The Smartwatch Wars Just Got Interesting Again

Four years is a long time in tech. When Meta abandoned its smartwatch project back in 2022, the move felt like another casualty of the metaverse hype cycle. Technical problems. Budget cuts. The usual story.

But here's the thing: Meta never actually stopped thinking about wrists.

Now, the company's reportedly dusting off those plans with something code-named Malibu 2, a smartwatch designed to launch later this 2025 with health tracking, AI capabilities, and integration with Meta's sprawling ecosystem of AR glasses and social platforms. This isn't some nostalgic throwback. It's a strategic pivot that reveals where Meta actually thinks the future of computing is headed.

And it's going to make things very complicated for everyone else.

The timing matters too. Apple is reportedly working on AI smart glasses that could arrive in 2026. Google has been quiet on wearables but dominant in health data. Samsung, Garmin, and Fitbit own the wrist real estate right now. Meta's move threatens to shake up the entire ecosystem, especially when you realize what the company is actually trying to build.

This isn't just about selling watches. It's about controlling the interface between AI, your body, and the world around you.

TL; DR

- Meta's comeback: After scrapping smartwatch plans in 2022, Meta is launching the Malibu 2 smartwatch in 2025 with AI and health features

- Ecosystem play: The watch works with Ray-Ban Display AR glasses and upcoming Phoenix mixed reality headset

- Serious competition: Apple's working on AI glasses, while Google, Samsung, and Garmin dominate the wrist market

- Control strategy: Meta wants to own health data, AI interactions, and AR/MR interface controls from your wrist

- AR/MR roadmap: Meta delayed Phoenix mixed reality glasses until 2027 to focus resources on smartwatch and glasses convergence

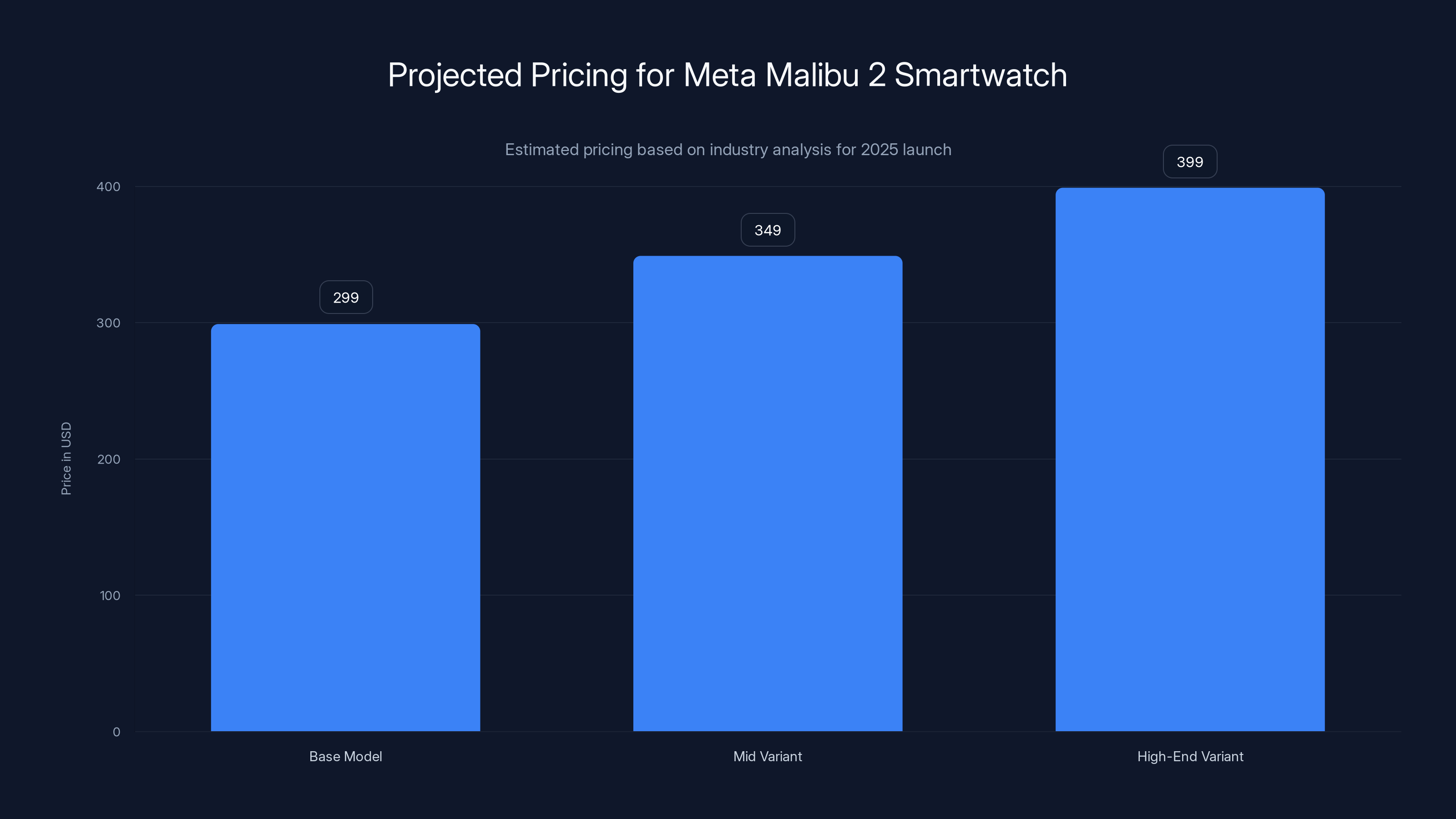

The Meta Malibu 2 is expected to be priced between

Why Meta Killed Its First Smartwatch, and Why That Failure Matters

Let's rewind to 2022. Meta announced an ambitious plan to build a smartwatch that would let people stay connected, track fitness, and eventually serve as a remote control for AR glasses. The company showed early concepts, filed patents, and seemed genuinely excited about the project.

Then it quietly died.

The official story involved technical challenges and cost-cutting as the company faced massive financial pressure following the advertising changes that decimated ad targeting on iOS. Meta was losing money on its metaverse division. The advertising apocalypse was happening. Priorities shifted fast.

