Introduction: The RAM Price Crisis Nobody Saw Coming

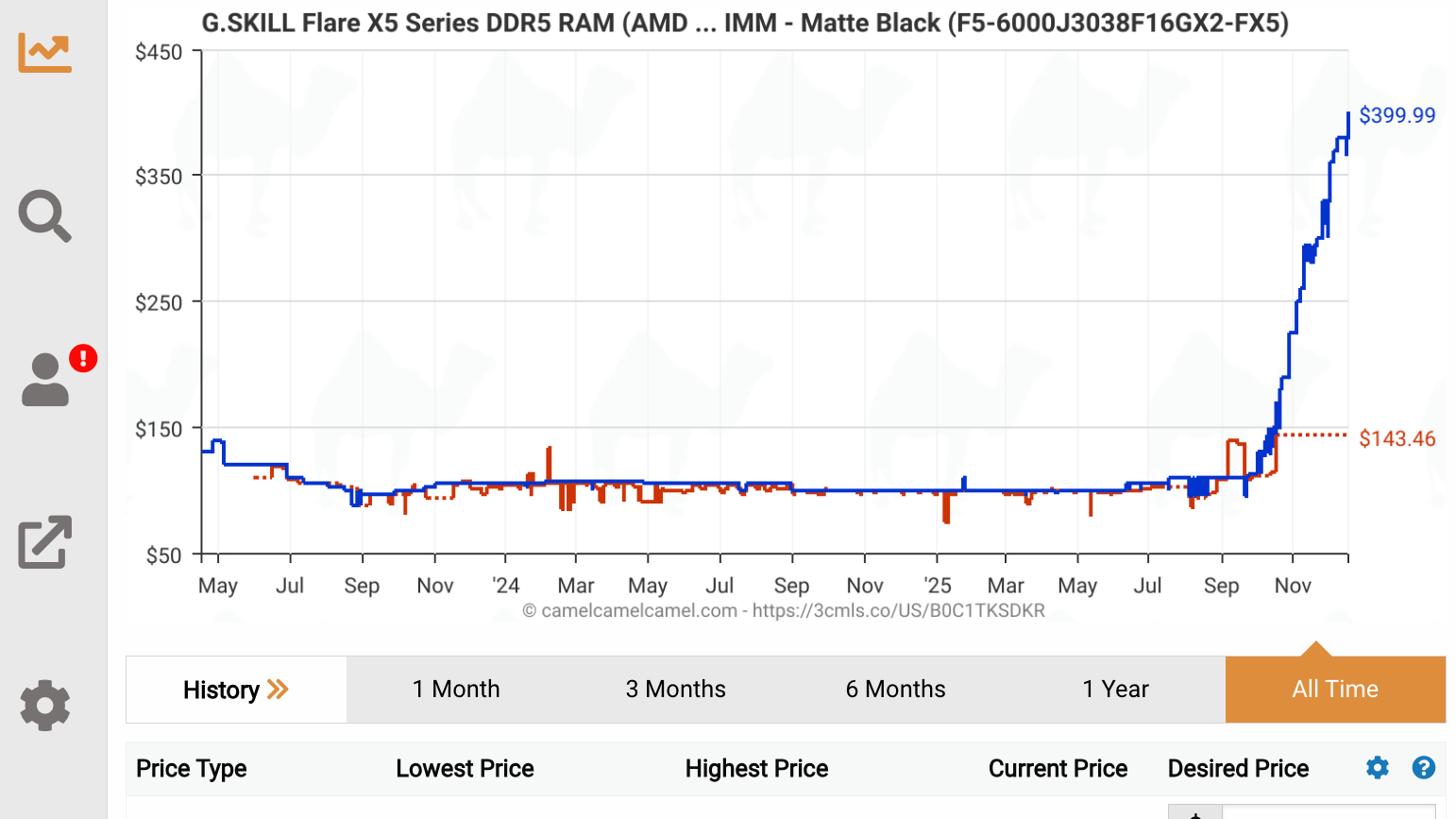

Something weird happened to computer memory in 2025. If you've been shopping for RAM lately, you've probably noticed prices have gone absolutely bonkers. What cost

But here's what most people don't understand: this isn't some random market fluctuation. There's a specific chain of events that caused this, and spoiler alert, it's going to get worse before it gets better.

I started researching this after noticing a client's PC build budget exploded. A system that should've cost

The worst part? Industry experts are predicting another 30-40% price increase over the next six months. If you need RAM, you basically need to decide right now: buy now at elevated prices, or wait and pay even more later.

Let me walk you through exactly what's happening, why Samsung got hit hardest, and what you can actually do about it.

TL; DR

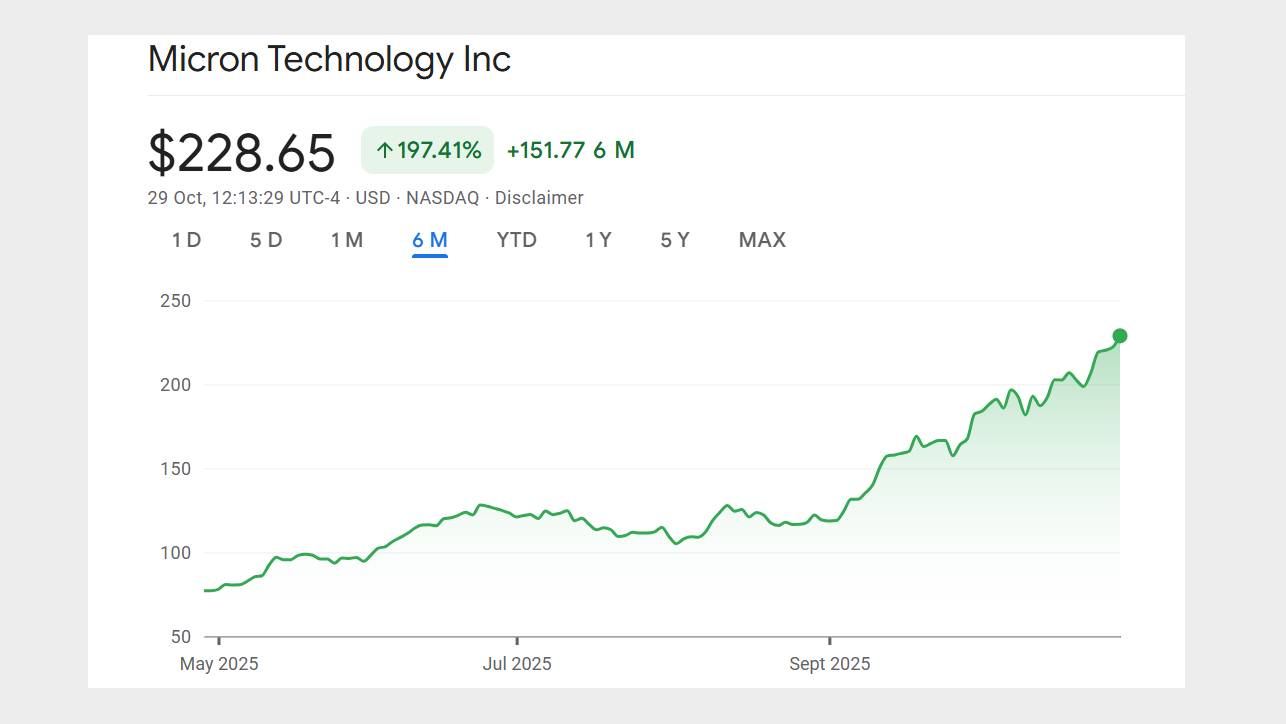

- Samsung RAM prices have doubled in 2025, with DDR5 modules seeing the steepest increases

