Netflix Faces Congressional Firestorm: The Hearing That Mixed Antitrust With Culture Wars

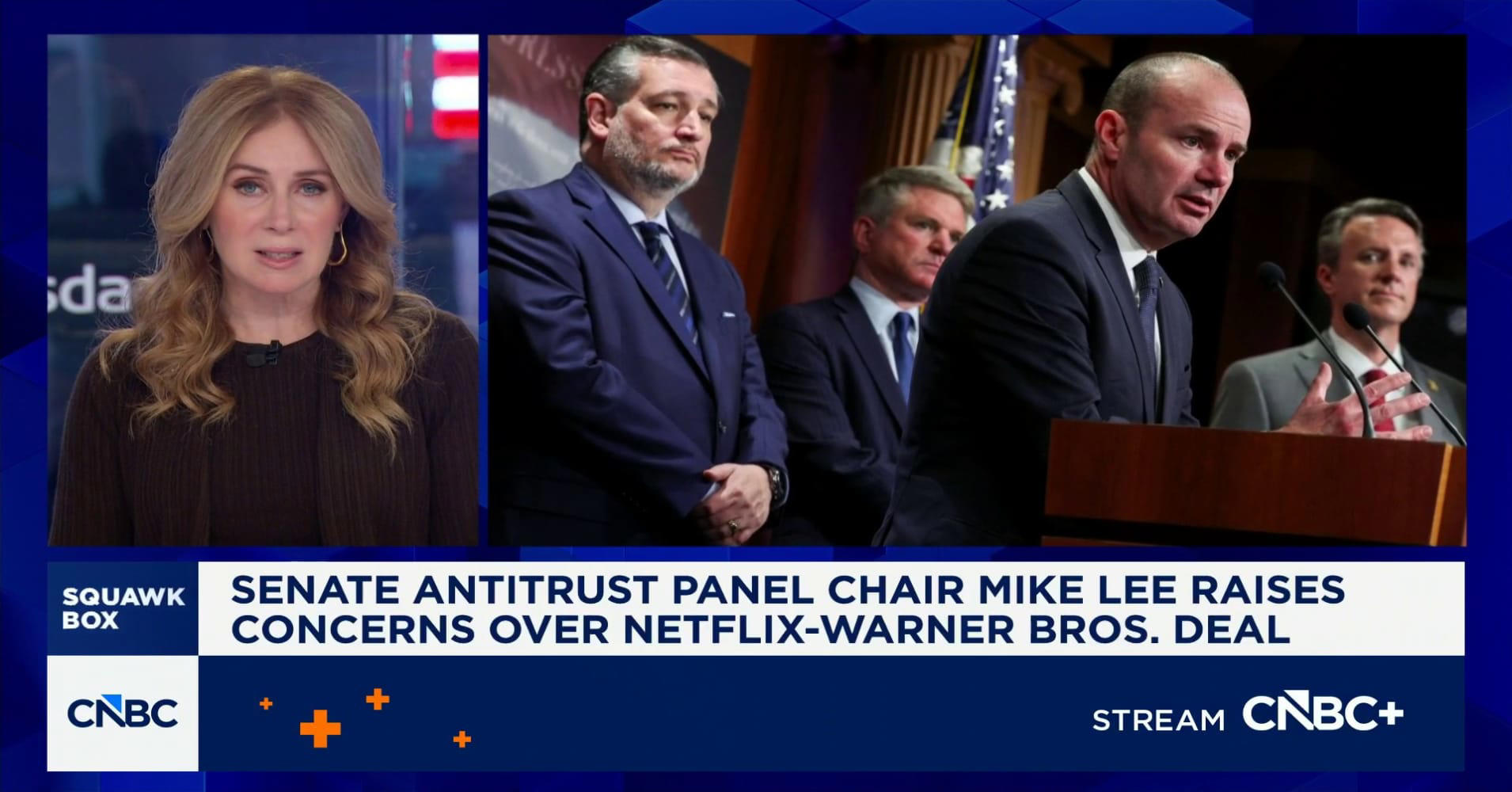

It was supposed to be a straightforward antitrust hearing. Netflix CEO Ted Sarandos walked into a Senate hearing room on Tuesday expecting questions about market consolidation, consumer pricing, and competitive concerns. What he got instead was something far messier: a collision between tech policy and American culture wars, all unfolding live on C-SPAN.

The Senate Judiciary Committee's Antitrust Subcommittee had summoned Sarandos and Warner Bros. Discovery Chief Revenue Officer Bruce Campbell to testify about Netflix's proposed acquisition of a major portion of WBD. On paper, this makes sense. The deal raises legitimate questions about media consolidation, streaming market power, and whether combining two entertainment giants would harm consumers or content creators.

