Introduction

Meta just made a quiet but significant announcement that's been flying under the radar for most VR enthusiasts. With version 85 of the Quest operating system, the company is pulling back Horizon integration from Quest 3 headsets. At first glance, this sounds like a step backward for a company that's spent billions betting on the metaverse. But the reality is far more nuanced.

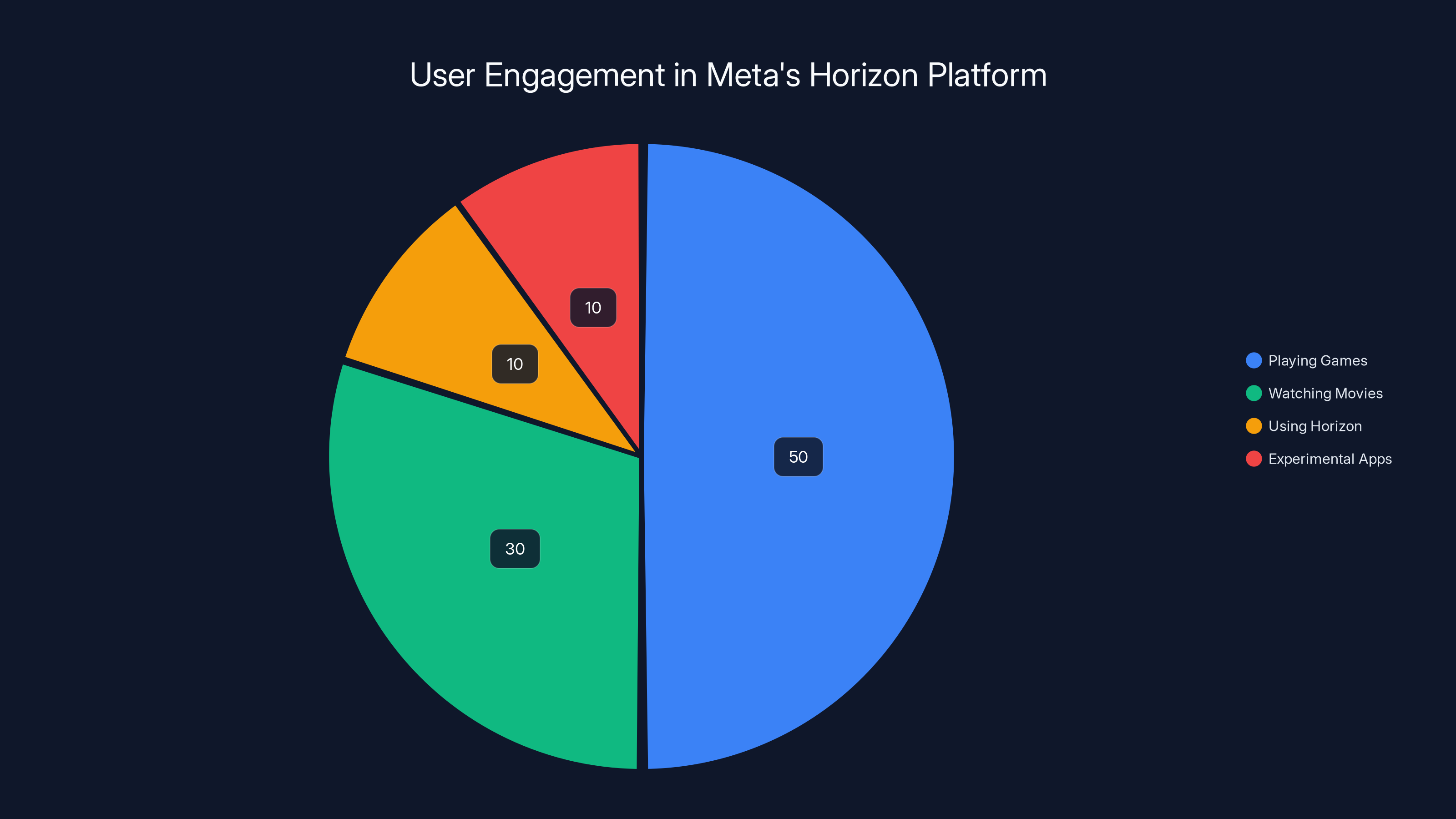

When Meta rebranded Facebook to Meta back in 2021, the vision was crystal clear: make virtual reality the next platform for human connection and commerce. Horizon was supposed to be the social operating system of the metaverse, a place where people could hang out, work together, and eventually spend money on digital goods. But here's what actually happened. Users logged in, looked around, and logged out. They weren't building communities in Horizon. They weren't hosting meetings there. They were playing Beat Saber, watching movies, and occasionally trying some experimental games.

The disconnect between Meta's vision and user behavior created a fundamental problem. Year after year, Meta executives were essentially pushing a product that nobody was actually using. It's like investing billions in a restaurant where 90% of customers only come for the coat check. At some point, you have to ask yourself if the coat check needs its own building.

Removing Horizon integration isn't admitting defeat, though it might look that way. It's actually Meta recognizing that you can't force adoption through software updates. You can't make something a priority just by installing it on everyone's device. This move suggests the company is finally listening to what Quest 3 owners actually want to do with their headsets, rather than what Meta executives hoped they'd do.

But here's where it gets complicated. This change has real consequences for VR development, for users who actually did embrace Horizon, and for the broader trajectory of Meta's entire metaverse bet. Some people see this as a necessary recalibration. Others see it as the beginning of the end for the metaverse dream.

TL; DR

- Horizon Integration Removal: Meta is stripping Horizon integration from Quest 3 with OS v 85, letting users operate the headset without forced metaverse features

- User-Driven Change: This reflects actual user behavior showing minimal Horizon adoption despite years of investment and promotion

- Developer Impact: Independent developers must rethink VR strategies since Horizon won't be the default social layer

- Competitive Advantage: Play Station VR2 and Apple Vision Pro have focused on gaming and content rather than unproven metaverse concepts

- Market Reality: The VR market needs viable use cases first, metaverse concepts second

