Why DDR5 RAM Prices Exploded: The Memory Market Crisis Everyone's Missing

Something wild is happening in the RAM market, and most people building PCs right now have no idea how bad it's gotten.

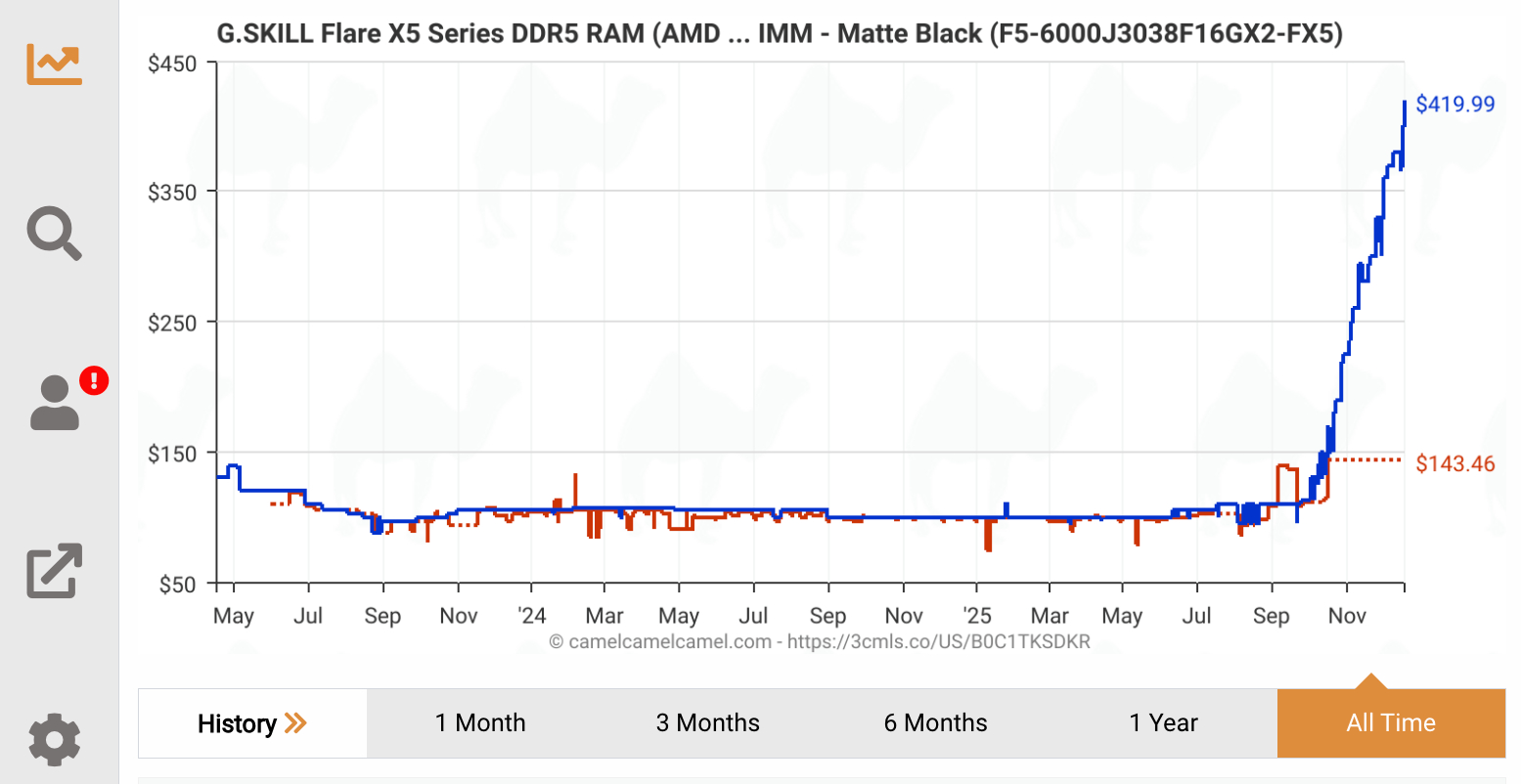

Back in September 2024, a solid 32GB DDR5 kit was running you about

I first noticed this when a friend texted me asking if I'd lost my mind recommending budget RAM options. When I checked the numbers myself, I couldn't believe what I was seeing. Amazon, Newegg, and other major retailers were advertising DDR5 memory at prices that would've been completely laughable back in the summer.

This isn't just annoying for enthusiasts. It's fundamentally changing the economics of building a PC in 2025. If you're planning a new system, you're looking at an extra

The question everyone's asking is simple: What the hell happened? And more importantly, will it get better?

The Perfect Storm: Supply, Demand, and Geopolitical Chaos

Memory prices don't spike 150% by accident. You need multiple factors aligning in just the wrong way, and 2024 provided exactly that.

First, let's talk about what happened on the manufacturing side. DDR5 production ramped up massively starting in 2023, flooding the market and driving prices down. By mid-2024, the memory industry was basically oversupplied. Prices hit rock bottom. This sounds great, right? Wrong. It was a problem.

When manufacturers are losing money on every unit they sell, they eventually stop making so much stuff. Around August and September 2024, several major DRAM manufacturers started cutting production. Samsung, SK Hynix, and Micron all announced production cuts to stabilize prices.

But here's where it gets interesting. While manufacturers were cutting supply, demand wasn't dropping. If anything, it was getting weird. Corporate buyers stocking up on AI servers needed massive amounts of high-bandwidth memory. Regular consumers were holding off on builds, waiting for prices to bottom out. Some retailers were actually sitting on existing inventory, not wanting to sell at loss-making prices.

Then came the geopolitical part. The U. S. government started getting more aggressive about regulating semiconductor exports to China, which created uncertainty about future production capacity and market access. Chinese manufacturers, cut off from the latest tools, couldn't scale up to fill the gap. This uncertainty rippled through the entire supply chain.

Add in the fact that data center demand for AI infrastructure was absolutely crushing, and you've got a situation where high-margin enterprise memory was soaking up production capacity that would normally go to consumer products. The result? Consumer DDR5 availability dropped while prices climbed.

