Introduction: The Million-Pound Question Nobody's Asking

You'd think one of the world's largest tech companies would be able to stop ads for illegal gambling sites from running on its platforms. Meta has 3 billion monthly active users across Facebook and Instagram. The company employs thousands of content reviewers, leverages AI detection systems, and publishes detailed policy documents about what it allows and doesn't allow.

Yet in 2024, the UK Gambling Commission found something troubling: Meta is essentially ignoring the problem.

The watchdog didn't accuse Meta of intentionally promoting illegal gambling. Instead, they found something more damaging to the company's credibility—Meta appears willing to look the other way. The commission's director, Tim Miller, was blunt in his assessment. He said Meta's approach suggests the company "doesn't know about those ads unless alerted," which he called "simply false." More provocatively, he stated that Meta's inaction "could leave you with the impression they are quite happy to turn a blind eye and continue taking money from criminals and scammers until someone shouts about it."

This isn't a minor compliance issue buried in a quarterly report. This is about consumer harm, regulatory failure, and a tech giant's unwillingness to invest in basic enforcement of its own stated policies. Here's what's really happening behind the scenes.

TL; DR

- The Problem: Meta hosts advertisements from unlicensed gambling operators despite policies requiring licenses in operating markets

- The Evidence: UK Gambling Commission found illegal gambling ads easily discoverable through basic searches, contradicting Meta's claim of ignorance

- The Scale: Millions of UK users could see illegal gambling promotions daily on Facebook and Instagram

- The Stakes: Illegal operators bypass player protections, fraud prevention, and responsible gambling safeguards

- The Reality: Meta likely has the technical capability to prevent this but prioritizes ad revenue over enforcement

Meta generated

Understanding the Regulatory Landscape in the UK

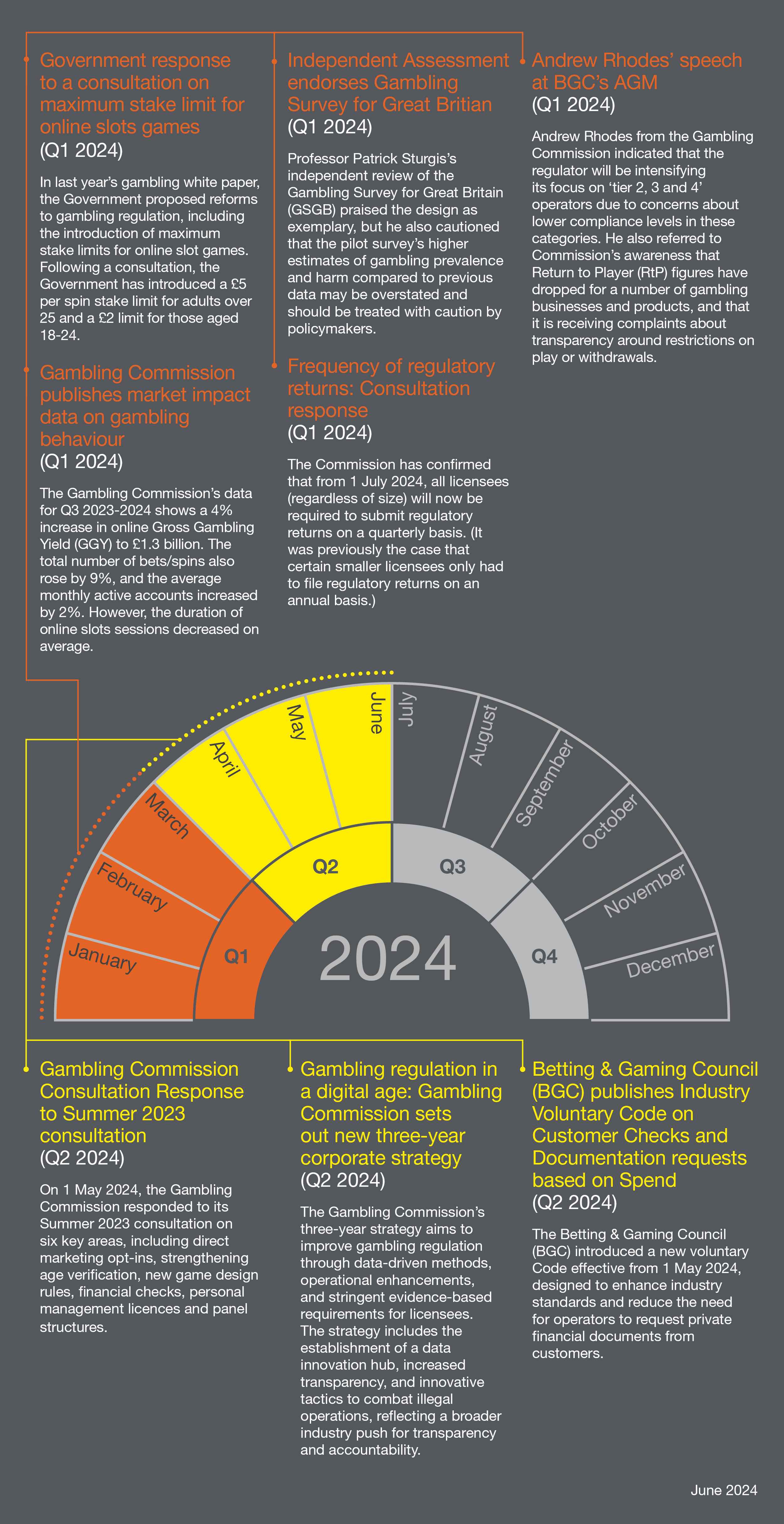

Before you can understand why the Gambling Commission's findings matter, you need to know how gambling regulation actually works in Britain. It's stricter than most countries, and that's intentional.

Under the Gambling Act 2005, any operator offering gambling services to UK consumers must obtain a license from the Gambling Commission. This isn't optional. It's not like getting a domain name where you can set up shop immediately. Obtaining a license requires meeting strict criteria: proof of financial stability, anti-money laundering compliance, responsible gambling measures, and demonstrated ability to protect minors.

The commission doesn't just issue licenses and disappear. Operators must integrate with Gam Stop, a national self-exclusion platform that allows players to block themselves from accessing all licensed gambling sites at once. They must implement deposit limits, reality checks (mandatory break reminders), and cooling-off periods. They must publish clear information about odds and house edges. They must employ staff trained in responsible gambling practices.

This framework exists because gambling addiction is real, documented, and costly. Problem gambling affects approximately 2.3% of UK adults, which sounds small until you realize that's roughly 1 million people. The social costs—depression, bankruptcy, relationship breakdown, job loss—are substantial.

