China Approves Nvidia H200 Imports: What It Means for AI [2025]

On a cold January afternoon in Beijing, something shifted. China's regulatory agencies quietly approved the import of over 400,000 Nvidia H200 artificial intelligence chips destined for three of the country's biggest tech companies. Byte Dance, Alibaba, and Tencent got the green light. It sounds bureaucratic. It's actually seismic.

This approval matters because it represents one of the most delicate balancing acts in modern geopolitics: how do you keep your AI capabilities competitive while simultaneously protecting your domestic semiconductor industry? China just tried to answer that question with a measured yes.

But the approval came with strings attached. The chips couldn't arrive without conditions. The licenses themselves contained restrictions that companies hadn't fully negotiated. And for other Chinese firms—state-backed operators, telecom giants—the door remained locked.

What happened here goes beyond a simple trade decision. It reveals how countries are positioning themselves in the AI era, how semiconductor supply chains have become weapons, and why the next five years will determine which regions own artificial intelligence infrastructure. This isn't about buying chips anymore. It's about who controls the computational foundation that AI companies build on.

Let's break down what just happened, why it happened, and what comes next.

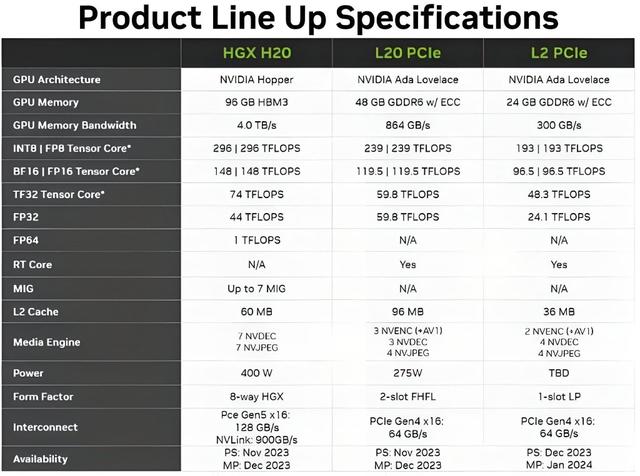

The H200: Why It Matters So Much

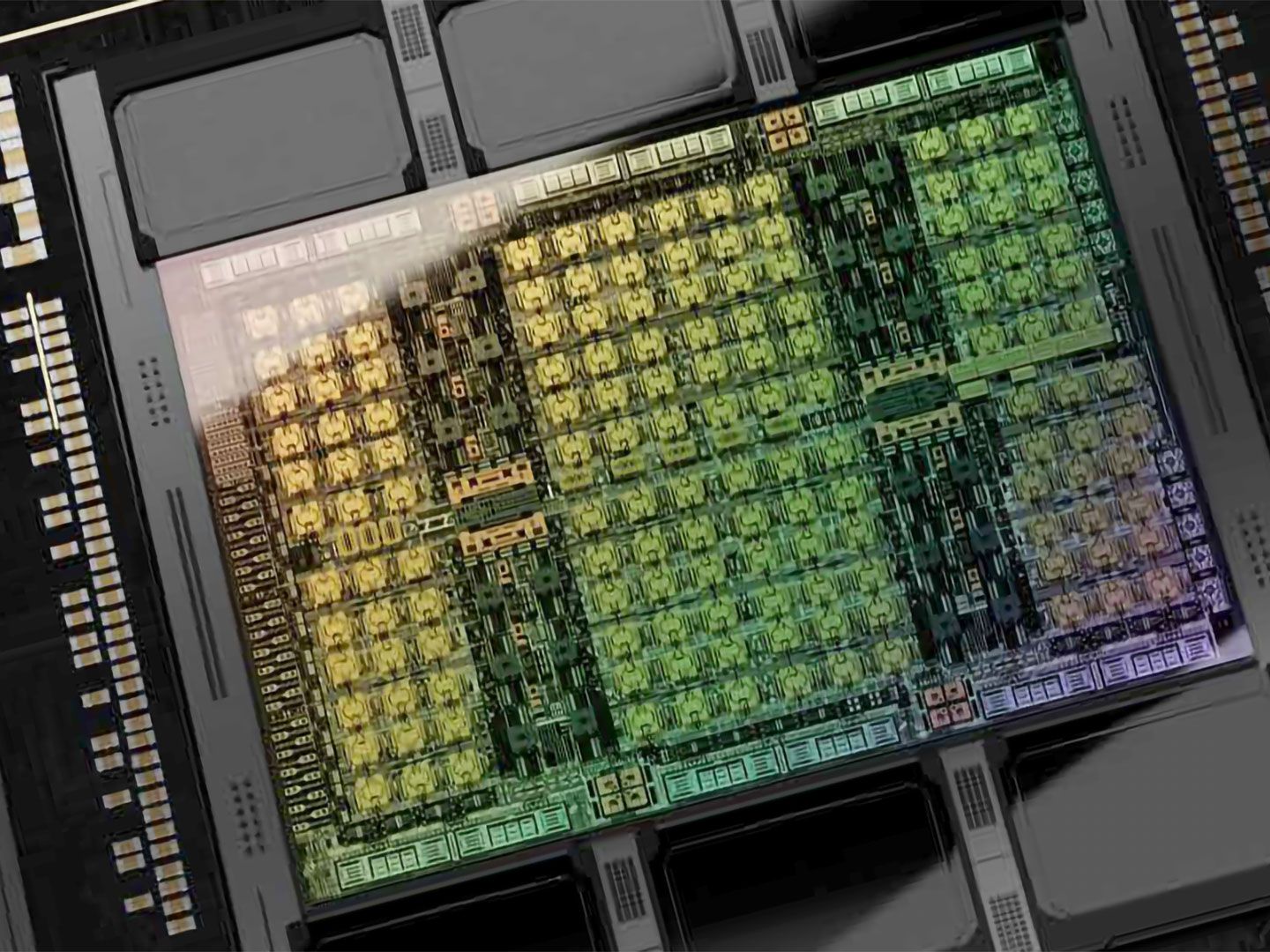

Nvidia's H200 isn't just another graphics processor. It's the company's second-most powerful AI accelerator chip, sitting just below the B200 in the hierarchy. And for companies training massive language models, the performance difference between what you can run and what you can't is the difference between competition and irrelevance.