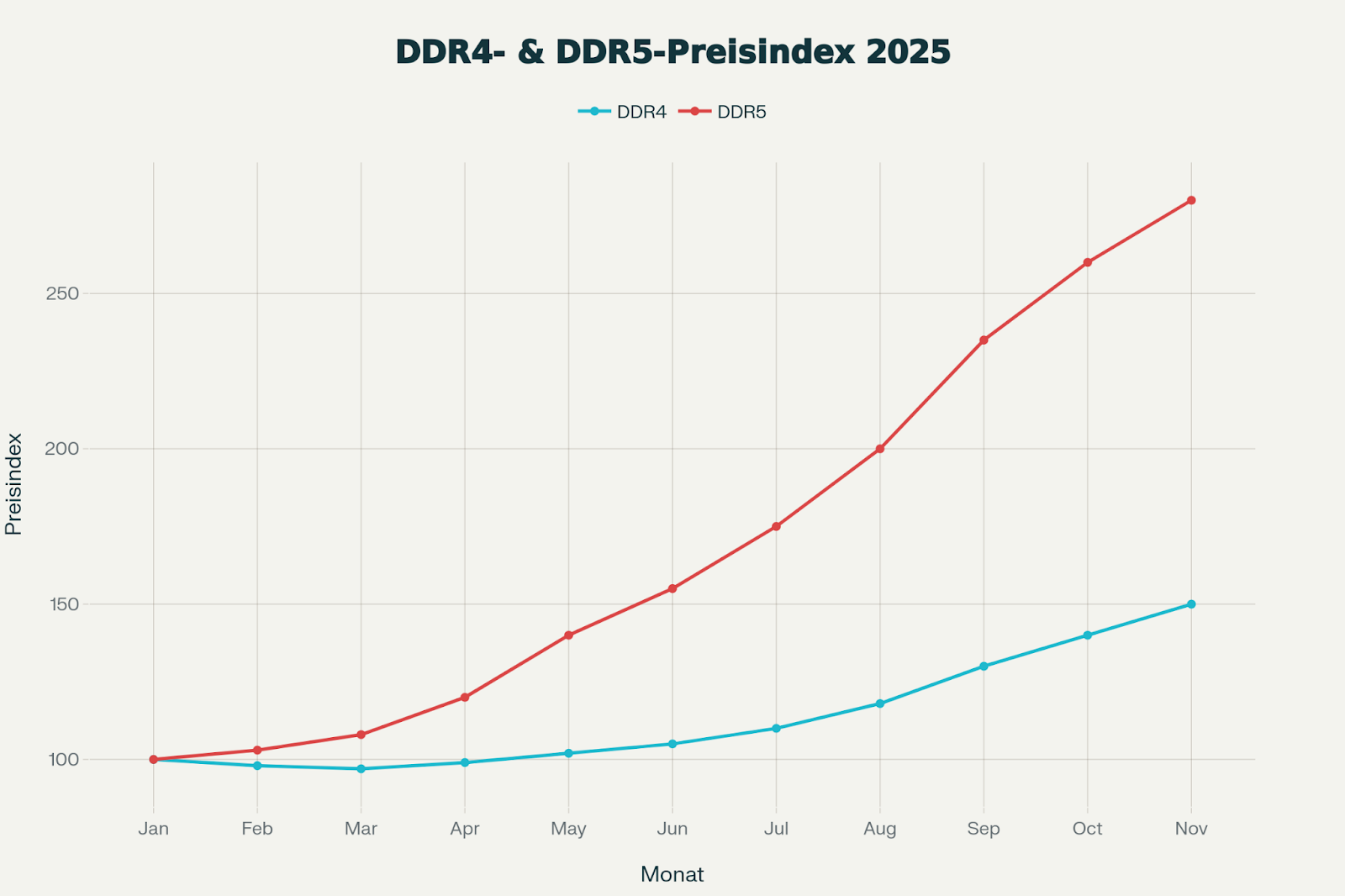

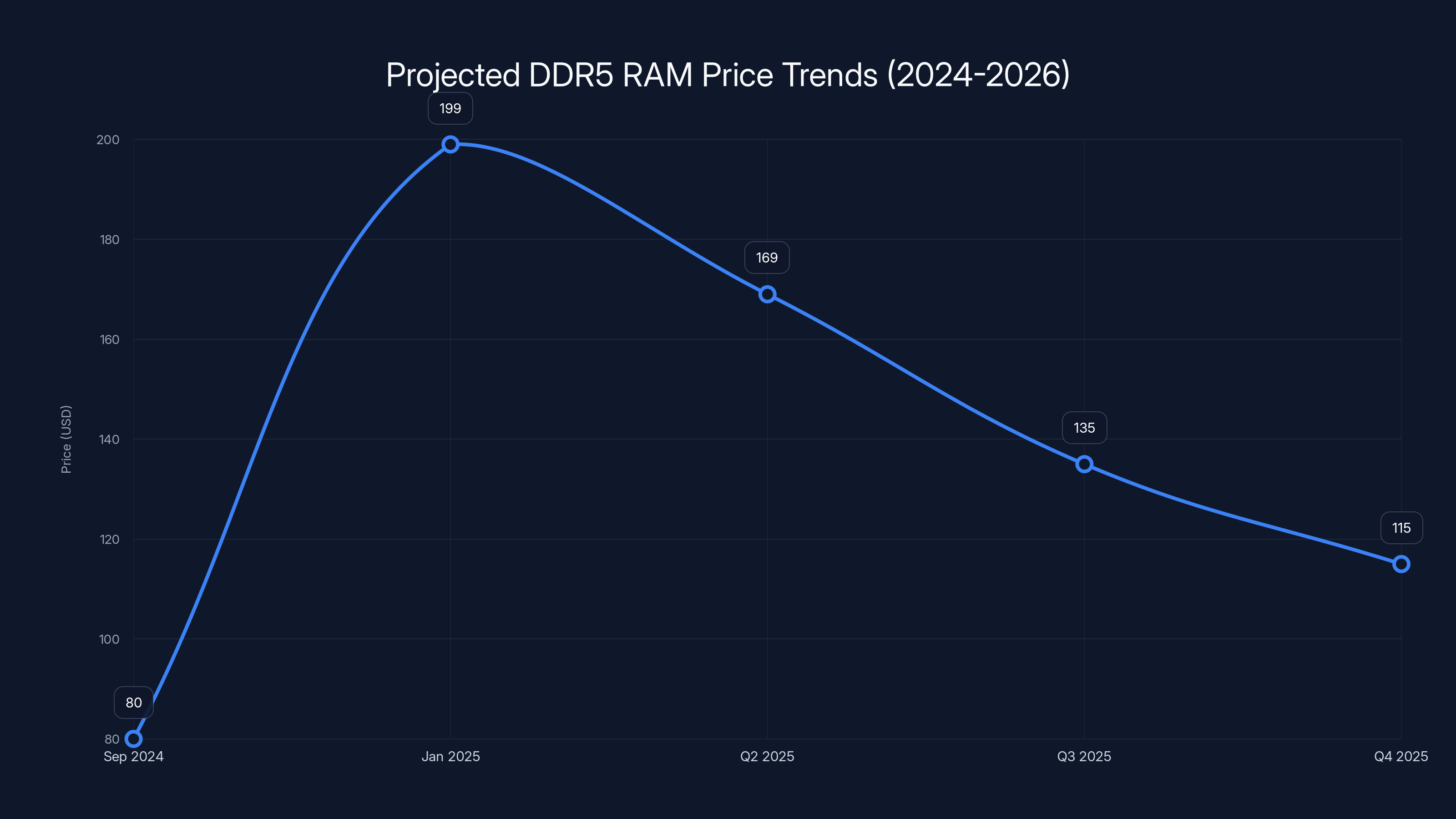

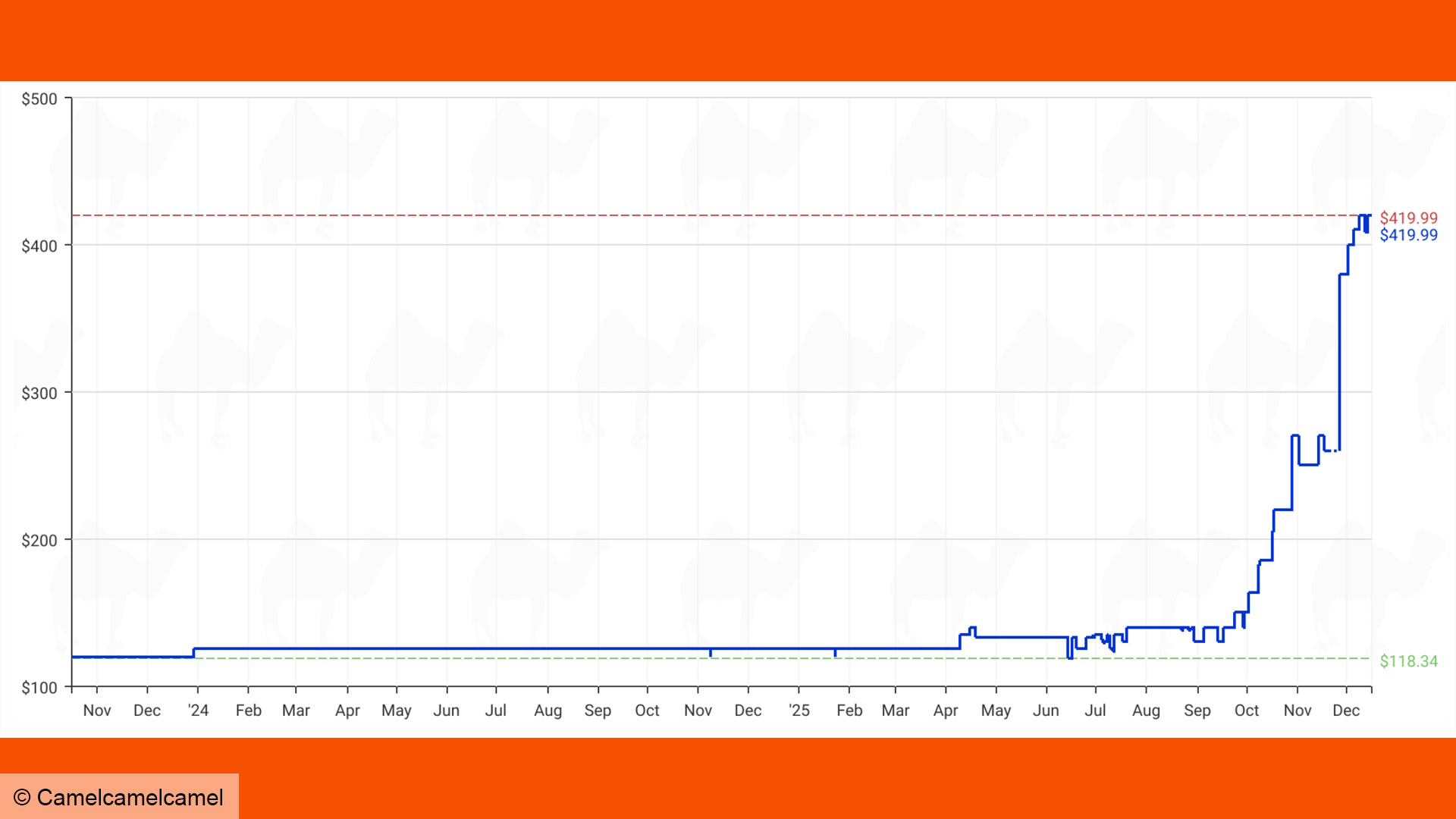

DDR5 RAM prices surged by over 150% from Sep 2024 to Jan 2025. Prices are expected to gradually decrease, potentially normalizing by Q4 2025. Estimated data based on market predictions.

