Meta's Horizon Workrooms Shutdown: Why VR Meeting Rooms Failed [2025]

Meta just pulled the plug on one of its biggest bets in the enterprise VR space. On February 16, 2026, the company will shut down Horizon Workrooms, its virtual reality collaboration platform designed for remote teams. And honestly? Most people won't notice.

This isn't just another product discontinuation. It's a signal that Meta's massive investment in metaverse technology—the $15 billion annual Reality Labs operating loss, the countless VR game studios, the commercial headsets—is being deprioritized in favor of artificial intelligence. But the real story here is deeper than a simple pivot. It's about why VR meeting rooms failed as a use case, what companies actually need from collaboration tools, and where Meta went wrong with its vision for how people work.

I've watched this play out in real time. I tested Horizon Workrooms when it launched in 2021. I talked to CTOs and remote team leads who tried it. And I saw firsthand why the product never gained traction despite Meta's resources and hype machine behind it.

TL; DR

- Meta is discontinuing Horizon Workrooms on February 16, 2026, with all user data permanently deleted

- Commercial Meta Quest headsets are also being pulled from sale (deadline February 20), signaling exit from enterprise hardware

- The platform struggled to gain adoption despite launching with fanfare, with only 300,000 users reported across the entire Horizon ecosystem in early 2022

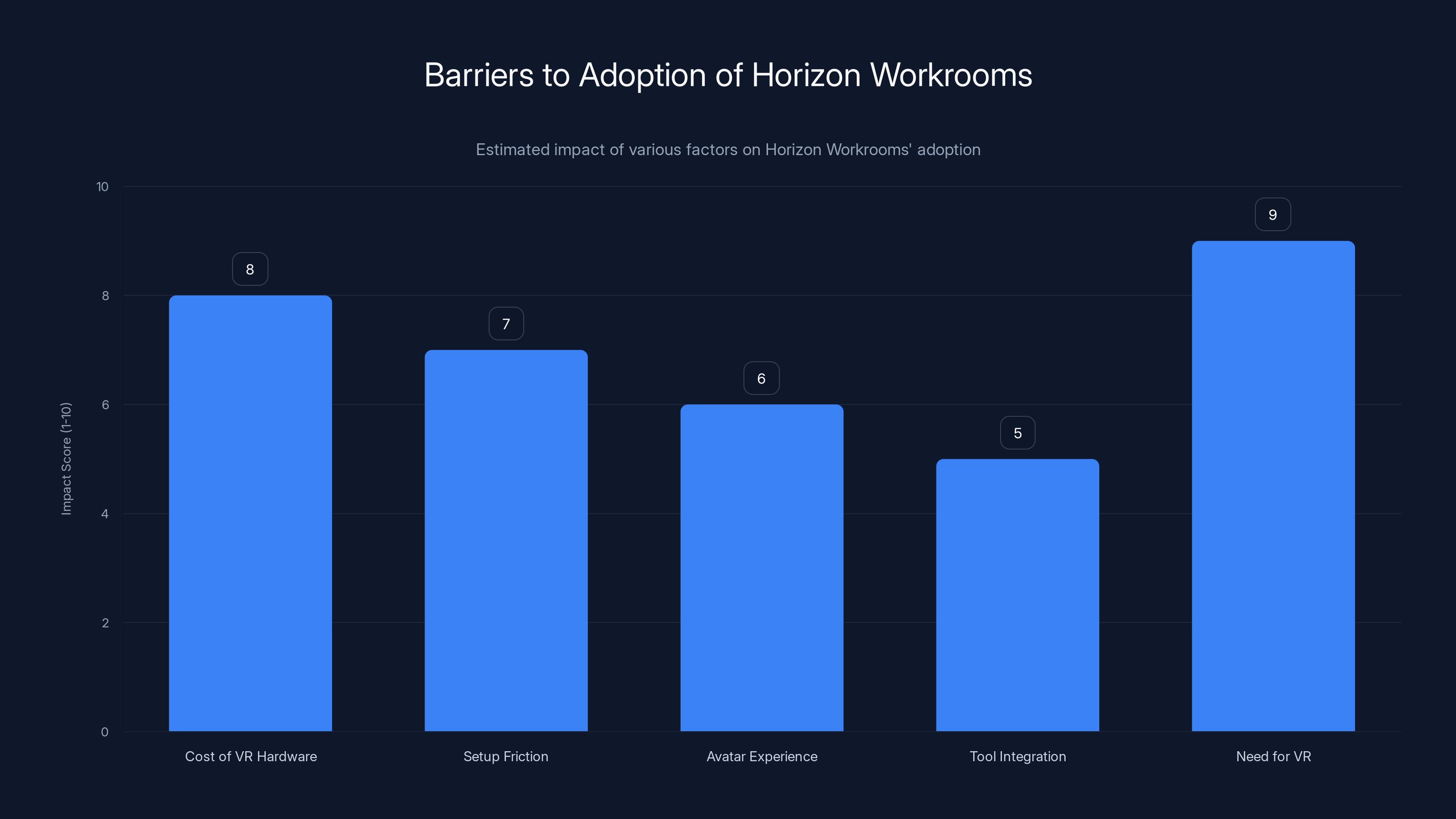

- VR meeting rooms solve problems nobody had like adding spatial context to calls at the cost of expensive hardware, setup friction, and significant complexity

- Simpler alternatives dominated because Zoom, Teams, and Slack meetings require zero friction and work across every device

- AI is the real priority for Meta going forward, indicating a fundamental shift in company strategy away from metaverse infrastructure

