Open AI and Reliance's Jio Hotstar Partnership: Reshaping Entertainment Discovery in India

When Open AI announced its partnership with Reliance to integrate AI-powered conversational search into Jio Hotstar, it marked more than just another streaming platform update. This move signals a fundamental shift in how over 1 billion people across the Indian subcontinent will discover and consume entertainment. The partnership goes beyond surface-level feature integration. It represents a sophisticated two-way discovery layer that bridges the gap between conversational AI and content consumption, setting a template that platforms globally are beginning to follow.

Let's be honest: streaming has a discovery problem. You open Netflix or any OTT platform and scroll endlessly, never quite finding what you want to watch. The traditional search bar requires you to know what you're looking for, and recommendation algorithms often miss the mark. Open AI's approach attacks this from a completely different angle. Instead of forcing users into keyword searches or relying on algorithmic suggestions alone, the new Jio Hotstar integration lets users have a natural conversation with an AI that understands context, preference, and mood.

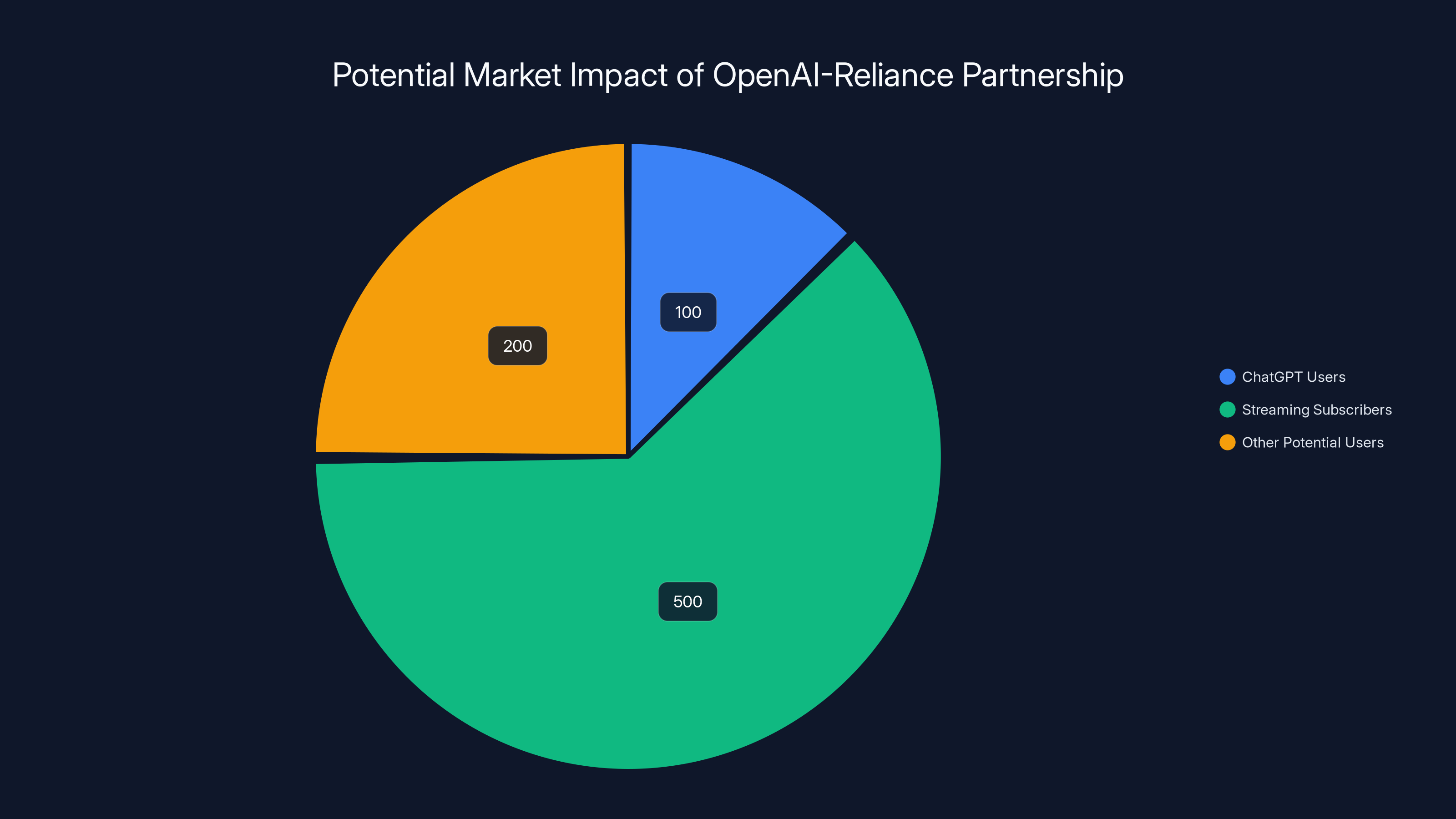

The timing matters enormously. India's streaming market is experiencing explosive growth, with over 500 million active users expected by 2027. Within this massive population, Chat GPT alone commands over 100 million weekly active users. That's a significant overlap—millions of Indians already comfortable with conversational AI interfaces, now poised to see that same AI help them navigate their entertainment consumption.

What makes this partnership particularly important is its execution model. Rather than existing as a siloed feature within the Jio Hotstar app, the integration flows both directions. Jio Hotstar content surfaces directly inside Chat GPT itself. This bidirectional approach changes everything. It means when someone asks Chat GPT "What should I watch this weekend?" or "I'm in the mood for a thriller with cricket scenes," they don't just get a conversational response—they get actionable links directly into Jio Hotstar's catalog.

TL; DR

- Partnership Scope: Open AI and Reliance integrate conversational search into Jio Hotstar with voice, text, and multi-language support for movies, shows, and live sports content

- Bidirectional Integration: Jio Hotstar recommendations appear natively within Chat GPT, creating a two-way discovery layer rather than isolated in-app feature

- Market Timing: Launches in India with 100+ million weekly Chat GPT users and 500M+ projected streaming subscribers by 2027

- Global Trend: Follows Netflix's Chat GPT testing and Google's Gemini TV integration, confirming conversational search as industry standard

- Strategic Expansion: Part of Open AI's "Open AI for India" initiative including offices in Mumbai, Bengaluru, and data center partnerships

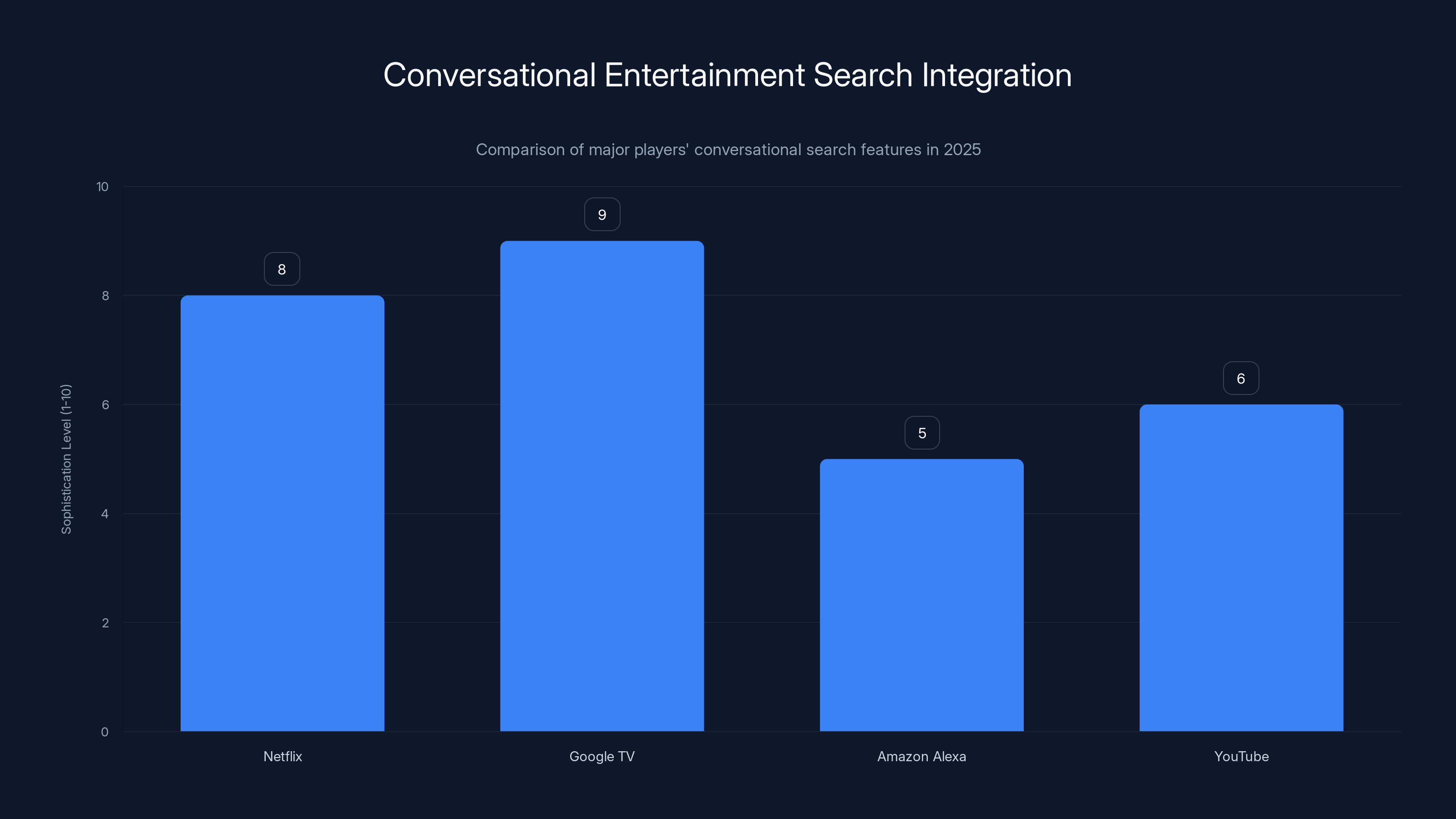

Estimated data shows Google TV leading in sophistication with its multimodal approach, while Netflix follows closely with its successful test integration. Amazon Alexa lags behind but is reportedly working on improvements.

