Did Nvidia Just Hand the Mid-Range GPU Market to AMD?

There's been a seismic shift brewing in the GPU world, and it could reshape everything you thought you knew about graphics cards in 2025. Word on the street: Nvidia has essentially killed off two highly anticipated graphics cards, the RTX 5070 Ti and the RTX 5060 Ti 16GB variant. If true, this isn't just a product lineup shuffle. This is Nvidia potentially ceding the lucrative mid-range segment to competitors like AMD.

Now, here's the thing: GPU product lineups matter. A lot. They determine what millions of gamers, creators, and developers can actually afford. They influence which cards show up in prebuilds at Best Buy. They shape the entire gaming and professional computing landscape. So when rumors swirl about Nvidia dropping two mid-range cards, that's worth paying attention to.

I've been tracking GPU releases for years, and these cancellations represent something unusual. Nvidia has built its dominance on having a product for every price point. Leaving gaps in that strategy signals something bigger is happening. Are these cards truly cancelled, or is this strategic repositioning? What does it mean for the $400-600 GPU market? And most importantly, how does this affect you if you're actually trying to buy a graphics card?

Let's dig into what the rumors actually say, what they mean for the GPU landscape, and what you should do if you've been eyeing a mid-range upgrade.

TL; DR

- Cancellation Claims: Recent leaks suggest Nvidia has killed the RTX 5070 Ti and RTX 5060 Ti 16GB, though neither card has been officially confirmed or cancelled

- Market Impact: Removing these models could leave a significant gap in the $400-600 price segment, potentially benefiting AMD's RDNA 4 lineup

- Timeline Uncertainty: No official announcement from Nvidia; all information comes from industry leaks and speculation

- AMD's Position: AMD may capitalize on this opportunity with aggressive pricing on its next-generation GPUs if Nvidia's mid-range strategy truly shifts

- Wait or Buy: Current RTX 40-series cards remain solid options, but waiting for official confirmation is prudent before making purchasing decisions

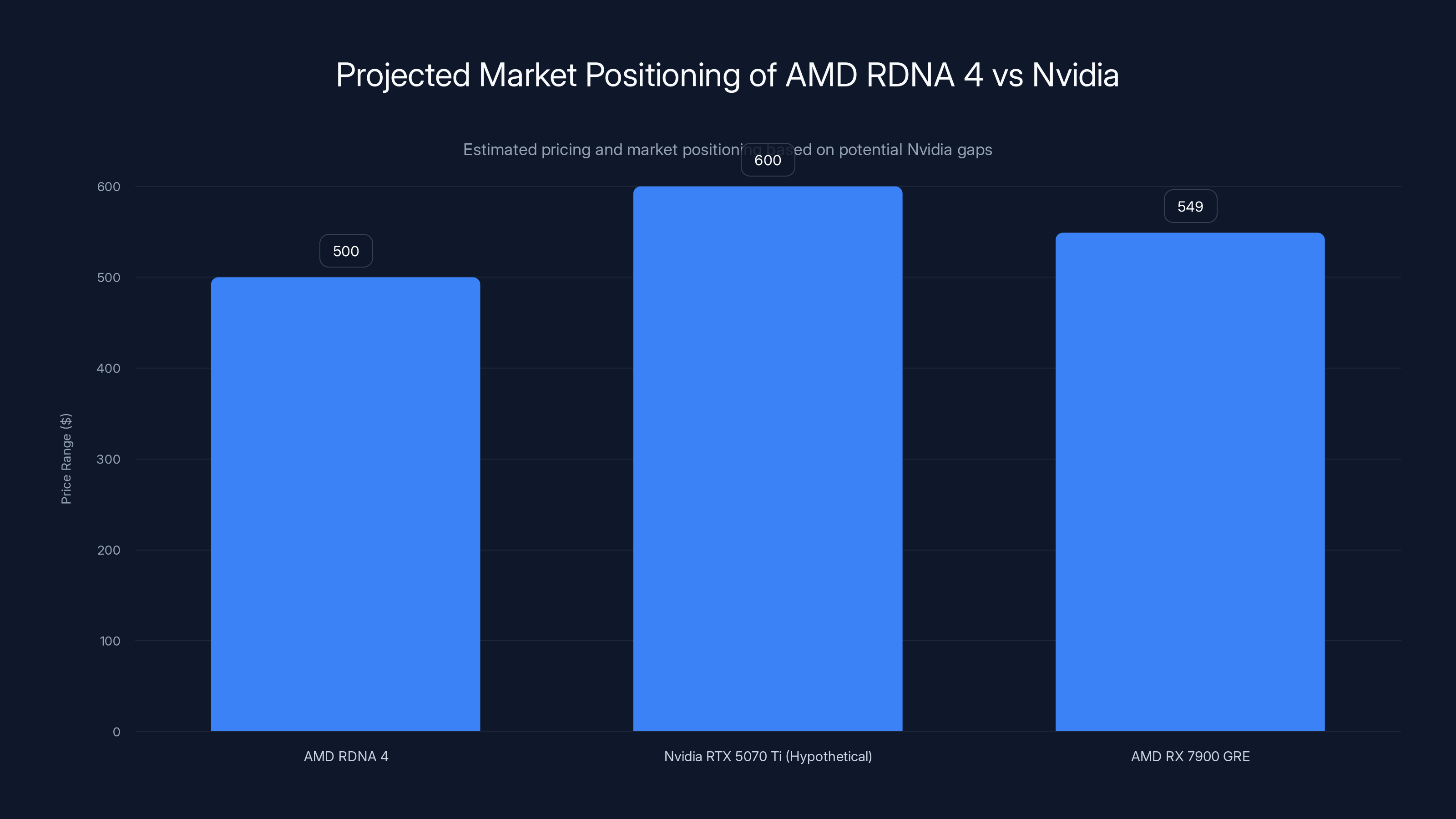

AMD's RDNA 4 cards are projected to fill the $400-600 market gap left by Nvidia, potentially strengthening AMD's market position. Estimated data based on strategic insights.

Understanding the GPU Lineup Structure and Why Mid-Range Matters

Before we dissect these rumors, let's establish why mid-range GPUs matter in the first place. The graphics card market exists across distinct price tiers, and each one serves a purpose.

At the top, you've got flagships. These are the

The mid-range represents the intersection of performance and accessibility. A $500 graphics card can handle 1440p gaming at high refresh rates. It can run professional applications like Blender or Da Vinci Resolve. It sits in that magical zone where you get serious performance without needing to take out a second mortgage.

Nvidia's strength has always been its vertical integration across these tiers. Whether you wanted to spend

But here's where it gets interesting. Over the past two years, AMD's RDNA architecture has improved dramatically. The RX 7700 XT started getting genuine respect. The RX 7800 XT became genuinely competitive. AMD began chipping away at Nvidia's mid-range dominance.

If Nvidia truly abandons the mid-range, even partially, it hands AMD precisely the opening it's been waiting for.