- Multiple factors collided simultaneously: chip manufacturing capacity constraints, AI server demand surge, cryptocurrency mining recovery, and geopolitical supply chain disruptions

- No immediate relief is coming, with analysts projecting another 30-50% price increase through Q3 2025

- Memory manufacturers can't scale production fast enough to meet demand, and new fabrication capacity won't come online until 2026 at earliest

- Consumers and businesses should budget accordingly, with enterprise IT departments facing the toughest decisions on upgrade timelines

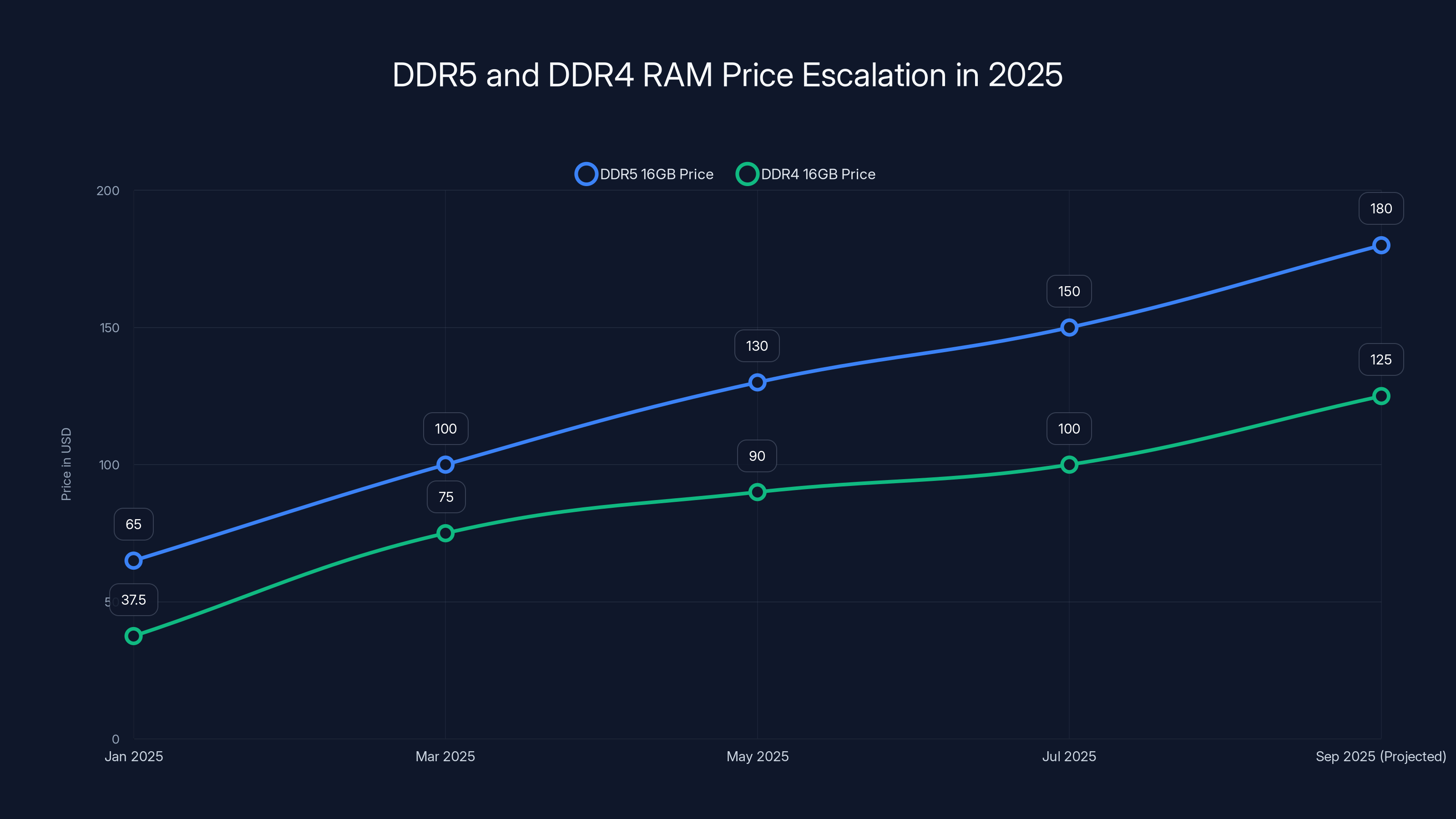

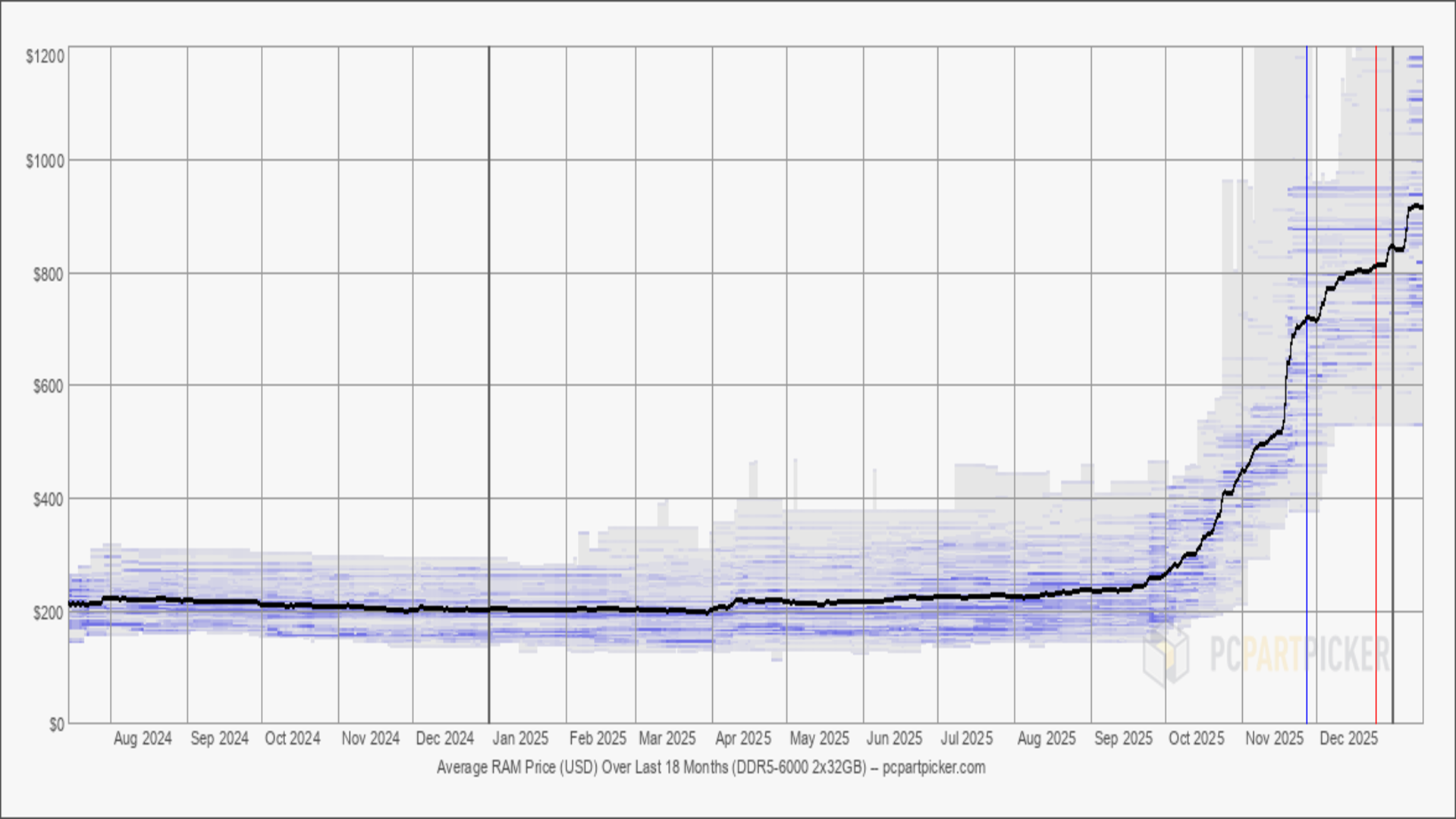

DDR5 prices increased by 130% by mid-2025, with further escalation projected. DDR4 prices rose faster percentage-wise due to data center demand. Estimated data for projections.

