Raspberry Pi Prices Just Hit an All-Time High. Here's What Happened (And What Comes Next)

Remember when a Raspberry Pi 5 cost you a reasonable chunk of change? Those days are gone.

In 2024, the Raspberry Pi Foundation announced a price increase that hit like a gut punch to the maker community. The Pi 5 jumped from around

But here's the thing: this story isn't just about sticker shock. It's about supply chains, memory costs, geopolitics, and the weird economy of single-board computers that power everything from home automation to industrial IoT devices.

The price hike matters because Raspberry Pi isn't some luxury gadget. It's the backbone of thousands of projects. Hobbyists build retro game emulators. Schools teach programming. Engineers prototype IoT devices. Makerspaces run on these boards. When the price nearly doubles, it reshapes what's actually possible for people working on tight budgets.

The good news? There's movement on the memory front. DDR5 adoption is finally cooling prices in some regions, and the Foundation is exploring ways to bring costs down again. Plus, the competitive landscape is shifting. Alternatives are getting stronger. Your options aren't disappearing—they're just expanding.

Let's break down what actually happened, why it happened, and what it means for your next project.

The Perfect Storm: How We Got Here

The Chip Shortage Legacy That Refuses to Die

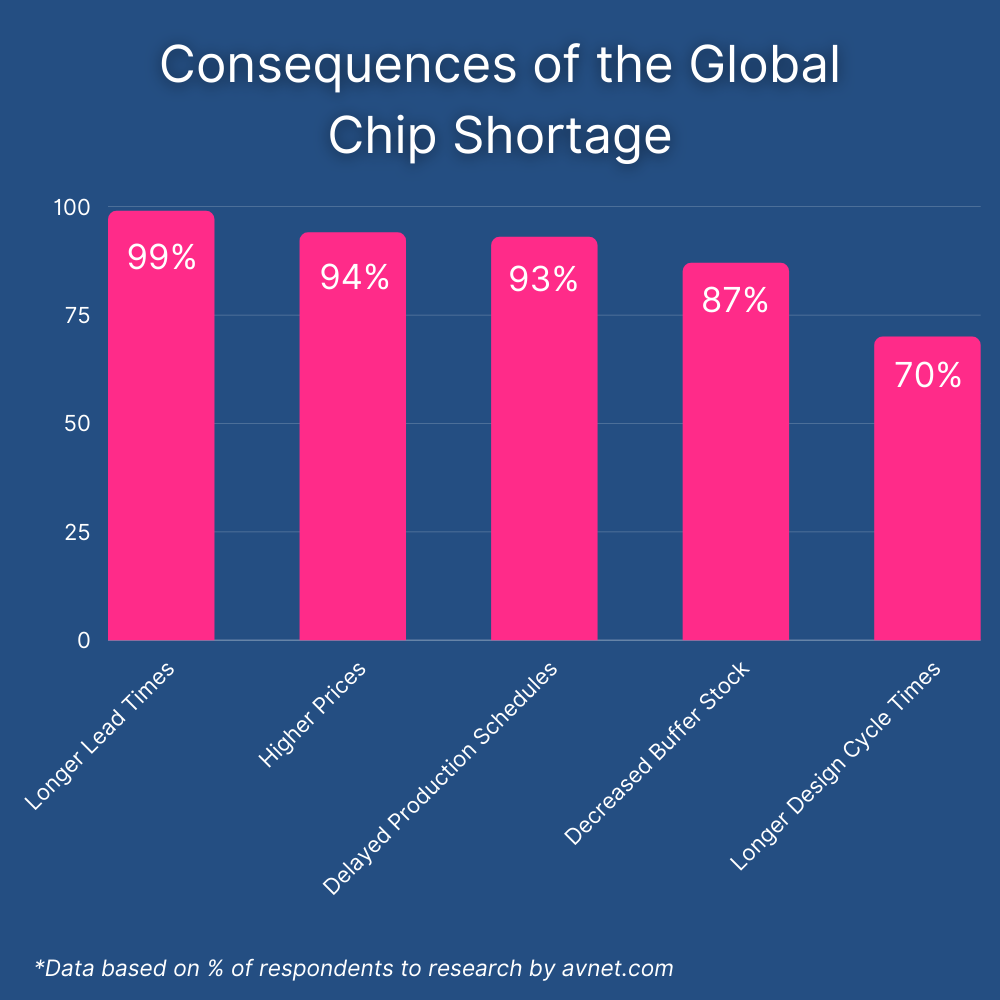

The 2021-2023 chip shortage wasn't just some random supply hiccup. It fundamentally altered how manufacturers source components, price products, and think about inventory. Factories couldn't get the chips they needed. Prices exploded. Demand outpaced supply by ridiculous margins.

Raspberry Pi got hammered during this period. The Foundation had to ration boards. Authorized distributors marked up prices 2x, 3x, sometimes more. Scalpers grabbed stock and flipped it. The community was frustrated, but everyone understood: this was a global problem.

When the shortage "ended" in late 2023, people expected prices to normalize. They didn't. Not completely. The Raspberry Pi Foundation had experienced real cost increases in their supply chain, and those didn't magically disappear when the shortage ended. Component costs stayed elevated. Manufacturing remained expensive. Logistics didn't get cheaper overnight.

So when the Foundation announced the price increase, they weren't price-gouging out of greed. They were absorbing cost increases they'd been carrying. The previous pricing had become unsustainable.

DRAM and Memory: The Hidden Cost Driver

Here's a detail most people miss: Raspberry Pi's biggest cost increase isn't the processor. It's the memory.

DDR4 memory prices doubled during the pandemic and shortage. That's not exaggeration. DRAM (Dynamic Random-Access Memory) hit prices nobody had seen in years. A single gigabyte of RAM that used to cost a dollar or two was suddenly costing three, four, sometimes five dollars.

Why? Because memory manufacturers had to rebuild capacity after the shortage. They couldn't just flip a switch and make more chips. Fabs (manufacturing facilities) take years and billions of dollars to expand. In the meantime, demand for memory exploded across every industry. Phones needed it. Servers needed it. Laptops needed it. Embedded systems like Raspberry Pi needed it.