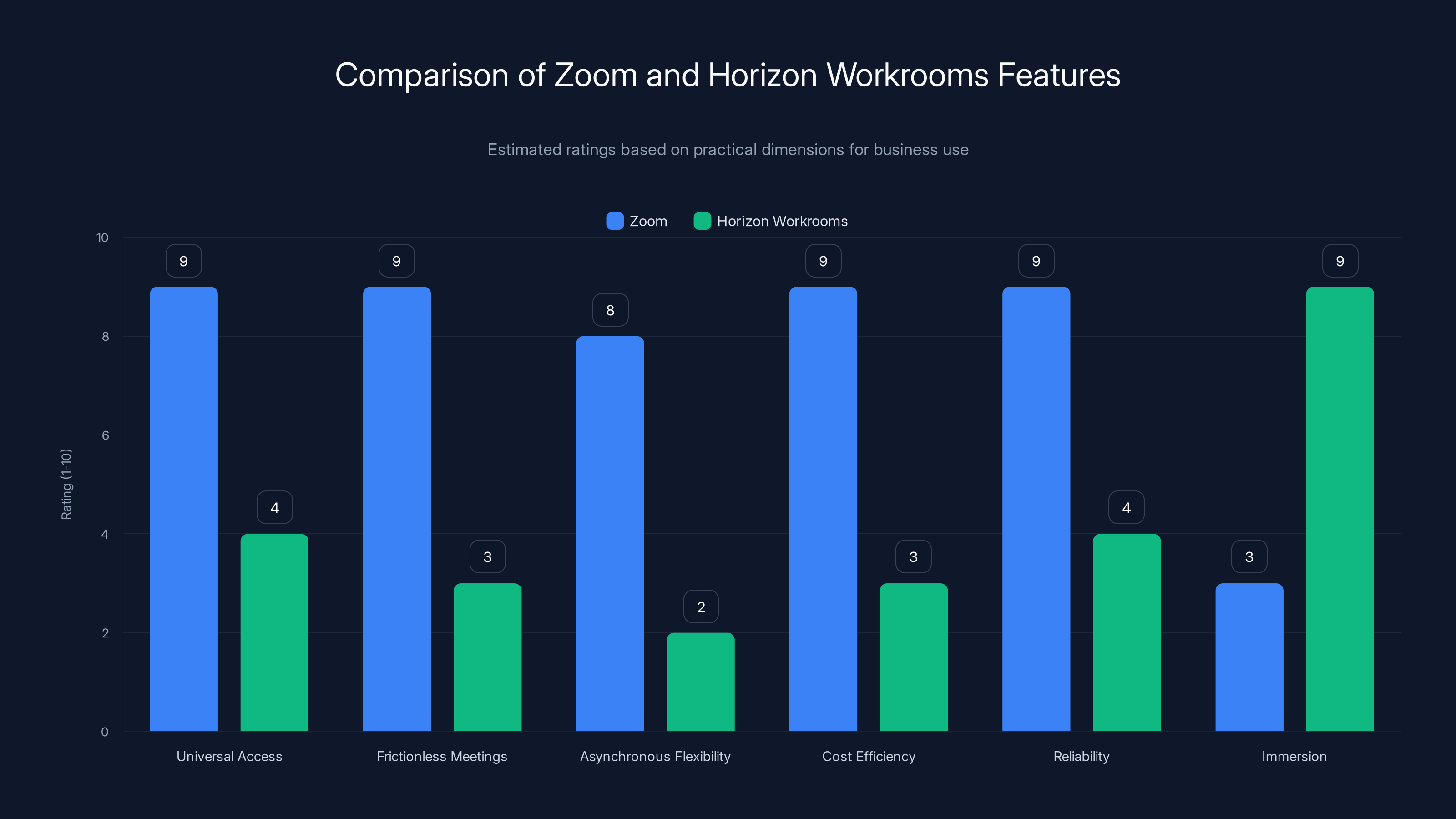

Estimated data suggests that the need for VR immersion was the biggest barrier to Horizon Workrooms' adoption, followed by the high cost of VR hardware. (Estimated data)

The Rise and Fall of Meta's VR Collaboration Bet

When Meta (then Facebook) announced Horizon Workrooms in August 2021, it felt like a watershed moment for remote work. Here was a tech giant betting billions that the future of meetings wouldn't be 2D grid video calls—it would be immersive virtual spaces where avatars sat around digital conference tables.

The pitch was compelling. Horizon Workrooms would let you join a virtual office with your colleagues. You'd see their avatars. You'd share screens. You'd have persistent workspaces where you could leave notes and documents for teammates to find later. It sounded like the killer app for VR.

Except it never was.

Meta Quest 2 headsets (around $400 at launch) became the de facto device for trying this out. The company pushed the product heavily. It published blog posts about companies using it. It released updates and improvements. And yet, adoption remained glacially slow.

By early 2022, the Horizon platform (which included the consumer VR experience Horizon Worlds) had only 300,000 users total. That's a rounding error for Meta. For context, Zoom added more users in a typical quarter during the pandemic. Discord's user base dwarfed it. Even Slack, despite skepticism about adoption, had tens of millions of monthly active users.

The writing was on the wall by 2023. Meta started shuttering VR game studios. It deprioritized Horizon development. And this week, it finally admitted defeat.

Why VR Meeting Rooms Sounded Great on Paper

Let's start with the concept, because it's actually not a bad idea in theory. A virtual meeting room has real advantages over a flat video grid.

First, spatial presence. When you're in a physical meeting, you unconsciously pick up spatial cues. Who's sitting near whom? What's the energy in the room? Are people engaged or checking their phones? A well-designed VR meeting room could recreate those dynamics.

Second, shared context. In Horizon Workrooms, you could gesture to a digital whiteboard on the wall. You could pull up documents and everyone could annotate them together. You could see multiple screens at once without juggling windows. This is genuinely harder in Zoom.

Third, persistence. Your virtual office could remain exactly as you left it. Documents you pinned to the wall stay there. Your teammates find them without needing you to share a link or send a message. This is actually valuable for distributed teams.

Fourth, focus. A dedicated VR space for meetings means no Slack notifications, no email, no desktop distractions. You're truly present with your team.

On paper, these are compelling advantages. In practice, every single one of them created friction that outweighed the benefits.