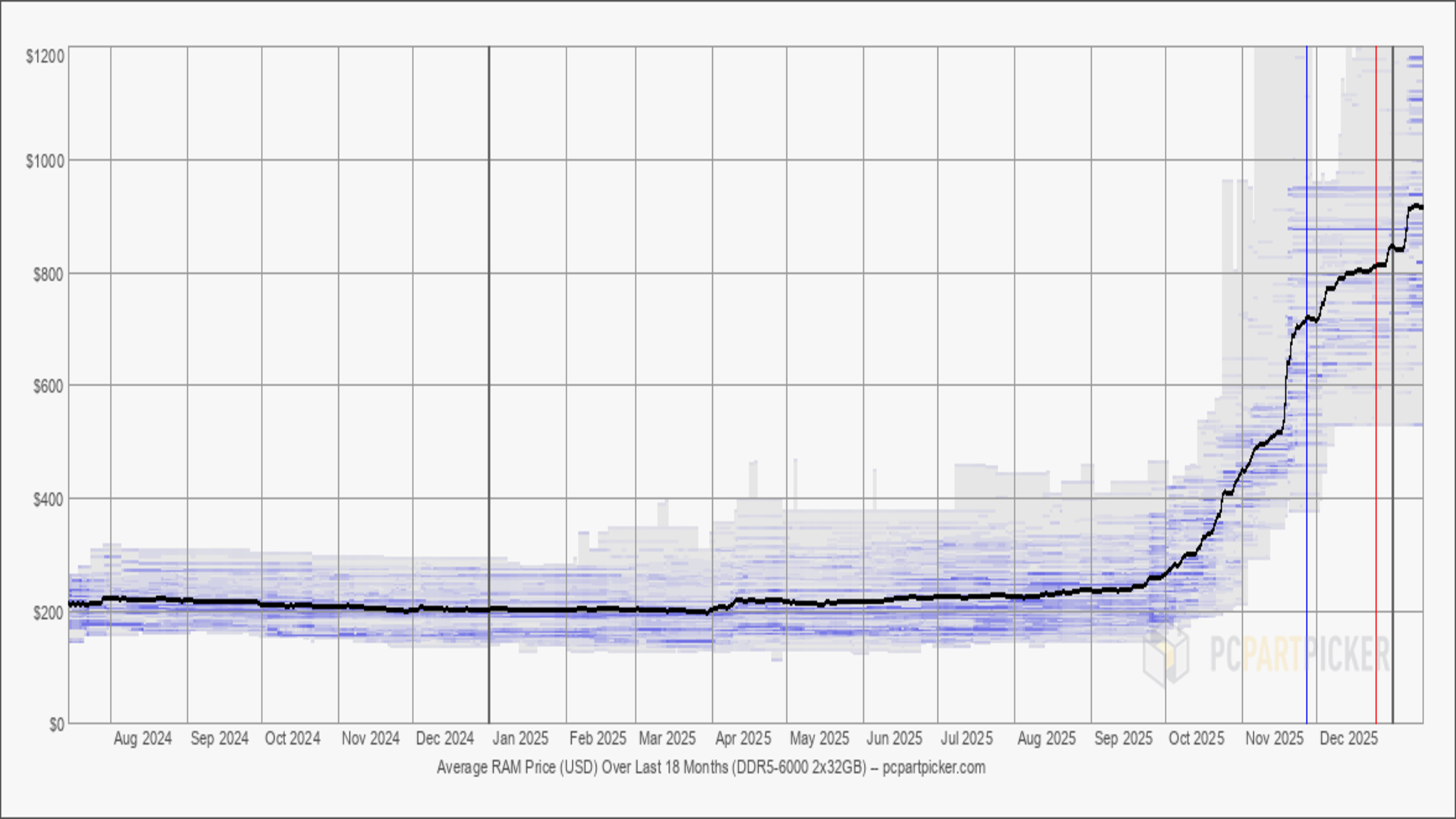

The Timeline: How We Got Here in Five Months

Understanding exactly when things went wrong helps predict what happens next.

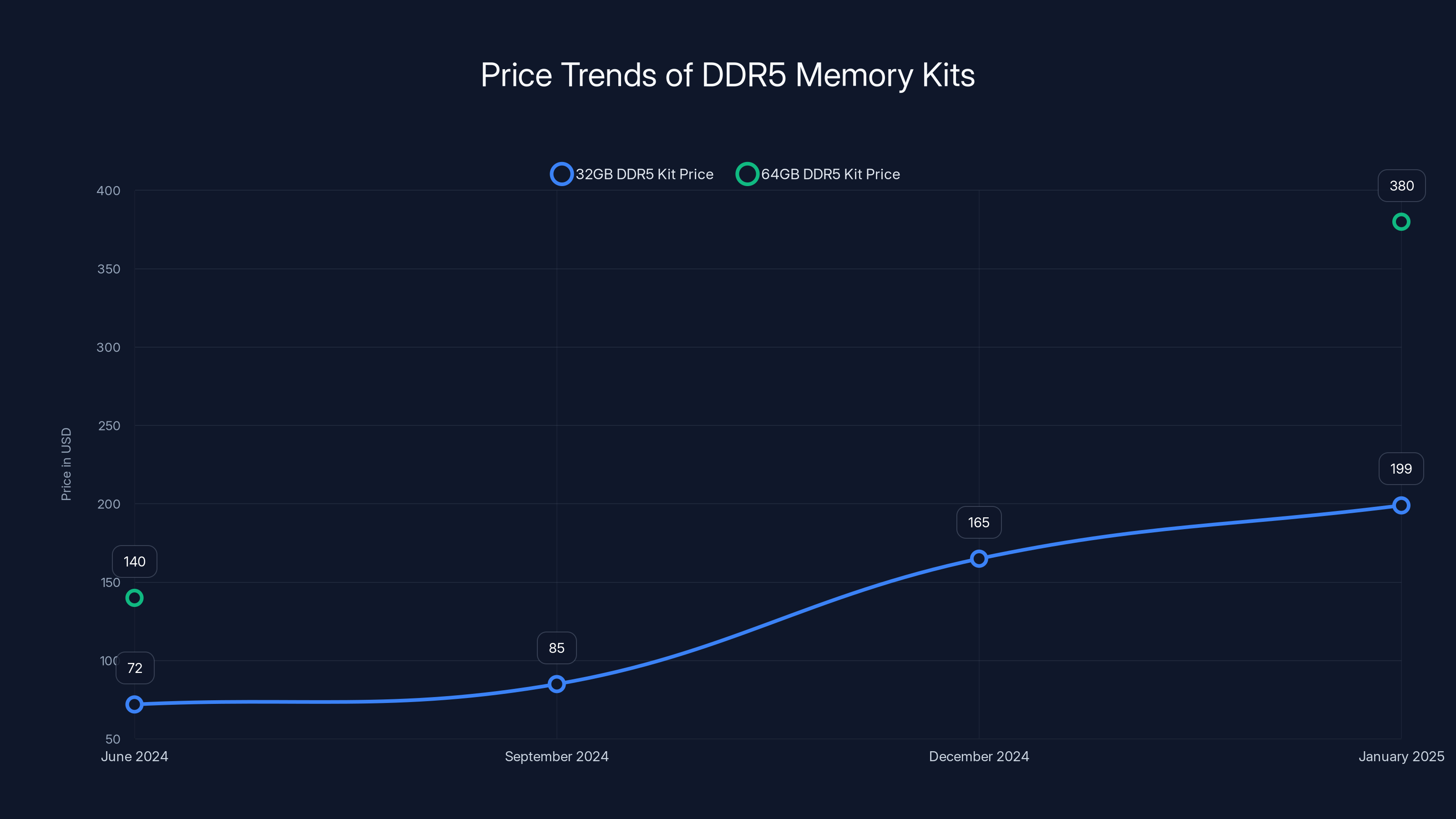

In June 2024, DDR5 32GB kits were hitting lows of

By August 2024, prices started twitching upward. Not dramatically, but noticeably. You could feel the market shifting. Retailers who'd been aggressively discounting suddenly became more cautious. The deals dried up faster than usual after back-to-school promotions ended.

September 2024 was the inflection point. Production cut announcements from Samsung and SK Hynix hit. Prices jumped 15% to 20% in the span of two weeks. This was unusual enough that tech forums started buzzing about it.

From October through December 2024, it was chaos. Prices kept climbing. Retailers either had nothing in stock or were charging premium prices for what they did have. Some sellers were clearly hoarding inventory, waiting to price-gouge.

By January 2025, we hit the current situation. That

Memory Types: Why DDR5 Got Hit Hardest

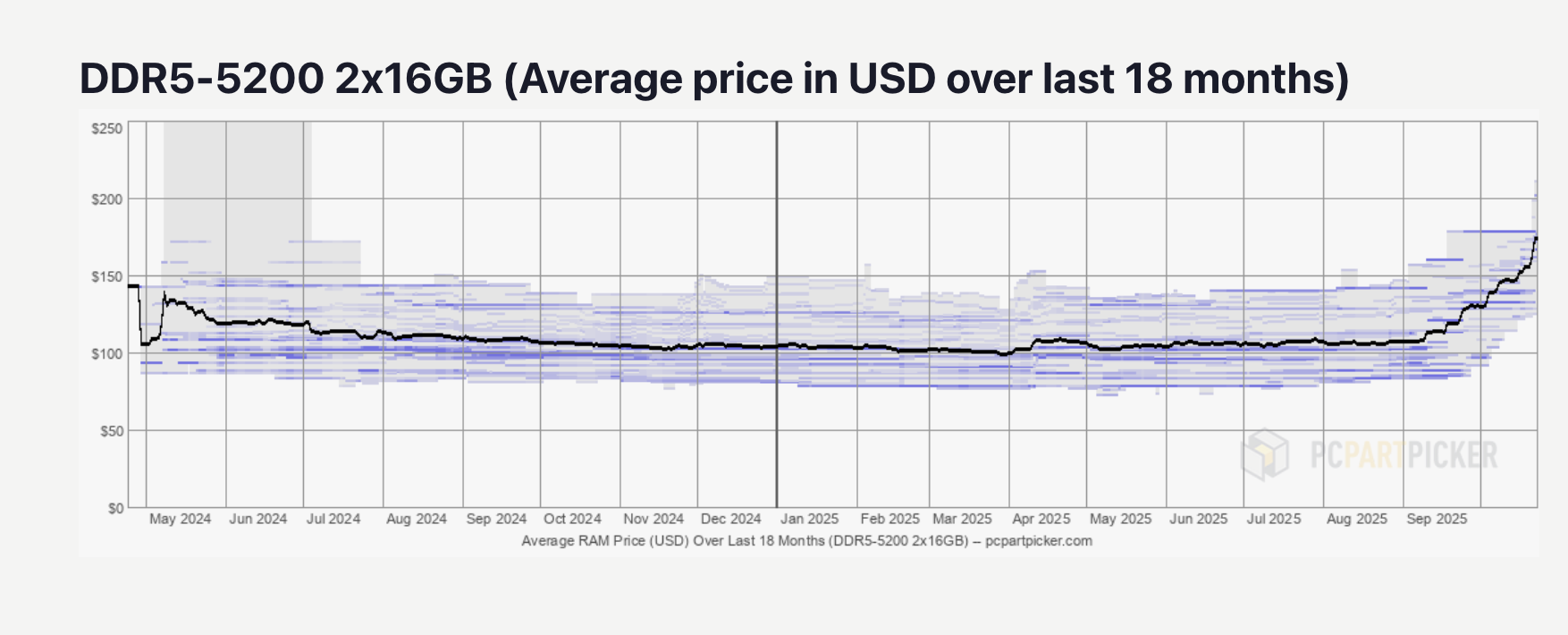

Not all RAM got expensive equally. This matters when you're trying to understand what's actually going on.

DDR5 took the biggest hit because it's the newest standard. Most capacity exists in DDR5 now since manufacturing shifted away from DDR4 starting in 2023. When supply got tight, there was nowhere to fall back to. DDR5 is also what cutting-edge systems need, so demand stayed strong even as prices climbed.

DDR4 actually became somewhat harder to find paradoxically. Since manufacturing capacity shifted to DDR4 production, and old-stock inventory got depleted, some DDR4 configurations actually went up in price too. Not as dramatically as DDR5, but noticeably. Some older laptop RAM and server-grade DDR4 actually became scarce.

