When Your Public Health Hero Becomes Tabloid News: The Peter Attia Controversy

You wake up on a Friday morning, scroll through your news feed, and see the name of someone you've admired for years splashed across major headlines. That's what happened to thousands of people in early February 2025 when Dr. Peter Attia's name surfaced in over 1,700 documents related to convicted sex offender Jeffrey Epstein. It's a stark reminder that public figures—no matter how accomplished or influential—aren't immune to controversy.

But this story isn't just about scandal. It's a complex intersection of Silicon Valley dynamics, longevity medicine, business reputation, and how quickly corporate relationships can collapse when controversy hits. It raises serious questions about due diligence, institutional accountability, and the relationship between celebrity doctors and venture capital.

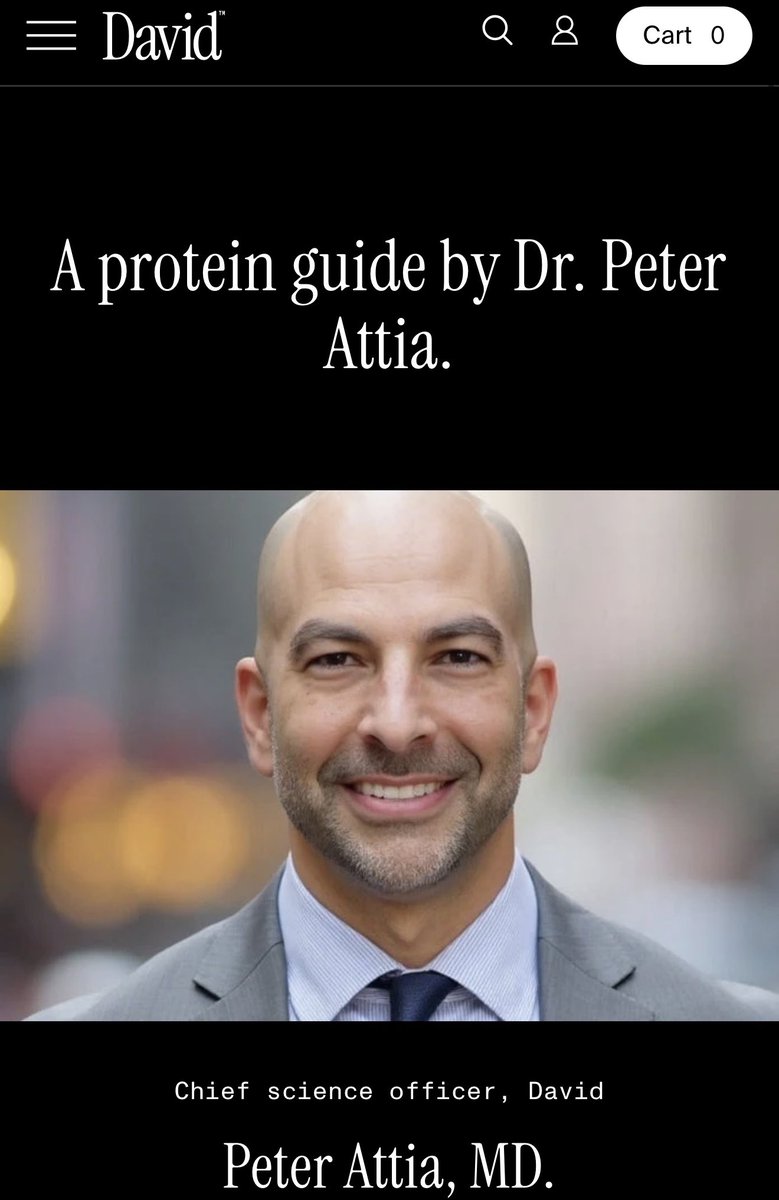

Peter Attia built an empire on the promise of living longer, healthier lives. His bestselling book "Outlive," his seven-year-old podcast with millions of listeners, and his media appearances all positioned him as a trusted voice in preventive health. Then, in a matter of days, he went from Silicon Valley golden boy to a name companies couldn't distance themselves from fast enough.

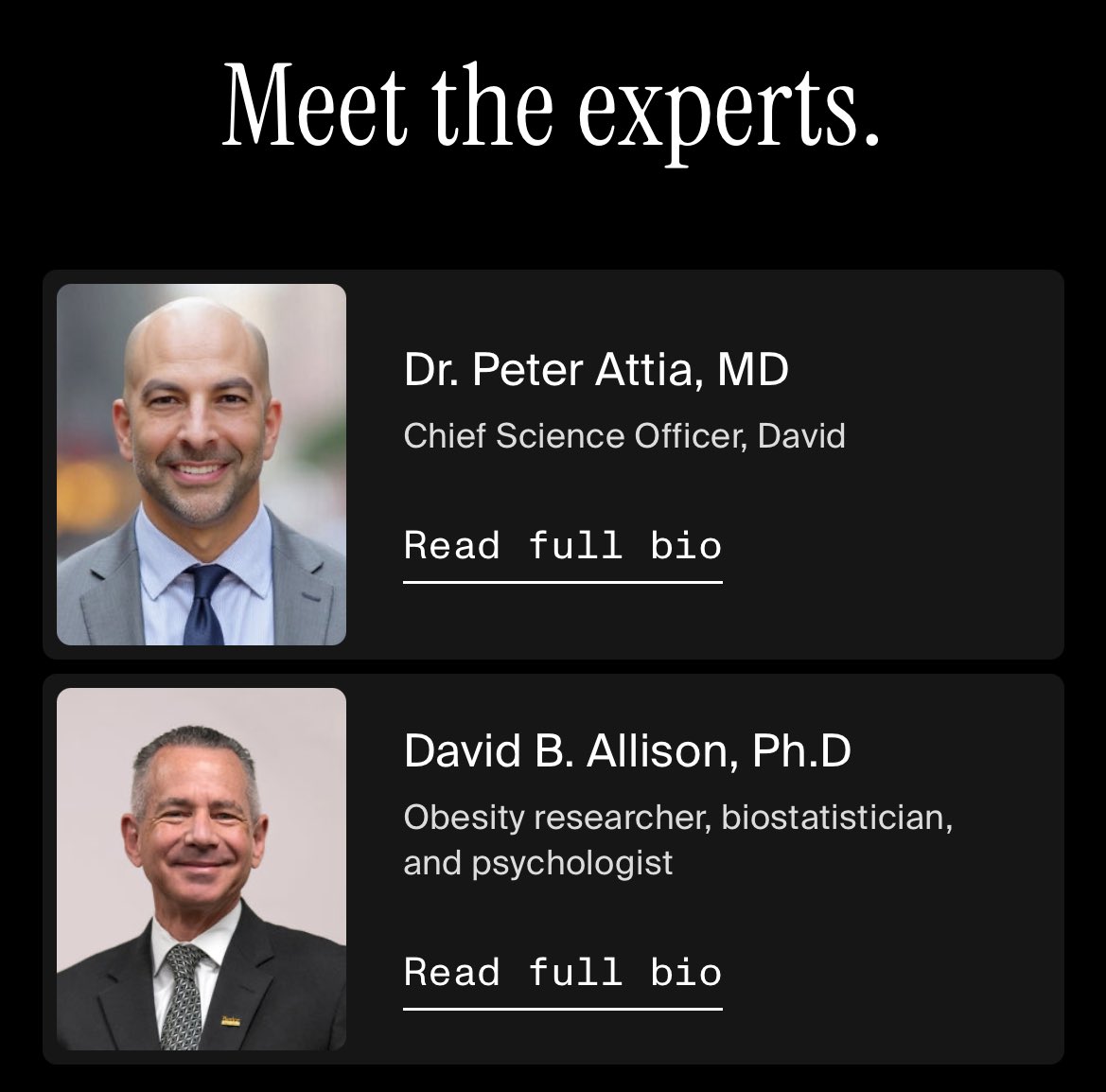

The fallout reveals something darker about how quickly reputational damage cascades through interconnected businesses. David Protein announced his departure as Chief Science Officer. Biograph, the longevity startup he co-founded, began scrubbing his name from its website. Major media outlets that had featured him suddenly faced uncomfortable questions about their editorial standards.

What makes this situation particularly interesting isn't just the drama—it's what it tells us about how venture-backed companies handle crisis management, how longevity medicine as an industry is perceived, and what happens when a founding team member becomes toxic to the brand. This article dives deep into every angle of this unfolding story, examining the business implications, the industry context, and the lessons for entrepreneurs and investors.

