Why RAM Prices Are Surging in 2025: The Complete Guide

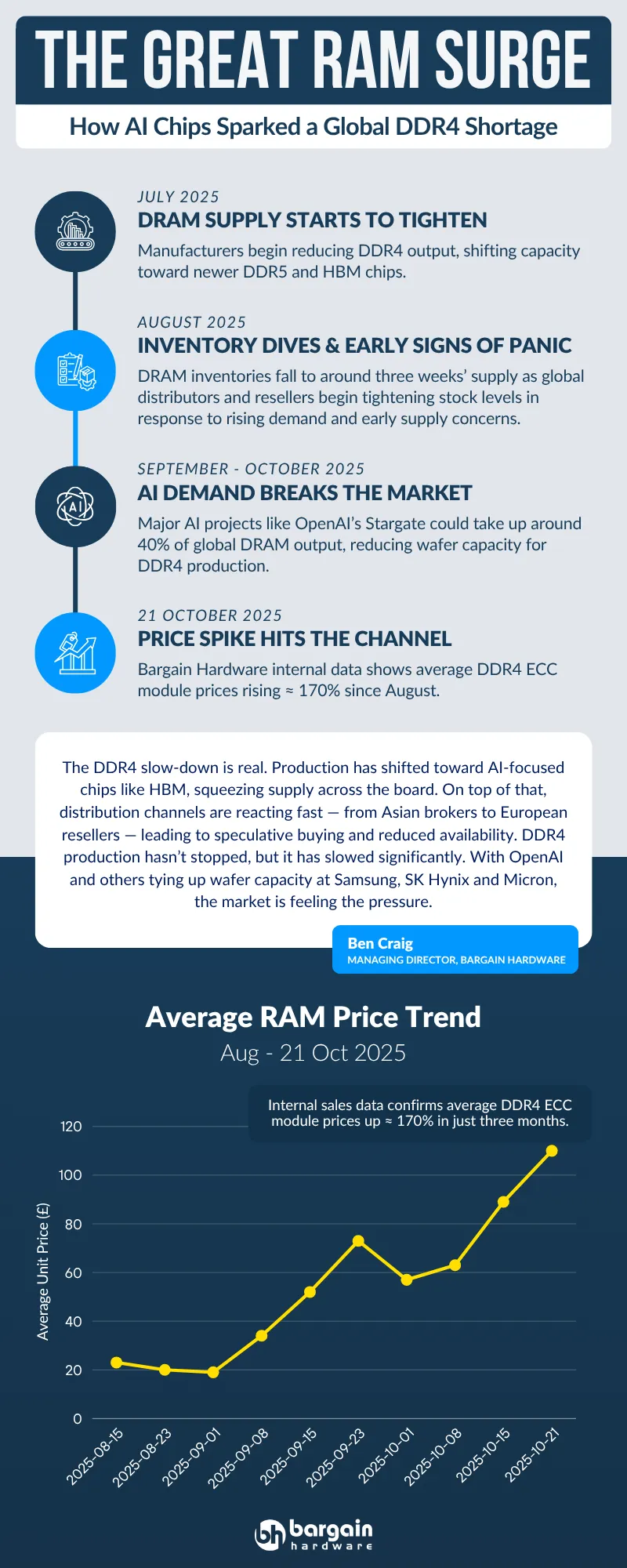

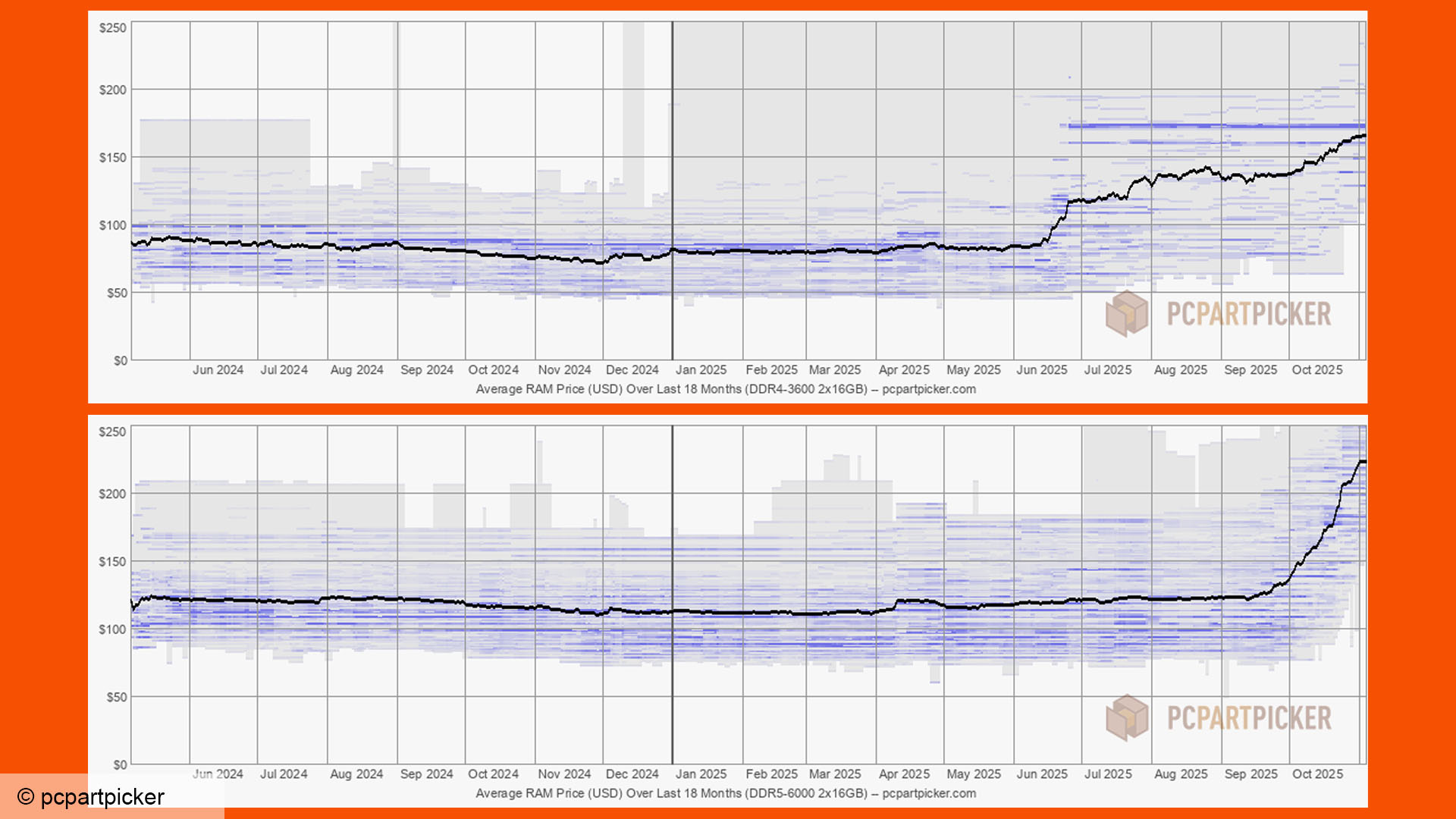

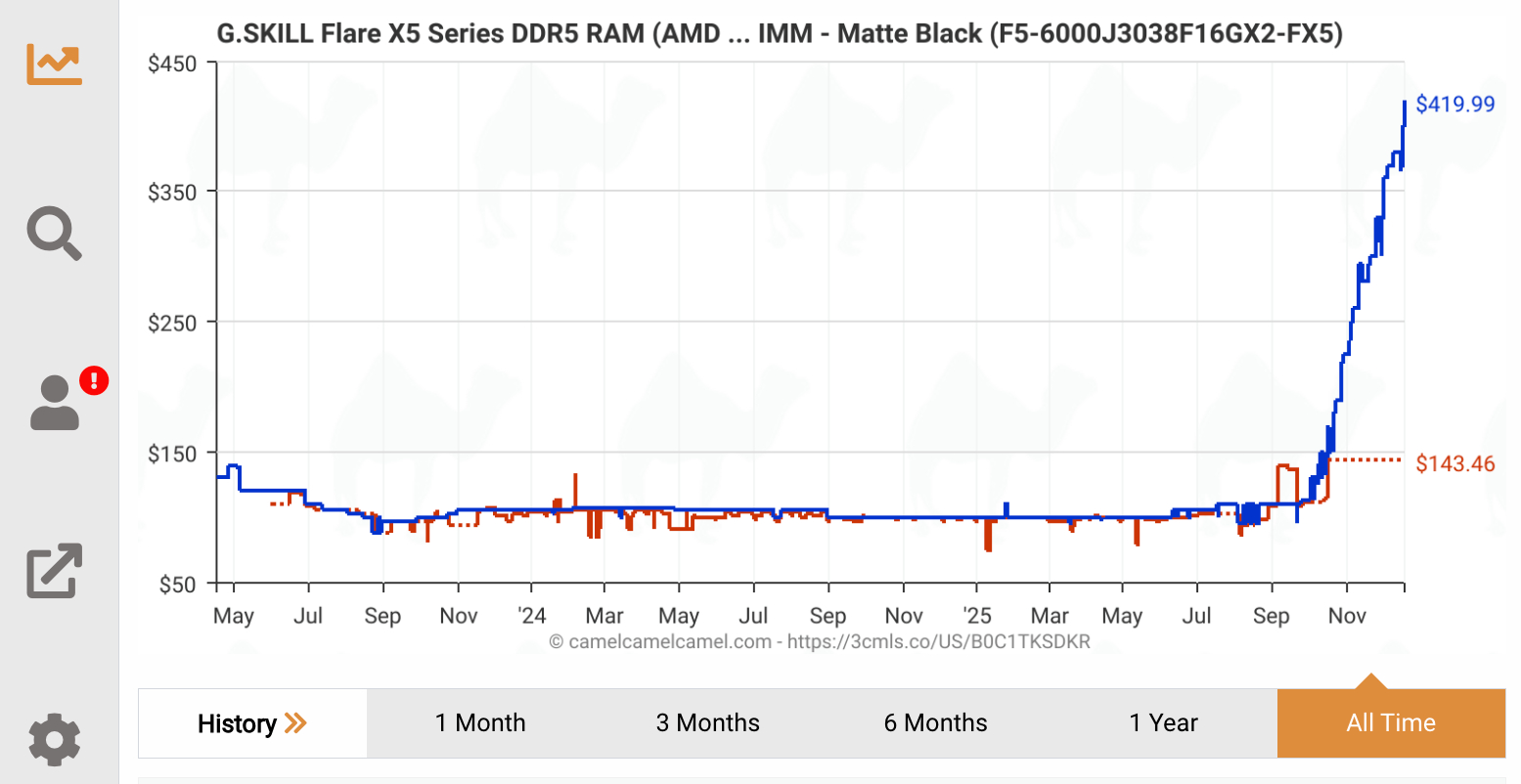

If you've been shopping for a new computer or upgrading your system recently, you've probably noticed something painful at checkout. RAM prices aren't just going up. They're going up in a way that industry analysts are calling "unprecedented and record-breaking" according to PC Gamer. We're talking about increases that make previous market fluctuations look quaint by comparison.

This isn't just a minor inconvenience for budget shoppers. It's a ripple that affects everyone from gamers building their dream setups to enterprises managing thousands of machines. When memory becomes expensive, everything downstream gets more expensive too. Your laptop costs more. Your workstation costs more. Even cloud computing prices edge upward because providers need to manage their infrastructure costs as reported by CNBC.

Here's what's actually happening behind the scenes, why it matters, and what you should do about it right now.

TL; DR

- Record-breaking surge ahead: Analysts warn of unprecedented price increases for RAM in the coming months, with some estimates suggesting double-digit percentage spikes according to Counterpoint Research.

- Supply chain constraints: Global memory manufacturers are facing production challenges and strategic decisions that limit available inventory as detailed by the Wall Street Journal.

- Enterprise demand pressure: AI infrastructure buildouts and data center expansion are creating massive demand that pushes consumer pricing higher as noted by CNBC.

- Timing matters now: Buyers should evaluate upgrade needs carefully, as prices may continue climbing before stabilizing according to Sourceability.

- Bottom line: Current market dynamics suggest this isn't a temporary blip. Planning ahead and making strategic purchase decisions are essential.