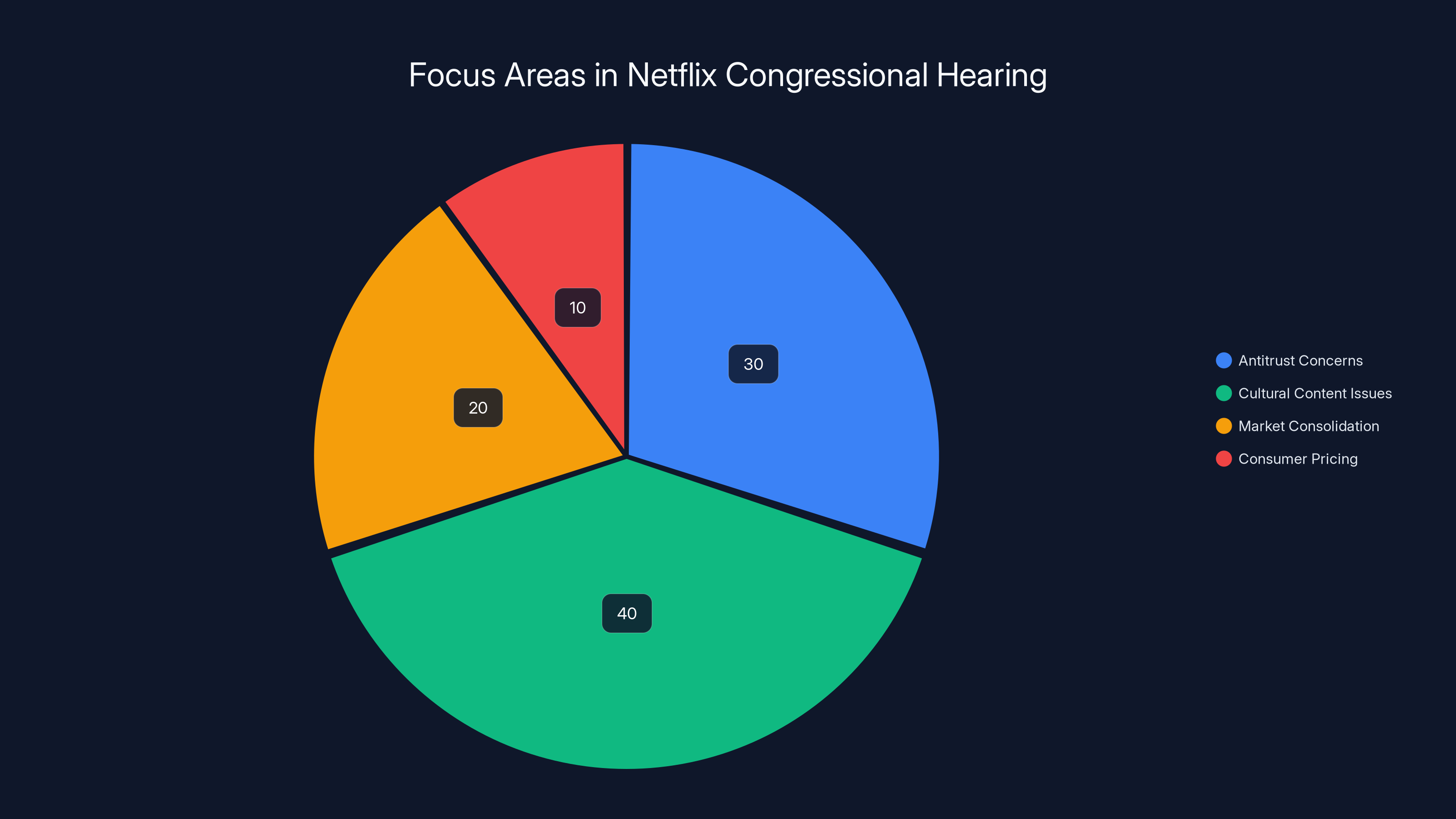

But the hearing revealed something deeper about Washington in 2025: the erosion of traditional policy boundaries. Antitrust law, which is supposed to focus on competition and market structure, suddenly became a proxy war over content values. Republican senators used their time to attack Netflix's programming choices, specifically content featuring LGBTQ+ characters and transgender storylines. One senator called Netflix's library "the wokest content in the history of the world."

This wasn't a mistake or a distraction. It was deliberate. Republicans see the Netflix merger as an opportunity to leverage regulatory power toward cultural goals. Democrats, meanwhile, tried repeatedly to steer the conversation back to traditional antitrust concerns. The result was a hearing that revealed the fragility of technocratic policy-making in an era of intense partisan division.

What makes this moment significant isn't just the political theater. It's what it tells us about how American regulation will work going forward. When antitrust review becomes a tool for cultural warfare, everyone loses: companies face unpredictable regulatory environments, lawmakers undermine their own authority, and consumers get distracted from real competitive concerns that actually affect their wallets.

The Deal Everyone's Fighting Over

Let's start with what Netflix is actually trying to do. The company has proposed acquiring a substantial stake in Warner Bros. Discovery, making it a major stakeholder in one of Hollywood's biggest content producers. This isn't Netflix buying WBD outright, but it's significant enough to reshape the entertainment landscape.

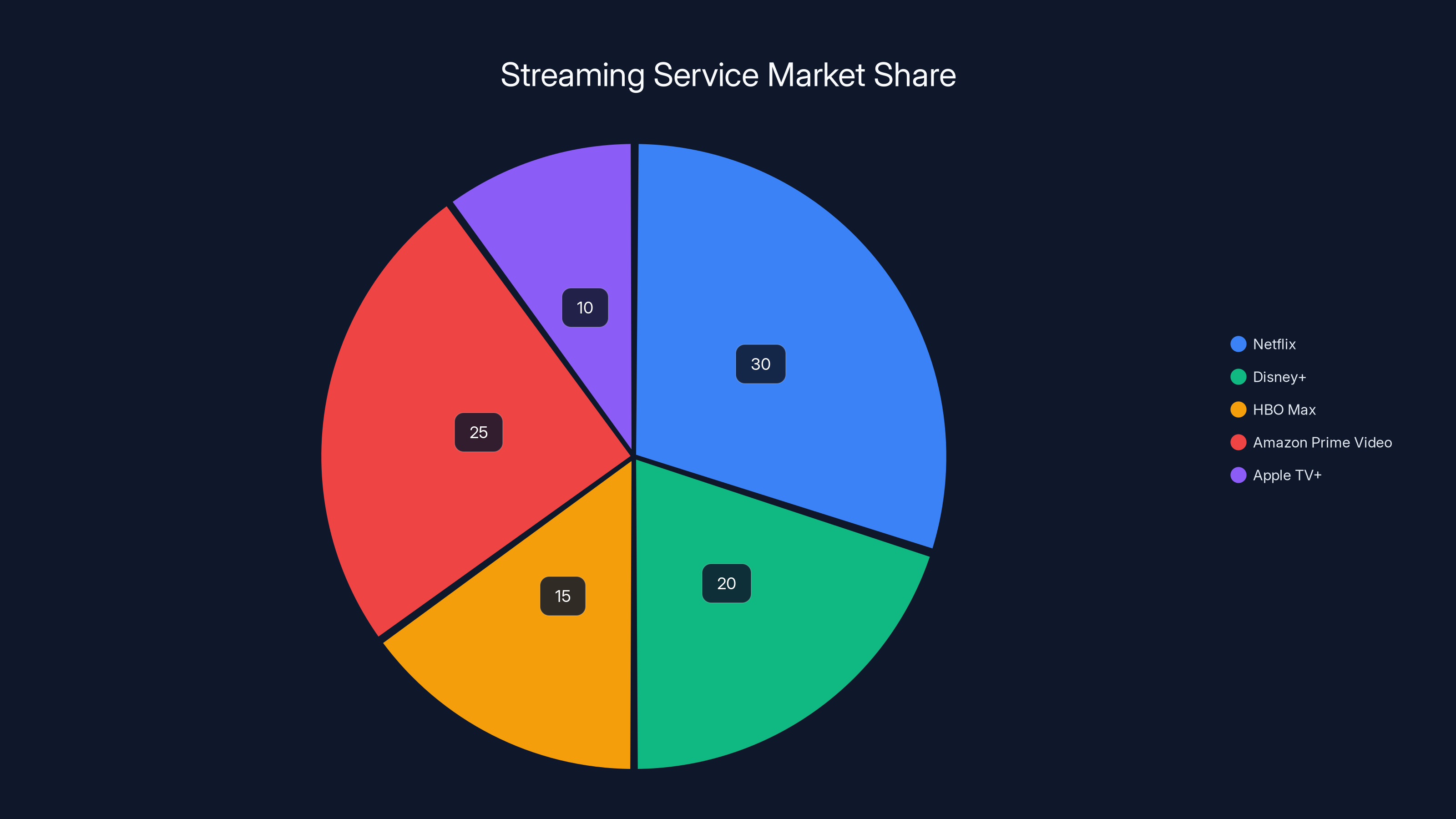

Why does this matter? Because streaming has fragmented the entertainment market. Fifteen years ago, people had cable. Now they have Netflix, Disney+, Max, Paramount+, Apple TV+, Amazon Prime Video, Peacock, and a dozen others. Netflix wants deeper access to premium content. WBD owns HBO, DC properties, Warner Bros. films, and a massive content library. For Netflix, this is about securing supply. For competitors, it's about market power.