Here's the crucial part: operators who don't jump through these hoops are illegal. They're not "operating in gray areas." They're not "waiting for regulation to catch up." They're criminals, full stop. They're almost always registered in countries with lax oversight, running their operations from servers scattered across multiple jurisdictions, operating payment processing through shell companies.

And Meta's platforms make perfect marketing channels for them.

How Meta's Gambling Ad Policy Actually Works

Meta's official policy is clear. The company publishes detailed guidelines that state gambling sites must be licensed in the markets where their ads run. This applies to Facebook, Instagram, Audience Network, and Messenger. The company claims it reviews all gambling ads before approval and regularly audits for violations.

On paper, this looks reasonable. The problem is in the execution.

Meta's approval process relies on advertiser self-reporting. An operator submits an application, claims to be licensed in specific markets, and Meta presumably verifies this. But here's where it gets interesting: Meta doesn't conduct ongoing monitoring. The company doesn't proactively scan its own platforms for keyword searches related to illegal gambling. It doesn't use publicly available databases of licensed operators to flag potentially unauthorized ads. It doesn't cross-reference advertiser claims against actual regulatory databases.

Instead, Meta waits. It waits for someone—a regulator, a competitor, a user—to report the violation. Only then does it investigate and remove the ad.

Tim Miller's criticism was specifically about this passivity. He pointed out that Meta, as a company with enormous technical resources, could easily implement keyword blocking for known illegal operators. The commission had identified specific unlicensed sites, looked them up on Facebook and Instagram using basic searches, and found active ads. Miller noted that the fact Meta claims ignorance about these ads is implausible. The company has sophisticated keyword matching technology, machine learning systems designed to detect violations, and millions of dollars invested in content moderation.

The logical conclusion isn't that Meta can't stop illegal gambling ads. It's that Meta isn't prioritizing the effort.

Estimated data suggests that 70% of gambling operators in the UK are fully compliant with regulations, while 10% operate illegally. Estimated data.

The Detection Problem: Why Meta's Approach Fails

Let's get specific about what the commission actually found. They conducted basic searches on Facebook and Instagram for gambling operators known to be unlicensed. These weren't obscure searches using code words or hidden in private groups. They were straightforward queries using the operators' actual brand names.

They found ads. Multiple ads. Running right there in the feed, targeting UK users.

This matters because it demonstrates that Meta's core defense doesn't hold up. The company claims it removes illegal gambling ads when notified. This implies the company genuinely doesn't know about them. But if a regulator can find them in minutes using basic keyword searches, a tech company worth $1.3 trillion can certainly find them too.

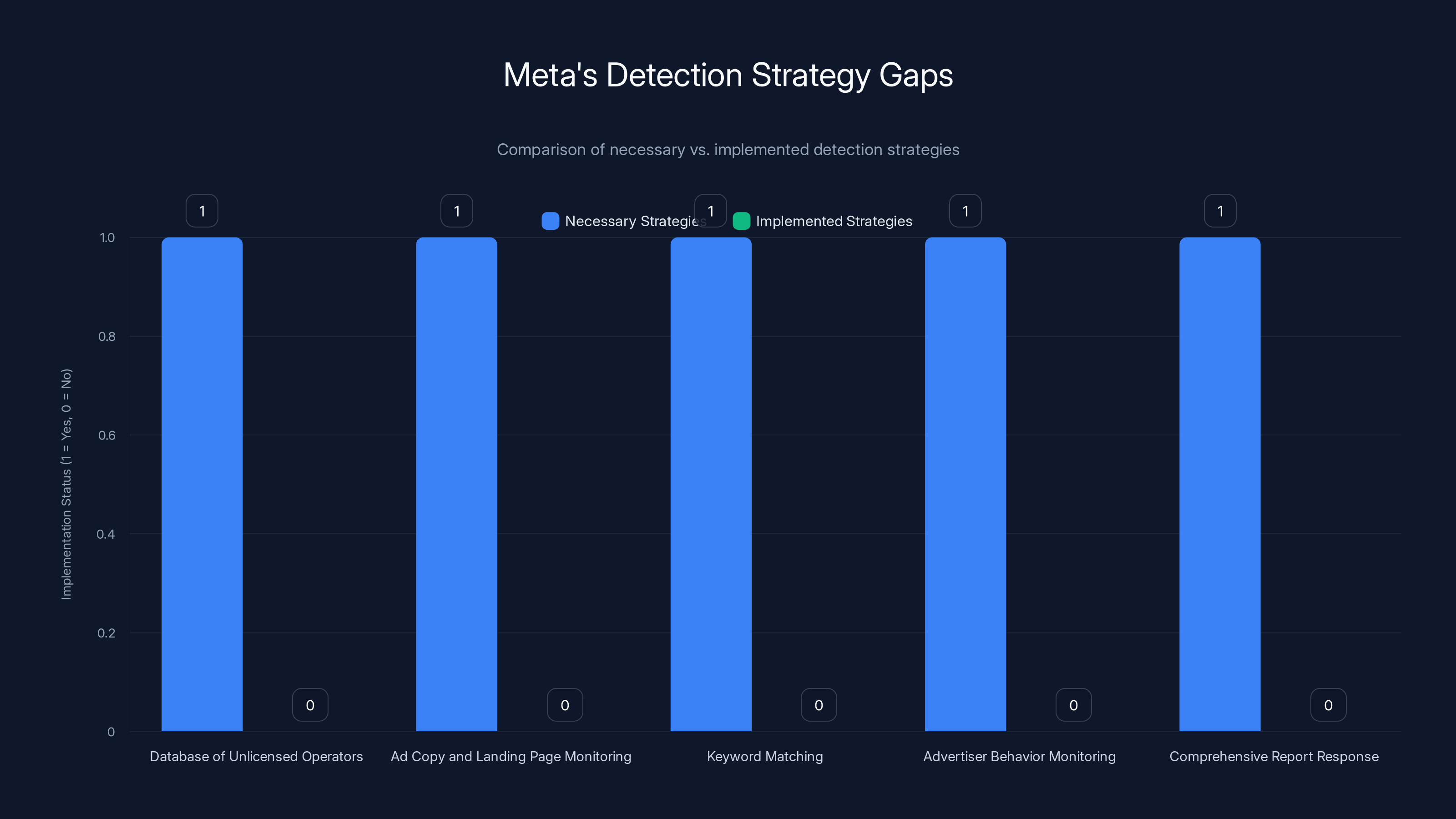

The detection problem isn't technical. It's organizational. Meta would need to:

-

Maintain a database of unlicensed operators: This would require downloading the Gambling Commission's licensed operator registry (publicly available) and using it as a blocklist.

