Netflix's $72B Warner Bros. Deal: How All-Cash Strategy Defeats Paramount [2025]

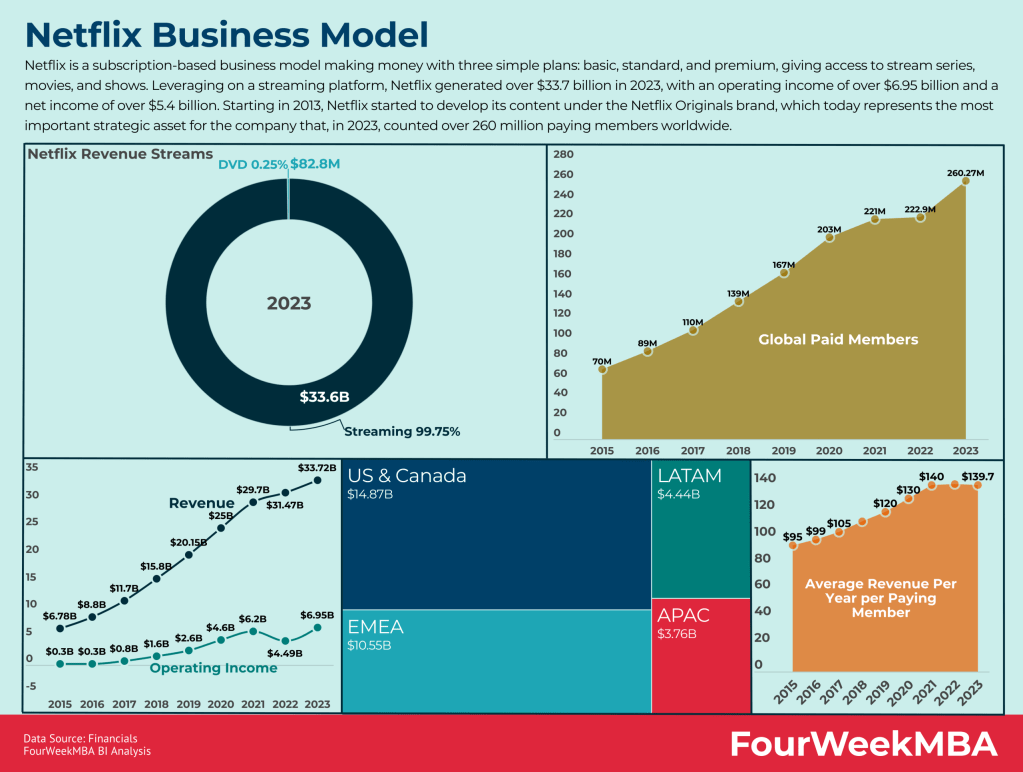

The streaming wars just escalated into territory that makes most corporate boardrooms look tame. Netflix announced it would pay all cash for Warner Bros. Discovery instead of the original mix of cash and stock, a tactical move that fundamentally changes the competitive landscape in entertainment and media consolidation. According to Yahoo Finance, this strategic shift was designed to fend off a hostile takeover attempt by Paramount.

Here's what happened: Netflix and Warner Bros. were supposed to close a

Netflix's response? Stop the bleeding. Remove uncertainty. Pay in cash. The move eliminates a financial variable that Paramount has been exploiting in its legal offensive, as noted by Netflix's investor relations.

What makes this moment significant isn't just the size of the deal—it's what it reveals about how streaming consolidation actually works, what competitive pressures exist in the industry, and why traditional media companies are desperately trying to avoid irrelevance. The cash offer changes everything about the negotiation dynamics, the shareholder vote, and Paramount's ability to claim Netflix can't close the deal.

Let's break down what's actually happening here, why it matters, and what comes next.

TL; DR

- Netflix converts $72B Warner Bros. deal to all-cash to eliminate collar risk and shareholder uncertainty as Paramount pursues hostile takeover, as detailed by Prestige Online.

- Paramount's $108.4B bid faces structural obstacles including junk credit rating, negative cash flows, and complex debt financing requirements, according to Seeking Alpha.

- Cash offer strengthens Netflix's position by removing stock price variability and accelerating shareholder vote to April 2026, as reported by Variety.

- Warner Bros. spinoff strategy creates separate Discovery Global entity, making Paramount's full acquisition impossible, as noted by TechCrunch.

- Legal battles are just beginning with Paramount lawsuit targeting disclosure inadequacies and valuation claims, as covered by Ars Technica.

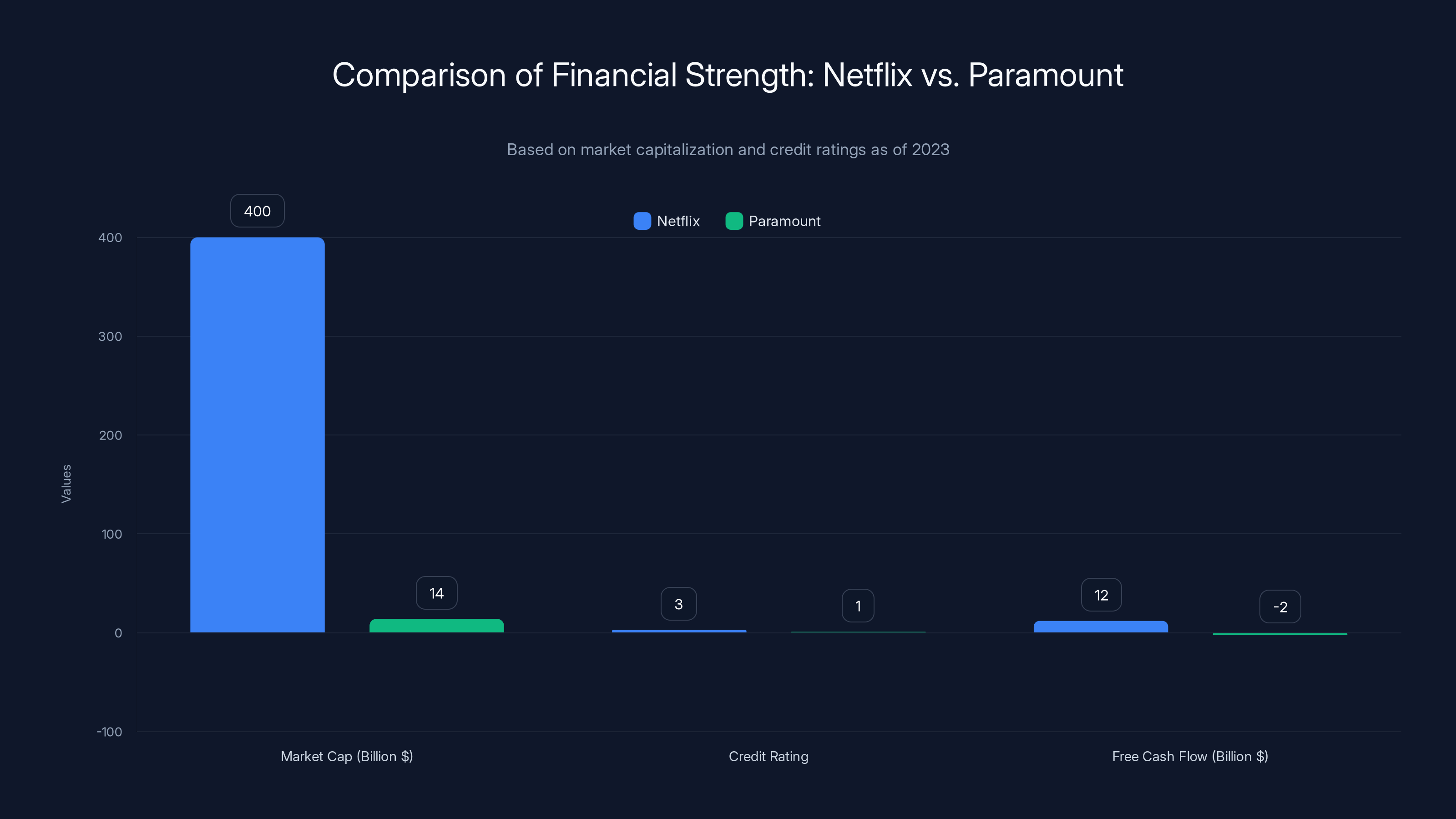

Netflix demonstrates superior financial strength with a market cap of

The Original Deal Structure and Why It Mattered

When Netflix first announced its Warner Bros. acquisition, the financial structure looked straightforward on the surface but carried hidden risks beneath. Netflix agreed to pay

But here's where stock deals become dangerous. The market price of Netflix shares fluctuates constantly based on earnings, competitor actions, investor sentiment, and macroeconomic conditions. Between the announcement of a deal and its closing months later, a lot can change. If Netflix stock drops significantly, shareholders receiving those shares as payment get less value than they bargained for. If it rises, they benefit. This uncertainty, called deal risk, affects how shareholder confidence plays out.

