Open AI's $100B Funding Round: What You Need to Know

Open AI just became the most valuable private company in history. And honestly, the numbers are almost hard to wrap your head around.

We're talking about a

To put that in perspective, that's more than the entire market cap of most Fortune 500 companies. It's a valuation higher than Ford, GM, and IBM combined. It's the kind of number that makes you pause and wonder: what does this moment actually mean for AI, tech, and the broader economy?

I've been covering the AI space for years, and this funding round feels different. It's not just about the size of the check. It's about what it signals. It's about the confidence level from some of the smartest tech executives on the planet betting that Open AI is worth nearly a trillion dollars.

But here's where it gets interesting. Open AI's burning through cash at an extraordinary rate. The company needs this money just to keep the lights on while it races toward profitability. And the path to profitability? That's where things get complicated.

This article breaks down everything you need to understand about Open AI's mega-round. We'll dig into why the valuation keeps climbing, who's investing and why, what the economics actually look like, and what this means for the future of AI development. We'll look at the risks, the opportunities, and the unspoken reality about whether even an $850 billion valuation can justify Open AI's burn rate.

Let's start with the numbers, because they're staggering.

TL; DR

- Open AI is raising 850 billion, making it the most valuable private company ever

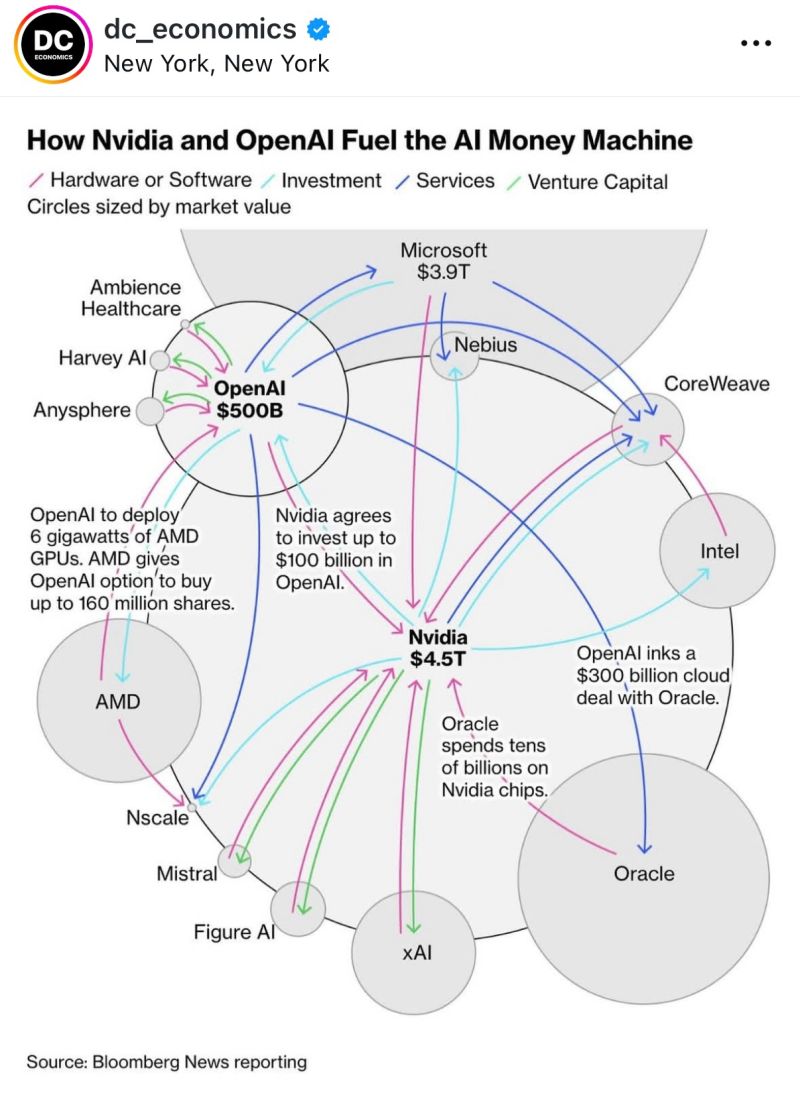

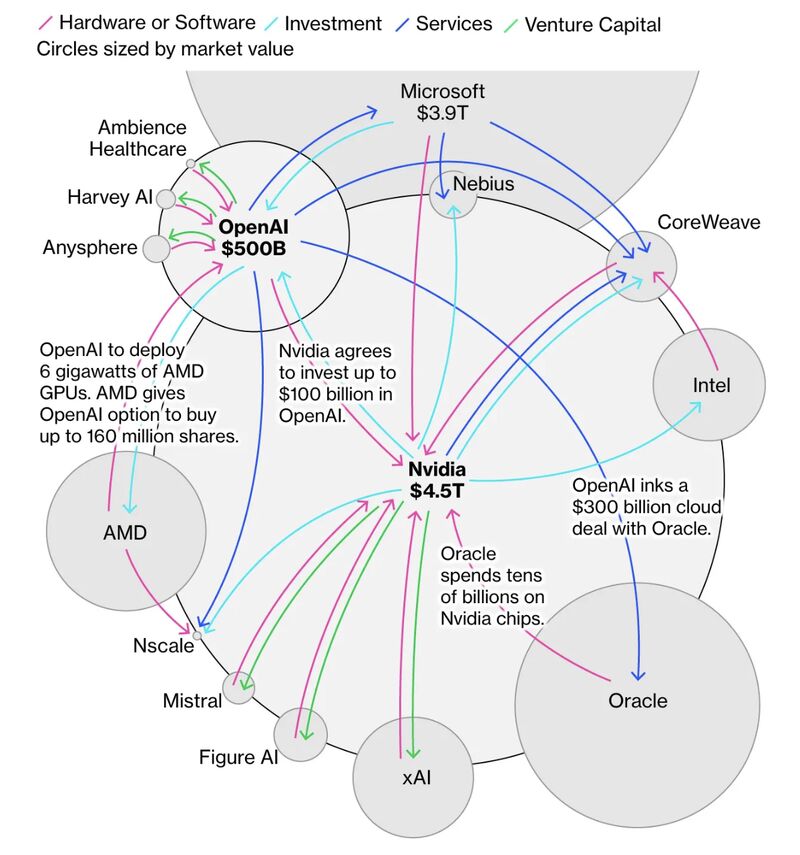

- Major investors include Amazon (up to 30 billion), Nvidia ($20 billion), and Microsoft

- **The pre-money valuation is 120 billion in valuation overnight

- Open AI is burning cash rapidly while racing to profitability through new revenue streams like ads in Chat GPT

