Understanding Raspberry Pi's Latest Price Increases in 2025

If you've been paying attention to single-board computer pricing, you've probably noticed something painful: Raspberry Pi just announced another round of price increases. And it's not a small bump. We're talking about

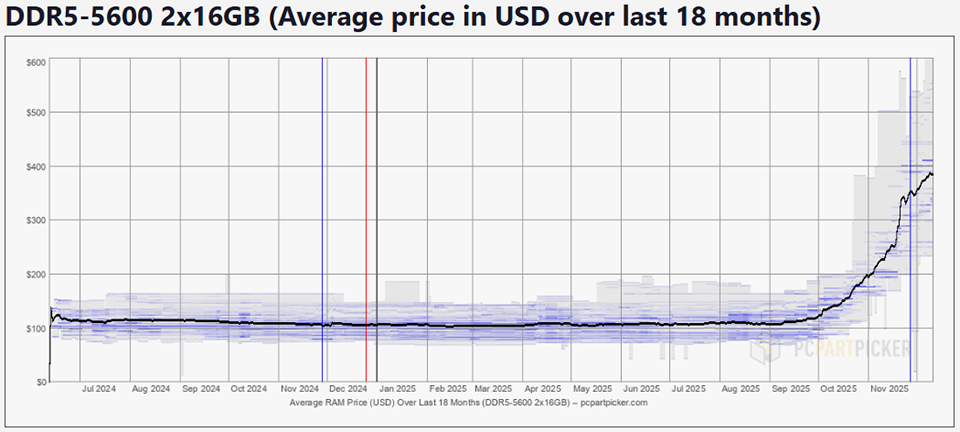

The core issue comes down to memory costs. Eben Upton, Raspberry Pi's CEO, stated plainly that "the cost of some parts has more than doubled over the last quarter." That's not hyperbole. When your primary component costs double, you can't absorb that forever. The company held on as long as it could, but eventually physics and economics catch up.

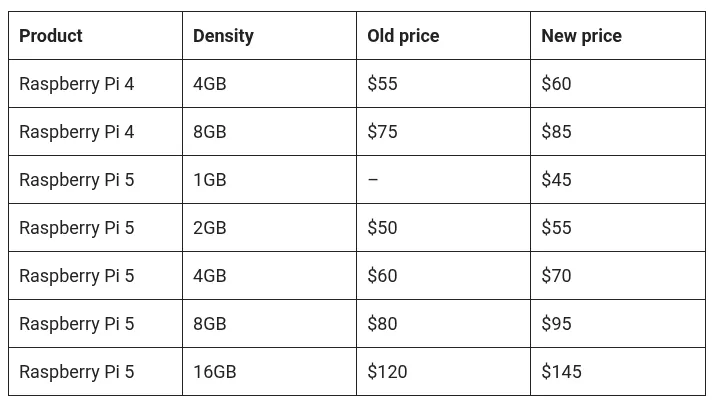

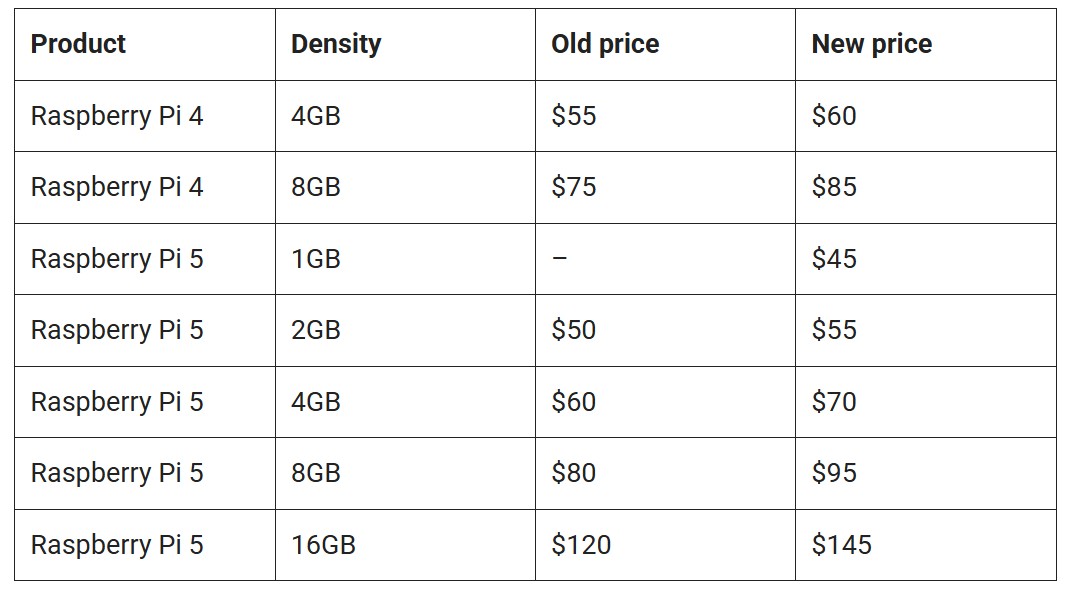

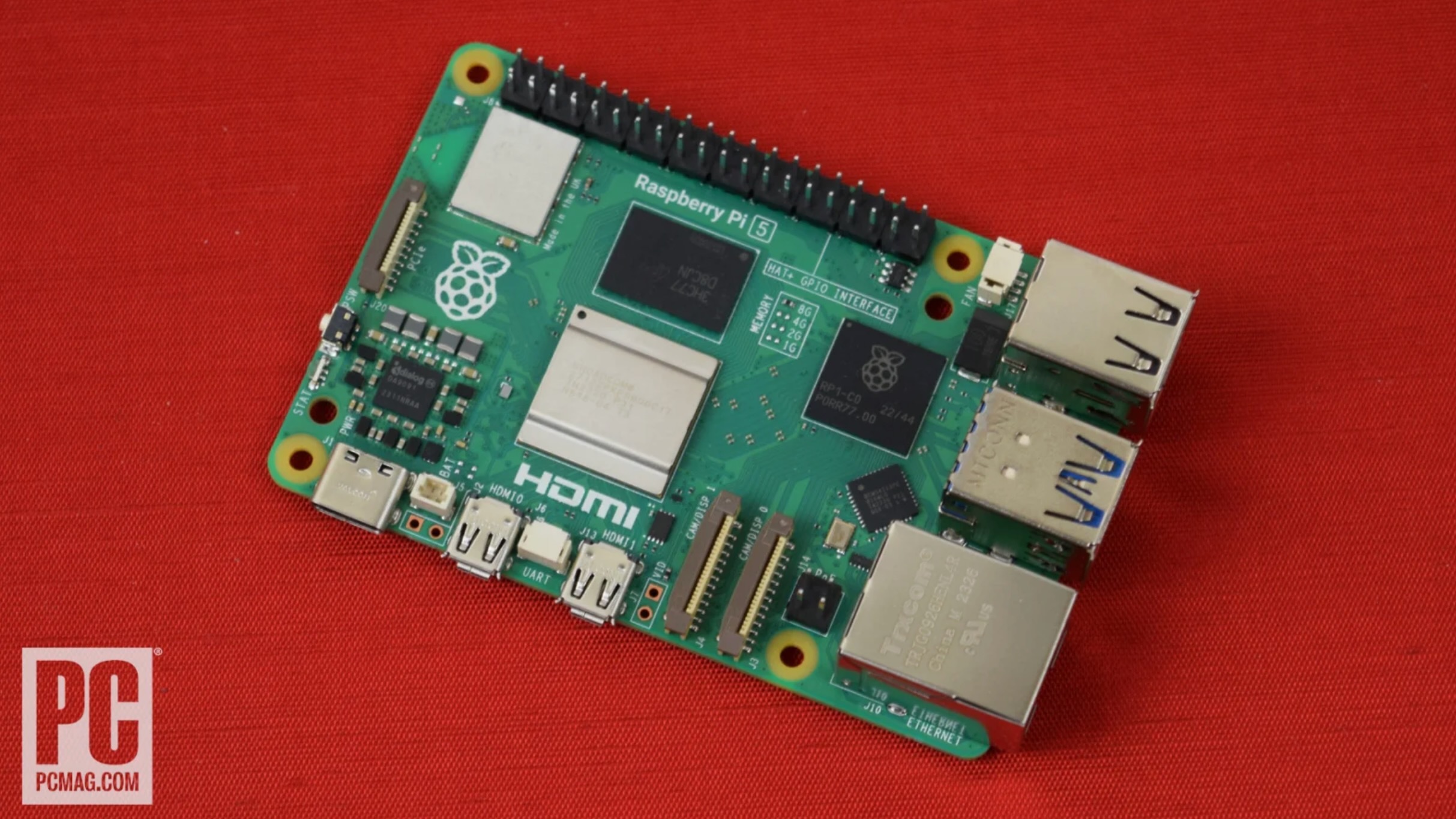

Here's what's happening: The Raspberry Pi 4 and 5, along with the Compute Module 4 and 5, are seeing significant increases across all configurations with 2GB of RAM or more. The new pricing structure works like this: a