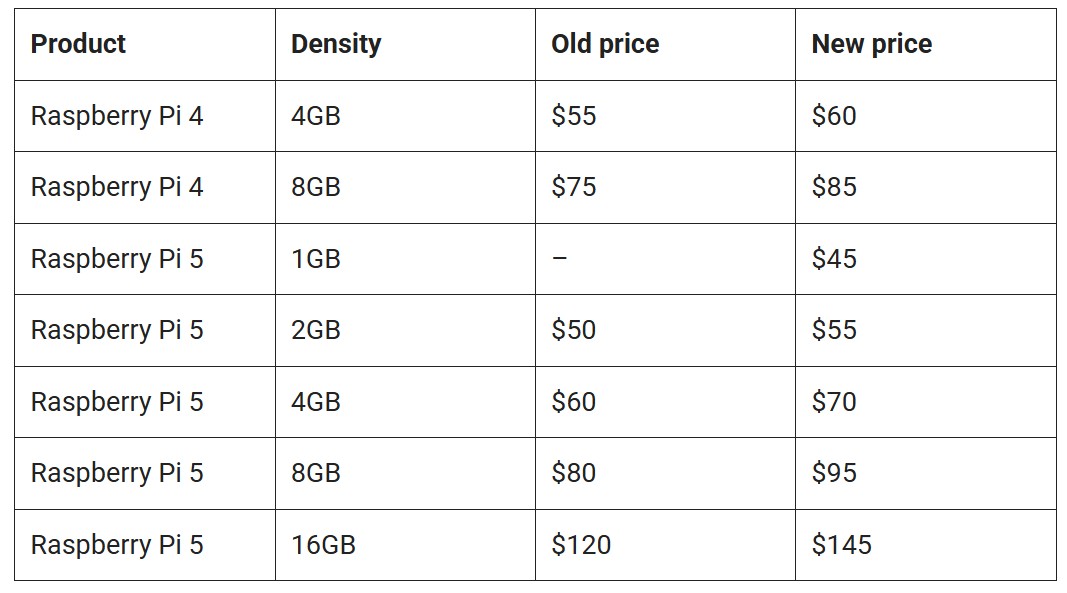

The Raspberry Pi 5, released in October 2023, came in different configurations: 4GB and 8GB models. That memory represents a significant chunk of the bill of materials (BOM). When you're running on thin margins—and single-board computer margins are razor-thin—doubling memory costs forces price increases.

Why Pricing Is So Transparent (And So Painful)

Unlike phone makers or laptop manufacturers, Raspberry Pi doesn't hide its costs or bundle in massive markups. The Foundation publishes detailed breakdowns. They explain where money goes. They show their margins.

This transparency is admirable, but it also means the community sees exactly how much profit they're making (or not making). A Raspberry Pi 5 probably costs the Foundation around

Compare that to consumer laptops, where manufacturers routinely mark up hardware 30-50%. Raspberry Pi's margin looks thin by comparison.

