The Hidden Signal Behind the AI Infrastructure Boom

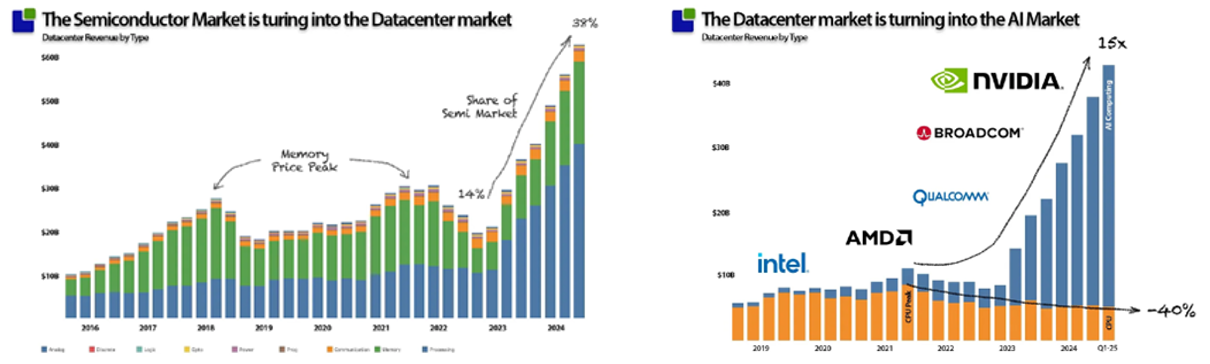

When people talk about the AI boom, they usually focus on the obvious players: OpenAI, Google, Meta, and the startups racing to build the next killer application. But the real story lives deeper in the supply chain, in the unglamorous world of semiconductor manufacturing equipment. And right now, that story is screaming growth.

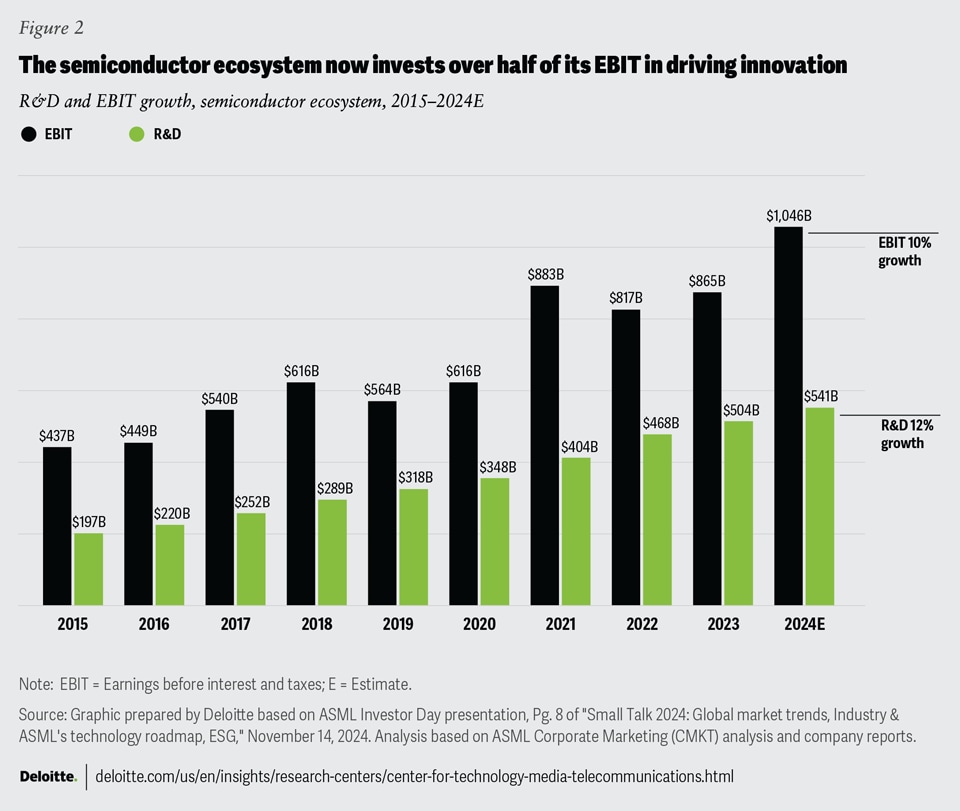

There's a specific company worth paying attention to if you want to understand whether the AI infrastructure buildout is genuinely accelerating or just hype getting recycled for the hundredth time. That company is ASML, a Dutch photolithography manufacturer you've probably never heard of, and they just released numbers that tell us something crucial: companies are betting massive amounts of money that the AI boom is sustainable, not a temporary spike.

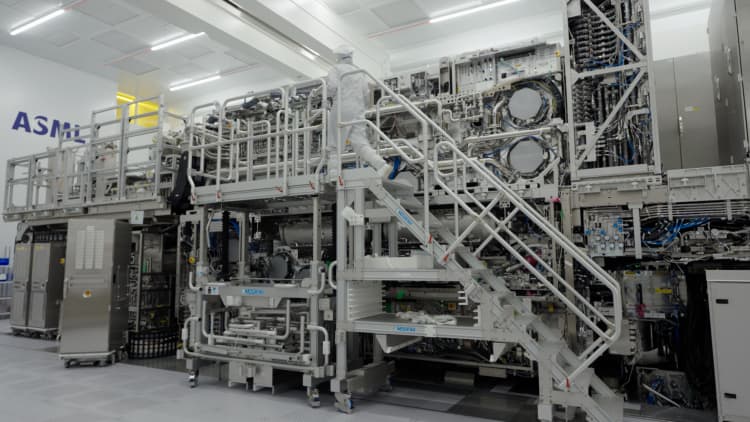

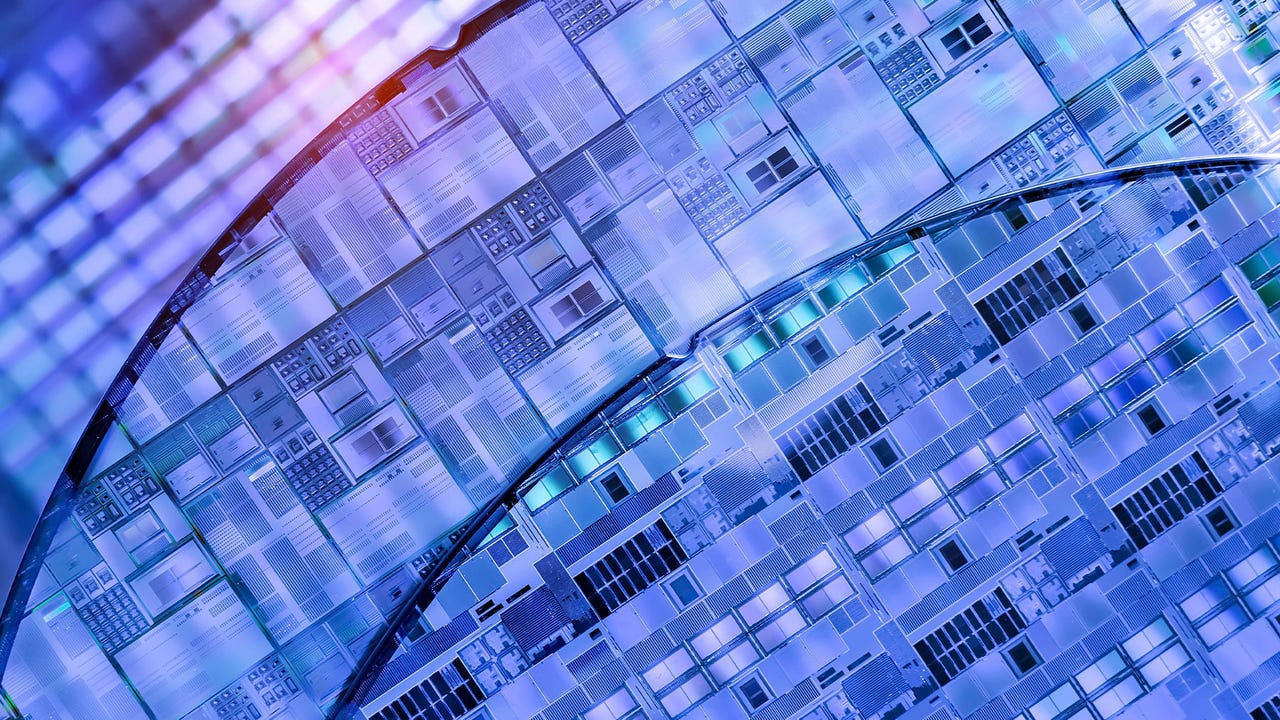

ASML doesn't make chips. They make the machines that make chips. More specifically, ASML manufactures the extreme ultraviolet (EUV) lithography equipment that's essential for producing the most advanced semiconductors on the planet. Think of them as the gatekeeper of cutting-edge chip production. They're so important that the U.S. government has basically weaponized their export restrictions, using ASML's technology as leverage in semiconductor politics with China.

When ASML releases quarterly results, they reveal something incredibly valuable: the order pipeline for chip manufacturing capacity. These aren't sales that happened in the past quarter. They're commitments for equipment that won't be delivered for months or years. By tracking ASML's new bookings, you get a window into what chip manufacturers believe they'll need to produce, which translates directly into how much demand they expect from data center operators, which translates into how much AI infrastructure they think will actually get built and used.

