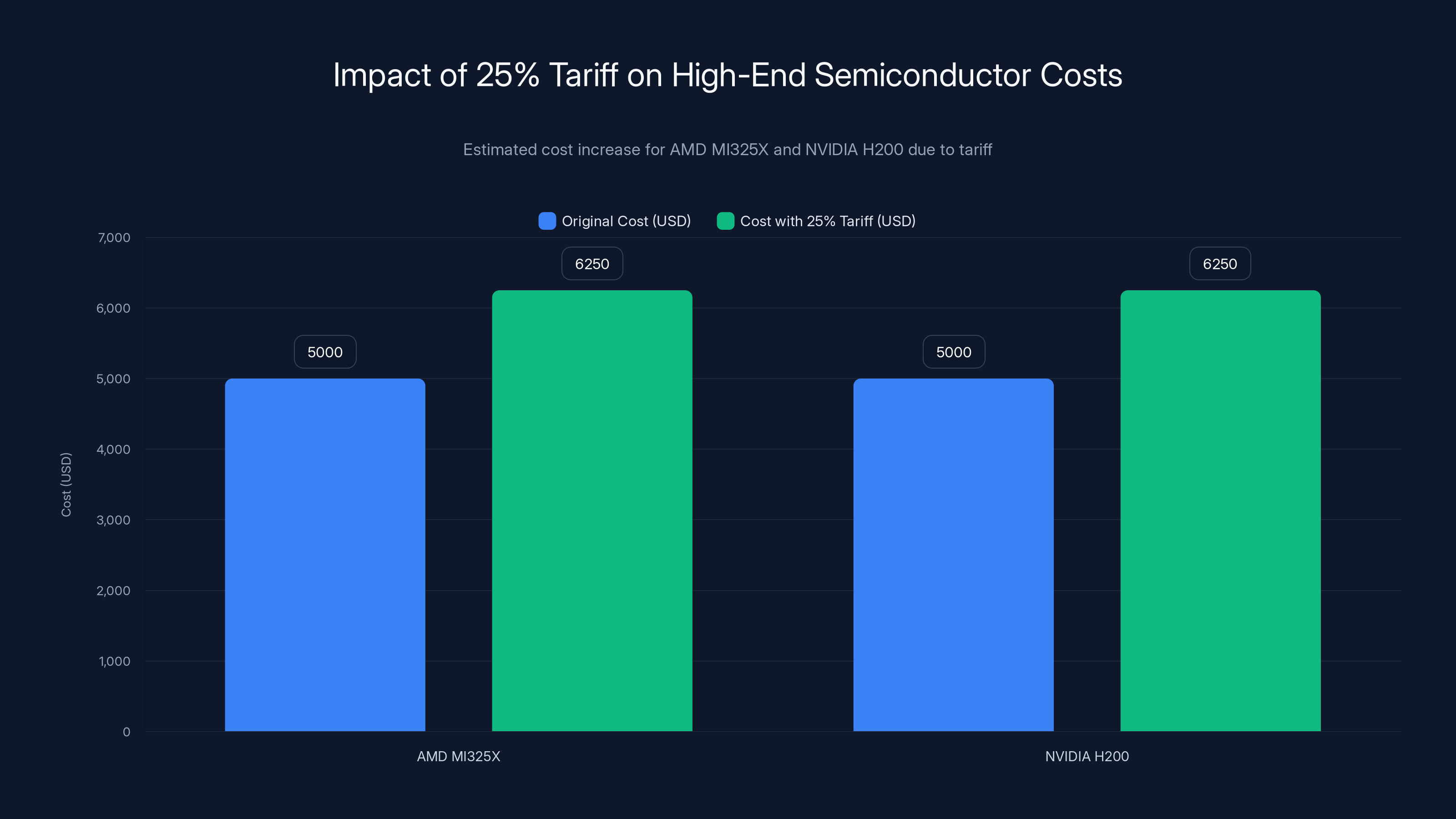

The White House specifically identified AMD MI325X and NVIDIA H200 as products subject to this tariff. These aren't consumer chips—they're enterprise-grade accelerators used in data centers worldwide. The MI325X is AMD's answer to NVIDIA's dominance in AI accelerators, while the H200 represents NVIDIA's latest generation designed for large language model training and inference. Interestingly, Trump previously approved H200 exports to China, arguing it's not NVIDIA's most advanced offering anymore and that the company has superior products like its Blackwell architecture.

The timing of this tariff is particularly interesting. It comes as global AI development has accelerated dramatically, with companies competing fiercely for access to the fastest chips. The tariff creates immediate cost pressure on international operations, especially for companies planning to deploy these chips in data centers outside the United States.

Why These Specific Chips?

AMD MI325X and NVIDIA H200 aren't random selections. These chips represent the cutting edge of AI infrastructure. The MI325X is AMD's most powerful accelerator, offering competitive performance with NVIDIA's offerings at a lower cost point. The H200 is part of NVIDIA's Hopper architecture family, specifically engineered for transformer-based AI models.

Both chips are primarily used in data center environments where organizations are building large-scale AI systems. They're not consumer products—you won't find them in laptops or phones. Instead, they power cloud computing services, enterprise AI deployments, and research facilities pushing the boundaries of what's possible with artificial intelligence.

The selection signals that the administration understands these are strategic technologies. By targeting AI accelerators specifically, Trump's team is essentially saying: we recognize that advanced semiconductors are critical infrastructure for AI development, and we're going to make them more expensive for companies that want to use them internationally.

The Domestic Use Exception

One of the most important aspects of this tariff that gets overlooked is the domestic use exception. Chips imported for use in products manufactured in the United States or for deployment in American data centers aren't subject to the 25 percent tariff. This carve-out was deliberate and reflects a core principle of the administration's approach: encourage domestic semiconductor use and manufacturing while discouraging international re-export.

The White House explicitly stated: "This tariff will not apply to chips that are imported to support the buildout of the U.S. technology supply chain and the strengthening of domestic manufacturing capacity for derivatives of semiconductors."

Translate that language, and it means companies investing in American data center infrastructure, manufacturing facilities, and domestic AI development face no tariff penalty. This creates a clear incentive structure: keep your advanced chip deployments and manufacturing in the United States, and you avoid the tariff entirely.

For cloud providers like Amazon Web Services, Google Cloud, and Microsoft Azure, this is actually manageable. These companies have massive U.S. data center footprints. The tariff doesn't directly impact their ability to deploy MI325X or H200 chips domestically. However, international expansion and cross-border chip movements become more expensive.

