Polestar's Station Wagon Strategy: How the EV Maker Is Challenging Tesla

Here's something you don't hear about anymore: a station wagon that's actually exciting. But that's exactly what Polestar just announced. The Swedish electric vehicle manufacturer is launching a shooting brake version of the Polestar 4, and it signals something bigger than just another model variant.

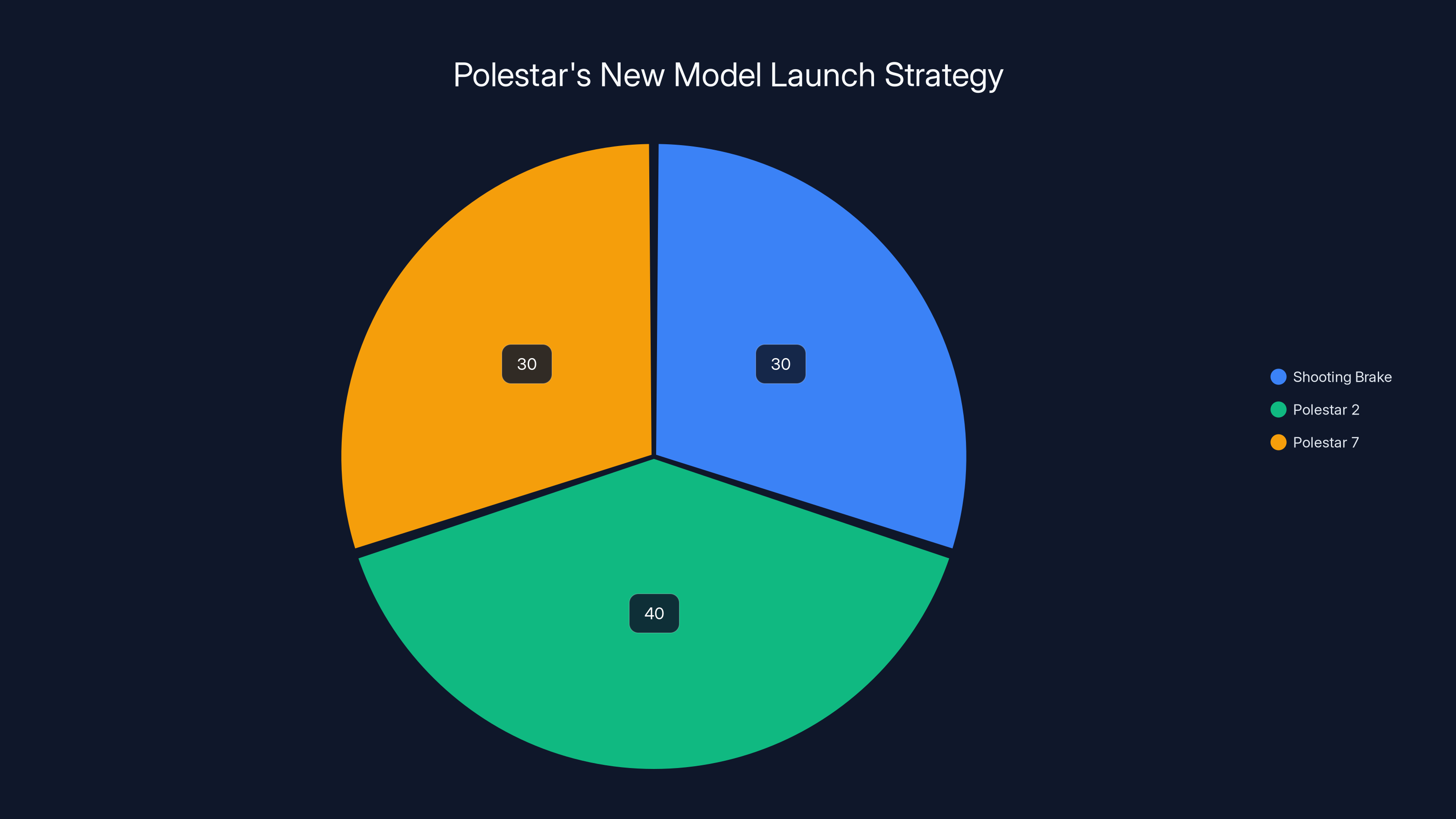

Polestar sold 61,000 electric vehicles in 2025, a record for the company. But that number tells only part of the story. What really matters is what's happening next. Over the next two years, Polestar is introducing three entirely new models designed to crack into profit pools that currently belong to Tesla and traditional automakers. The station wagon is one. A redesigned Polestar 2 sedan is another. A compact SUV called the Polestar 7 is the third.

This isn't random product development. This is strategic positioning. CEO Michael Lohscheller has been clear about the vision: "We want to get more volume out of a bigger cake." That means targeting different market segments, different regions, and different customer needs simultaneously.

What makes this moment interesting isn't just the new products. It's the philosophy behind them. While most EV makers chase performance or range, Polestar is chasing practicality. That's a bet that the EV market has matured beyond early adopters. Regular people want electric cars that work like regular cars. A station wagon with SUV versatility? That's not niche. That's mainstream.

Let's break down what Polestar is doing, why it matters, and what it tells us about the future of electric vehicles.

The Polestar 4 Station Wagon: Why a Shooting Brake Makes Sense

The Polestar 4 launched as a sleek, coupe-like SUV. It looked fast standing still. Performance was solid. But something was missing: cargo space that matched the promise of an SUV.

Enter the shooting brake variant, arriving later in 2025. Same platform. Same power. More practicality.