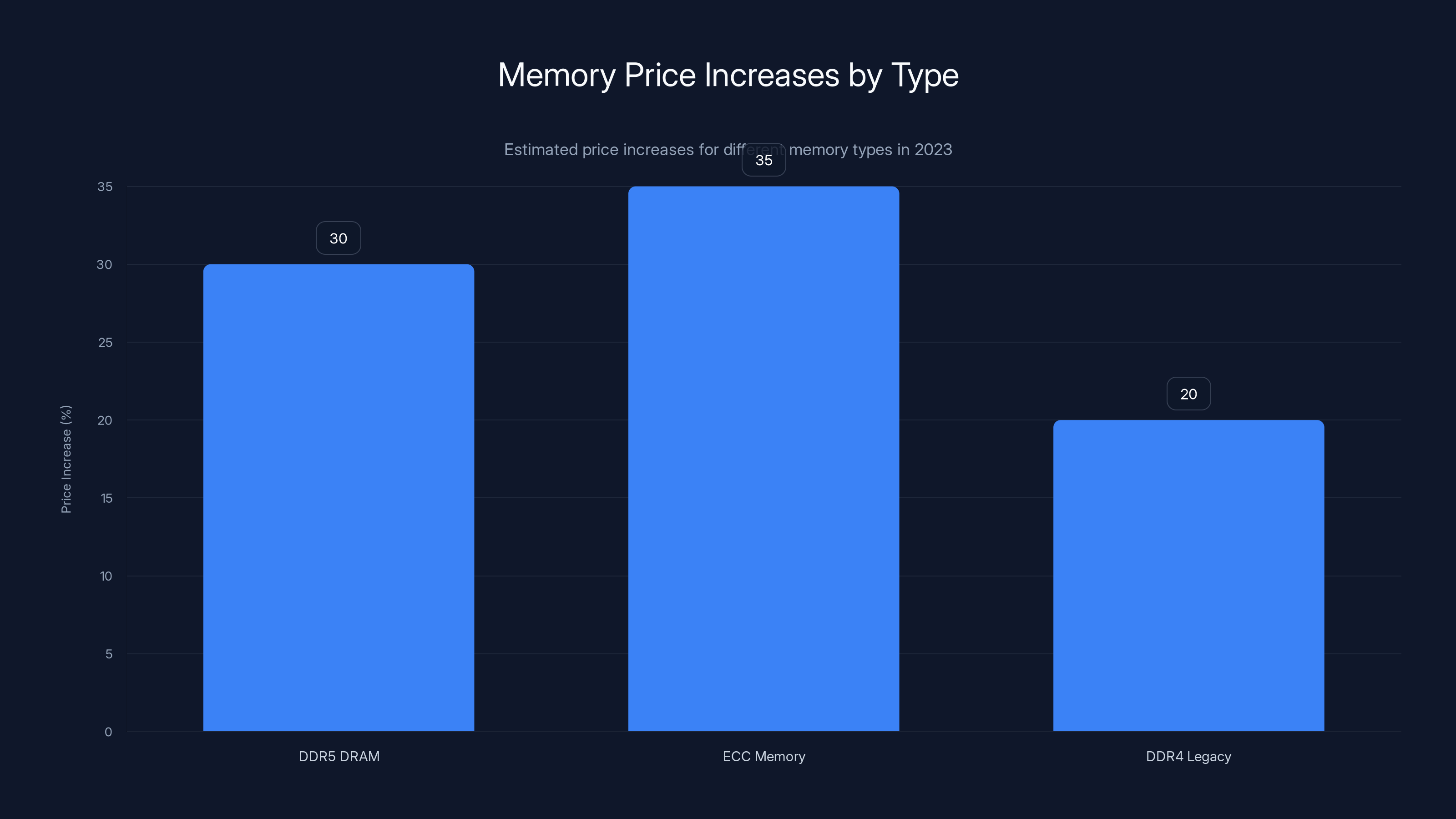

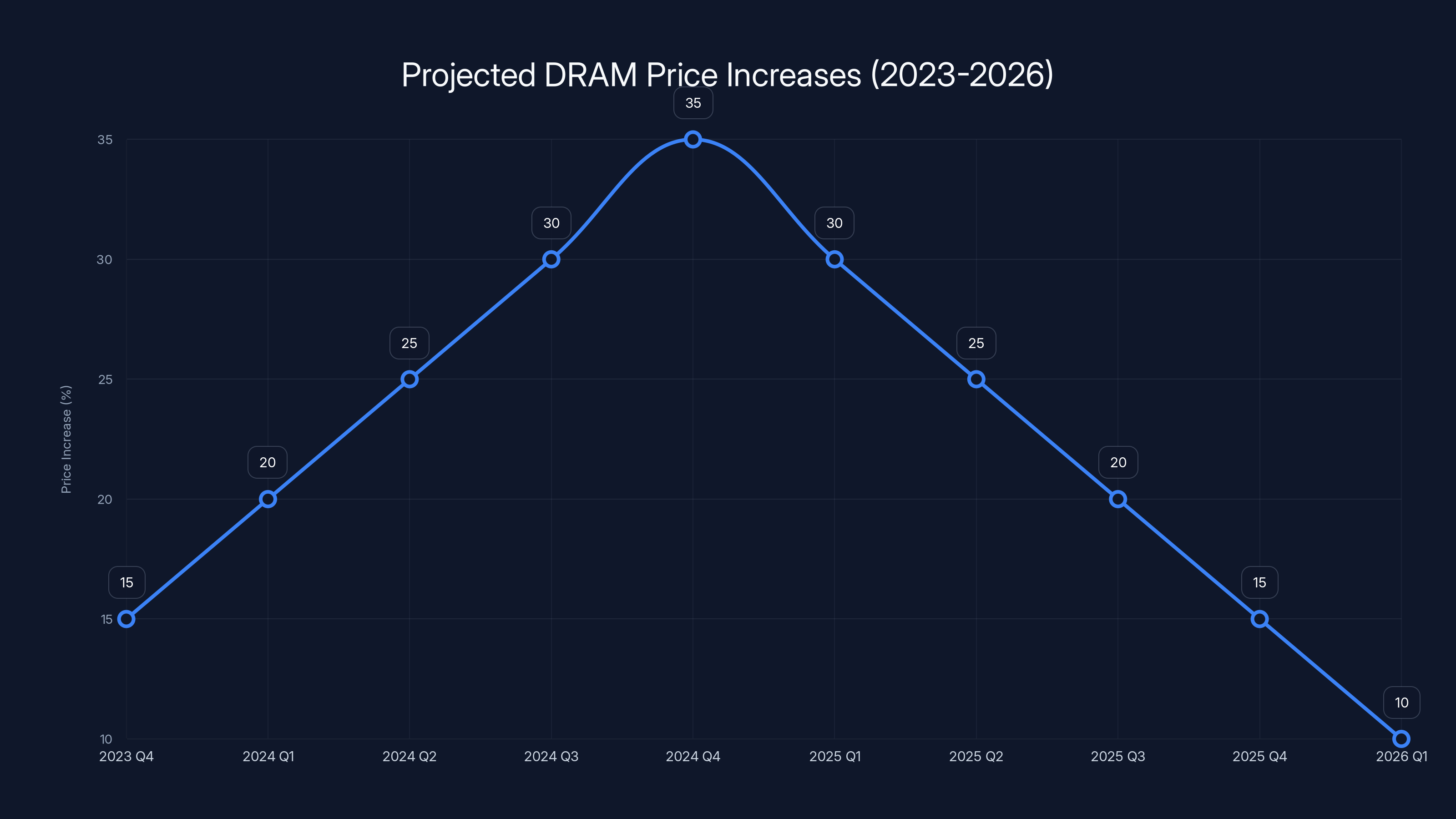

DDR5 DRAM and ECC memory are experiencing the largest price increases, estimated at 30-35%, while DDR4 legacy memory sees a 20% increase. Estimated data.

Understanding the RAM Market Fundamentals

Before diving into why prices are exploding, it helps to understand how the RAM market actually works. Memory isn't like processors or storage drives, where you have a relatively stable supply chain with clear manufacturing capacity. RAM is more complex, more specialized, and the industry operates with razor-thin margins that make it incredibly sensitive to disruption.

The memory chip industry is dominated by just a handful of players. Samsung, SK Hynix, and Micron control the vast majority of DRAM and NAND flash production worldwide as reported by CNBC. This concentration means that when one of these manufacturers makes a decision or faces a challenge, it reverberates across the entire global PC market. If one supplier cuts production, there's no easy way for others to instantly pick up the slack because building new fabrication plants takes years and costs billions of dollars.

Memory works on generational cycles too. Every couple of years, the industry moves to smaller nanometer processes, which allows for higher density, lower power consumption, and theoretically lower costs per gigabyte. But during transition periods, when older nodes are ramping down and newer ones are ramping up, the market gets weird. Pricing doesn't follow normal supply and demand curves. It follows whatever the market will bear.

There's also the matter of market sentiment. Memory traders and bulk buyers make purchasing decisions based on what they expect prices to do six months from now. If everyone believes prices are going up, they buy now, which actually causes prices to go up. It's a self-fulfilling prophecy that creates wild volatility.