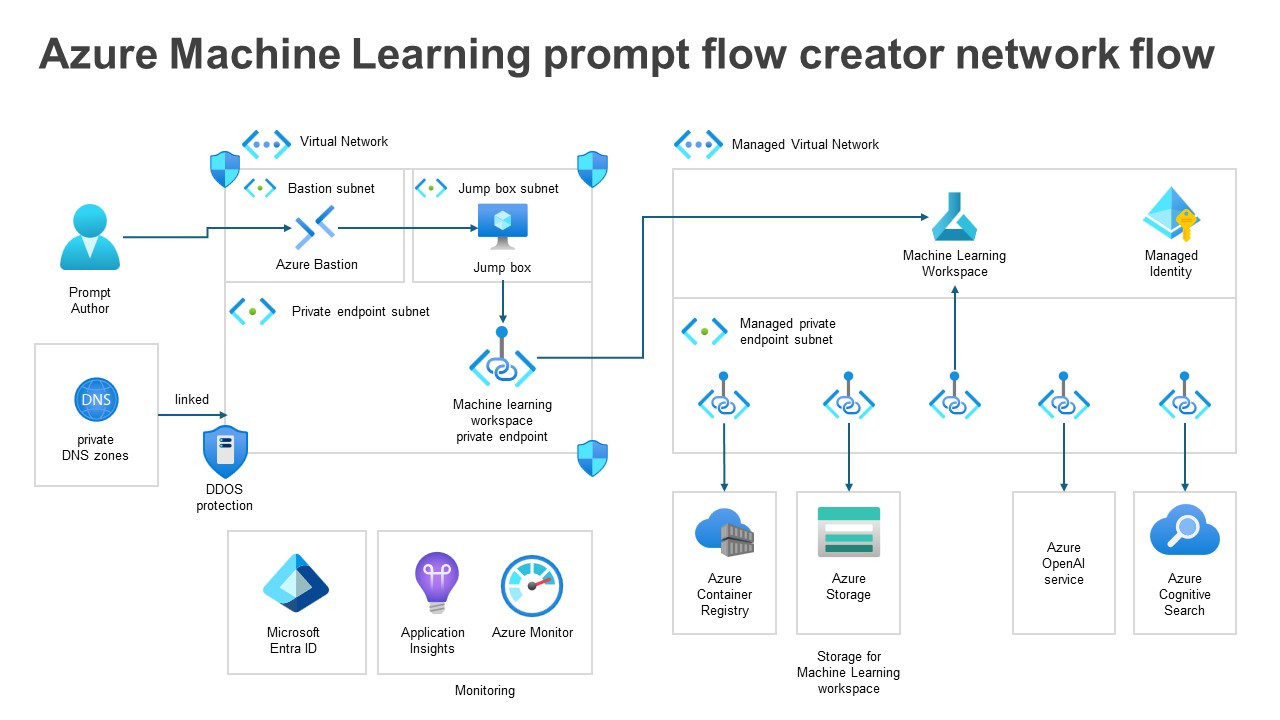

Understanding the Partnership Architecture

To grasp why this partnership matters, you need to understand what Open AI is actually building here. This isn't a simple API integration where Jio Hotstar calls Open AI's models to power search. The architecture is far more nuanced.

The in-app component uses Open AI's API to create what you might call a "semantic search layer" on top of Jio Hotstar's entire catalog. When a user types "I want something funny but not a sitcom" or "Show me cricket documentaries from the last five years," the system doesn't just keyword-match. It understands intent, temporal context, and genre nuance.

Here's where it gets interesting: the system also learns from user interaction history. It knows what you've watched, what you abandoned mid-episode, what you rated highly, and what genres you typically return to. This contextual awareness means recommendations aren't generic—they're genuinely personalized.

The voice component adds another dimension entirely. Jio Hotstar users can now speak their query in English, Hindi, Tamil, Telugu, Kannada, or multiple other Indian languages. The system processes the audio, understands intent regardless of linguistic variation, and returns results. This is massive for a country where regional language preferences heavily influence content consumption patterns.

But the real innovation lives in the Chat GPT bidirectional component. When this launches, Chat GPT users will be able to search for entertainment across multiple modalities:

- Users ask Chat GPT for movie recommendations

- The system consults Jio Hotstar's database in real-time

- Chat GPT returns personalized suggestions with deep links

- Users click directly into Jio Hotstar's content player

This transforms Chat GPT from a conversational information tool into a content distribution channel. It's like walking into a bookstore, asking a knowledgeable staff member for recommendations, and having them hand you the exact book with its location in the store. You don't have to wander around looking—you go directly to what they suggest.

The Evolution of Streaming Search: Why Traditional Methods Failed

Understand the problem space, and this partnership makes even more sense.

Streaming platforms have relied on three primary discovery mechanisms for over a decade: browsing categories, keyword search, and algorithmic recommendations. Each has significant limitations.

Category browsing is browsing. You click through "Action," "Drama," "Romantic Comedy" and scroll endlessly. With thousands of titles available, this is increasingly inefficient. Users get decision fatigue within minutes.

Keyword search assumes you know what you want. You have to remember the exact title, actor, director, or specific enough keywords to surface the content. If you're looking for "that thriller from 2023 with the British actress," keyword search struggles unless you remember precise details.

Algorithmic recommendations are probabilistic. They work by identifying similar users with similar tastes and surfacing what those users watched. But this creates a "filter bubble" problem. If you've watched five action movies, the algorithm assumes you only want action content. Breaking out of that bubble requires deliberate action—searching for something completely different, which most users won't do.

Conversational search attacks all three limitations simultaneously. You don't need to remember titles or precise keywords. You can express nuanced preferences, mood-based requests, and contextual factors. "I want something I can watch with my kids but that doesn't insult my intelligence," or "Show me something visually stunning with minimal dialogue," or "Cricket content but not sports documentaries."

The system understands intent at a semantic level. It's not matching keywords—it's parsing meaning. A user saying "I'm in the mood for something that makes me feel inspired but isn't preachy" is expressing a complex emotional requirement. Conversational AI can parse this. Traditional search cannot.