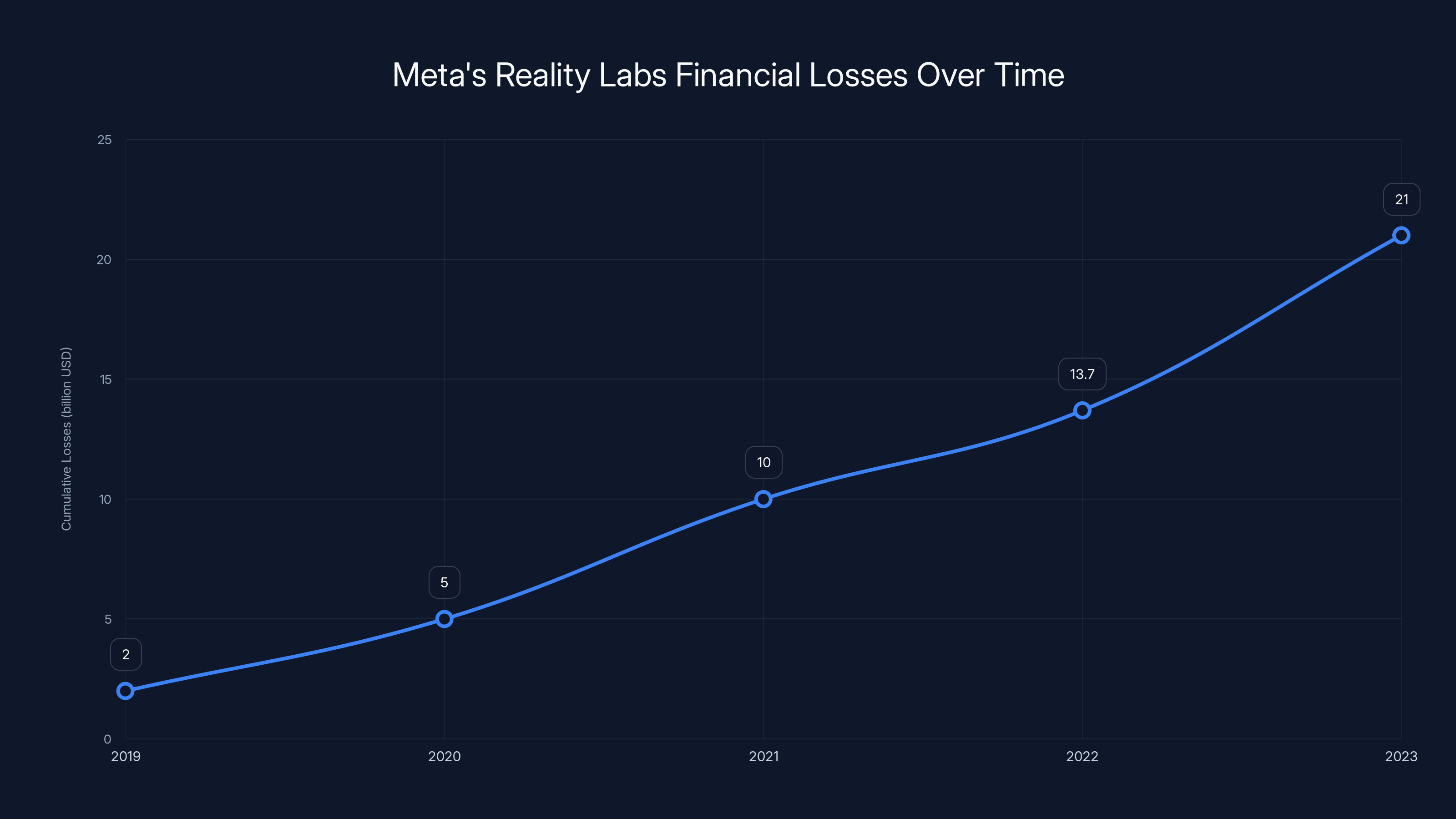

Meta's Reality Labs has seen increasing financial losses, reaching an estimated $21 billion by 2023. These sustained losses highlight the financial challenges of Meta's metaverse ambitions. Estimated data.

Understanding Horizon: What It Was Supposed to Be

Horizon started as Meta's grand vision for a persistent virtual world. Imagine logging into your Quest headset and finding yourself in a customizable space where you could invite friends, attend concerts, build experiences, and eventually, exchange real money for digital goods. It was positioned as the spiritual successor to Second Life, but better, easier, and backed by the resources of one of the world's most powerful tech companies.

The platform launched with three main components. First was Horizon Home, the central hub that would greet users when they put on their headsets. Second was Horizon Worlds, a creation tool where users could build custom spaces and experiences. Third was the social infrastructure that would supposedly tie it all together, creating a vibrant, user-generated metaverse.

Meta invested heavily in marketing this vision. Mark Zuckerberg appeared in promotional videos, showing off avatars with expressive hands and detailed environments. The company positioned Horizon as inevitable, as the natural evolution of social media. But there was a fundamental problem buried in this narrative: users didn't actually want it.

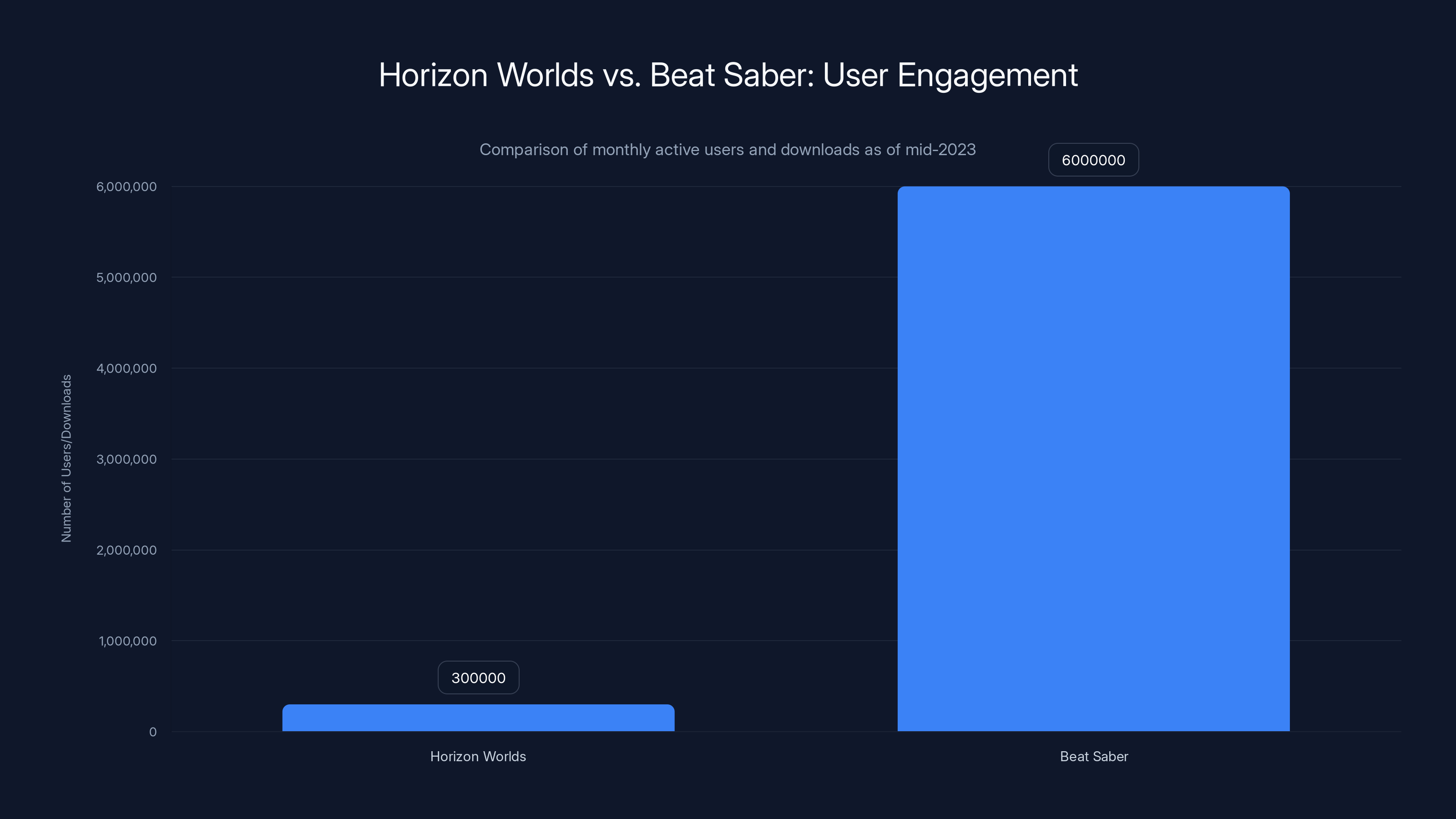

The numbers tell a brutal story. By mid-2023, Horizon Worlds had fewer than 300,000 monthly active users. For context, Beat Saber, a single game on the Quest platform, has been downloaded over 6 million times. When your grand vision for the future can't even reach the user base of a rhythm game, you have a credibility problem.

