Tech Crunch Founder Summit 2026: Everything You Need to Know About Scaling at the Industry's Premier Founder Conference

Starting a company is one thing. Scaling it without losing your mind? That's an entirely different beast.

You can read all the blogs, watch all the tutorials, and consume every playbook out there, but nothing replaces sitting across from a founder who's already done what you're trying to do. That's the core reason Tech Crunch created Founder Summit, and why thousands of entrepreneurs clear their calendars for the June 23 event in Boston.

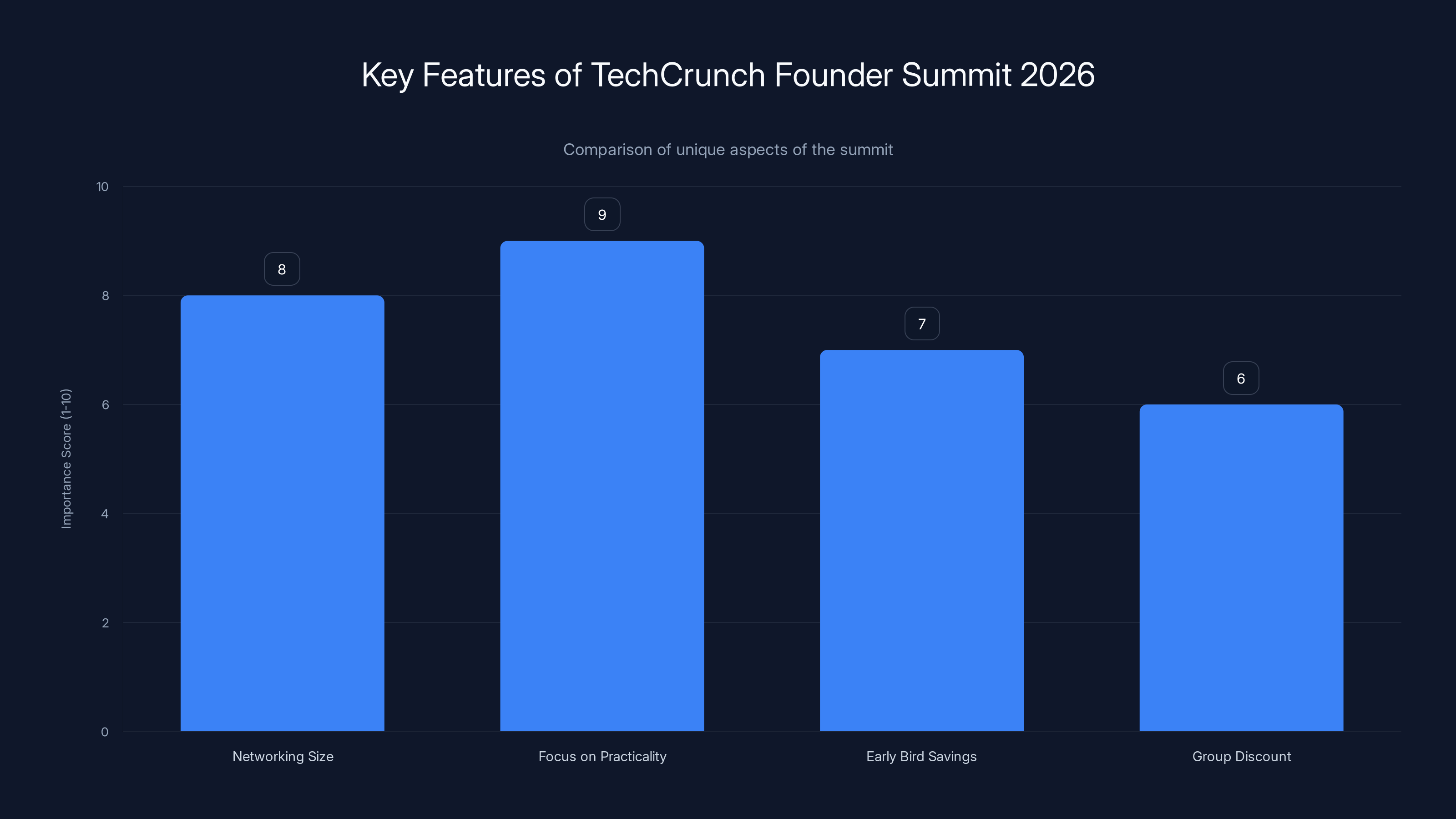

Here's what's actually different about this conference compared to the dozen others competing for your attention. First, it's intentionally small enough that networking isn't just "walking past badges in a hallway." With 1,100 founders and investors, you're not fighting through crowds of 10,000. Second, the agenda focuses ruthlessly on practical scaling problems, not theoretical fluff. The sessions are built by people who actually understand what breaks when you grow from 10 employees to 100.

Third, and this matters more than you'd think, Super Early Bird pricing is live right now. We're talking up to $300 savings if you move fast. For teams, the group discount hits 30% off when four or more of you register together.

This guide breaks down everything you need to know about the summit, why founders actually show up year after year, what to expect from the sessions and speakers, and how to make the most of your time there. Whether you're raising your first round or navigating the C-suite, there's something here designed specifically for your stage.