- The deal signals extraordinary confidence in AI's market potential, though it raises questions about whether the valuation is justified by current revenue

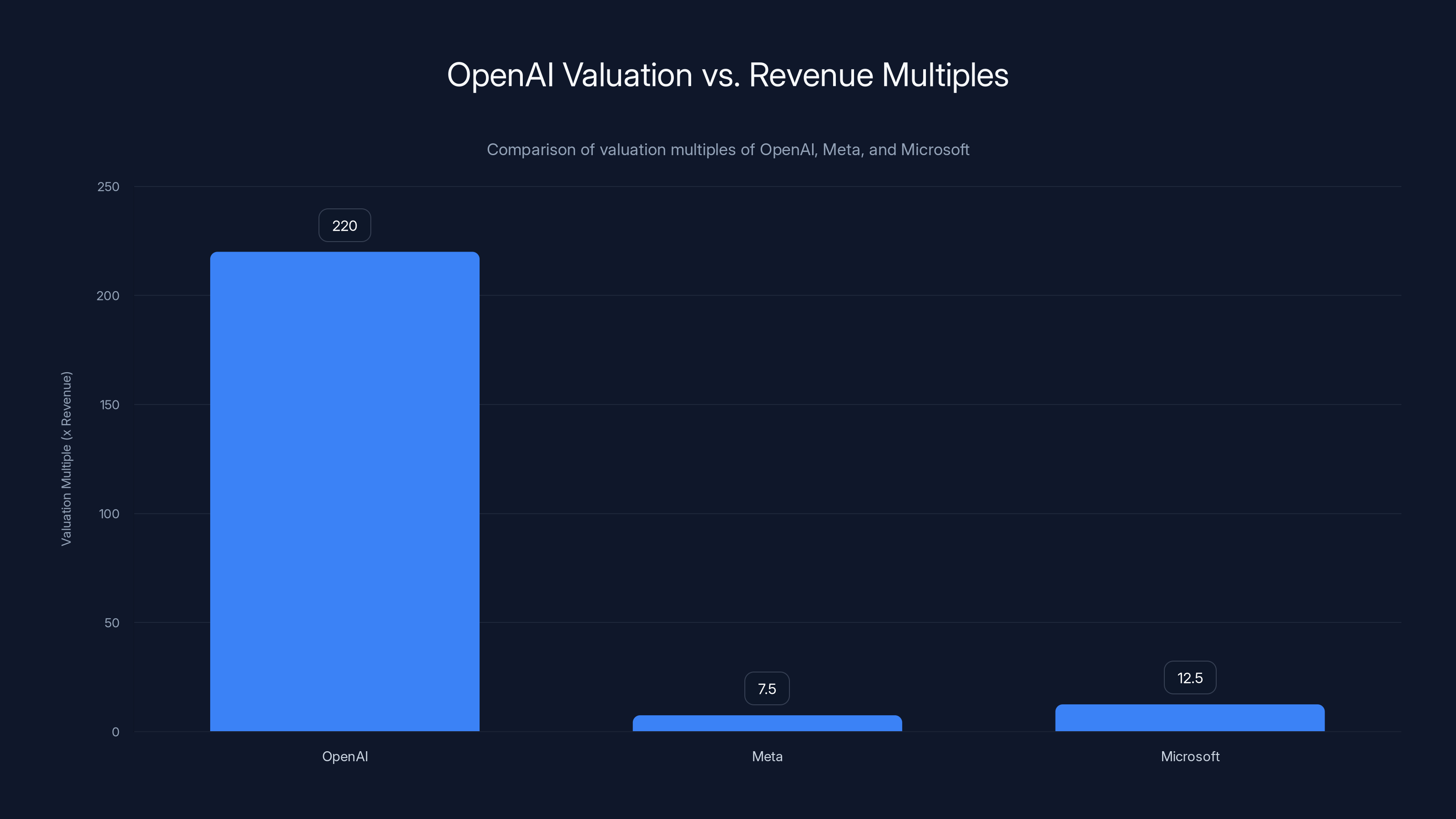

OpenAI's valuation is significantly higher relative to its revenue compared to Meta and Microsoft, with a multiple of 220x versus 7.5x and 12.5x respectively. Estimated data based on provided ranges.

