How AI Is Transforming Medical Sales Training

Sales is where everything changes in healthcare. A good rep can get a breakthrough therapy into a doctor's hands. A bad one? Patients miss out on treatments that could save their lives. That's the core belief driving Praxis Pro, a startup that just raised $6 million to tackle one of the most broken parts of the pharmaceutical and medical device industries: sales rep training.

The problem isn't new. For decades, medical sales teams have relied on fragmented training programs, inconsistent coaching, and ad-hoc mentorship from whoever had time to help. There's no real structure. No meaningful way to scale learning across teams. Sales reps get thrown into complex healthcare environments where one wrong word can violate compliance rules, and one missed opportunity can mean a patient doesn't get access to a treatment they need.

Praxis Pro is building an AI-powered solution to fix this. Founded by Cam Badger, a former pharmaceutical sales rep turned trainer, and Bhrugu Giri, the platform creates small language models trained specifically on life science data. These models power an AI agent that lets sales reps practice their pitch, refine their messaging, and prepare for objections before they ever talk to a healthcare provider.

The funding came from Alley Corp leading the round, with participation from Fly Bridge, South Loop Ventures, and Zeal Capital Partners. The capital will fuel product development and go-to-market expansion. But what makes this moment particularly interesting is what it represents: the first wave of specialized AI tools built not for the generic sales team, but for the highly regulated, data-sensitive world of medical commerce.

Let's dig into what's really happening here, why it matters, and what this tells us about the future of enterprise AI.

The Broken State of Medical Sales Training

Imagine you're a new pharmaceutical sales rep. You've been hired to sell a cancer drug. You walk into your first day of training, and here's what you get: a binder full of compliance rules, some Power Point decks about the product, and a veteran rep telling you "just watch what I do." That's still how most life science companies train their commercial teams.

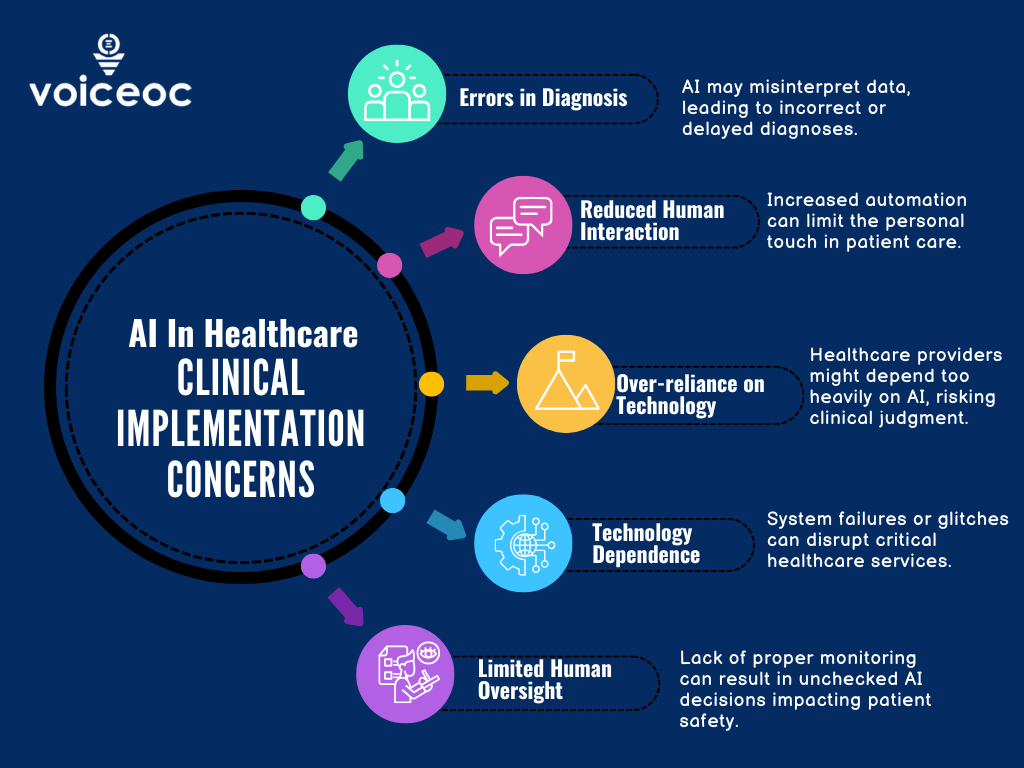

The problem is massive in scope. Medical sales is one of the highest-stakes selling environments on Earth. Healthcare providers (doctors, nurses, hospital administrators) make purchasing decisions based on complex clinical data, regulatory compliance requirements, and patient outcomes. If a sales rep gets the messaging wrong, they could violate FDA regulations. If they miss a key clinical point, they lose credibility. If they don't understand the provider's specific needs, the sale falls apart.

Yet most sales reps receive training that's fragmented across multiple systems: some compliance training in one tool, product knowledge in another, soft skills training from a third-party vendor, and real-world coaching scattered randomly depending on who's available. There's no consistency. A rep trained at one office gets different preparation than a rep trained at another. New reps struggle the most. Turnover is brutal.

The human cost is real. Cam Badger, Praxis Pro's CEO, lived this. He spent four years as a pharmaceutical sales rep and struggled initially. He nearly lost his job early on. But he was determined, worked obsessively, and eventually became one of his company's top performers. The thing is, not everyone has that resilience or determination. Some reps wash out. Some never reach their potential. And across the industry, that means treatments don't reach patients who need them.

Badger eventually moved into sales training roles, where he discovered the systemic problem wasn't individual reps—it was the lack of structured, scalable coaching. He met Bhrugu Giri at a medical startup, and they realized they were both frustrated about the same thing: the commercial side of life science was stuck in an analog age while the rest of enterprise software had modernized.

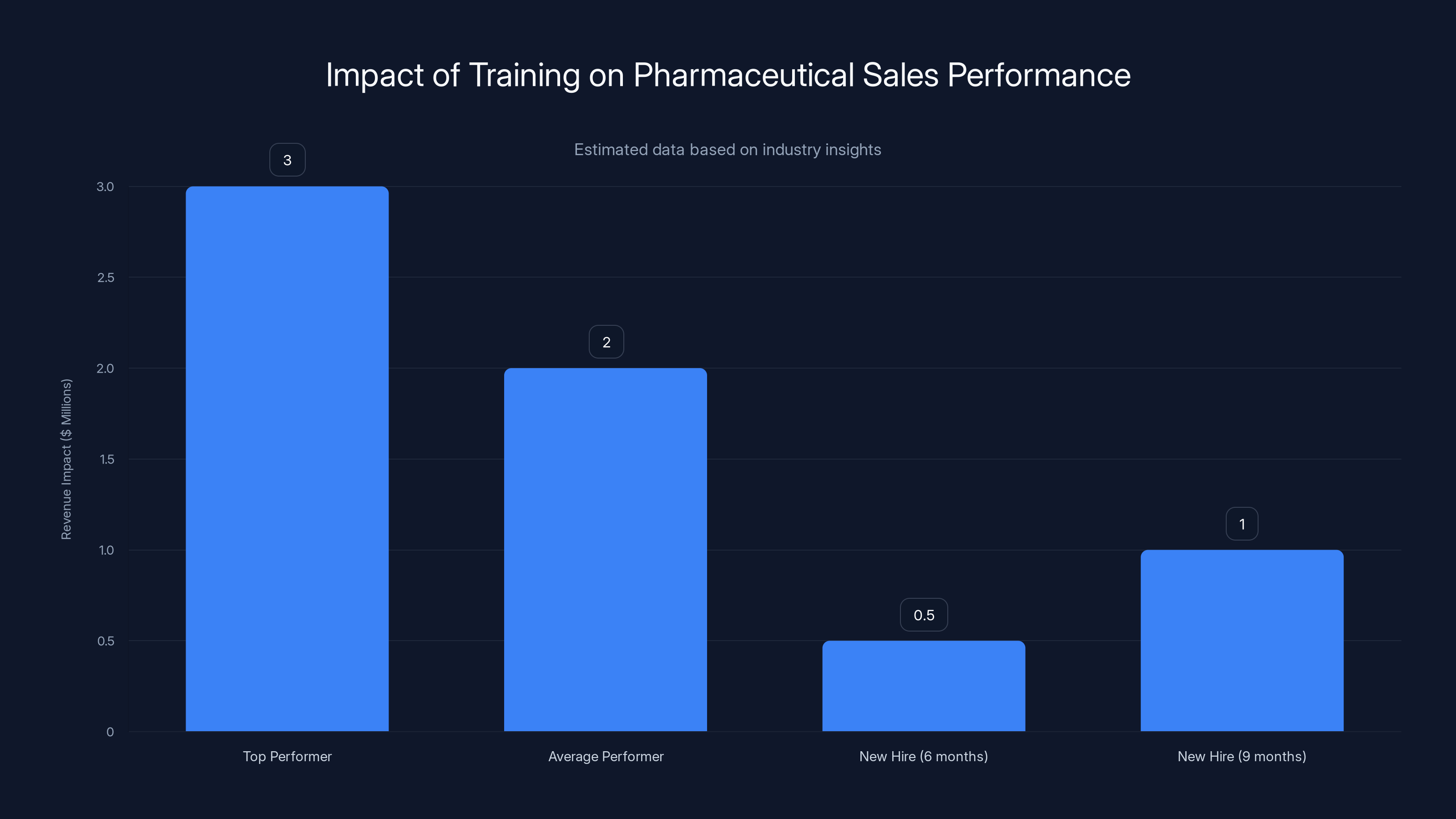

Better training can significantly increase revenue impact, with top performers generating up to 50% more revenue than average performers. Estimated data highlights potential revenue during different ramp-up periods.

