The Power Crisis No One Saw Coming

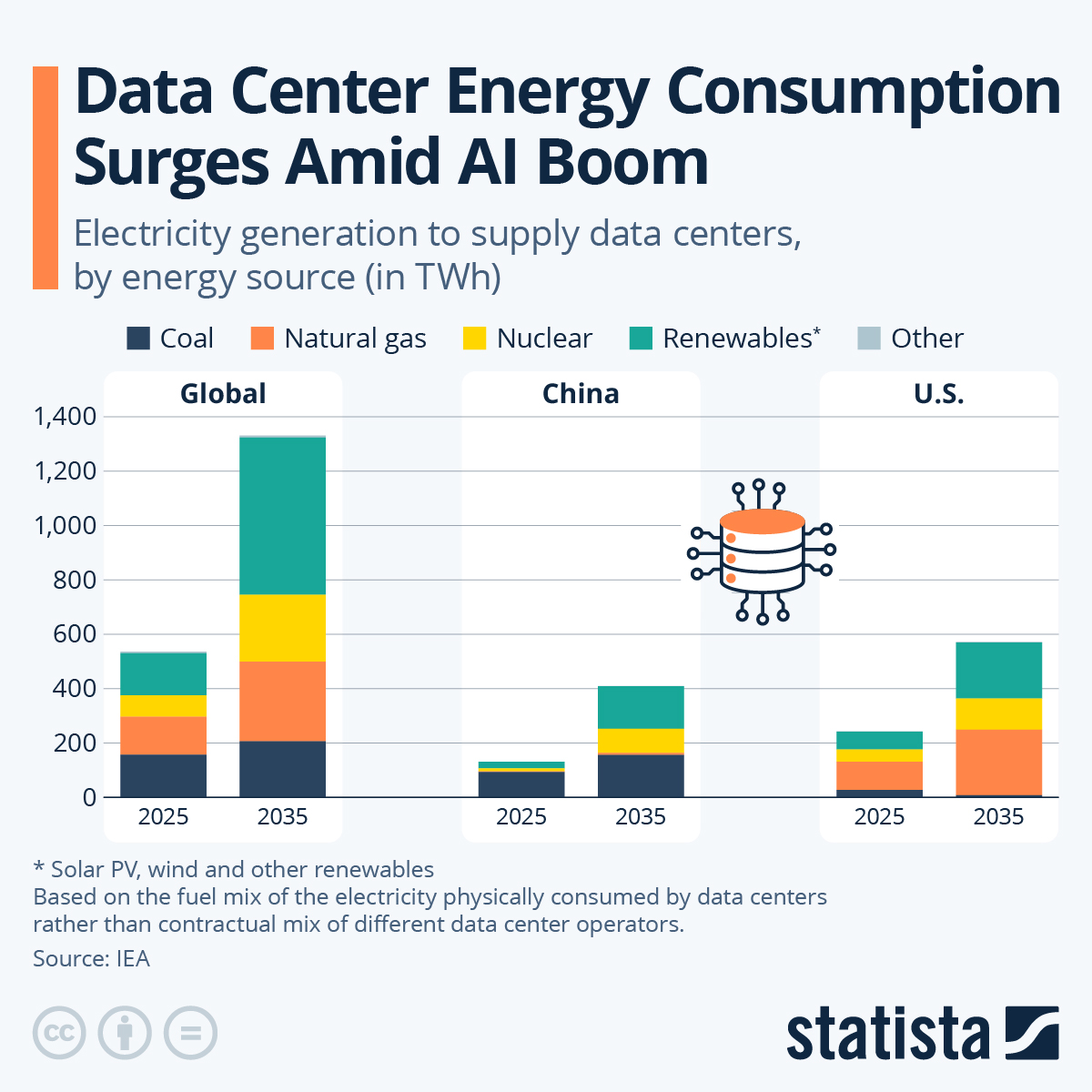

Think about the last time you asked Chat GPT a question. Behind that instant response sat thousands of server computers consuming enough electricity to power a small town. Now multiply that by millions of queries happening simultaneously across the globe. The energy appetite of generative AI has become so massive that it's literally rewriting how data centers are built.

Microsoft saw this coming. The company's infrastructure teams realized something fundamental: the copper wires carrying power through modern data centers were becoming a bottleneck. Not just in terms of efficiency, but in physical space. Traditional cables waste enormous amounts of energy as heat while taking up valuable real estate. In a world where AI companies are competing to deploy the largest possible models in the smallest possible spaces, that's a serious problem.

Enter high-temperature superconductors (HTS). These exotic materials allow electricity to flow with literally zero resistance. No heat loss. No waste. Just pure, unobstructed power transfer. It sounds like science fiction. It's actually the next evolution in data center design, and Microsoft is betting billions that superconducting cables will become the backbone of next-generation infrastructure.

But here's the reality check: this technology has been around for decades, used in medical imaging machines and experimental fusion reactors. What's different now is that the economics have suddenly aligned. AI's power demands have created an urgent need for exactly what superconductors offer: more efficiency, less space, lower energy costs. For the first time, the timeline for commercial deployment actually looks realistic.

Understanding Superconductivity: When Resistance Becomes Zero

Let's start with the physics, but don't worry—we'll keep it intuitive. Normally, when electricity flows through a conductor like copper, electrons collide with atoms in the material. These collisions create friction, which generates heat and wastes energy. This is called resistance, measured in ohms. Your home's electrical wiring has resistance. Your laptop's charging cable has resistance. That's why they get warm when electricity runs through them.

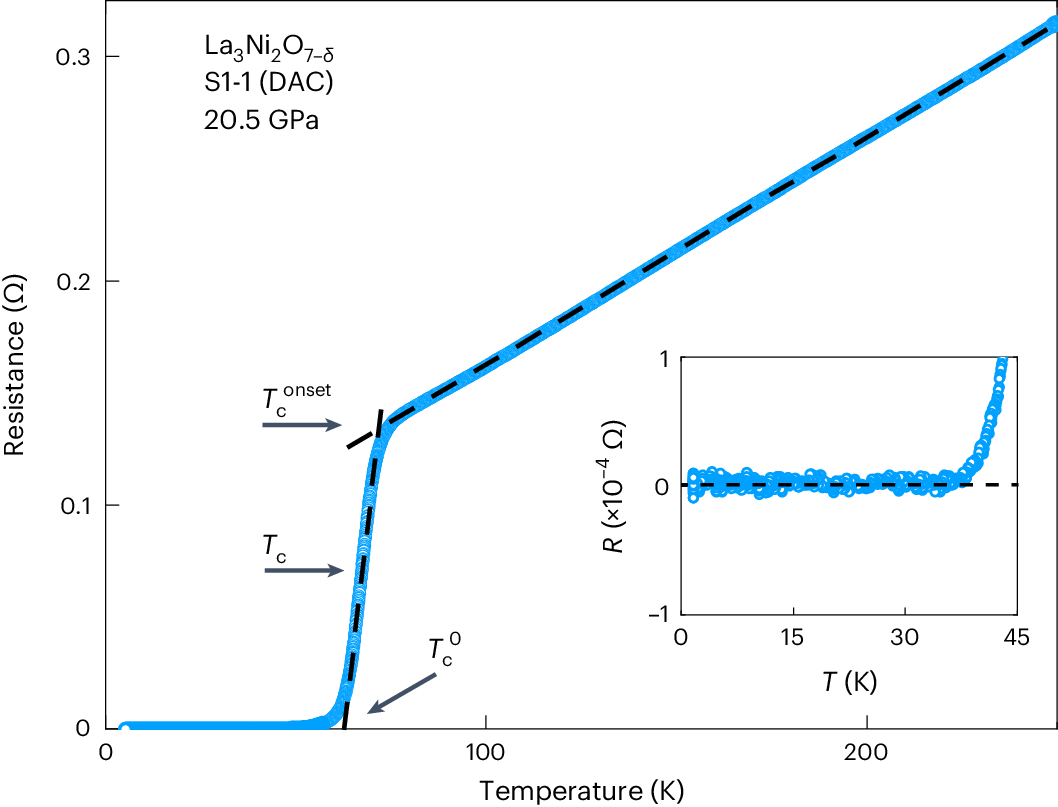

Now imagine a material where electrons could move completely freely, with zero collisions and zero resistance. That's a superconductor. In these materials, electrons pair up in a quantum phenomenon that allows them to flow without any energy loss whatsoever. The catch? This only happens at extremely cold temperatures. For the high-temperature superconductors Microsoft is studying, that means cooling the cables to around 77 Kelvin (about minus 196 degrees Celsius), which is roughly the boiling point of liquid nitrogen.