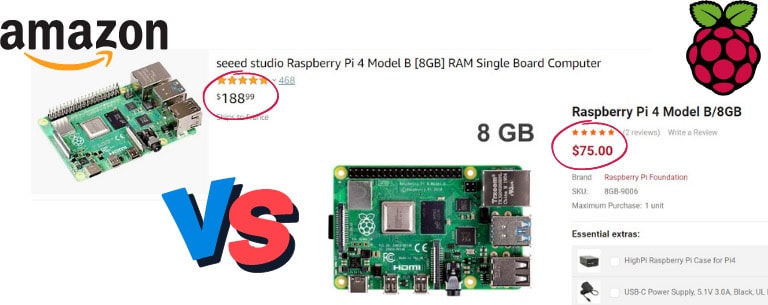

But try telling that to someone who bought a Pi 4 for

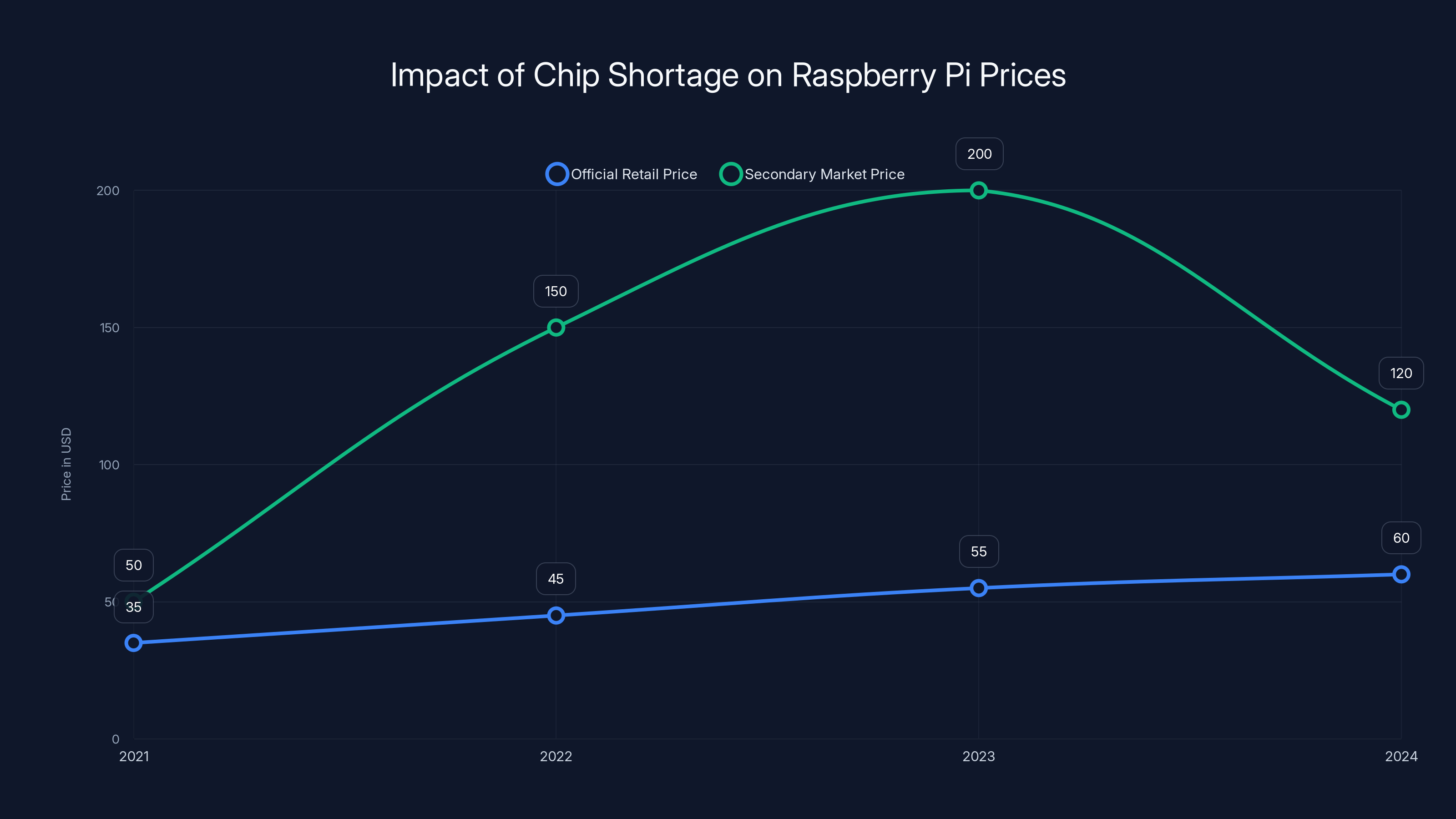

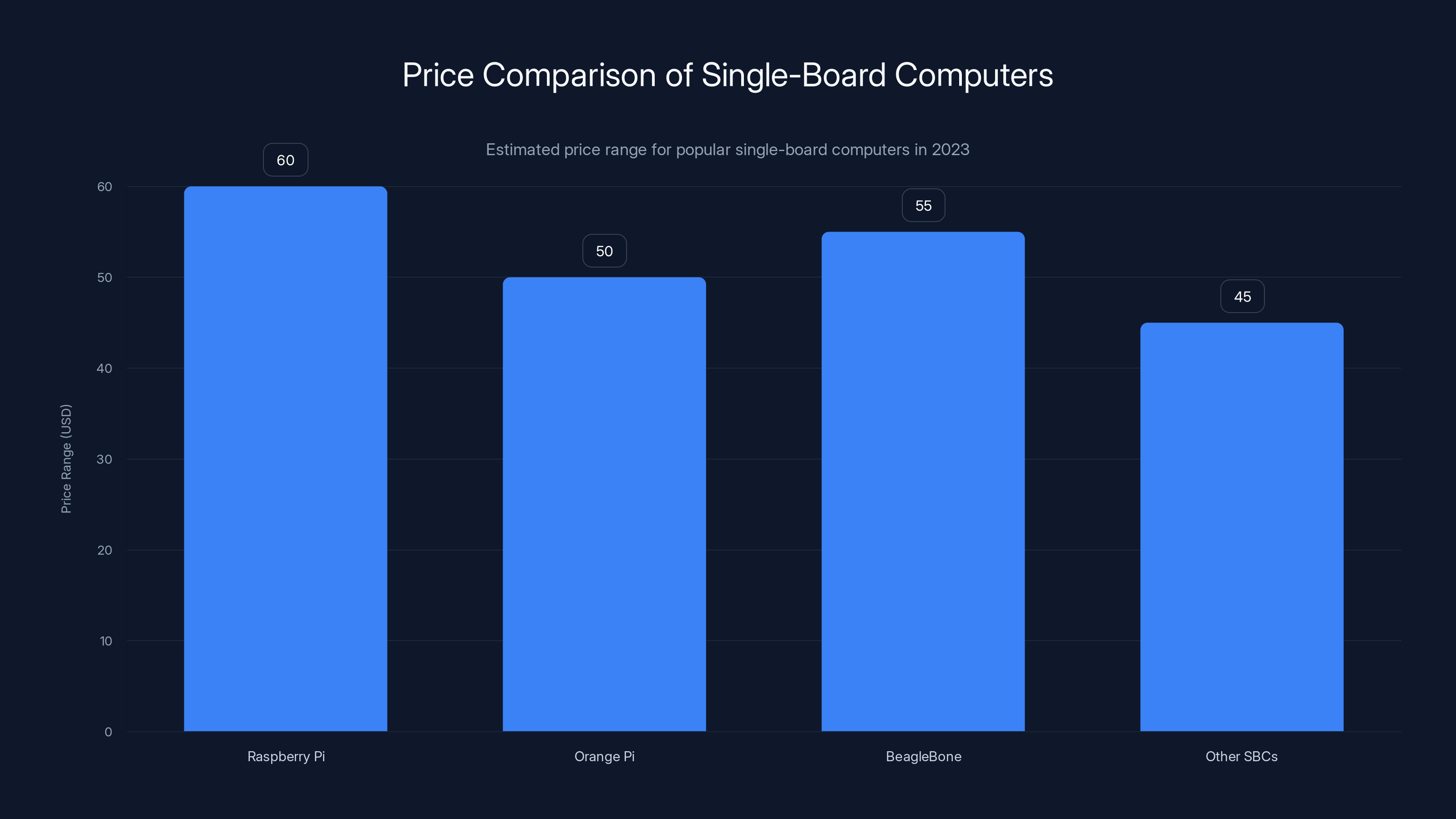

The chip shortage caused Raspberry Pi prices to spike on secondary markets, peaking in 2022. Although prices have somewhat stabilized, they remain above pre-shortage levels. (Estimated data)

The DDR5 Question: New Memory, New Hope

What's Actually Changing with DDR5

DDR5 memory is the next generation of RAM. It's faster, more power-efficient, and theoretically cheaper to manufacture at scale. But here's the catch: the transition from DDR4 to DDR5 isn't automatic. Manufacturers have to redesign boards. Compatibility changes. You can't just drop DDR5 into a DDR4 slot.

For Raspberry Pi, moving to DDR5 would be a major redesign. The Pi 5 uses LPDDR5 (a lower-power variant), but we're not seeing full DDR5 in single-board computers yet. That could change.

The reason DDR5 matters is economics. Right now, DDR4 is still the dominant memory type. Manufacturers are still ramping up DDR5 production. As DDR5 factories come online and reach scale, competition increases. Prices fall. Eventually, DDR5 becomes cheaper than DDR4.

In Germany specifically, reports showed that DDR5 price hikes had halted and demand was stabilizing. That's significant because Germany is a tech hub with visibility into European pricing. If prices are stabilizing there, it could signal broader stabilization.

The Timeline for Price Relief

Let's be realistic: Raspberry Pi isn't switching to DDR5 overnight. The Pi 5 was released in October 2023 using LPDDR5. A Pi 6, whenever it comes, might use more conventional DDR5.

That means we're looking at 18-36 months before a DDR5-based board hits the market, and another 6-12 months before prices settle. If you need a Raspberry Pi now, you're buying at peak pricing. If you can wait until late 2026 or 2027, prices might be noticeably lower.