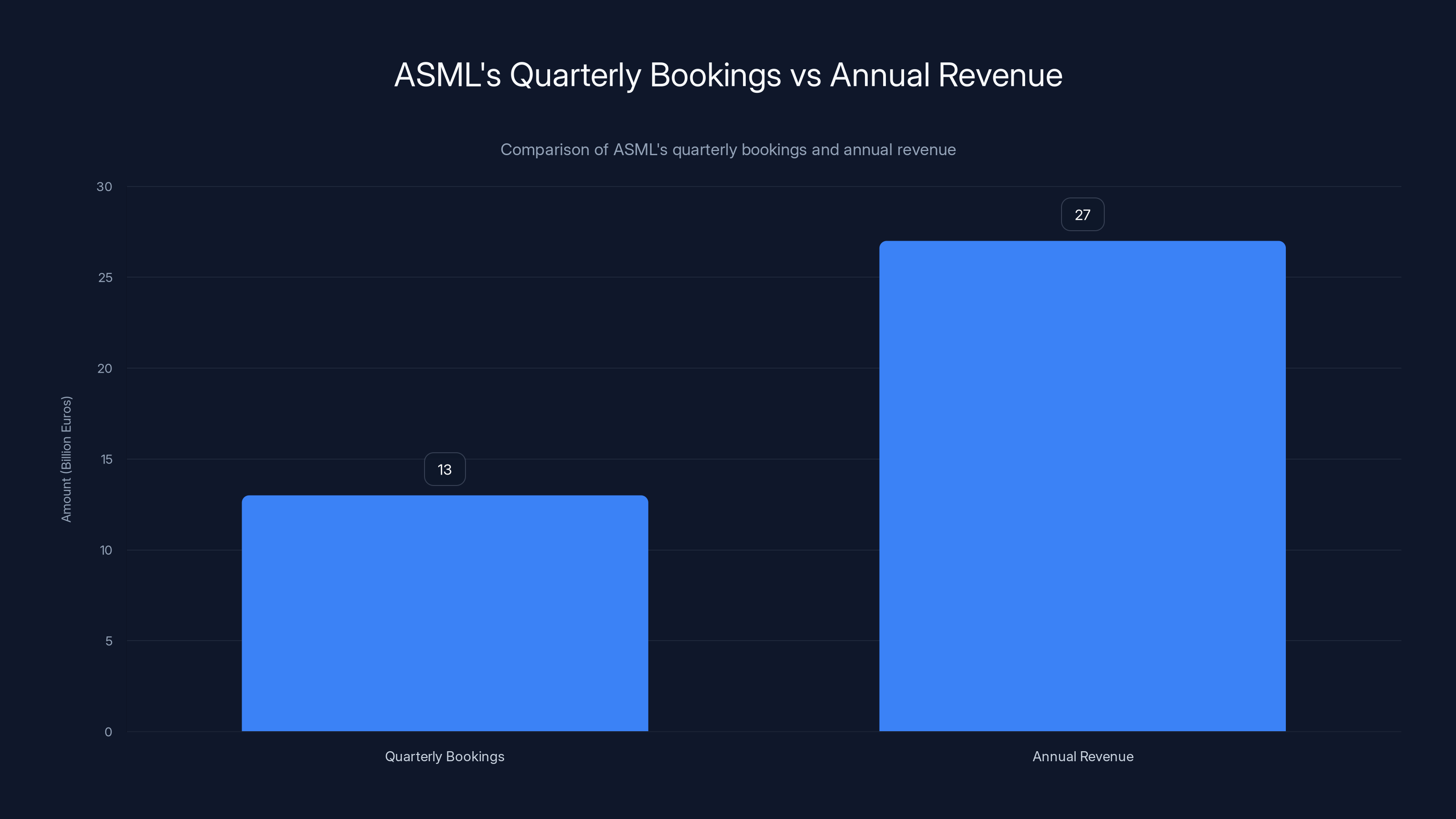

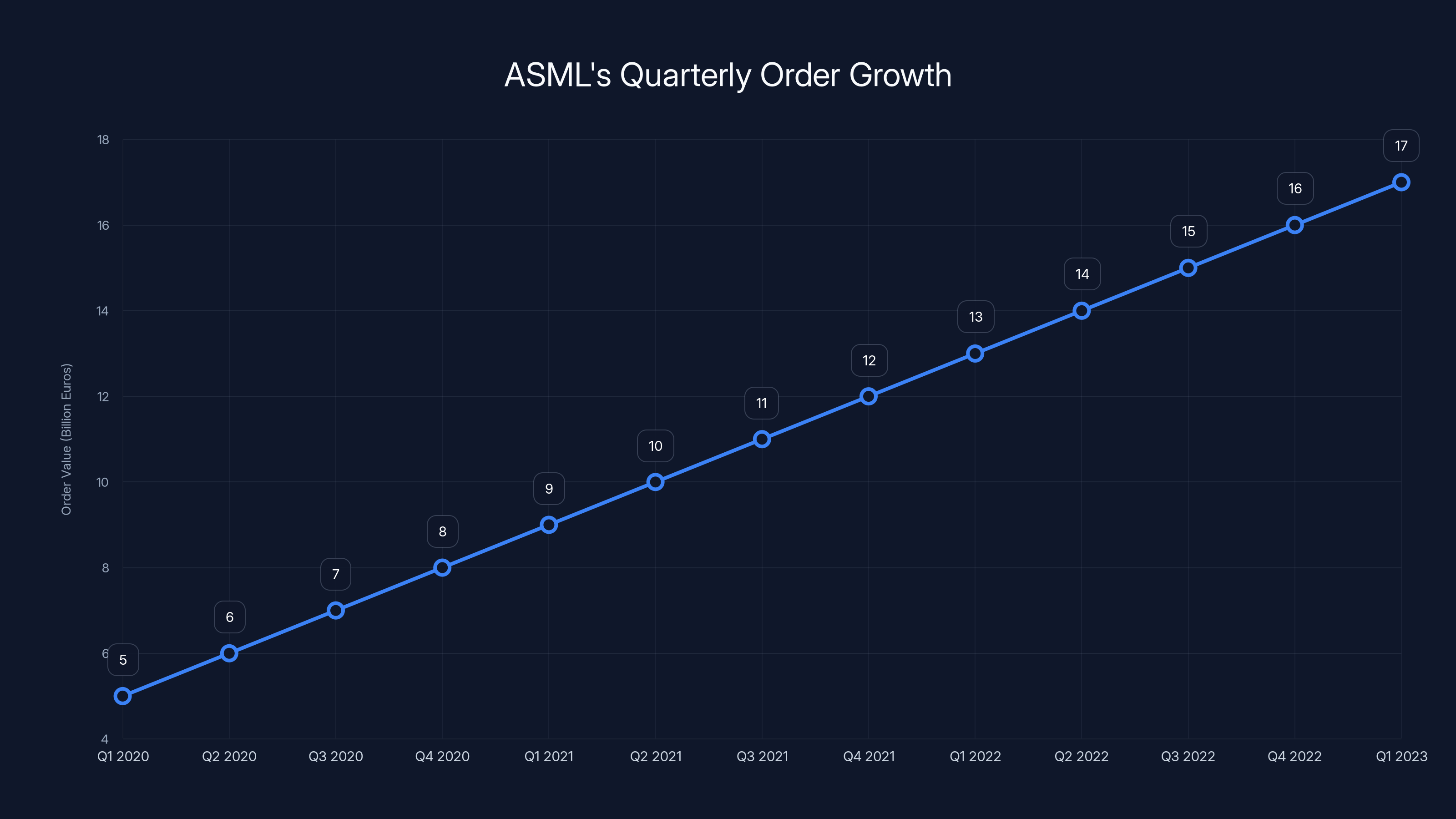

The numbers from their latest earnings are staggering. In a single quarter, ASML booked 13 billion euros in new orders. That's more than double the previous quarter and a new record for the company. This isn't static demand. This is acceleration. And according to ASML's CEO, virtually all of it is connected to AI.

Why this matters: If you're trying to figure out whether we're actually in the middle of a generational infrastructure buildout or just watching an extended hype cycle, ASML's order book is one of the clearest signals available. Companies don't order billions of dollars worth of chip manufacturing equipment unless they genuinely believe they'll need that capacity.