Warner Bros. shareholders were protected by something called a "collar." If Netflix stock fell below

But here's the problem: by late 2025, Netflix stock had already dropped to around $88, well below the collar floor. This created a situation where shareholders might worry, "Will Netflix stock keep falling? Will I end up getting even less value? Should I accept Paramount's offer instead?" That uncertainty was a weapon Paramount could exploit, as highlighted by Simply Wall St.

Why Netflix Made the All-Cash Move: Strategic Analysis

Netflix's decision to pay all cash for Warner Bros. is a calculated power move, but it's also a response to genuine threats. Let's examine what Netflix was actually solving.

First, the cash offer eliminates the collar problem entirely. Warner Bros. shareholders no longer have to worry about whether Netflix stock will bounce back. They get their $27.75 per share in actual dollars, full stop. This removes a major source of uncertainty that Paramount was weaponizing in its competing bid, as noted by Netflix's official announcement.

Second, it accelerates the shareholder vote. The original mixed structure required more regulatory scrutiny and complex documentation. An all-cash deal is simpler to execute, allowing Warner Bros. to accelerate the shareholder vote to April 2026. The faster the vote happens, the less time Paramount has to organize shareholder opposition or drag the situation through courts, as reported by Variety.

Third, it demonstrates financial strength and certainty. Netflix has approximately

Fourth, it changes the narrative with shareholders. Instead of asking shareholders to bet on Netflix's stock price recovery, Netflix is asking them to accept guaranteed cash at a predetermined price. Psychologically, this is far more attractive to risk-averse shareholders who just want certainty.

From a financial engineering perspective, Netflix can fund this through three channels: cash on hand, available credit facilities, and committed financing. This isn't Netflix burning through its war chest recklessly. It's a structured financing approach that preserves balance sheet flexibility while achieving the strategic objective of blocking Paramount, as explained by Netflix's investor relations.

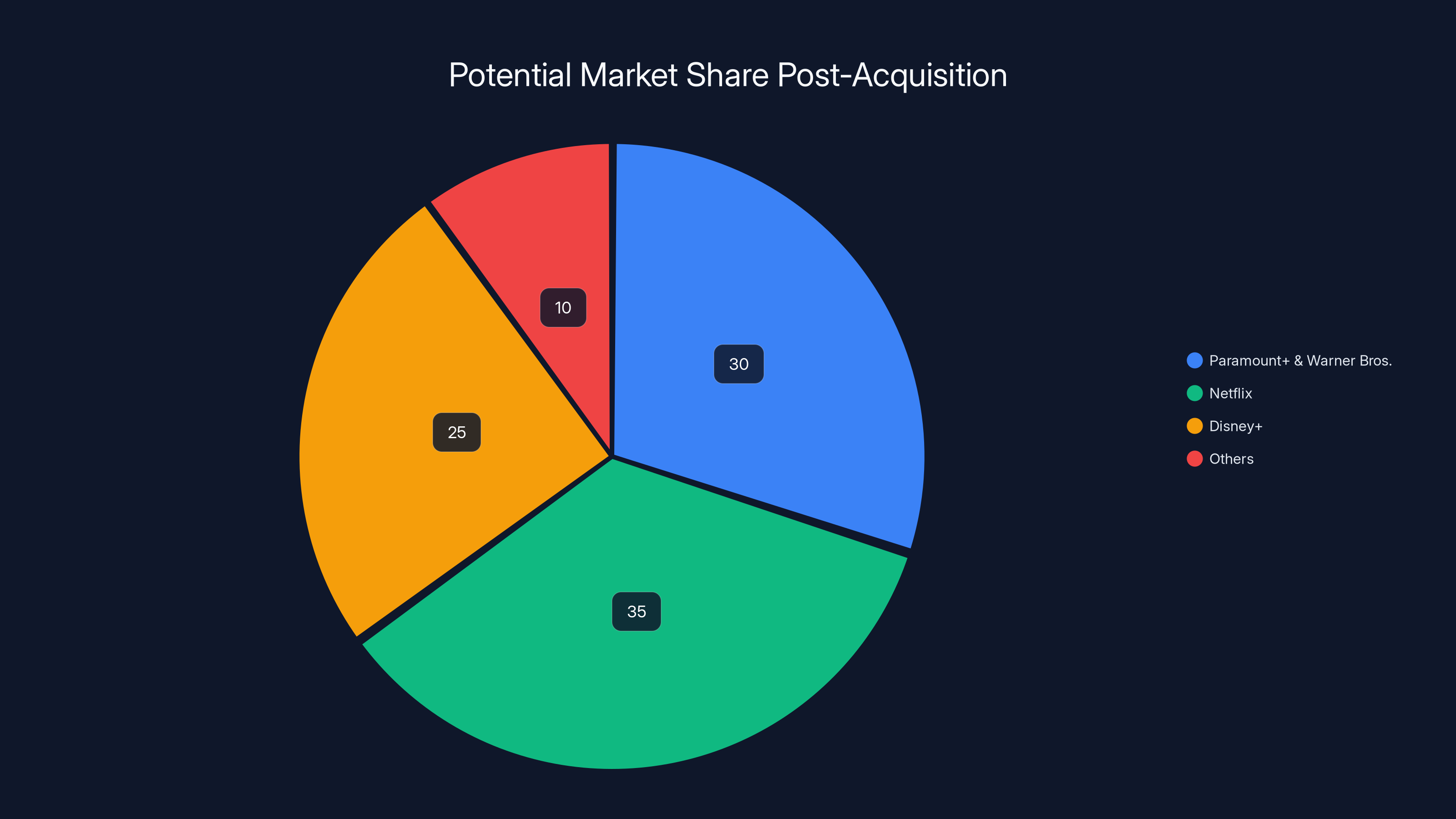

Estimated data shows that if Paramount acquires Warner Bros., it could control approximately 30% of the streaming market, challenging Netflix's dominance.

Understanding the Paramount Threat: Why Paramount Wants Warner Bros.

Paramount Global is in a precarious position in the streaming wars, and that's why it's making such an aggressive move against Warner Bros. Let's understand the context.

Paramount owns traditional media assets: cable television networks like CBS, MTV, and Comedy Central. It owns the CBS streaming service (now Paramount+), movies studios, and the Showtime premium channel. But here's the problem: cable television is dying. Cord-cutting is relentless. Paramount's linear TV business generates stable revenue today but is structurally declining. Paramount+ has been burning money trying to compete with Netflix and Disney+.