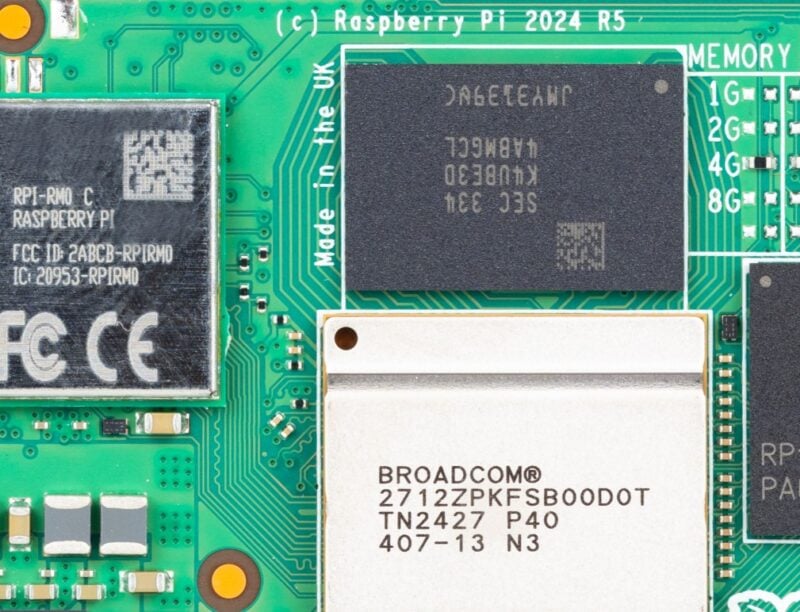

What's interesting is what doesn't change. The 1GB variants of both Raspberry Pi 4 and 5 remain stable. The Raspberry Pi 400 all-in-one computer isn't affected either. Why? Because these models use older LPDDR2 memory technology that Raspberry Pi manufactured years ago. The company stockpiled several years' worth of this older memory, so they have pricing stability for entry-level products. Meanwhile, the newer Raspberry Pi 5 and higher-capacity configurations require current-generation LPDDR4 and LPDDR5 memory, which is where the real supply crunch exists.

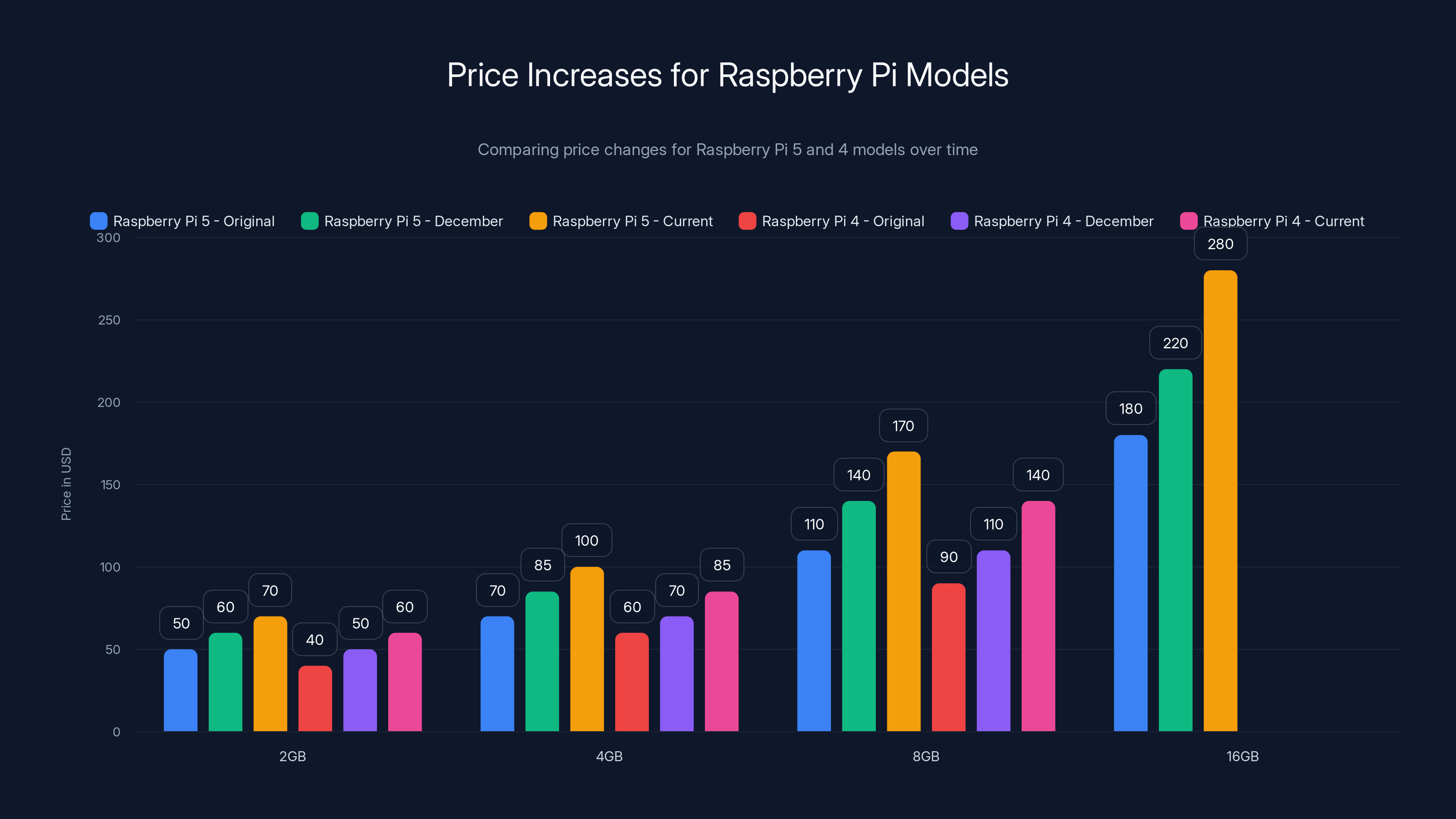

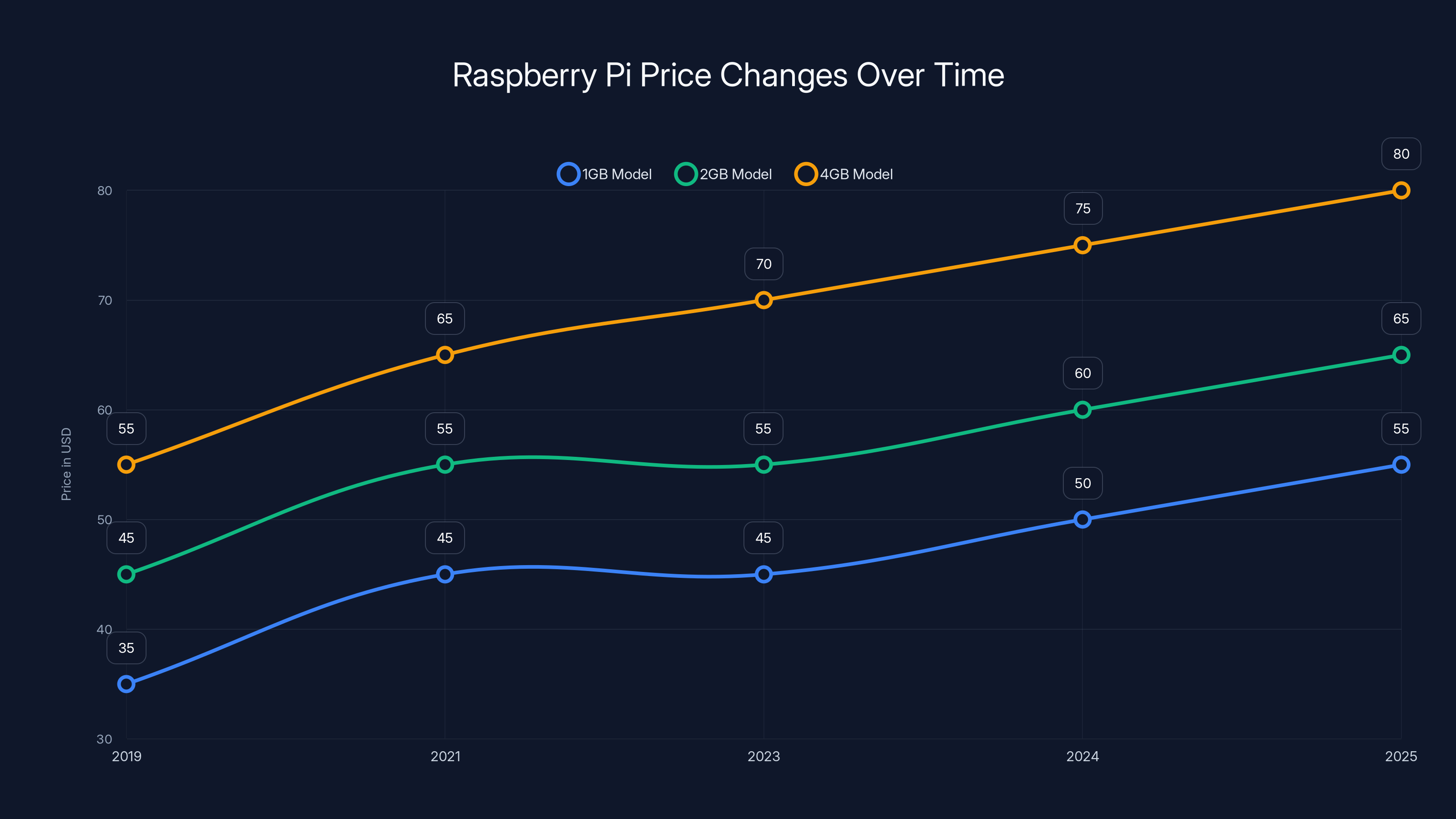

This situation didn't appear overnight. In December of last year, Raspberry Pi already announced their first major price increase since 2021, with increases ranging from

The Global Memory Shortage Explained

To understand why Raspberry Pi prices keep climbing, you need to understand what's happening in the DRAM and NAND flash memory markets. This isn't about capacity shortage. The world isn't running out of memory. Instead, this is about specific types of memory becoming expensive because of concentrated manufacturing issues and shifting demand patterns.

