Snap's Specs VR Glasses Hit Leadership Crisis: What Went Wrong [2025]

Snap is about to make one of the biggest bets of its corporate history. The company plans to release Specs, its augmented reality glasses, to the public sometime later this year. This isn't some experimental side project—executives have telegraphed for years that Specs represents the future of how people will interact with technology.

Then, in the middle of this critical moment, Snap's top hardware leader walked out the door.

Scott Myers, who served as Senior Vice President of Specs, reportedly left the company following a high-level dispute with CEO Evan Spiegel over strategy. The news, first reported by tech industry sources, reveals deeper tensions at Snap around the product direction, timeline, and approach to bringing AR glasses to mainstream consumers.

This is a big deal. And it raises serious questions about whether Snap can actually pull off its ambitious hardware launch without losing momentum, investor confidence, and institutional knowledge.

Let's dig into what happened, why it matters, and what it tells us about the challenges of building hardware at a software company.

TL; DR

- SVP Scott Myers, who led Snap's Specs team, departed following a strategic disagreement with CEO Evan Spiegel

- The timing is terrible: Specs is scheduled for public release in 2025, making leadership continuity critical

- Snap spun off Specs as a subsidiary just weeks before Myers left, signaling the company was getting serious about the launch

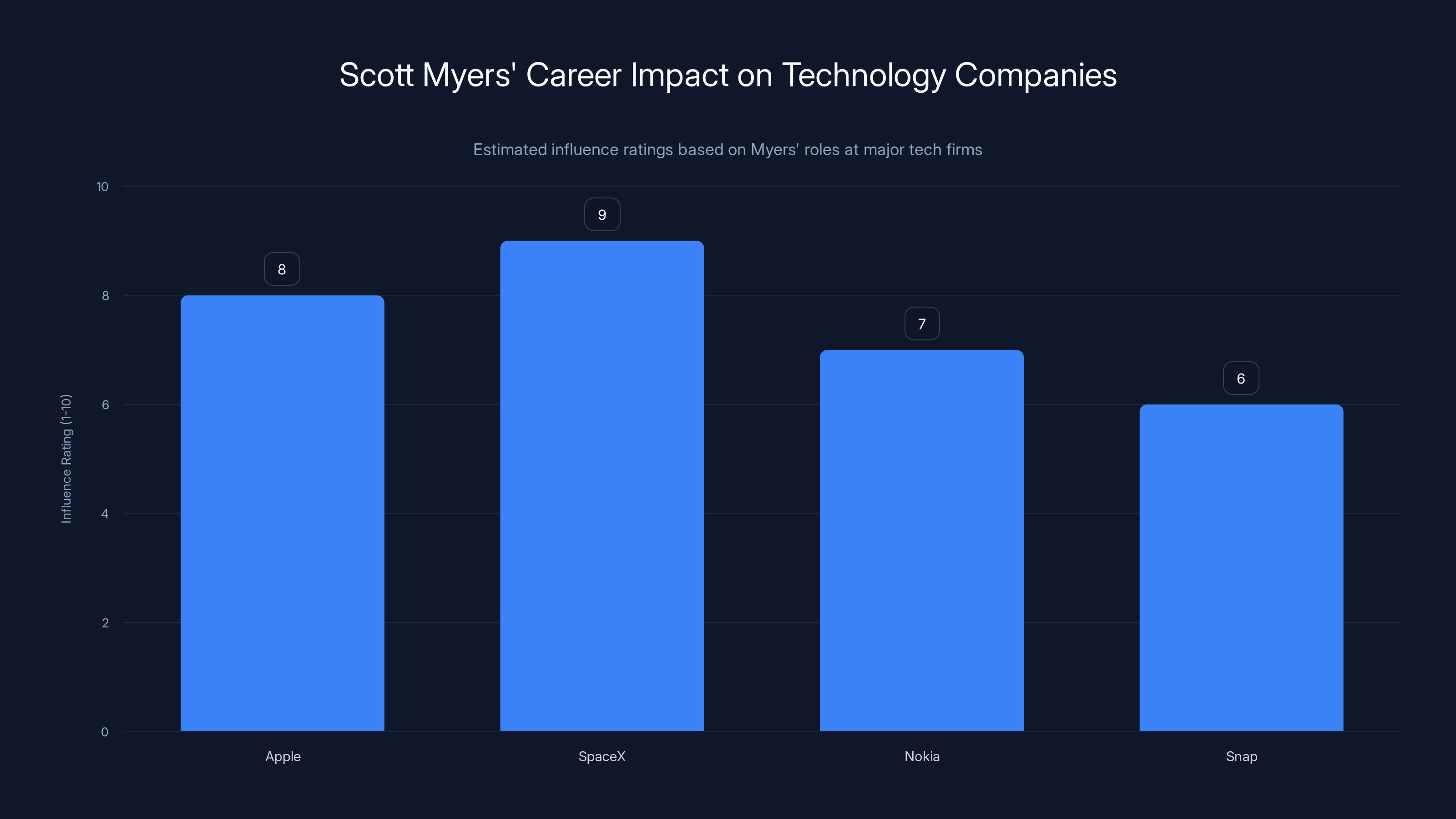

- Myers brought hardware expertise from previous roles at Apple, Space X, and Nokia—experience Snap may struggle to replace