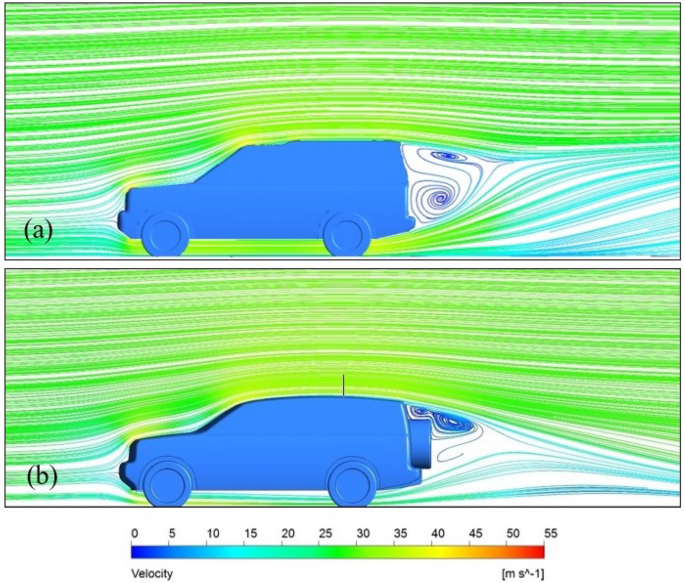

Here's the math on why this works. A traditional SUV is a box on wheels. A sedan is aerodynamic but cramped. A shooting brake splits the difference. You get the high seating position of an SUV, the sleek profile that cuts through air efficiently, and the cargo volume of an estate car. That combination reduces drag compared to a tall SUV while offering more space than a sedan.

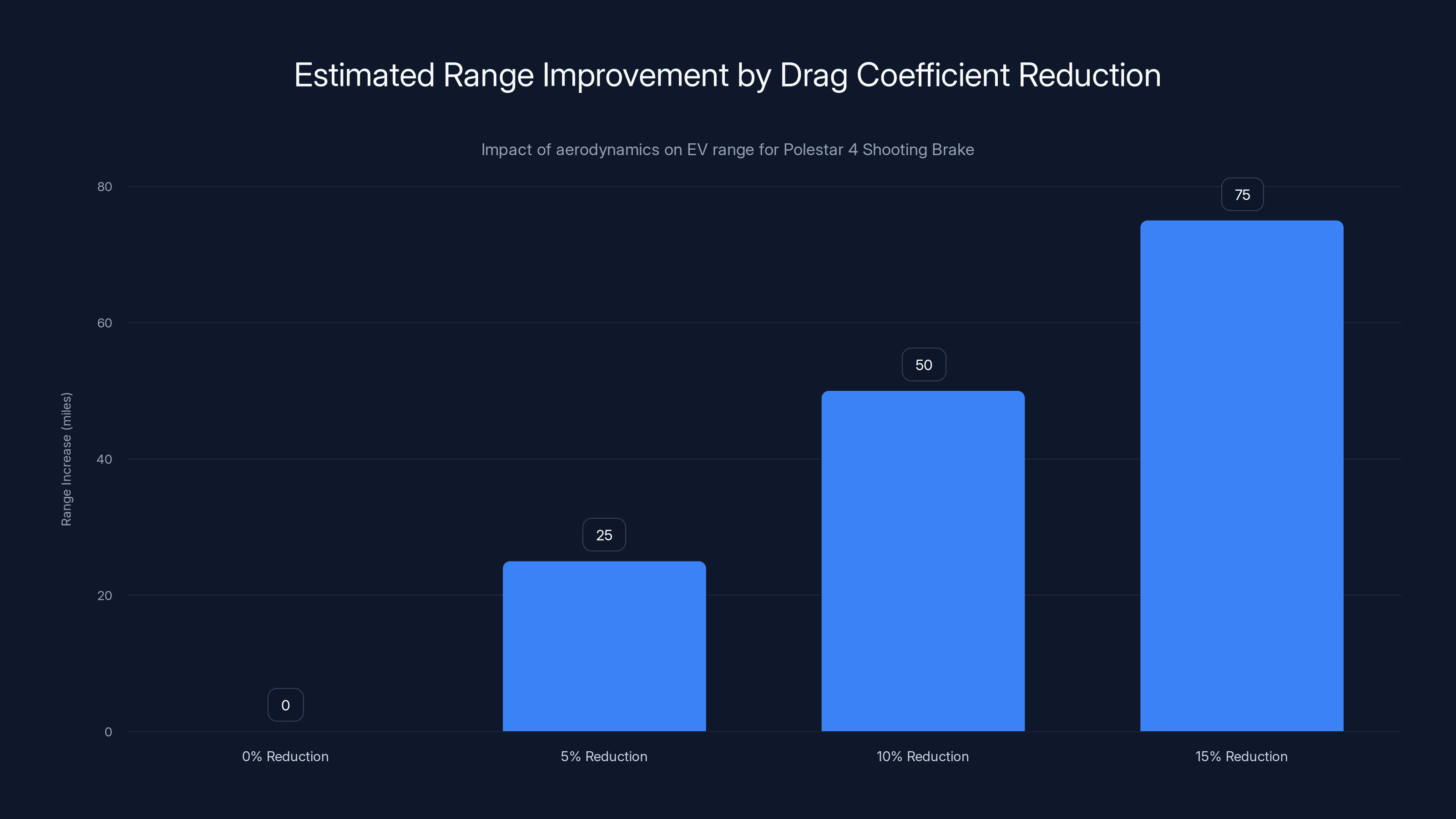

For electric vehicles, aerodynamics matter enormously. Every percentage point of drag reduction directly translates to range. A 10% improvement in drag coefficient can add 40-60 miles of range at highway speeds, depending on battery capacity. Polestar's engineers likely designed the shooting brake specifically to optimize this balance.

The shooting brake will come in two versions: the traditional SUV design continues, and the new wagon-type version adds a second option. This gives customers choice without diluting the brand. Both versions maintain Polestar's design language. Both come from the same engineering foundation.

Manufacturing location matters here too. The new Polestar 4 shooting brake will be built in Busan, South Korea. This is deliberate. It sidesteps U.S. tariffs on vehicles manufactured in China, a critical cost advantage. When you're competing on price and margin, tariffs aren't details. They're existential. Locating production in South Korea allows Polestar to offer competitive pricing without absorbing the full tariff burden.

The company faces real constraints. Volvo, Polestar's parent company, operates globally but has reduced Chinese manufacturing. That shift happened before Polestar even announced this strategy, but it created the perfect opportunity. Busan is an established automotive hub with skilled labor, existing infrastructure, and proximity to key markets. It's not a panic move. It's a calculated choice.

