Open AI Ads in Chat GPT: Why Free AI Just Got Monetized [2025]

Open AI just made a decision that felt inevitable the moment the company's operational costs exceeded $9 billion annually. After years of positioning Chat GPT as the world's most accessible AI assistant, the company announced in January 2025 that it's testing banner advertisements across its platform. According to Business Insider, this move is part of a broader strategy to monetize its user base.

The ads are coming to the free tier of Chat GPT and a new budget-friendly $8/month plan called Chat GPT Go. For millions of users accustomed to ad-free experiences, this represents a fundamental shift in how Open AI plans to fund its increasingly expensive infrastructure.

But here's where it gets interesting. Open AI's CEO Sam Altman previously described the combination of ads and AI as "uniquely unsettling," voicing concerns that advertising pressure could influence how Chat GPT responds to queries. Now the company is doing exactly that, albeit with stated safeguards. The contradiction reveals something crucial about the economics of modern AI: the math doesn't work without ads.

This shift isn't just about Open AI. It signals how the entire AI industry plans to achieve profitability. When the most well-funded AI company on Earth can't reach break-even without advertising, it changes everything about how we should think about "free" AI tools.

Let's break down what's actually happening, why it matters, and what comes next.

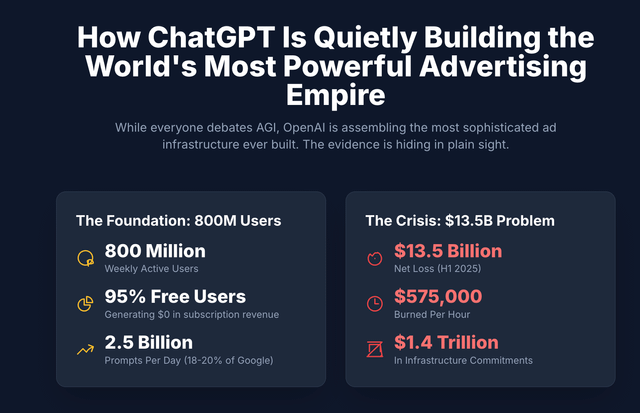

The Scale of Open AI's Financial Crisis

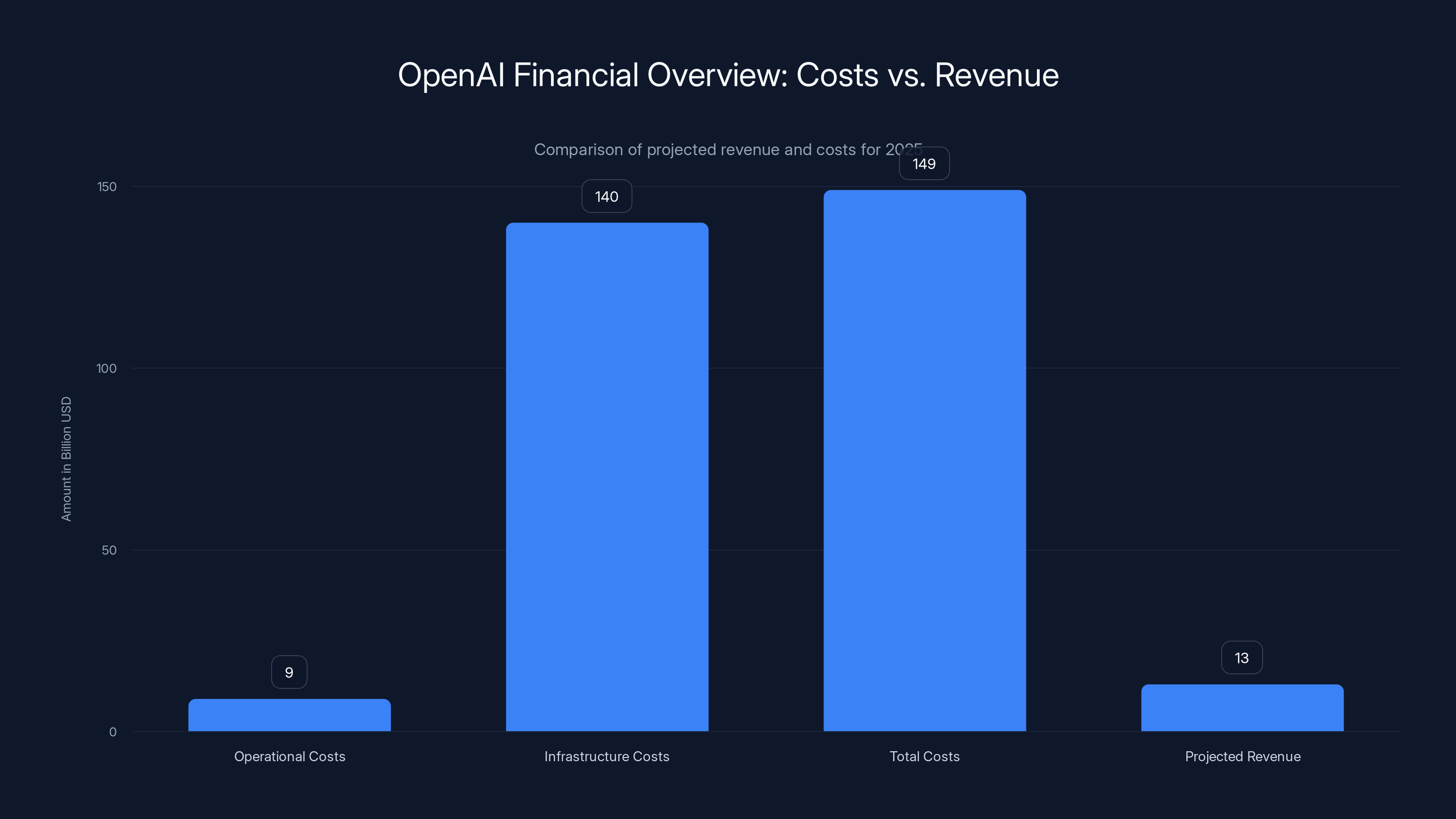

Open AI doesn't hide its financial situation—it just doesn't advertise it loudly. According to reports from late 2024, the company expects to burn through approximately

Open AI has committed to spending roughly

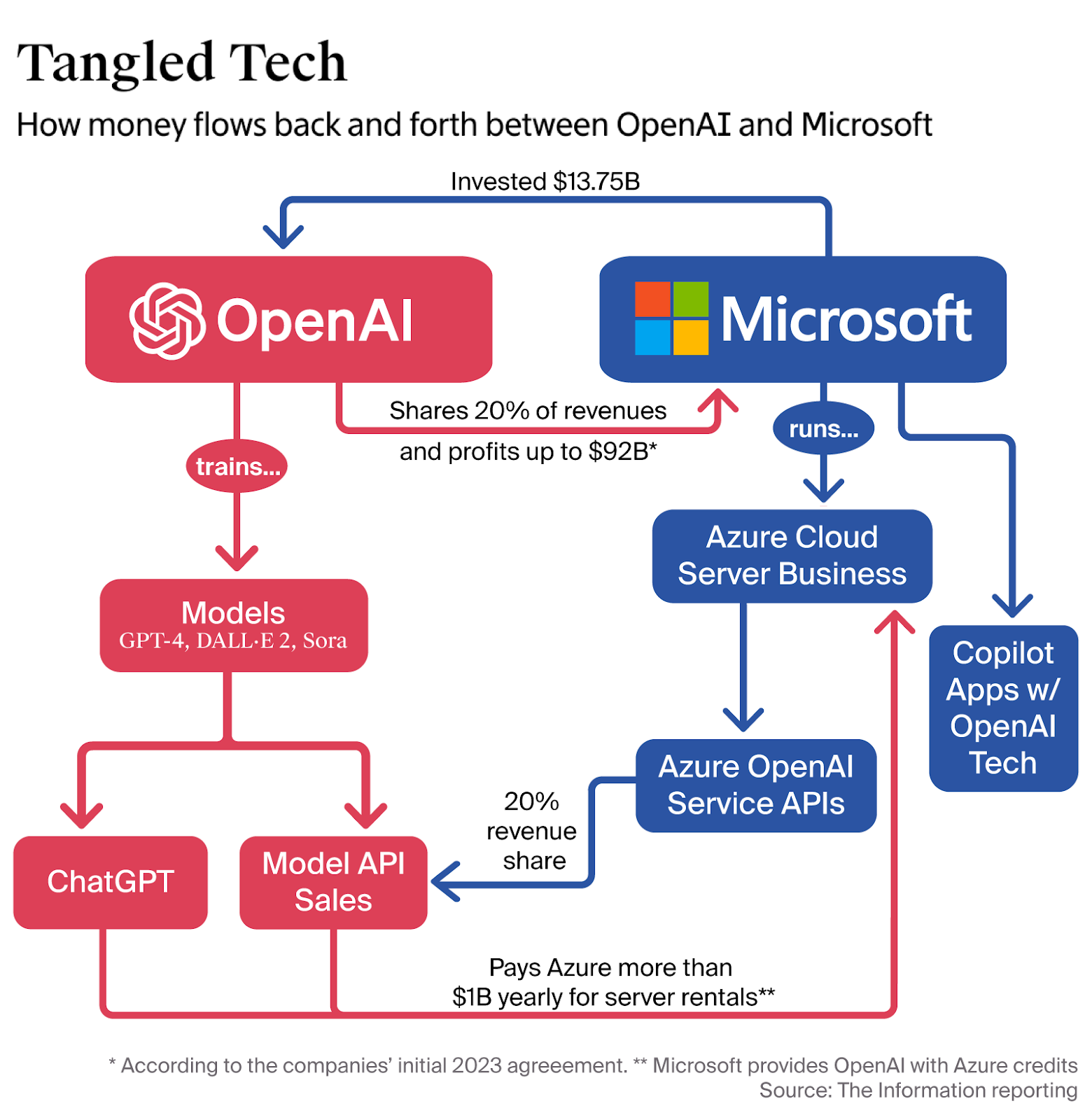

Where does that money come from? Initially, from venture capital and strategic partnerships. Microsoft pumped

Here's the problem: only about 5 percent of Chat GPT's 800 million weekly users pay for subscriptions. That's roughly 40 million paying users. At an average revenue per user of, say,

But that $9 billion in annual burn is just operational costs. It doesn't include the cost of the compute resources Chat GPT is using right now. Every API call, every free prompt, every Chat GPT web user running a query costs Open AI money. The infrastructure costs are theoretically infinite—they scale with usage.