How We Got Here: The Path to $850 Billion

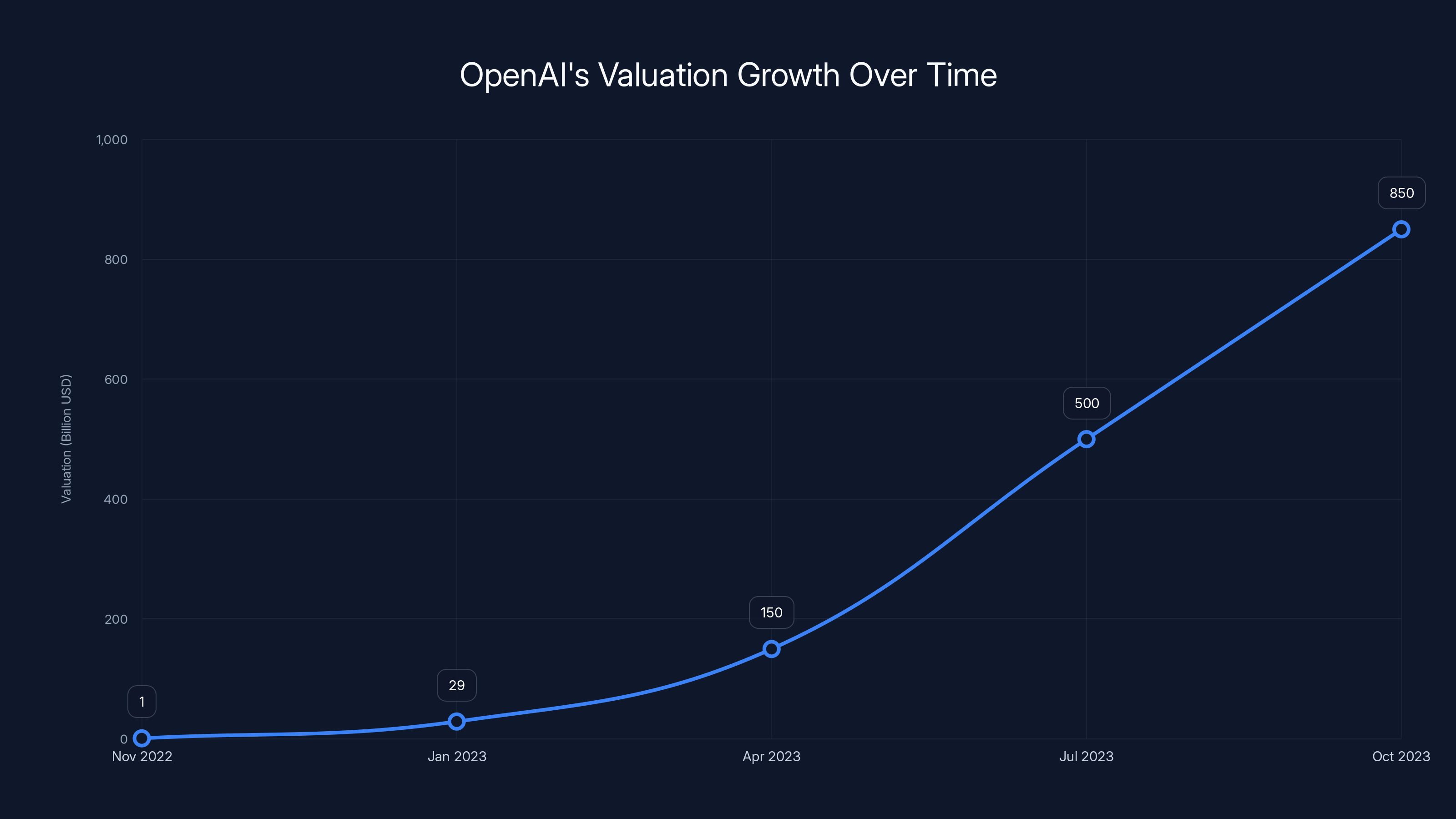

Open AI didn't wake up one day at $850 billion. This valuation is the result of a relentless climb over the past few years.

When Chat GPT launched in November 2022, nobody predicted what would come next. The AI boom hadn't happened yet. The world hadn't realized that large language models could actually do useful things at scale. But within weeks, Chat GPT had a million users. Within two months, it had 100 million users.

That explosive adoption changed everything. Suddenly, investors weren't asking if AI was going to matter. They were asking who would own the AI market. And in early 2023, the answer was obvious: Open AI.

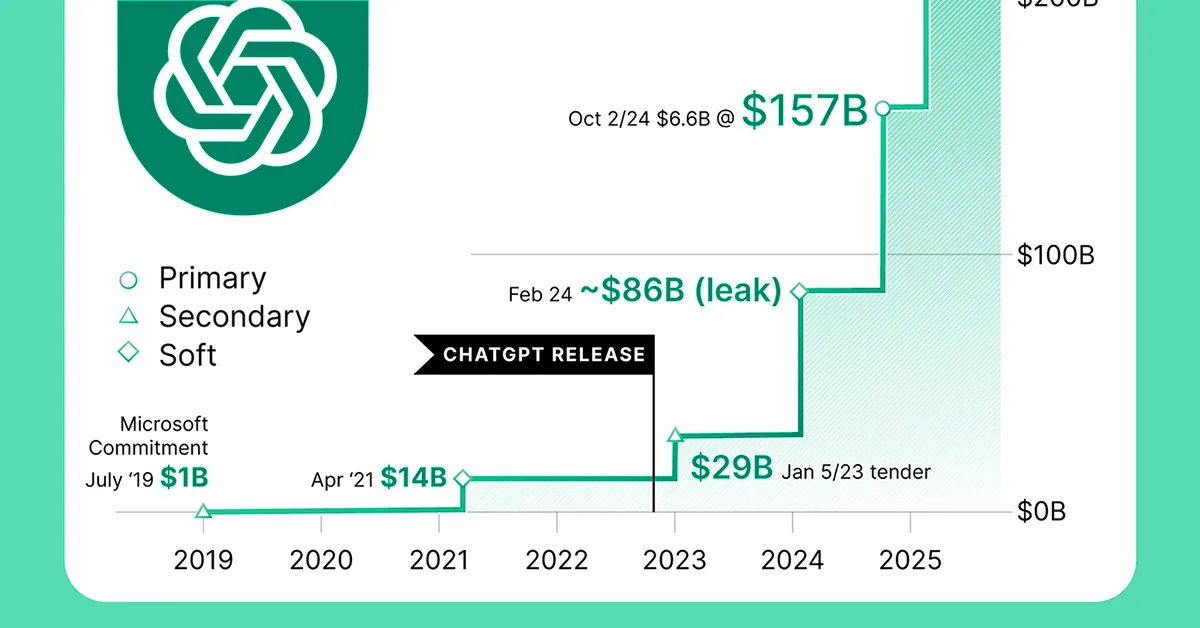

The company's valuation reflected that dominance. In early 2023, Open AI closed a funding round that valued the company at $29 billion. That felt enormous at the time. Less than two years later, the company is valued at nearly 30 times that amount.

What drove this astronomical climb? Several things happened simultaneously. Chat GPT didn't just become the fastest-growing application in history. It became a household name. Your mom heard about it. Your teenager was using it. It wasn't a niche product anymore.

Second, the competition arrived. Google released Gemini. Meta released Llama. Anthropic released Claude. Suddenly there were legitimate alternatives to Chat GPT. But none of them matched Open AI's brand recognition or user base. Open AI had first-mover advantage that turned into market dominance.

Third, enterprises started paying for AI. Companies realized they could use Chat GPT Plus for $20 a month. They could use the API for production use cases. They could fine-tune models for specific tasks. The consumer product that started as a research project turned into a real business.

And finally, investors realized that whoever controls the underlying model controls the future of knowledge work. If AI is going to automate anything, someone needs to build the models. If you want to be that someone, you need to be Open AI.

But here's the thing nobody wants to talk about too loudly: Open AI's burn rate is insane. Building and running these models costs staggering amounts of money. Every time someone uses Chat GPT, it costs Open AI money. Every inference uses GPU capacity that has to be purchased and maintained.

So in 2025, Open AI is at an inflection point. The company needs to prove that it can become profitable. That's where the new funding comes in. It's not just capital for growth. It's runway. It's time to figure out how to make money faster than the company burns it.

OpenAI's valuation surged from

The $100 Billion Check: Who's Investing and Why

Let's talk about the investors. Because the list of backers tells you a lot about the confidence level in this company.

Amazon is leading with up to

Why Amazon? Because Amazon understands that AI is going to be embedded in everything. And whoever provides the infrastructure for AI wins. Amazon Web Services already runs a huge portion of the AI ecosystem. By investing in Open AI, Amazon is ensuring that when Open AI's model becomes the standard for enterprise AI, AWS is the platform running it. That's a smart strategic move.

Soft Bank is putting in $30 billion. This is classic Soft Bank behavior. The company has a long history of making massive bets on technologies that could reshape industries. Soft Bank founder Masayoshi Son believes that artificial intelligence will be the most important technology of the 21st century. For him, this isn't even a question. It's inevitable that Open AI becomes hugely valuable. So you invest early and big.