Server-grade memory and high-bandwidth memory (HBM) for AI accelerators saw even crazier price movements. Some enterprise configurations doubled or tripled in price. This was driven by the absolute feeding frenzy around AI infrastructure buildout.

The consumer impact? Most people building PCs need DDR5 for anything remotely modern. If you're building around an Intel 13th-gen or newer, or AMD Ryzen 7000 series or newer, you're stuck with DDR5. There's no good fallback option.

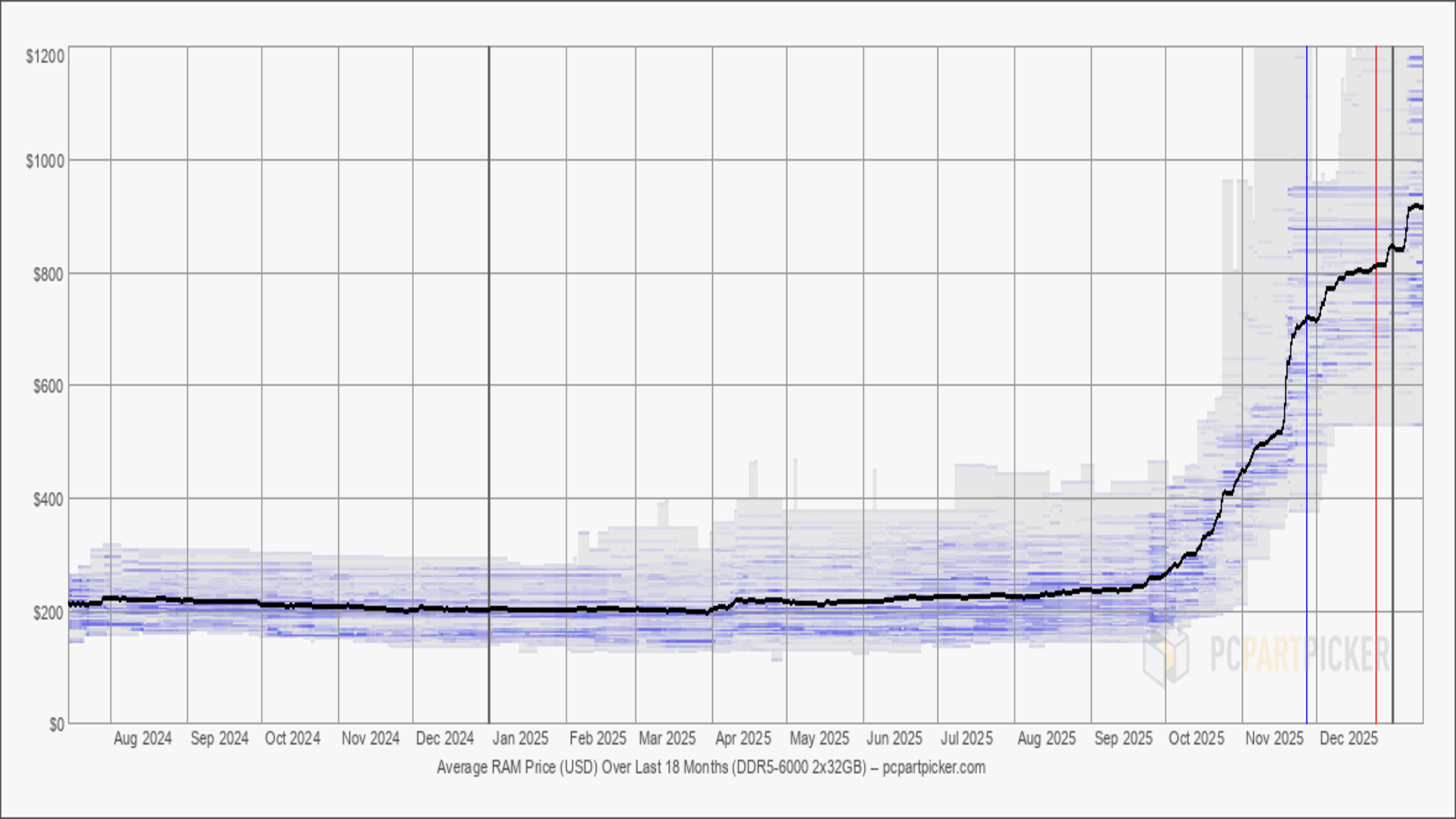

DDR5 memory kit prices have surged dramatically, with 32GB kits increasing by 176% and 64GB kits by 171% from June 2024 to January 2025.

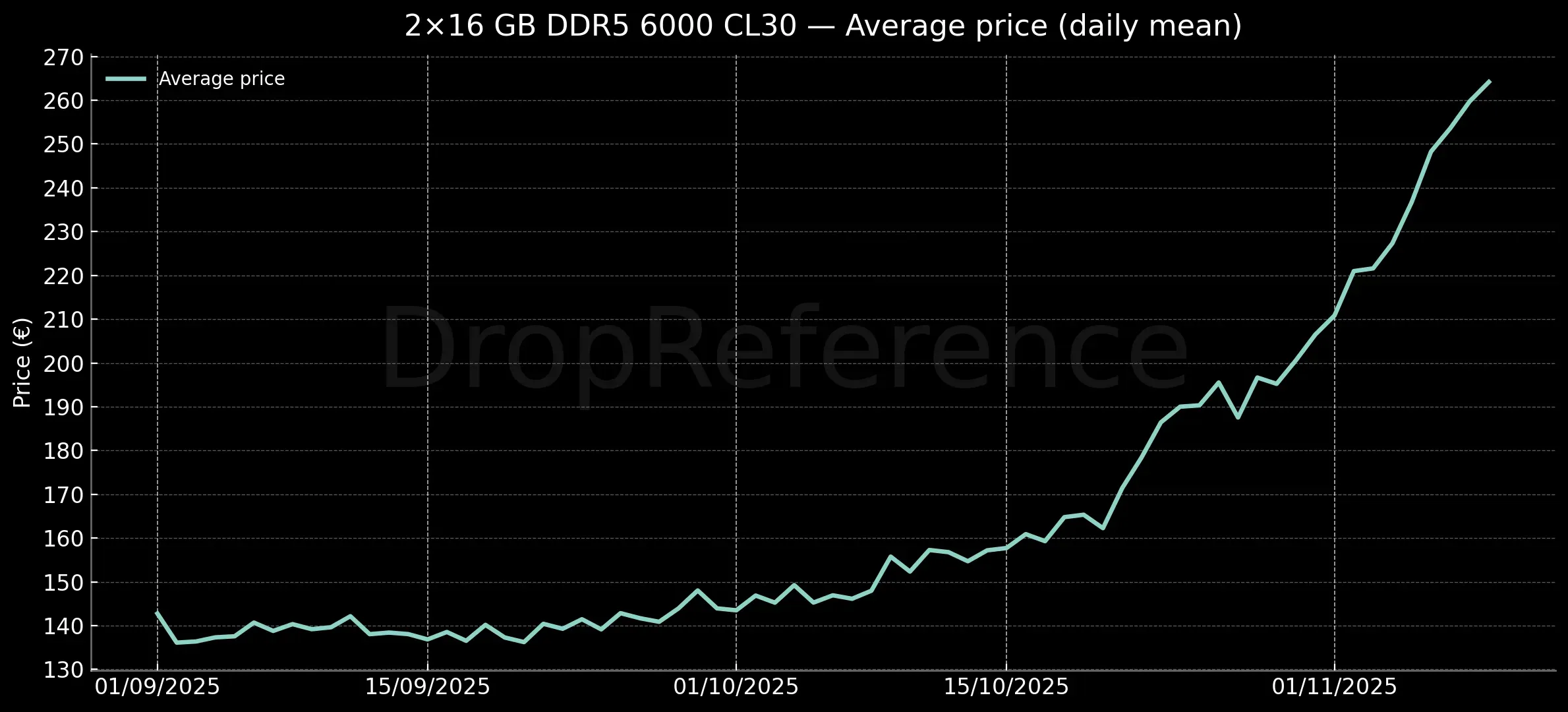

The Numbers Behind the Squeeze: What the Data Shows

Let's look at actual pricing data to understand the scale of this problem.

A 32GB DDR5-6000 CAS 30 kit serves as a good benchmark because it's what most mainstream builders grab:

- June 2024: $72 average retail

- September 2024: $85 average retail

- December 2024: $165 average retail

- January 2025: $199 average retail

That's a 176% increase in seven months. Even accounting for Black Friday and holiday noise, the trend is unmistakable.

For 64GB kits, which are becoming more common:

- June 2024: $140 average retail

- January 2025: $380 average retail

That's a 171% jump. Expensive gets more expensive.