Why Ads Became Inevitable

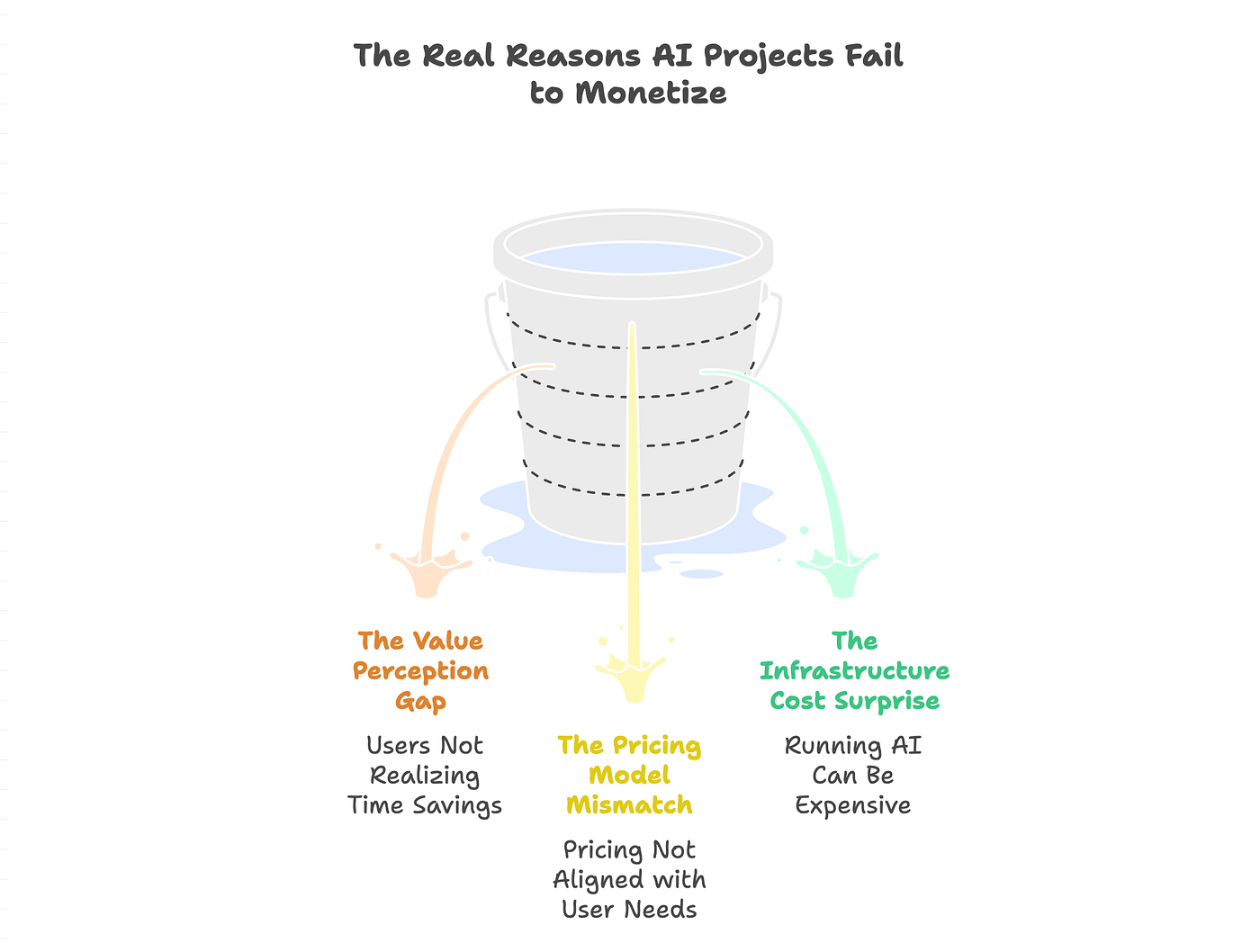

Open AI's leadership didn't wake up one morning and decide ads were the future of AI assistants. The decision emerged from a simple realization: subscriptions alone cannot fund this business.

Consider the math from a usage perspective. Chat GPT's free users generate enormous value for Open AI, but not in a way that translates to revenue. Each free query uses compute resources. Each free user represents marginal cost with zero marginal revenue.

Subscription tiers help, but they hit a ceiling. Charging $20/month attracts users willing to pay a premium. But for every paying user, there are roughly 19 free users. That ratio is brutal for a capital-intensive business.

Ads offer a third revenue lever that doesn't rely on converting users to paid subscriptions. Instead, ads monetize the free tier directly. If Open AI can generate even $1-2 in advertising revenue per monthly active user, that changes the unit economics substantially.

Let's do the math. If Chat GPT has 800 million weekly active users, that's roughly 200 million monthly active users (not all weekly users return monthly). If ads generate

That's not enough to cover the full burn, but it's enough to make a dent. More importantly, it provides a bridge during the years when Open AI hasn't achieved profitability.

The alternative would be to significantly raise subscription prices or stop serving free users entirely. Both options would alienate the core user base that made Chat GPT valuable in the first place. Ads seem like the least painful path to sustainability.

Open AI's Ad Implementation Strategy

How the Ads Actually Work

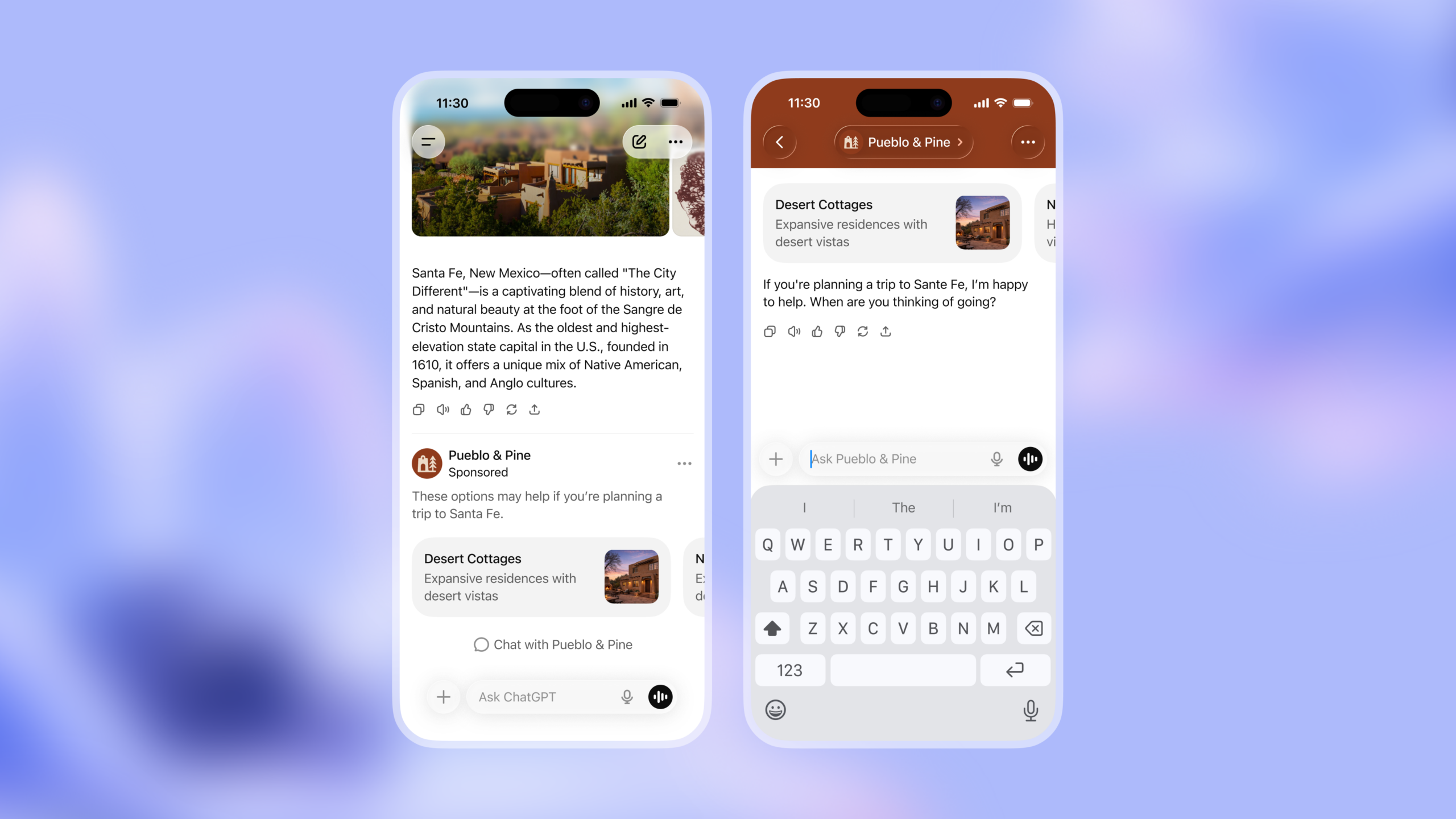

Open AI's ad implementation is surprisingly restrained compared to what the company could have done. According to the official announcement, ads will appear "at the bottom of answers in Chat GPT when there's a relevant sponsored product or service."

The key phrase here is "when there's a relevant sponsored product or service." Open AI isn't filling Chat GPT with random banner ads. The company is implementing contextual advertising—ads that match the topic of the conversation.

For example, if you ask Chat GPT "Where should I visit in Mexico?", the ads section might display travel-related sponsored content. If you ask about productivity tools, you might see ads for project management software.