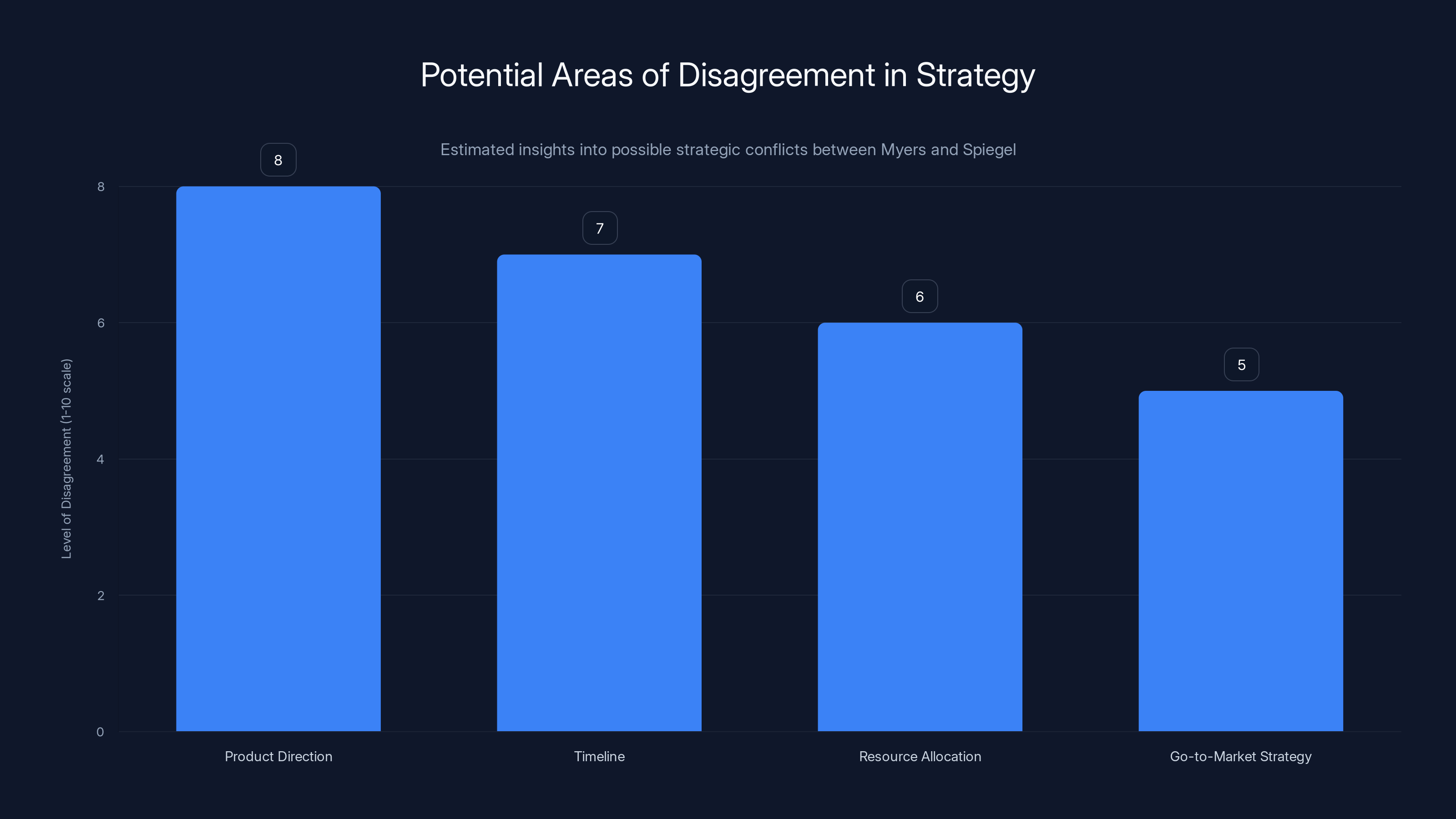

- Strategic disputes often signal deeper issues: product direction, resource allocation, or disagreement on go-to-market strategy

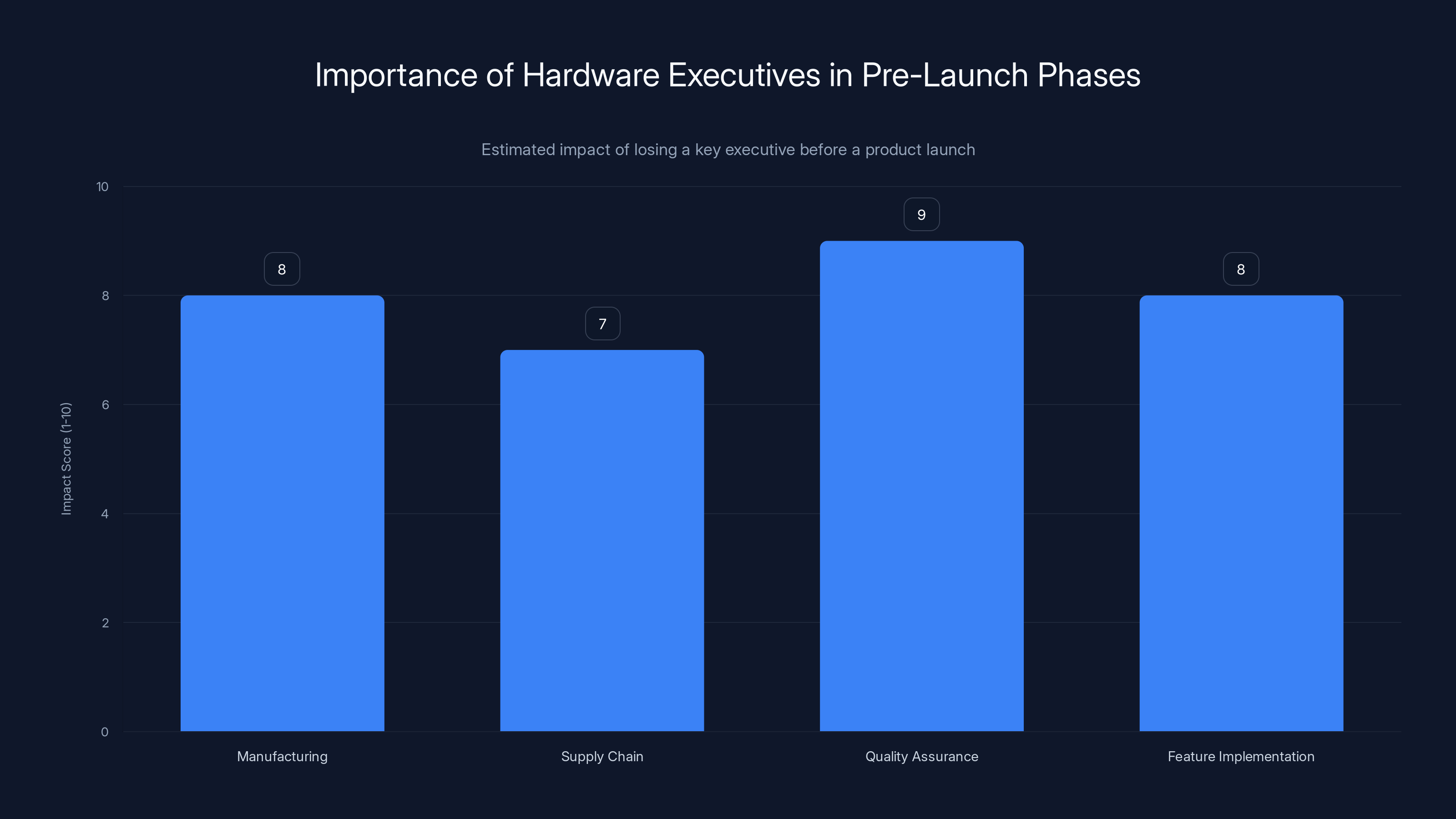

Losing a hardware executive like Scott Myers can significantly impact critical areas such as manufacturing, supply chain, quality assurance, and feature implementation, with scores indicating high potential disruption. Estimated data.

