Introduction: The Stunning Cost of Building the Metaverse

In January 2026, Meta revealed a number that made headlines across the tech industry: its Reality Labs division burned through $19.1 billion in 2025. That's not a typo. That's not a quarterly loss. That's an entire year of bleeding cash into virtual reality and augmented reality hardware, software, and infrastructure with almost nothing to show for it as reported by TechCrunch.

To put this in perspective, $19.1 billion is more than the annual revenue of Shopify, more than Twitter's peak valuation, and roughly equivalent to the entire market cap of Snap when it went public. It's money that could have funded thousands of startups, rebuilt infrastructure in underfunded cities, or solved actual problems in Meta's core social media business. Instead, it evaporated into the metaverse.

The worst part? CEO Mark Zuckerberg warned investors to expect nearly identical losses in 2026. In his earnings call, he stated that Reality Labs losses would "likely be the peak," suggesting a slow decline over future years. But peak or not, shareholders are watching billions of dollars disappear with no clear path to profitability according to 24/7 Wall St.

This wasn't supposed to happen. When Meta pivoted toward the metaverse in 2021, the company projected that immersive computing would become the next major computing platform, following smartphones and personal computers. Zuckerberg famously committed to spending "many billions of dollars per year" for years to build this future. Five years later, the bet looks increasingly like a catastrophic misjudgment as noted by MSN.

But this story goes deeper than just bad spending. It reveals fundamental questions about how mega-cap tech companies bet billions on unproven visions, how internal momentum can override market signals, and whether the metaverse was ever a real opportunity or just an expensive distraction. Understanding Meta's Reality Labs disaster offers lessons for anyone interested in technology strategy, capital allocation, and the dangers of visionary leadership without accountability.

TL; DR

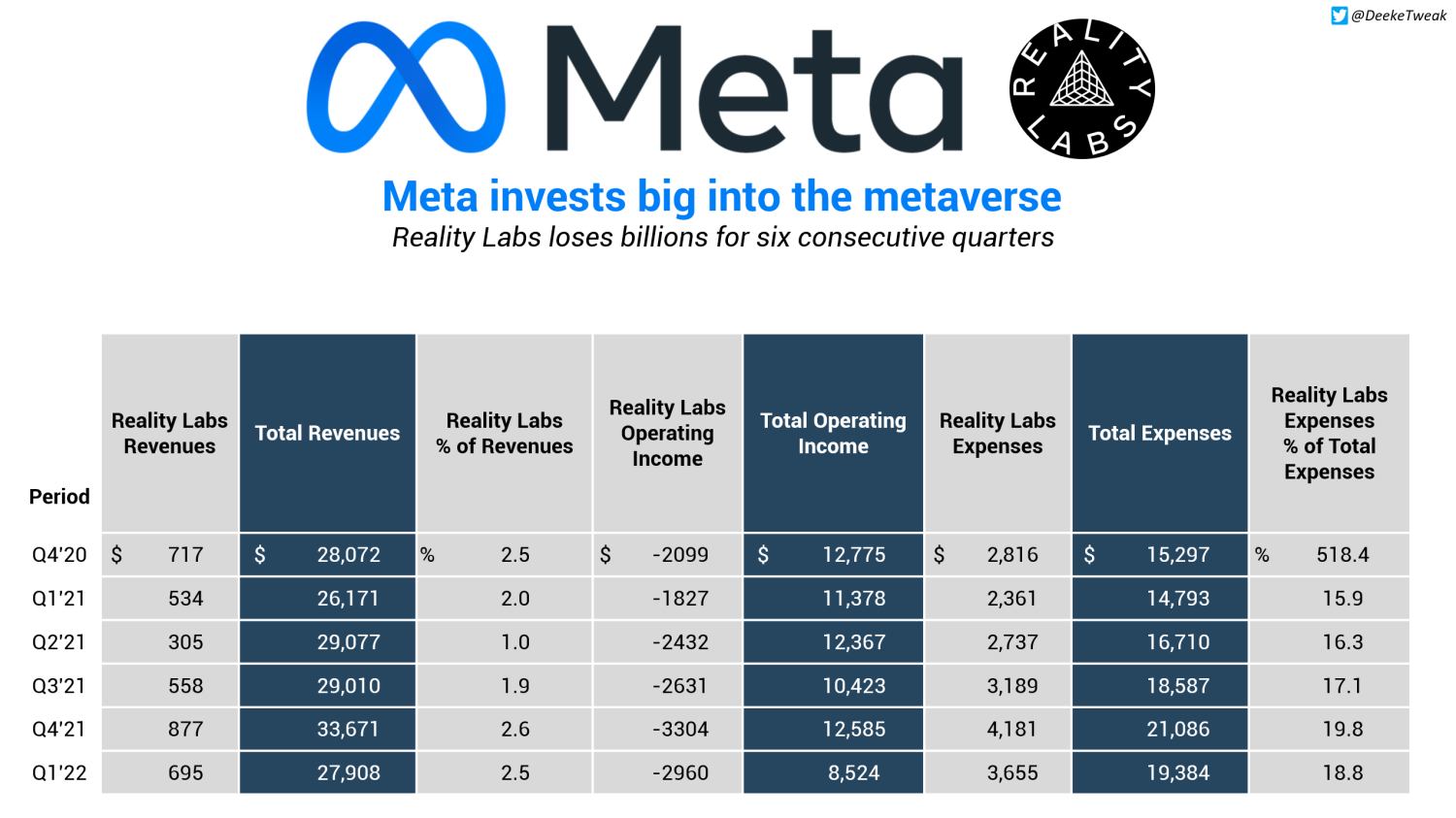

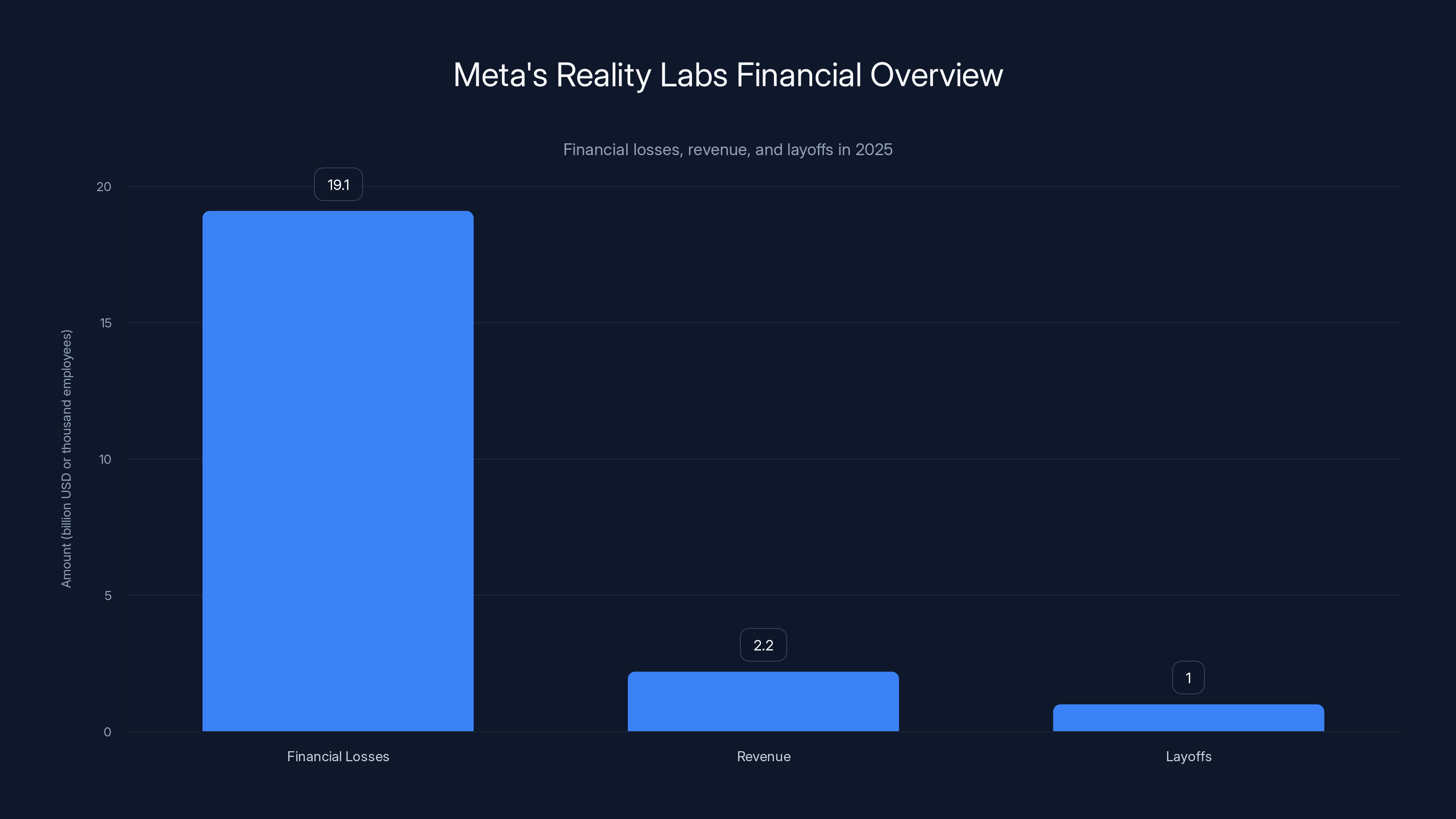

- Meta's Reality Labs lost $19.1 billion in 2025, with nearly identical losses expected in 2026 according to TechCrunch