But most projects can't wait years. People need boards now. So the real question isn't "when will prices drop?" It's "what are my alternatives while I wait?"

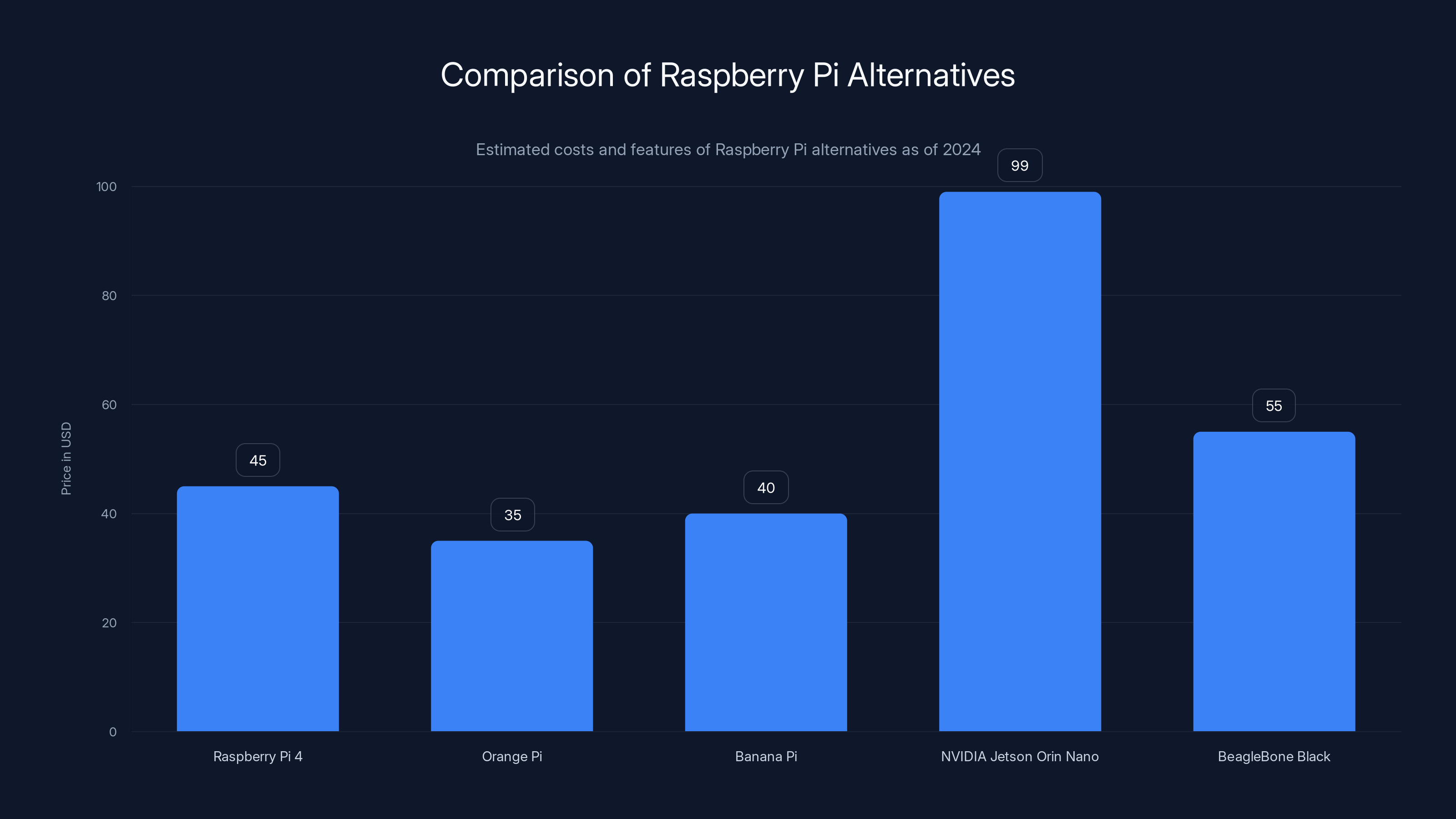

Raspberry Pi 4 remains a competitive choice at $45, with Orange Pi and Banana Pi offering lower-cost alternatives. NVIDIA Jetson Orin Nano is the most expensive due to its AI capabilities. (Estimated data)

The Price Breakdown: What Costs What

Bill of Materials (BOM) Reality

Let's talk actual numbers. A Raspberry Pi 5 4GB includes:

- Broadcom BCM2712 processor: $15-20 (estimated)

- 4GB LPDDR5 memory: $8-12

- 64GB e MMC storage (some models): $5-8

- Power management and support chips: $5-8

- PCB, connectors, and assembly: $8-12

- Packaging and logistics: $3-5

That gets you to roughly

For the 8GB model at

Compare that to older pricing: a Pi 4 2GB used to sell for

Regional Pricing Variations

Price isn't the same everywhere. In the US, a Raspberry Pi 5 4GB costs

These differences reflect local taxes, distribution costs, and market conditions. DDR5 developments in Germany might affect European pricing before they affect US pricing. Currency fluctuations matter too.

If you're in a region with higher pricing, it might be worth checking international retailers. Shipping costs can sometimes offset regional price differences.

Alternatives That Actually Make Sense

NVIDIA Jetson Orin Nano: Power on a Budget

If you need more computing power than a Pi can offer, the NVIDIA Jetson Orin Nano exists. It's pricier (around $99-129), but it has a proper GPU and 8GB of RAM standard.

For AI and machine learning projects, it's powerful. For general-purpose computing, it's overkill. The real advantage is flexibility. You get more processing headroom, which matters if you're training ML models or running demanding applications.

The trade-off? It uses more power and generates more heat. You need a fan. It's bigger. It's not ideal for simple projects, but it's excellent if you need serious computing power.

Beagle Bone Black and Open-Source Alternatives

Beagle Bone Black has been around since 2013. It costs less than a Raspberry Pi these days ($99), offers more I/O, and has a different processor architecture that some projects prefer.

It's still around because it's genuinely useful. The real-time capabilities are better for some robotics and control applications. The community is smaller than Raspberry Pi's, but it's active and knowledgeable.

If your project needs specific I/O capabilities or real-time performance, Beagle Bone might be the better choice at any price point.

Orange Pi and Other Chinese Alternatives

Companies like Orange Pi, Banana Pi, and others make boards that look like Raspberry Pi clones. Some are genuinely good. Some are mediocre.

