SMS Scams and How to Protect Yourself: Complete Defense Guide [2025]

Your phone buzzes. A message appears claiming your package won't arrive, asking you to click a link to reschedule delivery. Seems innocent enough. But that single click could drain your bank account, steal your identity, or give criminals access to your most sensitive information.

This isn't paranoia talking. SMS scams are exploding right now, and they're getting smarter every week.

We're in what security experts call "peak scam season"—the period after major holidays when cybercriminals go into overdrive. They know people are distracted, shopping online, making financial transactions, and generally letting their guard down. It's the perfect hunting ground.

Here's what makes SMS scams so dangerous compared to email phishing or other attacks: most people trust their phones more than any other device. When a message appears on your screen, it feels personal, immediate, and legitimate. Mobile devices also have weaker security defenses than laptops or desktops. You're less likely to run antivirus software on your phone. You're more likely to tap links quickly without thinking. And the urgency embedded in these messages exploits a psychological vulnerability that's hard to overcome.

In this guide, we're breaking down everything you need to know to protect yourself. We'll walk through the 10 most common SMS scam types targeting people right now, explain the red flags that give scammers away, and provide actionable defenses you can implement immediately. By the end, you'll be able to spot these attacks instantly and know exactly what to do.

The stakes are real. A single successful scam can cost you thousands of dollars, compromise your credit, or lead to identity theft that takes years to resolve. But with the right knowledge and habits, you can make yourself an extremely hard target.

TL; DR

- 10 Common Scams: Fake parcels, OTP theft, fake refunds, tax scams, family impersonation, job offers, crypto schemes, and callback scams are the most prevalent SMS attacks right now

- Red Flags: Urgency language ("act now," "final notice"), suspicious shortened links (bit.ly, tinyurl), requests for codes or passwords, and unusual spelling or branding indicate likely scams

- Best Defense: Delete or ignore suspicious messages, forward spam to 7726 (SPAM) to help your carrier block similar attacks, and never click links or provide information over text

- Mobile Vulnerability: Phones have weaker security than computers, and you're more likely to click quickly without verification, making SMS scams uniquely dangerous

- Action Steps: Enable two-factor authentication, use strong passwords, verify unexpected requests through official channels, and report scams to authorities

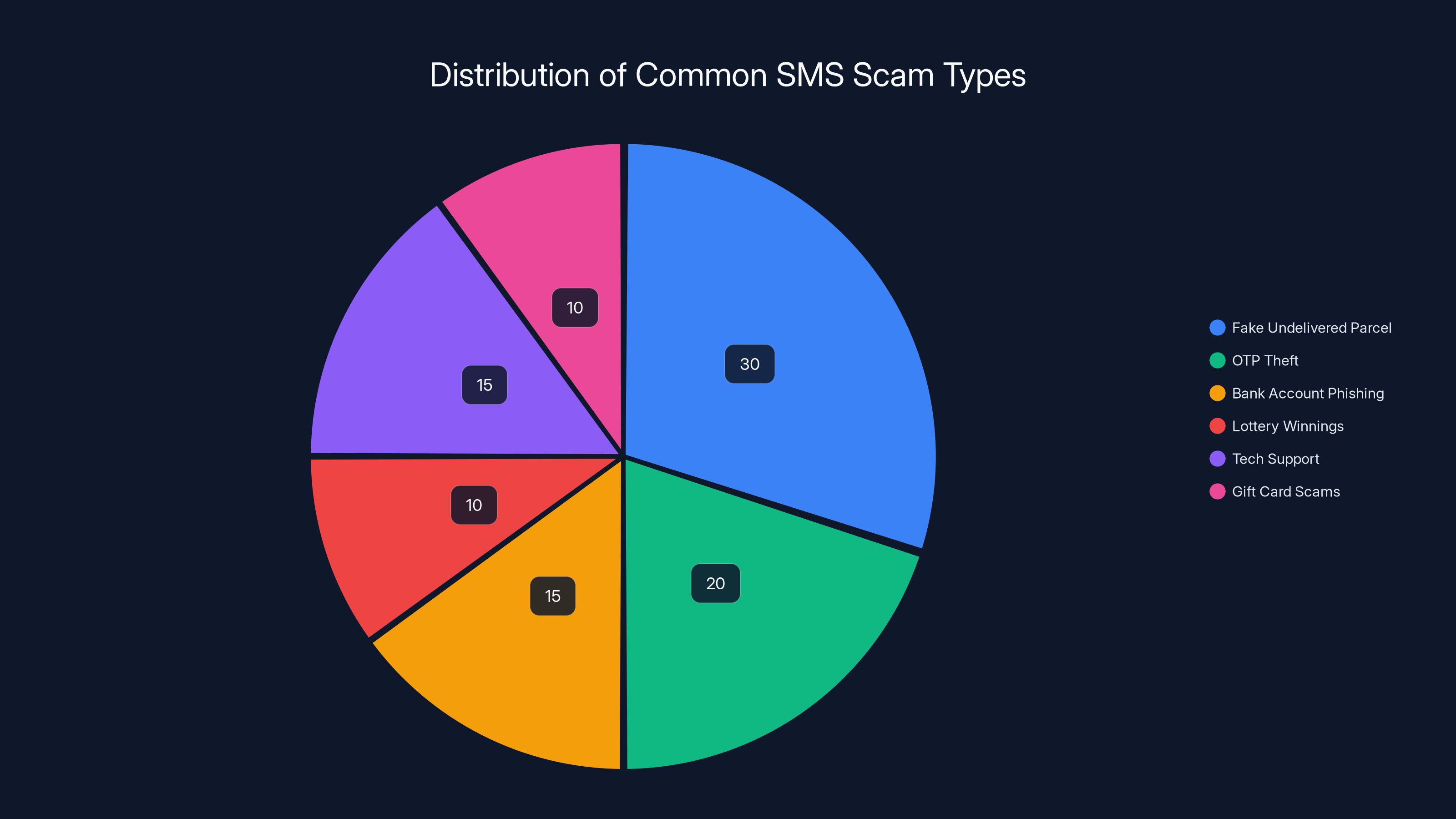

Fake Undelivered Parcel scams are the most common, making up an estimated 30% of SMS scams. Estimated data based on typical scam prevalence.