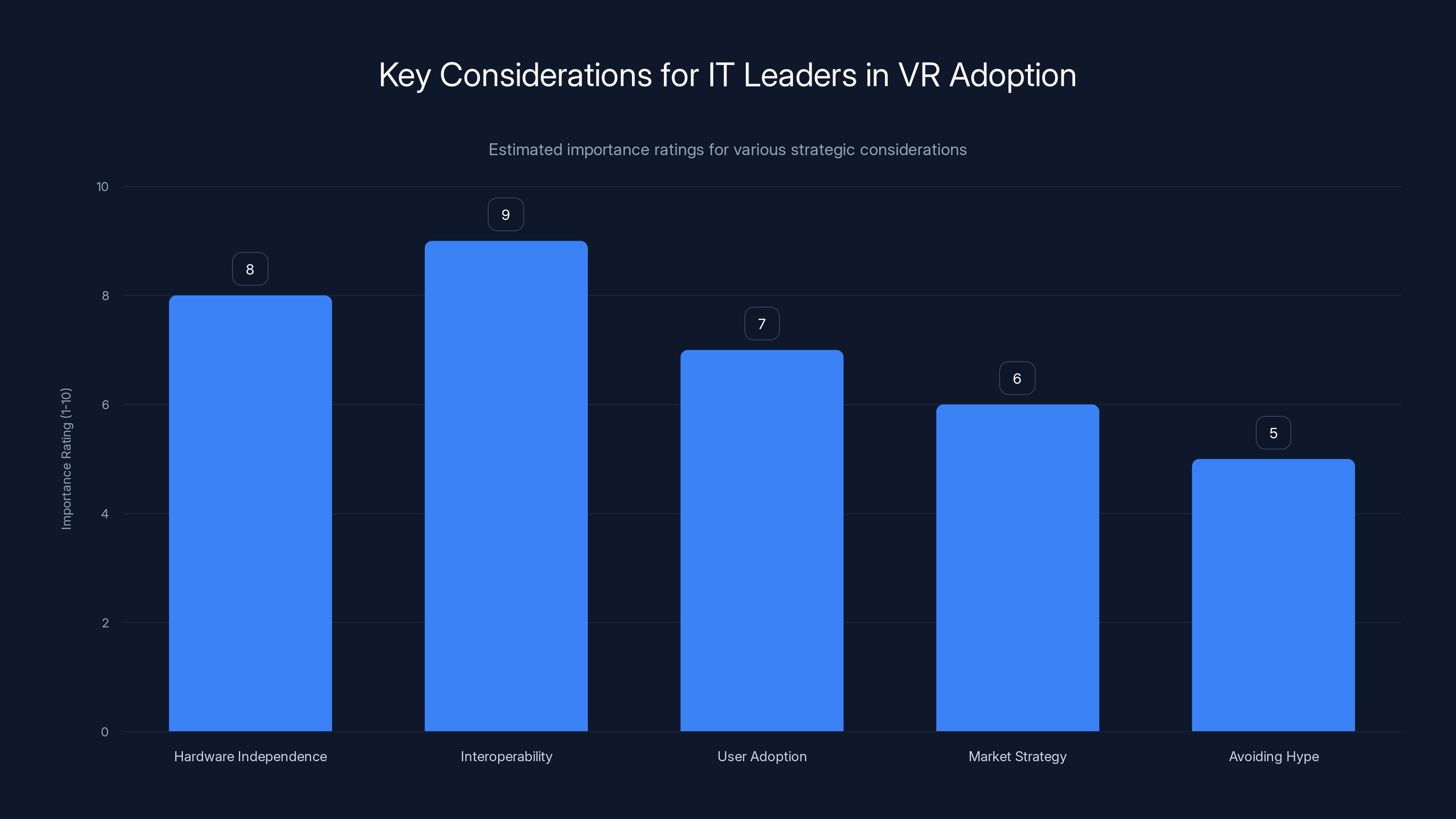

Interoperability and hardware independence are crucial for IT leaders considering VR, with high importance ratings. (Estimated data)

Problem 1: The Hardware Barrier

This is the most obvious issue, but it bears explaining because it's foundational.

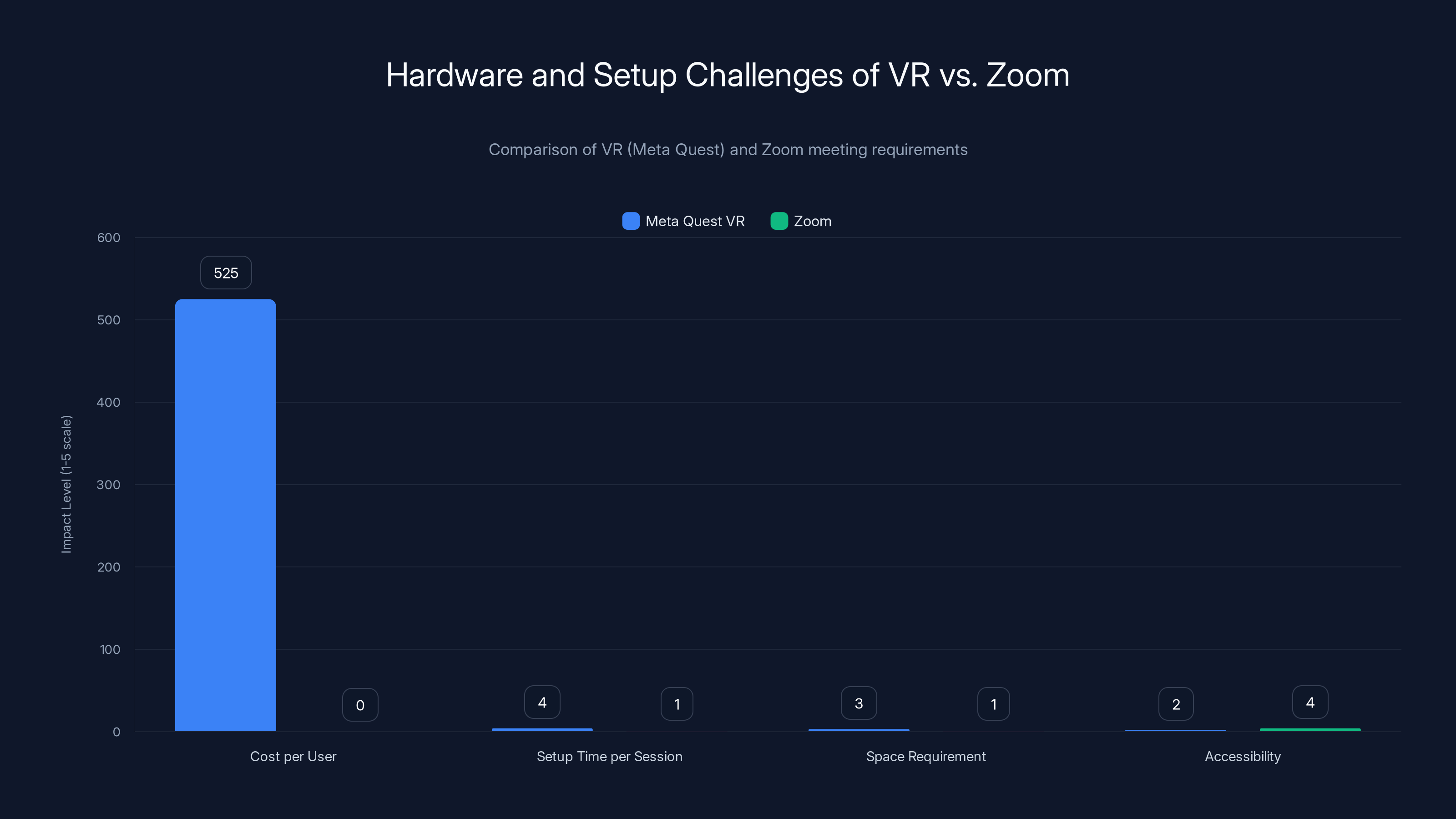

To use Horizon Workrooms, you needed a Meta Quest headset. That means:

- Cost: 650 per device, minimum. A team of 10 suddenly needs6,500 in hardware investment.

- Space requirements: VR headsets need physical space. You can't sit at a desk wearing one comfortably. You need room to move, or at minimum, a chair that spins freely.

- Onboarding friction: Putting on a headset, adjusting straps, calibrating the space, launching the app, navigating the UI. This takes 3-5 minutes per session. It doesn't sound like much until you're doing it five times a day.

- Device support: Your friend from another company? They need their own Quest headset to join. Your contractor using a Windows laptop? Doesn't work in VR (though Meta did allow desktop access, it was basic).