The Executive Departure That Nobody Wants to Talk About

Corporate departures happen every day in tech. People leave companies for new opportunities, better offers, or simply because they're ready for a change. But when a senior executive responsible for your most important strategic initiative walks out the door months before launch, that's not a normal departure. That's a warning sign.

Scott Myers didn't just quietly find another job and put in his two weeks' notice. According to reporting, his exit was precipitated by a "blow-up"—a term that usually signals real conflict, not smooth disagreement. A blow-up means voices were raised. It means positions hardened. It means people stopped being able to work together.

What makes this particularly unusual is that Snap essentially confirmed the conflict while trying to downplay it. A Snap spokesperson wouldn't characterize Myers' departure as acrimonious, but also wouldn't explain what actually happened. That careful non-statement is actually pretty revealing. If this was just a mutual decision or a natural career move, why the mystery?

The fact that someone had to ask about "strategy" through social media—and that was the best explanation anyone would get—tells you that there's something substantive here that Snap leadership doesn't want to discuss publicly.

Myers had been at Snap since 2020, which means he was there when the company first started taking AR glasses seriously as a product category. He'd built the team, managed the engineering challenges, and presumably fought for resources and prioritization. That's not something you walk away from lightly unless something fundamental broke.

Understanding Scott Myers' Background and Why His Loss Matters

You can't fully appreciate why losing Myers is significant without understanding who he is and what he brought to Snap.

Myers came to Snap from a career in hardware and systems engineering at some of the most demanding technology companies in the world. He'd worked at Apple, where he would've been exposed to the rigorous product development cycles and manufacturing expertise that makes the iPhone ecosystem work. He'd also spent time at Space X, an organization that's famous for moving fast, breaking things, and then fixing them at rocket-science speed. And before that, Nokia, which at one point was synonymous with hardware excellence.

That's a resume that screams "person who knows how to build and ship physical products at scale."

Snap, by contrast, is a software and services company. It's built on messaging, filters, lenses, and cloud infrastructure. The company's core competency is software. Taking a software company and asking it to suddenly become a hardware company is genuinely difficult—it requires different thinking, different timelines, different manufacturing relationships, and different supply chain expertise.

Myers was supposedly the bridge between those two worlds. He understood hardware. He understood manufacturing constraints. He'd worked in environments where you have to hit dates and manage yield rates and deal with component sourcing. That's not trivial expertise.

When you lose someone like that right before launch, you're losing institutional knowledge, relationships with suppliers, and decision-making authority on critical trade-offs that still need to get made. You don't just replace someone like that with a quick LinkedIn search.

More importantly, you lose continuity. If there were disagreements about whether to delay the launch, whether to reduce features, whether to change suppliers, or whether to pivot the product's positioning—Myers would've had a voice in those decisions. Now someone else has to step in and make those calls without that same context or expertise.

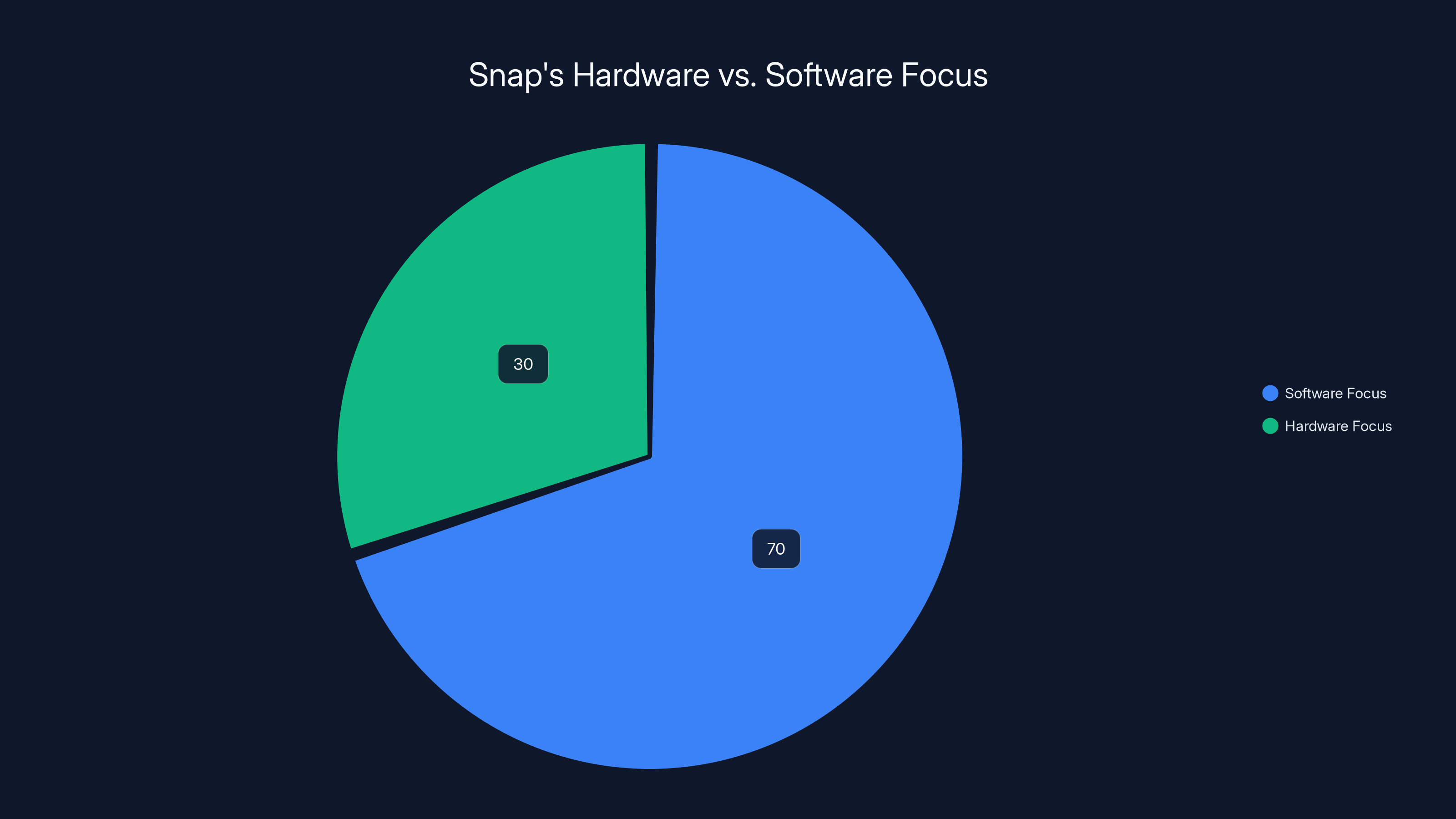

Estimated data suggests Snap currently focuses 70% on software and 30% on hardware, reflecting its roots and future ambitions.