Memory manufacturing is incredibly concentrated. A handful of companies control the vast majority of global production: Samsung, SK Hynix, Micron Technology, and Nanya Technology account for most DRAM production. When something disrupts any of these facilities, it ripples across the entire industry. Add in geopolitical tensions, particularly around Taiwan, and you've got structural uncertainty in supply chains.

LPDDR4 and LPDDR5 memory specifically serve mobile and embedded systems. LPDDR5 is the newest standard, offering better power efficiency and higher bandwidth than LPDDR4. These are the exact memory types that power not just Raspberry Pis, but also smartphones, tablets, IoT devices, and AI accelerators. Suddenly, you have competing demand from Apple's AI initiatives, new smartphone releases, the AI boom driving demand for edge computing, and hobbyist makers all competing for the same constrained supply.

When demand spikes across multiple industries simultaneously, manufacturers prioritize their largest customers. Apple orders memory by the millions. Samsung, their biggest customer and also a memory maker themselves, has their own internal allocation needs. Small device manufacturers like Raspberry Pi end up lower on the priority list, which means they face higher spot market prices when they need to acquire memory outside of long-term contracts.

The cost implications are brutal. Spot market prices for LPDDR5 have fluctuated wildly, sometimes doubling within a quarter. Raspberry Pi's CEO specifically said costs "more than doubled" over the last quarter. When your manufacturing cost doubles on your most popular components, profit margins evaporate. The company can either absorb those costs (destroying profitability) or pass them to customers (destroying demand). They chose the latter, which is economically rational but painful for users.

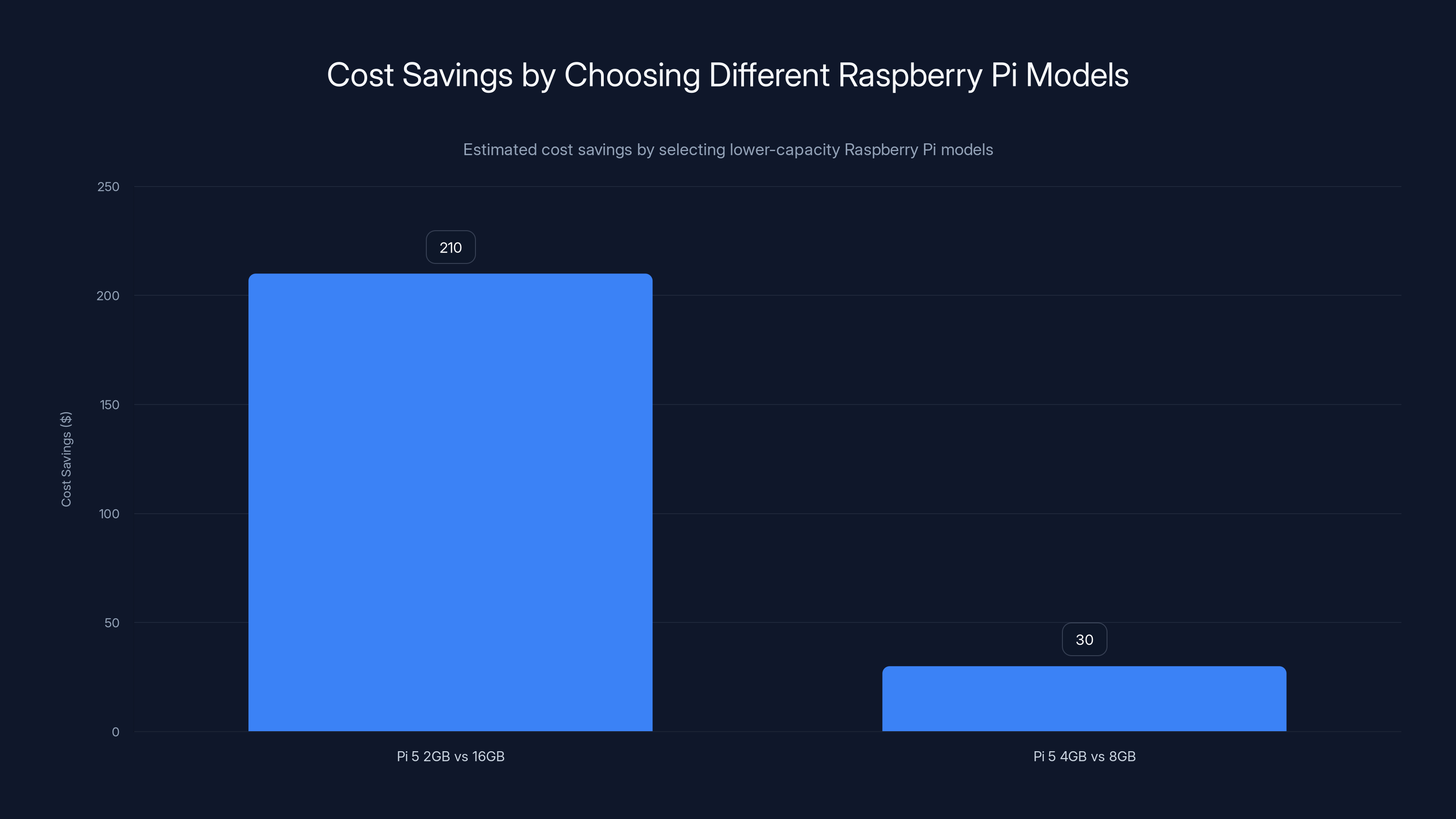

Choosing lower-capacity Raspberry Pi models can lead to significant cost savings, such as $210 when opting for a 2GB model over a 16GB one. Estimated data.

Breaking Down the Price Increase Impact by Model

Let's look at specific numbers so you understand exactly what's changed. This matters whether you're a hobbyist, a small business, or an enterprise deploying thousands of devices.

Raspberry Pi 5 Pricing Changes: The Raspberry Pi 5 2GB model went from

Raspberry Pi 4 Pricing Changes: The Raspberry Pi 4 doesn't have a 1GB option anymore (discontinued), so the minimum configuration is 2GB. These models don't get as much attention as the newer Pi 5, but they're still widely used in production systems. The 2GB version went from

Compute Module Impact: The Compute Module 4 and 5 are designed for industrial and embedded applications where makers need to integrate the Pi into their own custom hardware. These products see similar percentage increases, but they're often ordered in larger quantities, so the cumulative cost impact is more severe. A single Compute Module 5 8GB unit just cost you