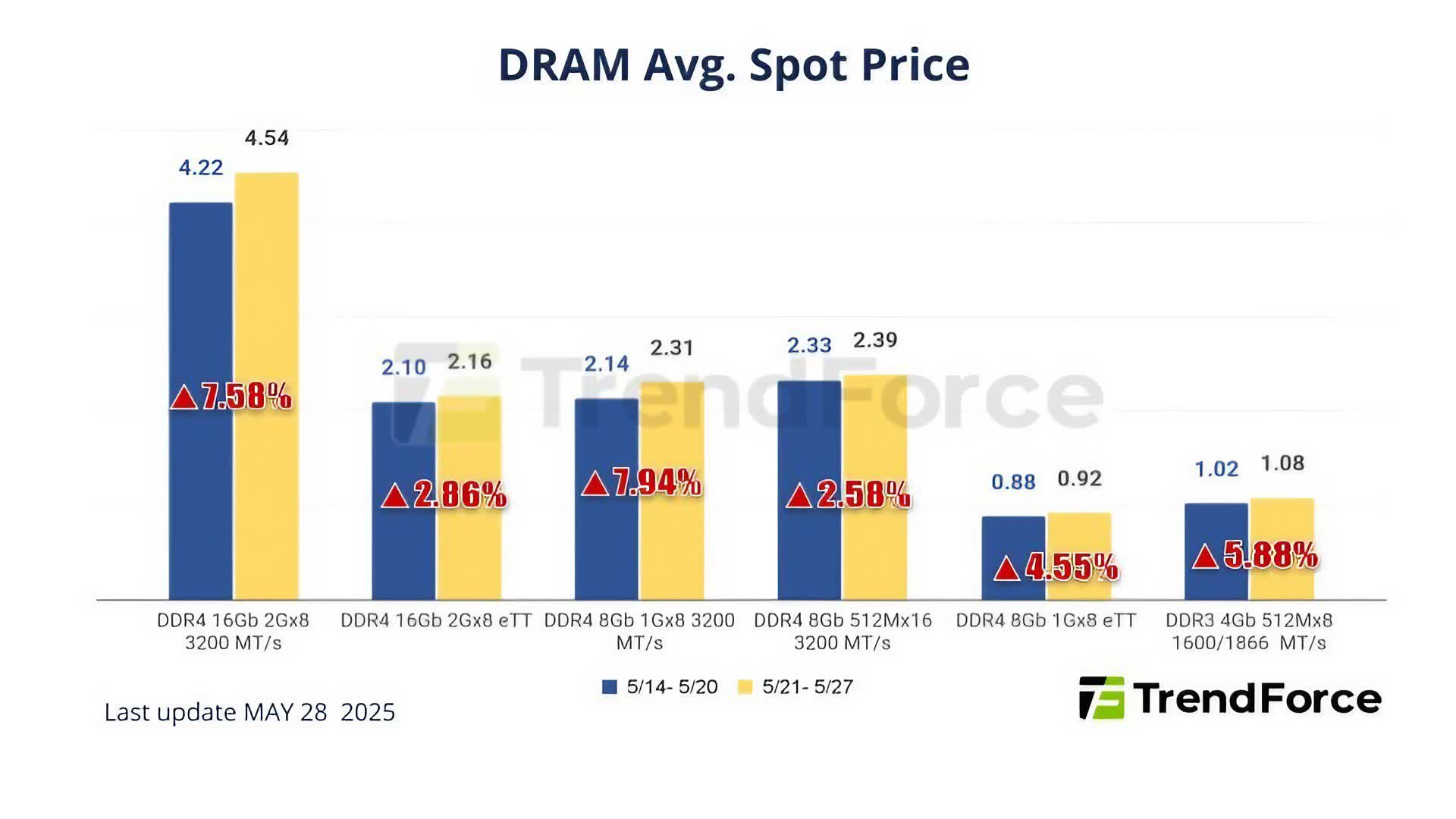

The spot market, which is what manufacturers actually pay, tells an even more dramatic story. DRAM spot prices went from roughly

What's fascinating is that these prices are still lower than they were during the chip shortage of 2021-2022, when DDR4 was hitting $80+ for 32GB kits. But that's cold comfort when you're building a PC in 2025.

Manufacturing Reality: Why Production Cuts Made Everything Worse

This part of the story is where people usually get confused. Cutting production sounds like it should help supply constraints. Doesn't it?

Not in the way most people think.

When manufacturers announced production cuts in late 2024, they weren't trying to fix the market overnight. They were trying to stabilize prices after months of losing money. Here's the actual sequence:

- Too much supply (early 2024) → prices collapse → manufacturers losing money

- Manufacturers cut production (August-September 2024) → intended to reduce supply slowly

- But demand shifts happen faster than production cuts → shortage develops

- Shortage + inventory hoarding by retailers → prices spike hard

- Manufacturers still ramping down production → shortage persists

The timeline matters here. Production cuts announced in September don't actually show up as reduced shipments until November or December. By then, the shortage is already here, prices are already spiking, and it's too late to course-correct quickly.

Samsung, SK Hynix, and Micron all said they'd be cutting production through Q1 2025. That means we're still in the squeeze period. Even if they ramp back up tomorrow, the actual relief at retail won't show until Q2 at the earliest.

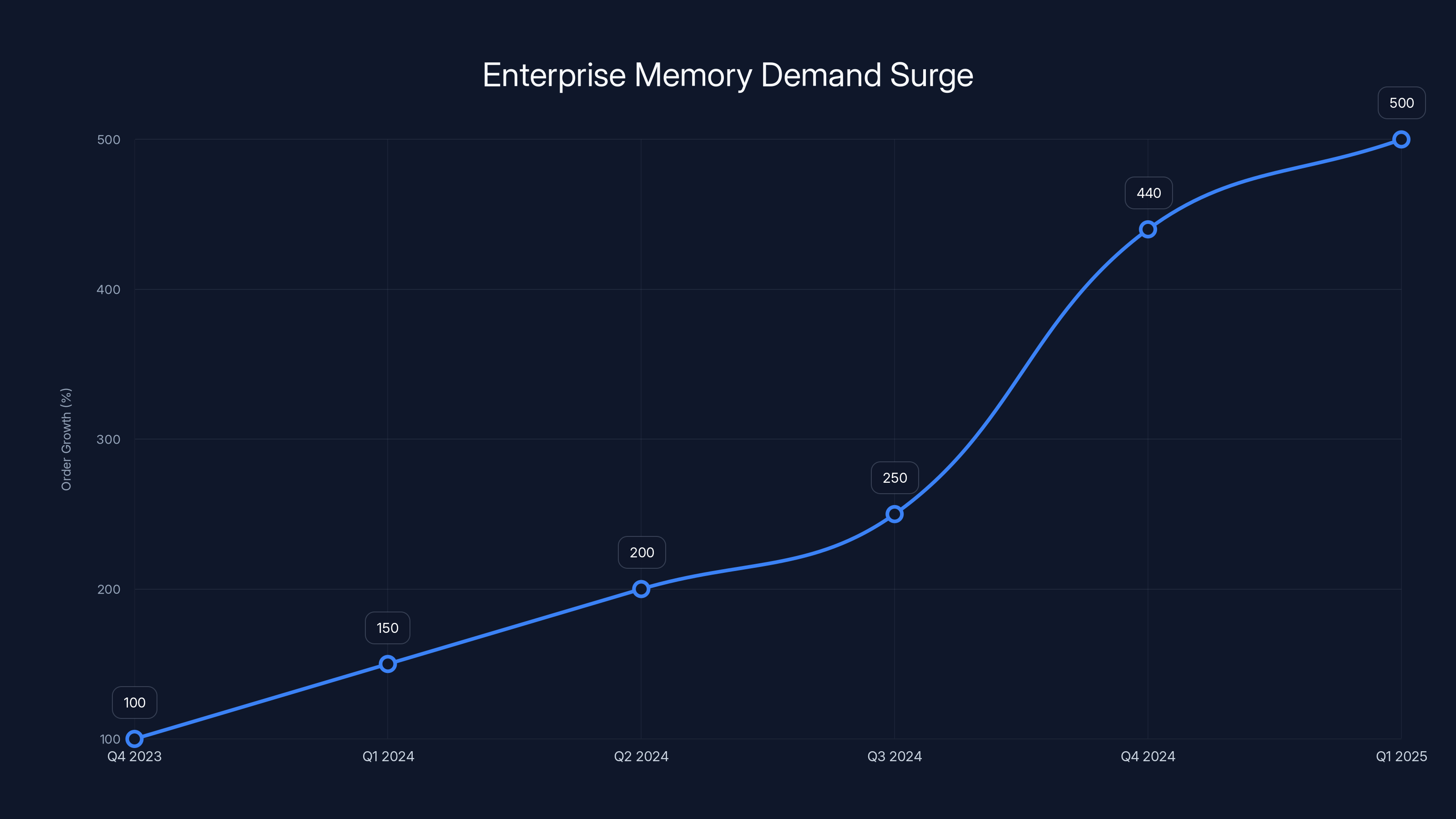

Enterprise Demand: The AI Suction Cup Pulling Memory Everywhere

Here's what most people don't realize when they're buying RAM for their gaming PC: they're actually competing for the same supply as data centers.

AI infrastructure buildout in 2024 and 2025 has been absolutely insane. Every major cloud provider (AWS, Azure, Google Cloud, etc.) is racing to build out GPU clusters for AI workloads. Those clusters need memory. Lots of it.

A single H100 GPU in a data center can use 80GB of high-bandwidth memory. A big enterprise might order thousands of H100s. That's hundreds of terabytes of memory, all bought at once, all at premium enterprise pricing.

When Nvidia, AMD, and other GPU makers can't keep up with demand for the actual chips, the next constraint becomes memory. If you're a data center operator and you can get GPUs, you'll buy as much memory as you can get. Why? Because memory doesn't go obsolete. Even if you have to pay 50% more for it today, you'll use it for years.

Consumer buyers, meanwhile, are price-sensitive. If DDR5 gets too expensive, they'll either:

- Delay their PC build

- Buy fewer modules (16GB instead of 32GB)

- Go back to older systems

- Buy AMD systems instead of Intel (AMD doesn't need as much RAM for the same performance)

So when memory gets tight, enterprise demand wins that auction every time.

The secondary effect? Retailers who supply both consumer and enterprise customers started prioritizing enterprise orders. A distributor shipping 1000 kits to a data center makes more money per unit than selling consumer kits to retailers. The economics are just better.