The 25% tariff adds

The Broader Context: From 100% Threats to 25% Reality

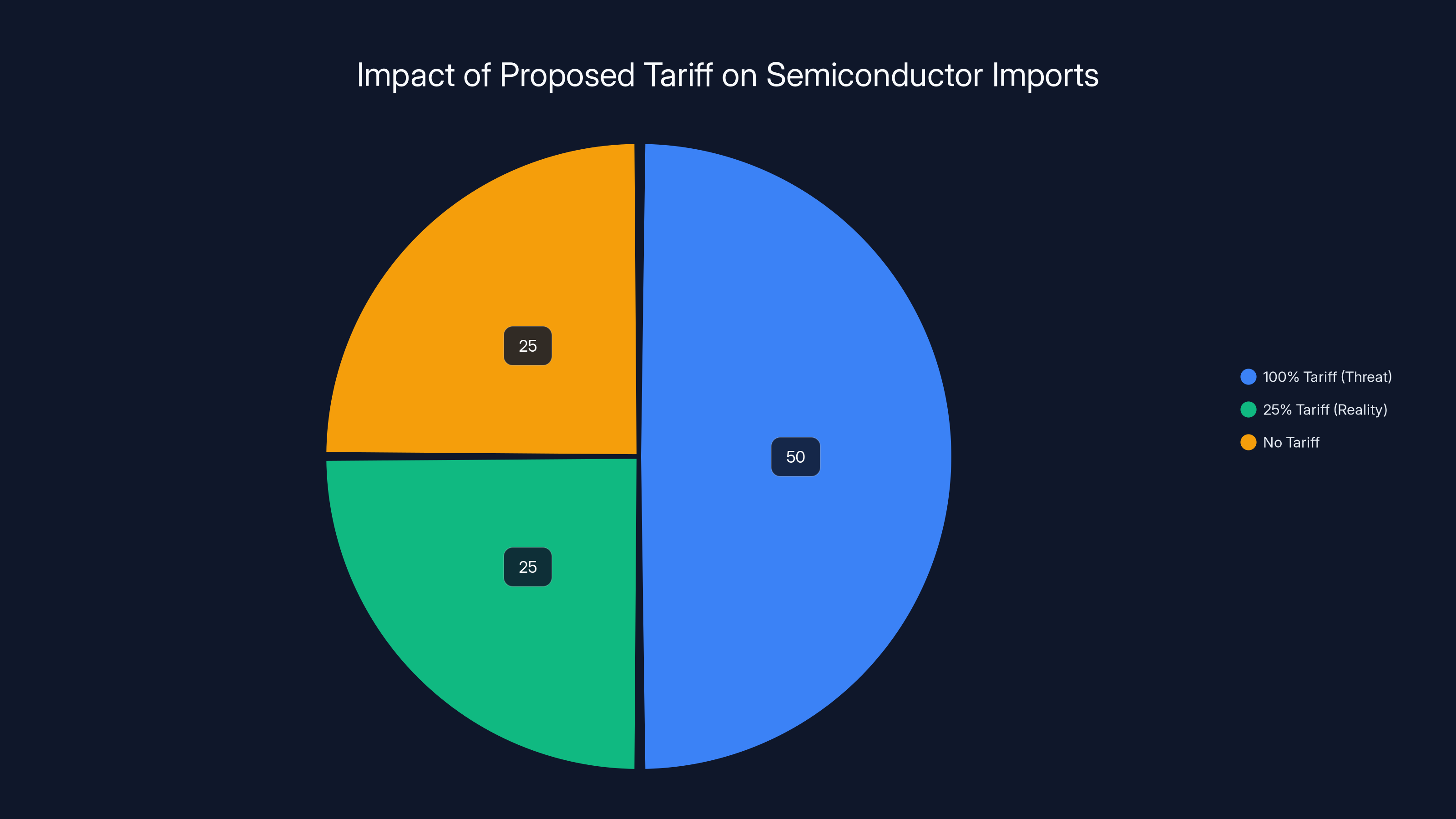

Understanding this tariff requires context. Trump previously threatened much more aggressive action. He publicly stated he was considering a 100 percent tariff on semiconductor companies unless they expanded manufacturing operations in the United States. That would have been devastating—essentially doubling chip prices overnight for imports.

Instead, 25 percent represents what might be characterized as a more measured approach, though it's still a substantial increase. It's significant enough to create real economic pressure but not so extreme that it triggers immediate supply chain collapse or forces dramatic restructuring.

This shift from rhetoric to more measured policy is instructive. It suggests the administration received feedback from industry stakeholders about the practical impacts of extreme tariffs. A 100 percent tariff would have created chaos in semiconductor markets and potentially triggered severe retaliatory measures from trading partners. Twenty-five percent is high enough to matter economically while remaining in the realm of manageable adjustment.

The fact that Trump himself explained the calculation—"we're going to be making 25 percent on the sale of those chips, basically"—indicates this is partially about revenue generation. Tariffs create government income, and that's clearly part of the calculation here. But it's not purely about revenue; it's also about leverage and influencing corporate decision-making around where semiconductor manufacturing and AI infrastructure development happens.

Which Companies Are Most Affected?