But the technical problems were real too. Building a smartwatch that differentiates in a market dominated by Apple and Samsung isn't trivial. You need custom silicon, battery efficiency that actually works, reliable sensors, and software that people want to use every day. You can't just slap an Android skin on generic hardware and call it innovation. Meta learned that lesson hard.

What makes the 2025 attempt different is context. In 2022, Meta was flailing. The company had pivoted hard into the metaverse narrative, burning billions on VR hardware, and was getting hammered by investors for the obvious lack of ROI. A smartwatch felt like another bet on unproven technology.

Now, Meta's actually proven something works: AR glasses that people want. The Ray-Ban Display smart glasses that launched last year sold well enough that Meta had to pause international orders due to "unprecedented demand and limited inventory." That's not marketing talk. That's a real product-market fit signal.

A smartwatch makes sense now because it serves a specific purpose in Meta's ecosystem. It's not a standalone device trying to convince people to switch from their Apple Watch. It's a control interface for AR glasses and a health data aggregator that feeds Meta's AI systems.

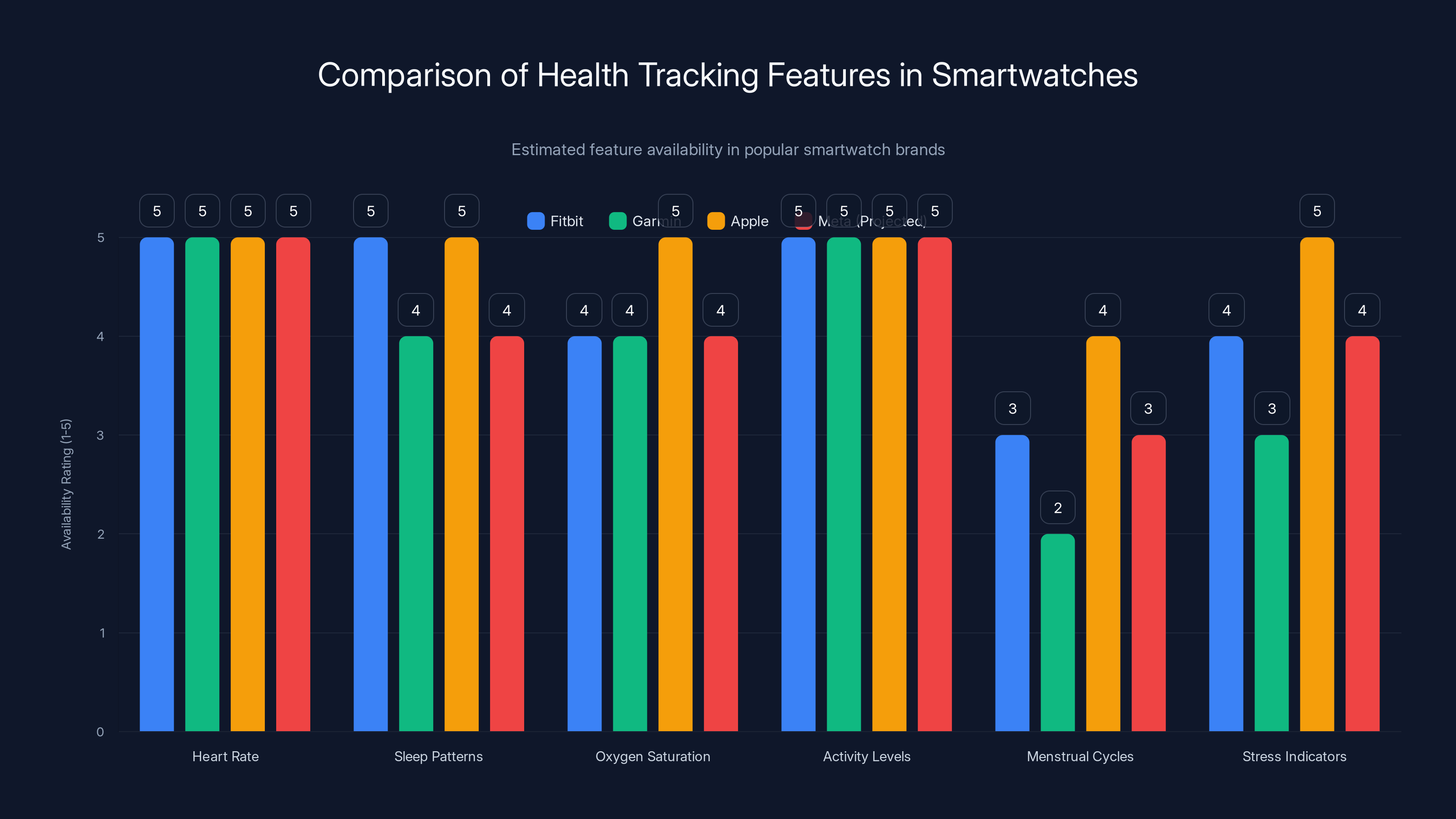

Smartwatches like Apple, Fitbit, and Garmin offer comprehensive health tracking features. Meta's entry into this market is projected to include similar capabilities. (Estimated data)

The Ray-Ban Display Connection: Why This Watch Actually Makes Sense

The Ray-Ban Display glasses use something called a neural wristband for gesture recognition. Tap your wrist, swipe in the air, make pinching motions with your fingers, and the glasses respond. It's clever input design for hands-free interaction.

But here's the problem with that approach: people already wear smartwatches. Most consumers have a watch on their wrist already, whether it's Apple, Garmin, or Samsung. Adding a special neural wristband on top of that feels redundant. It means two things on your wrist. Extra weight. Extra battery drain. Extra clunkiness.

Unless, of course, your smartwatch IS the control device.

If Meta's Malibu 2 smartwatch can replicate the gesture controls of the neural wristband while also tracking health metrics, managing notifications, and running AI features, you're consolidating hardware. One device. One battery to charge. One thing on your wrist.

That's the actual insight here. Meta's not trying to beat Apple at the fitness tracking game. The company is solving a real problem in its own product line: how do you control AR glasses without multiple wearables?