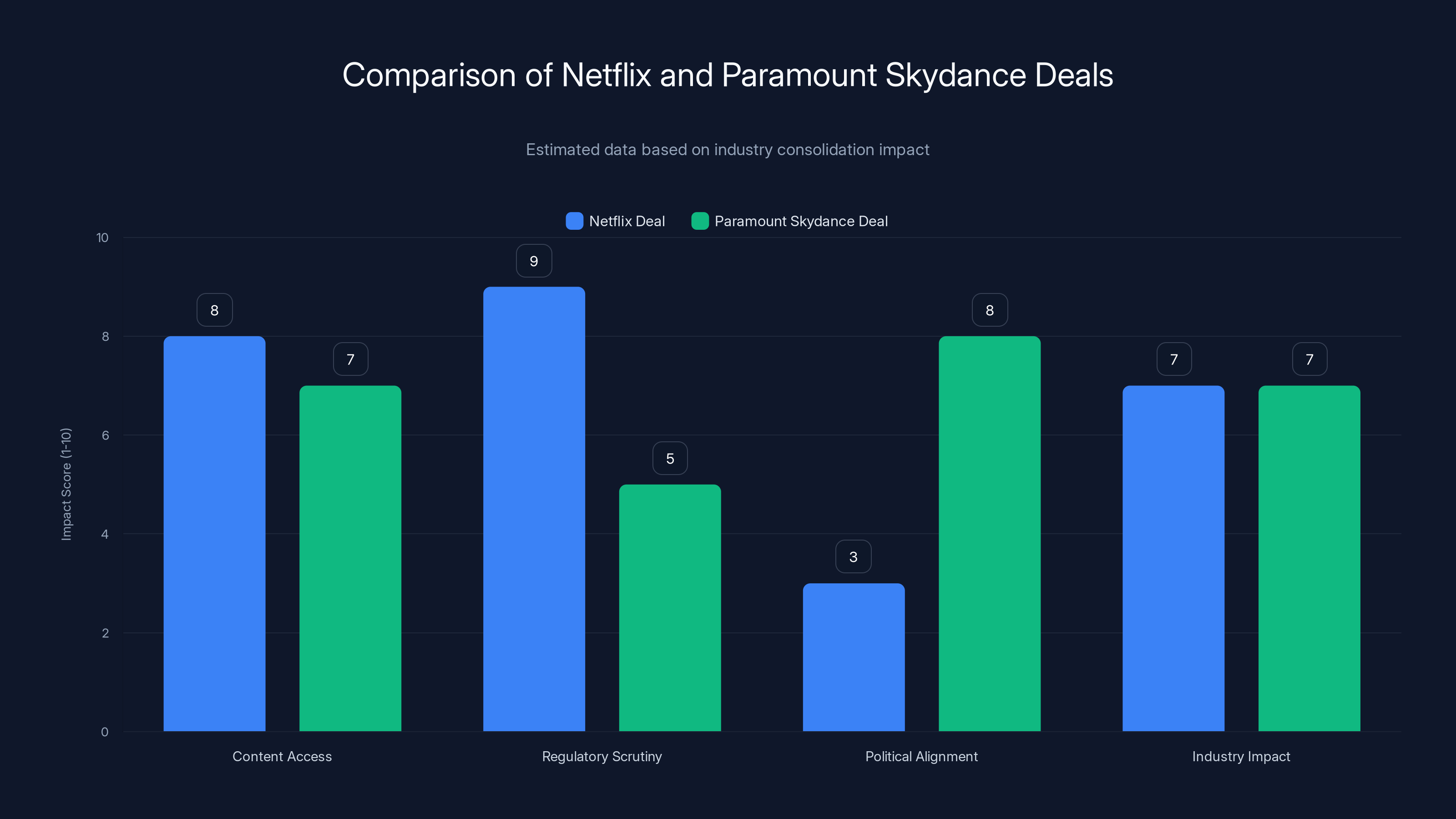

But here's where it gets complicated. Netflix faces a competing bid from Paramount Skydance, led by David Ellison. Ellison's company made an offer to acquire WBD, but WBD's board rejected it, preferring the Netflix deal. Republicans in Congress are openly pushing to block Netflix and clear the path for Paramount Skydance.

Why would Republicans prefer Paramount Skydance? David Ellison's father is Larry Ellison, Oracle's co-founder and a close ally of President Donald Trump. That's the real story beneath the culture war rhetoric. The antitrust hearing became a vehicle for Trump-aligned Republicans to reshape media consolidation in favor of politically connected players.

Paramount Skydance's offer valued WBD at a lower price than Netflix's proposal. If Republicans successfully kill the Netflix deal, they're not preventing consolidation. They're ensuring consolidation happens on different terms, favoring a company with Trump world connections.

Estimated data shows Netflix leads with 30% market share, but competitors like Disney+ and Amazon Prime Video hold significant portions, highlighting a competitive market landscape.

The 'Woke Content' Attack: How Antitrust Became Cultural

Sen. Eric Schmitt (R-Missouri) kicked things off with a question that revealed the real agenda: "Why in the world would we give a seal of approval to make you the largest behemoth on the planet when you've engaged in creating the wokest content in the history of the world?"

This framing is important. Schmitt isn't arguing that Netflix has monopoly power that will raise consumer prices or limit consumer choice. He's arguing that Netflix has the wrong values. The question assumes that antitrust law should be used to punish companies for content decisions lawmakers disapprove of.

Sen. Ashley Moody (R-Florida) doubled down. When Democratic Ranking Member Cory Booker tried to redirect the conversation back to actual antitrust concerns, Moody interrupted. "If there are folks across America struggling with limited options," she said, "you're proposing to become even larger. Let's truly talk about whether there will be options."

Moody's statement reveals the logical flaw in using antitrust to police content. She's claiming that Netflix having a large content library with diverse viewpoints reduces consumer options. But streaming gives consumers infinite choice. You can subscribe to Netflix, Disney+, Max, or any combination. If you don't like Netflix's content, you have ten other platforms to choose from. The idea that Netflix's size inherently limits options misunderstands how streaming works.

Then came Sen. Josh Hawley (R-Missouri), who pivoted sharply from questions about union labor to ask: "Why is so much Netflix content for children promoting a transgender ideology?"

Hawley alleged that "almost half" of Netflix's content for minor children "promotes a transgender ideology agenda." This number came from nowhere. Sarandos said he didn't know where Hawley got it. Netflix's actual content data would show nothing close to this percentage. Hawley was making a claim he couldn't substantiate, but the hearing format doesn't allow for real-time fact-checking.

Sen. Ted Cruz (R-Texas) took it even further, asking Sarandos if he'd watched the Grammy Awards and making a bizarre reference to a speech by Billie Eilish that mentioned "stolen land." Cruz seemed to be testing whether Sarandos would defend progressive rhetoric, baiting him into a culture war argument.

What's striking is that none of these attacks addressed Netflix's actual competitive power. They didn't ask whether Netflix has raised prices unfairly. They didn't ask whether Netflix exclusives harm creators. They focused entirely on content themes and political messaging.