What went wrong? Multiple factors compounded into a perfect storm of failure. First, the experiences in Horizon Worlds were genuinely unpolished. Early adopters encountered empty spaces, poor rendering, and limited tools. Second, there was no natural incentive to be there. People don't gather in virtual spaces just because the spaces exist. They gather for specific purposes: games, concerts, social events, work. Horizon offered none of these with any particular advantage.

Third, and perhaps most importantly, the entire metaverse concept was built on an assumption that turned out to be false. Meta believed that if you could socialize in VR with better avatars and more freedom than on Facebook, people would flock to it. But what they discovered is that people have deeply ingrained preferences about where they socialize. They go where their friends are. They go where the content is. They go where the experience is superior to alternatives.

Horizon had no answer to that question. It offered different, not better. It offered a place to go, not a reason to go.

The Announcement: What Version 85 Changes

The actual change is subtle but significant. With OS version 85, Horizon Home will no longer be the mandatory landing screen when Quest 3 users first put on their headsets. Instead, users can choose to customize their home environment or navigate directly to applications. The Horizon social infrastructure won't disappear entirely, but it will no longer be forced upon users who don't want it.

This is Meta's way of deprioritizing Horizon without officially killing it. It's a strategic retreat disguised as a feature enhancement. Instead of saying "we were wrong about the metaverse," Meta is saying "we're giving users more choice." Technically accurate. Fundamentally, it's an acknowledgment that the mandatory Horizon experience was a failed experiment.

What makes this announcement interesting is the timing and the method. Meta didn't hold a press conference. They didn't make a grand statement. The news leaked through developer communications and industry observers who noticed the change in the roadmap. This is intentional. A flashy announcement would draw attention to what is essentially a pivoting away from a multibillion-dollar bet. A quiet change to the OS buries the story in technical release notes where most users won't notice.

For longtime Quest users, this is liberating. For developers who invested in Horizon tools and APIs, it's concerning. For Meta's future VR strategy, it's a crucial admission that the social metaverse model isn't working on the consumer side.

The irony is that this change should have happened earlier. By forcing Horizon on users who didn't want it, Meta was creating negative associations with VR itself. Every time someone put on a Quest and was greeted with an empty social space, they were reminded that they could be doing something else. Now, Quest 3 becomes what users actually want it to be: a gaming and entertainment device.

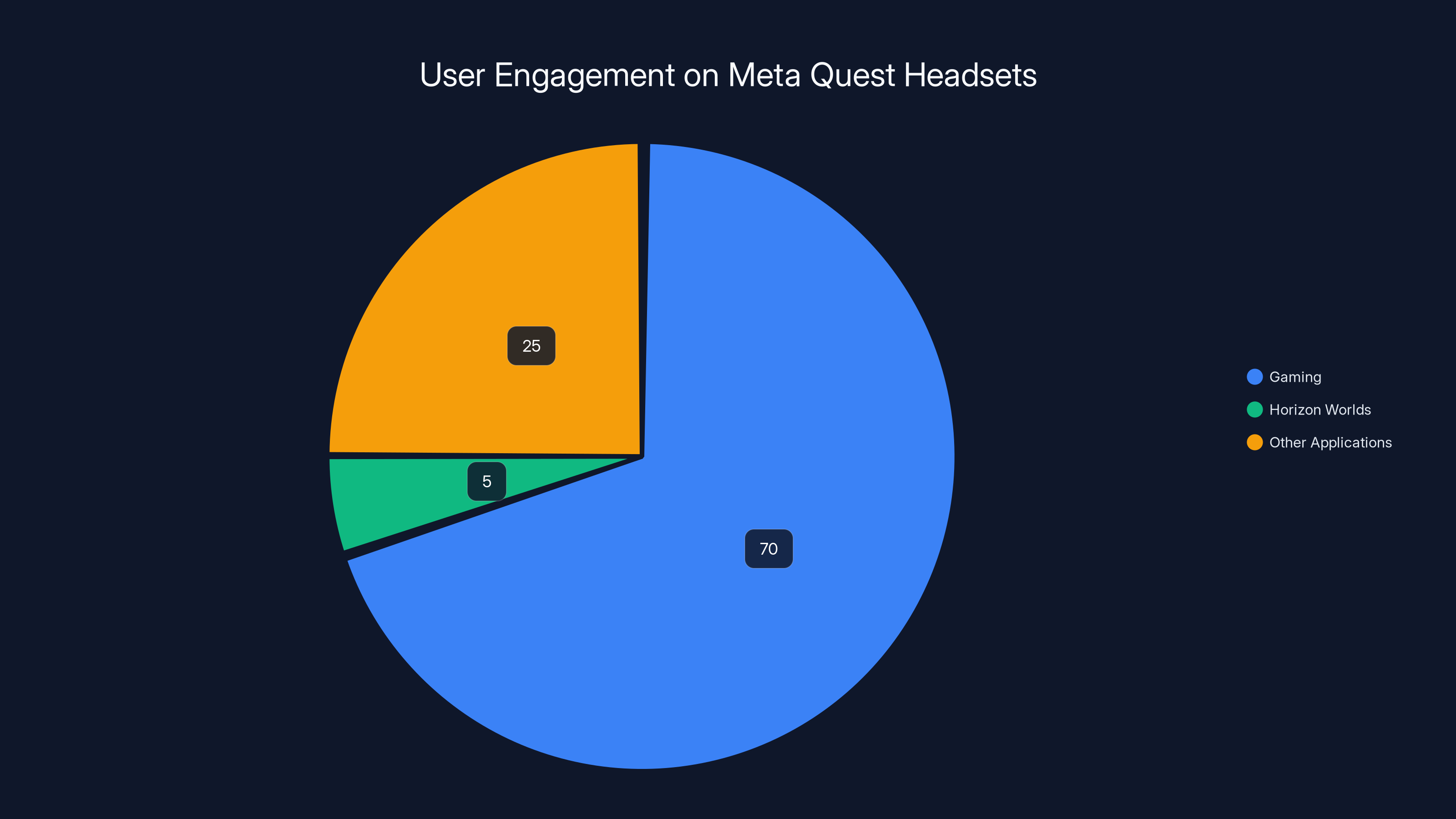

Estimated data shows that gaming dominates user activity on Meta Quest headsets, with Horizon Worlds having minimal engagement.

Why Users Never Wanted Horizon

Understanding the Horizon failure requires understanding how humans actually adopt social platforms and virtual spaces. This isn't about technology limitations. It's about human behavior and the network effect.

The network effect is ruthless. A social platform's value is directly proportional to how many people you know are already on it. Email succeeded because everyone needed email. Facebook succeeded because everyone you knew was on Facebook. Snapchat succeeded because teenagers were on Snapchat. These platforms won because they captured critical mass, not because they were conceptually superior to alternatives.

Horizon launched without critical mass and had no natural way to achieve it. It asked early adopters to inhabit empty virtual spaces and wait for other people to show up. That's not how social adoption works. You need a reason to be there. You need content. You need your friends. You need an experience you can't get anywhere else.