Nvidia is committing $20 billion. Now, here's where it gets interesting. Nvidia makes the chips that train and run AI models. The more successful Open AI becomes, the more chips Nvidia sells to Open AI and its customers. So Nvidia is essentially investing in its own future revenue. It's a smart move, but it's also somewhat circular. Nvidia wins when AI grows. Open AI is one of the main drivers of AI growth. So of course Nvidia invests.

Microsoft is also in the deal, though the exact amount hasn't been fully disclosed. This is important because Microsoft already has a deep partnership with Open AI. Microsoft has invested billions in Open AI previously, and Microsoft's Azure cloud platform is tightly integrated with Open AI's infrastructure. Microsoft investing again signals confidence that this partnership is going to remain central to Microsoft's AI strategy.

Beyond these giants, the funding round includes participation from venture capital firms and sovereign wealth funds. These are the investors who see a potential 10x or 100x return on their capital. They're betting that an $850 billion valuation is actually cheap relative to what Open AI could be worth in five years.

The pre-money valuation is

Sounds great for insiders. But it also raises a question: is the valuation real, or is it just a number investors agreed to because they're all betting on AI's future potential?

The Profitability Problem: Why Open AI Needs This Money Now

Here's the uncomfortable truth about Open AI: the company is profitable on paper, but only because of how you count revenue.

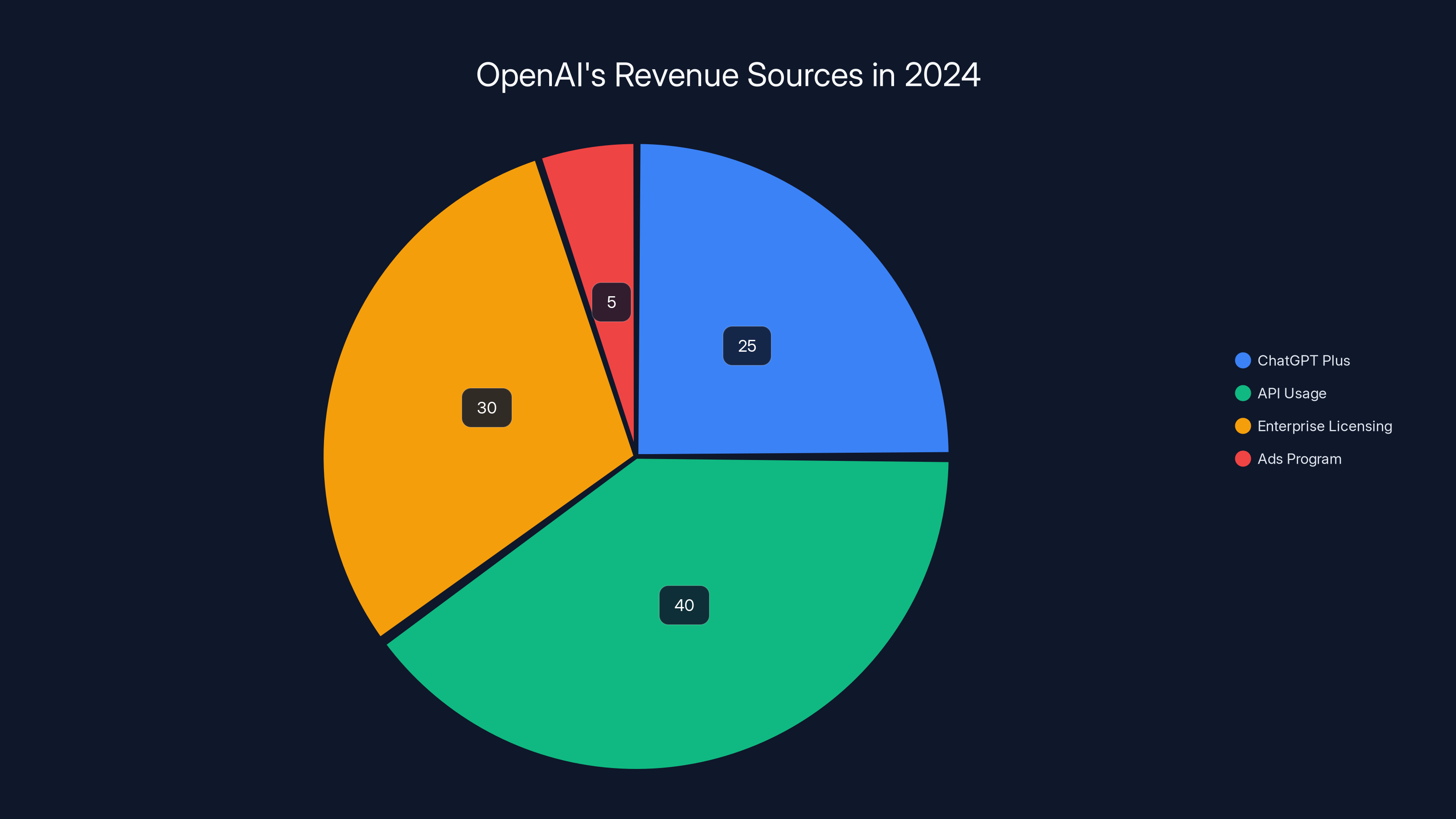

Open AI generates revenue from several sources. There's Chat GPT Plus, which is a $20-a-month subscription for consumers. There's the API, which enterprises use to build applications on top of GPT models. There's enterprise licensing agreements with large companies. There's also the newly launched ads program, which started testing in Chat GPT to see if free users will tolerate sponsored content.

Adding all this up, Open AI's 2024 revenue was estimated in the range of

But Open AI's costs are stratospheric. Running the infrastructure to power Chat GPT costs hundreds of millions every month. Computing costs. Data center costs. Research and development. Salaries for thousands of highly paid engineers and researchers. Total operating expenses are estimated to be close to revenue, with some analyses suggesting the company's cash burn is actually quite high when you account for all the capital expenditures.

In other words, Open AI is barely profitable right now, if at all. The company is at a critical juncture. It needs to either dramatically increase revenue or dramatically decrease costs. Preferably both.

This is where the ads initiative becomes crucial. Open AI is testing ads in Chat GPT for free users. The idea is that millions of people use Chat GPT every day for free. If even a small percentage of them see ads, that could add hundreds of millions in revenue annually.

But there's a risk. Chat GPT's free users are the moat. They're the reason Chat GPT has become so dominant. They use the platform daily, they build habits around it, and many of them convert to paying customers. If free users suddenly start seeing ads, some of them will leave. Some will pay for ad-free Chat GPT Plus. But some will just go use Claude or Gemini instead.