- Accessibility issues: VR headsets don't work well for people with certain disabilities. They can cause motion sickness. They require good eyesight to read small text. They're uncomfortable for extended wear.

Compare this to Zoom. You click a link. It opens in your browser. You're in the meeting. No hardware, no setup, no friction.

Meta tried to solve this by allowing desktop access to Horizon Workrooms via web browser. But the experience was watered down. You didn't get the immersion benefits. You still had to navigate an unfamiliar UI designed for VR. It satisfied nobody.

The hardware barrier alone was probably enough to doom the product. But Meta made things worse.

Problem 2: The Feature Mismatch

Horizon Workrooms was designed for a specific type of meeting that rarely happens in practice: focused, long-form collaborative work in a dedicated space.

But most meetings aren't like that.

Most meetings are quick syncs. Someone shares their screen for 10 minutes. You discuss a decision. You move on. You're back to Slack and email.

For these quick syncs, putting on a VR headset is absurd overhead. It's like showing up to a 5-minute conversation in a dedicated conference room when you could just lean over and talk at your desk.

There are some meetings where immersion helps. Whiteboarding sessions. Creative brainstorming. Long-form design reviews where spatial understanding matters. These exist, but they're maybe 10-15% of team meetings.

Horizon Workrooms solved for that 10-15%. For the other 85%, it added friction.

This is a classic product/market fit problem. Meta built a tool optimized for a niche use case and assumed the market was bigger than it actually was. Companies didn't want immersive VR meetings. They wanted friction-free video calls that work on any device, and they already had those.

Problem 3: Avatar Awkwardness and Social Friction

Here's something Meta didn't anticipate: most people hate their avatars.

Horizon used cartoonish avatar representations of users. This was intentional—Meta wanted to lower the barrier to entry for people self-conscious on camera. You don't have to look perfect in a meeting. Your avatar doesn't reveal your real appearance.

In theory, this removes social friction. In practice, avatars created weird new friction.

First, the uncanny valley problem. Avatar representations are close enough to human that small imperfections feel off-putting. Not quite right. Slightly unsettling.

Second, the identity problem. When you're on a Zoom call, you know who you're talking to. You can read their facial expressions. You pick up on subtle emotional cues. With avatars, that information is lost or falsified. It made conversations feel more formal and less natural.

Third, the customization problem. People spent time customizing avatars (clothing, appearance) but this felt frivolous in a work context. It wasn't professional. It wasn't personal. It was just weird.

Fourth, the disability and representation problem. Avatars couldn't accurately represent neurodiverse people, people with disabilities, or people from underrepresented backgrounds. It felt reductive and tone-deaf.

Meta's solution to these problems was to allow more realistic avatars and head tracking. But that brought you back to the original problem: you're on camera again, you need good lighting, you need to look presentable, and the main benefit of avatars disappears.

It's a catch-22. The product couldn't win.

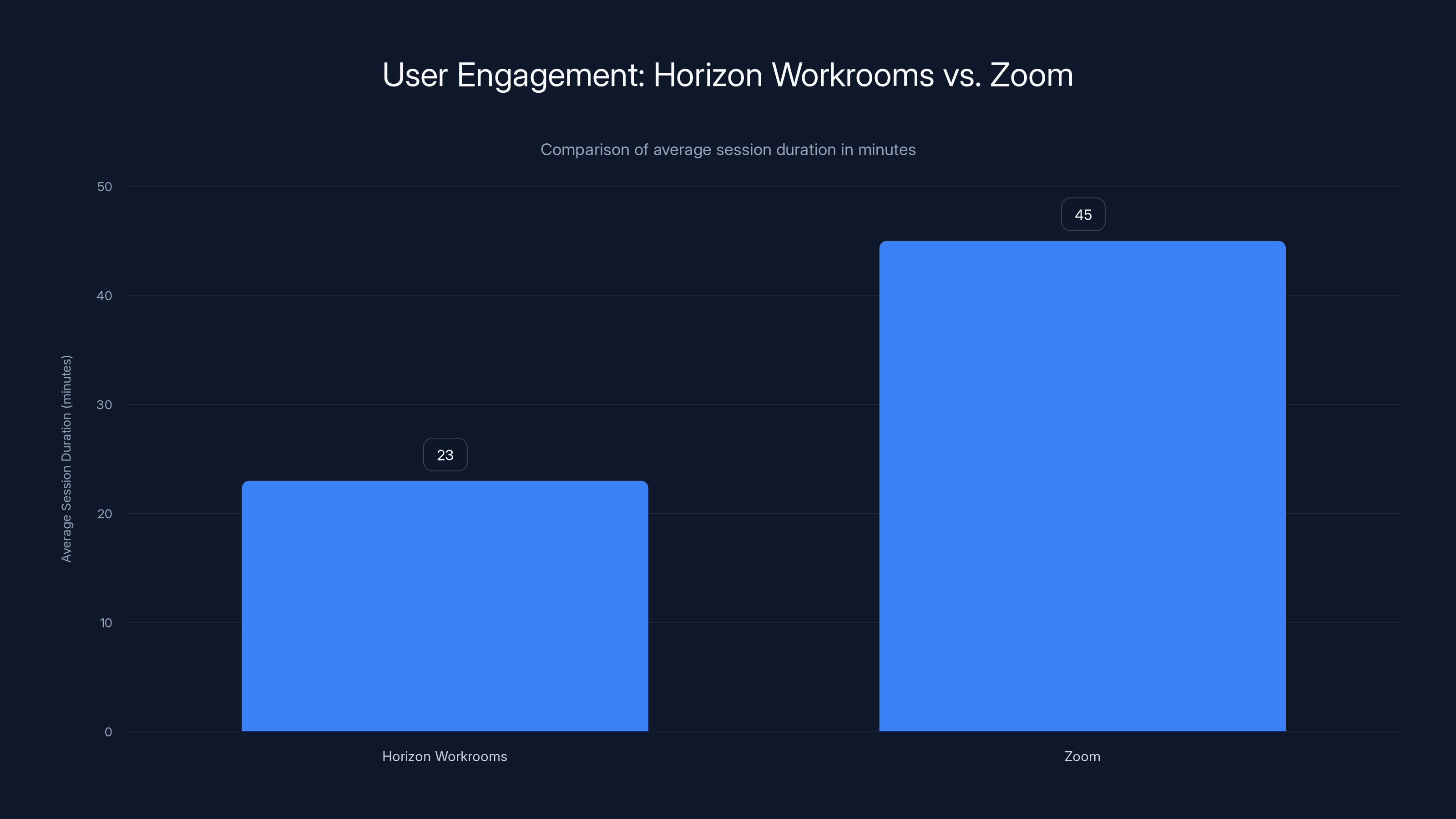

Horizon Workrooms users spent significantly less time per session (23 minutes) compared to Zoom users (45 minutes), highlighting engagement challenges with VR meetings.