Consider the experience of an average Quest 3 user. They put on the headset, Horizon Home loads, and they're greeted with their avatar standing in a customizable space. They can decorate this space, change their avatar's appearance, and theoretically invite friends to visit. But here's the problem: none of their friends are there. More fundamentally, their friends probably aren't on VR at all. They're on their phones, on Discord, on Snapchat, or watching content on other platforms.

Why would you spend 30 minutes customizing a virtual home to invite friends who aren't in VR? Why would you host a virtual gathering when you could just video call? Why would you attend a concert in Horizon Worlds when you could watch the same concert streamed on YouTube with better video quality and no motion sickness risk?

Meta's executives seemed to assume that the immersion of VR would automatically make social experiences more compelling. They were wrong. Immersion matters when you're doing something that benefits from immersion. Playing a game, exploring an environment, or learning a skill all benefit from VR's immersive qualities. Hanging out and chatting doesn't inherently need VR. It might even be worse in VR, where you can't multitask or have your attention partially elsewhere.

There's also the physical reality of VR adoption. VR headsets are expensive, require space, and create isolation from your physical environment. When you're in VR, you can't see or hear what's happening in the real world. You can't casually socialize while doing other things. This limits the use cases where VR is practical. Competitive gaming? Great. Immersive experiences? Perfect. Social hangouts? Awkward.

Meta didn't seem to grasp this fundamental constraint. They kept developing Horizon as if the immersion itself would drive adoption. But immersion is only valuable when it serves the user's actual goal. For social connection, many people prefer the non-immersive alternatives because they're more flexible and less isolating.

The Developer Perspective: What This Means

For developers who've built experiences on the Horizon platform, this announcement is a mixed bag. On one hand, removing mandatory Horizon Home integration means fewer forced users and more authentic engagement from people who genuinely want to use Horizon-based experiences. On the other hand, it signals that Horizon will never be the default social infrastructure for Quest, which was the original value proposition.

Many indie developers invested time in learning Horizon's tools and developing experiences for the platform, partly because Meta's promotion suggested it would be the center of VR's future. A developer might have spent months building a collaborative space, only to discover that Horizon would never have enough active users to justify the investment.

This creates a strategic problem for VR development. Developers need to choose between building on proprietary platforms like Horizon (which now have uncertain futures) or building standalone applications that exist on the app store and don't depend on a social layer. The safer bet is clearly the latter.

The broader lesson for developers is about platform risk. When you build on someone else's platform, you're betting that the platform owner's vision will align with user demand. If it doesn't, you're left building for an infrastructure that's being quietly deprioritized. This is why established developers tend to diversify across multiple platforms and avoid putting all their resources into one company's ecosystem.

For experienced VR developers, this isn't shocking. They've seen platform pivots before. But for newcomers to VR development, it's a cautionary tale about the importance of following user behavior, not corporate roadmaps.

Comparing Quest to Play Station VR2 and Vision Pro

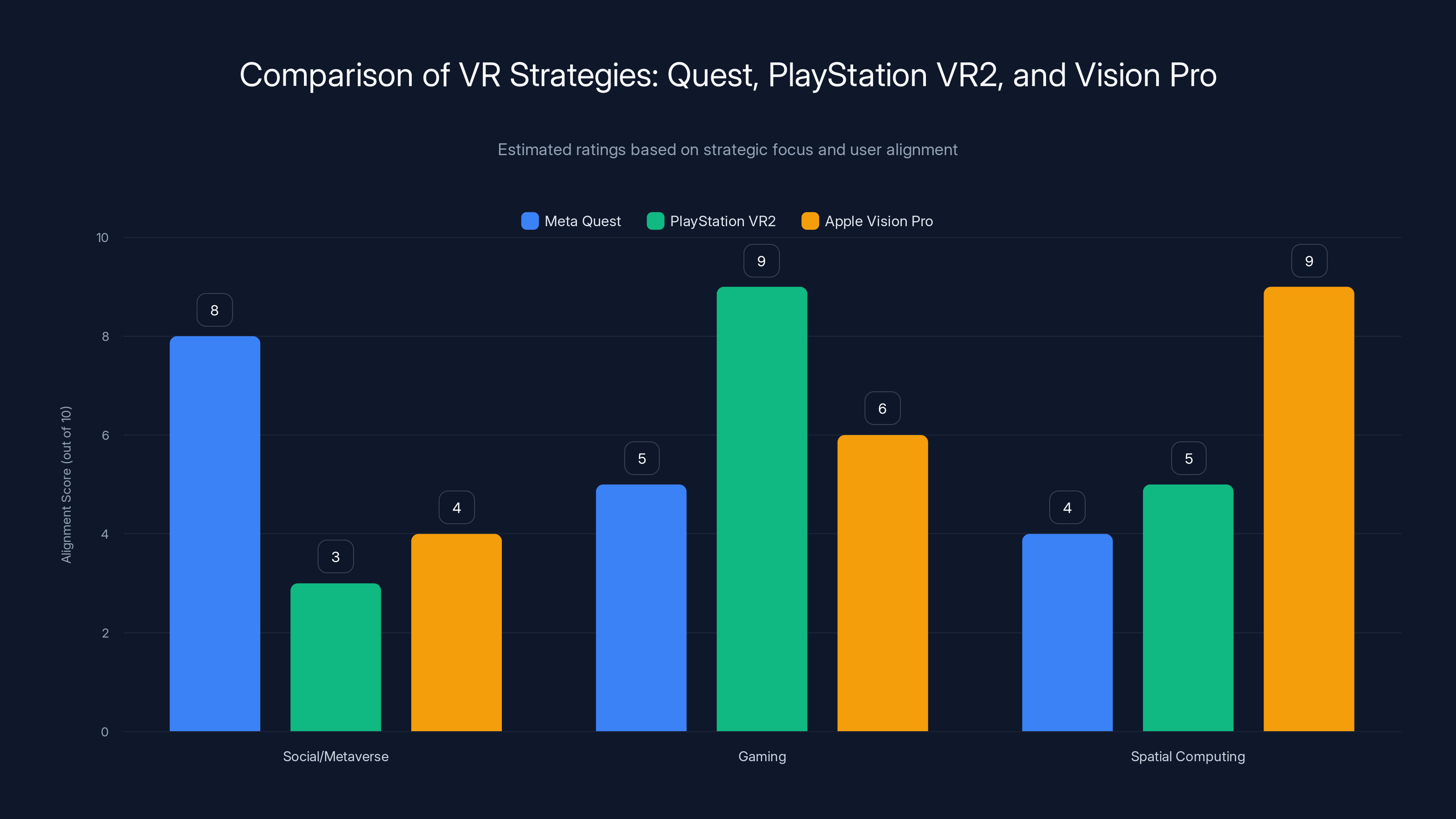

The Horizon removal becomes even more interesting when you compare Meta's approach to how competitors have positioned their VR products. Meta bet everything on social and metaverse. Sony and Apple took different paths, and the results suggest they might have made better bets.

Play Station VR2 launched with a different philosophy entirely. Rather than trying to create a new social layer, Sony focused on delivering premium gaming experiences that take advantage of VR's immersive qualities. Games like Resident Evil Village, Gran Turismo 7, and Horizon Call of the Mountain are the driving reasons people buy PSVR2. Sony isn't trying to reinvent social connection. It's selling entertainment.