The visual design keeps ads separated from conversational responses. In the example screenshots Open AI shared, ads appear in their own blocked-off section with a small image, headline, and description. They're clearly labeled as sponsored content.

This approach has several advantages:

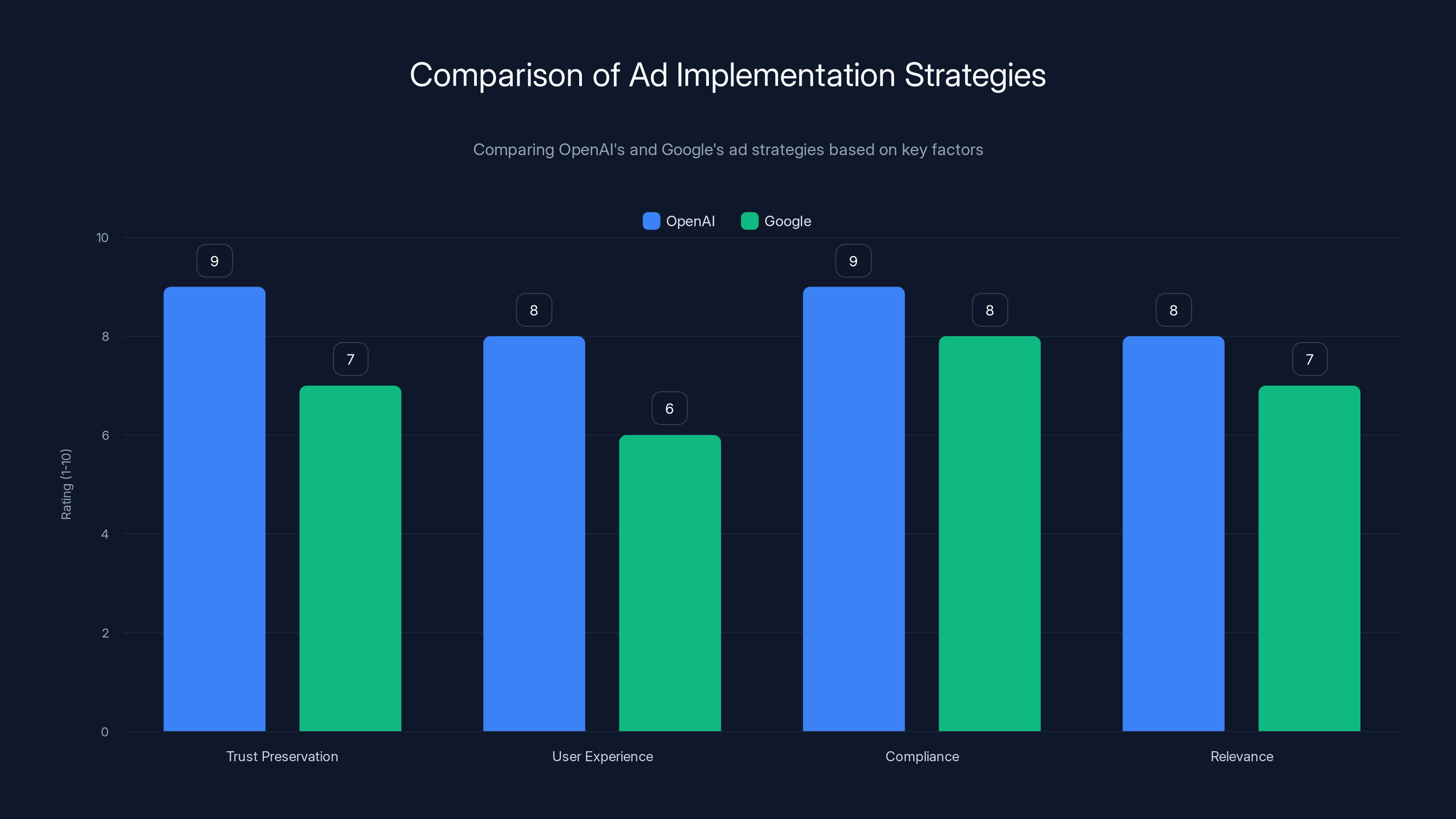

- Trust preservation: Ads don't get mixed into the actual response text, making it obvious what's an ad and what's Open AI's answer

- User experience: The design cleanly separates commerce from conversation

- Compliance: Clearly labeled ads satisfy regulatory requirements in most jurisdictions

- Relevance: Contextual ads are more useful to users than random ads

Compare this to how Google implemented ads in search results. Google's approach evolved over two decades—from simple text ads at the top of search pages to today's complex sponsored results that blend seamlessly with organic results. Open AI is taking a more conservative approach, at least initially.

Where Ads Will (and Won't) Appear

Open AI is explicit about ad placement boundaries. Ads won't appear on sensitive topics, particularly those involving mental health and politics. The company also won't show ads to users it identifies as under 18.

This represents a meaningful constraint on ad inventory. Mental health queries probably represent 5-10% of all Chat GPT queries. Politics is another huge category. Remove those from ad eligibility, and you're cutting available inventory substantially.

The rationale is clear: Open AI wants to avoid the worst-case scenario where ads seem to influence responses on sensitive topics. A user asking Chat GPT about depression therapy shouldn't see ads for a particular treatment method that happens to have paid for placement. That would erode trust fundamentally.

But here's where implementation gets tricky. How does Open AI detect what constitutes a "sensitive topic"? The company presumably uses content moderation classifiers, similar to those it already uses to detect harmful content.

These classifiers aren't perfect. They sometimes block legitimate queries and miss problematic ones. If Open AI's ad exclusion filters are too strict, ad inventory shrinks. If they're too loose, the company risks appearing to monetize sensitive conversations.

The New Chat GPT Go Tier

Along with ads on the free tier, Open AI announced Chat GPT Go—a new subscription tier priced at

Chat GPT Go launched initially in India in August 2025 and has now rolled out to over 170 countries. The tier is designed specifically for users who want some upgrades without paying the full Chat GPT Plus price.

What does $8/month actually get you? The specifics are somewhat vague in Open AI's announcements, but the positioning suggests:

- Access to newer models (likely GPT-4 class models, compared to potentially older models on free tier)

- Higher usage limits than free tier

- Still ads, though possibly fewer than the free tier

- No access to premium features like voice, advanced analysis, or custom GPTs

The $8 price point is strategically chosen. It's expensive enough to feel like a "real" subscription tier, creating psychological separation between free users and Go users. But it's cheap enough to not require a commitment or lifestyle change for the user.

Compare pricing tiers:

| Tier | Price | Audience | Ad Status |

|---|---|---|---|

| Free | $0 | Students, casual users, price-conscious | With ads |

| Chat GPT Go | $8/month | Budget-conscious power users | With ads (fewer) |

| Chat GPT Plus | $20/month | Professional users | No ads |

| Chat GPT Pro | $200/month | Power users, professionals | No ads, priority access |

The three-tier system is deliberate. Free users face ads. Plus users pay to avoid ads. Go users split the difference. This structure encourages users to upgrade (from free to Go, or from Go to Plus) while accommodating different willingness to pay.