TL; DR

- Epstein Connection: Dr. Peter Attia's name appeared in 1,700+ Epstein documents released in February 2025, leading to immediate corporate distancing

- David Protein Impact: The protein bar startup announced Attia's departure as Chief Science Officer just days after the revelations

- Biograph Fallout: His longevity startup co-founded with John Hering began removing him from the website and declined to comment on his status

- Business Implications: The incident demonstrates how quickly corporate partnerships can dissolve and the value of reputation insurance in venture deals

- Longevity Industry: The controversy raises questions about due diligence practices in health tech startups and celebrity endorsement risk assessment

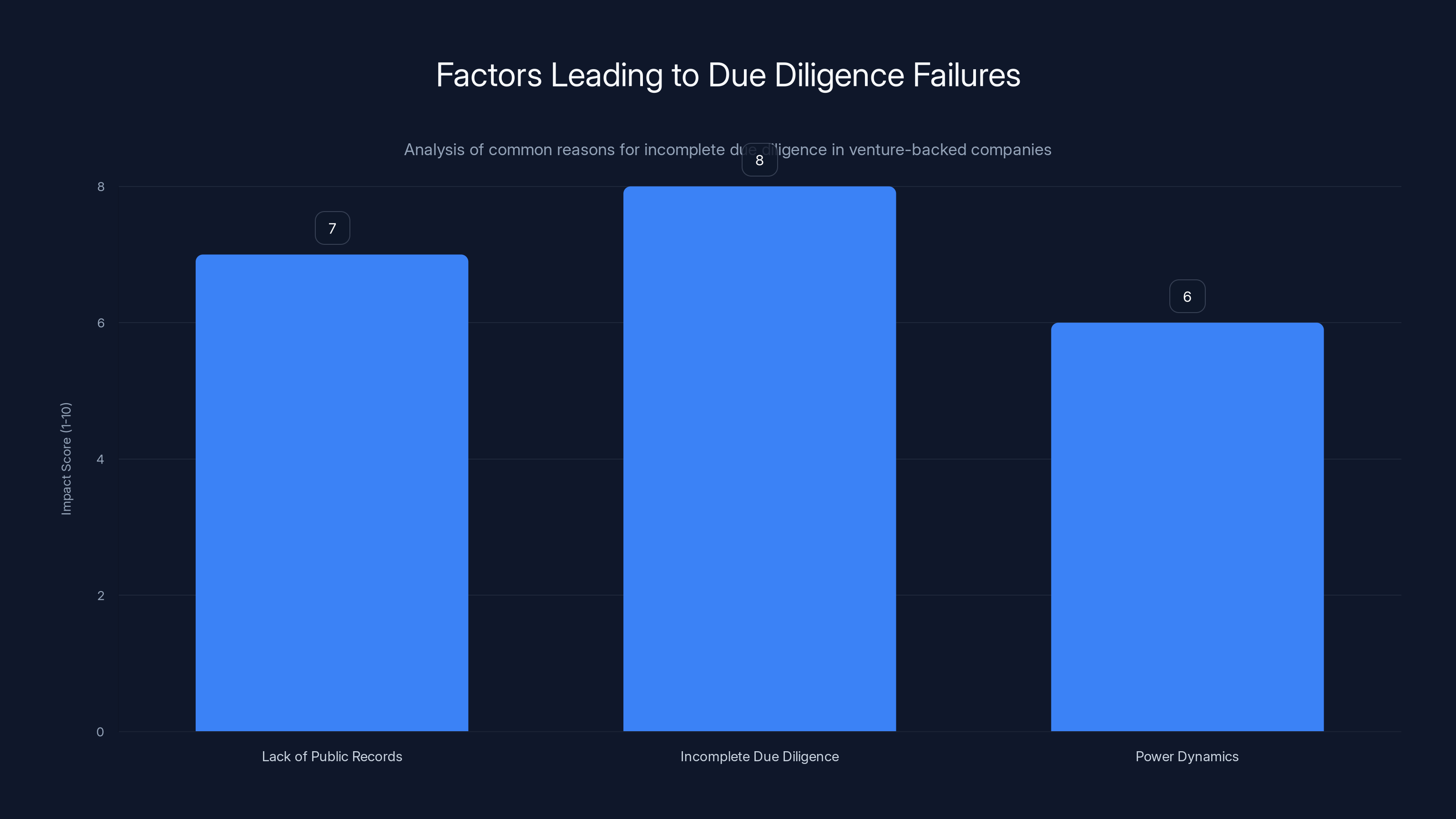

Estimated data shows that incomplete due diligence and lack of public records are major factors leading to due diligence failures, with power dynamics also playing a significant role.

Understanding Peter Attia: Rise of a Longevity Influencer

From Doctor to Digital Personality

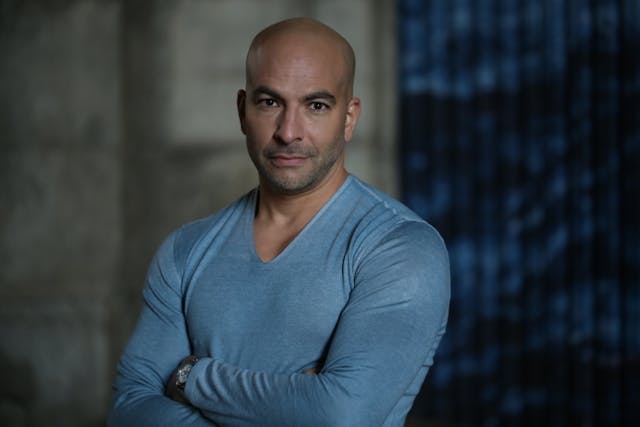

Peter Attia didn't start out as a household name. He's a Canadian-American physician who trained in emergency medicine and surgery before pivoting to what he calls "medicine for the healthy." This shift—from treating sick people in emergency rooms to helping healthy people stay healthier—represents a fundamental reorientation in how he approaches medicine.

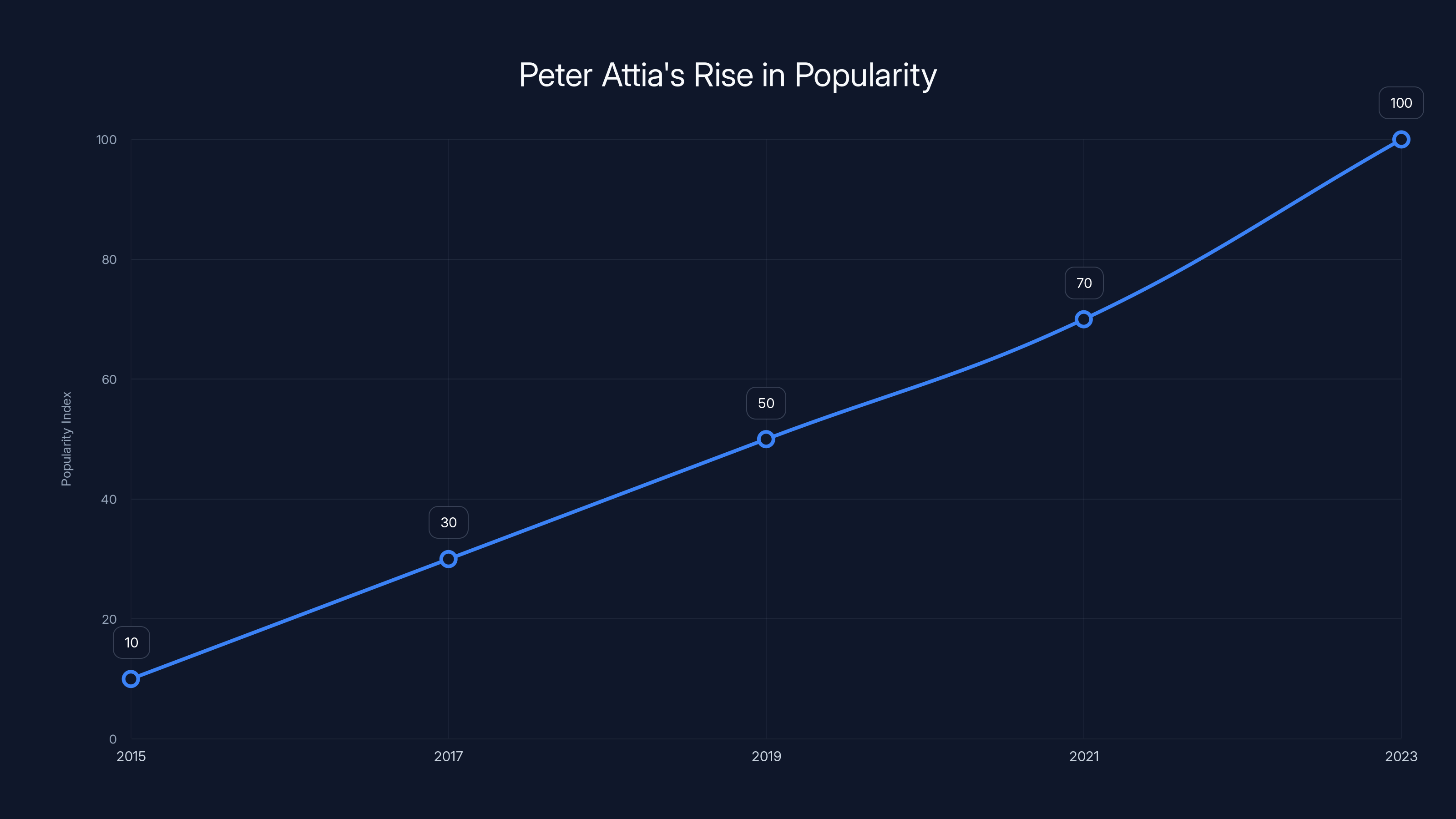

His path into prominence wasn't unusual for the modern era. He started writing on Medium, then expanded to podcasting. By 2022, his podcast had become one of the most popular health-focused shows in the world, attracting millions of listeners interested in longevity, sleep optimization, exercise science, and metabolic health. The audience skewed heavily toward affluent, educated listeners interested in self-optimization.

In 2023, he published "Outlive: The Science and Art of Longevity," which became a bestseller. The book synthesized years of his research, conversations with other experts, and practical advice for living longer. It became required reading in certain Silicon Valley circles, where the pursuit of lifespan extension has become almost religious in intensity.

Attia's credibility came from several sources. He had legitimate medical training and credentials. He appeared to do genuine intellectual work on his podcast, interviewing researchers, discussing methodologies, and admitting uncertainty. He didn't oversell miracle cures or questionable supplements. He seemed thoughtful, evidence-based, and humble about what we don't know about longevity.

Building a Business Around Longevity

But being a successful podcaster and author isn't just about content quality. It's about building a brand that extends into multiple revenue streams. For Attia, that meant co-founding Biograph with entrepreneur John Hering in 2024.