-

Monitor ad copy and landing pages: Even if an ad gets approved, someone needs to check what it's actually promoting. Does the landing page match the advertiser's claimed license status?

-

Implement keyword matching: Block ads containing specific branded terms associated with unlicensed operators. Meta's keyword matching technology is sophisticated enough to do this automatically.

-

Monitor advertiser behavior over time: If an advertiser that was previously approved suddenly starts targeting exclusively UK users, that's a signal worth investigating.

-

Respond to reports: When the Gambling Commission sends in a detailed violation report, Meta should investigate comprehensively, not just pull one ad and move on.

Meta does none of this systematically. This isn't a bug in the system. It's how Meta designed the system to work.

The Revenue Angle: Following the Money

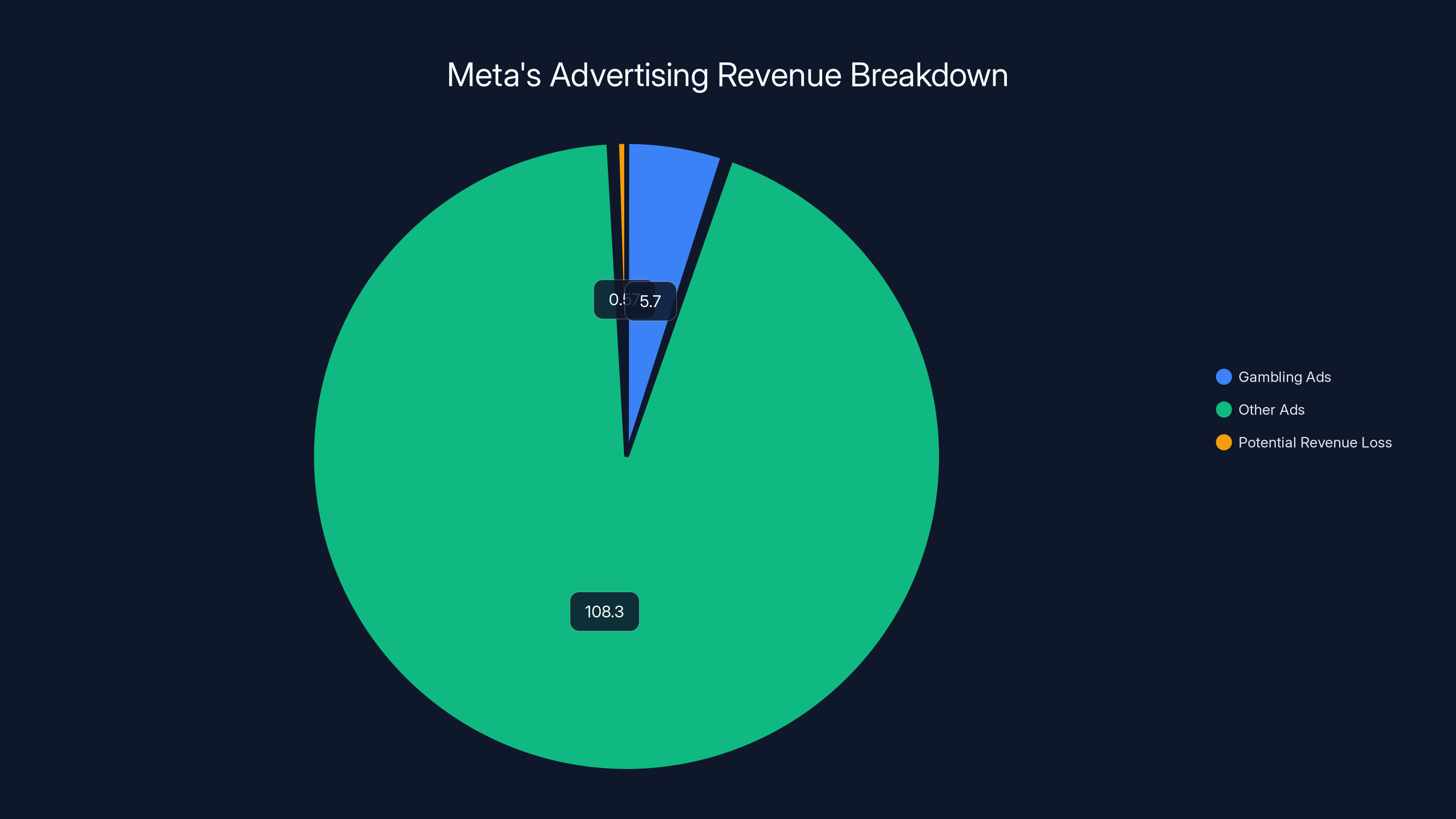

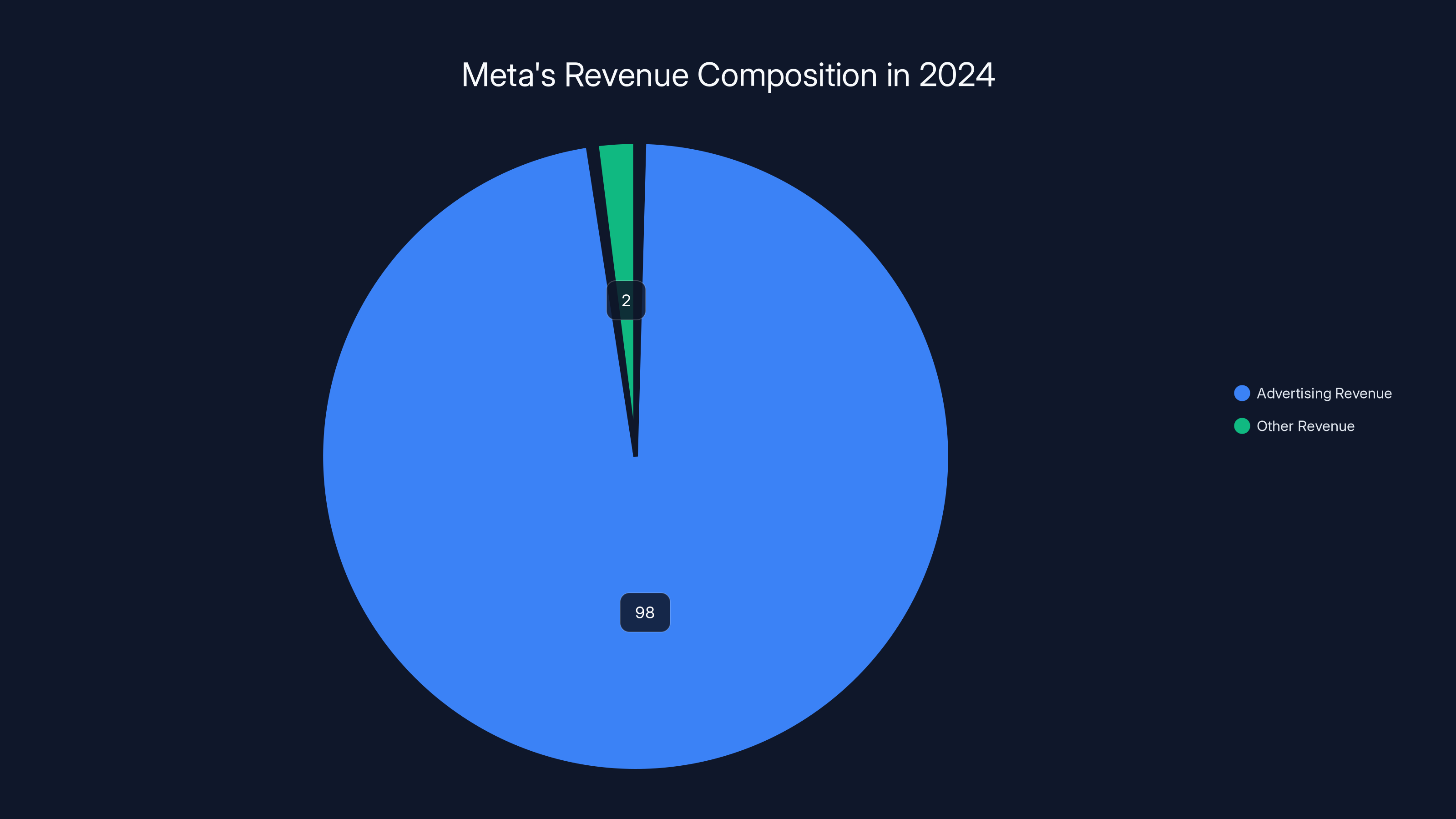

Let's be direct about why Meta's enforcement is weak. Advertising is where Meta makes its money. In 2024, ad revenue represented 98% of the company's total revenue. Every ad that runs, whether from a Fortune 500 company or an unlicensed gambling operation, generates revenue for Meta.

Most Meta advertisers are legitimate businesses that benefit from the company's enforcement. If someone's ad account gets hacked, they want Meta to notice and shut it down immediately. If a competitor is running fake ads to damage their reputation, they want action.

But an advertiser running illegal gambling ads doesn't care about enforcement. They expect it. They budget for the ads to run until Meta gets a complaint, at which point they move to another ad account or another platform entirely. For unlicensed operators, the cost of a few ads being removed is minimal—they're not trying to build a brand, they're trying to acquire customers quickly before regulatory heat shuts them down.

Meta sits in the middle, taking payment for ads it knows (or should know) are promoting illegal services. The company probably receives dozens of complaints monthly from regulators, researchers, and concerned users about illegal gambling ads. Rather than treating these as signals to overhaul enforcement, Meta treats them as isolated incidents requiring minimal response.

This isn't unique to gambling. Meta has faced similar criticism for housing discrimination ads, predatory lending, counterfeit goods, and arms sales. The pattern is consistent: Meta's stated policy prohibits the content, but enforcement is reactive rather than proactive.

Gam Stop Integration: The Missing Link

Here's a specific technical measure that illustrates how limited Meta's approach is. Gam Stop is a UK self-exclusion platform that allows problem gamblers to ban themselves from all licensed gambling sites simultaneously. To operate legally in the UK, every licensed gambling operator must integrate with Gam Stop.

Meta could check whether an advertiser is listed as integrated with Gam Stop. If they're not on the list, they don't have a UK license, and their ads shouldn't run in the UK. This would be straightforward to implement. Meta's ad system already checks advertiser credentials for other verticals. For gambling, this would add perhaps one additional database query.