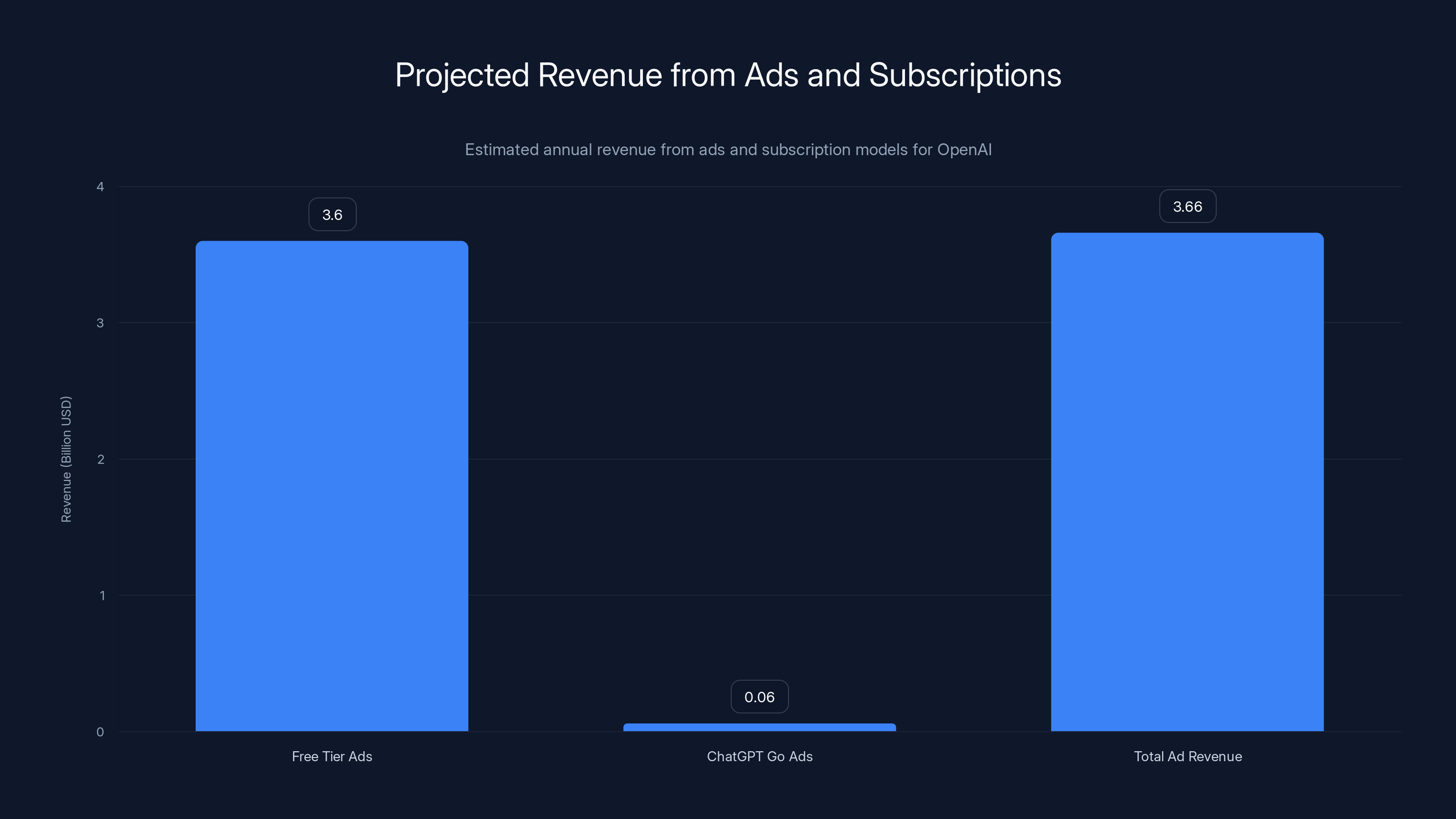

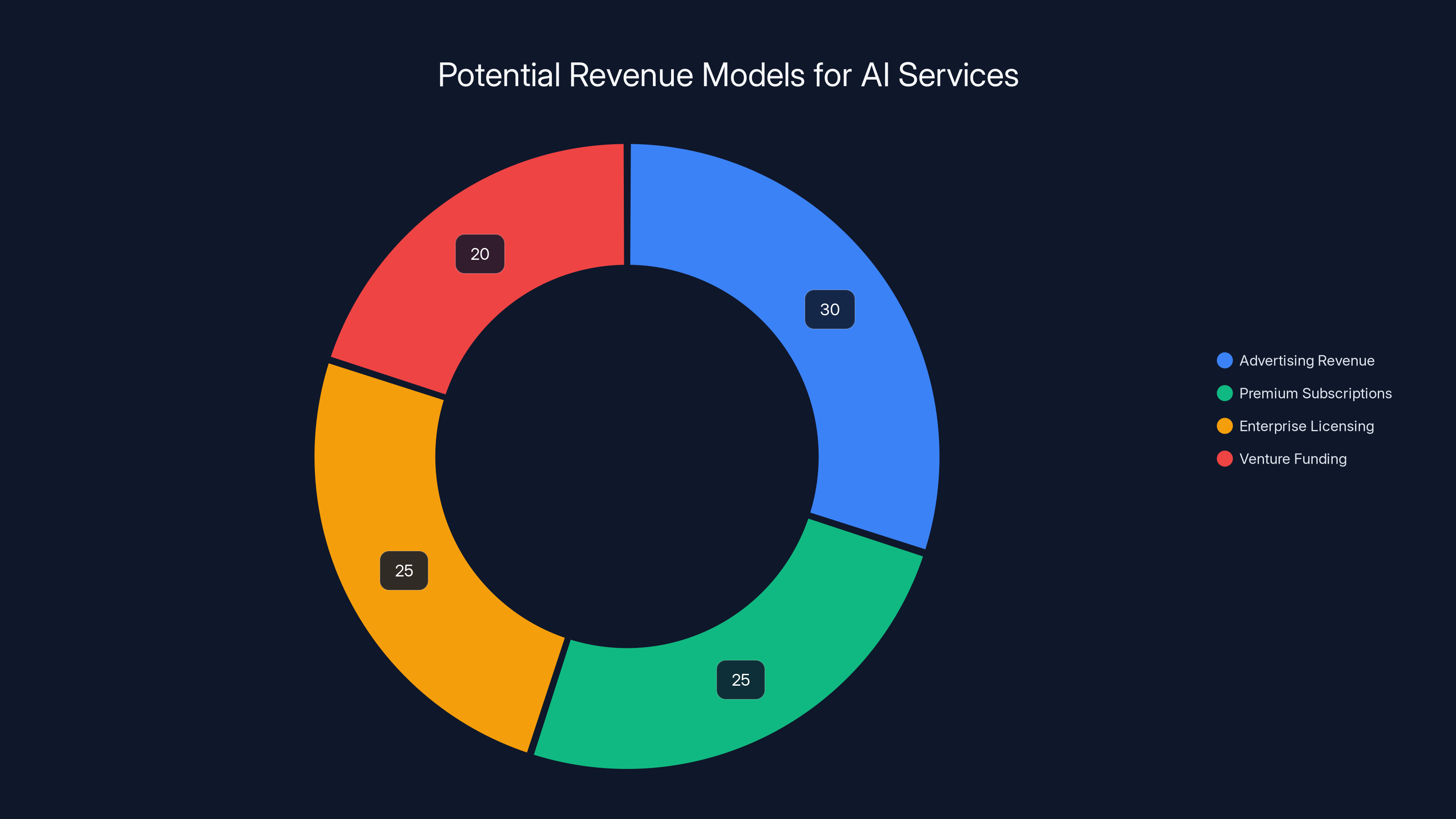

Estimated data shows that ads could generate approximately $3.66 billion annually, covering about 40% of OpenAI's operational costs. However, this alone may not achieve profitability.

The Contradiction That Started This

Sam Altman's Previous Stance on Advertising

Back in 2024, Sam Altman gave a fireside chat at Harvard University where he discussed his personal feelings about advertising combined with AI. His exact words matter:

"When I think of like GPT writing me a response, if I had to go figure out exactly how much was who paying here to influence what I'm being shown, I don't think I would like that."

He called the combination of ads and AI "uniquely unsettling." The concern was explicit: advertising creates incentives for AI systems to bias their responses based on sponsor interests rather than user interests.

This is a legitimate concern. If Open AI is paid by a particular coffee brand to recommend their products, what prevents Chat GPT from subtly steering users toward that brand? The incentive structure changes.

Open AI's current safeguards purport to address this. Fidji Simo, Open AI's CEO of applications, wrote in the announcement: "As we introduce ads, it's crucial we preserve what makes Chat GPT valuable in the first place. That means you need to trust that Chat GPT's responses are driven by what's objectively useful, never by advertising."

But this is where the contradiction becomes apparent. Open AI is essentially betting that it can maintain objectivity while implementing advertising. The company is trusting its own internal controls to prevent ad incentives from creeping into conversational responses.

Is that enough? Probably not forever. As ad revenue grows and becomes more important to Open AI's bottom line, the pressure to ensure advertiser satisfaction will inevitably grow.

The Reluctant Pivot

Open AI's move into advertising represents a reluctant pivot. The company clearly preferred a world where subscriptions alone could fund its operations. CEO Sam Altman has built his career and brand on being a visionary—someone who thinks bigger than conventional business models.

Advertising is the opposite of visionary. It's the business model every major tech company eventually adopts because nothing else works at scale. Google tried selling search results directly. Meta tried premium features. Both ended up heavily dependent on advertising.

Open AI's advertising announcement is essentially an admission that the company couldn't escape this gravity. The physics of capital-intensive AI businesses pulls companies toward advertising the way gravity pulls objects toward Earth.

But the announcement framing is interesting. Open AI positioned ads as part of "a diverse revenue model where ads can play a part in making intelligence more accessible to everyone." This reframes advertising as a feature, not a fallback. Ads make free Chat GPT possible, the argument goes. Without ads, Open AI couldn't afford to serve free users.

That's actually correct. The math doesn't work otherwise. But it's also a rhetorical flourish designed to make inevitable bad news seem like a positive development.

OpenAI's ad strategy scores higher in trust preservation and user experience compared to Google's more integrated approach. Estimated data based on qualitative analysis.

Why Other AI Companies Are Doing This Too

Google's Ad Sense for AI Chatbots

Open AI isn't alone in monetizing AI through advertising. Google began testing Ad Sense ads in chatbot experiences through partnerships with AI startups in late 2024.

Google's approach was different—it positioned itself as an advertising platform for other AI companies, not as a direct advertiser in its own products. This allowed Google to learn how ads work in conversational interfaces without immediately affecting its own Google Search or Google Assistant products.

But the direction is clear. Google is preparing to introduce ads into its own AI products. When (not if) Google launches ads in Gemini or a future conversational search product, it will have learned from its partnerships with startups.

Google's motivation is different from Open AI's. Google generates roughly $280 billion annually from search advertising. Adding AI to that mix could be incremental revenue. For Open AI, ads are essential for profitability.

The Broader Industry Pattern

Every successful tech company that reaches sufficient scale eventually monetizes through advertising. It's almost a law of nature:

- Google: Started as a pure search engine, monetized through Ad Words and Ad Sense

- Meta: Started as a social network, monetized through advertising

- Twitter/X: Started as a messaging platform, monetized through ads

- You Tube: Started as a video platform, monetized through ads

- Tik Tok: Started as a short-form video platform, monetized through ads

Each of these companies initially built their products without advertising. Each eventually realized that users alone couldn't fund the infrastructure and teams needed to maintain the service at scale.

AI is following the same trajectory, but faster. Open AI took roughly 2 years to move from pure subscription model (Chat GPT Plus) to a mixed subscription-plus-advertising model. For comparison, Google took about 3 years from founding to introducing Ad Words.