Open AI is betting that the revenue from ads exceeds the loss from users who churn to paid or to competitors. That's not guaranteed. It's a bet.

There's also enterprise licensing. Open AI can sell custom models, fine-tuned for specific industries, at premium prices. It can sell integration services where it helps enterprises deploy GPT models into their workflows. It can partner with companies across every industry to become their AI backbone.

But all of this requires time and execution. None of it is guaranteed. And while Open AI builds these new revenue streams, the company is still spending money at an incredible rate.

Estimated data shows that API usage and enterprise licensing are the largest revenue sources for OpenAI, while the ads program is a new and growing contributor.

Computing Costs: The GPU Elephant in the Room

Let's talk about the real constraint on Open AI's profitability: GPU costs.

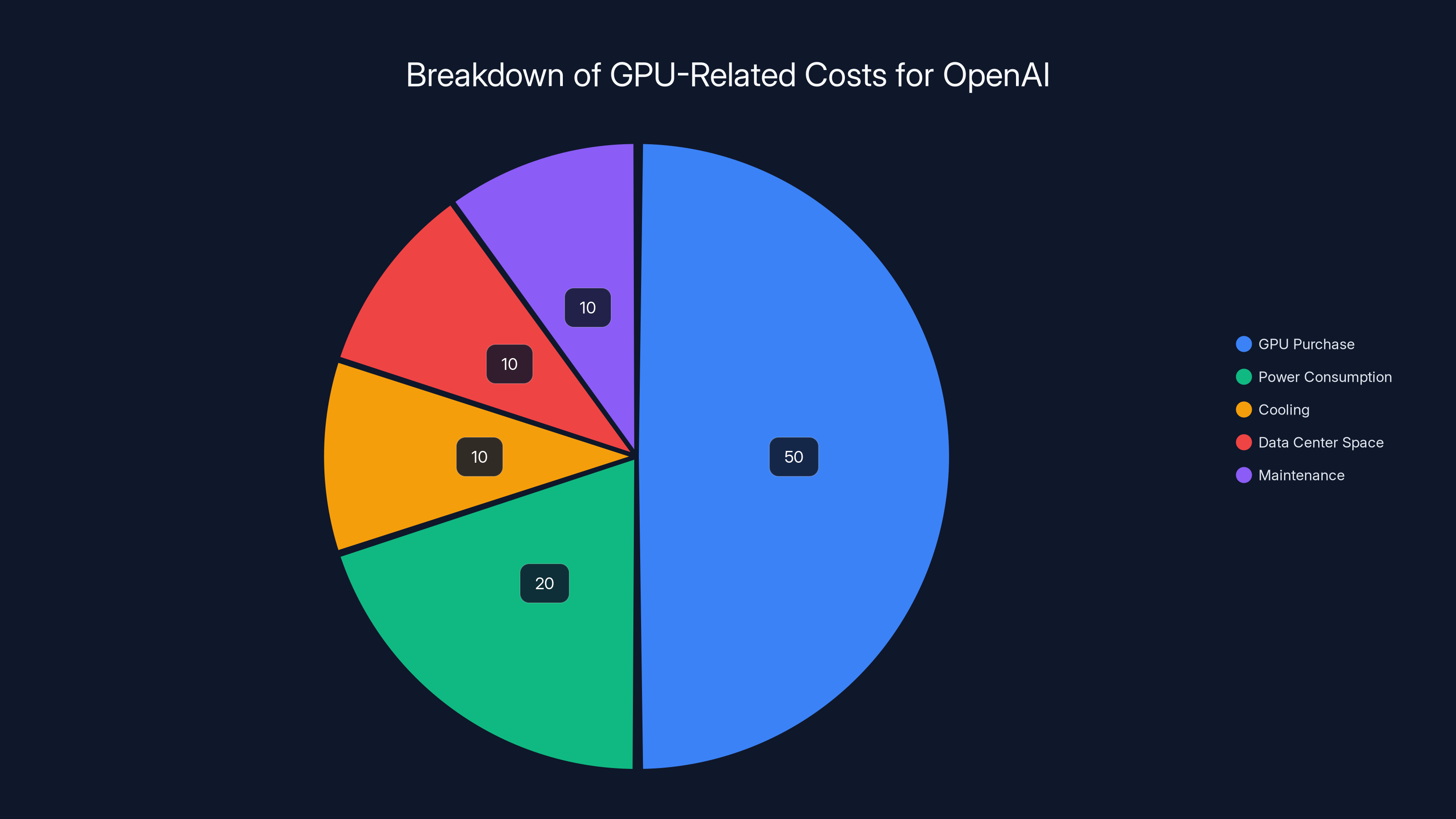

Training and running large language models requires specialized hardware. Mainly, it requires GPUs made by Nvidia. An Nvidia H100, one of the most advanced chips used for AI training, costs around

Do the math. If Open AI has 50,000 GPUs, that's

Every inference—every time a user types into Chat GPT and gets an AI response—costs fractions of a cent in compute. But those fractions add up fast when millions of people are using the service simultaneously.

The only way for Open AI to improve this economics is to either increase revenue per user or decrease the compute cost per inference. Increasing revenue is tough in a competitive market where users expect free access. Decreasing compute costs requires breakthroughs in model efficiency or hardware innovation.

Nvidia has been investing heavily in more efficient chips. Open AI and other AI labs are working on more efficient models. But these improvements take time. In the meantime, the company needs cash to keep the lights on.

This $100 billion is essentially a bet that either Open AI will solve this compute-cost problem, or revenue will grow so fast that it doesn't matter.

Who's Really Betting on What

It's worth understanding what each investor is really betting on.

Amazon is betting that AI becomes so important to enterprise computing that AWS becomes the default platform for running AI workloads. Amazon makes money when enterprises use AWS. So Amazon benefits whether Open AI succeeds or fails, as long as AI becomes central to business.

Nvidia is betting that GPU demand stays high or increases. Even if Open AI fails, Nvidia wins because other AI companies will buy chips. So Nvidia's bet is less risky than it appears.

Soft Bank is betting that Open AI becomes one of the most important technology companies in the world, and that the company will eventually have an exit event (acquisition, IPO) where the valuation multiplies further.

Microsoft is betting that being the closest partner to Open AI gives Microsoft advantages in the enterprise AI market. Microsoft sells the cloud infrastructure, the enterprise relationships, and the business applications where AI gets embedded. Open AI provides the AI capabilities. Together, they're stronger than either one alone.