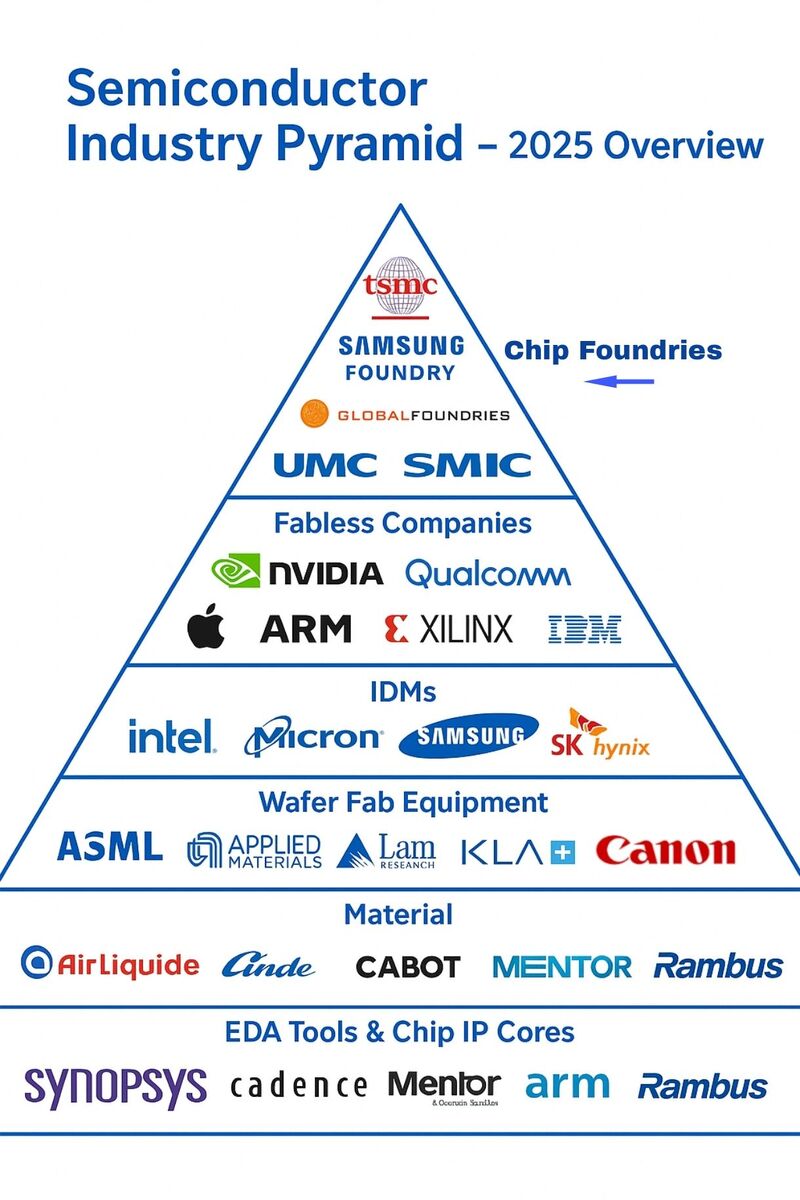

Understanding the Semiconductor Supply Chain Pyramid

Before you can appreciate what ASML's numbers mean, you need to understand how the semiconductor supply chain actually works. It's a pyramid structure, and ASML sits near the very top.

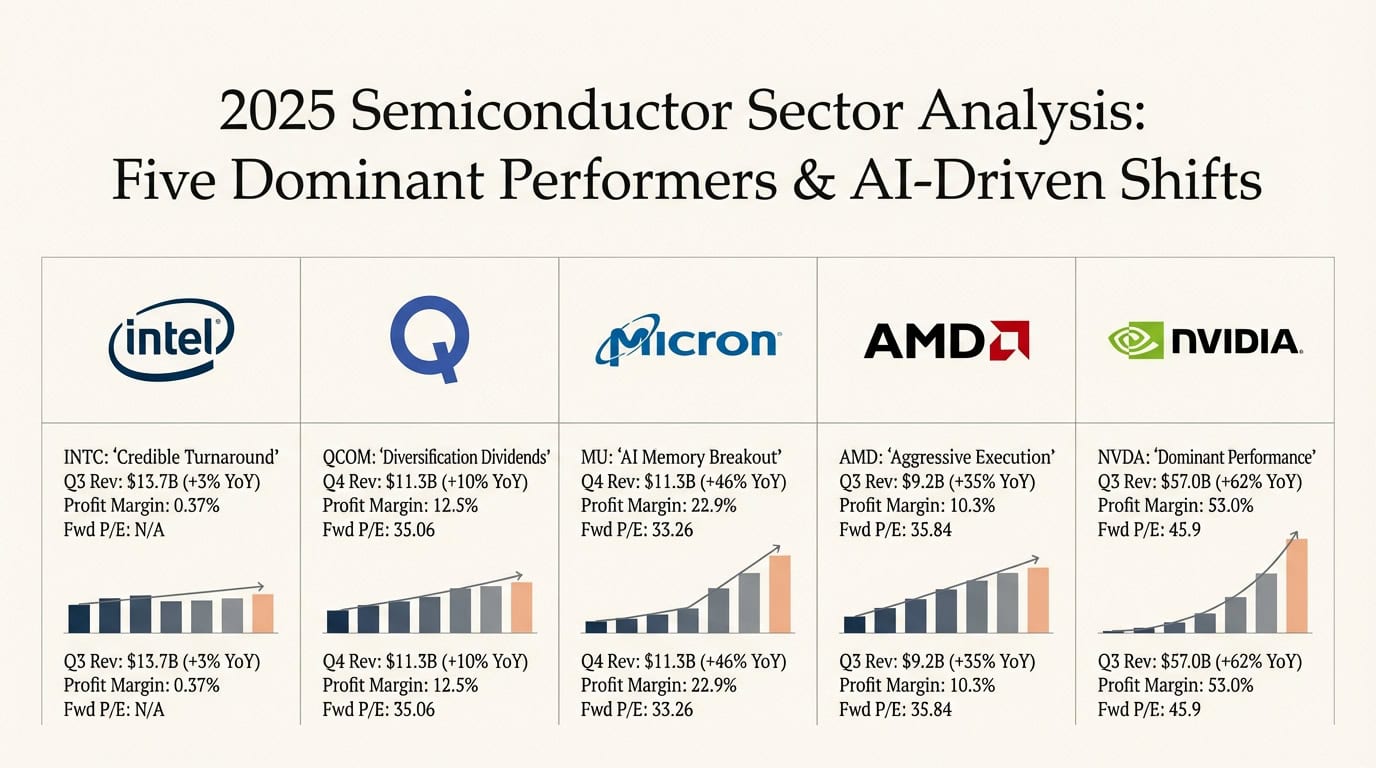

At the bottom of the pyramid are the raw materials: silicon wafers, specialty chemicals, rare earth elements. These flow into the middle layer, where companies like Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and Intel operate fabs, which are the actual factories where chips get manufactured. At the top of the pyramid are the companies buying finished chips: Nvidia, AMD, Intel (for some products), and increasingly, companies like Google and Microsoft who design their own AI accelerators.

But there's a hidden layer that most people ignore: the equipment makers. These are the companies that sell machines to the fabs. ASML is the most important one, but there are others. Companies like Lam Research and Applied Materials sell deposition and etching equipment. KLA Corporation sells inspection systems. The Dutch company ASM International sells atomic layer deposition equipment.

This layer is crucial because equipment purchases are leading indicators. When a fab wants to increase capacity, they don't just magically add more chip production next quarter. They order equipment, wait for it to be manufactured, arrange shipping, install it, calibrate it, and then start producing chips at scale. This cycle typically takes 6 to 18 months depending on the equipment and the complexity of the setup.

So when ASML books 13 billion euros in new orders, they're not just reporting what happened. They're forecasting what the chip industry thinks will happen years from now. The fact that these bookings are more than double the previous quarter tells us something important: chip manufacturers are being asked to produce way more capacity than they were being asked to produce just a few months ago.

The timing matters: ASML's CEO, Christophe Fouquet, made it explicit in the earnings call. He noted that customers have become much more optimistic about medium-term demand for AI-related semiconductors. They're not just riding out a peak. They believe this is sustainable.

That's a shift from earlier in 2024, when there was legitimate concern about whether data center buildouts would slow down. The fact that customers are now more confident, confident enough to commit to equipment orders that will take months to fulfill, suggests the narrative has changed from "is AI real?" to "how fast can we scale?"

