The Best Budgeting App Deal Right Now: Monarch Money at 50% Off

If you've been putting off getting your finances organized, this is the moment. Monarch Money, one of the best budgeting apps available today, is running a limited-time promotion for new users:

The fact that budgeting apps have become actually useful in the last few years still surprises me. Remember when budgeting meant opening a spreadsheet and manually typing in transactions? Those dark days are behind us. Modern budgeting apps connect directly to your bank accounts, automatically categorize your spending, show you where your money actually goes, and help you build healthier financial habits without the spreadsheet headache.

Monarch Money hits on all these points, but it goes deeper. This isn't just an app that shows you pie charts of where you spent money last month. It's built for people who want serious control over their finances, whether you're saving for something specific, trying to eliminate debt, planning with a partner, or just tired of not knowing why your bank account is smaller every month.

In this guide, we're breaking down what makes Monarch Money stand out, walking through its actual features (not just marketing claims), showing you real-world use cases, comparing it to other budgeting apps you've probably heard of, and explaining whether that $50 deal is worth jumping on. Spoiler: it is.

TL; DR

- The Deal: Monarch Money costs 100 regular price**

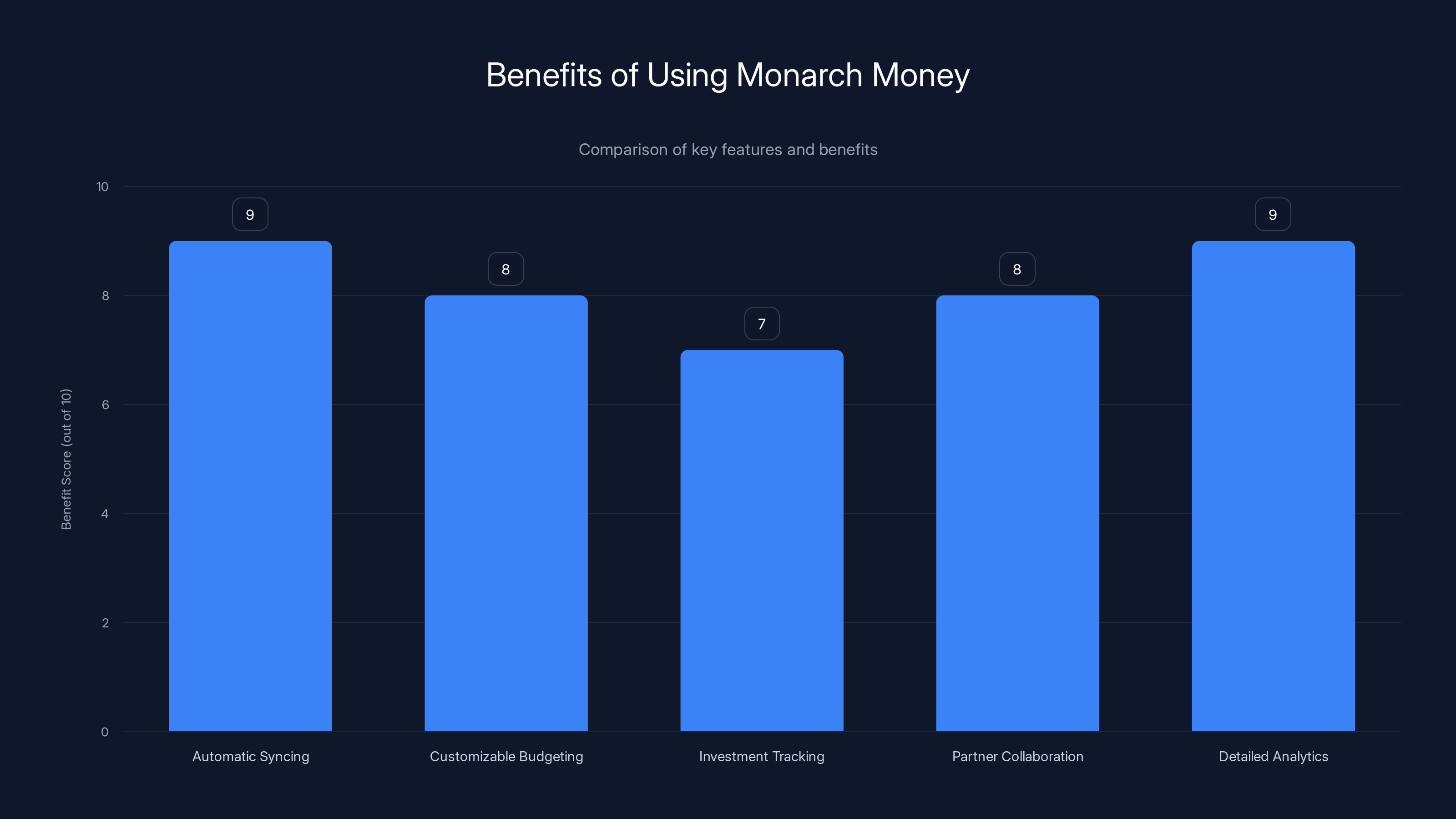

- What You Get: Connection to unlimited bank accounts, customizable budgeting approaches, transaction categorization, investment tracking, partner collaboration features, and detailed spending analytics

- The Learning Curve: Monarch Money is more complex than simple budgeting apps like Goodbudget, which means more power but also a steeper setup process

- Mobile vs Web: The iOS and Android apps are slick, but the web version has more features—sometimes creating a confusing experience

- Best For: People who want granular control, couples managing money together, or anyone tired of generic budgeting tools

- Bottom Line: At $50/year for new users, it's worth experimenting with, especially if you're serious about understanding and controlling your spending