TL; DR

- When & Where: June 23, 2026 in Boston, bringing together 1,100 founders and investors

- Early Savings: Super Early Bird pricing saves up to $300 per ticket, plus 30% group discounts for teams of 4+

- Core Focus: Peer-to-peer learning, investor connections, and practical scaling strategies for every stage

- Speaker Caliber: Past speakers include Jon Mc Neill (Tesla), partners from Sapphire Ventures, Index Ventures, Sequoia Capital, and Greylock

- Content Depth: 250+ sessions focused on raising capital, product scaling, team building, and exit strategies

- Bottom Line: This isn't a networking mixer—it's a working conference designed by founders, for founders

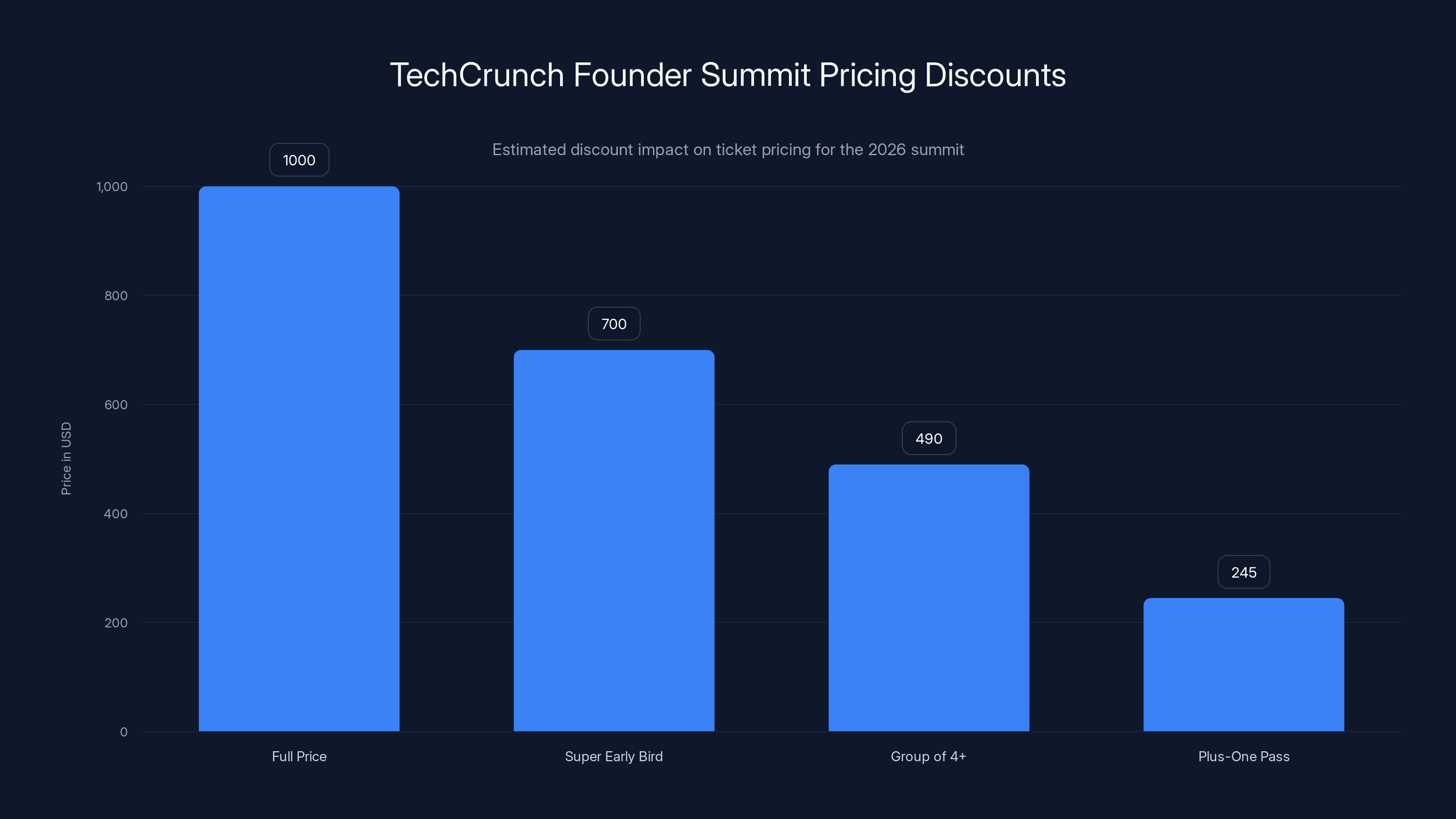

Estimated data shows significant savings with early bird and group discounts. Super Early Bird saves $300, and group discounts can further reduce costs by 30%.

Why Founders Actually Show Up: The Real Value Proposition

There's a specific moment that happens at founder conferences, and honestly, it's the only reason they matter. You're sitting in a breakout session about unit economics or Series A strategy, and someone raises their hand with a question that's been keeping them up at night. You realize that exact problem almost crushed your company two years ago. Suddenly, you're not in a sterile hotel ballroom anymore. You're in a real conversation with someone navigating the same gauntlet.

That's what separates Tech Crunch Founder Summit from the venture circuit noise. The entire event is built around the assumption that founders learn best from founders, not from consultants presenting five-year-old case studies.

The summit isn't trying to be all things to all people. There's no "AI is the future" keynote where some CEO with a vague vision rambles for 45 minutes. Instead, the content focuses on the decisions that actually determine whether your company survives the next 18 months. How do you know if you're raising too early or too late? What does a Series C pitch look like when you've already hit scale? When do you stop trying to fight the market and accept the pivot? When do you shut down gracefully instead of burning another two years of capital?

This is the stuff that doesn't make it into the polished founder interviews on podcasts. It's the real, messy conversation that happens when you get founders together who've actually been through it.

The investor presence matters too, but not in the way you might think. This isn't a cattle-call where you get 60 seconds to pitch someone between their phone calls. The investors who show up to Founder Summit are there because they're actively looking to learn where the market's heading, what founders are building, and where the category innovation is happening. It's a different energy than the sterile pitch competitions where both sides pretend the other's time isn't being wasted.