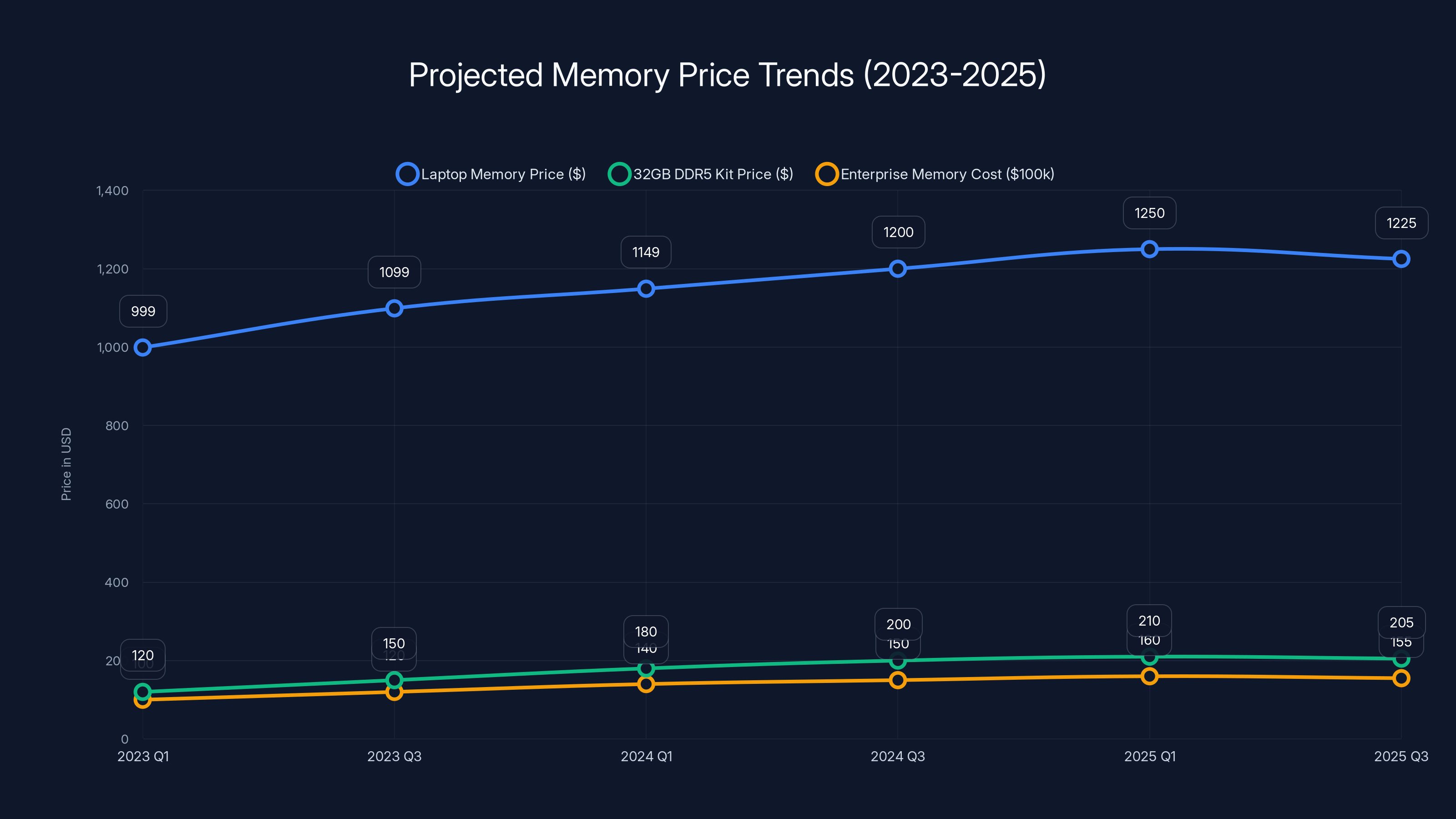

Memory prices are projected to rise through 2025, with potential stabilization in late 2025. Estimated data based on current trends.

The Current Supply Chain Crisis

We're not just dealing with normal market cycles here. Several overlapping crises have converged to create the perfect storm for RAM prices.

First, there's the ongoing global semiconductor shortage hangover. While the acute shortage that started in 2020 technically ended a couple of years ago, the industry never fully recovered to pre-shortage capacity. Manufacturers are still dealing with production inefficiencies, supply chain reorganization, and the long-term effects of disrupted logistics networks as detailed by Wired.

Second, and more critically, memory manufacturers are being extremely conservative about ramping up production. After the last market crash in 2022-2023, when memory prices collapsed and manufacturers got left holding billions of dollars in overstock inventory, companies like Samsung and SK Hynix learned their lesson. They're not going to aggressively expand capacity just because demand is strong right now. They've seen demand collapse before, and they're not eager to repeat that mistake as noted by Sourceability.

Third, there's a deliberate strategic decision happening. Manufacturers are prioritizing high-margin products and enterprise customers over the consumer market. Want HBM (high bandwidth memory) for AI accelerators? You can get it. Want regular DDR5 RAM for your gaming PC? Good luck. This prioritization is rational from a business perspective but devastating for consumers as CNBC reports.

The geopolitical angle matters too. Tensions with China have created uncertainty about where chips can be made, who can sell to whom, and what the rules will be next year. This uncertainty makes manufacturers cautious about long-term capacity decisions as highlighted by the Wall Street Journal.

AI Infrastructure is Eating All the Memory

Here's something that might not be immediately obvious: the AI boom is directly causing your RAM to get more expensive.

Not because AI systems use regular consumer RAM. They don't. AI data centers use specialized memory like HBM (high bandwidth memory) and massive quantities of VRAM on GPU accelerators. But there's a critical ripple effect.

Memory fabrication plants have limited capacity. Every wafer that goes to making HBM is a wafer that's not making regular DRAM. Every engineering team assigned to optimizing AI memory production is a team that's not working on consumer memory. Every marketing dollar spent promoting data center solutions is capital that's not going to consumer market expansion as CNBC explains.

When you're a memory manufacturer looking at

Enterprise customers are also pulling forward their purchases. Companies rolling out new AI infrastructure are ordering memory in bulk because they know lead times are long and prices might spike. This has basically emptied the available inventory of mid-range memory products that consumers actually use as noted by PC Gamer.

The data center expansion isn't slowing down either. If anything, it's accelerating. As AI models get bigger and more complex, data centers need even more memory capacity. This demand is only going to increase, pushing consumer prices higher as memory manufacturers continue prioritizing enterprise orders according to CNBC.