Biograph positioned itself in the growing concierge medicine market, offering premium preventive health services. The company came out of stealth with significant backing from venture investors including Vy Capital, Human Capital, Alpha Wave, and Wndr Co. Angel investors included Balaji Srinivasan, a well-known tech entrepreneur and investor.

The business model made sense on paper. Wealthy individuals increasingly want personalized health optimization services. Concierge medicine practices charge high fees—typically between

Attia's name and reputation were assets for the company. Having a well-known longevity physician as co-founder provided credibility, attracted media attention, and helped with recruitment of other talented doctors. This is standard venture capital logic: celebrity founders and advisors increase the perceived value of a company.

The David Protein Connection

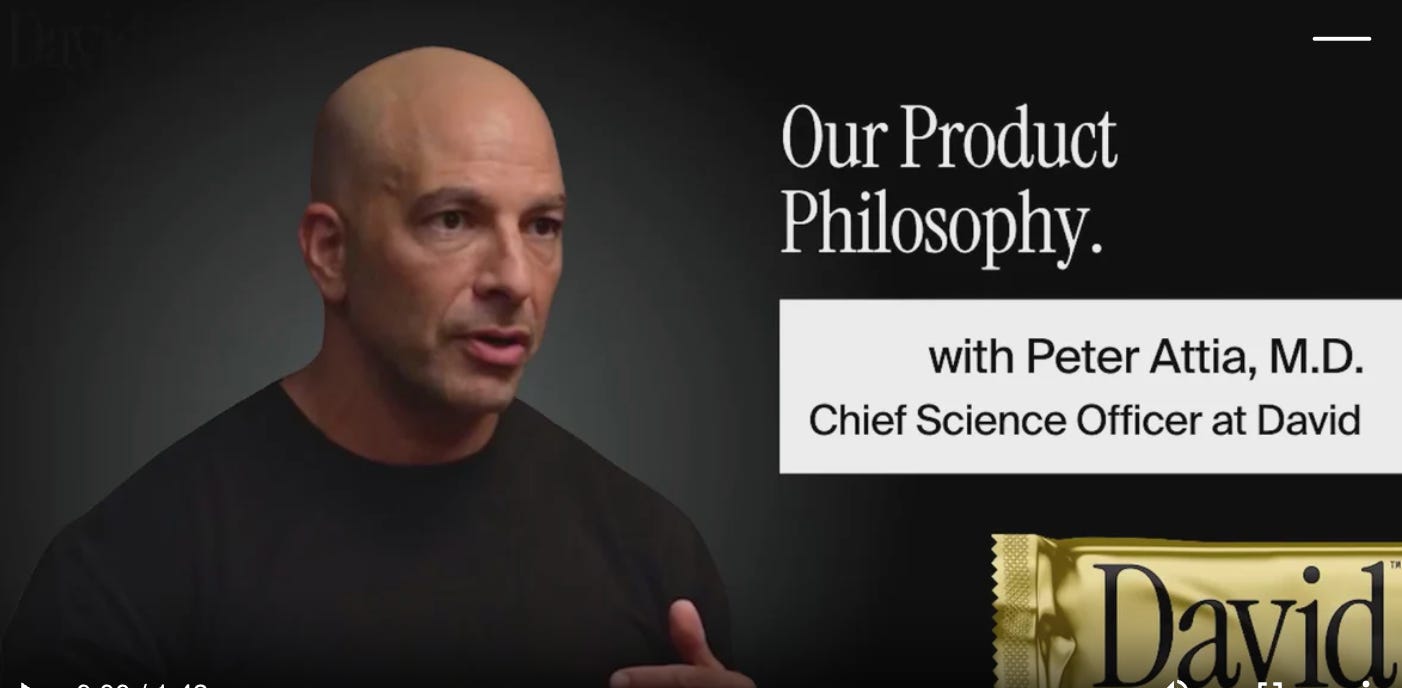

Attia's involvement with David Protein came separately but followed a similar pattern. David Protein is a company founded to sell high-protein nutrition bars. It's a straightforward CPG (consumer packaged goods) business operating in a crowded market.

In May 2024, David Protein raised a $75 million Series A round led by Greenoaks, with participation from Valor Equity Partners. The company claimed significant traction with its flagship product, which launched in September 2024 and marketed itself as having 28 grams of protein, zero sugar, and only 150 calories.

Attia served as Chief Science Officer and early investor. For David, this made business sense. Attia's podcast audience, book readers, and general media presence represented a built-in marketing channel. Millions of people who listened to his health and longevity advice would see his involvement with the company as an endorsement.

He also provided what appeared to be legitimate value: nutritional expertise, scientific credibility, and connections in the health and fitness space. It's the kind of relationship that Silicon Valley encourages—the intersection of credibility and marketing.

Peter Attia's popularity has grown significantly from 2015 to 2023, driven by his podcast and bestselling book. (Estimated data)

The Epstein Documents: What Changed in 48 Hours

The February Release and Media Coverage

On Friday, February 3, 2025, a massive cache of documents related to the Epstein case became public. These weren't new evidence of crimes—Epstein had already been convicted and had died in prison in 2019. Instead, the release contained over 1,700 documents from civil litigation, including depositions, email correspondence, and other materials that had been sealed.

The document dump was not focused on any particular individual. It was a broad release meant to provide transparency and allow people mentioned in the documents to see what was said about them. Major news outlets like NBC News covered the release extensively, helping readers understand what the documents revealed.

Peter Attia's name appeared in these documents in email correspondence. Without going into specifics that would require legal analysis, the documents reportedly contained crude or inappropriate content from their communications. Attia's name wasn't previously unknown to be connected to Epstein—the connection existed in a limited way—but the scale of the document release and the media coverage transformed it into a major story.

The critical detail: Attia maintained that he was not involved in criminal activity, never visited Epstein's island, and never traveled on his plane. In a lengthy post on X (formerly Twitter), Attia acknowledged being "ashamed" of some of the crude content in his emails but explicitly denied participating in any crimes.

For most observers, the distinction between inappropriate personal communications and criminal activity is important. But for companies that employ someone or associate their name with a brand, this distinction becomes irrelevant. The perception is the problem.

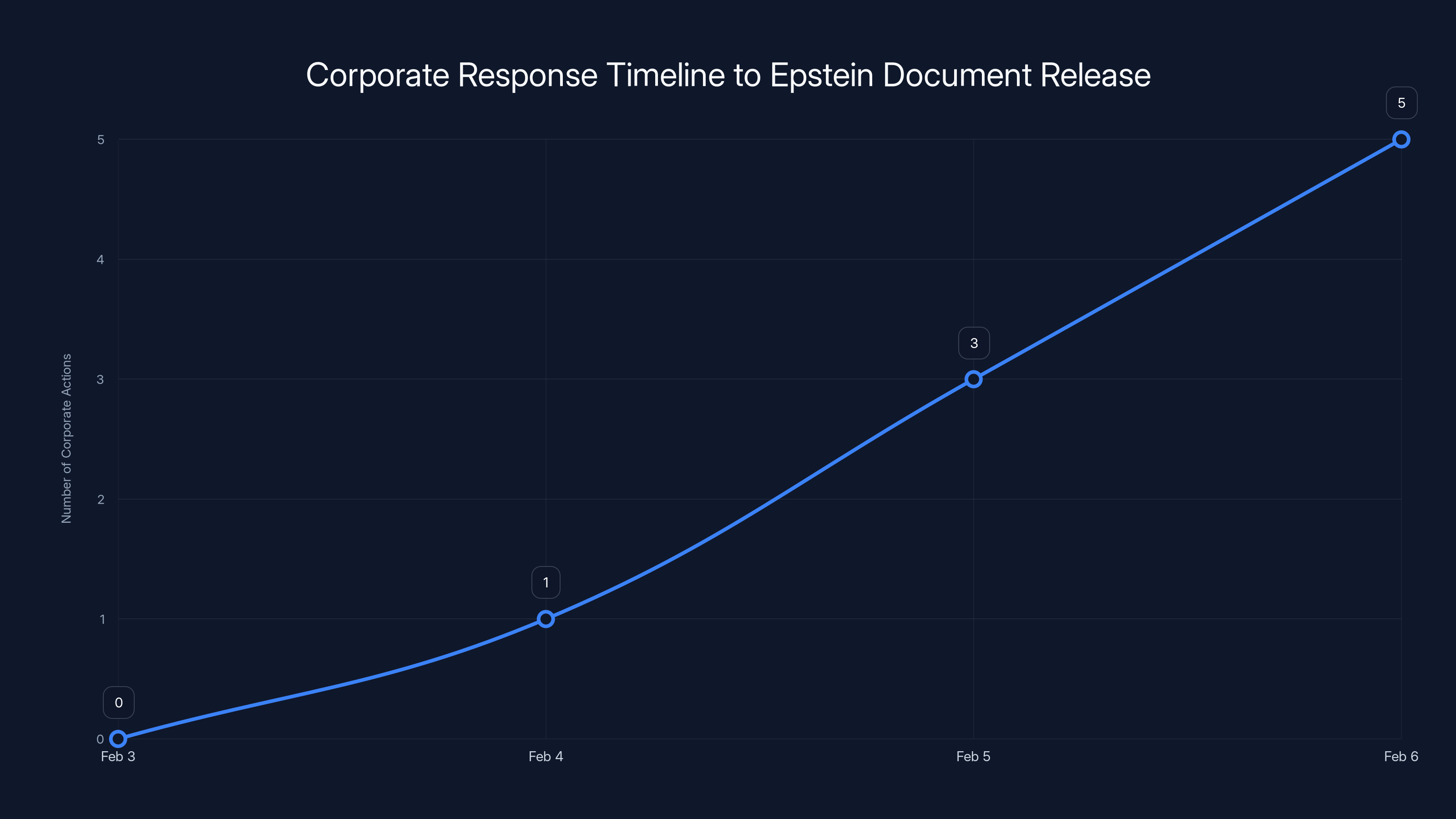

Corporate Response Timeline

The speed of corporate response was striking. Within days, David Protein announced that Attia had "stepped down from his role as Chief Science Officer." The announcement itself didn't explicitly reference the Epstein documents, maintaining a thin veneer of separation between the controversy and the business decision.