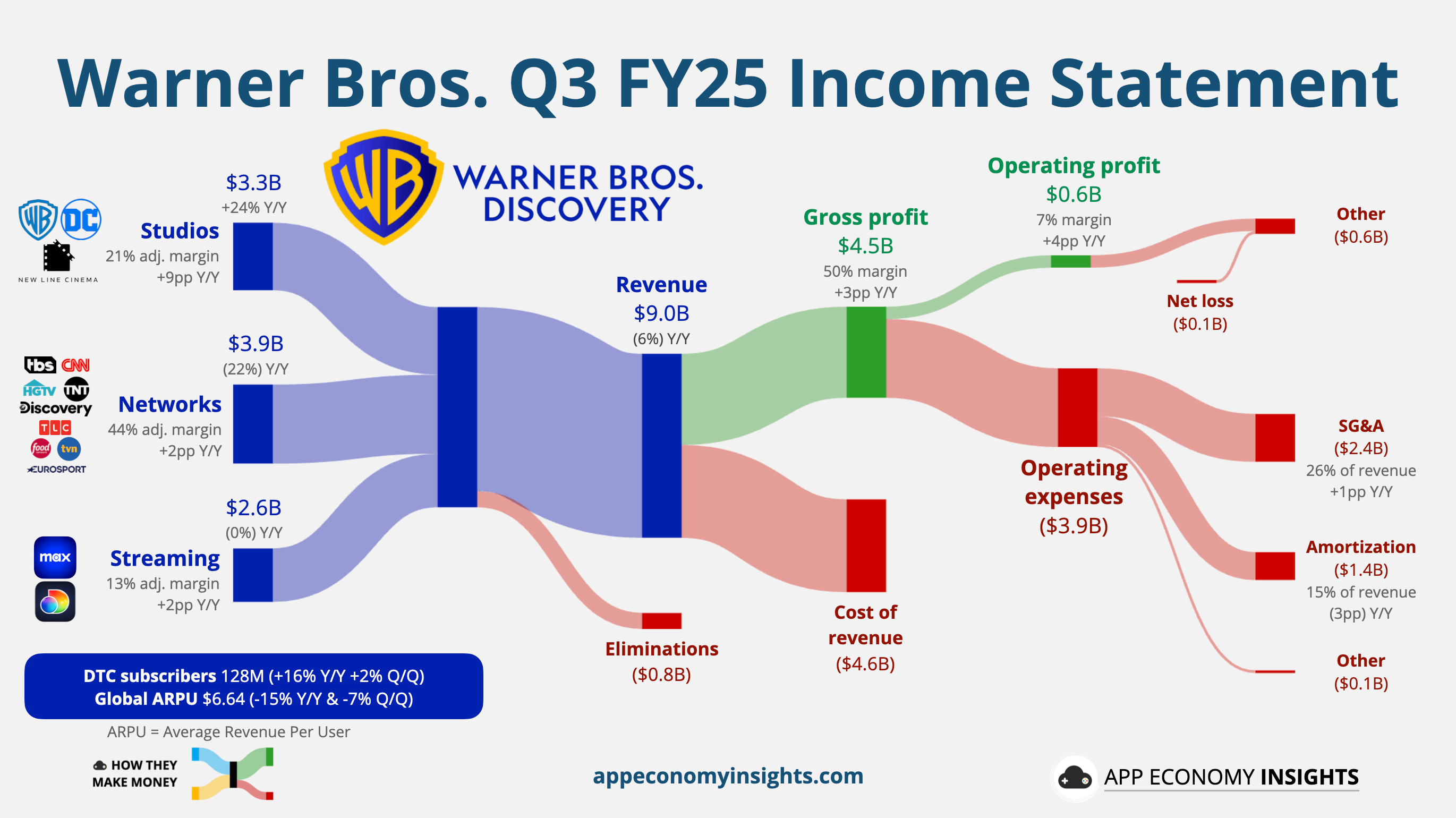

Warner Bros. Discovery, despite its own problems, owns HBO Max (now Max), which is the only streaming service besides Netflix that actually makes money consistently. It owns WB Studios with legendary film franchises, DC Comics properties, and decades of premium content. If Paramount could acquire Warner Bros., it would suddenly have a streaming asset with established monetization, valuable IP, and leverage in the market, as noted by TechCrunch.

But here's the catch: Warner Bros. is planning a spinoff of its cable television division into a separate company called Discovery Global. This spinoff is crucial to Warner Bros.' strategy. The idea is to separate the declining linear TV business from the valuable streaming and film production assets. Shareholders benefit because they can value each company separately, and growth investors can focus on the streaming side.

Paramount's hostile takeover attempt is trying to prevent this spinoff and grab the entire company including all assets. This would give Paramount control of Max, HBO, WB Studios, and the cable networks all together. But the spinoff is scheduled to complete before Netflix's deal closes, making it structurally impossible for Paramount to block it in a hostile takeover, as reported by Variety.