This approach has a clear advantage: it aligns with user expectations. People buy Play Station to play great games. VR games are just a premium tier of that offering. There's no cognitive dissonance, no forced ecosystem to navigate, no unmet expectations about what you can do with your hardware.

Apple Vision Pro is following a similar but slightly different path. Apple is positioning the Vision Pro as a personal spatial computing device, not primarily a social platform or gaming machine. You use it to view content, work with spatial applications, and experience immersive media. The social component exists, but it's built on existing Apple infrastructure like FaceTime, not on a new proprietary layer.

Apple's approach is particularly smart because it leverages existing behavior. People already use Apple devices for entertainment, productivity, and communication. The Vision Pro just extends those use cases into spatial computing. No new social network required. No new ecosystem to learn. Just better versions of what people are already doing.

Compare this to Meta's approach, which required users to adopt an entirely new social platform in addition to buying a new device. That's two layers of adoption friction. Meta was asking users to learn new tools, meet new people, and engage in a new form of social connection, all at the same time. The chances of that succeeding were never high.

Interestingly, all three approaches are succeeding in their own ways. PSVR2 is selling steadily to Play Station fans who want premium gaming. Vision Pro is selling to early adopters willing to spend $3,500 on a novel computing paradigm. And Quest continues to sell because it's the most affordable entry point to VR gaming and entertainment, regardless of what you do with Horizon.

The lesson is clear: VR adoption is driven by compelling use cases, not by promises of future social infrastructure. Users buy VR to play games, experience content, or engage in specific applications. They don't buy VR with the hope that maybe someday they'll meet interesting people in a virtual space.

Despite Meta's significant investment, Horizon Worlds had fewer than 300,000 monthly active users by mid-2023, compared to Beat Saber's 6 million downloads. Estimated data.

The Business Case: Meta's Financial Perspective

Understanding why Meta is making this change requires looking at the financial reality of the metaverse bet. The numbers are staggering and increasingly impossible to ignore.

Meta's Reality Labs division, which oversees all VR and AR development, lost

These aren't small adjustments or strategic investments in emerging technology. These are massive, sustained losses with no clear path to profitability. At some point, even a company as well-resourced as Meta has to acknowledge that the current approach isn't working.

Here's the core problem: the metaverse model assumes that virtual real estate, virtual goods, and virtual services will eventually become valuable enough that companies and individuals will spend real money on them. Meta was betting that Horizon Worlds would become like Second Life or Decentraland but bigger, better, and more mainstream.

But here's what actually happened. Second Life and Decentraland exist on the fringes of mainstream culture. Most people have never heard of them. Of those who have, most don't spend significant time or money in them. If these platforms, which have been around for years or decades, haven't achieved mainstream adoption, why would a newer platform with no clear advantages suddenly succeed?

Meta was essentially betting on a market transformation that has no historical precedent. Digital fashion, virtual real estate, and avatar-based commerce all require critical mass adoption. But critical mass requires a compelling reason to participate. Horizon offered no compelling reason. So critical mass never came.

The financial pressure mounted as investors increasingly questioned the metaverse strategy. During earnings calls, analysts would ask why Meta was spending billions on Horizon when the company's core business—advertising—was under pressure from Apple's privacy changes and competition from TikTok. Zuckerberg's responses about the long-term vision eventually ran out of runway with Wall Street.

Removing mandatory Horizon integration is a way to reduce the financial bleeding without formally abandoning the metaverse bet. If Horizon becomes an opt-in experience instead of a mandatory one, Meta can report that the platform still exists while reducing the resources allocated to making it work.

This is a common corporate move: you don't kill a failed project publicly. You defund it quietly, reduce expectations, and slowly shift resources elsewhere. Removing Horizon from the default user experience is the first step in this process.

What Users Actually Want from Quest

The reason Horizon integration is being removed is simple: it's not what Quest users want. Understanding what users actually use their Quest headsets for provides crucial insight into the VR market's real opportunities.

The most popular categories on Meta's Quest store are games, with titles like Beat Saber, Pavlov, Superhot VR, and Gorilla Tag consistently topping engagement charts. These are games that take advantage of VR's unique strengths: spatial awareness, hand tracking, and full-body immersion. There's no metaverse element. No virtual real estate. No avatar customization beyond what the game provides. Just pure gameplay.

After games, the next most popular category is media and entertainment. Apps like Netflix, YouTube, and specialized 360-degree video players let users watch content in VR. This makes sense because VR's immersion creates a cinematic experience that can be better than traditional screens for certain content types.

Third is fitness and health applications. VR fitness apps have found a genuine niche because the immersion and gamification elements make exercise more engaging. When you're slashing blocks in Beat Saber or boxing in Supernatural, you're not thinking about how much you dislike exercise. You're focused on the game.

Notably absent from the top categories is socializing. Not because people don't want to socialize. Because they do it more effectively on other platforms. They use Discord for voice chat while gaming. They use WhatsApp for messaging. They use regular video calls for face-to-face conversation. None of these require a VR headset or a metaverse.

What's fascinating is that Meta clearly understands user behavior. The company has access to engagement metrics that show exactly what people are doing with their Quest headsets. They know that gaming dominates usage. They know that Horizon Worlds is barely used. Yet for years, they continued pushing Horizon as if user behavior didn't matter.

This disconnect between user behavior and corporate strategy is common in tech. Companies often believe so strongly in their vision that they ignore signals from users that the vision isn't resonating. Eventually, reality sets in, and they have to adjust course.

The removal of mandatory Horizon integration is that adjustment. It's Meta saying, "Okay, we finally get it. You want to use Quest for gaming and entertainment. So let's give you that without the metaverse friction."

The Broader Metaverse Question

This move raises a fundamental question that goes beyond Meta or VR: Is the metaverse dead?

The answer is nuanced. The metaverse, in its most extreme form—a fully immersive, persistent virtual world where everyone lives, works, and socializes—is probably not happening anytime soon, if ever. The technology isn't there yet, and more importantly, user demand isn't there at all.

But elements of the metaverse are already here and thriving. Multiplayer games like Fortnite and Roblox create virtual spaces where millions of people socialize and spend money. Decentraland, despite its limitations, has an active community trading virtual property. VRChat has a dedicated user base. These aren't the metaverse in the grand vision sense, but they're proto-metaverse experiences.

The difference is that these platforms succeeded by focusing on specific value propositions first and metaverse elements second. Fortnite is a great game that happens to have social and economic elements. Roblox is a creation platform that happens to have an in-world economy. Neither of them succeeded by starting with the vision of a metaverse and asking users to join.

Meta did the reverse. It started with the vision and asked users to populate it. That's a fundamentally harder sell.

Meta's failure with Horizon doesn't mean virtual worlds or persistent multiplayer experiences are fundamentally flawed. It means that you can't create critical mass around a vision. You need a product that works, that serves user needs, and that provides immediate value. Virtual social spaces might eventually achieve those things, but Horizon never did.

The broader lesson is that the tech industry's obsession with grand visions often blinds companies to practical realities. Users don't adopt technology because it's theoretically important or because smart people say it's the future. They adopt technology because it solves problems or provides entertainment. The metaverse will only succeed if someone builds it in a way that solves real problems or provides genuine entertainment. Meta tried to build the vision and hope the value would follow. That approach failed.