Why General-Purpose AI Tools Don't Work for Medical Sales

You might ask: why not just use Chat GPT or a general sales coaching tool? The answer reveals why specialized AI matters.

Medical sales operates in a highly regulated environment with constraints that general-purpose AI tools simply don't understand. Every word a pharmaceutical rep says to a healthcare provider can trigger compliance reviews. The language around clinical efficacy, side effects, pricing, and patient outcomes is tightly governed by the FDA. A tool trained on general sales conversations won't understand these nuances. It might suggest messaging that's technically persuasive but legally problematic.

There's also the specificity problem. A tool trained on SaaS sales playbooks or enterprise software selling teaches completely different techniques than what works in medical environments. Healthcare providers care about different things. They ask different questions. They have different concerns. A generic role-play tool trained on broad sales data won't accurately simulate a conversation between a rep and a cardiologist, urologist, or hospital administrator.

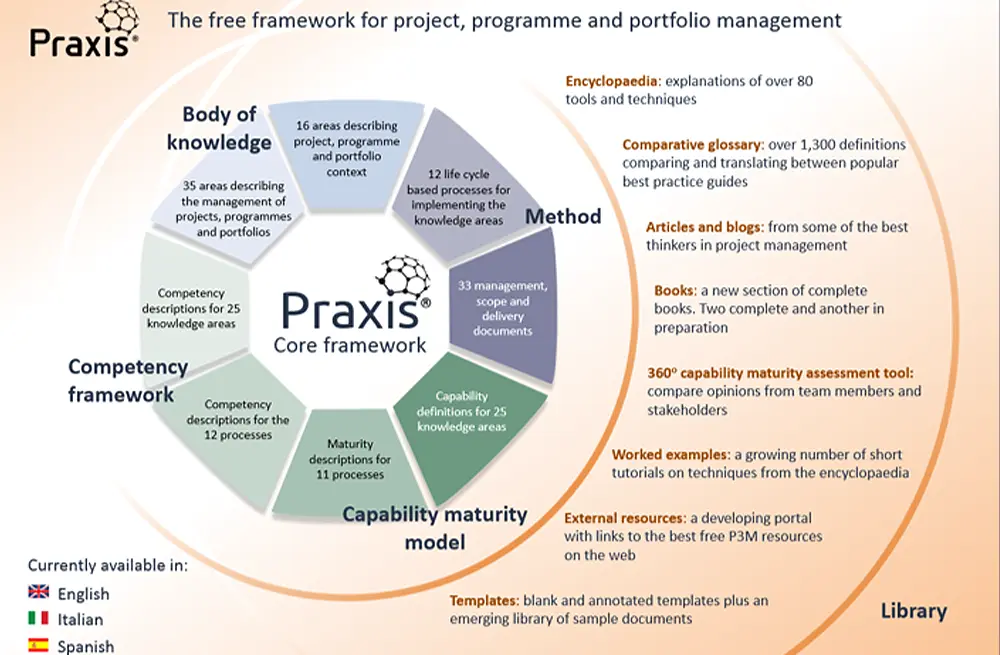

This is where small language models trained on domain-specific data become crucial. Praxis Pro isn't trying to build a general-purpose AI. Instead, they're creating models specifically trained on life science sales contexts, healthcare provider conversation patterns, compliance frameworks, and medical domain knowledge. The model learns what effective medical sales looks like from the ground up.

It's the difference between a general translator and a medical translator. A general translator can handle most conversations. A medical translator understands anatomy, drug names, dosing regimens, and the specific terminology that matters in healthcare. That specialized knowledge makes the AI actually useful.

Other role-playing sales tools exist in the market. Quantified offers AI role-play for sales teams. Smart Winnr provides training and coaching. But these tools are built for broad sales audiences. They're optimized for velocity, not for the deep compliance and domain knowledge that medical sales requires. Praxis Pro is betting that the specialized approach—smaller models trained on medical data, integrated into enterprise systems, focused on the life sciences sector—is the right way to build competitive advantage.