The advantage is price. An Orange Pi might cost $30-40. The disadvantage is community size and documentation. Raspberry Pi has millions of users. If something goes wrong, thousands of people have solved it. With Orange Pi, you might be on your own.

They're worth considering if you're cost-conscious and willing to do extra troubleshooting.

Raspberry Pi's price increase to $60-110 has opened the market for alternatives like Orange Pi and BeagleBone, which offer competitive pricing. Estimated data.

What This Means for Different Use Cases

Hobbyists and Makers

For someone building a retro gaming emulation station or a home automation hub, the price hike hurts but isn't a dealbreaker. You're probably only buying one or two boards. The $50 price difference stings, but it's not a project killer.

The real pain comes if you're building something that needs multiple Pis. A distributed sensor network with 10 nodes just became $500 more expensive. That changes project viability.

Educational Institutions

Schools buying Raspberry Pis in bulk for computer science curriculum now pay significantly more. A school that bought 100 boards for

Many schools are evaluating alternatives. Some are sticking with older Pi 4 inventory. Others are switching to different platforms entirely. The price increase is forcing real budget conversations.

Industrial and Commercial Use

Businesses using Raspberry Pi in products (edge computing, industrial IoT, etc.) face margin compression. If your product used a

Many companies are redesigning products to use cheaper single-board computers or custom hardware. The price increase is pushing the industry to innovate on the low end.

The Path Forward: What Might Happen

Scenario 1: DDR5 Adoption Accelerates Savings

If DDR5 scaling happens faster than expected, and if the Raspberry Pi Foundation moves to DDR5-based designs quickly, we could see prices start dropping in 2026. A Pi 6 with DDR5 might launch at

This scenario requires DRAM manufacturers to continue building DDR5 capacity and commodity prices to continue falling. It's plausible but not guaranteed.

Scenario 2: Prices Stay Elevated

The more likely scenario is that prices stabilize where they are. Raspberry Pi maintains these price points because that's what the market will bear and what margins require. You get used to

Over time, real wages grow and inflation adjusts expectations. In five years, these prices feel normal. Demand continues because the community adapts.

Scenario 3: Competition Intensifies

If other single-board computer makers recognize the opportunity, they'll flood the market with cheaper alternatives. Orange Pi, Banana Pi, and new entrants offer boards at $30-40 that do 80% of what a Raspberry Pi does.

This forces Raspberry Pi to either lower prices, improve specs, or accept a shrinking market share. The Foundation has been resistant to price drops historically, so this might play out as a gradual market shift where Pi loses dominance but remains popular.

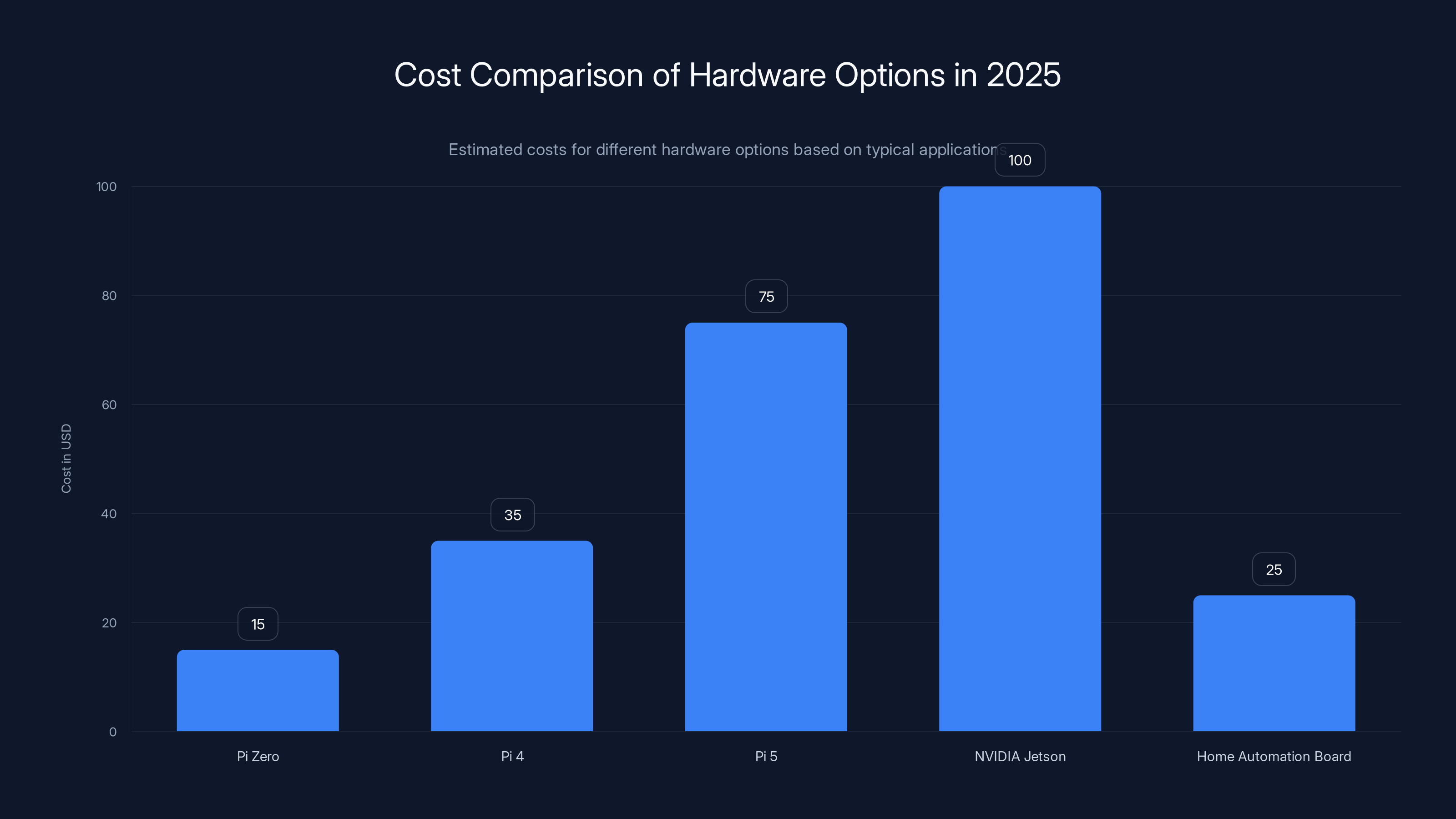

Estimated data shows that choosing appropriate hardware like a Pi Zero or a specific home automation board can significantly reduce costs compared to high-end options like a Pi 5 or NVIDIA Jetson.