Estimated data shows PlayStation VR2 excels in gaming, while Vision Pro leads in spatial computing. Meta Quest focuses heavily on social/metaverse.

Looking Ahead: What's Next for Meta VR

With Horizon integration being removed from default Quest experience, what's Meta's actual strategy for VR going forward?

The most likely scenario is consolidation. Meta will continue developing Quest hardware and maintaining the app store ecosystem. The company will invest in gaming partnerships because games clearly drive engagement. The company might also explore AI-powered features and social tools that actually solve problems for VR users.

But the grand metaverse vision is probably over. Not in the sense that Meta is killing VR entirely, but in the sense that Meta has accepted that you can't force adoption of a future that users don't want. Instead, Meta will build better VR experiences and let the social infrastructure emerge naturally if it ever does.

This is actually a healthy outcome. VR is an incredible technology. It enables gaming experiences you can't get any other way. It can be used for training, simulation, education, and entertainment. These are valuable applications that don't require a metaverse.

Meta's pivot away from forced Horizon integration is essentially Meta accepting that successful technology often looks different from what visionaries expected. The telephone was supposed to be a novelty. Television was supposed to be a short-lived fad. The internet was supposed to be just for scientists and academics. Technology succeeds by finding uses that matter to real people, not by manifesting visions that companies hope people will care about.

Meta still has enormous resources and deep expertise in VR technology. The company could still innovate in this space and create valuable experiences. But it will have to do so by following user behavior and solving real problems, not by pushing a predetermined vision about what the future should look like.

Implications for VR Adoption and the Industry

The removal of Horizon integration has broader implications for the entire VR industry, not just Meta.

First, it validates a user-centric approach to VR development. Companies like Sony with Play Station VR2 and Apple with Vision Pro have been focusing on specific use cases and high-quality execution rather than on grand visions about what VR should become. This approach is proving more sustainable and more aligned with actual user behavior.

Second, it shows that forced ecosystem integration doesn't drive adoption. Users will choose the best product for their needs, regardless of what else is bundled with it. This is important for the industry to understand as more companies enter the VR space.

Third, it demonstrates that network effects are critical for social platforms. You can't create a social network by mandate. You have to build something so compelling that people want to invite their friends. Horizon failed because it tried to shortcut this process.

For VR's future, this is probably positive news. The industry can now mature around the use cases that actually work: gaming, entertainment, and specialized applications. These are substantial markets. They're large enough to support a thriving ecosystem. And they don't require users to believe in a metaverse that doesn't exist yet.

The Consumer Experience After Version 85

For average Quest 3 owners, the removal of mandatory Horizon integration is straightforward. When you update to version 85, you'll get more flexibility in customizing your home screen. You can choose to skip Horizon Home entirely and go straight to your apps.

This is pure convenience. No more mandatory landing page. No more waiting for Horizon to load if you're just trying to launch a game. No more being reminded of a social experience you have no interest in using.

For users who actually enjoyed Horizon Home and using Horizon Worlds, nothing really changes. The feature still exists. You can still opt into it. The difference is that it's now a choice rather than a default.

The experience is similar to how other platforms work. On your smartphone, you can customize your home screen. You can choose which apps are visible and which are hidden. You can set a default app for different functions. This flexibility is table stakes for consumer technology. It's interesting that Meta took so long to provide it for Horizon, and that removal of this forced integration required a major OS update.

More broadly, this change represents better user experience design. Software products should serve users, not push users toward features they don't want. Meta spent years pushing users toward Horizon. Now they're finally letting users choose. It's a welcome change.

Estimated data shows that a majority of Quest users engage in gaming and movie watching, with minimal use of Horizon. This highlights the disconnect between Meta's vision and actual user behavior.

Lessons for Tech Companies and Investors

The Horizon failure offers multiple lessons for how technology companies should approach product development and long-term strategy.

Lesson One: User Behavior Trumps Vision. No matter how compelling your vision, if user behavior doesn't support it, the vision won't manifest. Tech leaders need to stay humble about their ability to predict how users will adopt technology. When user behavior diverges from your predictions, adjust course rather than doubling down on the original vision.

Lesson Two: Network Effects Can't Be Mandated. Social platforms need critical mass to become valuable. You can't create critical mass by bundling a social feature with hardware. You have to build something so good that people want to participate. If you're failing to achieve voluntary adoption, forcing adoption won't help.

Lesson Three: Financial Discipline Matters. Meta's willingness to spend $21 billion on a failing bet suggests weak financial discipline. While betting on the future is important, companies need to implement milestones and checkpoints. When a multibillion-dollar project clearly isn't working, you need to be willing to adjust course rather than continue escalating the investment.

Lesson Four: Grand Visions Are Seductive but Risky. Visions are useful for motivating teams and investors. But they can also prevent organizations from seeing reality clearly. When everyone around you is committed to a grand vision, it becomes difficult to acknowledge that the vision isn't working. Meta's willingness to finally acknowledge Horizon's failure shows that even powerful companies can overcorrect toward their own narratives.

Lesson Five: Build for Users, Not for Your Strategy. Too many product decisions are made based on corporate strategy rather than user needs. Meta's years of pushing Horizon happened because it fit the metaverse strategy, not because users wanted it. Building products that users actually want is hard, but it's the only sustainable approach.

Competing Visions and Alternative Futures

While Meta is retreating from the metaverse vision, other companies are exploring different approaches to spatial computing and virtual experiences.

Roblox has created a user-generated content platform that functions like a proto-metaverse. Users create games and experiences, other users play them, and everyone can spend money on in-game items. The difference is that Roblox succeeded by focusing on game creation, not social networking. The metaverse elements emerged naturally from the platform's success.

Decentraland is building a blockchain-based virtual world where users can own virtual property and trade digital assets. It has a dedicated community but has never achieved mainstream adoption. The barrier is that it's trying to create a new economy and social system from scratch, which is harder than building on existing behaviors and incentives.

VRChat has created a social platform where people can hang out in custom avatars. It has millions of users and an active community. It succeeded by not trying to be everything—it's just a social space. People use it specifically to socialize, not as a bundle with other experiences they want to do.

These alternatives suggest that virtual worlds and social VR experiences can work. But they work best when they're focused on specific purposes and when they build on existing user incentives rather than trying to create entirely new behaviors.

The Role of AI in VR's Future

One area where Meta might have better luck is integrating AI into VR experiences. Artificial intelligence could solve some of the fundamental problems that Horizon faced.

AI-powered NPCs could populate virtual spaces so they don't feel empty. Personalized recommendation systems could guide users to experiences their friends are enjoying. Conversational AI could explain complex spatial applications and help users navigate VR environments.

Meta has been investing in AI and has the resources to integrate it meaningfully into VR. If the company uses AI to build better VR experiences—not better social networks—it might find more success.

The key difference is that AI could be a tool to serve users' actual goals with VR. Better games, more responsive applications, smarter assistance. These are places where AI creates genuine value. Using AI to try to resurrect the metaverse dream would just be repeating the same mistake with better technology.