But the timing made the connection obvious to anyone paying attention. A major company doesn't suddenly ask its Chief Science Officer to step down based on coincidence.

The response from Biograph was even more revealing. The company began removing Attia's name from its website. Pages that previously identified him as a co-founder now returned "file not found" errors or simply omitted his name entirely. When pressed for comment by journalists about Attia's ongoing participation with the startup, Biograph declined to comment.

No comment is its own answer. It's corporate shorthand for "we're distancing ourselves but don't want to explicitly say so because it might create legal exposure."

The Business Implications: When Reputation Becomes Liability

Due Diligence Failures

One obvious question emerges from this situation: Why weren't these documents discovered during standard due diligence?

When a company hires someone as Chief Science Officer, especially someone whose personal brand is central to company positioning, due diligence should include background checks, reference verification, and investigation of public records. The connection between Attia and Epstein wasn't secret. It was discoverable.

There are several possible explanations. First, the documents weren't public until February 2025. While journalists and researchers could have potentially uncovered the relationship, it would have required specific effort. Companies sometimes assume that if something isn't in mainstream news, it doesn't exist.

Second, due diligence is often incomplete. Venture-backed companies move fast, and comprehensive background checking can seem like friction that slows deals. If everyone on the board and leadership team knows and respects someone, digging deeper can feel like a waste of time.

Third, there's a power dynamic issue. Attia wasn't being hired as an employee; he was a co-founder and investor in Biograph and an influential voice recruited to David Protein. When you're dealing with someone of significant status, skepticism can feel disrespectful. Due diligence on high-status individuals sometimes gets shortcuts.

This situation will likely change how venture-backed companies conduct due diligence on high-profile founders, advisors, and early hires. Expect future companies to do deeper background investigation on anyone whose personal brand is central to the company's positioning.

Valuation Impact and Investor Relations

For David Protein and Biograph, Attia's reputation provided measurable business value. He brought credibility, media attention, and access to his audience. That value wasn't guaranteed, but it was real.

When his name became publicly associated with controversial material, that value evaporated instantly. Investors who invested in these companies based partly on Attia's involvement faced uncomfortable questions about the quality of the management team and the robustness of the company's brand positioning.

For venture investors, this raises important questions about concentration risk. How much of a company's valuation depends on any single person's reputation? If key founders or advisors have significant personal brand risk, that's a material risk to the investment.

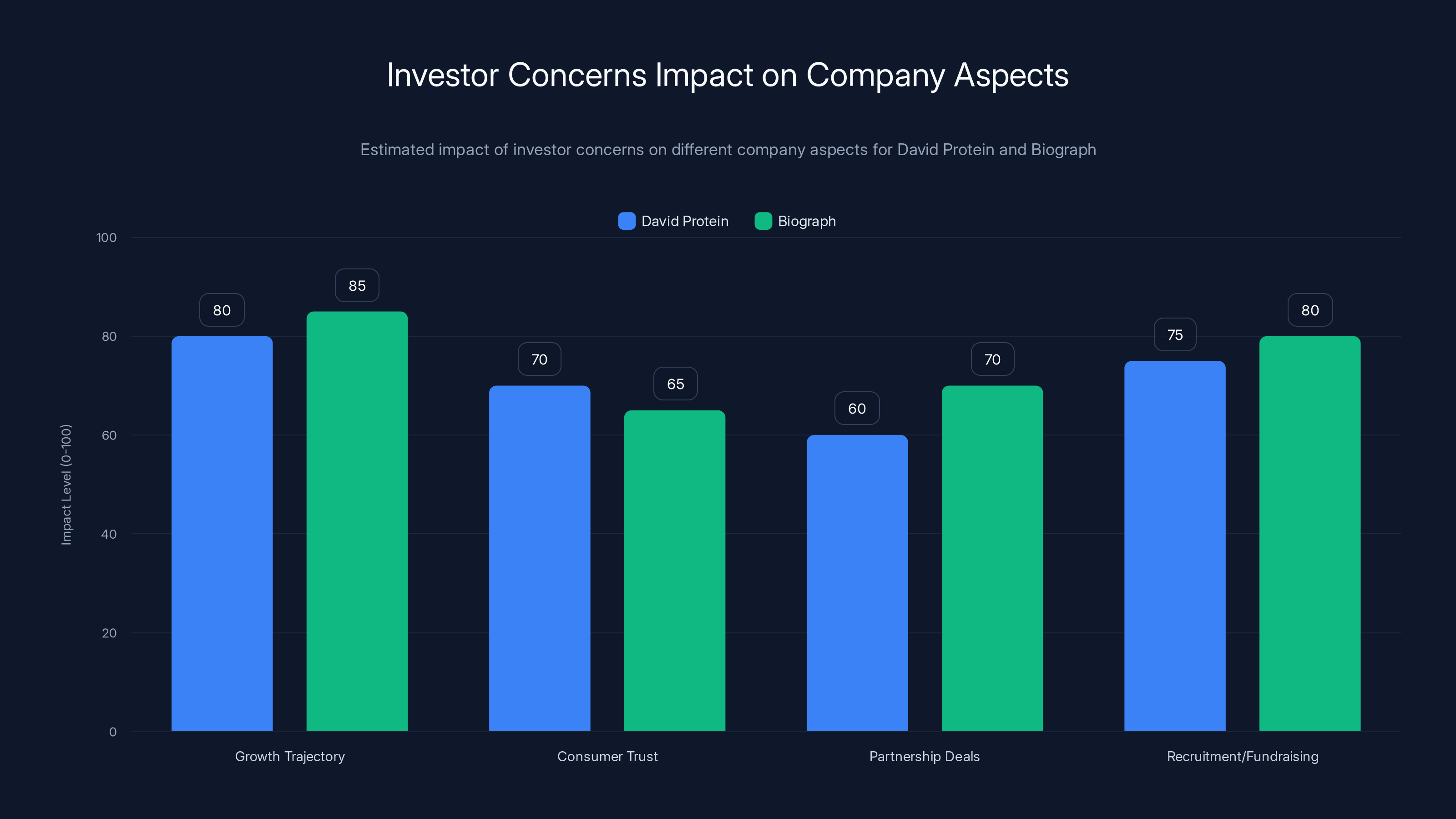

Both David Protein and Biograph likely experienced conversations with their boards, investors, and internal teams about the implications. These aren't pleasant conversations. They involve discussions about whether investor confidence has been shaken, whether recruitment will become harder, whether partnerships are at risk, and whether the company's fundamental value proposition has been damaged.

For private companies, this damage is hard to quantify. But it's real. Growth rates might slow. Recruiting talent becomes harder when a company is known for association with controversy. Partnership discussions might go sideways when counterparties hesitate to align their brand with the company.

Brand Positioning and Marketing Strategy

For David Protein specifically, the challenge was particularly acute. The company is selling a consumer product. Consumer product companies live or die by brand trust and perception. If consumers see the company as tainted by association with controversy, they'll choose a competitor's product instead.

Attia's involvement was likely featured in David Protein's marketing materials, pitch materials to investors, and recruitment narratives. His name probably appeared on the website, in press releases, and in interviews with journalists. Now all of that had to be undone.

This required rapid action: removing website references, pulling press releases, issuing statements, and adjusting investor communications. It's messy work that costs money, takes time from leadership, and signals to the market that something has gone wrong.

For Biograph, the challenge was somewhat different but similarly serious. As a medical services company, trust and credibility are existential. Patients pay between

Having a co-founder whose name is associated with controversial material creates exactly the wrong kind of attention for a medical services company. It raises questions about judgment, due diligence, and institutional standards.