What Didn't Change: Raspberry Pi 5 1GB still costs

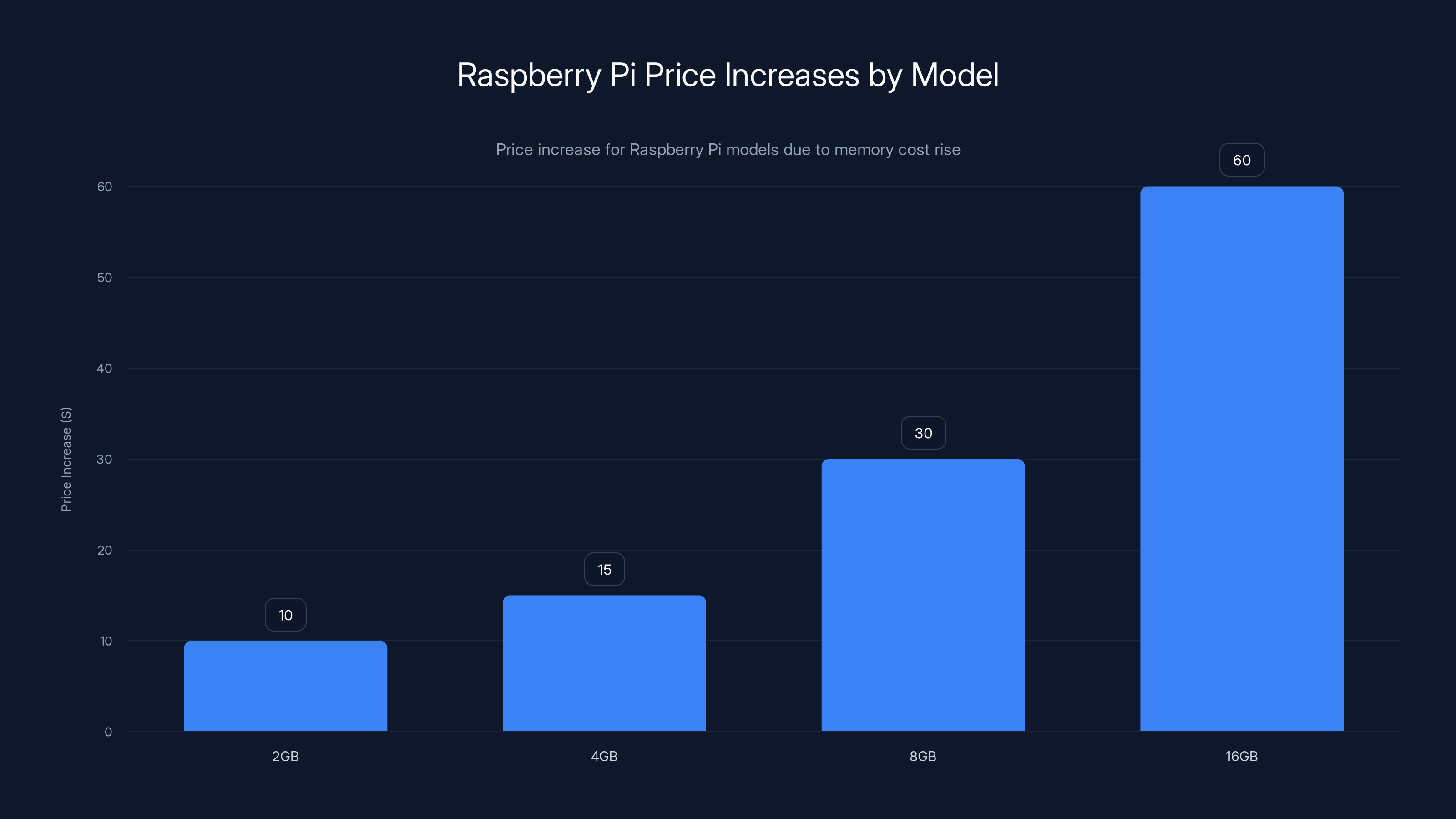

Raspberry Pi models with higher RAM configurations see significant price increases, with the 16GB model experiencing a $60 hike due to memory cost surges.

Comparing to Competitor Pricing and Alternatives

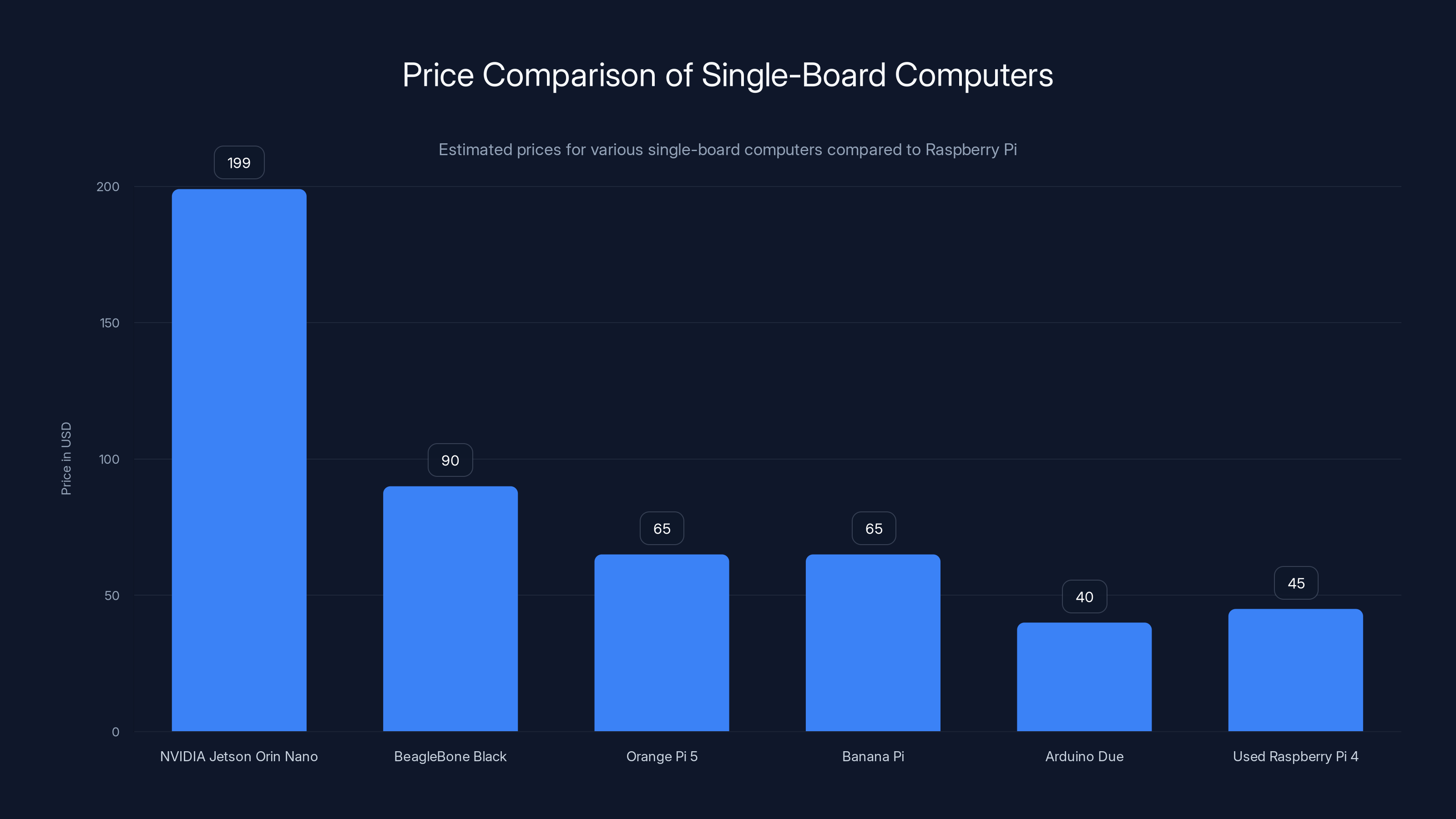

When Raspberry Pi prices climb, makers start asking: what else is available? The single-board computer market has exploded with alternatives, each targeting different use cases and price points.

NVIDIA Jetson Products: NVIDIA's Jetson Orin Nano costs $199 for the developer kit, offering significant AI acceleration capabilities that Raspberry Pi 5 can't match. For machine learning projects, this might be worth the premium. But for general-purpose computing and IoT, you're paying for capabilities you don't need.

Beagle Bone Black: Beagle Bone Black prices hover around $80-100, putting it directly in competition with Raspberry Pi 4 8GB. It offers different processor architecture (TI Sitara AM335x vs Raspberry Pi's Broadcom), which matters for specific applications. The community is smaller, which means less documentation and fewer tutorials.

Orange Pi and Banana Pi: These Chinese manufacturers offer Raspberry Pi clones at significantly lower prices. An Orange Pi 5 with 8GB might cost

Arduino and Smaller Boards: Arduino boards and microcontroller development kits start at $30-50 for more powerful options like Arduino Due. These aren't drop-in replacements—they offer less compute power and RAM—but they're perfect for specific embedded applications where a full Linux computer feels like overkill.

Used/Refurbished Market: The secondhand market for Raspberry Pi products is booming. You can find Pi 4 units for $40-50 on eBay and other platforms, undercutting new Pi 5 pricing. This creates an interesting dynamic where older hardware becomes economically attractive again.

Raspberry Pi's real strength isn't processing power—it's community, documentation, and software ecosystem. That's harder to replicate than raw specifications, which is why even with price increases, the Pi remains the dominant single-board computer platform.