Lohscheller emphasized that this shooting brake combines "the space of an estate and the versatility of an SUV." That's marketing language, but it's also factually true. You lose some of the ground clearance pretense of an SUV, but you gain actual usable space behind the rear wheels. For most buyers, that trade is worth it.

Polestar's strategy involves targeting different market segments equally with the Shooting Brake and Polestar 7, while giving slightly more focus to the Polestar 2 aimed at young professionals. Estimated data.

The Redesigned Polestar 2: Targeting Young Buyers in Europe

The original Polestar 2 was Polestar's first sedan, and it performed well in markets where sedan demand remained strong. But it's aging in product cycle terms. The new version comes with a different strategic focus: young buyers in Europe, not global markets.

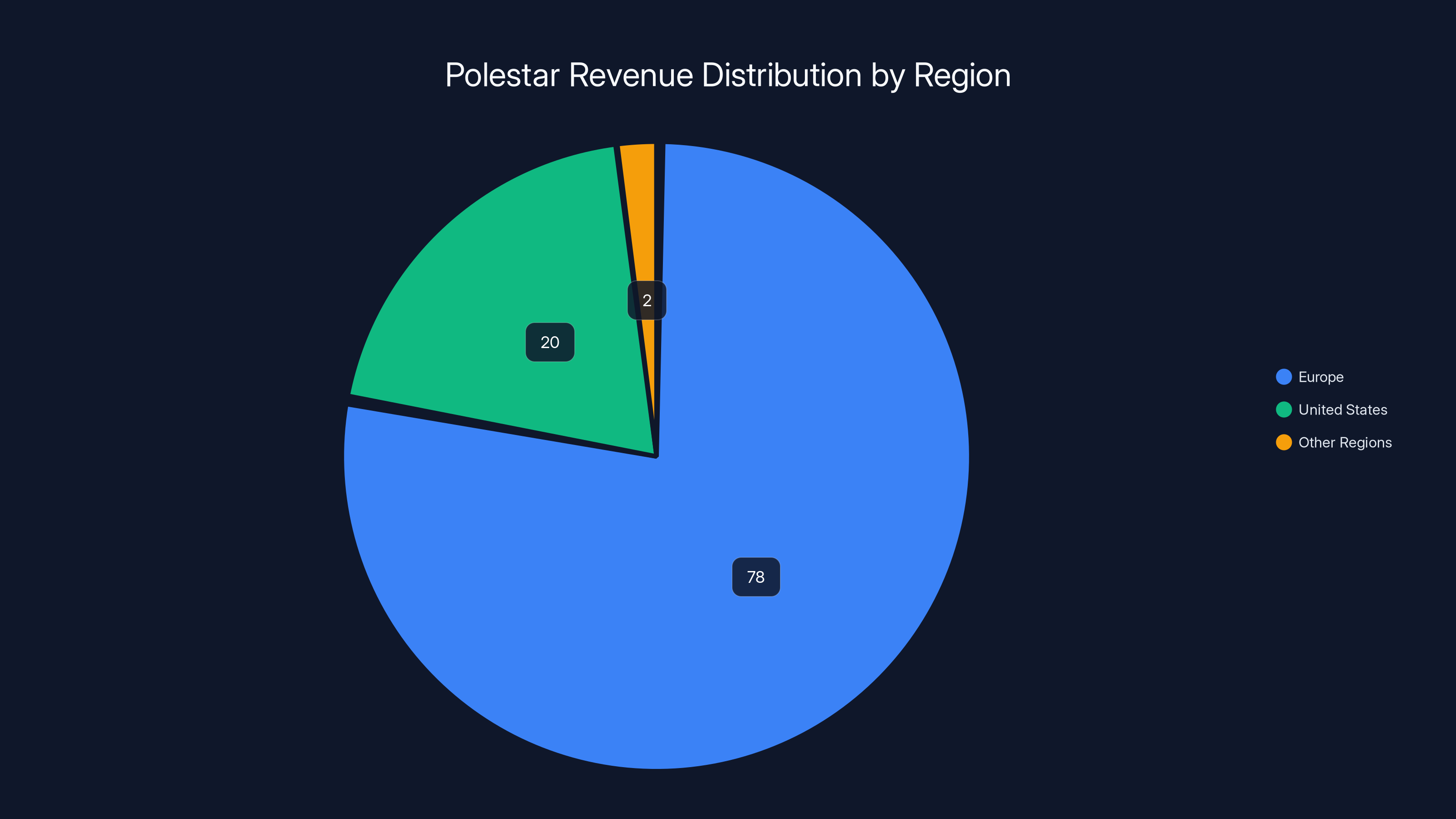

This is important context. Polestar's current sales split shows Europe accounts for 78% of revenue. The U.S. is "most of the rest." The new Polestar 2 isn't designed for Americans. It's designed for European cities where parking is tight, fuel prices are high, and buyers care more about efficiency than cargo volume.

The redesigned Polestar 2 will be slightly longer, adding passenger space without dramatically increasing overall footprint. It will be produced in China, not Europe or South Korea. This is a cost optimization decision. Chinese manufacturing plants have lower labor costs and mature EV supply chains. For a vehicle targeting price-sensitive European buyers, manufacturing where labor is efficient makes sense.

The strategy here reveals Polestar's regional sophistication. They're not building one car for everyone. They're building different cars for different markets. The Polestar 2 is optimized for European youngsters. The Polestar 4 in two variants targets global buyers who want practicality. The upcoming Polestar 7 targets the European compact SUV segment. This is the opposite of Tesla's one-size-fits-all approach.

The Polestar 2 redesign also signals something about market segments. Sedans are dying in the U.S., but they're resilient in Europe and especially strong in China. Polestar isn't abandoning sedans. It's being regional about them. This is disciplined product strategy. You could argue it's less ambitious than Tesla's global product line. You could also argue it's more realistic.