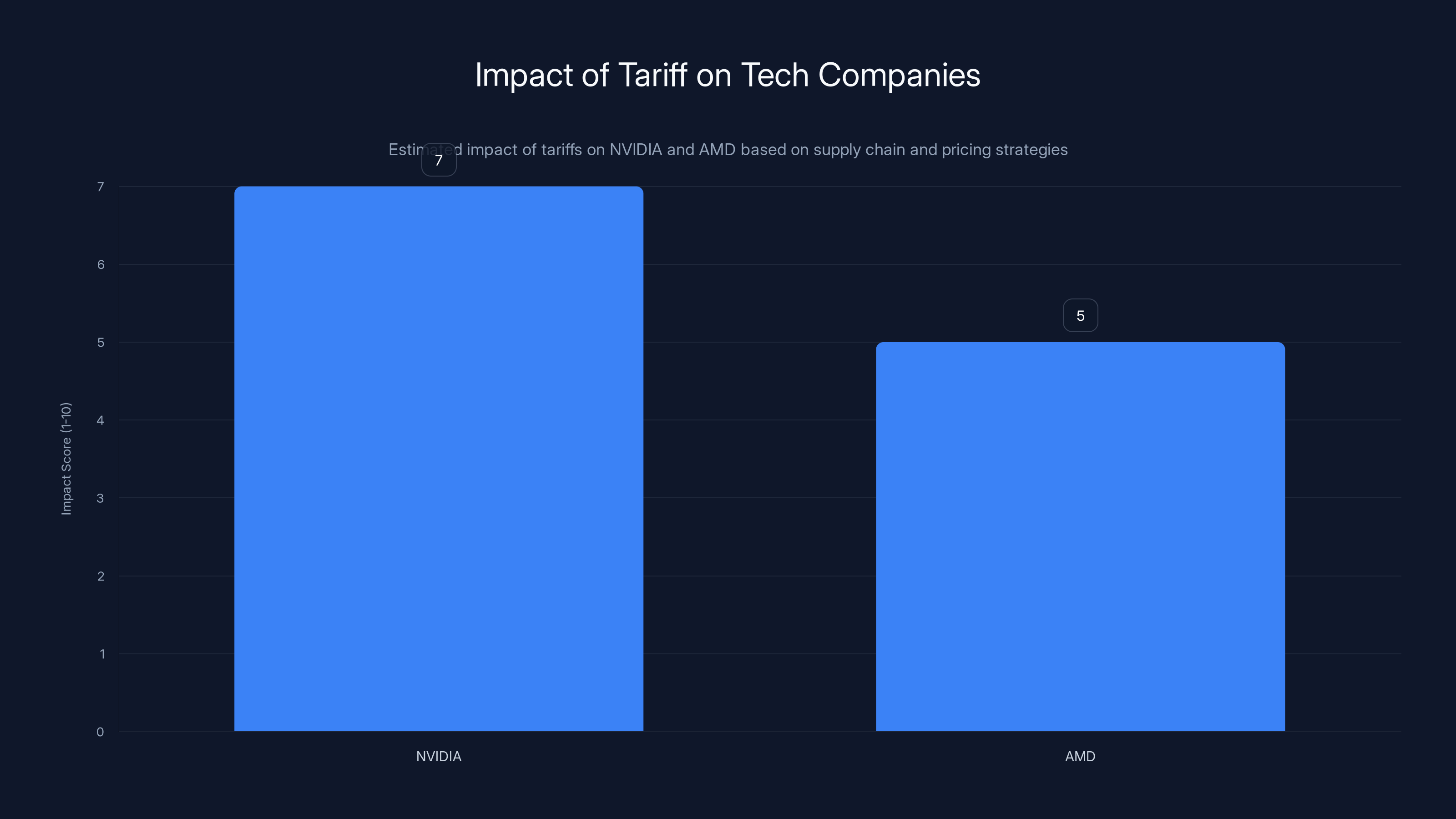

The impact of this tariff falls unevenly across the technology landscape. Some companies feel it acutely, while others navigate it relatively easily. Understanding who bears the burden requires looking at business models and geographic distribution.

NVIDIA's Position

NVIDIA faces direct pressure from this tariff, particularly on H200 exports. The company's revenue increasingly comes from international customers—cloud providers, research institutions, and enterprises across Europe, Asia, and other regions. When NVIDIA sells H200 chips to companies planning to deploy them internationally, that tariff adds a significant cost.

However, NVIDIA has strategic flexibility. The company can shift production to international locations or adjust pricing. NVIDIA already manufactures chips in various locations globally and has relationships with foundries worldwide. The company isn't entirely dependent on importing chips into the U.S. for re-export.

Moreover, NVIDIA's dominance in AI accelerators gives it pricing power. If H200 costs rise due to tariffs, NVIDIA can partially pass those costs to customers, though competitive pressure from AMD might limit how much they can increase prices.

The bigger issue for NVIDIA is competitive positioning. If AMD's MI325X isn't affected as severely by tariffs because AMD has different supply chain arrangements, AMD gains a cost advantage. That could shift market dynamics in AMD's favor in competitive bids for large data center deployments.

AMD's Competitive Opportunity

AMD is in an interesting position. Yes, MI325X faces the same 25 percent tariff as H200. But AMD has been positioning MI325X as a cost-competitive alternative to NVIDIA's offerings. A 25 percent tariff on both products could actually benefit AMD if the company has better supply chain flexibility or can negotiate tariff relief.

AMD has been gaining ground in data center AI accelerators, with several major cloud providers adopting MI325X for their systems. If AMD can maintain cost competitiveness despite the tariff, this could accelerate that trend.

Additionally, AMD's strategy of building partnerships with cloud providers—rather than attempting to dominate the market like NVIDIA—means the company is less vulnerable to large single-customer decisions about chip sourcing.

Cloud Providers: Mostly Insulated

Major cloud providers—Amazon, Google, Microsoft—are largely insulated from this tariff because they operate massive U.S. data centers where they'll deploy these chips. Neither the tariff on re-export nor any future domestic tariff would directly impact their ability to use MI325X or H200 in American infrastructure.

However, if the administration follows through on threats to impose broader tariffs on semiconductor imports used domestically, cloud providers would face direct pressure. That would increase the cost of deploying chips in data centers, reducing profit margins on cloud services.

Smaller Companies and International Players

The companies most directly affected are smaller chip aggregators, system integrators, and international technology companies that import advanced chips into the United States for re-export to customers elsewhere. For these businesses, the tariff is a direct cost hit with limited ability to absorb or pass the costs along.

International companies also face increased costs if they import chips into the U.S. for distribution to non-U.S. markets. This makes direct sourcing from non-U.S. locations or from international chip manufacturers more attractive, potentially reshuffling global supply chains.

The 25% tariff increases the cost of importing AMD MI325X and NVIDIA H200 chips by $1,250 each, significantly impacting companies involved in re-exporting these chips. Estimated data.

National Security and Strategic Considerations

Tariffs on semiconductors aren't purely economic policy—they're national security strategy. Advanced semiconductors power everything from artificial intelligence systems to military applications, surveillance technology, and critical infrastructure. Control over semiconductor production and distribution is increasingly seen as essential to national security.

The Trump administration's focus on advanced computing chips reflects this understanding. AI accelerators are critical infrastructure for modern artificial intelligence development. Countries that can cheaply access advanced chips gain advantages in AI development. The U.S. wants to maintain that advantage for American companies while preventing competitors from getting easy access to the latest technology.

This tariff is also partially about signaling. By imposing tariffs on specific chips used for AI, the administration sends a message: semiconductor policy is tied to broader strategic concerns, and companies need to think about where they locate manufacturing and deployment of these critical technologies.

Historically, semiconductor policy has become increasingly intertwined with national security. The Biden administration pursued this before Trump, with executive orders requiring advanced chip manufacturing to remain in the United States. Trump is taking that logic further by using tariffs as a lever.

Export Controls and Tariffs Working Together

It's crucial to understand that this tariff doesn't operate in isolation. The U.S. already restricts exports of advanced semiconductors to certain countries, particularly China and other strategic competitors. Those export controls are handled through the Commerce Department and represent absolute restrictions—you simply can't export certain chips to certain countries regardless of price.

The tariff is a different tool. It doesn't prohibit exports; it makes them more expensive. That creates economic incentives for companies to make different choices about supply chains, manufacturing locations, and product strategies without government prohibition.

The combination of export controls and tariffs creates a comprehensive strategy: absolutely prevent transfer of the most sensitive technology to strategic competitors, and make it economically difficult to export less-restricted advanced chips through re-export schemes to non-U.S. markets.

Potential Future Tariff Actions

The White House has explicitly stated that this 25 percent tariff on advanced chips might just be the beginning. The administration indicated it may impose broader tariffs on semiconductor imports and the products that use them in the near future.

That's significant language. "Broader tariffs" could mean:

- Expanding the list of affected chips beyond MI325X and H200

- Lowering the threshold for what counts as "advanced" chips

- Applying tariffs to chips imported for domestic use, not just re-export

- Imposing tariffs on finished products that contain semiconductors

Each of these would increase the pressure on the technology industry significantly. The first option—expanding the list of affected chips—seems most likely in the short term. Other accelerators, processors, and specialized semiconductors could be added.

A domestic tariff would be far more disruptive. If the administration taxes semiconductor imports even when they're used in American products or data centers, it fundamentally changes the cost structure for the entire U.S. technology industry. Companies would face pressure to either accept higher input costs or find ways to source chips from non-tariffed sources.

Tariffs on finished products containing semiconductors would ripple through consumer electronics, automotive, and industrial sectors. A laptop containing imported semiconductor components could face tariffs, making computers more expensive for American consumers.