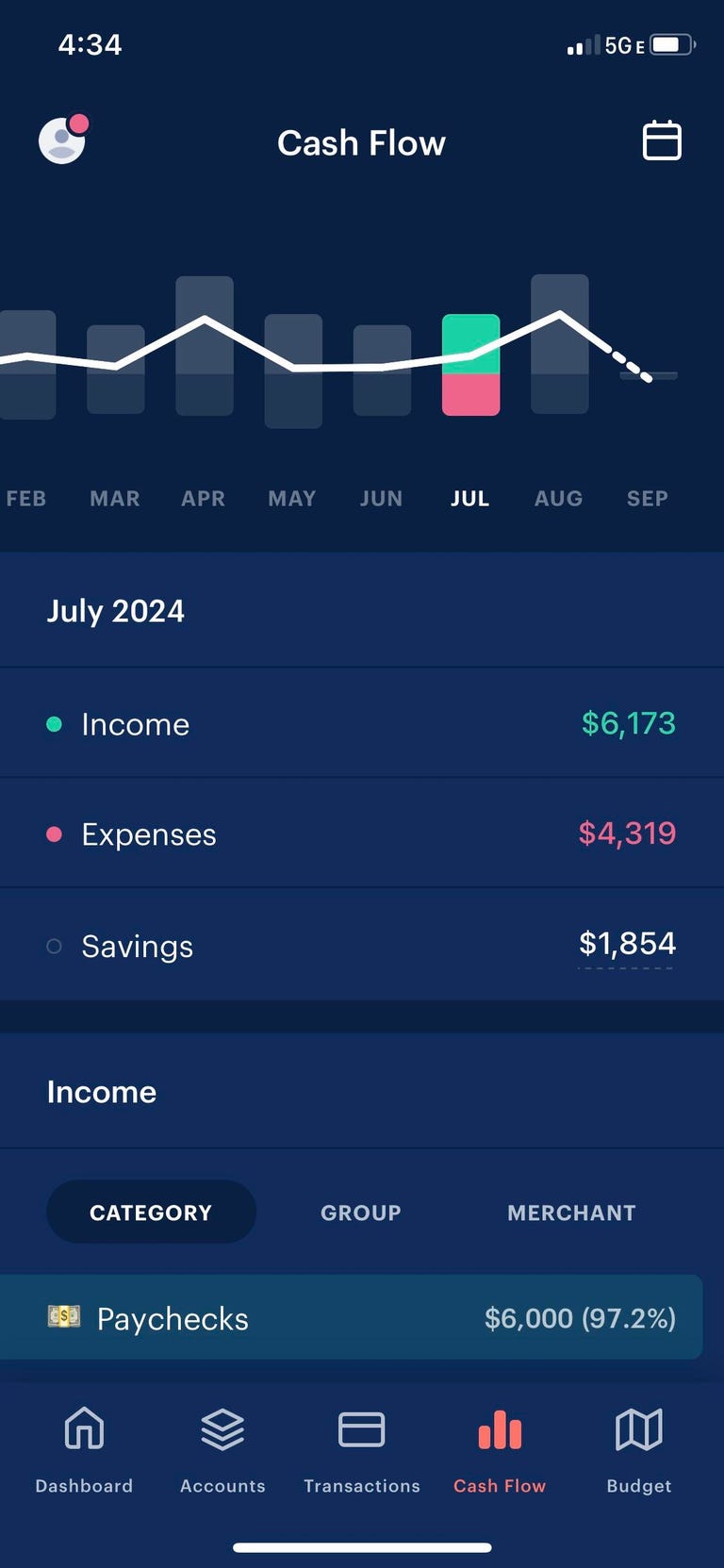

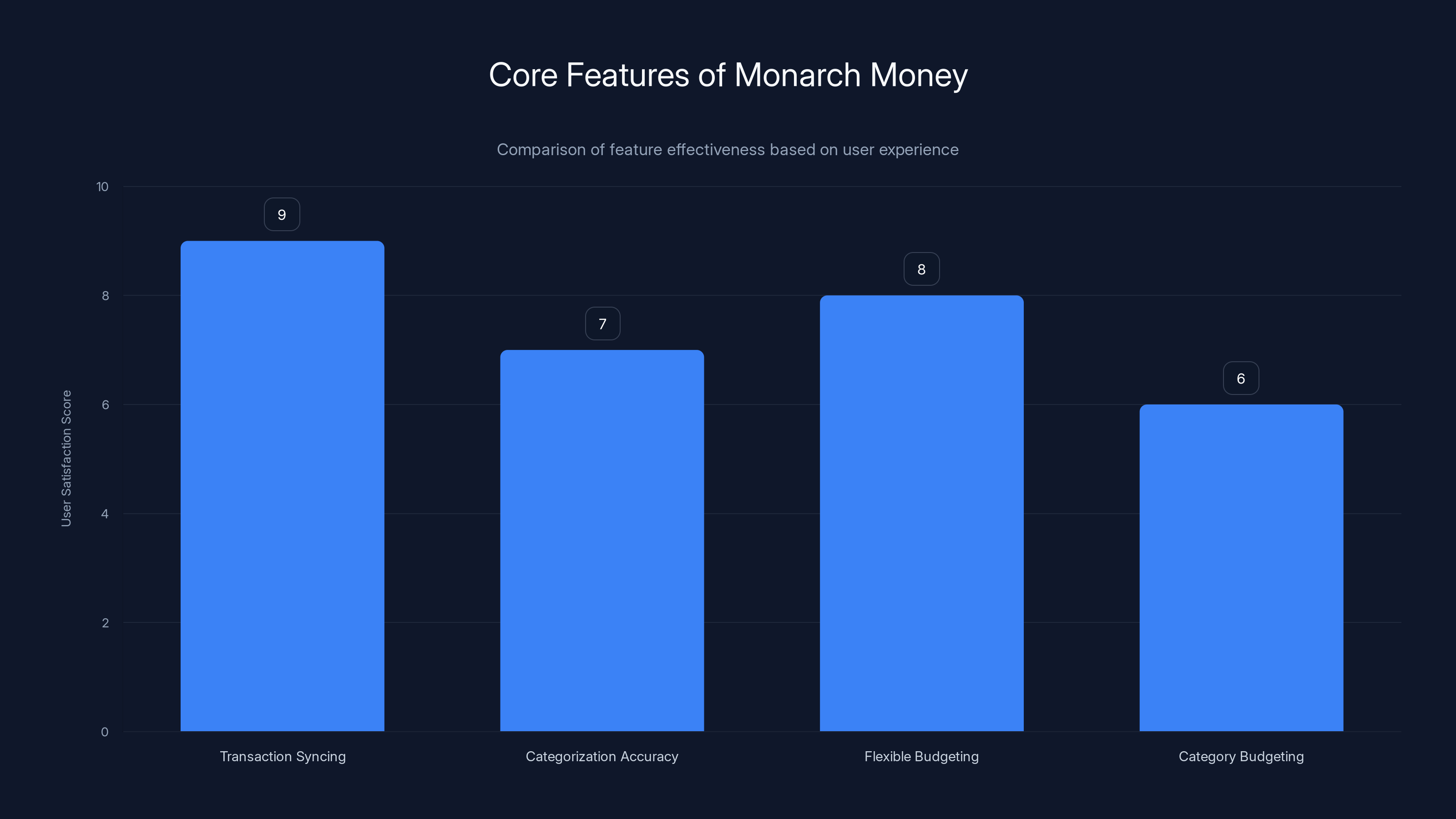

Automatic transaction syncing scores highest in user satisfaction, highlighting its importance in reducing budgeting friction. Estimated data based on typical user feedback.

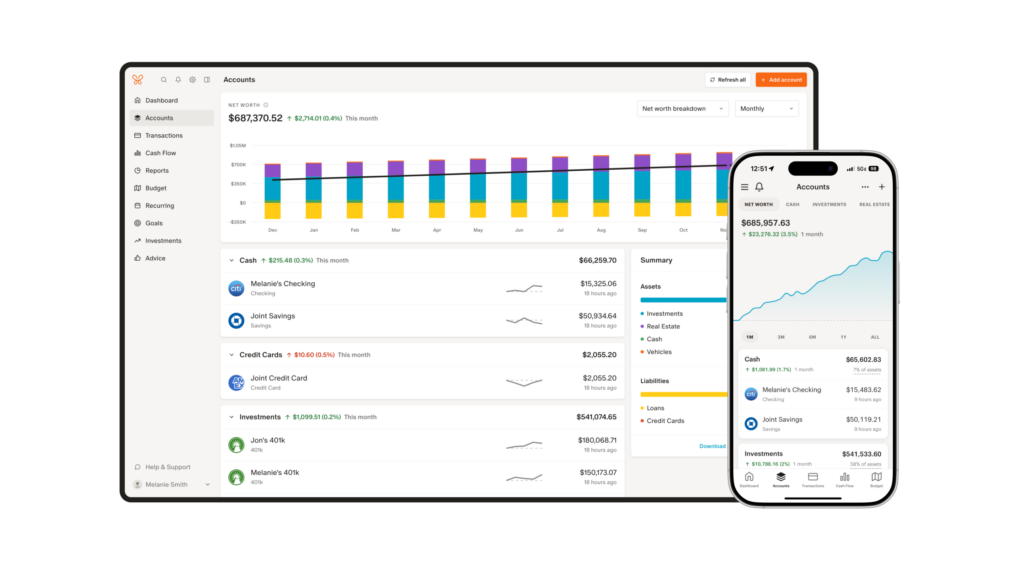

What Is Monarch Money, Really?

Let's start with the basics, but I'll go deeper than "app that tracks spending" because that's what every budgeting app claims.

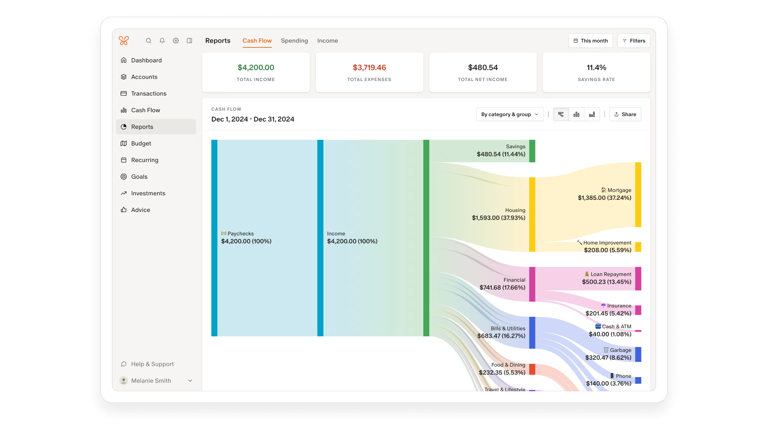

Monarch Money is a personal finance management platform that connects to your bank accounts, credit cards, investment accounts, and cryptocurrency wallets. Once connected, it automatically downloads your transactions, categorizes them, and presents them back to you in ways that actually make sense. Instead of looking at a list of 47 random transactions and trying to figure out if you're overspending on food, Monarch shows you exactly how much you spent on groceries, restaurants, coffee, and everything else, broken down by category.