Financial Pressure: The Real Story

Burn Rate vs. Revenue

The numbers behind Open AI's advertising decision tell a story of mathematical inevitability. Let's unpack the actual financial situation:

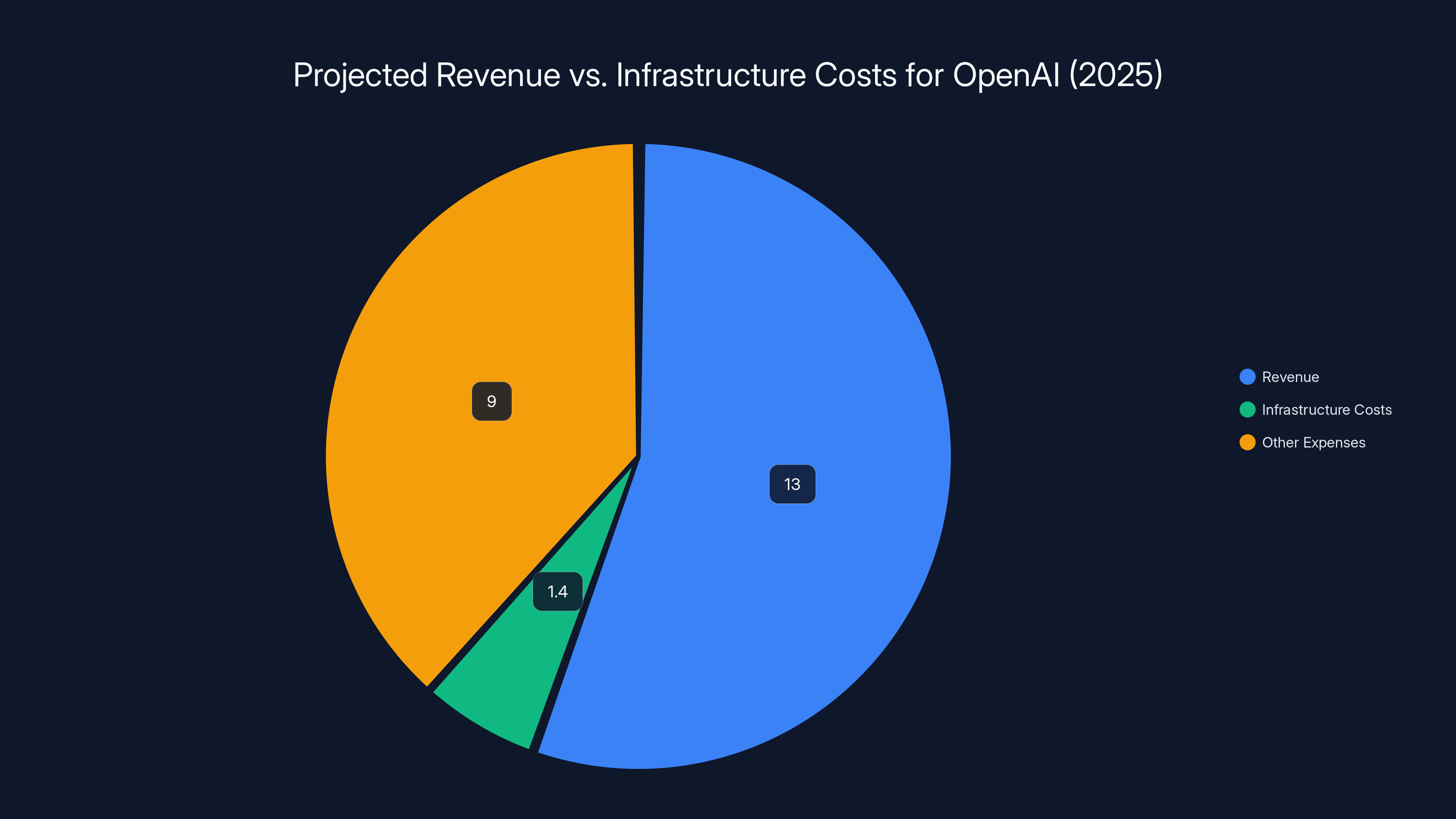

2025 Financial Projections:

- Expected operational burn: $9 billion

- Expected revenue: $13 billion

- Apparent profit: $4 billion

But wait, those numbers don't include the most important costs. Open AI's infrastructure spending—the chips, data centers, and compute resources—appears in a separate budget category that analysts sometimes don't include in "operational burn."

If we include infrastructure costs, the real burn rate is staggering. Open AI has committed to

With $13 billion in projected revenue, Open AI would need to grow revenue by more than 10x to break even on that infrastructure investment.

Now, Open AI's leadership would argue that this is a long-term investment. The $1.4 trillion represents an asymptote, not a sustainable burn rate. As Open AI builds more capacity, costs plateau, and revenue grows, the business eventually reaches profitability.

But here's the catch: that assumes revenue growth outpaces cost growth. And it assumes the venture funding to finance infrastructure never stops.

The Venture Funding Wall

Open AI's funding history:

- 2023: $10 billion from Microsoft

- 2024: $14 billion additional commitment from Microsoft

- Total committed: $24 billion

That's an enormous amount of capital. But consider the burn rate. At

The infrastructure costs are separate, but they're also separate from venture funding. Microsoft is directly funding these, essentially betting that Open AI will achieve profitability eventually.

But venture funding always has limits. Even Microsoft's balance sheet, impressive as it is, can't fund unlimited AI infrastructure spending indefinitely. Open AI needs to reach a point where revenue covers costs.

Advertising represents a path toward that goal. If ads can contribute even $3-5 billion annually in incremental revenue, it changes the trajectory materially.

If Open AI can drive ad revenue per active user from

Why Subscriber Growth Has Plateaued

Open AI's move to advertising coincides with apparent plateauing in subscriber growth. The company hasn't announced specific Chat GPT Plus subscriber numbers recently, but industry analysis suggests subscription growth is slowing.

Why? Several reasons:

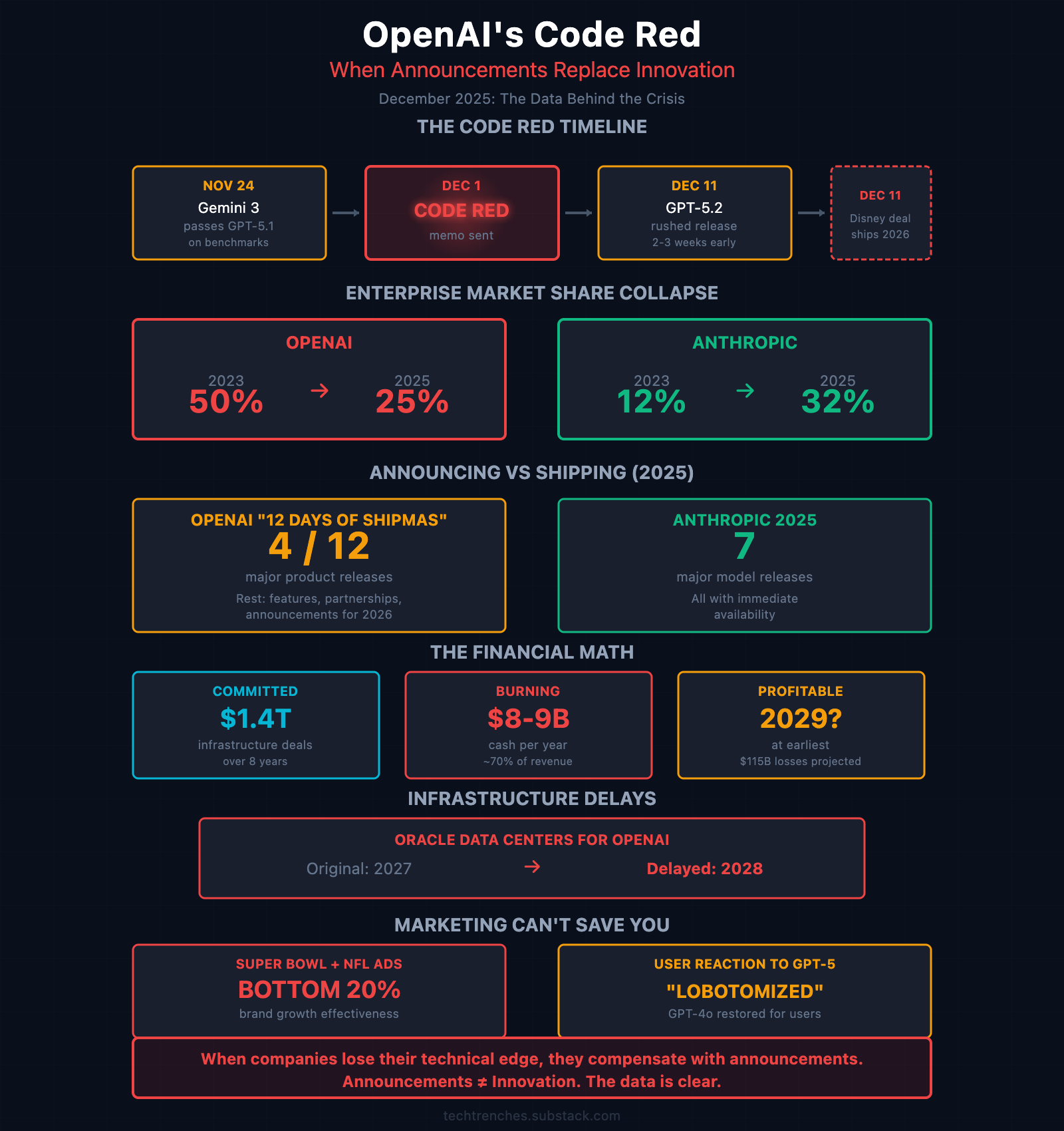

Increasing competition: Claude from Anthropic, Gemini from Google, and other AI assistants have improved significantly. Users are less willing to pay a premium to Open AI when competitive options are free.

Higher prices: Chat GPT Plus costs $20/month. That's expensive for students, freelancers, and international users in emerging markets. Even in the US, it's a meaningful monthly expense.

Sufficient free tier: For many users, free Chat GPT is good enough. The gap between free and Plus has narrowed as Open AI has upgraded the free tier with more capable models.

Usage patterns: Most users don't interact with Chat GPT daily. A $20/month subscription feels wasteful for occasional users.

The $8/month Chat GPT Go tier addresses some of these issues by offering a cheaper entry point to paid features. But it doesn't solve the fundamental problem: most people don't need enough Chat GPT functionality to justify a recurring payment.

Advertising solves this by monetizing users who would never convert to paid subscriptions.

OpenAI's projected total costs for 2025, including infrastructure, far exceed its projected revenue, highlighting a significant financial challenge. Estimated data shows the need for substantial revenue growth.