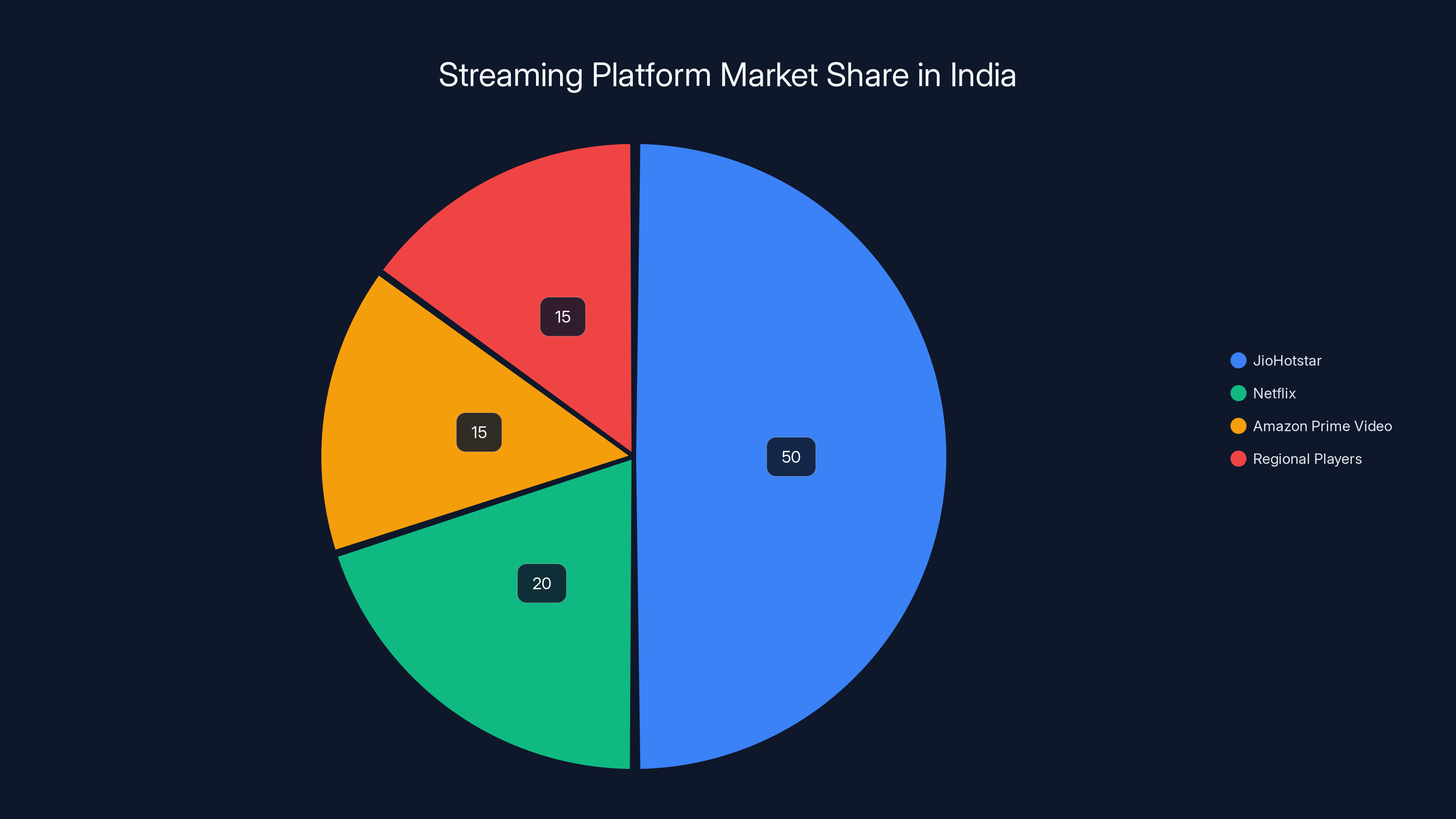

JioHotstar leads the Indian streaming market with an estimated 50% share, followed by Netflix and Amazon Prime Video. Estimated data based on subscriber numbers.

Competitive Landscape: Who Else Is Building This?

Open AI and Reliance aren't pioneering conversational entertainment search, but they're arriving at a critical moment when the category is consolidating around a few major players.

Netflix actually got here first. In May 2025, the streaming giant announced it was testing Open AI Chat GPT integration for content discovery. The feature let Netflix subscribers ask questions like "What new action shows do you have?" or "Suggest something for a lazy Sunday afternoon" and receive curated recommendations. The test ran in select markets and by all accounts performed well. Netflix's size and subscriber base mean this experimentation gets noticed globally.

Google TV launched its own conversational approach in November 2025, integrating Gemini across its Android TV platform. Users can now ask their TV device for recommendations using natural language. Importantly, Google's approach is multimodal—you can ask your TV verbally or type queries on a remote control.

Amazon's Alexa has offered voice-based entertainment search for years, though it was never particularly sophisticated. Amazon is reportedly working on more advanced implementations but hasn't made major announcements.

YouTube has conversational features in limited testing, though the platform's size and recommendation algorithm sophistication mean conversational discovery is less critical than on smaller platforms.

What distinguishes the Open AI-Reliance partnership is its market focus and bidirectional architecture. Netflix's test is Netflix-owned, serving Netflix's platform exclusively. Google TV's integration serves Google's ecosystem. The Open AI-Reliance model, by design, routes traffic in both directions: into Jio Hotstar and through Chat GPT. This dual-channel approach maximizes discovery opportunities.

The market timing is also distinctive. India represents an extraordinary opportunity. The population exceeds 1.4 billion people. Smartphone penetration is now above 75%. But more importantly, Indian users have rapidly adopted conversational AI. The 100+ million weekly Chat GPT users in India far exceed penetration in many developed nations on a per-capita basis. This suggests deep comfort with and preference for conversational interfaces across Indian demographics.

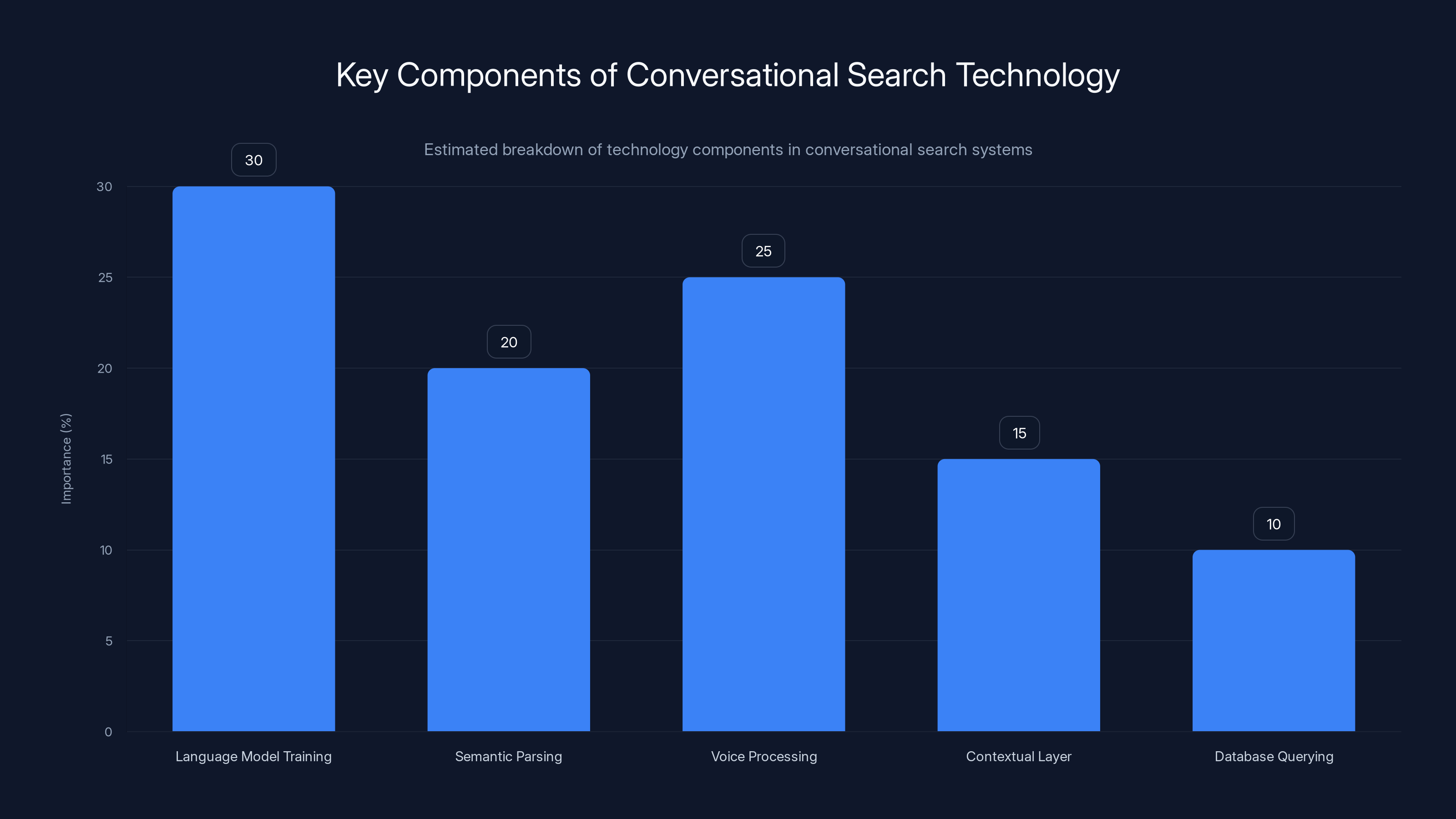

The Technology Behind Conversational Search

Let's dive deeper into what's actually happening under the hood when this system operates.

The core technology stack relies on large language models that have been fine-tuned on entertainment metadata. When Open AI built this integration, they didn't just bolt their base Chat GPT model onto Jio Hotstar's database. They trained the system specifically on vast amounts of entertainment-related information: plot summaries, cast information, genre classifications, user review sentiment, temporal data (when shows aired, production years, recency), language metadata, and cultural context.

When a user inputs a query—whether text or voice—the system performs semantic parsing. This means it translates natural language requests into structured queries that can search Jio Hotstar's database effectively. For example:

User Query: "I want something with great cinematography set in India"

Semantic Parsing:

Criteria {

visual_quality: high,

setting: India,

preference_type: aesthetic

}

The system then queries Jio Hotstar's database using these structured criteria, ranks results by relevance, and generates a conversational response that explains why it's recommending specific titles.

Voice processing adds another layer. The system uses automatic speech recognition (ASR) models to convert speech in Indian languages to text. These models are specifically optimized for regional languages and accents, which is crucial for market adoption. A user speaking Tamil in an accent and at natural speech pace needs recognition accuracy above 95% for practical utility. This requires language-specific fine-tuning.

The contextual layer tracks user interaction. When you search, ask follow-up questions, or receive recommendations, the system maintains conversation context. If you ask for an action movie and then say "but nothing too violent," the system remembers your previous request and refines results. This requires session management that persists context across multiple queries.