But here's where it gets interesting: Monarch doesn't force you into one budgeting methodology. Some people thrive with strict category-based budgets ("I'm allocating $400 to groceries this month"). Others find that suffocating and prefer flexible spending tracking ("Let me see where the money went and adjust next month"). Monarch supports both approaches, which means it adapts to how you actually think about money rather than forcing you into a system that might not fit your brain.

It works across platforms. You can use it on iOS, Android, iPad, or the web. There's a Chrome extension that automatically syncs transactions from Amazon and Target, saving you from manually logging shopping sprees. If you're in a relationship and share finances, you can invite a partner to collaborate on budgeting in one shared account, which solves a real problem that couples deal with: the "wait, did you already spend that?" conversation.

The app also tracks investments and cryptocurrency if you have those accounts connected. It monitors your net worth over time. It can show you spending trends—like whether you're actually spending less on takeout than you think you are (spoiler: you're probably not). It creates detailed reports you can review monthly or whenever you want to check in on your financial health.

Think of it as a financial command center. Not quite as comprehensive as working with a financial advisor, but way more detailed than scrolling through your banking app.

How the $50/Year Deal Works (And Whether It's Actually a Good Price)

New users can currently use the code NEWYEAR2026 at checkout to get 50% off their first year. That brings the annual subscription down from

That's less than $4.17 per month. To give you context: a decent lunch costs more than a month of Monarch Money. Most subscription services you probably use (Netflix, Spotify, gym membership) cost significantly more. Even a basic financial advisor relationship would cost you thousands per year.

But the real question isn't whether

Here's the thing about budgeting apps: the free ones are increasingly limited, and the premium ones actually work. You could use a free app like Goodbudget or YNAB's reduced-feature tier, but you'll quickly hit walls. Monarch Money's paid tier gives you unlimited account connections, full investment tracking, all the analytics features, and partner collaboration. These aren't marketing fluff—they're features that actually change how useful the app is.

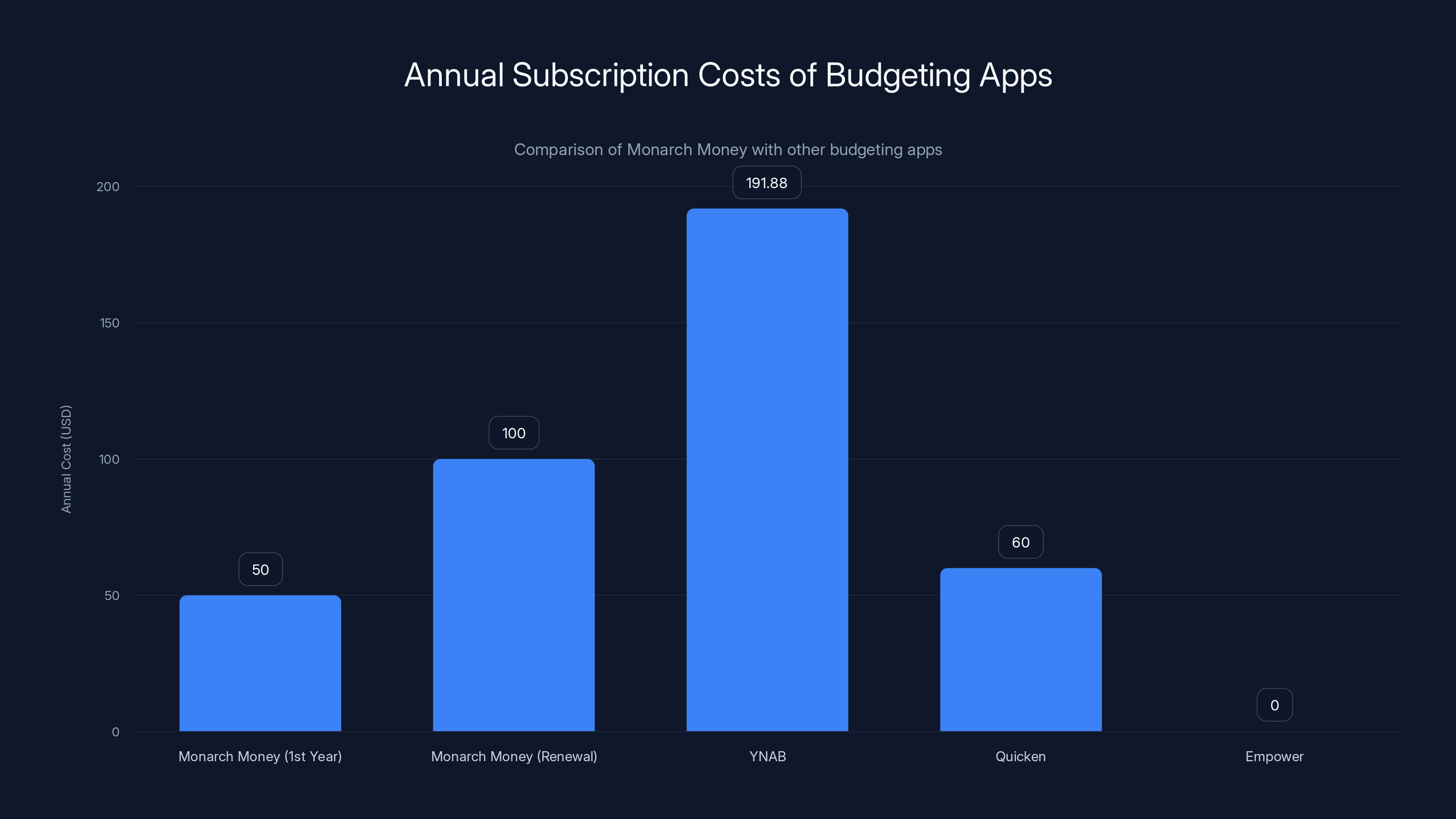

Compared to other premium budgeting apps, Monarch Money is competitively priced. You Need a Budget (YNAB) costs

One more thing: this deal is specifically for new users. If you're an existing Monarch Money subscriber, this won't apply. And it's time-limited, so if you're thinking about trying it, there's an actual reason to act now rather than "eventually."

Monarch Money excels in automatic syncing and detailed analytics, providing comprehensive financial management tools. Estimated data based on typical feature importance.

Core Features That Actually Matter

Let's go past the marketing bullet points and talk about what you actually get when you open Monarch Money.

Automatic Transaction Syncing and Categorization

When you connect your bank account, Monarch pulls in all your transactions—usually within a few hours, sometimes faster. Instead of manually entering each purchase (which would make you give up on budgeting by week two), the app automatically downloads them.

Then it categorizes them. That

Now, the AI isn't perfect. Sometimes it misses. That charge from Home Depot might be mislabeled. That weird transaction from a vendor you don't recognize might end up in the wrong category. But here's the beauty: you fix it once, and the app learns. Next time it sees a transaction from that vendor, it remembers. The categorization gets smarter over time.

This alone saves you enormous time. I'm not exaggerating when I say this is the difference between "I'll totally budget this year" and actually sticking with it. The friction is gone.

Multiple Budgeting Methodologies

Monarch Money offers two main budgeting approaches.

Flexible Budgeting is more forgiving. You set spending targets for categories ("I want to spend around $300 on groceries"), but if you go over, the world doesn't end. It's more about understanding patterns and gently guiding your spending than rigid control. This works well if you have unpredictable months or hate feeling constrained.

Category Budgeting is stricter. You allocate specific amounts to specific categories, and the app tracks whether you're under or over. If you allocate

Both approaches can be used in the same app, and you can switch between them. Some months might call for flexible budgeting (during the holidays, maybe), while other months benefit from category budgeting. The fact that Monarch doesn't force one approach is a huge advantage over apps that are rigid about methodology.