HTS cables are made from a special material: yttrium barium copper oxide (YBCO) in a tape form. This tape is wrapped around a cooling channel that circulates liquid nitrogen, keeping the material at the precise temperature needed to maintain zero resistance. When you do this correctly, something remarkable happens. A cable that would normally be thick and heavy becomes thin and lightweight. A transmission line that would carry current with 5-7% energy loss becomes one with essentially zero loss.

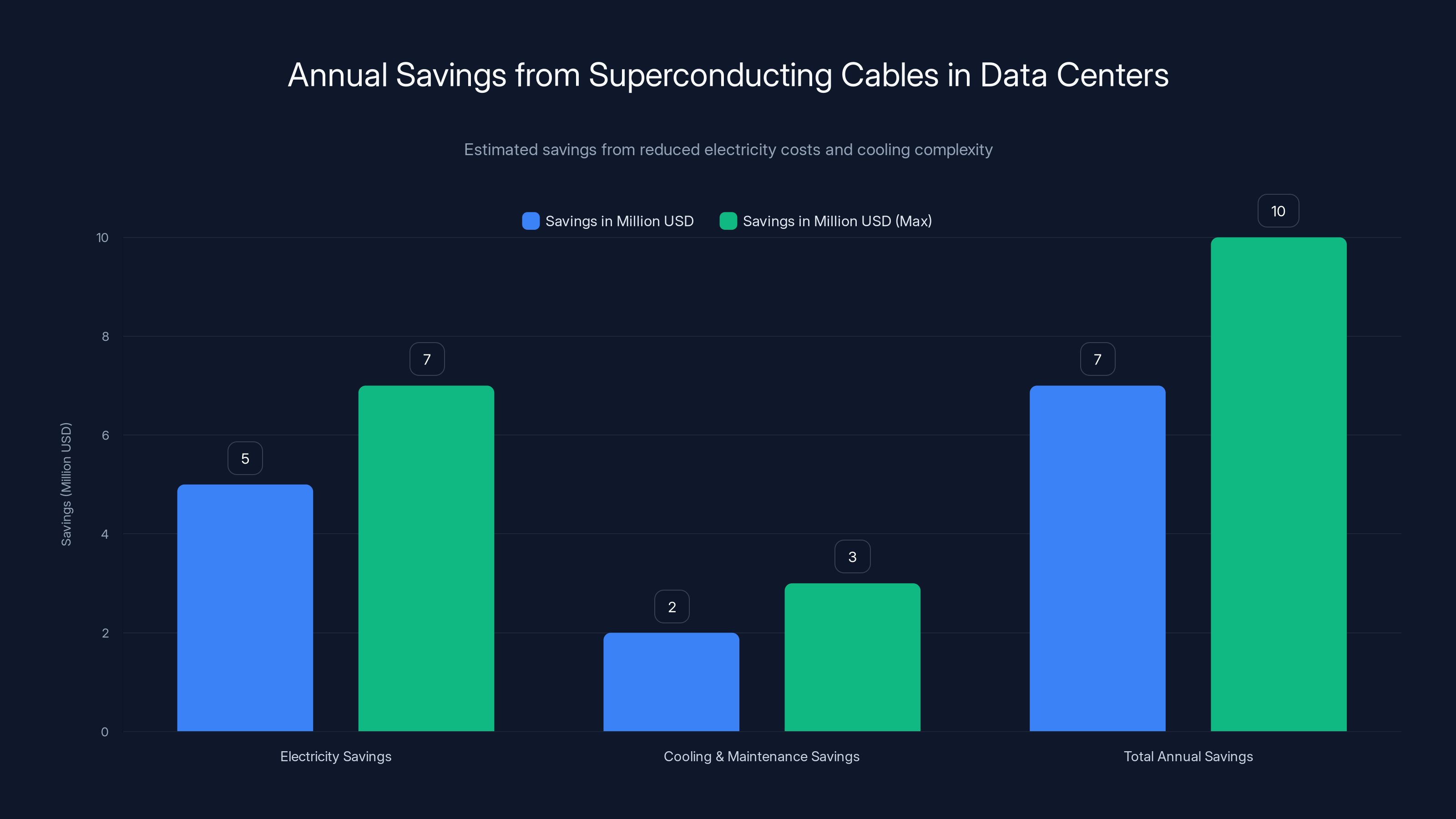

The math here is stunning. If you're transmitting electricity over long distances—say, from a power plant to a data center fifty miles away—that 5-7% loss adds up to millions of dollars annually. For a large data center drawing 100 megawatts of power, a mere 5% loss means 5 megawatts of wasted electricity simply evaporating as heat into the atmosphere. With superconductors, that number approaches zero.

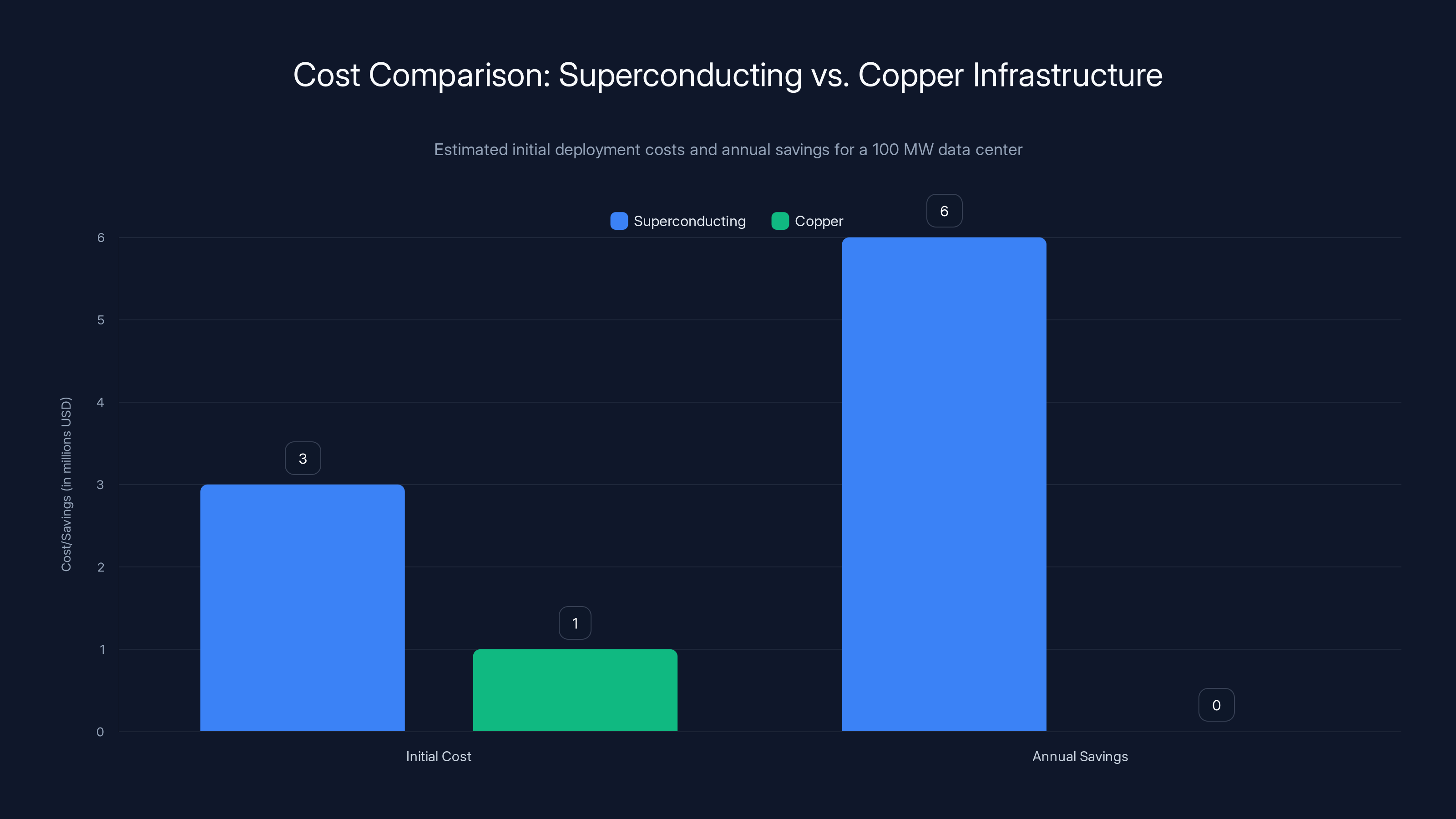

Implementing superconducting cables can save data centers $7-10 million annually by reducing electricity and cooling costs. Estimated data.