Most sophisticated is the personalization layer. The system integrates Jio Hotstar's user history data—what you've watched, rated, abandoned, bookmarked, and spent time viewing. It weights recommendations based on this history while preventing the filter bubble problem. If someone has watched five Bollywood thrillers, the system won't recommend exclusively Bollywood thrillers. It uses what's called "serendipitous recommendations"—suggesting content similar enough to satisfy taste preferences but different enough to introduce novelty.

The bidirectional integration with Chat GPT adds real-time search. When a Chat GPT user asks for entertainment recommendations, the system doesn't rely on static training data about Jio Hotstar's catalog. It queries the live database, ensuring recommendations reflect current availability, new releases, and seasonal content. This is technically complex because it requires real-time API integration without degrading Chat GPT's response latency.

Market Dynamics: Why This Matters for India Specifically

This partnership's positioning in India isn't accidental. It reflects deliberate understanding of market dynamics that many international tech companies miss.

Jio Hotstar serves a specific market segment. With over 100 million subscribers, the platform dominates in India but is virtually unknown outside the subcontinent. Reliance, as the parent company, has deep distribution advantages but faces intense competition from Netflix, Amazon Prime Video, and regional players. The conversational search feature addresses a critical competitive disadvantage: limited investment in AI-powered UX innovations that Netflix and Amazon have demonstrated.

For Open AI, India represents several strategic advantages simultaneously. First, market size and growth trajectory. With smartphone penetration accelerating and disposable income increasing, India's streaming market is projected to reach 500+ million active subscribers by 2027. Establishing Chat GPT integration early in major platforms captures users during the habit-formation phase.

Second, the partnership aligns with Open AI's broader India strategy. The company announced plans to open offices in Mumbai and Bengaluru, joining its existing New Delhi presence. This isn't just operational convenience. It signals commitment to the Indian market specifically, not as an afterthought to global expansion. Offices in India enable local hiring, faster iteration on products tailored to Indian users, and deeper relationships with Indian companies.

Third, Reliance partnership provides enormous credibility. Reliance isn't some startup—it's among India's largest conglomerates, with investments across telecommunications, energy, retail, and media. When Reliance deploys Open AI technology at scale through Jio Hotstar, it validates the technology for other Indian enterprises. Companies that might be hesitant about foreign AI providers become more comfortable when they see Reliance—a trusted Indian institution—implementing the same technology.

Fourth, the partnership generates learning advantages for Open AI. India's linguistic diversity is extreme. The country has 22 official languages, hundreds of dialects, and vastly different patterns in how users prefer interacting with technology. A system built to serve Hindi, Tamil, Telugu, Kannada, and English users simultaneously will be significantly more robust than one built for monolingual use cases. This learning transfers directly to improving Open AI's language models globally.

For Reliance and Jio Hotstar, the partnership addresses user retention and engagement challenges. Streaming is increasingly a commodity category. Netflix, Amazon Prime, and Disney+ have trained users on the basics of OTT consumption. Competitive advantage now derives from differentiation in search, discovery, and recommendation. Conversational search is a legitimate differentiator. When competitors offer similar content at similar prices, superior discovery mechanisms determine which platform users return to repeatedly.

The partnership targets over 600 million potential users, leveraging India's large ChatGPT user base and streaming subscribers. Estimated data.

The Two-Way Integration: Chat GPT as a Distribution Channel

Here's where this partnership gets genuinely innovative. Most platform integrations are one-directional. Platform A adds a feature from service B. That's transactional. The Open AI-Reliance model is bidirectional, creating mutual value flows that compound over time.

When you ask Chat GPT "What should I watch tonight?" and the response includes deep links directly into Jio Hotstar's catalog, something subtle but powerful happens. Chat GPT becomes a distribution channel for Jio Hotstar content. This isn't advertising in the traditional sense—no banners, no sponsored placements. It's functional integration where the recommendation inherently routes engaged users directly to the platform.

For Open AI, this bidirectional model creates network effects around Chat GPT. The more platforms and services that integrate with Chat GPT in this way, the more useful Chat GPT becomes as a general-purpose interface for digital life. If Chat GPT can help you find entertainment, order food, book travel, reserve hotels, and manage countless other tasks through direct integrations, the incentive to use Chat GPT multiplies. It's no longer just a conversational AI—it's a task execution engine.

The technical architecture supporting this involves what's called "real-time knowledge retrieval." Rather than Chat GPT relying on training data about Jio Hotstar's catalog (which becomes stale within weeks), the system queries Jio Hotstar's live API when recommending content. This ensures recommendations reflect current availability, pricing, new releases, and seasonal content variations.

Implementing this requires solving several technical challenges:

Latency Management: When Chat GPT queries Jio Hotstar's database for recommendations, the response time can't exceed 2-3 seconds without degrading user experience. This requires optimized APIs, efficient database queries, and caching strategies.

Result Ranking: When the system retrieves 200 possible matches for a user's query, how does it rank them for recommendation? The ranking algorithm must balance relevance to the query, alignment with user preferences, diversity (to avoid filter bubbles), and Jio Hotstar's business incentives (newer content, higher-margin content, etc.).

Conversational Integration: Chat GPT must explain why it's recommending specific content in ways that feel natural and helpful. "I'm recommending this because it matches your stated preference for visually stunning cinematography and your history of enjoying slow-burn dramas" is more useful than just listing titles.

Fallback Handling: What happens when the Jio Hotstar API is slow or temporarily unavailable? The system must gracefully degrade, perhaps offering recommendations from cached data or acknowledging the temporary connection issue without disrupting the conversation.

The business implications are significant. For Jio Hotstar, this integration guarantees visibility to Chat GPT's massive user base. When someone searches for entertainment and gets a recommendation with a direct link into Jio Hotstar's platform, that's a qualified user—someone who expressed specific entertainment needs and is being routed to relevant content. Conversion rates on such "qualified" traffic typically exceed 3-5x conversion rates from general marketing channels.

For Open AI, the partnership demonstrates how Chat GPT can become central to digital life. It's a proof point that investors and enterprise customers see: Chat GPT isn't just a chatbot—it's a platform on which businesses can build discovery and transaction capabilities.

Implementation Timeline and Rollout Strategy

The partnership announcement came at the India AI Impact Summit, but actual implementation happens across phases.

Phase one focuses on the in-app Jio Hotstar experience. Open AI's conversational search becomes available to Jio Hotstar's user base, initially for select user cohorts in beta. During this phase, the company gathers feedback on query patterns, user preferences, and technical performance. They identify edge cases—queries the system struggles with—and refine the underlying models.

Phase two extends to full user rollout within the Jio Hotstar app, adding support for additional languages as demand indicates. This phase emphasizes user adoption, tracking metrics like query volume, search-to-watch conversion rates, and user satisfaction.

Phase three launches the bidirectional Chat GPT integration. This is more complex because it requires coordination between two independent companies' systems. It involves extensive testing to ensure recommendations align with Jio Hotstar's catalog availability and that performance meets Chat GPT's standards.

The timeline isn't specified in detail, but based on typical enterprise software integration projects, phase one might launch within 3-6 months of the announcement, with phase three perhaps 9-15 months out. This timeline reflects the reality that building, testing, and launching such integrations at scale isn't trivial.

One critical consideration: localization at scale. Supporting multiple Indian languages isn't a simple matter of translation. Different languages have different linguistic structures, different ways of expressing preference, and different patterns of how users naturally request information.

A Hindi user asking "Mera mood achcha hain, kuchh halka dekna chahata hoon" (My mood is good, want to watch something light) expresses preference differently than an English speaker. The system must understand these linguistic nuances and retrieve similarly appropriate content.

