Startup Battlefield 200 2026: Complete Guide to Apply, Pitch & Win [2025]

There's something electric about walking onto a startup stage knowing that in the next few minutes, your company's trajectory could shift completely. That's the promise of Startup Battlefield 200, and it's not hype.

Every year, thousands of founders from around the world submit applications to join one of the most prestigious early-stage startup competitions on the planet. Only 200 get in. And of those 200, a select few walk away with something far more valuable than any prize money: credibility, press coverage, investor attention, and the kind of momentum that can define a company's future.

In 2026, Startup Battlefield is opening its doors again. Applications launch mid-February and close mid-June. If you're building something worth building, this guide walks you through everything you need to know: how to apply, what selection criteria actually matter, what happens after you're selected, and how to prepare a pitch that actually lands.

We're also diving into the data. What does a winning application look like? Which sectors are hot? Why do some founders nail it while others don't? And most importantly: how do you position your startup to stand out from the thousands of other applicants?

TL; DR

- Applications open mid-February 2026: Submit by mid-June for a shot at 200 highly competitive slots

- Alumni have raised $32 billion+: The program's track record speaks for itself, with founders like Jason Citron (Discord) as legendary examples

- Free exhibit space plus investor access: All 200 startups get three days of exposure at Tech Crunch Disrupt in San Francisco

- Pitch for $100K equity-free: Top startups compete on the main Disrupt stage for the iconic prize and credibility boost

- Preparation program included: Virtual training starts in September to sharpen your story, pitch, and investor narrative