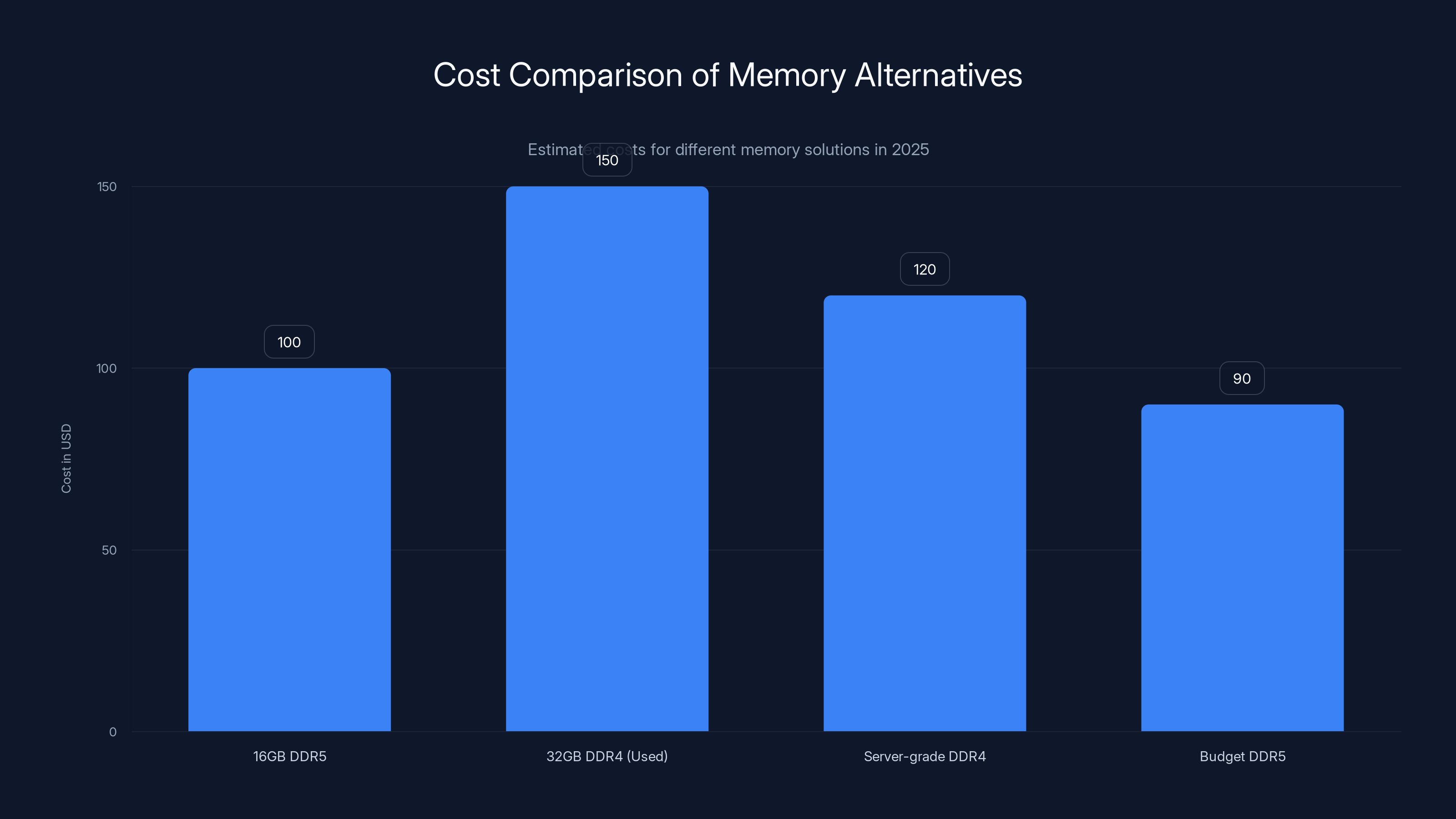

Estimated data shows budget DDR5 as the most affordable option, while 32GB DDR4 (used) offers a balance between cost and capacity.

Regional Variation: Why Your Country's Prices Are Different

If you're outside the United States, you probably noticed that DDR5 got expensive in your country too. But the magnitude might be different.

European markets saw similar percentage increases but sometimes smaller absolute prices due to different import dynamics and local inventory. UK and Northern European countries were hit harder because they depend more on imports. Germany and Netherlands, being distribution hubs, sometimes had slightly better availability.

Asia-Pacific markets are wild. Australia and New Zealand saw even more dramatic price increases than the US because they're at the end of the supply chain. Singapore and Hong Kong, being manufacturing hubs, had better availability and smaller price increases.

China had completely different dynamics. Chinese manufacturers not affected by export restrictions maintained lower prices, but Chinese consumers face tariffs and import costs for Western brands. Domestic brands like Zhixi and Apacer stayed cheaper.

What this means: if you're in a region where imports are slower or more expensive, you probably got hit even harder than US consumers. That

What's Happening With Retailers: The "Flash Deal" Nonsense

Let's talk about Amazon calling a

This is a psychological trick that works because most people don't remember prices from four months ago. A "flash deal" implies scarcity and urgency. It makes you feel like you're getting something special. In reality, they're just pricing the only stock they have.

Here's what actually happened with retailers:

- Q3 2024: Retailers have excess inventory from the oversupply period. Prices are aggressively discounted to clear stock.

- September 2024: Production cuts announced. Smart retailers start holding back inventory. Dumb retailers keep discounting trying to move everything.

- October-December 2024: Shortage develops. Retailers who held inventory now have leverage. They can price high because there's nowhere else for consumers to buy.

- January 2025: Stock is low. Any kit they have gets priced at whatever the market will bear. They call it a "flash deal" to manufacture urgency.

The retailers aren't stupid. They're exploiting the situation, but they're also constrained by their own supply. When you only have 50 units of a particular DDR5 kit left and you're getting 500 orders per week, you can either:

- Sell out in a day at old prices

- Raise prices to allocate scarce stock

Most retailers chose option 2. Can't blame them from a business perspective, but calling it a "deal" is marketing spin.

Impact on PC Builders: The Real Cost of Waiting

Let's do some actual math on what this means if you're building a PC right now versus waiting.

Scenario 1: Build today with current prices

- 32GB DDR5: $199

- Rest of system: $1,500

- Total: $1,699

Scenario 2: Wait three months for memory prices to normalize

- 32GB DDR5: $120 (estimated)

- Rest of system: $1,500 (might be slightly cheaper, might be more expensive—unknown variable)

- Total: $1,620

- Plus: You wait three months

- Plus: Hardware you were waiting for might be released, changing your calculus anyway

The math says waiting saves

For most people, the pragmatic choice is: buy what you need now if you can afford it. The memory cost is painful, but waiting costs you time. Time is worth money too.

For content creators who render videos or do 3D work, waiting might make sense. An extra 2-3 months of productivity on your new system could be worth the $79 savings.

Enterprise memory orders surged by 340% in Q4 2024 compared to Q4 2023, driven by AI infrastructure demands. Estimated data for 2025 shows continued growth.

Professional Sectors Getting Hit: Beyond Gaming

The RAM crisis isn't just affecting PC gamers. Entire industries are feeling the pinch.

3D Animation and VFX studios were particularly hard-hit because they were already investing in high-capacity RAM systems. Studios that were planning to upgrade their render farms in Q4 2024 or Q1 2025 suddenly faced 40-50% higher memory costs. Some pushed projects back or scaled down their hardware plans.

Data Science and Machine Learning teams needed massive RAM for training models locally before pushing to cloud. Organizations that were planning to upgrade their ML workstations got budget-shock when they saw memory costs.

Financial institutions running complex trading simulations and risk models—they use tons of RAM. Some trading firms that rely on sub-millisecond response times were already maxed out on system resources. The memory price spike meant they couldn't expand their capacity cheaply.

Video game development studios were affected twice: once for their own infrastructure, and again because their contractors and freelancers couldn't afford high-end workstations.

The common thread: anyone with capacity-dependent workloads got squeezed.

Manufacturer Statements: What They're Actually Telling Us

Let's decode what the manufacturers have actually said versus what they're implying.

Samsung said: "We're optimizing our bit supply to support market demand." Translation: We're cutting production because we're losing money at current prices.

SK Hynix said: "We're adjusting bit supply growth to balance market conditions." Translation: Same thing, more diplomatic phrasing.

Micron said: "We expect DRAM pricing to stabilize in 2025." Translation: We hope prices stay high enough that we don't lose money.

None of them said, "Prices will come down." None of them said, "Consumers are getting a raw deal." They said prices will stabilize, which is not the same thing.

Stabilize at what level? Manufacturers don't care if it's

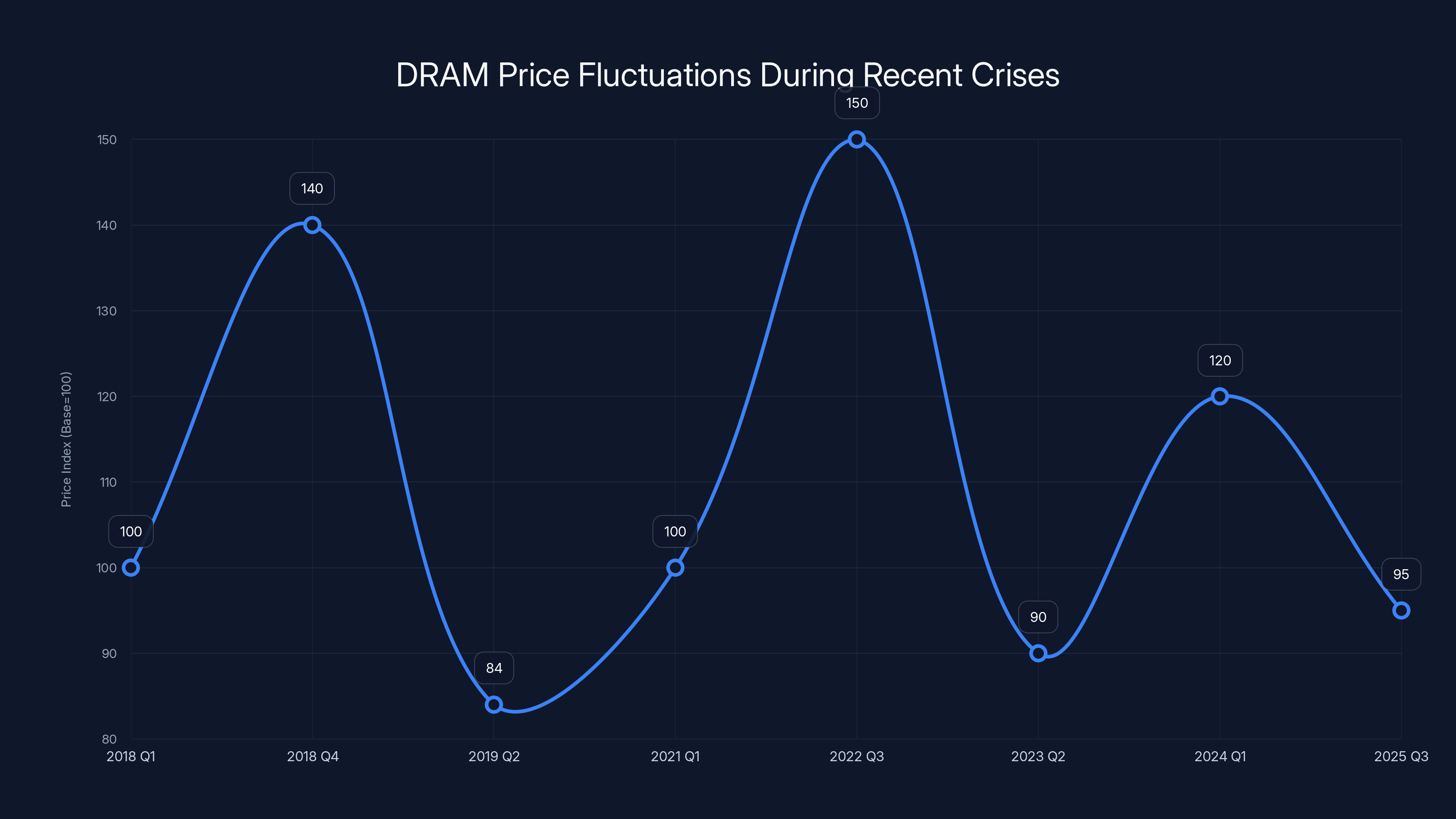

Comparing to Past Crises: Historical Context Matters

Memory prices spike every few years. Understanding how this compares to previous crises helps calibrate expectations.