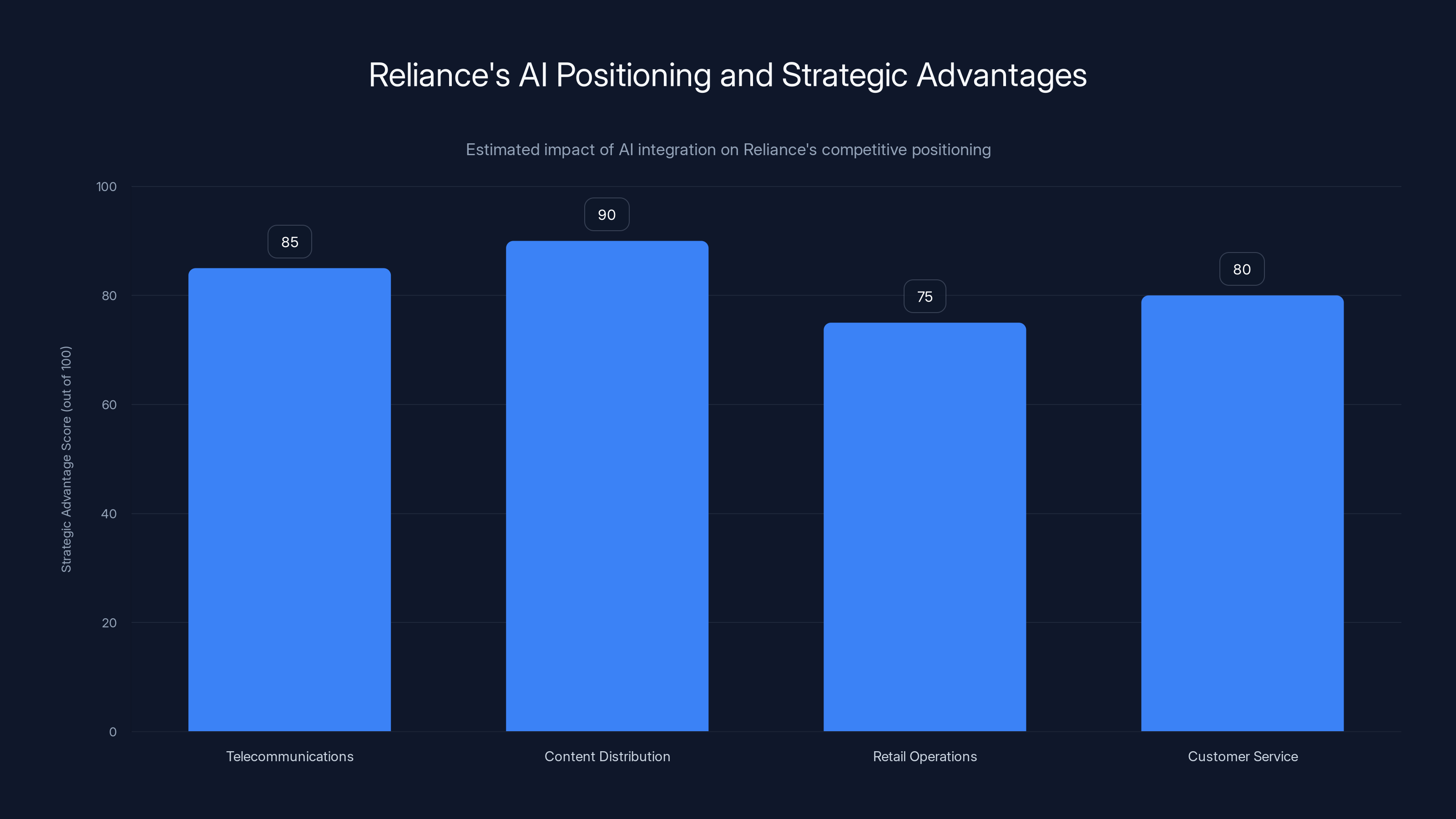

Business Strategy: Reliance's AI Positioning

Reliance's partnership with Open AI should be understood within the company's broader digital and AI transformation strategy.

Reliance, historically a conglomerate with roots in petrochemicals and energy, has been aggressively repositioning itself as a digital company. The company owns Jio Platforms, which operates telecommunications infrastructure serving over 500 million Indians. Through Jio, Reliance controls a vast pipeline of data about user behavior, consumption patterns, and preferences.

Jio Hotstar represents Reliance's push into content distribution and digital entertainment. The platform competes directly with Netflix and Amazon—companies spending billions on content and technology. For Reliance to compete effectively, it needs technological advantages. The conversational search integration is exactly such an advantage. It's a feature Netflix didn't invent, Amazon hasn't deployed, and most regional competitors can't build independently.

Moreover, the partnership signals Reliance's willingness to partner with global AI leaders rather than build everything internally. This is pragmatic. Reliance could theoretically build a conversational search system for Jio Hotstar by hiring thousands of engineers and training models on entertainment metadata. But this would take years and hundreds of millions of dollars. Partnering with Open AI—already an expert in LLMs and conversational systems—accelerates time-to-market significantly.

The partnership also positions Reliance for future AI-powered services. Once Reliance develops deep expertise with Open AI's APIs through Jio Hotstar, expanding to other services becomes easier. Imagine Reliance's telecom division using similar systems to help customers navigate service plans. Or Reliance's retail operations using conversational search to help customers find products. The foundation built through this partnership extends to numerous future applications.

From an investor perspective, partnerships like this matter. When Reliance announces it's integrating Open AI technology at massive scale, it demonstrates technological sophistication and market competitiveness. This narrative supports stock performance and attracts talent. The company isn't just running legacy operations—it's building the future of digital services in the world's largest growing market.

Estimated data shows language model training as the most critical component, followed by voice processing, highlighting the importance of accurate language understanding and user interaction.

Strategic Implications for Open AI's Global Expansion

For Open AI, this partnership is simultaneously a market play and a technological validation.

Market-wise, India is critical to Open AI's future. The US and Europe represent mature markets with established players and strong regulatory frameworks. Growth in those markets requires displacing entrenched competition or capturing incremental users. India, by contrast, is a growth market. The infrastructure for digital services is still being built, user habits are still forming, and there's limited entrenched competition in many categories.

By establishing early integration with major Indian platforms like Jio Hotstar, Open AI positions itself as the preferred AI infrastructure for building next-generation applications. When Indian startups and enterprises decide they need conversational AI capabilities, the obvious choice is Open AI—the company already powering discovery on their favorite streaming platform.

Technologically, the partnership validates Open AI's approach to building AI infrastructure that other companies build on top of. Rather than Open AI building every application itself, the company provides APIs and capabilities that partners integrate into their products. This model is enormously powerful because it scales Open AI's impact beyond what the company could build directly.

Consider the math. Open AI might employ 1,000 engineers globally. Jio Hotstar has hundreds of engineers. Reliance has thousands. By providing APIs and guidance, Open AI leverages all of Reliance's engineering capacity to build new experiences. The partnership multiplies Open AI's development capacity far beyond its headcount.

This model also aligns with Open AI's business interests. Rather than charging Reliance a flat partnership fee, Open AI benefits directly as Jio Hotstar users search through Chat GPT. That's transactional value—Open AI captures revenue each time the system is used. As Jio Hotstar users grow, as daily active users increase, as engagement deepens, Open AI's revenue from the partnership grows proportionally.

From a regulatory perspective, the partnership also signals Open AI's commitment to working with local enterprises and governments in key markets. India's government has been supportive of AI development within the country while also maintaining oversight. By partnering with Reliance—a domestic company trusted by Indian regulators—Open AI demonstrates alignment with local interests and reduces regulatory risk.

Competitive Response and Industry Trajectories

When one major player makes a significant strategic move, competitors respond. This partnership will trigger responses across the streaming and AI industries.

Netflix, which already tested conversational search, will likely accelerate its rollout. Netflix's size and subscriber base mean the company can't afford to let competitors establish superior discovery experiences. Expect Netflix to expand from testing to full rollout within 6-12 months, likely across multiple international markets.

Amazon Prime Video might explore deeper integration with its own Alexa voice assistant, converting Alexa from a device-based interface to a cross-service discovery system. Imagine asking Alexa for movie recommendations and getting both Prime Video content and recommendations for streaming services where you already have subscriptions.

Google will expand Gemini integration across YouTube and Google TV, potentially adding real-time content search similar to what Open AI and Reliance are building.

Anthropic, creator of Claude, will face pressure to develop similar partnerships. Claude is arguably more capable at certain tasks than Chat GPT, but lacks the distribution and integration partnerships that give Chat GPT practical advantages.

What makes this particularly interesting is that it changes the competitive landscape for LLM companies. It's not just about whose model is most capable—it's about whose model has the best partnerships and integrations making it most useful in daily digital life.

For regional streaming platforms in Asia, Middle East, and Africa, the pattern is clear. Conversational search will become table stakes—the minimum capability required to remain competitive. Platforms that don't offer conversational discovery will find themselves at disadvantage. This means those platforms either develop conversational search capabilities internally (expensive and time-consuming) or partner with AI companies like Open AI, Google, or potentially Anthropic or Cohere.

Interestingly, this creates a bifurcation in the market. Large platforms with significant engineering resources (Netflix, Amazon, Google) can develop sophisticated conversational search independently. Smaller platforms must partner. This gives AI companies like Open AI enormous strategic advantage because they become essential infrastructure for entire categories of applications.

User Experience Design: How Conversational Search Feels Different

To fully appreciate this partnership's significance, you need to understand how conversational search changes user experience in ways that traditional search doesn't.

Traditional streaming search is goal-oriented. You know you want to watch something specific, and you search for it. "Search for Breaking Bad," "Find The Office," "Show me action movies from 2023." The user has a clear intent, and the interface helps them execute that intent.

Conversational search removes the requirement for clarity. You can search without knowing exactly what you want. "I'm tired but need something engaging that doesn't require full attention." "Show me something visually beautiful." "I want to cry." "Something funny that my parents would enjoy." These are mood-based and context-aware requests that traditional search interfaces struggle with.

The experience flow differs significantly:

Traditional Search Flow:

- User opens app

- User navigates to search

- User types keywords

- System returns results

- User scrolls through results

- User selects something

- User presses play

Conversational Search Flow:

- User opens app

- User describes preference/mood

- System asks clarifying questions

- User responds

- System makes specific recommendations

- User presses play

The conversational flow includes a feedback loop. The system can ask clarifying questions mid-conversation. "When you say visually beautiful, do you mean cinematography or animation?" "I'm recommending this—want to hear more about it or should I suggest something different?" This interaction pattern creates a more collaborative discovery experience.