The gesture control angle also hints at something deeper. Microsoft has been exploring gesture-based AR interfaces. Magic Leap dabbled with hand tracking. Apple's been filing patents on spatial computing controls for years. Everyone knows the future of AR/MR interaction isn't going to be touchscreens or voice alone. It needs to be intuitive, contextual, and happen on the body.

Meta's betting that wrist-based gesture recognition is that future. Not because it's revolutionary technology, but because everyone already wears watches.

Health Tracking as the Real Trojan Horse

Here's what most people miss about smartwatches: they're health data collection devices masquerading as timepieces.

Fitbit, Garmin, and even Apple have spent years building massive databases of biometric information. Heart rate. Sleep patterns. Oxygen saturation. Activity levels. Menstrual cycles. Stress indicators. All tracked continuously, all stored, all analyzed.

That data is incredibly valuable. Not just for the individual wearer, but for pharmaceutical companies, insurance firms, health research, and yes, AI training.

Meta's reportedly building health tracking into Malibu 2. The company didn't specify what sensors it's including or what metrics it will track, but assume the basics: heart rate, sleep, activity. Maybe blood oxygen. Maybe temperature. The specifics matter less than the principle: Meta is positioning itself to collect health data at massive scale.

Why does Meta care about health data? Because health is fundamentally personal. It's something people care about deeply. Health tracking data is also extremely rich for machine learning. Your heart rate variability tells you things about your autonomic nervous system. Your sleep patterns reveal stress and hormonal changes. Your activity and location data, combined with your social graph, creates an incredibly detailed picture of who you are and how you live.

For an AI company trying to build personalized AI assistants, that's gold.

There's also the competitive angle. Apple has been using Apple Watch health data to build an incredibly detailed picture of user wellbeing. The company's even getting into clinical-grade features, partnering with researchers to study specific health conditions. Google's Fitbit acquisition put Google squarely in the health data game. Meta couldn't afford to miss this category entirely.

The watch is where Meta gets that data access.

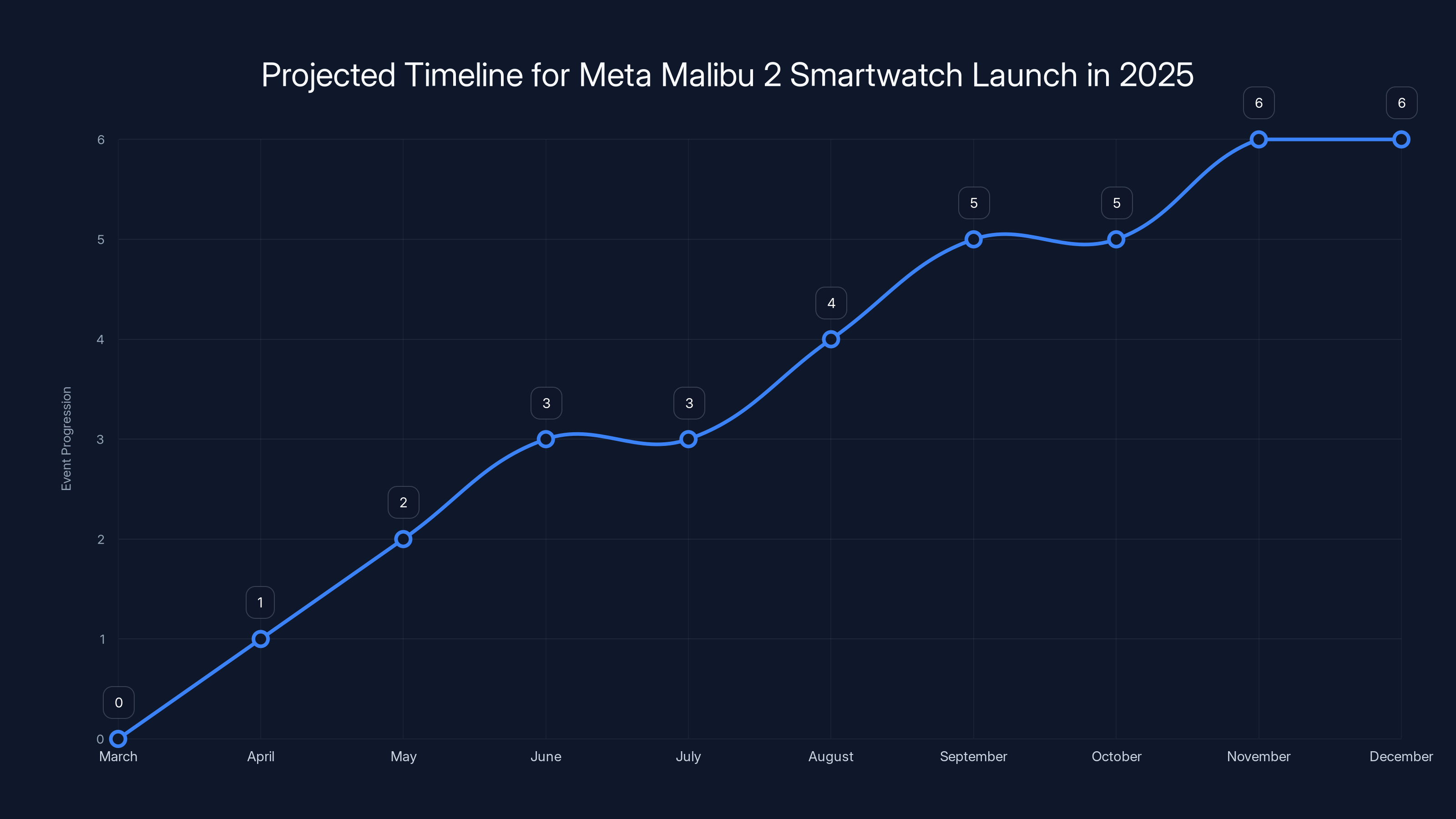

Estimated timeline for Meta Malibu 2 includes announcement in March/April, availability by May/June, and developer access by Q2/Q3 2025. Estimated data.