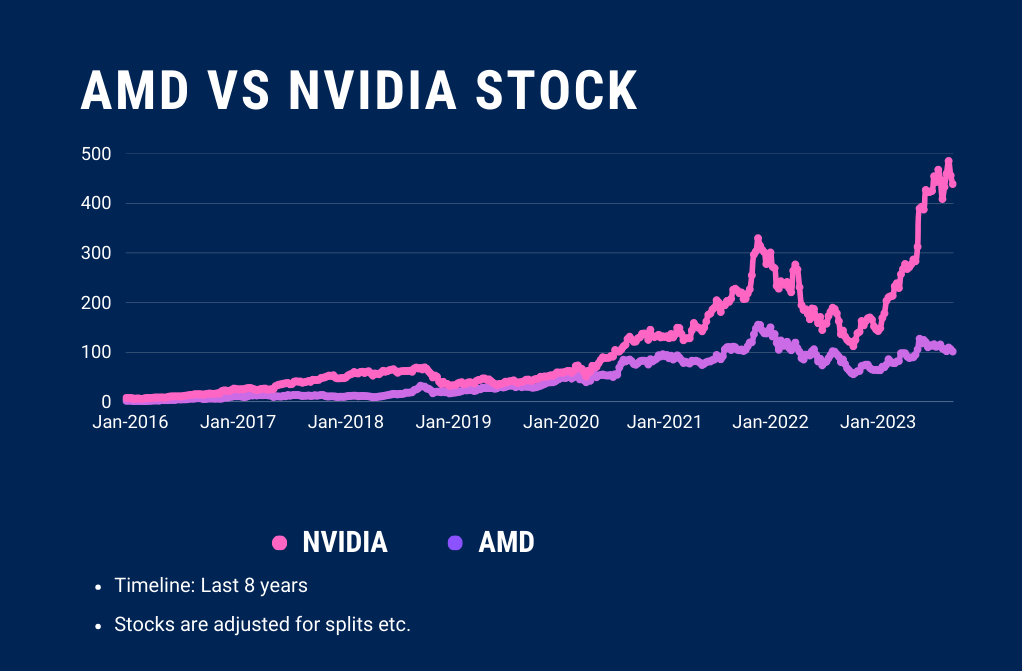

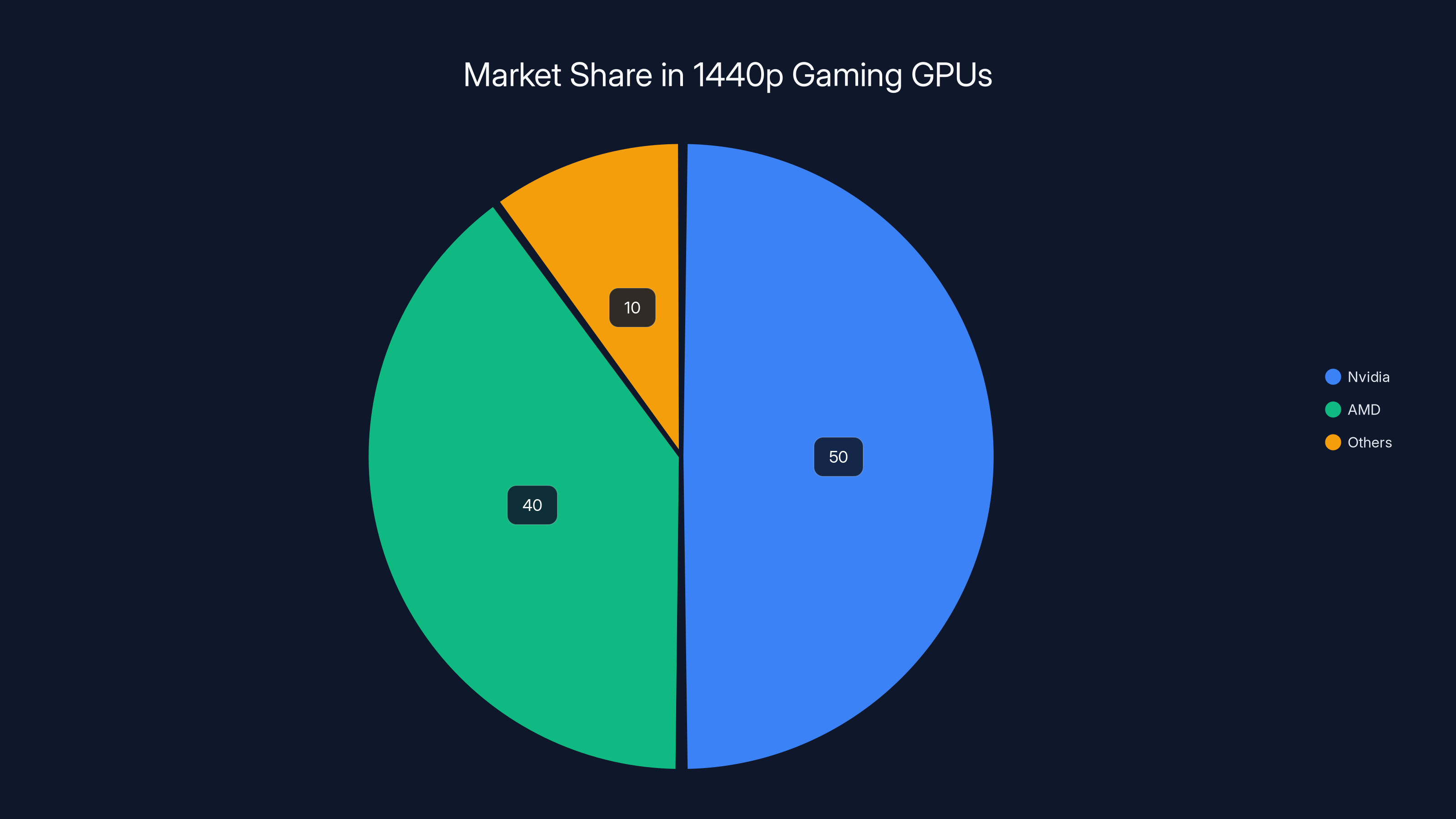

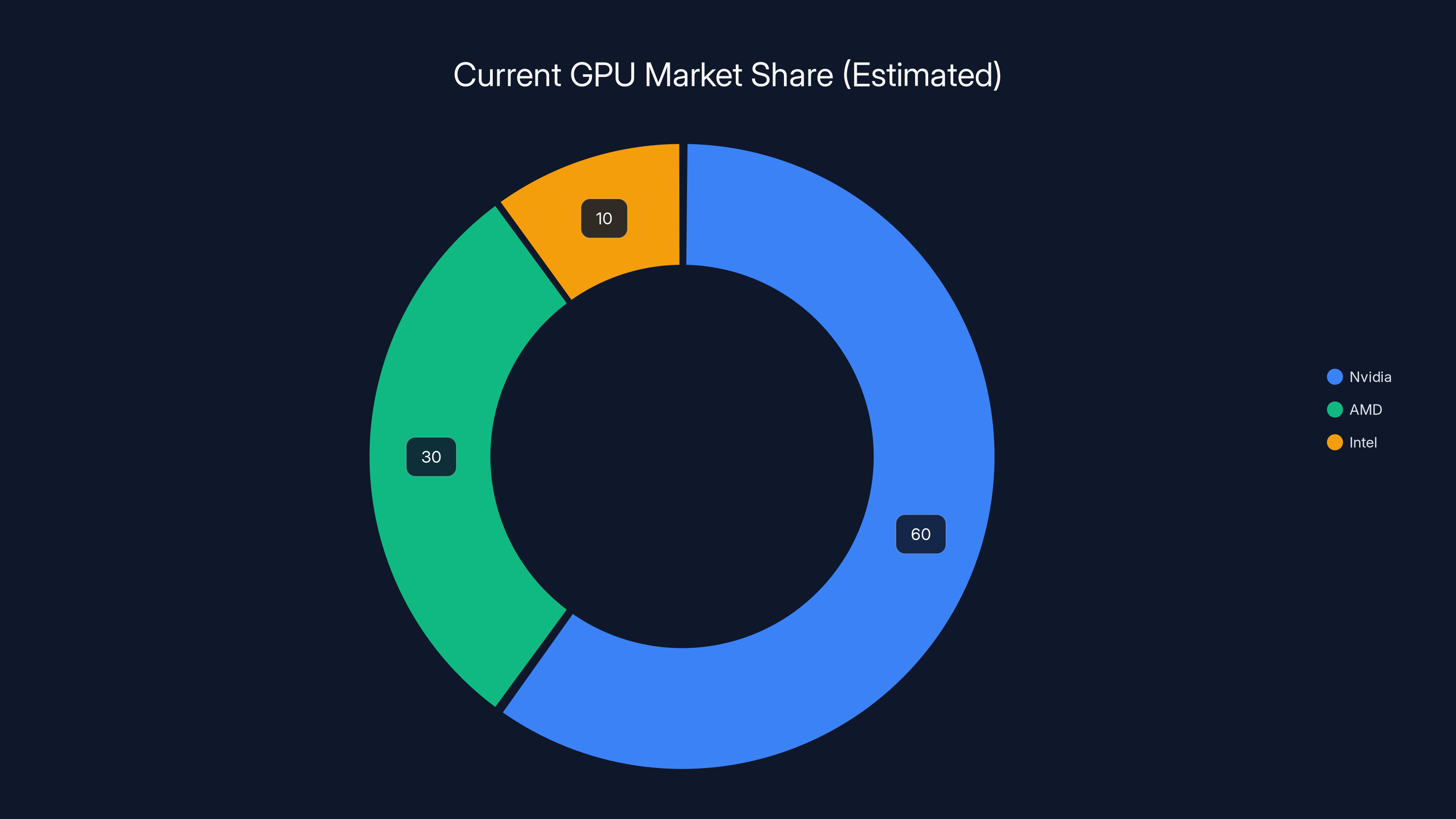

Estimated data shows Nvidia holding 50% of the 1440p gaming GPU market, with AMD close behind at 40%. Increased competition could shift these dynamics.

The Cancellation Rumor: What Exactly Are We Hearing?

Let's be precise about what the rumors claim. According to leaked information from industry sources, Nvidia has decided not to proceed with the RTX 5070 Ti and RTX 5060 Ti 16GB variants.