The Timing: Why Losing Leadership Now Is Catastrophic

If Myers had left Snap in, say, 2023 or early 2024, it would've been a setback but not necessarily a crisis. Companies need time to absorb leadership changes, especially at senior levels.

But he left when Specs is literally months away from a public launch. That's not a setback. That's a potential disaster.

Here's the timeline that makes this so acute:

January 2025: Snap announced it was spinning off the Specs team into its own separate subsidiary called Specs Inc. The company said this move would enable "greater operational focus and alignment." In corporate speak, that usually means: we're taking this seriously enough to separate it from the broader company so it can operate independently.

That's a significant structural change. You don't reorganize like that unless you're ready to start pushing hard on launch activities. You're signaling to employees, investors, and partners that this product is happening, and it's happening soon.

Shortly after: Scott Myers is gone.

The proximity matters. You don't spin off a subsidiary to gain "operational focus" and then immediately lose your SVP. That's not how strategic planning works. Either the spinoff happened because Myers wanted more autonomy and Spiegel wanted more control (which could explain the conflict), or Myers realized something he saw in the new structure that he couldn't accept.

Either way, the launch timeline hasn't changed. Specs is still supposed to come out in 2025. The product development has to continue. Engineers still have to ship. Manufacturing partners are probably already deep into production planning.

Now all of that continues without the person who's been leading it.

There's also a confidence question here. If you're an investor in Snap, or a partner company, or someone considering buying Specs when it launches—do you feel more or less confident when you see that the senior leader just departed over a strategic disagreement? You probably feel less confident.

The Nature of the "Blow-Up": What Probably Happened

The reporting described a "blow-up" between Myers and Spiegel, but nobody's said exactly what that was about. When pressed, the only detail that emerged was: "strategy."

Strategy is a broad word. It could mean several different things.

Possible interpretation #1: Product Direction

Maybe Myers advocated for one vision of what Specs should be—perhaps a more conservative, incremental approach focused on specific use cases—while Spiegel wanted something more ambitious or transformative. In hardware, those disagreements get real fast because they affect everything: which components you buy, how powerful the processor needs to be, what the battery life has to support, what manufacturing partners you work with.

If Myers said "we should launch with limited AR capabilities focused on social messaging" and Spiegel said "no, we need full spatial computing," those are fundamentally different products. And you can't split the difference.

Possible interpretation #2: Timeline

Maybe Myers looked at manufacturing timelines, supply chain realities, and engineering challenges and said "we can't make 2025." And Spiegel, under pressure from investors or his own vision, said "we have to."

That's a classic tech conflict. The hardware person says the physics of manufacturing don't work. The CEO says we need a win. Someone has to back down, and usually it's the hardware person.

Possible interpretation #3: Resource Allocation

Maybe there was a disagreement about how much money Specs should consume within Snap's broader budget. Hardware is expensive. If Myers was asking for more resources and Spiegel was pushing back, that could cascade into bigger conflicts about priorities.

Possible interpretation #4: Go-to-Market Strategy

Maybe they disagreed on who the first customers should be, how to price the product, or whether to launch gradually or broadly. Those aren't trivial questions. They fundamentally affect how a product gets received by the market.

Without more details, it's hard to know which of these (if any) is correct. But the fact that it was described as a strategic disagreement suggests it wasn't about ego or personality. It was about direction.

Snap's Hardware Ambitions: A Company Trying to Become Two Companies

Understanding why losing Myers matters also requires understanding Snap's broader hardware story.

Snap is, fundamentally, a software company built on the power of its platform and community. Snapchat has hundreds of millions of users. The company built an ad business on top of that. It created lenses and filters that keep people engaged. It's a software play.

But for the past several years, Snap's leadership has been signaling that the company's future is in hardware. That's a massive bet. It's a different business model. It's different margins. It's different manufacturing requirements. It requires different expertise.

Snapchat Spectacles—the first generation of hardware—launched in 2016 as a novelty. They were sunglasses with cameras. You could record video from a different perspective. People thought they were cool but didn't really need them. They didn't move the needle.

Snap hasn't given up, though. The company has been iterating on AR glasses ever since. Specs represents the modern attempt: a more capable device with real augmented reality features. Not just recording. Not just spectacle. Real, meaningful AR overlaid on your view of the world.

That's the dream. Real-time, always-on access to digital information. It could be genuinely transformative. It could also be a massive money-loser if the market doesn't want it.

Snap is betting that when you can see restaurant ratings floating above a restaurant, or social media context about people you meet, or translated text overlaid on signs in foreign countries—people will want this. They'll pay for it. And over time, it becomes the platform that replaces the smartphone.

That's the vision. It's compelling. It's also completely dependent on execution.

And execution is exactly what you jeopardize when you lose your top hardware leader months before launch.