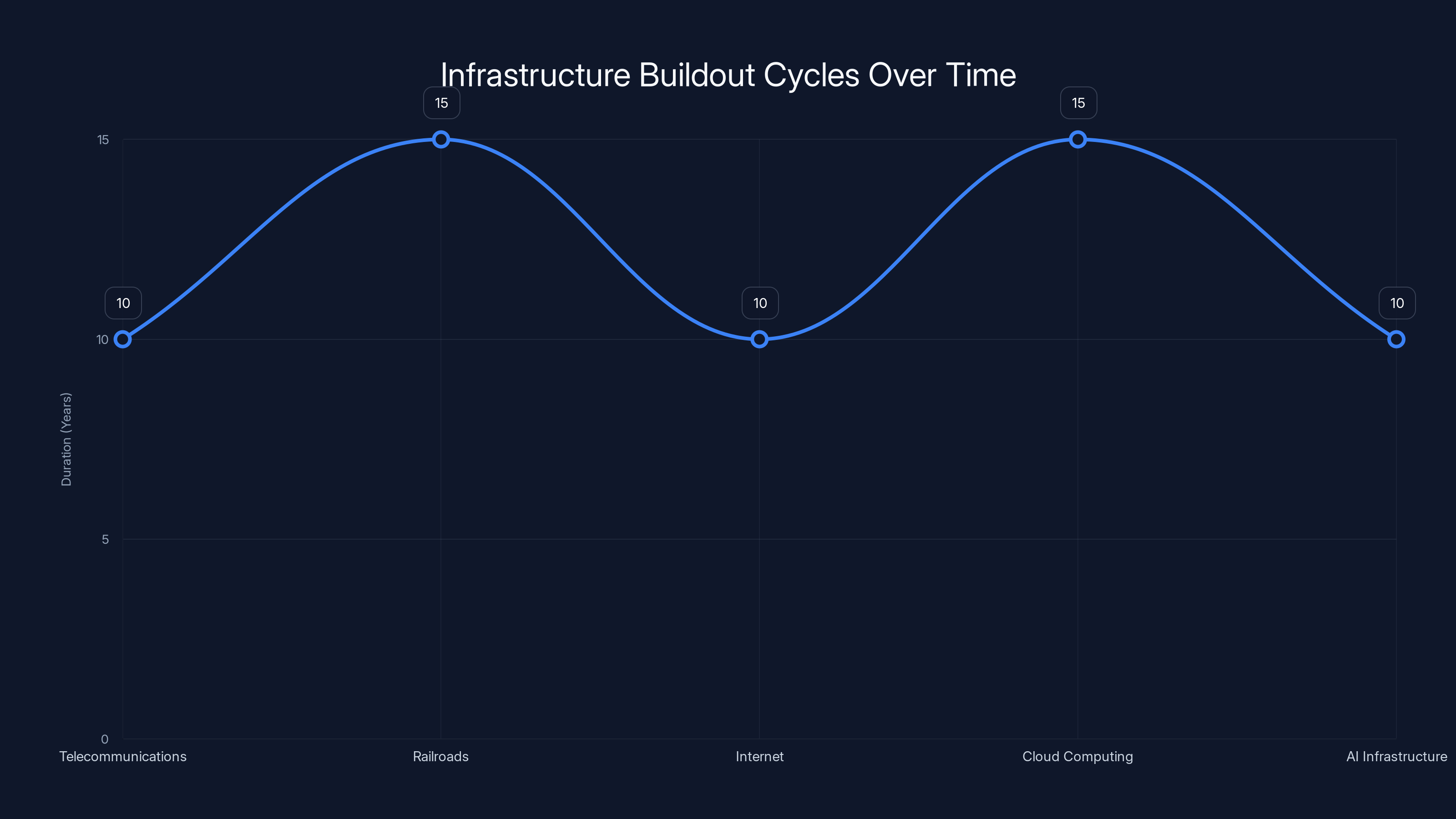

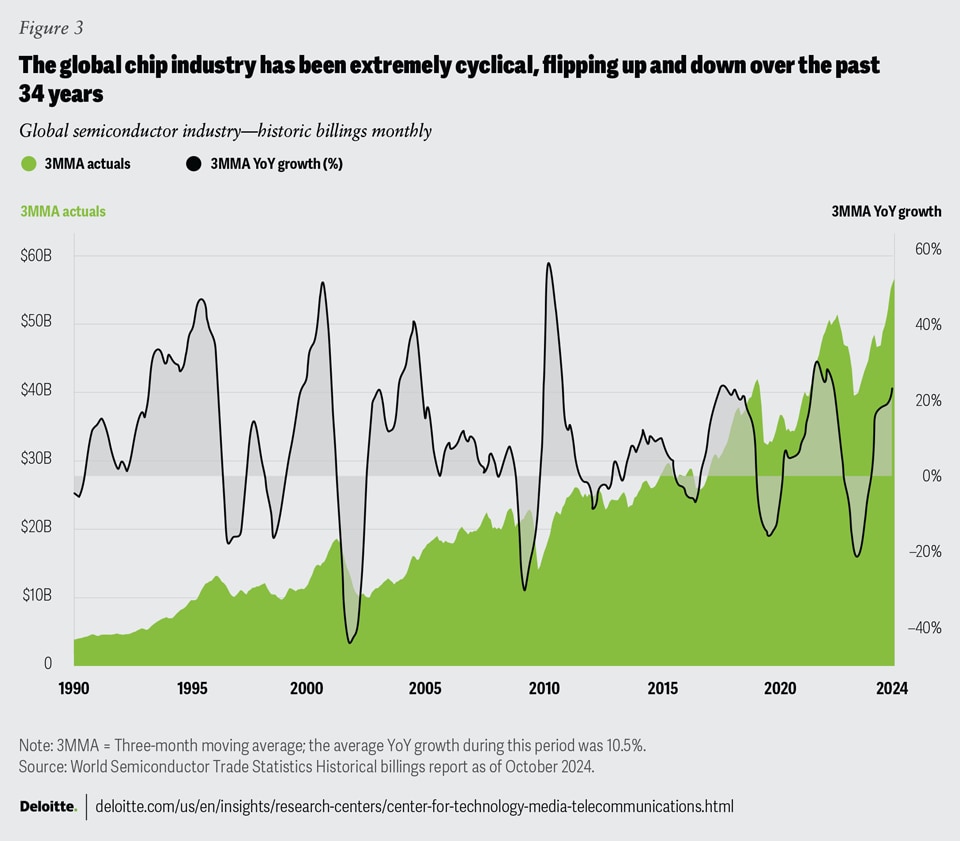

Historically, infrastructure buildout cycles last between 10 to 15 years. AI infrastructure is projected to follow a similar 5-10 year cycle. Estimated data.

Why Nvidia's Success Is Really ASML's Success

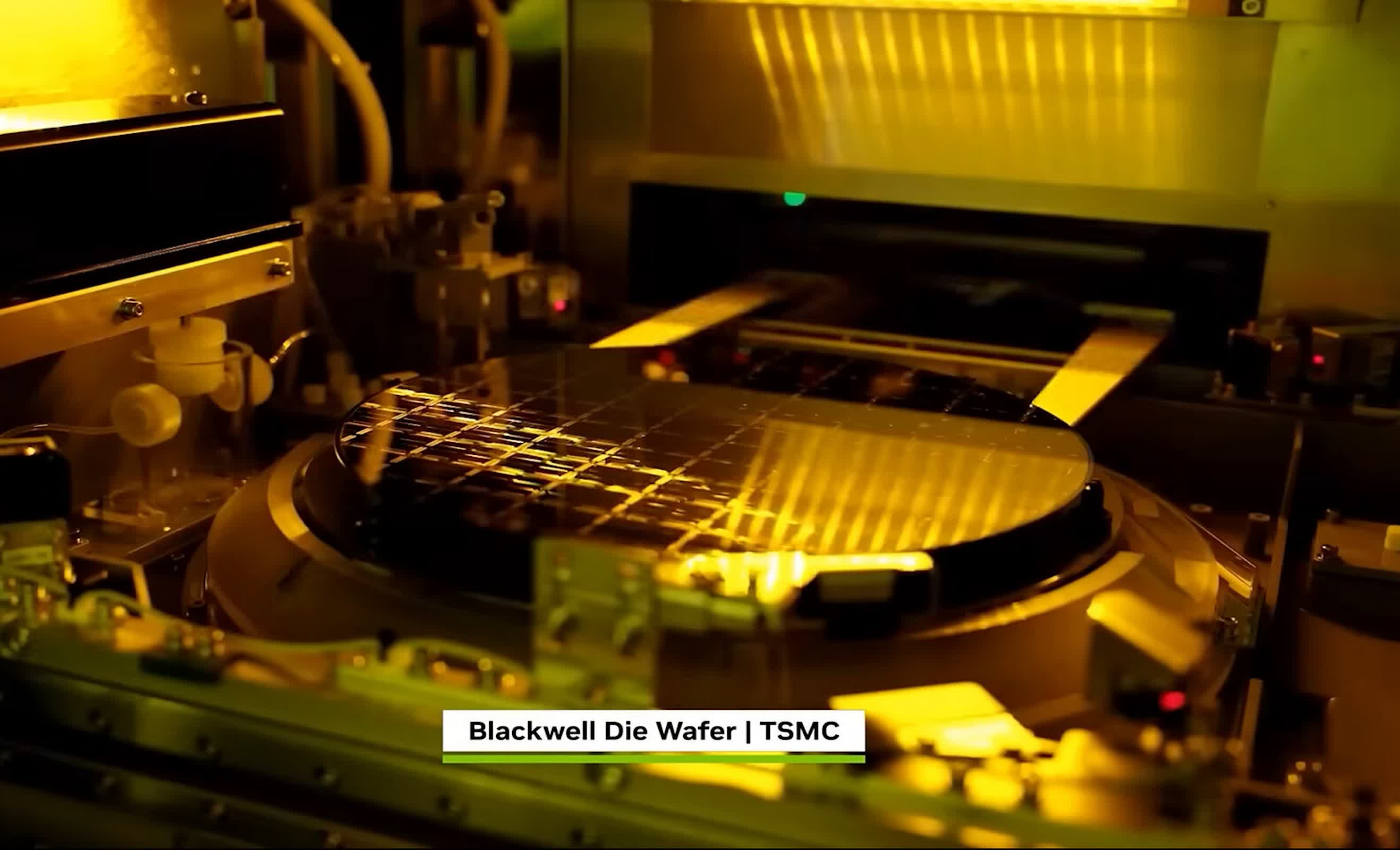

Nvidia has become synonymous with the AI boom. Their H100 and H200 GPUs power basically every serious AI data center in the world. When companies talk about the GPU shortage or GPU abundance, they're primarily talking about Nvidia. The company's market cap has ballooned past three trillion dollars, making it the most valuable company on earth at various points in 2024 and 2025.