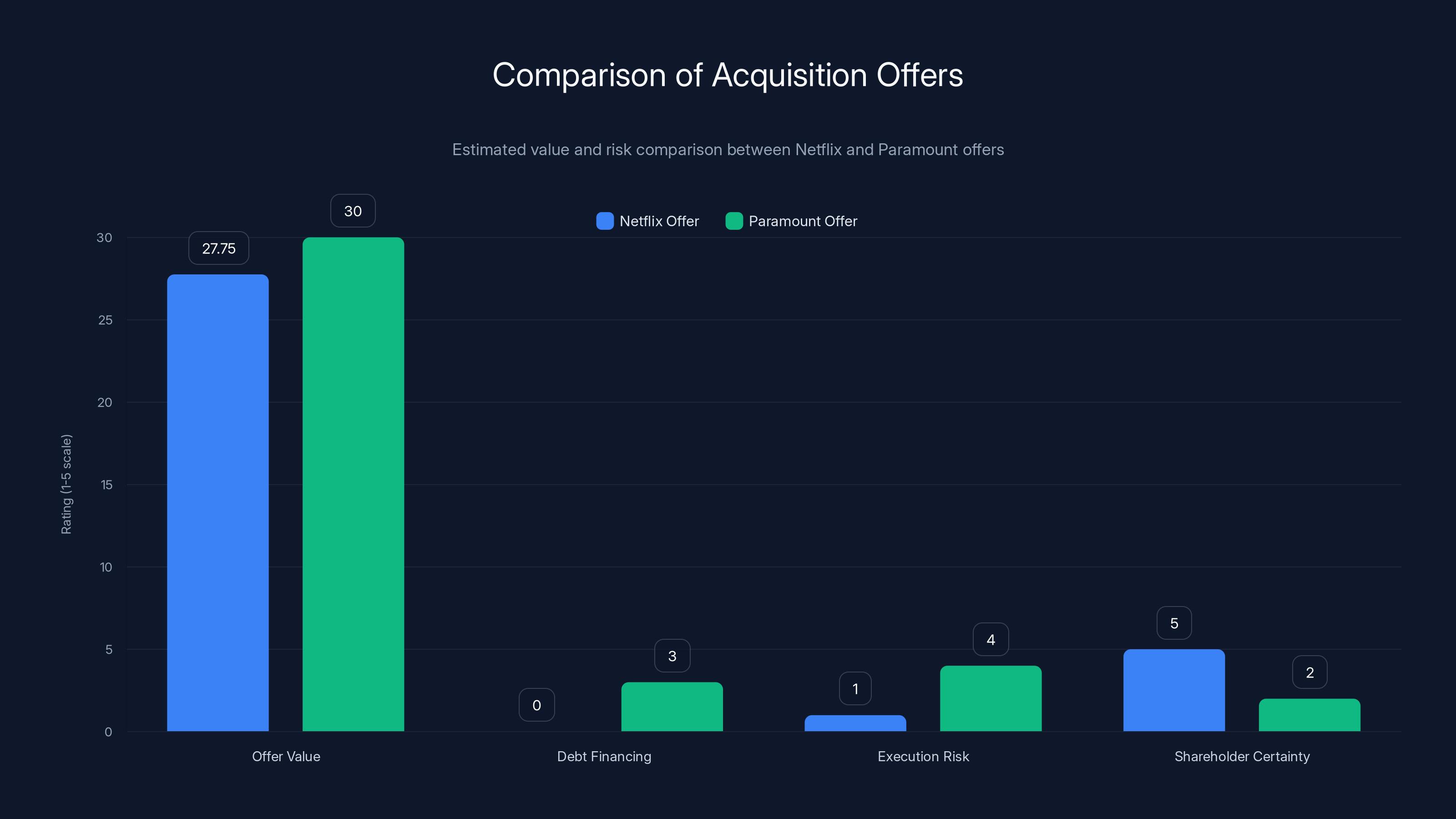

Paramount's offer of

The Financial Firepower Comparison: Netflix vs. Paramount

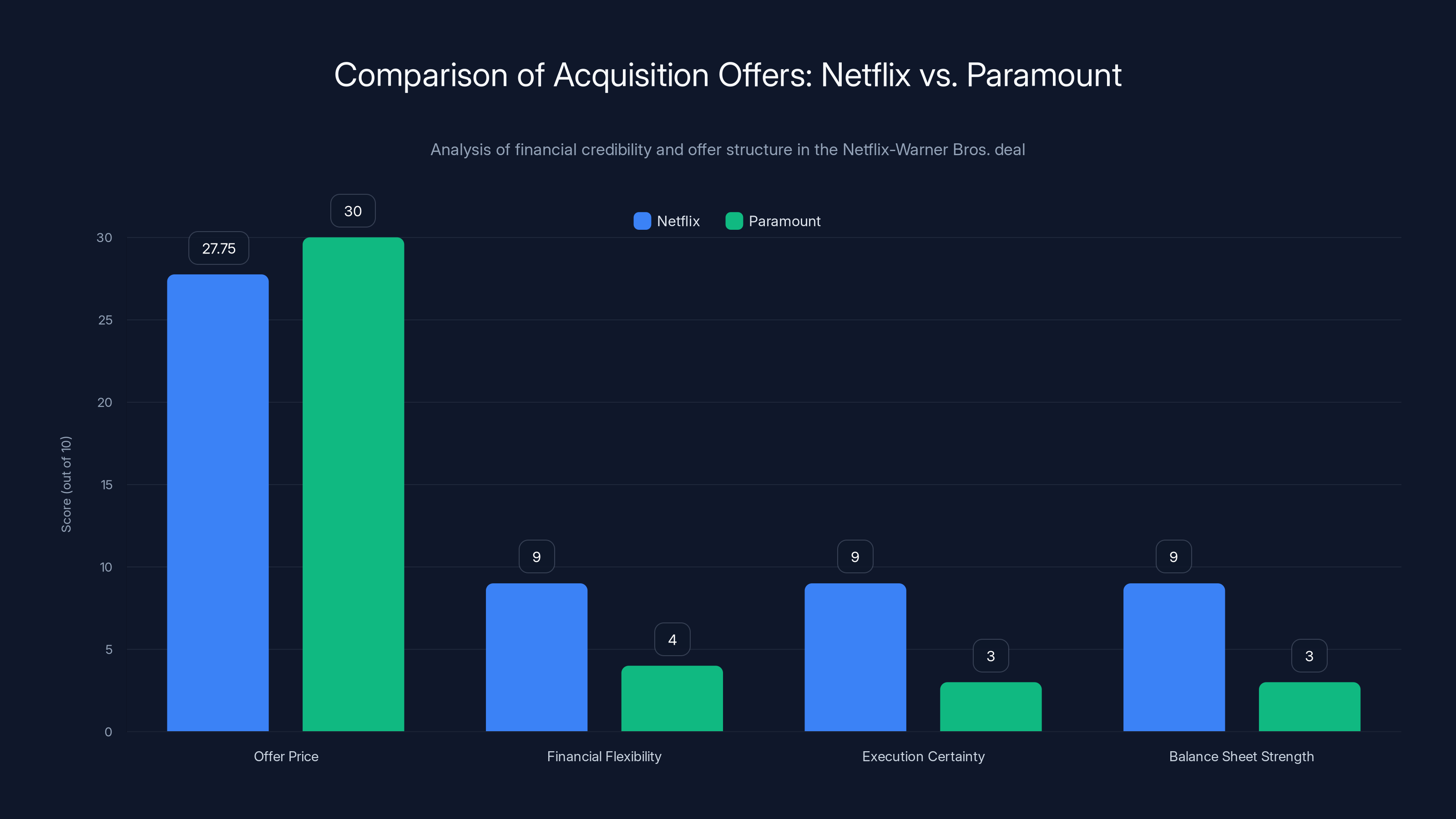

When you compare the two bidders' actual financial capacity to close the deal, the gap is almost embarrassing for Paramount. Let's look at the numbers side by side.

Netflix's Financial Profile:

- Market cap: $400 billion

- Credit rating: A/A3 (investment grade)

- Free cash flow 2026: $12+ billion

- Balance sheet: Healthy with debt management flexibility

- Ability to raise capital: Exceptional due to market position

Paramount's Financial Profile:

- Market cap: $14 billion

- Credit rating: Below investment grade (junk)

- Free cash flow: Negative

- Balance sheet: Strained by declining TV business and streaming losses

- Ability to raise capital: Limited due to credit rating and business challenges

Paramount is essentially a company that's struggling to fund its existing operations trying to acquire a company worth 5 times its market capitalization. Mathematically, it's possible if Paramount can borrow enough money at favorable rates. But in practice, lenders look at the borrower's ability to repay. Paramount's negative cash flows and junk credit rating mean it would have to pay premium rates for debt, making the deal economics worse, as explained by Seeking Alpha.

Warner Bros.' disclosure statements to shareholders made this case explicitly. Paramount "requires an 'extraordinary amount of debt financing'" and carries "a high degree of dependency on its linear business." Translated: Paramount would have to borrow a ton of money at expensive rates to finance this deal, betting that it could turn around its business enough to repay that debt. That's a gamble, not a certainty, as reported by Ars Technica.

Netflix, by contrast, is asking shareholders to accept a guaranteed price paid in actual cash from a company with $12 billion in annual free cash flow. Which offer feels more likely to close?

The Collar Elimination: Why Removing It Changes Everything

Let's dig deeper into why removing the stock collar is such a big deal strategically. Most investors don't think about collars because they happen behind the scenes, but they're actually critical to deal dynamics.

When Netflix stock was trading around

But as Netflix stock fell to

By moving to all-cash, Netflix eliminates this psychological pressure entirely. No more worrying about Netflix stock price. No more wondering if you should hold out for Paramount. You get your $27.75 in cash, period.

From a game theory perspective, this is brilliant. Paramount's counter-argument was always, "Netflix's stock is risky, so take our offer." But if Netflix removes the stock component, that argument evaporates.

The collar also had another subtle effect: it made the deal appear less certain. Collars exist precisely because both parties acknowledge price risk. By eliminating it, Netflix is saying, "We're so confident in our ability to close this deal that we'll pay cash and absorb any market risk ourselves." That confidence is worth real money in shareholder perception, as explained by Netflix's investor relations.

Netflix significantly outperforms Paramount in market capitalization, credit rating, and free cash flow, highlighting its stronger financial position. (Estimated data for credit rating score: A/A3 = 8, Junk = 3)

Warner Bros.' Spinoff Strategy: The Hidden Key to This Deal

People often miss the most important piece of this puzzle: Warner Bros. is spinning off its cable television division into a separate company called Discovery Global. This spinoff completely changes the competitive dynamics.

Here's why it matters. Warner Bros. Discovery currently owns:

- HBO Max (the valuable streaming service)

- WB Studios (movie production)

- Cable networks (CBS, HBO linear, Discovery Channel, etc.)