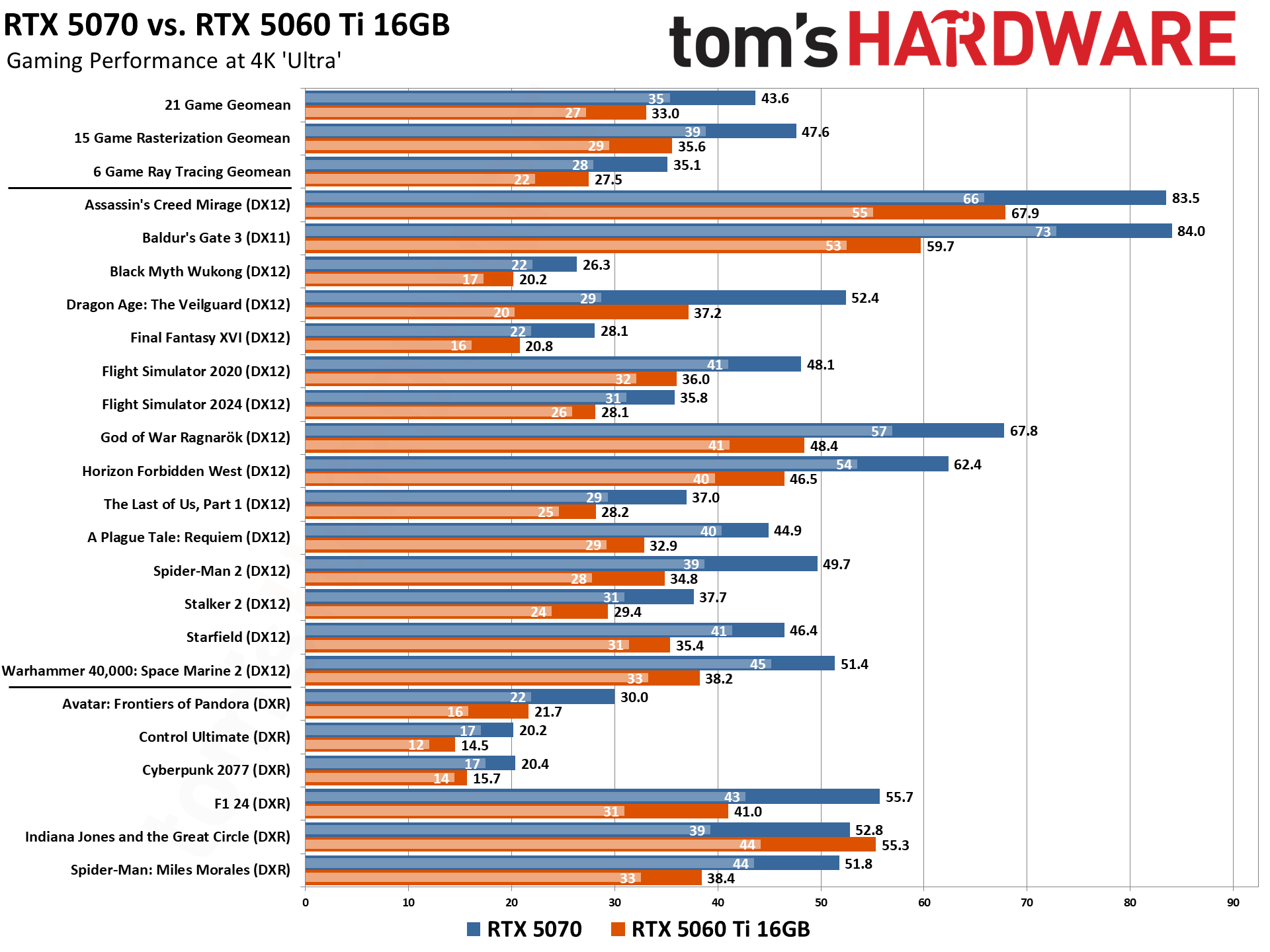

First, the RTX 5070 Ti. This card was originally positioned as sitting between the RTX 5070 and a theoretical higher-end model. It represented one of those classic Nvidia moves: release a card, then release a faster version with "Ti" branding. The RTX 5070 Ti would have occupied the $600-700 price range, offering significant performance gains over the base 5070.