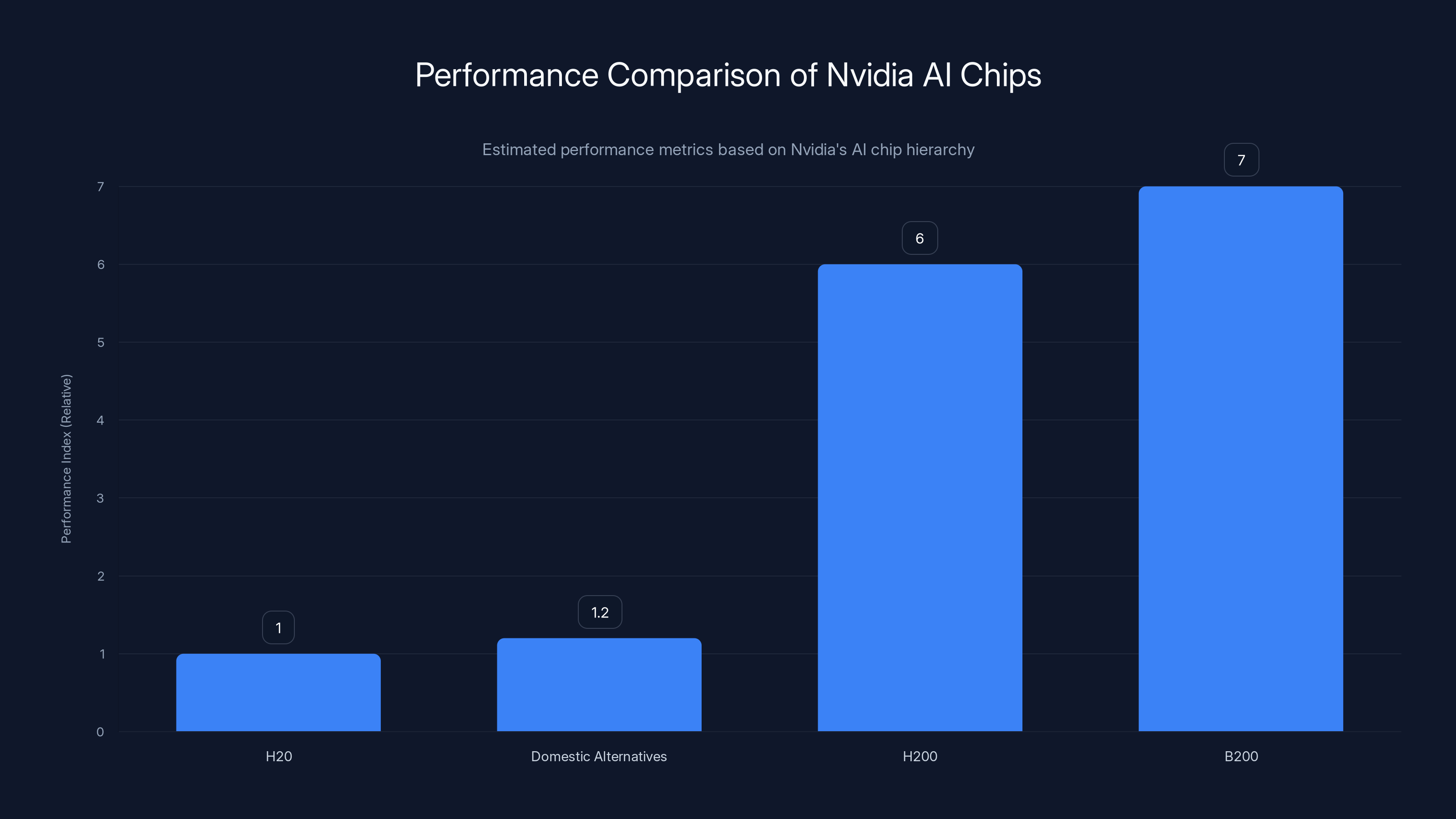

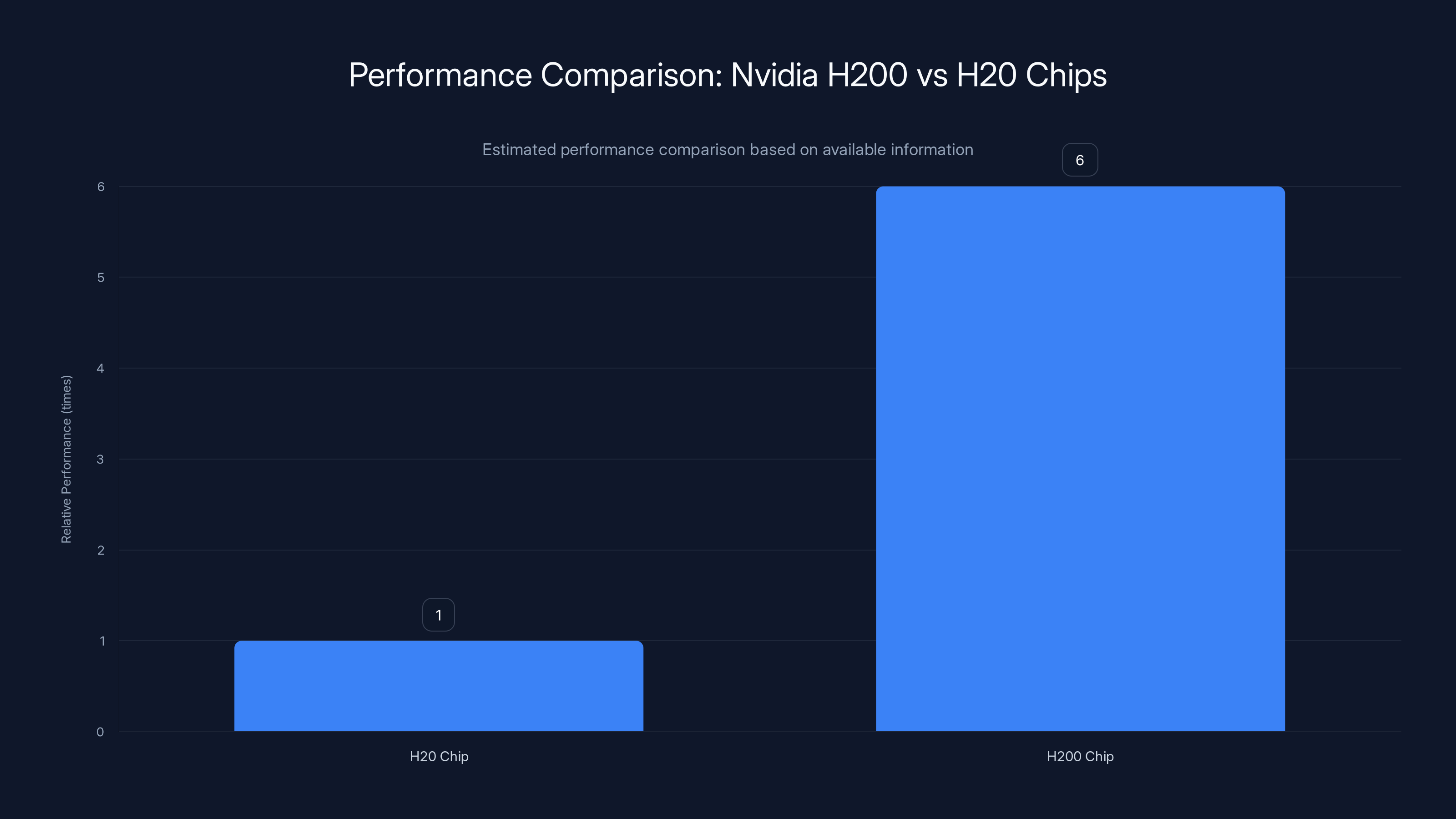

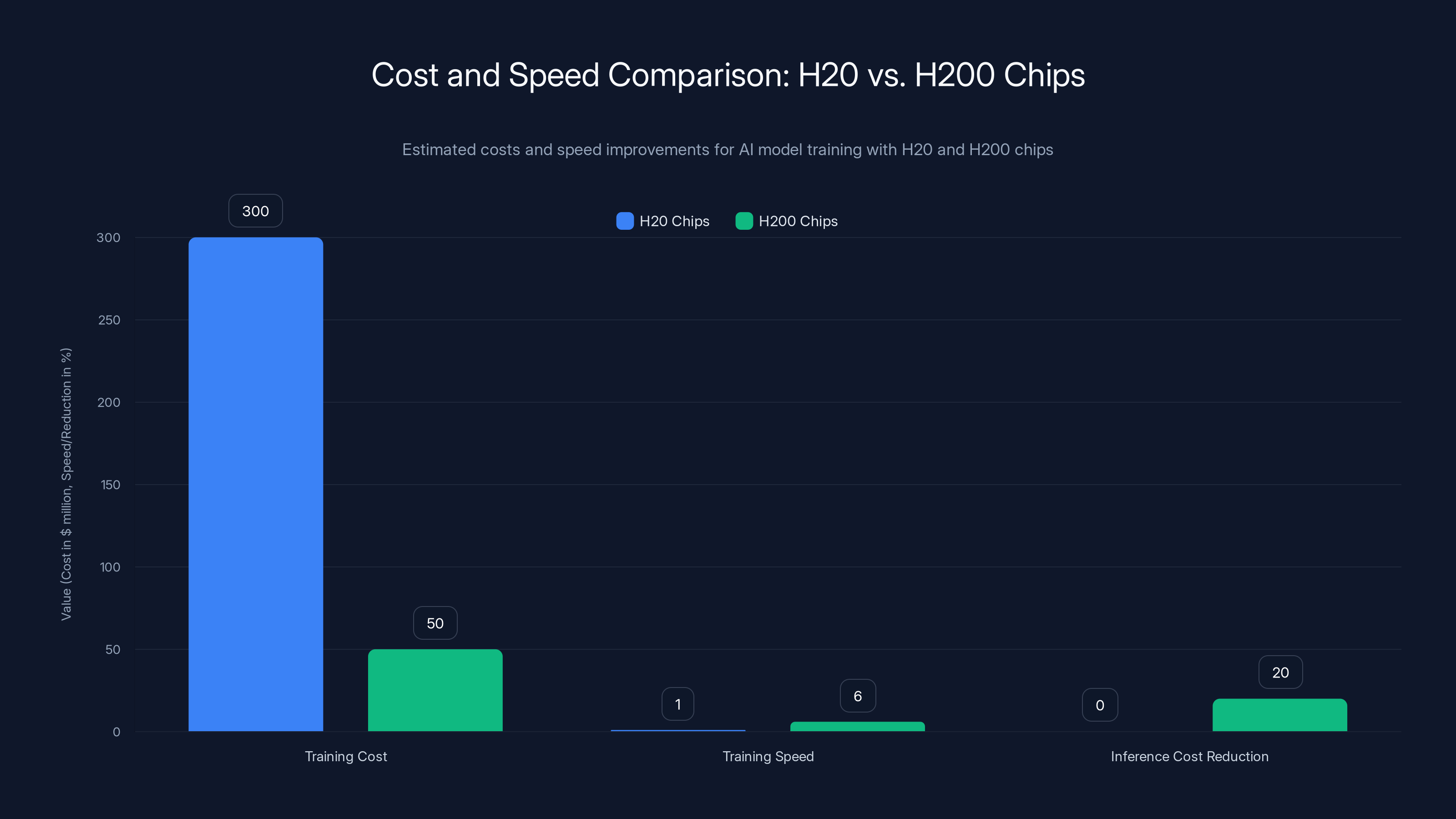

The H200 delivers roughly six times the performance of the H20 chip that Nvidia previously allowed to be exported to China. Let that sink in. Six times faster. Six times more inference capacity. Six times better economics on running AI services at scale.

Why does this matter? Because training a large language model is one of the most computationally intensive tasks humans have ever attempted. You're feeding data through neural networks millions—sometimes billions—of times, adjusting weights, optimizing performance. A fast chip doesn't just make this quicker. It makes it feasible for companies that aren't backed by unlimited capital.

The Performance Gap

Consider the economics. If you're Alibaba and you want to build a competitive AI service, you need to train massive models. The H200 lets you do this 6x faster than the H20. That's not just a speed bump. That's the difference between needing a

Moreover, the H200 enables better inference—the process of actually using a trained model to answer questions or generate content. When millions of users are hitting your AI system simultaneously, the cost per query drops dramatically with more efficient chips. Chinese companies estimated they had orders for more than two million H200 chips in their backlog, meaning the demand was absolutely crushing.

Huawei, Tencent, Alibaba—they've all built domestic alternatives. Some of these chips now perform at levels similar to the older H20. But none of them come close to H200 performance. And they won't for at least another year or two, maybe longer. In the AI race, that gap is eternity.

Comparing to Domestic Alternatives

China's semiconductor industry has made genuine advances. But there's a brutal reality: designing and manufacturing cutting-edge AI chips requires lithography capabilities, process nodes, and manufacturing expertise that take decades to develop. The US had that advantage already established. China is catching up faster than many expected, but catching up still means you're behind.

The gap matters because every month companies operate with inferior chips is a month they're not training better models, not serving customers faster, and not gathering the kind of user feedback that improves AI systems. In a field where first-mover advantage matters enormously, that lag compounds.

Estimated data shows

The Geopolitical Chess Game: US Export Controls vs. China's Self-Reliance

Here's the context that makes this approval controversial: the United States has spent the last two years tightening export controls on advanced semiconductors to China. The goal is explicit—slow China's AI capabilities enough that the US maintains strategic advantage in artificial intelligence.