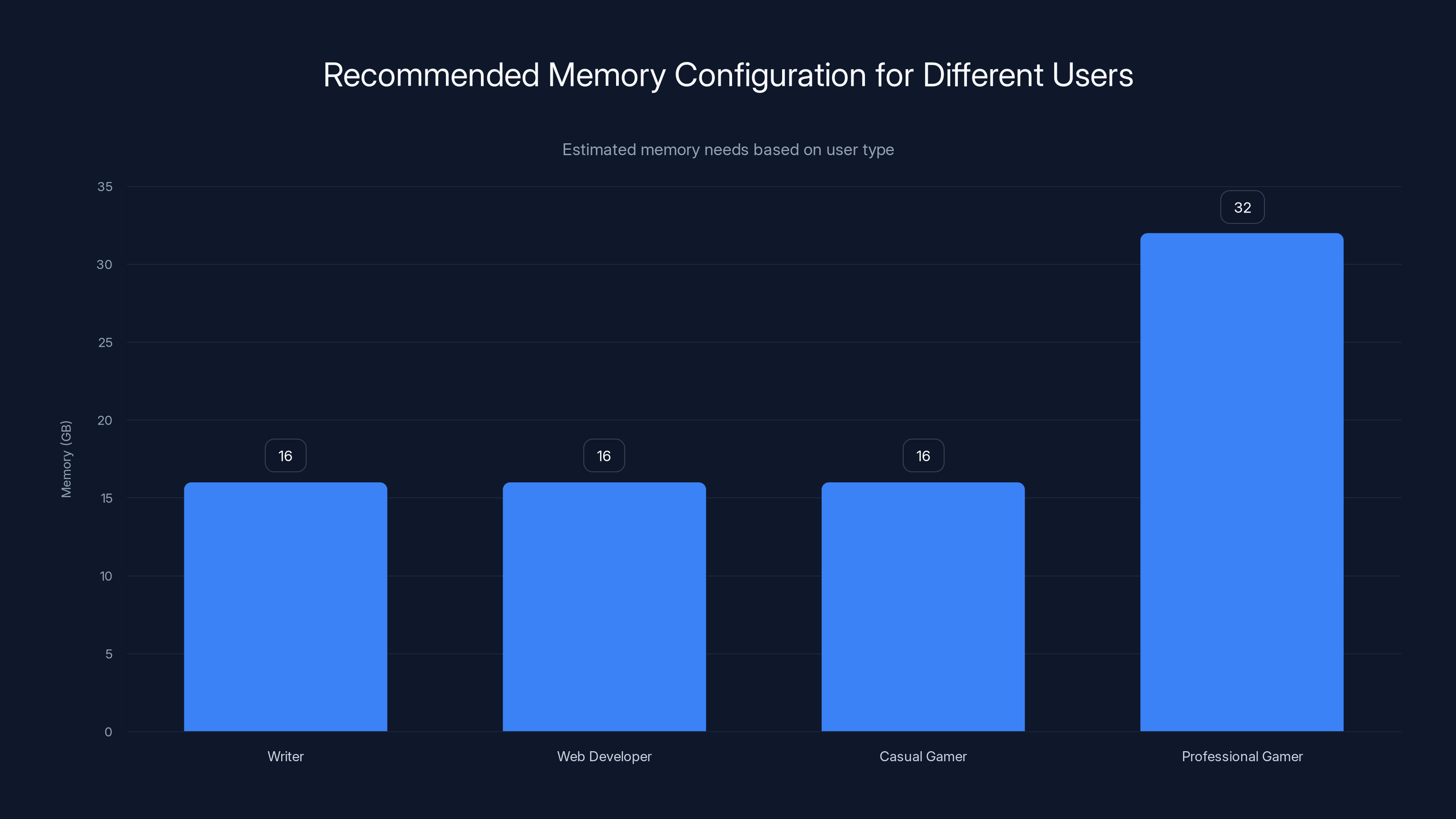

For most users, 16GB of memory is sufficient, while professional gamers might require 32GB. Estimated data based on typical usage.

Breaking Down the Analyst Predictions

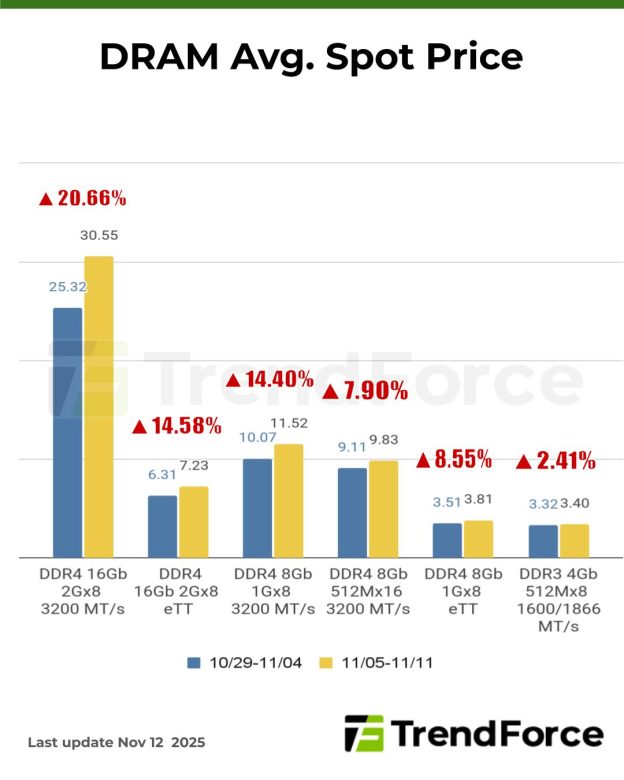

When industry analysts talk about "unprecedented and record-breaking" price surges, they're basing this on specific market data and trend analysis. Let's dig into what they're actually seeing.

Memory pricing is tracked through specific market indices. Bit prices (the cost per gigabyte) for DRAM have been rising steadily over the past few months. We're not talking about 5% increases. We're talking about 15% to 30% increases quarter-over-quarter for certain memory types and configurations according to Counterpoint Research.

The analysts who track this market closely are seeing inventory levels drop to levels that haven't been seen since the 2020-2021 shortage. Manufacturers' confirmed bookings are extremely strong, extending 12-18 months out. This means they're not expecting production to catch up to demand anytime soon as noted by TrendForce.

Here's what makes this different from previous cycles: the demand is driven by structural factors, not temporary booms. AI infrastructure investment isn't going away next quarter. Enterprise digital transformation isn't reversing course. These are multi-year trends that will keep memory prices elevated as CNBC highlights.

PC makers are also warning about the ripple effects. They're seeing memory costs squeeze their margins significantly. Some manufacturers are passing those costs directly to consumers with price increases. Others are absorbing some of the cost but planning to increase prices on next-generation models. Either way, consumers are feeling it at checkout as Sourceability reports.

The consensus among analysts is that we're in the early stages of a price increase cycle that could last through 2025 and potentially into 2026. It won't be like the shortage years where prices doubled. But we're probably looking at sustained increases of 20-40% depending on the memory type and configuration as detailed by PC Gamer.

Memory Types and Pricing Dynamics

Not all RAM is created equal, and pricing varies dramatically across different memory types. Understanding these differences helps explain why some categories are getting hit harder than others.

DDR5 Standard DRAM: This is the memory in most modern consumer PCs and laptops. It's also the most commodity-like product, which means competition is fierce and margins are thin. Paradoxically, this makes it both cheaper than specialized memory and more volatile in pricing. When manufacturers cut production, standard DRAM feels it hardest. We're seeing 15-20% increases here as CNBC notes.

DDR4 Legacy Memory: This is older generation memory that's still used in older systems and some budget devices. You might think this would be cheaper since it's older, but it's actually getting hit surprisingly hard. Why? Because manufacturers want to push everyone to DDR5, so they're reducing DDR4 production lines. If you need DDR4 for an older system upgrade, expect to pay premium prices as reported by the Wall Street Journal.

LPDDR Memory: This low-power memory is used in phones and tablets. Pricing here has been more stable because demand is more consistent and the supply chain is more established. But we're starting to see increases here too as smartphone manufacturers demand more memory for AI features as TrendForce reports.

Server Memory and ECC RAM: If you're building a server or a workstation, you need ECC memory (error-correcting code). This is specialized, has lower volumes, and commands premium pricing. We're seeing 25-35% increases here because both enterprise and professional users are buying heavily according to CNBC.

HBM and Specialized Memory: The most expensive category, used for AI and high-performance computing. Pricing here is actually declining slightly as manufacturers optimize production and increase capacity. But this is such a high-volume category that it's sucking up so much manufacturing capacity that it's hurting everything else as CNBC explains.

Analysts project sustained DRAM price increases of 15-35% through 2025, driven by structural demand factors. Estimated data reflects potential trends.