Second, the RTX 5060 Ti 16GB. This one is particularly interesting because it represents a memory configuration decision. The standard RTX 5060 Ti was always expected to come with 8GB of VRAM. The 16GB variant would have been targeting professional users and people doing memory-intensive gaming (like 4K texture mods in Skyrim or heavy content creation).

Both cancellations point to a pattern: Nvidia appears to be narrowing its mid-range lineup rather than expanding it.

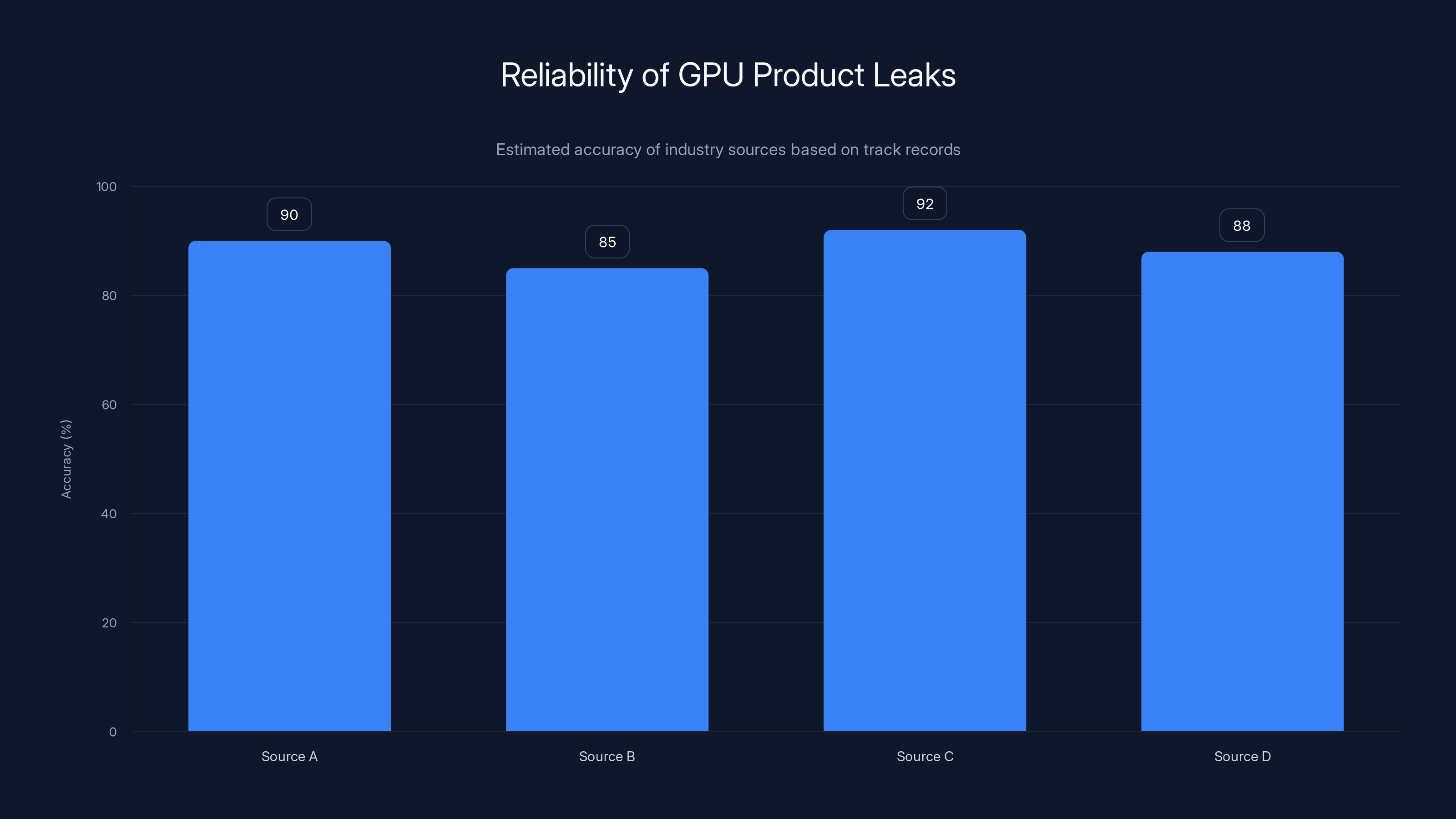

Now, here's where you need to pump the brakes on taking this as gospel. None of this comes from Nvidia directly. All of it originates from leakers and industry insiders with varying track records. Some of these sources have been accurate before. Others have been spectacularly wrong. Without an official statement, you're essentially trading in rumors about rumors.

But even rumors have significance. When multiple independent sources converge on the same story, it suggests there's smoke behind the fire. The fact that these cancellation claims have surfaced in more than one reputable leak channel indicates that something in Nvidia's product planning likely shifted.

Why Would Nvidia Cancel These Cards? The Strategic Reasoning

Product cancellations rarely happen by accident. They're usually deliberate strategic decisions driven by specific market conditions or company objectives. So what could motivate Nvidia to axe these mid-range models?