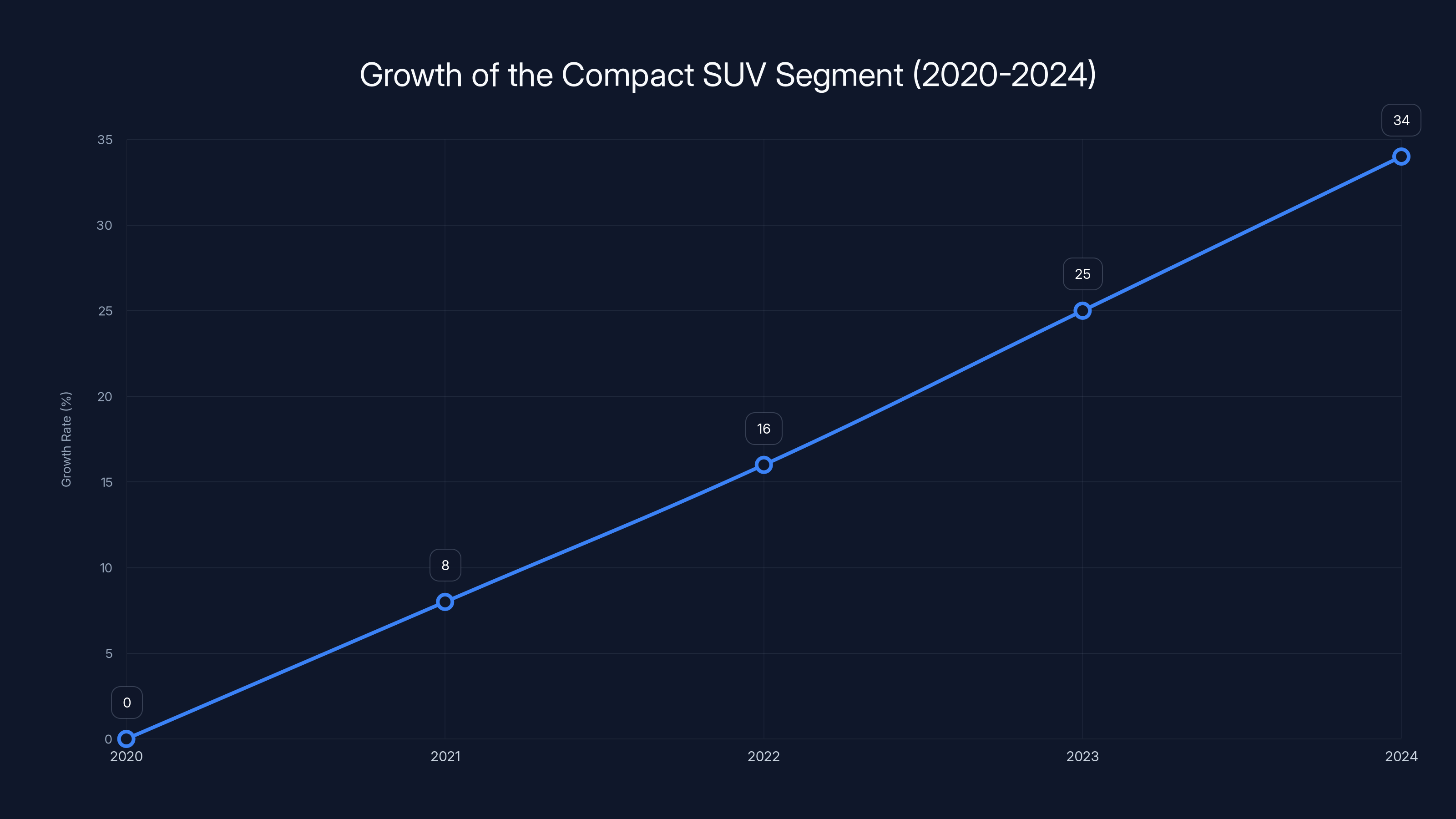

The Polestar 7: Attacking the Compact SUV Segment

The Polestar 7 is the wildcard. It's positioned to compete in the fast-growing compact SUV segment, the same segment that Volvo's EX60 targets. This is intentional. Polestar and Volvo aren't really competitors anymore. They're sister brands serving different market positions. Volvo targets luxury buyers willing to pay premium pricing. Polestar targets performance-conscious buyers who want design and capability without paying luxury markups.

The Polestar 7 will launch in Europe first. This makes sense. Europe has strong brand awareness for Polestar, established distribution channels, and the charging infrastructure necessary for EV adoption. North America will likely come later if the European launch succeeds.

Compact SUVs are hot right now. The segment is growing faster than full-size SUVs. Buyers want something between a hatchback and a traditional SUV. They want efficiency without sacrifice. The Polestar 7 is built in Europe, which matters. Lohscheller emphasized: "We are convinced that we can offer customers a progressive performance-driven car for a very attractive price point, built in Europe."

That statement is loaded with strategy. "Progressive" signals design and technology. "Performance-driven" targets enthusiasts. "Attractive price point" acknowledges that European compact SUVs have price-sensitive competition. "Built in Europe" matters for two reasons: local manufacturing supports nearby sales, and it signals commitment to European markets.

The Polestar 7 will compete against models like the BMW X1, Audi Q3, and increasingly, Chinese EVs. The price point matters more in this segment than in luxury segments. Polestar's claim of an "attractive price point" suggests aggressive pricing, probably competing with mainstream manufacturers rather than luxury brands.

Estimated data shows that a 10% reduction in drag coefficient can add approximately 50 miles to the range of the Polestar 4 Shooting Brake, highlighting the importance of aerodynamics in EV design.

Geely Ownership: Why This Matters for Strategy

Geely, the Chinese automaker that owns Polestar, has a specific philosophy about ownership. Geely doesn't micromanage brands. It provides capital, platform access, and supply chain advantages. Polestar operates as a distinct brand with distinct strategies.

This structure enables flexibility. Polestar can build cars in South Korea without Geely interference. Polestar can manufacture in China for cost efficiency. Polestar can decide that Europe is 78% of sales and act accordingly. Geely provides the financial runway for this experimentation. Volvo Cars provides technology sharing and engineering expertise.

What emerges is a company that combines Chinese manufacturing efficiency, Swedish design heritage, and independent brand strategy. This is harder to replicate than it sounds. Most automakers can't pull it off. Tesla tried and failed at regionalization. Traditional automakers struggle with brand independence. Polestar seems to be getting it right.