- Showtime (premium linear channel)

The spinoff splits these into two entities:

- Netflix acquires: HBO Max, WB Studios, streaming assets

- Discovery Global remains: Cable networks, linear TV business

Discovery Global will be a separate, publicly traded company that shareholders will own. This is actually good for shareholders in theory because they get exposure to both the growth streaming asset (Netflix/HBO Max) and the stable, dividend-paying cable business (Discovery Global). But it's terrible for Paramount's hostile bid.

Why? Because Paramount is trying to acquire the entire Warner Bros. Discovery company including cable assets. But if the spinoff completes before Paramount's takeover, there's nothing left to acquire. Paramount would only control Discovery Global (the declining cable business), not the valuable Max streaming service, as reported by Variety.

This is why Paramount sued to try to delay the spinoff and obtain more disclosure about how Warner Bros. is valuing it. Paramount's lawsuit argues that Warner Bros. isn't being transparent about Discovery Global's value, which suggests Paramount thinks the company is undervaluing it to make the Netflix deal look better. But the judge already rejected Paramount's request to expedite the case, saying Paramount didn't demonstrate "cognizable irreparable harm," as noted by Ars Technica.

This spinoff strategy essentially neutralizes Paramount's entire hostile bid because the crown jewel (HBO Max and streaming assets) will already be owned by Netflix or spun off separately. Paramount would be stuck with Discovery Global—the declining cable TV business—which is worth a fraction of what Paramount is paying, as explained by TechCrunch.

Paramount's Lawsuit: The Legal Front of the Hostile Bid

After its cash offer didn't sway Warner Bros.' board, Paramount filed a lawsuit in Delaware Chancery Court. The lawsuit is trying a different angle: attacking the process and disclosures rather than the financial offer.

Paramount's argument is that Warner Bros. hasn't provided shareholders with adequate information to make an informed decision. Specifically, Paramount wants detailed disclosure about:

- How Warner Bros. valued Discovery Global in the spinoff

- What methodology Warner Bros. used to determine that Paramount's offer was too risky

- Independent financial analysis supporting Warner Bros.' board decision

Paramount CEO David Ellison framed it as a corporate governance issue: "WBD shareholders need this information to make an informed investment decision on our offer—and importantly, Delaware law has consistently required that such information be provided to shareholders."

Paramount also claimed that its own analysis values Discovery Global at

But the Delaware judge didn't bite. The court rejected Paramount's request to expedite the case, finding that Paramount hadn't shown it would suffer irreparable harm from the alleged inadequate disclosures. This is significant because it suggests the judge isn't convinced Paramount's concerns are urgent or compelling, as reported by Ars Technica.

Warner Bros. responded that Paramount "has yet to raise the price or address the numerous and obvious deficiencies of its offer" and is "seeking to distract with a meritless lawsuit and attacks on a board that has delivered an unprecedented amount of shareholder value." This dismissal is the standard board response, but it's also partly true—Paramount hasn't modified its offer, which suggests even Paramount's own financial advisors might recognize the deal economics are challenging, as highlighted by Fortune.

The Financing Question: Can Netflix Actually Pay for This?

A natural question: Netflix is paying all-cash for a

Netflix's plan is to finance the deal through three sources:

1. Cash on hand: Netflix has substantial cash reserves, but not

2. Credit facilities: Netflix has access to committed credit lines from banks. These are pre-arranged loans that Netflix can draw down whenever needed. Given Netflix's A/A3 credit rating, banks are happy to provide these facilities at favorable rates. This might provide another $15-25 billion in available liquidity.

3. Committed financing: Netflix can raise additional capital through bond issuances or bank loans specifically for this deal. The finance markets are generally accessible to investment-grade companies with strong cash flows like Netflix. This could provide $30-40 billion or more.

The key insight is that Netflix doesn't need to pay the entire

Paramount's situation is vastly different. Paramount would need to finance roughly

This financial gap explains why Warner Bros.' board felt comfortable dismissing Paramount's offer as less certain to close. Mathematically, Netflix's balance sheet can accommodate the deal. Paramount's cannot.

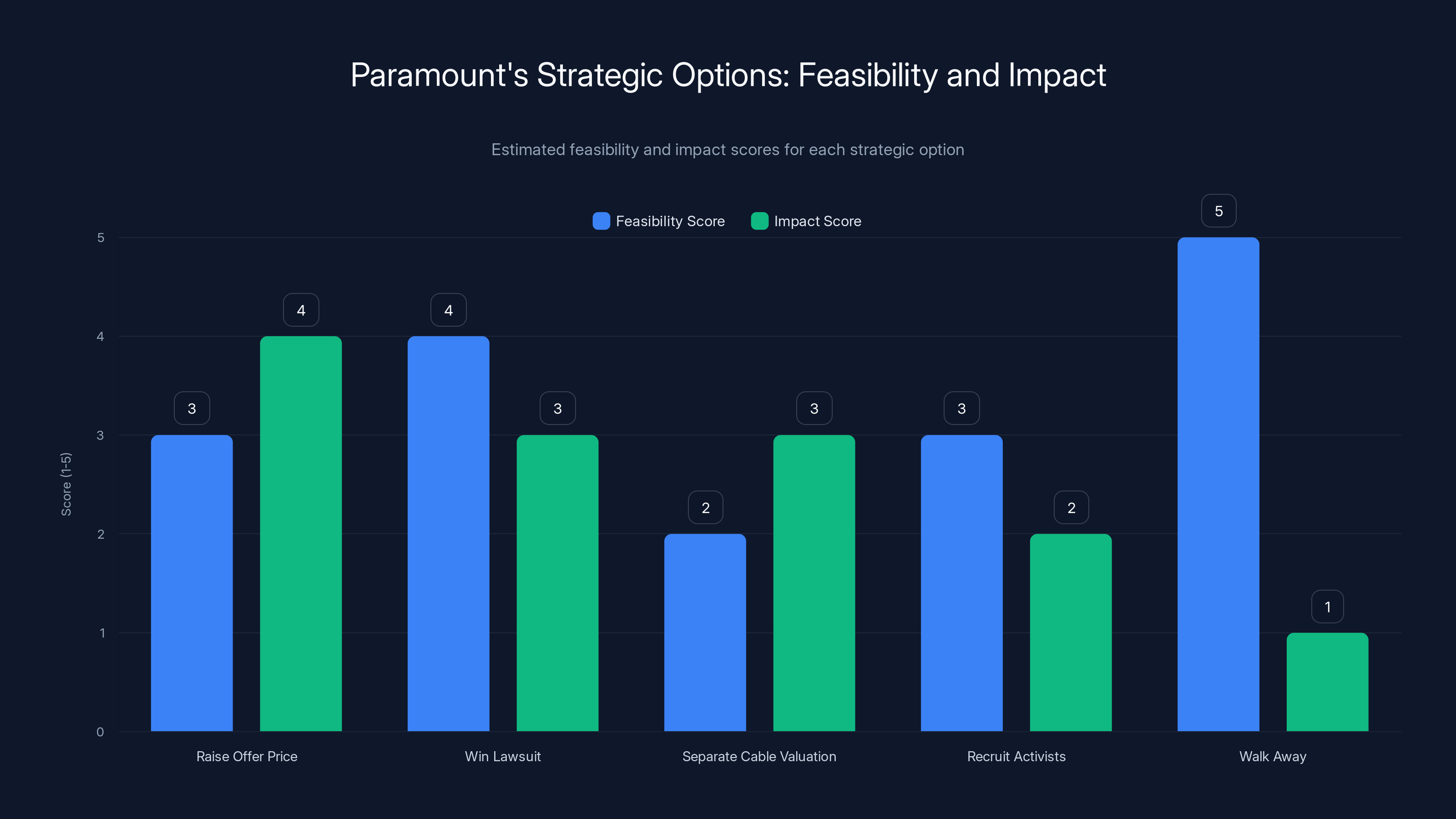

Estimated data: 'Walk Away' is the most feasible option for Paramount given its financial constraints, but it has the least impact. Raising the offer price has a higher impact but lower feasibility due to financial limitations.