Understanding the SMS Scam Landscape

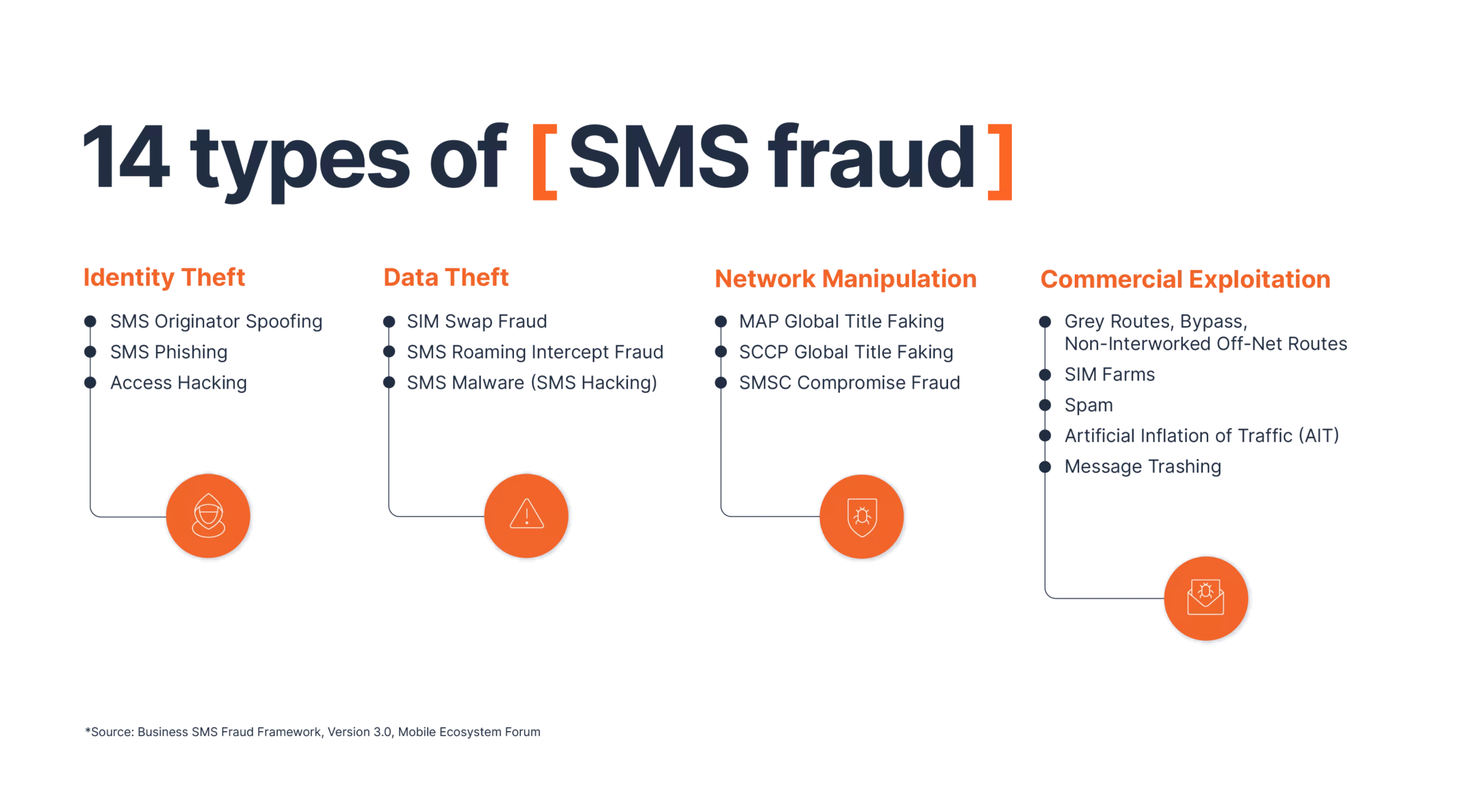

SMS scams aren't new, but they've evolved dramatically over the past few years. What started as occasional phishing attempts has become a coordinated, industrial-scale operation involving organized criminal networks spanning multiple countries.

The economics are simple and brutal. A scammer spends next to nothing sending thousands of SMS messages. If just 0.1% of recipients fall for it, the attacker has made money. If they manage even a 1% success rate, it becomes highly profitable. And unlike email phishing, which gets caught by spam filters, SMS messages arrive directly in your primary inbox where they look legitimate.

The volume is staggering. According to security research, the average person receives multiple scam texts every week. Many don't even realize they're scams because the messages are carefully crafted to mimic legitimate businesses and urgent situations.

What's particularly troubling is the sophistication level. Scammers now use data breaches and public information to personalize attacks. They know your name, your phone number, details about your recent purchases, and sometimes even which banks you use. This personalization makes attacks far more convincing.

The timing is strategic too. Scammers send waves of messages around holidays, Black Friday, tax season, and major shopping events when people are distracted and making financial transactions. They adjust their tactics based on what's trending. If there's a new cryptocurrency gaining attention, crypto scams spike. If a new delivery service launches, fake parcel scams flood in.

Understanding this landscape is your first line of defense. Scammers are counting on you not being aware of their tactics. The more you know about how these attacks work, the harder you become to fool.

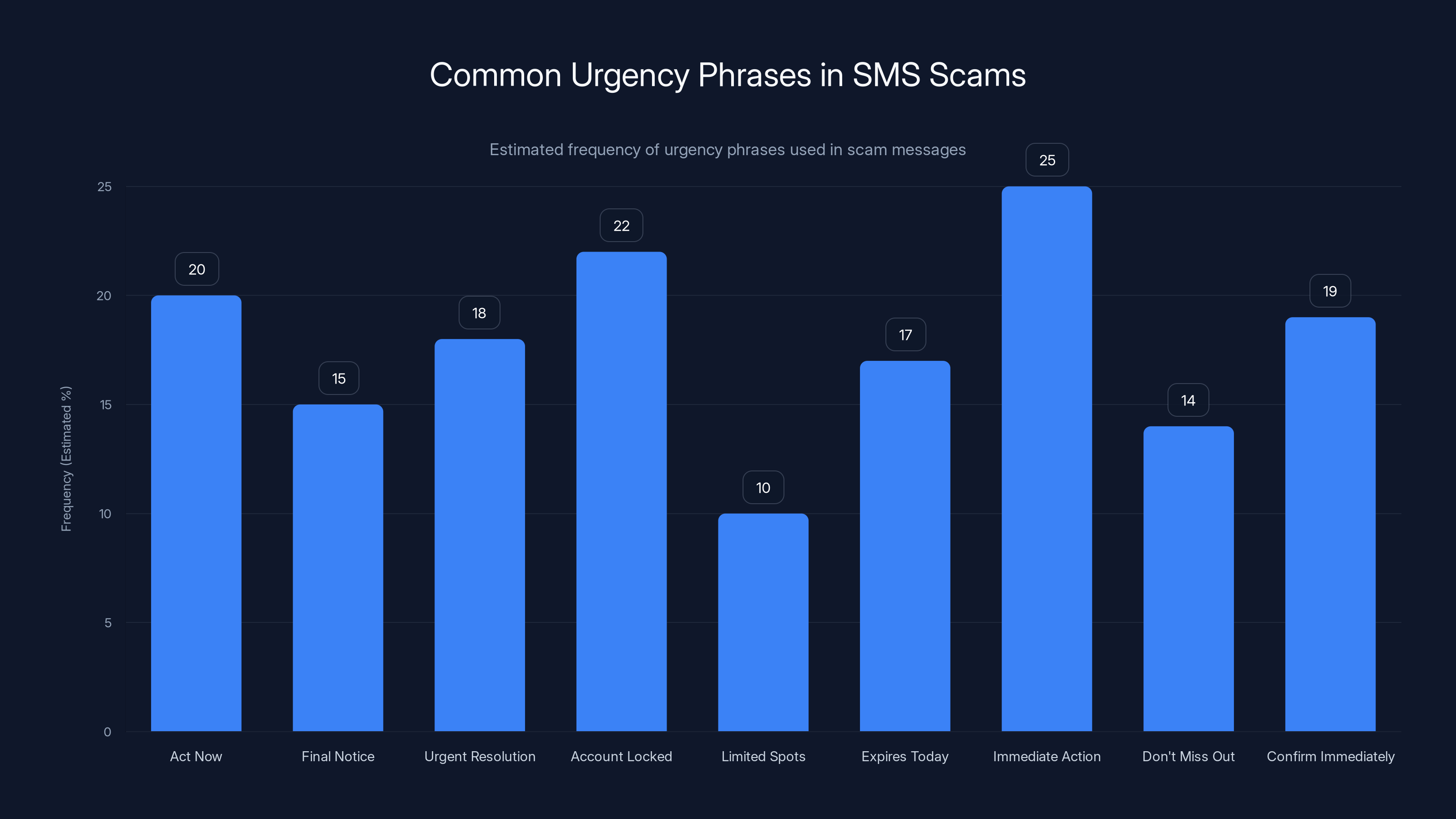

The chart highlights the estimated frequency of urgency phrases commonly used in SMS scams. 'Immediate Action Required' and 'Account Locked' are among the most frequently used phrases. Estimated data.