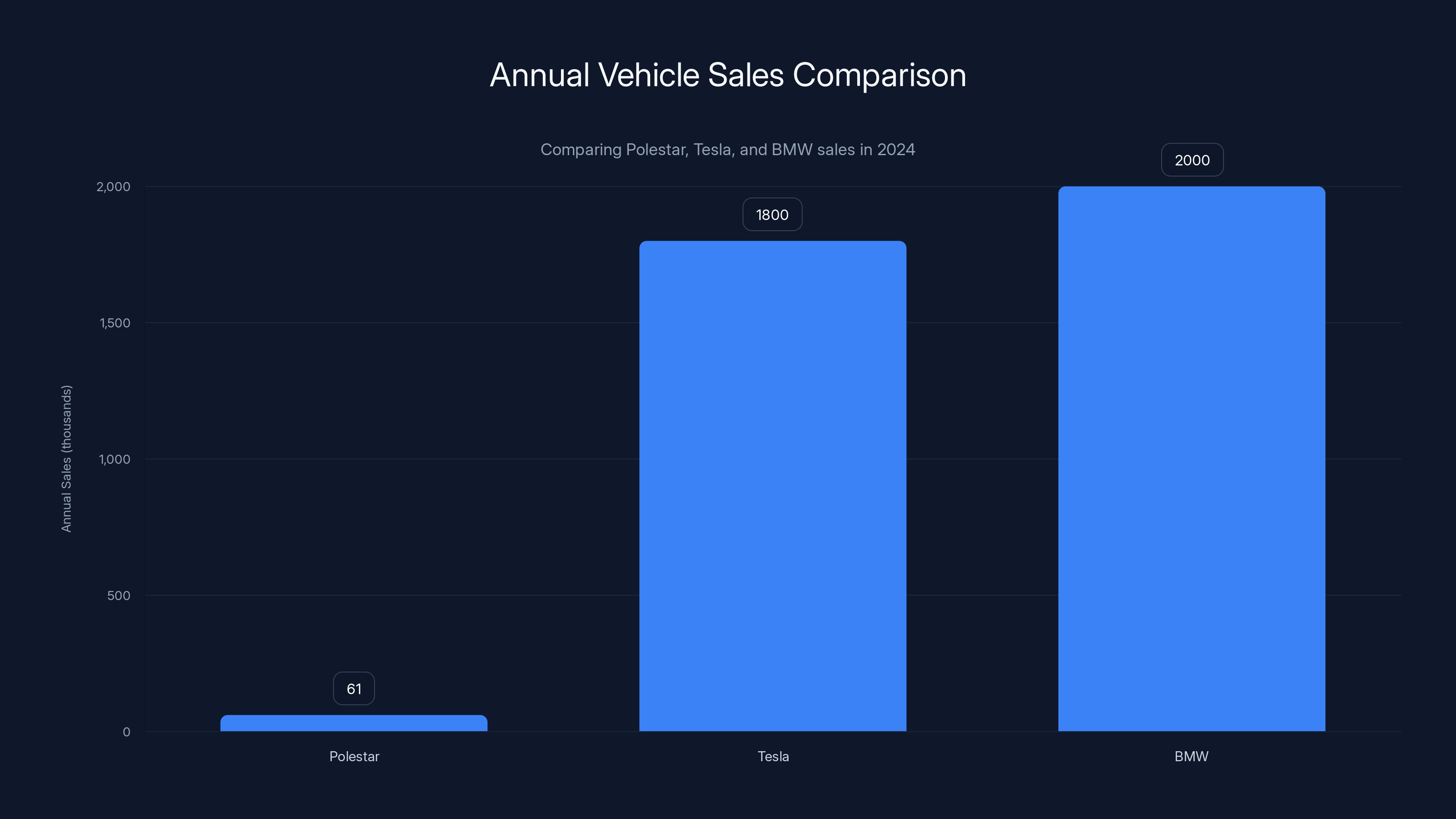

The question is whether this works long-term. Can Polestar be profitable with 61,000 annual sales? For context, Tesla sold over 1.8 million vehicles in 2024. BMW sold nearly 2 million. Polestar is at 3-4% of Tesla's volume, operating at completely different scale.

But profitability doesn't require scale. It requires margin. If Polestar can achieve 15-20% gross margins on these new vehicles (reasonable for EVs with differentiation), then 61,000 sales globally generates significant profit. The shooting brake, redesigned Polestar 2, and Polestar 7 all expand total addressable market. More models mean more customer segments reached.

Revenue Models and Profitability: The Real Story

Polestar's stated goal is 60% of global EV sales by some undefined timeline. That's oddly worded. Sixty percent of what? Polestar's own sales? Total global EV sales? The precision matters.

What Lohscheller likely means is that 60% of new Polestar sales will come from high-profit segments. These are the "big profit pools of the BEV segment." This is the real insight. Not all electric vehicles are equally profitable. Luxury EVs have fat margins. Mainstream EVs have thin margins. Chinese EV makers often sell at near-breakeven to gain market share.

Polestar's new models target the profitable segments. The shooting brake positions above mainstream but below luxury. The compact SUV fills a gap where buyers want capability and design but reject premium pricing. The redesigned Polestar 2 targets young Europeans who'll pay for design and technology.

The math works like this: if Polestar ships 100,000 vehicles annually by 2027, and 60 of those 100,000 come from high-margin segments averaging 18% gross margin, while 40,000 come from mainstream segments averaging 8% gross margin, the blended gross margin is 14.4%. At that scale, even a 14.4% gross margin is healthy.

Regional Strategy: Europe, U.S., and Beyond

Polestar's regional breakdown tells a story. Europe is 78% of sales. The U.S. is "most of the rest." That means the U.S. is probably 15-20% of sales. The remaining 2-5% is rest of world.

This split exists for good reasons. Europe has:

- Higher fuel prices (supporting EV adoption)

- Stronger environmental regulations

- Charging infrastructure in major cities

- Design-conscious buyers who appreciate Polestar's aesthetic

- Volvo brand heritage and service networks

The U.S. has:

- SUV preference over sedans

- Price sensitivity competing with Tesla

- Less established charging outside urban areas

- Lower brand awareness for Polestar

Polestar's strategy acknowledges these realities. The shooting brake suits American preferences better than the original Polestar 4. The compact Polestar 7 works well for European cities. The redesigned Polestar 2 targets European buyers where sedans remain popular.