How We Got Here: The Perfect Storm of Memory Market Conditions

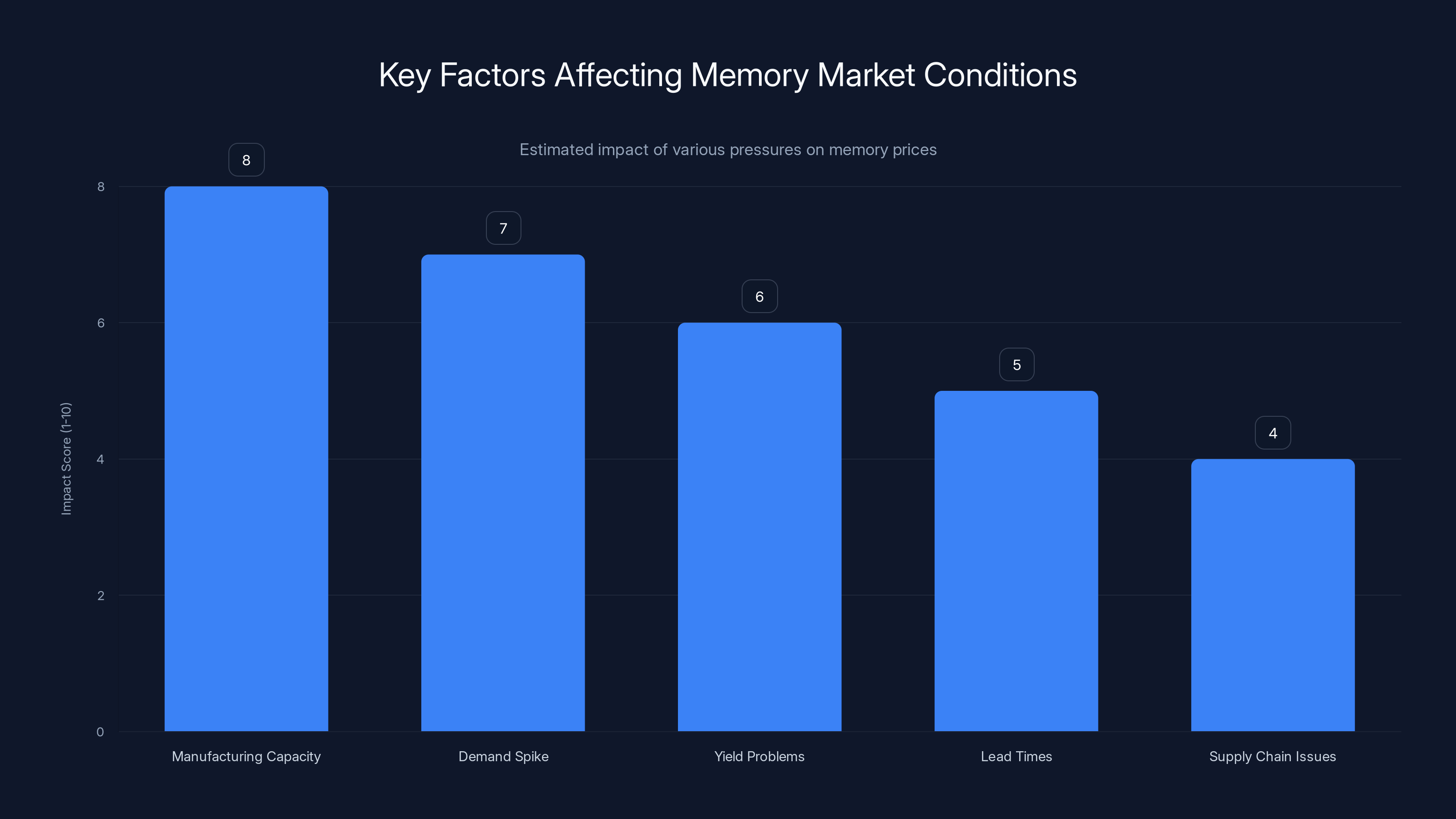

Memory prices don't just double randomly. There's always a reason, and usually it's a combination of factors that create what economists call a "supply-demand inelasticity shock." In this case, we've got about five major pressures squeezing the market simultaneously.

First, let's talk manufacturing capacity. Memory chip fabrication is one of the most capital-intensive processes in electronics manufacturing. Samsung, HYNIX, Micron, and SK Hynix operate massive fabs that cost billions to build and years to bring fully online. These aren't like software servers you can spin up in the cloud. You're talking about specialized equipment, clean rooms maintained to semiconductor-grade purity, and supply chains that are themselves global manufacturing marvels.

Samsung specifically operates fabs in South Korea, and those facilities were already running near maximum capacity heading into 2025. When demand suddenly spiked, they couldn't just ramp production overnight. Memory production has long lead times. If a fab starts a new production run today, the finished chips won't ship for eight to twelve weeks. That lag between demand signal and supply response creates the perfect environment for price spikes.

But here's where it gets interesting: Samsung isn't just constrained by available capacity. They're also dealing with yield problems. Not every chip coming off the production line is perfect. Manufacturing defects, process variations, and quality control issues mean that maybe 70-80% of what gets produced actually meets specifications. When yields drop even a few percentage points, available supply tightens dramatically without any change in production volume.

Adding to the pressure, geopolitical tensions have disrupted supply chains in ways we haven't seen in decades. Export restrictions on advanced semiconductor manufacturing equipment, particularly from the United States and Netherlands to China, have created uncertainty in the broader chip ecosystem. When there's uncertainty about future supply, buyers panic-buy. Companies stockpile inventory "just in case" supplies get cut off. This artificial demand acceleration makes a tight market even tighter.