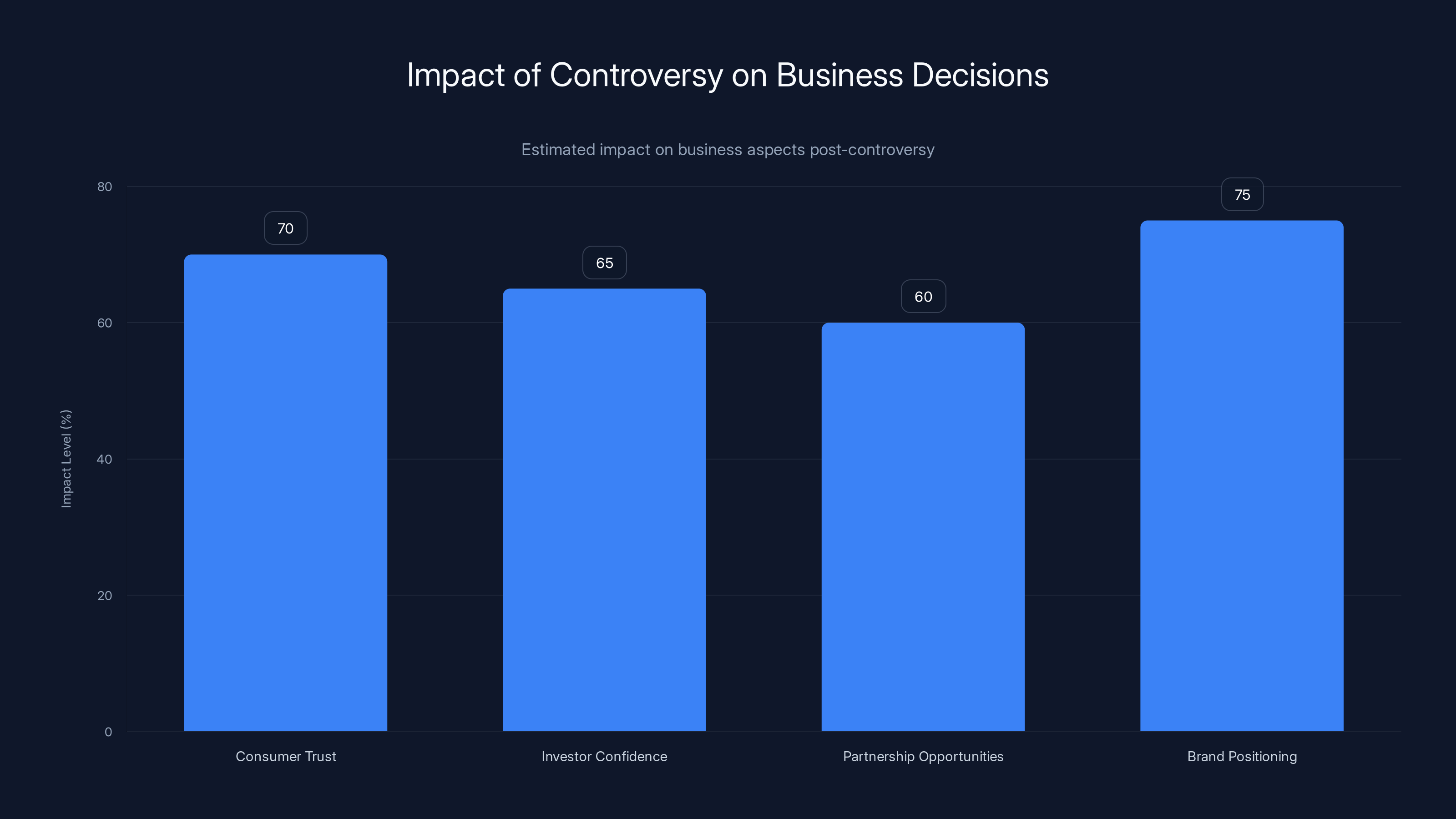

Estimated data shows that controversies can significantly impact business aspects such as consumer trust and brand positioning, with potential impact levels ranging from 60% to 75%.