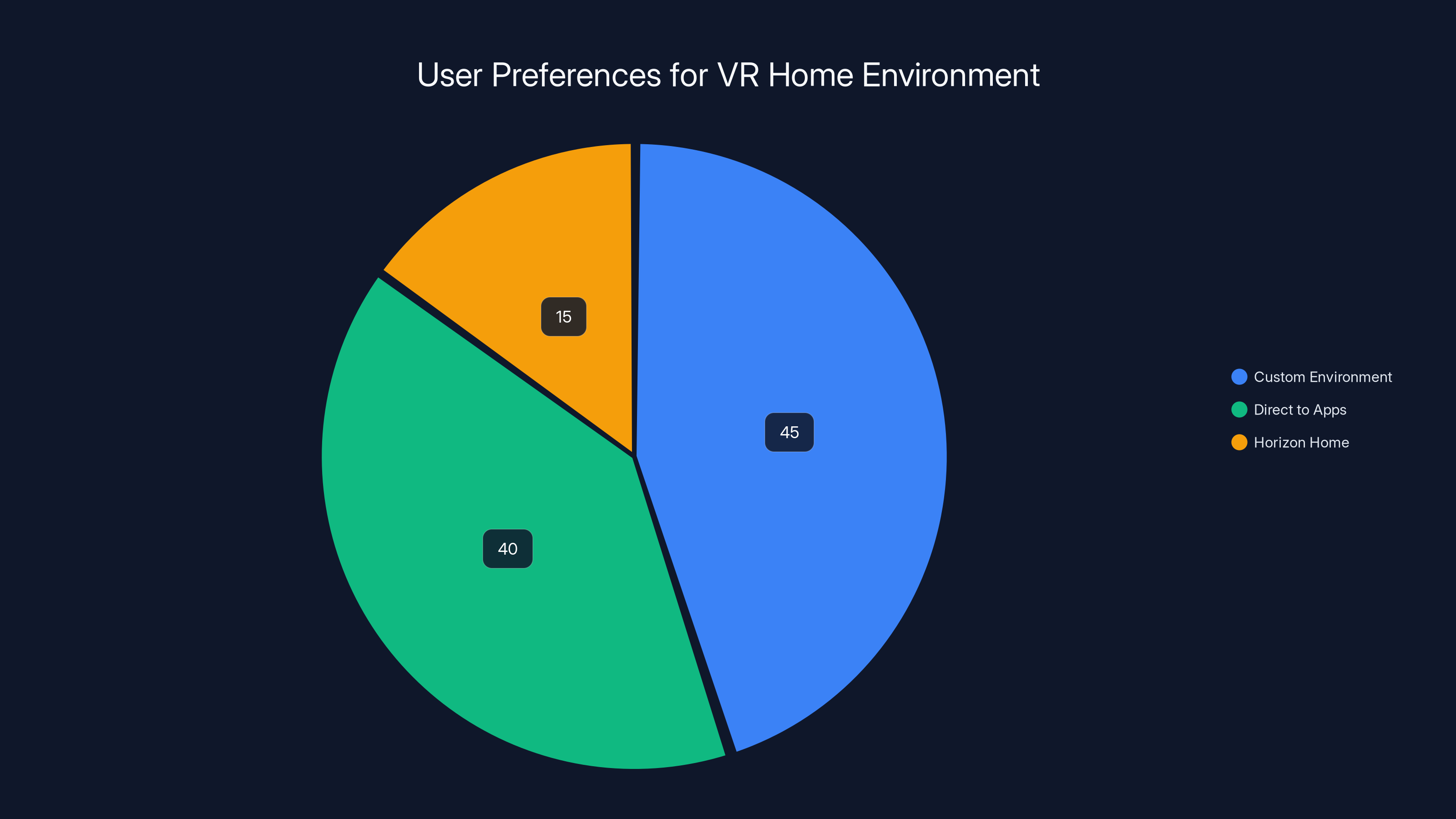

Estimated data suggests that post-Version 85, a majority of users prefer customizing their environment or navigating directly to apps, with only a small fraction opting for Horizon Home.

Timeline and Rollout Strategy

Version 85's rollout is happening gradually. Meta typically rolls out major OS updates to Quest headsets over several weeks to identify problems and allow for server-side adjustments.

This gradual approach is smart because it allows Meta to monitor adoption patterns and fix issues as they emerge. It also gives the company time to update documentation and help resources to guide users through the new customization options.

For developers, this timeline is important for planning how to adjust their applications. If your app depended on Horizon integration for discovery or user acquisition, version 85 is a wake-up call to diversify your strategy.

Expert Perspectives and Industry Reactions

The removal of Horizon integration has generated various reactions from industry observers and VR experts.

Some see it as a necessary correction that will allow Quest to reach its full potential by focusing on gaming and entertainment. Others see it as confirmation that the metaverse dream was fundamentally misguided. Still others view it pragmatically as Meta making smart business decisions by following user behavior.

What's notable is that there's broad agreement that the change makes sense from a user perspective. Even observers who believe in the long-term potential of virtual worlds acknowledge that Horizon Worlds wasn't the right vehicle to get there.

Recommendations for Quest Users

If you're a Quest 3 owner, here's what you should do in response to version 85 and the Horizon changes.

First, update to the latest version when it becomes available. The performance improvements and customization options are worth having.

Second, customize your home screen in a way that matches how you actually use Quest. If you primarily game, set your home screen to show your games. If you watch media, prioritize media apps. Let your setup match your behavior.

Third, don't feel obligated to try Horizon just because it's available. If you've tried it and didn't enjoy it, removing it from your home screen is perfectly reasonable.

Fourth, explore applications outside the most popular titles. There are excellent indie games, productivity apps, and experiences that most casual Quest users never discover.

Recommendations for VR Developers

If you're developing for VR, the Horizon changes carry important lessons.

First, build for specific use cases, not for grand visions. Ask yourself: what specific problem am I solving or what specific entertainment am I providing? If you can't answer that question clearly, your application probably won't succeed.

Second, don't rely on platforms to drive adoption. Build something so good that users will find it and share it with others. Word of mouth is the most reliable distribution channel for VR applications.

Third, focus on user retention metrics. VR's barrier to entry is high (cost of headset), so the users who download your app are valuable. Measure engagement, not just downloads. If users are abandoning your app quickly, there's a fundamental problem to solve.

Fourth, consider cross-platform development. Don't bet your entire business on one company's platform. The VR market is still young enough that platform changes can happen quickly.

Financial Predictions and Market Outlook

Meta's retreat from mandatory Horizon integration likely signals continued adjustment of the company's metaverse spending. Look for Reality Labs' losses to eventually decrease, not because VR becomes profitable, but because Meta will spend less on it.

This could actually be healthy for the VR market overall. When one company with $100 billion+ annual revenue is spending tens of billions on a failed vision, it distorts market dynamics. The VR industry can develop more naturally when Meta is spending at a sustainable level aligned with actual product traction.

For investors, the key question is whether Meta can generate returns from VR at all. Gaming is a proven use case with clear revenue models. Productivity and training applications are emerging. But the social metaverse vision that Meta was betting on has no proven revenue model. Until Meta finds one, VR should be viewed as a long-term, speculative investment rather than a near-term profit opportunity.

The Path Forward: What Success Looks Like

For Meta, success in VR doesn't require the metaverse anymore. Success looks like:

Sustained gaming engagement. Games are what drive Quest usage. Better games mean better headset sales, which means better position in the VR market. This is already happening with titles like Asgard's Wrath 2.

Profitable application ecosystem. As developers create more applications that users are willing to pay for, Meta's cut of that revenue becomes meaningful. This is a multi-year process but aligns with how app stores have worked on mobile.