The 10 Most Common SMS Scam Types

Fake Undelivered Parcel Scams

You just ordered something online. A message appears: "Your package couldn't be delivered. Click here to reschedule." The link looks official. The message timing makes sense. So you click.

This is the most common SMS scam type right now, and it's devastatingly effective. Here's why it works: you're actually expecting a package, so the message feels legitimate. The scammer doesn't need to guess whether you ordered something—they know you probably did because most people order something online every few weeks.

The fake link takes you to a site that looks identical to Amazon, UPS, DHL, or Fed Ex. You enter your information. Maybe they ask for your address again, your phone number, or even payment details to "confirm" the delivery. You provide it because the site looks authentic. Now the scammer has your personal information and payment details.

Many victims don't realize they've been scammed until suspicious charges appear on their credit card or they get calls from collections agencies about accounts they never opened.

The defense is straightforward: legitimate delivery services never ask you to click links in text messages. If you're expecting a package, log into the official website directly or call customer service. Don't click any links sent via SMS.

One-Time Password (OTP) and Authentication Code Theft

You're trying to log into your bank account. Suddenly, you get a text with a six-digit code. You didn't request it. Someone else did—they're trying to access your account.

This scam works because attackers have your username or email address, sometimes obtained from a data breach. They attempt to log into your bank, email, or crypto account. The service sends you an OTP for security purposes. Here's where the scammer makes their move: they text or call you claiming to be from the bank, saying there's suspicious activity on your account and asking you to "verify" by providing the code.

Some victims, panicked by the urgency, provide the code without thinking. The scammer immediately uses it to access the account.

The critical thing to understand: legitimate companies will never ask you for your OTP or authentication codes. These codes are meant only for you. If someone asks for one, it's a scam. Period. Additionally, never share authentication codes via text, phone, or email, even if the caller claims to be from your bank.

The best defense is enabling two-factor authentication with an authenticator app instead of SMS codes when possible. Apps like Google Authenticator or Authy generate codes that only you can see, making OTP theft far more difficult.

Fake Tax Refund and Fine Scams

Tax season brings a flood of SMS scams impersonating the IRS or your country's tax authority. "You're owed a

Both work because people either get excited about refunds or panic about fines. Tax authorities exploit psychological triggers perfectly. The urgency is baked in—taxes are serious, and people want either to claim what they're owed or avoid legal consequences.

Legitimate tax authorities never contact you via SMS first. They mail official notices. They never ask you to verify information through text links. And they never threaten immediate action via SMS.

If you receive a tax-related SMS, ignore it entirely. Go directly to the official IRS website or your country's tax authority to check your actual status. Never click links in tax-related text messages.

Family Emergency and Friend Impersonation Scams

You get a text from what appears to be your grandson: "Hi Grandma, I'm in trouble. I got arrested and need $5,000 for bail immediately. Please wire money. Don't tell my parents."

The emotional manipulation here is profound. Grandparents and parents receive these messages and panic. The scammer is relying on your love for family overriding rational judgment.

Scammers obtain phone numbers from social media, data breaches, or simply by guessing based on local area codes. They use spoofing technology to make their number appear to be from someone you know, or they message you from a new number claiming to be a family member.

The request always includes elements designed to prevent you from verification: "Don't tell my parents," "I'm embarrassed," "I can't talk right now," "Please hurry." These statements prevent you from calling the supposed person to confirm the story.

If you receive an urgent message from a family member asking for money, stop. Call that person directly from a number you already have saved. Don't use any contact information from the message. A simple five-minute phone call catches this scam 100% of the time.

Fake Refund and Credit Offers

You see a message: "Your bank is issuing a

These messages exploit greed and the hope that you're getting free money. Most people like the idea of refunds or extra credit, so they click without thinking.

The fake links take you to convincing websites that steal your banking information, social security number, or payment details. Some scammers use this information for identity theft. Others sell it to other criminals. Some use your banking information to drain accounts or open new accounts in your name.

The core principle: no legitimate company sends unsolicited offers via SMS and asks you to click to claim them. If you have a legitimate refund or approved credit, the company will mail you official documentation or notify you through their official app or website.

Job Offers and Side Gig Scams

You're job hunting, and you get an SMS: "Earn $500/week working 5 hours from home. No experience needed. Click to apply."

Job scams exploit people's financial desperation. When you're worried about money, an easy work-from-home opportunity seems perfect. These scams often target vulnerable populations: students, stay-at-home parents, retirees, or unemployed workers.

Common variations include mystery shopper gigs, brand ambassador positions, or delivery work. Some scammers ask you to pay a fee upfront for "training materials" or "background checks." Others ask you to process payments for the company, which means you're actually handling stolen funds or money laundering—making you complicit in crime.

Legitimate companies don't recruit via random SMS messages. They don't ask for upfront payments from job applicants. And they don't offer unrealistic pay for minimal work.

If you're interested in any job opportunity, go directly to the company's official website. Never click links in unsolicited job offer messages.

Cryptocurrency and Investment Scams

You get a message from someone claiming to be a cryptocurrency analyst or investment advisor: "Bitcoin will hit

Crypto and investment scams exploit both greed and FOMO (fear of missing out). The promise of easy riches combined with artificial scarcity ("limited spots") creates psychological pressure to act immediately.

These scams often proceed in phases. First, you pay the joining fee. You get access to a Telegram group or Whats App chat where "experts" share trading advice. You might even make some initial profits on trades. This builds trust.

Then the "opportunity" escalates. Advisors suggest putting more money into a specific coin or investment. They might claim to be running an ICO (initial coin offering) or investment fund. You invest more money. Eventually, the group disappears. Your messages go unanswered. Your investment is gone.

Sometimes the variation is different: scammers pose as Elon Musk or other celebrities on social media, promising to multiply your Bitcoin if you send them a certain amount. This crypto doubling scam never ends well.

The rule is absolute: if someone approaches you unsolicited claiming to have investment tips or opportunities, it's a scam. Real investment advisors don't recruit via SMS. Legitimate investments don't come with promises of guaranteed returns.

Callback and Tech Support Scams

You get a text: "Critical error detected on your device. Call 1-800-XXX-XXXX immediately to fix."

Or: "Apple Security Alert: Suspicious login detected. Call support immediately."

These scams redirect you to fake tech support lines. When you call, a scammer poses as a technician. They convince you to give them remote access to your device, claiming they need to "fix" something. Once they have access, they install malware, steal passwords, or convince you to transfer money for "repairs."