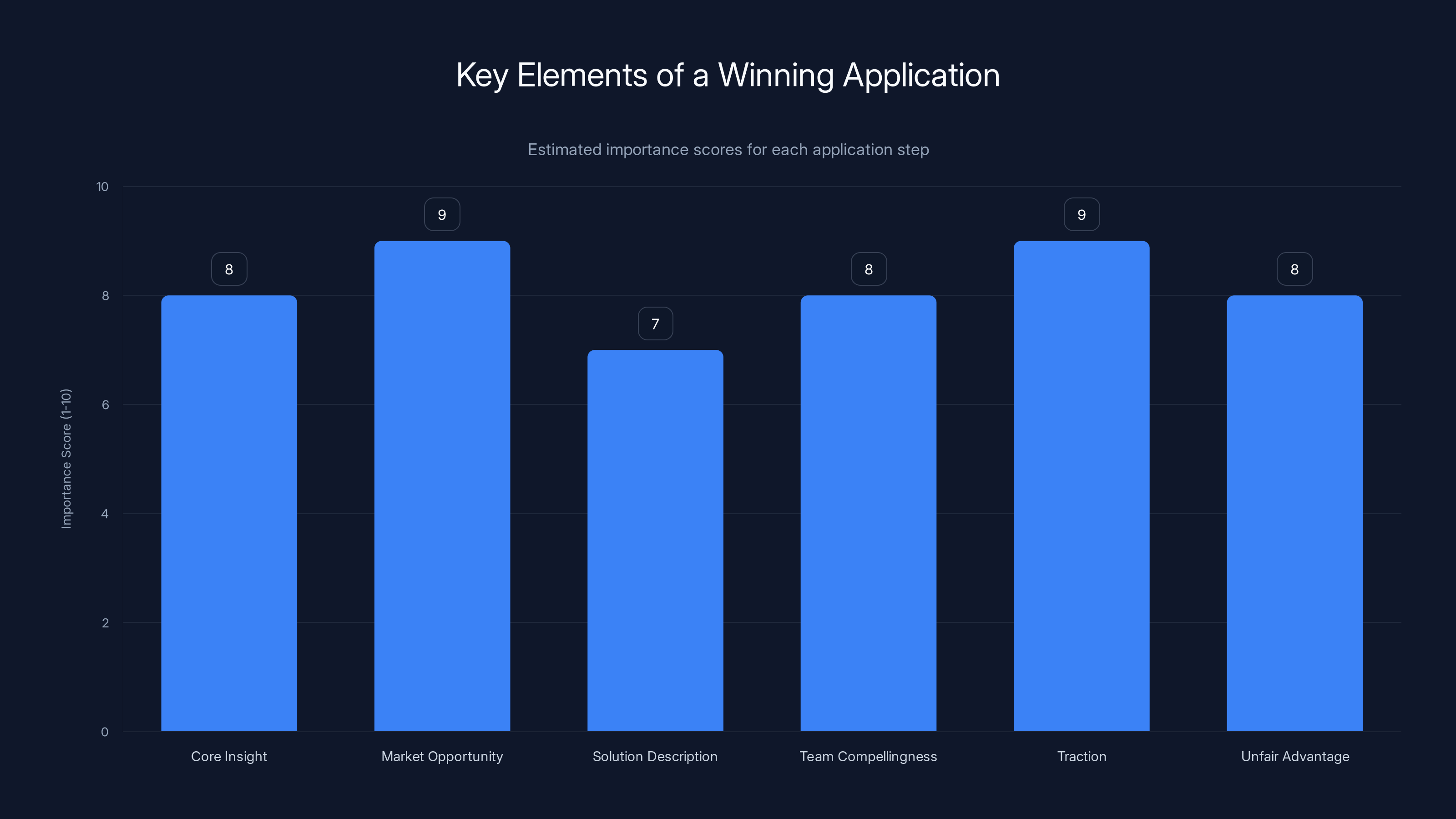

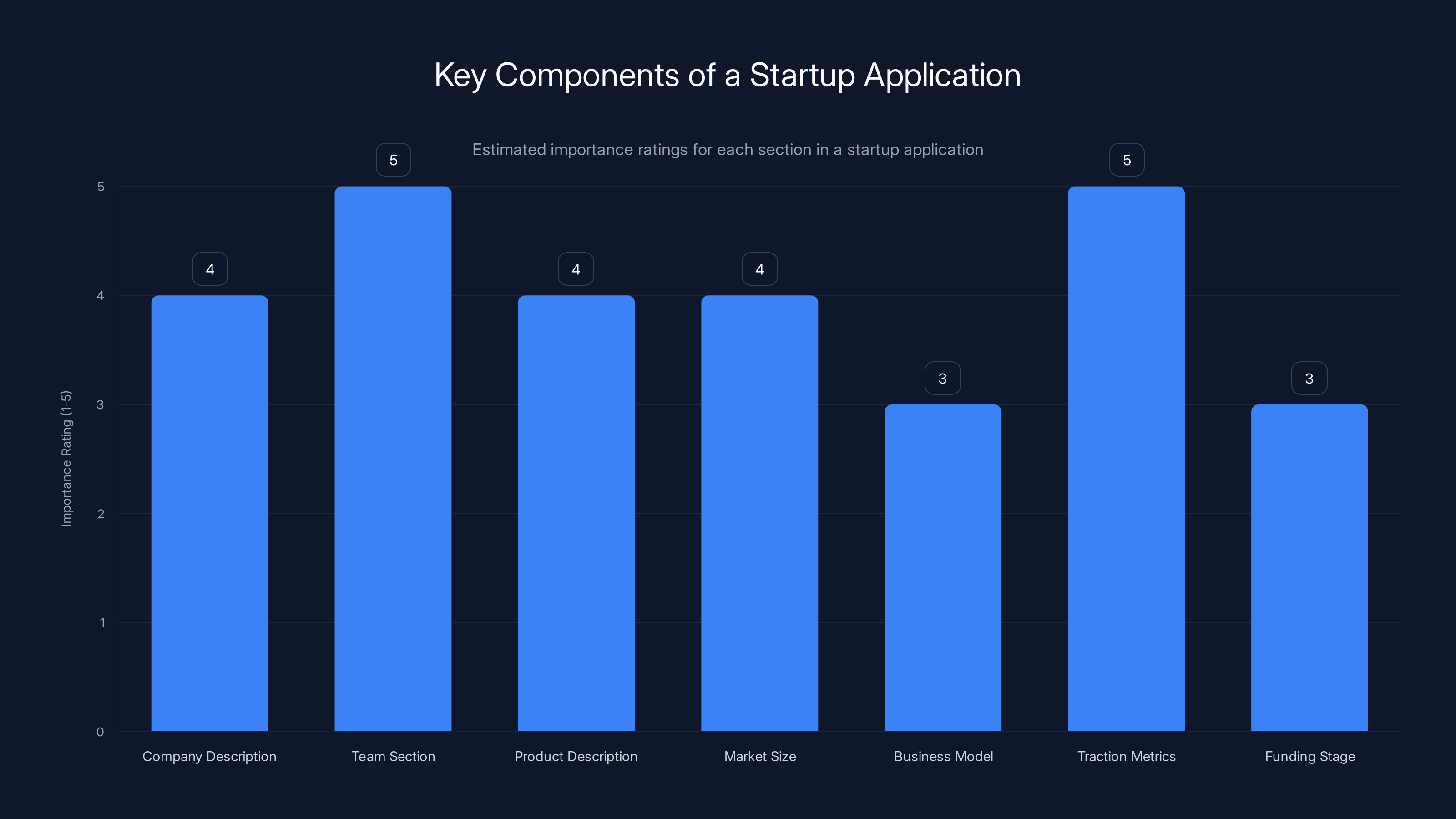

The framework emphasizes the importance of defining market opportunity and showing real traction, both scoring 9 out of 10 in importance. Estimated data based on typical application priorities.

What Is Startup Battlefield 200, and Why Does It Matter?

Let's start with the basics, because understanding what Startup Battlefield actually is matters more than you might think.

Startup Battlefield 200 isn't just another startup competition. It's a carefully curated platform held at Tech Crunch Disrupt in San Francisco that gives 200 early-stage companies global exposure, investor access, and the kind of credibility that normally takes years to build. Think of it as a compressed path to visibility.

Here's what makes it different from other pitch competitions: it's not primarily about winning prize money. Yes, there's a $100,000 equity-free prize for the top pitch. But the real value is the platform itself. You get three days of exhibit space at Tech Crunch Disrupt, direct access to top-tier investors, press coverage, masterclasses from established founders, and a shot at pitching live in front of a massive audience.

For early-stage startups, this is often the first major inflection point in their journey. You're not just getting in front of investors. You're getting validation from Tech Crunch, which carries weight in the startup ecosystem. When a VC hears that you got into Startup Battlefield, that's a signal. It means you passed a filter.

The numbers back this up. Alumni of Startup Battlefield have collectively raised over $32 billion. That's not coincidental. It's what happens when you combine 200 promising startups, expose them to thousands of investors, and give them credibility through association with Tech Crunch.

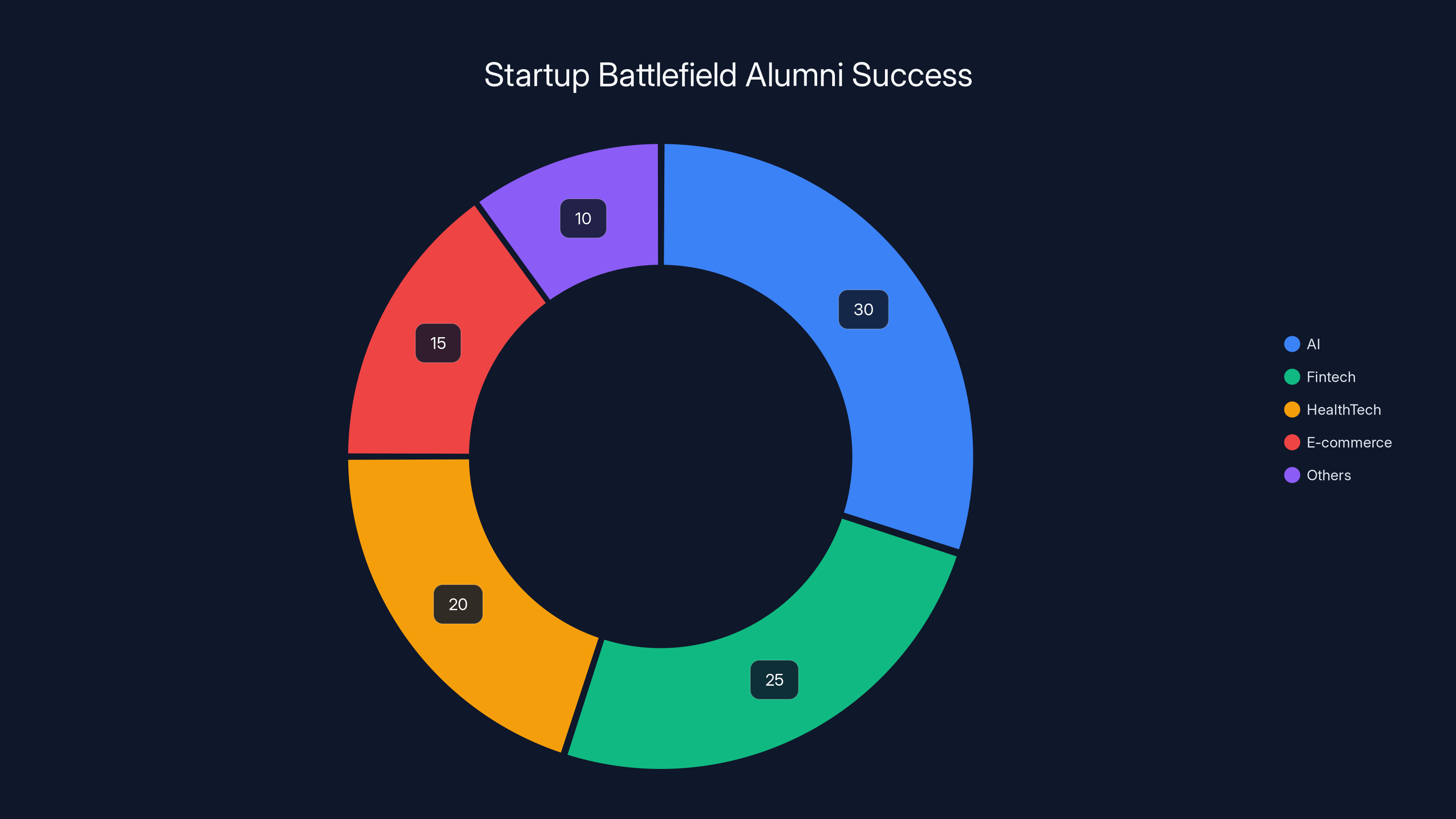

The program attracts startups from every sector. AI is hot right now, obviously. But Startup Battlefield also welcomes founders building in climate tech, healthtech, fintech, enterprise software, consumer apps, and sectors we haven't even named yet. Tech Crunch intentionally curates diversity in the cohort, because they know breakthrough innovation happens across sectors.