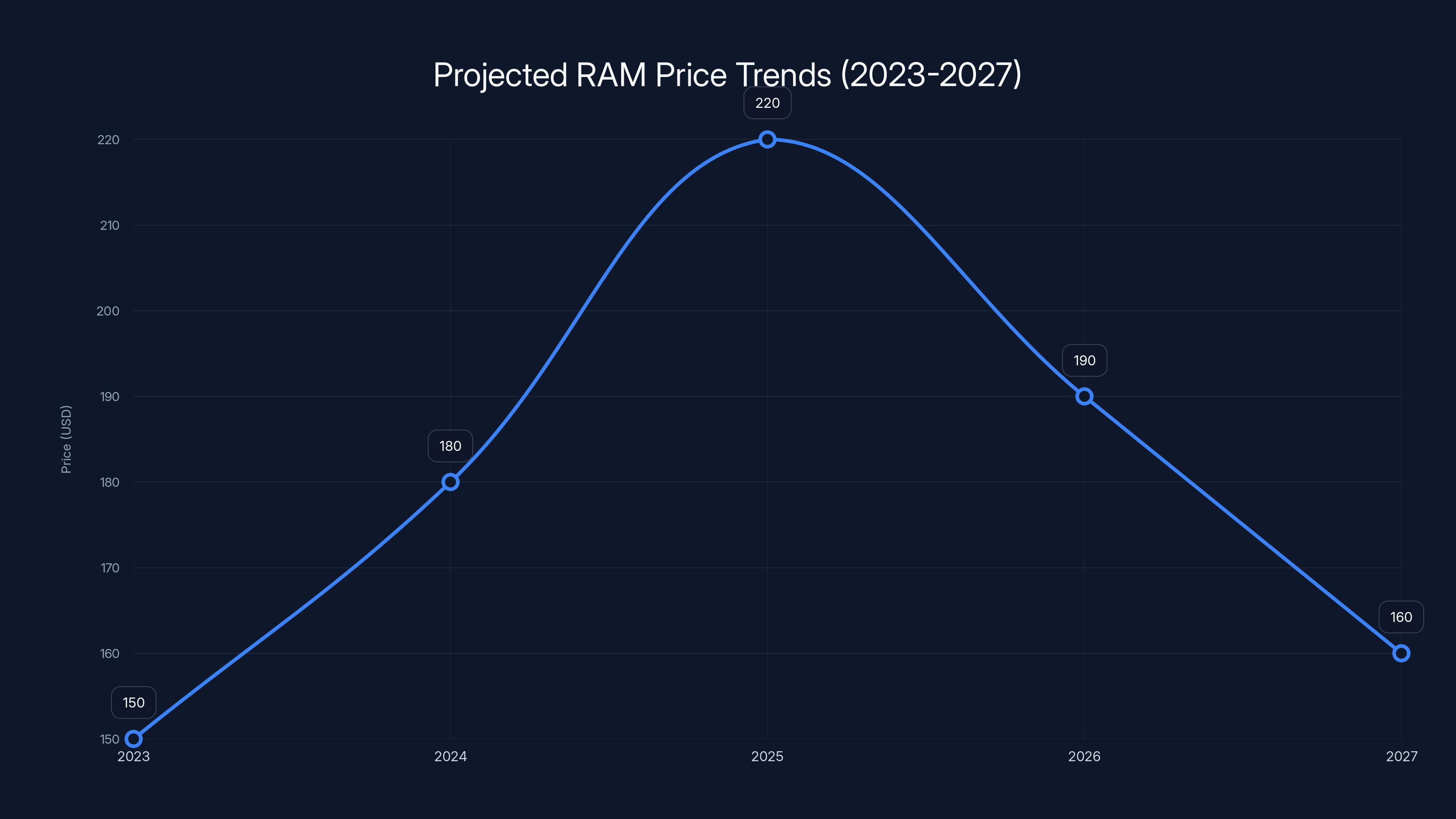

RAM prices are projected to peak in 2025 due to high demand and limited supply, with gradual declines expected as new manufacturing capacity comes online by 2027. (Estimated data)

The AI Explosion: How Data Centers Became the Biggest Memory Hog

Here's a fact that explains a huge chunk of the RAM shortage: artificial intelligence requires absurd amounts of memory. Not storage, but actual RAM.

When companies deploy large language models, they need to load entire model weights into memory for fast inference. Chat GPT, Claude, Gemini, and the thousands of custom models enterprises are building all require staggering amounts of high-speed memory. A single GPU server running a large language model might have 256GB or 512GB of VRAM, plus additional system RAM for handling requests, caching, and processing.

Data center operators are building AI clusters as fast as they can. Cloud providers like AWS, Azure, Google Cloud, and specialized AI infrastructure companies are purchasing memory by the ton. We're talking about millions of gigabytes of additional memory capacity needed in data centers globally, and this demand essentially came out of nowhere between 2024 and 2025.

Here's the mathematics: if a single AI server farm needs 10,000 GPU servers, and each server needs 512GB of high-speed memory, that's 5 petabytes of memory just for one facility. And there are hundreds of these facilities being built worldwide. The aggregate demand from data centers has essentially consumed whatever "slack" existed in memory supply.

Nvidia's H100 and H200 GPUs, which are the backbone of modern AI infrastructure, have their own memory requirements too. Enterprise buyers are locking up allocation because they know AI deployment is the strategic priority for 2025. Hardware budgets that used to be split across processing power, storage, and memory are now being weighted heavily toward memory to support model inference.

The fascinating part is that this demand is somewhat price-inelastic. Companies building AI infrastructure won't delay or reduce deployment because RAM costs 50% more. They need the capacity to hit their AI roadmap targets. So manufacturers can raise prices significantly without seeing demand drop proportionally. This is textbook supply constraint with inelastic demand, which leads to sharp price movements.

Cryptocurrency Mining's Unexpected Comeback

Just when you thought crypto mining was dead, it's back. And it's buying memory like there's no tomorrow.

After the crypto crash in 2022-2023, mining activity dropped significantly. But with Bitcoin prices recovering and new proof-of-work coins gaining attention, mining operations have restarted at scale. Proof-of-stake systems like Ethereum shifted away from mining, but new coins and emerging blockchain projects still require intensive computational resources.

What's interesting is that memory-intensive mining algorithms have become more popular. Algorithms like Random X and others that resist ASIC optimization require significant RAM, which means mining farms need to buy consumer and professional-grade memory to stay competitive. Some mining operations are purchasing memory at retail prices and building custom mining rigs just because the margin is there.

This might seem like a small factor compared to data center demand, but it's actually more significant than you'd think. Mining operations are flexible buyers. They'll jump into any market where they can find margin. So during this shortage, they're probably absorbing 5-15% of available memory supply, just enough to tip a tight market into crisis territory.

The problem is that this demand is temporary and speculative. If crypto prices crash again, mining demand evaporates. But in the meantime, it's soaking up real supply that could go to enterprise and consumer use cases.