Super Early Bird pricing offers significant savings of up to $300 per ticket. Group discounts provide an additional 30% off, making it affordable for teams. Estimated data based on typical conference pricing.

The Early Bird Pricing Structure: Your Window to Save Big

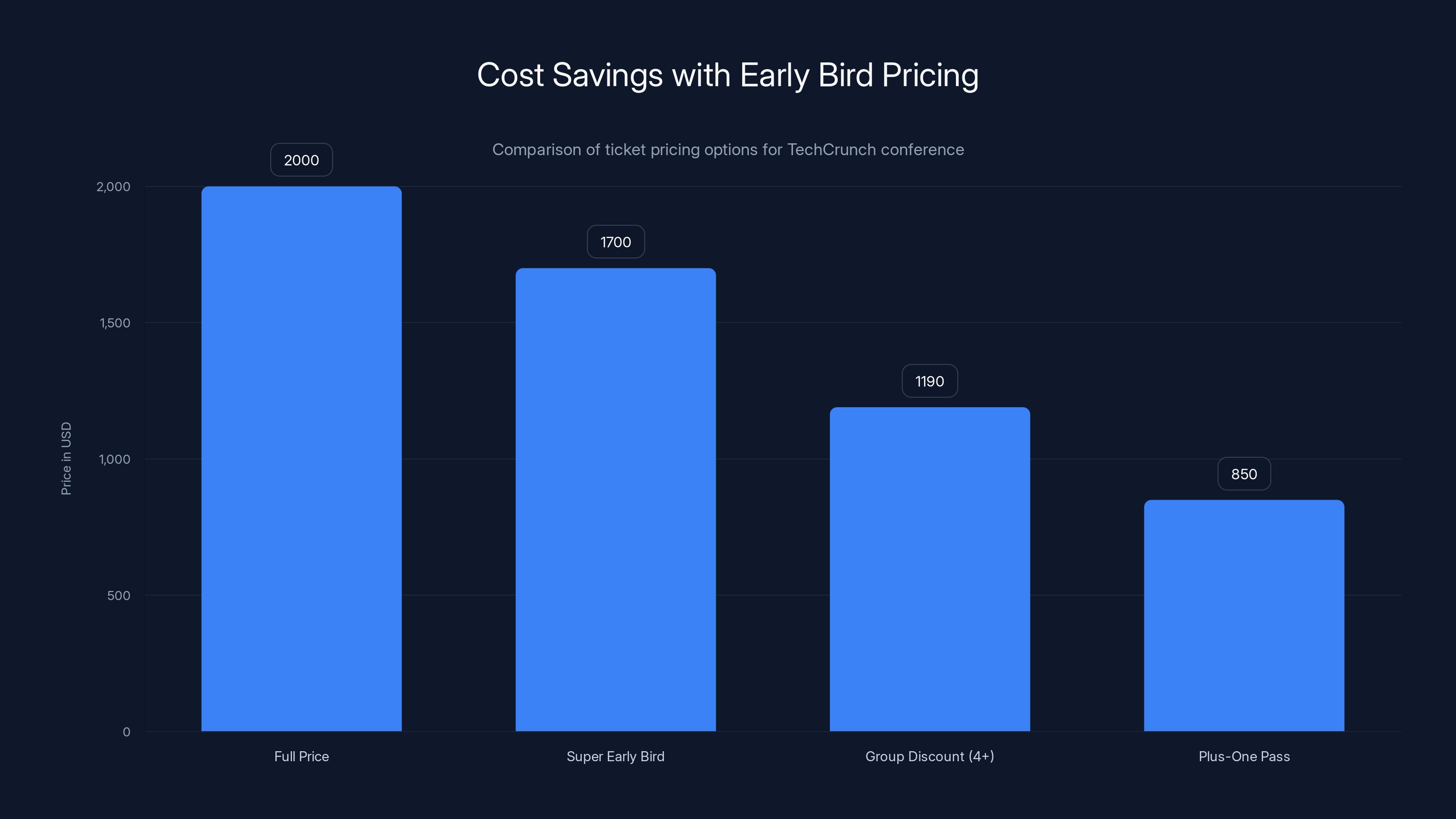

Let's talk about the money part, because ticket prices to founder conferences have gotten ridiculous in recent years. A single pass to some industry events can run you $2,000 or more, and that's before the hotel in whatever overpriced city the organizers picked.

Tech Crunch took a different approach. The Super Early Bird pricing is legitimately their lowest rate of the year. We're talking savings of up to $300 per ticket. That's significant whether you're a solo founder bootstrapping your way through or a team coordinator trying to get four people there without destroying your budget.

Here's the math that matters. If you register as a group of four or more, you get an additional 30% discount on top of the early bird rate. So a four-person team gets meaningful savings times four. For startups running lean, that difference between full price and early bird pricing might be the difference between "we can afford to send our whole founding team" and "we can only send the CEO."

The catch, predictably, is that these rates don't last all year. Super Early Bird pricing is available right now while spaces are opening. As the conference gets closer and more people commit, prices move up. If you're serious about going, the math says register sooner rather than later.

One note worth mentioning: the first 500 people who register as part of a group get 50% off a plus-one pass. That's actually generous considering the networking value of bringing a cofounder, CTO, or investor with you. You're essentially getting a second attendee for the price of a heavily discounted single ticket.

This pricing structure isn't random. Tech Crunch understands that the value of the summit compounds when teams attend together. You get more out of the sessions when you can debrief with someone from your company afterward. The investor meetings hit different when your technical cofounder can jump into the conversation halfway through. The whole experience works better as a group.

The Founder-Only Room: Where Real Connections Happen

Most conferences have a speaker stage, breakout sessions, and a hallway. Tech Crunch Founder Summit added something intentionally different: a dedicated founder-only space.