Lohscheller made an important comment: "People forget that the U.S. is a big EV market, especially on the east and west coasts. And it will stay a big market." This is accurate. The coasts have charging infrastructure. The coasts have high fuel prices. The coasts have wealthy buyers willing to pay for differentiated vehicles. Polestar's three-model strategy positions the company to capture meaningful share in coastal U.S. markets.

But Polestar won't dominate the U.S. market. Tesla's infrastructure advantages are too large. The Polestar brand is too young. Distribution is limited. The company is realistic about this. Rather than chase market share, Polestar chases profitable segments. That's a sustainable strategy.

Polestar models are strategically priced above mainstream but below luxury segments, appealing to design-conscious buyers willing to pay a premium. Estimated data.

Manufacturing Strategy: Why Geography Matters

Manufacturing location decisions reveal strategic thinking. Polestar's choices show sophistication.

The Polestar 4 shooting brake will be built in Busan, South Korea. Why? U.S. tariffs. In 2025, vehicles built in China face higher tariffs than those built in Korea. This is a direct response to trade policy. Polestar could absorb tariff costs and accept lower margins. Instead, the company relocated production. This shows commitment to profitability over convenience.

The redesigned Polestar 2 will be built in China. This is cost optimization. Chinese labor is less expensive than European or Korean labor. Chinese supply chains for EV batteries and motors are mature and competitive. This vehicle targets European buyers via import, not local production. The cost savings from Chinese manufacturing exceed the transport costs.

The Polestar 7 will be built in Europe. This aligns with market strategy. Europeans prefer locally built vehicles. European labor costs are higher than China, but the margin benefits from local production (shorter supply chain, faster response to regional demand, local sentiment) offset the cost difference.

What emerges is a manufacturer thinking tactically about location. Not every car gets built in one place. Each car gets built where total cost of ownership (including tariffs, labor, transport, regulatory compliance) is optimized.

Competitive Positioning Against Tesla

Polestar isn't directly competing with Tesla on performance metrics. The Polestar models don't match Tesla Model S or Model Y on acceleration or range. That's intentional.

Instead, Polestar competes on design, practicality, and regional presence. A shooting brake appeals to different buyers than a Model Y. Buyers who want a wagon shape and cargo space aren't considering Tesla anyway. Tesla doesn't make wagons. That's market opportunity.

The compact Polestar 7 directly competes with the Tesla Model Y in size and price. Here, Polestar's advantage is design differentiation and regional presence. Europeans prefer locally available service and warranty. Polestar has that. Tesla's service network in Europe is thinner.

What's interesting is what this strategy doesn't target: performance enthusiasts. Polestar's heritage includes performance. The original Polestar started as a performance division of Volvo. But these new models emphasize practicality and design over raw speed. This is a mature brand choice. Performance cars have smaller markets than practical cars.

The Role of Chinese EV Makers

The real threat to Polestar isn't Tesla. It's Chinese manufacturers like BYD, NIO, and XPeng.

These companies offer competitive EVs at lower prices. They innovate aggressively on battery technology and autonomous driving software. In China, they're dominant. In Europe, they're growing. In the U.S., they're blocked by tariffs (for now).

Polestar's strategy positions the company where Chinese makers are weakest: European premium segments and design-conscious buyers. This is strategic retreat mixed with niche focus. Polestar accepts smaller market share but pursues higher margins where the company can differentiate.

Geely ownership actually helps here. Geely is Chinese, so Polestar can access the same battery suppliers and manufacturing networks as Chinese competitors. But Polestar's European brand positioning and design heritage give advantages Chinese companies lack.

The compact SUV segment experienced a 34% growth from 2020 to 2024, highlighting its rapid expansion and attractiveness to automakers. Estimated data based on market trends.

Market Timing: Why Now?

The EV market has matured. Early adopters are no longer the primary customer. Regular people are buying EVs. These regular people want practical vehicles, not technology statements.

In 2024-2025, the market shifted from "Is an EV for me?" to "Which EV should I buy?" That shift favors practical designs. A shooting brake answers a practical question: how do I get an efficient vehicle with cargo space? It's not exciting. It's sensible.

Polestar's timing of these launches makes sense. The company has sales momentum (61,000 units in 2025). The brand is established enough to support multiple models. Manufacturing capacity exists. The market is ready.

Alternatively, the timing could be defensive. If Polestar doesn't expand the product line, competitors will capture market share. Waiting longer means missing the window when customer preference for practical EVs is strong.

The Profit Question: Can This Work?

Here's the critical question: is three new models in two years sustainable? Does Polestar have the engineering resources? The financial resources? The manufacturing relationships?

According to Polestar's parent structure, yes probably. Volvo handles high-level engineering. Geely provides manufacturing and cost expertise. Polestar handles design, brand, and market positioning.

This division of labor works if the companies trust each other. Early signs suggest they do. Polestar has shipped five million vehicles with minimal major recalls. The company is expanding, not contracting.

But there's risk. Three new models simultaneously strain resources. Quality could suffer. Launch delays could hurt brand momentum. Profitability could prove elusive if margins compress.

The upside is significant. If even two of these three models succeed, Polestar reaches 100,000+ annual sales within three years. At that scale, with differentiated products, the company becomes genuinely competitive with traditional premium brands.

Design Philosophy: From Volvo Heritage to Polestar Identity

Polestar's design language comes from Volvo, but it's evolved into something distinct. The original Polestar models borrowed heavily from Volvo design. The new models are more independent.

The shooting brake, for instance, isn't a Volvo design. It's pure Polestar. The proportions, the shoulder line, the graphic details all reflect Polestar's evolving identity. This matters because brand identity drives pricing power. Volvo charges premium prices for Swedish heritage and safety focus. Polestar charges premium prices for design, performance, and modernity.

The design philosophy emphasizes restraint. Where Tesla sometimes goes futuristic and BMW sometimes goes angular, Polestar designs cars that look good in five years, not just in the showroom.

This is harder to execute than flashy design. Restraint requires discipline. It requires knowing what not to include. But it builds brand loyalty. Owners of restrained designs tend to keep cars longer because they don't feel dated.