Trust, Transparency, and the Slippery Slope

The Trust Problem

Open AI's biggest risk in introducing advertising isn't technical—it's psychological. The moment users believe Chat GPT's responses might be influenced by advertising, trust erodes.

This is precisely the concern Altman expressed at Harvard. When you don't know "how much was who paying here to influence what I'm being shown," you lose confidence in the objectivity of the response.

Open AI has made explicit commitments:

- Ads won't influence conversational responses

- Conversations won't be shared with advertisers

- Ads won't appear on sensitive topics

- No personalized targeting based on conversation content

But these commitments are internal policies, not technical guarantees. There's no cryptographic verification that Open AI is following these rules. There's no audit trail showing that responses weren't biased by advertiser interests.

Users have to trust Open AI not to break these commitments. That's reasonable for now, but becomes harder as ads grow more important to the business.

Consider what happens over time:

- Year 1: Ads generate $500 million annual revenue (nice to have)

- Year 3: Ads generate $3 billion annual revenue (important)

- Year 5: Ads generate $8 billion annual revenue (essential)

As ad revenue becomes more important, the pressure to optimize for advertiser satisfaction increases. Maybe subtle biases creep in. Maybe response recommendations shift slightly toward advertiser interests. Maybe the definition of "sensitive topic" where ads are excluded gradually shrinks.

Open AI's explicit commitments today are genuine. But organizations change when incentive structures shift.

Comparison to Google's Evolution

Google provides a useful comparison. Google's search results famously were once purely algorithmic—ranking pages based on link authority and relevance. Google's founders touted this as an advantage over Yahoo and other search engines that sold placement.

Over time, Google introduced:

- Ad Words ads at the top of results

- Shopping ads with product images

- Knowledge panels (which are often generated from sponsored content)

- Local pack results (which businesses can optimize)

- Map ads

- Google Reviews integration (which affects visibility)

Today's Google search results are heavily optimized for advertiser interests. It's still useful for most queries, but the incentive structures have absolutely shaped what you see.

Google didn't wake up and decide to corrupt search results. Instead, small changes accumulated over time as ad revenue became more important. The same could happen with Chat GPT.

Regulatory Risk

Introducing advertising to an AI assistant also introduces regulatory risk. Advertising is heavily regulated in most jurisdictions.

In the US, the FTC has been increasingly scrutinizing tech companies' advertising practices. The FTC is particularly interested in deceptive advertising and ads targeting minors.

Open AI's commitment to exclude ads for users under 18 helps, but it depends on reliable age verification. How does Open AI verify that a user is actually an adult? If it's based on self-reported age, it's easy to circumvent.

International regulations are even stricter. The EU's Digital Services Act imposes strict requirements on content moderation and advertising practices. Brazil's regulatory environment is evolving rapidly around AI. China has its own requirements.

Open AI will need to maintain different advertising policies in different jurisdictions, which creates complexity and potential for regulatory violations.

What Users Should Actually Expect

Rollout Timeline

Open AI stated that ads will appear "in the coming weeks" for US users of the free tier and Chat GPT Go. The company started with the US market, which suggests a careful rollout before global expansion.

If patterns hold, expect:

- Weeks 1-4: US rollout to free and Chat GPT Go tiers, gradual percentage of users

- Weeks 4-8: Expand to larger percentage of US users, gather feedback

- Weeks 8-12: International rollout begins in English-speaking markets

- Months 3-6: Global rollout, with regional customization

During the rollout, Open AI will learn:

- Which ad formats perform well (in terms of engagement and CTR)

- Which topics generate advertiser interest

- How ads affect user experience and retention

- Which ad placements don't damage trust

Impact on Different User Segments

Free tier users: Will see ads. This is the key change. If you've been using Chat GPT for free, expect ads related to your queries.

Chat GPT Go subscribers: Will see fewer ads or potentially no ads. Open AI hasn't been explicit about this, but it's likely that paying users get some ad reduction.

Chat GPT Plus subscribers: Won't see ads. The $20/month tier is explicitly ad-free.

Chat GPT Pro subscribers: Won't see ads. The $200/month tier offers premium access.

Enterprise users: Already don't see ads (enterprise Chat GPT is a separate product).

Ad Frequency and Format

Open AI stated that ads will appear "at the bottom of answers." The use of singular "bottom" suggests one ad placement per response, not multiple ads.

Compare this to Google Search, which shows multiple ads at the top and side of results. Open AI's approach seems more restrained.

But "in the coming weeks" implies testing and iteration. Open AI might experiment with:

- Multiple ads per response

- Ads in the sidebar

- Ads within the response itself

- Sponsored result links

The initial implementation is probably conservative, and will expand based on performance data and user feedback.

Estimated data suggests a balanced revenue model with advertising, subscriptions, and enterprise licensing each contributing significantly to AI service funding.

The Precedent This Sets for AI Industry

Google's Next Move

Google was already testing ads in AI chatbots through partnerships. Open AI's move signals that advertising in conversational AI is viable and acceptable.

Expect Google to accelerate its AI advertising strategy. Google has multiple chatbot products:

- Gemini (consumer)

- Gemini Advanced (paid tier)

- Google Search's AI Overviews (which already include ads)

Google will likely introduce ads into Gemini free tier while keeping Gemini Advanced ad-free, mirroring Open AI's strategy.

Google has one advantage: it already has the most sophisticated advertising platform in the world. Google can target Gemini users based on their search history, Gmail contents, and browsing across Google properties. Open AI is starting from scratch with advertising.

Microsoft's Position

Microsoft has invested $24 billion in Open AI and deeply integrated Chat GPT into Windows, Office, and Azure. Microsoft also runs Copilot, its own AI assistant.

Microsoft's business model is B2B (business-to-business), not B2C (business-to-consumer). Enterprise customers pay for Microsoft services; they don't see consumer ads.

But Microsoft also needs to monetize consumer-facing AI. Copilot on Windows, Copilot in Office, and mobile AI assistants all need revenue models.

Open AI's advertising move doesn't directly compete with Microsoft's business. Instead, it validates Microsoft's bet that Open AI will eventually reach profitability, making Microsoft's investment more valuable.

Anthropic's Opportunity

Anthropic, Claude's parent company, competes with Open AI. Claude has always positioned itself as the "safety-focused" AI alternative. Anthropic has emphasized Claude's harmlessness and alignment with human values.

Open AI's move into advertising creates an opportunity for Anthropic. Anthropic could commit to never introducing ads into Claude, positioning the product as the "pure" alternative to ad-supported Chat GPT.

Of course, Anthropic faces the same financial pressures Open AI does. Anthropic has secured significant funding (Google invested $2 billion), but it still needs a sustainable business model.

Anthropic could avoid advertising by:

- Focusing on enterprise customers (who pay premium prices)

- Pursuing API licensing deals

- Building applications on top of Claude

- Selling access to specialized models

But these are harder paths to profitability than consumer subscription or advertising. If Anthropic wants to compete with Open AI at consumer scale, it will eventually face the same pressure to introduce ads or raise prices.

The Industry Inevitability

Here's the brutal truth: every AI company pursuing consumer-scale deployments will eventually face the same decision. The unit economics of serving free users don't work without either advertising or extremely high-margin premium tiers.

Unless AI costs drop precipitously (which could happen, but isn't guaranteed), advertising will become standard across the industry.

Optimization and Advertiser Opportunities

What Advertisers Actually Want

Open AI's advertising platform is theoretically interesting to advertisers because of Chat GPT's unique position. Chat GPT has:

- Intent signals: Users are telling Chat GPT what they want or need

- Engaged audience: People using Chat GPT are actively seeking information

- Conversational context: Chat GPT understands the user's needs in detail

- High-value demographics: Chat GPT users skew educated and affluent

For advertisers, this is valuable. A traditional Google search for "best project management tools" is intent-rich. But a Chat GPT conversation that explores the user's specific needs and constraints is even more valuable.

An advertiser for Asana, Monday.com, or another project management tool would be very interested in reaching users in that Chat GPT conversation.