The Regulatory and Antitrust Angle: Will Regulators Block This?

When a deal is this large—

The core issue is whether combining Netflix and Warner Bros. creates problematic market concentration in streaming or content production. Let's think about this:

Streaming service competition includes Netflix, Disney+, Amazon Prime Video, Apple TV+, Max (formerly HBO Max), Paramount+, and others. Adding Warner Bros.' HBO Max content to Netflix doesn't create a monopoly—it's one company with more content, but consumers still have many alternatives.

Content production is more fragmented. Netflix has its own studios. Warner Bros. has WB Studios. Disney has Disney Studios. Paramount has Paramount Studios. Sony has Play Station Productions. Adding WB Studios to Netflix creates a larger producer, but again, it's one of many studios competing for talent and projects.

The stronger antitrust concern might actually be whether a combined Netflix-Warner Bros. becomes too powerful in negotiating with cable providers or talent representatives. But modern streaming is distinctly not dependent on cable relationships, so that concern is arguably outdated.

Regulatory approval might take longer for an all-cash deal (paperwork, SEC filings, international reviews), but it's unlikely to be blocked entirely. The more likely scenario is conditional approval with divestiture requirements—forcing Netflix to sell certain assets or agree to certain commitments to maintain competition, as suggested by Goldman Sachs.

The fact that Warner Bros. is spinning off its cable division actually helps the deal from an antitrust perspective. Regulators were always going to scrutinize the combination of a major streaming service (HBO Max) with a major streaming platform (Netflix). By separating the cable division, the deal becomes about consolidation within streaming and premium content—important but less concerningly monopolistic than if Netflix were acquiring the entire bundle including linear TV networks.

What Happens at the April 2026 Shareholder Vote

Warner Bros. is targeting an April 2026 shareholder vote, which is coming up extremely fast. This accelerated timeline is itself strategic.

At the shareholder vote, two things happen simultaneously:

1. Warner Bros. shareholders vote on the Netflix merger. If approved, they formally agree to sell their shares at $27.75 cash per share. By law, shareholders who believe the price is unfair can seek appraisal rights, which allow them to take the company to court to argue for a different price. But this is rare and unsuccessful.

2. Warner Bros. shareholders vote on the Discovery Global spinoff. If approved, the cable division separates into its own company. Shareholders receive shares in Discovery Global proportional to their Warner Bros. holdings.

Both votes happening around the same time creates a package deal for shareholders: you can either accept $27.75 cash from Netflix plus a Discovery Global share, or you can vote against and potentially lose both benefits if Paramount's hostile bid fails.

Paramount is presumably hoping that shareholders will refuse the Netflix deal and accept Paramount's offer instead. But with the Netflix all-cash offer and the spinoff happening, the incentive for shareholders to hold out is much weaker.

The challenge for Paramount is that to defeat the Netflix deal, it would need to either:

- Convince shareholders that Paramount's offer is more valuable (hard when Paramount's financing is shakier)

- Delay the vote long enough to negotiate with new terms or convince more shareholders

- Win its litigation against Warner Bros. and force additional disclosures that sway shareholder opinion

None of these are certain, and the early court ruling against Paramount's expedited case request suggests the Delaware judge isn't impressed with Paramount's arguments, as reported by Ars Technica.

The Streaming Industry Consolidation Narrative

This deal is actually part of a much larger story in the media and streaming industry: consolidation is the only path to sustainable streaming businesses.

When streaming first emerged, the theory was that it would be radically decentralized. Anyone could launch a streaming service. Technology would be commoditized. Competition would be fierce but fair.

But the reality has been very different. Streaming is expensive because content is expensive. Producing quality originals costs hundreds of millions. Building a platform requires engineering talent and infrastructure investment. Supporting a global operation requires regulatory expertise.

This created a harsh selection pressure: only companies with massive content libraries, existing distribution channels, or deep financial pockets could afford to build sustainable streaming services.

Netflix won because it started early, built the largest subscriber base, achieved profitability, and generated the free cash flow to invest in originals and international expansion. Disney started with the world's most valuable content library. Amazon and Apple used streaming as a loss-leader to support their core businesses (Prime membership and hardware ecosystems).

Paramount, Warner Bros., and others started with strong content but struggled with the economics. They couldn't afford to lose money long-term the way Amazon and Apple could. But they also couldn't compete with Netflix's scale or Disney's content portfolio.

For these struggling streamers, consolidation is essentially the only way to survive. Netflix acquiring Warner Bros. makes Netflix stronger by giving it HBO's premium content library and WB's studio production capabilities. This is actually pro-consumer in some ways—it means a viable, well-capitalized company (Netflix) will run HBO Max and WB content effectively rather than these assets languishing under a financially stressed parent company.

Paramount's hostile bid can be seen as a last-ditch effort by a struggling traditional media company to acquire scale and assets before it's too late. But the market and shareholders are basically saying, "We'd rather partner with Netflix, which has the cash flow to make this work, than with Paramount, which is still burning money on streaming," as explained by TechCrunch.

Netflix's offer is more certain and carries less risk despite a lower headline value. Paramount's offer involves higher debt and execution risk. (Estimated data)

The Stock Price Movement: Why Netflix Investors Should Care

Netflix stock has fallen from around

But here's the interesting part: the all-cash move might actually help Netflix's stock price recover. Here's why:

-

It removes deal risk. Investors were worried the deal might not close or might close at a worse price due to stock fluctuation. An all-cash deal that's more likely to close removes this uncertainty.

-

It demonstrates financial confidence. Netflix is saying, "We're confident enough in our business that we can take on $72 billion in debt or use our balance sheet and still remain healthy." That confidence is attractive to investors.

-

It shortens the timeline. The faster the deal closes, the sooner Netflix can start generating synergies and demonstrating the deal's value to shareholders.

-

It eliminates the collar floor. Before, Netflix was protected by the collar—if Netflix stock fell below $97.91, the deal economics would shift in Netflix's favor but shareholders would get more Netflix stock, diluting existing shareholders. Now, the deal terms are locked in, which might be better for existing Netflix shareholders if the stock recovers.

Investors familiar with M&A history know that deals announced by strong acquirers with certain financing often perform better than deals announced by weak acquirers with uncertain financing. Netflix is positioning itself as the former, as noted by Netflix's investor relations.

Paramount's Options: What Can It Do Next

Paramount isn't giving up easily, but its options are getting narrower with each development.

Option 1: Raise its offer price. Paramount could increase its bid above

Option 2: Win the lawsuit and force shareholder vote delay. Paramount is betting it can win in Delaware Chancery Court and force Warner Bros. to provide more disclosures that sway shareholder opinion. But the early ruling suggests the judge isn't convinced. Even if Paramount wins, it only delays things by months, not years.

Option 3: Separate the cable division valuation. Paramount could try to argue that the spinoff is undervaluing the cable division, making Paramount's all-in offer more attractive. But Warner Bros. will argue it has independent fairness opinions from financial advisors, which are hard to challenge.

Option 4: Recruit activist shareholders. Paramount could try to find shareholders who are dissatisfied with the Netflix deal and organize opposition. But with Netflix offering guaranteed cash and the board supporting the deal, this is an uphill battle.

Option 5: Walk away. Paramount could acknowledge that it can't compete with Netflix's superior financial position and preserve its cash for other priorities. This might actually be the wisest choice given Paramount's financial constraints.