Investment and Net Worth Tracking

Monarch Money isn't just about tracking daily spending. If you have investment accounts (401k, brokerage, crypto), you can connect them too. The app shows your total net worth, breaks it down by account type, and tracks how it changes over time.

This is useful for reasons that might not be immediately obvious. First, it gives you a complete financial picture. You can see that while you spent $4,200 last month, your net worth actually increased because your investments went up. That changes the psychological weight of spending—you're not just losing money, you're shifting it between accounts.

Second, it helps you spot problems. If your investments are underperforming compared to benchmarks, the data is right there. If you have cash sitting in a checking account that should probably be invested, you can see it.

Third, for people getting serious about wealth building (not just spending less), net worth tracking is essential. It's the metric that actually matters in the long term. Monarch Money keeps it visible.

Partner Collaboration

If you're sharing finances with someone else—a spouse, a long-term partner, a roommate you split expenses with—Monarch Money lets you invite them to your account. You can see transactions together, manage budgets jointly, and have a shared view of your financial situation.

This solves a real problem. Without this feature, one person manages the budgeting and the other person is left in the dark. Or you both manage separate apps and can't see the full picture. With shared access, you can have real conversations about spending because you're both working from the same data.

I'll be honest: this feature occasionally surfaces conversations couples would prefer to avoid ("Why did we spend $600 on Door Dash this month?"). But those are conversations that need to happen, and at least now you're having them based on facts rather than vague feelings about spending.

Detailed Analytics and Reports

Monarch Money generates multiple types of reports. Spending breakdowns by category. Spending trends over time. Comparison of your spending this month to last month. Analysis of where your income went.

You can create custom reports for specific date ranges. You can compare different years ("Did I spend more on restaurants in 2024 or 2023?"). You can filter by category, account, or tag.

These aren't fancy for fancy's sake. When you're trying to understand your finances, you need visibility. These reports provide it. They're also useful for conversations with partners, for financial planning, or just for satisfying your curiosity about your own spending patterns.

Browser Extension and Mobile Widgets

Monarch Money offers a Chrome extension that syncs Amazon and Target transactions automatically. If you're an Amazon Prime member (and who isn't?), this saves you from manually logging purchases. Same with Target. It's a small feature, but it matters because those two retailers represent a huge portion of how many people spend money.

The mobile app also supports home screen widgets so you can see your budget status without opening the app. It's not life-changing, but it's a nice quality-of-life feature that keeps your budget visible.

Setting Up Monarch Money: The Reality

Here's where I need to be honest: setup takes longer than Monarch Money claims it does.

The company advertises a simple setup process, and technically, they're right. Connecting your first account takes maybe five minutes. Boom, you're in the app seeing your transactions.

But getting to the point where Monarch Money is actually useful takes longer. You need to review transactions and correct miscategorizations. You need to decide on your budgeting approach. You need to set budget amounts for your categories (which requires thinking about your actual spending). If you have a partner involved, you need to invite them and explain the system. If you have multiple accounts, connecting them takes a little longer than the first one because you're going through the same verification process multiple times.

Realistic timeline: expect one to two hours of setup for a single person with a few accounts. If you're doing this with a partner or you have complex finances (multiple accounts, investments, crypto), add another hour or two.

This isn't unique to Monarch Money. Most good budgeting apps require real setup. The apps that claim "two-minute setup" usually only get you to the point where you've connected one account and haven't actually set up budgeting yet.

The learning curve is real. Monarch Money is more complex than simple, minimal apps. The interface has more options. The features are deeper. This is a feature (power and flexibility) but it's also a genuine drawback (steeper learning curve). If you're someone who likes simple and minimal, this might feel overwhelming at first.

Monarch Money's Strengths (What It Does Really Well)

Let me be clear about where Monarch Money excels.

The Web Version Has Serious Depth

The web version of Monarch Money is genuinely impressive. It's not just a mobile app adapted for desktop. It has features that the mobile apps don't have, more detailed views, better analytics, and a more powerful interface. If you're doing serious financial planning or reviewing detailed reports, you probably want to use the web version.

This is good and bad, which I'll get to in a moment.

Multiple Account Connections

You can connect as many bank accounts, credit cards, investment accounts, and cryptocurrency wallets as you want. There's no limit. If you're someone with complex finances—maybe you have multiple checking accounts, a business account, several credit cards, investment accounts at different brokers, and some crypto holdings—Monarch Money handles it without nickel-and-diming you.

Compare this to some competitors that limit the number of connections on lower-tier plans. Monarch Money doesn't play that game.

Smart Categorization and Learning

The categorization isn't perfect out of the box, but it gets better. Monarch Money learns from your corrections. Tag a transaction incorrectly and fix it, and the app will remember that merchant. The system uses machine learning to improve categorization over time, and it works.

You can also create custom categories and tags, which means you can organize your finances however makes sense for you, not how the app designers think it should work.

Investment Tracking

For a budgeting app, investment tracking is usually an afterthought. But Monarch Money takes it seriously. You can connect investment accounts and see your full net worth in one place. This is useful for anyone who's building wealth and wants to see the complete picture.

Couple-Friendly Design

If you're managing finances with a partner, Monarch Money makes it relatively easy. You can invite them, see transactions together, and manage budgets jointly. The permission system lets you control who can make changes, so you don't end up with unexpected budget adjustments.

Other apps have this feature, but Monarch Money's implementation is particularly well thought out.

Monarch Money offers a competitive first-year price at

Where Monarch Money Falls Short

I need to be fair about the drawbacks too.

The Web/Mobile Disconnect Is Real

The web version and mobile apps have different features. Some things you can do on the web version aren't possible in the mobile app, and vice versa. This creates a confusing experience where you're not always sure whether something is unavailable or just in a different place.

For example, some advanced budget customization is easier on the web. Some quick actions are smoother on mobile. You end up switching between them depending on what you're trying to do, which defeats the purpose of having a unified app.

A good app would have feature parity across platforms. Monarch Money doesn't quite achieve this.

The Learning Curve

Monarch Money is not a pick-up-and-use app. If you're coming from a simpler budgeting app or no app at all, it's going to take time to understand all the features and how to use them effectively. The mobile app especially can feel overwhelming with all its options.

For some people, this complexity is a feature. For others, it's a dealbreaker. You need to know which type of person you are before committing.

Mobile App Stability Issues

During testing, the mobile app occasionally lagged or behaved unexpectedly. Not constantly, but often enough to notice. Loading a large number of transactions sometimes took a moment. The web version felt more stable.

That said, this is the kind of thing that improves with updates, and it's not so bad that it makes the app unusable. But it's worth knowing going in.

Account Connection Issues

Sometimes connecting to certain banks can be finicky. Most major banks work fine, but smaller regional banks or credit unions occasionally have issues. If your bank isn't well-supported, you might be manually uploading transactions, which defeats the purpose of automatic syncing.

Monarch Money is working on expanding bank coverage, but this is a limitation for some users.

How Monarch Money Compares to Other Budgeting Apps

Let's look at how Monarch stacks up against other popular budgeting tools.