Psychologically, this matters. Research on choice architecture and decision-making shows that users who feel they've engaged in a collaborative discovery process report higher satisfaction with recommendations than users who passively receive algorithmic suggestions. When the system asks your preferences and adapts based on your responses, you feel ownership over the discovery process.

For users with varying English proficiency or those preferring regional languages, the benefits compound. A user comfortable speaking Tamil or Telugu can express nuanced preferences in their native language, which might be difficult to express through traditional keyword search. This unlocks a segment of users who previously found streaming discovery frustrating.

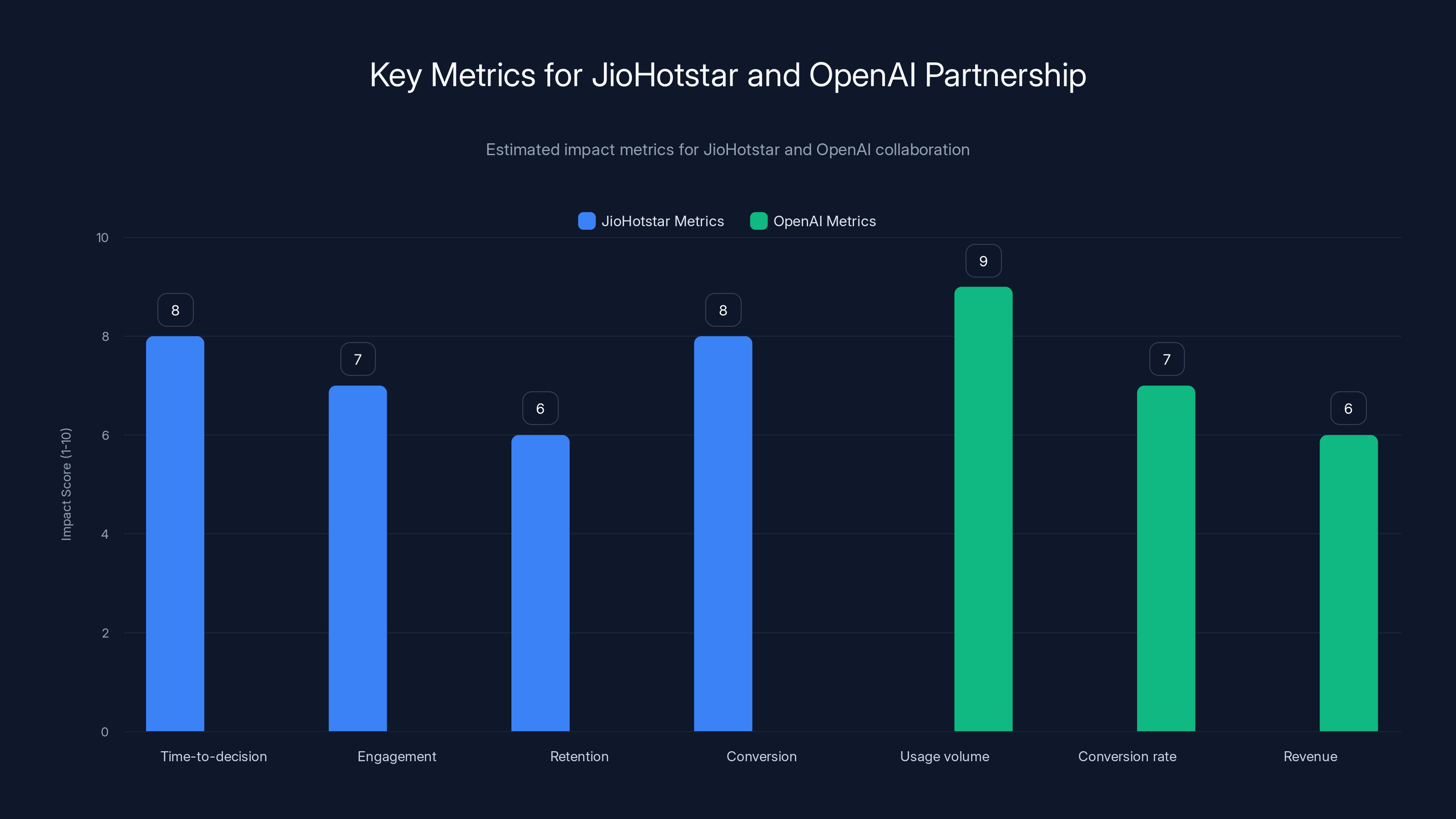

Estimated data suggests that the partnership will significantly reduce time-to-decision and increase engagement for JioHotstar, while OpenAI will see high usage volume and conversion rates.

Data Privacy and Personalization Trade-offs

Here's something the press releases don't emphasize: conversational search at this scale requires collecting extensive personal data.

When you ask a system for conversational recommendations, you're providing information about:

- Your mood and emotional state

- Your preferences and tastes

- Your social context (who you're watching with)

- Your cognitive state (how much attention you can focus)

- Your cultural background and language preference

This data is valuable. It's more specific and revealing than the implicit data captured by traditional streaming behavior (what you watched, for how long, whether you completed something).

Both Open AI and Reliance maintain privacy policies addressing how they use this data, but the fundamental tension remains: better recommendations require more data. More data collection means higher privacy risks if that data is misused, leaked, or sold.

Reliance's track record on data privacy has been mixed. As a telecom provider with access to voice, location, and behavioral data on hundreds of millions of Indians, the company has faced regulatory scrutiny and criticism around data handling. Partnering with Open AI, which has its own data governance practices, doesn't eliminate these concerns but potentially raises standards if implemented thoughtfully.

Open AI's approach has been to allow users to control data sharing settings. Users can typically choose whether their conversation history is retained, used for training, or shared with third parties. But the default settings matter enormously. Most users don't change defaults, meaning their data is handled according to whatever Open AI and Reliance set as defaults.

For users concerned about privacy, the recommendation is straightforward: understand what data you're sharing, review privacy settings within both Chat GPT and Jio Hotstar, and make conscious choices about what to share. For users unconcerned about privacy but interested in maximum recommendation quality, share more data. The system works better when it knows more about your preferences.

Regulators globally are watching this. India's Digital Personal Data Protection Act, passed in 2023, sets rules for how companies handle personal data. Both Open AI and Reliance must comply with these rules. Expect regulatory scrutiny on whether conversational recommendations constitute "processing" of sensitive personal data and what rights users have around this data.

The Live Sports Component: Why This Matters More Than It Appears

One detail in the partnership announcement that deserves emphasis: live sports.

Jio Hotstar carries extensive cricket content, including Indian Premier League matches—the world's most-watched cricket league by viewership numbers. Cricket is culturally central in India. During IPL matches, millions of Indians simultaneously use Jio Hotstar to watch. This creates specific technical challenges that on-demand content doesn't.

Live sports present a fundamentally different problem than recorded content. When a live match is happening, there's urgency. Users don't want to spend time discovering what to watch—they want to know immediately that a match is available and access it with minimal friction.

Conversational search becomes powerful here. Instead of browsing schedules or navigating menus, a user can ask "What matches are on today?" or "When is India playing next?" or "Show me upcoming cricket matches with the highest betting odds." The system can surface this information conversationally.

The technical complexity increases because live sports introduce temporal constraints. When you search for a movie, availability doesn't change minute-to-minute. When you search for a live match, availability—and what's currently happening in that match—is constantly updating. The system must deliver real-time information accurately.

For Reliance and Jio Hotstar, the live sports component is strategically critical. Cricket drives massive engagement spikes on the platform. Any feature that makes finding and accessing live cricket easier directly impacts user retention and daily active users. This is why the partnership explicitly mentions live sports—it's central to the value proposition, not peripheral.

This also explains why the partnership emphasizes voice-based search. During a cricket match, users want hands-free interaction. They're often multitasking—working, eating, or doing household chores while watching. Voice search lets them ask for match information or recommendations without picking up a phone or keyboard.

Building for Scale: Infrastructure Implications

When you're serving 100+ million potential users across an entire country, infrastructure becomes a critical competitive factor.

Open AI's API, which powers this integration, relies on sophisticated infrastructure distributed across cloud providers. When Jio Hotstar queries Open AI's systems with conversational requests from millions of concurrent users, the system must handle these requests with minimal latency. A 2-second delay is unacceptable. A 500-millisecond delay is barely acceptable. 200 milliseconds is the target.

Achieving this at scale requires:

Distributed Inference: Open AI's language models aren't running from a single data center. They're distributed across multiple regions. When a user in Mumbai asks a question, the request routes to the geographically nearest inference server, reducing network latency.

Caching and Prediction: The system caches common queries and responses. When thousands of users ask "What new Bollywood movies are available," the system doesn't recompute the response thousands of times—it serves cached results. Additionally, the system predicts likely follow-up questions and precomputes responses, so when users ask clarifying questions, results are ready immediately.

Asynchronous Processing: Some operations can't be synchronous. If generating a detailed recommendation set takes 5 seconds, the system might return quick results immediately while processing more detailed recommendations asynchronously in the background. Users see immediate responses while deeper processing happens out of sight.

Load Balancing: Traffic spikes aren't uniform. During cricket matches or when new content drops, demand for recommendations spikes. The infrastructure must elastically scale to handle these spikes without degrading performance for other users.