Why Data Centers Need Superconductors Right Now

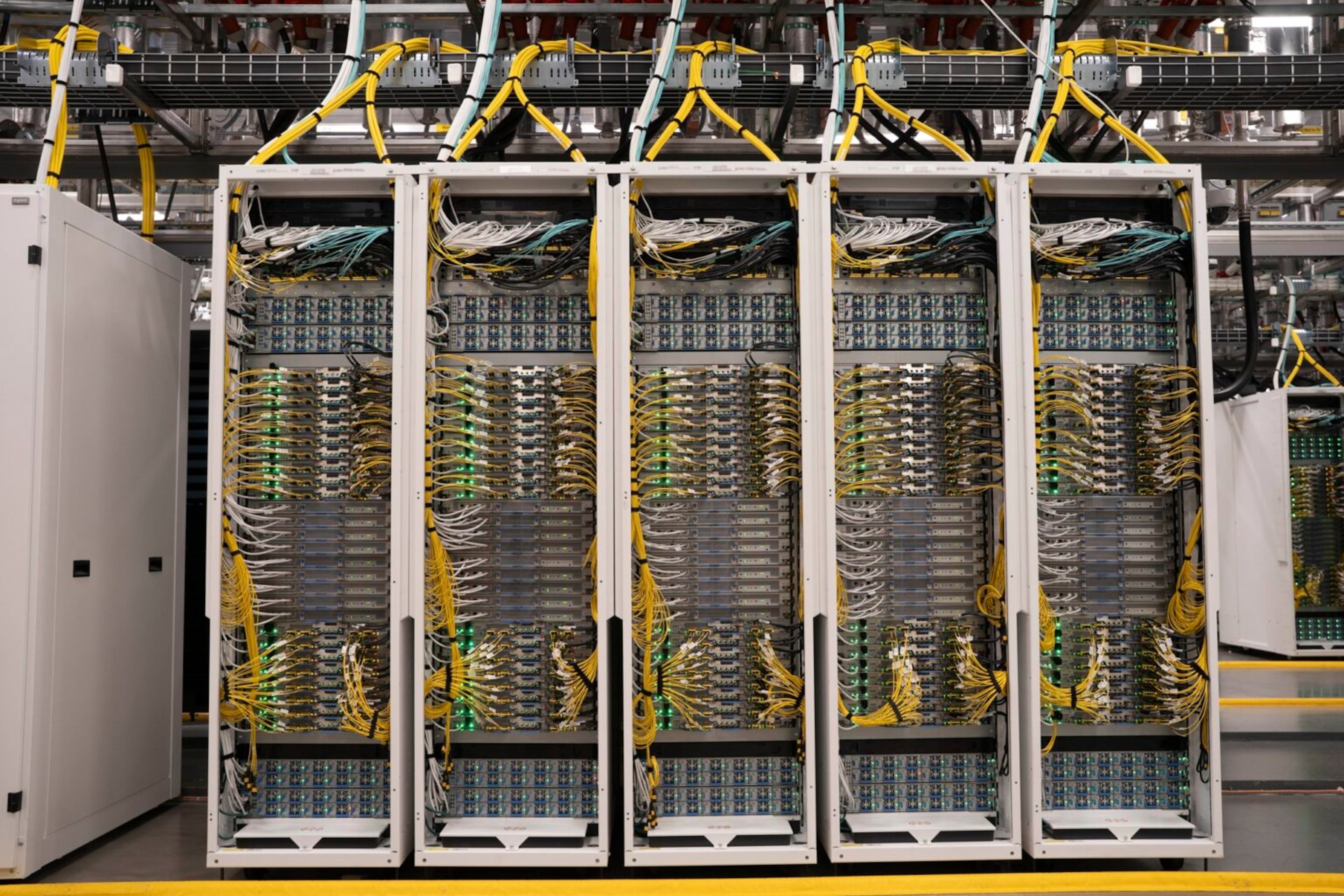

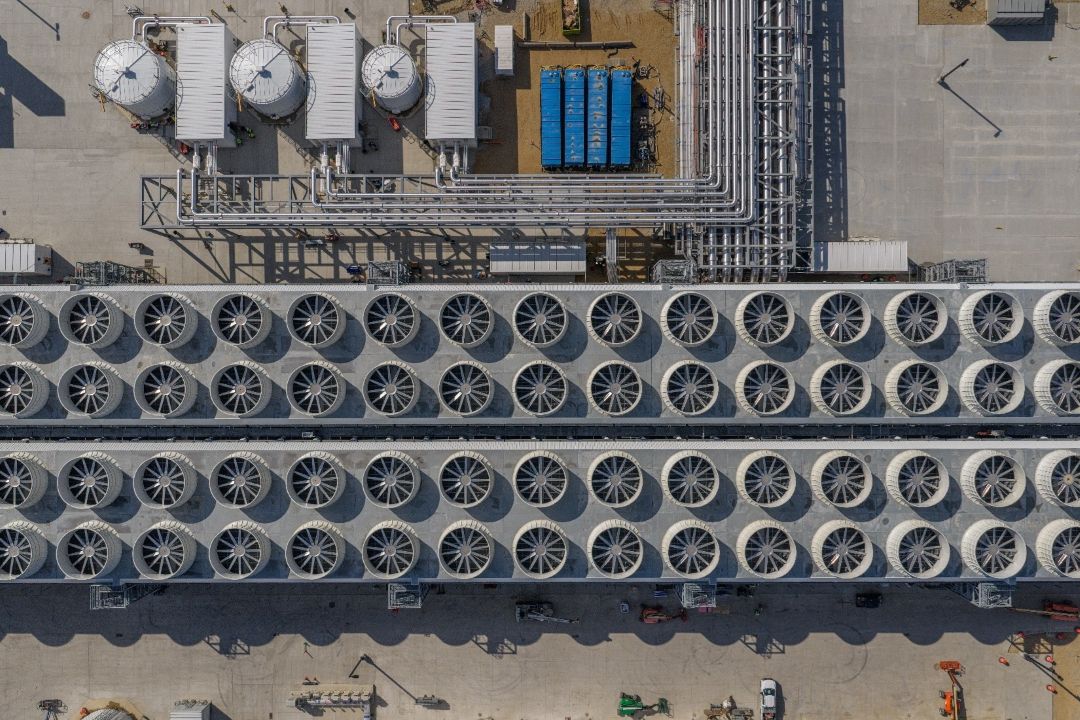

Modern data centers aren't small buildings. They're massive industrial facilities, often consuming 50 to 150 megawatts of power continuously. That's equivalent to the electricity usage of 40,000 to 120,000 homes. The infrastructure required to deliver that power is complex: power substations, massive copper cables, cooling systems for those cables, redundancy systems to ensure no single failure brings down operations.