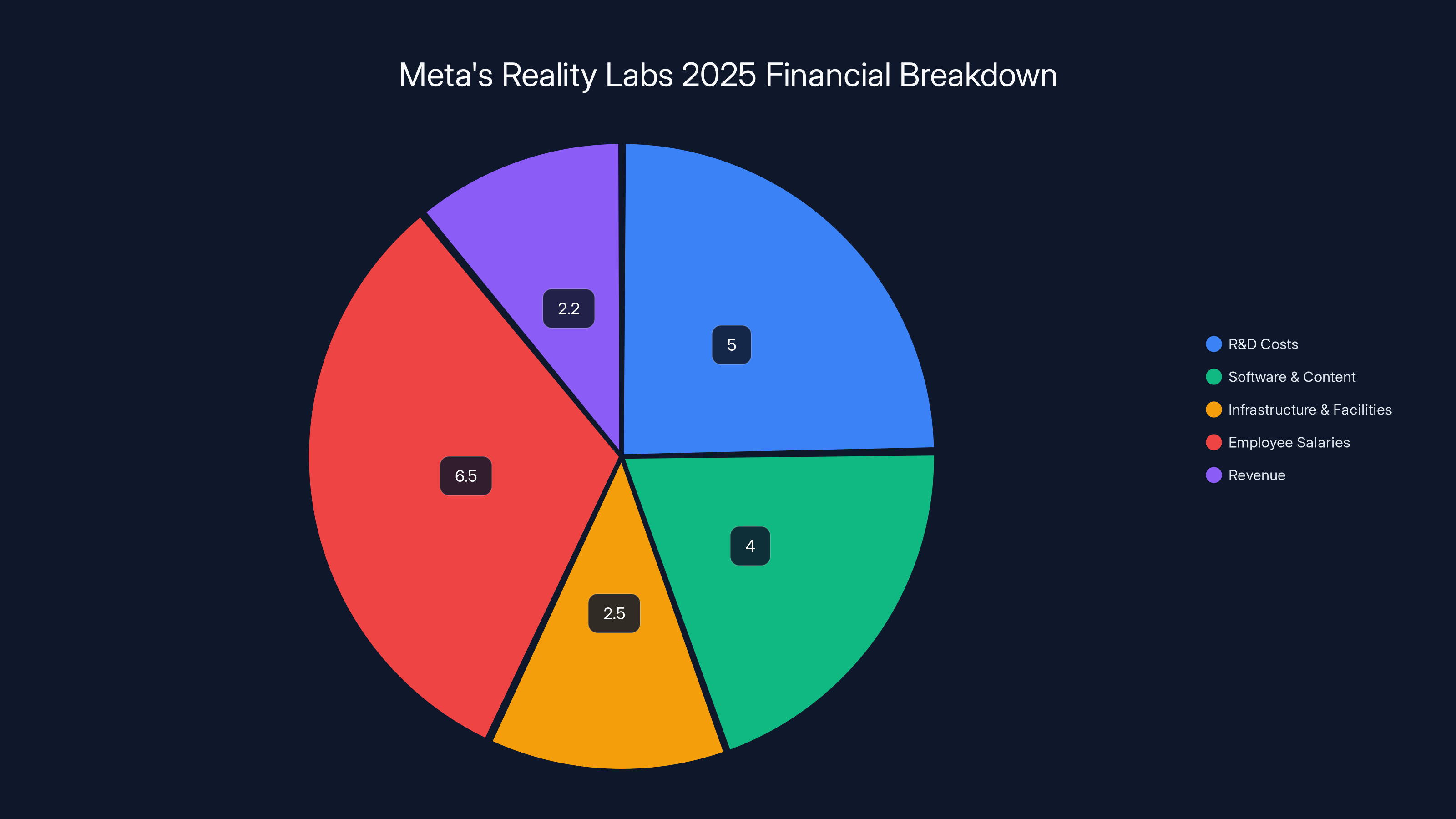

- Revenue from VR hardware and software remains negligible, totaling just $2.2 billion across the entire year

- The company laid off 10% of Reality Labs staff, cutting approximately 1,000 employees while simultaneously shuttering VR studios as reported by CNBC

- VR market adoption remains far below projections, with consumer interest stalling and enterprise applications limited according to DemandSage

- Zuckerberg expects losses to eventually decline, but no timeline or profitability target has been clearly defined

In 2025, Meta's Reality Labs experienced a $19.1 billion loss, with R&D and employee salaries being the largest expenses. Revenue from VR hardware and software sales was insufficient to cover these costs. Estimated data.

How Meta Got Here: The Rise of the Metaverse Vision

The 2021 Pivot That Changed Everything

In October 2021, Meta made one of the boldest strategic announcements in tech history: the company was rebranding from Facebook and reorganizing around the concept of the metaverse. This wasn't a minor pivot. Zuckerberg declared that the metaverse would be "the successor to the mobile internet" and that the company would invest aggressively to build infrastructure for an immersive, 3D internet where people would work, socialize, and play in virtual environments as detailed by Yahoo Finance.

At the time, this announcement was actually received with some enthusiasm from investors. The tech world had just witnessed the success of the iPhone (which created the mobile computing era), and many believed that immersive reality would be the next paradigm shift. If Meta could dominate virtual reality the way it had dominated social media, the financial returns could be astronomical.

Zuckerberg was explicit about the commitment. He stated that Meta would invest billions of dollars per year, for years, to build the infrastructure, hardware, and software needed to make the metaverse viable. The company created Reality Labs as a separate operating unit, hired thousands of engineers, and began developing VR headsets, AR glasses, and the software ecosystems to support them.

The strategic logic seemed sound on paper: Meta's core advertising business was facing increasing regulatory pressure and privacy challenges. A new platform where Meta could control hardware, software, and the ecosystem would theoretically give the company more power. Plus, if immersive computing really was the future, getting there first would be a massive advantage.

Reality Labs' Product Roadmap

In the years following the pivot, Reality Labs developed a hardware roadmap that attempted to address different segments of the VR and AR market. The strategy included multiple products at various price points and capability levels.

The company invested heavily in the Meta Quest line of VR headsets, which became the most successful consumer VR product on the market. The Quest 3, released in 2023, offered decent specs at a mid-range price point and gained meaningful market share in the consumer VR space. The company also developed Ray-Ban smart glasses, which incorporated AR capabilities and were positioned as a fashion accessory rather than a geeky gadget.

Beyond consumer products, Reality Labs invested in enterprise software, particularly through Horizon Workrooms, which was pitched as a VR collaboration platform for remote teams. The company also developed various content creation tools, gaming platforms, and social experiences designed to make VR more compelling.

On paper, this was a comprehensive strategy covering consumer, enterprise, and software segments. The problem? None of it generated significant revenue, and the costs spiraled dramatically as reported by Engadget.