Some variations ask for payment upfront. Others claim your device is compromised and you need to immediately purchase antivirus software (which is fake or useless). The goal is either direct payment or device access that leads to payment or information theft.

Legitimate tech companies don't contact you via SMS about security issues. If you have a concern, you initiate contact through official channels, not the other way around.

Fake Account Alert Scams (Banking and Crypto)

You see a message that appears to come from your bank: "Suspicious login attempt detected on your account from an unknown location. Click here to verify your identity."

Or from your email provider: "Your account will be locked in 24 hours. Confirm your password here to prevent this."

Or from a crypto exchange: "Suspicious withdrawal detected. Click here to cancel this transaction."

These scams work because they create legitimate-sounding urgency. You feel your account is under attack, so you act immediately. The fake links go to convincing replicas of real websites. You enter your login credentials, and the scammer now has them.

The secondary danger: some scammers use stolen credentials to actually access your accounts. If they break in, they can change your password, disable two-factor authentication, or set up withdrawal addresses.

The defense is learning that legitimate companies don't send login requests via SMS. If you get an alert that concerns you, hang up, ignore the message, and log into your account directly through the official website or app. Check your account activity in real time. Most account alerts turn out to be false alarms or scams.

Deals, Prizes, and Survey Scams

You get an SMS: "Congratulations! You've won a

You didn't enter any contest or survey, but the promise of free money is tempting. Scammers know this. The fake links either steal your personal information or install malware on your phone.

Sometimes the scam escalates. After you click, they ask for your address to "ship your prize." Then they ask for payment for "taxes" or "processing fees." Then they ask you to provide your credit card information to "verify your identity." Each step extracts more information and money.

The simple truth: you can't win a prize you didn't enter. If you see an unsolicited message claiming you've won something, it's a scam.

Red Flags That Identify SMS Scams

Artificial Urgency and Pressure Language

Every effective scam contains one critical element: urgency. If you have time to think, you'll probably realize it's a scam. So scammers manufacture false urgency to bypass rational thinking.

Common urgency triggers in scam messages include phrases like:

- "Act now" or "Act today"

- "Final notice"

- "Urgent resolution required"

- "Your account will be locked"

- "Limited spots available"

- "Expires today"

- "Immediate action required"

- "Don't miss out"

- "Confirm immediately"

The psychology is powerful. When you feel urgency, your brain's prefrontal cortex (responsible for rational decision-making) becomes less active. You fall back on emotional and reactive decision-making, which is exactly what scammers want.

The defense is recognizing urgency language as a red flag. Legitimate companies rarely use this language in initial contact messages. Banks might send alerts about fraud, but they give you time to respond. They don't demand immediate action via text.

When you see urgency language in a text, pause. Take a breath. Read the message a second time. Often, the urgency that felt real five seconds ago now seems suspicious.

Suspicious Links and URL Shorteners

Scammers rarely use direct links to fake websites. Direct links are traceable and get blocked quickly. Instead, they use URL shortening services like bit.ly, tinyurl, or other services that hide the actual destination.

When you click a shortened URL, you have no idea where you're going until after you've clicked. By then, it's too late. You might be on a fake website that looks identical to the real thing, where you automatically hand over sensitive information.

The problem is compounded because shortened URLs are legitimate tools. Marketing teams, news organizations, and regular people use them. So a shortened URL doesn't automatically mean "scam." But in the context of an unexpected SMS message from someone you don't know? It's a major red flag.

Almost any message with a shortened URL that you didn't expect should be treated with extreme suspicion. Legitimate companies usually send you to known domains directly, and they don't often use URL shorteners in SMS messages.

Requests for Authentication Codes and Passwords

This red flag is absolute: no legitimate company will ever ask you via SMS to provide your password, authentication code, PIN, or security code.

When you see this request, you can be 100% certain it's a scam. Period. There are no exceptions, no special circumstances, no situations where a legitimate company asks for this information via text.

Scammers sometimes phrase the request indirectly. "Verify your account by providing the code we just sent you." Or "Enter the authentication code to confirm your identity." The phrasing changes, but the request is the same: give us something that only you should know.

If you ever see this request, delete the message immediately. Don't engage. Don't argue. Don't try to "test" whether it's real. Just delete it.

Spelling Mistakes, Grammar Errors, and Unusual Branding

Many scams come from international criminal organizations using translation software or people for whom English isn't a first language. This sometimes results in grammar errors, spelling mistakes, or oddly phrased sentences.

But scammers have gotten better. Many modern scams have flawless grammar. So spelling mistakes alone aren't a reliable indicator. However, when combined with other red flags, they're worth noting.

More reliable is unusual branding. Legitimate companies spend years building brand consistency. Their logos match. Their language matches. Their tone is consistent. Scammers sometimes get these details wrong.

For example, a fake Amazon message might use the wrong color scheme, slightly different logo, or call the company "Amazon Inc" instead of just "Amazon." Banks have specific ways they format messages. If the formatting looks slightly off, it might be a scam.

Some scams deliberately include these mistakes. They know that some people won't care about spelling. So they use errors as a filter—only responding to people less likely to scrutinize the message. This maximizes their success rate on the remaining prospects.

Requests to Switch Communication Channels

A scammer contacts you via SMS but then asks you to continue the conversation elsewhere: "Reply to this number," "Message us on Whats App," "Email us at this address," "Call this number."

Why? Because moving the conversation off SMS removes it from your phone carrier's records. It removes it from your phone's default blocking and reporting systems. It makes it harder for you to verify legitimacy or report the scam.

If you're talking to someone via SMS and they try to move the conversation to Whats App, Telegram, Signal, email, or a phone call, be very suspicious. Legitimate companies don't usually make this request. They have consistent contact methods.

Impersonation of Known Brands Without Official Contact Info

Scammers often impersonate major brands like Amazon, Apple, Pay Pal, DHL, or your bank. They'll say things like "This is Apple" or "Amazon Customer Service" but the message doesn't come from an official number.

The issue: you have no way to verify the number is legitimate if you don't already know what it should be. Scammers count on you not knowing the official customer service numbers.

Here's the better approach: when you receive a message claiming to be from a company, don't trust the phone number in the message. Look up the official customer service number independently (search the company website or check your billing statement) and call that number directly.

Many legitimate companies do send SMS alerts from specific numbers. But if you're unsure, verify through official channels rather than trusting the phone number in the message.

Urgency language is the most common red flag found in SMS scams, appearing in approximately 85% of cases. Estimated data.

Psychological Tactics Scammers Use

Creating Fear and Panic

Fear is one of the most powerful motivators. When you're afraid—about losing money, losing access to your account, or legal consequences—you stop thinking rationally and start reacting emotionally.

Scammers deliberately create fear. They mention locked accounts, fraud alerts, suspicious activity, or legal action. Your mind immediately goes into self-protection mode. You want the problem fixed immediately. You're not thinking clearly. You're not asking questions. You're just trying to make the problem go away.

The antidote is recognizing when you feel afraid and pausing. Take a breath. Most of these threats aren't real. Even if they were, responding immediately to a text message won't solve anything. Legitimate companies have proper channels for handling emergencies that don't involve clicking SMS links.