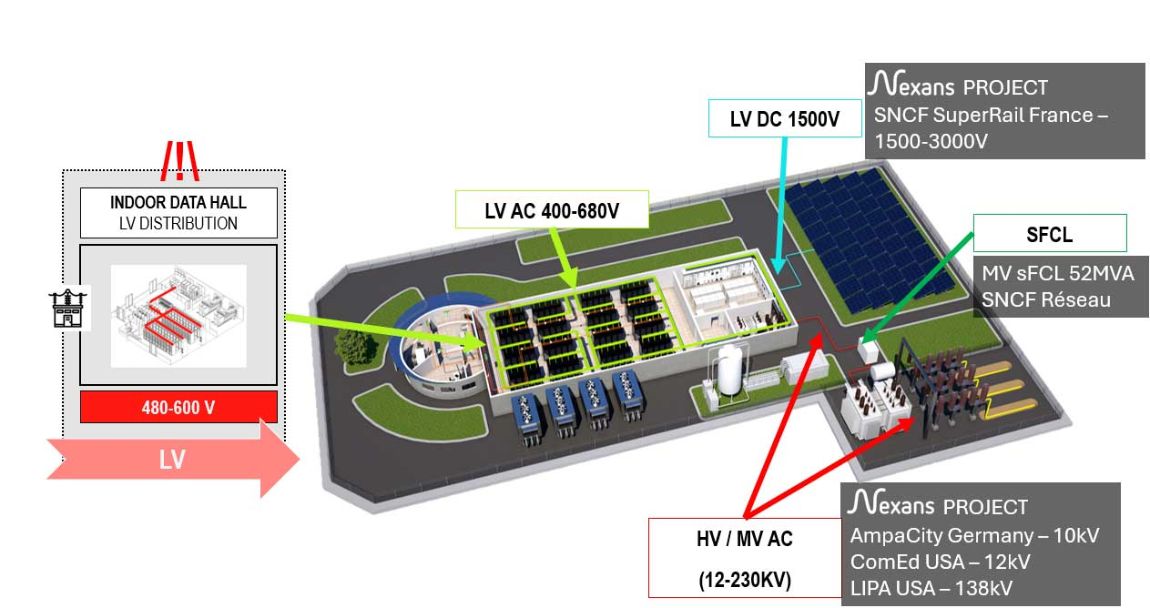

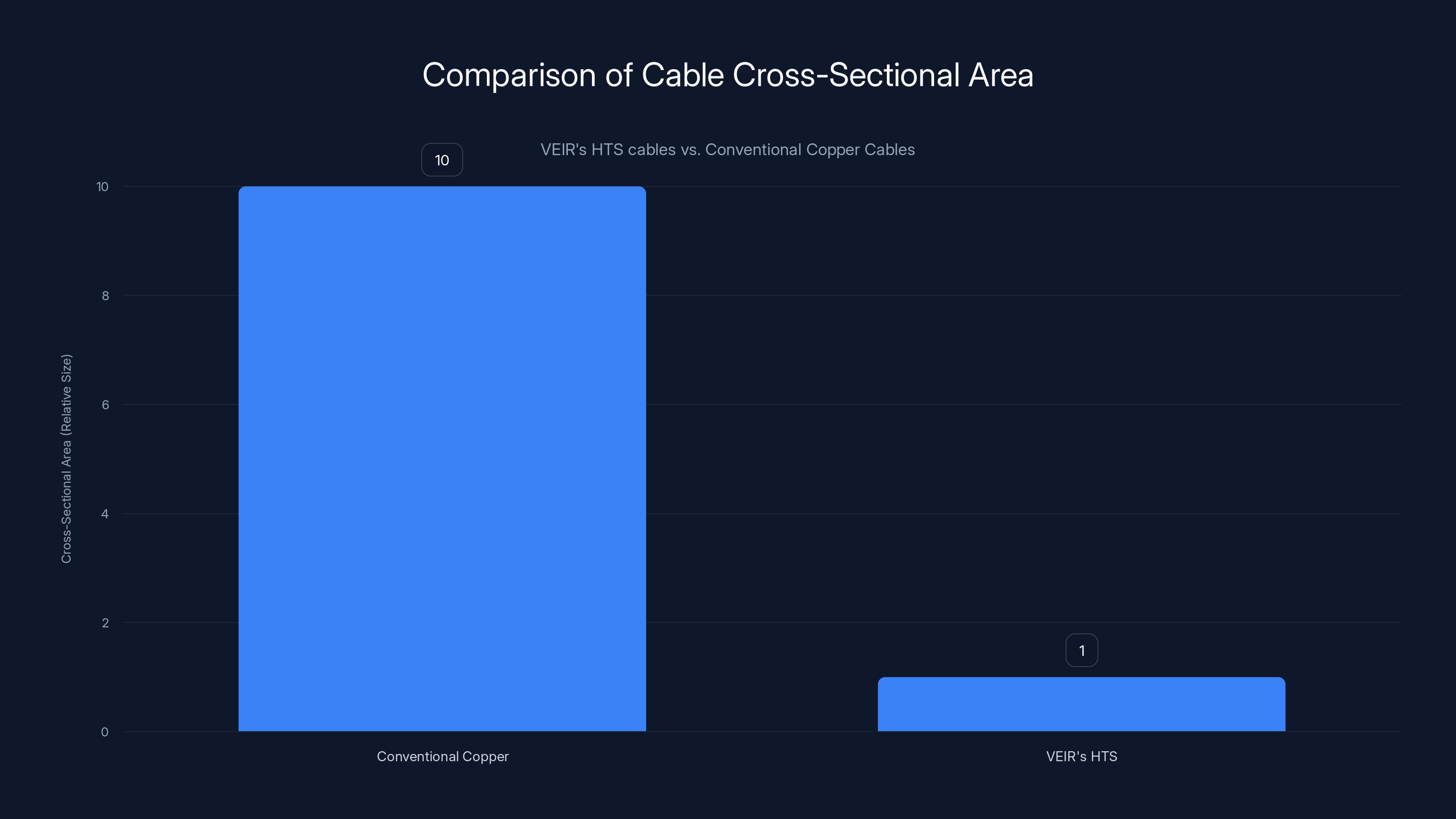

Superconducting cables change this equation because they accomplish multiple things simultaneously. First, they're dramatically smaller and lighter than copper alternatives. A superconducting cable can deliver the same power as a copper cable that's 10 times larger in cross-sectional area. This means the electrical rooms inside data centers can be redesigned. Instead of massive cable trays running through corridors, you have compact pathways. That freed-up space can house more server racks, more computational capacity in the same footprint.

Second, the elimination of heat loss means less energy wasted. For every 100 megawatts you try to deliver to a data center using traditional copper infrastructure, you lose 5-7 megawatts just to resistance. That energy becomes heat that requires additional cooling systems, which themselves consume power. Superconductors break this vicious cycle. You deliver the power you need without the parasitic losses.

Third—and this matters more than people realize—superconductors give data center operators incredible flexibility in how they lay out their infrastructure. Traditional cables are stiff and bulky. You have to plan layouts around them months in advance. Superconducting cables are more flexible, easier to route through tight spaces, and can be upgraded with less disruption.

Microsoft's own experiments with partner company VEIR demonstrated this concretely. In a real data center environment, they showed that superconducting cables could deliver the same power with roughly 1/10th the cable dimension and weight. Translate that to a facility planning exercise, and it's transformative. The amount of real estate dedicated to power infrastructure shrinks dramatically.

The Supply Chain Challenge: Can We Make Enough?

Here's where enthusiasm meets reality. HTS tape—the foundational material for superconducting cables—isn't cheap to manufacture, and the production capacity is limited. The material itself contains rare-earth elements, primarily barium but also yttrium, which require specialized sourcing and processing. Global rare-earth production is heavily concentrated in one place: China controls approximately 70% of global rare-earth mining and refining capacity.

That's the first problem. The second problem is manufacturing scale. Currently, HTS tape production is measured in thousands of kilometers annually. To retrofit even a single large data center, you might need hundreds of kilometers of tape. To deploy superconducting infrastructure globally across thousands of data centers, you'd need millions of kilometers. The gap between current capacity and future need is enormous.

But here's what's changed in the last three years: demand from fusion energy research has exploded. Companies and governments investing in fusion energy projects need massive quantities of HTS tape for their superconducting magnets. This research funding has kick-started manufacturing expansion. Multiple manufacturers—Superconductor Technologies Inc., Southwire, Furukawa, and others—have announced capacity expansions specifically driven by fusion demand.