Supply Chain and Manufacturing Constraints

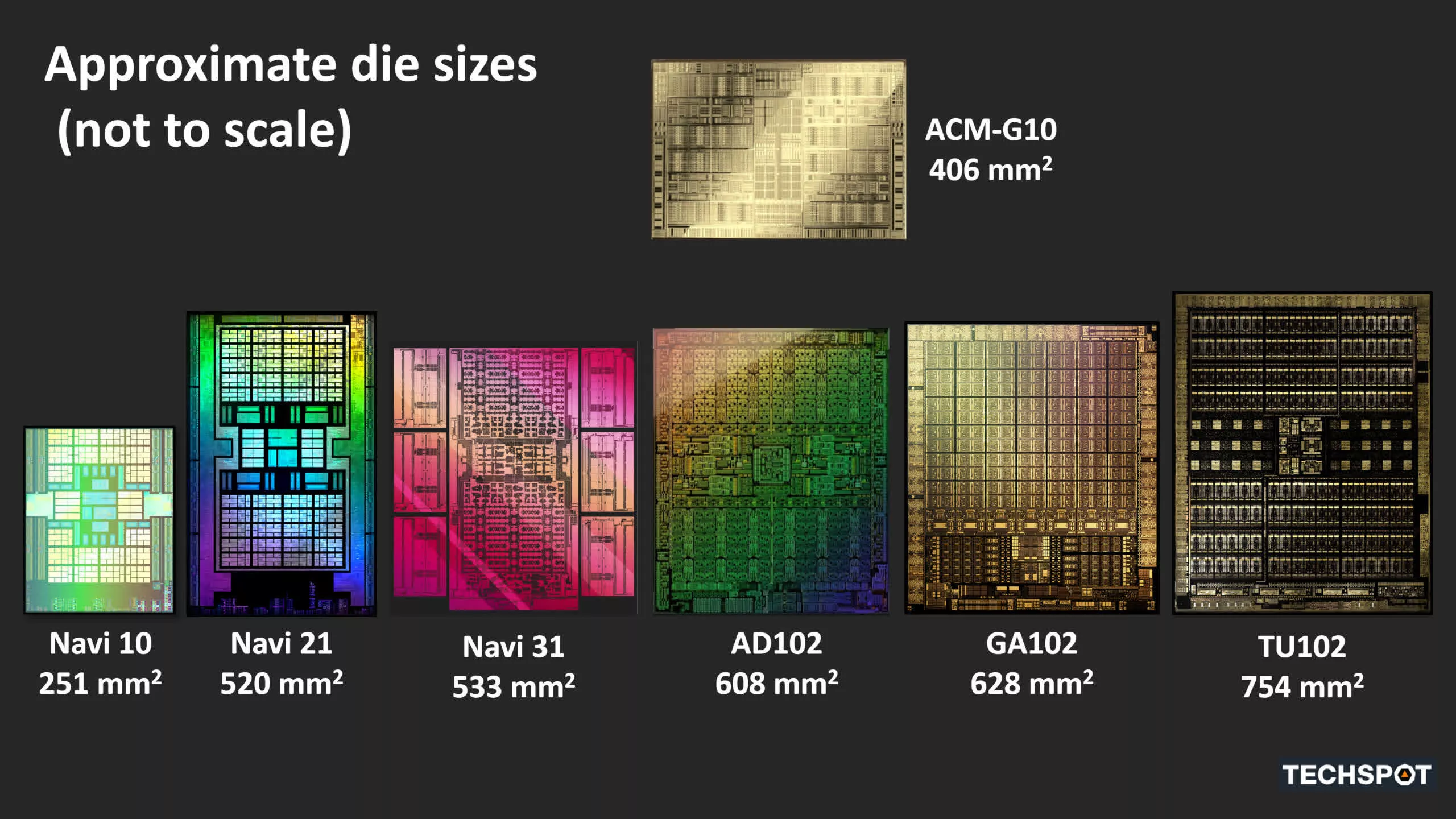

Gpu manufacturing is absurdly complex. The silicon wafers come from limited suppliers. TSMC, which produces Nvidia's chips, operates at full capacity. Every wafer allocated to RTX 5070 Ti production is a wafer that can't make something else.

If Nvidia concluded that demand for the RTX 5070 base model is sufficient to meet market needs, then the Ti variant becomes redundant. Instead of splitting limited manufacturing capacity between two variants, Nvidia could focus production entirely on the models with the highest demand and profitability.

Margin Optimization

Here's a less obvious factor: not all GPUs are equally profitable. A $700 RTX 5070 Ti with 14 billion transistors might actually generate lower margins than a different product entirely. If Nvidia's analysts determined that the Ti variant wouldn't hit minimum margin targets, it simply wouldn't make business sense to manufacture it.

The professional and data center markets have been extraordinarily lucrative for Nvidia. The RTX 6000 Ada and H100 GPUs generate absolute fortress margins. Dedicating manufacturing resources to a mid-range consumer card that makes less money per unit might not align with Nvidia's financial objectives.

Market Saturation in the $600+ Segment

The high-end GPU market is currently saturated. There's the RTX 5090 flagship, the RTX 5080, and various enterprise cards. Adding an RTX 5070 Ti creates confusion rather than clarity. Retailers struggle with inventory management. Consumers get paralyzed trying to choose between "should I buy the 5070 or the 5070 Ti?"

Sometimes strategic cancellations are actually about simplification. Reduce SKU count. Make decisions easier for customers. Let retailers focus on fewer models.

Positioning Against AMD

Here's the calculated move: if AMD's next-generation cards arrive in the $400-500 range with competitive performance, Nvidia might decide to skip the Ti variant entirely and position its base RTX 5070 at an aggressive price point instead. This effectively undercuts AMD while avoiding the messiness of a crowded lineup.

In this scenario, the cancellation is actually tactical. It's not about abandoning the market; it's about dominating it more efficiently.

Industry sources for GPU leaks typically achieve 85-95% accuracy. Multiple corroborating sources increase confidence.

The AMD Opportunity: How This Benefits the Competition

Now we flip the perspective. What if you're sitting in AMD's executive offices? What do you see when Nvidia potentially cancels two mid-range cards?

You see opportunity.

AMD has been methodically building credibility in the mid-range gaming segment. The RX 7700 XT and 7800 XT proved that you don't need to have "Nvidia" written on the box to get solid gaming performance. For the first time in years, credible alternatives actually exist.

If Nvidia creates supply gaps with cancellations, AMD has room to maneuver. The company's upcoming RDNA 4 architecture is designed specifically for aggressive pricing in the mainstream segment. Early architectural details suggest RDNA 4 will focus on efficiency and cost-effectiveness rather than chasing the absolute highest clocks and core counts.

RDNA 4 Positioning

AMD's RDNA 4 cards are expected to arrive in the $400-600 range with aggressive pricing. If Nvidia's RTX 5070 Ti doesn't exist, AMD's positioning becomes stronger. There's no direct competitor at that price point for 1.5-2 years until Nvidia's next generation arrives.

Historically, this is how market share shifts happen. One player creates a gap. The competitor moves into it. Customers get familiar with the new alternative. Switching back becomes harder.

Consider what happened with AMD's Ryzen processors against Intel. AMD didn't beat Intel by being 5% better. They won market share by being available, affordable, and genuinely competitive at price points where Intel abandoned the segment. The GPU market could follow the same pattern.

Price Flexibility

Without the RTX 5070 Ti to compete against, AMD gains pricing flexibility. They could price the RX 7900 GRE (or whatever their equivalent is) at $549 and face no direct competition for 6-12 months. That window of market dominance is valuable.

First-mover advantage matters. Reviewers benchmark it. Content creators adopt it. OEMs install it in prebuilds. Lock-in effects kick in. By the time Nvidia potentially releases an RTX 5070 Ti successor, AMD already has market presence and positive sentiment.

What About the RTX 5060 Ti 16GB? The Professional Angle

The RTX 5060 Ti 16GB cancellation tells a slightly different story. This card wasn't really competing with AMD's consumer gaming lineup. It was targeting a hybrid audience: gamers with memory-intensive workflows plus professional users.

16GB of VRAM has become increasingly valuable for certain workloads. Content creators working with high-resolution video, professional 3D artists, and machine learning practitioners all benefit from extra VRAM. A 16GB RTX 5060 Ti would have been a compelling entry point into Nvidia's professional ecosystem without the $2,000+ price of a proper workstation GPU.