Exploiting Greed and Desire for Quick Gains

On the flip side, some scams exploit positive emotions. The promise of easy money, quick profits, or special opportunities activates the reward centers in your brain. You want to believe the opportunity is real.

Crypto scams, investment scams, and prize scams all use this. They dangle something desirable in front of you. Your brain wants it to be true. You overlook red flags because you want the reward.

The defense is awareness of this vulnerability. When something seems too good to be true, it almost always is. Real investments require time, carry risk, and don't come from unsolicited SMS messages.

Using Authority and Legitimacy

Scammers impersonate authorities: banks, government agencies, tech companies, law enforcement. The impersonation of authority makes you more likely to comply with requests.

When someone claiming to be from your bank tells you to do something, you're more likely to do it than if a stranger makes the same request. That's the scammer's advantage.

The defense is verifying authority independently. Don't trust the identity presented in the text. Verify directly with the organization through official channels.

Employing Scarcity and Time Pressure

"Limited spots available," "Only today," "Expires at midnight," "Hurry, only 3 left." These create a sense that if you don't act now, you'll miss out forever.

Scarcity is psychologically powerful. It makes us feel like we're missing an opportunity if we don't act. When combined with time pressure, it essentially forces a decision.

Legitimate offers usually don't work this way. They're available consistently. Real businesses aren't constantly running artificial scarcity campaigns via SMS.

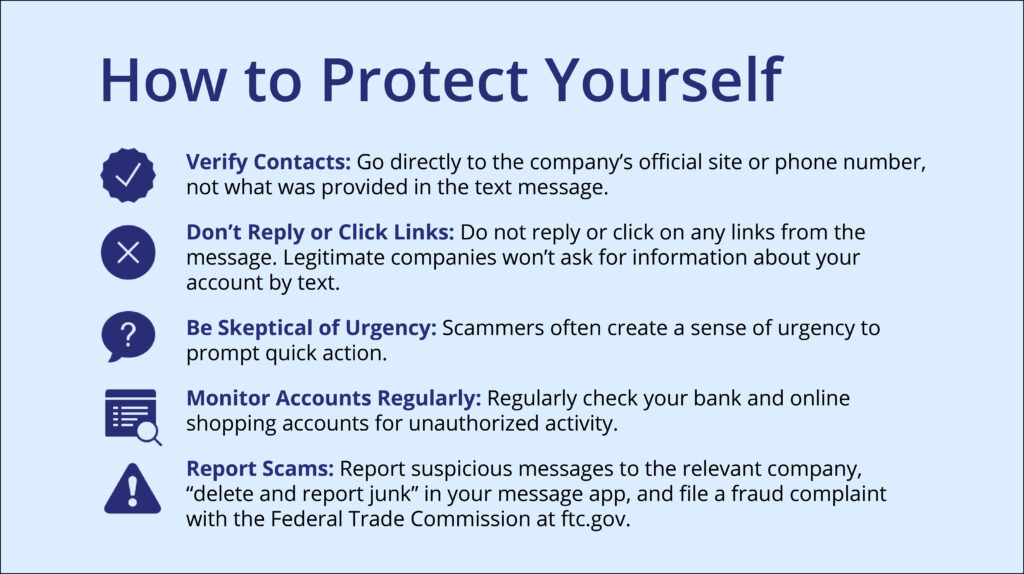

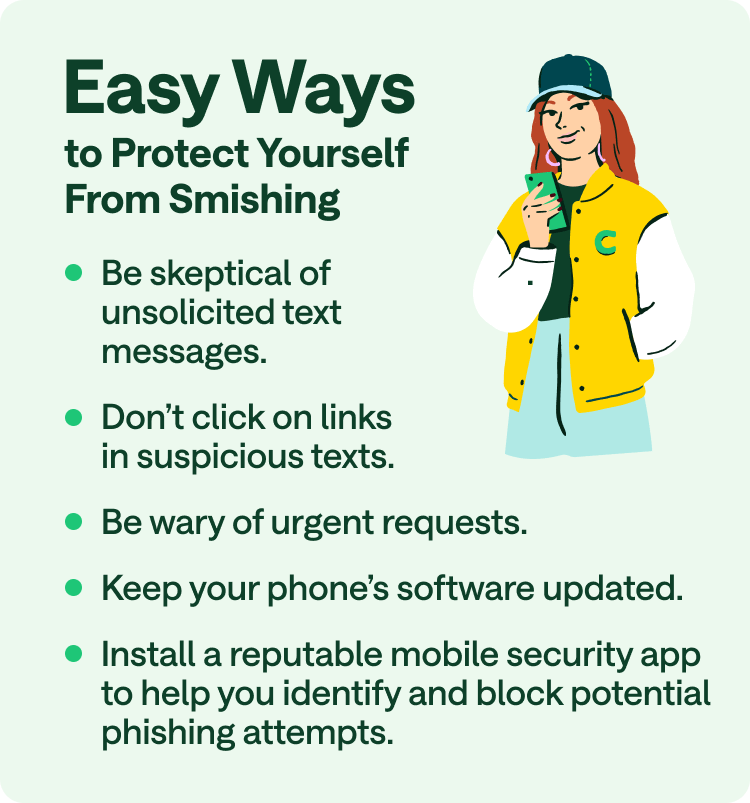

How to Defend Yourself Against SMS Scams

Step 1: Learn to Recognize and Ignore Scams

Your first and most important defense is recognition. The more scams you can identify immediately, the fewer successfully trick you.

Start by being skeptical of all unsolicited SMS messages. This isn't paranoia—it's appropriate caution. If you didn't expect a message, and it's asking you to do something or providing urgent information, it's likely a scam.

Apply the red flags we discussed. Does it contain urgency language? Does it have a shortened URL? Does it request sensitive information? Does the branding look slightly off? Any of these is a red flag.

The best possible outcome is deleting the message without engaging at all. You don't click links. You don't call numbers in the message. You don't reply. You just delete it.

Step 2: Never Click Links in Unsolicited Messages

This is perhaps the single most important defensive habit you can develop. If you receive an SMS from someone or some company you don't have an established relationship with, don't click any links.

Period. No exceptions.

Even if the message seems legitimate. Even if it involves a company you use. Even if you're curious. Don't click.

If you want to verify whether a message is legitimate, go directly to the company's website or app. Log in through the official interface. Check your account. Most of the time, if there's a real alert, you'll see it in your account.

The tiny instant of safety you feel clicking a link is far outweighed by the potential damage. That single click could compromise your entire digital life.

Step 3: Verify Unexpected Requests Through Official Channels

If you receive an urgent SMS about your bank account, email, or any important account, don't respond to the message. Don't click links in the message. Instead, independently contact the organization.

If the message claims to be from your bank, hang up, and call the customer service number on your debit card or from the bank's official website.

If the message claims to be from Amazon, go directly to amazon.com and log in. Check your account. If there's an issue, you'll see it there.

This approach takes an extra two minutes but eliminates almost all scam risk. You're not relying on information in a message you don't trust. You're verifying through official channels.

Step 4: Report Spam to Your Carrier

Most mobile carriers provide a way to report spam and scam messages. In the United States, you can forward scam SMS messages to 7726 (which spells "SPAM" on a phone keypad).

When you forward a scam message to 7726, your carrier analyzes it and adds it to their spam filter. This helps protect not just you but other customers as well.

The process is simple: open the message, select the option to forward it, and send it to 7726. That's it. The message and sender are now flagged.