How Praxis Pro's Platform Works in Practice

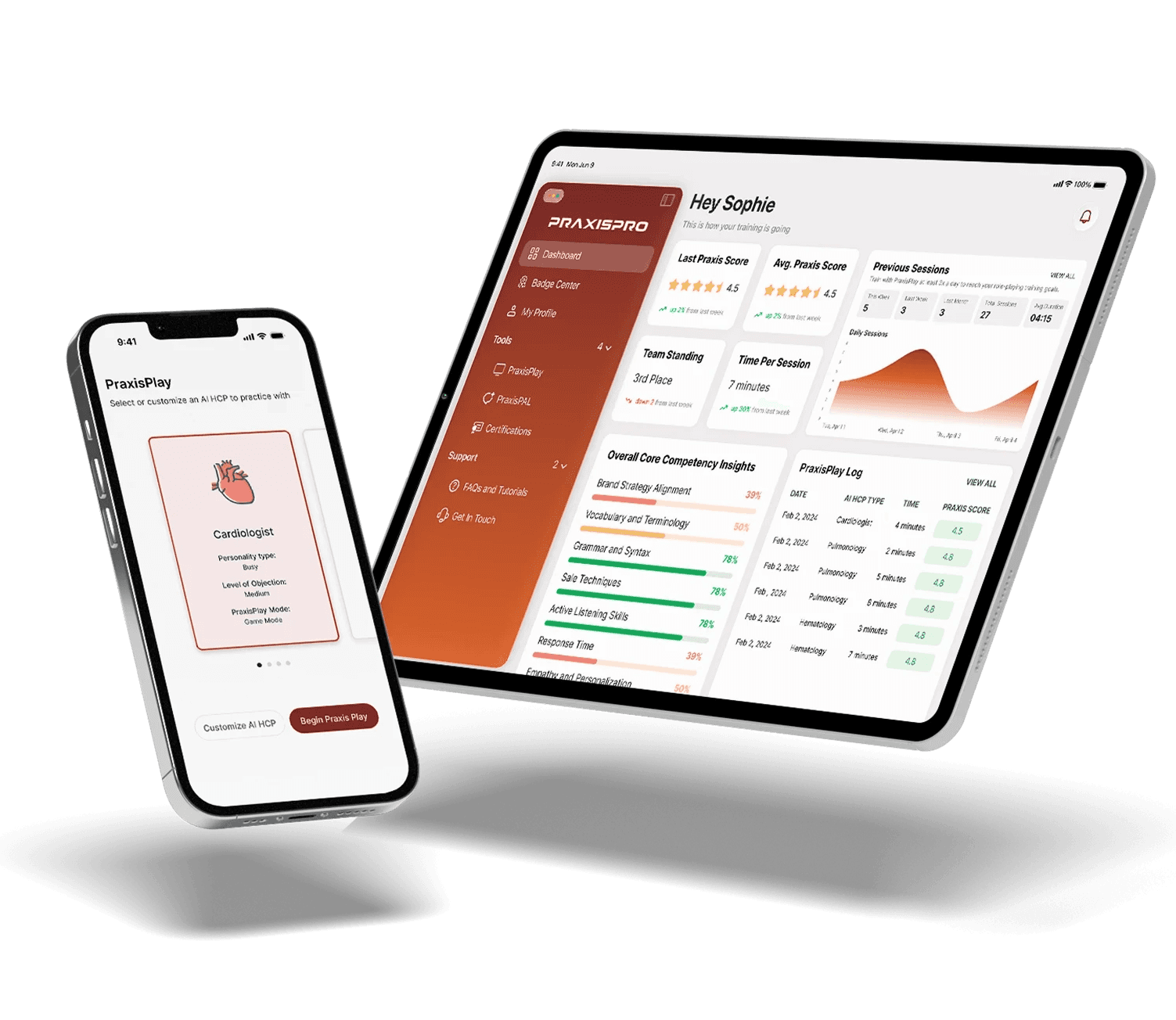

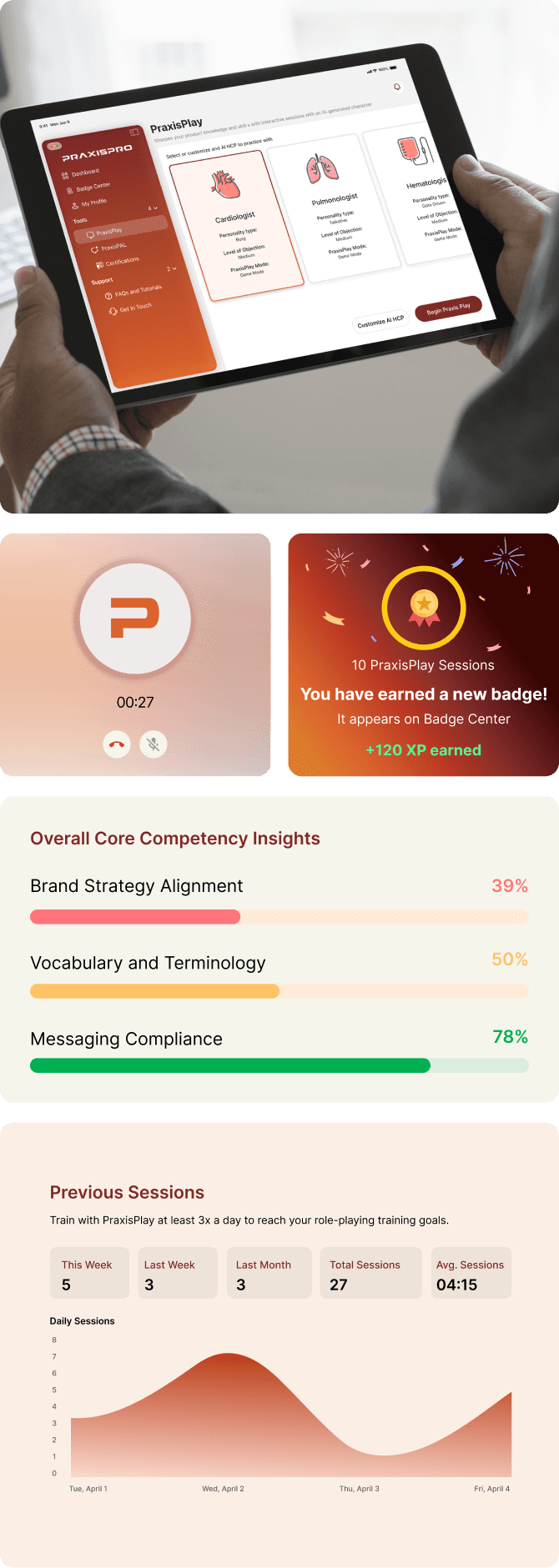

Let's walk through what actually happens when a sales rep uses Praxis Pro.

The platform starts by integrating into the rep's workflow. It can be deployed as a standalone web application or integrated into existing enterprise software that life science companies already use. This is important because sales teams won't use a tool that adds friction. It has to live where they work.

Once in the system, the rep approaches a conversation practice session. This is where the AI agent comes into play. The rep types or speaks their opening pitch to a healthcare provider. Let's say the rep is selling a new rheumatoid arthritis treatment and wants to pitch it to a rheumatologist. The AI agent responds like a real healthcare provider would, asking questions, raising objections, requesting clinical data, pushing back on pricing or efficacy claims.

This is the conversational loop. The rep talks. The AI responds with realistic pushback. The rep adjusts their messaging. The AI evaluates whether the adjustment was compliant, clinically accurate, and persuasive. The process repeats.

The real value emerges over dozens of practice interactions. A rep can simulate 15 to 20 potential conversations with healthcare providers before ever stepping into a real sales call. They've practiced different openings, different objections, different clinical questions. They've internalized what works and what violates compliance. They've built muscle memory around the right way to position their product in the specific context of their market.

There's also a preparation component. Before a specific real sales call, a rep can use Praxis Pro to plan that interaction. They input information about the provider they're meeting, the specific clinical scenario, the likely objections, and the rep practices for that specific context. It's like having a coach who knows exactly who they're about to meet.

The platform also tracks performance metrics. How many interactions has this rep completed? Which topics do they struggle with? Where are they most likely to stumble on compliance? Which objections catch them off guard? This data is visible to sales managers and training teams, enabling them to provide targeted coaching to reps who need help and celebrate reps who are excelling.

Compliance is baked in throughout. The AI agent knows the regulatory requirements. It can flag messaging that's problematic. It can suggest reframing that stays compliant while maintaining persuasiveness. This is crucial because in pharma and medical devices, compliance violations can result in massive fines, criminal charges, and reputational damage.

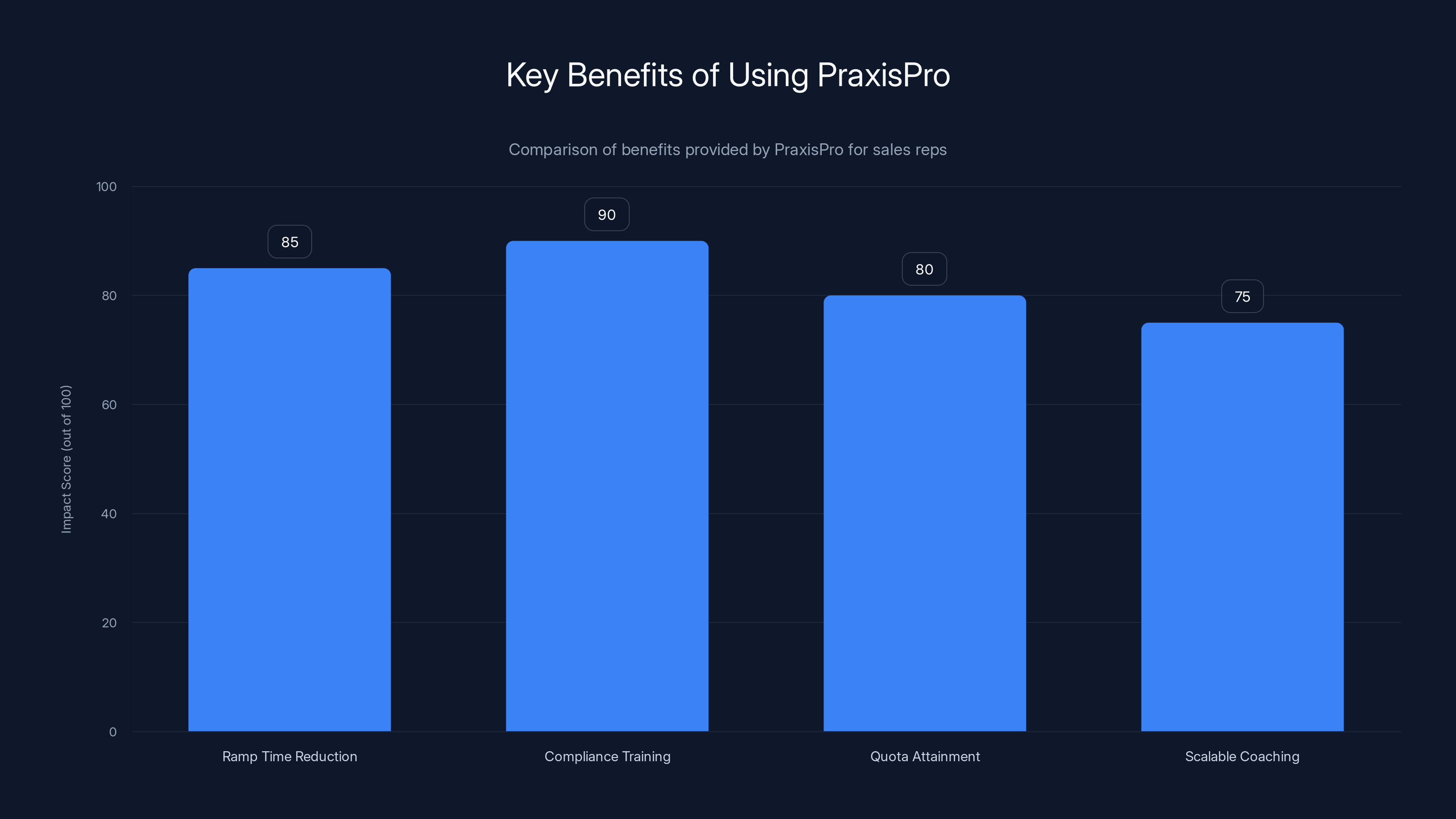

PraxisPro significantly enhances sales rep performance by reducing ramp time, improving compliance training, boosting quota attainment, and offering scalable coaching solutions. Estimated data based on typical platform benefits.

The Business Case: Why Medical Sales Needs Better Training

Why does this matter from a business perspective? Let's look at the numbers and incentives.

The life sciences industry is enormous. Global pharmaceutical sales exceed

A good sales rep can generate millions in revenue. A bad one costs the company money, wastes provider relationships, and creates compliance risk. The difference between a top performer and an average performer can be 50% or more in quota attainment.

Training and onboarding a new rep is expensive. Industry estimates suggest it takes 6-12 months for a new pharmaceutical rep to fully ramp to productivity. During that ramp period, they're drawing salary and expenses but not yet generating full revenue. The cost of onboarding, training, management, and lost productivity can reach

Rep turnover is also brutal. Annual turnover in pharmaceutical sales hovers around 20-25%, which means companies are constantly training new people. If you can cut that number by even 5 percentage points through better training and support, you're saving enormous amounts of money. If you can accelerate ramp time from 9 months to 6 months, that's meaningful acceleration of revenue productivity.