The Malibu 2 Specs: What We Know and What We're Guessing

Detailed specifications for the Malibu 2 haven't been officially confirmed, but some educated guesses based on industry patterns and reported details:

Hardware expectations:

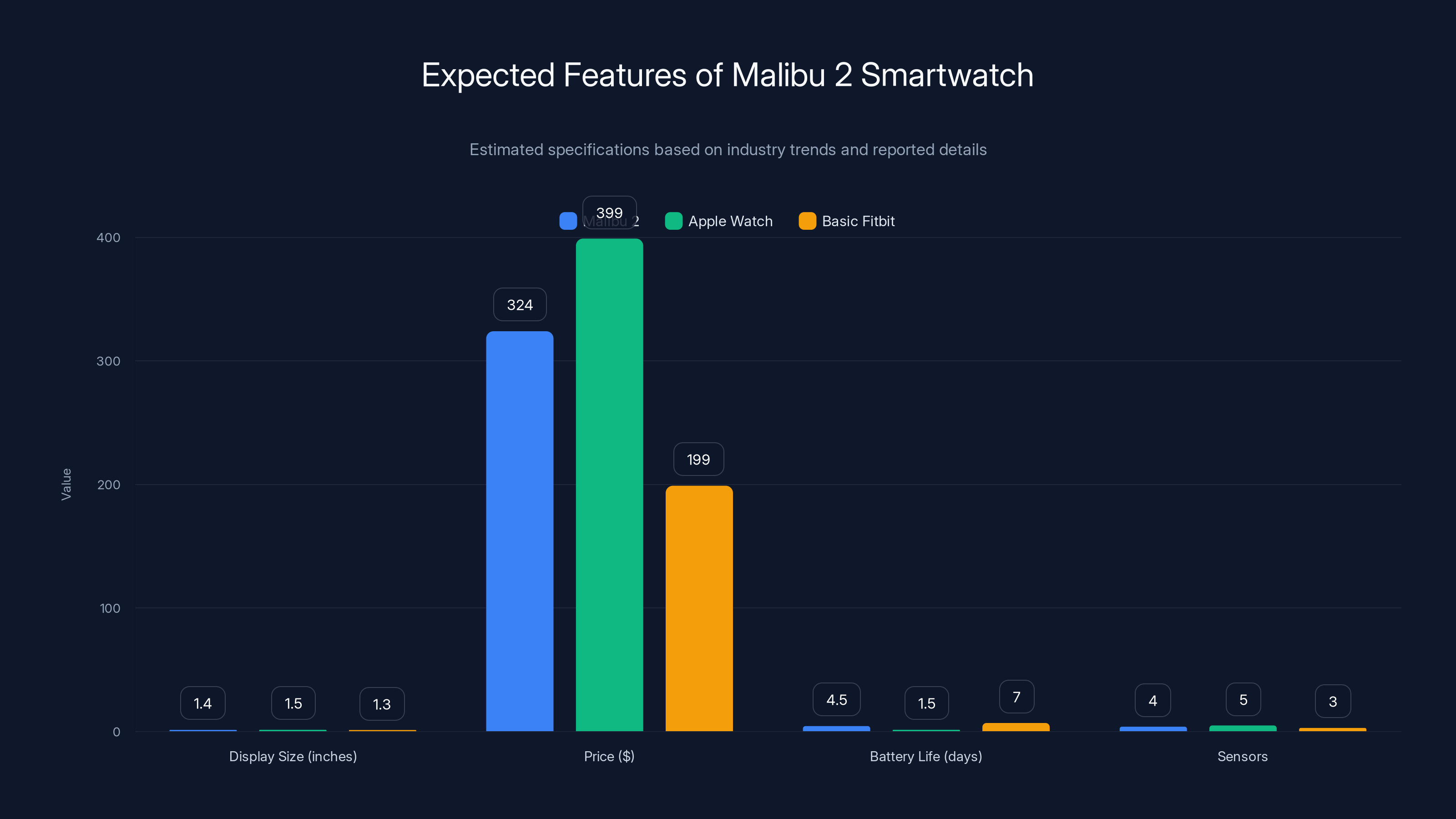

Meta will likely include a standard smartwatch form factor, probably with a round or rectangular display. Something between 1.3 and 1.5 inches diagonal, similar to Apple Watch or Garmin Epix size. The company needs to hit a price point that makes sense for a second watch in someone's collection, which suggests somewhere between

The processor will probably be a custom or semi-custom chip, similar to what Apple does with the S-series or what Qualcomm provides to other manufacturers. Nothing cutting-edge, but efficient enough to run health monitoring, AI features, and gesture recognition simultaneously.

Battery life is the critical metric. Most smartwatch buyers expect 3-7 days per charge. Apple Watch gets away with 1-2 days because of brand loyalty and ecosystem lock-in. Meta doesn't have that advantage. Malibu 2 needs to hit at least 4-5 days to be competitive.

Sensors will include the standard suite: accelerometer, gyroscope, heart rate, and probably blood oxygen. Maybe a microphone for voice commands to Llama or other Meta AI models. Probably no ECG or advanced medical sensors at launch. Those add cost and regulatory complexity that a first-gen product doesn't need.

Software and AI features:

This is where it gets interesting. Meta's invested heavily in Llama, its open-source large language model. Some version of Llama will probably run on or sync with Malibu 2. Voice commands, health insights, activity suggestions, and contextual notifications powered by AI.

The watch will definitely integrate with Ray-Ban Display glasses, using its sensors and Bluetooth connection to receive data and potentially control the glasses. It might also integrate with Meta's social platforms: WhatsApp quick replies, Messenger notifications, Instagram activity checks.

Health AI is the interesting angle. Meta could use watch data to generate personalized fitness coaching, sleep recommendations, stress management suggestions. Not novel functionality, but if the AI is actually good, it becomes sticky.

Price positioning:

Meta's reportedly targeting a middle ground: cheaper than Apple Watch (

That's actually smart strategy. It tells customers this watch is designed for a specific ecosystem, not a replacement for their current watch.

The Delayed Phoenix Problem: Why 2027 Now?