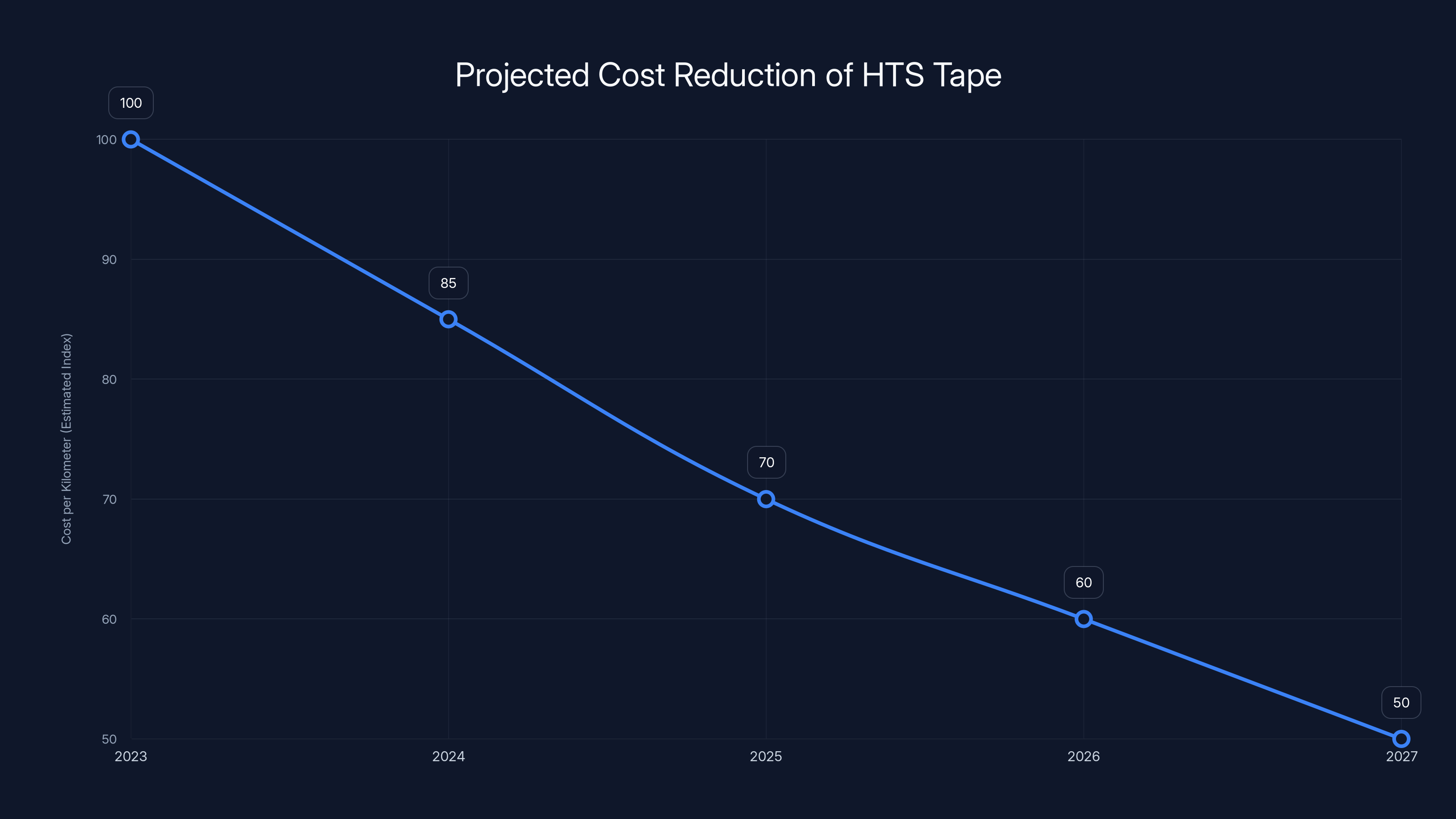

This creates a fascinating dynamic. Fusion research, which consumes the majority of HTS tape today, is essentially subsidizing the development and cost reduction of the same material that data centers will eventually use. As manufacturing scales up to meet fusion demand, the cost per kilometer of HTS tape has already begun declining. Industry analysts project 30-50% cost reductions over the next five years as production volume increases.

The rare-earth supply chain is trickier. While the amount of rare-earth material in a superconducting cable is relatively small, the concentration in China does create geopolitical considerations. However, this is driving investments in alternative processing, recycling, and even alternative superconductor compositions that might reduce dependence on specific rare-earth elements.

Superconducting infrastructure costs 2-3 times more initially but offers significant annual savings, leading to a payback period of 3-5 years. Estimated data.

Microsoft's Two-Pronged Strategy: Inside and Outside Data Centers

Microsoft's approach to superconductor deployment is pragmatic and two-part. Inside data centers, the company sees HTS cables as an immediate infrastructure optimization. Smaller cables mean flexible layout, less space dedicated to power distribution, easier upgrades. This is essentially an efficiency play. The ROI comes from getting more computational capacity in the same physical space and reducing operational complexity.

Outside data centers, Microsoft is looking at something even more ambitious: using HTS cables for long-distance power transmission. This is where the real game changes. Modern electrical grids rely on massive copper transmission lines running across continents. These lines lose power continuously. In the United States alone, transmission losses account for about 7% of all generated electricity—that's roughly 100 billion dollars worth of electricity vanishing into heat every year.

Replacing even a fraction of transmission infrastructure with superconducting lines would be transformative. A superconducting transmission line could move 2-3 times more power than the copper line it replaces, without expanding the physical footprint. For grid operators struggling to accommodate massive new power demands from data centers, this is game-changing.

However, deploying superconducting transmission lines requires coordination with utilities, regulatory approval, and massive capital investment. Microsoft isn't positioning itself as the manufacturer here. Rather, the company is working as a customer, helping to fund research and proof-of-concept projects that will eventually lead to commercial deployment.

The company's strategy has multiple timelines. Short-term (next 2-3 years): deploy HTS cables within new data centers, proving the concept and driving down costs through volume. Medium-term (3-5 years): partner with utilities on regional transmission projects, particularly in areas where data center clusters are creating power bottlenecks. Long-term (5-10 years): participate in wholesale grid modernization, where superconducting cables become standard infrastructure.

Real-World Proof: VEIR's Demonstration Project

Microsoft isn't making theoretical arguments. The company funded and collaborated on a genuine proof-of-concept with Massachusetts-based startup VEIR. In 2024, VEIR demonstrated superconducting cables operating in a real data center environment, delivering full production-level power loads. This wasn't a lab test. This was actual equipment carrying the electricity that powered actual server hardware.

The results were concrete. VEIR's HTS cables delivered the same power output as conventional copper cables at roughly 1/10th the cross-sectional area. If you visualize it, that's the difference between a cable the thickness of a fire hose versus the thickness of a garden hose carrying identical power.

Why does this matter? In a data center, space is engineered to the millimeter. Cable routing, thermal management, redundancy systems—everything is tightly optimized. Reducing cable size by 90% creates cascading benefits. You need less cooling for the cables themselves. You need smaller conduits to route them. You have more physical space for server racks or improved ventilation. You can redesign your electrical room layout to be more efficient.

VEIR's demonstration also showed that the operational complexity didn't increase proportionally. You can't just swap HTS cables in where copper would go. You need cooling infrastructure (the liquid nitrogen circulation system). You need more sophisticated monitoring. But these aren't showstoppers—they're engineering challenges that well-funded teams can solve.

The project also validated something crucial: HTS cables work reliably in the vibration-heavy, thermally variable environment of an operating data center. Lab tests are fine, but real-world deployment is different. Proving that these cables maintain their superconducting properties while surrounded by high-powered servers generating waste heat was critical validation.

Energy Economics: The Math That Makes Sense

Let's talk about the financial case because that's ultimately what drives deployment. A large hyperscale data center costs

If superconducting cables could reduce transmission losses by 5-7% (converting them to near-zero), and reduce operational complexity enough to eliminate one cooling system, that compounds to substantial savings. On a 100 MW facility, that's

Now, what does it cost to upgrade the power infrastructure to superconducting? The cables themselves will be expensive initially—perhaps 2-3 times the cost of copper alternatives—and you need the liquid nitrogen cooling infrastructure. Industry estimates suggest this might add 15-25% to the capital cost of power infrastructure in a data center. For a

The math works. The payback period is 3-5 years, and then you have 10-15 years of pure operational savings. As manufacturing scales and HTS cable costs decline, the payback period shrinks.

The cost per kilometer of HTS tape is projected to decrease by 30-50% over the next five years due to increased production driven by fusion energy demand. Estimated data.

The Cooling Requirement: Liquid Nitrogen as Infrastructure

One aspect of superconducting cables that seems daunting but is actually manageable: the need for liquid nitrogen cooling. Superconductors lose their properties if they warm up above their critical temperature. For the high-temperature superconductors Microsoft is using, that critical point is around 77 Kelvin (minus 196 Celsius). Liquid nitrogen boils at exactly 77 Kelvin, making it ideal.

However, liquid nitrogen isn't some exotic laboratory substance that's hard to source. It's a standard industrial chemical produced in volume. Major gas companies like Air Liquide, Linde, and Praxair produce hundreds of millions of liters annually. The infrastructure to deliver, store, and handle liquid nitrogen is mature and well-understood.

In practice, a data center using HTS cables would need a dedicated liquid nitrogen supply line, similar to how industrial facilities receive other consumables. The nitrogen would circulate through cooling channels in the cables, maintaining the required temperature. The nitrogen itself would eventually evaporate, and the companies would simply order more, similar to how facilities manage other ongoing supplies.

The cost of liquid nitrogen has been declining for decades—roughly 3-4% annually as production has scaled. For the superconducting cable application, companies estimate the cooling cost at roughly 1-2 cents per megawatt-hour, which is trivial compared to the value of eliminated transmission losses.

One interesting operational consideration: the cooling system itself can fail. If the liquid nitrogen supply is interrupted, the superconductor warms above critical temperature and loses its special properties. However, the cable itself doesn't fail—it just reverts to being a normal conductor, though an inefficient one. This means you need redundancy and backup systems, but again, this is standard engineering.

Grid-Level Deployment: The Bigger Picture

While data center applications are the near-term focus, the transformative potential of superconducting cables lies in grid-scale deployment. Power transmission lines crisscrossing the continent are aging, inefficient, and increasingly insufficient for growing demand. Building new transmission corridors is environmentally contentious and takes a decade of permitting and environmental review.

Superconducting transmission lines solve multiple problems simultaneously. First, they move more power with less physical footprint. A single superconducting line can replace multiple copper lines. Second, they're more efficient, reducing losses by 90%. Third, they can handle more power in the same space, which means you can upgrade transmission capacity without building new corridors or requiring new right-of-way acquisitions.

This becomes critical when you consider data center deployment patterns. Tech companies want to build massive AI clusters near population centers where electricity already exists. But existing transmission infrastructure is often insufficient. You either need to build new transmission—which takes 10-15 years—or find ways to move more power through existing corridors. Superconductors enable the latter.

Microsoft and other tech companies are in conversations with major utilities about demonstration projects. Cities like Denver, Phoenix, and others with significant planned data center expansions are looking at how superconducting transmission could integrate with their grids. These aren't live projects yet, but the conversations are happening, and preliminary engineering studies are underway.