There's also the quality angle. Better-trained reps make better clinical presentations. They're more credible with healthcare providers. They get more accurate information into the market. This builds long-term relationships and trust, which translates into higher close rates and deeper market penetration.

From a regulatory perspective, better training also reduces compliance risk. When sales teams are well-trained, they make fewer mistakes. They don't overpromise on clinical benefits. They don't misrepresent data. They understand what they can and can't say. Companies that maintain strong compliance records avoid costly investigations, settlements, and reputational damage.

Praxis Pro's value proposition taps into all of this. They're offering a tool that can improve rep performance, accelerate onboarding, reduce turnover, enhance compliance, and ultimately drive revenue growth. For a company with 200 reps and current onboarding costs of

Why Specialized AI Beats Generalist AI in Regulated Industries

This moment is particularly important for understanding the future of AI in enterprise. The initial wave of generalist AI tools—Chat GPT, Claude, Gemini—were remarkable. They could do anything reasonably well. But as companies deploy AI into actual business processes, they're discovering that "reasonably well" often isn't good enough. You need specialized AI.

Medical sales is the perfect case study for why. The domain has specific requirements: compliance knowledge, clinical accuracy, healthcare provider behavior patterns, regulatory constraints. A generalist AI model, no matter how large or well-trained, won't naturally understand these domain-specific nuances.

But when you take a focused model and train it specifically on medical sales data, you get something different. The model learns the patterns of successful medical sales conversations. It understands what healthcare providers value. It internalizes compliance requirements. It develops the ability to simulate realistic interactions that actually help reps improve.

This is why we're seeing the emergence of smaller, specialized models across different verticals. Instead of one giant AI that tries to be everything, we're moving toward an ecosystem of specialized AIs trained on domain-specific data, optimized for specific use cases, and integrated into specific business processes.

Praxis Pro is riding this wave. They're building a small language model specifically for medical sales. It won't win any generic AI benchmarks. It probably won't outperform GPT-4 on general knowledge questions. But at the specific task of helping medical sales reps practice, prepare, and improve their conversations with healthcare providers? It should be substantially better than anything general-purpose.

This is the future of AI in enterprise: specialization, domain focus, and tight integration with business processes.

The Competitive Landscape: Who Else Is Playing in This Space

Praxis Pro isn't alone in recognizing that sales coaching is a problem worth solving with AI.

Quantified has built an AI role-playing platform that lets sales reps practice conversations with AI agents. They've raised significant funding and work with many enterprise sales organizations. Their approach is broader—they're not specialized for any one vertical. This gives them the advantage of a larger addressable market but the disadvantage of less specialized domain knowledge.

Smart Winnr offers training, coaching, and sales enablement with AI components. They've built a comprehensive platform covering content, training, assessment, and coaching. Again, they're broad-based rather than specialized for medical sales.

There are also pharma-specific training platforms like Veeva MO, which is part of the Veeva ecosystem and focuses on mobile optimization and content management for pharmaceutical reps. But these are content and compliance tools, not AI coaching platforms.

The competitive advantage for Praxis Pro comes from specialization. They're deeply focused on medical sales. Their models are trained on medical data. Their compliance knowledge is specific to pharma and medical device regulations. They understand the healthcare provider psyche in ways general tools don't. This depth creates moat.

But specialization also creates vulnerability. Praxis Pro is betting that the medical sales market is large enough and the problem acute enough to support a specialized company. If generalist AI tools rapidly improve and become "good enough" for medical sales use cases, that specialization advantage shrinks. Conversely, if Praxis Pro can establish strong product-market fit in medical sales and expand into related life science verticals (clinical trials, medical affairs, market access), they've built something defensible.

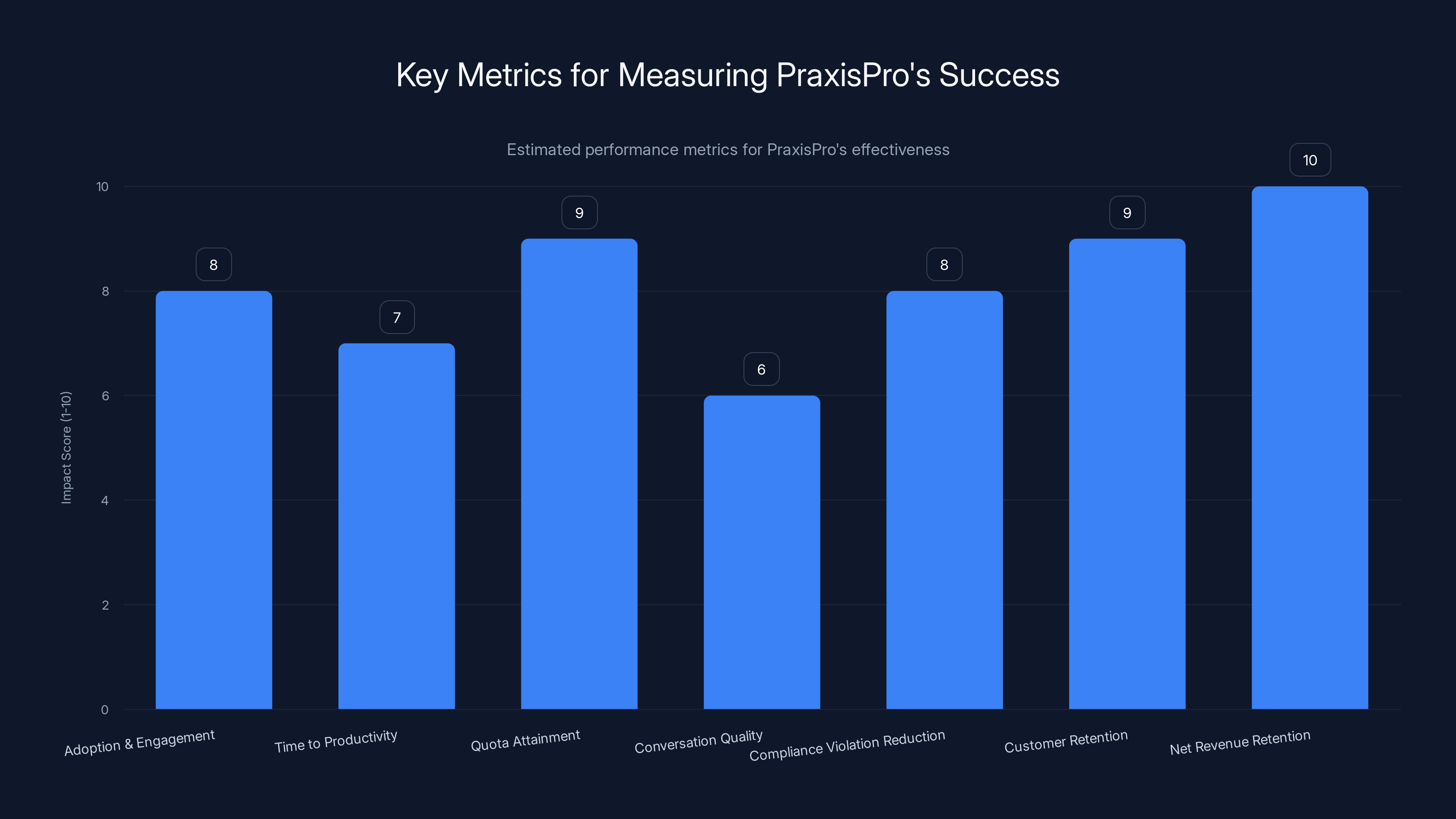

Estimated data suggests that Net Revenue Retention and Quota Attainment are the most impactful metrics for PraxisPro's success, indicating strong product value and sales performance improvements.

The Funding Landscape and What It Signals

A $6 million seed round in January 2026 tells us something important about the current funding environment and investor priorities.

First, Alley Corp is the lead investor. Alley Corp is a notable venture firm focused on early-stage companies, often co-founding or helping shape companies from ideation. Their involvement signals confidence in the founding team and the market opportunity. Alley Corp doesn't back every AI company that comes along. They're selective. The fact they're leading a round in medical sales AI suggests they see substantial opportunity here.

The additional investors—Fly Bridge, South Loop Ventures, and Zeal Capital Partners—are all established venture firms with healthcare and enterprise software expertise. Fly Bridge is particularly known for software and data infrastructure investments. South Loop focuses on startups backed by operators. These aren't random investors; they're investors with relevant domain expertise.

The size of the round—

What's being signaled: specialized AI tools in regulated industries are fundable. The market opportunity is real. And investors believe that domain focus plus AI creates value.