Monarch Money vs. YNAB (You Need a Budget)

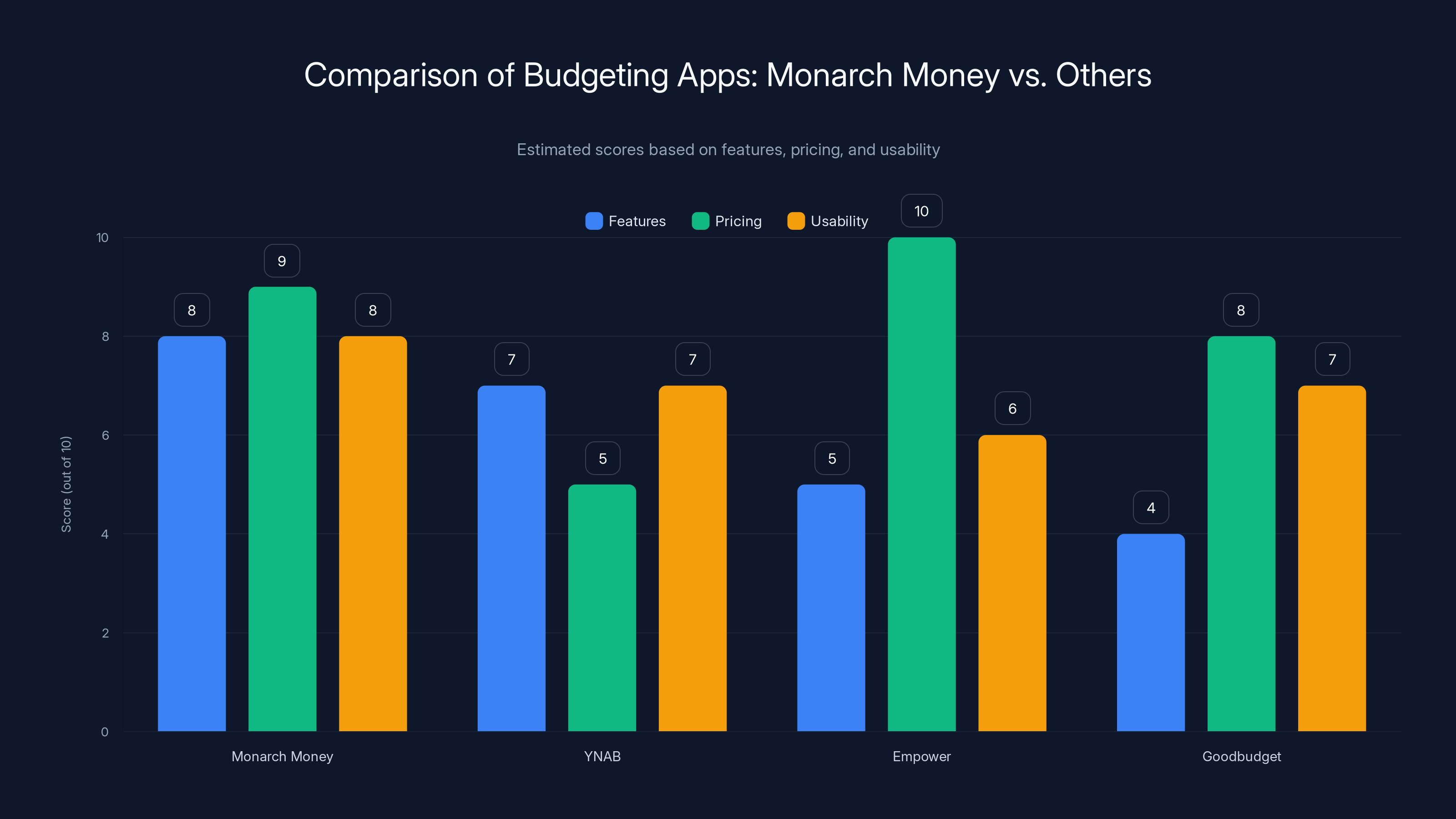

YNAB is the gold standard for intentional budgeting. It costs

YNAB's strength is behavioral change. It's designed to help you build better spending habits. Monarch Money's strength is comprehensive tracking and visibility.

If you want to be forced to think about every dollar you spend and aggressively change your behavior, YNAB is better. If you want to understand where your money goes without that level of intensity, Monarch Money is better.

Pricing: Monarch wins. YNAB costs about

Monarch Money vs. Personal Capital / Empower

Personal Capital (rebranded as Empower) is free but has fewer features than Monarch Money's paid tier. For basic budgeting and expense tracking, it's solid. If you also want investment management and robo-advisor services, Empower offers premium versions of those.

Monarch Money focuses purely on budgeting and personal finance tracking. It doesn't try to sell you investment services. For some people, that's cleaner. For others, the integrated approach of Empower is better.

Pricing: Empower is free (with paid upgrades). Monarch Money costs money but is cheaper than YNAB.

Monarch Money vs. Goodbudget

Goodbudget is simpler and lighter weight than Monarch Money. It uses an envelope system (digital version of the cash envelope method), which some people find intuitive. The free version is genuinely functional for basic budgeting.

Goodbudget doesn't have investment tracking or the same level of analytics that Monarch Money offers. It's more minimal. That's a strength if you want simplicity, a weakness if you want depth.

Monarch Money is more comprehensive. Goodbudget is simpler. Choose based on how much complexity you want.

Pricing: Goodbudget is free (with a paid version). Monarch Money costs $50-100/year.

Monarch Money vs. Rocket Money (formerly Truebill)

Rocket Money focuses on finding subscriptions you forgot about and savings opportunities. It's good at that specific task. For comprehensive budgeting, it's less robust than Monarch Money.

If subscription management is your main need, Rocket Money is excellent. If you want serious budgeting, Monarch Money is better.

Pricing: Rocket Money is free for basic features, with paid tiers for more advanced features.

The Real Comparison

In terms of pure budgeting features, Monarch Money offers more than most competitors for less money (at least for the first year). What you're trading is complexity in exchange for power. You need to be the type of person who wants that tradeoff.

Real-World Use Cases: When Monarch Money Actually Helps

Let's get concrete about scenarios where Monarch Money genuinely improves your financial life.

Scenario 1: The "Where'd All My Money Go" Person

You get to the end of the month and have no idea why your checking account is $2,000 lower than it was a month ago. You know you spent money, but it all feels like it disappeared into thin air. No major purchases, just... gone.

Monarch Money solves this immediately. Connect your accounts and you see exactly where the money went. Maybe you spent

Scenario 2: The Couple with Financial Disagreements

You and your partner have different spending habits. One person thinks the other spends too much, but there's no objective data, just feelings. Arguments ensue and nothing changes because you're not working from shared information.

Monarch Money creates objectivity. When you both see the same transactions, the same categories, and the same totals, you can have rational conversations about spending. "We're spending $800/month on restaurants" is a different conversation than "You're always wasting money on restaurants." One is solvable, one is a fight.

Scenario 3: The Person Building Wealth

You're not just trying to spend less. You're trying to build wealth. You have investment accounts, maybe some side income, maybe cryptocurrency. You want to see your complete financial picture.

Monarch Money shows your net worth and tracks how it changes over time. You can see that yes, you spent

Scenario 4: The Person Trying to Get Out of Debt

You have credit card debt and you're trying to pay it off. You need to understand how much money is actually available each month after necessities. You need to track progress toward paying down the debt.

Monarch Money shows you exactly what you're spending on necessities, what's discretionary, and therefore what you can allocate toward debt payoff. You can track your debt paydown progress month-by-month. You get the visual feedback of seeing that debt number get smaller, which is motivating.

Scenario 5: The Freelancer or Business Owner with Complex Income

Your income varies month-to-month. You have business expenses that are tax-deductible. You need to understand business finances separately from personal finances. You need to plan for taxes.

Monarch Money can handle multiple accounts and custom categorization, which means you can tag business expenses differently from personal expenses. You can see your actual business revenue and expenses. You're not perfect for business accounting (you'd need actual bookkeeping software for that), but for personal business financial tracking, Monarch Money works.

Monarch Money offers a balanced mix of features and usability at a competitive price, outperforming YNAB in cost and Empower in features. Estimated data based on typical user reviews.

Is the $50 Deal Worth Taking?

Let's be direct about this.

If you've been thinking about trying a budgeting app and haven't committed yet, this deal is your sign to do it. Fifty dollars for a year of Monarch Money is a low-risk way to figure out whether budgeting with this app actually improves your financial situation.

Worst case scenario: you try it for a month, realize it's not for you, and you've spent less than a decent dinner. You've lost nothing.

Best case scenario: you spend a few hours setting it up, you get real visibility into your spending, you realize you're wasting money on stuff you don't need, you cut back, and you save hundreds or thousands of dollars. The $50 pays for itself in days.

The only scenario where this deal isn't worth it is if you're certain you'll never use a budgeting app. If you know yourself well enough to know that you'll ignore it, then skip it. But if you're even slightly curious, the barrier to entry is low enough that you should try it.

One thing to remember: this is the deal for the first year. When you renew, it'll be

How to Get Started (Step by Step)

If you decide to try Monarch Money, here's how to do it properly.