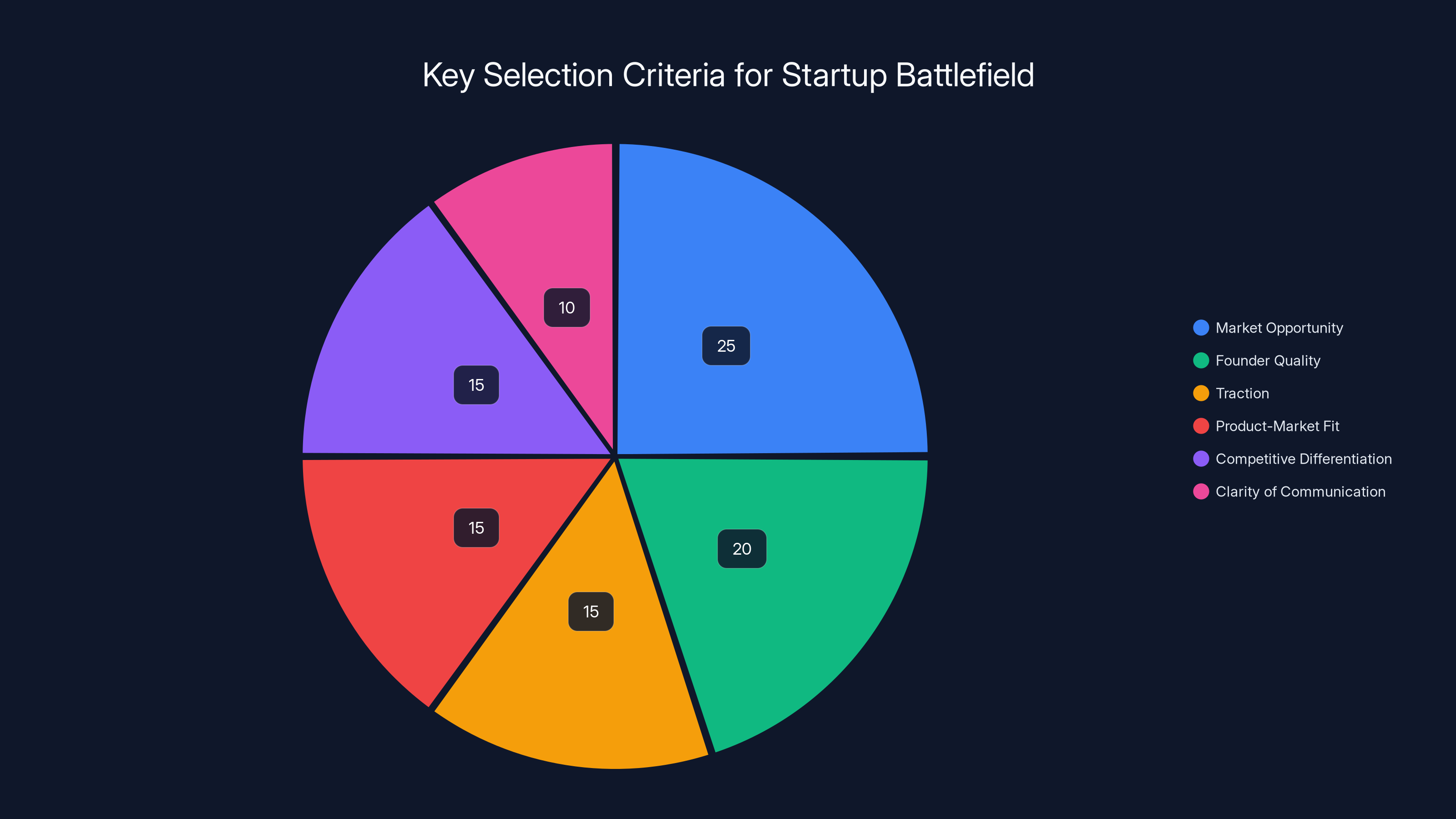

Estimated data shows that market opportunity and founder quality are the most critical criteria for selection into Startup Battlefield, followed by traction and product-market fit.

The 2026 Timeline: Key Dates You Need to Know

Timing is everything with Startup Battlefield, so let's lock in the 2026 calendar right now.

Applications open in mid-February 2026 and close in mid-June. That's a four-month window, which sounds like plenty of time, but trust me: founders who wait until May or June often rush their applications. You want breathing room to iterate on your pitch, refine your narrative, and let it marinate before submitting.

Selected startups get notified around September 1, 2026. Between September and October, Tech Crunch runs a virtual preparation program designed to help you sharpen your story and pitch. This program is underrated. Many founders think the program is just a formality, but the founders who get the most out of it treat it like a master class. You're working with mentors and coaches who've seen thousands of pitches. Listen to them.

Tech Crunch Disrupt 2026 happens later in the year (typically October in San Francisco). This is where the magic happens. Three days, thousands of attendees, hundreds of investors, and 200 startups competing for attention. The main stage pitch happens during Disrupt, and this is your moment.

The timeline matters because it affects your preparation strategy. If you're selected in September, you have about a month to really refine your pitch before walking on stage. That month is crucial. Don't waste it.

Understanding the Application Criteria: What Actually Gets You In

Here's the thing about Startup Battlefield's selection process: Tech Crunch doesn't publish a detailed rubric. So founders spend a lot of time guessing what they actually want. But after looking at decades of applications and successful vs. rejected startups, patterns emerge.

First, market opportunity. Tech Crunch cares about the size of the problem you're solving. They're not interested in optimizing a niche that affects 1,000 people. They want to see founders attacking problems that impact millions. This doesn't mean your product has to be massive right now. It means your addressable market needs to be huge.

Second, founder quality. This might be the most important factor, and it's the hardest to quantify. Investors often say they invest in the team, not just the idea. Tech Crunch applies the same logic. What's your background? Have you built something before? Do you have domain expertise in the space you're entering? Are you the right person to solve this problem?

Third, traction and validation. "Traction" has become an overused word, but it matters. Do you have users? Have you launched yet? What's your growth trajectory? If you're pre-launch, do you have waitlist signups, early customer commitments, or pilot agreements? Essentially, you need to prove that this isn't just a neat idea—people actually want it.