The Longevity Industry and Due Diligence Standards

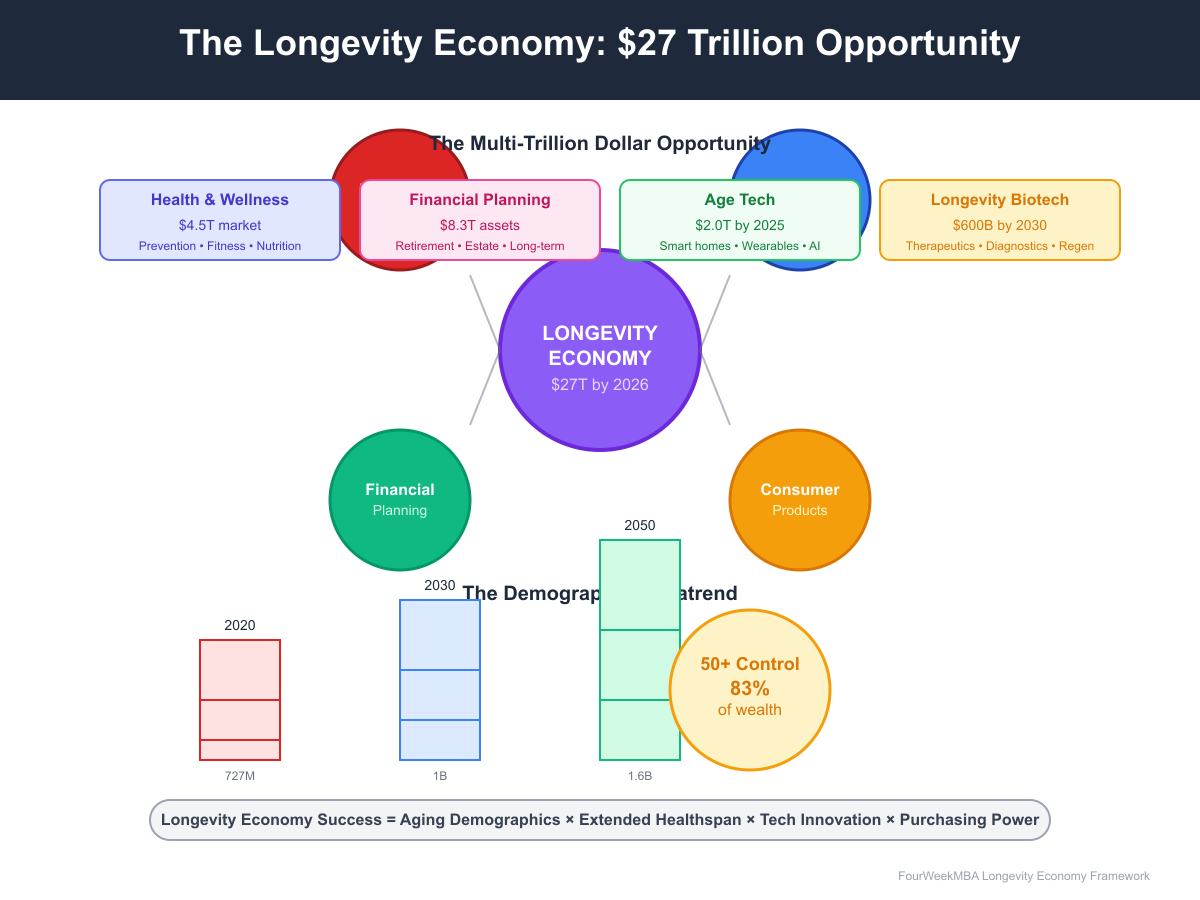

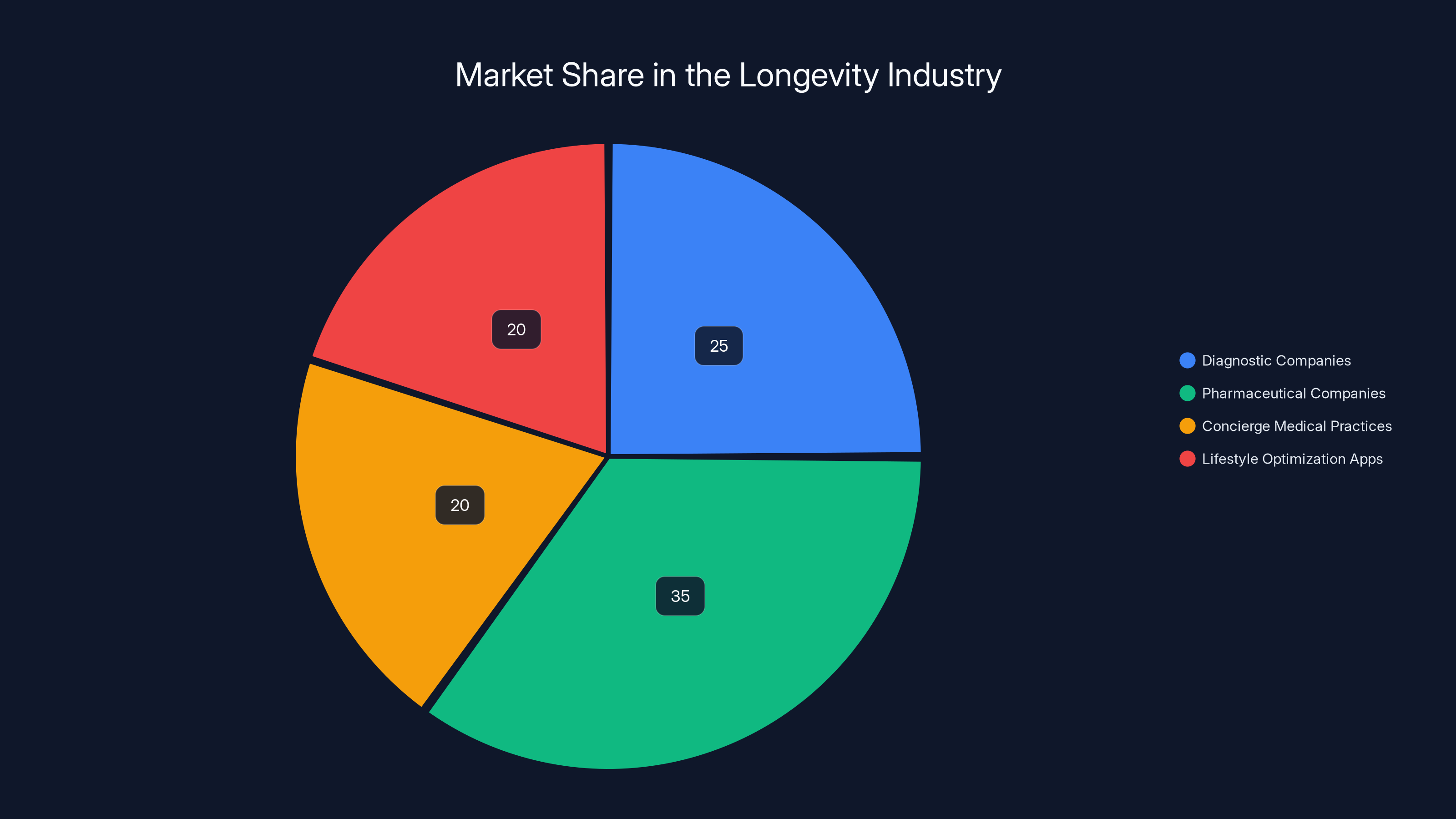

The Longevity Boom Context

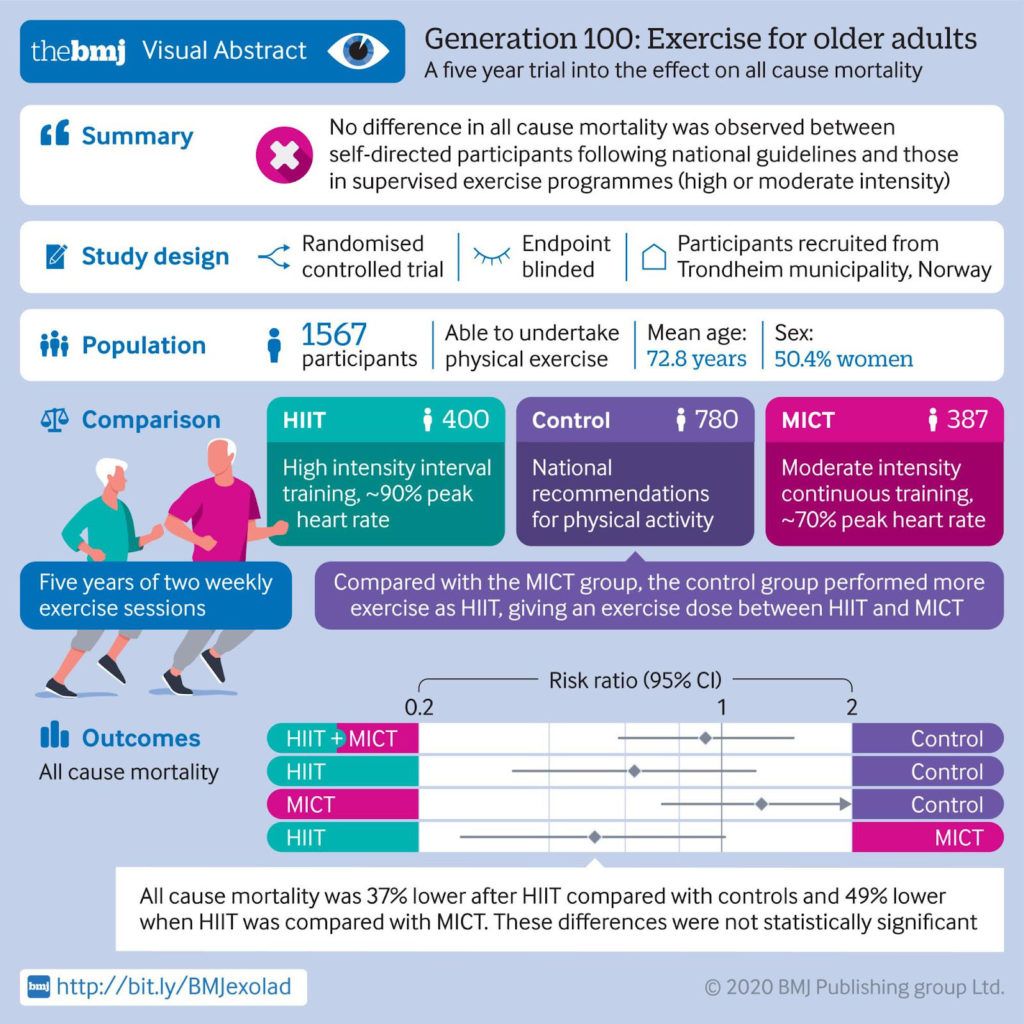

Peter Attia's rise and prominence need to be understood in the context of the longevity boom in venture capital and tech. Over the past decade, longevity medicine has moved from a fringe area of medical interest to a major focus for venture investors and tech entrepreneurs.

Companies in this space include everything from diagnostic companies (like Inside Tracker and Thorne) to pharmaceutical companies developing anti-aging drugs (like Calico and Unity Biotechnology) to concierge medical practices (like Biograph) to lifestyle optimization apps and products.

The investment thesis is straightforward: healthcare spending is massive and growing. If you can help wealthy people live longer and healthier lives, you can capture a significant market share. Venture investors have put billions into longevity companies with the expectation that this market will grow dramatically.

Peter Attia became famous partly because he was one of the few doctors willing to talk extensively about longevity optimization in public, accessible ways. His podcast and book introduced millions of people to the idea that healthspan—years of healthy living—could be optimized through specific interventions.

This created business opportunities for anyone associated with longevity. Companies wanted Attia involved because his involvement signaled that they were serious about the science and had credibility in the space.

Trust and Reputation in Healthcare

But healthcare is different from other industries when it comes to reputation and trust. Healthcare involves decisions about your body and your health. People take these decisions seriously. They want to trust the people advising them and the companies they're using.

When a medical professional or company is associated with controversy, patients and potential patients feel betrayed. It undermines the fundamental trust relationship that healthcare depends on.

This is particularly true for longevity medicine, which operates at the intersection of science and lifestyle optimization. Many longevity companies are marketing to affluent individuals who have money to spend on their health. These individuals are often more educated and more skeptical. They're more likely to do research on the people behind companies they're considering.

For Biograph, having Attia's name scrubbed from the website creates additional problems beyond the direct reputational damage. It signals uncertainty and raises questions about institutional stability. If a company is hiding a co-founder's involvement, what else are they hiding?

Industry-Wide Impact

The Attia situation will likely have ripple effects across the longevity industry. Investors will become more cautious about founders and advisors whose personal brands are central to company positioning. Companies will implement stricter due diligence processes. Founders will become more careful about personal brand management.

For legitimate longevity companies with strong science and transparent practices, this could be positive. It might raise standards across the industry. For companies that have been relying on celebrity and charisma rather than substance, it creates pressure to demonstrate actual scientific rigor.

It also raises questions about the relationship between personal brand and institutional credibility. How much should a company depend on any single person's reputation? What are the risks of that dependence? These are important questions for any venture-backed company, but they're particularly acute for healthcare and longevity companies.

Corporate Communication and Damage Control

The Announcement Strategy

The way David Protein and Biograph handled the situation offers a case study in corporate communication during crisis. Let's break down what happened and what it reveals.

David Protein issued a brief announcement on X: "Dr. Peter Attia has stepped down from his role as Chief Science Officer at David." The announcement didn't elaborate. It didn't mention the Epstein documents. It didn't provide context or explanation. It was the corporate communication equivalent of a tight-lipped statement.

This strategy makes sense from a legal and PR perspective. By not explicitly connecting the announcement to the Epstein documents, the company maintains deniability. The announcement could theoretically be unrelated to the controversy. In practice, of course, everyone knew what had happened.

Biograph took a different approach: silence. When journalists reached out asking about Attia's status with the company, Biograph declined to comment. The company didn't issue a statement. It didn't announce anything. It just quietly started removing his name from the website.

This approach is riskier. It creates a void that gets filled with speculation and media coverage that the company doesn't control. But it also avoids the need to make explicit statements that might have legal implications.

The "No Comment" Trap

When companies choose not to comment on significant developments, it creates problems. Journalists will continue asking questions. They'll talk to other sources. Rumors and speculation will circulate. The company's silence gets interpreted as guilt or evasion.

For Biograph, the failure to comment meant that stories about the situation framed the company negatively. Rather than shaping the narrative, the company ceded control of it to external parties.

A more strategic approach might have been a brief statement acknowledging the situation and reaffirming the company's commitment to its mission and values. Something like: "We're aware of recent developments and are focused on ensuring Biograph continues to deliver excellent care to our members. We remain committed to the highest standards of institutional integrity."

Instead, the silence left everything ambiguous. It's a good case study in how corporate communication strategy can either amplify or mitigate reputation damage.

Estimated data suggests that investor concerns have a significant impact on growth trajectory and recruitment/fundraising for both companies, with Biograph slightly more affected in consumer trust.

Founder Dynamics and Co-Founder Relationships

When One Founder Becomes Toxic

For Biograph, having a co-founder become associated with major controversy creates a specific set of problems distinct from hiring an employee who becomes controversial.

When you co-found a company with someone, your names are legally and operationally intertwined. That person is on cap tables, board documents, and founding paperwork. Their decisions have shaped the company's direction. Their equity stake gives them ongoing legal rights and claims.

You can't simply fire a co-founder the way you might fire an employee. The separation is more complex and often requires legal negotiation, buyout arrangements, and clear agreements about future rights and obligations.

Biograph's approach of quietly removing Attia from website pages and declining to comment suggests the company was navigating these complexities without public drama. This makes sense. Publicly announcing a messy co-founder separation would only amplify the negative coverage.

But it also means the company is dealing with significant uncertainty. What's Attia's actual status? Does he still have equity? Is he still involved in decision-making? Will he be involved in future fundraising rounds? These questions matter for investors, employees, and partners.

The Value of Co-Founder Separation Agreements

This situation highlights why venture-backed companies should have clear co-founder agreements that address scenarios where a founder becomes a liability to the company. These agreements should specify:

- What happens if a founder becomes associated with major controversy

- How the company can separate the founder's name from the brand

- Whether the founder's equity vests differently in case of early departure

- How decision-making authority is distributed among founders

- What happens to the founder's involvement in key decisions

Good co-founder agreements essentially ask: "If one of us becomes toxic, how do we separate ourselves from that person while honoring our legal obligations?"

Biograph likely had such an agreement. The agreement probably anticipated scenarios where a co-founder might become a liability and included provisions for handling that scenario. But executing those provisions in real-time, while the situation is still developing and media attention is high, is messy and complicated.

Investor Relations and Board Dynamics

Managing Investor Concerns

Both David Protein and Biograph reported their investors during this period. These conversations were likely uncomfortable.