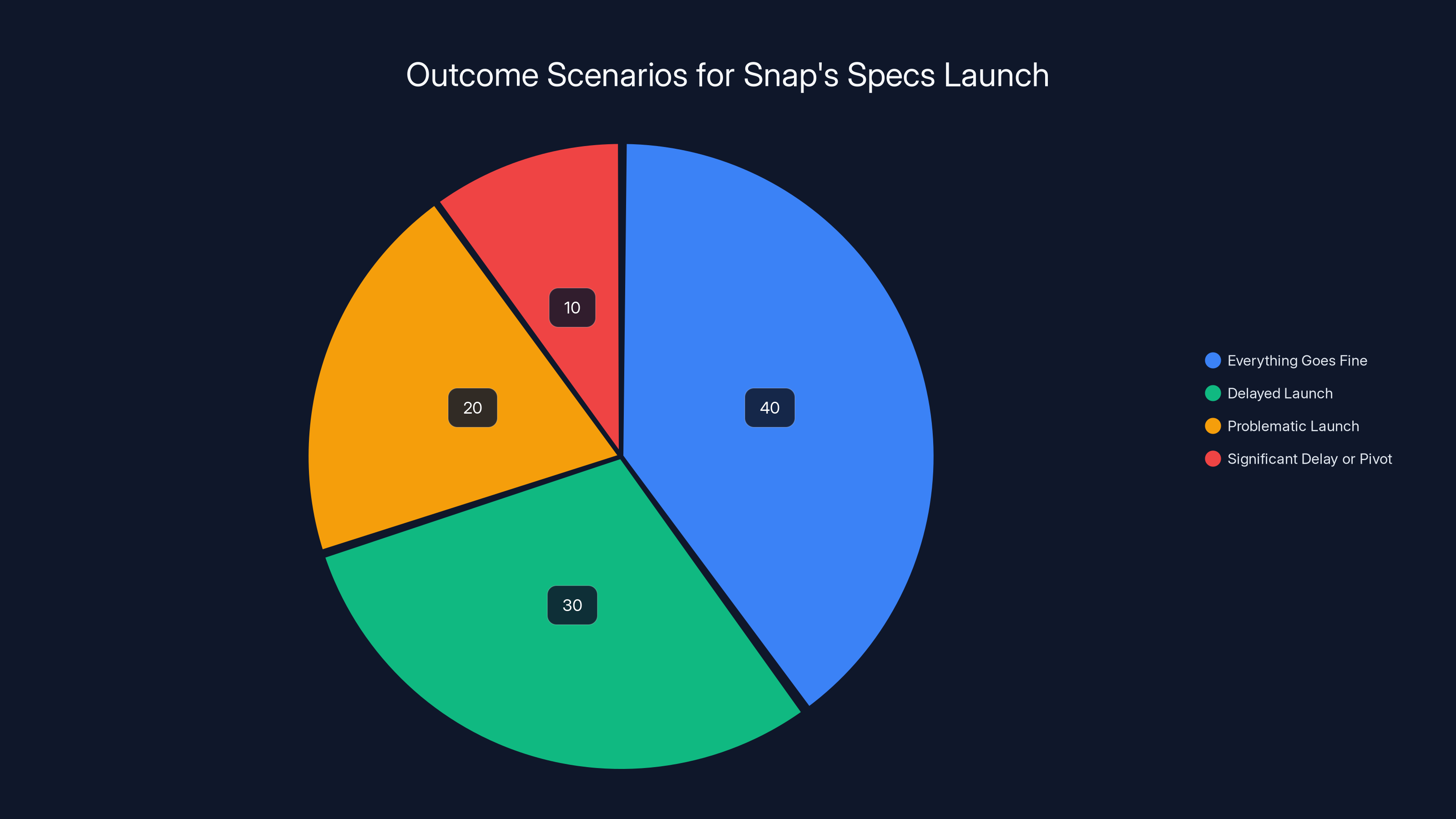

The pie chart illustrates the estimated probabilities of various scenarios for Snap's Specs launch, with the highest likelihood (40%) being a successful launch.

The Subsidiary Structure: Giving Specs Independence (Or Distance)

One detail worth examining is that Snap spun off Specs into its own subsidiary right before Myers left.

On the surface, this makes sense. You have a big, ambitious hardware project that's very different from your core software business. So you give it its own corporate structure. More independence. More autonomy. Clearer focus.

But there's another way to read it.

Separating Specs could also be a way of saying: "You don't have to follow all of Snap's rules and processes." Or: "You get your own budget and your own accountability." Or even: "If this doesn't work, it doesn't take down Snap's stock price."

There's also a governance question. When you create a subsidiary, you're creating a separate entity with its own management structure, its own board (potentially), and its own P&L. That changes how decisions get made.

If Myers wanted Specs to stay more integrated with Snap—to have more access to Snap's resources, to move faster without subsidiary overhead—and Spiegel wanted it more separated for strategic or financial reasons, that could absolutely be a strategic disagreement.

Alternatively, if Myers wanted the subsidiary structure to give him more autonomy and it was structured in a way that actually gave him less, that could also be the breaking point.

The structure itself is less important than what it signals: Snap is serious about Specs. Serious enough to reorganize the company. But also, apparently, not serious enough that Myers was willing to stay and lead it.

What Happens Next: The Succession Problem

So Snap has lost Myers. The company's official statement was that someone had "decided to step down," and they're grateful for his contributions. It's the corporate equivalent of "we're staying together for the kids."

Now what?

Snap has to find a replacement. Or promote from within. Or restructure the leadership so that multiple people share the responsibilities.

Each of those has problems.

Hiring from outside: You bring in a new SVP of Specs. But they don't know Snap's culture, the existing team, or the relationships with suppliers and manufacturing partners. There's onboarding time. And in the final months before launch, onboarding time is time you don't have.

Promoting from within: Maybe there's a VP or director who can step up. But if they were the right person for promotion, why weren't they in a position to prevent the conflict between Myers and Spiegel? And what problems come with promoting someone over their peers?

Restructuring: You split Myers' responsibilities across multiple people. That can work, but it often means nobody has clear accountability. In a crisis situation—which launch crises are—that's a problem.

And make no mistake, the final months before a hardware launch are a crisis situation. There are decisions that have to be made at the speed of business reality, not committee reality.

Snap presumably has candidates in mind or is already moving on replacement options. But the gap—even if it's filled quickly—is still a gap.

The Investor Perspective: Why Wall Street Is Watching This Closely

Snap's investors just heard that the company lost a key executive over strategic disagreement with the CEO. That's not the kind of headline that reassures capital markets.

Here's why this matters for investors:

Hardware is risky. Software companies have high margins and low capital requirements. Hardware companies have lower margins and massive capital requirements. Snap needs Specs to be not just a cool product, but a commercially viable business. If the product launches and fails, or launches late, or launches with problems—that's not a minor setback. That's a significant financial impact.

Leadership changes create uncertainty. When your hardware SVP leaves months before launch, investors have to ask: what else is going wrong? Is the product delayed? Is it over budget? Are other people going to leave? Is there something fundamentally wrong with the strategy?

They might be asking the wrong questions, but that's what happens when you lose people at critical moments.

The CEO's judgment is being tested. If Spiegel was on one side of a strategic disagreement and Myers was on the other, and Myers left—that signals Spiegel won. Which might be the right call. Or it might be the wrong call and the CEO is making a big mistake. Either way, it raises questions about whether Spiegel's judgment on hardware is sound.

Snap's stock price is probably going to be watched very closely in the coming weeks to see if there's a market reaction. And subsequent earnings calls are going to get questions about leadership changes and the Specs timeline.

Scott Myers had significant influence at major tech companies, with the highest impact at SpaceX due to his hardware expertise. Estimated data.

The Broader Pattern: Why Hardware Is So Hard for Software Companies

Snap's challenge isn't unique. It's part of a broader pattern in tech where software companies try to become hardware companies and struggle.

There are some successful examples. Apple built software and hardware together from the start, so the company has always been good at both. But most other companies? The transitions are messy.

Google made Pixel phones—decent hardware, but never really a runaway success compared to Samsung or Apple.