The administration's language about "potentially" expanding tariffs seems designed to give companies time to adjust while maintaining the threat. It's leverage—companies are incentivized to make manufacturing and supply chain decisions favoring domestic production to avoid more severe future tariffs.

Impact on AI Development and Deployment

Advanced chips are the infrastructure layer for artificial intelligence. Restrict or tax access to advanced chips, and you directly impact AI development and deployment strategies. This tariff will likely influence where AI development happens and how quickly it proceeds.

Data Center Expansion Decisions

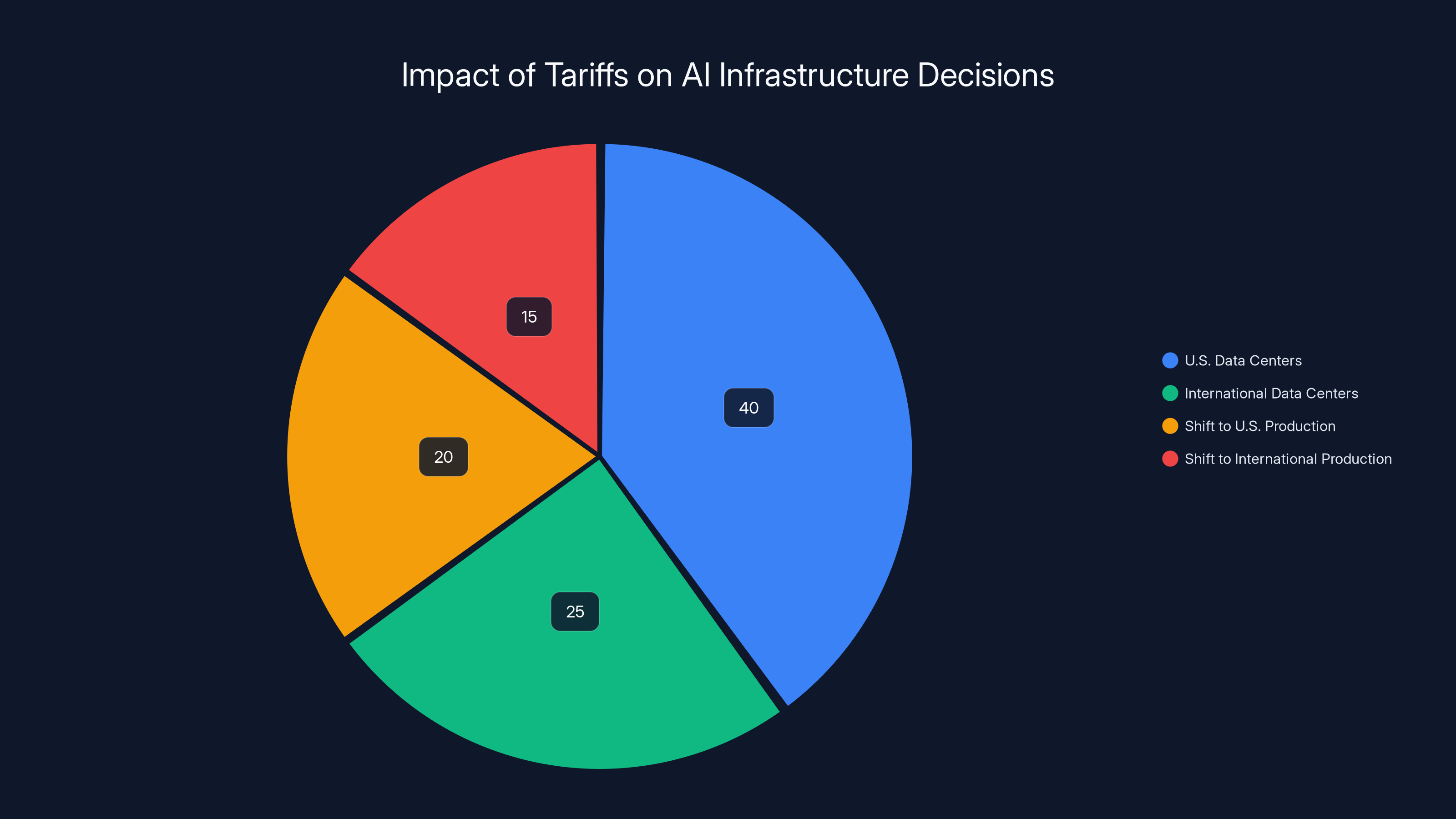

Cloud providers and AI companies making decisions about where to build data centers will factor in tariff costs. A company planning to build a massive AI training facility will consider: Should we locate it in the United States and avoid tariffs entirely? Or should we locate internationally and accept tariff costs on importing chips?

For companies planning U.S. data centers, the tariff is actually a positive—it makes their domestic location more competitive compared to international alternatives. For companies planning international expansion, the tariff adds costs that make U.S. locations relatively more attractive.

This creates a subtle incentive toward concentrating AI infrastructure development in the United States. That could accelerate U.S. dominance in AI deployment while potentially slowing AI infrastructure expansion in other regions.

Competitive Dynamics Between Chip Makers

As discussed earlier, the tariff creates opportunities for AMD to gain market share against NVIDIA if the company can maintain competitive pricing despite the tariff. More generally, any chip maker with supply chain flexibility or tariff workarounds can gain advantage.

Chip makers will explore manufacturing alternatives, tariff classification strategies, and other mechanisms to reduce tariff impact. Companies might shift production timing, adjust product classifications, or restructure how chips are imported to minimize tariff exposure.

AI Model Training vs. Inference

The tariff could also influence whether companies choose to train AI models in the United States versus elsewhere. Training large language models requires intense computational resources—lots of advanced chips for extended periods. If tariffs increase the cost of deploying those chips, it makes U.S.-based training more expensive.

However, inference—running trained models on new inputs—might increasingly locate in the United States as cloud providers seek to deploy models efficiently in tariff-advantaged locations. This could lead to interesting geographic splits where model training happens internationally but model deployment and inference happens in the U.S.

Estimated data shows that importers initially bear the full 25% tariff burden, but chip manufacturers and end users eventually share the cost through pricing adjustments.

Supply Chain and Manufacturing Implications

This tariff isn't just about cost; it's about restructuring supply chains and manufacturing decisions. Companies will respond by adjusting where semiconductors are made, how they're distributed, and who handles imports.

Incentives for Domestic Manufacturing

One of the implicit goals of this tariff is to encourage semiconductor manufacturing in the United States. The tariff makes importing chips more expensive, which theoretically makes investing in U.S. manufacturing more attractive from a cost perspective.

However, setting up semiconductor manufacturing facilities is extraordinarily capital-intensive and requires highly specialized expertise. You can't simply decide to manufacture chips domestically and do it in six months. It takes years of planning, massive capital investment, and recruitment of specialized engineers.

The reality is that this tariff might accelerate existing plans for U.S. semiconductor manufacturing, but it won't create entirely new capacity overnight. Companies like Intel, Samsung, and TSMC already have U.S. facilities or plans for U.S. expansion. The tariff makes those investments more valuable from a tariff-avoidance perspective.