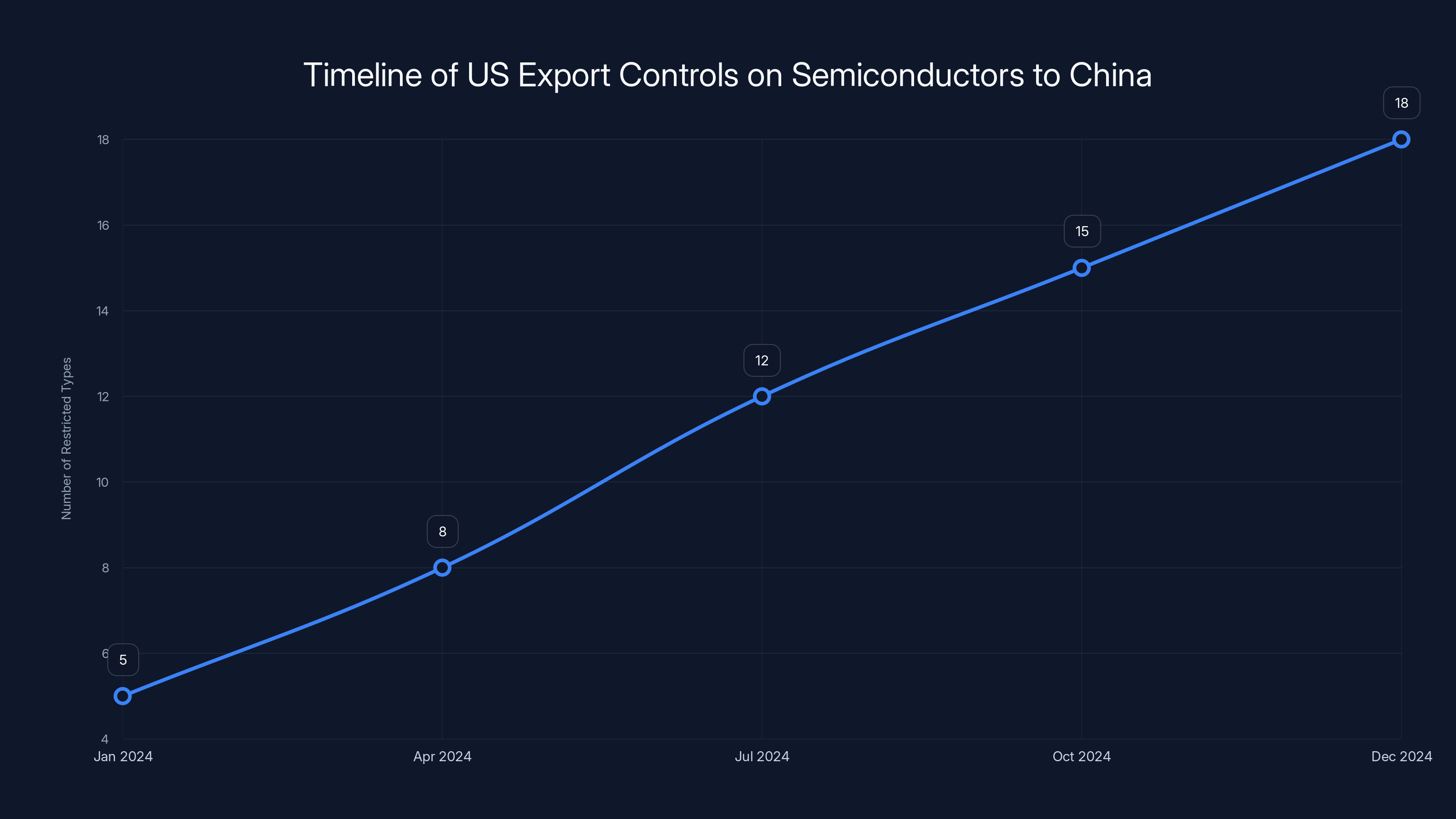

In January 2024, the Biden administration expanded restrictions on GPU exports. Then again in December 2024. The pattern is clear: every few months, new rules. Every few months, the list of restricted chips grows longer.

Nvidia was actually approved by Washington to export H200 chips to China on January 13. The company had the US blessing. But then something strange happened. On January 15, just two days later, China's customs authorities started blocking shipments. Agents were told the chips weren't permitted to enter. No formal announcement. No official statement. Just a quiet wall.

For two weeks, that's where things sat. Companies had placed orders. Ships were ready. Capital was allocated. But the chips couldn't land. The uncertainty was brutal for logistics and business planning. Companies couldn't commit to timelines. Users couldn't be promised service launches.

Why the Hold Happened

Several factors likely contributed to Beijing's initial freeze. First, optics. China's government is under pressure domestically to support local semiconductor companies. Approving a massive influx of Nvidia chips right away would look like surrender on self-reliance. The government needed to appear thoughtful, deliberate, protective of domestic interests.

Second, leverage. By holding up shipments for two weeks, Beijing demonstrated that it could control the flow of critical technology—even technology approved by the US to be exported. That's a negotiating position. It signals that China, despite being the buyer, has control over terms.

Third, domestic competition. State-backed semiconductor firms were likely lobbying hard. Every Nvidia chip that Chinese companies buy is a Nvidia chip, not a domestic alternative. If the government appeared to be waving through massive Nvidia orders without requiring some bundling with domestic chips, it would face internal pressure.

The US Perspective

On the American side, there's a genuine strategic calculation. Yes, US semiconductor companies (led by Nvidia) want to sell chips. China is probably their biggest market outside the US. Cutting off sales hurts revenue and shareholder returns.

But the national security perspective is different. If China gets access to unlimited H200 chips, their AI capabilities accelerate dramatically. Maybe they catch up in two years instead of five. Maybe they surpass the US in certain applications. The government has to weigh industry profits against national security.

It's a genuine tension with no perfect answer. Cut off sales and hurt American companies. Allow sales and potentially accelerate a strategic competitor. Congress and the Biden administration chose a middle path: allow sales through official channels, then tighten controls periodically.

The H200 offers six times the performance of the H20, significantly impacting the economics of AI training and inference. Estimated data based on chip hierarchy.

The Approval: Strategic Approval for Strategic Companies

On Wednesday, Beijing finally moved. It approved imports for Byte Dance, Alibaba, and Tencent. Not every company, just these three. Not unlimited, just over 400,000 chips (which is an enormous number, but smaller than the demand).

Why these three? Because they're the companies that matter most in China's AI competition. Byte Dance owns Tik Tok internationally and has massive AI research operations. They're pushing hard on recommendation algorithms, content generation, and video understanding. Alibaba runs China's biggest cloud platform and needs compute capacity to compete with AWS on AI services. Tencent is the gaming and social media giant expanding into AI infrastructure.

These are the companies that directly compete with Open AI, Google, and other US AI leaders. They're the ones that need expensive chips to train competitive models. And they're the ones that, if China allowed them to fall behind, would represent a strategic loss for Beijing.

The Conditions

But here's where it gets interesting. The approval came with conditions. Reuters reported that the license terms were "too restrictive" and that companies hadn't yet converted approvals into actual orders. That means the chips are approved to be imported, but the restrictions on how they're used, where they're located, or how they're deployed might be tight enough to make business difficult.

One proposal that had been discussed was requiring companies to bundle each H200 purchase with a set ratio of domestic chips. So if you order 100,000 H200s, you also have to order a certain number of Chinese alternatives. That bundling would give domestic companies revenue and deployment scale without directly banning foreign chips.

Whether this made it into the final conditions isn't clear. But the fact that companies were hesitant to actually place orders based on the approvals suggests the terms were genuinely restrictive. They're approved, but maybe not fully usable.

Who Didn't Get Approved

Just as important as who got approved is who didn't. State-backed telecom operators, government-affiliated research institutes, and military-adjacent technology firms were expected to remain on the restricted list. Beijing is signaling: if you're a private company that needs chips to compete globally, you might get them. If you're a state entity, the answer is no.

This is actually clever policy. It protects strategic assets from foreign technology dependencies (state infrastructure doesn't rely on Nvidia), while allowing the private sector the capability to compete internationally.

The Supply Chain Implications: What 400,000 Chips Actually Means

Let's talk concrete numbers, because scale matters here. 400,000 H200 chips is a massive order. But to understand what it actually means, you need to know how many chips these companies might need, what they cost, and how long they take to deliver.