Each option has drawbacks, and none looks particularly promising for Paramount. The company's junk credit rating and negative cash flows are fundamental constraints that no amount of competitive bidding can overcome, as highlighted by Fortune.

Timeline and What to Watch Next

The Netflix-Warner Bros. deal is moving at unprecedented speed for a transaction of this size. Here's the expected timeline:

January 2026: Netflix announces all-cash modification, accelerating the process.

Q1 2026: Regulatory filings with the SEC, FTC, and international authorities. Hart-Scott-Rodino (HSR) review by U. S. antitrust agencies. Paramount continues litigation in Delaware.

April 2026: Target shareholder vote on Netflix merger and Discovery Global spinoff. Court rulings on Paramount's lawsuit likely before this date.

Q2-Q3 2026: Regulatory approvals finalized. Potential conditions or divestitures required.

Q4 2026: Deal expected to close with Netflix acquiring HBO Max and WB Studios assets, Discovery Global spinning off as independent company.

This timeline is ambitious but achievable given Netflix's financial resources and the Warner Bros. board's aggressive push for certainty.

Paramount's lawsuit could accelerate or decelerate this timeline depending on court rulings, but the preliminary rejection of Paramount's expedited case request suggests Delaware courts aren't going to slow things down for Paramount's benefit, as noted by Ars Technica.

Netflix's offer, despite being lower in price, was more credible due to superior financial flexibility and execution certainty. Estimated data based on narrative insights.

Industry Implications: What This Means for the Streaming Wars

If the Netflix-Warner Bros. deal closes as expected, the streaming landscape will shift dramatically.

Netflix becomes the undisputed market leader in streaming scale. With HBO Max's premium content, Netflix will have the largest combined content library. This strengthens Netflix's ability to raise prices and sustain profitability that competitors are still chasing.

HBO Max effectively merges with Netflix. There will likely be a period where HBO Max and Netflix operate separately (to manage subscriber expectations), but eventually, they'll consolidate into a single platform. This gives Netflix's subscribers access to HBO's premium content, and HBO subscribers access to Netflix's originals.

WB Studios becomes Netflix's primary film and television production arm. Netflix will have in-house production capabilities comparable to Disney and Paramount. This reduces Netflix's dependency on licensing content from other studios and improves margins on original content.

Discovery Global becomes a pure-play traditional media company. The cable division, now independent, will operate cable networks and stream linear TV content. It will face the same structural headwinds as all traditional media but will at least be valued separately, allowing dividend-focused investors to own the stable cash flows without subsidizing streaming losses.

Paramount's position weakens materially. With Netflix owning HBO and WB Studios, Paramount+ becomes one of many streaming options rather than a top-tier contender. Paramount's survival likely depends on finding a buyer or consolidating with another struggling traditional media company.

Disney+ remains strong but faces intense Netflix competition. Disney's content library is unmatched, but Netflix's scale and profitability advantage will only increase if it adds HBO and WB to its portfolio.

The irony is that the streaming wars, which were supposed to democratize content distribution and eliminate the power of traditional studios, are actually reconsolidating around new giants (Netflix, Disney, Amazon) that have the financial power to dominate. The winners are the companies with strong balance sheets and sustainable business models. The losers are companies with great content but weak finances, as explained by TechCrunch.

Why All-Cash Matters in Modern M&A

The shift from mixed stock-and-cash to all-cash is more strategically significant than it might initially appear. This isn't just accountancy.

In the past 20 years, tech companies have favored stock as M&A currency because their stock prices were rising and they could use that growth as a tool to acquire companies without spending actual cash. Buying companies with your stock essentially transfers wealth from existing shareholders (dilution) to the acquired company's shareholders.

But all-cash deals send a different message: the acquirer is confident enough in its future that it will use actual cash rather than asking the seller to gamble on the acquirer's stock performance. This signals confidence and reduces risk for the seller.

For Netflix, paying all-cash for Warner Bros. is saying, "We're confident we'll generate enough free cash flow to make this deal work without stressing our balance sheet." For shareholders, this means Netflix believes the deal is accretive (value-creating) enough to justify using cash rather than preserving it for other investments.

Paramount offering all-cash would normally have the same effect, but Paramount's shaky balance sheet undermines the confidence signal. It's like a person living paycheck to paycheck offering to pay cash for something—you worry about where that cash is coming from and whether they'll have enough for rent next month, as highlighted by Fortune.

Lessons for Shareholders and Investors

This deal offers several lessons for investors watching from the sidelines.

First, financial strength matters. Netflix's investment-grade credit rating, positive cash flow, and large market cap gave it the option to pay all-cash. Paramount's junk rating and negative cash flow constrained its options. In competitive situations, balance sheet strength becomes a competitive moat.

Second, certainty is valuable. Shareholders prefer certain outcomes over uncertain ones, even if the uncertain outcome might theoretically be larger. Netflix's

Third, board governance and fiduciary duty matter. Warner Bros.' board accepted that its fiduciary duty was to shareholders, which meant accepting the deal most likely to close and create value, not the deal with the highest headline number.

Fourth, timing is a weapon in M&A. By accelerating the shareholder vote to April 2026, Netflix and Warner Bros. shortened the window for Paramount to organize opposition or find new leverage. Paramount is essentially out of time to make substantive changes.

Fifth, regulatory approval is often overblown as a deal risk. This deal will face regulatory scrutiny, but it's unlikely to be blocked entirely. Regulatory approval is more likely than, say, shareholder rejection of Netflix's offer.

The Bigger Picture: Media Consolidation in an Unbundled World

Here's a larger context that's important for understanding why Netflix is even acquiring Warner Bros. in the first place.

For decades, the media industry was highly consolidated. A few giant media conglomerates (Disney, Time Warner, Viacom, News Corp, Comcast) owned movies, TV networks, cable channels, theme parks, and publishing. This consolidation was actually somewhat natural—content production, distribution, and exhibition all required massive infrastructure and capital that only large companies could afford.

Streaming was supposed to change this. Without cable distribution, anyone could theoretically offer content. Costs should decrease. Competition should increase. New entrants should thrive.

But here's what actually happened: streaming became so expensive (producing quality originals, building infrastructure, competing for customers) that it reconcentrated around companies that either had massive content libraries (Disney, Warner Bros.), deep pockets (Amazon, Apple), or were willing to burn billions achieving scale (Netflix).

Now we're seeing consolidation again, but with a new cast of characters. Netflix is consolidating with Warner Bros., not because they're forced to, but because it makes economic sense. Netflix gets content, studios, and production capabilities. Warner Bros.' shareholders get certainty and liquidity.

This consolidation might actually be healthy in some ways—it prevents zombie media companies (like struggling versions of Paramount) from lingering in unprofitable streaming ventures, killing jobs and destroying shareholder value. Better that these assets go to a well-capitalized owner that can invest in them properly.

The risk is that we're reconsolidating toward a few winners (Netflix, Disney, Amazon) and many losers. But that might be the inevitable outcome of streaming economics. There might not be room for many profitable streaming services. There definitely isn't room for unprofitable ones, as explained by TechCrunch.

FAQ

Why is Netflix paying all-cash instead of using stock and cash like originally planned?

Netflix switched to all-cash primarily to eliminate shareholder uncertainty. The original mixed offer included a stock component, which exposed Warner Bros. shareholders to Netflix's stock price fluctuations. By switching to all-cash, Netflix removes this variable risk, eliminates the collar mechanism, and signals financial confidence that the deal will close. This strategic move also accelerates the shareholder vote timeline and weakens Paramount's argument that Netflix's offer carries too much uncertainty, as noted by Netflix's investor relations.

What exactly is the value difference between Netflix's 30 per share offer?

The headline numbers are misleading because the offers target different entities. Netflix is offering

Can Paramount actually afford to finance a $108.4 billion acquisition?