The Cuties Controversy: A Symbol of the Real Debate

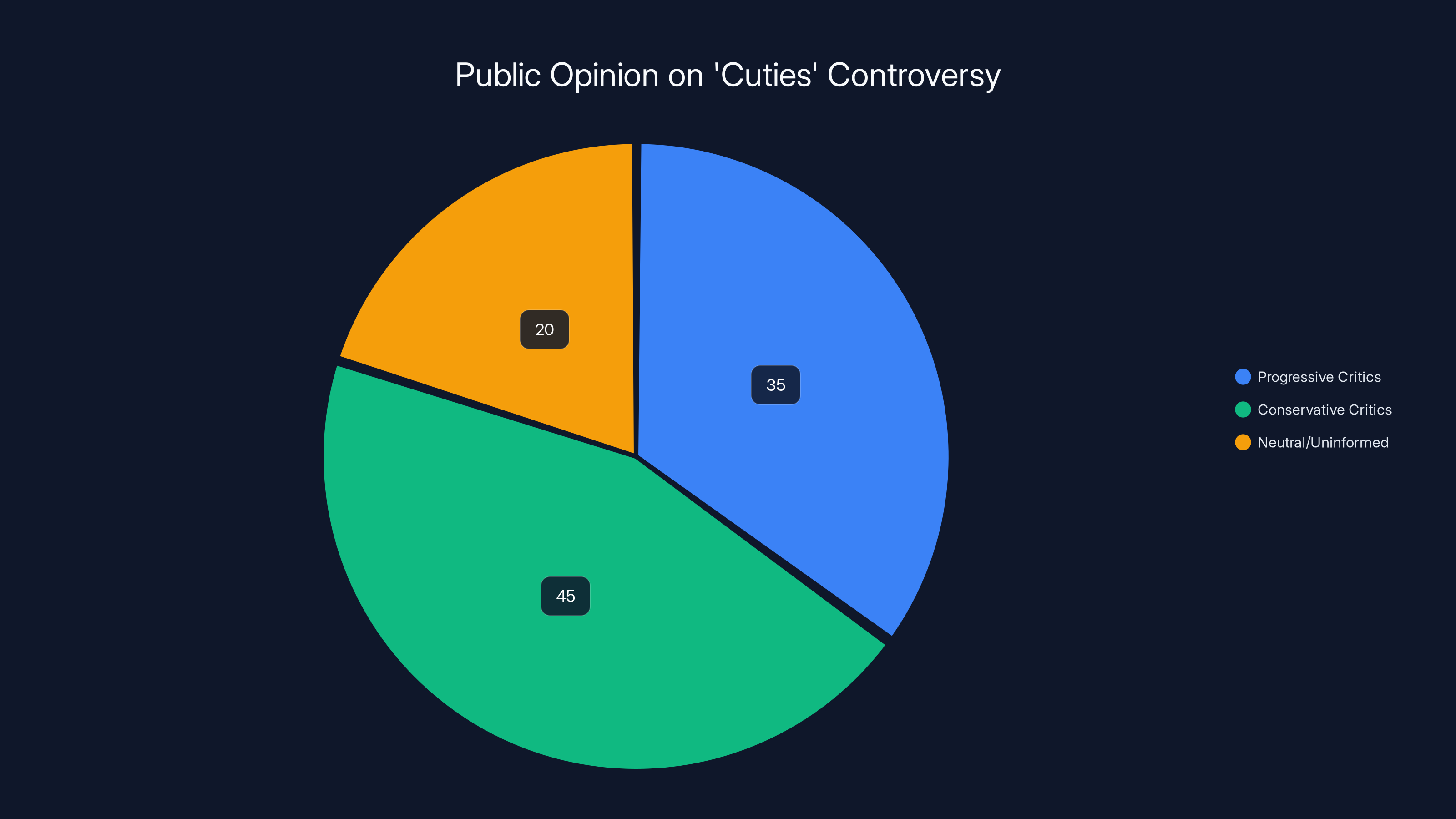

The 2020 French film "Cuties" came up repeatedly during the hearing. The movie, directed by Maïmouna Doucouré, is a social commentary on the sexualization of young girls in social media culture. It's told through the perspective of pre-teen dancers, and Netflix included it on its platform with a mature audience rating.

Conservatives have long targeted "Cuties" as an example of Netflix promoting inappropriate content involving children. The controversy exploded on social media, with some claiming Netflix was sexualizing minors, even though the film is rated for mature audiences, not children.

What's important to understand is why "Cuties" became symbolic. It represents a real debate about the purpose of art and entertainment. Progressive critics see the film as a legitimate critique of how capitalist consumer culture exploits childhood innocence. Conservative critics see it as inappropriate content that shouldn't be distributed.

But here's the thing: this debate has nothing to do with antitrust law. Whether "Cuties" is good art or inappropriate content is a cultural question, not a competition question. If antitrust law becomes the tool for settling cultural debates, we've fundamentally broken the legal system's intended purpose.

The hearing never asked the right questions about "Cuties." Did Netflix's distribution of this film harm competition? Did it give Netflix an unfair advantage over competitors? Could consumers who want family-friendly content easily choose another platform? The answer to all three questions is no. But those questions didn't come up, because this wasn't really about antitrust.

The pie chart illustrates the estimated distribution of topics discussed during the Netflix congressional hearing, highlighting a significant focus on cultural content issues over traditional antitrust concerns. Estimated data.

Dead End: Paranormal Park, The Baby-Sitters Club, and the Real Culture War

Republicans specifically called out Netflix shows featuring transgender characters. "Dead End: Paranormal Park" and "The Baby-Sitters Club" came up as examples of Netflix's alleged ideological bias.

The logic here is worth examining. Republicans argued that because Netflix has a large platform and substantial content library, it has an obligation to present diverse viewpoints and limit progressive representation. This is a remarkable inversion of free speech principles. The argument goes: if you're big enough, you should be forced to include content you wouldn't choose to include.

But this reveals the contradiction at the heart of the hearing. Netflix is being simultaneously attacked for:

- Being too large and powerful

- Using that power to pursue its own content vision

- That vision being too progressive

The unstated alternative would be either: Netflix remaining small (but then it wouldn't be a "monopoly"), or Netflix being large but forced to make content decisions based on government preferences rather than business judgment.

The Trump connection matters here. Elon Musk, a major Trump ally, has long attacked Netflix over shows like "Dead End: Paranormal Park." Musk led social media campaigns against Netflix for including trans characters. Now, Trump-aligned Republican senators were using Senate hearings to amplify those attacks through regulatory pressure.

This is how regulatory capture works in the cultural era. You don't need to change the law explicitly. You just need to make it clear that regulatory approval depends on cultural compliance.

Follow the Money: Campaign Contributions and Political Bias

Republicans also attacked Netflix's workplace politics. They noted that Netflix employees make significant campaign contributions, primarily to Democratic candidates. GOP lawmakers characterized this as evidence of Netflix's political bias.

This argument takes a false premise and runs with it. Netflix's employees giving money to Democratic campaigns isn't evidence that Netflix has a political agenda. It's evidence that creative workers in major cities tend to hold progressive politics, a pattern consistent across entertainment, journalism, academia, and tech.

The same argument could be made about workers at any major media company, including those owned by Republican-friendly investors. Fox News, for instance, is watched primarily by Republican audiences, but you wouldn't say that proves Fox News has a political agenda, even though its editorial choices clearly cater to that audience.

But the underlying question is worth taking seriously: should the government evaluate corporate mergers based on the political affiliations of employees or the content choices that follow from those affiliations? The answer should be a clear no. Antitrust law focuses on competitive harm, not ideological preferences.