This is worth understanding because it signals the organizers' priorities. They're not trying to maximize sponsor booths or create photo ops for their marketing team. They're creating protected time and space where founders can actually talk to other founders without feeling like they're performing or networking.

The founder-only room serves a specific purpose. It's a space designed for conversations that require a certain level of context or honesty. A founder struggling with their first round of layoffs can ask someone who's actually done it what that felt like, what they'd do differently, and what surprised them about the process. There's no investor in the room trying to get a founder to optimize their story for a pitch. There's no vendor trying to demo their product. It's just founders.

This matters more than it sounds. A lot of the real value at conferences happens in hallway conversations, but hallway conversations are random. You bump into someone, you talk for five minutes, and then you both move on. A structured founder-only space with clear time and purpose creates the conditions for deeper conversations. You can actually schedule time to talk with someone about a specific problem. You're not interrupted by the speaker starting the next breakout session.

The types of conversations that happen in these spaces tend to be the ones that stick with you. Someone shares how they rebuilt trust with their team after a major pivot. Another founder talks about how to know when to bring in professional management versus growing your current team. Another shares the specific metrics that convinced their board they weren't ready to raise Series B yet, and why waiting actually worked out better. These are conversations that might prevent you from making a mistake that could set your company back six months or a year.

The founder-only room also creates a sorting mechanism. Investors who show up to the summit respect that there are spaces for pure founder conversation. It actually enhances the quality of investor interactions that happen elsewhere because investors know founders aren't desperate for attention. When a founder and investor connect outside the founder-only room, it's because they both chose to have that conversation, not because one party was trapped in a networking line.

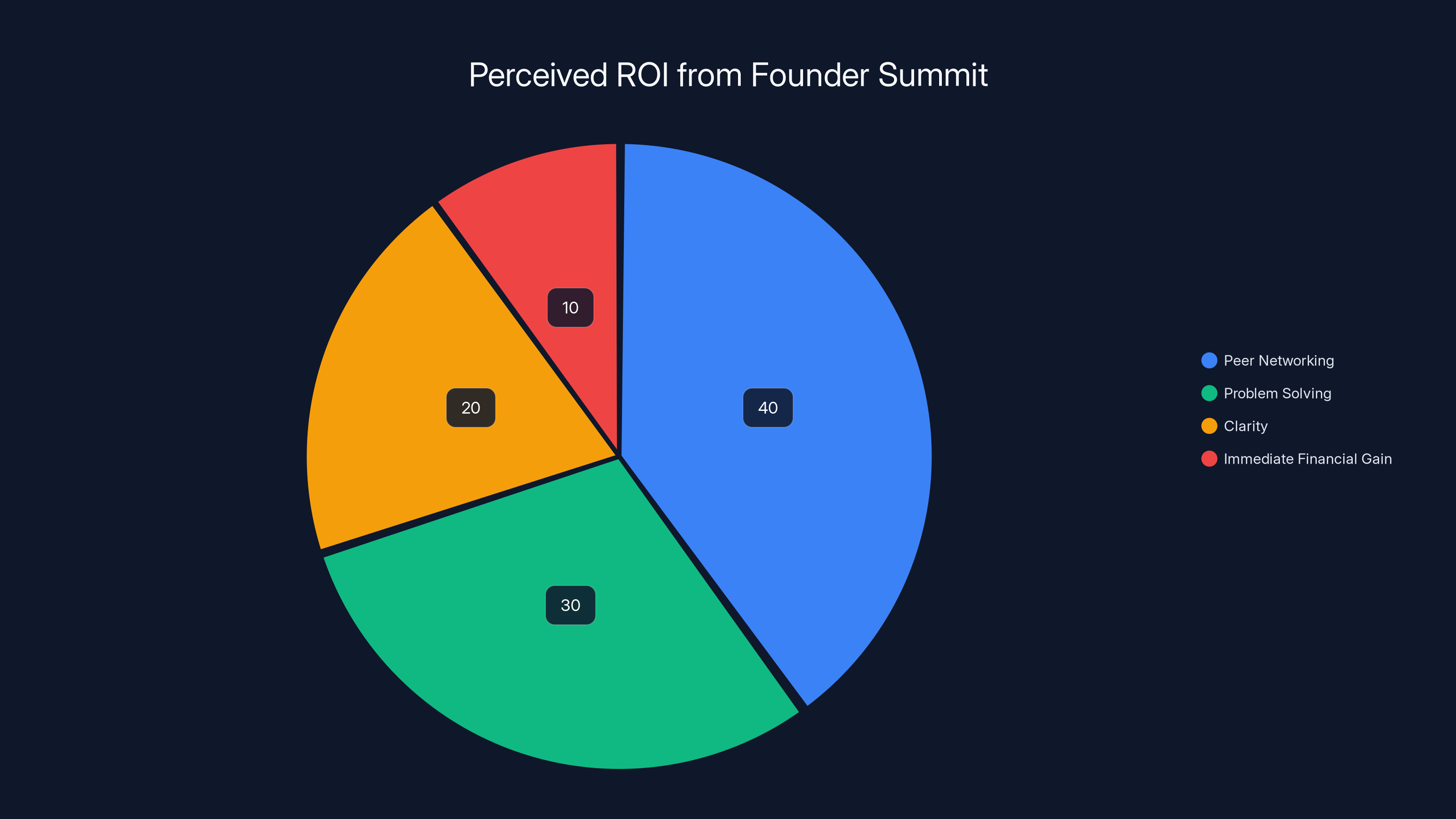

Estimated data suggests that peer networking is the most significant source of ROI for attendees, followed by problem-solving and gaining clarity. Immediate financial gain is less common.