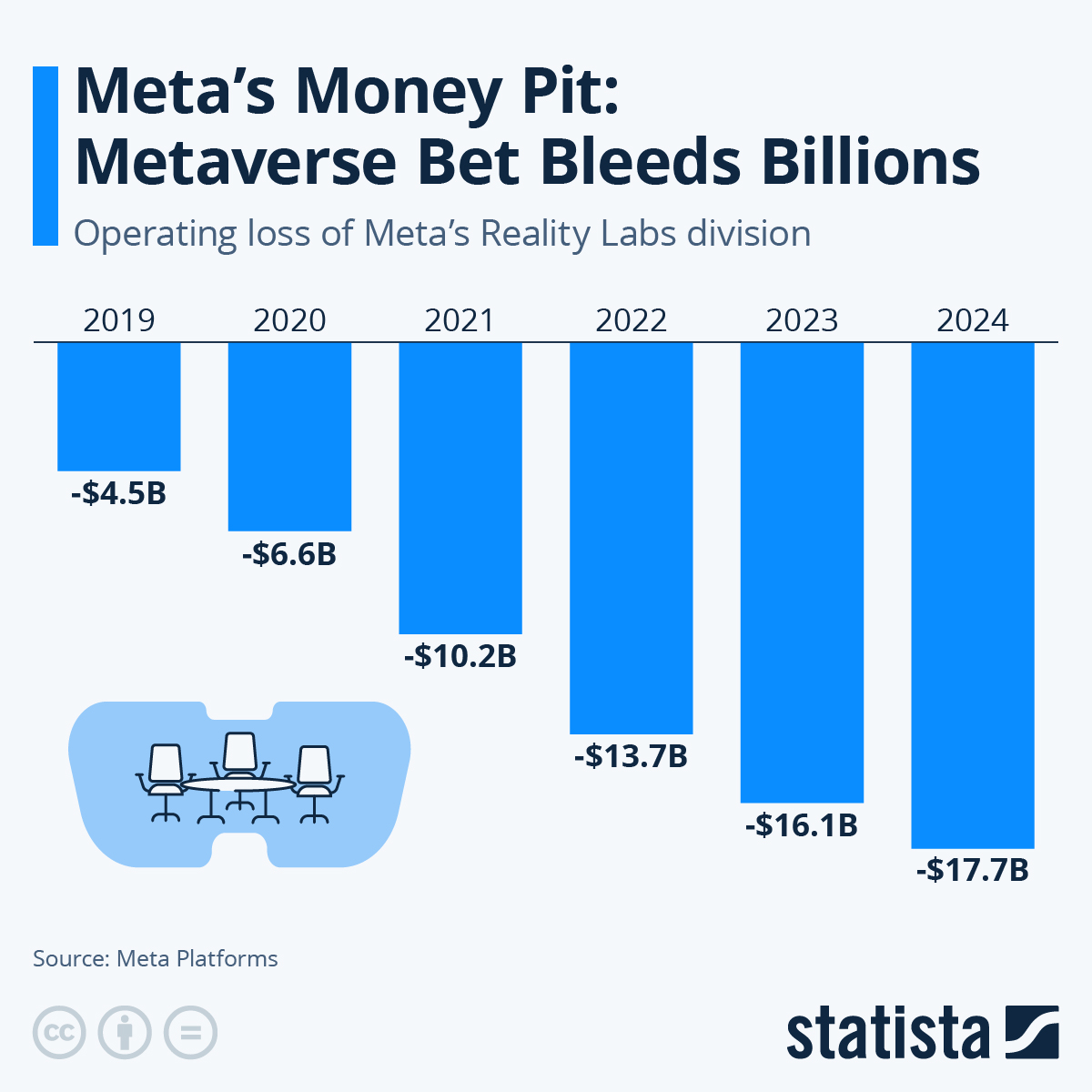

Reality Labs' losses have consistently increased from 2021 to 2025, reaching $19.1 billion in 2025. Despite expectations for reduced losses, the financial trajectory shows a worsening trend. Estimated data for 2021 and 2023.

The Financial Reality: $19.1 Billion Gone

Breaking Down the Numbers

Let's look at what the financial numbers actually tell us. In 2025, Reality Labs generated

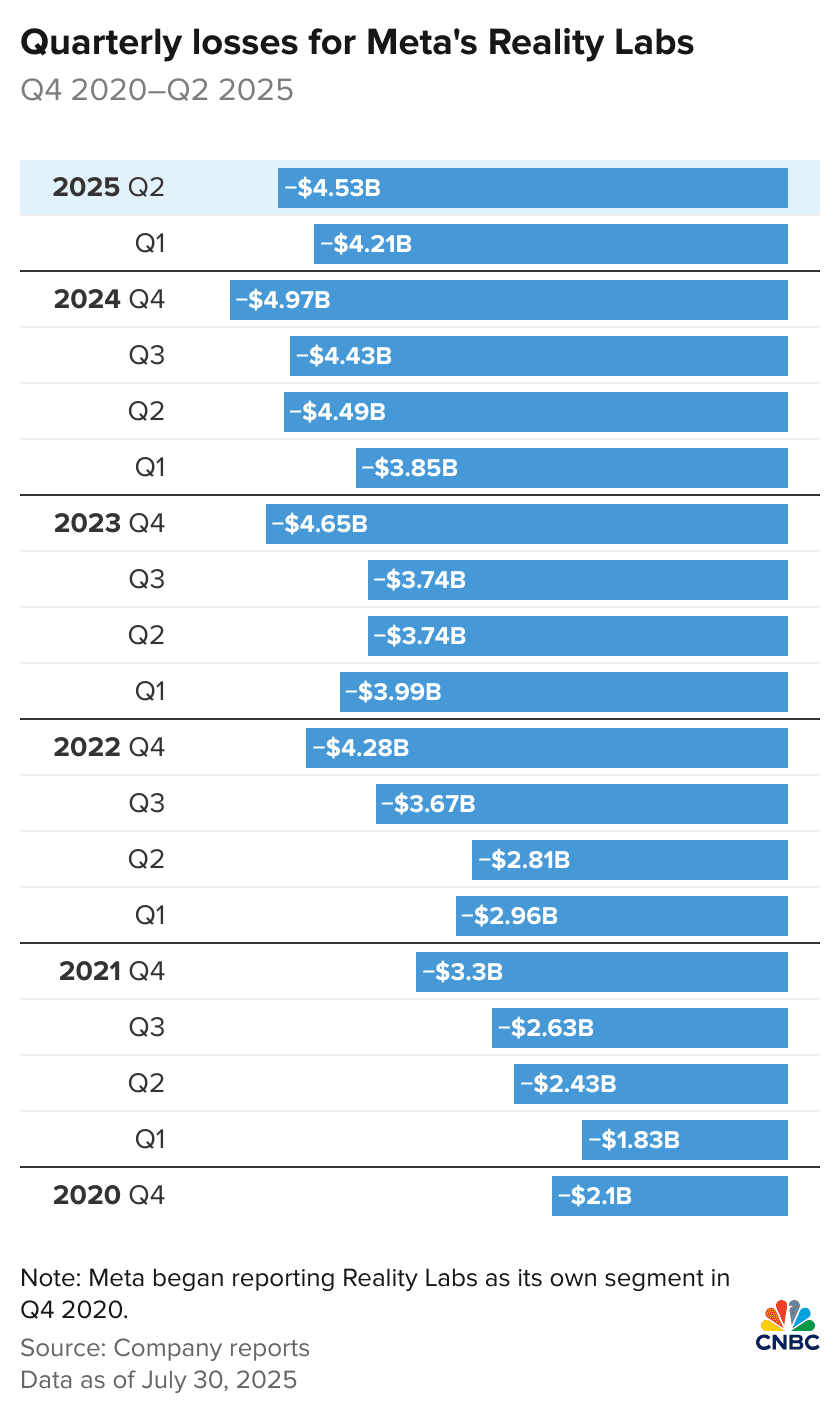

The loss in Q4 2025 alone was

To put this in context, the division is operating at a loss margin of approximately 865%. Using the formula:

In other words, the division is losing nearly

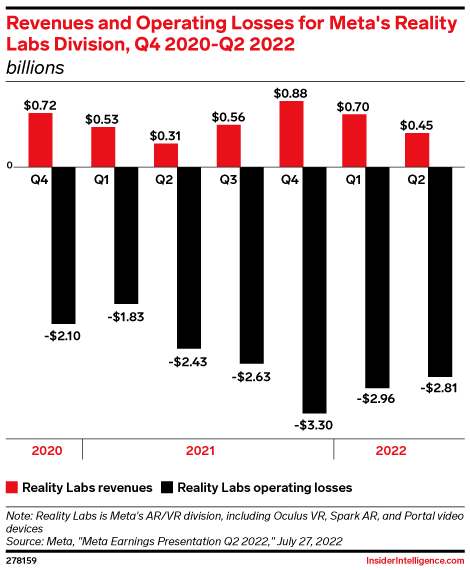

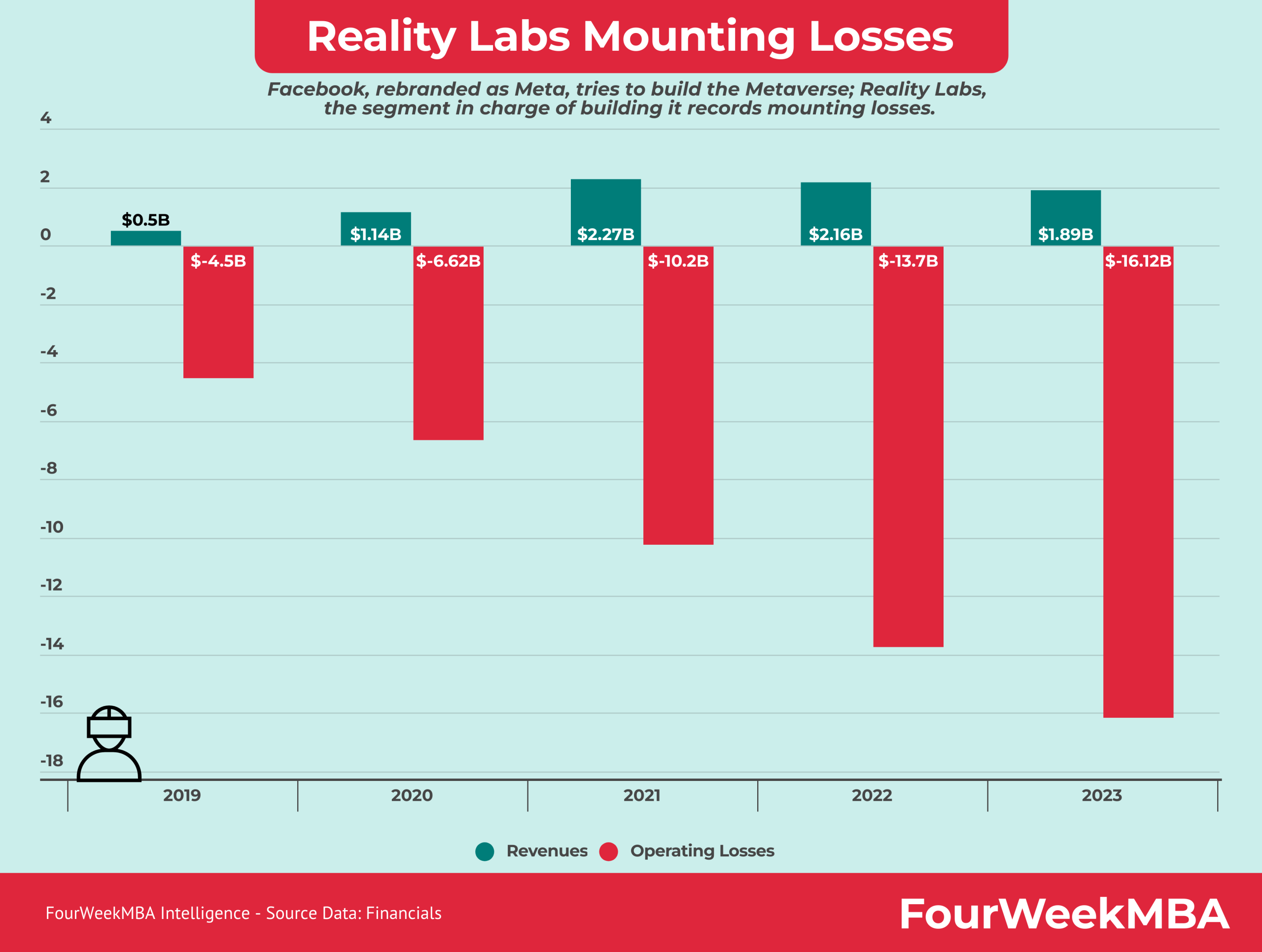

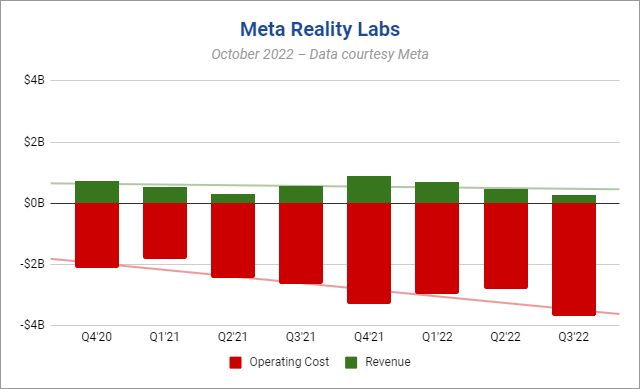

Comparison to Previous Years

These 2025 losses are actually worse than the previous year. In 2024, Reality Labs lost

The trend is concerning. If we chart the last few years of Reality Labs losses:

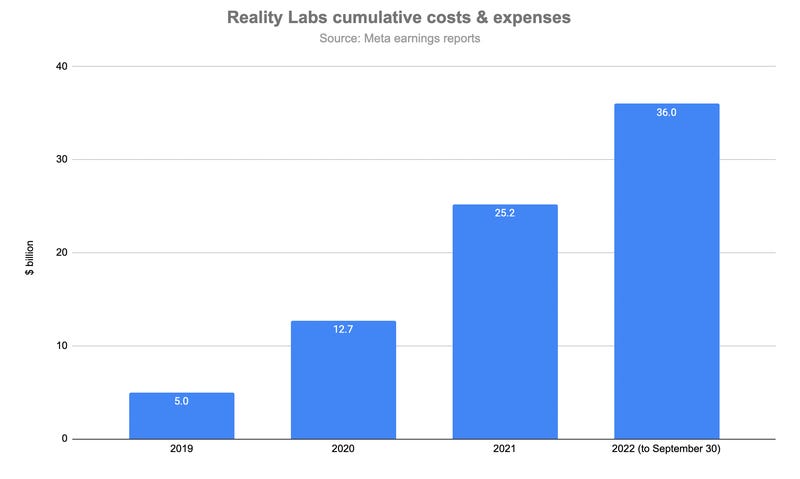

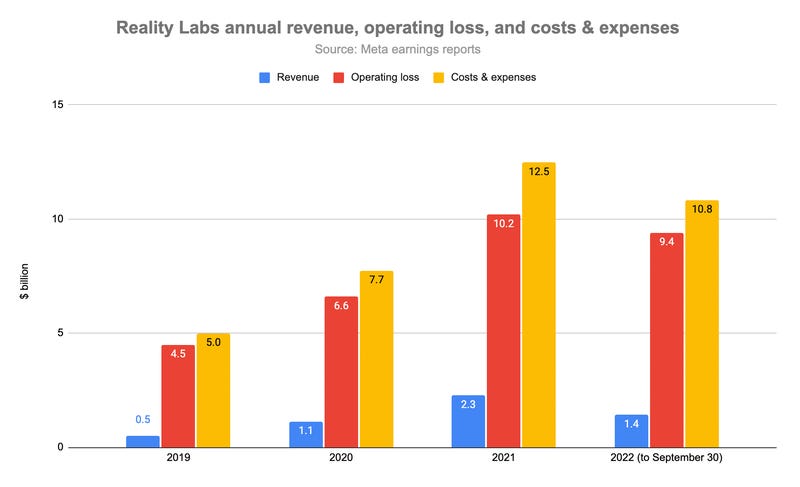

- 2021: First full year as a separate division, estimated $10+ billion loss (not fully disclosed)

- 2022: $13.7 billion loss

- 2023: $15.5 billion loss (estimated)

- 2024: $17.7 billion loss

- 2025: $19.1 billion loss

The trajectory shows that instead of reaching an inflection point where efficiency improved, costs kept rising. Revenue remained relatively flat while expenses continued to climb. This isn't the pattern of a business on a path to sustainability. It's the pattern of unconstrained spending without clear cost discipline.

Why the Losses Keep Growing: Inside Reality Labs Spending

The Cost of Building Hardware

One major driver of these massive losses is the inherent cost of developing consumer electronics. Building a VR headset from scratch requires massive R&D investment in custom chips, displays, optics, industrial design, and manufacturing setup. Unlike software, where marginal costs are nearly zero, each VR headset costs money to manufacture.

Meta's approach to hardware development has been aggressive. The company invested in custom silicon, attempting to reduce dependence on suppliers and differentiate its products. Building semiconductor fabrication partnerships costs billions. Developing proprietary display technology, custom operating systems, and tracking systems requires enormous teams of specialized engineers.

Then there's the manufacturing infrastructure. Setting up production lines for consumer electronics requires upfront capital investment that needs to be amortized across units sold. If sales are disappointing, those fixed costs become a massive burden.

For the Meta Quest line, the company pursued a strategy of aggressive pricing, offering headsets at prices below their manufacturing and development costs. The theory was that volume would eventually improve margins. But if volume isn't there, you're just losing money faster.

The Software and Content Spend

Beyond hardware, Reality Labs spent heavily on software development and content creation. The company wanted to create a compelling software ecosystem that would justify purchasing a headset, so it invested in developing games, social experiences, and productivity software.

More importantly, Meta invested directly in creating content. Rather than relying on third-party developers to build killer apps, the company essentially self-funded a game studio and content creation operation. This included acquiring companies like Beat Games (creator of Beat Saber), developing Horizon Worlds and Horizon Workrooms, and sponsoring numerous content creators.

This strategy didn't work the way Meta hoped. Even with direct investment in content, the software ecosystem for VR remains thin compared to traditional computing platforms. Most VR users have a handful of favorite apps and rarely explore beyond them. The idea that millions of people would spend hours per day in Horizon Worlds never materialized.

Real Estate and Infrastructure

Meta also invested in physical infrastructure. The company built new facilities, leased enormous office and development spaces, and set up testing laboratories. The company's Redmond, Washington office became a hub for VR and AR development, requiring massive real estate and facilities investment.

Infrastructure costs include cloud computing resources, content delivery networks, and the physical infrastructure needed to support VR services. As the software ecosystem grew, so did these costs.