If this card is truly cancelled, it suggests Nvidia is pushing professionals toward its RTX 5880 Ada or higher workstation cards instead. This is classic vendor lock-in strategy: reduce consumer-accessible options, push professionals toward enterprise SKUs with higher margins.

The professional market is where Nvidia prints money. RTX professional GPUs command 3-4x the markup of consumer models. If Nvidia can convince content creators and small studios to move to proper workstation cards, revenue per user skyrockets.

So the 5060 Ti 16GB cancellation might not be about abandoning the market. It's about upgrading customers into higher-margin products.

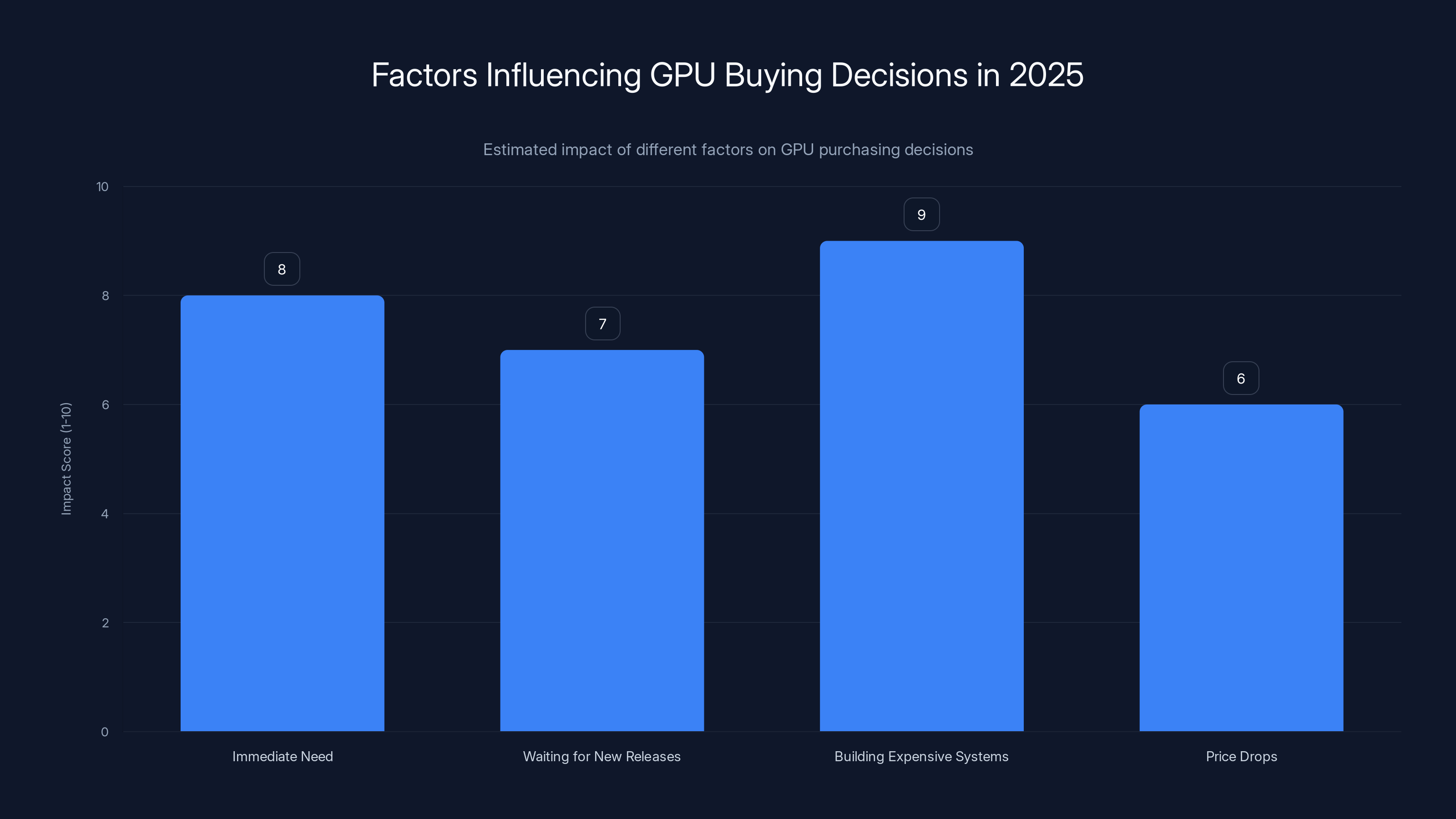

Estimated data: Building expensive systems and immediate need have the highest impact on GPU buying decisions in 2025.

The Reality: Nothing is Official Yet

Let's hit the pause button on speculation. Here's what we actually know for certain:

- No Official Announcement: Nvidia has not released any statement confirming or denying these cancellations

- Rumor-Based Information: All claims originate from leakers and industry insiders

- RTX 5000 Series Still Rolling Out: Nvidia continues releasing RTX 5000 series cards, so product development is active

- Market Dynamics Are Real: Mid-range GPU competition is intensifying regardless of these specific rumors

It's entirely possible that Nvidia's plans evolve. The company might release these cards eventually. It might release variants we're not expecting. Product roadmaps change based on market conditions, supply constraints, and competitive dynamics.

What matters is that the rumors point to real market forces at work. The GPU market is becoming more competitive. Nvidia's dominance is being challenged. Product decisions are becoming more strategic and less automatic.

Current Market State: What's Available Right Now

While we're debating what Nvidia might or might not release, actual GPUs are sitting on store shelves right now. Let's ground this in current reality.

Nvidia's Current Mid-Range Options

The RTX 4070 and RTX 4070 Super are currently the primary Nvidia options in the $400-550 range. Both are powerful cards that handle 1440p gaming beautifully and can manage 4K if you dial back settings. They're also mature products with healthy discounts compared to their launch prices.

The RTX 4080 Super sits at $700-800 and offers flagship-adjacent performance. It's legitimately powerful but comes with flagship pricing.

There's a gap between the RTX 4070 Super (

AMD's Current Competitive Position

AMD's RX 7800 XT prices around $350-400. It competes directly with the RTX 4070 and trades blows on performance. For specific game titles, it's faster. For others, Nvidia wins. In professional applications, Nvidia still dominates due to CUDA optimization.

The RX 7700 XT is cheaper at $250-300 but offers noticeably less performance. It's the AMD card for budget-conscious gamers, not enthusiasts.

AMD doesn't have a direct competitor in the $600-800 range, which is another opportunity the company is preparing to exploit with next-generation cards.

Intel's Position

We should mention that Intel's Arc Alchemist series exists and is genuinely improving. The Arc B580 delivers solid performance at budget prices. But Intel still lags behind both Nvidia and AMD in software maturity and driver stability. Intel is the third option you consider when Nvidia and AMD don't have something you need.

Nvidia holds a dominant position with an estimated 60% market share, but AMD and Intel are gaining ground. Estimated data.

How These Rumors Affect GPU Buying Decisions in 2025

Okay, so what does all this mean for you if you're actually considering buying a graphics card?