Fourth, product-market fit signals. This is slightly different from traction. It's about whether your early users are genuinely excited about what you've built. Are they using your product repeatedly? Do they evangelize it? Are you seeing organic growth?

Fifth, uniqueness. If you're solving the same problem as five other companies in the batch, you need a differentiated angle. What's your unfair advantage? Is it technology? Distribution? A unique insight into the market? Founder pedigree?

Lastly, clarity of communication. I know a handful of brilliant founders who got rejected from Startup Battlefield not because their idea was bad, but because they couldn't articulate what they were doing in a compelling way. Your application needs to communicate your vision clearly, quickly, and compellingly.

Here's the pattern I've observed: Tech Crunch prefers founders who are solving problems they personally believe need solving. This comes through in how you write your application. Generic pitches get rejected. Passionate, specific pitches get selected.

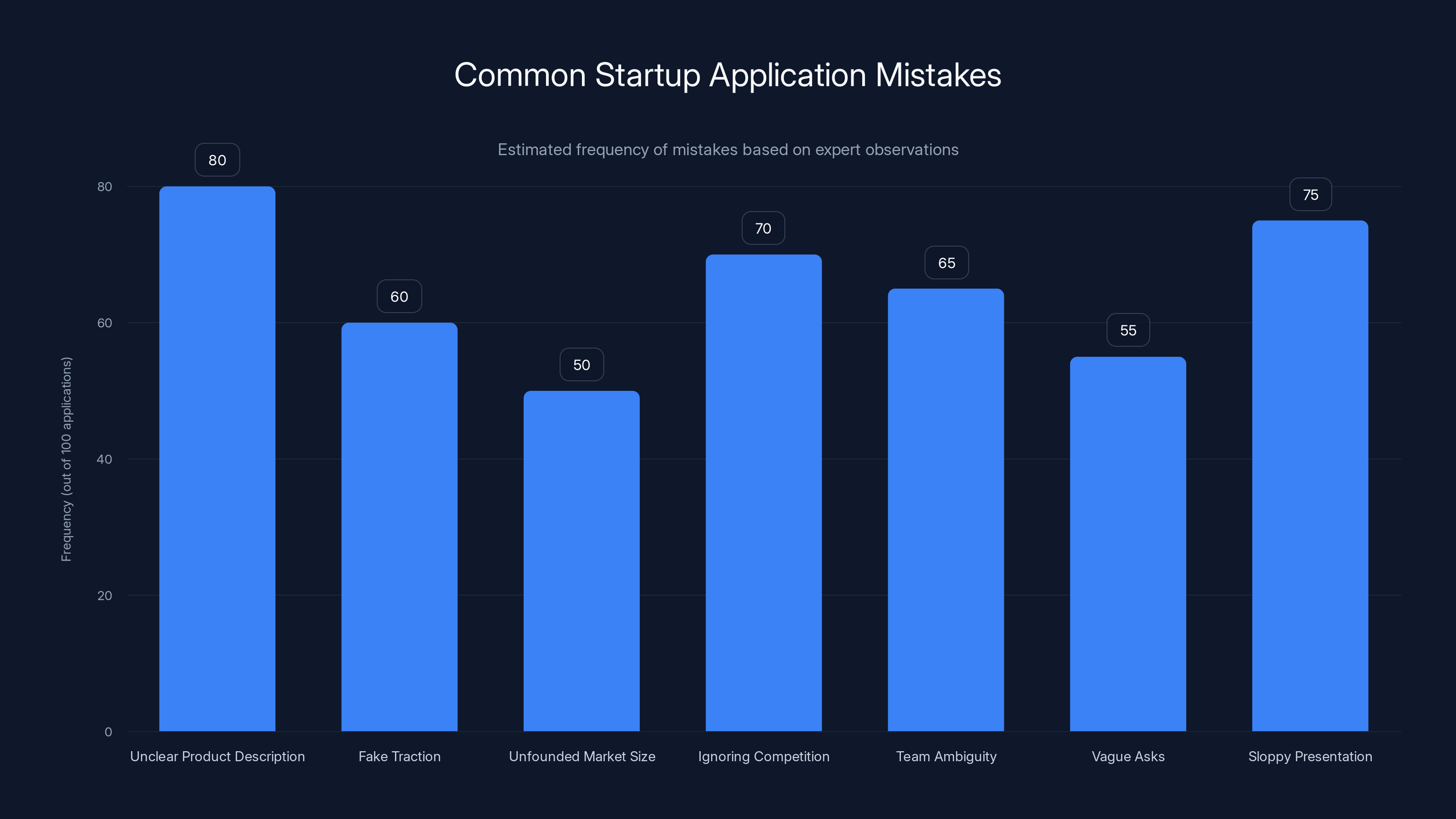

Estimated data suggests that unclear product descriptions and sloppy presentations are the most frequent mistakes in startup applications, appearing in 75-80% of cases.

Breaking Down the Application Components: What You're Submitting

When applications open, you're not just writing a couple paragraphs. You're completing a comprehensive submission. Here's what you're typically dealing with:

Company description and mission statement: This is your elevator pitch, but longer. You're explaining what your company does, the problem you're solving, and why it matters. Don't bury the lead. Say what you do in the first sentence.

Team section: Tech Crunch wants bios of your founding team. Include background, relevant experience, and why you're the right people to build this. If you have an advisory board or early advisors, mention them. This section is critical.

Product description: What exactly does your product do? Walk through the core features and benefits. If you have a demo video, this is where you include it. Visual representation matters significantly.

Market size and opportunity: How big is this market? What's your total addressable market (TAM)? Include data supporting your market size estimates. This shows you've done homework.

Business model: How do you make money? If you're not monetizing yet, what's your path to revenue? Investors want to see you've thought about unit economics.

Traction metrics: Users, revenue, growth rate, partnerships, pilot customers—whatever proof points you have that validates your idea. Numbers are powerful here.

Funding stage and amount: How much have you raised? How much are you raising now (if applicable)? What are you using funds for?

Links and media: Include a link to your website, demo video, and any press coverage you've received. If you have a YouTube demo, that's stronger than written description.

The application interface is designed to be straightforward, but the content you fill in is what matters. Many founders underprepare here. They treat it like a box-checking exercise. That's a mistake.

Alumni Success Stories: From Startup Battlefield to Scale

One of the best ways to understand what Startup Battlefield can do is to look at what alumni have actually accomplished.

Jason Citron and the Discord team pitched at Startup Battlefield years ago. At the time, Discord was competing in a crowded gaming communication space. Nothing about it seemed revolutionary. But Citron had a clear vision, smart positioning, and he nailed the execution. Today, Discord is valued at billions of dollars and serves millions of users daily. Discord is probably the most famous alumni company, but there are many others.

Looking at the broader alumni pool: we're talking about 200 startups per year for over a decade. That's thousands of companies. Some are unicorns. Some are profitable mid-market companies. Some got acquired by larger tech firms. Some pivoted multiple times and eventually found their niche. A few failed, obviously.