Step 1: Use the Correct Code at Checkout

The code is NEWYEAR2026. It's case-sensitive, so type it exactly as shown. Apply it at checkout and you'll see the price drop from

Step 2: Connect Your Primary Checking Account First

Don't connect everything at once. Start with the account you use most often. Go through the account connection process (it usually involves logging into your bank through Monarch's secure connection). The app will pull in all recent transactions.

Step 3: Review and Correct Categorizations

Scroll through your transactions and fix any miscategorizations. The app learns from these corrections. Spend 15-20 minutes on this. Yes, it's tedious, but it's necessary for accurate tracking.

Step 4: Set Your Budgeting Approach

Decide whether you want flexible or category budgeting (or both). If category budgeting, decide on rough amounts for your major categories based on what you actually spent last month. Be realistic, not aspirational.

Step 5: Connect Additional Accounts Gradually

Over the next week or two, connect your other accounts. Credit cards, savings accounts, investment accounts, whatever applies to you. You don't need to do it all on day one.

Step 6: If You Have a Partner, Invite Them

Invite your partner or co-account manager. Explain the system. Give them access to the shared account. Plan to have an initial conversation about your financial goals and approach.

Step 7: Review Your First Month's Data

After a month of use, look at your reports. What surprised you? What do you want to change? This is when budgeting starts actually changing behavior.

Maximizing Your Monarch Money Experience

Once you've got the basics down, here are some advanced uses that actually matter.

Create Custom Categories That Match Your Life

Don't just use Monarch Money's default categories. Add custom categories for things that matter specifically to you. If you care about how much you spend on hobbies, create a hobbies category with subcategories. If you're tracking a specific goal (vacation savings, house fund), create a category for it. The more you tailor it to your actual life, the more useful it becomes.

Use Tags for Deeper Categorization

Beyond categories, you can tag transactions. You might tag restaurant spending by type (casual, date night, business). You might tag shopping by whether it's necessary or discretionary. Tags let you slice and dice your spending in ways that matter to you.

Review Reports Regularly

Don't just set it up and ignore it. Review your spending reports monthly. Look for patterns. Are there categories where you consistently overspend? Are there areas where you're doing well? Use this data to inform your next month's budget.

Use the Partner Collaboration Feature Properly

If you're using Monarch Money with a partner, don't just share the account and never talk about it. Have a monthly budget review conversation. Look at the reports together. Discuss spending. Celebrate when you hit goals. The app is a tool; communication is what actually makes a difference.

Track Progress Toward Financial Goals

Whether you're saving for a vacation, paying down debt, or building investments, use Monarch Money to track progress. The visualization of progress is motivating. Seeing that debt number get smaller or that savings goal get closer to complete actually changes behavior.

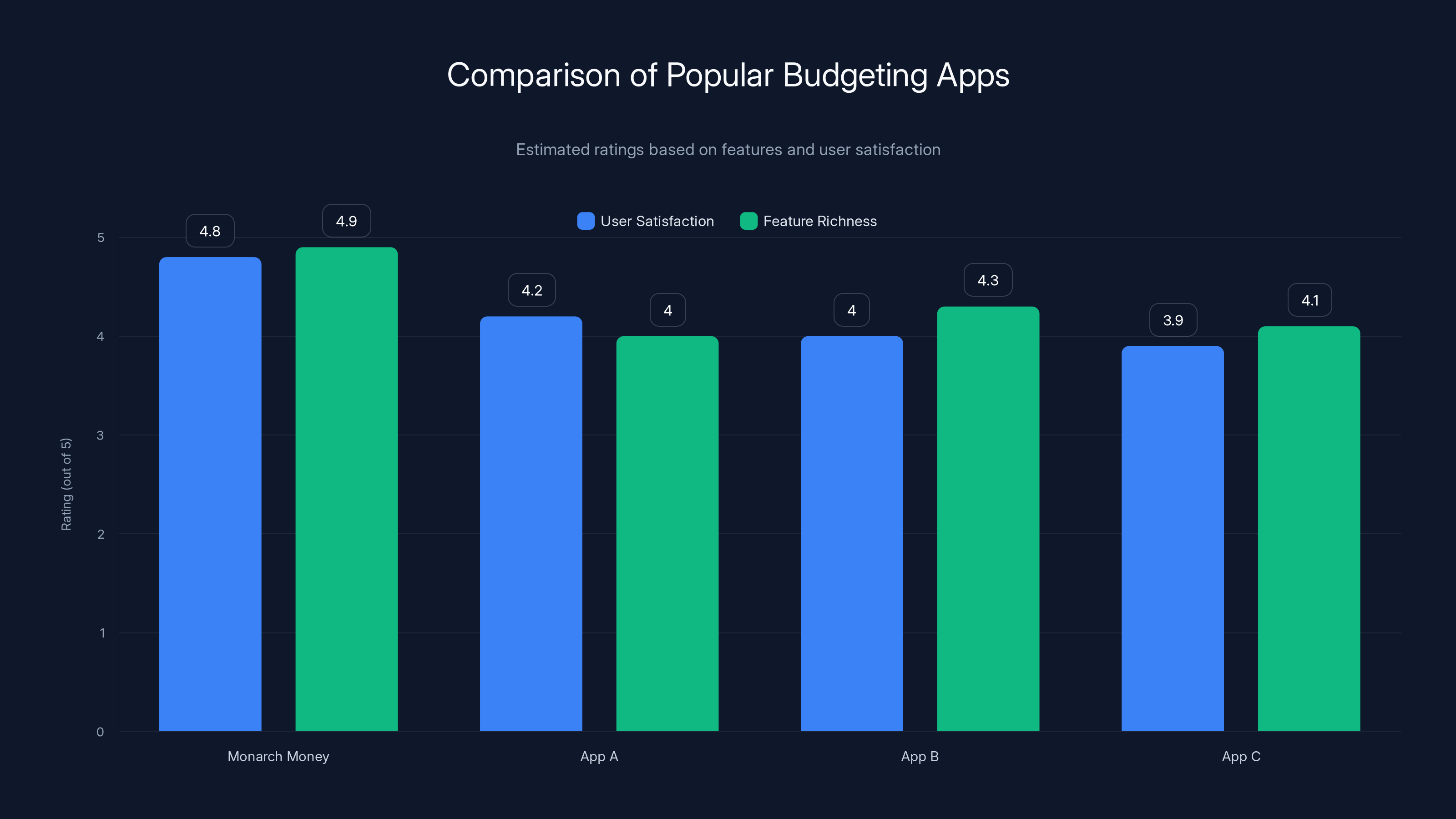

Monarch Money stands out with high user satisfaction and feature richness, making it a top choice among budgeting apps. Estimated data.

Common Questions and Potential Concerns

Let's address some things people worry about.

Is Connecting My Bank Account Safe?

Monarch Money uses bank-level encryption and security. They don't store your login credentials. The connections happen through secure API connections to your bank. From a security standpoint, it's as safe as any other legitimate financial service. You're not taking on additional risk by using Monarch Money. That said, always use a strong, unique password for Monarch Money itself (never reuse passwords across services).

What If My Bank Isn't Supported?

Monarch Money supports thousands of financial institutions, but not all of them. If your bank isn't supported, you can manually upload transactions via CSV or OFX file formats. It's less convenient than automatic syncing, but it works.

Will Monarch Money Help Me Spend Less?

Not automatically. The app provides visibility. What you do with that visibility is up to you. Some people see their spending data and make immediate changes. Others see it and don't change anything. The app is a tool that enables change, but you have to do the actual work. If you're looking for something that forces you to spend less without effort, you'll be disappointed. But if you want to understand your spending and make informed decisions, Monarch Money delivers.

What Happens If I Cancel?

You lose access to the app. Your data is deleted after a retention period (typically 30 days). If you resubscribe later, it's treated as a new subscription, so you wouldn't get the promotional pricing again.

How Often Is Data Updated?

Transactions typically sync multiple times per day, but it can vary depending on your financial institution. Most updates happen within a few hours of the transaction occurring. For real-time tracking, you might want to check manually, but for general budget tracking, the automatic updates are timely enough.