Supply Chain Economics: Why This Keeps Happening

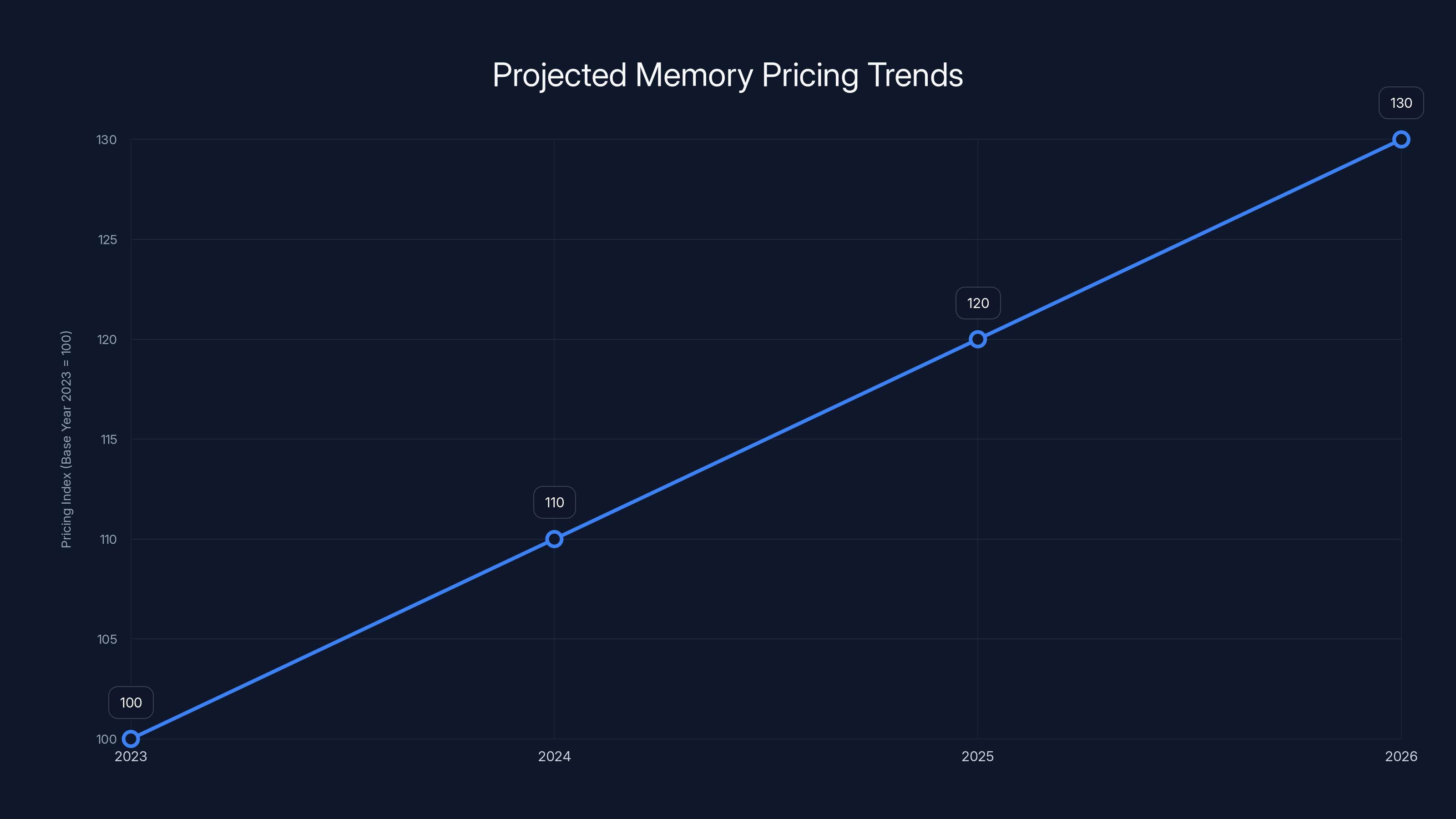

To predict whether these price increases stick around, you need to understand the underlying economics of the semiconductor industry. Raspberry Pi's CEO indicated that "2026 looks likely to be another challenging year for memory pricing," which is code for: don't expect relief anytime soon.

Here's the brutal reality: memory manufacturing requires massive capital investment. Building a new fab (manufacturing facility) costs $5-10 billion and takes 3-5 years to complete. That's not something companies do in response to quarterly demand spikes. Manufacturers plan production capacity 18-24 months in advance based on demand forecasts. When forecasts are wrong—when demand spikes faster than expected—there's no quick fix.

The current situation involves several overlapping demand drivers. AI acceleration is creating insatiable demand for high-bandwidth memory. New smartphone launches happen every quarter. The broader IoT and embedded systems market continues growing. Meanwhile, existing capacity is relatively fixed. You can't suddenly manufacture more memory; you're limited by fab capacity until new facilities come online.

Geopolitical factors compound the problem. Taiwan produces the majority of advanced semiconductor manufacturing capacity. Any risk to Taiwan—whether from actual military conflict or just trade tensions—puts pressure on supply and pricing. Memory manufacturers hedge their bets by maintaining higher prices and lower production commitments to avoid being caught with excess capacity if geopolitical situations deteriorate.

When memory costs rise, device manufacturers face a choice. Option one: absorb the costs and watch margins compress. Option two: raise prices and potentially lose price-sensitive customers. Option three: reduce product features to hit lower price points (like offering fewer storage options). Raspberry Pi chose option two, betting that their brand loyalty and ecosystem would maintain demand even at higher prices.

Raspberry Pi 5 models have seen a 40-55% price increase since their original pricing, while Raspberry Pi 4 models have increased by 33-55%. These changes impact both hobbyists and large-scale deployments.

Impact on Developers, Makers, and Small Businesses

These price increases aren't abstract. They affect real projects and real businesses. Understanding the impact requires looking at concrete scenarios.

For Hobbyist Makers: A hobbyist building a home automation system or robotics project might have allocated a

For Small Businesses: A startup building IoT monitoring systems for farms, factories, or buildings suddenly faces higher component costs. If they've already locked in pricing with customers, those price increases directly hit their bottom line. A company ordering 1,000 units of Raspberry Pi 5 4GB per month just saw their monthly component costs increase by $15,000. That's real money for a bootstrap startup.

For Educational Institutions: Schools use Raspberry Pi extensively for computer science and electronics education. Universities and high schools operating on tight budgets now face the choice: buy fewer Pi units, reduce the number of student projects, or reallocate budget from other programs. Some institutions might actually shift to older models (Pi 3 or Pi 4) that haven't experienced price increases, extending the lifespan of older hardware in educational settings.

For Industrial Applications: Companies deploying Raspberry Pi or Compute Modules in production environments often have margin commitments to customers. If their cost of goods sold rises unexpectedly, they either absorb it or renegotiate contracts. Either way, profitability suffers. Industrial customers with the scale to negotiate might push back or demand faster development of alternative solutions.

For Open Source Projects: Major open source projects that distribute Raspberry Pi-based solutions (home server projects, media centers, smart home hubs) face increased distribution costs if they ship hardware. Projects that sell pre-configured Pi systems see reduced demand at higher price points.

The cumulative effect is that some projects simply don't happen. A maker with a $200 budget might have built a four-device network; now they build a two-device network or use lower-capacity models. That's not just a personal disappointment—it's a lost sale, a smaller community project, and a reduction in the Raspberry Pi ecosystem's vibrancy.

Long-Term Trends: When Will Prices Stabilize?

Raspberry Pi's CEO offered a somewhat contradictory prognosis: "2026 looks likely to be another challenging year for memory pricing," but also "the current situation is ultimately a temporary one." Understanding when this resolves matters for planning.

Memory industry cyclicality typically follows predictable patterns. The industry experiences periods of tight supply and high pricing, followed by oversupply and price crashes. These cycles historically last 2-3 years. We're currently in a tight-supply phase that started in 2023 with the AI boom. Based on historical patterns, we might expect relief by late 2025 or 2026, but that's speculative.

Several factors could accelerate price normalization:

New Manufacturing Capacity: Samsung, TSMC, and SK Hynix all have new fab projects coming online. Intel is ramping production at new Arizona facilities. This added capacity would increase supply and put downward pressure on prices. However, most analysts predict meaningful capacity additions won't hit the market until 2025-2026.

Demand Reduction: If the AI boom cools or smartphone cycle weakens, demand pressure on memory would ease. This is possible but uncertain. AI infrastructure investment shows no signs of slowing.

China's Memory Production: China has invested heavily in domestic memory manufacturing through companies like YMTC (NAND flash) and efforts to build DRAM capacity. These facilities ramping production could increase global supply, though geopolitical complications could limit their access to advanced manufacturing equipment.

Shift to Alternative Architectures: Some device manufacturers are exploring different memory technologies or architectures that don't require LPDDR4/LPDDR5. Raspberry Pi could theoretically move to a different memory standard, but that would require redesigning products—expensive and disruptive.

Raspberry Pi's statement that they "look forward to unwinding these price increases once it abates" suggests they're not planning to maintain the higher margins. If memory costs eventually normalize, you might see price cuts. That's actually unusual transparency in the industry.

Memory pricing is projected to increase steadily from 2023 to 2026 due to high demand and limited manufacturing capacity. Estimated data based on industry trends.

Strategic Implications for the Raspberry Pi Ecosystem

These price increases carry strategic implications beyond simple economics. They test the loyalty of Raspberry Pi's community and could reshape the competitive landscape.

Market Segmentation Opportunity: Higher prices push price-sensitive customers toward alternatives or older models. This creates space for competitors offering lower-cost options. Orange Pi, Banana Pi, and other manufacturers suddenly look more attractive when Raspberry Pi 5 costs $280 for the top configuration. This could permanently erode Raspberry Pi's market share in price-sensitive segments.

Quality of Life for Existing Users: Longer-term, Raspberry Pi might actually benefit from higher prices if it pushes casual users toward alternatives while retaining serious developers and enthusiasts. The community that builds incredible projects tends to be less price-sensitive than casual hobbyists. Counterintuitive as it sounds, a smaller, more dedicated user base might be healthier for the platform.

Developer Retention Risk: However, reducing the installed base also reduces the pool of potential customers for services, courses, and advanced products. If fewer people own Raspberry Pis, fewer people learn the platform, and fewer eventually become customers for professional services or industrial solutions.

Strategic Positioning of Compute Module: Compute Modules are the true money-maker for Raspberry Pi long-term. These are sold to manufacturers building custom hardware. Price increases here are particularly painful because manufacturers can't absorb costs—they need to pass them to end customers or redesign products to use alternatives. Losing industrial customers to competitors would be a significant strategic loss.

Open Source Software Advantage: One area where Raspberry Pi maintains competitive advantage is software. The enormous collection of open source projects, documentation, and community tutorials represent massive accumulated value that competitors can't easily replicate. This ecosystem advantage gives Raspberry Pi pricing power even when competitors offer similar hardware at lower prices.

Historical Context: This Isn't Raspberry Pi's First Price Increase

Understanding the current situation requires historical perspective. This isn't the first time Raspberry Pi has raised prices significantly.

Before 2021, Raspberry Pi maintained stable pricing for years. The Raspberry Pi 4 launched in 2019 at

That 2021 increase shocked the community. It was the first real test of customer loyalty. What happened? Demand remained strong. Interestingly, the organization didn't introduce significantly new features to justify the price increase. It was pure cost-pass-through. The market absorbed it.