What they all had in common: they got exposure at a critical moment in their development. For many, Startup Battlefield was the inflection point where they went from "promising startup" to "startup we're actually going to invest in."

The diversity of outcomes is instructive. You don't need to be the next Discord to have a successful Startup Battlefield experience. Getting selected gives you credibility with investors, media attention that helps with recruiting and sales, and a network of founders going through similar journeys. Many founders cite the peer network as being almost as valuable as the investor access.

This is important context for your application. You're not applying to become the next Discord. You're applying to position your company for rapid scaling and to get validation at a moment when validation is hard to come by. The alumni track record shows this strategy works.

Team section and traction metrics are typically rated highest in importance when submitting a startup application. Estimated data.

Sector Trends for 2026: Where Opportunity Is Concentrating

Startup Battlefield attracts applications across all sectors, but certain spaces are notably hot in 2026.

Artificial Intelligence: This is obvious, but worth stating clearly. AI applications in every vertical are getting attention. If your startup is using AI to solve a real problem, that's compelling to reviewers. But—and this is important—generic AI applications are getting rejected at high rates. You need AI to actually solve something, not just be a feature.

Climate technology: There's consistent investor demand for climate solutions. Whether it's carbon removal, renewable energy optimization, sustainable materials, or climate adaptation, this sector is well-funded and growing. If your startup addresses climate challenges, position that prominently in your application.

Health and longevity: Post-pandemic, there's intensified interest in healthcare innovation. Telemedicine, mental health apps, biotech, longevity research—this sector is attracting capital and attention. If you're building here, emphasize the health impact alongside the business opportunity.

Enterprise software and developer tools: There's always demand for tools that help developers work faster and smarter. If you're building infrastructure, platforms, or tools for enterprise or developer audiences, you're in a sector with strong tailwinds.

Fintech: Financial services innovation hasn't slowed down. Payments, lending, investment platforms, accounting tools for SMBs—there's consistent interest across financial services.

What's getting less traction? Hyper-local services without clear paths to scale, consumer apps with saturated competition (another photo app, another social network), and ideas without clear business models.

Your sector doesn't determine your fate. Exceptional execution and a compelling founder story can overcome sector headwinds.

What Happens If You Get Selected: The Preparation Program

Let's say your application hits and you get that email in September saying you're in. Now what?

You enter the virtual preparation program. This is where many founders make a critical mistake: they view this as something to get through rather than something to leverage. It's actually your competitive advantage over other selected startups.

The program typically runs from September through early October (right up until Disrupt). You're working with pitch coaches, media trainers, and sometimes successful founders or investors who've pitched before. The goal is to refine your narrative, tighten your pitch, and get feedback on everything from your opening story to your closing ask.

Here's what separates founders who maximize this program from those who don't:

Obsessive iteration: The best founders go through 20+ iterations of their pitch during this period. They're not just doing what the coaches suggest. They're testing variations, getting feedback, and refining relentlessly.

Vulnerability: Founders who get the most value are willing to acknowledge where they're weak and ask for help. The coaches have seen thousands of pitches. Let them help you.

Specificity in your ask: By the end of the program, you should be crystal clear on what you want investors to do. Are you fundraising? Seeking pilots? Looking for partnerships? Your pitch should make this unmistakable.

Emotional resonance: Great pitches aren't just information delivery. They tell a story that makes people care about your success. The preparation program helps you find and refine that story.

One thing people don't realize: the preparation program also gives you networking time with other selected founders. You're going through this journey with 199 other teams. Some of your strongest business relationships might come from connecting with other Startup Battlefield founders during this period.

Many founders treat the prep program as a formality. That's leaving money on the table.

Estimated data shows AI and Fintech sectors lead in Startup Battlefield alumni success, reflecting current industry trends.

The Main Event: Pitching at Tech Crunch Disrupt

Now we're getting to the moment everyone's been preparing for. You're on the stage at Tech Crunch Disrupt in San Francisco. The room is full. Investors, press, founders, operators—there are thousands of people at Disrupt. Some are watching you pitch live. Some are watching the livestream. This is your moment.

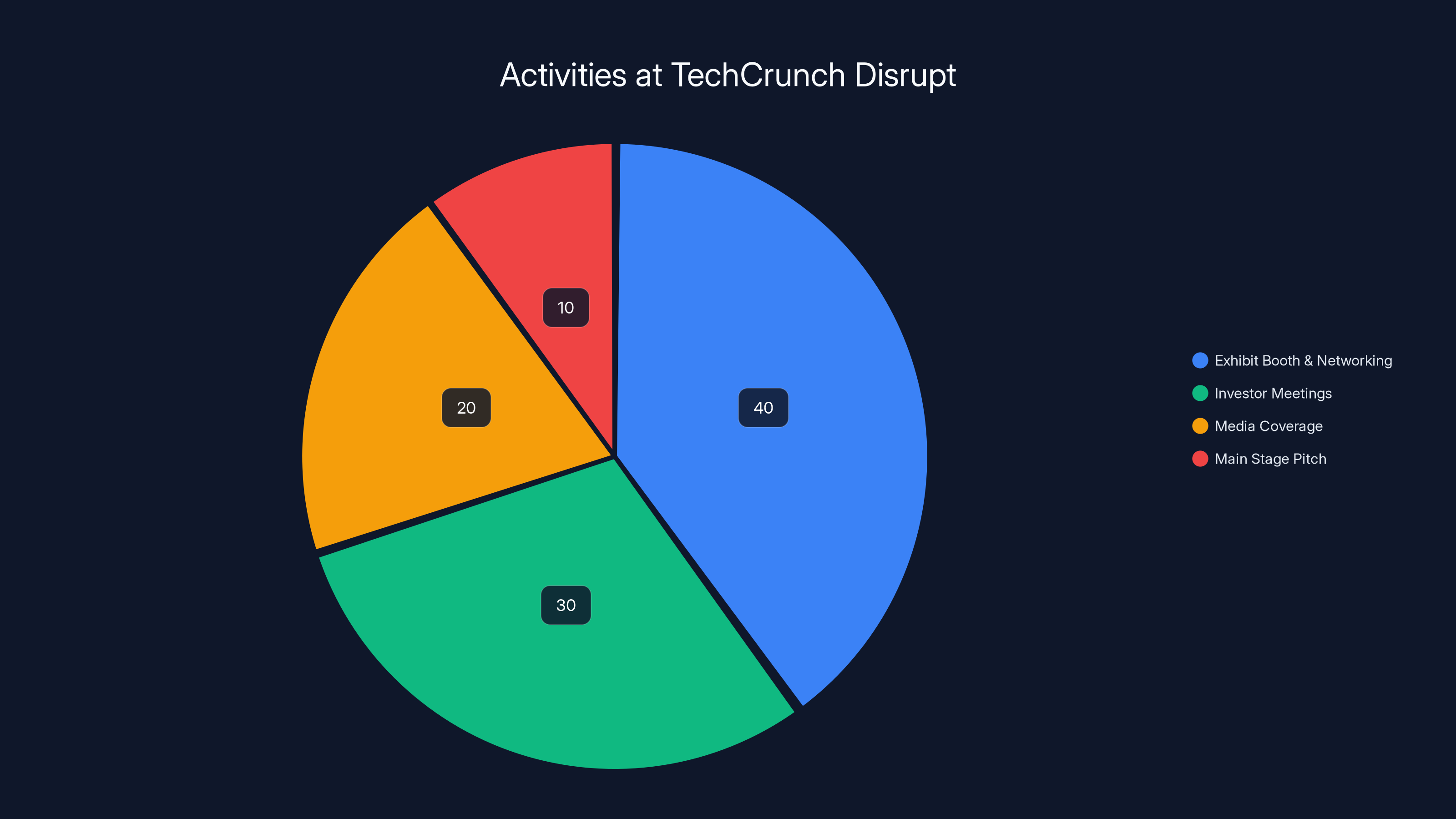

What you're doing during these three days:

Exhibit booth setup and networking: All 200 startups get exhibit space. You're manning a booth, talking to investors, media, and potential customers. This is actually where a lot of value happens. You're doing 50+ individual conversations with different people. These conversations can lead to meetings, partnerships, and commitments that matter more than the main stage pitch.

Investor meetings: Tech Crunch typically arranges investor speed dating sessions. You're sitting down with dozens of potential investors for short conversations. These initial meetings often lead to follow-up conversations and potential term sheets.

Media coverage: Journalists and podcasters are everywhere at Disrupt. If you're interesting, you can get press. This coverage matters for recruiting, sales, and future fundraising. Some startups get way more press than others. The difference is usually whether they have a compelling story.

Main stage pitch (if selected): About 15-20 startups get to pitch on the main Disrupt stage in front of a large audience. This is the prestige moment. If you're selected for main stage, that's a signal. You're competing for the $100,000 equity-free prize and the Disrupt Cup.

Here's what's important to understand: the main stage pitch is one moment in a three-day event. Don't get so focused on preparing for that moment that you neglect the booth networking and investor meetings. Some of the most successful Startup Battlefield experiences happen in one-on-one conversations, not on stage.

What makes a pitch work on stage? Speed, clarity, emotional connection, and a compelling closing. You have a limited amount of time to communicate what you're building, why it matters, and what you're asking for. Every word counts.

Crafting Your Winning Application: Step-by-Step Framework

Let's get tactical. If you're serious about getting selected, here's the framework for building a winning application.

Step 1: Start with your core insight. Before you write anything, articulate the single insight that makes you believe this opportunity exists. Why is this problem worth solving? What changed that makes now the right time? What do you know that others don't? Get this crystal clear, because it's going to inform everything else.

Step 2: Define your market opportunity. Research your total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM). Include sources for these numbers. Show you've done homework. This section tells evaluators you're thinking seriously about scale.

Step 3: Describe your solution clearly and specifically. What does your product actually do? Don't get abstract. Walk through the core workflow. What problem does it solve? What value does it create for users? Show, don't tell. If you have a product demo, a screenshot, or a video walkthrough, include it. Visual representation is more persuasive than description.

Step 4: Make your team compelling. Who are your co-founders? What relevant experience do they have? Why are you the right team to execute on this? Include photos, brief bios, and relevant achievements. If any team members have impressive credentials (previous founders, Stanford Ph Ds, 10 years at Google), highlight that.

Step 5: Show real traction. Do you have customers? Users? Revenue? Growth metrics? This is where you demonstrate that people actually want what you're building. Include specific numbers. "1,000 users" is more persuasive than "significant traction."

Step 6: Articulate your unfair advantage. Why can't a competitor replicate what you're doing? Is it exclusive technology? Founder expertise? First-mover advantage? Market access? What's the moat?

Step 7: Be crystal clear on your business model. How do you make money? What's your pricing? What's your unit economics path? If you're not monetized yet, show your path to monetization. This tells evaluators you've thought practically about sustainability.

Step 8: Ask for what you need. Are you raising funding? If so, how much and how will you use it? Are you seeking partnerships, pilots, or customers? Be specific about what success looks like for you.

Step 9: Tell your story. Throughout the application, there's a narrative arc that connects all these elements. Start with the problem and why you care about it. Move to your solution and how it's different. Show traction. End with vision for what's next. Make me care about your success.

Step 10: Review ruthlessly. Cut everything that doesn't serve the narrative. Tighten your language. Read it aloud. Does it sound like you? Does it flow? Have you made any claims that aren't backed up? Remove them.

This framework isn't about gaming the system. It's about communicating your story as effectively as possible. Tech Crunch reviewers are looking for signal. This framework helps you give them signal.

Estimated data shows that startups at TechCrunch Disrupt spend most of their time on exhibit booth networking and investor meetings, with less focus on media coverage and main stage pitching.

Common Application Mistakes: What Gets You Rejected

I've seen thousands of startup applications, and certain mistakes appear again and again. Knowing what not to do is almost as valuable as knowing what to do.

Mistake 1: Unclear what your product does. Some founders assume reviewers understand the space deeply, so they get abstract. "We're using AI to optimize data infrastructure." What does that actually mean? Show me. Walk me through what happens when a customer uses your product.

Mistake 2: Fake traction. Some founders inflate their metrics. "1 million users" when it's 1,000. This gets caught during due diligence. Don't do it. Real traction is always better than inflated claims.

Mistake 3: Unfounded confidence in market size. Founders sometimes claim a TAM that's clearly wrong. "Our market is $1 trillion." Maybe. But if you're claiming a market size that's larger than the entire addressable market in your sector, you've lost credibility.

Mistake 4: Ignoring the competitive landscape. Pretending you have no competitors signals naivety. Every company has competitors (sometimes they're just different approaches to the same problem). Acknowledge the competitive landscape and explain why your approach is better.

Mistake 5: Team ambiguity. If your co-founder's background is unclear or if you're missing critical expertise, that's a red flag. If you need someone who understands X and you don't have that on your team, be honest about it and show you're hiring for it.

Mistake 6: Asking for the moon without clear asks. Don't ask for everything. Be specific about what you need and when. "We're seeking strategic partnerships" is too vague. "We're looking to partner with 3-5 healthcare systems to pilot our solution in Q1 2026" is actionable.

Mistake 7: Sloppy presentation. Grammar errors, unclear screenshots, broken links—these things signal disrespect for the process. Tech Crunch reviews hundreds of applications. If yours is sloppy, it gets dropped. Polish matters.

Mistake 8: Trying to be too clever. Some founders try to make their pitch exceptionally creative or funny. Clever is great if it's also clear. Funny is great if it also communicates value. Don't sacrifice clarity for creativity.

Mistake 9: Not showing execution. Talk is cheap. Show work. Have you shipped? Do you have customers? Have you gotten feedback from users? The most persuasive applications show work, not just ideas.

Mistake 10: Ignoring your unfair advantage. If I know nothing about your company except what's in this application, why would I believe you'll win? What makes you different? Articulate this explicitly.