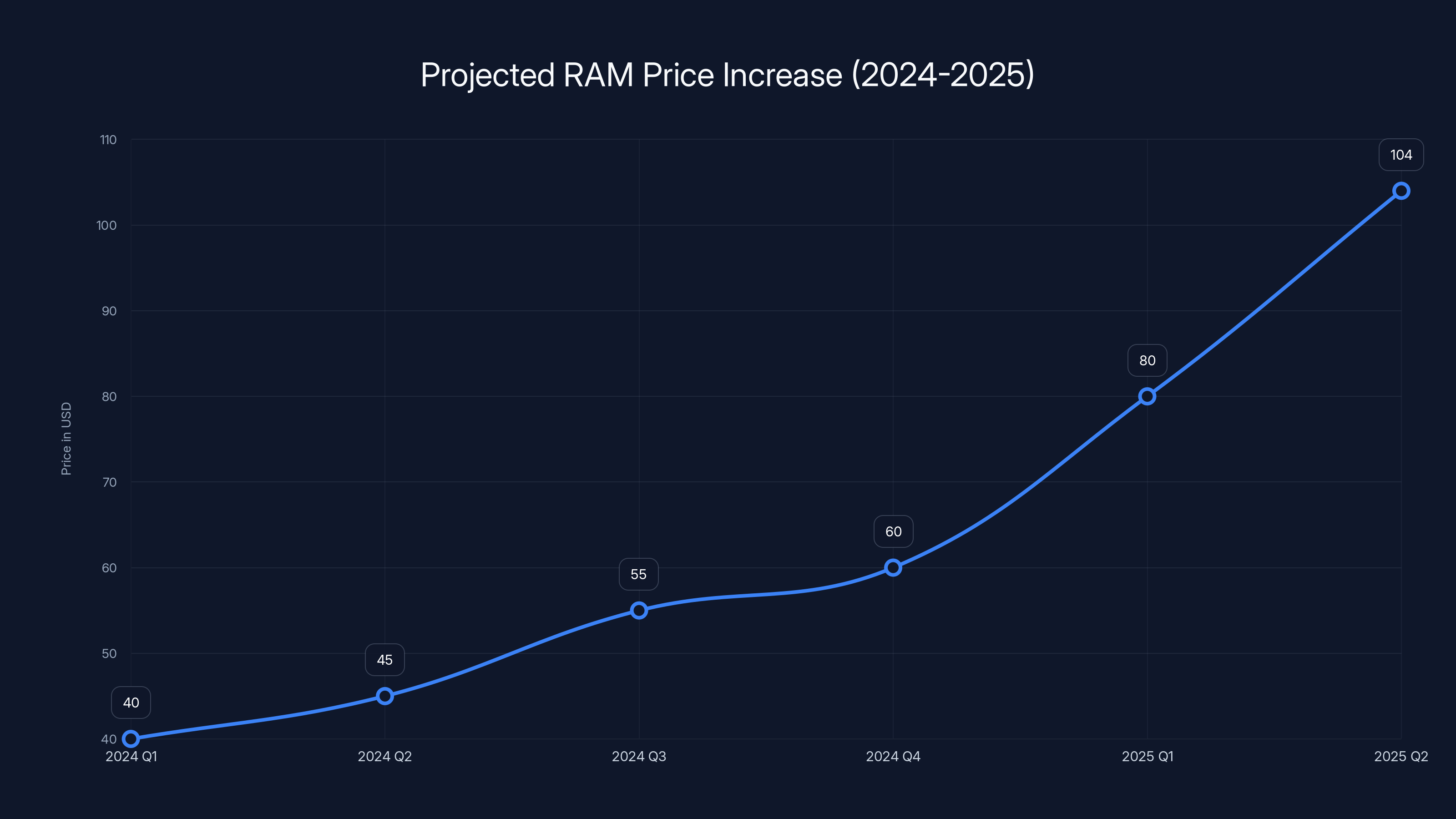

RAM prices are projected to increase significantly, with a potential 30-40% rise in the first half of 2025. Estimated data based on current trends.

Samsung's Manufacturing Reality: Why They Can't Just Make More

People often ask: "Why doesn't Samsung just build more memory?" The answer reveals how constrained semiconductor manufacturing really is.

Samsung operates some of the world's most advanced semiconductor fabrication plants. But here's the thing: those fabs are incredibly expensive to operate and they're often already running at or near maximum capacity. Every percentage point of additional throughput requires optimization, process tweaks, and careful engineering. You can't just "turn up the dial" on chip production.

Memory manufacturing specifically is a high-mix, low-volume operation compared to what it could be. Samsung produces DDR4, DDR5, LPDDR5, HBM (high-bandwidth memory), and specialized memory for various applications. Switching between production runs for different memory types requires clean-room re-qualification, equipment calibration, and process validation. These changeovers take time and cost money.

Additionally, Samsung is simultaneous competing in multiple memory markets. They can't just load all fabs with consumer DDR5 because enterprise customers, data center clients, and automotive memory have different specifications and different margins. Portfolio management means allocating limited capacity across these segments.

Yield rates are also a constraint most people don't consider. Memory manufacturing yields have been declining as companies push toward smaller process nodes and higher densities. When you're manufacturing at 8-nanometer or smaller scales, defect rates increase. Cosmic rays, process variations, and materials inconsistencies all impact yield. Samsung probably can't improve yields by more than 2-3% without major process investments that take years.

There's also the upstream supply chain. Samsung needs advanced equipment from manufacturers like ASML, Applied Materials, and Lam Research. These equipment suppliers have their own capacity constraints. You can't get tools overnight. There are waiting lists measured in months or years for some critical equipment.

Geopolitically, things are tense too. US export controls on advanced semiconductor equipment have created uncertainty about what production tools Samsung can even purchase. This makes them cautious about committing to massive expansion because they might not be able to get the equipment they need in future.

Price Escalation Timeline: What Happened Month by Month

Let's walk through exactly how RAM prices evolved through 2025 and what's projected forward.

Starting in January 2025, DDR5 16GB modules were trading around

DDR4 has followed a similar trajectory, though starting from a lower baseline. 16GB DDR4 modules went from roughly

For enterprise and data center memory, prices have moved even more dramatically. 32GB and 64GB modules targeting servers have seen 100-150% increases. This is partly because data center demand is concentrated and buyers can't easily substitute. If you're building a thousand-server deployment, you can't just use consumer memory. You need ECC, redundancy features, and compatibility validation. So enterprise buyers accept higher prices because they have no choice.

Analysts at major research firms project continued escalation through Q3 2025. Conservative estimates show another 15-25% increase likely. More aggressive projections from some supply chain analysts suggest potential 40-50% increases if geopolitical tensions escalate or demand remains strong.

What's important to understand is the ceiling. Prices can't increase infinitely. At some point, consumers and businesses will stop buying or will switch to alternatives. That price ceiling is probably somewhere around $200-220 for a 16GB DDR5 module. Beyond that, many consumers would delay purchases or build less memory-intensive systems.