Yet the hearing showed how these boundaries have collapsed. A senator can stand up and argue that a company's market power is problematic because the company's employees donate to Democrats. And in the current political environment, that argument doesn't get laughed out of the room. It becomes part of the public record of a Senate hearing.

David Ellison's Empty Chair: The Real Power Move

David Ellison, CEO of Paramount Skydance and the competing bidder for WBD, declined to attend the hearing. Through Cory Booker, Ellison said he didn't think it would be helpful to attend.

But Ellison met with lawmakers privately. This is where the real power dynamics become clear. Ellison didn't need to testify, because he didn't need to convince Congress. He just needed to convince Trump. By declining to attend, Ellison avoided saying anything that could be used against him or his company later.

Meanwhile, Sarandos had to sit there and defend Netflix's content choices to hostile senators. His company faces regulatory uncertainty. His competitor faces none, because the competitor has the right political connections.

This is how regulatory capture really works. It's not about explicit corruption. It's about structuring the process so that politically connected companies face less scrutiny and uncertainty.

Ellison's absence was a flex. It signaled that Paramount Skydance doesn't need to convince Congress. It just needs to wait for the Trump administration to make decisions based on other factors.

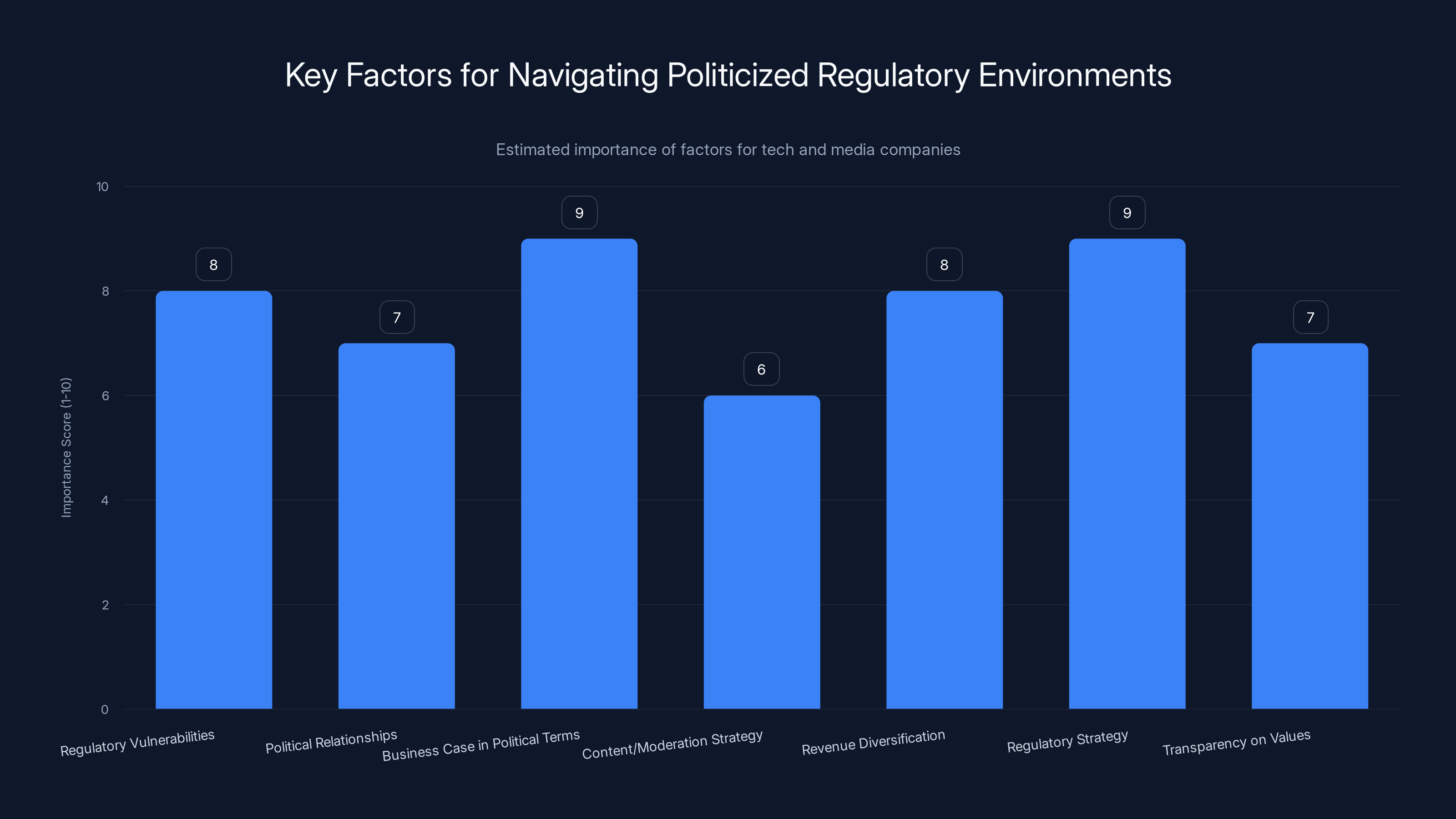

Estimated data suggests that articulating a business case in political terms and having a strong regulatory strategy are crucial for navigating a politicized regulatory environment.

The Democratic Response: Trying to Save Antitrust Law

Democratic senators attempted repeatedly to steer the hearing back to actual antitrust concerns. Cory Booker, the subcommittee's ranking member, kept trying to ask about the merger's competitive impact.

But Democratic senators faced their own bind. If they defended Netflix too strongly, they'd be defending a company that does make controversial content choices. If they defended the content, they'd be walking into the culture war trap Republicans set.

The smartest Democratic response would have been to say: "The question of whether this content is appropriate is a cultural question that has nothing to do with antitrust law. Our job is to assess competitive harm, not to judge whether a company's content aligns with our values. If Republicans want to regulate content, they can propose legislation to do that. But we shouldn't use antitrust law for that purpose."

But that response requires political courage. It requires saying that even though Netflix makes content that some Republicans find objectionable, the merger should be evaluated on competitive grounds alone. Few Democrats want to be on record defending Netflix's content decisions in 2025, when cultural warfare dominates media coverage.

So instead, Democrats largely sat back and let Republicans dominate the hearing's narrative.

What This Means for Antitrust Enforcement

The Netflix hearing signals a fundamental shift in how antitrust law will be weaponized going forward. It's no longer just about competition and consumers. It's about using regulatory power to reshape corporate culture according to government preferences.

This creates several problems. First, it makes the regulatory environment unpredictable. Companies can't know whether they'll face scrutiny based on competitive merit or cultural preferences. That uncertainty chills investment and innovation.

Second, it undermines antitrust law's actual purposes. Antitrust is supposed to protect competition and consumers from anticompetitive behavior. When antitrust becomes a tool for cultural warfare, actual competitive harms get ignored.

Third, it creates perverse incentives. Companies realize that political connections matter more than competitive merit. The optimal strategy becomes hiring connected politicians and making cultural decisions that align with whoever's in power, not building better products or serving customers better.

Fourth, it empowers regulatory capture. Companies that have the right political connections can navigate regulatory processes more easily, while competitors face harassment and uncertainty.