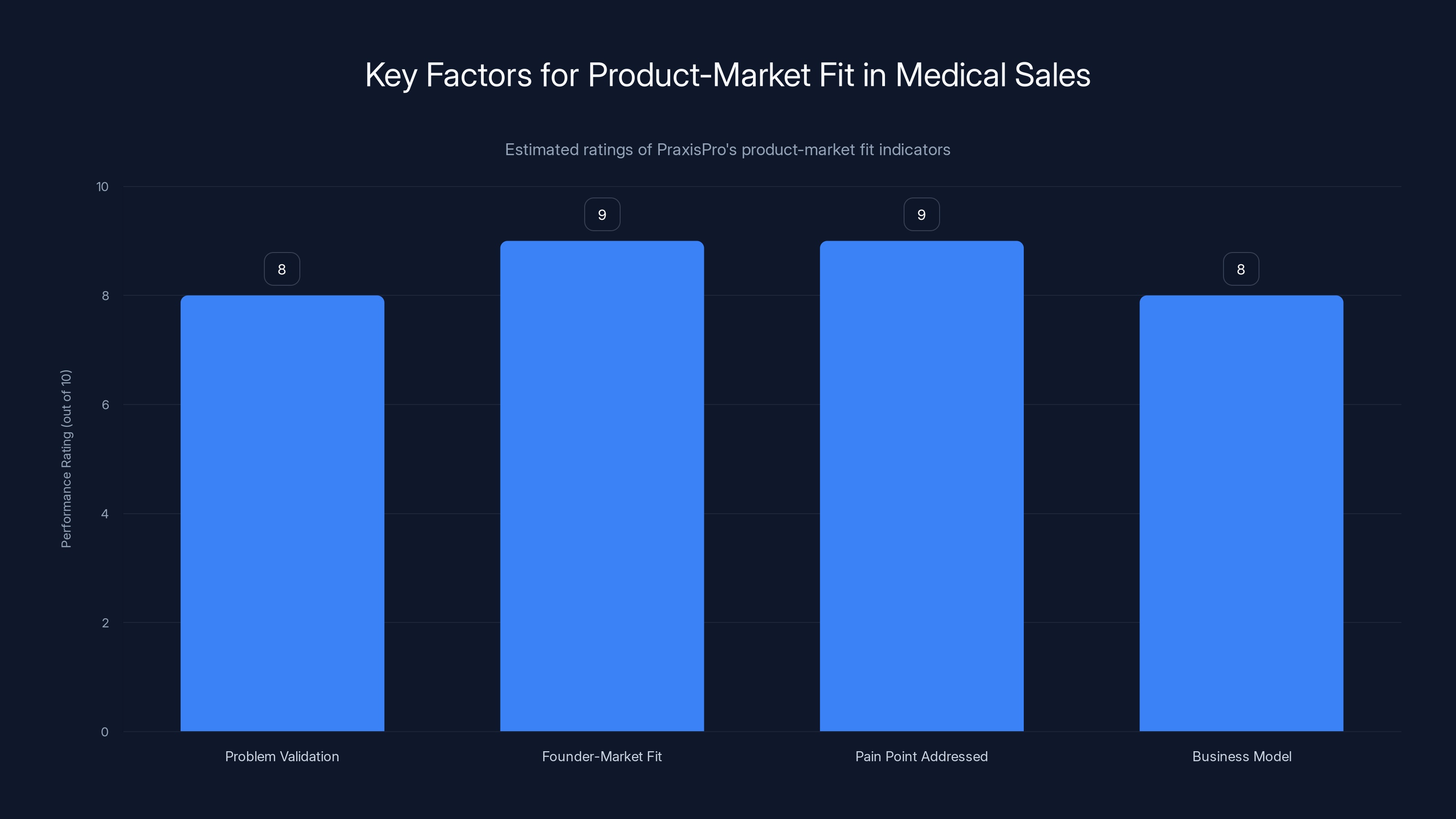

Product-Market Fit in Medical Sales

For a startup to raise $6 million at seed stage, they need to demonstrate some version of product-market fit or a compelling path to it.

Praxis Pro appears to have several markers of early product-market fit. First, they've been operating since 2023, launched their first product in 2025, and are already raising capital. This suggests they've been working on problem validation and customer discovery throughout that period. They didn't jump straight to raising money; they spent time understanding the market.

Second, the founding team has direct domain expertise. Cam Badger spent four years as a pharmaceutical sales rep and additional years as a sales trainer. He's not an outsider trying to solve a problem he doesn't understand. He lived the problem daily. Bhrugu Giri brings complementary expertise. This founder-market fit is crucial for enterprise companies, particularly in regulated industries where credibility with customers is essential.

Third, they've built a product that addresses a genuine pain point. Medical sales training is genuinely fragmented and ineffective. Sales managers struggle to scale coaching. Reps struggle with preparation. Compliance is always a concern. Praxis Pro's solution speaks to all of these problems. It's not solving a problem that doesn't exist.

Fourth, the business model appears sound. They're positioning as an enterprise software company selling to life science companies. This is a proven model. Enterprise SaaS companies targeting pharma and medical device companies have proven they can achieve substantial scale and profitability. Companies like Veeva have built multi-billion-dollar businesses in this space.

The remaining questions are: How many pharma and medical device companies will adopt the platform? What's the typical contract value? What's the customer acquisition cost? What's the retention rate? These are the metrics that will determine whether Praxis Pro becomes a meaningful business or a niche player. The $6 million seed round suggests investors believe the answers to these questions are favorable.

Implementation and Integration Challenges

Building the product is one thing. Selling it and implementing it in life science companies is another.

Life science companies have complex IT environments. They have legacy systems, strict security requirements, regulatory compliance standards, and often glacially slow procurement processes. A company that builds great technology but struggles with sales, implementation, and integration won't succeed in this market.

Praxis Pro's decision to offer both standalone deployment and integration into existing enterprise systems is smart. It acknowledges that different companies will have different needs. Some might want a standalone platform that training teams manage independently. Others might want deep integration with their existing learning management system or sales enablement platform.

Integration is particularly important. If Praxis Pro can integrate with platforms like Salesforce (which many pharma companies use for CRM), or with established LMS platforms, or with other enterprise software, it becomes more sticky. It becomes part of the infrastructure rather than an add-on tool.

The implementation process will be crucial. Does the platform require significant customization for each customer, or is it relatively plug-and-play? Customization slows time-to-value and increases customer acquisition cost. Plug-and-play solutions scale more efficiently.

Training and change management are also essential. Even a great tool won't drive results if reps don't use it or use it ineffectively. Praxis Pro will need to provide training, best practices, implementation guides, and ongoing support. This becomes part of the value proposition.

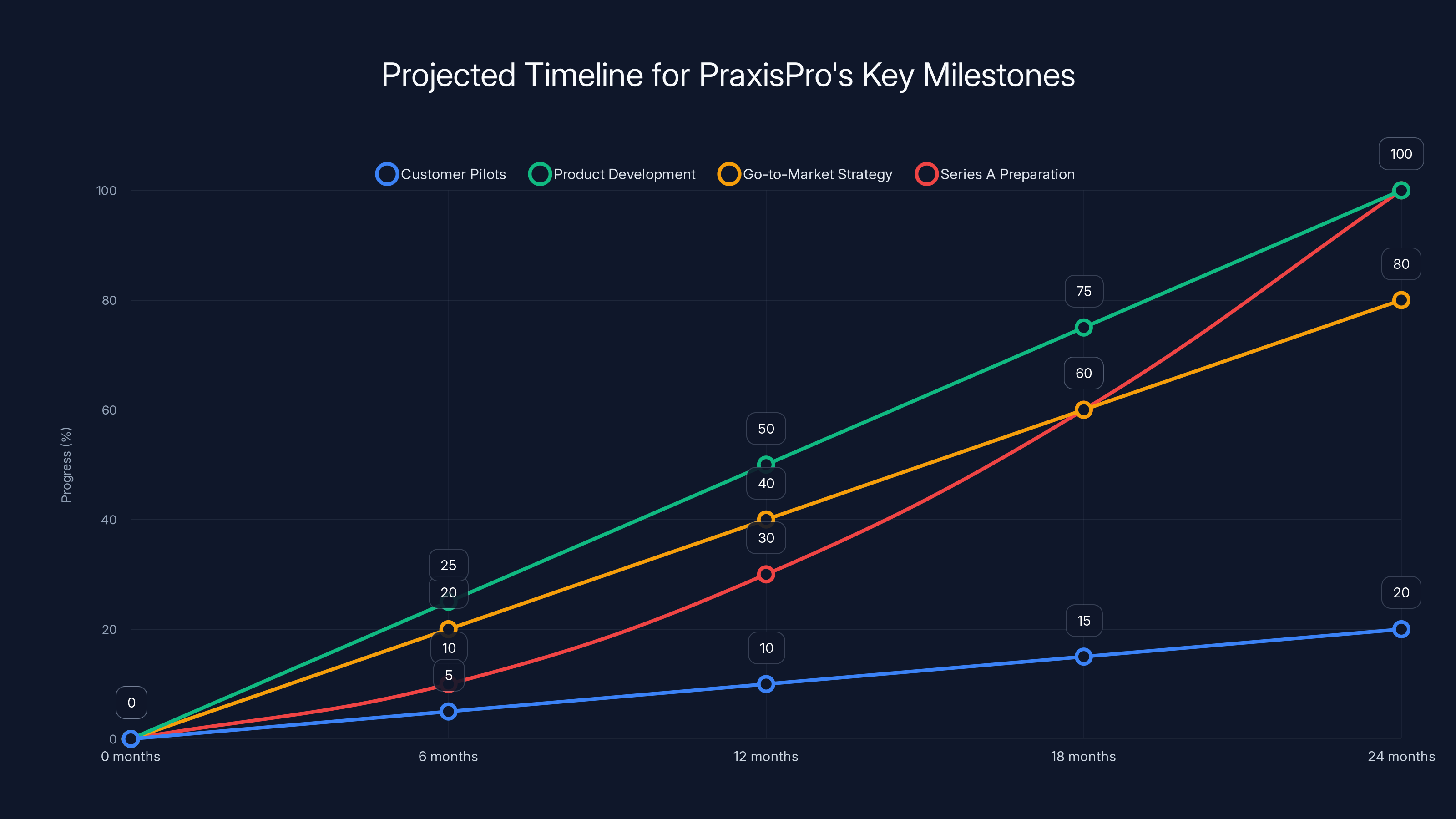

Estimated data shows PraxisPro's strategic milestones over 24 months, with customer pilots and Series A preparation as key focus areas.