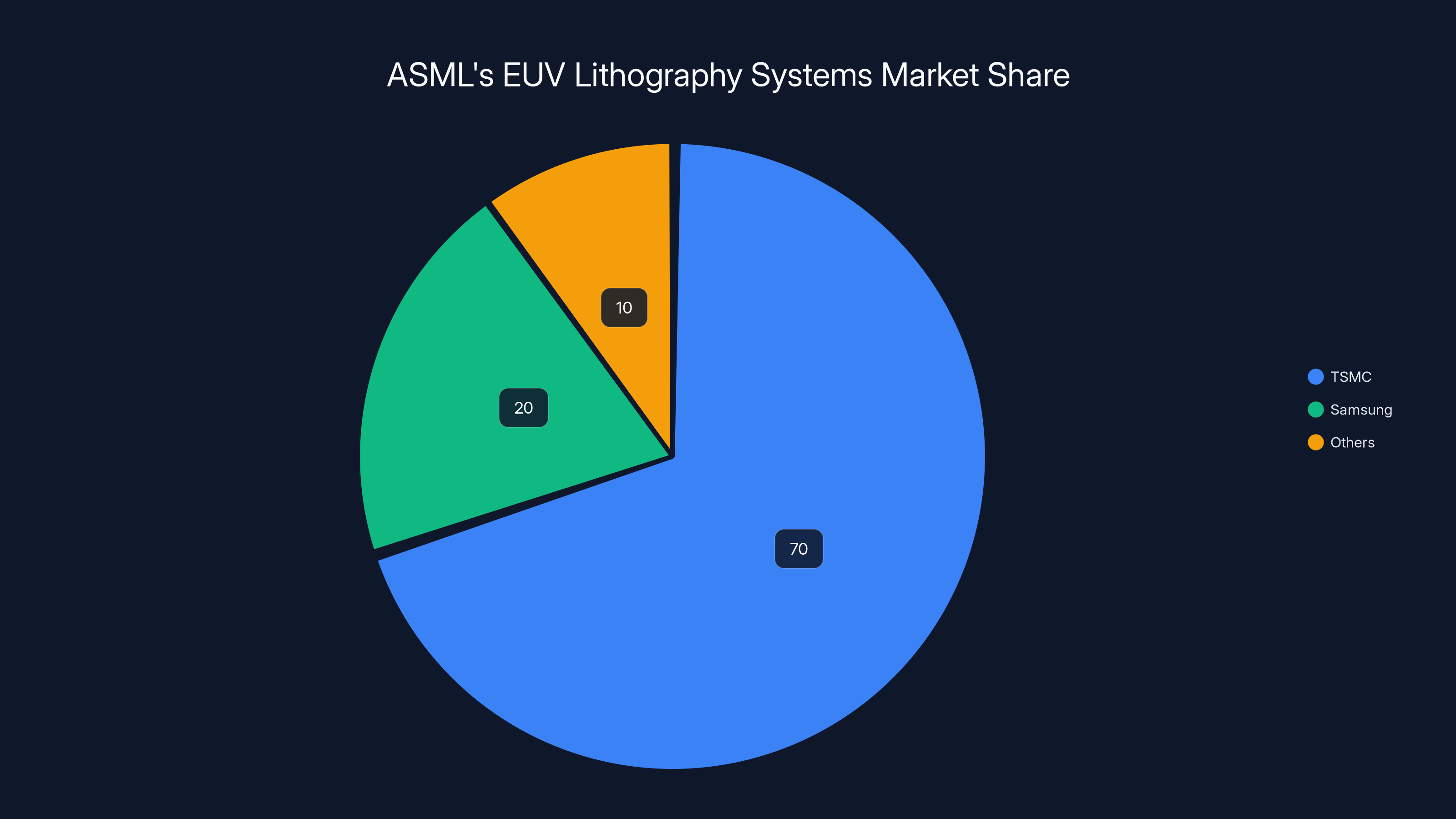

But here's what most people miss: Nvidia's success depends entirely on TSMC's ability to manufacture their chips in sufficient quantities. And TSMC's ability to do that depends entirely on ASML's ability to supply the equipment they need.

Nvidia doesn't own any fabs. They're a fabless company, which means they design chips and outsource manufacturing. TSMC manufactures the vast majority of Nvidia's chips. TSMC's competitive advantage comes from their access to cutting-edge technology, which comes from ASML's EUV lithography systems.

EUV lithography is not a commodity product. It's extremely difficult to manufacture. ASML is essentially a monopoly in this space. They're the only company in the world with the technical capability to produce EUV systems at scale. South Korea's Samsung and China's SMIC have different technology roadmaps and haven't reached EUV capability at the same level.

This monopoly position is why ASML's order book is so valuable as a signal. If TSMC or Samsung or any other major fab wanted to expand capacity, they have to go to ASML. There's no alternative. So when those companies decide to order millions of dollars worth of equipment, they're making a fundamental bet that the demand they're seeing from customers like Nvidia is real and sustainable.

The financial math: Let's think through what this means in concrete terms. A single EUV lithography system costs around

When you step back, this becomes a powerful endorsement of the AI infrastructure thesis. It's not just Nvidia saying "we can sell a lot of chips." It's not just Google and Microsoft saying "we need a lot of compute." It's the entire manufacturing chain saying "yes, we believe in this enough to commit capital at massive scale."

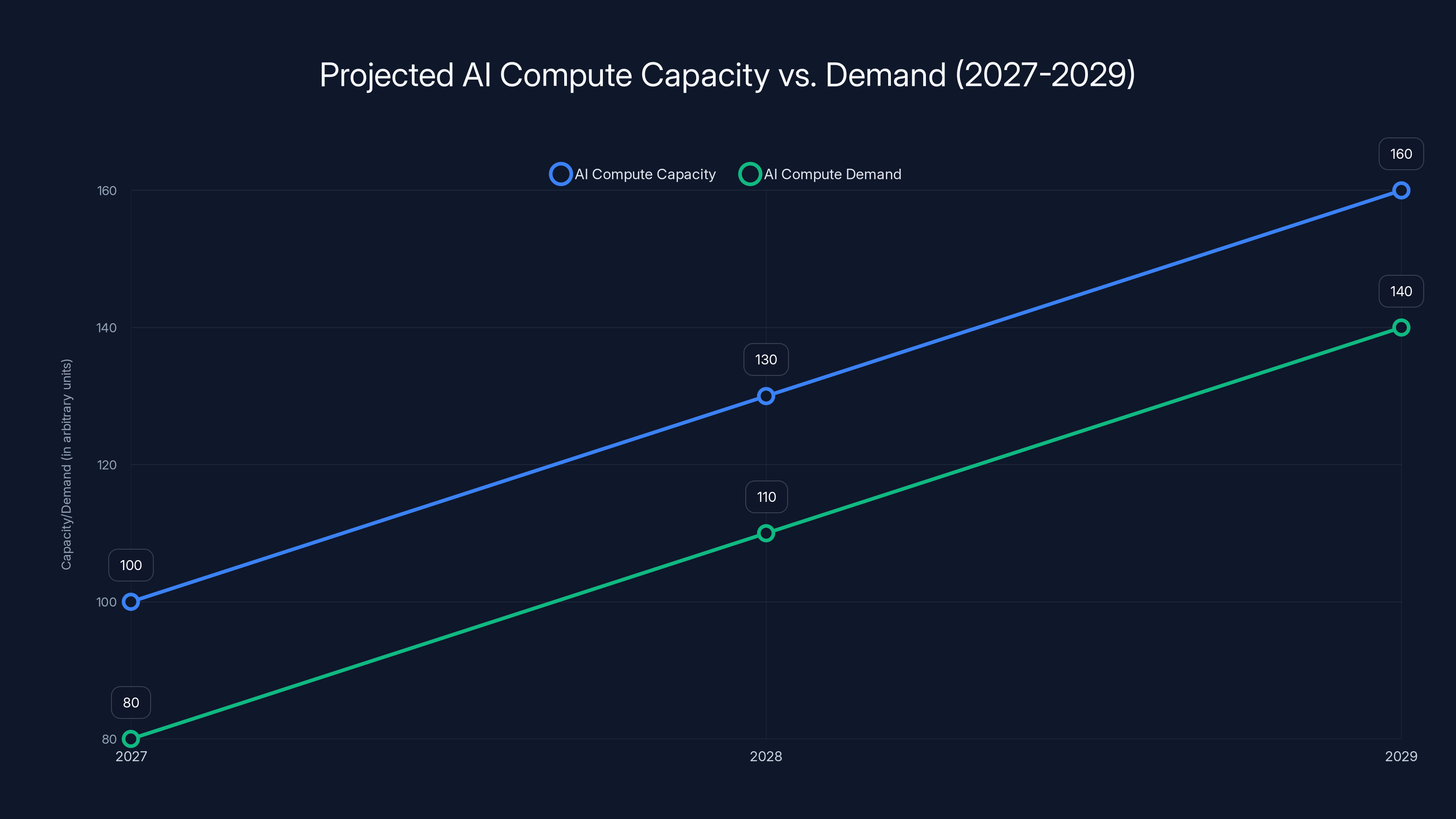

Estimated data shows AI compute capacity outpacing demand by 2029, potentially leading to underutilization and pricing pressure. Estimated data.