The Streaming Wars Context: Why the Netflix Deal Matters

To understand why this hearing matters, you need to understand the broader streaming market dynamics. Netflix dominates streaming by subscriber count, but it doesn't have monopoly power in the traditional antitrust sense.

Consumers subscribe to multiple streaming services. Households typically subscribe to four or five platforms simultaneously. If Netflix's pricing becomes too high or its content becomes too limited, consumers switch to competitors. This is the opposite of monopoly power.

But Netflix does face a real competitive challenge: content scarcity. As studios have launched their own streaming platforms (Disney+, HBO Max, Paramount+), Netflix has lost access to licensed content. The company can no longer rely on licensing films and TV shows from competitors. Instead, it must produce original content.

The WBD acquisition would give Netflix more predictable access to premium content. HBO originals, Warner Bros. films, and DC properties would feed Netflix's library. This is a strategic move to solve a real business problem: the fragmentation of content across competing platforms.

But this isn't monopolization. It's adaptation to a changed market. Other streamers are doing the same thing. Disney+ has all Disney content. Amazon bought MGM to get its library. Apple has been producing prestige content. Everyone is vertical integrating because the licensing model broke down.

The antitrust question should be: does this deal create barriers to entry for new competitors or raise prices for consumers? The honest answer is probably no on both counts. Netflix's pricing is actually declining or flat, and new competitors can still produce quality content.

Estimated data shows that weaponizing law for cultural purposes negatively impacts market efficiency, innovation, and trust in regulation while increasing cultural influence.

The Paramount Skydance Alternative: A Different Consolidation

Let's think through what happens if Congress kills the Netflix deal. Paramount Skydance's bid becomes the default acquisition path. That's consolidation too. It's just consolidation controlled by different people.

Paramount Skydance is owned by David Ellison's family office and involves several other investors. It's a private equity-ish structure, but with Trump-aligned leadership. If Paramount Skydance acquires WBD, you get the same consolidated entertainment company. The only difference is who controls it.

The Republican senators testifying seemed indifferent to this consolidation. Their concern wasn't consolidation per se. Their concern was that Netflix's consolidation would be controlled by people who make progressive content decisions.

This reveals that the "antitrust" objection was never really about antitrust. It was about power. Who controls the consolidated company matters to Republicans, because they believe that power will translate into content decisions.

If antitrust law is going to be used this way, then consolidation decisions will always be made based on political preferences, not competitive concerns. That's worse for competition and consumers than allowing the most efficient merger.

Netflix's Defense: The Sarandos Strategy

Ted Sarandos had to walk a careful line during the hearing. He couldn't defend all of Netflix's content choices without sounding partisan. He couldn't repudiate the content without looking like he was surrendering to political pressure.

Sarandos repeatedly said Netflix has no political agenda. He emphasized that Netflix produces content for all audiences and ideologies. He noted that Netflix has produced content that conservatives enjoy and that aligns with conservative values.

This is actually true. Netflix produces a huge range of content. You can find progressive shows and conservative-friendly shows on the platform. A massive streaming library will inevitably include content across the political spectrum.

But here's what Sarandos couldn't say without making things worse: "Netflix is a private company that should be free to make content decisions based on what it thinks will appeal to its audience and shareholders. If you don't like our content, you can subscribe to a different platform."

That's the right answer, but it's not a politically viable answer in 2025. It sounds like defending progressive content against conservative criticism. So instead, Sarandos had to claim that Netflix is politically neutral, which sounds defensive and unconvincing.

The real strategic error Netflix made was not challenging the premise of the hearing. Netflix should have said: "Antitrust law has nothing to do with whether you like our content. It's about whether we harm competition and consumers. We don't. We face intense competition from Disney+, Max, Paramount+, Amazon, and others. If you disagree with our content decisions, you have unlimited alternatives. That's not a monopoly. That's a functioning market."

Historical Parallels: When Ideology Infected Regulation

This isn't the first time American regulators have used their authority to enforce cultural preferences. In the 1950s, federal regulators and Congress went after the entertainment industry for alleged communist infiltration. The House Committee on Un-American Activities conducted hearings that blacklisted hundreds of writers, directors, and actors.

Was there a national security problem that justified this? Historians have long debated that. But what's clear is that regulatory authority was used to enforce ideological conformity, regardless of whether it served the actual purpose of the regulation.

That's what's happening with Netflix. The regulatory authority (antitrust law) is being repurposed to enforce content conformity.

There's also a parallel to recent debates about Section 230 of the Communications Decency Act. Both Republicans and Democrats have attacked tech companies for moderating content according to what they see as ideological bias. Republicans argue that tech companies censor conservative voices. Democrats argue that they spread misinformation.

Both sides want to use regulatory authority to force tech companies to make different content moderation decisions. Neither side is interested in whether the regulation serves its actual purpose.

When regulation becomes a tool for cultural warfare, the normal guardrails on state power disappear. Regulations become weapons deployed in partisan conflicts rather than tools for solving concrete problems.

Estimated data suggests Netflix faces higher regulatory scrutiny and less political alignment compared to Paramount Skydance, despite similar industry impact.

The Broader Implications for Tech and Media

If this hearing sets a precedent, the implications are significant. Any large tech or media company will know that regulatory approval depends partly on cultural factors. That creates incentives to hire politically connected people and to make content decisions based on regulatory expectations rather than market demand.

You can imagine Facebook being told by regulators that its content moderation policies are acceptable only if the company makes certain ideological changes. You can imagine Google being pressured to adjust search results or recommendations based on political preferences. You can imagine Amazon being told to make certain content decisions about Prime Video.

Once the door opens to using regulatory authority for cultural enforcement, companies throughout the tech and media industries have to figure out how to navigate an increasingly politicized regulatory environment.

Smaller companies might face even worse pressure, because they have less ability to weather the regulatory uncertainty. Netflix can probably survive a hostile regulatory environment because it has billions in revenue and market power. A smaller streaming competitor or content platform might not be able to.

This creates a strategic advantage for politically connected players and a disadvantage for everyone else.

The Role of Elon Musk and Trump-Aligned Media

Elon Musk has been aggressively attacking Netflix on social media for years. He's criticized specific shows and the company's content decisions. He's positioned himself as the voice of anti-woke consumer preferences.

Musk's attacks weren't just consumer activism. They were part of a broader strategy to position Trump-aligned figures as defenders against cultural progressivism. When Republican senators cite Musk's criticisms during Senate hearings, they're legitimizing his cultural agenda through regulatory authority.

This is a powerful dynamic. Musk uses his platform to attack Netflix. Republican senators hear the criticism and adopt it into their regulatory strategy. Netflix faces pressure from multiple directions: market pressure from alternative platforms, cultural pressure from influential figures like Musk, and regulatory pressure from Congress.

None of this is illegal or necessarily improper. But it creates an ecosystem where political power translates into regulatory power, and regulatory power translates into cultural influence.

The Trump administration's approach to tech and media regulation seems likely to involve more of this kind of cultural pressure. Regulatory decisions will be based not just on traditional legal factors but also on political loyalty and cultural alignment.

Looking Forward: What Happens Next

The hearing was theater, but the decision is real. The Trump administration will decide whether to block the Netflix-WBD deal or allow it to proceed. That decision could come down to pure political calculation.