Investors in David Protein had invested in the company based on its growth trajectory, its market position, and its leadership team. Attia's involvement was part of the pitch. Now investors had to assess whether the Attia controversy would materially affect company performance.

Questions investors likely asked:

- How much of the company's growth trajectory depends on Attia's involvement?

- Will consumer trust be affected by the association with controversy?

- Are there partnership deals at risk?

- Could this affect recruitment or fundraising going forward?

Biograph investors had similar concerns. They'd invested in the company partly because Attia's involvement signaled credibility in the longevity space. The investors who came in early, like Vy Capital and Wndr Co, had made a bet on Attia's judgment and involvement.

Board meetings probably involved detailed discussions about the situation, its implications, and the company's response strategy. These discussions would have covered everything from legal implications to marketing strategy to talent retention.

The Impact on Future Fundraising

For both companies, this situation will likely affect future fundraising rounds. It's not a dealbreaker, but it's a complicating factor.

New investors will ask tough questions. Why did due diligence miss the Epstein connection? What does this reveal about the company's institutional judgment? How robust is the company's strategy if it depends on any individual's personal reputation?

These questions are fair. Companies need to have good answers. And companies need to demonstrate that they've learned from the situation and improved their processes.

For Biograph specifically, future fundraising might be complicated by the ambiguity around Attia's ongoing involvement. Investors will want clarity: Is Attia still on the cap table? Does he have board rights? Is there a path to complete separation? These are concrete questions that need concrete answers.

Estimated data shows a rapid increase in corporate actions following the Epstein document release, highlighting the swift impact on associated individuals.

The Media and Narrative Control

Why This Story Matters to Journalists

The Peter Attia story became a major news story for several reasons, and understanding those reasons reveals something about how media coverage shapes corporate reputation.

First, it's a fall-from-grace story. Attia had built a public profile as a trusted voice in health. Seeing that reputation threatened is inherently interesting to journalists. It's the inverse of the typical success story.

Second, it involves high-profile figures and companies. David Protein raised $75 million in Series A funding. Biograph raised money from prominent venture investors. These aren't obscure startups. The companies and people involved are significant enough to warrant coverage.

Third, it involves systemic questions about due diligence, institutional judgment, and celebrity culture in Silicon Valley. The story isn't just about Attia; it's about how tech companies evaluate and vet high-profile people.

Fourth, there's the CBS connection. Attia had recently been hired as a contributor to CBS. That meant a major media company had also made a decision about Attia's credibility and would also have to revisit that decision. That's additional complications for the narrative.

Managing Media Relationships

When facing media scrutiny, companies have limited options. They can engage with journalists, ignore them, or push back aggressively.

Neither David Protein nor Biograph appeared to have pursued an aggressive media strategy. Both took minimalist approaches: acknowledge the situation without elaboration (David Protein) or remain silent (Biograph).

This strategy has trade-offs. On one hand, it avoids feeding the story with additional material. On the other hand, it allows journalists to fill the void with speculation and critical framing.

A more sophisticated media strategy might have involved background briefings with key journalists, providing context about due diligence processes, and explaining the company's values and governance structures. But that requires confidence in the company's position and willingness to engage openly with media scrutiny.

Personal Reputation Management for Founders

The Risks of Celebrity Founder Status

Peter Attia's situation illustrates the risks of building a company around a celebrity founder. The benefits are obvious: attention, credibility, marketing reach. The risks are less obvious but potentially catastrophic.

When a company's brand is tightly linked to a founder's personal reputation, the company is only as secure as that reputation is solid. If the founder faces personal controversy, the company faces reputation damage by association.

For founders building companies, this suggests a strategic approach: build the company's brand and institutional reputation independently from your personal brand. Use your credibility to launch the company, but then invest in building the company's own institutional credibility.

Companies that succeed long-term are ones where the business has value independent of any individual person. Apple transcended Steve Jobs. Amazon is much larger now than when it was entirely defined by Jeff Bezos. Successful companies develop institutional brands that can survive the departure or controversy of founding team members.

Founders as Brand Risk

For venture investors, this situation reinforces important lessons about founder risk and diversification. If a company's value depends primarily on one founder's reputation and judgment, that's concentrated risk.

Investors increasingly think about this when evaluating founding teams. Teams with complementary skills and reputation distribution are lower risk than teams where one person is the primary face and voice of the company.

Similarly, venture firms thinking about who they hire as partners and advisors should apply the same due diligence they apply to companies. A venture partner's personal reputation affects the firm's reputation. If a partner becomes associated with controversy, it affects the entire firm.

Pharmaceutical companies hold the largest estimated market share in the longevity industry at 35%, followed by diagnostic companies at 25%. Estimated data.

The Epstein Connection: What We Know and Don't Know

The Complexity of Document Interpretation

One challenge in discussing the Attia situation is that it involves interpretation of documents that most of us haven't read. We're relying on media reports about what the documents contain.

What we know is that Attia's name appeared in 1,700+ documents and that he acknowledged the existence of crude content in his communications with Epstein. What we don't know is the full context and meaning of those communications.

Attia's statement that he was "ashamed" of some of the crude content is consistent with the idea that the communications were inappropriate but not necessarily criminal. His statement that he was never involved in criminal activity, never visited Epstein's island, and never traveled on his plane suggests an attempt to draw a line between knowing Epstein and participating in his crimes.

But this nuance gets lost in media coverage. Epstein's name, on its own, triggers strong emotional reactions. Association with Epstein, even indirect association, becomes reputationally toxic regardless of the specific facts.

The Precedent Challenge

One longer-term question this situation raises is about precedent. If companies can distance themselves from people based on associations revealed in historical documents, what standards should apply?

Epstein's crimes were horrific. But as we move further away from the initial revelations, we'll see document releases and investigations touching other parts of his network. At what point does the association become too remote to justify corporate distancing?

These are uncomfortable questions. But they matter for thinking about how institutions should respond to historical revelations about people they've worked with or associated with.

Looking Forward: Lessons for Venture-Backed Companies

Strengthening Due Diligence Processes

The Attia situation will prompt venture-backed companies to strengthen their due diligence processes. This is healthy. More rigorous diligence creates better outcomes for everyone.

Key areas for improvement include:

Background investigations: Especially for high-profile founders, advisors, and early hires whose personal brand is central to company positioning, comprehensive background checks should be standard.

Public records research: Journalists don't have special access to public records. If reporters can discover connections, so can companies. Assigning someone to systematically research key figures is a valuable investment.

Reference checking rigor: Calling three people who will say nice things about someone isn't thorough reference checking. More comprehensive approaches might include talking to people who've worked with the person in different contexts, former employees or collaborators, and people who might have had conflicts.

Values and judgment assessment: Companies should explicitly assess whether key figures' public statements and behavior align with company values. This isn't about enforcing political correctness; it's about assessing judgment and integrity.

Ongoing monitoring: Due diligence shouldn't be a one-time event. For high-profile people, ongoing monitoring of public statements, media coverage, and professional reputation is reasonable.

Building Institutional Credibility

Companies should also invest in building institutional credibility independent from any individual person. This means:

Developing institutional expertise: Rather than relying on one person's credibility, build teams with complementary expertise and public profiles.

Documenting and communicating methodology: For scientific or medical companies, making the methodology and evidence basis publicly available builds credibility that extends beyond any individual person.

Creating governance structures: Clear governance structures with boards, advisory committees, and decision-making processes create institutional credibility.

Transparency about limitations: Being honest about what you know and don't know, what's been tested and what's theoretical, builds long-term credibility even when specific claims later need to be revised.

The Broader Context: Celebrity in Tech and Healthcare

The Culture of Founder Celebrity

Silicon Valley has always had a tendency toward founder mythology. We celebrate brilliant founders who transform industries. We tell stories about visionary leaders who changed the world. This creates a culture where founder celebrity is valued.

But founder celebrity comes with risks. It creates pressure on founders to maintain public personas that might not match their private realities. It makes companies vulnerable if those personas crack. It encourages investing in people based on charisma rather than judgment and substance.

The Attia situation is a reminder that founder celebrity is fragile. It can evaporate quickly when circumstances change.

Healthcare as a Special Case

Healthcare and medical startups are particularly susceptible to founder celebrity effects. People make health decisions based on trust. If they trust the founder, they're more likely to trust the company.

But this creates vulnerability. Healthcare companies should be especially careful about building business models that depend on any individual's personal reputation. The stakes are higher when people are making health decisions based on that reputation.

For the longevity industry specifically, the emphasis on founder credibility and personal brand is particularly acute. Longevity medicine is still developing. Much of the advice is based on emerging science and personal optimization philosophy rather than proven interventions. In that context, trusting the founder and the company becomes very important.

This suggests that longevity companies should invest even more heavily in building institutional credibility, documenting methodology, and being transparent about limitations.

The Question of Rehabilitation and Separation

Can Reputations Be Rehabilitated?

One question the Attia situation raises is whether people and companies can rehabilitate reputations after major controversy.

For David Protein, the separation from Attia is relatively clean. A company can replace a Chief Science Officer with someone else. The company's products and strategy can continue. Over time, new leadership can define the company's brand.

For Biograph, the situation is murkier because Attia is a co-founder. His connection to the company's founding is permanent, even if his ongoing involvement is minimized. Biograph can continue operating and building its reputation, but Attia's co-founder status is a permanent historical fact.

For Attia personally, the path to rehabilitation is unclear. He's built a significant reputation over years. That reputation has been damaged in a relatively short period. Whether he can rebuild it depends on many factors: whether his version of events becomes accepted, whether he continues to generate valuable content and insights, whether other controversies emerge.

Historically, public figures have rebounded from controversy through various strategies: transparency and accountability, continued quality work in their field, time and distance, institutional support, or a combination of these factors.