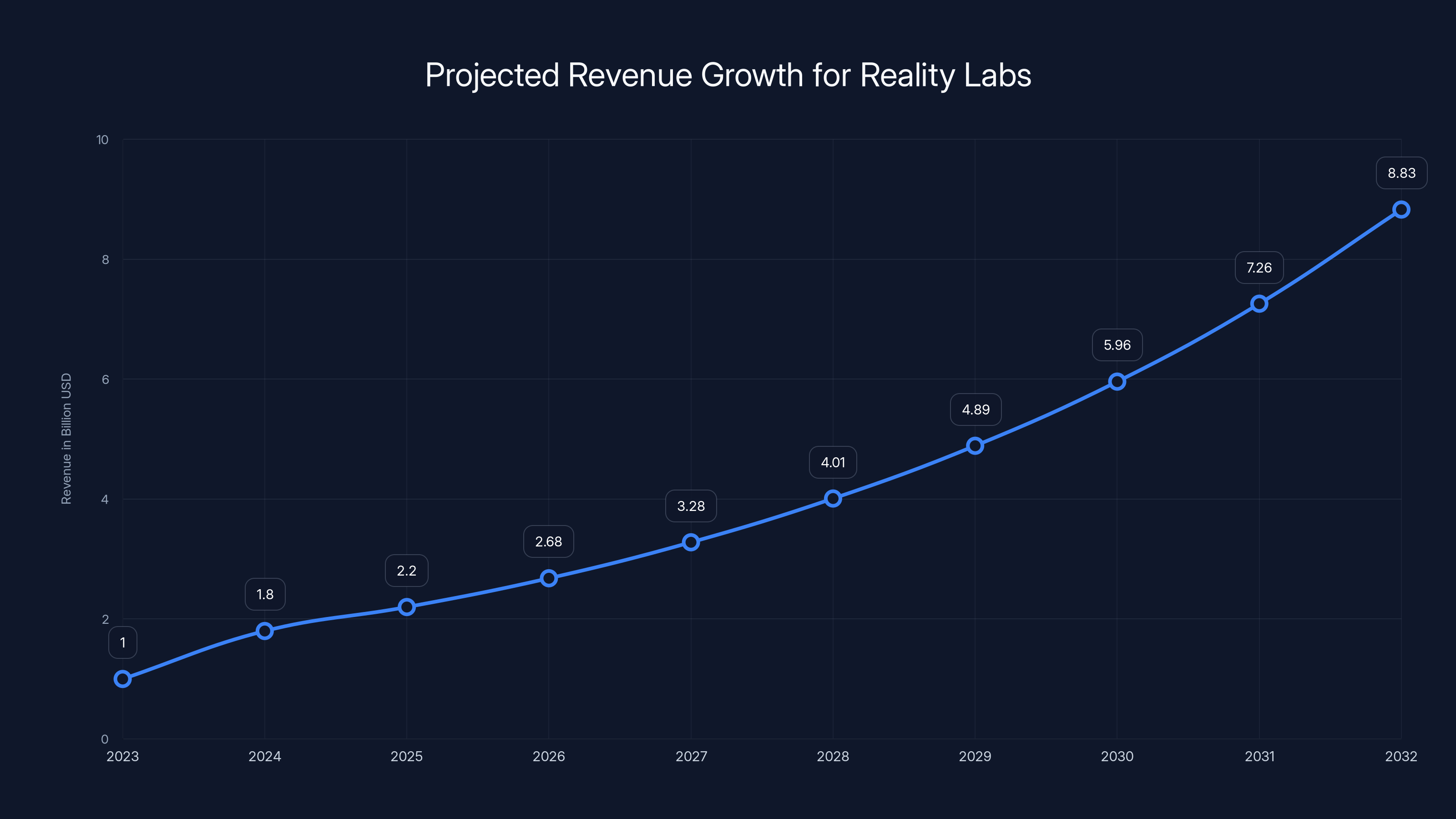

Reality Labs' revenue is projected to grow to approximately $8.83 billion by 2032 if the current 22% annual growth rate continues. Estimated data.

The Market Reality: Why VR Adoption Stalled

Consumer VR Adoption Plateaued

Here's the uncomfortable truth that Reality Labs has been reluctant to acknowledge: the consumer VR market never achieved mainstream adoption. After the initial excitement in 2016-2018, the market matured at a much smaller level than anyone anticipated as analyzed by TechTarget.

Consumer VR headsets have sold in the millions, not tens of millions. The Meta Quest 3 is the best-selling VR headset in the market, but annual sales are measured in low single-digit millions. Compare this to smartphones, which sell hundreds of millions per year, or gaming consoles, which sell tens of millions annually. VR remains a niche product used primarily by gaming enthusiasts and early adopters.

Why hasn't VR broken through? Several factors:

Physical barriers to adoption: VR headsets are still uncomfortable for extended use. They're heavy, they cause motion sickness in some users, they're socially isolating, and they require significant physical space. Most people can use a smartphone for hours. Few people can comfortably use a VR headset for more than 30 minutes.

Killer app never materialized: The VR industry has never produced a "killer app" that compels casual users to purchase a headset. Gaming is the primary use case, but most gamers prefer traditional gaming on consoles, PCs, or mobile devices. Productivity applications like Workrooms saw adoption measured in thousands, not millions.

Price remains a barrier: A VR headset costs

Better solutions often exist: For most use cases that VR promised to solve (collaboration, training, entertainment), other technologies often work better. Video calls work fine for remote meetings. YouTube and streaming work fine for entertainment. Traditional gaming works fine for games. VR is often worse at these tasks than the alternatives.

Enterprise VR Never Took Off

Meta pinned hopes on enterprise applications, particularly with Horizon Workrooms as a VR collaboration platform. The pitch was compelling: in a hybrid work world, VR could create immersive meetings where remote workers felt like they were in the same room.

This market opportunity never materialized. Enterprise VR adoption remains minimal. Most companies that experimented with VR meetings found that the technology created more friction than video conferencing. Users had to put on headsets, the experience was often glitchy, and the social dynamics were awkward. Most enterprises concluded that a Zoom meeting was actually better than a VR meeting.

Meanwhile, traditional enterprise software companies like Microsoft, Google, and Cisco kept improving their video conferencing and collaboration tools. These established players had existing customer relationships and distribution advantages. By the time Reality Labs pivoted to enterprise, the competitive window had closed.

The Strategic Missteps: Why the Metaverse Vision Failed

Overestimating Technology Readiness

One critical error was assuming that VR technology was ready for mainstream adoption. The company believed that if they built impressive hardware and software, users would come. This reflects a particular type of thinking common in tech companies: the assumption that technology quality and capability are the limiting factors.

In reality, technology adoption is driven by many factors beyond raw capability. Comfort, social acceptance, ecosystem maturity, and clear value proposition matter enormously. Meta built impressive hardware, but that wasn't enough.

Underestimating Competitive Responses

When Meta announced the metaverse strategy, competitors were initially slow to respond. But eventually, Apple, Microsoft, Google, and Sony all invested in mixed reality and spatial computing. Apple's Vision Pro, released in 2024, was a technical marvel but didn't achieve mainstream adoption either. The fundamental market constraint wasn't Meta's lack of innovation. It was that the market itself was smaller than anticipated.

Building the Ecosystem Backwards

Traditional successful tech platforms grew from grassroots developer enthusiasm and third-party innovation. Meta tried to build the metaverse top-down, with Meta as the primary creator of content and experiences. This approach meant that the company bore all the costs and risks of content creation without having a clear user base to justify the investment.

The successful platforms of the past (iOS, Android, Windows, the web) succeeded because third-party developers saw a path to profitability and built ecosystem content organically. Meta created Horizon Worlds, Beat Saber, and numerous applications, but they never achieved the engagement levels that would justify the investment as discussed by CMSWire.

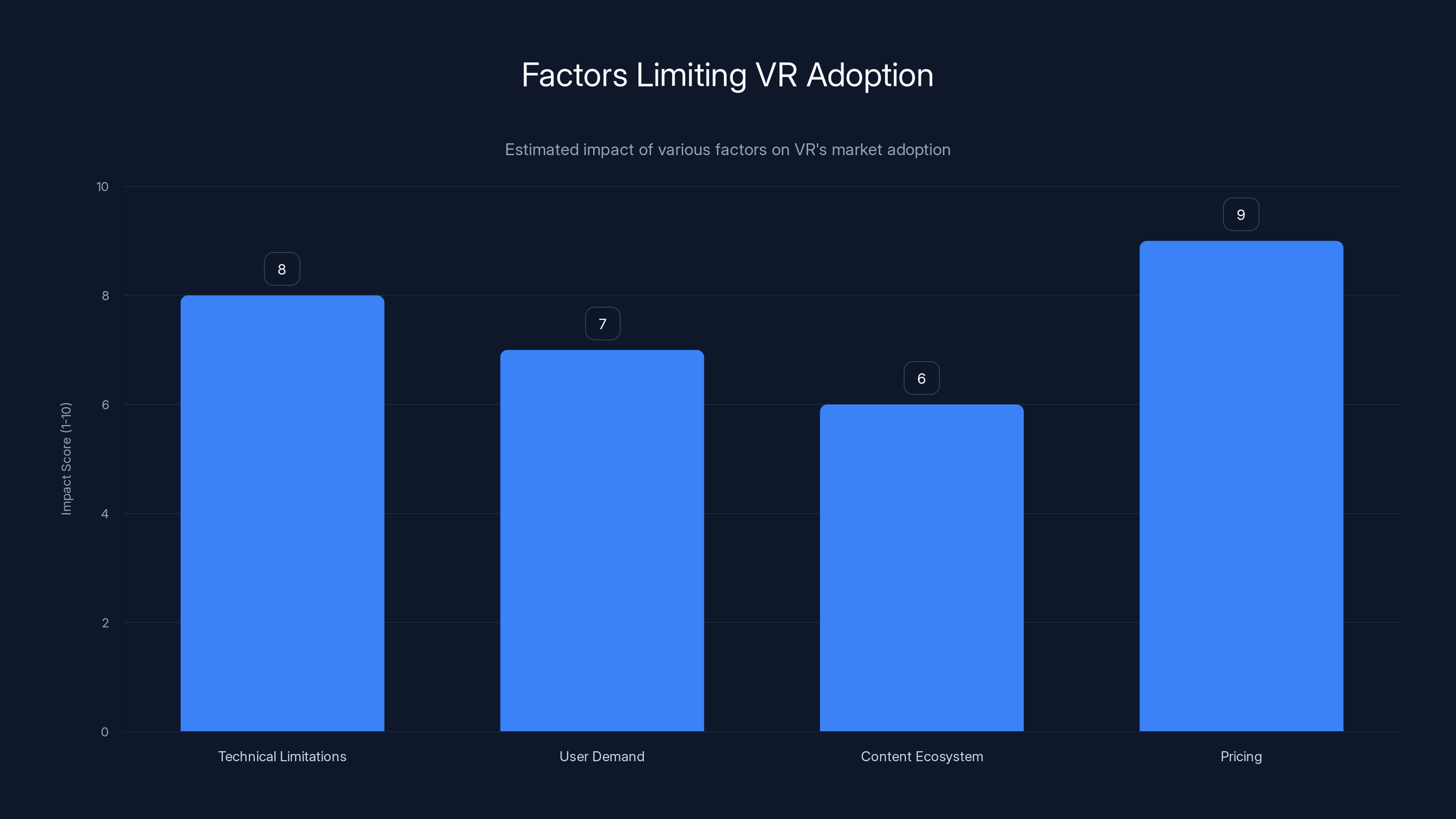

Estimated data shows that pricing and technical limitations are the most significant barriers to VR adoption, with user demand and content ecosystem also playing major roles.