Memory Markets and Global Implications

Why DRAM Prices Matter Beyond Raspberry Pi

DRAM is a commodity. When prices rise, everything that uses memory gets more expensive. Phones cost more. Laptops cost more. Servers cost more. IoT devices cost more.

The stabilization of DDR5 pricing in Germany signals that the market is reaching equilibrium. Supply and demand are matching. New fabs are coming online. Competition is working.

But this takes time. Memory markets move slowly because manufacturing capacity can't change quickly. A new fab takes 3-5 years to build and another 1-2 years to reach full capacity.

Geopolitical Considerations

DRAM manufacturing is concentrated in three countries: South Korea (Samsung, SK Hynix), Taiwan (Micron's operations), and China. Supply chain disruptions in any of these regions affect global pricing.

There's growing discussion about building memory manufacturing capacity in the US and Europe for supply chain resilience. This could eventually lower prices in these regions, but implementation is years away.

For now, accepting that memory prices are volatile and planning accordingly is smart strategy.

The Math Behind Price Elasticity

How Price Changes Affect Demand

Economics teaches us that higher prices reduce demand. But how much? For Raspberry Pi, demand remains strong despite the price increase because the alternatives are limited.

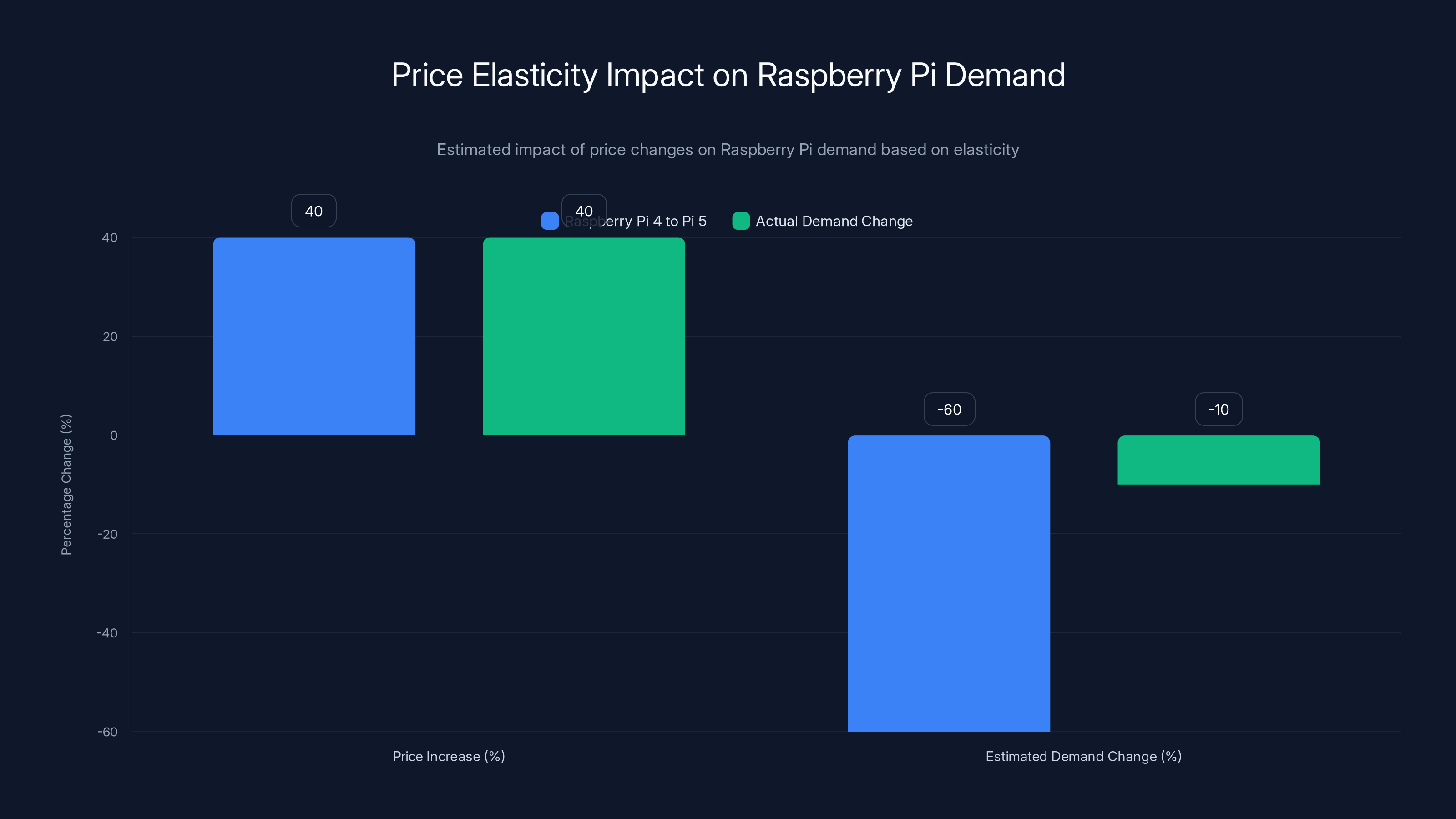

If we assume price elasticity of -1.5 (a 10% price increase reduces demand by 15%), the 40% price increase from Pi 4 to Pi 5 would reduce addressable market by roughly 60%. But that's not what's happening. Demand remains robust.

Why? Because the value proposition is still exceptional. Where else can you get a fully capable computer for $60? The price increase hasn't made the Pi uncompetitive. It's just made it more expensive.

Educational institutions and hobbyists with tight budgets are more price-sensitive. Commercial users who incorporate Pis into products are less sensitive (they pass costs to customers). This bifurcation is reshaping the market.

The Discounting Strategy

Raspberry Pi has historically resisted discounting. The Foundation prices boards at value and maintains those prices. This is different from most tech companies, which use heavy discounting.

This pricing discipline keeps resale markets healthy and prevents channel conflict. But it also means anyone wanting a Pi pays full price. In 2025, watch for whether this changes. Sustained demand at current prices suggests pricing power. Slowing sales suggest room for discounting.

Despite a 40% price increase, Raspberry Pi demand only decreased by an estimated 10%, indicating strong market resilience and value perception. Estimated data.