Problem 4: Integration Hell

Horizon Workrooms was a walled garden.

It didn't integrate with your existing tools. No Slack connection for scheduling. No Calendar integration. No way to join a Horizon meeting from your regular email without some friction.

Meanwhile, Zoom and Teams are becoming platforms. They integrate with Slack. They work with Calendars. They're where your existing workflows live.

If you wanted to use Horizon Workrooms for your team, you had to add it on top of your existing stack. It wasn't replacing something. It was adding another tool to an already crowded toolbox.

This is death for a collaboration platform. The collaboration tool market is won by the platform that requires the least context switching. That's why Zoom won. Not because it's the best video quality (Skype was fine). Not because it's the most feature-rich (Teams is more feature-rich). But because it's the easiest to use and the most universal.

Horizon required you to commit to Meta's ecosystem, buy Quest hardware, and adopt a completely different interface. That's not a value prop. That's a barrier to entry.

Why Companies Chose Zoom Instead

Let's zoom out (pun intended) and understand why the market chose Zoom and Teams over VR alternatives.

Zoom offered five critical things:

-

Universal access: Join from any device, any browser, no app installation required (though an app existed). This is huge. It meant you didn't need to coordinate device types across your organization.

-

Frictionless meetings: Click a link, you're in the call. Takes 10 seconds. Compare this to 5 minutes with a VR headset.

-

Asynchronous flexibility: Zoom calls are easy to record. You can watch the recording later. You can catch up async. This is critical for distributed teams across time zones.

-

Cost efficiency: Free tier available. Paid tiers are cheap. You don't need hardware investment. Just software licensing.

-

Reliability: Zoom's infrastructure is proven. It handles millions of concurrent users. It's been tested to death. You know it will work.

Horizon offered immersion. But it required hardware, space, setup, and time. And it didn't reliably offer better meeting outcomes.

In a head-to-head comparison, Zoom wins on almost every practical dimension. The only dimension Horizon wins on—immersion and spatial presence—wasn't something companies actually needed.

This is why Meta's Horizon Workrooms never achieved traction.

The Broader Context: Meta's Metaverse Bet Failed

Horizon Workrooms is just one casualty in Meta's larger metaverse strategy failure.

Mark Zuckerberg bet that the future of the internet would be immersive, spatial, virtual. He spent billions on this vision. He acquired VR companies. He invested in VR research. He rebuilt Meta's entire organizational structure around the "metaverse" concept.

And he was wrong.

Not completely wrong. VR will exist. VR games will exist. VR training and simulation have real applications. But the immersive virtual future didn't arrive. And more importantly, users didn't want it as urgently as Zuckerberg assumed.

Meanwhile, AI—particularly large language models—became the dominant tech trend of 2022-2025. Every major tech company pivoted. Open AI released Chat GPT. Google released Bard. Microsoft integrated AI into everything. Startups raised billions on AI.

Meta watched this happen and realized it had misallocated resources. It had spent billions on VR while falling behind on AI.

So it started shifting. Reality Labs, Meta's VR division, continued losing $15+ billion annually. But AI initiatives suddenly got priority. The company began retiring VR products that weren't core to its mission.

Horizon Workrooms is Meta's acknowledgment that it bet on the wrong technology trend.

VR solutions like Meta Quest face significant barriers in cost, setup time, and space requirements compared to Zoom, which offers a more accessible and frictionless experience. Estimated data based on typical user feedback.

What Meta's Shift Means for Enterprise VR

Meta's exit from enterprise VR collaboration doesn't kill the entire category. But it does signal something important: the major players have moved on.

Apple is pushing spatial computing with Vision Pro, but it's positioning it as a premium consumer device, not an enterprise collaboration tool. Microsoft has mixed reality capabilities with Holo Lens, but it's focused on specific verticals (manufacturing, healthcare) rather than general office work. Smaller VR companies continue building, but without the backing of a tech giant, their reach is limited.

The question is: will anyone else try to do what Meta attempted with Horizon?

Probably not on the scale Meta did. The fundamental problems don't change just because Meta couldn't solve them. Hardware costs are still high. VR setup friction is still real. Spatial presence is still a benefit for a minority of use cases.

We'll likely see VR collaboration tools continue to exist in specific niches. Architecture and design firms might use them for spatial visualization. Gaming companies might use them for collaborative level design. Medical training could benefit from immersive simulation.

But for the general office worker? For the distributed startup? For the team that needs to have a quick sync meeting?

Zoom and Teams won. And they're not going anywhere.

The Lessons for Product Builders

Horizon Workrooms' failure offers several important lessons for anyone building products.

First: Don't confuse capability with demand.

Meta had the capability to build Horizon Workrooms. It had the resources, the talent, the VR hardware. But it didn't have user demand. The company assumed that if you built immersive VR meetings, people would want them. They didn't.

The lesson: start with the problem users actually have, then build the solution. Don't start with technology and work backward to find problems.

Second: Friction matters more than features.

Horizon had better features than Zoom for specific use cases. Shared virtual whiteboard. Spatial audio. Persistent rooms. But none of these features mattered because the friction of using the product was too high.

Users have a friction threshold. If a tool requires too much setup, investment, or learning, they'll choose a worse product that's easier to use.

Third: Ecosystem lock-in is a liability, not an advantage.

Meta bet that if it owned both the hardware (Quest headsets) and the software (Horizon Workrooms), it would create a defensible moat. Instead, it created a single point of failure. As soon as Zuckerberg decided VR wasn't the future, the entire product was vulnerable.

Tools that interoperate with existing ecosystems (Zoom works with Slack, Calendars, etc.) are more resilient. They become infrastructure, not isolated platforms.

Fourth: Meeting actual market needs beats visionary thinking.

Zuckerberg had a vision of the future. Immersive. Spatial. Virtual. It was a compelling vision. But users just wanted reliable video calls that work anywhere.

The most successful products aren't built on vision. They're built on the boring, unglamorous process of meeting actual user needs better than anyone else.

What Happens to Horizon Workrooms Users

Meta's announcement puts current Horizon Workrooms users in an awkward position.

If your company is using Horizon Workrooms for collaboration, you have until February 16, 2026 to migrate to something else. That's about one year. All your data will be deleted after the shutdown.

Meta's official recommendation is to switch to Microsoft Teams or Zoom. Which is kind of hilarious—the company is essentially saying, "Yeah, our competitors' products are better. Use those instead."

For most teams using Horizon, the migration should be straightforward. You're probably just recording meetings and sharing screens. Both Zoom and Teams do that without requiring headsets.

For teams that were genuinely using the spatial and avatar features, the migration is more disruptive. But those teams are probably small. The adoption numbers suggest that the spatial features weren't driving usage.