The Data Center Buildout That's Driving Everything

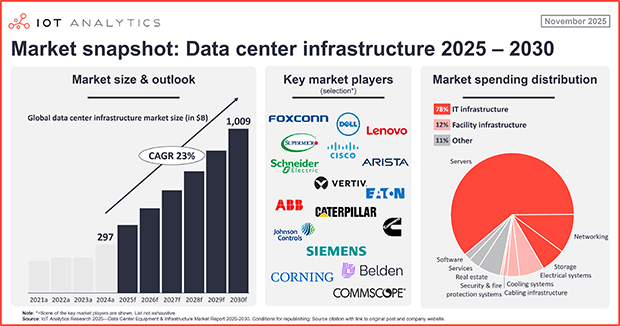

All of this equipment ordering exists because of one fundamental need: data centers. AI models require training on enormous datasets with GPUs processing in parallel. Inference requires serving those models to millions of users. Both processes need physical infrastructure: buildings full of specialized computers, cooling systems, power distribution, networking.

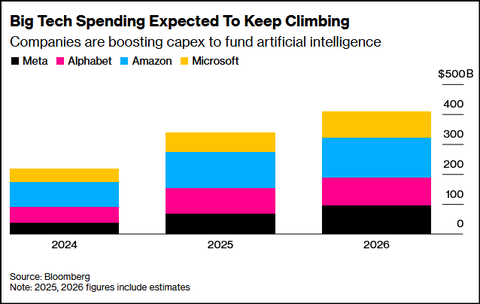

The scale is almost impossible to comprehend. A single large language model like GPT-4 required hardware purchases in the billions of dollars just for training, and that's a one-time cost. Now multiply that by dozens of major AI companies, each building their own models. Multiply that again by companies building specialized models for specific industries. Add inference capacity on top. The total capital expenditure is in the hundreds of billions of dollars.

Google, Microsoft, Meta, OpenAI, Anthropic, and dozens of other companies are all engaged in what amounts to a capital arms race. They need to control compute capacity to train models and serve them to users. The company with the most compute and the ability to use it efficiently has a massive competitive advantage.

This is why they're willing to spend at such scale. This isn't irrational exuberance or bubble economics. This is strategic necessity in a market where compute is a scarce resource and a primary competitive advantage.

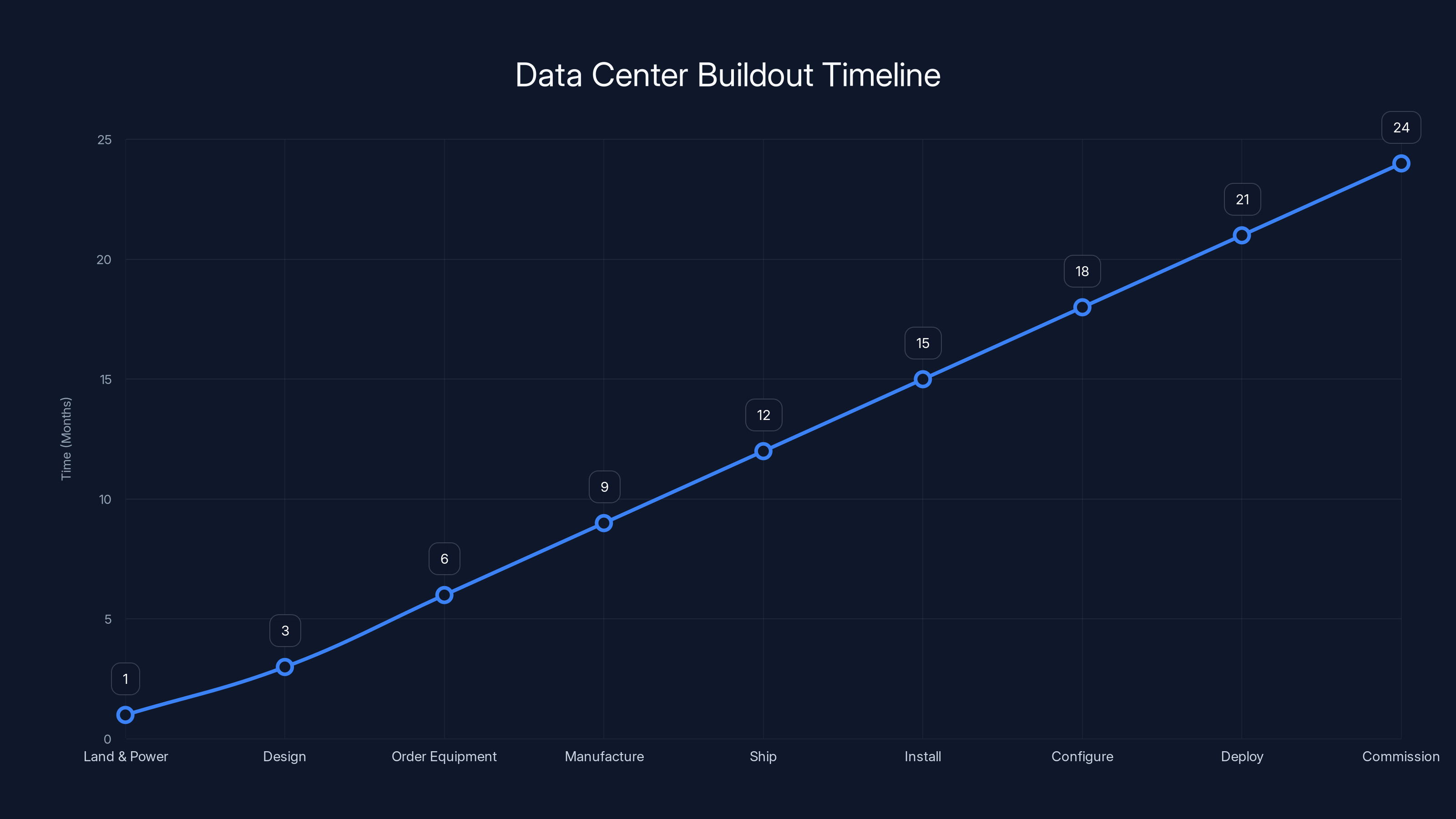

But data centers take time to build. The timeline looks roughly like this: secure land and power, design the facility, order equipment, manufacture equipment, ship equipment, install equipment, configure networking, deploy accelerators, commission the whole thing. That entire process takes 12 to 24 months minimum. Some of it can happen in parallel, but there's a natural lag.

The current state: As of early 2025, we're in the middle of a massive buildout cycle. Companies are still in the early-to-middle phases for many data centers. They've placed orders for equipment. Much of that equipment is in manufacturing or in shipping. The capacity hasn't come online yet.

This is actually bullish for the entire supply chain. It means there's a multiyear runway of orders coming through the system. Equipment manufacturers like ASML can forecast multiple quarters or years of demand. This stability allows them to plan manufacturing, hire workers, and optimize their own operations.

What ASML's Record Bookings Really Signal

Let's zoom in on what ASML's CEO actually said, because the language matters. He noted that customers have a "notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand."

Translate that into plain English: customers used to be nervous. They wondered if all this AI stuff was real or just hype. They were cautious about committing to major capital expenditures. But something shifted. They now believe the demand is sustainable. They're not just betting on the next 6 months. They're betting on years of healthy demand.

What could have caused this shift? Several factors probably contributed:

First, the emerging clarity on AI applications. Early in the cycle, there was genuine uncertainty about whether AI models would be useful enough to justify the investment. But by late 2024 and early 2025, the evidence was mounting. Companies were deploying large language models in production. They were seeing measurable productivity gains. The ROI cases were becoming clearer.

Second, the validation from major cloud providers. Google, Microsoft, and Amazon have all committed to massive AI infrastructure buildouts. These aren't startups making wishful predictions. These are companies with decades of data center experience, sophisticated financial planning, and the ability to absorb losses if a bet goes wrong. When they say they're going to spend tens of billions on AI infrastructure, people believe them.

Third, the regulatory and geopolitical backdrop. The U.S. and Europe are increasingly focused on developing their own AI capabilities and not depending on China. This creates policy support for domestic chip manufacturing. CHIPS Act funding is flowing. Export controls are driving demand for domestic capacity. This provides a more stable long-term market than any single product cycle.

The important caveat: None of this is guaranteed. Future demand could decline. Technological breakthroughs could change the economics. A recession could reduce capital spending. Companies could complete their buildouts and pullback. ASML's CEO himself noted that some customers might cancel orders before delivery.

But the current signal is clear: the people with capital are voting with their money. They believe in AI infrastructure.

ASML's quarterly bookings reached 13 billion euros, nearly half of its annual revenue of 27 billion euros, indicating strong customer confidence and demand.

The Economics of Chip Manufacturing at Scale

To really understand why ASML's numbers matter, you need to grasp the economics of modern chip manufacturing. It's not intuitive unless you've studied the semiconductor industry.