The Clinical and Ethical Dimensions

Here's where this gets truly interesting from a societal perspective.

Badger articulated the core belief: "When commercial interactions with healthcare providers are ineffective, patients don't get a fair shot at therapies that could meaningfully change their lives." This reframes sales training as a patient access issue.

It's a compelling argument. If a pharmaceutical sales rep doesn't effectively communicate the clinical benefits of a new cancer treatment to an oncologist, that oncologist might not prescribe it. The patient might never learn that the treatment exists. An opportunity for better outcomes is missed.

Conversely, if a rep oversells a product's benefits or misrepresents clinical data to a healthcare provider, that's also harmful. The provider might prescribe a treatment that's not actually optimal for their patient. Patients could be harmed.

Better training creates a virtuous cycle. Reps communicate more accurately. Healthcare providers receive better information. Providers make better-informed decisions. Patients get access to treatments that are actually right for them. This isn't just about commercial success; it's about patient outcomes.

But there's also a more cynical lens. Pharmaceutical sales is, at its core, about persuading healthcare providers to prescribe more of a company's products. Better sales training means more persuasive sales reps. More persuasive sales reps mean higher sales. Higher sales mean more revenue for the pharmaceutical company. If the training also helps ensure reps stay within compliance, that's great for the company but it's not purely philanthropic.

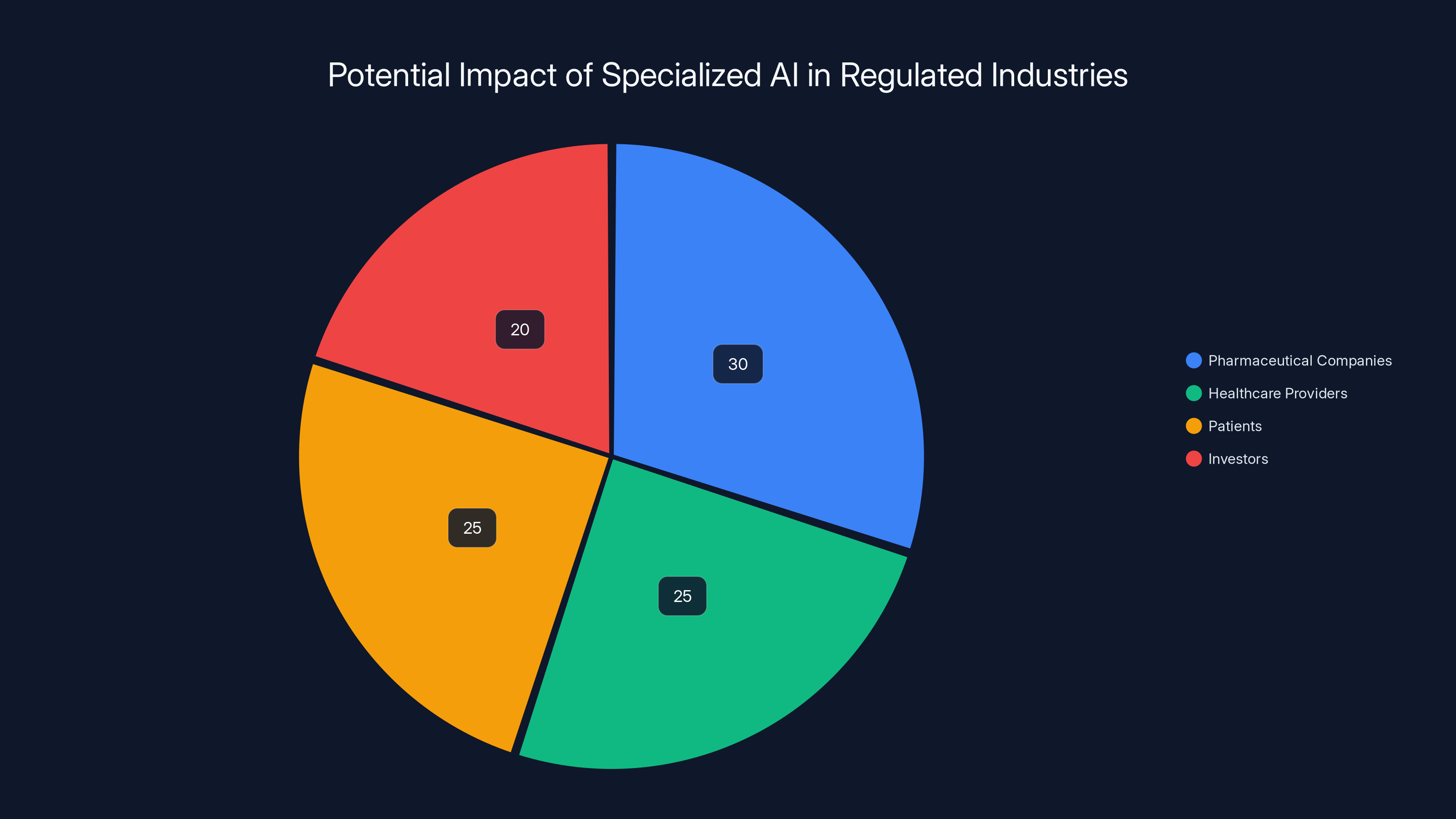

The ethical question is: Does better pharmaceutical sales rep training primarily benefit patients through improved access to needed treatments, or does it primarily benefit pharmaceutical companies through higher sales? The answer is probably both. The two aren't mutually exclusive.

What matters is that the training enforces compliance, encourages accuracy, and helps reps understand the clinical evidence. If Praxis Pro does that effectively, it creates positive outcomes for all stakeholders: pharma companies get better commercial results, healthcare providers get better information, and patients get better access to appropriate treatments.

Regulatory and Compliance Implications

Compliance is woven throughout medical sales. The FDA regulates pharmaceutical advertising and sales claims. The DEA oversees certain controlled pharmaceutical sales. Healthcare providers operate under HIPAA and other privacy regulations. Sales interactions can't violate any of these frameworks.

For a platform like Praxis Pro, compliance is both an opportunity and a risk.

It's an opportunity because compliance training and enforcement is a core part of their value proposition. If the platform helps reps avoid compliance violations, they're solving a real problem for their customers. Life science companies spend millions on compliance training and still struggle with reps making mistakes. A tool that reduces mistakes is valuable.

It's a risk because if Praxis Pro's platform fails to catch a compliance violation, or worse, suggests problematic messaging, the liability falls on the company. If a rep uses Praxis Pro to practice a sales pitch, the AI approves the pitch as compliant, but the pitch later triggers an FDA investigation, who's responsible? Praxis Pro will need to think carefully about liability, disclaimers, and indemnification.

This is why specialization in medical domain knowledge is so important. A generic AI tool that misses medical compliance nuances could create risk. A specialized platform built by people who understand medical compliance deeply should catch issues that general tools would miss.

The Addressable Market and Growth Opportunity

Let's estimate the addressable market for Praxis Pro.

The global pharmaceutical market has approximately 800,000 to 1 million sales representatives. Medical device companies employ another 500,000 to 700,000 sales reps. Clinical trials, medical affairs, and related life science functions employ hundreds of thousands more. We're talking about 1.5-2 million people in life science sales globally.

If Praxis Pro captures even a small fraction of these through their customers' organizations, the opportunity is enormous. A mid-size pharmaceutical company might have 300-500 sales reps. A large one might have 5,000+. Medical device companies vary widely. Across the customer base, if Praxis Pro reaches 10,000 to 50,000 individual users within the first 3-5 years, that's remarkable penetration.

The financial model works like this: if Praxis Pro charges a per-user annual subscription of

For venture investors, the question is: Can Praxis Pro become a

PraxisPro demonstrates strong product-market fit indicators, particularly in founder-market fit and addressing genuine pain points. Estimated data.