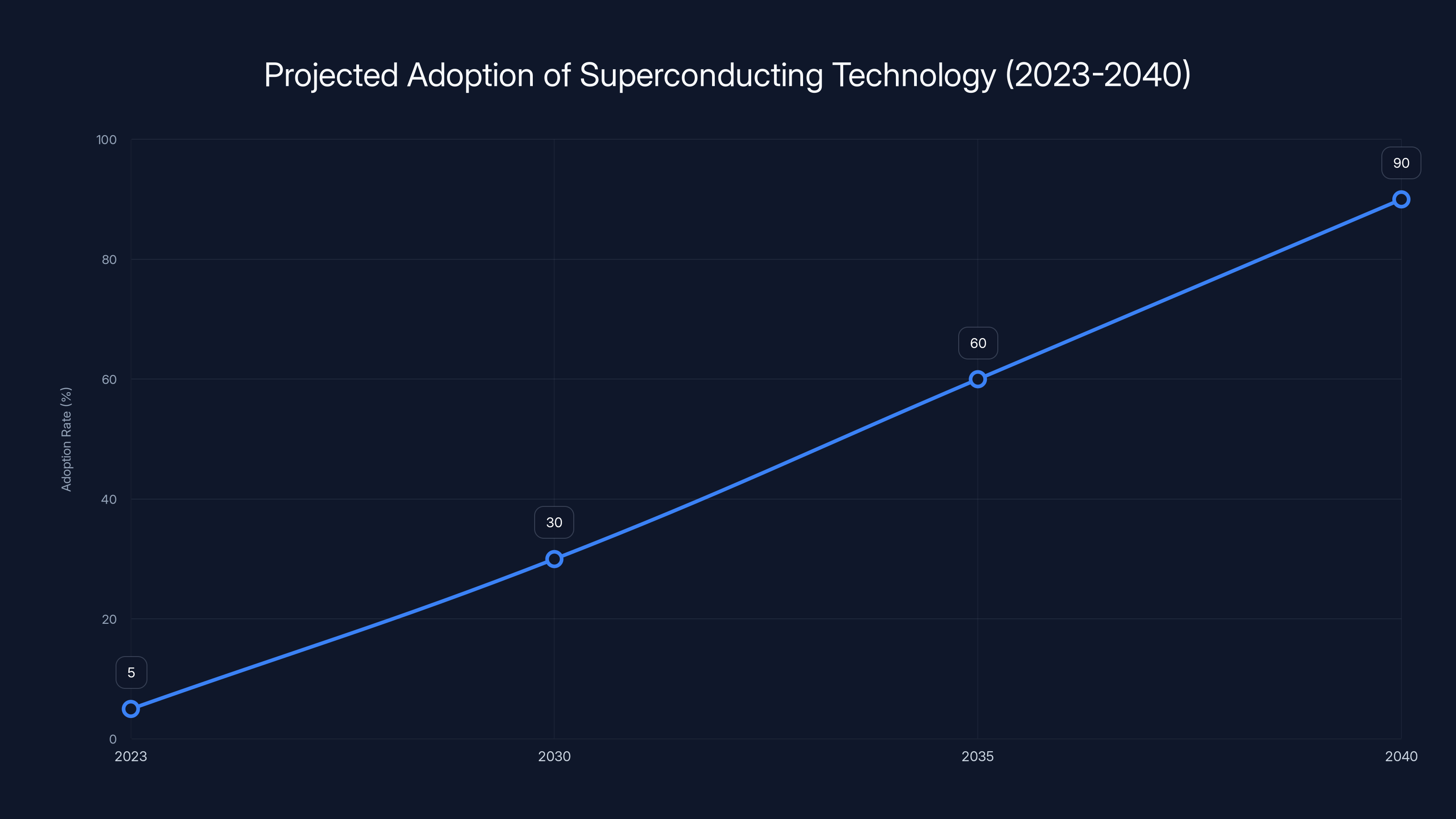

The timeline for grid deployment is longer than data center deployment. Utilities are conservative, regulatory approval takes time, and you need supply chains in place. But we're probably looking at the first commercial superconducting transmission projects launching in 2027-2030, with broader deployment ramping through the 2030s.

The Competition: Who Else Is Moving on Superconductors?

Microsoft isn't alone in recognizing the potential. Major cloud providers, including Amazon and Google, are exploring superconductor applications, though they've been less public about it. Hyperscale operators understand the physics and the economics, and they're all competing on efficiency.

On the manufacturing side, VEIR (the startup Microsoft funded) has become the poster child for HTS data center cables, but it's not alone. Companies like Nexans Superconductors, Composite Technology Development, and others are developing competing approaches. Some use different superconductor compositions. Others focus on different cooling systems. The competitive landscape is active and innovations are happening rapidly.

Utilities are also invested. Major transmission operators like Duke Energy, Southern Company, and others are funding research into superconducting transmission lines. There's genuine competition to be the first mover in practical, commercial deployment.

International competition matters too. China is investing heavily in superconductor research, partly because of the rare-earth dominance but also because they understand the strategic importance of this technology. Whoever deploys superconducting infrastructure at scale first will have massive competitive advantages in AI and data center efficiency.

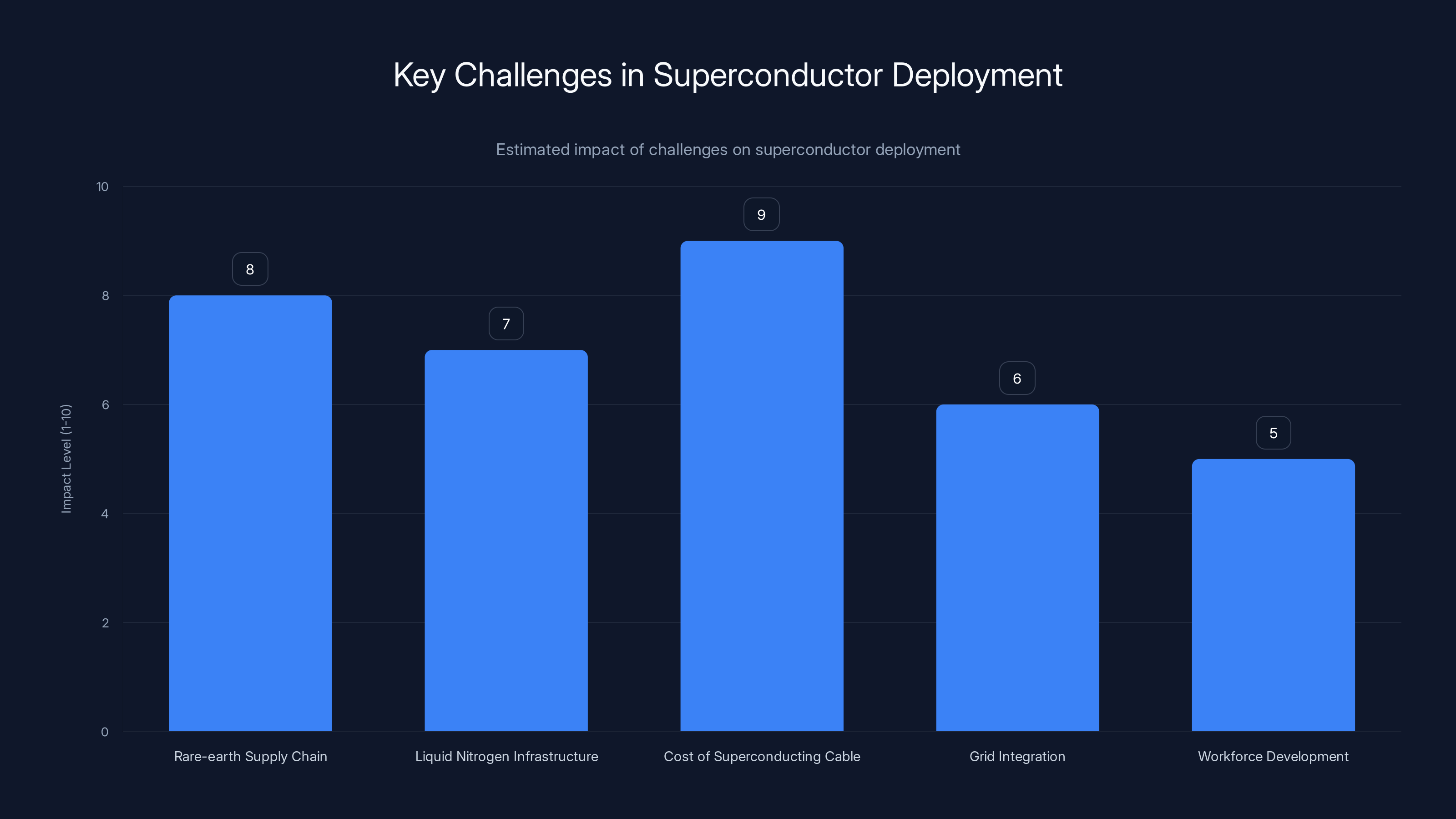

The cost of superconducting cable and rare-earth supply chain issues are the most significant challenges, with impact levels estimated at 9 and 8, respectively. Estimated data.