International Sourcing and Partnerships

Alternatively, companies will explore sourcing semiconductors from non-U.S. locations when possible. If a company can import chips from a facility in Mexico or Canada rather than importing them into the U.S. for re-export, they avoid the tariff entirely.

This could accelerate nearshoring—moving manufacturing to countries close to the United States with lower tariff exposure. Mexico, in particular, could become a hub for semiconductor manufacturing, re-export, and distribution for American companies looking to avoid U.S. import tariffs.

Supply Chain Transparency and Planning

The tariff will force companies to develop more sophisticated supply chain management. Rather than assuming they can easily import chips into the U.S. and re-export them, companies will need to plan supply chains more carefully, considering tariff implications and potential regulatory changes.

This could actually lead to more resilient supply chains in some respects—companies will be incentivized to develop multiple sourcing options and geographic diversification. Alternatively, it could create supply chain vulnerability if companies offshore manufacturing to avoid tariffs and lose control over supply disruptions.

Economic Impact and Cost Pass-Through

Ultimately, someone pays this tariff. The question is who bears the burden and how much of it they can shift to others. Understanding cost pass-through is crucial for predicting this tariff's actual economic impact.

Initial Burden: Importers

Immediately, the 25 percent tariff is paid by whoever imports the chips into the United States. That's usually chip distributors, system integrators, or companies importing for their own re-export purposes.

These companies face immediate margin pressure. A 25 percent cost increase is substantial—it either reduces profits or requires passing costs to customers.

Secondary Pass-Through: Chip Prices

Chip manufacturers like NVIDIA and AMD can adjust their pricing in response to tariffs. If importers are paying 25 percent more in tariffs, chip makers might increase their base prices, knowing that customers understand the tariff is adding costs.

Alternatively, chip makers might offer tariff rebates or adjust pricing strategies to help customers absorb tariff costs. NVIDIA's dominant market position gives it more flexibility to pass costs along. AMD might use tariffs as an opportunity to gain market share by offering better tariff-adjusted pricing.

Tertiary Pass-Through: End Users

Eventually, costs reach end users. A data center customer buying systems with advanced chips might pay more. A cloud service using these chips for AI might increase prices. A researcher accessing computational resources might face higher costs.

However, the domestic use exception limits this effect for U.S.-based data centers. Companies deploying chips domestically avoid the tariff, which limits how much they can justify price increases to customers.

Global Competition Impact

International competitors to American companies might gain advantage if tariffs make U.S. chip costs uncompetitive globally. An international company paying no tariff might offer cheaper AI services than an American company paying tariffs on chip imports for re-export.

This could gradually shift AI market share to international competitors, which would be ironic given that the tariff's stated purpose is to strengthen American technological leadership.

Responses from Industry Players

Industry players are already responding to this tariff announcement. Understanding these responses helps predict how this policy will actually play out in practice.

NVIDIA's Strategic Response

NVIDIA has already begun exploring supply chain options. The company is increasing manufacturing partnerships outside the United States to reduce dependency on imports. Additionally, NVIDIA might adjust pricing on H200 or develop new product variants with different tariff classifications.

NVIDIA is also likely engaging with the administration to request tariff exemptions or classifications that reduce tariff burden. The company has significant political and economic leverage, and it's investing that leverage in tariff mitigation.

AMD's Competitive Strategy

AMD is using this as an opportunity to position MI325X as a better value proposition. Even with tariffs, if AMD can maintain cost advantage, this strengthens AMD's competitive position against NVIDIA.

AMD is also likely exploring supply chain optimization and tariff mitigation strategies, but the company's secondary position in AI accelerators means it faces less immediate tariff burden than NVIDIA.

Cloud Provider Responses

Cloud providers are mostly adjusting their planning rather than their immediate operations. For future data center expansions, companies are considering tariff implications in location decisions. Some companies might accelerate U.S. data center investments to benefit from the tariff-free treatment of domestically-used chips.

Cloud providers are also exploring partnerships with chip makers for domestic manufacturing or assembly, which could provide tariff advantages.

Advocacy and Lobbying

The semiconductor industry is collectively advocating with the administration for tariff relief. Industry associations are likely to request exemptions for specific use cases or to argue that broader tariffs would harm rather than help American competitiveness.

That advocacy will likely have some effect—tariff policy often evolves based on industry input, and the administration indicated willingness to consider adjustments through its statement about "potentially" imposing broader tariffs.

Estimated data suggests tariffs may lead to 40% of AI infrastructure development favoring U.S. locations, with 25% still opting for international sites. Shifts in production strategies also reflect tariff impacts.

Precedent and Historical Context

Tariffs on semiconductors have a long history, but recent policy has become increasingly strategic and technology-focused. Understanding that history helps contextualize the current situation.

Semiconductor Tariffs in the 2000s and 2010s

During the Bush and Obama administrations, semiconductor tariffs existed but were relatively modest. The focus was more on intellectual property protection and ensuring American companies could compete globally.

The semiconductor industry generally succeeded in keeping tariff rates low, arguing that semiconductors are critical inputs for American technology companies and that high tariffs would reduce competitiveness.

Trump's First Term and Section 301 Tariffs

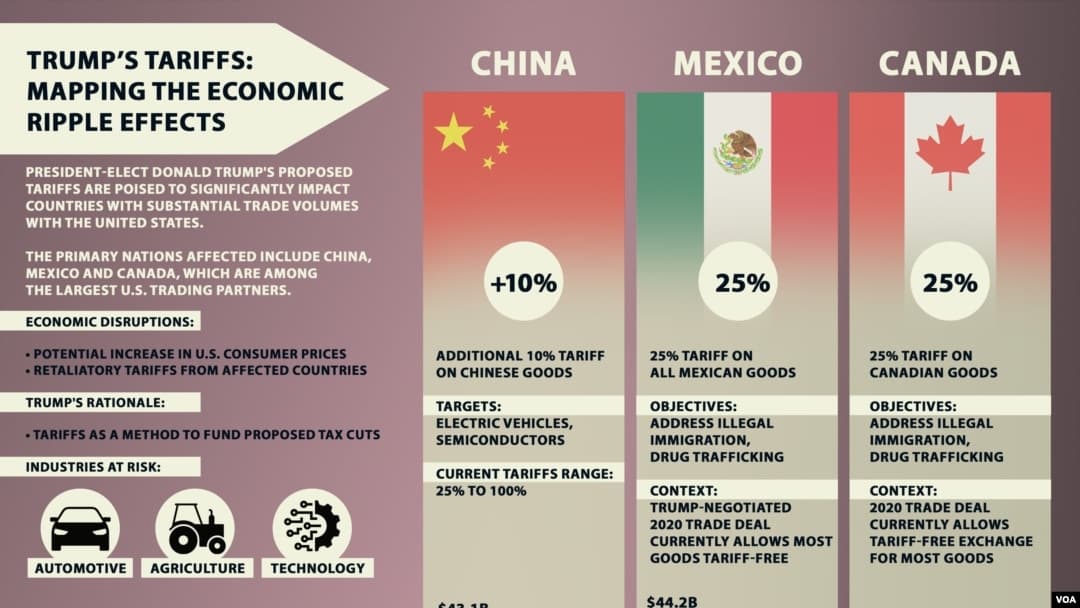

During his first term, Trump imposed Section 301 tariffs targeting Chinese products and practices. Semiconductors were included, but the focus was more on addressing trade imbalances and intellectual property theft rather than strategically controlling semiconductor distribution.