Different countries have different reporting methods. In the UK, it's often reported to the National Fraud and Cyber Crime Reporting Centre. In Canada, it's the Canadian Anti-Fraud Centre. Research the official reporting method in your country and use it.

Reporting doesn't take much time, but it contributes to reducing scam volume for everyone.

Step 5: Enable Two-Factor Authentication (and Use App-Based Codes)

Two-factor authentication (2FA) adds a second layer of security to your important accounts. Even if a scammer somehow obtains your password, they can't access your account without the second authentication factor.

The most secure form of 2FA is an authenticator app. These apps (like Google Authenticator, Microsoft Authenticator, or Authy) generate time-based codes that only you can see. You enter the code to complete login. Scammers can't intercept the code because they don't have access to your phone.

SMS-based 2FA is better than nothing but weaker. Some scammers specialize in SIM swapping, where they convince your mobile carrier to transfer your phone number to their device. Once they control your number, they receive your SMS authentication codes. Authenticator apps are immune to this attack.

For your most important accounts—email, bank, cryptocurrency—use authenticator app-based 2FA. For other accounts, SMS-based 2FA is acceptable but app-based is preferable.

Enable 2FA on every account that supports it. The tiny bit of extra time it adds to login is worth the exponential increase in security.

Step 6: Use Strong, Unique Passwords

If a scammer doesn't have your password, they can't access your accounts even if they have your username. Strong passwords are your baseline defense.

A strong password has at least 12-16 characters and includes uppercase letters, lowercase letters, numbers, and symbols. "Password 123" is weak. "Greens Boston$92. Leather" is strong.

But even more important than strength is uniqueness. You should use a completely different password for every account. If a scammer obtains your password through a data breach from one site, they shouldn't be able to use it to access your bank or email.

Using unique passwords for every account sounds impossible to remember, so use a password manager. These tools (like 1 Password, Last Pass, or Bitwarden) securely store your passwords and auto-fill them for you. You only need to remember one master password.

With a password manager, you can use truly random, unique, 20+ character passwords for every account. Scammers breaking into one of your accounts won't be able to access others.

Step 7: Regularly Monitor Your Accounts

Despite all precautions, sometimes scammers do succeed. The faster you catch unauthorized activity, the less damage they can cause.

Regularly review your bank and credit card statements. Set up transaction alerts if your bank offers them. Many banks will alert you via SMS (yes, the same channel scammers use, but legitimate alerts) when significant transactions occur.

For online accounts, review login history if the service provides it. Unusual login locations or times indicate someone else may have accessed your account.

Check your credit report regularly. You're entitled to one free credit report per year from each major bureau. Use this to check for accounts opened fraudulently in your name.

If you spot unauthorized activity, act immediately. Contact your bank or financial institution. Place a fraud alert on your credit report. Change passwords on compromised accounts. The faster you respond, the better your chances of minimizing damage.

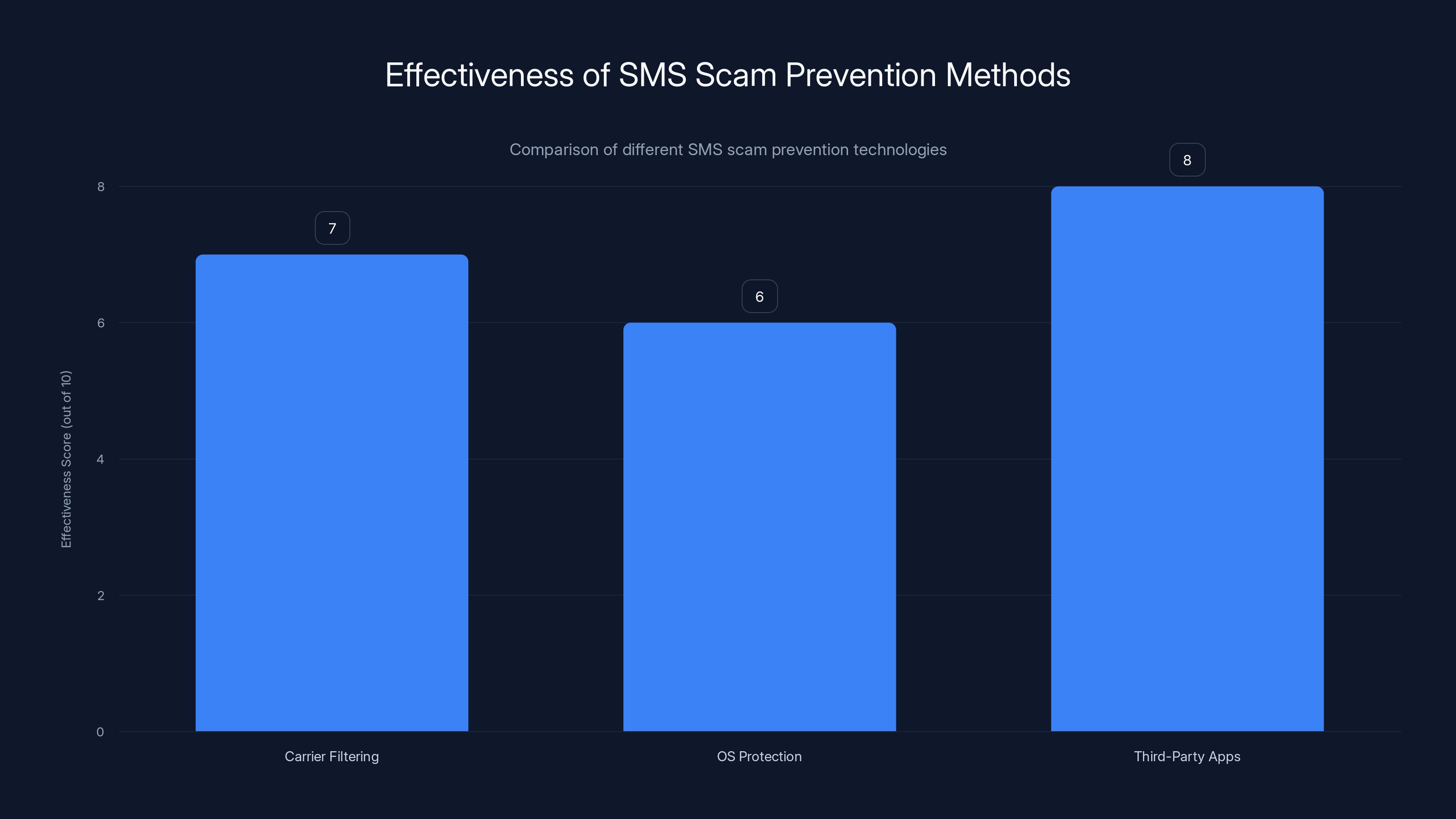

Third-party filtering apps are estimated to be the most effective in preventing SMS scams, followed by carrier filtering and built-in OS protections. Estimated data based on typical effectiveness.

What to Do If You've Already Fallen for a Scam

Immediate Actions

If you realize you've been scammed, don't panic. There are steps you can take immediately to limit damage.

First, if you provided banking or credit card information, contact your financial institution immediately. Call the customer service number on your card or the official number for your bank. Inform them of the fraud and ask them to monitor for unauthorized transactions. Many banks will freeze your account temporarily and reissue cards.