Breaking Down the Summit Content: Sessions Designed for Real-World Problems

The agenda for Founder Summit isn't built by someone reading articles about startup trends. It's built by talking to founders about what actually keeps them up at night, then finding people who've navigated those exact problems.

Here's the pattern you'll see across the breakout and roundtable sessions. They're specific enough that you can actually use the insights immediately. "Raising Capital" isn't a session. "How to Prepare Your Metrics for Series A Conversations" is. "Building Your Pitch Deck" isn't what you'll find. "What Investors Actually Look at in Your Deck (And What You Should Cut)" is closer to the real topic.

Past sessions have covered the moments that actually determine a company's trajectory. How to know when you're ready for Series A and what preparation that requires. The specific messaging that resonates with Series A investors versus Series B, versus later stage. How companies get to ten million in annual recurring revenue without burning through venture capital. The technical and operational decisions that let you scale from ten employees to one hundred without everything falling apart. How to know when selling the company makes more sense than continuing to build it.

There are also sessions on the stuff nobody talks about in polite founder circles. How and when to shut down gracefully when a company isn't working. What founders should do in the year before going public to prepare operationally. How to negotiate with acquirers when your leverage is asymmetrical. When to bring in professional management and what that transition feels like.

The roundtable format deserves specific mention because it's different from typical conference sessions. Instead of a speaker on stage and passive audience, roundtables are structured conversations where everyone has skin in the game. A partner from a venture firm moderates, maybe three to five founders with different stage companies sit around a table with fifteen to twenty other founders, and the conversation bounces between the moderator's questions and organic discussion. You get the benefit of hearing specific questions from people in your situation, which often surface insights better than any prepared remarks could.

Learning From Proven Operators: The Speaker Lineup

When Tech Crunch books speakers for Founder Summit, they're not interested in hiring motivational speakers or people who've written a book about entrepreneurship. They want people who've actually been inside the chaotic reality of scaling a real company.

That's why Jon Mc Neill shows up on the agenda. Mc Neill was president of Tesla, so he's not theorizing about how to scale manufacturing, supply chain, and personnel simultaneously. He's lived the specific nightmare of trying to scale production when component availability is the limiting factor. He's navigated the politics of being a non-founder running a high-growth company. He's handled the moment when the founder's vision and the operational constraints collide. Now he invests and advises founders, so he's seeing the patterns across dozens of companies trying to solve similar problems.

When Mc Neill talks about product innovation at scale, he's not presenting a framework that sounds good in a slide deck. He talks about why reviewing actual product instead of mockups drives better decisions. This matters because most startup advice is about frameworks and processes. But the specific difference between looking at a prototype versus a pitch deck might change a product roadmap completely. That's the kind of concrete insight that comes from someone who's actually made that decision at scale.

Cathy Gao from Sapphire Ventures brings a different but equally practical perspective. She's seen hundreds of founders preparing to raise Series C, so she knows exactly what they're missing in their preparation. The narrative they're telling isn't matching their unit economics. The team size is growing faster than their operational maturity. They're optimizing for growth rate when they should be optimizing for unit economics first. These aren't theoretical problems. They're the specific mistakes she watches founders make repeatedly because nobody told them what Series C investors are actually looking for.

Jahanvi Sardana from Index Ventures brings insight from the European and global perspective, which matters because many founders are still thinking about TAM (total addressable market) in outdated ways. The insight that founders should focus on something other than TAM sizing might sound simple, but it reshapes how many founders think about market opportunities. Instead of spending six months building a bottom-up TAM model that's probably wrong anyway, they could focus on building something people actually want and letting the market size reveal itself through usage patterns.

The pattern across all the speakers is consistent: people who've been in the actual chair, made the actual decisions, and lived with the consequences. Sequoia Capital partners, Greylock leaders, Precursor Ventures investors, team builders from multiple ventures. They're not professional speakers. Some of them are actually awkward on stage. But they have something worth hearing because they've been inside the problems that are probably affecting your company right now.

The 2026 agenda is still being finalized, which means more speakers are coming. The way Tech Crunch typically approaches this is they're adding voices from founders who've recently hit milestone moments. Someone who just raised an oversubscribed Series B. Someone who recently scaled to profitability. Someone who navigated an unexpected pivot and came out stronger. The agenda builds toward a narrative arc where each speaker's insight builds on the previous one.

The TechCrunch Founder Summit 2026 stands out with its focus on practical scaling solutions and manageable networking size, scoring high in importance compared to other features. Estimated data.

Planning Your Summit Experience: Making the Most of Two Days

Most founders show up to conferences and treat it like buffet dining, trying to hit every session. That's actually the worst strategy because the value isn't the sessions themselves. The value is focused learning, strategic conversations, and specific connections.

Here's how productive founders approach Founder Summit. They identify three specific problems they want to solve or questions they want answered during the event. They choose two breakout sessions and one roundtable that directly address those problems. Then they leave time for unstructured conversations and founder-only room discussions.

This approach works because it creates a filter. You're not trying to absorb everything. You're trying to solve three things. That mental clarity makes it easier to have good conversations in the founder-only room because you know what you're looking for. When you meet someone, you can ask whether they've dealt with one of your three problems. Suddenly the conversation has direction instead of being generic networking small talk.

The second principle is to attend with intention about investor meetings. If you're raising, you probably have three to five investors you want to actually talk to at the summit. Don't try to pitch every investor in the room. Use the summit as a low-pressure way to have a real conversation with someone about your space and your company. It's better to have one good conversation with a relevant investor than ten mediocre conversations with people who aren't actually in your target stage.

The third principle is to bring your team. If you're a founding team of two or three, bring both or all of you. The summit is significantly more valuable when you can debrief with someone from your company afterward. You might both attend a breakout session on financial modeling, but you'll extract completely different insights based on your roles and your company's specific stage. When you compare notes afterward, both insights deepen.