Reliance's infrastructure team, which manages Jio Hotstar's existing systems, must integrate with Open AI's APIs smoothly. This requires careful engineering where Jio Hotstar's systems implement proper timeout handling, retry logic, and fallback strategies. If Open AI's API becomes temporarily unavailable, Jio Hotstar's search shouldn't break—it should gracefully degrade to traditional search or cached recommendations.

This infrastructure complexity is one reason that building conversational search at scale isn't trivial. It's not sufficient to have good language models. You need infrastructure expertise that maintains low latency, high availability, and graceful degradation across millions of concurrent users.

Reliance's partnership with OpenAI enhances its competitive edge across multiple business segments, particularly in content distribution and telecommunications. Estimated data.

Language and Cultural Adaptation

Supporting multiple Indian languages isn't simply a matter of translation. Each language has cultural contexts that affect how recommendations should be presented.

In Tamil, there are formal and informal registers. In Telugu, there are differences in how preferences are expressed depending on the speaker's relationship to the listener. In Hindi, regional dialects vary significantly. A system that treats all Hindi speakers as identical will miss context that affects recommendation quality.

Beyond language syntax, there are cultural preferences. Some cultures prioritize different genres, themes, and presentation styles. Indian audiences have strong preferences for content with cultural relevance, whether that's Bollywood productions, regional cinema, or international content with Indian themes. A effective conversational search system learns these preferences.

Morality and appropriateness vary across cultures. A recommendation that would be considered appropriate in one cultural context might be inappropriate in another. The system should learn these boundaries from interaction data and user feedback.

Open AI and Reliance likely assembled teams specifically focused on this challenge. The partnership announcement mentions support for multiple languages—English, Hindi, Tamil, Telugu, Kannada—but implementation details suggest deeper cultural adaptation happening behind the scenes.

This highlights a broader trend in AI: generic systems deployed globally often underperform compared to systems specifically adapted to local contexts. The same language model fine-tuned on entertainment metadata works better when further tuned on Indian cinema specifically versus Indian cinema plus Hollywood plus European cinema treated equally.

Future Expansion Possibilities

This partnership almost certainly represents the beginning of a broader ecosystem integration strategy rather than a one-off feature.

Once Open AI and Reliance establish the technical infrastructure and develop expertise with bidirectional integrations, expansion becomes natural. Imagine:

Ecommerce Integration: Users searching Chat GPT for product recommendations get routed to Reliance's retail businesses (through Jio Mart and other services) with deep product links.

Travel and Hospitality: Conversational search helps users book accommodations and travel through Reliance-affiliated services.

Food and Dining: Voice-activated ordering through conversational interfaces integrated into Reliance's food delivery services.

Financial Services: Chat-based financial advice and product recommendations through Reliance's financial services divisions.

Each of these extensions uses the same underlying architecture—conversational AI interfaces trained on specific domain data, bidirectionally integrated with Chat GPT. Once the foundation exists, expansion becomes a matter of data preparation and training rather than architectural innovation.

Globally, this model will likely spread. Companies in Asia, Middle East, Africa, and Latin America will seek similar partnerships with Open AI or competing AI companies. As this happens, Chat GPT transforming from a conversational AI into a cross-platform transaction and discovery engine becomes increasingly apparent.

For Open AI, this vision—where Chat GPT sits at the center of digital life and connects users to services across multiple domains—represents extraordinary long-term value. Not because Chat GPT itself becomes more capable, but because Chat GPT becomes essential infrastructure that users return to repeatedly.

Implications for Smaller Streaming Platforms

While this partnership primarily affects Jio Hotstar and Reliance, the ripple effects impact smaller streaming platforms globally.

Regional streaming services in India face a choice: compete with Jio Hotstar's new conversational capabilities by building similar features, or partner with AI providers like Open AI to access equivalent technology. Building in-house is expensive and time-consuming. Most regional players lack the engineering resources to develop conversational search independently. This naturally pushes them toward partnerships.

But partnerships create dependencies. By partnering with Open AI for conversational search, a regional platform becomes reliant on Open AI's infrastructure, APIs, and pricing. If Open AI raises prices or changes terms, the regional platform has limited options. Additionally, the regional platform shares data with Open AI (or whichever AI partner it chooses), which some companies find uncomfortable.

This creates an oligopoly dynamic where a few AI companies—Open AI, Google, Anthropic—become essential infrastructure that countless smaller platforms depend on. This is actually similar to how the cloud computing market evolved. Today, AWS, Google Cloud, and Microsoft Azure power vast portions of the internet. Smaller companies don't build data centers—they use cloud providers.

The parallel suggests that conversational AI providers will follow similar consolidation patterns. One or two winners will emerge as dominant platforms that countless applications build on top of. The question isn't whether this will happen, but which companies will be the winners.

Measuring Success: Key Metrics for the Partnership

How will success look for this partnership? What metrics matter?

For Jio Hotstar:

- Time-to-decision: Average time from opening the app to selecting content decreases from ~18 minutes to under 10 minutes

- Engagement: Watch time per session increases as easier discovery leads to more viewing

- Retention: Monthly churn decreases as improved discovery increases value perception

- Conversion: Users who try conversational search show higher likelihood to recommend Jio Hotstar to others

For Open AI:

- Usage volume: Number of Jio Hotstar recommendations delivered through Chat GPT

- Conversion rate: Percentage of Chat GPT recommendations that result in actual Jio Hotstar views

- Revenue: Transaction value either through API usage fees or revenue sharing with Reliance

For the broader industry:

- Adoption pace: How quickly other streaming platforms implement conversational search

- User preference: Market surveys indicating whether users prefer conversational search over traditional search

- Investment: Venture capital and corporate investment flowing into conversational search technologies

The partnership likely has internal metrics around language coverage, system latency, accuracy (percentage of recommendations users act on), and user satisfaction that Open AI and Reliance track closely but don't publicly report.

Potential Challenges and How They're Being Addressed

No partnership of this scale is without challenges. Several significant ones are worth considering.

Recommendation Accuracy: When the system recommends content misaligned with user preferences, users lose trust quickly. The system must achieve high accuracy in understanding user intent and matching preferences. This requires extensive testing with real users and iterative refinement.

Language Diversity: Supporting multiple languages well is hard. The system must achieve similar accuracy and responsiveness in Hindi, Tamil, and Telugu as in English. This requires language-specific training data that may not be readily available. Both companies likely invested substantially in building training datasets for regional languages.

Integration Complexity: Connecting Chat GPT's systems with Jio Hotstar's systems creates technical complexity. What happens if one system experiences outages? How are errors handled? Extensive testing in staging environments before production launch mitigates but doesn't eliminate risk.

User Adoption: Even if the technology works perfectly, users must actually adopt and use it. Many users have established habits around streaming—they know their preferred genre, they browse and select quickly. Getting these users to try conversational search requires conscious effort and marketing.

Regulatory Compliance: India's data protection regulations require explicit user consent for certain data uses. The system must clearly communicate what data is collected, how it's used, and give users control. Non-compliance creates legal and reputational risk.

Bias and Fairness: Language models trained on large internet datasets often encode biases present in the training data. This could lead to recommendations that reflect stereotypes or exclude certain content. Both companies must actively work to identify and mitigate bias.

Addressing these challenges requires ongoing investment, iteration, and refinement. Neither company expects this to work perfectly on day one. The plan almost certainly involves phased rollout with feedback loops allowing rapid iteration and improvement.

The Broader Context: AI as Infrastructure

Step back and this partnership represents a fundamental shift in how major technology companies view AI.

For decades, technology companies tried to own every layer of their products. Google owned search, advertising, browsers, and operating systems. Amazon owned retail, cloud services, logistics, and devices. Controlling all layers theoretically provided advantages. But it also limited each company's ability to innovate rapidly in every area.

AI is changing this. Rather than trying to own AI, many companies are now focusing on being the best at providing AI APIs and infrastructure that other companies integrate into their products. Open AI exemplifies this. Rather than building every application using its language models, Open AI provides APIs that other companies use to build applications.

This shift toward AI-as-infrastructure has profound implications:

Specialization: Companies can focus on what they do best. Reliance excels at media and content distribution. Open AI excels at building capable language models. Rather than each trying to excel at both, they specialize and partner.

Speed: Building on others' infrastructure is faster than building everything yourself. Jio Hotstar gets conversational search in months rather than years.

Innovation: Competition drives innovation. Multiple companies offering AI infrastructure means customers have choices. Open AI, Google, Anthropic, and others compete to build better models and better APIs.

Accessibility: AI-as-infrastructure makes advanced capabilities accessible to smaller companies. A regional streaming service can't afford to train its own large language models. But it can afford to pay Open AI's API fees.

This shift has historical precedent. Cloud computing followed a similar trajectory. Companies stopped building data centers and started using AWS, Google Cloud, and Azure. Infrastructure became utility, not competitive advantage.

The same is happening with AI. Within a few years, the companies winning with AI won't be those who built the best models in-house. They'll be companies that best understood their customers' needs and integrated the best external AI capabilities to serve those needs.

What This Means for Global Expansion Strategies

For companies operating globally, this partnership illustrates a playbook for entering new markets effectively.