Global Manufacturing Capacity Constraints

Why can't manufacturers just build more factories and make more memory? The simple answer is: it's incredibly complicated and expensive.

Building a new semiconductor fabrication plant costs $10-20 billion and takes 3-5 years to complete. That's not a decision manufacturers make lightly, and certainly not based on current market conditions. They make these decisions based on long-term projections about where demand will be in 2028 or 2029 as CNBC reports.

Right now, manufacturers are skeptical about long-term memory demand growth. They remember the last crash. They're uncertain about AI's actual impact on the market. They're dealing with geopolitical uncertainty about where they can manufacture and sell. Given all that, they're not eager to commit tens of billions of dollars to new fabrication capacity as noted by the Wall Street Journal.

Instead, they're optimizing existing capacity. Pushing yields higher, improving efficiency, using advanced manufacturing techniques. But there are limits to how much you can optimize. Eventually, you hit physical constraints. Each plant can only produce so much silicon no matter how hard you push as PC Gamer highlights.

Geography adds another layer of complexity. Memory manufacturing is concentrated in Asia, primarily South Korea, Taiwan, and increasingly Japan. If there's any disruption to transportation routes or trade relationships, the entire global supply chain feels it. We've already seen this with recent port issues and logistic challenges as Wired reports.

The NAND flash market (used for SSDs and storage) has it slightly easier because there are more manufacturers competing. DRAM has it much harder because three companies basically control the market. When Samsung and SK Hynix make similar strategic decisions, the entire market moves in the same direction as CNBC notes.

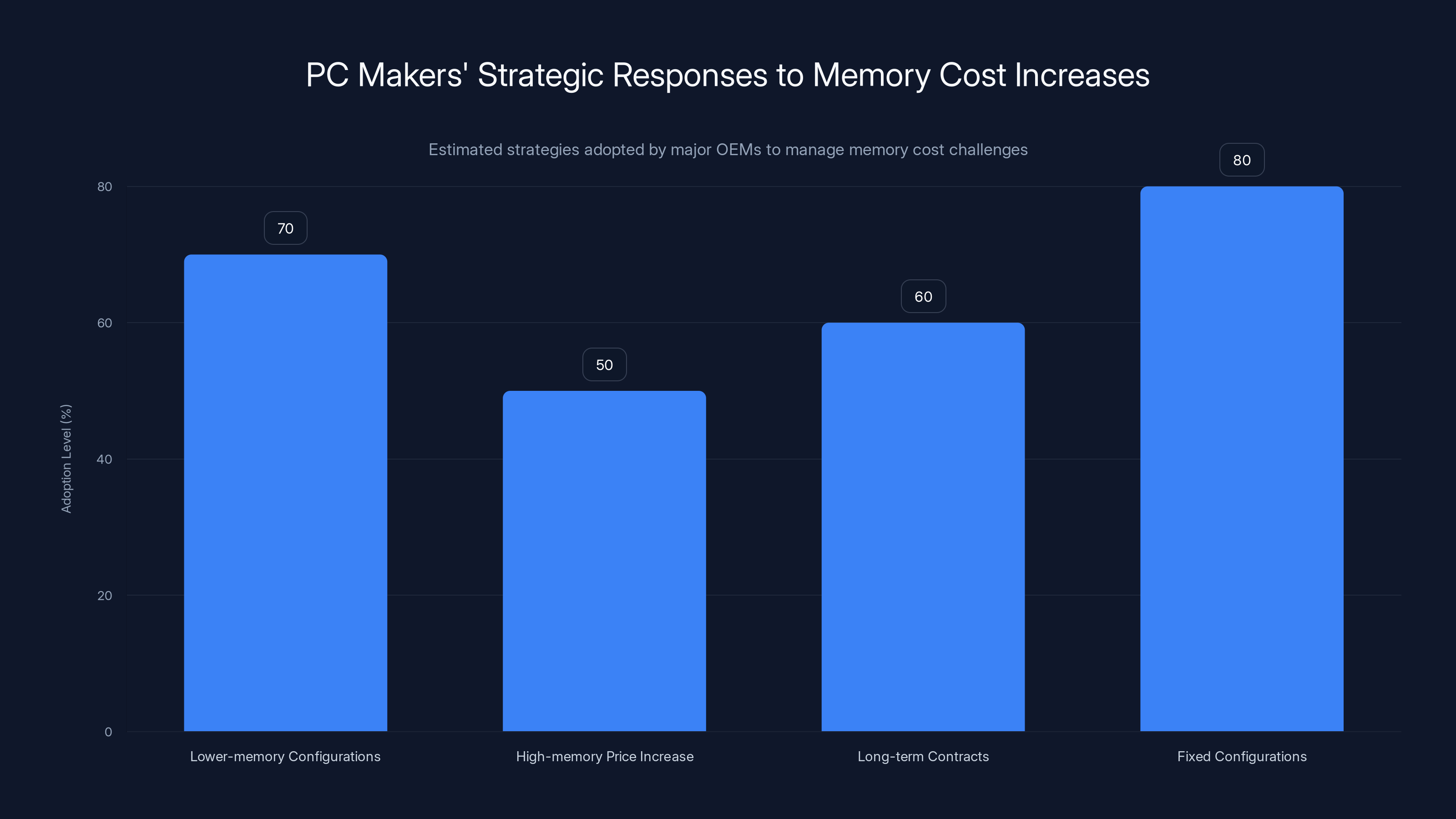

How PC Makers Are Responding

Computer manufacturers are caught in an awkward position. They need memory to build computers, but they can't pass all the cost increases to consumers without pricing themselves out of the market.

Dell, HP, Lenovo, and other major OEMs are making strategic decisions about their product mix. Some are emphasizing lower-memory configurations, hoping to sell systems that are "good enough" for most users and cheaper than high-memory alternatives. Others are aggressively raising prices on high-memory systems, betting that customers who need 32GB or 64GB of RAM will pay whatever it costs as CNBC reports.

Some manufacturers are hedging by locking in memory prices with suppliers through long-term contracts. This protects them from future spikes but also means they're paying premium prices now to lock in those guarantees. Those costs eventually work their way into consumer pricing as Sourceability explains.

The supply chain for PC makers is also getting reorganized. Companies that historically bought memory through spot market channels are now making long-term commitments to specific suppliers, similar to what enterprise customers do. This is changing the market structure in ways we haven't fully seen yet as noted by the Wall Street Journal.

Warranty and support costs are also increasing. More memory problems mean more RMAs and support tickets. Some manufacturers are probably experiencing higher failure rates due to the sourcing challenges of working with alternative suppliers during supply crunches as PC Gamer reports.

Manufacturers are also bundling differently. Instead of offering "configure your own" systems, many are moving to fixed configurations that make sense from a supply chain perspective. You might find it harder to get exactly the memory configuration you want and easier to buy what manufacturers want to sell you as CNBC highlights.

Estimated data suggests that fixed configurations and lower-memory options are the most adopted strategies by PC makers to manage rising memory costs.

Consumer Impact and Price Predictions

Let's talk about what this actually means for your wallet.

If you're shopping for a new laptop, expect to pay

For gamers and enthusiasts buying individual memory modules, prices are even more shocking. A 32GB DDR5 kit that cost

Enterprise pricing is even more dramatic. A company deploying 1,000 servers and suddenly needing to upgrade memory could see their memory costs jump from

What about future predictions? Most analysts are forecasting that prices will continue rising through the first and second quarter of 2025, with potential stabilization or slight decreases beginning in Q3 or Q4, assuming no major supply disruptions occur as TrendForce predicts.