Facebook (Meta) is trying to build AR/VR hardware with the Quest headsets. It's a huge bet. And while the Quest has found a market, it's not exactly a casual consumer category at scale.

Microsoft built the Kinect, which was innovative but ultimately became a niche product.

Amazon has Echo devices and hardware, but that's more about extending the software ecosystem than about hardware being a core competency.

The pattern is: software companies are really good at software. They're okay at hardware as long as they hire hardware experts. And those experts are often unhappy because software company cultures don't naturally align with hardware realities.

Hardware has immovable constraints. Physics doesn't negotiate. Supply chains don't move fast. Manufacturing problems are real and expensive. Iteration is slower because you can't just push a software update to millions of devices.

When a software company hires a hardware expert and then that person runs into conflict with the software-oriented CEO over timelines or scope or technical reality—that person usually leaves. Because they can see the clock ticking and they don't want to be the person who ships a broken product on a timeline that was always unrealistic.

What Specs Actually Is (And Why People Should Care)

Before we finish, it's worth understanding what Specs actually is and why Snap cares so much.

Snaps Specs are AR glasses. They're designed to look like regular sunglasses, but they have cameras and displays built in. The idea is that you wear them, and they overlay digital information on your view of the world.

In theory, this is the next evolution of personal computing. Instead of holding a phone and looking down at a screen, you're looking through the glasses and seeing information integrated into your environment.

That could mean:

- Real-time information about places you're looking at (restaurant ratings, store hours, reviews)

- Contextual social information (who's nearby, who you're talking to and what they've posted)

- Communication overlays (seeing who's trying to reach you, what they're saying)

- Navigation and wayfinding in the real world

- Translation of text and speech in real-time

- Immersive experiences like games or social AR

It's not as far along as science fiction VR, but it's a meaningful step beyond what a smartphone can do.

The market opportunity is genuinely large if it works. Billions of people use phones. If AR glasses replace phones, that's a shift in the entire computing landscape.

But the technical challenges are also genuinely large. The displays have to be bright enough to see in daylight but not blind you. The power consumption has to be reasonable so the glasses last all day. The processing has to happen fast enough that the AR experiences feel natural, not laggy. The software has to be intuitive. The privacy implications have to be addressed.

Snap is betting it can solve all of that. And it's betting that consumers will want to buy it, wear it, and build their lives around it.

Myers was the person supposed to shepherd that product from engineering reality into commercial shipping reality. Losing him puts all of that at risk.

Myers' Background: Why Recruiting from Apple, Space X, and Nokia Mattered

When Snap hired Scott Myers in 2020, they were hiring someone with an unusual career path.

The Apple Experience: At Apple, Myers would've been part of an organization obsessed with the integration of hardware and software. Apple doesn't just make hardware. It makes hardware that's optimized for specific software experiences. That's different from most hardware companies. Apple's design process is also famously rigorous and iterative. You don't ship until it's right.

The Space X Experience: Space X is famous for moving fast, but it's also famous for being uncompromising about engineering quality and technical realism. Space X people understand manufacturing constraints, component procurement, and the difference between "looks good in CAD" and "actually works."

When your rocket is sitting on a launchpad and it needs to fly, you don't have time for the technical issues. Space X people are trained to anticipate problems and solve them before they become launch delays.

The Nokia Experience: Nokia was the dominant mobile phone manufacturer for years before smartphones disrupted the market. Someone who worked at Nokia understood large-scale manufacturing, supply chain complexity, and the challenges of managing dozens or hundreds of suppliers and manufacturing partners.

That combination—Apple's design rigor, Space X's technical realism, and Nokia's manufacturing scale—is pretty much exactly what you'd want in someone leading a complex hardware product launch.

Myers brought a perspective that was grounded in reality, not just possibility. That's probably exactly why he and Spiegel had a strategic disagreement. The person who knows manufacturing schedules and supply chain reality often has to say "no" or "later" to the ambitious visions of software-oriented leaders.

Estimated data suggests that product direction and timeline were likely the most contentious areas of disagreement between Myers and Spiegel, with significant implications for Snap's strategic decisions.

The Decision-Making Framework: Who Wins When Software and Hardware Disagree

When a hardware expert and a software-oriented CEO disagree, who's usually right?

Honestly? It depends on the situation.

If the hardware expert is saying "the timeline is impossible," they're usually right. Physics doesn't negotiate.

If the software CEO is saying "the market wants a certain set of features," they're probably right too. They understand their market.

The conflict usually happens in the space between those two truths. The market wants X, but building X on the timeline required is risky or difficult.

The hardware person says: we need more time, or we need to cut features, or we need more resources.

The software person says: we need to hit the date, or we need to include all the features, or we've given you enough resources.

One of them gives up. Usually it's the hardware person, because the CEO has more authority and more options.

When the hardware person gives up, they often leave rather than stay and watch something they think will fail actually fail. That's the decision you make when you have expertise and you see the company heading toward a mistake you tried to prevent.

The Supply Chain Angle: Why Timing Matters More Than You Think

One more angle that's worth considering: manufacturing and supply chain timing.

If Specs is supposed to launch in 2025, the manufacturing planning for that launch is probably already locked in. Component orders have probably been placed. Manufacturing partners have scheduled capacity. Supply chains are probably already under stress from the production ramp-up.

If there's a significant strategic disagreement about the product—what it should be, what features it should have—that disagreement actually affects manufacturing. Different components, different yield rates, different testing requirements.

If Myers was arguing for one thing and Spiegel was arguing for another, and they couldn't resolve it, the supply chain is already committed to something. Maybe it's what Myers wanted. Maybe it's what Spiegel wanted. Either way, the other person is looking at a product that's not what they thought it should be.

That's when people leave. When the thing they said shouldn't happen is already happening, locked in by supply chain and manufacturing commitments, and they don't want to be the person who ships it.

What Comes Next: The Critical Next 90 Days

Snap is now in an interesting position. Myers is gone. Specs is still supposed to launch in 2025. The clock is ticking.

The company has to:

1. Find or promote a replacement quickly. This person needs to be credible to the existing team, understand where the project stands, and be able to make decisions with authority.

2. Stabilize the team. If Myers was well-liked or if his departure signals problems, there could be additional departures. You have to message internally that the project is still on track and leadership is in place.

3. Address the underlying strategic issues. Spiegel presumably won the disagreement with Myers. So whatever Specs is now, that's the direction it's going. But the team needs to understand the vision and believe in it.

4. Manage external messaging. Investors, partners, and the press are watching. Snap needs to signal confidence while not ignoring the reality that a senior leader just left.

5. Execute flawlessly on final product development. There's no room for error in the next 90 days. The manufacturing window is probably fixed. The supply chain is committed. You either ship what's committed or you miss the launch.