During that period, companies largely absorbed or worked around tariffs through supply chain adjustments and pricing changes.

Biden Administration Chip Policy

The Biden administration took a different approach, focusing on subsidies and incentives for domestic semiconductor manufacturing rather than tariffs on imports. The CHIPS and Science Act provided billions in subsidies to encourage U.S. semiconductor manufacturing and research.

The approach was carrot rather than stick—make domestic manufacturing more attractive through subsidies rather than making imports more expensive through tariffs.

Current Trump Approach: Back to Tariffs

Trump's current approach returns to tariffs as a primary policy tool, but with more strategic focus on specific technologies like AI accelerators. This represents a shift from his first term and is clearly informed by the intervening years of developments in artificial intelligence and semiconductor competition.

International Trade Implications

Tariffs don't exist in a vacuum. They trigger responses from trading partners and can affect broader trade relationships. Understanding international trade implications is crucial for predicting this tariff's full impact.

Potential Retaliatory Measures

Countries that export semiconductors or whose companies are affected by U.S. tariffs might implement retaliatory tariffs on American technology products. South Korea and Taiwan, major semiconductor producers, might impose tariffs on American software, cloud services, or other tech products.

Europe, which has its own semiconductor ambitions, might also respond with retaliatory tariffs or trade actions.

Retaliatory measures could escalate trade tensions and create broader uncertainty in technology markets.

Impact on Semiconductor Supply Chains

Global semiconductor supply chains are deeply integrated. A tariff on advanced chips imported into the U.S. affects companies globally, not just American companies. This could lead to supply chain restructuring that extends far beyond the United States.

Companies might seek to establish semiconductor production hubs in neutral countries or locations with favorable trade arrangements. Mexico, Canada, or other countries might become more attractive locations for semiconductor operations.

Trade Agreement Negotiations

This tariff also affects broader trade negotiations. Countries negotiating trade agreements with the U.S. will want semiconductor tariffs to be part of negotiations. That creates opportunities for countries to reduce tariffs in exchange for concessions in other areas.

Over time, tariff structures might become part of bilateral or multilateral trade agreements rather than unilateral U.S. policy.

Long-Term Industry Dynamics

Beyond the immediate impact of this 25 percent tariff, broader trends are reshaping the semiconductor industry. Understanding those trends helps predict how tariffs will interact with other forces changing the landscape.

AI Accelerator Specialization

The semiconductor industry is increasingly segmented toward specialized chips for specific applications. AI accelerators like MI325X and H200 represent this specialization. Rather than competing purely on general-purpose processor speed, companies are competing on specialized architecture for specific workloads.

This specialization means that tariffs on specific chip types could create unusual competitive dynamics. A tariff on AI accelerators might benefit companies focused on other chip categories, for example.

Power Constraints and Design Evolution

As AI chips become more powerful, they also generate more heat and consume more power. Data centers deploying advanced chips face power constraints. This is pushing chip design toward more power-efficient architectures and encouraging data center investments in power infrastructure.

Tariffs interact with this trend by making the already-expensive process of deploying advanced chips even more costly, which might slow adoption rates or encourage efficiency investments.

Generational Cycles and Technology Shifts

Semiconductor technology evolves in generational cycles. NVIDIA's Blackwell architecture follows Hopper. AMD's next-generation EPYC chips will follow MI325X. Tariffs affect how these generational transitions happen and how quickly companies deploy new technology.

A company delaying deployment of H200 due to tariff costs might leap directly to newer generations rather than doing staged upgrades. That changes replacement cycles and inventory dynamics.

Open Source and Alternative Architectures

Faced with high costs for proprietary chips, some companies might invest more heavily in open-source chip designs or alternative architectures. RISC-V, an open instruction set architecture, has been gaining attention from companies looking to reduce dependence on proprietary alternatives.

Tariffs could accelerate movement toward open-source semiconductor design by making proprietary alternatives more expensive.

The proposed 100% tariff would have doubled semiconductor import prices, while the actual 25% tariff represents a significant but more manageable increase. Estimated data.

Potential Workarounds and Mitigation Strategies

Companies are already developing strategies to mitigate tariff impact. Understanding these workarounds is crucial for predicting actual tariff effects, which often differ significantly from intended policy.

Tariff Classification Optimization

Tariffs apply to specific product classifications. Companies might adjust how chips are classified to minimize tariff exposure. A chip classified as a consumer processor might face different tariffs than one classified as an enterprise accelerator.

This is entirely legal and represents standard business practice. Companies work with customs brokers and trade lawyers to ensure optimal tariff classification of their products.

Manufacturing Location Adjustments

Companies might shift manufacturing or assembly of chip packaging to locations with lower tariff exposure or better trade relationships with the U.S. Final assembly in Mexico, for example, might reduce tariff burden compared to final assembly in China.

This doesn't necessarily change where chips are manufactured at the semiconductor level, but it can adjust final product tariff treatment.

Timing and Inventory Strategies

Companies might adjust inventory and ordering timelines to manage tariff exposure. Advance purchasing before tariff implementation or strategic inventory building can reduce long-term tariff costs.

However, this strategy has limits. Holding excessive inventory creates storage costs and obsolescence risk, particularly with semiconductors where technology evolves rapidly.

Alternative Supplier Development

Companies are exploring alternative suppliers with different geographic bases or tariff exposure. If one supplier is heavily affected by tariffs, developing relationships with suppliers less affected provides bargaining power and reduces tariff risk.

For NVIDIA and AMD, this might mean expanding manufacturing partnerships with foundries outside the United States.

Domestic Sourcing Investment

Most directly, companies are accelerating investments in domestic semiconductor sourcing. Intel's U.S. manufacturing facilities, for example, become more valuable if importing competing chips becomes more expensive.

That was arguably the intended effect of this tariff—to incentivize domestic sourcing and manufacturing investment.

Predicting Future Tariff Developments

Based on the administration's language and historical patterns, it's reasonable to predict certain tariff developments. Understanding likely scenarios helps companies plan strategically.

Scenario 1: Gradual Expansion (Most Likely)

The administration could gradually expand the list of affected chips and tariff rates over the next 12-24 months. New AI accelerators, processors used in AI infrastructure, or other advanced chips might face tariffs. Rates might increase from 25 percent to 35 or 40 percent.

This gradual approach allows companies time to adjust supply chains while maintaining pressure and demonstrating follow-through on tariff threats.

Scenario 2: Exemption and Carve-Outs

Specific companies or use cases might receive tariff exemptions or reduced rates. NVIDIA or AMD might secure exemptions for certain product lines or manufacturing arrangements. Critical infrastructure applications might be exempted.

These exemptions would be politically valuable—they let the administration claim success in influencing corporate behavior while reducing overall economic impact.

Scenario 3: Domestic Tariff Implementation

The administration could expand tariffs to include domestically-used chips, not just those imported for re-export. This would create broader pressure on the technology industry but would also trigger significant economic resistance.