Unit Economics

An H200 chip costs somewhere in the range of

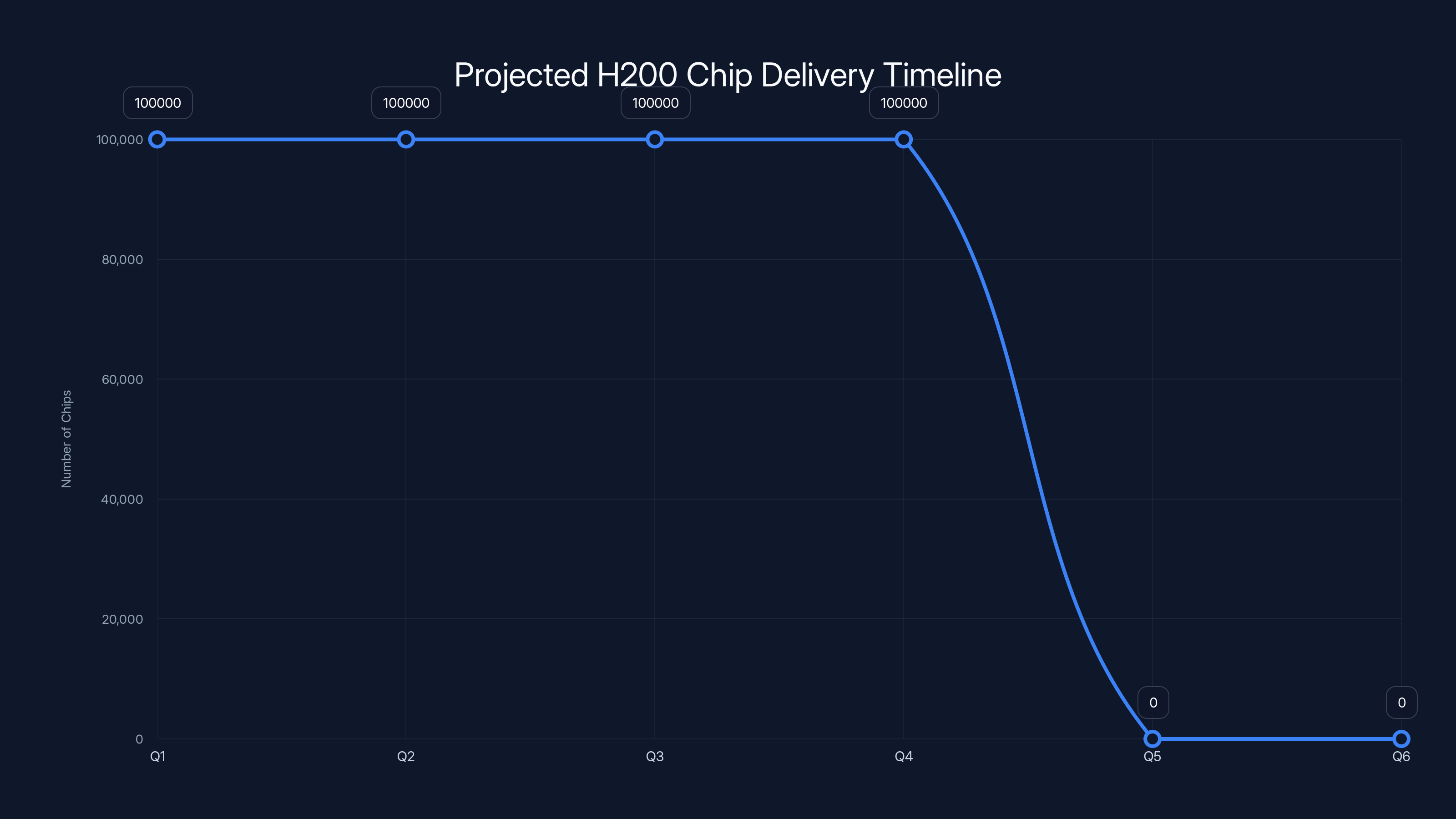

The real constraint is manufacturing capacity. Nvidia doesn't make these chips themselves; they rely on TSMC (Taiwan Semiconductor Manufacturing Company) to produce them. TSMC is already running at near-full capacity, producing chips for Nvidia, AMD, Apple, and dozens of others.

Historically, Nvidia can deliver between 100,000 and 200,000 H200 chips per quarter. That means the 400,000 chip approval might represent 2-4 quarters of Nvidia's entire H200 production. It's a massive chunk of supply, which partly explains why the approval was conditional. If Nvidia suddenly shipped all those chips to three Chinese companies, Western customers would face severe shortages.

Timeline and Delivery Constraints

Approvals don't mean instant delivery. Even with bureaucratic clearance, there's lead time. Manufacturing, packaging, testing, shipping, and customs clearance take months. Companies probably won't see these chips flowing in at full volume for 6-12 months.

But what matters is the predictability. Once companies know chips are approved and will flow over the next year or two, they can plan data center builds. They can commit to timelines for AI service launches. They can make hiring decisions and allocate resources.

Competitive Implications

For Chinese companies, this approval is genuinely important. It means they can outbid other Chinese competitors for scarce resources. Byte Dance, Alibaba, and Tencent will get H200 chips; smaller Chinese AI startups won't. This concentrates capability among the biggest, most established firms.

For global AI companies, it means Chinese competitors just got a major upgrade. The models they train with H200 chips will be more sophisticated, trained faster, and more competitive. American startups and even mid-size companies building AI applications will face tougher competition from Chinese firms that now have access to better hardware.

Estimated data suggests that the delivery of 400,000 H200 chips will be spread over 4 quarters, aligning with Nvidia's production capacity constraints.

Beijing's Domestic Chip Industry: Supporting Self-Reliance Without Sacrificing Competition

Part of what makes this approval complex is that it requires Beijing to navigate a tension between two goals: nurturing a domestic semiconductor industry while keeping Chinese tech companies globally competitive.

China has invested hundreds of billions of dollars into semiconductor manufacturing over the past decade. Huawei spun out Hi Silicon to design chips. Alibaba acquired Pingtouch and started T-Head. Tencent invested in semiconductor startups. State-backed entities like SMIC (Semiconductor Manufacturing International Corporation) and CITIC have poured capital into chip production.

These efforts have genuine results. Chinese-designed chips now exist for everything from mobile processors to data center accelerators. Some of them are actually competitive with international alternatives, at least in specific applications.

But here's the brutal reality: making state-of-the-art AI accelerator chips requires advanced manufacturing nodes. Nodes like 3 nanometers, 5 nanometers—the absolute cutting edge. China's domestic manufacturing capabilities are probably around 7-14 nanometers, and getting better but not fast enough to close the gap.

This creates a policy bind. If you ban Nvidia imports, Chinese companies can't compete internationally—they'll lose market share, revenue, and the ability to gather user data that improves AI systems. If you allow unlimited imports, domestic chip companies don't get revenue, don't achieve scale, and never develop the expertise to compete long-term.

The Bundling Strategy

One solution Beijing has discussed is bundling requirements. For every foreign chip purchased, companies must also purchase domestic chips in a set ratio. This creates guaranteed revenue for domestic manufacturers without banning foreign chips.

It's not perfect—it increases costs for companies and makes their systems more complex—but it bridges the gap. Companies get the performance they need, domestic industry gets the scale it needs, and the government achieves self-reliance goals.

State vs. Private Sector Split

The approval also reveals a smart policy distinction. Private companies like Byte Dance, Alibaba, and Tencent are allowed to buy Nvidia chips. But state-backed entities and government agencies face restrictions.

This protects critical state infrastructure from foreign dependencies while allowing the private sector to compete globally. A state-backed telecom operator or military research institute shouldn't depend on Nvidia for capability. But a private company competing in global markets needs access to the best tools, including chips.

It's a pragmatic split: you can't have national security dependent on foreign suppliers, but you also can't expect to compete globally while handicapping your best companies.

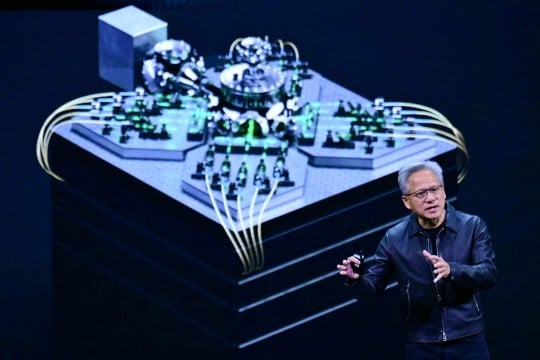

The Role of Nvidia CEO Jensen Huang: Strategic Presence at Strategic Time

Timing is everything in diplomacy and business. Jensen Huang, Nvidia's CEO, was in China visiting the week that approvals came through. That's probably not a coincidence.

Companies at this scale don't move executives around carelessly. If Huang was in Beijing, it was planned. If the approval came through during his visit, the timing sent a signal: Nvidia and China's government have a working relationship. Channels are open. Business can happen.

Why does a CEO visit matter? Because approvals like this come from high-level decision makers. The customs agents, the trade officials—they get direction from above. When a CEO is physically present in the capital, it signals to those decision makers that the company is committed, that it's a serious partner, that it's worth regulatory ease.

Moreover, Huang is one of the world's most effective executives at managing powerful relationships. He's careful, diplomatic, and skilled at navigating political complexity. His presence in Beijing carries weight with policymakers who understand that this person controls a company critical to both US and Chinese technology ecosystems.