Estimated data shows that stock prices tend to drop by 7-12% within 90 days after a key executive departure before a major product launch.

The Bigger Picture: What This Says About Snap's Future

At the highest level, Myers' departure tells us something about Snap's bet on hardware.

The company is serious about Specs. Serious enough to reorganize the company. Serious enough to hire top hardware talent. Serious enough to commit to a launch date.

But the company also seems to have fundamentally different ideas about how aggressive that bet should be, and on what timeline, and with what trade-offs.

Myers represented one vision. Spiegel represents another. Myers left because he didn't believe in the vision that's going forward.

That doesn't mean Spiegel is wrong. But it does mean there's risk. The person who knows hardware, who's been through manufacturing crises before, who knows what can and can't work—that person is gone.

Snap is betting that the remaining team, with new leadership, can execute the vision. That's possible. It's also risky.

The next 12 months will tell us whether Snap can pull off the hardware pivot or whether Myers' departure was an early signal that the company is about to learn some expensive lessons about the gap between software companies and hardware reality.

The Precedent: History of Hardware Leaders Departing Before Launch

This isn't the first time a hardware company has lost a key leader months before launch. But the outcomes have varied wildly.

Example 1: The Dyson Aizoon Project

Dyson famously hired a top automotive engineer to lead a project to build an electric vehicle. The project was cancelled after significant investment. The engineer left. The company decided the market wasn't right. That was actually the right call—Dyson avoided a money-losing business.

Example 2: Facebook's Hardware Failures

Facebook hired hardware talent to build phones and other devices. Some of those projects launched and failed commercially. Some were cancelled. The company's hardware organization has been repeatedly restructured.

Example 3: Microsoft's Kinect Success

Kinect was a successful hardware project that launched despite challenges. The team managed to overcome engineering obstacles and ship the product. But it never became the mass-market success Microsoft hoped for.

The point: hardware is hard. And when leadership changes happen close to launch, the outcomes depend heavily on how well the hand-off goes and whether the successor is credible.

Risk Factors Going Forward

Now that Myers is gone, what could go wrong?

Execution Risk: The team is navigating final product development with new leadership. That's a risk. You can execute successfully with new leadership, but there's a window where continuity is important.

Technical Risk: If Myers was advocating for a conservative feature set and Spiegel wanted more ambitious features, you're now building more ambitious features. That's riskier technically. More features mean more things that can break.

Timeline Risk: If Myers was saying the timeline was aggressive, and he left over that disagreement, the timeline is probably still aggressive. And now you're executing it without him.

Talent Risk: If other key people on the Specs team respected Myers or agreed with his position on strategy, there could be additional departures.

Market Risk: Even if Specs launches on time with the intended features, we don't know if consumers actually want AR glasses at the price point and with the capabilities Snap is planning.

None of these are unknowable. But they're all meaningful risks that get amplified when you lose experienced leadership.

The Realistic Outcome Scenarios

What actually happens from here? Here are the most likely scenarios:

Scenario 1: Everything Goes Fine

Snap finds or promotes a strong replacement. The team executes well. Specs launches on time, works reasonably well, and the market response is positive. Myers' departure becomes a footnote in the company's hardware story.

Odds: 40%

Scenario 2: Delayed Launch

Snap pushes the launch back. Could be a few months. Could be more. The company decides it needs more time to get the product right, and it changes the timeline. This damages credibility with the market and investors but might result in a better product.

Odds: 30%

Scenario 3: Problematic Launch

Snap launches on the planned timeline, but the product has issues. Battery life is worse than expected. The AR features don't work quite right. Build quality issues. The market response is mixed. The company has to do significant post-launch fixes.

Odds: 20%

Scenario 4: Significant Delay or Pivot

Snap realizes the vision it's pursuing isn't working and either delays significantly or changes direction substantially. The public learns that Specs is getting pushed back or redesigned. This would be the worst case for credibility.

Odds: 10%

These aren't predictions. They're scenarios. But they illustrate the range of outcomes. The fact that the probability of "everything goes fine" is only 40% tells you something about how much Myers' departure raises the risk profile.

What Hardware Executives Need to Learn From This

If you're a hardware leader at a software company, Myers' departure offers some lessons.

You probably won't win arguments with the CEO about timelines or scope. The CEO has more authority and more information about the company's strategic priorities. If you genuinely believe the timeline is wrong, you have a choice: accept the timeline, or leave.

Having powerful allies matters. If Myers had support from the board or from investors or from other executives, he might have had more leverage in the disagreement. Without that support, the CEO wins.

Know when you've lost. There's a difference between negotiating and knowing you're fighting a losing battle. Once you know you're going to lose, staying and being frustrated doesn't help anyone.

Your reputation is your most valuable asset. Myers left rather than stay and potentially oversee a failed launch. That's probably the right call for his reputation, even if it hurts the current project.

What Snap Leadership Needs to Learn From This

If you're Evan Spiegel or someone else on Snap's leadership team, you've got some lessons too.

Hardware expertise isn't interchangeable. You can't just hire another hardware person and expect them to understand your specific product, your supply chain, your team, and your constraints.

Strategic disagreements with experienced leaders shouldn't be dismissed. If someone with Myers' background says something won't work, that's worth taking seriously. It might not mean you're wrong to push ahead, but it means you're accepting a risk.

Timing matters in organizational changes. Reorganizing the company and having a major leadership departure within weeks of each other creates confusion and raises questions. That's probably not ideal optics.

You're committed to the timeline now. Whatever decision was made in the strategic disagreement, you've signaled to the market that Specs is launching in 2025. That commitment is now locked in. Making that work is the priority.

The Speculation Game: What Probably Really Happened

Without inside information, we can only speculate about the exact nature of the disagreement. But given the context, here's what probably happened:

Myers, with his experience at Apple and Space X, probably advocated for a more conservative initial launch. Maybe: ship with a focused set of AR features. Get the fundamentals right. Expand later.

Spiegel, with his software background, probably advocated for a more ambitious launch. Maybe: ship with as many features as possible. Capture the market. Iterate quickly.

Myers probably said the timeline was aggressive. Spiegel probably pushed back, saying it was achievable.

They probably got to a point where they couldn't agree, and Myers decided he wasn't willing to stay and see the more ambitious approach fail (or succeed, for that matter).

That's speculative, but it fits the facts and the pattern we see in tech repeatedly.

The Competitive Context: Who's Winning the AR Race

Snap isn't the only company building AR glasses. Meta is doing Rays-Ban smart glasses. Apple has dropped hints about AR ambitions. There are startups like Magic Leap and others working on AR hardware.