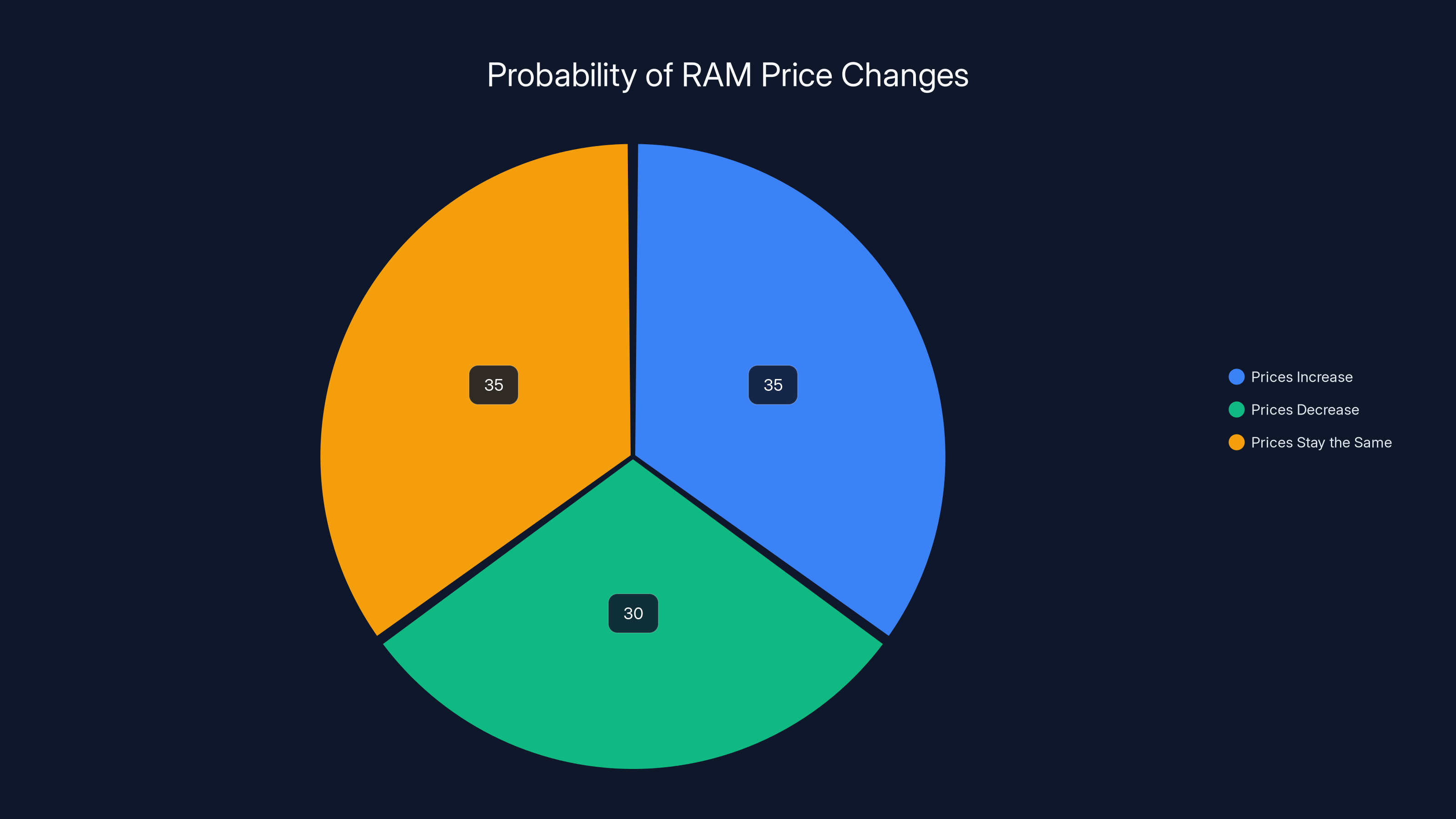

Estimated data suggests a 35% chance of RAM prices increasing, a 30% chance of them decreasing, and a 35% chance of them staying the same over the next six months.

Who Gets Hit Hardest: Consumers vs. Enterprises vs. OEMs

Different types of buyers feel the pain differently when memory prices spike.

Consumers building gaming PCs or workstations are definitely hurt, but they have options. You can build a system with 16GB instead of 32GB. You can delay an upgrade six months. You can buy used RAM from systems being retired. There's flexibility in consumer purchasing decisions.

Small businesses and professionals are in a tougher spot. If you need a new workstation for video editing, 3D rendering, or software development, you might need 64GB or more. At current prices, that's a difference of $500-800 compared to a year ago. That's real money for a small business. And you can't really defer the decision if you need the system now.

Enterprise IT departments face the hardest decisions. If a company needs to provision 500 new servers for a data center or refresh aging systems, the memory cost delta is millions of dollars. A

Original equipment manufacturers (OEMs) like Dell, HP, and Lenovo are also squeezed. They typically build their margins into the system as a whole. When components spike, they either eat the cost (reducing margins) or raise prices and risk losing customers. Most are raising prices, which pushes the pain downstream to businesses and consumers buying pre-built systems.

Cloud providers and data center builders are probably least affected, ironically. They're big enough to negotiate directly with Samsung and other manufacturers for better pricing. Plus, they can use their purchasing power to secure allocation. A mid-sized company trying to source 10,000 memory modules won't get better deals than Hyperscale Cloud Mega Corporation wanting 500,000 modules.

Supply Chain Bottlenecks: Where Exactly Things Are Breaking

The memory supply chain has several critical chokepoints, and understanding them helps explain why the shortage persists.

First, there's raw material constraints. Memory chips require high-purity silicon, various chemical precursors, and specialized materials. Some of these materials have limited global suppliers. If a key supplier experiences disruption, it cascades through the entire industry. Taiwan and South Korea together account for roughly 60% of global memory production, and both regions have complex supply chains dependent on materials from Japan, Europe, and the US.

Second, there's manufacturing equipment. Leading-edge memory production requires equipment that only a handful of companies can supply. ASML (Netherlands) produces extreme ultraviolet lithography tools that are critical for advanced memory. Applied Materials (US) produces deposition and etching equipment. Lam Research (US) produces plasma processing equipment. These suppliers have their own capacity constraints and are experiencing huge demand from all memory manufacturers globally.

Third, there's packaging and testing. After memory chips are manufactured, they need to be tested (binned for speed grade and quality), packaged into modules, and assembled. This back-end process requires specialized equipment and skilled labor. Testing is particularly important because memory needs to be screened for defects before it ships. Any defects in testing mean modules get discarded or downgraded.

Fourth, there's logistics. Memory modules need to be transported from manufacturing sites (primarily Asia) to distribution centers and customers globally. Shipping capacity, customs delays, and cold-chain logistics for semiconductor transport all add friction. A ship with a thousand containers of memory can get delayed, and that impacts availability globally.

What's remarkable is how interdependent these stages are. If testing capacity is the bottleneck, the fab could produce more chips but they'd sit in queues waiting for testing. If packaging equipment has problems, it causes backups in the assembly process. It's not a simple linear system. It's a complex network where bottlenecks can appear at multiple points simultaneously.

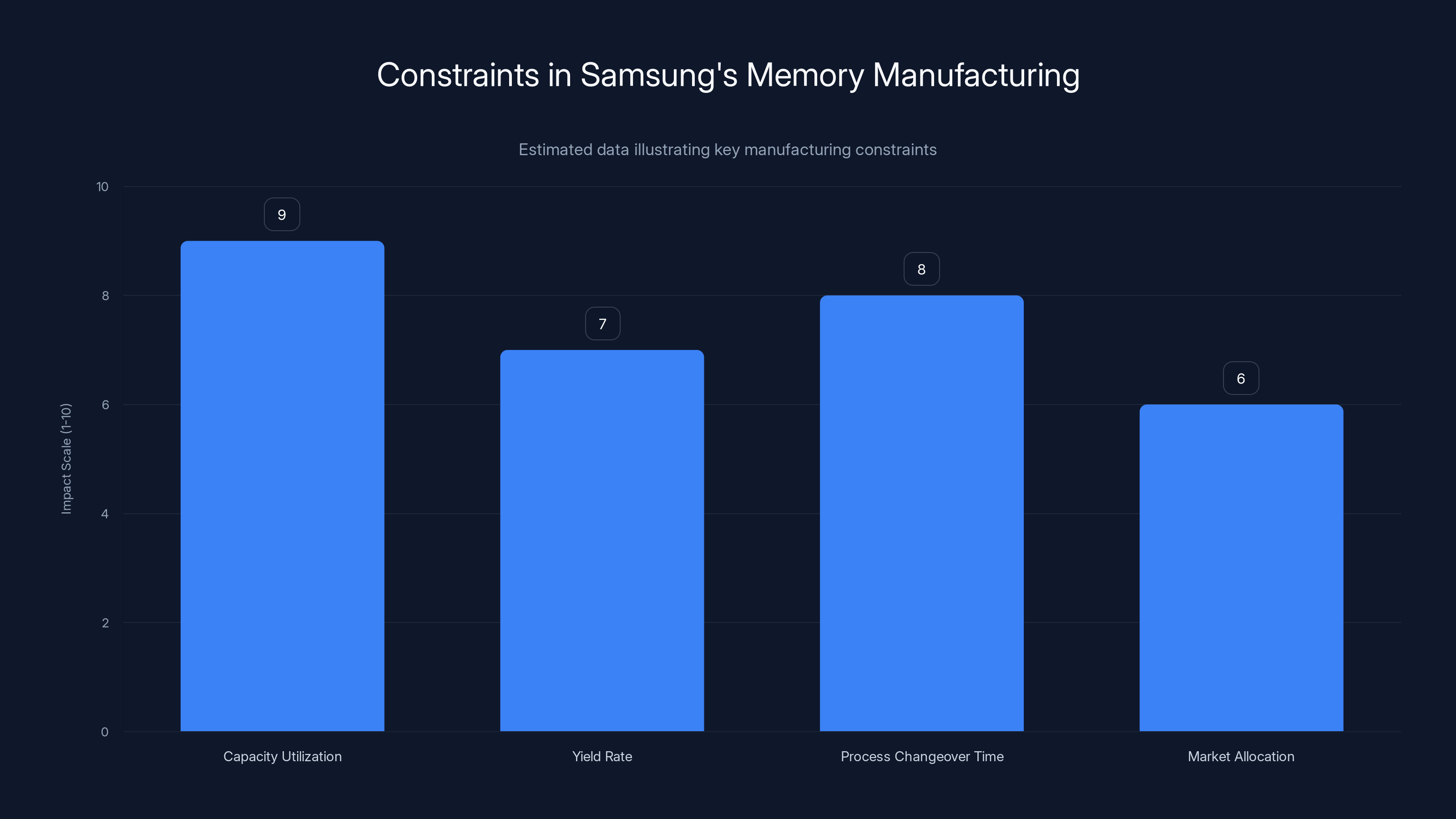

Manufacturing capacity and demand spikes are the most significant factors affecting memory prices, with yield problems also playing a crucial role. Estimated data.