Smaller investors are betting on pure venture returns. They think Open AI's worth will be

But the common thread: they're all betting that artificial intelligence matters. They're all betting that whatever Open AI builds next will be important. They're all betting that the $850 billion valuation is cheap relative to what's coming.

OpenAI needs to grow its revenue from approximately

The Valuation Question: Is $850 Billion Reasonable

Let's address the elephant in the room. Is Open AI actually worth $850 billion?

Depends on your framework. If you're valuing Open AI based on current revenue and earnings,

But venture capitalists don't value companies based on current metrics. They value companies based on future potential. The question isn't what Open AI is worth today. It's what Open AI will be worth in 2030.

And that's where the assumptions get aggressive. For an $850 billion valuation to make sense, you need to believe one or more of these things:

First, you need to believe that GPT models will become a fundamental technology layer in computing, similar to how databases or operating systems are today. If every company uses GPT models in their workflow, and Open AI gets a cut of every use, that's a multi-trillion-dollar market.

Second, you need to believe that Open AI will maintain or expand its market dominance. Chat GPT might have 100 million monthly active users today, but competitors are catching up. Google's Gemini is now good. Anthropic's Claude is excellent. Open-source models like Llama are getting better. If Open AI loses market share, the valuation gets cut in half at minimum.

Third, you need to believe that Open AI can achieve profitability at scale. This is the hardest assumption. It means solving the compute-cost problem, finding sustainable revenue streams, and doing both while competing in a field where the biggest tech companies in the world are also competing.

Fourth, you need to believe in continued AI breakthroughs. Investors are betting that AGI or something approaching it is coming, and that Open AI will build it. If AI progress slows or plateaus, the valuation is too high.

All of these assumptions could be correct. Or some of them could be wrong. That's what makes this valuation interesting and controversial.

From an investor's perspective, the question is probability-weighted. If you think there's a 20% chance Open AI becomes a

That math suggests paying something in the

But the counterargument is that this logic creates bubbles. Everyone is making the same bet. Everyone is assuming Open AI will dominate AI forever. What if that assumption is wrong?

The Competitive Landscape: Is Open AI Really Unbeatable

Here's something nobody wants to admit: Open AI doesn't have any sustainable competitive advantages. It has first-mover advantage and brand. But those can erode fast.

Google has infinite engineering talent and computational resources. If Google decides to go all-in on AI, Google can outcompete Open AI. In fact, Google already released Gemini 2.0, which is competitive with GPT-4 in many benchmarks.

Meta has open-sourced Llama, which is catching up to proprietary models. And Meta has a distribution advantage through billions of users on Facebook and Instagram.

Anthropic has Claude, which many developers prefer to Chat GPT because it's less prone to hallucination and more transparent about its limitations.

Chinese competitors like Baidu have models that are competitive in Chinese language tasks.

Open-source models are improving at an extraordinary rate. A year ago, open-source models were generations behind Chat GPT. Today, they're pretty close on many benchmarks. In another year, they might be ahead on many metrics.

So the competitive moat isn't as wide as Open AI's valuation assumes. The company has a brand and distribution advantage, but not a defensible technological moat.

This is why execution matters so much. Open AI needs to launch products and features that are so useful that users don't want to switch, even if alternatives exist. Open AI needs to build relationships so deep with enterprise customers that switching costs are prohibitively high. Open AI needs to move fast enough that competitors can't catch up.

That's possible. It's been done before. But it's not guaranteed. And the $850 billion valuation assumes not just that Open AI will succeed, but that it will dominate.

For OpenAI's $850 billion valuation to be reasonable, strong assumptions about GPT's role, market dominance, profitability, and AI breakthroughs are necessary. Estimated data based on narrative.

What This Means for AI Development and the Industry

Beyond Open AI, what does this funding round signal about the broader AI landscape?

First, it signals that investors believe AI is going to be huge. Like, transformative levels of huge. This much capital doesn't flow into an industry unless the investor class is convinced the upside is massive.

Second, it signals consolidation around a few key players. Open AI, Google, Meta, Amazon, and maybe a few others will be the dominant forces in AI. Smaller players will either get acquired, go out of business, or find narrow niches to dominate.

Third, it signals that talent is going to be heavily concentrated. Whoever can raise the most capital can hire the best people. And that creates a feedback loop where the biggest companies get bigger, smarter, and more capable.

Fourth, it signals that open-source is the underdog. When billions of dollars are flowing into proprietary models, open-source projects struggle for resources and funding. This round essentially bets that proprietary models (Open AI, Google, Anthropic) will beat open-source (Meta's Llama, community projects) in the long term.

Fifth, it signals that geopolitics matters. The U. S. wants American companies to win the AI race. China wants Chinese companies to win. Europe wants European companies to win. This funding round is partly strategic positioning in that competition.

All of this means the next few years are going to be critical. The companies that can execute on AI will be hugely rewarded. The ones that stumble will lose relevance fast. And the competitive dynamics will shape how AI gets deployed across the economy.

The Risk of Valuation Bubbles

It's worth being honest about this: Open AI's valuation could be part of a bubble.

Tech has a history of bubbles. The dotcom bubble saw companies valued in the billions with no clear path to profitability. The recent crypto bubble saw projects valued at billions despite having no real product. The current AI bubble could follow the same pattern.

Bubbles don't mean companies fail. Amazon's peak valuation during the dotcom era was inflated relative to its earnings, but Amazon survived and thrived. The question isn't whether the bubble will pop. The question is what happens to the companies inside when it does.

If Open AI's valuation compresses from

On the other hand, if Open AI's valuation is truly detached from fundamentals, and the company can't prove it can be profitable at scale, the correction could be much more severe.

The key question is: what metrics should we monitor to determine if the valuation is justified?

Revenue growth is first. If Open AI's revenue is still in the

Profitability is second. Open AI doesn't need to be hugely profitable, but it needs to demonstrate that profitability is possible at scale. If the company is losing money or barely breaking even in 2026, investors will start to worry.

Market share is third. If Chat GPT is still gaining users and competitors are not closing the gap, the valuation is justified. If competitors are gaining share and Chat GPT growth is slowing, the valuation needs to compress.

These are the real tests. Not the hype. Not the headlines. The fundamentals.

GPU purchase costs account for about 50% of total GPU-related expenses for OpenAI, with power consumption and other operational costs making up the remainder. (Estimated data)

What Open AI Will Do With $100 Billion

So what's Open AI going to do with all this money?

First, infrastructure. Open AI needs to expand its computational capacity to support more users and more advanced models. That means buying more GPUs, building more data centers, and expanding globally to reduce latency.

Second, R&D. Open AI needs to keep pushing the boundaries of what's possible with AI. The company needs to work on next-generation models, new architectures, new training techniques. This funding gives Open AI the resources to compete with Google's research budget.