The Recent Layoffs and Studio Closures: Admission of Failure

10% Workforce Reduction

In January 2026, Meta announced that it would lay off 10% of the Reality Labs workforce, cutting approximately 1,000 employees. This was part of a broader cost-cutting initiative across the company, but it was particularly significant for Reality Labs as reported by CNBC.

This layoff wasn't just about general cost management. It was an admission that the division's workforce had grown beyond what was sustainable given revenue and market conditions. The layoffs suggest that either Meta's leaders recognized that their ambitions for Reality Labs were unrealistic, or they were forced to cut costs by the board or investors.

The timing is particularly telling. Zuckerberg announced the Reality Labs losses and projected continued losses in 2026, then immediately followed with layoffs. This suggests that even Zuckerberg recognizes that the current spending trajectory is unsustainable.

Shuttering VR Studios

Beyond workforce reductions, Meta announced that it would close multiple VR development studios. This includes the retirement of the Workrooms application, which had been pitched as a key enterprise productivity tool.

Closing studios is an even more telling sign than layoffs. When you shut down a studio, you're not just reducing headcount. You're admitting that an entire product line or strategic bet isn't working out. In this case, Meta closed studios that had been developing social experiences, enterprise tools, and gaming content.

The studio closures follow a pattern: Meta invested billions in building content and software for the VR ecosystem, realized that the ecosystem wasn't growing, and concluded that further investment wasn't justified. This is rational, but it's also an admission of the core strategy's failure as noted by Engadget.

Financial Analysis: When Will Reality Labs Break Even?

Projections Based on Current Trends

Let's do some math on profitability timelines. For Reality Labs to break even, one of two things needs to happen:

- Revenue grows dramatically while costs remain flat

- Costs reduce significantly while revenue grows modestly

Looking at revenue trends, Reality Labs has generated roughly

Meanwhile, if costs remain at

A more realistic scenario requires aggressive cost reduction. If Meta can cut Reality Labs costs to

The Opportunity Cost Question

What's particularly striking about Reality Labs losses is the opportunity cost. Meta generates approximately

- Increase shareholder returns through stock buybacks or dividends

- Fund R&D in profitable areas like AI, which is becoming Meta's new strategic focus

- Acquire smaller companies and integrate them into the core business

- Reduce ad prices to gain market share against Google

- Invest in infrastructure to support core products

Instead, that capital evaporated into a division with uncertain prospects.

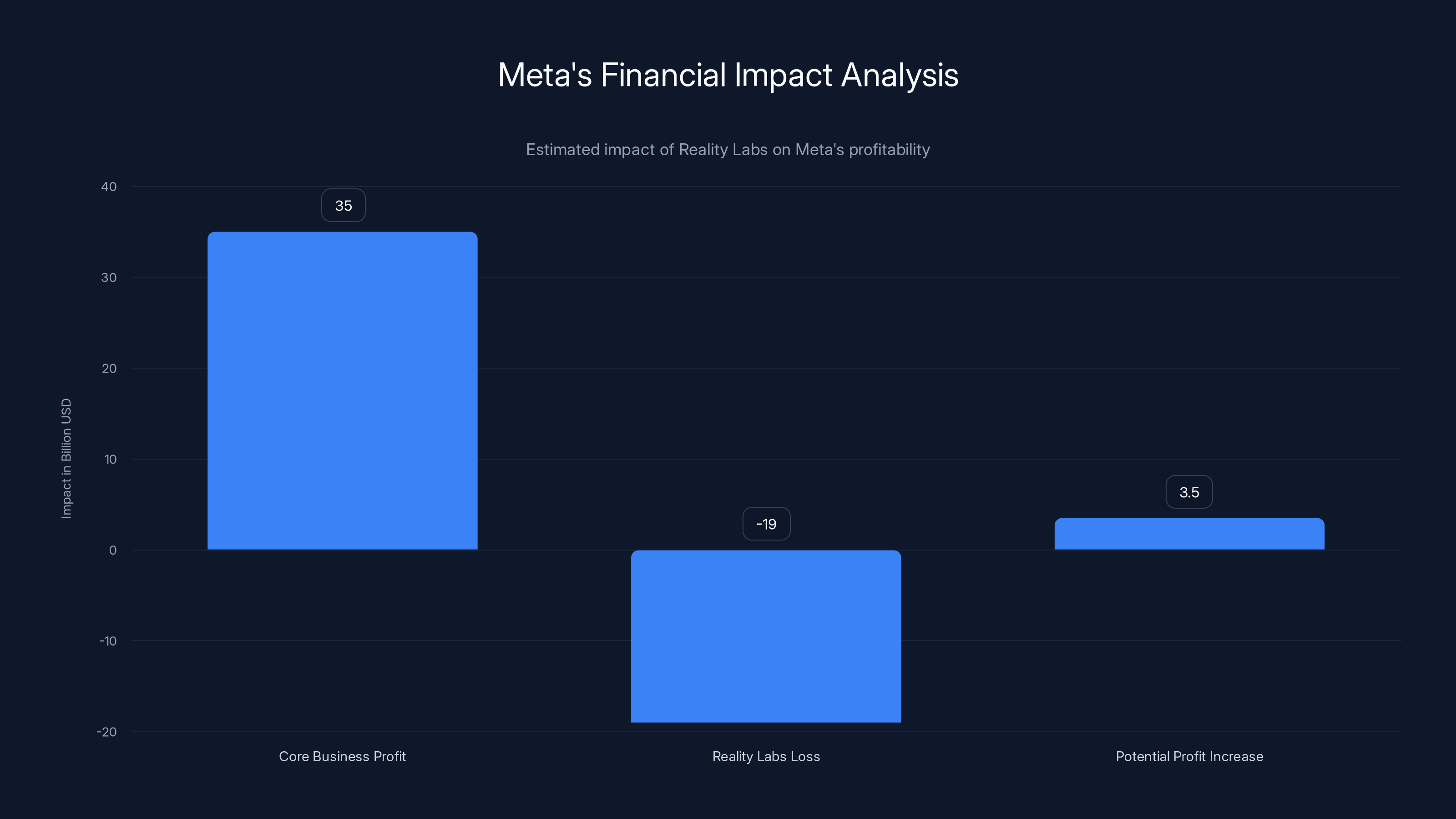

Estimated data shows that eliminating Reality Labs'

The AI Pivot: Meta's New Strategic Focus

Zuckerberg's Shift in Rhetoric

Notably, while Zuckerberg maintained optimistic public statements about Reality Labs during the earnings call, his strategic focus has clearly shifted toward artificial intelligence. The company is aggressively investing in AI research, developing large language models, and positioning AI as the core technology driving Meta's future as reported by CNBC.

This pivot is significant because it reveals priorities. Meta has finite capital to deploy. The fact that the company is simultaneously investing heavily in AI (a fundamentally different technology direction than VR/AR) suggests that leadership views the AI opportunity as more promising than the metaverse opportunity.

Zuckerberg stated that Meta is "directing most of our investment towards glasses and wearables going forward" for Reality Labs, which is corporate-speak for "we're reducing investment in this division." Meanwhile, the company is pouring resources into AI infrastructure, researcher hiring, and model development.

The Implicit Admission

The timing of the AI pivot simultaneously with massive Reality Labs losses is an implicit admission that the metaverse strategy didn't work out as planned. If the metaverse was truly the future of computing, Meta wouldn't be pivoting to AI. But executives clearly believe AI represents a more promising path forward.

This isn't necessarily a sign of weakness. Shifting strategies based on market feedback and technological progress is rational. The problem is that Meta spent five years and over $100 billion on the previous strategy, and the market told it clearly that the metaverse wasn't ready for mainstream adoption.

Broader Industry Implications: What VR's Failure Teaches Us

The Limits of Top-Down Technology Development

Meta's Reality Labs experience demonstrates something important about technology adoption: you can't force a major new platform into existence through sheer capital investment if the underlying technology, economics, and user demand aren't aligned.

This challenges a common belief in the tech industry: that money and engineering talent can solve any problem and create any market. In reality, some technologies are genuinely not ready, and some markets are smaller than people hope.

VR is technically impressive. The Meta Quest 3 has excellent specs, compelling software, and competitive pricing. But technical quality didn't create a large consumer market. The technology has fundamental limitations (comfort, field of view, locomotion sickness) that make it unsuitable for extended use. The content ecosystem is shallow because users aren't willing to spend money on VR games and experiences at the volume needed to justify developer investment.

This is an important lesson for other companies pursuing emerging technologies. Apple's Vision Pro, for instance, is an even more impressive piece of hardware than Meta's Quest devices. But it's also wildly expensive ($3,500 starting price) and solving a problem that most people don't have. Early indicators suggest it will have limited adoption, despite Apple's exceptional product design and brand power.

The Cost of Chasing Trends

Meta's Reality Labs spending also illustrates the cost of a company being seen as chasing trends. When Zuckerberg announced the metaverse pivot, many observers saw it as the company desperately seeking the next big thing to maintain growth and stock price. The narrative was that Meta, despite its enormous existing business, was trying to reinvent itself around an unproven concept.

This perception had real consequences. It made investors nervous. It made employees question leadership direction. It gave competitors a sense that Meta was vulnerable and distracted. None of this was helped by the fact that the Reality Labs business model never worked out.