This scenario is less likely given the domestic use exception's explicit inclusion in the current tariff, but the administration's language about "potentially" imposing broader tariffs suggests it remains possible.

Scenario 4: Trade Deal Resolution

Tariffs could be partially or fully resolved through broader trade deals. The administration might use tariff threats as negotiating leverage to secure concessions from China, the EU, or other trading partners.

In this scenario, tariffs might be adjusted downward as part of larger trade agreements.

Market Reactions and Investor Sentiment

When the tariff was announced, technology stocks reacted with caution. NVIDIA and semiconductor-adjacent companies faced downward pressure as investors assessed potential profit impacts.

Longer-term, investor sentiment depends on clarity. If the tariff remains at 25 percent and applies only to re-exports, and if companies successfully adjust supply chains, long-term impact might be limited. If tariffs expand unexpectedly, investor confidence in semiconductor and technology stocks could deteriorate.

The administration's language about potential future tariffs creates ongoing uncertainty. That uncertainty itself has economic cost—companies make less aggressive expansion plans and investors reduce positions in uncertain industries.

Estimated data shows NVIDIA facing a higher tariff impact due to its international revenue dependency, while AMD's supply chain flexibility offers a competitive edge.

Consumer Impact: Indirect but Real

While consumers don't directly pay tariffs, tariff costs eventually reach consumers through higher prices for electronics, cloud services, and other technology products.

For consumer electronics—laptops, phones, smart devices—tariff impact is more diffuse. These products contain many components, and semiconductor costs are just one input. A 25 percent tariff on chips might increase consumer electronics prices by 2-5 percent, depending on the device.

For cloud services powered by advanced chips, impact is even more indirect. Cloud providers absorb some tariff costs and pass along others through price increases. Consumer cloud service costs might increase 1-3 percent as a result of this tariff.

AI services specifically—using Chat GPT, Claude, Gemini, or other large language models through cloud platforms—are indirectly affected. If cloud providers raise prices due to tariff costs, AI service prices might increase.

Over time, compounding tariffs and price increases could create meaningful consumer impact. But in the short term, 25 percent tariffs on specific advanced chips translate to 1-5 percent retail price increases at most.

Technical Requirements and Definitions

For companies trying to understand tariff applications, several technical definitions matter:

Advanced computing chips: Semiconductors with advanced processing capabilities, typically measured by chip complexity (transistor count), power consumption, or intended application. AI accelerators like H200 and MI325X clearly qualify. The precise boundary is less clear for mid-range processors.

Re-export: Importing a product into the U.S. with the intention of exporting it to another country without substantial transformation or use in a product manufactured in the U.S.

Domestic use: Using imported chips in products manufactured in the United States or deploying them in U.S. data centers for use within the country.

These definitions matter because they determine tariff application. A company needs to clearly document the intended use of imported chips to ensure proper tariff treatment.

Comparative Analysis: Tariffs vs. Alternative Policies

Tariffs are one tool for semiconductor policy. Other approaches exist, each with different implications.

Subsidies (Biden's approach): Provide direct government funding for domestic semiconductor manufacturing. This incentivizes capacity building without raising prices for consumers. Disadvantage: expensive for government budgets.

Export controls: Prohibit exports of sensitive technology to strategic competitors. This prevents technology transfer but doesn't affect domestic costs. Disadvantage: only works for controlled technologies.

Regulatory requirements: Mandate that certain technology be produced domestically or by trusted partners. This reshapes supply chains but creates compliance complexity.

Research investment: Fund semiconductor research and education to build domestic capacity. This takes decades but creates long-term competitive advantage.

Tariffs: Make imports more expensive, incentivizing domestic sourcing and manufacturing. This works quickly but raises consumer costs and might trigger retaliation.

The Trump administration has chosen tariffs as the primary tool, supplementing it with the threat of subsidies and investment in domestic manufacturing. Whether this combination proves more effective than subsidies alone remains to be seen.

Looking Forward: The Five-Year Outlook

Predicting five years of semiconductor tariff policy is inherently uncertain, but certain trends seem likely:

Years 1-2: Tariff rates likely remain around 25 percent or increase gradually. Additional chips might be added to the tariff list. Companies adjust supply chains and make manufacturing location decisions based on tariff exposure. Market acceptance and adaptation occur.

Years 2-3: First-generation impacts fully manifest. Companies that invested in U.S. manufacturing or supply chain optimization gain competitive advantage. Companies that failed to adjust face margin pressure. Market consolidation might occur as smaller players struggle with tariff costs.

Years 3-5: Tariff policy might stabilize or evolve into trade deals that incorporate tariff levels. Semiconductor manufacturing in the United States increases, reducing import dependence. International competitors potentially establish manufacturing in tariff-advantaged locations like Mexico.

The critical variable is policy consistency. If tariffs shift unexpectedly or expand rapidly, adaptation becomes difficult. If tariff policy remains relatively stable, companies manage costs through supply chain optimization.

Conclusion: Understanding the Broader Picture

The 25 percent tariff on advanced computing chips like AMD MI325X and NVIDIA H200 is significant policy, but its impact is more nuanced than headlines suggest. The tariff specifically targets chips imported for re-export, not domestic use, which fundamentally shapes who bears the burden and what the economic impact will be.

This tariff represents a shift in U.S. semiconductor policy from subsidy-focused approaches to tariff-based leverage. It's designed to influence corporate decision-making about where to manufacture, deploy, and source semiconductors. It's also clearly designed to strengthen U.S. negotiating position in broader trade discussions.

Companies in the semiconductor and technology industries face immediate pressure to respond—adjusting supply chains, exploring tariff mitigation strategies, and planning for potentially expanded future tariffs. Cloud providers and AI companies deploying chips internationally face the most acute pressure, while companies with primarily domestic operations are largely insulated.

For consumers, impact is indirect but real. Technology prices will likely increase 1-5 percent as tariff costs ripple through supply chains. AI service prices might increase modestly as cloud providers adjust for increased infrastructure costs.

The semiconductor industry's response will likely involve supply chain optimization, potential tariff exemption requests, and selective investment in U.S. manufacturing. These responses might mitigate the tariff's intended effects or might prove sufficient to align incentives with administration goals of increasing U.S. semiconductor production and strengthening domestic technology infrastructure.

Ultimately, this tariff is one policy lever in a broader strategy to reshape U.S. technology competition with China and other strategic competitors. Whether that strategy proves effective depends on implementation, international response, and the willingness of the administration to adjust policy based on economic feedback. For now, the technology industry faces a new constraint to navigate and a 25 percent tariff premium on advanced semiconductor exports—not an insurmountable barrier, but a significant cost that will reshape global semiconductor supply chains over the next few years.

FAQ

What is the 25 percent tariff on advanced chips?

The 25 percent tariff is a government tax imposed on advanced computing chips like AMD MI325X and NVIDIA H200 when they are imported into the United States for the explicit purpose of being re-exported to other countries. The tariff adds a 25 percent cost premium to the base chip price. For example, if an advanced GPU costs

How does the tariff affect chip manufacturers like NVIDIA and AMD?