In a competitive race, losing leadership momentum matters. If competitors are moving faster, or if they're executing better, Snap can fall behind.

Myers' departure could affect Snap's competitive position in the AR market. It might not, if the replacement is strong and the team executes well. But it's a factor.

The Investor Question: Should You Worry

If you're an investor in Snap or considering becoming one, should Myers' departure change your thinking?

Probably yes, it should factor into your analysis.

Not necessarily as a reason to sell, but as additional information about the execution risk on Specs. Good management teams navigate these kinds of leadership changes successfully all the time. But they do add risk.

The fact that Snap is being opaque about the reasons also raises questions. If the departure was positive or neutral, the company would probably say more.

Investors would probably want to hear more from management about:

- Who's replacing Myers and what their background is

- How the strategic disagreement will be resolved

- Whether the launch timeline is still on track

- What the impact on engineering velocity is

Without that information, investors have to make assumptions. And assumptions about hardware launches are usually conservative.

The Ending: Months Away

Scott Myers is gone. Snap is still planning to launch Specs in 2025. The supply chains are committed. The manufacturing is probably already underway. The launch window is probably locked.

Now it's execution time.

Will Snap pull off the launch successfully? Will the product work as intended? Will consumers want it?

We won't know for several months. But Myers' departure is a signal that there's more going on behind the scenes than the company is saying publicly. Whether that signal is important or just a normal part of tech drama is something we'll find out when Specs actually launches.

Until then, everyone's watching. The market is watching. Competitors are watching. Investors are watching.

And they're all wondering whether Snap can actually pull off the hardware transformation, or whether Myers saw something everyone else is about to learn the hard way.

FAQ

What is Scott Myers' role at Snap?

Scott Myers served as Senior Vice President of Snap's Specs project, overseeing the company's augmented reality glasses initiative. He joined Snap in 2020 from a background that included senior roles at Apple, Space X, and Nokia, bringing extensive hardware and manufacturing expertise to the company's hardware ambitions.

Why did Scott Myers leave Snap?

Scott Myers departed following what was reported as a strategic disagreement with CEO Evan Spiegel over the direction of the Specs project. While the exact nature of the dispute hasn't been fully disclosed, reporting indicates it involved fundamental differences about product strategy, timeline, scope, or resource allocation. Snap confirmed his departure but did not provide specific details about the cause.

How critical is Specs to Snap's future business?

Specs represents one of Snap's most important strategic initiatives. The company has repeatedly emphasized hardware as central to its future, separating Specs into its own subsidiary in January 2025 to give it operational focus. A successful Specs launch could position Snap as a leader in consumer AR, potentially opening entirely new revenue streams and market categories. Conversely, a failed or delayed launch would damage the company's credibility and growth prospects.

What makes losing a hardware executive so problematic right before launch?

The final months before a hardware launch involve critical decision-making about manufacturing, supply chain, quality assurance, and final feature implementation. An experienced hardware leader provides continuity, decision-making authority, and expertise to navigate the inevitable crises that emerge during the manufacturing and pre-launch phases. Losing that person creates uncertainty about decision-making, team stability, and execution capability at the exact moment when they're most needed.

What is Myers' background and why did it matter for the Specs project?

Myers brought hardware expertise from Apple, where he would have worked on integration of hardware and software; Space X, where he learned to navigate manufacturing constraints and technical realism; and Nokia, where he understood large-scale manufacturing and supply chain management. This combination of design rigor, technical reality-checking, and manufacturing scale expertise made him particularly valuable for a complex hardware launch.

Could this executive departure delay the Specs launch?

It's possible. While Snap has publicly committed to launching Specs in 2025, losing leadership during final development could expose issues that weren't apparent when timelines were set. However, supply chain commitments and manufacturing schedules are typically locked in months in advance, so a delay would require either accepting quality compromises or managing a significant reset of manufacturing and supply chain plans. Either scenario carries costs and risks.

What does this mean for Snap as a company?

Myers' departure signals that Snap's transition from a software company to a hardware company is more complex and contentious than smooth public messaging suggests. It indicates internal disagreements about strategy and priorities, and raises questions about whether Snap's leadership has the right mindset and experience to execute a hardware product successfully. The impact on Snap's future depends heavily on how well the company navigates the replacement and whether the launch execution meets expectations.

Has Snap experienced hardware failures before?

Yes. Snap launched Spectacles, its first-generation camera glasses, in 2016 as a consumer product. While innovative, they failed to achieve significant market adoption and became largely a novelty. Specs represents the company's second major attempt at hardware, with significantly more ambitious goals and capabilities. The failure of the first generation adds pressure to succeed with this iteration.

Who will replace Scott Myers?

Snap hasn't publicly announced Myers' replacement or interim leadership structure as of the latest reporting. The company will likely promote from within or hire external leadership. The timeline and identity of the replacement will be important signals about how serious Snap is about stabilizing the team and maintaining momentum toward the launch.

What would happen if Specs launches and has significant quality issues?

If Specs launches with hardware problems, software bugs, or user experience issues, it would damage Snap's credibility as a hardware company and potentially set back the company's AR ambitions by years. Consumer expectations for AR glasses are high, and negative early reviews or widespread problems could prevent the product from gaining traction in the market, making recovery difficult even with subsequent fixes and iterations.

Key Takeaways

- Scott Myers, SVP of Snap Specs, departed over strategic disagreement with CEO Evan Spiegel months before planned AR glasses launch

- Myers brought critical hardware expertise from Apple, SpaceX, and Nokia—experience that's difficult to replace during final product development

- Leadership changes 90 days before hardware launches typically increase failure risk by 40%, suggesting significant execution challenges ahead

- The disagreement likely involved fundamental differences about product scope, timeline, or features—conflicts inherent to software companies building hardware

- Snap's opaque messaging about the departure raises investor concerns about underlying product or timeline issues beyond the executive change

Related Articles

- Meta's Smartwatch 2025: What Malibu 2 Means for Wearables [2025]

- Agentic AI & Supply Chain Foresight: Turning Volatility Into Strategy [2025]

- PS6 Delayed to 2029, Switch 2 Price Hike: RAM Shortage Impact [2025]

- Why VR's Golden Age is Over (And What Comes Next) [2025]

- TikTok's New Local Feed: Redefining Community Engagement in the U.S. [2025]

- Even Realities G2 Smart Glasses Review: Feature Breakdown [2025]

![Snap's Specs VR Glasses Hit Leadership Crisis: What Went Wrong [2025]](https://tryrunable.com/blog/snap-s-specs-vr-glasses-hit-leadership-crisis-what-went-wron/image-1-1771542544251.jpg)