The 2021-2022 Chip Shortage: DDR4 went crazy, hitting $80+ for 32GB. DDR5 was just becoming available and super expensive (because it was new). This lasted roughly 12-14 months before prices normalized. The eventual drop was dramatic.

The 2018-2019 Correction: DRAM prices peaked after years of growth, then dropped 30-40% in a relatively short time. That was driven by oversupply, similar to early 2024.

Normal market cycles: DRAM prices fluctuate 15-25% in regular years. Sometimes they rise, sometimes they fall. 150% moves are unusual but not unprecedented.

The current situation is closer to 2021-2022 in magnitude but different in character. Back then, supply was physically constrained (factories couldn't produce). Now, supply is constrained by manufacturer choice (factories won't produce at loss-making prices).

The 2021-2022 shortage lasted until roughly mid-2023 before prices stabilized. Current predictions suggest we'll see relief starting in Q2 or Q3 2025, which would be 6-9 months from the peak. That's actually faster than the last major crisis.

DRAM prices have shown significant volatility during past crises, with notable peaks in 2018-2019 and 2021-2022. Current trends suggest a faster recovery compared to previous disruptions. (Estimated data)

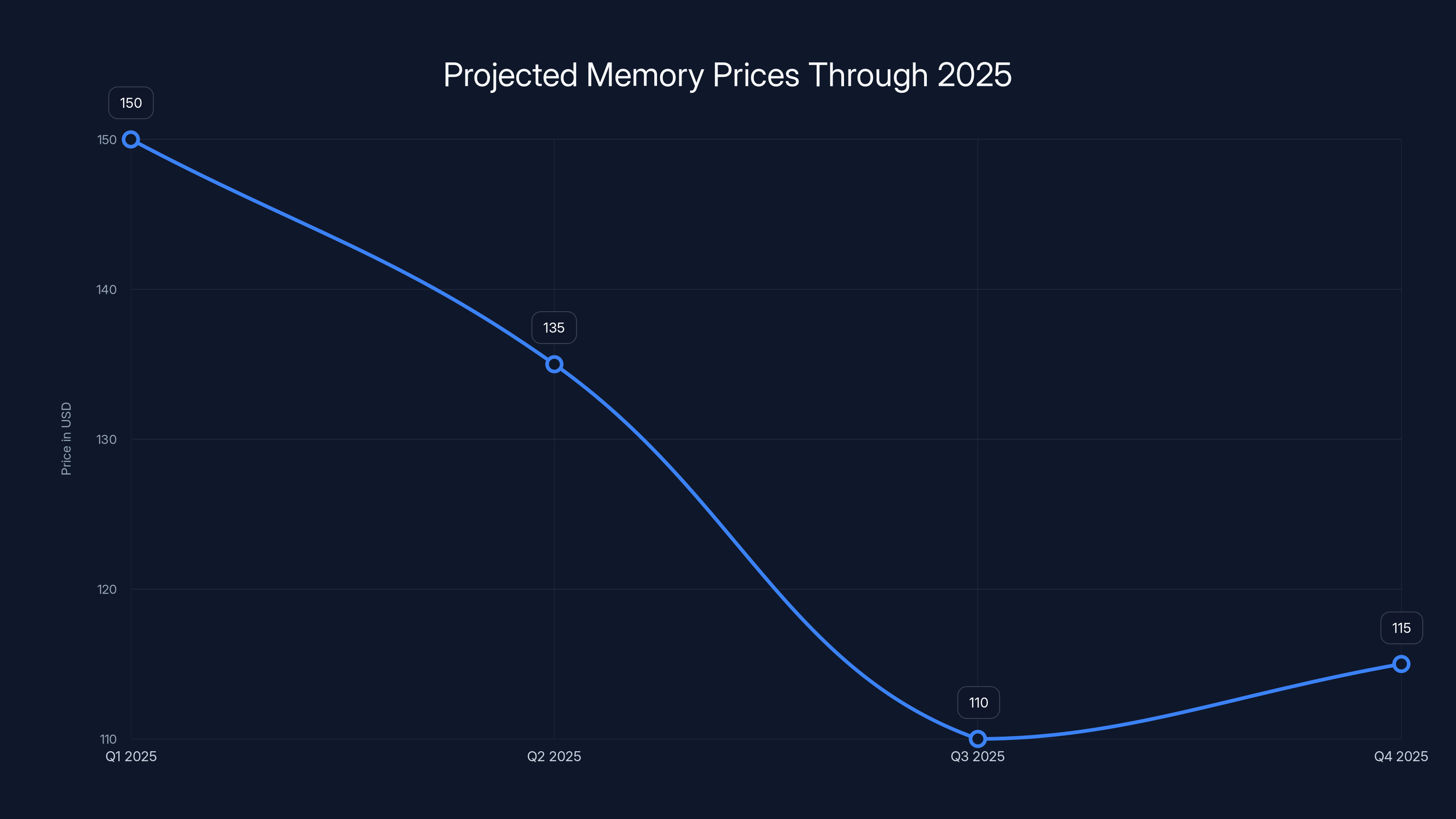

Future Predictions: When Does This End?

Crystal ball time. Here's what the supply chain usually looks like.

Q1 2025 (Current): Prices remain elevated. Production cuts still in effect. No relief yet.

Q2 2025 (April-June): Manufacturers should start seeing stable pricing. They'll begin ramping production back up gradually. Retail prices start creeping down, maybe 10-15% relief.

Q3 2025 (July-September): Supply catches up with demand. Prices drop more noticeably, maybe 25-35% from current levels. This is when it becomes worth buying again if you haven't already.

Q4 2025 and beyond: Prices normalize around $100-130 for mainstream 32GB kits. Possible oversupply again if manufacturers ramp too aggressively.

The wildcard: What if AI demand doesn't cool down? If data center orders stay at 2024 levels through 2025, consumer memory will stay constrained and expensive. That's the biggest risk to this forecast.

Another wildcard: Geopolitical escalation. If export restrictions to China get worse, some supply chain disruption could happen. If they ease, Chinese manufacturers could flood the market and drive prices down faster.

Based on typical market behavior and manufacturer timelines, expect meaningful price relief by mid-2025, substantial relief by late 2025.

Strategic Advice: How to Navigate This Right Now

Okay, practical time. Here's what you should actually do.

If you absolutely need a PC: Buy DDR5 at current prices. It sucks, but having the system now is worth more than saving $100 in three months. Get 32GB minimum—it's the future-proof choice.

If you can wait 2-3 months: Wait. Q2 2025 should see some meaningful price drops. It's not worth building now just to have the system 2 months earlier.

If you can wait 4-6 months: Definitely wait. Q3 2025 prices will be significantly better. Saving $150+ is worth delaying your build.

If you're going high-end (64GB): The price premium is even more insane right now. Seriously wait if you can. The percentage drops will be steeper for premium configurations.

Special case—professional work: If you need the system for income-generating work, buy now. Lost productivity costs more than expensive RAM.

Special case—content creator: Depends on your timeline. If you have projects coming, buy now. If things are slow and you can push projects, wait.

The Broader Implication: What This Says About Market Dynamics

Step back from just RAM for a second. This situation reveals something important about tech markets in 2025.

Manufacturers have incredible pricing power right now. They can throttle supply and move prices without much resistance because:

- There's no meaningful alternative product

- Enterprise demand will buy at any price

- Consumer demand is price-sensitive but willing to wait

- Retailers can't do much about it

This is a fundamentally different market than, say, CPUs or GPUs, where competition is more intense. DRAM is a commodity product with limited differentiation. When supply gets tight, whoever controls production controls prices.

It also shows how AI infrastructure buildout is genuinely reshaping the entire tech supply chain. Enterprise demand for AI is so massive that it's absorbing supply that would normally flow to consumer products. That dynamic probably persists through 2025.

For consumers, the implication is uncomfortable: if enterprise demand for any tech component stays high enough, consumer supply will remain constrained and expensive. We might be seeing a new normal where consumer hardware stays more expensive than it was in 2020-2023.

Estimated data shows memory prices starting to decrease in Q2 2025, with significant relief by Q3 2025 as supply catches up with demand.

Alternative Solutions: When DDR5 Is Too Expensive

If current DDR5 prices are genuinely unaffordable, you have some (imperfect) options.

Go with 16GB instead of 32GB: Not ideal for future-proofing, but 16GB DDR5 is actually usable for gaming and most productivity work in 2025. Prices are slightly better per-gigabyte. You can always upgrade later.

Consider AMD Ryzen 5000 or 7000 series used: DDR4 systems are still functional and actually more affordable right now. A used Ryzen 7000 system with 32GB DDR4 might cost less than a new DDR5 build with 16GB. The used market has good inventory.