Business as Diplomacy

In the modern era, major tech executives function as quasi-diplomats. Their visits to countries, their statements, their relationships with government officials—they all matter. Huang's trip to China signals that Nvidia isn't abandoning the market despite US export controls. It signals commitment.

For Beijing, welcoming him and delivering the approval tells a story to domestic constituencies: the government is protecting Chinese interests while maintaining necessary business relationships. It's a careful balance, and Huang's visit helped enable it.

The Nvidia H200 chip delivers approximately six times the performance of the H20 chip, significantly enhancing AI model training and inference capabilities. Estimated data.

Market Impact: Stock Prices, Growth Estimates, and Investor Sentiment

When news of the approval broke, markets moved. Nvidia's stock price barely flinched—the company's been expecting incremental access to the Chinese market—but semiconductor industry analysts updated their revenue projections upward.

Why? Because every million dollars of AI chip sales represents market share and capability growth. If Chinese companies are buying 400,000 H200 chips, they're training bigger models, serving more users, and competing more aggressively against Western AI companies.

Nvidia's China Revenue

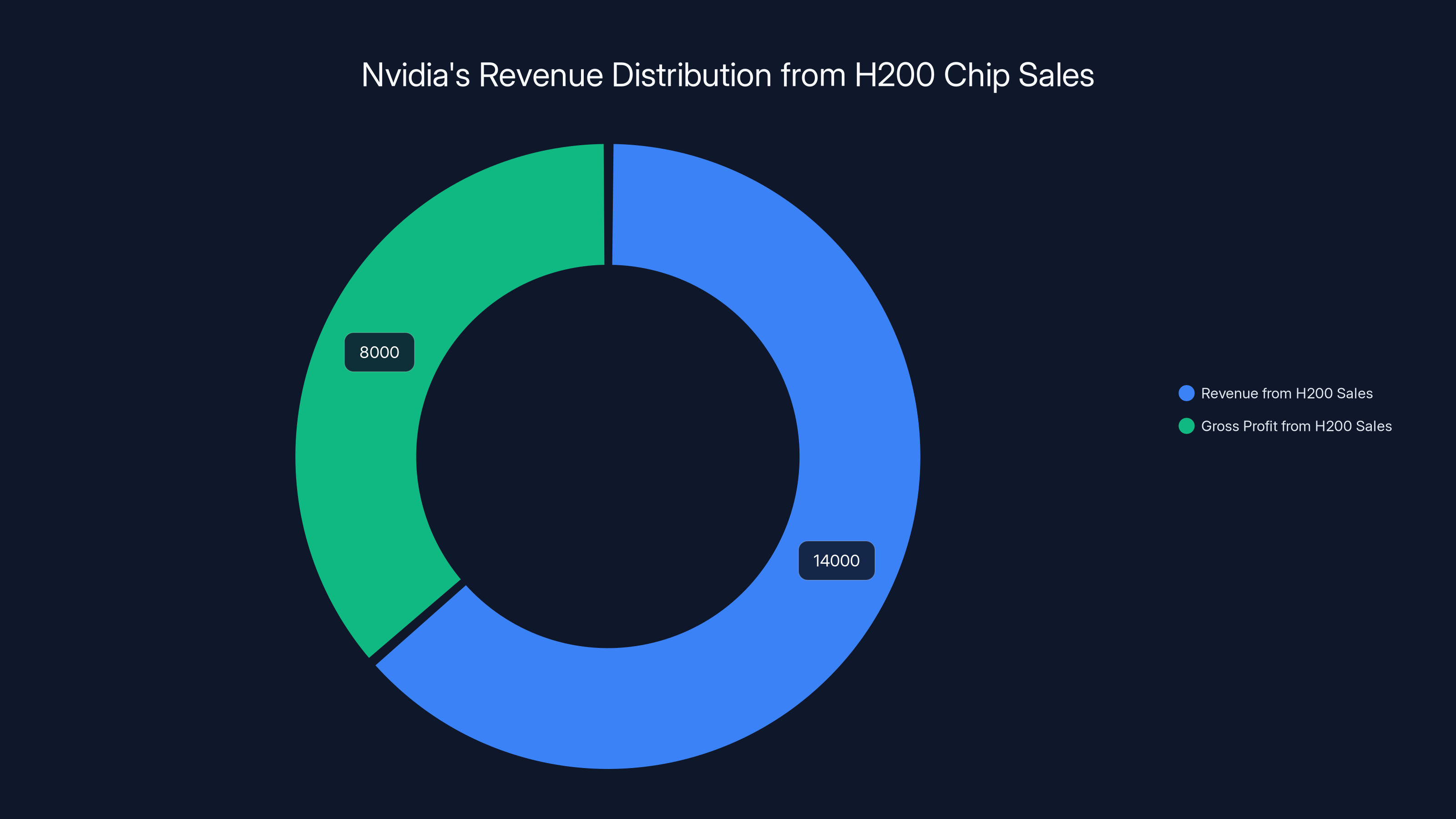

China probably represents 15-20% of Nvidia's data center revenue, one of the company's biggest segments. Export restrictions have cost Nvidia billions. The H200 approval doesn't fully restore that market, but it's a meaningful chunk back.

For investors, the question is simple: how much revenue flows from this approval? If 400,000 chips sell at

But it's not just Nvidia's revenue that matters. TSMC benefits from the manufacturing orders. Equipment makers like ASML benefit from the tools needed to produce chips. Supply chains light up.

Longer-Term Implications

Investors also care about strategic implications. If Chinese AI companies get H200 chips and become significantly more competitive, they might eventually threaten Nvidia's dominance in the Chinese market. Or they might compete so aggressively that AI service prices drop globally, pressuring margins.

On the flip side, there's a bear case: if the US tightens export controls further, Nvidia could lose access to China entirely. That would be catastrophic for the company's growth projections.

So the approval is good news (revenue flowing), but partial (conditions and competitive implications). Markets price in that nuance.

The AI Training Economy: What Companies Will Actually Build with These Chips

Understanding why companies want H200 chips requires understanding what they'll actually do with them. These aren't purchased for theoretical capability. They're purchased to train specific models and launch specific services.

Model Training Economics

Suppose you're Alibaba and you want to build an LLM (large language model) competitive with GPT-4. You need to train it on hundreds of billions of tokens of text. You need to run it through multiple training runs, adjusting hyperparameters, testing different architectures.

With H20 chips, that's extraordinarily expensive. Maybe

But speed matters beyond cost. If you're training a model and you discover on day 30 that your approach is wrong, you want to know that immediately, not on day 180. H200 chips compress the feedback loop, which means faster iteration, which means better models.

Inference at Scale

But training is just one use case. Once you've trained a model, you need to run it. That's inference. When a user hits Alibaba's AI assistant with a question, the system has to process that query and generate a response. Billions of these queries happen daily.

H200 chips are exceptional at inference. They can process more queries per second with lower latency (response time). That means Alibaba can serve more users from the same hardware, or serve the same users with faster responses, or reduce the cost per query.

For a company planning an AI service at scale, this economics is decisive. A 20% reduction in cost per inference is $100+ million annually in savings.

Competitive Services

With H200 chips, expect:

- Alibaba to aggressively expand Dash Scope (its generative AI platform) with more capable models and lower-cost access

- Byte Dance to build stronger recommendation systems that integrate generative AI, making Tik Tok's algorithm even more sophisticated

- Tencent to expand QQ and We Chat's AI capabilities, embedding generative AI deeper into their messaging and gaming platforms

- All three to launch new AI services (AI image generation, video synthesis, AI workplace tools) that compete with Open AI, Google, and other Western providers

These aren't theoretical possibilities. These are services that Chinese companies are already building. More chips just means faster, better versions.