While Meta's launching a smartwatch in 2025, the company's also delayed its much more ambitious mixed reality headset, code-named Phoenix, until 2027. This is significant, and not just because of the delay itself.

Phoenix is Meta's answer to Apple's Vision Pro. It's supposed to be a full mixed reality device, more advanced than the Ray-Ban Display glasses, with the ability to overlay digital content onto the physical world in ways that feel native and intuitive. Heavy compute, fancy optics, probably a $1,000+ price point.

Meta's decision to delay Phoenix until 2027, while pushing the smartwatch to 2025, reveals something about company priorities. The smartwatch is achievable with current technology and current R&D progress. Phoenix isn't. The company decided it makes more sense to consolidate its wearable strategy: get the smartwatch out, prove the ecosystem, and then layer in the heavier device.

This also suggests Meta's being more realistic about mixed reality timelines. Everyone predicted MR would take off by 2024-2025. It hasn't. Apple's Vision Pro is selling poorly compared to hype. Meta's Quest 3 is doing okay but not transformative. Microsoft's Holo Lens remains a niche enterprise product.

Meta's essentially saying: "We're going to focus on AR glasses and smartwatches first, get those embedded in people's lives, and then introduce the heavier MR stuff when the market is actually ready."

That's more pragmatic than the metaverse-obsessed narrative from 2021.

The Malibu 2 is expected to have a mid-range price and battery life compared to Apple Watch and basic Fitbit. Estimated data based on industry patterns.

Apple's AI Glasses Counter-Move: The Real Threat

While Meta's launching a smartwatch, Apple's reportedly building AI smart glasses that could arrive in 2026. This is the move that actually matters.

Apple's advantage is ruthless ecosystem integration. If those glasses work with Apple Watch, iPhone, AirPods, and Mac, Apple creates a closed loop that's incredibly sticky. Add in the fact that Apple has better battery tech, superior supply chain management, and vastly more cash than Meta, and suddenly Meta's Malibu 2 looks less imposing.

But here's where Meta actually has leverage: Meta's glasses already exist and already sell. The Ray-Ban Display glasses are out in the wild. People are buying them. Meta's building software for them. A smartwatch that controls those glasses, released before Apple's glasses even launch, gives Meta a year-plus head start on building an installed user base.

Apple's going to face the same problem every tech giant faces when entering wearables: how do you convince someone to switch? Fitbit couldn't do it. Garmin can't do it. Samsung can only barely do it. Apple succeeded because it launched the Apple Watch before alternatives matured, backed it with relentless marketing, and integrated it perfectly with iPhone.

Meta's trying a different playbook: launch the watch as an accessory to glasses you already bought. Less direct competition with Apple Watch, more strategic positioning as part of a larger AR ecosystem.

It might actually work, at least for a meaningful subset of users.

The Competitive Landscape: Who Else Is Scrambling?

Meta's move creates ripples across the entire wearables industry.

Google's position: Google owns health data through Fitbit but doesn't have coherent AR glasses. The company announced Pixel Watch glasses ages ago and nothing materialized. A Meta smartwatch threatens Google's health data monopoly without Google having a glasses story of its own. Expect Google to accelerate something, probably integrating Fitbit more directly with Android, maybe even launching a Google smart glasses project sooner than planned.

Samsung's dilemma: Samsung makes excellent smartwatches that already sell in massive volumes. The Galaxy Watch line is legitimate competition. But Samsung doesn't have committed AR glasses plans like Meta. If Meta successfully positions its watch as the AR control interface of choice, Samsung becomes the generic alternative. That's a vulnerable position over time.

Garmin's moat: Garmin dominates fitness and outdoor categories. People choose Garmin for serious athletic tracking and navigation. Meta's AI watch doesn't threaten Garmin in runners, cyclists, or outdoor adventurers. But for regular people who want a watch that controls their AR glasses and does decent health tracking? Garmin's out of the picture.

Fitbit's irrelevance: Fitbit was the fitness watch brand before Apple destroyed that category. Google bought Fitbit but largely kept it independent. Meta's smartwatch, if it's actually good at fitness tracking, makes Fitbit less relevant. Basic fitness tracking is table stakes now, not a differentiator.

The real interesting question is whether any of these competitors preemptively launch AR glasses. If Google suddenly announced glasses with gesture control, or if Samsung partnered with someone for AR glasses, the dynamic changes fast. Right now, Meta has AR glasses and is adding a watch. Everyone else is adding glasses to existing watch businesses. That's a structural advantage for Meta, but only if the execution is good.

Estimated data suggests Meta's smartwatch could significantly impact Google and Fitbit, while Garmin remains less affected due to its niche market focus.

Health Data Privacy: The Elephant in the Room

Meta collecting health data at scale raises obvious privacy questions. This is the same company that faced FTC investigations over data practices, that platforms user data for ad targeting, that's gotten caught red-handed on multiple privacy issues over the years.

The company's gotten better about privacy, or at least more careful about PR around privacy. But the fundamental business model hasn't changed: Meta makes money from advertising. Advertising becomes more effective with more personal data. A smartwatch that collects intimate health information is incredibly valuable for that model.

Don't expect Meta to do anything sinister with the data. The company's smart enough to avoid obvious violations. But expect the data to be used for ad targeting. Health status influences purchasing decisions. Your sleep patterns correlate with mood, which influences what you're interested in buying. Your stress levels predict shopping behavior. Meta will find ways to use health data to make its ads more effective, all within the bounds of GDPR, CCPA, and other privacy laws.

If that bothers you, the Ray-Ban Display and Malibu 2 smartwatch probably aren't the products for you. And that's fine. There are alternatives.

But users should understand the trade-off they're making. You get an AI-powered watch and glasses that integrate seamlessly and probably offer genuinely useful features. In exchange, Meta gets deep visibility into your health and daily life. Whether that trade is worth it depends on your risk tolerance.

Software Ecosystem: Can Meta Actually Build Compelling Watch Apps?

A smartwatch is only as good as its apps. Apple Watch succeeds partly because of Apple's own apps but mostly because third-party developers support it. Garmin has a huge ecosystem of sports and navigation apps. Fitbit does basic fitness well enough that apps aren't the differentiator.