Server-grade DDR4 for non-gaming work: If you do data science, coding, or content creation, server-grade DDR4 ECC RAM is sometimes cheaper per-gigabyte than consumer DDR5. Not ideal for gaming, but perfectly fine for work.

Wait for next-generation console architectures: PS5 Pro and upcoming Xbox systems might trigger CPU/motherboard refresh cycles that change the value proposition. Sometimes waiting for generational transitions pays off.

Budget tier DDR5: The absolute cheapest DDR5 (CAS 40, slower speeds) is cheaper than premium DDR5. Slight performance hit, but your gaming experience difference will be maybe 2-3% worse. Worth considering if price is the bottleneck.

None of these are ideal. But they're real options if you need a system now and can't drop $200 on memory.

Building Your System Anyway: If You Must Buy

If you're building now despite the prices, here's how to minimize the damage.

Don't buy high-end DDR5. The performance difference between CAS 30 and CAS 40, between DDR5-6000 and DDR5-5600, is genuinely small for most workloads. A

Buy reputable brands. Corsair, G. Skill, Kingston, and Crucial all have solid 32GB kits in the

Pair with power-efficient CPUs. If memory is expensive, at least pair it with a CPU that doesn't need tons of bandwidth. Intel 13th or 14th gen pairs nicely with DDR5 and doesn't require the fastest memory. AMD Ryzen 9 9950X actually prefers slower, cheaper DDR5 to fast DDR5.

Consider the motherboard carefully. Some boards have better power delivery and memory overclocking headroom, meaning you might not need the fastest RAM. A good $150-180 board can work magic with mid-tier memory.

Buy from retailers with good return policies. If prices drop 15% in the next month, you want to be able to return and reorder. Amazon and Newegg's 30-day return windows are lifelines.

Common Mistakes to Avoid When Buying DDR5 Right Now

People are making predictable errors in this market. Don't be them.

Mistake 1: Overbuying capacity. Some people are panic-buying 64GB kits thinking prices will skyrocket further. 32GB is enough for 99% of people. Save the money.

Mistake 2: Buying the fastest RAM expecting huge performance gains. DDR5-7200 CAS 28 costs

Mistake 3: Buying without checking compatibility. Some older DDR5 boards have weird compatibility quirks with newer RAM. Check your motherboard's QVL (Qualified Vendor List) before buying random kit.

Mistake 4: Not checking return policies. If you buy from some random marketplace seller, you might not be able to return if prices drop. Stick to Amazon, Newegg, B&H Photo.

Mistake 5: Assuming current prices are temporary. They might not be. Prices might creep up further before coming down. Budget accordingly.

Mistake 6: Comparing to peak shortage prices. Yes, it's cheaper than 2021-2022 peak. But that's not the relevant comparison. Compare to September 2024 or mid-2023 prices. Those are the true baseline.

The Bigger Picture: Why Tech Pricing Feels Broken Right Now

This RAM situation is part of a larger pattern in 2025 tech markets.

GPU prices stayed weirdly high through 2024 even as new-generation cards launched. SSDs are more expensive than they were in 2023. Power supplies jumped in price. Even DDR4 RAM, which is supposedly obsolete, got more expensive.

The common thread isn't supply constraints. It's enterprise demand for AI infrastructure pulling on every supply chain simultaneously, and manufacturers recognizing they can charge more when demand is high.

Consumer tech in 2020-2022 benefited from excess manufacturing capacity and competition driving prices down. 2023 was the sweet spot for value. 2024-2025? Manufacturers have tighter control of supply, and enterprise demand is more aggressive.

This might be the new normal. Not as bad as the 2021-2022 shortage, but worse than the 2023 peak-value moment.

Historically, these cycles eventually shift. By 2026-2027, if AI demand stabilizes or slows, you'll probably see consumer tech prices normalize again. But for the next 12-18 months, expect to pay more for less. Plan accordingly.

FAQ

What is the DDR5 RAM price crisis?

The DDR5 RAM price crisis refers to the dramatic price increase in consumer DDR5 memory modules from mid-2024 to early 2025, where prices increased by 150-200% in just six months. A 32GB DDR5 kit that cost

Why did DDR5 RAM prices increase so dramatically?

Multiple factors converged simultaneously: manufacturers cut production starting in August-September 2024 to stabilize prices after the oversupply period of 2023-2024, enterprise data centers building out AI infrastructure created massive demand that prioritized high-margin corporate orders over consumer supply, geopolitical restrictions on semiconductor exports to China created uncertainty about future capacity, and retailers began hoarding inventory rather than selling at loss-making prices. The combination created a perfect storm that compressed consumer supply while demand stayed strong.

How long will DDR5 prices stay elevated?

Based on typical market cycles and manufacturer timelines, expect meaningful price relief starting in Q2 2025 (April-June), with 15-25% drops from current levels. Substantial relief should arrive by Q3 2025 (July-September) with another 20-30% decrease. Complete normalization to $100-130 per 32GB kit probably occurs by Q4 2025 or early 2026. The timeline assumes AI demand doesn't further accelerate and geopolitical factors don't worsen.

Should I build my PC now or wait for RAM prices to drop?

If you need the system now for work or gaming, buy now and accept the memory cost. If you can wait 2-3 months, consider waiting for Q2 relief. If you can wait 4-6 months until Q3 2025, definitely wait—you'll save $150+ per kit. For professional work that generates income, the productivity gain from using the system sooner usually justifies buying now. For hobbyist uses, waiting usually makes sense.

Which DDR5 kits represent the best value right now?

Current best value is mainstream DDR5-5600 or DDR5-6000 with CAS 30-40 latency from brands like Corsair, G. Skill, or Kingston in the

How does this compare to the 2021-2022 chip shortage?

The current situation is similar in percentage terms (150% price increases) but different in character. The 2021-2022 shortage was driven by physical production incapacity—factories literally couldn't produce enough. The current crisis is driven by manufacturer choice—factories can produce but won't at loss-making prices. The 2021-2022 shortage lasted 12-14 months. Current predictions suggest relief within 6-9 months, making this cycle shorter but still painful.

What impact does AI infrastructure demand have on consumer RAM prices?

AI infrastructure buildout in 2024-2025 is directly competing with consumers for the same DRAM supply. Data centers building out GPU clusters need massive amounts of high-bandwidth memory and pay enterprise prices without negotiating much. When supply is tight, enterprise demand wins the auction because it offers higher profit margins. This phenomenon probably persists through 2025 as AI infrastructure buildout continues, meaning consumer supply will remain constrained relative to demand.

Are DDR4 RAM prices affected equally?

DDR4 saw smaller but notable price increases, roughly 30-50% depending on configuration. This is because DDR4 production is winding down and inventory is depleted, creating secondary scarcity. Most modern PC builds require DDR5 (Intel 13th gen+, AMD Ryzen 7000+), so DDR4 price movements matter less for new builds but might affect budget builds or used system purchases. Some server-grade DDR4 actually became scarce and expensive.

Should I consider older platform alternatives to avoid DDR5 costs?

For some use cases, yes. A used AMD Ryzen 7000-series system with 32GB DDR4 might cost less total than a new DDR5 build with 16GB, especially when factoring in current memory prices. However, this locks you into older architecture for 3-4 more years. Only practical if your workload doesn't require latest-gen CPU performance and you plan to keep the system several years.

Conclusion: The Painful Reality of 2025 PC Building

The RAM crisis is real, it's painful, and it's probably going to persist for the next 6-12 months. But it's also not the apocalyptic shortage of 2021-2022. You can still build a functional PC. It just costs more than it should.

The core lesson here is brutal but important: when enterprise demand is strong enough, consumer supply gets squeezed. AI infrastructure is reshaping tech markets in ways that most people building gaming PCs aren't even thinking about. The choices made by Meta, Open AI, Google, and other hyperscalers cascade down to affect your RAM prices.

For consumers right now, the pragmatic move is simple. If you need a system, buy the memory and accept the cost. If you can wait until mid-2025, absolutely wait. Either way, buy from retailers with good return policies. If prices drop 15% in the next month, you want options.

On the manufacturer side, this situation probably looks perfect. They're making more money on DRAM than they have in years. Enterprise demand is insatiable. Consumer demand is price-sensitive but still exists. They have zero incentive to flood the market with cheap chips.

Manufacturers will start ramping production as prices stabilize and margins look sustainable. That ramp will start appearing in retail around Q2 2025. By Q3, it should be obvious that the shortage is easing. By Q4, prices should be noticeably better.

Until then, if you see a "flash deal" on DDR5 RAM, remember: it's not a deal unless it's cheaper than it was four months ago. And right now, nothing is.

The wait is the hardest part. But for most people, waiting pays off.

Key Takeaways

- DDR5 RAM prices increased 150% from September 2024 (199) due to production cuts, enterprise AI demand, and retailer inventory manipulation

- Manufacturer supply decisions matter more than physical scarcity—DRAM makers cut production to stabilize margins, not because they couldn't make chips

- Enterprise data center buildout for AI infrastructure is competing with consumers for the same supply, and corporate buyers always win pricing auctions

- Meaningful price relief should arrive Q2-Q3 2025, but prices will likely stay elevated through Q1 2025 as production cuts remain in effect

- If you need a PC now, buy at current prices and accept the cost; if you can wait 3-6 months, waiting saves $100-150 per memory kit

Related Articles

- Intel Core Ultra Series 3 Launch Delayed by Supply Crunch [2025]

- Kioxia Memory Shortage 2026: Why SSD Prices Stay High [2025]

- Data Center Backlash Meets Factory Support: The Supply Chain Paradox [2025]

- AMD vs Intel: Market Share Shift in Servers & Desktops [2025]

- AI Bubble or Wave? The Real Economics Behind the Hype [2025]

- How Trump's Tariffs Are Creeping Into Amazon Prices [2025]

![DDR5 RAM Price Crisis Explained: Why Prices Surged 150% [2025]](https://tryrunable.com/blog/ddr5-ram-price-crisis-explained-why-prices-surged-150-2025/image-1-1769440238430.jpg)