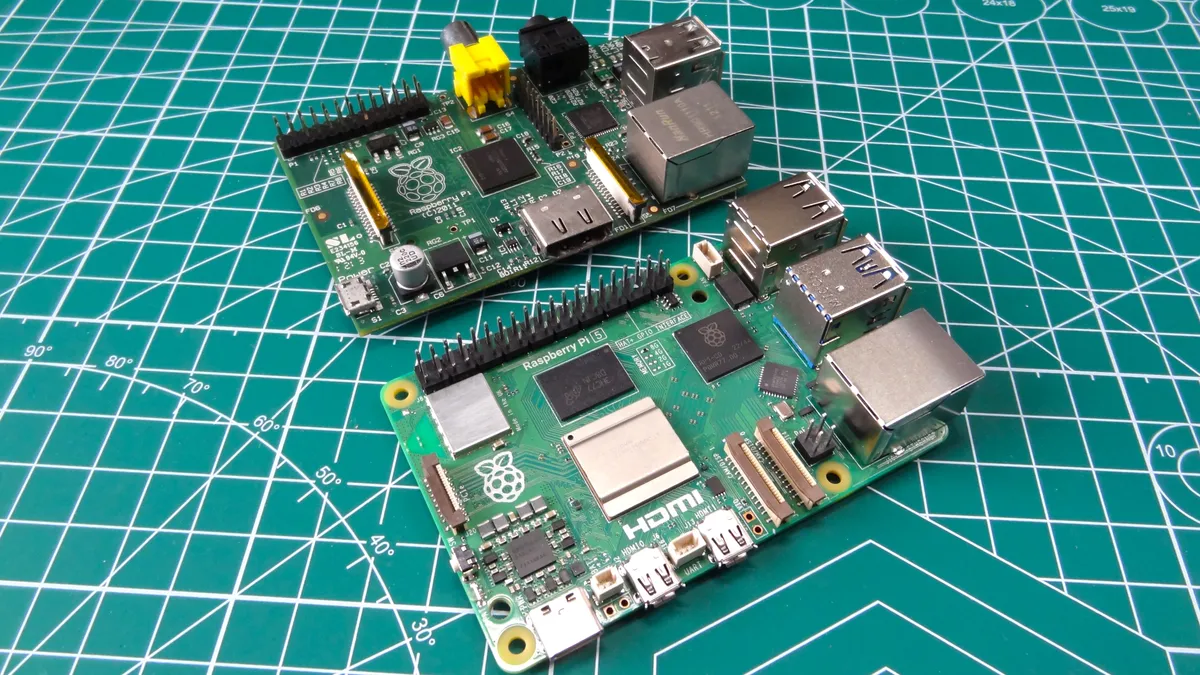

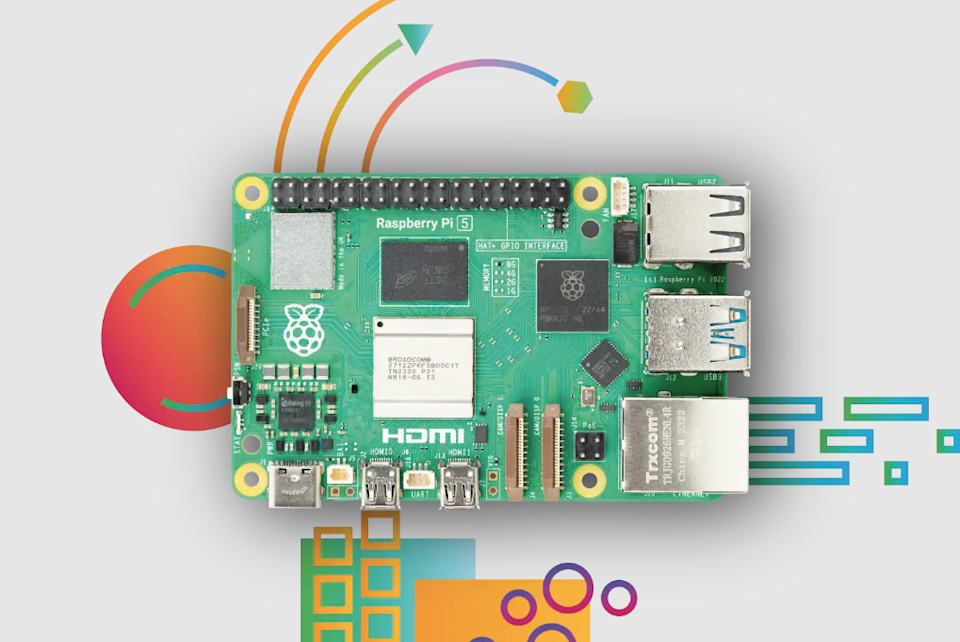

When Raspberry Pi 5 launched in 2023, Raspberry Pi reset pricing lower than what Pi 4 costs had climbed to, using a lower-cost processor architecture while maintaining performance leadership. It was a strategic move to attract customers frustrated with Pi 4 pricing. The 4GB model launched at $70, less than the Pi 4 4GB at that time.

Then 2024 brought the current crisis. The pattern is clear: whenever the memory market tightens, Raspberry Pi experiences cost pressure and passes it to customers.

Raspberry Pi models have experienced price increases due to supply chain pressures, with notable hikes in 2021 and 2024. Estimated data for 2024 and 2025.

Competitive Responses and Market Reactions

How have competitors responded to Raspberry Pi's difficulties? The market's reaction has been telling.

Industry Silence: Most competitors haven't announced price cuts or major value-add offerings in response. NVIDIA is sticking with Jetson pricing. Beagle Bone and Orange Pi haven't launched aggressive campaigns. This suggests that memory cost pressures are affecting the entire industry, not just Raspberry Pi. If competitors had cost advantages, they'd be marketing them aggressively.

Used Market Surge: The real response has come from the used and refurbished market. Secondary markets for Raspberry Pi products are booming. Older Pi 3 and Pi 4 units are finding new life as customers seek price relief. This is actually healthy for Raspberry Pi—keeping devices in use extends the ecosystem's reach.

Community Solutions: The maker community has responded by sharing optimization techniques, using lower-capacity models more creatively, and in some cases redesigning projects around alternative platforms. Some developers are maintaining code compatibility with multiple platforms as hedging strategy.

Enterprise Adoption Pressure: Industrial customers with specific needs are finally pulling the trigger on custom hardware. Instead of using COTS Raspberry Pi products, they're investing in custom boards optimized for their applications. This was inevitable eventually, but price increases accelerate the timeline.

Mitigation Strategies for Affected Users

If you're affected by these price increases, what can you actually do? There are concrete options beyond just accepting higher costs.