Building in 2025: Strategies for Managing Cost

Optimizing Your Hardware Choices

Not every project needs a Pi 5. A Pi 4 is still capable and cheaper if you can find one. A Pi Zero at $15 works for many applications. Think about actual requirements instead of always buying the latest.

For image processing or machine learning, an older NVIDIA Jetson might be cheaper per FLOP. For simple home automation, a $25 board does the job. Matching hardware to requirements instead of just buying the best available saves money.

Bulk Purchasing and Distributor Relationships

If you're building multiple projects or bringing something to market, work with authorized distributors. They offer volume pricing and consistent availability. Buying individual units from retail sources costs more.

Authorized distributors in the US include Adafruit, Digi-Key, and others. They typically offer 10-15% discounts on volume orders. For a 100-unit project, that's meaningful savings.

Designing for Obsolescence

If your product uses a Raspberry Pi, design it so the board can be upgraded or replaced without redesigning everything. Use standard GPIO pinouts and interfaces. Don't hardcode assumptions about future boards.

This gives you flexibility if prices drop or better alternatives emerge. You're not locked into a specific board forever.

Future Developments Worth Watching

Raspberry Pi's Roadmap

The Foundation has indicated interest in a Pi 6 (codename, not official yet). Current rumors suggest it might use improved processors, more memory options, and potentially DDR5.

Timing is uncertain. It could be 2026 or later. When it arrives, pricing will tell us a lot about whether memory cost declines are being passed to consumers.

Emerging Alternatives

Companies like Qualcomm, Intel, and others are eyeing the single-board computer market. They see opportunity. We might see reference designs that other manufacturers implement at different price points.

This could fragment the market but also drive innovation. We might see boards with better processors at similar prices, which would put pressure on Raspberry Pi.

Integration and Customization

As volumes increase, custom designs become cost-effective. Some companies are starting to build custom boards instead of using Raspberry Pi. This requires engineering resources but pays off in volume.

This is likely for commercial applications, not hobbyists. But it shows that the price increase is pushing serious users away from standard platforms.

The Bigger Picture: Supply Chains and Technology Pricing

Why Hardware Pricing Is So Volatile

Software scales infinitely at zero marginal cost. Hardware doesn't. Every device requires physical components manufactured in specific facilities by specific companies with specific constraints.

When demand exceeds capacity, prices rise. When capacity exceeds demand, prices fall. The gap between these equilibrium points creates volatility. DRAM markets are particularly volatile because they're commodities traded globally.

Understanding this helps contextualize Raspberry Pi's pricing. It's not arbitrary. It's a response to real economic forces.

Lessons for Tech Consumers

The Raspberry Pi story teaches us that tech prices are often higher than they "should" be due to supply constraints, not manufacturer greed. When shortages hit, prices rise not because companies are evil but because supply can't meet demand.

For consumers, this means:

- Build flexibility into projects. Don't hardcode specific devices.

- Buy when available, not when you need it (if possible).

- Understand that "previous price" doesn't reflect true cost of manufacturing.

- Monitor commodity prices (DRAM, chips) to predict future consumer hardware pricing.

The Role of Open Hardware

Raspberry Pi's open documentation (though not fully open-source) means enthusiasts can design compatible boards. This creates pressure on pricing by offering alternatives.

If truly open-source designs emerged with lower prices, they could reshape the market. We're seeing this with projects like RISC-V, but they're still niche.

The more open and documented hardware becomes, the more price-competitive the market should become.

Regional Deep Dive: Why Europe's Situation Matters

The German DDR5 Signal

Germany's role in the DDR5 market isn't accidental. The country has strong electronics manufacturing, a tech-savvy workforce, and established distributor relationships.

When DDR5 price hikes halted in Germany, it meant several things: manufacturers had sufficient inventory, demand was stabilizing, and competition was working. This information propagates globally as distributors adjust expectations and buyers make decisions.

For the rest of Europe, German pricing often signals what's coming. If prices stabilize in Germany and then drop, that pattern typically spreads to UK, France, and other markets.

Impact on UK Pricing

Post-Brexit, UK supply chains shifted. Some products became more expensive due to tariffs and logistics. Raspberry Pi pricing accounts for these factors.

A Raspberry Pi that costs $60 in the US might cost £50 in the UK (accounting for VAT). But that exchange rate fluctuates, and Brexit logistics add costs. Watching UK pricing gives insight into European supply chain dynamics.

Scandinavian Market Dynamics

Scandinavia pays premium prices for most tech, but it also sees early adoption of new technologies. If a new board or pricing model works in Scandinavia first, it often spreads to other regions.

Competitive intensity is high in Nordic countries because populations are wealthy but price-sensitive. This creates opportunities for cost-optimized alternatives.

Practical Next Steps: What You Should Do

If You're Planning a Hobby Project

Buy now if you're committed. Prices aren't dropping in the next 12 months. Waiting won't save you money. The marginal benefit of waiting for a potential Pi 6 in 2026 is probably not worth delaying your project.

If budget is tight, consider older boards (Pi 4) or alternatives (Orange Pi, Beagle Bone). You'll save money and still build something great.

If You're Evaluating Commercial Use

Analyze whether Raspberry Pi is the right platform at current pricing. Run the math. If the board cost represents more than 5% of your product's BOM, consider alternatives. Custom designs might be cheaper in volume.

Talk to contract manufacturers. They often know cost-optimized approaches you haven't considered.

If You're Buying for Educational Purposes

Bundle purchases. Approach authorized distributors about volume pricing and potentially negotiated terms. Explore alternative platforms (Orange Pi, Chinese boards) that might meet 80% of requirements at significantly lower cost.

If your institution has limited budgets, the price increase forces difficult choices. Don't assume you have to use Raspberry Pi. Evaluate the entire market.

FAQ

Why did Raspberry Pi prices increase 70%?

The price increase reflects real cost increases in the supply chain, particularly memory (DRAM) costs. During the 2021-2023 chip shortage, DRAM prices doubled and stayed elevated. When Raspberry Pi increased prices in 2024, it was absorbing these underlying cost increases rather than cutting margins. Component costs, particularly memory, remain significantly higher than pre-shortage levels.

Will Raspberry Pi prices drop when DDR5 becomes standard?

Probably, but not immediately and not by 70%. DDR5 might eventually cost less to manufacture than DDR4, creating modest price reductions. However, Raspberry Pi boards would need a complete redesign to use DDR5, which takes engineering resources and time. Even if memory costs drop 20%, the overall price reduction would likely be 10-15% at best, not a return to previous pricing levels.