Can I Export My Data?

Yes. You can export transactions and reports in various formats. This is important for data portability and for creating backups. You're not locked in.

The Bottom Line: Should You Buy Monarch Money at $50?

Here's my honest take.

If you're currently not using any budgeting app and you're even slightly curious about where your money goes, buy it. The

If you're already using another budgeting app and it's working for you, there's less urgency. You could wait for another deal or just keep doing what you're doing.

If you've tried multiple budgeting apps and none of them have stuck, Monarch Money's depth and customization might be what finally works. It's more powerful and more flexible than simpler alternatives. That's worth trying.

What you shouldn't do is buy it thinking it will magically fix your finances. No app does that. But if you're willing to spend a few hours understanding your spending and making conscious decisions about it, Monarch Money is a great tool for that purpose.

The $50 price for the first year is genuinely a good deal. Compared to other premium budgeting apps, it's competitive. Compared to the time and money you might save by understanding your spending, it's essentially free.

If you're going to try budgeting, this is a good time and a good app to try it with.

Tips for Success with Any Budgeting App

While we're talking about budgeting, here's some advice that applies regardless of which app you use.

Start With Understanding, Not Judgment

When you first look at your spending data, you might feel guilty or shocked. "I spent WHAT on coffee?" This is normal. Don't use that feeling as an excuse to beat yourself up. Use it as information. You're building a baseline understanding of your actual spending patterns.

Don't Try to Cut Everything at Once

Some people look at their spending data, feel bad, and try to cut spending across the board immediately. That usually fails. Instead, pick one or two categories where you're okay with cutting back. Make those changes. See if they stick. Then tackle other categories.

Build the Budget From Actual Spending, Not Aspirational Spending

Don't set a

Review Monthly, but Don't Obsess

Look at your spending data monthly. More than that and you're probably obsessing. Less than that and you're losing the benefit of the visibility. Monthly is the right rhythm for most people.

Celebrate Wins, No Matter How Small

If you usually spend

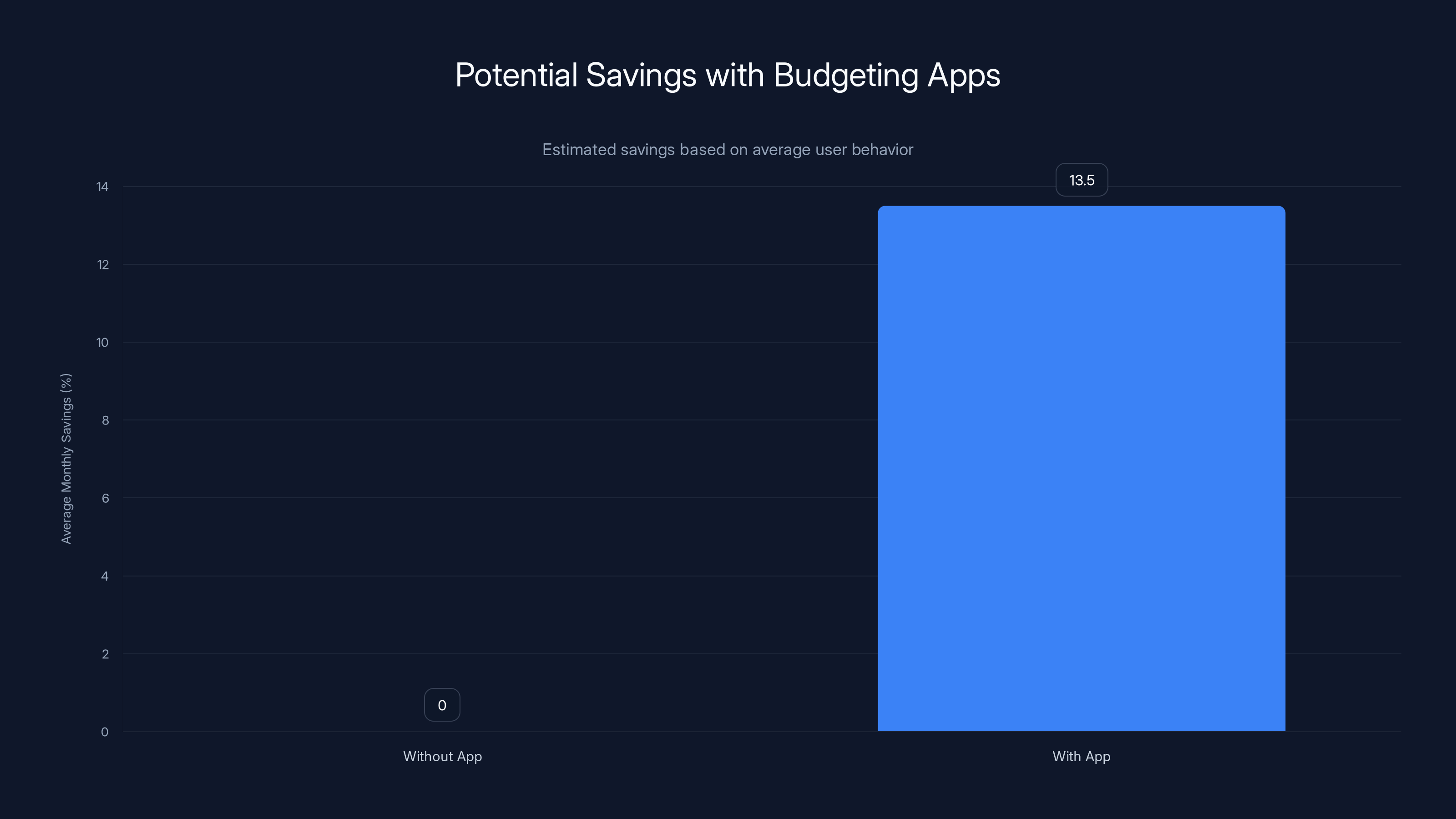

Users of budgeting apps save an estimated 12-15% more per month, making a $50/year app a worthwhile investment. Estimated data.

Alternative Approaches If Monarch Money Isn't Right for You

Not everyone needs a sophisticated app. Here are some alternatives depending on your situation.

For Minimalists: The Spreadsheet Approach

If you like simplicity, you can track spending in a basic spreadsheet. It's tedious because you're manually entering data, but some people actually prefer that—there's something about the manual entry that makes spending more real. You could use Google Sheets and create your own budget template.

For the Envelope Lover: Goodbudget or Green Light

If you liked the old envelope method of budgeting (allocating specific cash to specific purposes), digital envelope apps like Goodbudget recreate that system. You might find it more intuitive than Monarch Money's approach.

For the Minimal App User: Empower (Free Tier)

If you want basic expense tracking without the complexity, Empower's free tier does the basics: connect accounts, categorize spending, see reports. It's not as powerful as Monarch Money, but it's much simpler.

For the Serious Wealth Builder: Personal Capital / Empower Premium

If your main focus is investing and building wealth rather than just tracking spending, Empower's premium tiers include robo-advisor services and more sophisticated investment tracking.

For the Accountant Type: YNAB

If you want to be forced to account for every single dollar and you like a structured methodology, YNAB might be better. It's more intense than Monarch Money, but for some people, that intensity is what works.

What Monarch Money Could Improve

I mentioned some weaknesses earlier, but let me expand on what would make Monarch Money even better.

Feature Parity Between Web and Mobile

The single biggest improvement would be making sure everything that exists in one version exists in the other. Right now, the experience differs depending on which platform you're using. Fix that.

Better Mobile App Performance

The mobile app could be snappier, especially when dealing with large numbers of transactions. It's not terrible, but it could be smoother.

More Banks Integrated

Expanding the list of supported financial institutions would help. Some smaller banks and credit unions still aren't supported, which limits the usefulness for some users.

Better Reporting for Business Finances

If you're a freelancer or business owner, Monarch Money is decent but not specialized. Better business-specific reporting would make it more valuable for that use case.

Budgeting Templates

While you can create custom budgets, templates for common situations (50/30/20 rule, zero-based budgeting, etc.) would help people who don't know how to structure their budget from scratch.

Bill Reminders and Notifications

A feature to remind you about upcoming bills or subscriptions would be useful. The app doesn't currently do this proactively.