Meta's watch is going to run what, exactly? A custom version of Android? A fork of Wear OS? Something proprietary?

If it's Wear OS, Meta gets compatibility with existing Android apps but ties itself to Google's platform. That's awkward strategically. If it's custom, Meta needs to convince developers to build for a completely new platform with a small install base at launch.

This is the unsexy problem that Meta has to solve. The watch itself can have perfect hardware and great AI features, but if there's nowhere to get weather, no Spotify integration, no Strava, no third-party fitness apps, it becomes a closed device. And closed devices lose.

Garmin's solved this by focusing on their core use case (sports, outdoor) so well that you don't need many apps. Apple solved it with ecosystem lock-in and enough resources to attract developers. Samsung solved it by using Wear OS and accepting that it's a secondary device to iOS users.

Meta's probably going to take the Wear OS approach, which is sensible but limiting. It's not a proprietary opportunity, but it's a pragmatic choice.

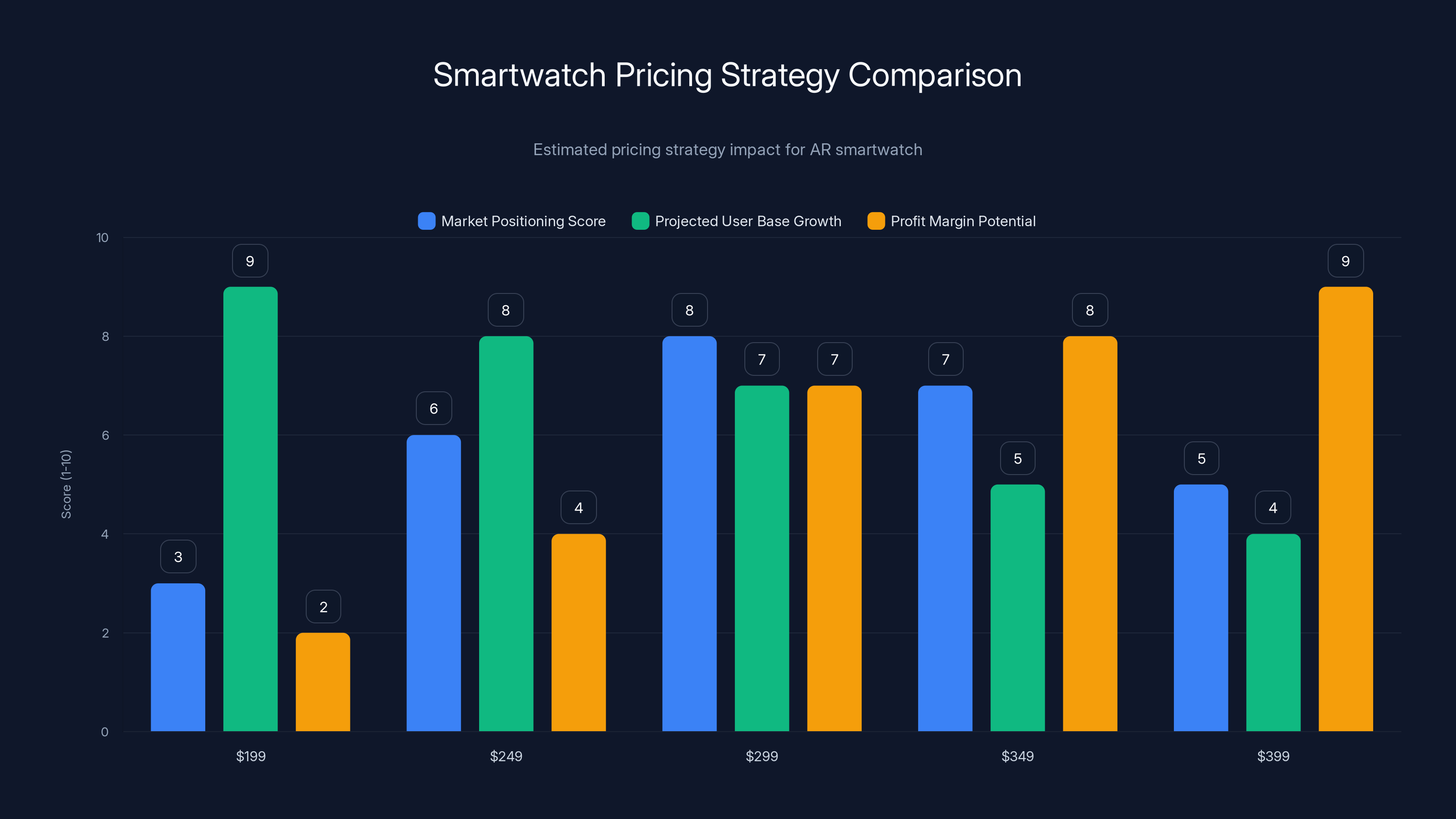

The $299 price point offers a balanced strategy with strong market positioning, reasonable user base growth, and solid profit margins. Estimated data.

The AR Gesture Control Feature: This Might Actually Be Revolutionary

Let's focus for a moment on something that could genuinely matter: using a smartwatch to control AR glasses through wrist gestures.

This is not an obvious idea until you think about it. AR glasses need input. Voice commands work sometimes. Touchpads on the glasses frame work sometimes. But what about on your wrist, where you're already used to interacting with a smartwatch?

The gesture vocabulary could be elegant: tap the watch to activate, swipe to navigate, pinch to select, rotate the digital crown to scroll. All familiar from Apple Watch. All learned from years of smartwatch use. All happening on a device you're checking regularly anyway.

Compare this to the current ray-ban Display neural wristband, which users have to learn and wear in addition to potentially their regular watch. Or to glasses with integrated touchpads, which feel fragile and awkward. Or to voice commands, which are only comfortable in private.

Wrist-based gesture control for AR glasses could actually be a killer interaction model. If Meta executes this well, it becomes harder for Apple or others to compete. You can't just add gesture control to glasses. You need a full smartwatch ecosystem that happens to enable gesture control.

That's a moat, if Meta can build it.