Strategic Expansion Opportunities

As Praxis Pro matures, they have several potential expansion vectors.

First, adjacent life science functions. Medical affairs teams need training. Market access teams need coaching. Clinical trial teams need to communicate complex study designs. Each of these functions has training and coaching needs that could benefit from AI-powered platforms. Praxis Pro could expand horizontally within their customers' organizations.

Second, international markets. Medical sales exists globally. European pharma companies, Asian pharma companies, and Australian pharma companies all need training solutions. International expansion opens new markets and diversifies revenue.

Third, vertical integration into related platforms. Companies like Veeva have built ecosystems where different tools integrate seamlessly. Praxis Pro could eventually integrate with sales enablement platforms, content management systems, CRM systems, and learning management systems. This creates stickiness and increases customer lifetime value.

Fourth, data analytics and insights. As Praxis Pro accumulates data on millions of practice sales interactions, they could build analytics and intelligence products that reveal industry trends, best practices, and market patterns. This becomes a separate revenue stream and a competitive moat.

Fifth, AI model licensing. If Praxis Pro builds truly differentiated models trained on medical sales data, they could license those models to other platforms, companies, or integrators. This creates licensing revenue.

The most likely near-term expansion is probably horizontal (adjacent functions within existing customers) followed by international expansion.

The Founder Story and Founder-Market Fit

The origin story of Praxis Pro is worth paying attention to because it reveals something important about how great enterprise software gets built.

Cam Badger didn't start as a software entrepreneur. He started as a pharmaceutical sales rep who struggled, nearly failed, but persisted and eventually succeeded. This lived experience created empathy for the problem. When he became a sales trainer and confronted the systemic inadequacy of training systems, he didn't say "that's just how it is." He said "this should be fixed."

That's how great software gets built. Someone with deep domain expertise experiences a real problem repeatedly, becomes frustrated, and decides to solve it. They're not trying to apply some AI or software trend to a market. They're trying to fix something they've personally experienced.

Badger's subsequent experience as a sales trainer validated the problem at scale. It wasn't just his own struggle. It was systemic across the industry. That validation was crucial for moving from personal frustration to product vision.

When he met Bhrugu Giri, they shared the frustration and the vision. Giri presumably brought technical expertise or product expertise that complemented Badger's domain knowledge. Together, they had the pieces needed to build something real.

This is a pattern that venture investors reward. Founder-market fit is often more important than the specific technology. A founder who deeply understands the market, has lived the problem, and is passionate about solving it has an enormous advantage over a founder who saw an opportunity and decided to attack it.

Praxis Pro has founder-market fit. That's one reason they were fundable at seed stage.

The Competitive Moat and Defensibility

Why doesn't a larger, more established software company build something like Praxis Pro? Or why couldn't a general AI platform company build this?

The answers reveal what makes Praxis Pro defensible:

First, domain focus requires commitment. A general software company has to maintain backward compatibility with existing products, serve a broad customer base with different needs, and manage feature creep across multiple verticals. A specialized company can go deep on one problem.

Second, domain expertise is scarce. If you need to build specialized AI models trained on pharmaceutical and medical device data, you need people who understand that domain. You need data that's compliant with healthcare regulations. You need expertise in compliance, clinical affairs, and sales operations. Recruiting or acquiring that expertise is expensive and difficult.

Third, regulatory expertise is valuable. Building AI systems for regulated industries requires understanding compliance deeply. Most software companies don't have that embedded in their culture. Praxis Pro can embed it from day one.

Fourth, customer relationships and trust matter. Pharma and medical device companies are conservative. They want to work with vendors who understand their world. A vendor with deep expertise and credibility in that world has an advantage.

Fifth, data creates defensibility. As Praxis Pro accumulates data on pharmaceutical and medical device sales interactions, that data becomes more valuable. Models trained on more data and better data become better. Competitors trying to catch up have to recreate that data advantage.

The moat isn't insurmountable. A well-funded competitor could enter and potentially outcompete. But they'd have to overcome the domain expertise, customer relationships, and data advantages that Praxis Pro is building.

Specialized AI in regulated industries like pharma can significantly benefit pharmaceutical companies, healthcare providers, and patients, with investors also seeing substantial returns. (Estimated data)

How AI-Powered Sales Coaching Scales What Was Formerly One-on-One Mentorship

Let's think about what's happening at a systemic level.

Traditionally, sales coaching was one-on-one. An experienced rep or sales manager would mentor a less experienced rep. They'd share war stories, give feedback, role-play scenarios, and provide guidance. This was valuable but it didn't scale. One experienced rep can mentor maybe 2-3 people at a time. Once you have 100 reps, or 1,000 reps, personal mentorship isn't feasible.

Sales training became impersonal. Companies developed programs, hired training vendors, built e-learning modules, and created formal curricula. This scaled but it lost the personalization and adaptability of one-on-one coaching.

AI-powered coaching offers a middle ground. It can provide personalized, adaptive coaching to many people simultaneously. Each rep gets a coach that's available 24/7. The coach adapts to their level, style, and needs. The coach provides feedback in real-time. The rep can practice as much as they want without waiting for a real manager to be available.

From a business perspective, this is a replicable model. Instead of hiring sales trainers and coaches (expensive, limited supply), companies deploy AI. The marginal cost of coaching an additional rep approaches zero.

Praxis Pro is building the AI infrastructure that makes this scaling possible for medical sales. They're essentially automating the best parts of what a great mentor would do.

There's a risk here: AI coaching can't replace human mentorship entirely. It can't provide the perspective, judgment, intuition, and wisdom that comes from years of experience. But for 80-90% of coaching needs, AI can be quite good. It's the 10-20% where human wisdom matters most that remains a role for experienced sales managers and mentors.

Metrics That Matter: How to Measure Praxis Pro's Success

For investors and customers alike, the question is: How do we know if this is working?

Traditional sales training metrics track things like completion rates, test scores, and survey ratings. These are inputs, not outcomes. They tell you that people completed the training, but not that their performance improved.

Meaningful metrics for Praxis Pro would be:

Adoption and Engagement: What percentage of reps are actively using the platform? How frequently do they use it? How many practice sessions do they complete? Higher adoption and engagement suggest the tool is valuable and easy to use.

Time to Productivity: For new reps, how long does it take them to reach quota? Do reps at companies using Praxis Pro reach quota faster than reps at companies not using it? This is a hard metric because it requires longitudinal data, but it's the most meaningful.

Quota Attainment: Do reps who use Praxis Pro regularly hit quota more often than reps who don't? This is the ultimate business metric.

Conversation Quality: Before and after using Praxis Pro, are reps' actual conversations with healthcare providers more compliant, more clinically accurate, more persuasive? This requires analyzing recorded calls or call notes, but it's doable.

Compliance Violation Reduction: Does Praxis Pro reduce the frequency of compliance violations among sales teams? This is a concrete business metric that companies care about deeply.

Customer Retention: How many customers renew their contracts? Do they expand to additional users or functions? High retention and expansion indicate strong product-market fit.

Net Revenue Retention: As Praxis Pro gets more valuable to customers over time, do customers expand their spending? NRR above 100% indicates a product that becomes more valuable over time.

Investors will be watching these metrics closely. If Praxis Pro can demonstrate that customers achieve meaningful improvements in ramp time, quota attainment, or compliance, the business becomes much more defensible.

The AI Innovation Cycle and What's Next

We're in a moment where AI capabilities are advancing rapidly. What does that mean for a company like Praxis Pro?

In the near term, Praxis Pro benefits from advancing AI. Better language models, better reasoning capabilities, better contextual understanding all make their coaching platform more effective. They can harness public model improvements to improve their product.

In the medium term, they're building proprietary datasets and fine-tuned models. As they accumulate data on medical sales interactions, their models become more specialized and more effective than public models. This creates differentiation.

Longer term, the competitive dynamics might shift. If AI becomes so general-purpose and effective that specialized models lose their advantage, Praxis Pro's moat shrinks. But that's years away. For the next 3-5 years, specialization is competitive advantage.

There's also a possible scenario where Praxis Pro becomes a component of a larger platform. If Veeva, Salesforce, or another large platform decides they want AI sales coaching built into their system, they might acquire Praxis Pro. This is a reasonable exit for investors.

Or Praxis Pro could remain independent, grow into a substantial standalone business, and eventually go public or be acquired at a later stage for a much larger amount.

The Broader Ecosystem and Where This Fits

Praxis Pro doesn't exist in a vacuum. It's part of a broader ecosystem of companies applying AI to different aspects of pharmaceutical and medical device commerce.

Other companies are building AI for medical communications, clinical documentation, market access, real-world data analysis, and various other functions. As the ecosystem matures, we'll see increasing integration and consolidation. Some companies will specialize deeply. Others will integrate into larger platforms. The market will eventually settle into an equilibrium.

For customers (pharma and medical device companies), this ecosystem matters. They want tools that work together, that share data securely, that integrate with their existing systems, and that provide comprehensive solutions. A company that excels at orchestrating these tools or integrating deeply with existing systems has value.