H200 chips significantly reduce training costs (by up to 83%) and increase speed (6x faster) compared to H20 chips. They also offer a 20% reduction in inference costs, highlighting their economic advantage for AI services. Estimated data.

The Broader Export Control Strategy: Biden, Trump, and the Future

The approval of H200 chips happens in the context of a longer US strategy to restrict advanced semiconductor exports to China. But strategy doesn't happen in a vacuum, and administrations change.

The Biden-Era Approach

Under President Biden, the strategy was explicit restrictions with narrow exceptions. Export licenses were tightened. Chip design rules (like the 2.5 exaflops computing rule) were implemented. The presumption was "no," exceptions required special pleading.

But even under Biden, there was flexibility. Nvidia got approval to sell H200s. Taiwan's TSMC got approval to build a facility in Arizona. The strategy wasn't total decoupling, it was managed slowdown.

Political Uncertainty Ahead

As new administrations take office (in 2025 and beyond), semiconductor strategy could shift. A more business-friendly administration might loosen restrictions, arguing that Nvidia needs China revenue to stay competitive globally. A more hawkish one might tighten further.

China is probably gaming out all scenarios. If they can secure consistent access to Nvidia chips through official channels, great. If they can't, they're investing in alternatives.

Semiconductor Sovereignty

Ultimately, what both the US and China understand is that advanced semiconductors are strategic assets. Control the chip supply, and you influence the country that controls AI. This approval is part of a longer chess game that will play out over years.

Taiwan: The Critical Constraint in the Semiconductor Equation

Understanding semiconductor geopolitics requires understanding Taiwan. Because Nvidia doesn't manufacture chips; TSMC does. And TSMC is in Taiwan, a territory claimed by China but governed independently.

This is the leverage point in the entire system. As long as cutting-edge chip manufacturing happens in Taiwan, every major power depends on Taiwan's stability. The US wants Taiwan to remain independent. China wants to "reunify." Taiwan wants to exist peacefully and profitably.

TSMC's Capacity Constraints

TSMC produces the world's most advanced chips. Every Nvidia H200, Apple A18, AMD processor, and most Intel processors come from TSMC's fabs (manufacturing facilities). The company is running at near-full capacity right now.

When Nvidia and other chip designers want to increase production, they're begging TSMC for capacity. TSMC responds by investing in more fabs and more advanced equipment (sourced largely from ASML, a Dutch company). But building new fabs takes 3-5 years.

This creates a natural bottleneck. Even if Beijing approved purchasing 2 million H200 chips, Nvidia probably couldn't deliver them quickly because TSMC can't make them fast enough.

Geopolitical Exposure

But here's the scary part: if China ever invades Taiwan, the world's chip supply gets disrupted catastrophically. You can't move a TSMC fab to mainland China without losing the expertise, the equipment supply relationships, and probably the employees. Suddenly, advanced chips become unavailable globally.

This is why the US is investing in domestic chip manufacturing (via the CHIPS Act) and why companies are diversifying suppliers. It's existential infrastructure that shouldn't depend on one island.

But for now, TSMC is the constraint. And that constraint protects the global chip supply even as it creates vulnerability.

The number of semiconductor types restricted by US export controls increased steadily throughout 2024, reflecting a strategic effort to limit China's AI capabilities. Estimated data.

Consumer Impact: Why AI Chip Approvals Matter to You

It's easy to think that semiconductor approvals and geopolitical chip politics don't affect regular people. You're wrong. They affect everything you do.

AI Service Availability and Cost

If Chinese companies build better AI services faster, consumers get more options. If Alibaba launches an AI assistant cheaper than Chat GPT, you can switch. If Byte Dance's recommendation algorithms get smarter, Tik Tok's user experience improves (or maybe gets more addictive).

Competition drives prices down. More competition means better deals for consumers. Chinese companies with H200 chips have the capability to compete aggressively on cost.

Technology Innovation Speed

The rate of AI innovation is partly determined by who has access to the best hardware. Chinese companies now have more access, which means they'll innovate faster in certain areas. Recommendation systems. Content generation. Real-time translation.

They might even innovate in areas where Western companies haven't focused. That's good for everyone—more innovation in more directions.

Privacy and Data Concerns

On the flip side, more capable Chinese AI companies operating at scale raises privacy questions. A more capable recommendation system knows more about you. A better generative AI system can generate more convincing disinformation.

These are trade-offs that societies will grapple with. But they start with capability, and capability starts with hardware.

Looking Forward: What Happens Next in the Semiconductor Sandbox

This approval isn't the end of semiconductor geopolitics. It's one move in a long game that's still in early innings.

Likely Next Steps

Expect other Chinese companies to request H200 approvals. The second tier of tech companies—Baidu, JD.com, Meituan—will be next. Some will get approved. Some will get conditions. Some will be denied.

Expect the US to review and potentially tighten export controls. Every approval generates lobbying pressure from domestic chip companies and national security hawks. That pressure will increase.

Expect Taiwan to stay nervous. The more valuable TSMC becomes, the more geopolitically exposed Taiwan is. Investment in Taiwan's military and international relationships will likely increase.

Expect China to continue investing in domestic alternatives. The government won't accept permanent dependence on Nvidia. They'll fund research, build fabs, and develop domestic competitive chips. They might succeed in 5-7 years.

The Acceleration of AI Capabilities

Most importantly, expect AI capabilities to accelerate faster than anyone predicted. China gets 400,000 H200 chips, trains better models, launches better services, attracts more users, and gathers more data to improve models. That's a flywheel.

Within two years, Chinese AI services will be noticeably more capable. Within five years, they might match or exceed Western services in certain applications. That changes the global competitive landscape.

The Real Question

The real question isn't whether China gets H200 chips. They just got approved. The real question is what comes next. Does the US tighten controls further and initiate a chip cold war? Does China invest enough in domestic capabilities to achieve independence? Does Taiwan remain stable as an independent manufacturer?

All of those scenarios are possible. And this approval is one step toward determining which scenario plays out.

The Role of Uncertainty: Why Ambiguity Might Be Intentional

One thing worth noting: Beijing's two-week hold on H200 imports followed by conditional approval creates ambiguity. Companies got approved to buy chips, but some restrictions remained unclear. That's probably intentional.

Political ambiguity serves several purposes. First, it preserves flexibility. If conditions are vague, Beijing can tighten interpretation later without formally changing policy. Second, it signals to domestic constituencies that the government is protective. "We approved it, but with restrictions." Third, it maintains negotiating leverage. Uncertainty keeps companies and governments from getting comfortable.

The US has used similar tactics. Export controls are often written ambiguously, letting officials interpret rules in different ways depending on context. It's not a bug; it's a feature. It allows for strategic flexibility.

Companies have to navigate this ambiguity. When you get regulatory approval with unclear restrictions, you hire lawyers, you negotiate, you push back, you try to clarify. That process takes time and capital but also gives officials multiple opportunities to adjust course.

It's not efficient. But it gives policymakers control, and control is often more valuable to governments than efficiency.

Broader Implications: Semiconductor Supply Chains in the Era of Strategic Competition

This approval is part of a larger trend: the weaponization of supply chains. Semiconductors, rare earth elements, battery materials, pharmaceutical ingredients—countries are rethinking where they source critical materials.

From Globalization to Strategic Autonomy

For the past 30 years, the trend was globalization. Companies sourced materials wherever they were cheapest. Supply chains optimized for cost, not resilience.