Building a modern fab costs around 10 to 20 billion dollars. That's just the building and the primary equipment. Staffing, training, optimization, and operational overhead add billions more. A single fab might take several years to become profitable.

So when a company like TSMC or Samsung decides to expand capacity, they're not casually placing orders. They're committing to a multiyear, multibillion-dollar bet that demand will justify the investment.

Here's where it gets interesting: the person making the decision to place that order isn't one person with a hunch. It's a team of financial analysts, marketing people, engineers, and executives looking at data, customer commitments, and long-term demand forecasts. The decision to order new equipment is the output of sophisticated analysis and consensus across multiple departments.

When ASML books 13 billion euros in orders, what they're really capturing is the aggregated confidence of dozens of board meetings at semiconductor manufacturers around the world. It's not speculative. It's not hype. It's institutional capital making decisions based on their best understanding of future demand.

The multiplier effect: Here's what's important to understand about this. Once equipment is ordered and delivered, it doesn't immediately show up as new chip production. There's a lag. But once it's installed and ramped, it runs for years. A new fab might be in production for 10 or 15 years. During that time, it produces millions of chips.

So when ASML books orders today, they're essentially locking in chip production capacity for the next decade. This has huge implications for how much compute capacity will be available for AI workloads over the coming years.

Competing Supply Chains and Global Dynamics

ASML operates in a complex global context. The United States has been applying export controls to restrict advanced semiconductor technology from reaching China. The Netherlands has followed suit with its own restrictions on ASML. These geopolitical tensions are shaping the entire supply chain.

What this means in practice: ASML can't sell advanced EUV systems to Chinese fabs. China has had to pursue alternative approaches. They're investing in older technology node production and trying to develop their own EUV lithography capabilities, but they're years behind the cutting edge.

This creates an interesting dynamic. The restrictions are intended to constrain China's AI capabilities, but they might actually accelerate investment in Western data center infrastructure. If companies operating in Western jurisdictions can get cutting-edge chips but companies operating in China can't, that creates a competitive advantage for Western AI companies.

But here's the complexity: many AI companies operate globally. They need to serve users worldwide. If Chinese companies can't access advanced chips, they might build different types of models optimized for lower-precision computing. Or they might license models from Western companies. The long-term dynamics are genuinely uncertain.

What seems clear: ASML's order book is strongly weighted toward Western fabs (TSMC, Samsung, Intel). There's no indication that Western fabs are slowing down orders. If anything, they're accelerating.

ASML's quarterly orders have shown a consistent upward trend, indicating strong confidence in future AI infrastructure demand. (Estimated data)

The Path from Orders to Actual Chip Production

One thing worth emphasizing: ASML's orders don't immediately translate to new chips in data centers. There's a significant lag.

The process works like this:

- Equipment is ordered and customized based on the customer's specific needs.

- ASML manufactures the system. This can take 12-18 months for complex EUV systems.

- The system is shipped, installed, and qualified. Engineers from ASML work with fab engineers to ensure everything works.

- The fab begins pilot production, testing the system with small batches of chips.

- Once qualified, full production ramps. But ramping takes time. You don't go from zero to full capacity overnight.

- Finally, the chips reach customers and get deployed into data centers.

This entire cycle typically takes 18 to 30 months from order to production volume. In some cases, it's longer.

What this means: the chips that ASML is enabling with these current orders won't fully hit the market for another year or two. We're potentially in the early stages of a capacity wave that will reach peak impact in 2026 and 2027.

The implication: If anything, ASML's record orders suggest that the AI infrastructure boom is likely to accelerate before it decelerates. The capacity that's currently being added will come online just as demand from AI applications is increasing.

Why Software Companies Should Care About Hardware Supply Chains

If you work in AI, machine learning, or building applications powered by AI, you might be wondering why any of this matters to you. You don't manufacture chips. You don't build data centers. Why should you care about ASML?

The answer is straightforward: hardware supply chains determine compute availability and pricing. And compute availability and pricing determine what's possible to build with AI.

Right now, compute is expensive and somewhat scarce. Advanced GPUs are expensive. Data center space is expensive. Using large language models is expensive because of the infrastructure required.

But as ASML's orders translate into production capacity, as fabs ramp new equipment, as new data centers come online, something shifts. Compute becomes more abundant. Prices potentially decline. What's currently expensive and difficult becomes cheap and easy.

This has massive implications for software development. As compute gets cheaper, you can afford to run larger models. You can afford to fine-tune models. You can afford to do real-time inference at scale. You can afford to experiment.

We've seen this pattern before with cloud computing. As compute became cheaper and more abundant, it enabled entirely new categories of applications. Companies stopped building monolithic applications and started building microservices. They stopped worrying about resource efficiency and started focusing on feature velocity.

Something similar might happen with AI as compute capacity expands.

ASML holds a monopoly in EUV lithography systems, with TSMC being the primary customer, followed by Samsung and other companies. (Estimated data)

Historical Precedent: Pattern Matching to Past Infrastructure Booms

This isn't the first time the world has seen an infrastructure buildout cycle like this. We've seen it before with data centers, with cloud computing, and in earlier eras, with telecommunications and railroads.

The pattern is generally consistent: a new technology emerges that promises significant productivity improvements. Early adopters invest heavily to capture advantages. This drives demand for infrastructure. Equipment manufacturers see surging orders. They expand production. New capacity comes online. This initially drives explosive growth in capability. Prices fall. More people adopt. Eventually, the market saturates or consolidates, and growth normalizes.

The question investors and builders ask is: where are we in that cycle right now? Early innings? Middle? Late?

Based on ASML's signals, it looks like we're still in the early-to-middle phase. Orders are accelerating, not decelerating. Confidence is growing, not shrinking. New capacity is being built at an unprecedented scale.

Historically, this phase in the cycle continues for several more years before hitting saturation. The internet buildout cycle lasted roughly a decade. The cloud computing buildout has been ongoing for 15+ years and still has room to grow.

AI infrastructure could follow a similar trajectory. We might be looking at a 5-10 year cycle of sustained high capital investment before it normalizes.

The Risk of Over-Investment and Correction

Here's the honest counterargument: just because orders are high doesn't mean the bets will pay off. Over-investment and subsequent correction is a real possibility.

Consider what happened in the dot-com era. Companies invested massively in internet infrastructure. Billions of dollars went into fiber optic networks, data centers, and equipment manufacturing. Some of that investment was justified and created long-term value. Some of it was completely wasted on technology that never got built or deployed.

Or consider what happened in the solar panel industry, where massive global capacity investments led to oversupply and price crashes.

The same thing could happen with AI infrastructure. Companies could over-build data center capacity. Demand could plateau. Pricing could collapse. This would be painful for investors but probably positive for users.

The people most attuned to this risk are the venture capitalists and strategic investors funding AI companies. They're watching ASML's numbers and drawing their own conclusions about whether the buildout is sustainable.

What might trigger a correction: If major AI applications fail to deliver on their promises, if adoption slows, if model efficiency improvements reduce compute requirements faster than anticipated, if a recession reduces capital spending, or if regulatory changes constrain demand.

None of these seem imminent, but they're all possible.

Estimated timeline for data center construction shows a minimum of 12 to 24 months from securing land to commissioning. Estimated data.

International Competition and the Chip Wars

The semiconductor industry is increasingly geopolitical. The U.S. government has made clear that advanced chip manufacturing capability is a matter of national security. Europe, Japan, and South Korea are all investing heavily in domestic chip manufacturing.

ASML, being a Dutch company, sits in the middle of these geopolitical tensions. The U.S. has lobbied the Netherlands to restrict ASML's exports. The Netherlands has imposed restrictions. ASML itself has expressed concerns about the export control regime limiting their business.

Meanwhile, TSMC, the most advanced fab in the world, is increasing production both in Taiwan and in Arizona (with a large U.S. fab being built with government subsidies).

All of this creates a dynamic where advanced chip manufacturing is being geographically diversified. Companies are investing in domestic capacity in the U.S., Europe, and other Western democracies. This might be less efficient than concentrating production in Taiwan, but it provides more resilience and independence.

How this affects ASML: If the geopolitical climate continues to shift toward diversification of chip manufacturing, it could actually increase orders for ASML equipment. Instead of relying on a single fab region, companies want to distribute across multiple countries. This might mean more equipment gets ordered even if total global capacity doesn't need to increase.

In other words, geopolitical fragmentation could be a hidden driver of ASML's record orders.

What the Numbers Actually Mean: Decoding ASML's Earnings

Let's get specific about ASML's numbers because they tell a very precise story.

Total sales: 32.7 billion euros for the full year. That's massive. For context, that's more than AMD's entire annual revenue.

But the most important number is new bookings: 13 billion euros in a single quarter. That's annualized to 52 billion euros if the pace continues.

For comparison, ASML's annual revenue is roughly 27 billion euros. So they're taking orders at a pace of nearly 2x annual revenue in a single quarter.

This isn't sustainable indefinitely, of course. You can't keep growing at 200% year-over-year forever. But it shows the current moment is extremely strong.

What explains the doubling from previous quarter: The previous quarter had bookings of around 6-7 billion euros (estimates vary). The jump to 13 billion euros more than doubled. What changed?