NVIDIA and AMD face direct pressure on chips intended for international markets, as the 25 percent tariff increases the cost of importing these chips into the U.S. for re-export. This reduces competitiveness in price-sensitive markets and potentially reduces export margins. However, the domestic use exception means that chips deployed in U.S. data centers face no tariff burden. Both companies are exploring supply chain optimization, manufacturing partnerships, and tariff mitigation strategies. AMD potentially benefits if it can maintain cost competitiveness despite tariffs, gaining market share against NVIDIA in competitive situations.

Which semiconductors are affected by this tariff?

The tariff specifically targets advanced computing chips, with AMD MI325X and NVIDIA H200 explicitly named. These are AI accelerators used in data center environments for training and running large language models. Other advanced chips used in AI infrastructure might also be subject to the tariff or become subject to it as the administration potentially expands the tariff list. The White House has indicated it may impose broader tariffs on additional semiconductors and products containing semiconductors in the future.

Why did the Trump administration choose 25 percent specifically?

Trump administration officials explained that the 25 percent rate represents "25 percent on the sale of those chips." This suggests the administration wanted a significant economic impact—enough to meaningfully change corporate incentives—without being so extreme that it triggers severe supply chain disruption or international retaliation. The administration had previously threatened 100 percent tariffs but apparently received feedback suggesting that extreme tariff rates would be counterproductive.

What companies face the most severe impact from this tariff?

Chips aggregators, system integrators, and international companies importing advanced chips into the U.S. for re-export to non-U.S. markets face the most direct impact. NVIDIA and AMD experience pressure on international chip exports. International companies that don't have domestic data center operations are more affected than large cloud providers with significant U.S. infrastructure. Smaller technology companies with international focus face more acute burden than companies with primarily domestic operations.

Will the tariff increase prices for consumers?

Consumer impact is indirect. The tariff adds costs to advanced semiconductor imports, but those costs are distributed across supply chains. Consumer electronics prices might increase 2-5 percent as a result of tariff-driven semiconductor cost increases, depending on the device. Cloud service prices might increase 1-3 percent as providers pass along some tariff costs. AI service prices are also indirectly affected through cloud provider pricing. The impact is real but diffuse—not a dramatic price spike but a gradual increase reflecting higher semiconductor input costs.

What are companies doing to respond to this tariff?

Companies are implementing multiple strategies: tariff classification optimization to ensure products receive the lowest applicable tariff rate, manufacturing location adjustments to minimize tariff exposure, inventory and timing strategy adjustments, alternative supplier development to reduce dependence on single sources, and investment in domestic semiconductor sourcing. Larger companies with significant resources can absorb tariff costs through supply chain optimization and accept reduced margins. Smaller companies face more acute pressure and might restructure business operations or pricing.

Might the administration expand these tariffs further?

Yes, the White House explicitly stated it may impose broader tariffs on semiconductor imports and products containing semiconductors in the future. Possible expansion scenarios include adding additional chips to the tariff list, increasing tariff rates above 25 percent, applying tariffs to chips imported for domestic use (not just re-export), or imposing tariffs on finished products containing semiconductors. The administration's language about "potentially" imposing broader tariffs seems designed to maintain pressure on companies to adjust supply chains while leaving room for negotiation.

How do these tariffs relate to China and national security?

Semiconductors are strategic technology critical to national security, as they power AI systems, military applications, and critical infrastructure. The U.S. already restricts exports of the most sensitive semiconductors to China and strategic competitors through export controls. The tariff complements those controls by making it more expensive to export less-restricted advanced chips to international markets. This multi-layered approach—absolute export prohibitions for sensitive technology plus tariffs on less restricted technology—represents comprehensive strategic control over semiconductor distribution.

Could other countries impose retaliatory tariffs in response?

Yes, this is a realistic possibility. South Korea and Taiwan, major semiconductor producers, might impose retaliatory tariffs on American software, cloud services, or other technology products. The European Union might also respond with trade actions. Retaliatory tariffs could escalate trade tensions and create broader economic uncertainty. The administration might use tariff threats and implementation as negotiating leverage to secure concessions from trading partners, which could eventually lead to tariff reductions as part of broader trade deals.

What happens if companies relocate manufacturing or supply chains in response?

Relocation would represent a significant shift in global semiconductor supply chains. Companies might move manufacturing to tariff-advantaged locations like Mexico or establish new manufacturing partnerships in neutral countries. This could actually achieve the administration's goal of encouraging some semiconductor manufacturing capacity in North America while potentially reducing U.S. manufacturing relative to nearshoring arrangements. Supply chain relocations typically take 12-24 months to fully implement, so immediate impact would be limited with most changes appearing over the next 1-3 years.

How long is this tariff expected to remain in place?

There's no announced expiration date, suggesting the tariff is intended as a permanent or long-term policy. However, tariffs can be modified, exemptions can be granted, or policy can shift based on political or economic feedback. Historical patterns suggest semiconductor tariffs often evolve over time as companies adapt and policymakers observe economic impacts. The administration's explicit mention of potentially imposing broader tariffs suggests this tariff is phase one of an evolving semiconductor policy rather than the final form.

If you're looking to optimize your business operations or automate reporting workflows that track these complex tariff implications and supply chain changes, consider exploring Runable's AI-powered automation platform. Teams use Runable to generate reports on supply chain data, create presentations analyzing tariff impacts, and automate documentation of policy changes—all starting at $9/month. Whether you're tracking semiconductor costs or visualizing tariff scenarios, AI-powered document and report generation can save hours of manual work.

Key Takeaways

- Trump's 25% tariff targets advanced chips like NVIDIA H200 and AMD MI325X specifically when imported for re-export, not domestic use

- Tariff was reduced from threatened 100% to 25%, reflecting industry feedback about practical supply chain impacts

- Domestic use exception means U.S. data centers deploying chips face no tariff burden, creating geographic incentives

- NVIDIA faces more acute pressure than AMD due to dominant market position in AI accelerators

- Cloud providers are largely insulated due to significant U.S. data center footprints, but international expansion becomes more expensive

- Administration explicitly reserved right to expand tariffs to additional chips and domestic semiconductor imports

- Companies responding with supply chain optimization, tariff mitigation strategies, and manufacturing location adjustments

- Consumer impact is indirect but real, with 1-5% price increases expected in technology products as tariff costs ripple through supply chains

- Tariff represents shift from Biden's subsidy-focused approach to Trump's leverage-focused tariff strategy

Related Articles

- RAM Price Hikes & Global Memory Shortage [2025]

- OpenAI's $10B Cerebras Deal: What It Means for AI Compute [2025]

- China's Technological Dominance: The Chinese Century Explained [2025]

- The End of Cheap Phones: Why Prices Are Rising 30% in 2025

- Wikipedia's Enterprise Access Program: How Tech Giants Pay for AI Training Data [2025]

- Meta Compute: The AI Infrastructure Strategy Reshaping Gigawatt-Scale Operations [2025]

![Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]](https://tryrunable.com/blog/trump-s-25-advanced-chip-tariff-impact-on-tech-giants-and-ai/image-1-1768488188299.jpg)