Meta is being kind to departing users by giving a year's notice. It's not an abrupt shutdown. But it is a clear signal that the company is done investing in this space.

Zoom outperforms Horizon Workrooms in most practical dimensions for business use, except for immersion. Estimated data based on feature analysis.

The Future of VR in the Workplace

Does this mean VR is dead for enterprise?

No. But it means the vision of VR as a general-purpose collaboration platform is dead.

VR will likely thrive in specific verticals where immersion provides clear value:

Manufacturing and maintenance: Technicians could use VR to practice complex repairs on virtual equipment before touching the real thing. A technician in Mumbai could guide a technician in Miami through a repair in shared VR space.

Medical training: Surgeons could practice complex procedures in virtual operating rooms. The spatial and tactile aspects of surgery make VR training valuable.

Design and architecture: Teams could collaborate in virtual 3D spaces to design buildings, products, or environments. Spatial understanding is core to these disciplines.

Gaming and entertainment: This is where VR actually thrives. And it's where most VR investment continues.

But for everyday office collaboration? For remote teams? For quick standups and status meetings?

The VR future never arrives. Zoom, Teams, and Slack remain dominant. They're good enough, they're universal, and they're cheap.

This is actually healthy. It means the market selected the best solution, not the sexiest one.

Why Remote Work Didn't Embrace VR

The pandemic accelerated remote work adoption. Video calls became ubiquitous. Companies invested in collaboration infrastructure.

But they didn't invest in VR. They invested in better internet, better monitors, better Zoom setups.

Why?

Because remote work is already solving the main problem VR was supposed to solve: bringing people together without physical proximity.

Video calls aren't perfect. You lose body language. You get Zoom fatigue. You miss casual hallway conversations. But they're good enough for 95% of work.

And they don't require hardware investment, don't require headsets, don't require VR setup.

Meanwhile, the problems VR was supposed to solve—spatial presence, embodiment, natural interaction—turned out to be secondary concerns. The primary concerns were ease of use, reliability, and cost.

Meta built a solution to a problem the market didn't prioritize. So the market rejected the solution.

The Messaging Around the Shutdown

Meta's messaging around the Horizon Workrooms shutdown is interesting because it tries to spin a loss as a strategic pivot.

The company wrote: "Meta Horizon has since developed into a social platform that supports a wide range of productivity apps and tools. We're grateful for the customers who have worked with us and will continue to focus on the broader Horizon ecosystem for consumers."

Translation: "We're killing the business product because nobody used it. But the consumer side is still cool, we promise."

This is classic tech company messaging when a product fails. You don't say "we were wrong, the market rejected our vision." You say "we're focusing on our core business" or "we're pivoting to where the real opportunity is."

The real signal is that Meta is pulling commercial Quest headsets from sale. This is the canary in the coal mine. Meta is saying that VR for work is not a business they want to be in.

Consumer VR will continue. Meta still believes in consumer VR gaming and experiences. But enterprise VR collaboration? Done.

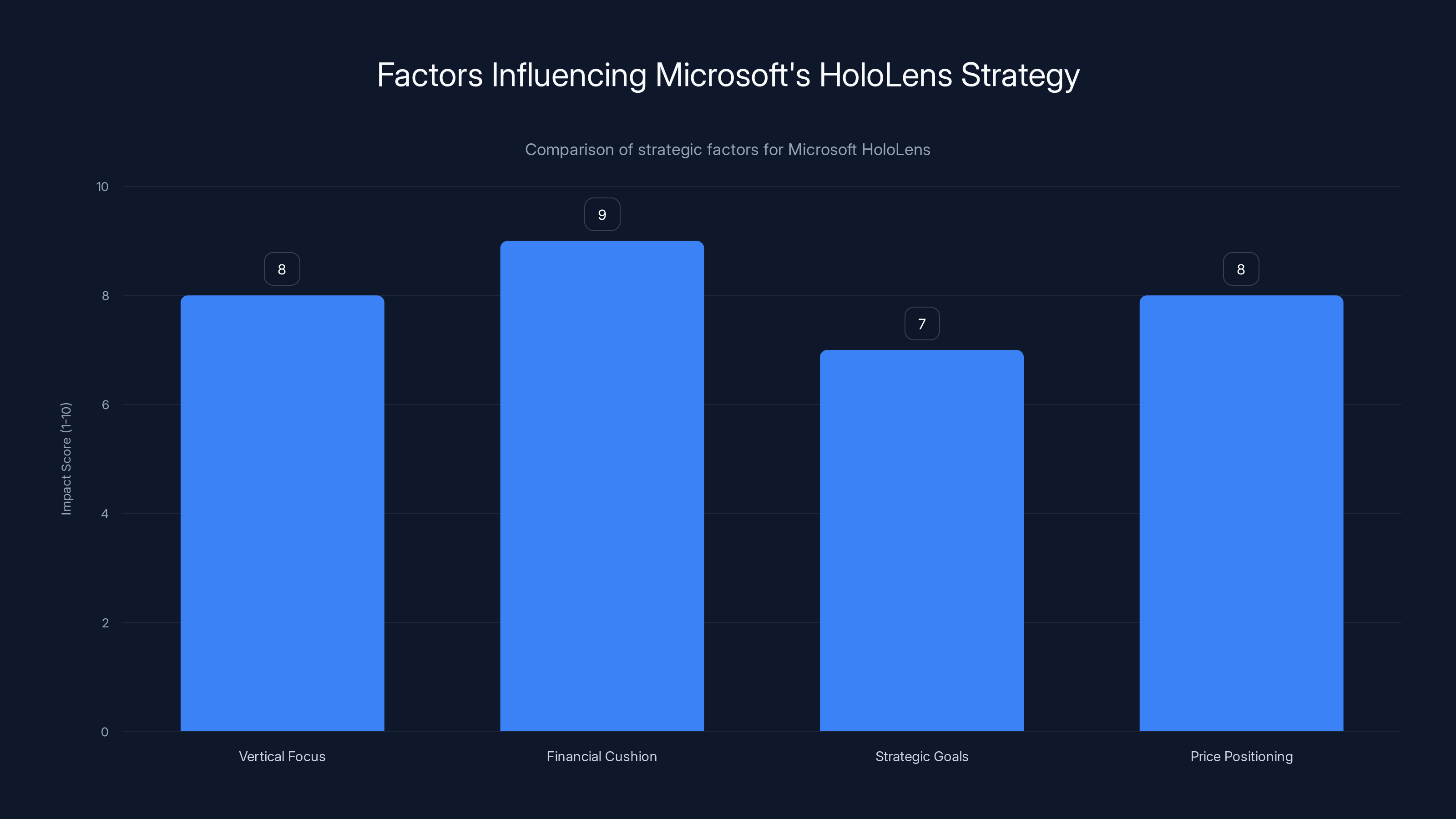

Microsoft's HoloLens strategy is influenced by its vertical focus, financial strength, strategic goals, and price positioning, with financial cushion being the most impactful factor. Estimated data.