If the administration wants to favor Paramount Skydance, it can find antitrust reasons to block Netflix. If it wants to be pragmatic, it can allow the deal based on the actual competitive analysis.

There's no way to know for certain what the administration will do. But the hearing sent a clear signal: cultural factors matter in merger review. Companies can't assume that traditional antitrust analysis will determine outcomes.

That changes corporate strategy. Companies will invest more in political relationships and less in pure competitive innovation. They'll make cultural decisions based on regulatory expectations. They'll try to anticipate what politicians want and deliver it proactively.

This is how regulatory capture becomes systemic. You don't need explicit corruption. You just need to make the regulatory environment unpredictable in ways that reward political connection and punish independence.

Estimated data shows a division in public opinion on 'Cuties', with 45% viewing it as inappropriate and 35% as a critique of social issues.

The Deeper Issue: When Law Becomes a Weapon

The Netflix hearing ultimately reveals something uncomfortable about contemporary American politics. Law is increasingly being used as a weapon in cultural warfare.

This isn't unique to Republicans or to this particular hearing. Democrats have done similar things when they had power. The point is that when politics becomes zero-sum and cultural warfare becomes the dominant frame, every regulatory tool gets weaponized.

Antitrust law has a specific purpose: protecting competition and consumers. When it's repurposed for cultural enforcement, it stops serving that purpose. Regulations become unpredictable. Companies face uncertainty that has nothing to do with competitive merit.

The irony is that this weakens everyone's ability to use regulatory authority for its actual purposes. If antitrust becomes a tool for cultural warfare, regulators can't be trusted to make decisions based on competition. Markets become less efficient. Innovation suffers.

The Netflix hearing won't be the last time we see regulatory authority repurposed for cultural warfare. As long as politics remains deeply polarized and cultural issues dominate the political agenda, we should expect more of this.

The only way to prevent this is for political actors to commit to keeping regulatory authority separate from cultural preferences. That requires restraint. It requires sometimes accepting outcomes you disagree with because the alternative is making the regulatory system itself unreliable.

There's no evidence that restraint is coming.

Key Takeaways: What the Hearing Really Meant

So what's the actual significance of the Netflix Senate hearing? Here are the real insights:

First, antitrust law is increasingly being politicized. Merger review is no longer a technocratic process focused on competition. It's becoming a tool for enforcing political preferences.

Second, cultural warfare is now embedded in regulatory decision-making. Companies can't assume that traditional legal analysis will determine regulatory outcomes. Political alignment matters.

Third, consolidation in streaming and media will happen regardless. The question isn't whether companies will merge and concentrate. The question is who controls the consolidated companies.

Fourth, predictability and rule of law matter for markets. When regulatory decisions depend on cultural preferences rather than clear legal standards, companies face uncertainty that chills investment and innovation.

Fifth, smaller companies face disproportionate pressure. Netflix has enough resources to weather regulatory uncertainty. Competitors and new entrants might not.

Sixth, this strategy favors politically connected players. Paramount Skydance benefited from Trump alignment without having to testify or defend its merger. Netflix faced hostile questioning despite similar consolidation.

Seventh, the streaming market remains competitive despite consolidation. Consumers have abundant choices. Netflix faces real competition from multiple platforms.

Eighth, content decisions are cultural choices, not antitrust issues. Whether Netflix should have produced different content is a cultural and market question, not an antitrust question.

Ninth, precedent matters. Once regulatory authority is used for cultural enforcement in one case, it becomes the template for future cases.

Tenth, the underlying debate is about power. Who should control major media platforms? The answer in a market economy should be companies and their shareholders, constrained only by competitive pressure from alternatives. The answer in a politicized regulatory environment increasingly becomes: whoever has the most political influence.

The Streaming Landscape: Beyond Netflix

The Netflix hearing happens in the context of dramatic change in how Americans consume entertainment. Streaming has fundamentally transformed the media landscape.

When streaming launched, it seemed like it would create abundant choice and break the power of traditional media companies. In theory, the internet would reduce distribution barriers, allowing creators to reach audiences directly without gatekeepers.

What actually happened is more complicated. Streaming created choice in some ways and concentration in others. There are now dozens of streaming platforms, so consumers have abundant options. But creating original content is expensive. Most successful streaming shows require production budgets in the tens of millions. Only companies with substantial capital can make those shows consistently.

This has actually favored large, diversified media companies. Netflix, Disney, Warner Bros., Paramount, Amazon, and Apple can afford to produce prestige content and absorb the risk of failure. Smaller platforms struggle to compete.

The consolidation that's happening in streaming is partly a response to this economic reality. To compete, you need content, and content is expensive. Mergers and acquisitions are one way to build content libraries and spread risk.

From a pure efficiency standpoint, consolidation might make sense. Merging two companies can eliminate duplicate infrastructure and spread costs more efficiently.

But consolidation also has downsides. Fewer independent companies might mean less diversity in what gets produced. Merged companies might optimize for the broadest possible audience rather than taking creative risks.

The question for antitrust policy should be whether consolidation creates competitive harm. Does it raise prices for consumers? Does it limit consumer choice? Does it reduce incentives to innovate?

In the case of Netflix and WBD, the answer to all three questions seems to be no. Streaming prices have been relatively flat or declining. Consumers have more entertainment options than ever. Netflix continues to invest heavily in new content to compete.

But if antitrust review becomes about cultural preferences rather than these economic questions, you get the Netflix hearing: lots of argument about content ideology, and very little analysis of actual competitive harm.

International Dimensions: How Other Countries Handle This

The Netflix hearing is distinctly American. It reflects American political dynamics and the particular role of Senate committees in regulatory oversight.

But other countries are also grappling with how to regulate large streaming platforms and media consolidation.

Europe has been more aggressive about media consolidation review. European regulators have blocked mergers that American regulators might allow. But European regulators also tend to be more technocratic and less subject to cultural political pressure.

China regulates streaming platforms explicitly based on content. The government dictates what can and can't be shown on Chinese platforms. But that's authoritarianism, not antitrust policy.

Canada and Australia have both investigated streaming platforms and content consolidation. But they tend to focus on economic impacts rather than cultural preferences.

The risk of the American approach is that it combines the worst of both worlds. You have market-oriented antitrust policy being warped by cultural politics. That's less effective at protecting competition than technocratic review, and it's less transparent about censorship than explicit content regulation would be.

Preparing for a More Politicized Regulatory Environment

For companies operating in tech and media, the Netflix hearing is a warning. Regulatory approval will increasingly depend on factors beyond traditional legal analysis.

Companies should prepare for more politicized review by thinking through several factors:

First, what regulatory vulnerabilities do you have? Are there aspects of your business that could be politically controversial?

Second, what political relationships do you need? You don't need to be politically connected to survive, but you need to know how to navigate a more politicized environment.

Third, how can you make your business case in political terms? You need to be able to articulate why your company benefits not just shareholders but workers, consumers, and communities.

Fourth, what's your content or moderation strategy? If your business involves content decisions, you need to think through how different regulatory environments might pressure those decisions.

Fifth, how diversified is your revenue? Companies that depend on a single market or regulatory jurisdiction face more vulnerability. Companies diversified across geographies and business lines can weather regulatory uncertainty in any single jurisdiction.