Meta's Reality Labs faced significant financial challenges in 2025, with

The Path Forward: What Reality Labs Needs to Do

Radical Cost Reduction

For Reality Labs to eventually become a sustainable business, the division needs to aggressively reduce costs. The current spending level is clearly unsustainable relative to revenue. This means:

- Reducing the workforce further, not just 10% but potentially 30-50% beyond current levels

- Closing underperforming product lines, such as VR hardware development

- Narrowing the focus to areas with the most potential, like smart glasses

- Reducing internal content creation and relying more on third-party developers

- Outsourcing more development to lower-cost geographies

This would be painful, but it's probably necessary to put Reality Labs on a sustainable path.

Focusing on AR Rather Than VR

Long-term, augmented reality likely has more potential than virtual reality. AR devices overlay digital information onto the real world, making them useful for navigation, information lookup, and productivity tasks. VR fully immersive experiences are fun but limited in practical application.

Meta's Ray-Ban smart glasses are positioned as AR devices, though currently with limited functionality. Focusing investment on AR—particularly AR glasses that could eventually match smartphone capabilities—is probably more realistic than the current VR-heavy strategy.

Accepting a Smaller Market

Meta needs to accept that the metaverse market is smaller and developing slower than initially hoped. Rather than investing for a market of billions of daily active users, the company should design for a market of millions of enthusiasts and professionals. This means:

- Abandoning grand vision of mainstream metaverse adoption

- Focusing on niche applications where VR provides genuine value

- Accepting that ROI will be negative for many more years

- Building sustainable unit economics before pursuing scale

This is a more humble vision than the metaverse dream, but it might actually be achievable.

Comparing to Apple's Vision Pro: Why Even Apple Can't Make VR Mainstream

Apple's Impressive but Limited Product

Apple's Vision Pro, released in early 2024, represents the state of the art in spatial computing hardware. The device is technically superior to Meta's Quest headsets in many ways: higher resolution displays, better tracking, more polished software, and superior brand positioning.

Yet initial reviews and sales data suggest that Vision Pro will have limited adoption, despite Apple's ability to influence consumer technology trends. The $3,500 price point puts it out of reach for most consumers. The use cases remain unclear. And most importantly, it's solving the same fundamental problems that VR has always faced: comfort, isolation, and lack of compelling applications.

Apple's struggles with Vision Pro, despite the company's hardware expertise and brand power, further validate the conclusion that the market for immersive computing is fundamentally smaller than many expected. If Apple can't make VR mainstream with its design and brand advantages, it's unlikely that anyone can.

What Vision Pro's Struggle Means for Reality Labs

For Meta, Apple's Vision Pro struggles are actually bad news. If Apple—with superior design, manufacturing, brand positioning, and ability to integrate across a hardware ecosystem—can't gain significant market traction with AR/VR, then Meta's prospects are even dimmer.

This creates a strategic problem for Reality Labs. The market for VR/AR is smaller than anticipated, and the competition includes the world's most powerful tech company. Meta's best hope is to own a disproportionate share of a niche market, not to create the mainstream metaverse that Zuckerberg initially envisioned.

The Human Cost: What the Layoffs Mean for Employees

Job Security in Reality Labs

Beyond the financial metrics, the layoffs and studio closures have real human consequences. Thousands of engineers, designers, product managers, and other professionals who bet their careers on the metaverse vision are now facing unemployment or transfers to other parts of Meta.

For many of these employees, joining Reality Labs represented a chance to work on what seemed like the future of computing. They took lower salaries or relocated to work on cutting-edge technology. And then the business case evaporated.

The layoffs hit particularly hard in places like Redmond, Washington, which became a hub for VR development. Sudden job cuts in these communities have ripple effects on local real estate markets, schools, and service businesses.

The Broader Message About Strategic Leadership

Meta's Reality Labs experience sends a message to tech workers about strategic risk and corporate decision-making. It demonstrates that even at the world's largest tech companies, massive capital investments can turn out to be mistakes. It shows that working on strategically important projects is no guarantee of job security.

This isn't to say that Zuckerberg made obviously bad decisions. At the time of the metaverse pivot, the move was defensible. But five years later, with massive losses and stalled adoption, continuing to invest at the same level was clearly unsustainable.

The lesson for employees is to be cautious about betting your career entirely on a company's strategic vision, especially when that vision lacks clear validation in the marketplace.

What Investors Need to Know: The Stock Impact and Future Outlook

Market Reaction and Stock Performance

Meta's stock price has held up reasonably well despite the massive Reality Labs losses, partly because:

- The core business is still highly profitable, generating $35-40 billion in annual operating profit

- Markets value the company's AI investments and see them as positioning Meta well for the future

- Investors have largely priced in Reality Labs losses and don't expect the division to contribute positively to earnings in the near term

However, the continued losses are a drag on overall profitability and represent a real opportunity cost. If Meta could eliminate Reality Labs' losses, company profitability would improve by roughly 5-10% immediately.

Future Investor Questions

Savvy investors should be asking:

- Why is Meta continuing to fund a division that loses $19 billion annually? The company should either commit to a path toward profitability with clear milestones, or divest/wind down the division.

- What would it take for Reality Labs to break even? The company has provided no clear answer to this question.

- Is Zuckerberg's vision overriding market feedback? The fact that losses increased year-over-year despite layoffs suggests cost discipline is still lacking.

- How is the AI pivot affecting Reality Labs investment? If Meta is reducing Reality Labs funding to fund AI, that should be transparent to investors.

These questions will likely dominate investor calls and analyst discussions in the coming years.

Lessons for Other Tech Companies: Strategic Betting and Capital Allocation

The Danger of Visionary Leadership Without Accountability

Zuckerberg's strengths as a leader include long-term thinking, technological ambition, and willingness to invest in future bets. But Meta's Reality Labs experience suggests that these strengths need to be balanced with accountability for results.

When a visionary leader can bet billions on a strategy without clear milestones for validation, companies risk burning enormous capital pursuing vision rather than value. The question isn't whether metaverse investment was reasonable in 2021. It was defensible. The question is why the company didn't establish clear go/no-go criteria for the investment and pull back when market signals indicated the bet wasn't working.

Building Accountability into Strategic Investments

Other companies pursuing ambitious technology bets should learn from Meta's experience:

- Establish clear success metrics before making massive investments

- Set go/no-go decision points at regular intervals (annually or quarterly)

- Require validation from the market, not just internal teams

- Build accountability so that if targets aren't met, the investment is reevaluated

- Avoid treating strategic investments as untouchable just because they're led by visionary executives

Meta's recent cost cuts suggest the company is finally implementing some of these practices. But it would have been better to do so five years ago, when losses were smaller.

The Opportunity Cost Trap

Meta's Reality Labs experience also illustrates a broader trap that successful companies fall into: the opportunity cost of pursuing unproven bets.

When a company is profitable and has more capital than it can usefully deploy in core business, the temptation is to invest in transformative new bets. But the true cost of these bets isn't just the capital deployed. It's the opportunity cost of what else the company could do with that capital.

For Meta, that opportunity cost is enormous. The $100+ billion invested in Reality Labs over five years could have been used to:

- Become the world's leading AI company with an even larger lead over competitors

- Improve core products and deliver shareholder value

- Acquire promising startups across multiple domains

- Build new product categories beyond social media

By the time companies recognize that a strategic bet isn't working out, years and billions of dollars have typically passed. The key is to institutionalize processes that force faster recognition and course correction.

The Future of VR: Will the Technology Ever Go Mainstream?

Technical Improvements Won't Solve the Core Problem

One common argument is that VR will eventually go mainstream once the technology improves enough. This argument assumes that current VR adoption is limited primarily by technical constraints (resolution, field of view, tracking accuracy, comfort).

But this misses the fundamental issue: even with perfect technology, VR faces market demand constraints. Most people simply don't want to spend hours per day in a fully immersive virtual environment. The use cases are real but niche: gaming, training, professional applications. But these markets are measured in millions of users, not billions.

Better technology might expand the addressable market slightly, but it won't create the mainstream adoption that metaverse proponents imagined.

The Long Tail of VR Applications

That said, VR will likely continue to exist and grow in narrow niches. Specific applications where VR provides clear value will continue to develop:

- Professional training (medicine, military, heavy equipment operation)

- Enterprise engineering and design (architecture, manufacturing, product design)

- Niche gaming and entertainment for enthusiasts

- Therapy and rehabilitation

- Scientific research and visualization

These applications can sustain a healthy industry. But the industry will be much smaller than the metaverse vision suggested. More comparable to today's gaming or software industries, not to the ubiquity of smartphones or the internet.

AR More Likely Than VR for Mainstream Adoption

Augmented reality, which overlays digital information on the real world, has better long-term prospects than full virtual reality. AR doesn't require the user to be fully immersed or isolated from their environment. AR glasses that provide useful information, navigation, and communication while allowing normal interaction with the physical world are genuinely useful.

But even AR adoption will be slower than many anticipated. AR requires solving technical challenges (battery life, miniaturization, display quality) that make current AR glasses too bulky and power-hungry for mainstream use. And AR requires a killer app—a use case so compelling that millions of people want the device.

Smartphones had a killer app: mobile internet, email, maps, and eventually gaming and social media. PC had killer apps: word processing, spreadsheets, and web browsing. What's the killer app for AR glasses? Better heads-up directions? Digital reading glasses? These are useful but not compelling enough for everyone to carry another device.