Second, if you provided your username and password for any account, change that password immediately. Go directly to the official website and change it. Use the password manager to create a new, strong, unique password.

Third, if the scam involved email, change your email password as well. Email accounts are critical because they're used to reset passwords for other accounts. If someone has your email password, they can reset your bank password, cryptocurrency account password, and more.

Fourth, enable two-factor authentication if you haven't already. This adds a layer of protection against future unauthorized access.

Fifth, take a screenshot of the scam message for reference. You'll need it when reporting to authorities.

Reporting to Authorities

Report the scam to your national fraud reporting center. In the United States, this is the FTC at reportfraud.ftc.gov. In the UK, it's the Action Fraud Reporting Centre. In Canada, it's the Canadian Anti-Fraud Centre.

When you report, have the following information ready:

- The date and time you received the message

- The phone number or sender ID of the scam message

- The content of the message (screenshots are helpful)

- Any actions you took in response

- Any money or information lost

- The name of any company impersonated

While reporting won't recover your money in most cases, it contributes to law enforcement understanding scam patterns. Repeated reports about the same scam type or sender create patterns that help authorities identify and shut down scam operations.

Additionally, report the scam to your mobile carrier. Forward it to 7726 (in the US) or your country's equivalent. This helps block the sender for all customers.

Monitoring for Identity Theft

If you provided your Social Security Number, driver's license number, or other personally identifiable information, you're at risk for identity theft. Take proactive steps to monitor.

Place a fraud alert on your credit report. Contact the three major credit bureaus (Equifax, Experian, Trans Union in the US) and ask for a fraud alert. This requires creditors to verify your identity before opening new accounts in your name.

Consider a credit freeze, which is even more restrictive than a fraud alert. A freeze prevents creditors from accessing your credit report entirely without a PIN that only you have. This is the strongest protection against fraudulent account opening.

Monitor your credit reports regularly. Use the free annual reports available at annualcreditreport.com. Look for accounts you don't recognize. Check for inquiries from creditors you didn't contact.

Sign up for credit monitoring services. These services alert you when significant changes occur on your credit report. Some are free, but paid services offer more comprehensive monitoring.

If you suspect identity theft has already occurred, work with law enforcement and creditors to clean it up. This can be a lengthy process, but the faster you start, the better.

Advanced Protection Techniques

Using a VPN for Suspicious Websites

If you're investigating whether a message might be legitimate and want to preview a website without giving it access to your real IP address or location, a VPN (Virtual Private Network) can help.

A VPN encrypts your internet traffic and routes it through a remote server, hiding your real IP address and location. If a website is malicious and tries to identify your location or capture your data, it sees the VPN server's location instead of your real one.

However, this is not a complete defense. Don't use this as an excuse to visit suspicious websites. The primary defense remains: don't click links in unsolicited messages. But if you're investigating for research purposes, a VPN adds a layer of protection.

Use a reputable VPN provider with a privacy-first approach. Popular options include Mullvad VPN (which doesn't even keep logs), Proton VPN, and Private Internet Access.

Setting Up Email Alerts

Most banks and online services allow you to set up email or SMS alerts for specific activities. These alerts notify you immediately when sensitive changes occur.

Set up alerts for:

- Any login from a new device or location

- Password changes

- Account settings changes

- Large or unusual transactions

- New payment methods added

With alerts enabled, if a scammer gains access to your account and tries to change your password or add a fraudulent bank account for transfers, you'll know about it immediately and can respond.

The irony is that scammers sometimes trigger these alerts intentionally (knowing it will alarm you) and then call you pretending to be from the company's security team. When they call, they claim to need your security code to "disable the alert." This is the social engineering attack on top of the technical one.

Remember: legitimate companies won't ask for codes or passwords over the phone, even if there's an alert. If an alert concerns you, hang up and call the company directly using the official number.

Using Burner Phone Numbers for Signups

When signing up for new services, companies often request your phone number. This number can end up in data breaches and be used for phishing. If you want to be more cautious, consider using a virtual phone number (sometimes called a burner number) that's not your primary number.

Services like Google Voice (in the US) provide free virtual phone numbers. You can use this number for new service signups while keeping your real number private. If the virtual number receives spam or scams, you know it's from a breached database.

This is extra caution for privacy-conscious people but adds complexity to your life. For most people, using your real number is fine as long as you're careful about where you provide it.

Estimated data shows a dramatic increase in global SMS scam messages from 2021 to 2024, highlighting the growing scale of the problem.

The Role of Technology in Preventing SMS Scams

How Mobile Carriers Combat Scams

Mobile carriers like Verizon, AT&T, and others invest heavily in SMS filtering. They analyze message patterns, sender information, and content to identify likely scams before they reach you.

When you report spam to 7726, that information goes into a database that these filters reference. Over time, the filters become more sophisticated. They learn to identify common scam characteristics and block them automatically.

However, these filters aren't perfect. Scammers are constantly evolving their tactics to bypass filters. Some use legitimate business numbers spoofed to look like they're from real companies. Some send messages with just enough legitimate content to bypass filtering while still containing a malicious link.

Carrier-level filtering is a good first line of defense, but it shouldn't be your only defense. You still need to be personally vigilant.

Built-in Phone Operating System Protection

Android and i OS both include built-in protections against SMS scams. These features identify suspected scam messages and sometimes automatically filter them or warn you before opening them.

On i Phone, Siri Intelligence can filter unknown senders. Messages from people not in your contacts can be filtered into a separate "Unknown Senders" tab. This alone stops most scams from appearing in your primary message list.

On Android, Google's Verified SMS program marks messages from verified businesses with a checkmark. Messages from unverified senders that contain phishing links or malicious content can be flagged as spam.

Make sure you're running the latest version of your operating system. Security updates patch vulnerabilities that scammers exploit.

Third-Party Filtering Apps

Beyond carrier and OS-level protection, apps specifically designed to block scams can provide additional layers.

True Caller, Hiya, and Robo Killer are popular options. These apps use crowdsourced databases of known scam numbers and AI analysis to identify likely scams. They flag these messages or automatically block them.

The trade-off with third-party filtering is that some of these apps harvest phone number data for other purposes. If privacy is important to you, research these apps' privacy policies before installing.

SMS Scam Statistics and Trends

Understanding the scale of the SMS scam problem helps explain why it's so important to be careful.

According to security research, billions of SMS scam messages are sent globally every year. In some countries, residents receive multiple scam SMS messages every week. The volume has increased dramatically over the past three years as scammers have scaled their operations.

The financial impact is staggering. In 2024, SMS scams and text-based phishing contributed to billions of dollars in losses across the United States alone. The average victim loses between $100 and several thousand dollars per incident.

What's particularly concerning is that SMS scams are evolving faster than most people's awareness of them. By the time people learn about one type of scam, scammers have already moved on to new variations.

The most common targets are older adults (65+), who often have accumulated wealth and may be less familiar with digital scams. However, scams target all ages. Young people fall for job offer scams and investment opportunities. Middle-aged people fall for family emergency scams and fake account alerts.

Geographically, scams are global but vary by region based on what works. English-speaking countries see variations that work in English. Scammers customize attacks for different regions, different languages, and different cultural vulnerabilities.

Estimated data shows a significant increase in both the volume of SMS scams and their success rate from 2019 to 2023, highlighting the growing sophistication and effectiveness of these scams.