The founder-only room deserves a specific strategy too. Show up with an open mind, but bring a question you're actually struggling with. "How do you know if you're raising too early?" or "We're struggling with unit economics, how did you get to positive?" These real questions generate real conversations. Generic networking questions like "What stage are you at?" are conversation enders, not beginners.

Timing matters as well. Some founders optimize for attending all the sessions. Others optimize for having the most interesting conversations possible. The ones who get the most value tend to be the ones who skip some sessions intentionally because they're in the middle of a good conversation with someone useful. Your conference organizer might not like this, but your business will.

Who Should Actually Attend: Mapping It to Your Stage

Tech Crunch Founder Summit works for founders at different stages, but in different ways. Understanding your stage helps you extract maximum value.

If you're pre-seed or seed stage, you should be going for pattern recognition and founder camaraderie. You're not ready to raise Series A yet, so the Series A breakdown sessions are useful for planning, but you're mainly there to understand what the next 18 months actually look like. You want to hear from someone who was in your position two years ago and understand what they'd do differently. You want to meet other founders at your stage because those are the people you're going to compare notes with for the next five years. The founder-only room is genuinely the most valuable part of the summit for early stage founders because you're normalizing the chaos with people experiencing the same thing.

If you're Series A, the summit is specifically designed for you. The sessions are mostly about Series A readiness and early growth. The investors present are Series A investors or early B investors who've been looking at companies like yours. The roundtables are packed with other Series A founders navigating the same challenges. This is probably the stage where you get the highest ROI per dollar of ticket cost because the content is most directly applicable.

If you're Series B or C, you're there for different reasons. The tactical sessions might be less directly applicable because your company is further along. But the value shifts to navigating growth challenges that only come up at scale, connecting with later stage investors, and understanding where the market is actually heading in your space. Founders at this stage tend to value the investor conversations and the peer group more than the sessions.

If you're in the "exploring exit" phase, there are sessions specifically about that trajectory. When do you start conversations with acquirers? How do you position your company? What are acquirers actually looking for at different price points? These aren't topics covered at every founder conference, so if that's your trajectory, the summit has value most conferences don't offer.

The startup operator or CTO thinking about moving into a founder role should probably attend too. You get to see what the role actually requires, what the real decisions look like, and you can have conversations with people currently in that role. It's a much better way to figure out if founding is actually what you want than reading Medium posts about entrepreneurship.

The one person who might want to think twice is someone in the immediate pre-launch phase. If you're two weeks away from launch and still in crisis mode, maybe skip the summit and use that time to ship. But basically everyone else at every other stage extracts value from the event.

Super Early Bird pricing offers the highest savings of

The Investor Dynamics: What's Actually Happening

There are investors at Founder Summit, and understanding what they're doing there helps you understand how to interact with them productively.

Investors don't typically fly to founder conferences because they're desperate for deal flow. They get deal flow constantly. They're at Founder Summit for a different reason: to understand what founders are building, what categories are starting to emerge, where the smart people are focusing, and what investor themes are starting to validate in the market.

This changes the dynamic. An investor at Founder Summit is usually in a more open, exploratory mode than an investor you cold email or get introduced to through a traditional VC channel. They're not sitting at a booth expecting pitches. They're wandering around conversations, listening to what themes keep coming up, and evaluating where the market is actually heading versus what they predicted in their fund thesis.

For founders, this means the dynamic is almost inverted from a formal pitch process. Instead of you trying to convince the investor they should care about you, you're both exploring the same space and having a conversation about what you're noticing. An investor who hears from three different founders that supply chain logistics for climate tech is becoming tractable might have just learned something important about their portfolio. You might learn from that investor that they're seeing the same trend and are actively thinking about investments in that space.

The partner from Sapphire Ventures, Sequoia Capital, or Index Ventures at Founder Summit is there partly to source deals, but more importantly, they're there to calibrate. They're checking their market understanding against what they're hearing from founders. They're evaluating whether their team's thesis about what's coming next is matching founder intuitions. They're building the relationships that, six months or two years from now, might become formal investment conversations.

This distinction matters because it changes how you should interact with investors at the summit. You're not optimizing for a killer pitch. You're optimizing for a real conversation about something you've noticed in the market, a problem you think is important, or the space you're building in. Tell an investor what you're actually seeing, not what you think they want to hear. Ask them what they're noticing, not for money. Build real relationship foundations.

Many founders walk away from Founder Summit with a deeper relationship with an investor they met in the hallway for ten minutes, not because they pitched perfectly, but because they had a real conversation about the market. That relationship is actually more valuable than a formal pitch process because it's built on substance, not presentation.

The Boston Location: Why This Venue Matters

Tech Crunch holds different events in different cities, and there's actual strategy to why Founder Summit is in Boston in 2026.

Boston has a particular startup ecosystem that's different from San Francisco, New York, or Los Angeles. It's built heavily on deep tech, life sciences, climate tech, and enterprise software. The founder population trends toward founders with technical backgrounds, strong operational discipline, and less focus on "move fast and break things" culture and more focus on building things that actually work at scale.

This means the founder group at a Boston Founder Summit skews differently than the same event would in San Francisco. You'll meet more biotech founders, more enterprise B2B founders, more climate tech founders than you would at an SF event. You'll hear more conversations about technical feasibility and operational excellence. The investor base shows up differently too because Boston investors have a particular thesis about what they're looking for.

For founders in East Coast companies, the location cuts down on travel friction. You're not flying across the country. For founders building to sell to East Coast enterprise customers, the investor and founder density in Boston is actually quite valuable. For founders in West Coast companies, it's an opportunity to understand how East Coast venture capital works and what Boston investors are thinking about.