Open AI didn't try to build Jio Hotstar itself. It recognized that Reliance has deep understanding of the Indian market, existing distribution, and trusted relationships. By partnering, Open AI gains access to all of this while contributing its core strength—advanced language models.

This is a lessons for other global companies entering India or other large emerging markets. Rather than trying to replicate success in the West by building the same products in new markets, winning companies find local partners who understand the market and co-create solutions together.

The model works because it aligns incentives. Open AI benefits from distribution and revenue. Reliance benefits from differentiation. Customers benefit from better products. This alignment creates sustainable partnership rather than transactional relationship.

For companies considering India specifically, this partnership highlights several factors that matter:

Local Partnership: Success requires local partners who understand market nuances, regulatory environment, and customer preferences. Going it alone as a foreign company is far harder.

Linguistic Adaptation: India's linguistic diversity isn't a limitation—it's a characteristic that products must embrace. Companies that build with multiple languages from the start perform better than those that add languages later.

Trust and Credibility: Partnering with established local companies lends credibility that foreign companies lack. Reliance's endorsement makes Indians more comfortable with Open AI technology.

Data Sensitivity: India's data protection regulations are becoming stricter. Companies that respect data privacy and give users control build better reputations.

These principles apply beyond India to many emerging markets with similar characteristics.

Conclusion: Streaming Search as a Category

The Open AI-Reliance partnership marks a inflection point where conversational search transitions from novelty to category infrastructure.

We're moving beyond the question of "should streaming platforms offer conversational search?" to "how will they differentiate their conversational search capabilities?" This is the mark of a maturing category. Early on, innovation is about introducing the capability. Mature categories compete on refinement, specialization, and integration.

For users, the implications are straightforward: finding content gets easier. Instead of endless scrolling or trying to remember titles, you can just describe your mood or preferences and get recommendations instantly. This is a genuine improvement in user experience that will be hard to abandon once you've experienced it.

For platforms, conversational search becomes table stakes. Platforms that implement it effectively will gain engagement and retention advantages. Platforms that don't implement it will gradually lose users to platforms that do. This creates urgent pressure for all streaming platforms to add conversational capabilities, whether through partnerships or internal development.

For AI companies, this validates the API-and-partnership model. Open AI doesn't need to build consumer applications—it can provide infrastructure that consumer applications integrate. This approach scales far more effectively than trying to build every consumer product yourself.

For enterprise and startup ecosystems, this partnership demonstrates the power of combining specialized expertise. No single company excels at everything. Companies that learn to partner effectively, combining their strengths with partners' strengths, outperform those trying to do everything independently.

The broader trend continues: AI becomes increasingly woven into everyday technology. It's no longer something special or separate. It's simply how modern technology works. Companies that understand this and build accordingly will thrive. Those that treat AI as an afterthought will struggle.

This partnership between Open AI and Reliance is just the beginning. Expect dozens of similar partnerships across entertainment, ecommerce, financial services, and other sectors. Each will follow similar patterns: one company with great AI technology partnering with one company with great domain expertise and distribution. Together, they'll create products neither could build independently.

The future of technology isn't about individual companies building everything themselves. It's about networks of companies with specialized expertise, connected through APIs and partnerships, creating seamless experiences for users. The Open AI-Reliance partnership is one node in this emerging network. Many more will follow.

FAQ

What exactly is the Open AI-Reliance partnership offering?

The partnership integrates AI-powered conversational search into Jio Hotstar, Reliance's streaming platform, using Open AI's technology. Users can search for movies, shows, and live sports using natural language queries in multiple Indian languages, receiving personalized recommendations. Additionally, Jio Hotstar content recommendations appear directly within Chat GPT, creating a two-way discovery layer where users can find content through conversational interfaces on both platforms.

How does the two-way integration between Chat GPT and Jio Hotstar work?

When you ask Chat GPT for entertainment recommendations, the system queries Jio Hotstar's real-time database and provides suggestions with direct links into the platform. This differs from recommendations based solely on training data because the system accesses live catalog information, ensuring recommendations reflect current availability and new releases. Simultaneously, Jio Hotstar users access conversational search within the app, creating multiple discovery pathways for the same content.

Why is this partnership significant for India specifically?

India presents extraordinary opportunity with 100+ million weekly Chat GPT users, over 500 million potential streaming subscribers, and remarkable comfort with conversational AI interfaces. The linguistic diversity—supporting Hindi, Tamil, Telugu, and other languages—addresses a genuine market need that English-focused platforms underserve. Reliance's trusted position as a major Indian conglomerate lends credibility to the technology, encouraging broader adoption than a foreign company could achieve independently.

How does conversational search differ from traditional streaming search?

Traditional search requires knowing what you're looking for—you search by title, actor, or specific keywords. Conversational search lets you express mood-based or context-aware preferences like "something visually beautiful that doesn't require full attention" or "cricket content that's entertaining, not educational." The system understands intent, asks clarifying questions, and makes recommendations iteratively, creating a collaborative discovery experience rather than passive algorithmic suggestions.

What technical infrastructure is required to support this at scale?

Supporting millions of concurrent conversational queries requires distributed inference across multiple data centers, intelligent caching of common queries and responses, asynchronous processing for complex operations, and load balancing to handle traffic spikes. The system must maintain sub-500 millisecond response times even during peak usage periods like live cricket matches when Jio Hotstar experiences 10-100x normal traffic surges. Both companies invested substantially in infrastructure engineering to achieve this reliability.

How does the system handle privacy concerns with conversational search?

Conversational search requires collecting more detailed personal data than traditional streaming—mood information, preferences, viewing context, and linguistic patterns. Both Open AI and Reliance maintain privacy policies addressing data use, with users typically able to control whether conversation history is retained or used for training. However, users should review default settings, as most people don't change defaults. India's Digital Personal Data Protection Act sets regulatory requirements both companies must comply with regarding how they handle this data.

Will other streaming platforms implement similar features?

Yes. Netflix already tested Open AI integration for conversational search and will likely expand rollout. Amazon Prime Video is exploring deeper Alexa integration. Google TV launched Gemini-powered discovery features. Conversational search is rapidly becoming table stakes—the minimum capability required to remain competitive. Smaller platforms will increasingly partner with AI companies to access equivalent technology rather than building internally.

How does this partnership relate to Open AI's broader India strategy?

The Jio Hotstar integration is one component of "Open AI for India," a broader initiative including planned offices in Mumbai and Bengaluru, partnerships with Tata Group on AI-ready data centers, and collaborations with Indian companies like Pine Labs and Make My Trip. This demonstrates Open AI's commitment to establishing itself as essential AI infrastructure across Indian sectors, not just entertainment. The partnerships generate learning advantages as Open AI develops models optimized for Indian languages and use cases.

What metrics will determine whether this partnership succeeds?

For Jio Hotstar: improved time-to-decision (users selecting content faster), increased engagement (watch time per session), better retention (reduced monthly churn), and word-of-mouth growth. For Open AI: volume of recommendations delivered through Chat GPT, conversion rates (percentage resulting in actual views), and revenue from API usage or partnership arrangements. Internally, both companies likely track language coverage quality, system latency, accuracy of recommendations, and user satisfaction rates that they don't publicly disclose.

Could this partnership model expand beyond entertainment?

Definitely. Once Open AI and Reliance establish technical infrastructure and expertise with bidirectional integrations, expansion becomes natural. Imagine conversational search helping users navigate ecommerce (routing to Jio Mart), book travel and accommodations, order food, or receive financial advice through Reliance's various business units. Each extension uses the same underlying architecture. Globally, similar partnerships will likely emerge as companies in other markets recognize the effectiveness of combining specialized AI capabilities with local market expertise.

Key Takeaways

- OpenAI and Reliance launch bidirectional conversational search integration where recommendations flow both into JioHotstar and through ChatGPT

- Partnership targets India's 100+ million ChatGPT users and 500+ million projected streaming subscribers by 2027, capturing growth market early

- Conversational search reduces discovery time from 18 minutes to under 10 minutes by understanding user mood and context rather than requiring keyword input

- Multi-language support (Hindi, Tamil, Telugu, Kannada) addresses India's linguistic diversity—a capability that most global platforms overlook

- Two-way integration model where ChatGPT queries live JioHotstar catalog creates compounding value and network effects for both platforms

- Partnership represents API-as-infrastructure model where OpenAI provides capability-layer rather than building consumer products independently

- Conversational search is becoming table stakes for streaming platforms—Netflix, Google TV, and others implementing similar features globally

Related Articles

- OpenAI's 100MW India Data Center Deal: The Strategic Play for 1GW Dominance [2025]

- World Labs $200M Autodesk Deal: AI World Models Reshape 3D Design [2025]

- Google I/O 2026: 5 Game-Changing Announcements to Expect [2025]

- OpenAI Loses Cameo Trademark Case: What It Means for AI Companies [2025]

- YouTube and YouTube TV Outage: What Happened & How to Fix It [2025]

- Google I/O 2026: Dates, AI Announcements & What to Expect [2025]

![OpenAI & Reliance's JioHotstar AI Search Partnership [2025]](https://tryrunable.com/blog/openai-reliance-s-jiohotstar-ai-search-partnership-2025/image-1-1771513637671.jpg)