This is not a prediction of prices returning to 2024 levels. Even when the current surge moderates, prices will likely remain elevated compared to historical norms. The memory industry has structurally higher demand now, and manufacturers will adjust their production strategy accordingly as CNBC highlights.

However, certain scenarios could make things worse. If enterprise demand for AI infrastructure intensifies faster than expected, we could see even steeper increases. If there's any manufacturing accident, natural disaster, or geopolitical event affecting major manufacturers, prices could spike even harder and stay elevated longer as noted by the Wall Street Journal.

Conversely, if AI investment slows down faster than expected, or if new manufacturers successfully challenge the incumbent duopoly, prices could come down faster. But neither of those scenarios looks particularly likely in the next 12-18 months as PC Gamer explains.

Strategic Approaches to Managing Rising Memory Costs

Given that prices are likely to remain elevated for the foreseeable future, what should you actually do?

For consumers buying personal computers: First, assess whether you actually need to upgrade right now. If your current system is functional, waiting six months might result in modestly better pricing. But if you need a new system for work or gaming, waiting probably isn't the answer because prices aren't expected to drop significantly. Better to buy now and amortize the cost over several years of use as CNBC advises.

When you do buy, be strategic about memory configuration. Buy what you'll actually use for the next 3-4 years, not what you think you might use. If you're a writer, web developer, or casual gamer, 16GB is probably sufficient. Don't overpay for 32GB just because you're worried about "future-proofing." You'll save more money by upgrading in a few years when prices are hopefully better as Sourceability suggests.

For businesses and IT departments: Start assessing your replacement cycles. If you have a wave of aging systems hitting end-of-life, you might want to accelerate some of those replacements to beat the worst of the price increases. Conversely, you might want to extend the life of existing systems if possible, accepting some risk to avoid buying at peak prices as TrendForce recommends.

Lock in pricing through long-term contracts with your preferred suppliers. This protects you from further increases but commits you to buying at current prices. Run the numbers on both approaches and make a data-driven decision based on your actual risk tolerance as the Wall Street Journal suggests.

Consider whether your systems can be more efficiently deployed to reduce total memory needs. For instance, can you move more workloads to cloud services rather than on-premise servers? Cloud providers are better positioned to absorb memory costs and optimize utilization. Sometimes the cloud is actually cheaper when you factor in memory costs as CNBC notes.

For IT professionals and builders: Learn the market deeply. Understand which memory types are experiencing the most inflation and which configurations offer the best value. Become skilled at spec'ing systems that deliver needed performance at the lowest cost. This expertise becomes increasingly valuable as memory pricing becomes a larger factor in overall system cost as Sourceability advises.

Build relationships with multiple suppliers. Don't rely on just one distributor. Having options gives you negotiating power and flexibility when one supplier runs short as the Wall Street Journal suggests.

For everyone: Stop assuming that memory will always get cheaper. That was true for decades, but we're entering a period where memory pricing is going to be volatile and unpredictable. Adjust your budgeting and planning assumptions accordingly as PC Gamer warns.

Invest in tools and processes that help you use existing memory more efficiently. Better memory management software, more efficient applications, and smarter resource allocation can deliver productivity gains equivalent to adding more RAM but at a fraction of the cost as CNBC advises.

The Role of Technology Evolution

Some of the pressure on memory pricing might actually ease as new technologies mature and adoption spreads.

DDR6 development: The next generation of DRAM, DDR6, is in advanced development. When it's ready for market, probably in 2026-2027, manufacturers will need to invest heavily in new production lines. This could actually help alleviate current DDR5 supply constraints because some manufacturers will shift capacity to DDR6. However, it will also cannibalize DDR5 demand as systems slowly migrate to the new standard as CNBC reports.

High Bandwidth Memory advances: As HBM production matures and manufacturers move to the next generation, yields improve and costs come down. This could free up capacity for other memory types. But that's a medium-to-long-term effect, not something that helps in the next 6-12 months as CNBC notes.

Alternative memory technologies: There's ongoing research into different memory architectures like 3D XPoint, emerging memories, and other exotic technologies. None of these are likely to disrupt the DRAM market in the near term, but they might provide options for specialized applications, reducing pressure on commodity DRAM as the Wall Street Journal highlights.

Manufacturing automation: Advances in chip manufacturing automation might allow manufacturers to do more with existing capacity. But this is a very gradual process. You don't suddenly double output by deploying new robots as PC Gamer explains.

The most likely scenario is that these technological trends help moderate price increases in the 2026-2028 timeframe, but they don't provide relief in the next 12-18 months. We're stuck with the current market dynamics for at least another year as CNBC notes.

Industry Expert Perspectives

What are the people who actually work in the memory industry saying about all this?

Management at major memory manufacturers are being carefully optimistic in their public statements, which is code for "we expect to do very well financially." They're investing in capacity for specialized memory types like HBM, which signals confidence in continued strong demand for AI applications as CNBC reports.

PC manufacturers are significantly less optimistic. They're publicly warning about margin pressure, supply constraints, and pricing challenges. Some have explicitly called out memory costs as a key challenge for 2025 as noted by the Wall Street Journal.

IT consultants and industry analysts are generally recommending that companies start their upgrade and procurement planning now rather than waiting. The consensus seems to be that prices have probably peaked or are very close to peaking, but even if prices fall slightly, they'll remain elevated by historical standards as Sourceability advises.

Memory retailers are reporting strong demand and very tight inventory for certain products. Some popular configurations are backordered, and lead times are extending. This reinforces the sense that we're in a tight market as TrendForce reports.

The general tone from industry insiders is that this is a significant market disruption but not unexpected given the fundamental supply and demand dynamics. It's painful, but it's not a catastrophe. The memory industry has dealt with supply constraints before and will deal with them again as CNBC explains.

Preparing for the Long Game

Here's the uncomfortable truth: memory prices might never go back to the levels they were at in 2020-2021. We're in a structural shift in how memory is valued and allocated.

AI applications are now competing directly with consumer applications for limited manufacturing capacity. That competition isn't going away. In fact, as AI applications become more sophisticated and prevalent, that competition will probably intensify as CNBC notes.

Geopolitical factors are also here to stay. The semiconductor industry will remain politically sensitive, subject to export controls, trade restrictions, and strategic national concerns. That adds a permanent risk premium to memory pricing as the Wall Street Journal explains.

The supply chain has become permanently more complex and fragile. Companies are more cautious about capacity expansion. Manufacturers are more focused on maximizing margins rather than chasing volume. All of these dynamics support higher, more stable pricing rather than a return to the cheap memory era as PC Gamer highlights.

This doesn't mean memory will cost 10x more. But it probably means that memory will consistently cost 20-50% more than it did in the 2015-2020 era. That's a structural change, not a temporary disruption as TrendForce predicts.

Planning accordingly means building memory cost into your budgeting assumptions, optimizing your systems to use memory efficiently, and not betting on future price decreases to bail out today's decisions as Sourceability advises.

If you're an architect designing a system today, design for the assumption that memory will cost meaningfully more than it does now. If you're a purchasing manager, assume that memory will remain one of your top cost line items for the next several years. If you're a technologist, look for opportunities to reduce memory consumption or find alternatives to traditional RAM-heavy architectures as CNBC suggests.