The Geopolitical Dimension: Trade Restrictions and Export Controls

There's a geopolitical aspect to this shortage that's often overlooked.

The United States has implemented export controls on advanced semiconductor manufacturing equipment, particularly targeting China but affecting the broader global supply chain through uncertainty and complexity. The Netherlands, which is home to ASML (the world's leading producer of advanced lithography equipment), has also implemented export restrictions.

These restrictions create uncertainty for manufacturers. Samsung needs equipment from US and Dutch suppliers. If geopolitical tensions escalate, Samsung might struggle to source critical tools. This uncertainty makes companies cautious about expansion and increases their reluctance to commit production capacity to specific products.

Additionally, there's strategic competitiveness. Memory manufacturing is viewed as strategically important. Countries want to ensure they have domestic memory manufacturing capacity. This has led to government incentives (US CHIPS Act, Korean government subsidies, EU funding) spurring manufacturers to invest in new facilities. But these investments take 3-5 years to bear fruit.

China's memory industry is developing but still lags behind Samsung, SK Hynix, and Micron significantly. If geopolitical tensions restrict their access to foreign memory, China will accelerate domestic production. But in the short term, this doesn't help global supply.

The geopolitical factor adds maybe 10-15% to current price pressures. It's not the biggest factor, but it's real, and it's unpredictable.

When Will Prices Actually Come Down? Realistic Timelines

Every shortage ends eventually. But when will memory prices actually normalize?

Honestly, the timelines are not encouraging. Here's the realistic scenario based on manufacturing capacity expansion and demand trends:

Q2-Q3 2025 (Next 6 months): Prices likely remain elevated or increase further. Manufacturing capacity improvements happen slowly. New production lines take months to ramp. Demand from AI and data centers continues strong. Expect prices to stay at current levels or increase 15-30%.

Q4 2025 - Q1 2026 (6-12 months): This is when some new capacity might come online. Samsung, SK Hynix, and Micron have announced new fabrication lines. If they hit their timelines (which is a big if), you might start seeing supply pressure ease slightly. Prices might stabilize or decline slowly, maybe 10-20% reductions.

Mid-2026 onward (12+ months): New fabs become fully operational and ramped to production. Yields improve on newer production lines. Supply-demand balance begins to shift back toward normal. Prices could decline 30-50% from peak levels. But getting back to 2024 price levels probably takes until late 2026 or early 2027.

The key variables are:

- Yield improvements: If manufacturing yields improve faster than expected, supply increases and prices fall

- Demand moderation: If AI deployment slows or crypto crashes, demand drops and prices fall

- New capacity timing: If new fabs come online ahead of schedule, supply increases earlier

- Geopolitical escalation: If tensions worsen, supply tightens and prices spike

- Macroeconomic slowdown: If recession hits, business and consumer demand drops, easing supply pressure

Most likely scenario: prices stay elevated through 2025, begin declining slowly in late 2025/early 2026, and approach normal levels by late 2026.

Samsung's semiconductor manufacturing is constrained by high capacity utilization, yield rates, lengthy process changeovers, and complex market allocations. Estimated data highlights these challenges.

Strategic Responses: What Companies Are Actually Doing

Enterprise customers aren't just accepting higher prices. They're adapting their strategies.

Some companies are negotiating multi-year supply agreements with memory manufacturers at fixed prices. This locks in current pricing but commits them to purchasing specific volumes. It's a risk mitigation strategy. If prices fall, they overpaid. If prices rise, they saved money. Most large companies are choosing to lock in supply rather than gamble on spot market pricing.

Others are substituting technology. Some workloads can run with less memory if you optimize algorithms, compress data, or use faster storage hierarchies. Companies are revisiting architecture decisions and sometimes redesigning systems to be less memory-intensive. This is more effort but can save money.

Data center operators are particularly creative. Some are staggering deployments, building out capacity in waves rather than all at once. Others are optimizing model inference to use less memory through quantization and other compression techniques. These approaches preserve capacity for new deployments.

Some manufacturers are also shifting product mix. If DDR5 is more expensive than DDR4, some customers are choosing DDR4 even though DDR5 is newer. Manufacturers follow demand, so there's actually increased DDR4 production despite being "older" technology.

Governments are getting involved too. The US CHIPS Act is providing subsidies for memory manufacturing expansion. South Korea and the EU have announced funding. These policy levers don't help short-term supply, but they signal that governments view memory manufacturing as critical infrastructure and will support capacity expansion.

The Ripple Effects: How Memory Prices Impact Everything Else

Memory isn't just another component. Price spikes ripple through the entire computing ecosystem.

PC manufacturers face margin pressure. They can't just absorb memory cost increases without raising prices on final products. So you'll see higher prices for laptops, desktops, and workstations across the board. A

Server and data center economics shift. Companies with older servers might extend those refresh cycles another year because new servers are more expensive. This actually extends the lifetime of older, less efficient technology, which has knock-on effects on power consumption and cooling costs.

Smartphone manufacturers like Samsung ironically face internal supply chain complications. Even though phones use much less RAM than PCs, Samsung is competing internally for manufacturing capacity. They might shift some phone production to other fabs or reduce memory allocation to phones to prioritize higher-margin server memory.

Edge devices and Io T get hit too. Io T applications increasingly need local memory for edge processing and AI. Memory costs for these devices increase, making deployments more expensive and potentially slowing Io T adoption.

The broader effect is that computing becomes more expensive across the board. This probably slows some adoption cycles and tilts budgets toward core capabilities and away from expansion or experimentation.

What You Should Do Right Now: Practical Advice

If you need memory, here's what actually makes sense to do.

First, assess your real needs honestly. Do you actually need 64GB of RAM, or would 32GB handle your workload fine? Be ruthless about this. Every 16GB you don't buy saves you money.

Second, if you're going to buy, buy now rather than later. Yes, prices are high. Yes, they might come down. But they're more likely to stay high or increase than decrease significantly in the next six months. The probability that you save money waiting is maybe 30-40%. The probability that you lose money waiting is 60-70%. Those odds favor buying now.

Third, consider buying from retailers with flexible return policies. Some retailers like Newegg and Amazon allow returns up to 30 days. If prices suddenly drop (which would be surprising but possible), you can return and rebuy at lower prices. This costs you nothing but gives you optionality.

Fourth, if you're an enterprise buying in bulk, negotiate hard with your suppliers. Large volume commitments can get you discounted pricing compared to spot market prices. Work with distributors who have allocation from manufacturers.

Fifth, consider buy-what-you-need-now pricing. If you're building a system, buy the memory now but wait on other components if prices are reasonable. Memory has longer production lead times than CPUs or GPUs, so securing allocation is important.

Sixth, monitor pricing trends but don't overthink it. Set a price target where you're comfortable buying and pull the trigger when you hit it. Obsessive price monitoring creates analysis paralysis.