But Meta doesn't do this. The company has never implemented Gam Stop integration checking into its advertiser approval system. Why? Because it would reduce the number of approved gambling advertisers, which would reduce ad revenue.

The commission found that unlicensed operators aren't even trying to hide. They're running ads openly, sometimes with landing pages that explicitly don't mention Gam Stop (a red flag for UK users who understand the regulatory landscape). Meta's systems should catch this immediately. They don't.

In 2024, advertising accounted for 98% of Meta's total revenue, highlighting its dependence on ad sales.

The Scale of the Problem: How Many Users Are Exposed?

It's difficult to quantify exactly how many UK users see illegal gambling ads on Meta's platforms on any given day. Meta doesn't publish this data, and conducting a comprehensive audit would require either Meta's cooperation or access to the company's ad logs.

But we can make reasonable estimates. Meta has approximately 33 million monthly active users in the UK. These users spend an average of 30 minutes daily on Facebook and Instagram combined. The Gambling Commission found multiple illegal gambling ads running at the time of their investigation.

Assuming even a fraction of 1% of UK daily active users encounter an illegal gambling ad on any given day, that's thousands of exposures. For a country where problem gambling affects a million people, and where younger users are particularly vulnerable, this is a meaningful risk.

The Gambling Commission's findings suggest this isn't an edge case. The commission was able to find illegal ads using basic searches. This indicates the ads are running at sufficient volume and visibility to be discoverable by someone simply scrolling through the platform.

Harm Beyond the Direct Gambler: Secondary Effects

When someone clicks on an illegal gambling ad and gets drawn into an unlicensed operator's site, the harm doesn't stop with that person.

Unlicensed gambling operators operate without oversight. They don't employ responsible gambling specialists. They don't verify player age. They don't implement deposit limits or reality checks. They don't contribute to national problem gambling research or treatment funding (UK licensed operators pay a levy supporting treatment services). When a player loses money to an unlicensed operator, there's no recourse, no chargeback protection, no regulatory complaints process.

For minors, the harm is compounded. UK law strictly prohibits anyone under 18 from accessing gambling. Licensed operators implement age verification systems. Unlicensed operators frequently don't bother. A 16-year-old scrolling Instagram might see an illegal gambling ad with minimal friction between clicking and account creation.

For people in financial hardship, illegal gambling ads represent predatory targeting. These operators often advertise aggressively during times when people are most vulnerable: late night, during sporting events, after major paydays. They offer unrealistic odds and welcome bonuses specifically designed to hook users into higher spending. Without the regulatory constraints that licensed operators face, they can run the most aggressive, predatory marketing imaginable.