Most applications that get rejected aren't rejected because the ideas are bad. They're rejected because the communication is muddled or the founder hasn't yet validated that people care. Clear communication + real traction = invitation.

Maximizing Your Disrupt Experience: Networking and Beyond

Assuming you get selected and you're at Disrupt, you want to extract maximum value from those three days. This is about strategy, not just showing up.

Pre-Disrupt: Before you arrive, research which investors, journalists, and potential partners will be there. Identify 20-30 people you want to meet. Use LinkedIn, Twitter, and Disrupt's attendee list to make warm introductions beforehand. "Hey, I'm speaking at Startup Battlefield at Disrupt in October. I noticed you'll be there. Love to grab coffee." This can result in pre-scheduled meetings during Disrupt.

Booth strategy: Your booth is your home base. Design it to be approachable. Have materials (one-pagers, not a pile of brochures). Staff it with people who can intelligently discuss your product. Position it so people walking by can see what you're doing. Don't sit behind a table looking defensive.

Investor meetings: Go in with a clear 2-minute pitch. Practice it beforehand. Know what you want from each conversation. Ask questions. What would make this investor want to take a deeper look? Listen more than you talk. The best investors ask good questions.

Media outreach: Before Disrupt, email relevant journalists covering your sector. "We're at Startup Battlefield. Here's why our story might be interesting to your readers." Some will ignore you. Some will want to meet. A few will do coverage.

Peer networking: Talk to other founders. Share advice. Trade contact information. Some of your best partnerships might come from other Startup Battlefield founders going through the same journey.

Follow-up: Disrupt is a sprint, but the real work happens after. Within 48 hours, you should be sending follow-up emails to everyone meaningful you met. "Great talking with you about X. Wanted to follow up with Y." The founders who are disciplined about this get the best results.

Treat Disrupt like a sales process. You're selling investors, partners, and customers on your company. The three days at Disrupt are your sales event. Prepare accordingly.

Strategic Positioning: How to Make Your Application Stand Out

Thousands of applications. 200 slots. How do you make sure yours is one of them?

Positioning is about making your story resonant and memorable. This goes beyond just describing what you do.

Find your unique angle: Every startup is solving some problem. But why are you the one telling this story? What's your personal connection to the problem? The strongest applications have founders who are passionate about the problem because they've lived it. "I spent 10 years in logistics and saw this inefficiency." That's stronger than "The logistics industry is inefficient."

Show momentum, not perfection: You don't need a perfect product to get into Startup Battlefield. You need momentum. Are you growing? Are customers excited? Are you learning and iterating? Momentum matters more than polish.

Be honest about what you don't know: The smartest founders acknowledge limitations. "We haven't cracked our CAC payback period yet, but here's what we're testing." This shows maturity and realism.

Contextualize your sector: If you're in an unsexy space, show why it matters. "Boring" sectors often have less competition and more money available. Position your sector as an opportunity.

Make your financials understandable: If you're monetized, show your unit economics. What's your gross margin? What's your customer lifetime value relative to customer acquisition cost? These numbers are boring but powerful.

Use specificity as a weapon: Specific numbers, specific timelines, specific use cases—all of these make your application more credible than vague claims. "We're partnering with 5 health systems for a pilot in Q1" is stronger than "We're exploring healthcare partnerships."

The Post-Selection Timeline: What to Do Next

Let's say you get that email in September. Congratulations. Now, what's your timeline for the next few months?

September 1: You get notified. Start the virtual prep program. Connect with your assigned pitch coach.

September 1-15: Attend all prep sessions. Work on your narrative. Get feedback. Iterate on your pitch. Start researching which investors will be at Disrupt.

September 15-30: Third iteration of your pitch. You should feel significant improvement from iteration 1. Get feedback from mentors and advisors outside the program.

October 1: Final weeks of preparation. You should be able to pitch in your sleep. Focus on delivery, presence, and handling unexpected questions.

October 1-7: Confirm your travel, hotel, and logistics for Disrupt. Research specific investors and journalists you want to meet. Prepare one-pagers or leave-behinds.

October (Disrupt week): You're at Disrupt. Execute flawlessly. Follow up aggressively after the event.

November-December: You're having follow-up meetings with interested investors and partners. You're closing deals, whether that's funding, partnerships, or customers.

This timeline is fluid. Your specific timeline might look different. But the general arc is clear: prepare obsessively, execute with presence, follow up ruthlessly.

Building Your Personal Brand Before Application

Here's something most founders don't think about: your personal brand matters. Who you are as a founder influences how your application is reviewed.

When Tech Crunch reviewers look at your application, they might google you. They might check your social media. They might look at your background. This is all part of the signal.

So, what should you do?

Start building your founder brand now: Write about your startup journey on LinkedIn or Twitter. Share insights about your sector. Show your thought process. This isn't about self-promotion. It's about demonstrating that you're serious and thoughtful.

Engage meaningfully in your community: If you're in fintech, follow fintech founders and investors. Comment thoughtfully on their posts. Build relationships. When application time comes, you're not a stranger.

Speak publicly if you can: Give talks at meetups, podcasts, conferences. Get comfortable presenting your ideas. This also builds credibility.

Get introduced to investors early: Don't wait until Disrupt to start building investor relationships. Start now. Many of the best outcomes happen when founders have already had preliminary conversations with investors before Disrupt.

Show you're executing: Launch your product. Get customers. Show work. The founders with the strongest applications have already proven they can get stuff done.

Your personal brand doesn't guarantee you'll get into Startup Battlefield. But it increases the odds because it shows you're serious, thoughtful, and already moving.

Funding After Startup Battlefield: Capitalizing on Your Selection

One of the biggest questions founders have: if I get into Startup Battlefield, will it help me fundraise?

Short answer: yes, significantly.

Getting into Startup Battlefield is a credibility signal. When you tell an investor you got selected, that's a positive data point. It means you passed a filter. You're in a cohort with 199 other companies. Statistically, some of them will be successful. Being in that cohort is good signal.

But here's what matters more: how you use the Disrupt platform to build relationships and demonstrate traction. If you get selected and you spend three days at Disrupt having intelligent conversations with investors, showing your product, and articulating your vision, that's what leads to funding.

The strongest post-Disrupt outcomes typically follow this pattern:

- You meet an investor at Disrupt

- You have a great conversation

- You follow up within 48 hours with a specific ask: "Let's do a more formal conversation about our Series A"

- You schedule a meeting for November

- You spend 4-6 weeks having conversations with that investor

- You send a pitch deck and financials

- You get a term sheet

This timeline is typical. Some investors move faster. Some move slower. But the pattern is clear: Disrupt is the meeting point. The funding round happens afterward.

How much does Startup Battlefield selection actually help with fundraising? Hard to quantify, but anecdotally, founders report that selection significantly accelerates conversations with investors. You go from "sending cold emails" to "having warm intros and scheduled meetings."

Why Startup Battlefield 2026 Is Worth Your Time

Let's zoom out for a second. Why should you spend the time to apply? Why should you commit to the preparation program if you get selected? Why should you rearrange your schedule to be at Disrupt?