What About Microsoft Holo Lens

Microsoft is still investing in spatial computing and mixed reality. Holo Lens is still a product. Why isn't Microsoft also shutting down its mixed reality efforts?

A few reasons:

-

Microsoft's approach is more vertical-focused: Holo Lens isn't marketed as a general collaboration tool. It's marketed for specific use cases like manufacturing and healthcare. This limits the addressable market but increases the value prop in those markets.

-

Microsoft has more financial cushion: Microsoft can sustain losses on experimental products longer than other companies. It has massive revenue from cloud, office, gaming. Meta doesn't have the same cushion.

-

Different strategic goals: Microsoft sees mixed reality as a complement to its existing products, not as a standalone business. Meta saw VR as a core bet on the future.

-

Price positioning: Holo Lens is expensive ($3,500+), so it's marketed to enterprise with high ROI expectations. Horizon was trying to be more accessible, which meant competing on broader appeal.

Microsoft's approach is probably more sustainable. It's investing in specific use cases with clear ROI rather than betting on mass-market adoption.

The Broader Tech Industry Trend

Meta's exit from enterprise VR is part of a broader trend in tech: companies are moving away from hardware-first platforms and back toward software and services.

Google learned this with Glass (the consumer glasses project that failed). Facebook learned this with its hardware products like Portal. Amazon learned it with Fire Phone.

Hardware is expensive. It requires supply chains. It requires support. It's hard to update. It creates lock-in risks.

Software is cheap. It's flexible. It's easy to update. It doesn't require physical distribution.

Meta is doubling down on AI and software services. The company is investing in large language models. It's building AI assistants. It's focusing on Llama (its open-source AI model). It's moving back to software.

The VR hardware business wasn't making money. Reality Labs lost $15 billion. So it's getting scaled back.

This is a natural correction. Zuckerberg over-indexed on VR. The market corrected him. Now the company is reallocating resources to areas with better ROI.

Opportunities for Horizon Workrooms Competitors

Meta's exit creates a small opportunity for competitors.

Any existing VR collaboration tool (like v Spatial or Mozilla Hubs) can now pitch displaced Horizon users. The pitch is simple: "You're comfortable with VR collaboration. Stick with us instead of moving to Teams."

But this is a small market. The reality is that most Horizon users will migrate to Teams or Zoom because those tools are simpler and more integrated.

The real opportunity for VR competitors isn't in the B2B collaboration space. It's in vertical markets where VR provides genuine advantage: design, manufacturing, medical training, gaming.

Companies building VR tools for these verticals don't need to worry about competing with Meta. Meta already left the building.

The Role of AI in Meta's Pivot

Underlying Meta's shift away from VR is a deeper realization: AI is the more valuable technology trend.

AI can be deployed on any device. It doesn't require hardware investment. It doesn't require VR expertise. It can be integrated into existing products and services.

Meta is investing heavily in:

- Large language models: Llama is now a competitive open-source model. Meta is making it available to companies.

- AI assistants: Meta is building AI assistants for its apps.

- AI for creators: Meta is adding AI tools to help creators produce content.

- AI for commerce: Meta's platforms enable AI-driven product recommendations and customer service.

Each of these leverages AI to create direct value without requiring new hardware or new platforms.

Compare this to VR, which requires new hardware, new expertise, and new interfaces. VR is a harder sell.

From a business perspective, Meta's shift makes sense. AI offers more immediate value and broader applicability.

From a visionary perspective, it's a retreat. Zuckerberg's bet on the metaverse was a bet on computing's future. By pivoting to AI, he's acknowledging that the future isn't what he thought it was.

Lessons for CIOs and IT Leaders

If you're an IT leader considering VR for your organization, what's the takeaway?

-

Be skeptical of hardware-first platforms: Hardware creates lock-in and friction. Choose platforms that work across multiple devices.

-

Prioritize interoperability: Tools that work with your existing stack are more valuable than standalone platforms with more features.

-

Focus on friction, not capability: A simpler tool that everyone will actually use beats a feature-rich tool that creates resistance.

-

Watch company strategy, not just products: When a major company like Meta exits a market, it's a signal about long-term viability.

-

Don't chase technology hype: The best collaboration tool isn't always the newest one. Sometimes it's the boring one that works for everyone.

For most organizations, Zoom and Teams are still the right choice for general collaboration. Specialized tools can supplement them for specific use cases. But betting on VR as your primary collaboration platform was never a smart move.

Meta's failure validates this thinking.

The Shutdown Timeline and Migration Path

For organizations currently using Horizon Workrooms, here's what you need to know:

February 16, 2026: Horizon Workrooms is shut down. All user data is deleted permanently.

February 20, 2026: Meta Quest commercial headsets are pulled from sale.

You have about one year to plan your migration.

Migration steps:

-

Assess current usage: Which teams use Horizon? How frequently? For what types of meetings?

-

Document workflows: What specific features of Horizon do you rely on? Spatial whiteboarding? Persistent rooms? Avatar interaction?

-

Select replacement platform: For most teams, Zoom or Teams will be sufficient. For specialized use cases, consider vertical-specific tools.

-

Plan phased migration: Don't switch everyone at once. Migrate teams gradually. Learn what works.

-

Communicate to users: Give your teams clear guidance on what's happening and why. Provide training on the new tool.

-

Archive data: Export any important documents or records from Horizon before the shutdown.

-

Decommission hardware: Evaluate what to do with Quest headsets. Donate them, resell them, or recycle them.

This isn't a crisis. You have a full year. But you should start planning now.

Where Is VR Actually Succeeding

For all the talk of VR failure in collaboration, VR is actually succeeding in other areas.

Gaming: VR gaming is thriving. Beat Saber has sold millions of copies. Half-Life: Alyx was acclaimed. VR arcades exist. Gaming remains the strongest use case for VR.

Training and simulation: VR training for hazardous situations (firefighting, military operations, industrial maintenance) is growing. The value prop is clear: practice in a safe virtual environment before real-world application.

Entertainment: VR experiences, escape rooms, and attractions are popular. People will pay to experience immersive VR.

Healthcare: VR therapy for PTSD, anxiety, and phobias is gaining traction. VR is being used for pain management during procedures.

Education: VR is being used for immersive educational experiences, particularly in fields like anatomy and history.

The pattern: VR succeeds when it offers unique value that can't be replicated in 2D. Gaming has spatial mechanics. Training has muscle memory and instinct building. Healthcare has therapeutic benefits.

VR fails when it's used as a replacement for something that already works well in 2D. Collaboration via video calls works fine. Replacing it with VR adds friction without commensurate benefit.

Meta bet on VR collaboration. The market rejected it. But the VR market itself is alive and well—just not for office meetings.