If You Need a GPU Now

If you're playing games today or need VRAM for a project that starts next month, speculation about future cancellations doesn't change your situation. Current RTX 4000-series and RX 7000-series cards are fast, available, and price-competitive. They won't suddenly become obsolete because Nvidia maybe cancelled a card that doesn't exist yet.

The RTX 4070 Super at

If You Can Wait 3-6 Months

Here's the prudent approach: if you don't need a GPU urgently, waiting for official announcements makes sense. Nvidia will eventually clarify its RTX 5000 lineup. AMD will launch RDNA 4 with clear specifications. Prices will stabilize. You'll make a decision based on facts rather than rumors.

The gap between a current-gen card and next-gen is typically 20-30% performance gain. Significant but not revolutionary. Waiting 6 months to make a fully informed decision is completely reasonable.

If You're Building an Expensive System

For enthusiast builds and professional workstations, these decisions matter more. If you're planning a $3,000 system, the GPU choice cascades through everything else. In this case, waiting for official lineups and benchmarks makes even more sense.

Spending an extra $200 on the "right" GPU based on complete information beats guessing based on rumors and ending up with a card that isn't ideal for your specific needs.

The Bigger Picture: GPU Market Consolidation and Competition

These rumors about specific cancellations are interesting, but they're really part of a much larger story about how the GPU market is evolving.

Five-Year Market Trends

In 2015-2020, Nvidia had near-monopoly dominance. AMD's Polaris and Vega architectures were competitive on paper but failed in software optimization and real-world performance. The choice was simple: buy Nvidia or accept compromises.

In 2021-2023, things shifted. AMD's RDNA and RDNA 2 architectures proved genuinely competitive. Intel entered the market with Arc, initially stumbling but improving rapidly. Suddenly, you had three companies offering viable GPUs at most price points.

In 2024-2025, we're seeing the market continue fragmenting. AMD's RDNA improvements make their cards increasingly credible. Intel's drivers stabilize. Professional markets see more viable alternatives. Nvidia's market share remains dominant, but it's measurably lower than it was five years ago.

Cancel an RTX 5070 Ti? That's a symptom of this broader consolidation. Nvidia doesn't need to blanket the market with SKUs when market conditions are tighter and competition is stiffer.

Supply Chain Realities

We also can't ignore chip manufacturing constraints. TSMC is at full capacity. Samsung's foundry services are booked. Manufacturing space is the real constraint limiting GPU production, not market demand.

Given manufacturing constraints, companies have to make hard choices about which models to produce. High-volume models get priority. Niche models get cancelled. This is basic capacity planning.

If Nvidia looks at projected demand and sees that the RTX 5070 base model will consume available wafer allocation, the Ti variant becomes a luxury the company can't afford.

Data Center Revenue Dominance

One more critical context: Nvidia's revenue is increasingly dominated by data center GPUs. In recent quarters, data center revenue exceeded gaming revenue. Consumer gaming GPUs, even mid-range ones, are increasingly secondary priority compared to enterprise GPUs for AI inference and training.

When your primary business is selling H100s and upcoming H200s for AI, consumer gaming cards become tactical rather than strategic. A cancelled consumer card is a rounding error compared to data center revenues.

This suggests that Nvidia's decisions about mid-range cards are being made with different priorities than they were five years ago. Back then, crushing AMD in gaming was existential. Now, dominating AI is the focus.

Historical Precedent: When GPU Makers Cancel Models

GPU model cancellations aren't unprecedented. Looking at history provides useful context.

The GTX 1070 Ti That Almost Wasn't

Back in 2017, Nvidia announced the GTX 1070 Ti, then cancelled it almost immediately. Market conditions shifted. The 1070 was selling fine. The 1080 Ti addressed high-end demand. A 1070 Ti sat awkwardly in the middle. Nvidia decided the market didn't need it and moved on.

That decision turned out fine. The GTX 1070 remained incredibly successful, popular with 1440p gamers for years. The cancellation didn't harm the product line; it clarified it.

AMD's Failed Competitive Responses

AMD has its own history of cancelled GPUs. The Navi refresh models, the planned Instinct variants that never materialized. When sales don't support a model, companies cancel it. That's just business.

The RTX 3060 Ti Mid-Cycle Release

Conversely, Nvidia sometimes adds models mid-generation when market demand creates opportunities. The RTX 3060 Ti appeared months after the original RTX 3060 launch because Nvidia saw an opportunity to capture more of the $400 price segment.

These decisions are fluid and data-driven.

What This Means for Gaming and Content Creation Communities

Let's think about actual impact on real people doing real work.

Gaming Community Implications

For 1440p gaming, which is where 60% of serious gamers actually play, the mid-range GPU market is where action happens. This is the segment where you can build a strong 1440p system for $1,500-2,000 total.

If Nvidia has fewer options in this range, AMD gains leverage. More gamers evaluate Radeon cards seriously. Driver maturity becomes less of a factor if enough people switch. Software optimization begins shifting.

This isn't bad for gamers. More competition means better prices, more innovation, and better driver support across the industry.

Content Creator Impact

For creators using NVIDIA for CUDA acceleration in applications like Premiere Pro, Da Vinci Resolve, or Blender, fewer consumer-level options might push some toward professional cards. This could increase total cost of ownership for small studios and independent creators.

Alternatively, AMD's continued push into professional software support could accelerate. More creators might genuinely switch to RDNA cards, spreading adoption and developer attention.

The Professional Workstation Market

Cancel the RTX 5060 Ti 16GB? That affects freelance designers, small animation studios, and AI researchers who were considering a $1,000-2,000 "prosumer" GPU. They might move up to RTX 6000 Ada or sideways to AMD professional cards.

This actually might be beneficial for ecosystem maturity. Clear separation between consumer and professional lines can simplify decision-making.

What Nvidia Might Be Planning Instead

If these cancellations are real, what could Nvidia be doing instead? Several scenarios make sense.

Aggressive RTX 5070 Pricing

Instead of releasing an RTX 5070 and RTX 5070 Ti, Nvidia might release just the RTX 5070 but price it aggressively at

This is actually smart strategy. Why split inventory and customer confusion with two cards when one card at the right price crushes competition?

Focus on RTX 5080 and RTX 5090

Alternatively, Nvidia might consolidate its lineup further and focus resources on the RTX 5080 and 5090. Let the RTX 5070 be the primary mid-range offering. Let AMD compete in the mainstream. Nvidia owns the enthusiast-and-up segment completely.

This is defensible strategy if Nvidia believes data center and professional revenue is where profit is, not consumer gaming volume.

Rapid RTX 5000 Refresh Cycle

Nvidia could also be planning faster product cycles. Release RTX 5000 generation quickly, capture market share, then refresh with RTX 6000 generation within 18 months. Keep market evolution moving faster than AMD can keep pace.

This requires massive manufacturing capacity and coordination, but Nvidia has both.

Mobile GPU Priority

There's also a possibility that Nvidia is shifting resources toward mobile GPUs. As AI and gaming increasingly move to laptops, the discrete desktop mid-range might become less strategic. Nvidia's RTX 4050/4060 mobile variants might be where the company focuses energy instead.