For society broadly, unlicensed gambling operations represent a leakage of potential tax revenue and problem gambling funding. The UK gambling sector generates significant tax revenue that funds treatment services and research. Money flowing to unlicensed operators generates zero public benefit and actively harms the same populations that licensed operators' levies are designed to help.

Meta's passive enforcement approach isn't just failing individual users. It's undermining an entire regulatory framework designed to minimize gambling-related harm.

Meta's Response: Deflection and Technical Excuses

When the Gambling Commission raised concerns, Meta's response was characteristically defensive. The company acknowledged that gambling ads must comply with local licensing requirements and claimed it has systems in place to enforce this. Meta stated it removes illegal gambling ads when reported.

What Meta didn't do is commit to proactive monitoring. The company didn't acknowledge that its current system is fundamentally inadequate. It didn't announce any changes to how it evaluates gambling advertisers. It simply reiterated existing policies and suggested that further reports should go through its standard violation reporting process.

This response is telling. Meta knows what the Gambling Commission wants: proactive enforcement using tools the company clearly possesses. By refusing to commit to this, Meta is essentially saying it prefers the current system, passive enforcement and all.

For regulators, this is frustrating. They can't force Meta to implement specific technical solutions (that's the company's prerogative). But they can point out that Meta's claims about enforcement don't match reality. And they can continue reporting specific violations, forcing Meta to respond to each one individually while the broader problem persists.

It's a game of regulatory whack-a-mole, and Meta holds the mallet.

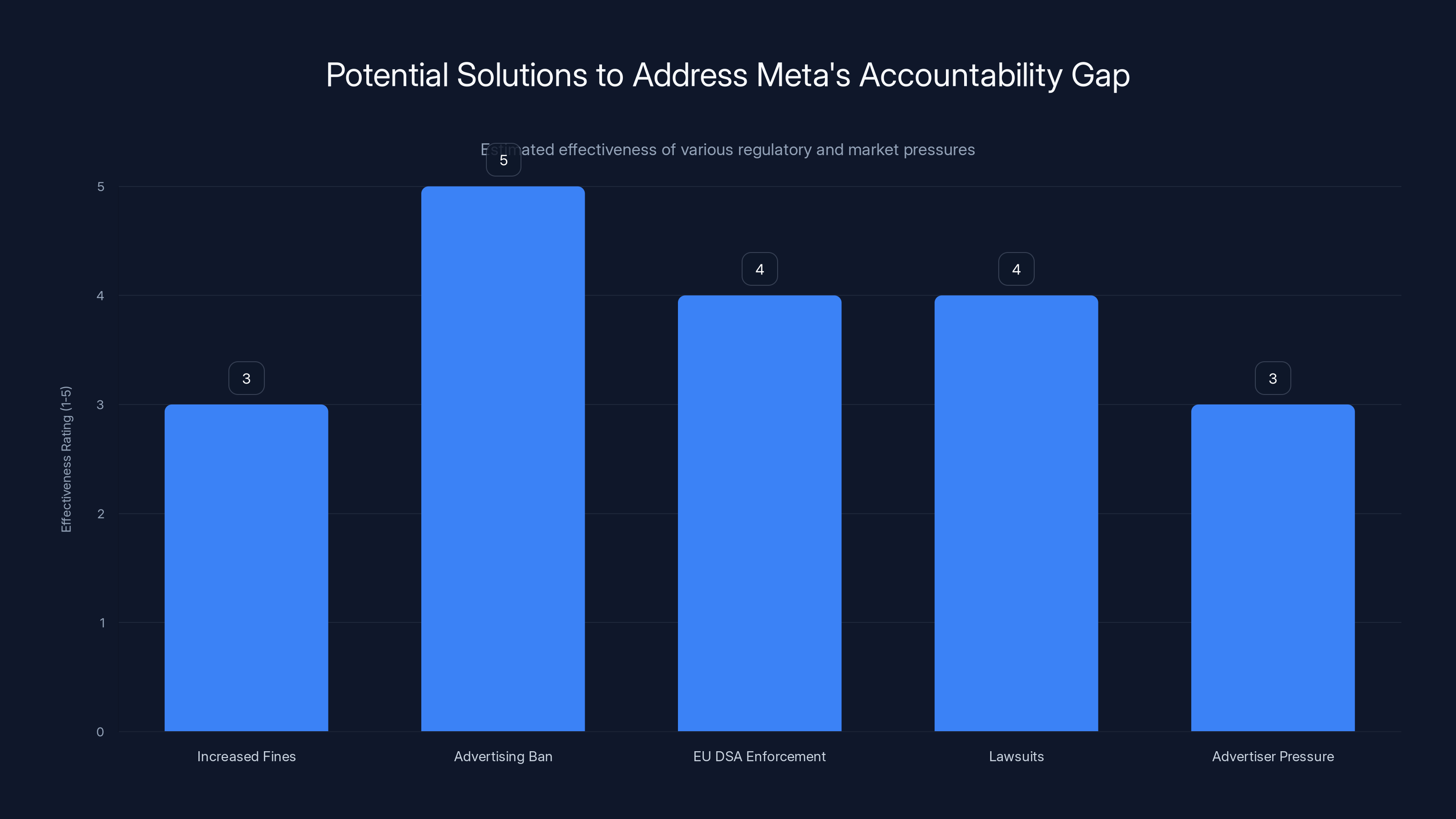

Estimated data suggests an advertising ban on Meta could be the most effective solution to address the accountability gap, followed by aggressive enforcement of the EU Digital Services Act.

Regulatory Precedent: Why This Matters Globally

The Gambling Commission's investigation isn't an isolated regulatory action. It's part of a broader global pattern of regulators pushing back against Meta's enforcement practices.

In Australia, regulators have criticized Meta for hosting ads for unlicensed gambling operations. In Spain and Portugal, regulators have taken similar positions. The EU's Digital Services Act contains provisions specifically requiring platforms to demonstrate compliance with national gambling regulations.

Meta's response in the UK sets a precedent for how the company handles regulatory pressure on advertising enforcement generally. If Meta can maintain passive enforcement on gambling advertising despite regulatory complaints, it signals to other regulators that similar pressure will be met with the same response. If, conversely, the UK forces Meta to implement proactive monitoring, that creates pressure for the company to do the same in other jurisdictions and for other categories of harmful advertising.