How Open AI Will Price Ads

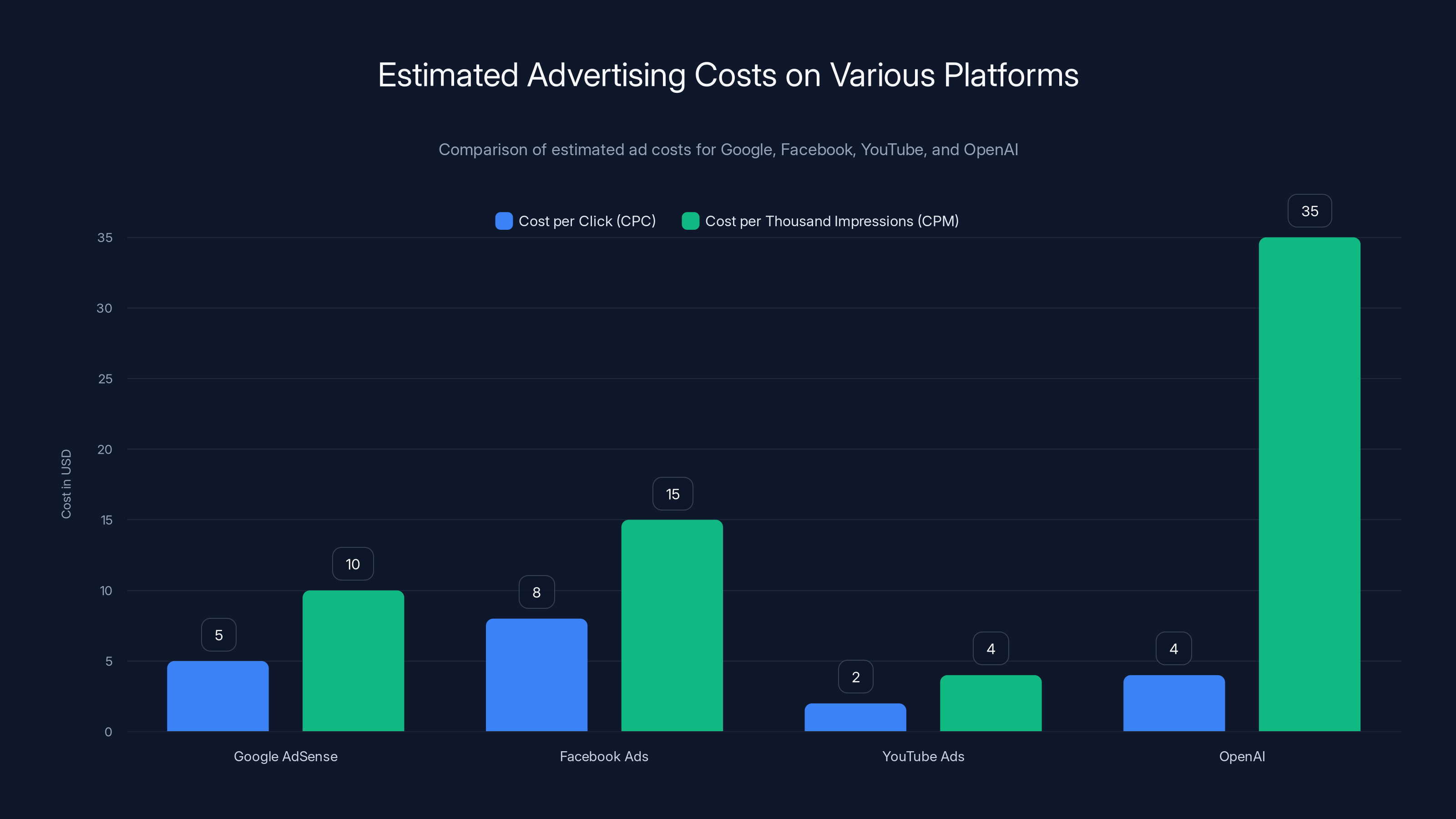

Open AI hasn't announced pricing for advertisers. But we can infer based on comparable platforms:

Google Ad Sense: Advertisers pay per click, with rates ranging from

Facebook Ads: Advertisers pay per click or per thousand impressions (CPM), ranging from $1-15 CPM depending on targeting

You Tube Ads: Advertisers pay per view, with rates around

Open AI's rates will likely be higher than Google or Facebook because:

- Higher user value (educated, affluent audience)

- More specific intent signals

- Lower ad inventory (fewer ads per user per day)

Open AI might charge

Industries That Will Advertise

Initially, expect advertising from:

- Software/Saa S: Project management tools, productivity software, collaboration platforms

- Education: Online courses, bootcamps, certification programs

- Finance: Banking, brokerage, credit card companies

- Travel: Hotels, flights, vacation rental platforms

- Ecommerce: Amazon, shopping aggregators, marketplaces

- Services: Consulting, freelance platforms, professional services

These industries have high customer acquisition costs and benefit from reaching engaged, intent-rich audiences. They'll be willing to pay premium rates for Chat GPT placements.

Industries less likely to advertise:

- Fast food and consumer goods: Lower margins, less value in reaching Chat GPT's affluent demographic

- Healthcare: Regulatory restrictions on advertising, sensitive topics that won't allow ads

- Finance (sub-category: predatory lending): Open AI will likely restrict these anyway

Estimated data suggests OpenAI's advertising costs could be higher than traditional platforms due to its high-value audience and specific intent signals.

Potential Negative Outcomes and Risks

User Backlash

The most immediate risk is user backlash. Free users accustomed to ad-free Chat GPT might feel frustrated or betrayed by the introduction of ads.

Social media will likely fill with complaints:

- "So Chat GPT is just Google now"

- "Ads ruin AI responses"

- "Time to switch to Claude"

- "Capitalism ruins everything"

Some of this is inevitable and manageable. Open AI can expect a 5-10% drop in free tier engagement as some users abandon the platform.

But if ads are too intrusive or appear too frequently, backlash could be more severe. Users might migrate to competitors. The image of Chat GPT as the "pure" AI assistant gets damaged.

Response Quality Degradation

Even if Open AI sincerely maintains that ads don't influence responses, users might believe otherwise. This creates a trust problem that persists regardless of the truth.

If a user asks Chat GPT about productivity tools and sees ads for a particular tool, the user might wonder: "Did Chat GPT recommend this tool because it's objectively best, or because the advertiser paid?"

This suspicion could spread even if it's unfounded. Chat GPT's usefulness depends partially on trust in its objectivity. Ads introduce reasonable doubt.

Ad Blocker Proliferation

Some users will use browser extensions or other tools to block Open AI's ads. Ad blockers are common on the web, and they'll likely emerge for Chat GPT as well.

This creates an arms race. Open AI implements ad-blocking countermeasures. Users implement anti-countermeasure workarounds. Eventually, both sides settle into an equilibrium.

But this dynamic suggests that ads might not generate as much revenue as Open AI hopes. Maybe 10-30% of free users will block ads, reducing total ad inventory.

Advertiser Dissatisfaction

Advertisers might be disappointed by click-through rates or conversion rates. Chat GPT ads might underperform compared to Google or Facebook ads because:

- Users might ignore ads at the bottom of chat responses

- Users might view ads as interruptions to conversation

- Chat GPT's users might be less commercially oriented than search users

If early advertiser results disappoint, Open AI might double down on more aggressive ad placements, creating a negative feedback loop of user backlash and advertiser pressure.

What This Means Long-Term

The Profitability Question

Open AI's introduction of ads is a signal that the company doesn't expect to reach profitability through subscriptions alone. The math simply doesn't work.

But will ads be enough? Let's project:

Assumptions:

- 200 million monthly active free tier users

- 10 million monthly active Chat GPT Go users (very optimistic)

- Average ad revenue per free user: $1.50/month

- Average ad revenue per Chat GPT Go user: $0.50/month

Revenue: (200M ×

That's significant but not transformative. It covers roughly 40% of current operational burn.

Additionally, subscription revenue might decrease slightly as free users who don't want to see ads are less likely to upgrade to paid tiers (they'll just use competitors instead).

So ads might contribute $3-4 billion in net incremental revenue annually, extending Open AI's runway and improving the path to profitability. But they don't solve the fundamental problem: Open AI's infrastructure costs exceed potential revenue.

Alternative Models Open AI Didn't Choose

Open AI considered (and rejected) several other monetization approaches:

Pure B2B model: Focus entirely on enterprise customers paying millions for Chat GPT integration. This would eliminate free tier and reduce total users but maximize revenue per user. Problem: loses the consumer brand and reduces competitive moat.

Extreme pricing: Charge $50+ per month for Chat GPT Plus, making it affordable only to true power users. Problem: dramatically reduces market size and makes it easier for competitors to acquire users.

Sponsored models: Partner with wealthy companies (similar to how universities partner with tech companies) to fund research. Problem: sacrifices independence and creates conflicts of interest.

Open sourcing: Release Open AI's models to the open-source community, allowing others to run inference locally. Problem: eliminates the entire business model.

Ads represent the middle path—maintaining free tier (protecting user base and network effects) while generating incremental revenue without extreme price increases.

Five-Year Outlook

Assuming current trajectory continues, expect:

2025: Ads test begins, generates $1-2B annually, user backlash is manageable, Chat GPT remains dominant

2026: Ads expand globally, improvements based on learnings reduce user friction, Chat GPT Pro tier gains traction

2027: Ads account for 15-20% of revenue, subscription growth accelerates due to ad pressure, competitors launch their own ads

2028: Ad technology becomes more sophisticated (contextual targeting, frequency capping), Open AI approaches profitability on core operations

2029-2030: Infrastructure costs plateau as deployment matures, ads + subscriptions + API access generate sufficient revenue for profitability, Open AI transitions to a traditional tech company model (growth at all costs transitions to profitable growth)

This assumes no major technical breakthroughs (which could change everything) and no serious competitive threats (which might emerge).

OpenAI's projected revenue of

Alternatives to Advertising

Token-Based Monetization

One alternative Open AI didn't pursue (yet) is explicit token pricing. Users could buy tokens that they use when querying Chat GPT, similar to how API credits work.

Advantages:

- Immediate profitability signal (users pay before they use)

- Better alignment with actual cost (expensive queries cost more tokens)

- Fair to light users (they don't overpay for a subscription)

Disadvantages:

- Complexity discourages adoption

- Feels more expensive to users than fixed-price subscriptions

- Creates friction in the user experience (checking token balance before queries)

Open AI could still implement this alongside advertising. Free tier uses ads + limited free tokens per day. Paid tier uses purchased tokens.

Referral Rewards

Another approach: reward users for referring friends to Chat GPT's paid tier. Many Saa S products do this effectively (Dropbox, Slack, Tailwind).

Advantages:

- Leverages existing user base for viral growth

- Aligns user incentives with profitability

- Less intrusive than ads

Disadvantages:

- Lower revenue per user than ads

- Unsustainable at scale (referral rewards eventually exceed subscription cost)

Open AI could implement a referral program, but it probably doesn't generate enough revenue to significantly improve profitability.

Enterprise Bundling

Microsoft already bundles Chat GPT with Office and Windows. Open AI could expand this approach by:

- Licensing Chat GPT to other enterprise software vendors

- Creating custom versions for specific industries

- Building marketplace of third-party plugins and data sources

Advantages:

- High-margin revenue (enterprise customers pay premium prices)

- Reduces reliance on consumer-facing monetization

- Aligns with B2B momentum

Disadvantages:

- Slower growth than consumer advertising

- Lower total market size than consumer products

- Requires significant enterprise sales infrastructure

Open AI is pursuing this path alongside advertising, but it's not a complete solution.

Lessons for Startups and Other AI Companies

What Open AI's Move Signals

Open AI's advertising announcement sends a clear signal to the startup ecosystem and investors:

-

Free AI assistants can't sustain at scale: If Open AI can't survive on subscriptions alone, smaller companies definitely can't. Every AI startup needs to think about advertising, enterprise deals, or very high-margin products.