Hardware innovation. Better graphics, more comfortable headsets, improved battery life, and new interaction methods all drive adoption. Meta has the resources to lead in these areas.

Enterprise applications. VR training, design, and collaborative applications have proven value in enterprise settings. This is a slower-moving but more stable market than consumer social applications.

None of this requires a metaverse. All of it aligns with user behavior and market dynamics. If Meta executes well on these fundamentals, the company can build a successful VR business without the metaverse vision.

Conclusion: A Necessary Reckoning

Meta's removal of mandatory Horizon integration from Quest 3 isn't the end of VR. It's the end of one particular bet about what VR should become. The company spent years and tens of billions of dollars building a social metaverse that users didn't want. Now it's finally acknowledging that reality and adjusting course.

This is actually a positive development for the entire VR industry. When the biggest player in the space is pursuing a vision that conflicts with user behavior, it distorts the market. Now that Meta is realigning with what users actually want to do with VR, the industry can develop more naturally.

Virtual reality is an incredibly powerful technology. It enables experiences that aren't possible any other way. It will eventually support social and collaborative applications that matter. But it will do so by building on genuine use cases and real user demand, not by manifesting visions that tech executives hope people will care about.

Version 85 represents Meta finally understanding that lesson. The company built amazing hardware. The company has brilliant people working on VR. But brilliant execution of the wrong vision is still the wrong vision. By removing mandatory Horizon integration and letting users customize their experience, Meta is finally letting VR become what users actually want it to be.

That's not a curse in disguise. It's a blessing.

FAQ

What is the Horizon integration being removed from Quest 3?

Meta is removing the mandatory Horizon Home experience from Quest 3 headsets with OS version 85. Instead of being forced to see the Horizon home environment when putting on the headset, users can now customize their home screen, navigate directly to applications, or opt into Horizon if they prefer. The Horizon Worlds creation platform and social features still exist as optional experiences, but they're no longer pushed as the default interface.

Why did Meta decide to remove mandatory Horizon integration?

User behavior data showed minimal engagement with Horizon Worlds despite years of promotion and integration. Meta's own metrics revealed that Horizon Worlds had fewer than 300,000 monthly active users, a tiny fraction of Quest's user base. Meanwhile, the most frequently used applications on Quest headsets are gaming titles like Beat Saber and Gorilla Tag. By removing the forced Horizon experience, Meta is aligning the default interface with how users actually want to use their headsets, which is primarily for gaming and entertainment rather than social experiences.

What does this mean for developers who built experiences in Horizon Worlds?

Developers who invested in Horizon Worlds need to diversify their strategies. Removing mandatory Horizon integration means fewer forced users and signifies that Horizon will never become the default social infrastructure for Quest as originally planned. The safest approach for VR developers is to focus on delivering specific value through standalone applications on the Quest app store, rather than relying on Horizon's ecosystem for user acquisition. Games, entertainment, and productivity applications with clear value propositions have better prospects than experiences built primarily around social networking in VR.

How does Meta Quest 3 compare to Play Station VR2 and Apple Vision Pro in terms of strategy?

Play Station VR2 focuses primarily on premium gaming experiences that leverage VR's immersive qualities, positioning itself as an extension of Sony's existing gaming ecosystem. Apple Vision Pro emphasizes personal spatial computing with existing infrastructure like FaceTime, rather than building new social networks. Both companies avoided forcing users into new social platforms. Meta's approach was different—it tried to create an entirely new social network (Horizon) on top of VR hardware. The competitors' strategies proved more successful because they aligned with existing user behaviors and expectations rather than attempting to create new ones.

Is the metaverse dead after Horizon's failure?

The metaverse vision of a fully immersive persistent virtual world where everyone lives and works is not happening anytime soon, if ever. However, elements of metaverse-like experiences are already thriving in gaming platforms like Roblox and Fortnite, which provide virtual spaces where users socialize and spend money. The key difference is that these platforms succeeded by focusing on gaming and creation first, with social and economic elements emerging naturally. The metaverse concept itself isn't dead, but the idea of forcing adoption through a dedicated platform separate from compelling use cases appears to be dead. Virtual worlds will likely develop through gaming and specialized applications, not through dedicated metaverse platforms.

What should Quest users do in response to version 85?

Quest users should update to version 85 when it becomes available to access customization options for their home screen. After updating, customize your home environment to match how you actually use the headset. If you primarily use Quest for gaming, set it to display your games prominently. If you watch media, prioritize media apps. You can choose to skip Horizon Home entirely if you prefer. The flexibility is the main improvement—you can now set your experience to match your actual usage patterns rather than Meta's preferred ecosystem.

What are the best ways to actually use a Meta Quest 3 headset?

The most popular and engaging uses for Meta Quest 3 are gaming (with titles like Beat Saber, Pavlov, and Gorilla Tag leading engagement metrics), watching media and entertainment content, and fitness applications that gamify exercise. These use cases take advantage of VR's immersive and spatial qualities. Building your Quest experience around these proven use cases will provide the most value. Trying optional social features is fine if you're interested, but the core value of the hardware comes from gaming and entertainment applications.

How does this change affect Meta's broader metaverse strategy?

Removing mandatory Horizon integration represents Meta's practical retreat from the grand metaverse vision while maintaining optionality for future development. The company will likely continue investing in VR hardware and gaming partnerships because these drive engagement and revenue. However, the multibillion-dollar bet on building a new social platform through Horizon appears to be over. Meta is essentially adjusting to follow user behavior rather than trying to shape it. The company still has resources and expertise in spatial computing, but future VR success will depend on building compelling use cases rather than pursuing predetermined visions.

What should investors understand about Meta's VR business after this change?

Investors should view Meta's VR business as a long-term, speculative investment focused on gaming and enterprise applications rather than near-term metaverse revenue. Gaming is a proven use case with clear monetization models. Enterprise applications in training, design, and collaboration are emerging. However, the social metaverse model that would have generated massive revenue has no proven market. The good news is that Meta's spending on failing metaverse projects will likely decrease, reducing future losses. The challenge is that VR's path to profitability remains uncertain and may take many years to materialize.

Key Takeaways

- Meta is removing mandatory Horizon integration from Quest 3 with OS v85, allowing users to customize their home experience instead

- Horizon Worlds adoption failed dramatically with under 300,000 monthly active users compared to millions who use gaming applications

- User behavior data shows gaming drives 70% of Quest engagement, not social experiences, forcing Meta to align with reality

- Meta accumulated $21 billion in Reality Labs losses pursuing the metaverse vision between 2020-2024

- Competitors like PlayStation VR2 and Apple Vision Pro succeeded by focusing on specific use cases rather than forcing new social platforms

Related Articles

- Meta's Horizon Workrooms Shutdown: Why VR Meeting Rooms Failed [2025]

- Meta's VR Studio Closures: The Metaverse Reality Check [2025]

- Meta Quest Layoffs and VR's Future: Why Palmer Luckey's Optimism Might Be Misplaced [2025]

- Meta's VR Fitness Collapse: What Supernatural Users Lost [2025]

- Meta's VR Fitness Reckoning: Why Supernatural's Shutdown Matters [2025]

- Meta's Reality Labs Layoffs: What It Means for VR and the Metaverse [2025]

![Meta's Quest 3 Horizon Integration Removal: What It Means [2025]](https://tryrunable.com/blog/meta-s-quest-3-horizon-integration-removal-what-it-means-202/image-1-1769105345849.png)