Paramount has the theoretical capacity to finance the deal through debt, but the practical constraints are severe. Paramount has a $14 billion market cap, a junk credit rating, and negative free cash flows. This means any debt Paramount raises would be expensive and come with onerous covenants. Lenders would demand high interest rates and strict financial controls, making the deal less attractive. Warner Bros.' board concluded that Paramount's financing uncertainty was a material risk factor—a key reason the Netflix deal was superior, as reported by Ars Technica.

What happens to HBO Max and Discovery Global after this deal closes?

After the deal closes, HBO Max will become part of Netflix, likely operating as a distinct brand initially before eventually consolidating into the main Netflix platform. WB Studios becomes Netflix's primary in-house content production company. Discovery Global, the independent cable division company spun off from Warner Bros., will operate as a separate publicly traded company focused on cable television networks and linear streaming. Discovery Global will pay dividends to shareholders and operate as a traditional media company facing structural industry challenges, as explained by Variety.

Why does the April 2026 shareholder vote timing matter so much?

The accelerated vote timeline is strategically crucial because it compresses the window for Paramount to influence shareholder opinion, win litigation battles, or organize opposition. Shareholder votes happen on board recommendations, and Warner Bros.' board strongly supports the Netflix deal. By voting in April, before Paramount can fully develop its legal arguments or organize activist shareholders, Netflix and Warner Bros. reduce the probability of deal complications. Paramount would prefer a delayed vote giving it more time to make its case, as noted by Ars Technica.

What are the chances Paramount's lawsuit delays the deal?

The preliminary indication is that Paramount's lawsuit faces an uphill battle. The Delaware judge already rejected Paramount's request for expedited case treatment, suggesting the court doesn't view Paramount's claims as urgent or compelling. Even if Paramount wins some elements of the lawsuit, it would likely only force additional disclosures rather than blocking or materially delaying the deal. Delaware courts generally defer to board decisions in M&A situations unless there's clear evidence of self-dealing or breach of fiduciary duty, which isn't present here, as reported by Fortune.

Will antitrust regulators block or materially condition this deal?

Regulatory approval is unlikely to be blocked entirely, though conditions are likely. The deal combines two major streaming services and one of the largest studios, which triggers antitrust scrutiny. However, the streaming market remains competitive with Netflix, Disney+, Amazon Prime Video, Apple TV+, Paramount+, and others all competing vigorously. Regulators might require divestitures of certain content rights or commitments to licensing, but blocking the deal entirely would be difficult to justify given the competitive landscape. The spinoff of Discovery Global actually helps the deal from an antitrust perspective by separating content production from distribution, as suggested by Goldman Sachs.

How does Netflix's credit rating affect its ability to pay all-cash?

Netflix's investment-grade A/A3 credit rating is crucial to the deal's execution. This rating means Netflix can raise capital through debt markets at favorable interest rates. Netflix's positive free cash flow (estimated at $12+ billion for 2026) gives it substantial capacity to service additional debt without risking its rating. By contrast, Paramount's junk credit rating means any additional borrowing would be expensive and potentially downgrade the company further. Netflix's financial flexibility is a major competitive advantage in the bidding war, as explained by Netflix's investor relations.

What happens to Paramount's streaming ambitions if the Netflix deal closes?

Paramount+ will continue operating but faces significantly diminished competitive positioning. Without the Hollywood library and production capabilities that a combined Netflix-Warner Bros. would control, Paramount+ becomes one of many streaming options rather than a top-tier player. Paramount's survival likely requires consolidation with another traditional media company or acceptance of a smaller role in the streaming landscape. The company's traditional cable networks (CBS, MTV, Comedy Central) will remain valuable but face continued cord-cutting pressures. Paramount's next strategic move, likely after the Netflix-Warner Bros. deal closes, will be critical to its long-term survival, as noted by TechCrunch.

Why is the cable division spinoff so important to this deal's success?

The spinoff prevents Paramount from acquiring the valuable assets (HBO Max, WB Studios) that made Paramount's

Conclusion: How Strategic Financing Defeats Hostile Takeovers

The Netflix-Warner Bros. deal represents a masterclass in using financial structure as a competitive weapon. This isn't a story about who offered the most money. Paramount offered

It's a story about who could actually afford to pay, who had the financial flexibility to provide certainty, and who could execute without threatening their own viability. Netflix wins on all three fronts.

Paramount's hostile takeover bid failed not because it was illegal or impossible but because Paramount's fundamental financial weakness made its offer less credible than Netflix's. A company with negative cash flows and a junk credit rating offering to finance a $108 billion acquisition without its balance sheet imploding isn't a credible buyer. Shareholders know this. Lenders know this. Courts are getting the hint based on early litigation rulings, as reported by Fortune.

Netflix's pivot to all-cash financing isn't just a bid sweetener. It's a structural solution that removes uncertainty, accelerates timelines, and demonstrates a confidence that Paramount simply cannot match. It's Netflix saying, "Not only will we pay your price, but we'll pay it with the certainty of actual dollars, not the financial gymnastics required to make Paramount's offer work."

The April 2026 shareholder vote will almost certainly approve the Netflix deal. Regulatory approval, while requiring scrutiny, is unlikely to block the transaction. Paramount's lawsuit has already lost its first motion. The spinoff of Discovery Global will proceed, making Paramount's hostile bid structurally obsolete.

For shareholders, the lesson is clear: in competitive M&A situations, balance sheet strength and financial flexibility are competitive advantages that no amount of higher headline numbers can overcome. Netflix's superior financial position didn't just help it win this bid. It fundamentally changed what winning means in modern media consolidation.

For Paramount, the lesson is harder: you can't acquire your way out of fundamental business challenges if you lack the financial capacity to execute acquisitions. Paramount's traditional media business is under structural pressure from cord-cutting. Its streaming service, like many competitors', has been unprofitable. Fighting Netflix and Disney for streaming supremacy while burdened by junk-rated debt and negative cash flows was always going to be an uphill battle.

The Netflix-Warner Bros. deal will close. Discovery Global will spin off as an independent company. Paramount will have to accept its diminished position and chart a new strategic course. And the media industry will be one step closer to the new consolidated reality where scale, profitability, and financial flexibility determine winners and losers.

That's not the streaming revolution anyone predicted. But it might be the one the market actually delivers.

Key Takeaways

- Netflix converted its Warner Bros. offer from mixed stock-and-cash to 100% all-cash consideration, eliminating shareholder uncertainty and removing a key weapon from Paramount's hostile takeover arsenal, as noted by Netflix's investor relations.

- Paramount's $108.4 billion bid fails to account for structural issues: the company has a junk credit rating, negative cash flows, and requires extraordinary debt financing that makes the deal less likely to close than Netflix's offer, as explained by Fortune.

- The planned Discovery Global spinoff prevents Paramount from acquiring HBO Max and WB Studios, making Paramount's entire hostile bid structurally obsolete even if the company could somehow fund it, as reported by Variety.

- Netflix's investment-grade credit rating and $12+ billion annual free cash flow provide genuine financial flexibility that Paramount's strained balance sheet cannot match, making financial strength itself a competitive moat in M&A bidding, as noted by Netflix's investor relations.

- Delaware courts signaled early skepticism of Paramount's lawsuit by rejecting expedited case treatment, suggesting that legal challenges offer Paramount minimal leverage compared to the board-backed Netflix deal accelerated to April 2026 shareholder vote, as reported by Ars Technica.

Related Articles

- Netflix's Warner Bros. All-Cash Bid: What It Means for Streaming [2025]

- Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]

- Netflix's $82.7B Warner Bros Deal: The Streaming Wars Heat Up [2025]

- Paramount Skydance's Lawsuit Against Warner Bros. Discovery [2025]

- Netflix's 7 Golden Globes Wins Signal Streaming Dominance [2026]

- Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]