Europe accounts for 78% of Polestar's revenue, indicating a strong market focus there. Estimated data for 'Other Regions'.

Technology Roadmap: Autonomous Driving and Connectivity

Polestar's press releases mention these cars but don't emphasize autonomous driving or cutting-edge infotainment. This is deliberate under-promise. The company knows it can't match Tesla's Full Self-Driving or NIO's autonomous features.

Instead, Polestar positions as pragmatic. The vehicles will have Level 2 autonomous features (adaptive cruise, lane keeping) but not aspirational Level 3+ claims. This is honest market positioning. Buyers know what they're getting.

Connectivity is solid. Polestar cars integrate with smartphones seamlessly. Updates are delivered over-the-air. The infotainment systems use Android Automotive, the same architecture found in Volvo and BMW vehicles. This is proven, reliable, and familiar to buyers.

The tech roadmap is evolutionary, not revolutionary. That suits Polestar's strategy. You don't differentiate by chasing bleeding-edge tech you can't deliver better than competitors. You differentiate by executing what you promise, reliably and profitably.

Pricing Strategy: Positioning Between Mainstream and Luxury

Pricing these three new models will be critical. Position too high and they're luxury brand prices without luxury brand heritage. Position too low and they're mainstream brand prices without volume efficiencies.

Likely pricing based on competitive positioning:

Polestar 4 Shooting Brake:

Polestar 2 Redesigned: €45,000-€55,000 (approx

Polestar 7: €42,000-€52,000 (approx

These price points are speculative, but they reflect market logic. Polestar occupies a specific niche: design-conscious buyers who reject luxury brand markups but won't compromise on quality. That niche exists and will pay 10-20% premiums over mainstream alternatives for differentiated design and heritage.

The Competitive Landscape: Who's Building Wagons?

Polestar isn't alone in reviving wagons for the EV era. Skoda offers the Superb electric in wagon form. Volkswagen will offer wagon variants of upcoming EVs. Porsche's Taycan Cross Turismo is essentially a performance wagon.

But Polestar's shooting brake is different because it's a volume car, not a premium outlier. Porsche's wagon starts at

The wagon renaissance in the EV era makes sense. Gasoline wagons were penalized by fuel efficiency ratings that counted cargo volume against them. Electric vehicles have no such penalty. An efficient wagon shape helps EVs achieve better range.

Polestar's timing here is smart. Before anyone else established wagon EV dominance, Polestar claimed the segment. The shooting brake arrives in late 2025. Competitors are still planning their wagon launches. First-mover advantage in a specific segment matters.

Polestar's annual sales are significantly lower than Tesla and BMW, comprising only 3-4% of Tesla's volume. Estimated data.

Supply Chain Resilience and Battery Strategy

None of Polestar's announcements emphasize battery technology. That's because Polestar doesn't make batteries. The company sources from established suppliers, likely including CATL, LG, and Samsung.

Geely's advantage here is deep relationships with Chinese battery makers. CATL, the world's largest battery supplier, has ties to Geely. This means Polestar likely gets favorable pricing and priority allocation during battery shortage periods.

For the shooting brake and compact Polestar 7, battery sourcing will be critical. If Polestar can't get affordable battery packs, margins evaporate. Geely's supply chain relationships protect against this risk.

Future battery technology (solid-state, longer-lasting cells) will eventually change the game. But for the next 3-5 years, conventional lithium-ion batteries dominate. Polestar's existing supply relationships position the company well for this period.

The Path to 100,000+ Annual Sales

Lohscheller's vision is growth. Three new models targeting different segments should drive volume expansion. Here's the potential arithmetic:

Current state (2025): 61,000 annual sales (probably split as Polestar 3 and 4)

2026-2027 target: 100,000+ annual sales

That requires:

- Polestar 3 continuing at current levels (if not discontinued)

- Polestar 4 shooting brake adding volume alongside original Polestar 4

- Redesigned Polestar 2 ramping production

- Polestar 7 launching successfully in Europe

The math works if each new model hits sales targets within 12 months of launch. For a company with Geely's manufacturing experience and Volvo's engineering prowess, this is achievable if not certain.

Challenges Ahead: The Real Risks

Polestar's expansion strategy carries execution risks. Here's what can go wrong:

Economic downturn: EV purchases are discretionary for most buyers. A recession reduces demand faster for premium EVs than mainstream vehicles.

Tariff escalation: Polestar's South Korea production strategy hedges against current tariffs. Future tariff changes could render that decision suboptimal.

Competition intensification: Chinese EV makers are entering European markets at aggressive prices. Polestar's price positioning could get squeezed from below.

Brand awareness: Polestar remains unknown outside automotive enthusiast circles in many markets. Building brand awareness costs money and time.

Quality issues: Rapid expansion stresses quality systems. A major recall or quality scandal could undermine brand momentum.

None of these are insurmountable. But they're real risks that Polestar must navigate. The company's track record (few major recalls, steady sales growth) suggests operational competence. But five-year forecasts are inherently uncertain.

The Bigger Picture: What Polestar's Strategy Signals About the EV Market

Polestar's moves signal that the EV market is normalizing. The "winner takes all" narrative is fading. Tesla remains dominant, but it's not inevitable. Specific brands can carve niches by being excellent at differentiation, not dominance.

Polestar's three-model expansion says: the market is big enough for multiple profitable strategies. You don't have to be Tesla to succeed. You have to be excellent at what you choose to do.

For Polestar, that means premium design, regional focus, and profitability over growth-at-any-cost. If the company executes well, it proves the thesis. If it stumbles, it proves the opposite.

Either way, the next two years will be revealing. Three new major product launches in 24 months is ambitious. Succeeding at that pace would establish Polestar as a major force in premium EVs globally.

Looking Forward: 2026-2027 and Beyond

The immediate future is clear: the shooting brake launches in late 2025, the redesigned Polestar 2 follows, and the Polestar 7 debuts in Europe. These are concrete timelines.

Beyond 2027, the picture is speculative. Will Polestar continue expanding the lineup? Will the company move into mass-market segments? Will the brand remain exclusively premium? These questions will determine Polestar's long-term trajectory.