Third, product development. Open AI will build new products and features. Chat GPT is just the beginning. The company will likely launch new applications for different markets and use cases. Think Chat GPT for sales, Chat GPT for code, Chat GPT for medicine.

Fourth, talent. Open AI will use this funding to hire more researchers, engineers, and business people. In the AI market, talent is the constraint. The more smart people you can hire, the more you can accomplish.

Fifth, international expansion. Chat GPT is mainly used in the U. S. and Europe. Open AI will expand in Asia, Latin America, and other regions. This means localizing products, building partnerships, and adapting to local regulations.

Sixth, strategic acquisitions. Open AI might acquire smaller AI companies, teams, or technology. This is faster than building from scratch and gets you specialized talent and capabilities quickly.

All of this makes sense. The money is basically giving Open AI a war chest to compete, innovate, and expand globally. It's insurance that Open AI won't run out of capital while building the future of AI.

The Path to Profitability

Here's what needs to happen for Open AI's $850 billion valuation to look reasonable in hindsight.

First, the company needs to reach $10-20 billion in annual revenue within three years. That's a roughly 3-5x increase from current levels. It's ambitious but not impossible if ads, enterprise licensing, and new products gain traction.

Second, the company needs to achieve 20-30% operating margins. This is tougher because compute costs are high. But as models become more efficient and compute costs decrease, margins should improve.

Third, the company needs to demonstrate that it can maintain or expand market share against competitors. This means continuous innovation, superior products, and strong brand loyalty.

Fourth, the company needs to solve the compute-cost problem. Either through more efficient models, cheaper hardware, or better algorithms. If compute costs stay high, profitability at scale becomes much harder.

If Open AI executes on all of these, the $850 billion valuation starts to look cheap. If the company fails on any of them, the valuation is too high.

The next two years will be decisive. This is when Open AI will either prove it can be a durable, profitable, world-changing company, or when it will be exposed as a company riding a wave of hype that will eventually crash.

Based on what I know about Open AI's team, ambition, and resources, I lean toward the former. But I'm not certain. Nobody should be.

Implications for the Broader Economy

Open AI's valuation matters beyond just the company. It has implications for how capital flows, how technology gets built, and how the future gets shaped.

First, it signals that AI is now a foundational investment category. Billions of dollars will flow into AI companies. This will accelerate AI development, but it also means resources get concentrated in a few large players rather than distributed among many smaller teams.

Second, it means the U. S. is investing heavily in maintaining AI dominance. American investors are betting that American companies will control the future of AI. This is a strategic bet, not just a financial one. It affects national competitiveness and geopolitics.

Third, it means workers need to adapt. If AI is going to be as transformative as investors believe, then millions of jobs will change or disappear. Society needs to prepare for that transition.

Fourth, it means regulation matters. Governments need to figure out how to regulate AI companies without stifling innovation. This is a hard problem. But the stakes are high enough that we can't ignore it.

Fifth, it means education is critical. If AI becomes as important as electricity, we need to teach people how to work with AI, think about AI, and prepare for an AI-driven economy. That starts with education.

Open AI's $100 billion funding round is more than just a business transaction. It's a bet on the future of intelligence, automation, and human capability. The outcome of that bet will shape the next decade.

Comparing Open AI's Valuation to Other Tech Giants

Let's put the $850 billion valuation in context.

As of early 2025, Open AI's valuation is higher than Meta, higher than Nvidia, and approaching Microsoft's market cap. For a company that was founded just eight years ago and has only been profitable for a couple of years, that's extraordinary.

Meta is valued at around

Nvidia is valued at around $1.5-2 trillion, but Nvidia actually generates profits. Lots of them. Nvidia's high valuation is justified by the company's ability to print money.

Microsoft is valued at around $3 trillion, but Microsoft also generates hundreds of billions in revenue and tens of billions in profit every year.

Open AI, by contrast, has maybe $3.5-4 billion in revenue and is barely profitable. So on a revenue multiple basis, Open AI is valued at 200-240x revenue, while Meta is valued at 5-10x revenue, Nvidia at maybe 80-100x revenue, and Microsoft at 10-15x revenue.

This tells you that Open AI's valuation is entirely dependent on future growth. Not on what the company is today, but on what investors believe it will become.

Is that reasonable? Maybe. If Open AI grows revenue 50% year-over-year for five years, it could be at

But it's a bet. A big bet. If revenue growth slows or plateaus, the valuation will need to compress.

Key Uncertainties and Risks

Let's be clear about what could go wrong.

First, competition could intensify faster than expected. Google, Meta, and Anthropic are all building competitive AI models. If the pace of innovation accelerates, Open AI's advantages could erode. If a competitor launches something significantly better, Open AI's business suffers.

Second, regulation could hit harder than expected. Governments are increasingly concerned about AI. If countries pass regulations that restrict what AI companies can do, that directly impacts business. It also increases compliance costs.

Third, the hardware situation could tighten. GPUs are in short supply. If Nvidia can't scale production, compute costs stay high. If geopolitical tensions escalate and countries restrict semiconductor exports, compute becomes even scarcer.

Fourth, the AI bubble could burst. Valuations are stretched. If that becomes obvious, capital dries up. Suddenly, the venture investors funding AI companies start asking for returns. Pressure on profitability increases. Some companies fold.

Fifth, breakthrough AI could come from an unexpected direction. What if the next major advance in AI comes from an open-source project rather than a proprietary lab? What if a startup in another country makes a breakthrough that shifts the competitive landscape?

Sixth, users could reject ads in Chat GPT. If the ad experiment tanks, that revenue stream doesn't materialize. Open AI needs new sources of revenue to justify the valuation.

Seventh, the compute-cost problem could prove harder to solve than expected. If models don't become more efficient, and hardware costs don't decrease, Open AI's margins will be permanently capped.

Any of these could happen. Probably some of them will. The question is whether Open AI's team can navigate these risks and still come out on top.

Strategic Implications for Different Companies

Open AI's funding round has ripple effects across the tech industry.

For Amazon, it's about ensuring that Open AI stays on AWS. Amazon benefits when customers use AWS. By investing, Amazon locks in that relationship.

For Microsoft, it's about maintaining the closest partnership with Open AI. Microsoft has already bet billions on Open AI. This new funding makes the partnership even deeper.

For Google, it's a wake-up call. Google has been defensive about AI, worried about cannibalizing search. But Open AI's success shows that being cautious isn't enough. Google needs to move faster and more aggressively.

For Anthropic, it's a competitive signal. Anthropic raised

For Meta and other open-source advocates, it's proof that open-source models are valuable but that proprietary models have advantages in terms of capital, distribution, and brand.