FAQ

What is Horizon Workrooms and why is Meta shutting it down?

Horizon Workrooms was Meta's virtual reality collaboration platform designed to enable remote teams to hold immersive meetings in virtual spaces with avatar representations. Meta is shutting it down on February 16, 2026, because it failed to achieve meaningful adoption despite years of investment. The company is pivoting toward artificial intelligence as a higher-priority technology trend.

Why didn't Horizon Workrooms gain traction with businesses?

Horizon Workrooms faced multiple adoption barriers: the need for expensive VR hardware (Meta Quest headsets), significant setup friction compared to simple video calls, uncomfortable avatar experiences, lack of integration with existing collaboration tools like Slack and Outlook, and the fundamental problem that most business meetings don't actually need VR immersion. Companies found that existing solutions like Zoom and Teams solved their collaboration needs more simply and cost-effectively.

When will Horizon Workrooms shut down and what happens to user data?

Horizon Workrooms will be officially shut down on February 16, 2026. All user data will be permanently deleted after this date. Meta is providing approximately one year's notice to allow organizations time to migrate to alternative collaboration platforms. Meta Quest commercial headsets will also be pulled from sale on February 20, 2026.

What should companies currently using Horizon Workrooms do?

Companies should begin planning their migration to alternative collaboration platforms immediately. The recommended path is to switch to established tools like Microsoft Teams or Zoom, which already integrate with existing enterprise systems and don't require VR hardware. Teams should document their current Horizon workflows, identify critical features they depend on, and plan a phased transition over the coming months.

Is this a sign that VR is dead for enterprise?

No. VR collaboration for general office meetings is dead, but VR continues to succeed in specific enterprise verticals with clear use cases: manufacturing training, medical procedure simulation, architectural visualization, and hazardous operations training. The failure is specific to using VR for routine video meetings, not VR enterprise applications broadly.

Why is Meta pivoting from VR to AI?

Meta's Reality Labs division lost approximately $15 billion annually. Meanwhile, artificial intelligence emerged as the dominant technology trend of 2022-2025, with major companies like Open AI, Google, and Microsoft leading innovation. Meta realized it had misallocated resources and is refocusing on AI language models, AI assistants, and AI-driven features within its existing products and platforms.

What about Microsoft Holo Lens and other spatial computing platforms?

Microsoft continues investing in mixed reality, but with a different strategy than Meta. Holo Lens is positioned for specific high-value enterprise verticals (manufacturing, healthcare) rather than general office collaboration. Microsoft can sustain longer-term investment because of diversified revenue streams, and it's pursuing spatial computing as a complement to existing products rather than as a standalone platform.

Could another company build a successful VR collaboration tool?

Unlikely at scale. The fundamental problems that doomed Horizon Workrooms—hardware costs, setup friction, integration challenges, and the fact that video calls adequately solve the collaboration problem—remain unsolved. A smaller company could build vertical-specific VR tools for fields like architecture or manufacturing, but general office collaboration via VR is unlikely to see significant adoption.

How does this affect employees with Quest headsets?

Employees won't be able to use their Quest headsets for work collaboration after February 16, 2026. Remaining VR content will shift to consumer gaming and entertainment. Organizations will need to provide alternative devices and applications for any collaboration needs. The commercial Quest headset variants are being discontinued, though consumer Quest devices will remain available.

What does Horizon Workrooms' failure teach product teams?

The primary lessons are: don't confuse technological capability with market demand, prioritize friction reduction over feature addition, build solutions to problems users actually have rather than problems you assume they have, avoid hardware lock-in when possible, and watch market signals carefully. Meta's failure validates that boring tools solving existing problems often outcompete innovative tools that create friction.

The Bigger Picture: Why Smart Bets Sometimes Fail

Meta's Horizon Workrooms shutdown is ultimately a story about why even well-resourced companies can fail when they bet on the wrong future.

Mark Zuckerberg had a vision. It was a coherent vision. The metaverse would be the next computing platform. VR would be how people work and play in a spatial internet. Meta would own the infrastructure.

It was a reasonable bet from a strategic perspective. Vision Pro, Holo Lens, and other spatial computing devices all exist. Some use cases for VR are real. The general trajectory of computing has been toward more immersive interfaces.

But Zuckerberg was wrong about the timeline and the adoption curve. He assumed that VR collaboration for remote work would be a major use case by 2024. It wasn't. He assumed users would tolerate hardware friction for the benefit of immersion. They wouldn't. He assumed that better features would drive adoption. They wouldn't.

Meanwhile, he was right about AI being important. But by the time he recognized it, other companies had already captured mindshare and resources in that space.

The lesson isn't that Zuckerberg is bad at strategy. It's that even brilliant strategists can misread markets. And when you misread a market, you have to be willing to admit it and redirect resources.

Meta is doing that now. The company is killing products that don't have a path to value and investing in areas with clearer return on investment.

This is actually a sign of organizational health. Meta could have doubled down on VR, insisting that the market would eventually catch up to the vision. Instead, it's acknowledging that the market has different priorities and reallocating accordingly.

Companies that can't do this—that can't admit they were wrong and redirect—often fail. Meta is showing the ability to adapt.

For the rest of us, the lesson is clear: don't assume that better technology wins. Simpler, friction-free solutions often prevail. And when choosing between competing visions of the future, follow adoption signals, not hype.

Meta bet on immersion. The market chose friction-free simplicity. The market won.

Key Takeaways

- Meta is shutting down Horizon Workrooms on February 16, 2026, signaling the company's exit from enterprise VR collaboration business

- VR meeting rooms failed because they added friction (hardware costs, setup time, learning curve) while solving problems users didn't actually have

- Zoom and Teams won by prioritizing simplicity and universal access over immersive features, validating that boring solutions often outcompete innovative ones

- Meta's $15 billion annual Reality Labs losses reveal the cost of betting on the wrong technology trend while missing the AI pivot that other tech giants made

- The failure of Horizon Workrooms demonstrates that technological capability and visionary thinking alone don't guarantee market success without solving actual user problems

Related Articles

- Meta's VR Studio Shutdowns: What Happened to Reality Labs [2025]

- Meta's Reality Labs Layoffs: What It Means for VR and the Metaverse [2025]

- Meta's VR Studio Closures: The Metaverse Reality Check [2025]

- LEGO Smart Brick: Inside the Best-in-Show Demo at CES 2026 [2025]

- Apple Vision Pro: Why This $3,500 Headset is Actually Dying [2025]

- Plaud NotePin S & Desktop App: AI Meeting Notes [2025]

![Meta's Horizon Workrooms Shutdown: Why VR Meeting Rooms Failed [2025]](https://tryrunable.com/blog/meta-s-horizon-workrooms-shutdown-why-vr-meeting-rooms-faile/image-1-1768568934066.jpg)