Timeline to Deployment: Realistic Expectations

Here's the honest timeline based on current progress. For data center internal applications (cables routing power within the facility): first commercial deployments will likely happen in 2026. Microsoft and other hyperscalers are actively planning their first full superconductor installations now. These will likely be new, purpose-built facilities where superconductors are part of the original design rather than retrofits.

These early deployments will be expensive and require specialized expertise. You'll need engineers trained in superconductor systems, specialized installation teams, ongoing monitoring. But the technology will be proven at scale, which will unlock the next wave of deployment.

For large-scale transmission line deployment: timeline is 2028-2030 for first commercial projects. The permitting and coordination required means we're talking 3-4 years of engineering and regulatory work before the first line goes live. Once the first grid-scale project succeeds, others will follow more quickly.

For mainstream, commodity deployment across data centers globally: that's a 2032-2035 story. By then, manufacturing costs will have dropped, supply chains will be established, engineering best practices will be documented, and trained technician availability will have increased significantly.

This isn't crazy-far future. It's 5-10 years. Companies making infrastructure decisions today should absolutely factor in superconductor capabilities as part of their longer-term roadmaps.

Challenges Still to Overcome

Despite the excitement, substantial challenges remain. First, the rare-earth supply chain concentration in China creates geopolitical exposure. Any serious effort to deploy superconductors at scale will need to either build alternative supply capacity in other regions or develop superconductor compositions that don't require specific rare-earth elements. Research is happening on both fronts, but it's not solved yet.

Second, the liquid nitrogen supply chain, while mature, isn't distributed the way industrial companies need for continental deployment. Building infrastructure to deliver and manage liquid nitrogen at thousands of data center and grid locations requires investment in new storage facilities, transport networks, and supplier relationships.

Third, the cost of superconducting cable itself needs to continue declining. Manufacturing volumes must increase, and costs must drop 40-60% from current levels to make grid-scale deployment cost-competitive with traditional infrastructure on a lifecycle basis. This is happening, but not guaranteed.

Fourth, there are legitimate technical challenges in grid integration. Superconducting transmission lines behave differently electrically than copper lines. Grid operators need new monitoring, control, and protection systems. Standards need to be developed. These are solvable problems, but they require time and coordination.

Fifth, the workforce needs development. Installing, maintaining, and operating superconducting infrastructure requires specialized knowledge. Universities and training programs need to catch up to create the workforce that will be needed in 5-10 years.

Environmental Implications: More Than Just Efficiency

The environmental case for superconductors extends beyond just saving electricity. First, reduced power losses mean less waste heat entering the atmosphere. Data centers already generate enormous amounts of waste heat that must be managed and dispersed. Reducing transmission losses means less heat to manage.

Second, if superconductors enable more efficient power transmission, they make long-distance renewable energy transfer viable. Wind and solar resources are often located far from population centers. Currently, transmitting electricity that far results in 10-15% losses. Superconducting lines could reduce that to near-zero. This would make it economically feasible to build massive renewable energy projects far from grid centers and transmit power efficiently to where it's needed.

Third, more efficient transmission infrastructure means less need to build new transmission corridors. Less construction means less environmental disruption in sensitive areas. This matters more than people realize—transmission corridor acquisition and environmental review often takes longer than the actual construction and generates significant community opposition.

However, superconductors aren't a complete environmental solution. They don't solve the fundamental problem that data centers consume enormous amounts of electricity. They make that consumption more efficient, which is important, but not transformative on a global scale unless paired with renewable energy expansion.

The real environmental win comes when you combine superconducting infrastructure with massive renewable energy deployment. Efficient grids enable efficient use of renewable sources. That's the combination that could meaningfully reduce data center carbon footprints.

Superconducting technology is projected to become standard infrastructure by 2040, with significant adoption starting in the 2030s. Estimated data.

Industry Reactions and Market Sentiment

Industry reaction to Microsoft's superconductor initiative has been remarkably positive. Equipment manufacturers see new products and solutions. Utilities see ways to defer massive transmission infrastructure investments. Data center operators see efficiency improvements. Even environmental groups see potential benefits.

The main skepticism comes from two places. First, some experts worry about over-optimism and timeline slippage. They've heard promises about superconductor commercialization before (most famously from fusion energy, which has been "20 years away" for 50 years). They're cautious about believing transformation timelines of 5-10 years.

Second, some are concerned that focusing on efficiency improvements pulls attention away from more fundamental solutions: using less data, running AI models more efficiently, deploying computation at the edge rather than in centralized data centers. These are valid concerns, but not necessarily in conflict. Superconductors can coexist with these other approaches.

Investor sentiment has been increasingly bullish on superconductor companies. VEIR, the startup Microsoft funded, raised significant venture capital in 2024 specifically to scale production. Stock prices of superconductor material manufacturers have appreciated notably. The market is pricing in near-term commercialization.

The Competitive Dynamics: Who Wins?

In this emerging superconductor ecosystem, several groups have advantages. First, companies that secure supply contracts for HTS tape early will have manufacturing capacity reserved when demand ramps up. Microsoft's funding of VEIR is partly about securing partnership and potentially supply agreements.

Second, utilities that move first on transmission projects will develop expertise and standards that others follow. Being the first utility with a successful superconducting transmission line deployed is worth billions in competitive advantage over the next decade.

Third, data center operators who incorporate superconductors into their next generation of facilities will see cost advantages that compound over the facility's 15-20 year lifetime. This creates cost-of-operation advantages that affect pricing power and profitability.

Fourth, equipment manufacturers that develop superconductor-compatible systems (cooling, monitoring, control) will capture market share. This includes cooling system manufacturers, monitoring equipment makers, and control system providers.

The competitive dynamic is healthy. We're seeing genuine competition between multiple approaches to superconductor systems, multiple manufacturers, multiple potential deployment use cases. That competition will accelerate innovation and drive costs down faster than monopolistic dominance would.

What This Means for AI and Data Infrastructure

Ultimately, superconductor deployment is about enabling the next generation of AI infrastructure. The current bottleneck in AI capability isn't compute speed or programming capability—it's power and physical space. Companies want to build bigger, more capable models, and the limiting factor is how much power and cooling they can fit in a facility.

Superconductors remove one major constraint: the size and weight of power distribution infrastructure. This enables more efficient use of physical space and eliminates parasitic power losses. That means you can deliver more computational capacity per unit of physical space, which translates to more capable AI models deployable in constrained environments.

Over the next 5-10 years, we'll see a split in data center infrastructure. Legacy facilities running on copper-based infrastructure will become increasingly expensive to operate. New facilities designed with superconductors will have efficiency advantages that translate directly to cost advantages. This will accelerate consolidation toward operators who deploy advanced infrastructure.

For the broader AI industry, more efficient infrastructure means AI capability deployment becomes less constrained by power and space, which means innovation can accelerate. Models can get larger and more capable without hitting hard limits on infrastructure constraints.

But it also means the companies best positioned to leverage this technology—those with capital to invest in cutting-edge infrastructure, supply chain relationships to secure HTS materials, and engineering teams capable of deploying novel technology—will pull further ahead. The barrier to entry for competing in hyperscale AI increases.

VEIR's HTS cables achieve the same power output as conventional copper cables at only 1/10th the cross-sectional area, significantly reducing space requirements in data centers.

Future Projections: The 2030s and Beyond

Assuming current trajectories hold (and there are legitimate uncertainties), by 2030 we should see: (1) superconducting cables in standard use within new hyperscale data centers, deployed by Microsoft, Amazon, Google, and others; (2) first generation commercial superconducting transmission lines operating in several regions; (3) HTS tape manufacturing capacity increased 5-10x from current levels, with costs down 40-60%; (4) engineering standards and best practices documented and widely known.

By 2035, superconducting infrastructure should be the standard for new data center and transmission projects. Retrofit projects on existing infrastructure will begin as costs decline. The competitive disadvantage of using traditional copper infrastructure will become pronounced.

By 2040, superconductor deployment will have transitioned from "advanced technology" to "standard infrastructure," similar to how fiber optic cables went from exotic to ubiquitous.

These projections assume normal technology adoption curves and no major supply chain disruptions. The risks that could accelerate deployment: breakthrough in alternative superconductor materials that don't require rare-earth elements. The risks that could slow deployment: geopolitical disruption of rare-earth supply, unexpected technical challenges in grid integration, or simply slower-than-projected manufacturing capacity expansion.