-

Consumer unit economics are brutal: The gap between what users will pay (

50-100+ monthly) is extreme. This gap persists as long as AI compute costs remain high. -

Advertising is not a fallback, it's a necessity: Advertising isn't weakness; it's the only sustainable model for serving free users at scale. Competitors who don't advertise will need to either charge more or serve fewer users.

-

Network effects matter more than ever: Open AI can monetize ads because it has 800 million weekly users. A smaller competitor with 10 million users generates far less ad revenue. This gives Open AI a structural advantage that's hard to overcome.

Strategic Implications for Startups

AI startups should:

-

Expect lower lifetime revenue from free users: Don't plan on converting 5-10% of free users to paid if you're competing with heavily funded competitors offering free tiers.

-

Focus on enterprise first: B2B customers pay higher prices and generate more predictable revenue. Consumer advertising is a long game that requires substantial scale.

-

Build defensible moats: Ads only work at scale. Startups need technological advantages (better models, faster inference, unique features) or network effects (more valuable with more users).

-

Plan for advertising from day one: Don't treat ads as a fallback. Design the product experience to accommodate ads, train users to expect them, and implement advertiser infrastructure early.

-

Diversify revenue: Relying on any single revenue stream is risky. Mix subscriptions, enterprise, API access, and advertising. Open AI is smart to pursue multiple revenue angles.

How This Changes Your AI Experience

For Students and Students

If you're using free Chat GPT for homework or studying, you'll start seeing ads. These ads might be relevant (if you're studying finance, ads for financial courses could appear) or irrelevant (random product ads).

Does this affect your experience? Minimally. Ads at the bottom of responses are unobtrusive. But the knowledge that ads exist creates a subtle psychological shift—you're now the product being monetized, not just the user.

For $8/month with Chat GPT Go, you get the same thing with potentially fewer ads.

For Professionals

If you use Chat GPT for work (coding, writing, analysis), the free tier ads might be annoying. A single ad per response adds 2-3 seconds to your workflow. Multiply that across hundreds of daily queries, and you waste time.

Paying $8-20/month becomes more justified if you use Chat GPT frequently for professional work.

For Developers

Developers using the Chat GPT API (not the web interface) aren't affected by ads. The API is priced separately and doesn't display advertising.

But the consumer app moving to ads-based monetization might eventually influence API pricing. As Open AI's ad revenue grows and accounts for a bigger portion of total revenue, the company might lower API prices to compete with alternatives. Or it might raise them to harvest more value from developers.

Questions and Uncertainties

What We Don't Know Yet

Open AI's announcement leaves several questions unanswered:

-

Ad frequency: How many ads will users see per day? Per week? Just one per response, or multiple?

-

Ad targeting: Will ads be truly just contextual, or will Open AI use aggregate data about user behavior to target ads better?

-

Pricing tiers: Will Chat GPT Go have fewer ads than free tier? Exactly what features are included in Go that aren't in free?

-

International variations: Will ad policies and ad inventory vary by country? (Probably yes, but Open AI hasn't specified.)

-

Data policy: Open AI says conversations won't be shared with advertisers, but will aggregate data about users be used for targeting? (Unclear, but likely yes.)

-

Performance impact: Will ads slow down response times? (Technically they shouldn't, but worth monitoring.)

As ads roll out, these details will become clearer through user experience and advertiser feedback.

Red Flags to Watch

Monitor for these potential warning signs that ads are negatively impacting Chat GPT:

-

Response quality degradation: If Chat GPT's answers get noticeably worse (shorter, less helpful, more generic), advertising pressure might be influencing the system.

-

Ad bloat: If ads expand from "one per response" to multiple ads or intrusive placements, monetization is winning over user experience.

-

Sensitive topic spillage: If ads start appearing on health, mental health, or political topics despite stated policies, trust is eroding.

-

Recommendation bias: If you notice Chat GPT consistently recommending advertiser products, bias has crept in.

-

Performance degradation: If Chat GPT gets slower or less responsive, it could signal that ad infrastructure is consuming resources.

None of these are guaranteed, but they're worth monitoring.

Conclusion: What This Means for the Future of AI

Open AI's move into advertising represents a watershed moment for the AI industry. It signals that free, capital-intensive AI services can only exist through some combination of:

- Advertising revenue

- Premium subscription tiers

- Enterprise licensing

- Venture funding

No single model is sufficient. The economics are just too challenging.

For users, this means the era of free, ad-free, premium AI experiences is ending. Future AI services will look more like Google Search and You Tube—some features free with ads, some features paid without ads, some features available only to enterprise customers.

For the industry, it means the competitive advantage will increasingly go to:

- Companies with existing ad platforms (Google, Meta)

- Companies with existing enterprise relationships (Microsoft, Amazon, Oracle)

- Companies willing to accept lower profitability in exchange for user growth (early startups)

Open AI doesn't have the first two advantages (though Microsoft's partnership helps). But Open AI's unmatched brand and user base give it a structural advantage in advertising that other AI companies will struggle to match.

The bigger question is whether advertising can ever be sufficient to fund the infrastructure buildout that AI requires. Even if ads generate $3-4 billion annually (likely the peak), that's still only a fraction of Open AI's infrastructure ambitions.

This suggests that either:

- AI compute costs drop precipitously (possible with better silicon and software)

- AI productivity improvements justify much higher pricing (likely)

- Most AI companies eventually consolidate to the few that can afford the infrastructure (possible)

- AI development slows as companies reach the limit of what's sustainable (possible)

Open AI's advertising experiment is a necessary step, but it's not a sufficient solution to the fundamental challenge of making AI sustainable at scale.

The next few years will tell whether this model works.

FAQ

What exactly are Open AI's new ads in Chat GPT?

Open AI is testing banner advertisements that appear at the bottom of Chat GPT responses on the free tier and new $8/month Chat GPT Go plan. These ads are contextual, meaning they relate to the topic of the conversation. For example, if you ask about travel destinations, you might see ads for hotels or flights. Ads are clearly labeled as sponsored content and separated from Chat GPT's actual responses to preserve the conversational experience.

When will the ads appear for me?

Open AI stated that ads will begin appearing "in the coming weeks" for US users. The rollout started with users in the United States, with plans for international expansion afterward. The rollout is gradual, meaning not all users will see ads simultaneously—Open AI is testing with a subset of users first to gather feedback and optimize the experience before wider deployment.

Will Chat GPT Plus users see ads?

No, Chat GPT Plus (the

How does this affect response quality or accuracy?

Open AI has explicitly committed to ensuring that ads do not influence Chat GPT's conversational responses. The company has stated that responses will be "driven by what's objectively useful, never by advertising." However, users have legitimate reasons to monitor whether this commitment holds over time as advertising becomes more important to Open AI's business model.

Why is Open AI introducing ads if Sam Altman previously said he found ads and AI "uniquely unsettling"?

Open AI's financial situation made advertising necessary. The company projects $9 billion in annual operational burn, with subscriptions alone insufficient to cover costs. Only about 5% of Chat GPT's 800 million weekly users pay for subscriptions, leaving the company dependent on venture funding. Advertising provides a third revenue stream to improve the path to profitability. This represents a reluctant pivot from Altman's previous stance, driven by economic necessity.

What's Chat GPT Go and should I subscribe?

Chat GPT Go is a new

Will ads appear on sensitive topics like health and politics?

Open AI has stated that ads won't appear on sensitive topics like mental health or politics, and the company also won't show ads to users it identifies as being under 18 years old. However, these restrictions depend on Open AI's content classification systems, which aren't perfect. There's a possibility that as ad revenue becomes more important, these restrictions could gradually relax, though Open AI currently treats this as a core commitment.

How much will Open AI make from ads?

Open AI hasn't disclosed specific financial projections for advertising revenue. However, industry analysis suggests that if ads generate

Should I switch to Claude or another AI to avoid ads?

Other AI assistants like Claude (from Anthropic) will likely face similar pressures to monetize through advertising eventually. Anthropic currently positions Claude as safety-focused and hasn't introduced ads, but the same unit economics apply to other AI companies. If you want to avoid ads entirely, you'll need to either pay for a subscription or run open-source models locally, both of which have trade-offs in terms of convenience or capability.

Could this lead to biased AI responses?

There's a theoretical risk that as advertising becomes more important to Open AI's revenue, subtle biases could creep into responses in favor of advertiser interests. Open AI has committed to preventing this, but these commitments are internal policies rather than technical guarantees. Users should monitor Chat GPT's responses on commercial topics over time to detect any potential bias emerging.

How do I turn off ads?

You can't turn off ads on the free tier or Chat GPT Go—ads are part of these tiers' business model. To avoid ads entirely, you need to upgrade to Chat GPT Plus (

Key Takeaways

- OpenAI generates 9B in operating costs, plus $140B+ in amortized infrastructure spending—subscriptions alone cannot fund operations

- Only 5% of ChatGPT's 800 million weekly users pay for subscriptions, forcing the company to monetize free tier through contextual advertising

- ChatGPT Go (20/month), addressing price sensitivity while still generating ad revenue

- Sam Altman previously called ads and AI 'uniquely unsettling,' but economic necessity forced OpenAI to reverse this position—a pattern that signals industry-wide inevitability

- Advertising introduces trust risks if subtle biases creep into responses over time as ad revenue becomes more critical to profitability

Related Articles

- OpenAI Ads in ChatGPT: What It Means for Users [2025]

- Why Apple Chose Google Gemini for Next-Gen Siri [2025]

- US 25% Tariff on Nvidia H200 AI Chips to China [2025]

- Wikipedia AI Licensing Deals: How Big Tech Is Paying for Knowledge [2025]

- How People Use ChatGPT: OpenAI's First User Study Analysis [2025]

- OpenAI's $10B Cerebras Deal: What It Means for AI Compute [2025]

![OpenAI Ads in ChatGPT: Why Free AI Just Got Monetized [2025]](https://tryrunable.com/blog/openai-ads-in-chatgpt-why-free-ai-just-got-monetized-2025/image-1-1768599445897.jpg)