The memory market is changing, and the winners will be those who adapt their strategies and expectations accordingly.

FAQ

Why are RAM prices increasing so dramatically right now?

Memory prices are rising due to a combination of factors: limited manufacturing capacity from just three major global producers, strong enterprise demand for AI infrastructure that's consuming available memory supply, conservative investment decisions by manufacturers following the 2022-2023 crash, and structural market shifts prioritizing high-margin products over consumer-grade memory. These factors have converged to create supply constraints that are pushing prices significantly higher as PC Gamer reports.

How long will elevated memory prices last?

Analysts predict that rapid price increases will continue through the first half of 2025, with potential stabilization beginning in Q3 or Q4 of 2025. However, prices are unlikely to return to 2020-2021 levels even after prices stabilize. Structural market changes, ongoing AI demand, and geopolitical factors suggest that memory will remain more expensive than the historical norm for the foreseeable future, probably permanently elevated by 20-50% compared to pre-2023 pricing as TrendForce predicts.

Should I buy memory now or wait for prices to drop?

If you need memory for a system upgrade right now, buying now is generally better than waiting because prices aren't expected to drop significantly in the next 6-12 months. However, be strategic about how much memory you buy. Purchase what you'll actually need for 3-4 years of use rather than over-specifying for hypothetical future needs. If you can delay your upgrade by several months without negatively impacting productivity, waiting until Q3 2025 might yield slightly better pricing, but the difference probably won't be dramatic as Sourceability advises.

Which memory types are most affected by price increases?

Standard DDR5 DRAM and server-grade ECC memory are experiencing the largest price increases, with increases of 20-35% depending on configuration. DDR4 legacy memory is also seeing surprising increases because manufacturers are deliberately reducing production to push customers toward DDR5. Specialized memory types like HBM for AI applications are actually seeing more stable pricing because manufacturers are aggressively expanding capacity for these high-margin products as CNBC notes.

How can I reduce the impact of high memory costs?

You can manage memory costs by being strategic about system specifications, using optimization tools to improve memory efficiency, considering cloud-based solutions that spread memory costs across many users, building relationships with multiple suppliers to increase negotiating power, and locking in prices through long-term contracts if you're making large purchases. Additionally, investing in better memory management practices and more efficient software can deliver performance gains equivalent to adding more memory at a lower total cost as the Wall Street Journal suggests.

Will AI infrastructure demand eventually ease and bring memory prices down?

While AI infrastructure demand could theoretically decrease if investment slows, the more likely scenario is that AI demand will remain strong for years to come, ensuring continued competition for memory manufacturing capacity. Even if AI investment moderated, the industry has already restructured around this demand. Additionally, new generations of AI models require even more memory than current models, so demand pressure is more likely to increase than decrease over the next several years as CNBC notes.

Are there alternatives to traditional DRAM that might be cheaper?

While experimental memory technologies like 3D XPoint and emerging memory types are in development, none offer near-term alternatives to traditional DRAM for consumer or enterprise applications. The most practical alternatives are architectural changes, such as using cloud services with managed memory, optimizing software to use less memory, or redesigning systems to work with lower memory configurations. These approaches can be effective but require planning and expertise to implement successfully as the Wall Street Journal explains.

Is this price situation unique, or has it happened before?

The memory market has experienced supply disruptions and price spikes before, most notably during the 2020-2021 shortage and the 2018-2019 DRAM price decline. However, the current situation is different because it's driven by structural market changes rather than temporary disruptions. The prioritization of enterprise and AI demand, conservative manufacturing investment, and geopolitical complexities create a more persistent supply constraint scenario. This suggests that today's situation represents a more fundamental market shift than previous cycles as PC Gamer explains.

Conclusion

Memory prices are rising in ways that matter for consumers, businesses, and the entire computing ecosystem. This isn't a minor price adjustment or a temporary blip. Industry analysts are warning about unprecedented, record-breaking increases because the fundamentals supporting those increases are real and persistent as Counterpoint Research highlights.

The root causes are understandable: three manufacturers controlling a global market, structural shift in demand toward AI and enterprise applications, cautious investment decisions following past crashes, and geopolitical uncertainties creating supply chain risk. No single factor is driving prices up. Instead, multiple factors are compounding each other to create a genuinely constrained market as the Wall Street Journal explains.

The timing is particularly unfortunate because we're at a point where most users are upgrading to newer systems anyway. Windows 11 adoption is accelerating, newer applications are demanding more resources, and hardware refresh cycles are natural. But those upgrades are now more expensive because memory is more expensive as CNBC notes.

Your best move is to accept that memory will cost more than it used to and plan accordingly. Don't assume prices will drop significantly. Don't over-specify memory hoping to future-proof your system. Don't ignore memory costs when making purchasing decisions. Instead, be deliberate about your memory needs, realistic about pricing, and strategic about timing as Sourceability advises.

For those managing IT infrastructure, the moment to reassess your upgrade and procurement strategies is now. For those building new systems, this is the time to seriously consider architecture decisions that can work more efficiently with limited memory. For everyone, this is a good reminder that the comfortable era of perpetually cheaper memory that characterized the last few decades is probably over as PC Gamer highlights.

The memory market is changing. Understanding why and planning accordingly will help you navigate these rising costs more effectively than hoping for a return to the pricing of years past.

If you want to streamline your system management, planning, or documentation processes while memory costs are climbing, tools that help you work more efficiently become even more valuable. Platforms like Runable help teams automate workflow documentation and system planning at just $9/month, freeing up resources to focus on optimizing your actual infrastructure rather than managing administrative overhead. Smart tools that reduce friction on non-hardware concerns become more important when hardware gets more expensive.

The memory market will evolve, supply dynamics will eventually improve, and prices will eventually stabilize. But that evolution is measured in years, not months. Until then, understanding the market, making strategic decisions, and planning ahead are your best tools for managing the reality of rising memory costs.

Key Takeaways

- RAM prices are surging with unprecedented, record-breaking increases of 15-35% as three manufacturers control 95% of global DRAM production as Counterpoint Research reports.

- Supply chain constraints stem from conservative investment decisions following the 2022-2023 crash, plus enterprise demand consuming available capacity for AI infrastructure as CNBC explains.

- Prices likely to remain elevated through mid-2025 with stabilization possible by Q4, but unlikely to return to pre-2023 levels even after increases moderate as TrendForce predicts.

- Strategic purchasing focuses on buying what you'll actually use rather than over-specifying, timing upgrades when possible, and optimizing memory efficiency as Sourceability advises.

- Structural market changes suggest memory will remain permanently 20-50% more expensive than the 2015-2020 era due to ongoing AI demand and manufacturing complexity as noted by the Wall Street Journal.

Related Articles

- Raspberry Pi Price Increases 2025: Impact of Global Memory Shortage

- Samsung RAM Prices Doubled: What's Causing the Memory Crisis [2025]

- Data Centers to Dominate 70% of Premium Memory Chip Supply in 2026 [2025]

- Nvidia RTX 50 Super Delayed: RTX 60 Series May Miss 2027 [2025]

- Raspberry Pi Price Surge: How AI Memory Wars Broke Affordable Computing [2025]

- Raspberry Pi Price Hikes: The RAM Crisis Explained [2025]

![RAM Price Surge 2025: What's Driving Costs Up and How to Cope [2025]](https://tryrunable.com/blog/ram-price-surge-2025-what-s-driving-costs-up-and-how-to-cope/image-1-1770392520187.jpg)