Because being at Startup Battlefield is an inflection point. It's the moment where your company goes from "a startup I heard about" to "a company that got selected for Startup Battlefield." That's a real signal in the startup world.

Yes, you might not win the main stage pitch. You might not raise $50 million immediately after Disrupt. But you will have three days to accelerate your trajectory. You'll have relationships with investors. You'll have press coverage. You'll have credibility. You'll have confidence that you're building something real.

For early-stage founders, that's invaluable.

The timeline is clear. Applications open mid-February. If you're thinking about applying, start preparing now. Build your product. Get customers. Build your narrative. By the time applications open, you'll be ready to submit something compelling.

Discover whether your startup idea is truly compelling and worth the next chapter of your entrepreneurial journey.

FAQ

What is Startup Battlefield 200?

Startup Battlefield 200 is an annual early-stage startup competition held at Tech Crunch Disrupt in San Francisco that selects 200 promising companies from thousands of global applicants. The program provides free exhibit space at Disrupt for three days, exclusive access to investors and press, masterclasses from successful founders, and a chance to pitch on stage for potential prize money. Alumni have collectively raised over $32 billion, making it one of the most credible early-stage startup platforms in the industry.

How do I apply for Startup Battlefield 2026?

Applications for Startup Battlefield 2026 open mid-February and close mid-June on Tech Crunch's website. You'll complete an online application that includes company description, team bios, product overview, market opportunity, traction metrics, business model, and links to your website and demo. The application process is designed to be comprehensive but not overly complex—Tech Crunch reviewers evaluate clarity, team quality, market opportunity, and founder credibility.

What are the key selection criteria for getting into Startup Battlefield?

Tech Crunch primarily evaluates market opportunity (size of the problem you're solving), founder quality and relevant background, traction or validation from users, product-market fit signals, competitive differentiation, and clarity of communication. While there's no published rubric, the strongest applications clearly articulate a compelling founder story, show real evidence that users want the product, demonstrate an unfair advantage, and are written with clarity and specificity rather than generic startup language.

What happens after I get selected for Startup Battlefield?

If selected in September, you'll enter a virtual preparation program running through October where you work with pitch coaches to refine your narrative and pitch. You'll receive feedback on everything from your opening story to your closing ask, participate in media training, and connect with other selected founders. The preparation program culminates in you attending Tech Crunch Disrupt in October in San Francisco, where you'll exhibit your startup, participate in investor meetings, and potentially pitch on the main stage.

How much does it cost to participate in Startup Battlefield?

Startup Battlefield 2026 is completely free to apply for and free to participate in if selected. Tech Crunch covers your exhibit space at Disrupt and provides the preparation program at no cost. However, you will need to cover your own travel and accommodation costs to attend Tech Crunch Disrupt in San Francisco, which is typically the largest cost associated with participation.

What's the prize for winning the main stage pitch?

The top startup selected to pitch on the main Disrupt stage competes for a

How should I position my application to stand out?

Stand out by being specific rather than generic, showing real traction with actual numbers rather than vague claims, articulating a clear unfair advantage, and telling a compelling founder story that explains why you personally care about solving this problem. Remove anything that doesn't serve your narrative, acknowledge your competitive landscape rather than pretending you have no competitors, and ensure your application is polished with no typos or unclear sections. Specificity and clarity are far more persuasive than cleverness or hype.

What's the timeline for Startup Battlefield 2026?

Applications open mid-February 2026 and close mid-June. Selected startups are notified around September 1st and begin the virtual preparation program. Tech Crunch Disrupt 2026 takes place in October in San Francisco, where all selected startups exhibit and top startups pitch on the main stage. The entire timeline runs from February through October 2026.

How do I maximize my experience at Tech Crunch Disrupt?

Research which investors, journalists, and potential partners will attend and try to schedule meetings beforehand. Prepare a clear 2-minute pitch and have materials ready at your booth. Actively network with both investors and other founders—many valuable partnerships come from connections made with fellow Startup Battlefield companies. Most importantly, follow up aggressively within 48 hours of meeting anyone significant, as the real value of Disrupt happens in the follow-up conversations and meetings that occur in the following weeks.

How does Startup Battlefield help with fundraising?

Being selected for Startup Battlefield is a credibility signal that accelerates investor conversations. You're no longer sending cold emails—you have warm introductions and scheduled meetings with investors who are interested in the Disrupt cohort. While selection doesn't guarantee funding, the relationships you build during the three days at Disrupt typically lead to follow-up meetings that result in funding conversations. Many founders report that Startup Battlefield selection cuts months off their fundraising timeline by providing direct access to relevant investors.

Can non-US startups apply for Startup Battlefield?

Yes, Startup Battlefield explicitly welcomes applications from startups around the world. Tech Crunch is a global platform, and the Disrupt event attracts international founders and investors. Non-US startups with compelling ideas and strong founders have been selected and have had successful experiences at Startup Battlefield. However, note that you will need to cover your own travel costs to San Francisco to attend Disrupt if selected.

Final Thoughts: Your Next Steps

Startup Battlefield 2026 is opening soon. Whether you're ready to apply depends on one question: are you building something worth building?

If yes, start preparing now. Polish your product. Get users. Get feedback. Talk to customers. Build your narrative. By the time applications open in mid-February, you'll be ready to submit something compelling.

If you're selected, embrace the preparation program. Iterate obsessively on your pitch. You're not wasting time—you're sharpening the tool that's going to help you scale.

And when you're at Disrupt, remember that the stage is just one moment. The real value is the three-day immersion: the conversations, the connections, the validation that you're building something real. Extract maximum value from those days.

Good luck. The startup world is watching.

Key Takeaways

- Startup Battlefield 2026 opens applications mid-February and closes mid-June, selecting 200 companies from thousands of applicants globally

- Alumni have collectively raised over $32 billion, making selection a credible signal that significantly accelerates investor conversations and funding timelines

- Success requires clear communication about market opportunity, strong founder credentials, real traction metrics, and a compelling personal narrative

- The three-day Disrupt event is valuable primarily for the relationships built and follow-up meetings scheduled, not just the main stage pitch

- Founders who maximize the preparation program with iterative pitch refinement and strategic networking significantly outperform those who treat it as a formality

Related Articles

- Student Startup Accelerators: How Breakthrough Ventures is Reshaping Founder Funding [2025]

- Kofi Ampadu Leaves a16z: What TxO's Collapse Means for Founder Diversity [2025]

- TechCrunch Founder Summit 2026: The Ultimate Guide to Scaling Your Startup [2026]

- Skyryse's $300M Series C: Aviation's Autonomous Future [2025]

- Epstein Files Expose Peter Thiel's Silicon Valley Ties and Extreme Diet [2025]

- The Future of Domains in 2026: How AI is Empowering Builders [2025]

![Startup Battlefield 200 2026: Complete Guide to Apply & Win [2025]](https://tryrunable.com/blog/startup-battlefield-200-2026-complete-guide-to-apply-win-202/image-1-1770145668192.jpg)