The stakes extend beyond gambling. The same enforcement challenges apply to ads for prescription drugs without proper licensing, financial services operating without registration, counterfeit goods, and other categories where regulatory compliance is crucial. Meta's approach to gambling ads will likely influence how the company approaches enforcement across all these categories.

The Technical Reality: What Meta Could Do

Let's be specific about what's actually possible. Meta's ad system already implements sophisticated compliance checking for many advertising categories.

For financial services, Meta requires advertiser certification from recognized financial regulators. For healthcare advertising, Meta requires evidence of proper licensing. For real estate, Meta implements age restrictions and blocks certain predatory lending tactics.

For gambling, Meta could implement:

Whitelist system: Only approved advertisers whose licenses have been verified against official registries can run gambling ads. This is a higher bar than Meta currently implements, but it's technically straightforward.

Dynamic blocklisting: Meta could subscribe to feeds of unlicensed operators identified by regulators globally. Any advertiser or landing page matching these entities would be automatically blocked.

Landing page verification: Meta could scan the actual content of gambling ads' landing pages to verify that advertised operators have the claimed licenses.

Gam Stop integration checking: For UK advertisers, Meta could automatically verify Gam Stop registration.

Behavioral monitoring: Meta could flag accounts that suddenly start running dozens of gambling ads after being previously non-gambling advertisers—a common pattern when accounts are compromised or repurposed for spam.

Frequency capping: Meta could limit how many gambling ads a given user sees, reducing exposure for vulnerable populations.

None of these are technically challenging for a company of Meta's size. They're not even particularly expensive. What they require is prioritization—Meta would need to treat gambling ad compliance as important enough to warrant dedicated resources and automated systems.

Currently, Meta treats it as a complaints-handling problem rather than a compliance problem. The difference is fundamental.

The Enforcement Gap: Why Regulators Are Limited

The UK Gambling Commission has authority over licensed gambling operators. It can fine them, revoke licenses, and force operational changes. But it has limited direct authority over Meta.

Under UK law, Meta is responsible for content on its platforms. Regulators can pressure the company, issue formal notices, and in extreme cases fine it (though fines for a company the size of Meta have become laughably small relative to its revenue). But regulators can't directly force Meta to implement specific technical systems.

This creates a regulatory gap. The Gambling Commission can identify illegal operators. It can prove illegal ads are running on Meta's platforms. It can request that Meta remove them. But it can't compel Meta to implement proactive enforcement.

Meta knows this. The company's strategy is essentially to work within this gap, doing the minimum required to maintain plausible deniability while refusing to go further.

Other regulators have tried different approaches. The EU's Digital Services Act attempts to address this by imposing baseline requirements on how platforms must enforce compliance with national laws. But even the Digital Services Act relies on platforms' good faith implementation.

Ultimately, unless a regulator is willing to threaten something Meta genuinely fears—like banning the platform from operating in the jurisdiction, or imposing fines that actually hurt the company's bottom line—the gap persists.

Meta's current approach lacks systematic implementation of essential detection strategies against illegal gambling ads, highlighting significant organizational gaps.

Industry Response: What Licensed Operators Think

Licensed gambling operators in the UK face a peculiar problem. They invest substantially in compliance. They employ staff dedicated to responsible gambling, fraud prevention, and regulatory affairs. They conduct audits, implement safeguards, and contribute to national levies. Their compliance costs run into the millions annually.

Meanwhile, unlicensed competitors can market aggressively on Meta with zero compliance overhead. They don't contribute to treatment funding. They don't implement player protections. They operate with lower costs and higher margins.

This creates competitive pressure on licensed operators to reduce their compliance spending—why invest in responsible gambling measures if illegal competitors don't? Regulators see this pattern and recognize that failure to enforce licensing requirements ultimately weakens the entire regulated industry.

Some licensed operators have called for more aggressive regulatory enforcement against platforms hosting illegal gambling ads. They recognize that Meta's passivity doesn't just harm consumers—it distorts competitive dynamics in favor of unlicensed operators.

This creates an unusual alliance: consumer protection advocates and legitimate industry players both pushing regulators to pressure Meta harder. But without Meta's cooperation or meaningful regulatory authority, progress has been limited.

The Broader Platform Accountability Question

Meta's approach to illegal gambling ads raises a fundamental question about platform accountability more broadly. Should platforms be held responsible for the compliance status of their advertisers? To what extent should platforms be required to verify advertiser claims?

Different regulators are arriving at different answers. The EU's Digital Services Act is moving toward stronger platform accountability. The UK is moving more cautiously. The US has generally been more permissive.

Meta's strategy has been to minimize accountability by arguing that verification burdens are excessive and that bad actors will always find ways around enforcement. To some extent, this is true. But regulators like the UK Gambling Commission are pointing out that Meta's current system isn't even trying hard—the company isn't at the edge of what's technically feasible, it's falling far short.

If regulators succeed in forcing stronger enforcement from Meta on gambling ads, the precedent will likely extend to other advertising categories. We could see stronger verification requirements for financial services, healthcare, and other high-risk advertising verticals. Alternatively, regulators could step back, deciding that platforms can't be expected to police every category of advertiser compliance. That scenario would likely lead to stricter requirements on advertisers themselves.

For Meta, the worst outcome would be strong enforcement requirements that create meaningful operational friction. The company is probably betting that regulatory pressure will remain just annoying enough to require some response but not so strong as to require fundamental changes.

Consumer Protection Gaps: What Users Don't Know

Most UK users aren't aware that some gambling ads they see on Facebook and Instagram are for illegal operators. They assume that Facebook wouldn't host ads for illegal sites. This assumption is reasonable but incorrect.

The typical user has no easy way to verify whether a gambling operator is licensed. You need to know to go to the Gambling Commission's website, search the registry, and verify a license number. Most people don't do this before clicking an ad.

For younger users, the gap is even larger. They may not know that licensing even exists, let alone how to verify it. They see an ad from what appears to be a legitimate gambling operator and click without hesitation.

Problem gamblers face a specific vulnerability. A person struggling with gambling addiction is likely to be targeted by illegal gambling ads (these operators use detailed targeting similar to licensed operators) and may have reduced judgment when it comes to evaluating whether a site is legitimate. By the time they realize they're on an unlicensed platform, they've already deposited money.

Meta could mitigate this by adding clear labels to all gambling ads indicating licensing status. This would immediately alert users when an ad is for an unlicensed operator. But Meta doesn't do this, and there's no regulation currently requiring it.

Estimated data shows that proactive enforcement could cost Meta significantly more in lost revenue ($30 million) compared to engineering and operational costs, with potential fines being relatively minor.