But the timeline for reputation rehabilitation is usually measured in years, not months. Quick rebounds are rare.

Competitive Implications in the Longevity Market

Winners and Losers

When one longevity startup's leadership becomes controversial, what happens to competitors?

In the short term, competitors gain relative advantage. Potential customers and partners might view other longevity companies more favorably by contrast. Investors might rotate out of Attia-connected companies and into competitors without the controversy.

But the longer-term effect is murkier. If the Attia situation causes broader skepticism about longevity medicine leadership, it could affect the entire industry. Customers might become more skeptical about founder credibility and more focused on rigorous evidence. That would be healthy for the industry long-term but could reduce growth in the short term.

Investors might also become more cautious about investing in longevity companies, especially those with celebrity founder dynamics. That could reduce the total venture funding available for the space.

For serious longevity companies with strong science, rigorous methodology, and institutional credibility independent from founder personalities, the Attia situation could actually create opportunity. It raises the bar for entry and credibility, which advantages companies that have invested in those dimensions.

The Role of Transparency and Accountability

Institutional Responsibility

The Attia situation raises important questions about institutional responsibility. When a company hires someone or promotes someone, what responsibility does the company have for vetting that person?

Companies can't be expected to predict every future controversy. But they can be expected to exercise reasonable diligence in assessing character, judgment, and background.

For companies going forward, this means treating due diligence on key hires and advisors as seriously as they treat due diligence on acquisition targets or partnerships. Invest the time and resources to assess the person thoroughly.

It also means having processes in place for responding when controversies do emerge. What's the communication strategy? What's the separation strategy? What are the legal and business implications?

Companies that have thought through these scenarios are better positioned to respond effectively when they happen.

Founder and Advisor Responsibility

From the other direction, founders and advisors have responsibility to be transparent about their backgrounds and any potential issues that might affect company reputation.

This doesn't mean founders need to disclose every embarrassing personal detail. But it does mean being honest about anything that might reasonably affect the company's business if it became public.

If Attia had been transparent about the Epstein connection when taking on roles at David Protein and Biograph, both companies could have assessed whether they wanted to take on that risk. They might have decided it was acceptable given the strength of the business case. Or they might have decided to pass.

Instead, the companies learned about the connection the same way the public did: through major news coverage.

FAQ

What exactly was Peter Attia's connection to Jeffrey Epstein?

Peter Attia's name appeared in over 1,700 documents released in February 2025 related to the Epstein case. According to reports, the documents contained email correspondence with crude content. Attia stated that he was not involved in any criminal activity, never visited Epstein's island, and never traveled on Epstein's plane. The specific nature and extent of their relationship remains subject to interpretation of documents that have been made public.

Why did David Protein and Biograph distance themselves from Peter Attia so quickly?

Both companies took swift action to separate themselves from Attia following the Epstein document release. David Protein announced his departure as Chief Science Officer within days, while Biograph began removing his name from the website and declined to comment. Companies make these decisions because association with major controversy becomes a business liability. It affects consumer trust, investor confidence, partnership opportunities, and brand positioning. Speed of response signals to stakeholders that the company is taking the situation seriously and moving to mitigate damage.

What does this situation teach venture investors about founder and advisor selection?

The Attia situation highlights the importance of rigorous due diligence on high-profile founders and advisors whose personal brands are central to company positioning. Investors should conduct comprehensive background checks, verify references thoroughly, assess judgment and character, and understand the risks of depending too heavily on any individual's reputation. The situation also suggests that companies with diversified leadership teams and institutional credibility are more resilient to individual controversies than companies that depend on celebrity founders.

Could this situation have been prevented?

Prevention would have required more thorough due diligence by both David Protein and Biograph before hiring or associating with Attia. However, the documents related to the Epstein case weren't public until February 2025, so the connection wasn't discoverable through standard public records research before then. The situation illustrates that even rigorous due diligence has limitations when information is not yet public. Companies can't prevent every possible controversy, but they can respond more effectively when it occurs by having clear procedures in place.

How does this affect the longevity industry more broadly?

The Attia situation affects the longevity industry by raising questions about leadership credibility, due diligence standards, and the risks of depending on founder celebrity. For legitimate longevity companies with strong scientific methodology and institutional credibility, the situation might create opportunity by raising industry standards and increasing skepticism about companies that depend primarily on charismatic founders. For the industry overall, it likely increases investor caution around healthcare startups and greater emphasis on institutional governance and scientific rigor over founder personality.

What are the legal implications for Attia and the companies involved?

The Epstein documents don't appear to contain evidence of criminal activity by Attia according to his statements and public reporting. However, the documents contain content he acknowledged as crude or inappropriate. For the companies, the legal implications are primarily around liability for association rather than direct legal exposure. The rapid separation from Attia helps companies demonstrate they were unaware of the connection and are taking appropriate action. Attia's legal exposure is primarily reputational rather than criminal unless new information emerges.

Can Peter Attia rebuild his reputation?

Reputation rehabilitation after major controversy is possible but typically requires years rather than months. Factors that could support rehabilitation include demonstrating that his version of events is accepted, continuing to produce high-quality work in his field, maintaining transparency and accountability, and having continued support from institutions that value his expertise. However, the timeline for rebuilding is usually measured in years, and the extent of rehabilitation depends on how the broader narrative around the situation develops.

What should founders do to protect themselves from similar situations?

Founders should work to build their companies' institutional credibility independent from their personal brand. This means developing strong teams with complementary expertise, documenting and communicating methodology, creating governance structures, and being transparent about limitations. Founders should also be prepared for the possibility that personal controversies might emerge and have plans for separating personal reputation from company reputation. Finally, founders should be honest about anything that might affect company reputation if it became public, allowing the company to make informed decisions about risk.

Conclusion: What This Means for the Future of Venture-Backed Health Tech

Peter Attia's journey from celebrated longevity expert to controversial figure illustrates something important about reputation, institutional structure, and how quickly business relationships can change. His departure from David Protein and the distancing by Biograph happened with striking speed—a testament to how vulnerable companies are to reputational association with their leaders.

But the broader lessons here extend well beyond one person's situation. The Attia controversy reveals structural vulnerabilities in how venture-backed companies are built, how they're evaluated, and how they manage risk.

First, the situation demonstrates the inherent fragility of company brands that depend too heavily on founder celebrity. This is particularly acute in healthcare and longevity, where personal trust and credibility are central to consumer decision-making. Companies that build lasting value are ones that develop institutional credibility independent from any individual founder or leader.

Second, the situation highlights the importance of rigorous due diligence on high-profile figures before they're hired or promoted into roles where their personal brand affects company reputation. This due diligence should be ongoing, not just at the moment of hiring. Companies should systematically monitor public coverage and statements by key figures, especially those whose personal brands are central to company positioning.

Third, the situation reveals how venture investors and board members should think about founder risk and diversification. When companies depend entirely on one person's reputation and judgment, they're exposed to concentrated risk. Smart companies and investors build redundancy and institutional structures that can weather controversies affecting any individual person.

Fourth, the Attia situation teaches us about crisis communication and reputation management. The speed and clarity with which companies respond to controversy matters. Companies that have thought through their response in advance are better positioned to execute effectively. Companies that react without a strategy often make things worse.

For the longevity industry specifically, this situation might have a silver lining. By raising questions about due diligence and credibility, it could push the industry toward greater scientific rigor and institutional integrity. Longevity medicine is still emerging as a field. Having higher standards for leadership credibility and institutional methodology is good for long-term industry development.

For individual founders and leaders, the Attia situation is a reminder that personal brand is fragile. It can take years to build and days to damage. Smart leaders invest in institutional credibility that's independent from their personal reputation. They also remain transparent about anything that might affect their professional reputation, allowing the institutions they work with to make informed decisions about risk.

Ultimately, the Attia situation is a cautionary tale about how venture-backed companies are built and how they respond to crisis. It's a reminder that due diligence matters, that institutional credibility matters more than founder celebrity, and that companies need to think systematically about reputation risk and crisis response.

As the longevity industry continues to grow and mature, we'll likely see companies that learned these lessons succeed while companies that didn't pay attention to these issues struggle. The Attia situation, uncomfortable as it is, provides valuable lessons for anyone building or investing in the future of health technology and healthcare.

The companies and investors who take those lessons seriously will be better positioned to build lasting, valuable institutions. Those who don't will remain vulnerable to the kind of rapid reputation collapse we saw in early February 2025. In the end, that's the real significance of the Peter Attia story: it's not just about one person, but about how to build resilient, credible institutions in an age of rapid information flow and institutional scrutiny.

Key Takeaways

- Companies must conduct rigorous due diligence on high-profile founders and advisors whose personal brands affect company positioning

- Institutional credibility matters more than founder celebrity for long-term company resilience and valuation

- Crisis response speed and clarity significantly affect how reputational damage propagates through investor and customer networks

- Healthcare startups are particularly vulnerable to founder reputation risks due to the trust-dependent nature of healthcare decision-making

- Companies should develop clear governance structures and separation protocols for scenarios where leaders become liabilities to the brand

Related Articles

- Nvidia's $100B OpenAI Gamble: What's Really Happening Behind Closed Doors [2025]

- Startup Battlefield 200 2026: Complete Guide to Apply & Win [2025]

- Skyryse's $300M Series C: Aviation's Autonomous Future [2025]

- Epstein Files Expose Peter Thiel's Silicon Valley Ties and Extreme Diet [2025]

- Student Startup Accelerators: How Breakthrough Ventures is Reshaping Founder Funding [2025]

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

![Peter Attia Leaves David Protein: Longevity Startup Drama Explained [2025]](https://tryrunable.com/blog/peter-attia-leaves-david-protein-longevity-startup-drama-exp/image-1-1770165395816.jpg)