Sixth, what's your regulatory strategy? Some companies have full-time government relations teams. The Netflix hearing suggests that's increasingly essential.

Seventh, how transparent should you be about your values? Companies face pressure to take stances on cultural issues. But those stances create regulatory vulnerabilities. You need to think through the tradeoffs.

The Bigger Picture: Law, Politics, and Power in the 2020s

The Netflix hearing is one data point in a much larger story about how American institutions are changing in the 2020s.

Tradition held that regulatory agencies would be relatively technocratic. They'd make decisions based on expertise and legal standards, not politics. That tradition has eroded significantly.

Several factors contributed to this erosion. First, regulatory law became more open to presidential direction. Agencies increasingly see themselves as serving the president, not as independent technocratic institutions.

Second, politics became more polarized and zero-sum. When politics is about distributing the same resources, regulatory compromise is possible. When politics is about cultural identity, compromise feels like surrender.

Third, regulatory decisions became more visible and consequential. As the economy became more dominated by a few large platforms and companies, regulatory decisions about those companies mattered more politically.

Fourth, politicians learned that they could weaponize regulatory authority for political purposes. Threatening companies with regulatory investigation or blocking their mergers gets media attention and mobilizes supporters.

The Netflix hearing is both a cause and a symptom of this broader shift. The hearing itself contributes to the politicization of antitrust, but it's also responding to political dynamics that were already in place.

The question for the future is whether we'll maintain any separation between regulatory authority and politics. If we don't, we end up with an environment where market outcomes depend less on competition and innovation, and more on political alignment.

That's not good for innovation, consumer welfare, or the rule of law.

FAQ

What was Netflix being asked to testify about at the Senate hearing?

Netflix CEO Ted Sarandos was called to testify before the Senate Judiciary Committee's Antitrust Subcommittee about the company's proposed acquisition of a major stake in Warner Bros. Discovery. While the hearing was ostensibly about merger approval, it quickly expanded to include Republican questioning about Netflix's content choices, specifically programs featuring LGBTQ+ and transgender characters.

Why did Republicans focus on Netflix's "woke" content during an antitrust hearing?

Republican senators used the hearing as an opportunity to leverage regulatory power toward cultural goals. They argued that Netflix's large platform and substantial content library gave it power that shouldn't be expanded, and they tied that argument to objections about the company's content featuring progressive themes. This represented a departure from traditional antitrust analysis, which focuses on competitive harm and consumer welfare rather than content ideology.

How does the Netflix deal compare to the competing Paramount Skydance bid?

Both deals involve consolidating major entertainment companies. Netflix's proposed acquisition would give the company access to premium HBO and Warner Bros. content. Paramount Skydance's competing bid represented an alternative path to the same consolidation, but with different ownership and control. The key difference is that David Ellison's Paramount Skydance had Trump administration alignment, while Netflix faced hostile regulatory scrutiny despite both deals creating similar levels of industry consolidation.

What does "woke content" actually mean in this context?

During the hearing, Republican senators used "woke" to refer specifically to Netflix shows and content featuring LGBTQ+ characters, transgender storylines, and progressive political messaging. The term itself is contested, with critics arguing it's used too broadly to describe any progressive-leaning entertainment. Netflix's actual content library includes a wide range of programming across the political and cultural spectrum, but Republican senators focused specifically on the more progressive-leaning shows.

Why did the Cuties film come up repeatedly during the hearing?

The 2020 French film "Cuties" has been a target for conservative criticism since its release on Netflix. The film, which is a social commentary on the sexualization of young girls in social media culture, was framed by Republican senators as an example of Netflix distributing inappropriate content involving minors. Sarandos explained that the film is rated for mature audiences, not children, but the dispute itself became symbolic of broader disagreements about appropriate content standards.

Does Netflix actually have monopoly power in streaming?

Netflix is the largest streaming company by subscriber count, but it doesn't have traditional monopoly power in the economic sense. Consumers subscribe to multiple streaming platforms simultaneously (Netflix, Disney+, Max, Paramount+, Apple TV+, etc.), and switching between platforms is easy and inexpensive. If Netflix raises prices or reduces content quality, consumers can switch to competitors. This market structure is fundamentally different from a monopoly, where switching costs are high and consumers have few alternatives.

How did this hearing change antitrust review in America?

The hearing signaled that regulatory approval for media mergers will increasingly depend on cultural and political factors, not just traditional competitive analysis. This creates unpredictability for companies and potentially gives politically connected players an advantage. It also suggests that antitrust authority will be used to enforce political preferences, which could undermine the rule of law and market efficiency. Whether this represents a permanent shift or a temporary politicization remains to be seen.

What's the relationship between David Ellison and the Trump administration?

David Ellison's father is Larry Ellison, Oracle's co-founder and a close ally of President Donald Trump. This family connection gave Paramount Skydance perceived political alignment with the Trump administration. Ellison declined to attend the Senate hearing, instead meeting with lawmakers privately, which suggested he didn't need to publicly defend his merger proposal the way Netflix did. This dynamic revealed how political connections can affect regulatory outcomes.

How does content moderation relate to antitrust law?

Traditionally, antitrust law focuses on competitive harm, consumer welfare, and market structure. It doesn't address whether companies make content decisions that some people approve of or disapprove of. By using an antitrust hearing to question Netflix about content choices, Republican senators were attempting to expand antitrust law's scope beyond traditional competitive analysis. This represents a significant shift in how regulatory authority is being used and weaponized for cultural purposes.

What could happen to Netflix's merger if the Trump administration blocks it?

If the Trump administration blocks Netflix's acquisition of Warner Bros. Discovery, the most likely outcome is that Paramount Skydance would acquire WBD instead, creating consolidation controlled by Trump-aligned ownership. This would still result in media consolidation, but with different corporate and political control. The hearing suggested that the issue wasn't consolidation per se, but rather who would control the consolidated company and what content decisions would follow.

Additional Resources and Context

The Netflix Senate hearing occurred in a broader context of tech regulation becoming increasingly politicized across the Trump administration. Similar dynamics have appeared in regulatory reviews of other tech platforms, with antitrust scrutiny being applied alongside cultural and political considerations.

For companies operating in regulated industries, the lesson is clear: regulatory approval increasingly depends on factors beyond traditional legal and economic analysis. Political alignment, cultural preferences, and relationships with those in power now matter significantly.

The hearing also revealed deep partisan disagreement about what antitrust law should accomplish. Republicans used it as a tool for cultural enforcement. Democrats attempted to steer the conversation back to traditional competitive concerns. That clash between different visions of regulatory authority will likely define the Trump administration's approach to tech and media policy.

Related Articles

- Netflix vs. Paramount: The $108B Streaming War Reshaping Hollywood [2025]

- Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]

- Netflix's $82.7B Warner Bros. Acquisition: What You Need to Know [2025]

- Netflix's $72B Warner Bros. Deal: How All-Cash Strategy Defeats Paramount [2025]

- Netflix's $82.7B Warner Bros Deal: The Streaming Wars Heat Up [2025]

- Streaming in 2026: What Subscribers Should Expect [2025]

![Netflix Senate Hearing: When Antitrust Meets Culture War [2025]](https://tryrunable.com/blog/netflix-senate-hearing-when-antitrust-meets-culture-war-2025/image-1-1770165519923.jpg)