Conclusion: The End of the Metaverse Dream

Meta's $19 Billion Lesson

Meta's Reality Labs experience represents one of the largest corporate technology bets in history, and it appears to have failed. The company invested over $100 billion and committed enormous human capital to building the metaverse, and the market has decisively voted no.

This doesn't mean the technology is worthless. VR and AR will continue to have niche applications and enthusiast adoption. But it does mean that the grand vision of the metaverse replacing smartphones and the internet was a misjudgment.

For Zuckerberg and Meta, the lesson is painful but instructive: even the world's most powerful tech companies, led by visionary executives with essentially unlimited capital, cannot force markets to adopt technologies that don't solve real problems better than existing alternatives.

The Importance of Market Feedback

The most critical lesson from Reality Labs is the importance of market feedback. Meta had all the signals that its metaverse bet wasn't working: adoption was stalling, losses were accelerating, employee morale was declining, and competitive advantages were disappearing. Yet the company continued investing aggressively for years.

This pattern repeats across companies and industries. Leaders become committed to a strategy, and then filter information through the lens of that commitment. They see market signals as temporary setbacks rather than fundamental problems. They interpret losses as necessary investments rather than warnings. They surround themselves with teams who share their conviction.

Meta is now course-correcting, but the course correction comes after five years of delay and over $100 billion in cumulative losses. Faster recognition of the problem would have been better.

What Comes Next for Reality Labs

Looking forward, Reality Labs will likely follow this trajectory:

- 2026-2027: Continued losses at roughly current levels, with annual losses in the $15-20 billion range

- 2027-2029: Gradual cost reduction as unprofitable projects are shut down, losses declining to $10-15 billion annually

- 2029-2031: Stabilization at smaller scale, with the division becoming a niche player focused on AR glasses and specific enterprise applications

- Post-2031: Either breakeven as a small specialized business, or divested/spun off

This projection assumes Meta follows through on cost reduction and doesn't double down on the current strategy. If Meta continues investing at current levels while losses remain high, the timeline extends and the financial impact deepens.

The Broader Tech Ecosystem Takeaway

Meta's Reality Labs saga is important for everyone paying attention to technology strategy and capital allocation. It demonstrates that:

- Visionary leaders with resources can pursue unproven bets, and sometimes those bets don't work out

- Market feedback is more important than internal conviction, and companies that ignore market signals pay a heavy price

- Opportunity cost matters enormously; the capital spent pursuing failed bets could have created more value elsewhere

- Technology quality isn't destiny; even brilliant engineering can't force market adoption of solutions to problems people don't want solved

- Course correction eventually comes, but it comes too late and costs too much if delayed

For investors, entrepreneurs, and executives, Meta's $19 billion Reality Labs loss is a reminder that size, resources, and brilliant people are not sufficient to guarantee that strategic bets will work out. Market dynamics, timing, and genuine value creation matter more than most leaders want to admit.

The metaverse may still become important someday. But it won't be because Meta forced it into existence by spending billions. It'll be because the technology matured, real use cases emerged, and consumers wanted it. Those conditions don't exist yet, and Meta's losses suggest they won't exist for a long time.

FAQ

What is the metaverse and why did Meta bet so heavily on it?

The metaverse is a vision of immersive, 3D virtual environments where people work, socialize, and play using virtual reality or augmented reality devices. Meta CEO Mark Zuckerberg believed the metaverse would become the next major computing platform after smartphones, comparable in importance to the internet or personal computers. In 2021, he rebranded the company from Facebook to Meta and committed to investing billions annually to build metaverse infrastructure, hardware, and software. The bet was that whoever dominated the metaverse could control the next era of computing and maintain platform power as they had with smartphones. However, the predicted mainstream adoption never materialized.

How did Meta lose $19 billion in 2025?

Meta's Reality Labs division lost

Why didn't VR adoption reach the levels Meta projected?

VR adoption stalled for several reasons: physical barriers (headsets are uncomfortable for extended use and cause motion sickness in some users), limited killer applications (no single app created mainstream appeal like email or messaging did for previous platforms), price barriers (VR headsets cost

What does Meta plan to do with Reality Labs going forward?

Meta is pursuing what CEO Mark Zuckerberg calls a "reset" for Reality Labs, which includes significant cost reduction (the recent 10% workforce cuts and studio closures), redirecting remaining investment toward AR glasses and wearables (which have better long-term potential than VR), focusing on narrower use cases rather than the broad metaverse vision, and accepting that the division may never become a major profit contributor. Zuckerberg stated that Reality Labs losses in 2026 would be "similar to last year" ($19 billion) but that the company expects losses to "gradually reduce" in subsequent years as investments are scaled back. However, no clear timeline or profitability target has been communicated to investors.

How does this compare to Apple's Vision Pro and the broader AR/VR market?

Apple's Vision Pro, released in 2024, is technically superior to Meta's Quest headsets in many dimensions but has struggled to gain significant market traction despite Apple's design excellence and brand power. The device costs

What were the main strategic mistakes Meta made with Reality Labs?

Meta's strategic errors included: overestimating technology readiness (assuming impressive hardware would drive adoption), building the ecosystem top-down (Meta created content rather than letting third-party developers drive adoption), underestimating the comfort and social barriers to VR use, failing to establish clear success metrics or go/no-go decision points, continuing to invest heavily even as market signals became increasingly negative, and allowing visionary leadership to override market feedback for too long. Additionally, the company pursued VR primarily when AR (augmented reality) likely has better long-term potential. Perhaps most critically, Meta failed to recognize early enough that the market dynamics simply weren't supporting the metaverse vision, costing the company years of unnecessary investment and over $100 billion in cumulative losses.

What is the opportunity cost of Meta's Reality Labs investment?

The opportunity cost is enormous. The

Will VR ever become mainstream like smartphones did?

Likely not. While VR will continue to exist and grow in specific niches (professional training, enterprise design, gaming for enthusiasts), it will never achieve the universal adoption of smartphones. The fundamental barriers are too high: physical discomfort, social isolation, limited killer applications, and the fact that existing technologies solve most use cases better. Augmented reality (AR) has better long-term potential than full VR because it allows users to overlay digital information on the real world without requiring full immersion or isolation. However, even AR adoption will be slower and more limited than many anticipated. The metaverse as originally envisioned—a universal immersive computing platform replacing smartphones—appears unlikely to occur within any reasonable timeframe, if ever.

Why didn't Meta pull back from Reality Labs earlier when losses were mounting?

Several factors contributed to the delayed response: (1) Zuckerberg's strong personal conviction in the metaverse vision created organizational momentum that was hard to redirect, (2) Executive teams often filter market signals through the lens of their strategic commitment rather than taking them at face value, (3) Large organizations develop vested interests (thousands of employees, organizational identity) that create resistance to strategic changes, (4) Meta's core business was so profitable that losing billions on Reality Labs could be absorbed without forcing immediate action, and (5) Tech companies and leaders are generally optimistic about long-term technology trends and often underestimate the time required for adoption. The company is now course-correcting, but the course correction comes years late and after hundreds of billions in cumulative losses. This pattern repeats across companies and industries when visionary leaders pursue unproven bets without sufficient accountability.

What metrics should investors watch for Reality Labs going forward?

Investors should monitor: (1) actual losses in 2026 compared to Zuckerberg's projected "similar to 2025" level—if losses increase further, cost discipline is clearly lacking, (2) revenue growth rate and whether the division can achieve revenue of $5+ billion annually, (3) the pace of workforce reductions and whether the division achieves meaningful cost decreases, (4) progress on AR glasses development (which likely has better prospects than VR), (5) cash burn rate and cumulative losses trajectory, and (6) any strategic milestones or go/no-go decision points that would signal when the company will pivot further or potentially divest the division. Clear communication on these metrics would help investors assess whether Reality Labs is on a path toward sustainability or represents ongoing capital destruction.

Key Takeaways

- Meta's Reality Labs lost 2.2 billion in revenue, operating at an 865% loss margin

- Consumer VR adoption plateaued at millions of users instead of reaching billions, invalidating the metaverse vision

- The company laid off 10% of Reality Labs staff and closed VR studios while projecting similar losses for 2026

- Fundamental technology and market constraints prevent VR from becoming a mainstream computing platform comparable to smartphones

- Meta failed to establish clear success metrics or go/no-go decision points, delaying course correction for years at enormous cost

- The opportunity cost of $100+ billion Reality Labs investment could have created far greater shareholder value in core business

- Even Apple's superior hardware and brand power couldn't drive mainstream AR/VR adoption with Vision Pro, validating market limitations

Related Articles

- Meta's Quest 3 Horizon Integration Removal: What It Means [2025]

- Pinterest Lays Off 15% for AI: What This Means for Tech [2025]

- Meta's VR Pivot: Why Andrew Bosworth Is Redefining The Metaverse [2025]

- FTC's Meta Antitrust Appeal: What's at Stake in 2025

- 55 US AI Startups That Raised $100M+ in 2025: Complete Analysis

- Meta Quest Layoffs and VR's Future: Why Palmer Luckey's Optimism Might Be Misplaced [2025]

![Meta's $19 Billion VR Gamble: Reality Labs Losses Explained [2025]](https://tryrunable.com/blog/meta-s-19-billion-vr-gamble-reality-labs-losses-explained-20/image-1-1769647050148.jpg)