Pricing Strategy: The 349 Calculation

How much should a smartwatch designed to control AR glasses cost? The calculation is complex.

The $249 argument: Position it as "the affordable AR accessory." Get volume. Build ecosystem. Make money on hardware margins and future services. Compete head-to-head with Garmin and Samsung. Accessible to more people, faster user base growth. The watch becomes the gateway to the AR ecosystem.

The $349 argument: Position it as "premium AR device." Higher margins. Attract users who are already committed to the Ray-Ban Display ecosystem. Signal quality and commitment to building this category seriously. Compete with Apple Watch in aspirational categories, not volume. Healthier unit economics from day one.

Meta's probably going with something like

If Meta prices it at

Integration With Ray-Ban Display: The Coherent Ecosystem

Here's what makes the Malibu 2 smartwatch actually strategic rather than just another device: it integrates with Ray-Ban Display glasses in ways that make both products better.

Right now, Ray-Ban Display uses that neural wristband for gesture control. Switching to a smartwatch consolidates hardware. But it's more than that. The watch can also serve as a companion device for notifications, a battery indicator, a data display, and a processor for computationally lighter tasks.

Imagine controlling your Ray-Ban display entirely through watch gestures. Tap to activate. Swipe on the watch to navigate menus on the glasses. Pinch to select. Rotate the crown to adjust settings. All intuitive, all familiar, all on a device you're already touching frequently.

The watch can also display information in a context where you're already looking: on your wrist. Notification previews, activity rings, health alerts, AI suggestions. Everything Meta wants you to interact with, organized on a device that's designed for frequent quick checks.

This is actually good UX design. It's not shoehorning two products together. It's designing them to complement each other.

The deeper integration is in data and AI. The watch sensors feed health data into a local model that provides contextual AI assistance. You're stressed (based on heart rate variability), so the glasses overlay calming visuals or suggest a break. You've been sitting too long, so a notification suggests movement. Your sleep was poor, so the AI adjusts your schedule recommendations for the day.

This ecosystem thinking is where Meta actually has an advantage over point products like Apple Watch or Samsung Galaxy Watch. Those watches are mainly interfaces to smartphones. Meta's ecosystem is designed around wearables, glasses, and AI working together as a system.

If the execution is good, that's better than the Apple Watch by itself, even if Apple's watch is technically superior in individual categories.

2025 Timeline: What Happens When?

Assume Meta launches the Malibu 2 smartwatch sometime in mid-2025, probably around Q2 or Q3. This gives the company time to finish R&D, complete testing, ramp manufacturing, and avoid holiday season cannibalization with the glasses already selling well.

Expect an announcement around March or April, with availability in May or June. That's the typical tech release cadence.

Updated Ray-Ban Display glass firmware will definitely ship before the watch launches, adding software features that prepare for the watch's arrival. You'll probably see gesture recognition testing in beta versions.

The messaging will emphasize the watch as a "Ray-Ban Display controller," not as a fitness watch competitor. Meta will lean into the ecosystem angle: "Get more out of your glasses with a smartwatch designed for AR."

Pricing will drop at announcement. Expect base model at

Developer access probably comes Q2 or Q3, with early apps from Meta itself: Llama-powered health insights, WhatsApp integration, Instagram activity notifications. Third-party app support follows later, probably Q4 2025 at the earliest.

By end of 2025, Meta will have some number of watches sold, probably somewhere in the hundreds of thousands to low millions. Not massive, but enough to establish a beachhead.

The real competitive pressure comes in 2026 when Apple's reportedly launching its AI glasses. That's when we'll know if Meta's Malibu 2 strategy actually worked, or if it's another device that tried to compete with Apple and lost.

Manufacturing Reality: Can Meta Actually Scale This?

Here's the thing about hardware: designing it is one challenge. Manufacturing it at scale is a different beast entirely.

Meta hasn't successfully launched hardware at volume since... well, it hasn't. Oculus headsets exist but are niche. Ray-Ban Display sold out because inventory was limited, but we don't know how much inventory Meta was actually planning to produce.

A smartwatch is more accessible than a VR headset, so volume potential is higher. But it's also more competitive. Supply chain for watch components is complicated. Qualcomm supplies processors. Samsung might supply displays. Various suppliers handle sensors, batteries, casings.

Qualcomm, interestingly, has strong incentive to support Meta. Apple uses its own silicon, cutting Qualcomm out of one of the highest-value markets. Google is increasingly in-house. Meta probably means significant volume for Qualcomm, making the chipmaker want to see Meta succeed.

That's actually important. When you're building hardware, having suppliers who want you to succeed makes a huge difference.

Manufacturing challenges are real though. Quality control gets harder at scale. Supply chain delays happen. Yields might not be perfect. Early units might have issues. Meta needs to manage expectations, something the company historically hasn't been great at.

If Malibu 2 launches and there are immediate issues with battery life, gesture recognition, or durability, the narrative tanks instantly. People compare it directly to Apple Watch, which is extremely reliable. Meta has zero room for product quality failures.

The Deeper Question: Is AR Even Mainstream Yet?

All of this assumes AR glasses are going to be a mainstream category. But are they actually?

Ray-Ban Display glasses sell well, but that's partly novelty, partly because they're a legitimate way to listen to music and take photos. Remove the audio and camera functionality and ask people if they want glasses that overlay information on the world, and you get a very different answer.

AR glasses have been "the future" for over a decade now. Microsoft's been trying with Holo Lens. Magic Leap tried. Snapchat's Spectacles haven't taken off. Nobody's cracked the code of mass-market AR glasses.

The problems are real: optics are hard, power consumption is brutal, content is limited, use cases are uncertain. A smartwatch designed to control glasses doesn't fix those fundamental issues.

What Meta might actually be doing is hedging. The company's betting on AR glasses with smartwatch control because it's the most credible path forward given current technology. But the watch itself is a standalone product that works with or without glasses. It's health tracking, it's AI features, it's a general-purpose smart device.

In other words, if AR glasses never take off, Malibu 2 becomes a regular smartwatch, still valuable, still useful. It's a strategic hedge dressed up as ecosystem integration.