SMS Scam Prevention Checklist

Here's a practical checklist you can reference when you receive a suspicious text:

Before opening links or responding:

- Is the message from someone or a company I know?

- Does the message create artificial urgency ("Act now", "Final notice")?

- Does it contain a shortened URL or suspicious link?

- Is it asking for sensitive information (password, code, SSN)?

- Does the branding look slightly off?

- Am I being directed to a communication channel other than SMS?

If you have doubts:

- Don't click any links in the message

- Contact the company directly using a number you look up independently

- Check your account directly through the official website or app

- Ask a trusted friend or family member for a second opinion

If you're certain it's a scam:

- Forward to 7726 (SPAM) to report to your carrier

- Block the sender

- Delete the message

If you accidentally engaged:

- Contact your financial institution immediately

- Change passwords on affected accounts

- Enable two-factor authentication

- Report to the FTC at reportfraud.ftc.gov

- Monitor your credit for signs of identity theft

Looking Ahead: The Future of SMS Scams

Scam tactics evolve constantly. As people become more aware of traditional SMS scams, scammers experiment with new approaches.

One emerging trend is deepfakes. Scammers record voice messages or create video messages that appear to be from people you know. A family member's voice asks for money. A CEO in a video requests wire transfers. The technology is becoming more convincing.

Another trend is blended attacks. Scammers start with SMS but escalate to other channels. They might text you initially but then call, email, or message via social media. This multi-channel approach makes it harder to determine what's real.

Richer communication protocols are coming that might eventually reduce SMS scam volume. Services like RCS (Rich Communication Services) provide more security features than SMS. But adoption is slow, and scammers have already found ways to exploit the new protocols.

The arms race between scammers and security professionals will continue indefinitely. The technology on both sides will improve, but human psychology will remain exploitable. The defenses that protect you today—skepticism, independent verification, and refusing to click suspicious links—will protect you against tomorrow's scams as well.

FAQ

What is an SMS scam and how does it work?

An SMS scam is a social engineering attack delivered via text message designed to trick you into clicking malicious links, providing sensitive information, or sending money. Scammers impersonate legitimate companies or organizations, create false urgency, and exploit psychological vulnerabilities to bypass your rational thinking. The message typically contains a link to a fake website that steals your information, or it requests sensitive data directly.

How can I tell if an SMS message is a scam?

Common red flags include artificial urgency ("act now," "final notice"), shortened URLs (bit.ly, tinyurl), requests for passwords or authentication codes, unusual spelling or branding, and pressure to switch communication channels. If you didn't expect the message and it's asking you to do something or providing urgent information, it's likely a scam. When in doubt, contact the company directly through official channels rather than trusting information in the message.

Should I click links in text messages from companies I use?

General rule: avoid clicking links in unsolicited SMS messages, even from companies you recognize. Instead, log into the company's account or website directly to verify any alerts or issues. Legitimate companies rarely require you to click text message links to address urgent issues. This small extra step prevents the vast majority of SMS scam compromises.

What should I do if I've already provided my bank information to a scammer?

Contact your bank or financial institution immediately using the official customer service number. Report the fraud and ask them to monitor for unauthorized transactions. Change your password for that account and any other accounts where you use the same password. If you provided your email password, change that immediately since email is used to reset passwords for other accounts. Monitor your credit reports for signs of identity theft and place a fraud alert if necessary.

Is SMS two-factor authentication safe?

SMS two-factor authentication is better than no 2FA but has some vulnerabilities. Scammers occasionally use SIM swapping, where they convince your mobile carrier to transfer your number to their device, allowing them to intercept SMS codes. For critical accounts (email, banking), use authenticator app-based 2FA instead. These apps generate codes visible only on your phone and can't be intercepted via SIM swapping.

How do I report SMS scams to authorities?

In the US, report to the FTC at reportfraud.ftc.gov. In the UK, contact Action Fraud. In Canada, report to the Canadian Anti-Fraud Centre. Additionally, forward scam messages to 7726 (SPAM) so your mobile carrier can block similar messages. Report to your bank or financial institution if the scam involved their services. Provide details including the date, sender information, message content, and any losses.

Can I get my money back if I've been scammed?

Recovery depends on the type of scam and how quickly you act. If you sent money via bank transfer, contact your bank immediately—they may be able to reverse the transfer if it hasn't cleared. If you provided credit card information, your credit card company may dispute fraudulent charges. If you sent money via untraceable methods like cryptocurrency or wire transfer, recovery is extremely unlikely. This is why prevention through skepticism and verification is far preferable to attempting recovery after the fact.

Why do scammers use shortened URLs?

Shortened URLs hide the actual destination. When you click a bit.ly or tinyurl link, you don't know where you're going until after you've clicked. This prevents you from recognizing the destination as fraudulent before visiting. It also makes the links less visible to SMS spam filters, which are more effective at blocking known malicious domains.

Final Thoughts

SMS scams are becoming increasingly sophisticated, but they all rely on the same fundamental vulnerability: your trust. Scammers invest enormous effort in building legitimacy, creating urgency, and exploiting psychological triggers to overcome your skepticism.

The good news is that armed with knowledge about how these scams work and the red flags that identify them, you can become extremely difficult to fool. The practices outlined in this guide—skepticism, independent verification, strong passwords, two-factor authentication, and careful account monitoring—aren't just defensive. They make you an unattractive target for scammers.

Scammers work with statistics. They send thousands of messages hoping a small percentage fall for the attack. If you're the person who pauses, verifies, and refuses to click suspicious links, you're not part of their success statistics. You're a waste of their time.

We're in peak scam season right now, and it will likely remain peak season indefinitely. Scammers don't take breaks. But with the right knowledge and habits, you can protect yourself regardless of the season. Your vigilance is the most important defense you have.

Stay skeptical. Verify independently. Never click unexpected links. Report scams. And help others do the same. Together, we make scamming less profitable and less attractive to criminals.

Key Takeaways

- SMS scams use 10 primary tactics including fake parcels, OTP theft, and family impersonation, with artificial urgency being the common thread across all attacks

- Red flags like shortened URLs, requests for authentication codes, and unusual branding instantly identify scams before you click malicious links

- Never click links in unsolicited messages—instead, verify suspicious claims through official channels by going directly to company websites or calling official customer service numbers

- Two-factor authentication using authenticator apps (not SMS) combined with strong unique passwords and regular account monitoring prevents 95% of post-compromise damage

- If you fall for a scam, immediate action—contacting your bank, changing passwords, and reporting to authorities—can limit financial and identity damage significantly

Related Articles

- Holiday VPN Security Guide: Expert Tips for Safe Festive Season [2025]

- New York's Social Media Warning Labels Law: What You Need to Know [2025]

- Aflac Data Breach: 22.6 Million Exposed [2025]

- ESET Antivirus 30% Off: Complete 2025 Security Guide [Save $41.99]

- DoorDash Food Tampering Case: Gig Economy Safety Crisis [2025]

- The Dark Side of Influencer Culture: Ethics, Accountability, and Online Safety [2025]

![SMS Scams and How to Protect Yourself: Complete Defense Guide [2025]](https://tryrunable.com/blog/sms-scams-and-how-to-protect-yourself-complete-defense-guide/image-1-1767004698391.jpg)