That's changing. The pandemic exposed vulnerabilities. US blockades on Russia showed how sanctions can bite. Climate concerns made some supply chains problematic. So countries are asking: can we source this critical material domestically or from trusted allies?

For semiconductors, the US is investing in domestic manufacturing. The European Union is doing the same. Japan, South Korea, and Taiwan are all expanding capacity. China is investing aggressively in alternatives.

The end state probably isn't perfect autarky (countries making everything themselves). But it's definitely a shift toward regional supply chains and strategic partnerships, away from pure global cost optimization.

Implications for Companies

For technology companies, this means planning for multiple scenarios. Can you get chips from China? Maybe not in two years. Can you get them from Taiwan? Depends on stability. Can you source from US or allies? Probably, but more expensive.

Smart companies are already planning for this. They're diversifying suppliers, investing in alternatives, and building supply chain flexibility. That costs more upfront but saves you when disruptions happen.

The New Normal

The approval of 400,000 H200 chips to China isn't the new normal. The new normal is uncertainty, strategic competition, and governments actively managing supply chains for geopolitical advantage. Companies that adapt fastest will win. Companies that assume the old rules still apply will struggle.

FAQ

What exactly is the H200 chip and why is it so powerful?

The H200 is Nvidia's second-most powerful artificial intelligence accelerator chip, delivering approximately six times the performance of the H20 chip that was previously allowed to be exported to China. It accelerates both AI model training (processing billions of training iterations) and inference (running the trained model for end users). This raw performance advantage allows companies to train larger, more capable AI models faster and to serve more users with lower latency and costs.

Why did China initially block H200 imports if the US approved them?

China's temporary hold, despite US export approval on January 13, reflected several strategic considerations: protecting optics around domestic semiconductor self-reliance, maintaining negotiating leverage with companies and the US government, shielding state-backed semiconductor manufacturers from being undercut, and ensuring domestic companies could access chips without appearing to surrender to foreign suppliers. The two-week pause allowed Beijing to signal protective intent before ultimately approving imports for its three largest tech companies.

How does the 400,000 chip approval affect global AI development?

With 400,000 H200 chips, Chinese companies like Byte Dance, Alibaba, and Tencent can train more sophisticated AI models faster, run AI services at larger scale with lower costs per user, and iterate on AI products more rapidly through compressed feedback loops. This accelerates Chinese AI development and improves competitive positioning against Western AI companies, while also likely driving faster innovation in recommendation systems, content generation, and other AI applications globally.

What are the restrictions attached to the approval that companies are concerned about?

While the exact terms haven't been fully disclosed, sources indicate the license conditions are restrictive enough that companies hadn't immediately converted approvals into actual purchase orders. Proposed restrictions have included requirements to bundle Nvidia chips with Chinese domestic chips in set ratios, limitations on where chips can be deployed, usage restrictions for certain applications, and requirements that chips remain within Chinese borders—all of which increase operational complexity and capital costs.

How does Taiwan's role as a chip manufacturer complicate this approval?

Nvidia doesn't manufacture H200 chips; Taiwan Semiconductor Manufacturing Company (TSMC) does. This creates a critical vulnerability: TSMC is running at near full capacity globally, meaning even approved purchases face real manufacturing bottlenecks. Additionally, TSMC's location in Taiwan—a territory claimed by China but governed independently—creates geopolitical exposure. Any disruption to Taiwan's stability could catastrophically impact global chip supply.

What does this approval signal about US-China semiconductor competition going forward?

The approval signals that strategic semiconductor competition will continue through measured approvals and restrictions rather than complete embargoes. The US allows some sales to preserve industry revenue and maintain diplomatic channels, but limits them through export controls. China approves purchases selectively, supporting national champions while protecting domestic industry. Expect this pattern of periodic approvals followed by tightened restrictions to continue as both sides pursue strategic advantage in the AI era.

How might this H200 approval impact consumer-facing AI services?

With more H200 chips, Chinese companies can build more capable AI services faster, potentially launching features and products at lower costs than Western competitors. Consumers could see improved recommendation systems in apps like Tik Tok, more competitive AI assistant services, and faster innovation in AI-powered products. This competition should drive better features and lower prices globally as Western companies respond to Chinese advances.

Why didn't all Chinese companies get approved, just Byte Dance, Alibaba, and Tencent?

Beijing strategically concentrated approvals among its three largest tech companies to balance multiple competing interests: supporting the firms most critical to China's AI competitiveness, maintaining negotiating leverage by rationing approvals, protecting state-backed semiconductor companies from being immediately displaced, and demonstrating government control by showing selectivity rather than blanket approval of all requests.

Conclusion: The Chip Wars Are Just Beginning

On the surface, this story is simple: China approved the import of advanced chips. Companies are happy. Business continues.

But underneath, it's much more complex. This approval represents a high-wire act between competing national interests, corporate survival, and the future of artificial intelligence. Beijing had to show it supports Chinese competitiveness while also protecting domestic industry. Washington had to balance Nvidia's business interests against national security concerns. Companies had to navigate regulatory uncertainty and supply constraints.

Everyone executed reasonably well. The chips are approved. Business will proceed. Companies will train better models. Users will get better services.

But this isn't the end of semiconductor competition between the US and China. It's an early chapter. More approvals will come. More restrictions will too. Taiwan will become more important as TSMC remains the world's most advanced chip manufacturer. Supply chains will fragment further.

The real story is that artificial intelligence has become too important to globalize anymore. Countries want the capability domestically. They want to control who gets access. They want strategic advantage. That competition is happening in real-time through semiconductor approvals, export controls, and supply chain investments.

For companies building AI, the lesson is clear: your capability is limited by your access to chips. Plan accordingly. Diversify suppliers. Don't assume today's approvals mean tomorrow's access. And keep an eye on Taiwan—the stability of a small island now determines the future of artificial intelligence worldwide.

The approval of 400,000 H200 chips is a move in a much longer game. The AI race just got more interesting, and the stakes just got higher. Because whoever controls the chips controls the future of the technology that's reshaping everything.

Key Takeaways

- China approved 400,000 H200 chips for ByteDance, Alibaba, and Tencent after a strategic two-week hold, balancing global competitiveness with domestic semiconductor protection

- The H200 delivers 6x the performance of the H20 chip previously allowed, fundamentally accelerating Chinese companies' AI model training and inference capabilities

- Taiwan's TSMC remains the critical manufacturing bottleneck—even with approvals, actual chip delivery faces 6-12 month timelines due to global capacity constraints

- The approval signals strategic selectivity in both US export controls and Chinese import policies, with conditions attached that may restrict how chips can be deployed and used

- This move will likely accelerate Chinese AI development by 2-3 years, with ByteDance, Alibaba, and Tencent launching more capable AI services competitive with OpenAI and Google

Related Articles

- China Approves NVIDIA H200 GPU Imports: What It Means [2025]

- US Semiconductor Market 2025: Complete Timeline & Analysis [2025]

- AI Infrastructure Boom: Why Semiconductor Demand Keeps Accelerating [2025]

- Samsung RAM Prices Doubled: What's Causing the Memory Crisis [2025]

- GPU Memory Crisis: Why Graphics Card Makers Face Potential Collapse [2025]

- 7 Biggest Tech Stories This Week: LG OLED TVs, Whoop Fitness Trackers [2025]

![China Approves Nvidia H200 Imports: What It Means for AI [2025]](https://tryrunable.com/blog/china-approves-nvidia-h200-imports-what-it-means-for-ai-2025/image-1-1769621798825.jpg)