The city also creates a different social environment than a massive conference center in Vegas or a tech center like SF. Boston in June is pleasant. The city has personality. You can actually have dinner with someone you met in a breakout session and continue the conversation. You can duck into a good coffee shop before an investor meeting. These seem like small things, but they affect the quality of conversations and how long people stay engaged at the event.

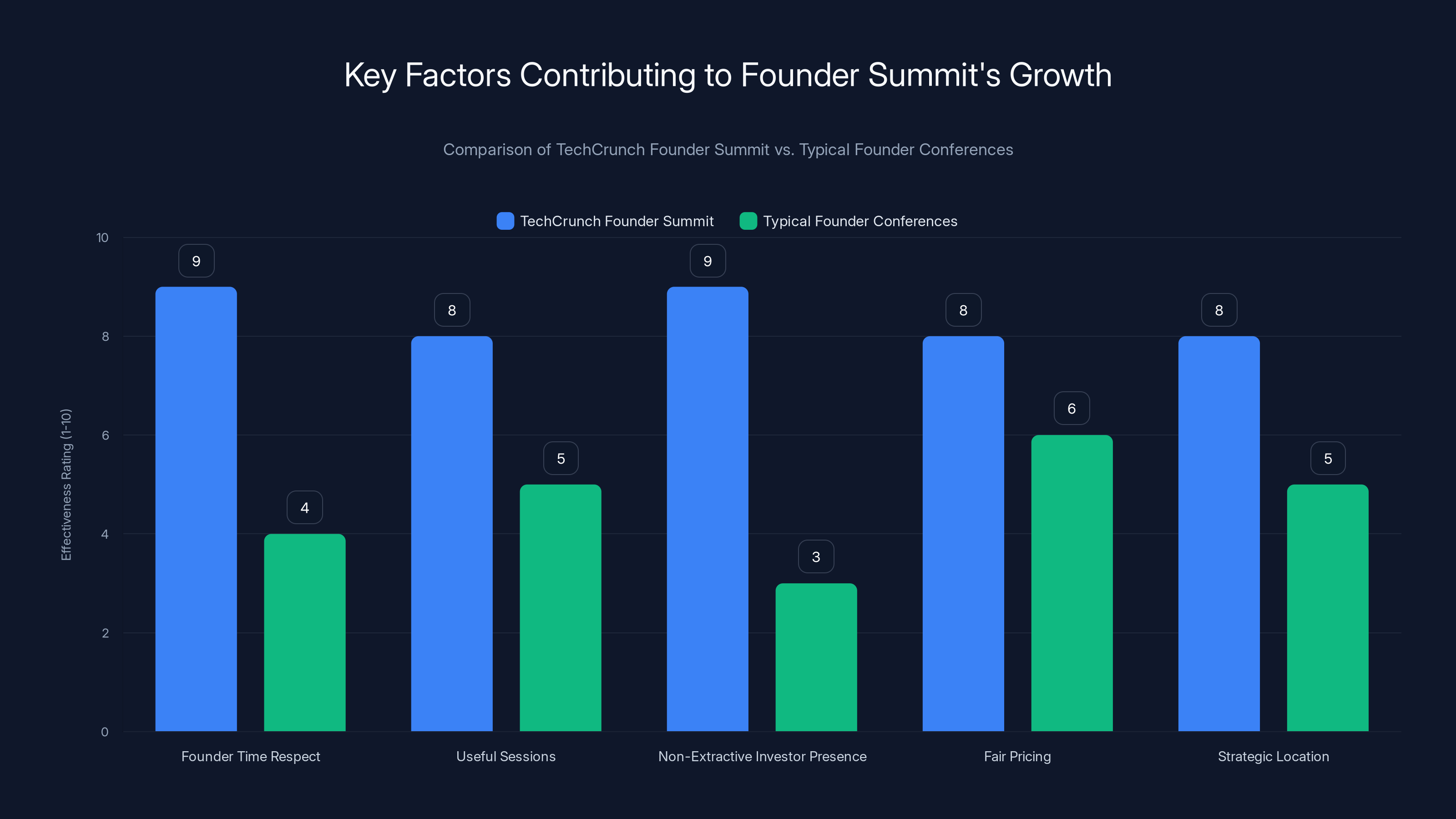

TechCrunch Founder Summit excels in respecting founder time and providing valuable sessions, unlike typical conferences which often focus on marketing. Estimated data.

Logistics and Practical Details: What You Actually Need to Know

Showings up to a conference and figuring out logistics the day of is a recipe for stress. Here's what you need to think through in advance.

First, accommodation. June in Boston is busy, so if you're flying in, book your hotel immediately after you register for the summit. The conference organizers likely have a hotel block negotiated at a specific rate, so check the summit website for that information. If you're within driving distance, you might skip the hotel and drive in the day of, but the trade-off is you miss the evening networking opportunities.

Second, transportation. If you're flying in from the coast, Boston Logan is the major airport, with decent connectivity. The city has decent public transportation, so renting a car probably isn't necessary. If you're driving, parking at hotels runs $20-40 per day, so factor that into your planning.

Third, schedule building. The summit likely provides the full agenda a few weeks in advance. Download it, make your session choices, and put them in your calendar immediately. If you wait until the morning of the event, you'll be making reactive choices based on what sounds interesting rather than strategic choices based on your goals.

Fourth, networking prep. Before you go, add relevant people to a list. People you want to connect with, investors who fit your stage, other founders doing interesting things in your space. Bring those names and use them to guide conversations or ask if anyone's connecting you. Linked In introductions before the event are worth more than trying to connect with strangers during the event.