Future Prevention: How to Avoid This Happening Again

From a systemic perspective, this shortage reveals vulnerabilities in memory supply chains that need fixing.

First, there needs to be more geographic diversification in memory manufacturing. Currently, South Korea and Taiwan dominate. If there's regional disruption, global supply gets cut off. Governments should incentivize memory manufacturing in multiple regions (North America, Europe, Southeast Asia) to create redundancy.

Second, capacity planning needs to be more flexible. Manufacturers should invest in modular production capacity that can be ramped up or down more dynamically. Current fab designs are optimized for continuous operation and are slow to adjust.

Third, there should be strategic reserves. Governments could maintain stockpiles of critical memory modules (like the petroleum reserve) that release onto market during shortages to stabilize prices. This sounds crazy but actually makes economic sense for critical infrastructure.

Fourth, supply chain transparency needs improvement. Right now, actual demand versus hoarding versus speculative buying are hard to distinguish. Better demand forecasting and supply chain visibility would help manufacturers plan more accurately.

Fifth, backward compatibility standards should be maintained longer. The rapid transition from DDR4 to DDR5 forced customers to buy new systems or accept price premiums. Extending compatibility windows for older technology would allow more substitution during shortages.

Finally, investment in manufacturing research and automation could improve yields and reduce production time. Memory manufacturing still relies heavily on human expertise. More automation and AI-optimized processes could increase throughput.

None of these are quick fixes, but they're what a more resilient memory supply chain would look like.

FAQ

Why did Samsung RAM prices double so quickly?

Multiple factors converged simultaneously: manufacturing capacity constraints at Samsung's fabs, massive demand from AI data centers needing memory for model inference, cryptocurrency mining resuming at scale, geopolitical supply chain disruptions, and limited ability to increase production quickly. Memory manufacturing requires years to add new capacity, so prices spiked when demand exceeded available supply.

Will memory prices ever return to 2024 levels?

Eventually, yes, but probably not until late 2026 or early 2027. New manufacturing capacity from Samsung, SK Hynix, and Micron comes online gradually through 2025-2026. Prices will likely stabilize in mid-2026 and slowly decline as supply increases. Complete normalization to 2024 prices requires substantial new production to come fully online and demand to moderate.

Should I buy RAM now or wait for prices to drop?

If you need memory, buying now is statistically better than waiting. Prices might drop eventually, but the probability they increase further in the next 6 months is higher than the probability of meaningful decreases. If you can wait until Q4 2025 or Q1 2026, that's ideal timing when new capacity starts ramping. Otherwise, buy now.

How much higher will RAM prices go?

Analysts project another 15-50% increases possible through Q3 2025, depending on demand trends and supply developments. The ceiling is probably around $200-220 for premium 16GB DDR5 modules. Beyond that price point, consumers begin deferring purchases, creating demand destruction that naturally caps further increases.

Are there memory brands less affected by shortages than others?

All major manufacturers (Samsung, SK Hynix, Micron) are capacity-constrained, so prices are rising across the board. However, enterprise-grade ECC memory for servers shows higher price increases than consumer DRAM. Used or refurbished memory might be slightly cheaper but comes with warranty and reliability risks.

Can AI development proceed without more memory, or is this a hard blocker?

AI deployment can proceed with different optimization strategies. Companies are using quantization, model compression, and distributed processing to reduce memory requirements. However, absolute memory capacity still limits the size of models you can run and the throughput of inference. Memory shortages slow AI scaling but don't completely block progress. They just make it more expensive.

Will geopolitical tensions make memory shortages permanent?

Unlikely to be permanent, but geopolitical issues could extend shortages. If export controls on manufacturing equipment worsen, it delays new capacity coming online. Most countries recognize memory manufacturing as strategically important and are investing in domestic capacity, which eventually adds supply even if global trade gets restricted.

How do memory shortages affect smartphone and tablet prices?

Smartphones and tablets use significantly less memory than PCs, so they're less directly impacted. However, manufacturing capacity is shared across products, so smartphone makers might see slightly elevated memory costs. This usually doesn't translate to much higher phone prices because memory is a smaller percentage of phone costs compared to PCs. Expect maybe 2-3% phone price increases due to memory costs, if any.

What's the difference between DDR4 and DDR5 pricing during shortages?

DDR5 prices are higher in absolute terms, but DDR4 prices are growing faster percentage-wise because data center demand for DDR4 remains strong. Many servers still run DDR4, and enterprises are still buying DDR4 for some deployments. This dual demand for both technologies tightens supply for both. Interestingly, older technology (DDR4) doesn't necessarily cost less during shortages.

Could manufacturing countries like China increase supply to undercut prices?

China is investing heavily in memory manufacturing, but current technology lags behind Samsung and SK Hynix significantly. Chinese manufacturers can make commodity DRAM, but not the cutting-edge modules commanding premium prices. Building advanced capacity takes years. In the near term (2025-2026), Chinese suppliers won't meaningfully increase global supply.

Conclusion: The Long Road to Normal

Memory prices have doubled, and it sucks. There's no way around that reality.

What's important to understand is that this isn't irrational market behavior or manufacturers being greedy. It's a genuine supply-demand imbalance in a market where supply adjusts very slowly. Memory manufacturing is capital-intensive, geographically concentrated, and requires years to scale. When demand suddenly spikes from AI deployment and geopolitical supply chain complexity simultaneously, prices have nowhere to go but up.

The worst news is that this isn't over. Another 15-50% price increase is realistic through mid-2025. The good news is that it's not permanent. New production capacity comes online starting in late 2025, prices stabilize in early 2026, and normalization happens through 2026-2027.

For consumers and businesses, the pragmatic approach is acknowledging that memory is currently expensive and will likely stay that way for 6-12 months. If you need a system upgrade, buy memory now rather than later. If you can wait, aim for Q4 2025 or Q1 2026 when the supply situation improves. For enterprises, locking in multi-year supply agreements at current prices beats gambling on spot market volatility.

The broader lesson is that computing infrastructure supply chains are more fragile than most people realize. A shortage in one component cascades through the entire ecosystem. The memory shortage of 2025 reveals how dependent modern computing is on just a few manufacturers in a couple of geographic regions. Governments and companies should be thinking about how to build more resilient supply chains.

But for now, if you're shopping for RAM, take a deep breath and accept the reality of current prices. It's temporary, even though it doesn't feel that way.

Key Takeaways

- Samsung RAM prices have doubled in 2025 due to simultaneous supply constraints and demand surge from AI data centers requiring massive memory allocations

- Manufacturing capacity cannot scale quickly; new fab production comes online 2026 at earliest, meaning elevated prices through mid-2025

- AI infrastructure deployment is the primary driver, with data centers needing 512GB+ per server multiplied across thousands of servers globally

- Geopolitical tensions and export controls add 10-15% to price pressure by creating uncertainty in supply chains and limiting equipment access

- Prices likely remain elevated or increase another 15-50% through Q3 2025, with normalization expected late 2026-early 2027

Related Articles

- US Semiconductor Market 2025: Complete Timeline & Analysis [2025]

- AI Storage Demand Is Breaking NAND Flash Markets [2025]

- 7 Biggest Tech Stories This Week: LG OLED TVs, Whoop Fitness Trackers [2025]

- AMD Ryzen 9800X3D ASUS Motherboard Issues: What You Need to Know [2025]

- Reused Enterprise SSDs: The Silent Killer of AI Data Centers [2025]

- Neurophos Optical AI Chips: How $110M Unlocks Next-Gen Computing [2025]

![Samsung RAM Prices Doubled: What's Causing the Memory Crisis [2025]](https://tryrunable.com/blog/samsung-ram-prices-doubled-what-s-causing-the-memory-crisis-/image-1-1769440368855.png)