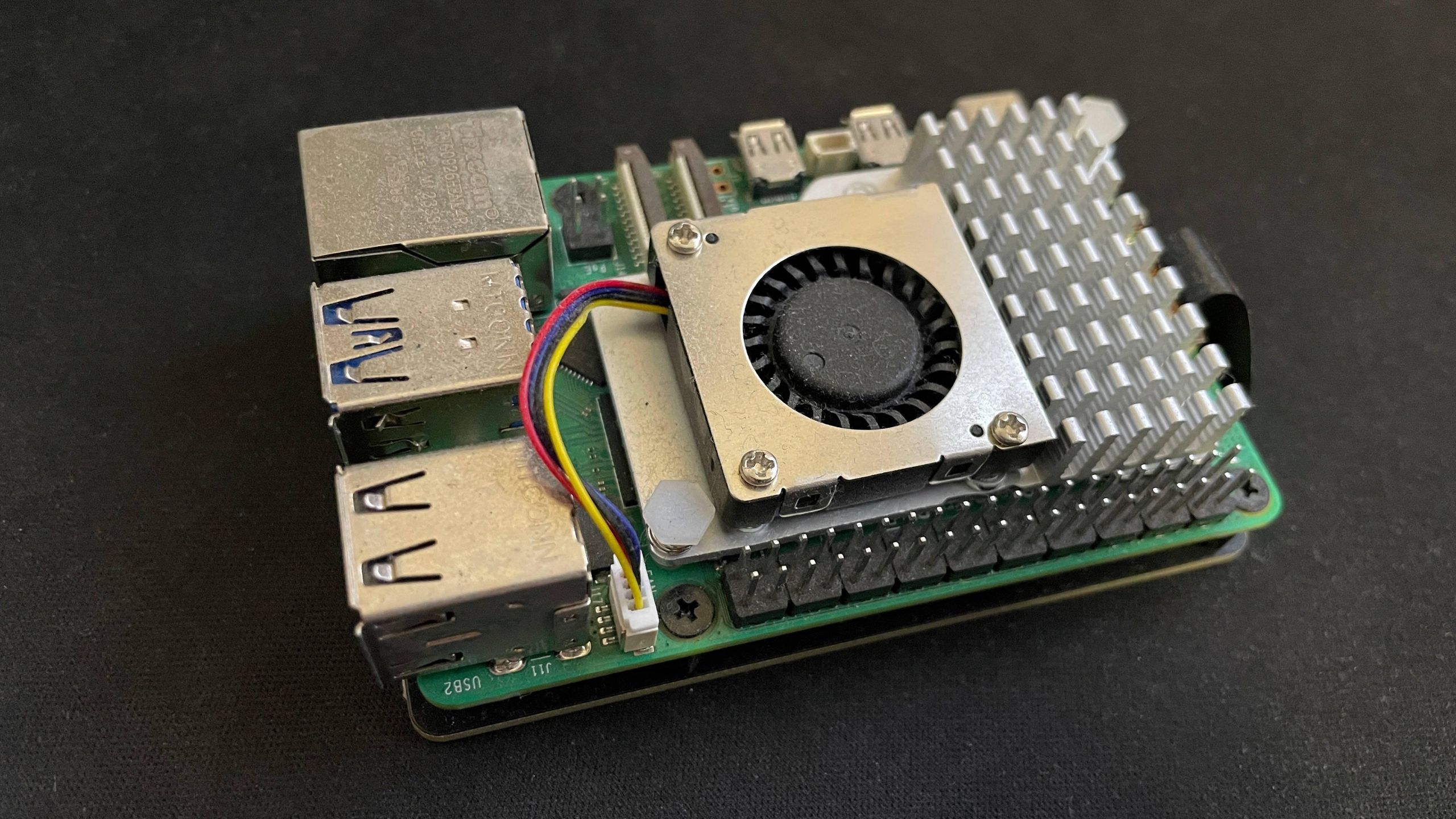

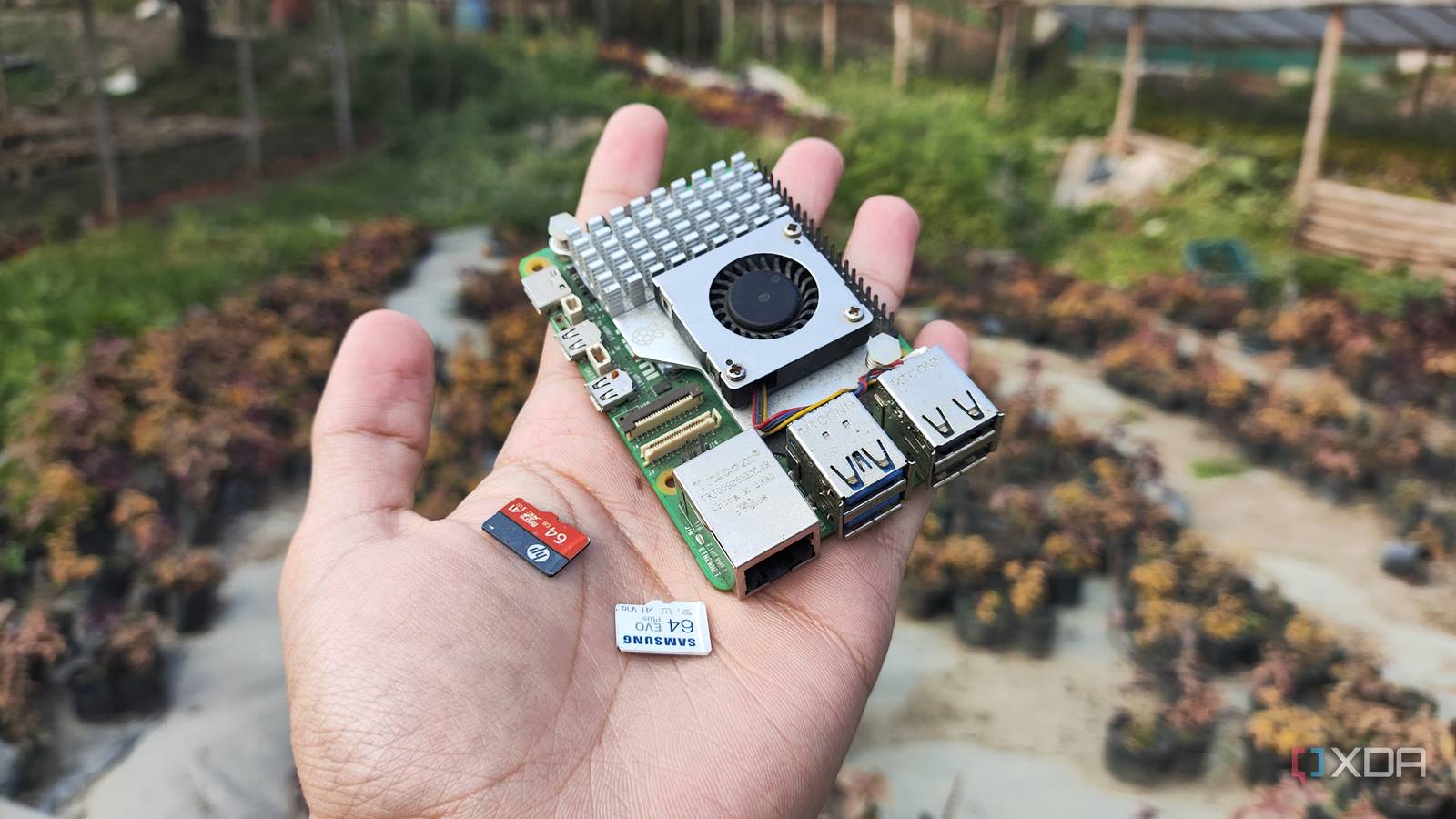

Optimize Project Requirements: Many projects don't actually need the highest-end Raspberry Pi. A Raspberry Pi 5 8GB might seem powerful, but a Pi 5 4GB might handle your workload fine. Running benchmarks on your specific application could reveal that stepping down one tier saves $30-40 without impacting performance. I've seen plenty of over-specified projects where stepping down actually improved reliability because thermal management became less challenging.

Extend Existing Hardware Lifespan: Raspberry Pi 4 and older models still work great. If you're maintaining existing systems, there's often no compelling reason to upgrade immediately. Keep your Pi 3s and Pi 4s running longer. The software improvements in new OS releases are incremental, not revolutionary.

Use Lower-Capacity Models Where Viable: A Pi 5 2GB costs

Evaluate Alternatives Genuinely: If you're starting a new project, actually evaluate alternatives. Build a comparison matrix of your requirements. Maybe a Beagle Bone Black or Orange Pi 5 makes sense for your specific use case. The community and documentation are smaller, but if your project doesn't require extensive troubleshooting, the cost savings might justify the trade-off.

Leverage Open Source Community: The Raspberry Pi ecosystem's real advantage is free software. Organizations like The Pi Foundation, community projects, and corporate backers invest enormous resources in open source tools. Maximize use of these resources to avoid paying for commercial alternatives.

Plan Inventory Carefully: If you're building systems that require specific hardware, lock in quantities now while you understand pricing. Futures buying doesn't make sense for fast-moving consumer hardware, but understanding your needs for 3-6 months ahead and purchasing accordingly reduces exposure to further surprise increases.

Estimated data shows that while NVIDIA Jetson Orin Nano offers advanced features, it is the most expensive option. Orange Pi and Banana Pi are the most cost-effective alternatives to Raspberry Pi.

Looking Forward: The Raspberry Pi Foundation's Position

The Raspberry Pi Foundation operates differently from typical tech companies. It's a charity organization, not a for-profit, focused on furthering computer science education. This matters for understanding their approach to pricing.

Charities need financial sustainability just like businesses do. The foundation relies on Raspberry Pi product sales revenue to fund its educational mission. Allowing margins to compress too severely would threaten the organization's ability to fund schools, create educational content, and develop new products. In this context, price increases are not greed—they're financial necessity.

However, the foundation also needs to maintain its educational mission focus. There's inherent tension between maximizing revenue and keeping computers affordable for developing countries and low-income communities. The 1GB models remaining stable in price suggests the foundation is trying to balance these concerns—keeping entry-level products accessible while raising prices on premium configurations.

Long-term, the foundation's success depends on the ecosystem thriving. If developers and makers switch to competitors because prices become prohibitive, the ecosystem shrinks and the platform's value diminishes. Raspberry Pi's leadership appears aware of this risk, which is why the CEO specifically discussed this situation being temporary.

The foundation has historically been responsive to community feedback. They hear concerns about pricing and take them seriously. Their track record of eventually bringing prices down (after cost pressures ease) suggests they're not playing permanent price-increase games.

Expert Perspectives on Market Dynamics

Industry analysts and observers have weighed in on Raspberry Pi's pricing situation, offering insights into broader market trends.

Memory market experts note that the current cycle is unusual in severity and duration. Normally, memory price spikes last 6-12 months before supply catches up with demand. The AI-driven demand starting in 2023 has proven more persistent than typical cycles, lasting longer and affecting more device categories. This suggests we're in a structural shift rather than a temporary hiccup.

Semiconductor industry analysts point to geopolitical risk as an underappreciated factor in current pricing. Taiwan manufactures about 60% of the world's advanced semiconductors. Any increase in tensions around Taiwan pushes prices higher as manufacturers create pricing hedges for geopolitical risk. This component of current pricing might persist even after supply tightens.

Device manufacturer perspectives suggest they're in a painful position. Companies like Raspberry Pi Foundation, smartphone makers, and IoT device manufacturers are all competing for the same limited memory supply. None of them have easy solutions. The manufacturers with the most vertical integration (like Samsung, which makes its own memory) have advantages, but even they're passing costs to customers.

The Broader Supply Chain Lesson

Raspberry Pi's price increases illustrate a critical supply chain principle: just-in-time manufacturing and optimized global supply chains have vulnerabilities. When everything is optimized for cost and speed, there's no resilience buffer when disruptions occur.