For investors, this ecosystem creates opportunities across multiple companies. Some will specialize (like Praxis Pro), some will integrate, some will provide data and analytics infrastructure. The winners will be companies that solve real problems for pharmaceutical customers.

Lessons for Other Enterprise Software Companies

Praxis Pro's story offers lessons for anyone building enterprise software:

Founder-market fit matters more than technology. Cam Badger's background as a pharmaceutical sales rep is more important than Praxis Pro's technology. He knew the problem intimately.

Specialization beats generalization in regulated industries. General-purpose AI tools can't compete with specialized tools in healthcare, pharma, and other regulated sectors. Domain expertise is valuable.

Compliance and regulation are features, not bugs. In healthcare, understanding regulation deeply and building compliance into your product is a competitive advantage, not a constraint.

Enterprise SaaS in pharma works. The pharma industry has shown willingness to invest in software that improves commercial operations. If you solve a real problem, you can build a substantial business.

Sales execution matters. Building great technology is necessary but not sufficient. You need to actually sell it to life science companies, implement it successfully, and help customers achieve results.

The Path Forward for Praxis Pro

With $6 million in seed funding, Praxis Pro has a runway of probably 18-24 months, depending on burn rate. In that time, they need to:

First, validate product-market fit by landing 10-20 customer pilots or early adopters. These customers should show measurable improvement in rep performance or compliance metrics.

Second, build the product into something that customers find indispensable. This might involve expanding features, improving the AI model, enhancing integrations, or adding analytics.

Third, establish a go-to-market engine that enables efficient customer acquisition. This probably involves hiring sales talent, building marketing, and establishing thought leadership in the medical sales space.

Fourth, prepare for Series A fundraising by demonstrating strong initial traction. By the time they've depleted their seed runway, they should have clear evidence that the market wants this product.

If they execute on these priorities, Series A is likely available in the 18-24 month timeframe. A successful Series A would provide 2-3 years of runway to build a real business.

Conclusion: Why This Matters Now

Praxis Pro's $6 million seed round represents an important inflection point in enterprise AI.

For years, the conversation around AI has been dominated by generalist models, consumer applications, and broad enterprise use cases. The implicit assumption was that general-purpose AI would be good enough for most problems.

But enterprise software is proving otherwise. Specialized AI, trained on domain-specific data, optimized for specific use cases, and built by teams with deep domain expertise, is creating tremendous value in specific industries and functions.

Praxis Pro exemplifies this shift. They're not trying to build a general AI assistant. They're building a specialized tool for a specific industry (pharma and medical devices) solving a specific problem (sales rep training and coaching) using domain-specific models and expertise.

This is the future of enterprise AI: specialization, domain focus, and integration into specific business processes.

For the pharmaceutical and medical device industries, this matters because better sales coaching means better commercial execution, which means better access to treatments, which means better patient outcomes. It's a win for all stakeholders: companies, healthcare providers, and patients.

For the broader tech industry and AI ecosystem, Praxis Pro signals that specialized AI in regulated industries is a worthy investment thesis. Other investors will likely pursue similar companies in healthcare, financial services, legal tech, and other regulated verticals. The flywheel of domain-specialized AI is spinning up.

The fact that Cam Badger, a former pharmaceutical sales rep, built this company is also important. It reinforces the lesson that the best software solutions come from people who've lived the problems they're solving. Founder-market fit remains one of the most reliable predictors of success in enterprise software.

The next 18-24 months will be critical for Praxis Pro. They need to demonstrate that their platform materially improves pharmaceutical sales rep performance and that customers see the ROI. If they do, they'll likely raise Series A at a higher valuation and build a company that becomes a standard tool across the pharma industry.

If they don't, they'll struggle to raise follow-on funding and might pivot or fold. But given the founding team's domain expertise, the market opportunity, and the real problem they're solving, I'd bet on Praxis Pro succeeding.

FAQ

What is Praxis Pro?

Praxis Pro is an AI-powered sales coaching platform designed specifically for pharmaceutical and medical device companies. Founded in 2023 by Cam Badger and Bhrugu Giri, the platform uses small language models trained on life science data to help medical sales representatives practice their pitches, prepare for healthcare provider conversations, and improve their commercial execution.

How does Praxis Pro's AI coaching work?

The platform employs conversational AI agents that simulate realistic interactions between sales reps and healthcare providers. Reps can practice their opening pitch, respond to objections, handle compliance questions, and refine their messaging through repeated practice sessions. The AI agent responds like a real healthcare provider would, providing feedback on what worked, what didn't, and whether messaging remained compliant with regulatory frameworks.

What are the key benefits of using Praxis Pro?

The platform offers several concrete benefits: it accelerates ramp time for new sales reps by enabling practice before real customer interactions, reduces compliance violations by training reps on regulatory requirements, improves quota attainment through better preparation and messaging, and enables scalable coaching that doesn't depend on limited manager availability. For companies with hundreds of sales reps, these improvements translate into significant revenue impact and risk reduction.

How does Praxis Pro differ from general-purpose AI coaching tools?

Praxis Pro uses specialized, domain-specific models trained exclusively on pharmaceutical and medical device sales data, whereas general-purpose AI tools like Chat GPT lack the medical compliance knowledge and healthcare provider behavior patterns that Praxis Pro's models contain. This specialization enables Praxis Pro to provide more accurate simulations, better compliance checking, and more relevant coaching than generalist platforms.

What compliance and regulatory features does Praxis Pro include?

The platform is built with compliance at its core. It understands FDA regulations, healthcare interaction guidelines, and life science industry compliance requirements. The AI agent can flag messaging that might violate compliance rules, suggest compliant alternatives, and help reps understand the regulatory constraints of their specific products and markets.

Who are Praxis Pro's target customers?

The primary customers are pharmaceutical companies, medical device companies, and other life science organizations with significant sales teams. These organizations range from mid-size companies with 100-200 reps to large enterprises with 5,000+ reps. Any organization seeking to improve sales rep training, reduce compliance risk, or accelerate rep productivity can benefit from the platform.

How much does Praxis Pro cost?

While specific pricing wasn't disclosed in the funding announcement, typical enterprise SaaS platforms targeting pharmaceutical companies charge between

Can Praxis Pro integrate with existing pharma software systems?

Yes, Praxis Pro is designed as both a standalone platform and as an integrated solution that can connect with existing enterprise software. This flexibility allows companies with established tech stacks (like Salesforce, Veeva, or custom learning management systems) to integrate Praxis Pro without replacing existing tools.

What metrics does Praxis Pro track to measure success?

The platform tracks adoption rates, engagement frequency, practice session completeness, user progress, and ultimately the impact on real sales rep performance. Key business metrics include time to productivity for new reps, quota attainment rates among platform users, compliance violation reduction, and customer retention rates.

What's the broader significance of Praxis Pro's $6 million seed round?

The funding signals investor confidence in specialized AI for regulated industries. It demonstrates that domain-specific AI models trained on industry data are more valuable than general-purpose AI for highly specialized use cases. It also validates the market opportunity for AI-powered training and coaching in pharmaceutical and medical device sales.

How does Praxis Pro scale sales coaching?

Traditionally, sales coaching required one-on-one mentorship between experienced reps and trainees, which doesn't scale beyond a few mentees per coach. Praxis Pro scales this through AI, enabling unlimited reps to access personalized, adaptive coaching simultaneously. Each rep gets a virtual coach available 24/7, with the marginal cost of training additional reps approaching zero.

What are the future expansion opportunities for Praxis Pro?

Praxis Pro could expand horizontally within customers' organizations by serving medical affairs, market access, and clinical trial teams. They could expand geographically into international pharma markets. They could vertically integrate with other platforms, build analytics services, or license their specialized AI models to other companies in the life science ecosystem.

Key Takeaways

- PraxisPro raised $6M seed funding to deploy AI coaching specifically designed for pharmaceutical and medical device sales teams

- Small language models trained on life science data enable more accurate compliance checking and realistic healthcare provider simulations than general-purpose AI

- Better sales rep training creates a virtuous cycle: more effective reps, better healthcare provider information, improved patient access to appropriate treatments

- Specialized AI in regulated industries outperforms generalist models because domain expertise and compliance knowledge are competitive advantages

- Founder-market fit (Badger's pharma sales background) is arguably more important than the technology itself for enterprise software success

Related Articles

- OptiMind: Transforming Business Problems Into Mathematical Solutions [2025]

- Hupo's AI Sales Coaching Pivot: From Mental Wellness to $15M Startup [2025]

- Serve Robotics Acquires Diligent: Why Healthcare Robots Are the Next Frontier [2025]

- How to Train AI SDRs That Actually Work: Clone Your Best Human [2025]

- ChatGPT Health: How AI is Reshaping Medical Conversations [2025]

- ChatGPT in Healthcare: 40M Daily Users & AI's Medical Impact [2025]

![PraxisPro's $6M Seed Round: AI Coaching for Medical Sales [2025]](https://tryrunable.com/blog/praxispro-s-6m-seed-round-ai-coaching-for-medical-sales-2025/image-1-1769004433663.jpg)