Is Raspberry Pi 4 still a good buy at its current price?

Yes, if you can find one. Raspberry Pi 4 costs less than Pi 5 ($35-50 depending on configuration) and handles the vast majority of projects. If you don't need the Pi 5's marginal improvements (slight processor speed increase, better I/O), a Pi 4 is genuinely the better financial choice. The performance difference won't matter for most hobby and educational projects.

What are the best alternatives to Raspberry Pi right now?

It depends on your use case. For pure cost, Orange Pi or Banana Pi offer similar boards at

Should I buy a Raspberry Pi now or wait for the Pi 6?

If you have a project in mind now, buy now. Waiting for a future board that might arrive in 2026 or later means delaying your project 1-2 years for potentially marginal price savings. The Raspberry Pi 5 is capable and relevant. If your project timeline extends to 2026+, then waiting makes sense, but for most people, starting now beats waiting.

How does memory pricing affect other single-board computers?

All single-board computers containing DRAM are affected equally. When memory prices are high, board prices are high. This affects Orange Pi, Beagle Bone, and even NVIDIA Jetson Orin Nano. The entire market experienced cost pressure simultaneously. You're not escaping memory costs by choosing different hardware unless you use something with no onboard RAM, which isn't practical.

Will custom competitors force Raspberry Pi to lower prices?

Possibly, but not necessarily. Raspberry Pi has built an ecosystem with millions of users, extensive documentation, and strong community support. Cheaper alternatives with fewer resources and documentation might not be appealing despite lower prices. Competition usually improves offerings (better specs, more documentation) before forcing price cuts. Watch for this evolution over the next 1-2 years.

What's the realistic timeline for price relief?

Realistic timeline: prices stabilize where they are (within 12 months), marginal declines start appearing (18-24 months), and meaningful improvements arrive with new board designs (2-3 years). Expecting a sharp drop back to 2020 pricing isn't realistic. The supply chain has fundamentally changed. Even if memory costs normalized completely, they'd only represent part of the board's cost. Full restoration to old pricing requires overall manufacturing and logistics cost reductions unlikely to happen quickly.

Are there risks to buying Raspberry Pi at current prices?

The risk is primarily financial. You're paying a premium price that might decline. If you buy a Pi now and prices drop significantly in 12 months, you'll feel the sting. To mitigate this, buy used boards if possible (prices might be lower), wait if your timeline allows, or start with single boards before committing to multi-unit projects. The technical risks are minimal—the boards are mature and reliable.

How do geopolitical factors affect Raspberry Pi pricing?

DRAM manufacturing is concentrated in Korea, Taiwan, and China. Any disruption in these regions (conflict, natural disaster, regulations) affects global pricing. The Raspberry Pi Foundation is aware of this and likely exploring supply chain diversification. For consumers, this means accepting that pricing can fluctuate unpredictably based on global events. Building projects with flexibility in hardware choices reduces risk.

Should schools switch away from Raspberry Pi due to price increases?

Not necessarily. The ecosystem value (documentation, community, curriculum materials) is substantial. But schools should absolutely evaluate alternatives and negotiate bulk pricing with distributors. Using a mix of platforms (some Pi, some cheaper alternatives) spreads risk and keeps budgets manageable. The decision depends on specific educational goals and budget constraints. Raspberry Pi is still the best educational platform overall, but cost is now a legitimate consideration.

Conclusion: Navigating the New Raspberry Pi Reality

The 70% price increase is real, it hurts, and it changes the landscape. But the story isn't doom and gloom. It's a market adjusting to new economic reality while communities adapt and innovate.

Raspberry Pi remains the best single-board computer for most applications. The community, documentation, and ecosystem support are unmatched. But the price increase forces harder decisions about hardware choices, particularly for budget-conscious makers and educational institutions.

The good news is choice. More alternatives exist than ever. Some are genuinely competitive. Orange Pi, Beagle Bone, and others have improved significantly. If Raspberry Pi's pricing doesn't work for your budget, alternatives can. The market is responding to opportunity.

On the memory front, DDR5 developments in Germany and elsewhere suggest that the worst of the price inflation is behind us. Stabilization is happening. Full price relief is years away, but the trajectory is improving. The next Raspberry Pi board, whenever it launches, will likely show modest price improvements. That won't restore 2020 pricing, but it will signal movement in the right direction.

For 2025 and beyond, success means being intentional about hardware choices. Don't assume you need the latest board. Evaluate actual requirements. Buy in bulk if possible. Watch community discussions for cost-saving strategies. Participate in the ecosystem feedback. The maker community has survived price increases before. It will survive this one.

The Raspberry Pi isn't going anywhere. Millions of users, tens of thousands of projects, strong institutional support. The platform is mature and sustainable. Higher prices reduce addressable market, but they don't eliminate it. Demand remains strong. Communities adapt.

The era of

Make peace with the pricing. Start your projects anyway. Build what you envision. In a year or two, when prices might be 10-15% lower, you'll be glad you didn't wait. In the meantime, you'll have working, functional projects running on capable hardware. That's what matters.

The maker community has always been resourceful. Higher prices demand more creativity, not less. In addressing cost constraints, we'll likely see innovation that wouldn't have emerged with cheap hardware. That's the eventual upside to this story.

Key Takeaways

- Raspberry Pi prices increased 70% in 2024, driven primarily by persistent DRAM memory cost increases from the 2021-2023 chip shortage.

- The Pi 5 now costs $60-110 depending on configuration, representing the first major pricing regime change in the platform's 13-year history.

- DDR5 memory stabilization in Germany and other regions signals potential for modest price reductions (10-15%) when new board designs launch in 2026 or later.

- Viable alternatives exist (Orange Pi, BeagleBone, NVIDIA Jetson) offering lower cost or higher performance, reshaping the competitive landscape.

- Educational institutions and commercial users face significant budget pressure, with bulk purchasing and platform evaluation becoming necessary strategies.

Related Articles

- Raspberry Pi Price Hikes: The RAM Crisis Explained [2025]

- DDR5 Memory Prices Could Hit $500 by 2026: What You Need to Know [2025]

- Minisforum MS-01 Compact Workstation: Full Review & Specs [2025]

- Crunchyroll Price Increase 2025: Complete Breakdown & What It Means [2025]

- Raspberry Pi Price Increases 2025: Impact of Global Memory Shortage

- DDR5 RAM Price Crisis Explained: Why Prices Surged 150% [2025]