International Context: How Other Countries Handle This

The UK's approach to regulating online gambling is stricter than most countries but not the strictest globally. Some comparisons provide useful context.

Sweden implemented a state monopoly on gambling, heavily restricting private operators. The country's approach reduces advertising concerns because ads for unlicensed operators simply don't exist—there are no unlicensed operators. This works for Sweden but creates other policy trade-offs.

Germany's multi-state licensing system created fragmentation similar to the UK's unified Gambling Commission approach. German regulators have pushed harder on platforms to verify license status, with some success.

Austria has been particularly aggressive, fining platforms for hosting unlicensed gambling ads and threatening to block platforms from operating in the country. This has been more effective at driving compliance than the UK's approach has been.

The US has a different system entirely. Online gambling is prohibited at the federal level but permitted in specific states with their own licensing regimes. This fragmentation makes it harder for platforms to implement uniform enforcement. As a result, illegal gambling ads are common on US platforms as well.

The EU's Digital Services Act creates a framework that might push platforms toward stronger enforcement across European markets. We'll see whether Meta adjusts its practices once the DSA's enforcement mechanisms fully activate.

Data Privacy and Problem Gambling: The Secondary Harm

Here's an angle that deserves more attention: unlicensed gambling operators often engage in aggressive data collection and usage practices that go beyond even Meta's loose standards.

When someone signs up for an unlicensed gambling operator, they're providing personal data to a company operating outside regulatory oversight. This data might be sold to other operators, used for spam marketing, or shared with criminal elements. Licensed operators in the UK are subject to data protection regulations and regular audits. Unlicensed operators have zero incentive to protect data responsibly.

For problem gamblers specifically, this creates a unique vulnerability. Someone struggling with gambling might seek help and sign up for self-exclusion on Gam Stop. But if they've previously gambled on unlicensed sites accessed through Meta ads, their data is in the hands of unregulated operators who might continue marketing to them despite their self-exclusion attempts.

This compounds the harm. Not only are users exposed to predatory marketing on Meta, but they're also providing data to companies operating outside protective frameworks.

Meta could mitigate this by not hosting ads for operators that can't demonstrate proper data protection practices. But again, this would require proactive enforcement the company currently doesn't implement.

The Economic Argument: Meta's Math

Let's think through Meta's actual incentives using basic economics.

Meta makes roughly $35 per user annually in advertising revenue (this varies by geography; UK revenue is higher due to higher advertiser demand). A UK user seeing an illegal gambling ad might generate a few cents in immediate revenue for Meta. If that ad is removed 48 hours later due to a complaint, Meta got paid for the impressions anyway.

Mean time to removal for reported illegal gambling ads is currently estimated at 24-48 hours. During that time, the ad has already generated revenue for Meta and likely acquired some customers for the illegal operator.

To implement proactive enforcement would require:

- Engineering time to build systems: roughly $2-5 million

- Ongoing operational costs: roughly $1-3 million annually

- Lost advertising revenue from more restrictive policies: potentially $10-50 million annually (estimate based on gambling ad volume)

From a purely financial standpoint, Meta is better off keeping the current system. The company absorbs minor regulatory complaints, removes ads when explicitly reported, and continues profiting from illegal gambling advertising.

This changes only if regulators impose costs large enough to exceed the lost revenue from stricter enforcement. UK fines, historically, haven't reached that threshold. A

Solutions and Path Forward

So what could actually force change?

Regulatory fines that scale with advertiser volume: Instead of flat fines, regulators could impose fines based on the number of illegal gambling ads hosted. If each illegal ad carried a $1,000 fine, and Meta was hosting hundreds of them, the math changes dramatically.

Operational restrictions: Regulators could threaten to ban gambling advertising entirely on Meta unless the company implements specific enforcement mechanisms. This would be nuclear, but Meta's continued non-compliance might eventually provoke it.

Advertiser liability: Rather than holding only Meta accountable, regulators could impose liability on advertisers who run on platforms hosting illegal content. This creates liability up the chain.

Consumer lawsuits: Class action suits from problem gamblers harmed by ads accessed through Meta could create financial pressure. This has proven effective against other defendants.

Jurisdictional bans: A country could threaten to block Meta entirely if the company doesn't improve gambling ad enforcement. Austria's threat proved more effective than anything the UK has tried.

Industry pressure: Licensed operators could organize collectively and petition regulators to enforce more aggressively, creating political pressure.

Currently, none of these are at the level of implementation. The UK's approach has been to issue warnings and issue reports. These have minimal impact on Meta's behavior.

The Broader Takeaway: Platform Regulation and Consumer Trust

The Meta illegal gambling ad story is a microcosm of broader tensions in platform regulation. Platforms are massively profitable partly because they externalize costs. The cost of hosting illegal gambling ads is borne by consumers (who face predatory marketing and fraud risk), by regulators (who must respond to harms), and by legitimate industry players (who face competition from unlicensed operators).

Meta bears the cost only if and when regulators force the company to.

This creates a natural tension. Regulators want platforms to police content more aggressively. Platforms prefer passive systems that minimize operational burden. Without forcing mechanisms, platforms will optimize toward the minimal compliance that avoids serious regulatory consequences.

For consumers, the lesson is simpler: trust platform enforcement policies at your own risk. Verify independently. For gambling, check the Gambling Commission registry. For other products and services, do your own due diligence. Platform policies are useful guidelines, but they're not guarantees.

For regulators, the lesson is that voluntary cooperation from platforms is insufficient. Meaningful enforcement requires teeth—regulations that create actual costs for non-compliance, not just reputational pressure.

The UK Gambling Commission's findings are damaging to Meta's credibility because they prove the company could be doing more but isn't. As other regulators around the world see this pattern, pressure will likely increase. But Meta's threshold for accepting real enforcement costs is likely higher than regulators have been willing to impose so far.

FAQ

What is an illegal gambling site according to UK law?

An illegal gambling site is any operator offering gambling services to UK consumers without holding a valid license from the UK Gambling Commission. These operators are registered in countries with lax oversight, often operating from multiple jurisdictions simultaneously. They're not "operating in gray areas" or "waiting for regulation"—they're breaking UK law, which explicitly restricts gambling services to licensed operators.

How can I verify if a gambling operator is licensed in the UK?

You can verify licensing by visiting the UK Gambling Commission's official website and searching their register of licensed operators. You should see a specific license number for any legitimate operator. If you can't find the license number on the operator's website or in the commission's registry, the operator is illegal, and you should not deposit money. This verification takes about two minutes and is worth doing before any deposit.