Internally at ASML, they credit improved customer confidence about medium-term AI demand. Externally, several things happened:

- Major cloud providers announced continued massive capital expenditure commitments.

- AI adoption metrics continued to improve. Chat GPT, Claude, and other models showed increasing usage.

- Regulatory support in the U.S. and Europe for domestic chip manufacturing increased.

- The geopolitical backdrop continued to favor Western fabs over Chinese capacity.

All of these factors combined created a moment where customers felt confident enough to commit to record equipment purchases.

The Long Tail: What Happens After Orders Are Fulfilled

Here's something worth thinking about: what happens after ASML's current order backlog is delivered and installed?

Assuming 13 billion euros in annual bookings continues, ASML would have a multi-year backlog (they actually do, with current backlog reported around 40 billion euros). This means equipment orders being placed today won't deliver for 3-4 years.

By the time all this equipment is installed and ramped, we're looking at 2027-2029. At that point, data centers will have significantly more AI compute capacity than they do today.

What will demand look like then? Will there be enough AI applications and adoption to justify all that capacity? Or will it sit underutilized?

This is the billion-dollar question. The optimistic view: AI applications will expand dramatically, creating massive new use cases that require enormous amounts of compute. The pessimistic view: growth will slow faster than expected, leading to stranded capacity.

Base case: Something in the middle. There will be plenty of demand for compute, but not enough to maximize utilization of all capacity being built. This will lead to pricing pressure and consolidation in the data center and AI infrastructure space.

Implications for AI Development and Innovation

If all this infrastructure is getting built, what does it mean for AI development?

More compute capacity generally enables bigger models, more experimentation, and faster iteration. If the infrastructure buildout succeeds, we should expect continued rapid progress in AI capabilities throughout the rest of this decade.

Bigger models tend to be better models (within limits). More training data and compute enable more sophisticated reasoning and capabilities.

But there are diminishing returns. The relationship between compute and capability isn't linear. You don't get 2x better models with 2x compute. The scaling laws are complex and partially understood.

Still, having abundance of compute removes one constraint on AI development. Engineers and researchers can focus on algorithmic innovations and data quality rather than worrying about whether they have enough compute to test their ideas.

This could accelerate progress in domains like reasoning, multimodal understanding, and long-context processing.

Zooming Out: What This Means for Different Audiences

For investors: ASML's record orders are a strong signal that the AI infrastructure thesis is alive and healthy. Companies aren't just talking about buildouts; they're committing capital at unprecedented scale.

For engineers: More compute capacity coming online means more opportunities to work on ambitious projects. Projects that required weeks of compute allocation today might require days in a couple of years. This enables experimentation.

For business leaders: The infrastructure buildout creates a period of 2-3 years where compute will gradually become more abundant and potentially cheaper. This affects your long-term strategy for AI integration.

For policy makers: The geopolitical backdrop is intensifying. Countries are betting on domestic chip manufacturing. ASML's numbers show global demand is strong. Countries that miss this cycle might find themselves dependent on others for a critical technology.

For founders: If you're building an AI-native company, the timeline matters. The next 3-4 years will see compute capacity increase significantly. Businesses that depend on cheap compute might have runway to scale further before hitting cost constraints.

The Skeptic's Case: Why This Might All Be Wrong

It's worth spending some time on the counterargument. Why might ASML's record orders prove to be a misjudgment?

First, demand forecasting is notoriously unreliable. Companies often over-forecast. They see strong current demand and extrapolate it forward indefinitely. But markets often shift. Customers cancel or delay orders.

Second, AI model efficiency is improving rapidly. Smaller models are becoming more capable. Quantization and other techniques reduce compute requirements. If model efficiency improves faster than anticipated, the need for raw capacity decreases.

Third, alternative compute architectures might emerge. GPUs have been the standard for AI, but other accelerator designs are being developed. If a new architecture becomes dominant, existing GPU capacity becomes less valuable.

Fourth, generative AI applications might not create as much economic value as anticipated. If companies can't monetize AI effectively, capital spending might slow.

Fifth, a recession could reduce capital expenditure across the board. Companies would cut back on infrastructure spending.

Any of these could happen. The future is genuinely uncertain. ASML's CEO himself acknowledged that some customers might cancel before delivery.

The base case remains bullish, but the risks are real.

Conclusion: Betting on Sustained Infrastructure Growth

ASML's record orders send a clear message: the people with capital believe in the AI infrastructure buildout. They're not hedging their bets. They're going all-in.

This doesn't guarantee success. Infrastructure booms can and do overshoot. Not every investment pays off. But the current trajectory is unambiguous.

Over the next 3-5 years, data center capacity for AI workloads will increase dramatically. Compute will become more abundant. This will enable new applications and use cases that currently aren't possible because compute is too expensive.

The supply chain has spoken. The verdict is clear. We're still in the early-to-middle stages of a transformational infrastructure cycle. The wave is just building.

For anyone working in AI, building with AI, or investing in AI, understanding these supply chain dynamics is essential. The future of what's possible with AI is being determined right now in ASML's factories and shipping containers. The orders placed today will become the compute capacity of tomorrow.

FAQ

What is ASML and why does it matter for AI infrastructure?

ASML is a Dutch company that manufactures extreme ultraviolet (EUV) lithography equipment used to produce advanced semiconductors. It's the only company in the world capable of producing EUV systems at scale, making it an essential supplier to chip manufacturers like TSMC and Samsung. When ASML's orders spike, it signals that major chip manufacturers believe they'll need significantly more production capacity in the future, which is a leading indicator of AI infrastructure buildout confidence.

How do ASML's orders translate to actual chip production and data center capacity?

When ASML books an order for equipment, it takes 12-30 months before that equipment is installed, qualified, and running at full capacity in a fab. Once installed, the equipment can produce chips for 10-15 years. So ASML's 13 billion euro quarterly order book represents a multiyear commitment to expanded chip production capacity. This capacity will gradually come online over the next few years, enabling more chips for AI data centers.

What do ASML's record orders tell us about the sustainability of AI demand?

ASML's CEO specifically stated that customers have become more optimistic about medium-term sustainability of AI-related demand. This isn't casual buying. Chip manufacturers make billion-dollar equipment decisions based on sophisticated demand forecasting. Record orders indicate they genuinely believe AI infrastructure demand will justify the capital investment, not just for the next quarter but for years to come.

How does ASML's monopoly position affect semiconductor supply chains?

ASML has no real competitors for advanced EUV lithography systems. This monopoly means any company wanting to build cutting-edge chip manufacturing capacity must work with ASML. This makes ASML's order book incredibly valuable as a signal of global capacity intentions. It also makes ASML a critical strategic asset in geopolitical tensions around semiconductor manufacturing.

Why are companies willing to spend billions on data center infrastructure if demand isn't guaranteed?

Major AI companies like Google, Microsoft, and Meta view AI compute as a strategic necessity. The company with the most compute capacity and efficiency has a competitive advantage in AI. The potential payoff from controlling compute capacity exceeds the risk of over-investment. Additionally, once data centers are built, they can be repurposed for other computing tasks if AI demand softens, providing some downside protection.

When will ASML's current orders translate to increased compute availability for users?

Based on typical equipment manufacturing and installation timelines, the current wave of orders should result in significantly increased data center capacity coming online in 2026-2027. This creates a 2-year runway where compute supply will gradually increase while demand continues to build. Eventually, increased supply should lead to price decreases and wider availability of AI computing resources.

Could ASML's record orders turn out to be a mistake or over-investment?

Yes. Over-investment followed by correction is possible and has precedent in previous technology cycles. Demand could plateau faster than expected, model efficiency improvements could reduce compute requirements, or a recession could curtail capital spending. However, the current signal is strongly bullish. The risks are real but don't appear imminent. Most sophisticated market participants are still betting on continued strong demand.

How do geopolitical tensions affect ASML's business and chip manufacturing?

The U.S. and Netherlands have restricted ASML's ability to sell advanced equipment to China. This creates incentives for Western companies to develop domestic chip manufacturing capacity rather than relying on Taiwan or other Asian fabs. Paradoxically, geopolitical fragmentation might increase total equipment orders because companies want to distribute manufacturing across multiple countries for resilience, even if it's less efficient than concentrated production.

Key Takeaways

- ASML booked record 13 billion euros in new orders, more than double the previous quarter, indicating sustained confidence in AI infrastructure demand

- Chip manufacturers' equipment orders are leading indicators of data center capacity buildout plans 18-30 months in advance

- ASML's monopoly on EUV lithography makes it the critical gatekeeper for advanced chip production capacity globally

- Current equipment orders suggest significant new data center compute capacity will come online in 2026-2027

- While risks exist, the current signal from capital-heavy companies suggests the AI infrastructure boom has multiple years of runway remaining

Related Articles

- China Approves NVIDIA H200 GPU Imports: What It Means [2025]

- Samsung RAM Prices Doubled: What's Causing the Memory Crisis [2025]

- GPU Memory Crisis: Why Graphics Card Makers Face Potential Collapse [2025]

- AI Chip Startups Hit $4B Valuations: Inside the Hardware Revolution [2025]

- Photonic Packet Switching: How Light Controls Light in Next-Gen Networks [2025]

- Microsoft Maia 200: The AI Inference Chip Reshaping Enterprise AI [2025]