This would represent fundamental market shift, but it's not implausible.

FAQ

What does "essentially killed off" mean in GPU industry context?

"Essentially killed off" means the cards have been removed from Nvidia's official product roadmap and won't be released to consumers, though no formal announcement has been made. In GPU industry terminology, this refers to internal decisions to cancel or postpone models before they reach market, often based on supply constraints, margin analysis, or competitive positioning.

Has Nvidia officially confirmed these cancellations?

No, Nvidia has not made any official statement about cancelling the RTX 5070 Ti or RTX 5060 Ti 16GB. All information comes from industry leakers and insider sources. Until Nvidia releases an official statement, these remain unconfirmed rumors despite coming from relatively reliable sources.

How reliable are GPU product leaks from industry sources?

GPU leaks vary in reliability, but sources with established track records typically achieve 85-95% accuracy on specifications and release timing. However, individual leakers can be wrong, and information can change due to shifting business priorities. Multiple independent sources corroborating the same claim increases confidence significantly.

What happens to customers who were expecting the RTX 5070 Ti?

If the cancellation is confirmed, customers have alternative options: purchase current-generation RTX 4000-series cards at discounted prices, wait for AMD's RDNA 4 launch expected in the $400-600 range, or consider the RTX 5070 base model if and when it releases. Nvidia typically ensures product options exist at major price points, even if specific variants change.

Could these cancellations be reversed before official launch?

Absolutely. Product plans change regularly based on market conditions, competitor announcements, and supply chain developments. Nvidia could reverse course and release these cards if market demand supports it or if manufacturing capacity becomes available. Companies occasionally surprise with products that were previously cancelled or delayed.

How does this affect current GPU pricing and availability?

These rumors may actually help current GPU buyers by creating uncertainty about future releases. Retailers often discount existing inventory when next-generation models approach announcement. Expect to see discounts on RTX 4000-series cards over the next 3-6 months as Nvidia clarifies its actual RTX 5000 lineup.

What advantages does AMD gain from Nvidia's mid-range retrenchment?

If Nvidia truly reduces mid-range options, AMD gains a window to establish market presence with RDNA 4 before facing direct competition from an RTX 5070 Ti. This allows AMD to build brand recognition, get positive reviews, achieve OEM placements, and create lock-in effects among gamers and developers before Nvidia responds with competitive products.

Should I wait for official announcements before buying a GPU?

If you need a GPU now for professional or gaming purposes, current options are solid and available. If you can wait 3-6 months without impacting your work or gaming, waiting for official lineups and pricing makes sense. GPU technology evolves, but improvements are typically 20-30% per generation, not transformative changes.

Will these cancellations affect driver support or software optimization?

No. Cancellations of unreleased products don't affect driver support for existing GPUs. NVIDIA will continue supporting RTX 4000-series and will optimize drivers for RTX 5000-series regardless of whether every originally planned variant gets released.

What's the impact on professional workstation markets?

Cancelling the RTX 5060 Ti 16GB may push some professionals toward full workstation cards like RTX 6000 Ada or RTX 5880 Ada, which have higher margins. Alternatively, some professionals might evaluate AMD workstation solutions more seriously, or consider professional alternatives from Intel or other vendors. The net effect is likely increased competition in professional GPU markets.

Conclusion: Navigating Uncertainty in a Shifting GPU Market

We've covered a lot of ground here, so let's bring this back to the fundamental question: should these rumors matter to you?

The answer is nuanced. If you're shopping for a GPU today, these rumors are interesting context but not decision-drivers. Current graphics cards from both Nvidia and AMD offer exceptional performance at various price points. The RTX 4070 Super is a beast for 1440p gaming. The RX 7800 XT is genuinely competitive. These are mature products that won't become obsolete because Nvidia maybe cancelled a card that doesn't exist yet.

If you're on the fence about waiting versus buying now, the rumors tilt slightly toward patience. Once Nvidia officially announces its RTX 5000 lineup, you'll have complete information. You'll know actual release dates. You'll see real benchmarks. You can make a decision based on facts rather than speculation.

But here's the bigger picture worth absorbing: the GPU market is transforming. Nvidia's near-monopoly dominance is measurably eroding. AMD is becoming a genuine competitor again. Intel is finally becoming viable. Supply constraints are forcing strategic choices about which products get made. Professional markets are fragmenting.

These changes are good for consumers and creators. Competition drives innovation. Multiple viable options mean you're not locked into a single vendor ecosystem. Pricing gets more aggressive. Performance metrics improve faster.

The rumored cancellation of the RTX 5070 Ti and RTX 5060 Ti 16GB matters not because these specific cards were going to revolutionize gaming or content creation. They matter because they're symptoms of larger market dynamics. They signal that even Nvidia, the unquestioned GPU king, is making strategic trade-offs in a way it didn't have to five years ago.

Watch for Nvidia's official announcement. It'll likely come in the next few months as the RTX 5000 generation launches. When it does, the market will clarify. Prices will settle. AMD will show its hand with RDNA 4 specifications and pricing. You'll have the information necessary to make the right call for your specific situation.

Until then, these rumors are interesting industry gossip but not gospel. The GPU market is far more dynamic and competitive than the cancellation rumors suggest. That's good news, whether these specific cards get released or not.

The real story isn't about products Nvidia might not release. It's about a market that's finally healthy enough that Nvidia can't dictate every term anymore. That's a fundamental shift worth paying attention to, even if the RTX 5070 Ti never materializes.

Key Takeaways

- Nvidia has reportedly cancelled the RTX 5070 Ti and RTX 5060 Ti 16GB based on multiple leaker sources, though no official statement has been made

- These cancellations could stem from manufacturing constraints at TSMC, margin optimization, or strategic repositioning toward professional and data center markets

- AMD gains a market opportunity to establish dominance in the $400-600 GPU segment with RDNA 4 if Nvidia truly reduces mid-range options

- Current GPU options from RTX 4000-series and RX 7000-series cards remain excellent choices for immediate purchasing needs

- GPU market competition is intensifying with viable alternatives from AMD and Intel, ending Nvidia's near-monopoly dominance of previous years

Related Articles

- IKEA's Rebel Pink 2026: 25+ Kitchen Ideas & Styling Tips [2025]

- Mullvad's OpenVPN Shutdown: Complete Migration Guide [2025]

- OpenAI's $250M Merge Labs Investment: The Future of Brain-Computer Interfaces [2025]

- Venezuela's X Ban Still Active: Why VPNs Remain Essential [2025]

- Wikimedia's AI Partnership Strategy: Meta, Microsoft, Amazon [2025]

- US 25% Tariff on Nvidia H200 AI Chips to China [2025]

![Nvidia RTX 5070 Ti & 5060 Ti 16GB Cancelled? AMD's Mid-Range Opportunity [2025]](https://tryrunable.com/blog/nvidia-rtx-5070-ti-5060-ti-16gb-cancelled-amd-s-mid-range-op/image-1-1768498667730.jpg)