That's actually wise. Bets in consumer electronics usually don't work if you're counting on one category to succeed. You need the watch to be viable even if glasses never catch on.

FAQ

What is the Meta Malibu 2 smartwatch?

The Malibu 2 is Meta's upcoming smartwatch reportedly launching in 2025. It features health tracking, AI capabilities, and gesture controls designed specifically to integrate with Meta's Ray-Ban Display AR glasses. The watch is positioned as an ecosystem device that consolidates wearables and AR control into a single product.

How does the Malibu 2 integrate with Ray-Ban Display glasses?

The watch replaces the neural wristband that currently enables gesture control on Ray-Ban Display glasses. Through wrist-based gestures like taps, swipes, and pinches, users can navigate menus, control information displays, and activate features on the glasses. The watch also provides notifications, battery indicators, and health data that contextualizes AI assistance delivered through the glasses.

What health features will the Malibu 2 include?

Meta hasn't officially detailed health features, but expect standard smartwatch tracking: heart rate monitoring, sleep analysis, activity tracking, and possibly blood oxygen measurement. The watch will likely include AI-powered health insights that provide personalized recommendations based on collected biometric data, similar to competing devices from Apple, Garmin, and Samsung.

How much will the Meta Malibu 2 cost?

Pricing hasn't been officially announced, but industry analysis suggests a base model around

When exactly will the Meta smartwatch launch?

Meta is reportedly aiming for a 2025 launch, likely in the second or third quarter. An official announcement probably comes in spring 2025, with availability following in May or June. The exact date depends on manufacturing completion and regulatory approvals, which Meta hasn't publicly committed to specific timing.

How does the Malibu 2 compare to Apple Watch and Samsung Galaxy Watch?

The Malibu 2 is positioned differently from Apple Watch or Galaxy Watch. Rather than competing as a fitness tracking or smartphone companion device, Meta's watch is designed primarily to control AR glasses and integrate with Meta's ecosystem. Health tracking matches competitors, but the unique value proposition is AR integration. For pure fitness tracking or iPhone integration, Apple Watch remains superior.

What does this mean for the delayed Phoenix mixed reality headset?

Meta's decision to delay the Phoenix MR glasses until 2027 while accelerating the smartwatch suggests the company is prioritizing consolidating its wearable ecosystem. The watch becomes the foundational device for both Ray-Ban Display glasses today and Phoenix glasses in 2027. This allows Meta to build critical software infrastructure and user habit formation before launching the heavier MR device.

Will the Malibu 2 work with non-Meta devices?

Details haven't been confirmed, but the watch likely runs Android or a customized version compatible with Android phones. Whether it pairs equally well with iPhone or other non-Meta devices remains unclear. Meta's history suggests stronger integration with Android and its own apps, but standard smartwatch protocols probably allow basic compatibility with other platforms.

What's Meta's strategy for competing with Apple's reported AI glasses?

Meta's advantage is that Ray-Ban Display glasses already exist and already sell, giving the company a year-plus head start. By launching a smartwatch designed specifically to enhance those glasses, Meta builds ecosystem lock-in before Apple even enters the market. If executed well, this installed base advantage protects Meta when Apple launches in 2026.

Should I buy a Meta smartwatch if I already own an Apple Watch?

That depends on whether you own Ray-Ban Display glasses or plan to buy them. If you don't, the Malibu 2 offers health tracking and AI features that are comparable to existing watches but not uniquely superior. If you do own or want to own AR glasses, the Malibu 2 becomes more compelling as an integrated control interface.

The Bottom Line: Why This Matters

Meta's smartwatch isn't really about smartwatches. It's about control and ecosystem positioning in a future where AR glasses might actually become mainstream.

The company's taking a lesson from Apple: build hardware that integrates your software, your services, and your ecosystem so tightly that switching becomes irrational. Apple did this with the iPhone, then with the Apple Watch. Meta's attempting it with glasses and smartwatches and AI.

Will it work? That depends on execution. Malibu 2 needs to be genuinely good. It needs to integrate seamlessly with Ray-Ban Display. It needs to offer health features people actually use, not just metrics they glance at. It needs to run without constant battery anxiety.

If Meta nails all that, the watch becomes a powerful tool for building AR glass adoption. If Meta fumbles any of it, the watch becomes another "interesting product" that doesn't actually change the market.

Here's the crucial insight: every watch company is trying to own the wrist. Every glasses company is trying to own your eyes. Meta's trying to do both simultaneously. That's ambitious. That's risky. That's also the only way Meta competes with Apple, which owns the wrist for iPhone users and is launching glasses too.

The Malibu 2 smartwatch launching in 2025 matters not because smartwatches are interesting, but because it reveals Meta's actual strategy. The company's not building random devices. It's building connected hardware that makes AR glasses more viable and more integrated into daily life. That's a coherent vision.

Will the vision succeed? We'll know by 2026 when Apple's glasses arrive and real competition begins. Until then, Meta's essentially establishing territory: "We got here first with glasses that actually work. We have the watch to control them. Your move, Apple."

It's a credible move. Execution will determine whether it's also a winning one.

Key Takeaways

- But here's the thing: Meta never actually stopped thinking about wrists

- Adding a special neural wristband on top of that feels redundant

- Battery life is the critical metric

- Meta could use watch data to generate personalized fitness coaching, sleep recommendations, stress management suggestions

- This is significant, and not just because of the delay itself

Related Articles

- Startup's Check Engine Light On? Google Cloud's Guide to Scaling [2025]

- Samsung Galaxy Tab S10 Ultra: The 14.6-Inch Laptop Killer [2025]

- AI Music Generation: History's Biggest Tech Panic or Real Threat? [2025]

- Western Digital's 2026 HDD Storage Crisis: What AI Demand Means for Enterprise [2025]

- Netflix, Warner Bros., and Paramount Merger War [2025]

- Indian Pharmacy Chain Data Breach: How Millions Were Exposed [2025]

![Meta's 2025 Smartwatch Launch: What It Means for AI Wearables [2025]](https://tryrunable.com/blog/meta-s-2025-smartwatch-launch-what-it-means-for-ai-wearables/image-1-1771455945960.jpg)