Why doesn't Meta remove illegal gambling ads immediately?

Meta relies on reactive enforcement rather than proactive monitoring. The company waits for someone to report violations rather than systematically scanning for them. This approach is less expensive operationally and generates more advertising revenue by keeping illegal ads running until complaints arrive. The Gambling Commission found this approach implausible for a company of Meta's size and resources, pointing out that basic keyword searches can easily identify illegal operators' ads.

What harm do illegal gambling sites cause?

Illegal gambling sites operate without consumer protections, responsible gambling measures, age verification, or regulatory oversight. Players have no recourse if they're defrauded, no access to treatment services if they develop gambling addiction, and no protection for their personal data. The sites often target minors and problem gamblers with aggressive marketing. They also undermine licensed operators' compliance investments and drain revenue from public gambling treatment funding.

What is Gam Stop and why does it matter for licensing?

Gam Stop is the UK's national self-exclusion platform that allows people to ban themselves from all licensed gambling sites simultaneously. To operate legally in the UK, every gambling operator must integrate with Gam Stop. If an operator isn't on Gam Stop's system, it isn't licensed, and its ads shouldn't run anywhere. Meta could verify Gam Stop integration but currently doesn't.

Can I get my money back if I gamble on an illegal site accessed through Meta?

No. Illegal sites operate outside regulatory frameworks, so there's no legal protection or recourse mechanism. You cannot file complaints with the Gambling Commission about unlicensed operators—they handle only licensed operators. If you've deposited money on an illegal site and suspect fraud, you might report it to law enforcement, but recovery is unlikely. This is why verification before deposit is so important.

What is Meta's responsibility for ads on its platform?

Under UK law, Meta is responsible for content on its platform, including advertisements. The company isn't liable for isolated violations, but it can be held liable for patterns of non-compliance and failure to enforce stated policies. Regulators have argued that Meta's passive approach—waiting for reports rather than proactively monitoring—doesn't meet a reasonable enforcement standard for a company of Meta's resources.

Could Meta implement stricter gambling ad enforcement?

Yes. Meta has the technical capability to implement proactive enforcement using existing tools like keyword blocking, landing page verification, Gam Stop integration checking, and dynamic blocklisting of known illegal operators. The company doesn't do these because they would reduce ad volume and revenue. The enforcement gap is about incentives, not capability.

What is the Gambling Levy Regulations 2025?

In April 2025, the UK introduced a statutory gambling levy requiring licensed operators to pay a percentage of their gross gambling yields to the Gambling Commission. This funding goes toward treatment services, research, and harm prevention. Unlicensed operators contribute nothing to this system, creating a subsidy dynamic where harm from illegal gambling is externalized onto society rather than being funded by the industry generating the harm.

How does the EU's Digital Services Act affect gambling ads?

The Digital Services Act includes provisions requiring platforms to enforce compliance with national laws, including gambling regulations. Meta must demonstrate compliance with national gambling requirements across EU markets. This creates pressure for more standardized, proactive enforcement, though implementation details are still being determined. If the EU proves willing to enforce the DSA's provisions with serious consequences, it could drive global policy changes by Meta.

Conclusion: The Accountability Gap

The UK Gambling Commission's findings about Meta aren't surprising to anyone who understands how large platforms actually operate. What's notable is that a regulatory body finally said it publicly and clearly: Meta's enforcement isn't inadequate because it's hard, it's inadequate because the company doesn't want to invest in it.

This is the core of the accountability gap. Meta has stated policies against illegal gambling ads. Meta has the technical resources to enforce these policies proactively. Meta chooses not to.

The consequences of this choice are real. Millions of UK consumers see illegal gambling ads on Meta's platforms weekly. Unlicensed operators acquire customers they never would have reached through legitimate channels. Problem gamblers are targeted with predatory marketing from operators operating outside protection frameworks. Meanwhile, licensed operators struggle to compete fairly against unlicensed operators who skip compliance costs.

For consumers, the lesson is direct: platforms' stated policies aren't guarantees. Meta says it doesn't tolerate illegal gambling ads, but the company's actions contradict this claim. Regulators are right to push back, but regulatory pressure alone hasn't been strong enough to force meaningful change.

What might force change? Regulators would need to impose consequences significant enough that Meta's cost calculation shifts. Current fines don't reach that threshold. Threats need teeth. The UK could ban gambling advertising on Meta entirely unless enforcement improves. The EU could enforce Digital Services Act provisions aggressively. Lawsuits could create liability. Advertiser pressure could create political consequences.

None of this has happened yet. For now, Meta's math remains simple: the revenue from illegal gambling ads exceeds the cost of modest regulatory pressure. Until that calculation changes, don't expect Meta's behavior to.

In the meantime, protect yourself. Verify licenses independently. Report illegal operators when you find them. Support regulatory efforts to strengthen platform accountability. These won't solve the problem, but they're what individuals can do while waiting for structural change.

Key Takeaways

- Meta hosts advertisements from unlicensed gambling operators despite policies requiring licenses, exposing millions of UK users to predatory marketing from unregulated companies operating outside player protections.

- The UK Gambling Commission proved Meta has the technical capability to prevent illegal gambling ads but chooses not to, using reactive enforcement (responding to complaints) rather than proactive monitoring (systematic detection).

- Illegal gambling operators are criminals operating outside regulatory frameworks, with no responsibility for consumer fraud, data protection, age verification, or responsible gambling measures that licensed operators must implement.

- Meta's enforcement approach is economically rational: the revenue from illegal gambling ads exceeds enforcement costs and regulatory fines, creating misaligned incentives where the company profits from the status quo.

- Meaningful change would require regulatory consequences significant enough to shift Meta's cost calculation—either through severe financial fines, operational restrictions, or jurisdictional bans, none of which the UK has currently implemented.

Related Articles

- Trump Mobile FTC Investigation: False Advertising Claims & Political Pressure [2025]

- FTC Finalizes GM Data Sharing Ban: What It Means for Your Privacy [2025]

- Apple and Google's App Store Deepfake Crisis: The 2025 Reckoning [2025]

- Grok AI Deepfakes: The UK's Battle Against Nonconsensual Images [2025]

- TikTok Shop's Algorithm Problem With Nazi Symbolism [2025]

- Roblox's Age Verification System Catastrophe [2025]

![Meta's Illegal Gambling Ad Problem: What the UK Watchdog Found [2025]](https://tryrunable.com/blog/meta-s-illegal-gambling-ad-problem-what-the-uk-watchdog-foun/image-1-1768858591687.jpg)