For startups, it's a mixed message. The capital available for AI is enormous. But the winners get bigger, faster. If you're a small AI startup, you're either acquired or you find a niche where you can survive the competition.

What This Means for Users

Final point: what does this funding round mean for the actual users of Open AI's products?

In the short term, probably not much. Chat GPT continues to work the way it always has. The user experience doesn't change.

But over time, this funding means:

New features will roll out faster. Open AI will have resources to build new products, new capabilities, new ways to interact with AI.

Ads might come to the free tier. Open AI is testing ads to generate revenue. If that works, free users will see advertising. That's a trade-off: better products, but less privacy and more interruptions.

Pricing could change. Open AI might experiment with different pricing models. The company might launch new tiers with different features at different prices.

Global availability will expand. Open AI will work on launching in more countries and supporting more languages. This is important for adoption and market share.

Accuracy and capabilities will improve. With more resources for research, Open AI can build better models with better performance, fewer hallucinations, and more safety safeguards.

Integrations will deepen. Open AI will work on integrating Chat GPT deeper into other software, making it more central to how people work.

Basically, this funding accelerates the trajectory that was already happening. Open AI becomes more powerful, more ubiquitous, and more central to how people work. For most users, that's good. Better products, more features, broader access.

For some users, it's concerning. The more powerful Open AI becomes, the more influence it has over how information is presented and how decisions are made. That raises questions about responsibility, bias, and power that society will need to grapple with.

Conclusion: The $850 Billion Question

Open AI is now the most valuable private company in the world. At $850 billion, the company is valued higher than most of the Fortune 500. The funding round signals extraordinary confidence from the smartest investors in tech.

But extraordinary valuation comes with extraordinary expectations. Open AI needs to execute flawlessly. The company needs to maintain its technological lead, expand revenue rapidly, achieve profitability at scale, and fend off competitors who are getting smarter every day.

Is the $850 billion valuation justified? That depends on whether Open AI becomes one of the most important companies in the world over the next decade. If the company does, the valuation will look cheap in hindsight. If it doesn't, the valuation is a bubble.

My take is that Open AI has a genuine shot at being hugely important. The team is talented. The product-market fit is clear. The capital position is now fortress-like. But "having a shot" and "being guaranteed to succeed" are different things.

The next two years will be decisive. Watch Open AI's revenue growth. Watch whether the ads experiment works. Watch whether competitors catch up. Watch whether the company solves the compute-cost problem. These are the metrics that will determine whether this valuation is visionary or delusional.

For now, the

Time will tell if that bet pays off.

FAQ

What is Open AI's new valuation?

Open AI is being valued at approximately

Why is Open AI raising $100 billion?

Open AI is raising $100 billion primarily to fund infrastructure expansion, research and development, and international growth. The company is burning through cash rapidly due to high computational costs associated with training and running large language models. This funding provides a significant runway for the company to reach profitability while continuing to innovate and compete against other AI companies.

Who are the main investors in Open AI's funding round?

The major investors include Amazon (committing up to

How does Open AI's valuation compare to other tech companies?

Open AI's

What are Open AI's main revenue streams?

Open AI generates revenue from several sources: Chat GPT Plus (a $20-per-month subscription), API access for developers and enterprises, enterprise licensing agreements with large companies, and a newly launched advertisement program being tested in Chat GPT's free tier. The company is also exploring additional revenue opportunities through partnerships and custom model development for specific industries.

Is Open AI profitable?

Open AI is barely profitable or likely break-even on a cash basis when you account for all operating expenses and capital requirements. While the company reports profitability, its actual cash burn is likely substantial due to high infrastructure costs. The company needs to significantly increase revenue or decrease costs to achieve meaningful profitability at scale. This is why the $100 billion funding round is critical—it gives Open AI time to solve the profitability problem before capital becomes constrained.

What are the risks to Open AI's $850 billion valuation?

Several risks could impact the valuation: intensifying competition from Google, Meta, and Anthropic; stricter government regulation of AI; supply chain constraints in semiconductor production; the AI bubble bursting as valuations are questioned; breakthrough innovations from unexpected competitors; user rejection of advertisements; and difficulty solving the high compute-cost problem. Any combination of these could force the valuation to compress significantly.

How will Open AI use the $100 billion?

Open AI will likely use the funding for infrastructure expansion (more data centers and GPUs), research and development of next-generation models, product development and new features, hiring top talent, international expansion, and strategic acquisitions. The money essentially gives Open AI the resources to invest aggressively while working toward profitability.

What does this funding round mean for AI adoption?

The funding round signals that investors believe AI will become foundational to business and society. It will accelerate AI development and deployment across industries, but it also consolidates resources among large players. This means continued rapid innovation, but also increasing concentration of power in a few dominant companies. For users, it means better AI products and features, though potentially with advertising and privacy trade-offs.

How long will the $100 billion last?

Based on Open AI's estimated annual burn rate, the $100 billion could last three to five years, depending on how fast the company grows revenue and how aggressively it invests in infrastructure and R&D. However, if Open AI reaches profitability during this period (which is the goal), the runway extends much longer. The funding is meant to provide sufficient runway for the company to transition from a cash-burning startup to a self-sustaining business.

Looking to streamline workflows and automate content generation across your organization? Consider how AI-powered automation platforms like Runable can help teams create presentations, documents, and reports in minutes rather than hours. With Runable's AI agents starting at just $9/month, you can focus on strategy while automation handles content creation.

Key Takeaways

- OpenAI closed a 850 billion valuation, making it the most valuable private company ever

- Major investors Amazon, SoftBank, Nvidia, and Microsoft are betting on OpenAI's ability to dominate the AI market for decades

- OpenAI's current revenue of 850B valuation and reach profitability

- Significant risks include intensifying competition from Google, Meta, and Anthropic, plus uncertainty around compute cost economics

- The next 2-3 years will determine if this valuation is visionary or bubble-priced based on revenue growth and market share retention

Related Articles

- Google I/O 2026: 5 Game-Changing Announcements to Expect [2025]

- Why Divvy's $1B Exit Left Founders With Nothing: The Debt & Cap Table Truth [2025]

- Sarvam AI's Open-Source Models Challenge US Dominance [2025]

- RentAHuman: How AI Agents Are Hiring Humans [2025]

- Google I/O 2026: Dates, AI Announcements & What to Expect [2025]

- Thrive Capital's $10B Fund: What It Means for AI and Venture Capital [2026]

![OpenAI's $100B Funding Round: $850B Valuation Explained [2025]](https://tryrunable.com/blog/openai-s-100b-funding-round-850b-valuation-explained-2025/image-1-1771517338535.jpg)