These aren't dealbreakers, just opportunities for improvement.

Making the Most of Your First Year

If you buy Monarch Money at the $50 rate, here's how to make sure you actually use it and benefit from it.

First Week: Setup and Exploration

Spend time understanding the app. Connect accounts, categorize transactions, explore all the different report types. Get comfortable with how it works.

Weeks 2-4: Monitor Without Judgment

Let the app run. Don't try to change spending yet. Just watch. Notice where the money goes. Let the data accumulate. Get surprised by what you discover.

Month 2: Start Making Adjustments

Now that you understand your baseline, pick one or two spending categories to reduce. Don't go overboard. Make small adjustments.

Months 3-12: Ongoing Refinement

Review monthly. Adjust budgets based on actual spending. Celebrate wins. Keep the conversation going if you're using this with a partner.

End of Year 1: Evaluate

Before the subscription renews at the full $100 price, evaluate whether you want to continue. Did Monarch Money change your financial life? Did it help you understand and reduce spending? Did it improve conversations with your partner about money? These answers will tell you whether to renew.

The Bigger Picture: Why Budgeting Matters Right Now

This deal is about more than saving $50 on an app. It's about taking control of your finances at a time when that's increasingly important.

Inflation has made everything more expensive. Wages haven't kept pace. The cost of housing, healthcare, and education have skyrocketed. In this environment, having a clear understanding of where your money goes and making intentional decisions about spending isn't luxury, it's necessity.

Most people can find

Beyond the pure financial aspect, there's the psychological benefit. Many people have a low-level anxiety about money because they're not exactly sure where they stand. That anxiety goes away when you have clear data about your finances. You might find out you're spending more than you thought, which is uncomfortable at first, but at least you're not wondering anymore.

Money is one of the biggest sources of stress for many people, and often that stress is because of lack of visibility, not actual lack of money. Monarch Money creates visibility. Visibility reduces stress.

FAQ

What is Monarch Money?

Monarch Money is a personal finance management app that connects to your bank accounts, credit cards, investments, and cryptocurrency wallets to track spending, create budgets, monitor net worth, and provide detailed financial analytics. It works across iOS, Android, iPad, web, and includes a Chrome extension for automatic Amazon and Target transaction syncing. The app supports multiple budgeting methodologies and allows partner collaboration for couples managing finances together.

How does Monarch Money work?

Once you connect your financial accounts to Monarch Money, the app automatically downloads your transactions, categorizes them intelligently, and presents them back to you in the form of budgets, spending breakdowns, and financial reports. You can choose between flexible or category-based budgeting, review your spending data, track your net worth, and share your financial information with a partner or co-manager. The app learns from your corrections to improve its automatic categorization over time.

What are the benefits of using Monarch Money?

Monarch Money provides comprehensive visibility into your spending patterns, helping you identify areas where you're overspending and make more intentional financial decisions. The benefits include automatic transaction syncing that eliminates manual data entry, customizable budgeting approaches that fit your financial style, investment and net worth tracking for a complete financial picture, partner collaboration features for couples managing finances together, and detailed analytics and reports that help you understand long-term spending trends. Research shows that people using budgeting apps save an average of 12-15% more per month by having clear visibility into their spending.

How much does Monarch Money cost?

Monarch Money is currently offering a promotional price of

How does Monarch Money compare to YNAB (You Need a Budget)?

YNAB costs

Is my bank data safe when connected to Monarch Money?

Monarch Money uses bank-level encryption and secure API connections to your financial institutions. The company does not store your banking login credentials. Your data security with Monarch Money is equivalent to any other legitimate financial service. To enhance security, always use a strong, unique password for Monarch Money itself and never reuse passwords across different services.

What if my bank isn't supported by Monarch Money?

While Monarch Money supports thousands of financial institutions, some smaller regional banks or credit unions may not be integrated. If your primary bank isn't supported, you can manually upload transactions using CSV or OFX file formats. Before subscribing, check Monarch Money's website to confirm that your bank is supported, as manual uploads are significantly less convenient than automatic syncing.

Can I use Monarch Money with a partner to manage shared finances?

Yes, Monarch Money includes partner collaboration features. You can invite a co-manager to your account, allowing both of you to view transactions, manage budgets jointly, and discuss spending from a shared data perspective. This feature is particularly useful for couples managing finances together or any situation where multiple people need visibility into shared accounts. You can control permission levels so partners can view accounts without necessarily having the ability to make all changes.

Will Monarch Money help me spend less money?

Monarch Money provides visibility into your spending, which enables better decision-making, but the app doesn't automatically reduce your spending. The tool reveals where your money goes, allowing you to make conscious choices about that spending. Some users dramatically reduce spending after seeing their data, while others see the data and choose not to change. The app's value depends on your willingness to act on the information it provides. If you're looking for something that forces reduced spending without personal effort, this app won't accomplish that.

How long does it take to set up Monarch Money?

While initial account connection takes about 5 minutes, getting Monarch Money to the point where it's actually useful typically requires 1-2 hours for single users with multiple accounts. This includes reviewing and correcting transaction categorizations, deciding on a budgeting approach, setting initial budget amounts, and exploring all features. Couples or users with complex finances (multiple accounts, investments, cryptocurrency) should expect 2-3 additional hours for full setup. This upfront investment is necessary for accurate tracking and meaningful results.

What's the difference between Monarch Money's web and mobile versions?

Monarch Money's web version is more feature-complete and powerful, with more detailed views, better analytics, and a more comprehensive interface. The mobile apps for iOS and Android are designed for quick access and monitoring but have fewer features than the web version. This difference in feature sets can be frustrating because some customizations and advanced analyses are easier or only available on the web version, creating an inconsistent experience across platforms. For serious financial planning or detailed reporting, the web version is typically better.

Can I export my data from Monarch Money?

Yes, you can export your transactions, budgets, and reports from Monarch Money in various formats. This ensures data portability and allows you to create backups of your financial information. You are not locked into Monarch Money and can take your data with you if you decide to switch to another service.

Conclusion

Monarch Money at $50 for the first year is a solid entry point into serious personal finance management. It's not perfect. The web-mobile disconnect is real. The learning curve exists. The mobile app could be snappier. But these are relatively minor issues compared to what the app actually delivers.

For people who want comprehensive visibility into their finances, who want to understand exactly where their money goes, who want to make informed decisions about spending, or who want to manage finances collaboratively with a partner, Monarch Money works. It works particularly well at this promotional price, which removes the friction of the decision.

What surprises most people when they first use Monarch Money isn't just how much they're spending on certain categories. It's how liberating clarity actually feels. When you know where your money is going, you can make real decisions about it. That knowledge alone often drives meaningful changes in spending behavior.

If you've been thinking about taking your finances seriously, this is a good time. The promotion is temporary. The learning curve gets easier the more you use the app. And a hundred dollars a year (or fifty for the first year) is genuinely affordable for a tool that could save you thousands annually.

The code is NEWYEAR2026. Use it. Try the app. Give yourself a real chance to benefit from it by actually using it for a full month. You'll either find it valuable or you'll confirm that budgeting apps aren't for you. Either way, fifty dollars is a small price for that clarity.

Key Takeaways

- Monarch Money is offering 50% off (100 annual price

- The app provides comprehensive spending tracking, customizable budgeting approaches, investment tracking, and partner collaboration features

- Setup takes 1-2 hours for proper categorization, but users save an average of 12-15% monthly by having spending visibility

- Monarch Money's main drawbacks are the learning curve and feature inconsistency between web and mobile versions

- At 191.88/year) and more feature-rich than free options like Empower

Related Articles

- Monarch Money Deal: $50 for One Year (50% Off) [2025]

- Best Budgeting Apps 2025: Complete Guide After Mint Shutdown

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

- Best Mint Alternatives in 2025: Complete Guide to Top Budgeting Apps

- TurboTax Discount Codes & Coupons: Save Up to 54% [2026]

![Monarch Money Budgeting App: $50/Year Deal + Complete Review [2025]](https://tryrunable.com/blog/monarch-money-budgeting-app-50-year-deal-complete-review-202/image-1-1768570746079.jpg)