Below a certain price point, keeping inventory is economically irrational. Raspberry Pi historically maintained just enough component stock to support manufacturing for weeks ahead. This minimizes capital tied up in inventory. It works great when supplies are stable. It becomes catastrophic when supplies tighten suddenly.

Some manufacturers are learning this lesson and rebuilding buffers. Intel, TSMC, and Samsung are all increasing safety stock. The cost of carrying extra inventory is real, but the cost of supply interruptions is higher. We might see structural changes in how semiconductor companies manage supply over the next few years.

For device makers like Raspberry Pi, this suggests a future of higher strategic inventory costs. That translates to higher product prices. Even once memory prices stabilize, holding safety stock adds ongoing cost. This might represent a permanent increase in baseline Raspberry Pi pricing from the pre-2021 era.

What This Means for Your Next Project

If you're planning a Raspberry Pi project, the practical implications are straightforward:

Budget for current pricing, not historical pricing. Don't assume you can replicate projects that were designed around $35-55 pricing for the same component cost. That era is likely over.

Build contingency into project planning. If you're designing systems that must work reliably, design around components that will be available at higher prices, or design to tolerate longer lead times for cheaper alternatives.

Consider total system cost, not just single-component cost. A Raspberry Pi 5 4GB (

Lock in long-term supply agreements if you're building products. For small batches, spot market prices hit hard. For production volumes, locking in pricing with distributors provides predictability. This is why small businesses suffer more than large manufacturers in commodity shortage situations.

Stay flexible on hardware choices. Design software and firmware that could run on multiple platforms. This gives you negotiation power with suppliers and options if pricing becomes untenable on your chosen platform.

Conclusion: Normalcy and the New Normal

Raspberry Pi's price increases reflect real economic conditions, not arbitrary corporate greed. Memory costs genuinely doubled over the relevant period. Component costs more than doubled according to the company's leadership. These aren't sustainable margins for any organization.

The question isn't whether Raspberry Pi should have raised prices. They likely had no choice without destroying the organization's financial health. The questions are whether they'll compete effectively at higher prices and whether the price increases prove temporary as leadership suggests.

Historically, Raspberry Pi has navigated price pressures well. The ecosystem's strength comes from community, software, and documentation—advantages that don't evaporate when prices rise. The brand loyalty in the maker and educational communities is genuinely strong.

However, every price increase carries risk. Some projects get cancelled instead of redesigned around cheaper components. Some developers try competitors and discover viable alternatives. Some institutional customers redesign around custom hardware. These are asymmetric losses—you never fully recover the developers and projects that switched platforms.

The key variable going forward is how long these prices stick. If Raspberry Pi has to raise prices again in six months, confidence in the platform erodes significantly. If prices hold stable, community sentiment stabilizes. If prices eventually come down as leadership suggests, they emerge from this with credibility enhanced.

For now, the practical approach is acceptance with strategic adaptation. Yes, Raspberry Pi products cost more. No, that doesn't mean your projects are impossible. Optimization, alternative platforms, and creative use of lower-capacity models keep Raspberry Pi projects viable even at higher price points.

The ecosystem that made Raspberry Pi special—the tutorials, the projects, the community—remains free and valuable. That foundation of goodwill might be Raspberry Pi's greatest asset as they navigate this challenging period.

FAQ

Why did Raspberry Pi raise prices twice in two months?

Memory component costs more than doubled during a single quarter due to global supply constraints in LPDDR4 and LPDDR5 memory production. When Raspberry Pi couldn't absorb those costs without destroying profitability, they passed increases to customers. The first increase in December was substantial, but further cost escalation required a second increase just weeks later.

Which Raspberry Pi models are affected by the price increase?

All Raspberry Pi 4 and Raspberry Pi 5 models with 2GB of RAM or more are affected, along with Compute Module 4 and 5 with 2GB or more. Specifically, pricing increases by

What's causing the global memory shortage?

This isn't a shortage of total memory capacity—it's a shortage of specific memory types (LPDDR4 and LPDDR5) driven by concentrated manufacturing with competing demand. AI infrastructure expansion, new smartphone launches, and IoT device growth all create simultaneous demand for limited manufacturing capacity. Adding geopolitical risks around Taiwan (where much advanced manufacturing occurs) increases pricing hedges. Manufacturers can't instantly increase capacity; fab construction takes 3-5 years and billions of dollars.

Should I upgrade to a Raspberry Pi 5 now before prices increase again?

That depends on your specific needs. If you have a viable project that would benefit from Pi 5 capabilities, current pricing is unlikely to improve significantly in the near term. However, if you can accomplish your goals with a Pi 4 or lower-capacity Pi 5 configuration, the cost difference might be worth accepting some performance trade-offs. Consider whether your project genuinely needs the higher tier or whether you're future-proofing unnecessarily.

When will Raspberry Pi prices return to pre-2021 levels?

Raspberry Pi's leadership suggests 2026 will still be challenging but indicates price increases are ultimately temporary. Historically, memory market cycles last 2-3 years. We're currently about halfway through the AI-driven cycle that started in 2023. New manufacturing capacity coming online in 2025-2026 should ease supply pressures. However, don't expect dramatic price cuts—safety stock and geopolitical hedging costs might mean prices never fully return to the 2019-2020 era, even after memory supply normalizes.

Are there viable alternatives to Raspberry Pi at better prices?

Several alternatives exist at lower price points, though with trade-offs. Orange Pi and Banana Pi offer similar hardware at significantly lower prices (

How do price increases affect the Raspberry Pi community and ecosystem?

Higher prices reduce the number of people who can afford to experiment with Raspberry Pi, potentially shrinking the community and reducing the pool of developers who learn the platform. This is ultimately harmful to Raspberry Pi's long-term platform strength, though the extensive free software ecosystem provides resilience. Some advanced users and business customers are reevaluating alternatives and might permanently switch to competitors. The most dedicated community members typically prioritize capability and ecosystem over price, so serious makers and developers will likely remain loyal despite higher costs.

Will Raspberry Pi introduce new lower-cost products to address pricing concerns?

Raspberry Pi hasn't announced new budget-focused products yet. They maintain the Raspberry Pi Zero at low price points, though that product line is separate from the Pi 4 and Pi 5 main lines. The organization might introduce new budget variants eventually, but that would require new product development, which takes time and resources. For now, the strategy appears to be maintaining existing products at higher prices rather than introducing new lower-cost alternatives.

How are businesses adapting to Raspberry Pi price increases?

Companies with existing Raspberry Pi-based products face margin pressure. Some are redesigning around alternative platforms or custom hardware to reduce component costs. Others are raising prices to customers if they haven't already locked in pricing. Smaller businesses absorb cost increases, directly reducing profitability. Industrial customers sometimes push back on price increases by demanding faster development of alternative solutions or threatening to switch platforms. This pressure is driving innovation in competitive products, though no direct Raspberry Pi competitor has emerged with clearly superior value propositions at scale.

Real-World Context and Developer Impact

The abstract economics of memory supply chains matter less than how these price increases affect real people building real projects. Understanding developer impact requires looking at specific scenarios.

Consider a small robotics club at a high school. Previously, they might have built a fleet of ten robot platforms using Raspberry Pi 4 computers, spending roughly

Or consider a startup building IoT monitoring devices for small farms. They might build business models assuming a Raspberry Pi component cost of

These are real constraints that affect whether projects happen. Some projects that would have succeeded at old pricing become unviable at new pricing. That's the true cost of price increases—not just higher prices for existing projects, but projects that never get built.

However, Raspberry Pi's market strength means many projects do persist despite price increases. The community's investment in the platform, the vast library of tutorials and documentation, the compatibility across generations—these create switching costs that hold many developers in place even when pricing pressures emerge.

The tension between price pressures and community loyalty will likely define Raspberry Pi's trajectory through 2025 and 2026. If leadership successfully navigates this period without further surprise increases, they emerge with reputation enhanced. If additional increases hit unexpectedly, community sentiment shifts measurably. Understanding this dynamic matters for anyone relying on Raspberry Pi products for important projects.

Key Takeaways

- Raspberry Pi announced second major price increase in two months, with 2GB+ models rising 60 due to memory component costs doubling

- LPDDR4 and LPDDR5 memory shortages stem from concentrated manufacturing in Taiwan, competing AI and smartphone demand, and geopolitical hedging

- Affected products: Raspberry Pi 4 and 5, Compute Modules 4 and 5; Unaffected: 1GB models using legacy LPDDR2 memory that Raspberry Pi pre-manufactured

- Competitors like Orange Pi offer 30-40% cost savings but sacrifice community support, documentation, and software ecosystem advantages

- Leadership expects 2026 to remain challenging but views pricing pressures as temporary, suggesting eventual price normalization as manufacturing capacity increases

Related Articles

- Samsung RAM Prices Doubled: What's Causing the Memory Crisis [2025]

- China Approves Nvidia H200 Imports: What It Means for AI [2025]

- AI Infrastructure Boom: Why Semiconductor Demand Keeps Accelerating [2025]

- iPhone 18 Pricing Strategy: How Apple Navigates the RAM Shortage [2025]

- GPU Memory Crisis: Why Graphics Card Makers Face Potential Collapse [2025]

- How to Find an Affordable GPU in 2026: The RAMageddon Survival Guide [2025]