But the base case is that superconductors go from interesting research project to standard infrastructure over the next 10 years. Companies making infrastructure decisions should factor this into their planning.

The Role of Competition in Driving Innovation

One underappreciated factor in superconductor development is how competitive dynamics accelerate progress. Multiple cloud providers competing on efficiency. Multiple utilities competing to deploy first. Multiple equipment manufacturers competing for market share. Multiple superconductor companies competing for contracts.

This competition drives innovation, reduces costs, and accelerates deployment timelines. Companies are willing to take risks and invest capital because they see competitive disadvantage in falling behind.

This also explains why we're seeing more announcements and movement now than in previous decades. The convergence of AI-driven infrastructure demands, supply chain improvements driven by fusion research, and genuine commercial competition has created perfect conditions for this technology to move from lab to deployment.

Making Sense of the Hype

It's fair to be somewhat skeptical. Superconductor hype cycles have happened before. "Room-temperature superconductors are just around the corner" is a perennial claim that keeps turning out to be further away than expected. But this particular push is different.

First, the focus is on high-temperature superconductors (77K), not room-temperature superconductors, which are genuinely very far away. The technology needed already exists.

Second, the economic drivers are genuine and urgent. Data center operators actually need this. Utilities actually have pressure to upgrade transmission. The demand is real, not speculative.

Third, we have proof of concept. VEIR's demonstration wasn't a projection—it was an actual superconducting system operating at full power in a real data center environment.

Fourth, manufacturing capacity is actively being built, not promised for sometime in the future. Manufacturers are making capital investments to scale production.

Does this mean timeline predictions are perfect? Absolutely not. Engineering timelines slip. Unexpected problems emerge. But the trajectory is real, and the next 5-10 years should see genuine deployment progress.

What You Should Do With This Information

If you work in infrastructure, energy, or technology, superconductors should be on your radar. This isn't theoretical anymore—it's becoming practical deployment reality.

If you work in utilities, start conversations with your transmission operators and grid planners about superconductor opportunities. The first utilities to deploy will establish standards that others follow.

If you work in data center operations, start evaluating superconductor compatibility in your facility design process. Even if you don't deploy in the next 2-3 years, designing for future compatibility is smart.

If you work in equipment manufacturing, understand how your products will integrate with superconductor systems. This is becoming a core competency.

If you're investing in infrastructure or energy companies, superconductor progress should factor into your analysis of long-term competitive positioning.

The superconductor revolution isn't coming in 2026. But it's real, it's moving from laboratory to deployment, and companies positioning themselves now will have significant advantages over those waking up in 2028 and realizing they've fallen behind.

FAQ

What are high-temperature superconductors and how do they work?

High-temperature superconductors (HTS) are materials that exhibit zero electrical resistance when cooled below a critical temperature, typically around 77 Kelvin (the boiling point of liquid nitrogen). These materials are made of compounds like yttrium barium copper oxide that allow electrons to move without any friction or energy loss, enabling electricity to flow perfectly efficiently through specially designed cables or transmission lines.

Why do data centers need superconducting cables?

Data centers need superconducting cables because they dramatically reduce energy waste in power distribution (from 5-7% losses to near-zero), allow smaller cable dimensions that save physical space, and reduce cooling requirements. These benefits translate directly to lower operating costs and more efficient use of facility real estate, which becomes critical as AI computing demands scale exponentially.

What are the main challenges preventing widespread superconductor deployment?

The primary challenges include scaling manufacturing capacity to meet demand (currently production is limited), managing the supply chain for rare-earth materials concentrated in China, establishing liquid nitrogen delivery infrastructure in new regions, developing workforce expertise in superconductor installation and maintenance, and creating regulatory standards and grid integration protocols for large-scale transmission deployment.

How much does it cost to deploy superconducting infrastructure compared to traditional copper infrastructure?

Initially, superconducting infrastructure costs about 2-3 times more than copper alternatives due to the cable material costs and cooling system requirements. However, over a facility's 15-20 year lifespan, operational savings from eliminated transmission losses (typically $5-7 million annually for a 100 MW facility) and reduced cooling complexity create payback periods of 3-5 years, after which it becomes cost-competitive and superior.

When will superconducting cables become standard in data centers?

Based on current progress, superconducting cables should begin appearing in new hyperscale data centers by 2026-2027, become more commonplace by 2030-2032, and achieve full mainstream adoption by the mid-2030s. The timeline depends on manufacturing capacity scaling, cost reductions, and supply chain maturation for liquid nitrogen distribution and rare-earth materials.

Can superconductors be retrofitted into existing data centers?

Retrofitting superconductors into existing facilities is technically possible but complex and expensive, involving reconfiguration of power distribution systems and installation of new cooling infrastructure. Most industry experts expect superconductors to be incorporated into new facility designs rather than retrofitted into legacy infrastructure, at least in the next decade.

What happens if liquid nitrogen cooling fails in a superconducting system?

If the liquid nitrogen supply is interrupted, the superconducting cable simply reverts to behaving as a normal conductor with normal (high) electrical resistance, temporarily losing its efficiency advantage. The cable itself doesn't fail—it simply becomes less efficient until cooling is restored. This is why data center designs include redundancy and backup cooling systems, similar to power grid backup protocols.

Will superconductors help solve data center environmental impacts?

Superconductors contribute to environmental benefits by reducing transmission losses (which eliminates wasted heat), enabling more efficient long-distance power transmission (making remote renewable energy deployment viable), and reducing the need for new transmission corridors (avoiding environmental disruption). However, they address efficiency, not fundamental electricity consumption—data centers will still consume massive amounts of power, but more efficiently.

How does China's rare-earth dominance affect superconductor deployment?

China controls roughly 70% of global rare-earth mining and refining, creating potential supply chain vulnerabilities for superconductor production. However, the amount of rare-earth material in each superconducting cable is relatively small, and research is underway on alternative superconductor compositions and recycling methods. Alternative sourcing and processing capacity in other countries is also being developed to reduce dependence.

What companies are leading superconductor technology development?

Key players include VEIR (Microsoft-backed startup focused on data center applications), Superconductor Technologies Inc., Southwire (diversified manufacturer), Furukawa (Japanese manufacturer), Nexans Superconductors, and various university research programs. Additionally, major cloud providers (Amazon, Google) and utilities are funding research, though they're typically less public about their specific superconductor initiatives compared to Microsoft.

The Bottom Line

Microsoft's push into superconducting infrastructure isn't a gamble on exotic future technology—it's a pragmatic response to present constraints. Data centers need to be bigger and more efficient. Power grids need to move more electricity with less waste. These are today's problems requiring tomorrow's solutions. Superconductors solve both.

The technology is ready. The economics work. The supply chains are developing. The competition is intense. The timeline is realistic. Over the next 5-10 years, superconducting cables will transition from research projects to standard infrastructure in hyperscale facilities.

For companies building AI infrastructure, deploying this technology early provides years of cost and efficiency advantages. For utilities managing power grids, early deployment positions them as innovators and efficiency leaders. For equipment manufacturers and service providers, the market opportunity is substantial.

For the broader AI industry, more efficient infrastructure removes one category of constraint on compute scaling, which means AI capability progression can accelerate. Superconductors aren't a magic bullet that solves all infrastructure challenges, but they're one of the few technological levers that can meaningfully improve data center and transmission efficiency at scale.

The superconductor revolution in infrastructure won't arrive overnight. But it's arriving, and the companies and organizations moving now will be the ones setting standards and capturing value when it does.

Key Takeaways

- High-temperature superconductors eliminate 95% of electrical transmission losses, reducing waste heat and operational costs dramatically

- Microsoft's partnership with VEIR demonstrated superconducting cables delivering full power loads with 1/10th the cable dimensions of copper alternatives

- First commercial deployments in data centers expected 2026-2027, with grid-scale transmission projects following in 2028-2030

- Payback periods of 3-5 years make superconductor infrastructure economically competitive despite higher upfront costs

- Manufacturing capacity scaling and rare-earth supply chain maturation remain critical challenges, but progress is accelerating driven by fusion research demand

- Superconductor adoption will create competitive advantages in AI infrastructure efficiency and cost of operations over the next decade

Related Articles

- Zettlab D6 Ultra NAS Review: AI Storage Done Right [2025]

- Runway's $315M Funding Round and the Future of AI World Models [2025]

- Deploying AI Agents at Scale: Real Lessons From 20+ Agents [2025]

- Nvidia RTX 5090 Ti Release Date: Why 2025 Isn't Happening [2025]

- Network Modernization for AI & Quantum Success [2025]

- New York's Data Center Moratorium: What the 3-Year Pause Means [2025]

![Microsoft's Superconducting Data Centers: The Future of AI Infrastructure [2025]](https://tryrunable.com/blog/microsoft-s-superconducting-data-centers-the-future-of-ai-in/image-1-1770741634114.jpg)