Lohscheller's comment about "more volume out of a bigger cake" suggests the company isn't satisfied with niche positioning forever. But the path from 100,000 annual sales to 500,000+ is different from the path to 100,000. Maintaining premium positioning at higher volume is harder than building premium positioning at lower volume.

The next 24 months will establish whether Polestar can achieve that balance. If the three new models hit sales targets while maintaining margins and brand equity, the company proves the strategy works. If volume grows but margins compress, the strategy is less successful.

What's certain is that the EV market has room for multiple profitable approaches. Polestar's approach—regional focus, design emphasis, manufacturability discipline—is one valid option among many. Whether it succeeds depends on execution.

FAQ

What exactly is a shooting brake?

A shooting brake, also called an estate or wagon, is a car that combines the height and practicality of an SUV with the aerodynamic efficiency of a sedan. It features an extended cargo area behind the rear wheels while maintaining a sleeker profile than a traditional SUV. For electric vehicles, this shape is advantageous because reduced aerodynamic drag translates directly to greater range and efficiency.

Why is Polestar launching three new models simultaneously?

Polestar is expanding its product line to address multiple market segments and increase overall sales volume. The shooting brake targets buyers who want cargo space and practicality, the redesigned Polestar 2 targets young European professionals, and the Polestar 7 targets the fast-growing compact SUV segment. This multi-pronged approach allows Polestar to capture customers from different demographics and regions rather than competing head-to-head with Tesla on one vehicle type.

How does manufacturing location affect EV pricing?

Manufacturing location determines labor costs, tariff exposure, supply chain efficiency, and local regulatory compliance. Polestar's decision to build the shooting brake in South Korea is specifically designed to avoid higher U.S. tariffs on Chinese-manufactured vehicles. Building the Polestar 2 in China optimizes for cost efficiency since it targets price-sensitive European buyers. Manufacturing location directly impacts final vehicle pricing and profit margins.

What is Polestar's competitive advantage against Tesla?

Polestar's advantages include regional brand presence (especially in Europe), design differentiation that appeals to buyers who value aesthetics alongside performance, and practical vehicle designs like the shooting brake that Tesla doesn't offer. Rather than competing on performance specifications, Polestar targets design-conscious buyers willing to pay premiums for differentiated vehicles that won't feel dated in five years.

Why does Polestar emphasize profitability over market share growth?

At Polestar's current scale (61,000 vehicles annually), achieving profitability is more important than chasing growth-at-any-cost. Companies like Tesla and BYD can afford to compete on volume because they've achieved massive scale. Polestar lacks that scale advantage, so the strategy instead focuses on margin-rich segments where design and regional presence create pricing power and customer loyalty.

What does 60% of EV sales mean in Polestar's context?

Lohscheller's statement about "60% of EV sales" likely means that 60% of Polestar's own vehicle sales will come from high-profit market segments within the broader EV market. High-profit segments include premium design-conscious buyers, regional leaders in established markets, and niche vehicle types like wagons where differentiation commands pricing premiums. This is more specific than achieving 60% of global EV market share, which would be unrealistic.

When will these three new models launch?

The Polestar 4 shooting brake is scheduled to launch in late 2025 and will be manufactured in Busan, South Korea. The redesigned Polestar 2 will follow in 2026 and will be built in China for cost efficiency. The Polestar 7 compact SUV will debut in Europe in 2026-2027. Exact launch dates may shift, but this timeline provides the framework for Polestar's expansion.

Is Polestar planning to enter the U.S. market more aggressively?

Yes, Polestar intends to increase U.S. market presence. Currently, the U.S. represents roughly 15-20% of Polestar sales, while Europe dominates at 78%. The new product lineup, particularly the shooting brake (which appeals to American preferences for practical vehicles) and compact SUV, is designed to increase U.S. market penetration. However, Polestar won't dominate the U.S. market due to Tesla's infrastructure advantages and limited distribution.

How does Geely ownership enable Polestar's expansion strategy?

Geely provides manufacturing expertise, supply chain access (especially for batteries through relationships with suppliers like CATL), and financial capital for product development. Crucially, Geely doesn't micromanage Polestar's strategy, allowing the brand to operate independently and make regional decisions. This structure combines Chinese manufacturing efficiencies with European brand positioning and design heritage.

What are the main risks to Polestar's expansion plan?

Key risks include economic recession reducing discretionary EV purchases, escalating trade tariffs making current manufacturing strategies suboptimal, intensified competition from Chinese EV makers at lower prices, low brand awareness outside Europe, and quality issues from rapid expansion. None of these are unique to Polestar, but they require careful management. The company's track record of few recalls and steady growth suggests operational competence, but five-year forecasts remain uncertain.

Key Takeaways

- Polestar launches three new models in 24 months (Polestar 4 shooting brake, redesigned Polestar 2, and Polestar 7 compact SUV) targeting growth from 61,000 to 100,000+ annual sales

- Manufacturing strategy optimizes tariffs and costs by producing the shooting brake in South Korea, Polestar 2 in China, and Polestar 7 in Europe

- Regional focus concentrates 78% of sales in Europe, with strategic expansion into U.S. coastal markets where EV infrastructure and demand are strongest

- Shooting brake design combines sedan aerodynamic efficiency with SUV practicality, improving range while addressing customer demand for cargo space

- Profitability over growth strategy positions Polestar in premium segments where design differentiation commands pricing power rather than pursuing mass-market competition

Related Articles

- 2027 Toyota Highlander Electric: 320-Mile Range & Features [2025]

- Tesla Stops Using 'Autopilot' in California: What Changed [2025]

- Ford's $30,000 EV Pickup Truck Strategy: How Efficiency Replaces Battery Cost [2025]

- Rivian's Software Partnership Saves the EV Maker: 2025 Analysis [2025]

- How Rivian's Software Strategy Saved the Company in 2025

- Waymo's Sixth-Generation Robotaxi: The Future of Autonomous Vehicles [2025]

![Polestar's Station Wagon Strategy: How the EV Maker Is Challenging Tesla [2025]](https://tryrunable.com/blog/polestar-s-station-wagon-strategy-how-the-ev-maker-is-challe/image-1-1771427378761.jpg)