Fifth, pitch materials. You don't need your entire deck, but bring business cards and maybe a one-pager with your company's mission and what you're raising (if applicable). Most investor conversations at Founder Summit don't require a full pitch, but you want enough materials that if someone asks, you can follow up efficiently.

Sixth, what to bring physically. Business casual is standard. A water bottle because hotel conference centers are always too warm. Comfortable shoes because you'll walk more than you expect. Your phone fully charged. A notebook because you'll want to capture insights from sessions without being distracted by typing.

Seventh, the evening before. Don't stay up late networking the night before. Get rest. Most founders come to conferences exhausted already, then burn themselves out completely during the event. You'll be more present and have better conversations if you show up rested.

The ROI Calculation: Is This Worth Your Time and Money?

Let's be direct about the financial and time ROI of attending Founder Summit.

The cost is

What's the return? This is where you need to be honest about what would actually constitute a win for you.

If you measure ROI as "did I make an investment?" then most founder conferences fail that test. Most founders who attend Founder Summit don't immediately raise money from someone they met there. That's not the design. The summit isn't a pitch competition or a vendor fair where you're supposed to convert attendees into customers.

But if you measure ROI differently, the picture changes. Did you solve one specific problem that was costing you time or money? If you went to a roundtable about unit economics and came away understanding why your CAC payback period is too long, and that insight changes how you allocate the next quarter of resources, that's a return. If you met a founder who's five years ahead of you and now you have a peer advisor you can ask questions to, that's a return. If you heard from an investor about where they're placing bets and that changes your product roadmap to better fit investor expectations, that's a return.

For most founders, the best ROI comes from the peer group. You meet other founders, you stay in touch, and over time you learn from their mistakes and wins. You might not create a deal or raise capital at the summit itself, but you build relationships that compound over years. The founder you meet who's navigating the same growth challenges you are becomes a permanent resource.

The second best ROI typically comes from clarity. A founder goes in confused about whether they should raise Series A or spend another year raising from angels. A session and a few conversations with investors clarifies the path forward. That clarity might be worth thousands of dollars in preserved capital because you're not spinning your wheels on an approach that isn't working.

The worst ROI comes if you go, collect a bunch of business cards, and never follow up. You spent the money, took the time, had the conversations, and then let it all dissipate because you didn't systematize follow-up. The summit provides the opportunity. You have to do the work to convert it into actual value.

For a founding team, the ROI usually works out to about

Tying It Together: Why Founder Summit Keeps Growing

Tech Crunch Founder Summit keeps expanding and getting booked out because it does something deliberately that most conferences don't do. It respects founder time.

The sessions are designed to be directly useful. The speakers are people who've actually navigated the problems founders are facing. The investor presence is structured so conversations are real, not extractive. The founder-only space creates protected time for honest conversation. The pricing is fair. The size is intentional. The location is chosen strategically. Everything about the event design signals that organizers understand what would actually be valuable for a founder to spend time on.

Compare this to most founder conferences, which are basically marketing events disguised as educational conferences. They're packed with speakers pitching their services, sessions designed to make problems sound solvable with the right product, investor booths set up like trade shows. Founders show up exhausted, leave exhausted, and often walk away with expensive software licenses they don't actually need.

Tech Crunch Founder Summit is different because the Tech Crunch team actually cares about founder success as the primary metric, not conference attendance or sponsorship revenue. This comes through in a thousand small details: the fact that there are spaces specifically for non-pitching conversations, the fact that the sessions focus on real problems and don't just evangelize the latest trends, the fact that the investor participation is curated so you get serious investors, not every VC trying to build a pipeline.

For founders trying to scale in 2026, when the market is tightening and capital is less forgiving, this kind of focused peer learning is valuable. You're not going to the summit to get hyped up about the potential of your company. You're going to get smarter about how to actually execute.

The early bird pricing is available right now because Tech Crunch is banking on the fact that founders will recognize this value and commit early. For most founder events, early commitment doesn't happen until they feel FOMO kicking in. But for the Founder Summit, the pattern is different. Founders who've been before come back, and they're willing to register early. Founders who are new to the summit recognize the value from the speaker lineup and the event design, so they commit early too.

If you're a founder and you're trying to decide whether to allocate

The early bird pricing being available right now means you can make the call without artificial pressure. Look at the speaker lineup. Look at the session topics. Ask yourself if solving one specific problem would be worth $500. If yes, register. If no, skip it and use the time on something that's more directly valuable to your company.

Looking Forward: The Evolution of Founder-Focused Events

The success of Founder Summit speaks to a broader shift in how the startup ecosystem is maturing. There's less interest in the generic "startup culture" conferences and more demand for deep, specific learning around the actual problems founders face.

Five years ago, founder conferences were primarily about inspiration and networking at scale. Today, the best founder conferences are designed more like working sessions. Tech Crunch is reading this trend correctly by doubling down on the practical, stage-specific content and the peer learning aspect.

The trend we're likely to see continue is even more specialization. You'll see more founder summits organized around specific industries (climate tech founders, biotech founders, developer tools founders) rather than general-purpose founder events. You'll see more round-table formats and fewer traditional panel discussions. You'll see more investor participation focused on genuine conversations rather than pitching. You'll see smaller, more curated events that optimize for depth over breadth.

The implications for founders are good. As these events get better designed and more aligned with what actually helps you improve your company, they become more valuable. The trade-off is they're more competitive to get into because everyone recognizes the value. The Tech Crunch Founder Summit isn't the only event worth your time, but it's positioned well in this landscape because it's been intentional about not becoming a generic conference.

For investors, the same trend is playing out. The best VCs are using events like Founder Summit as listening posts and relationship builders, not as deal pipelines. They're there to understand what founders are noticing, where the market is shifting, and to build relationships that might become investments down the road. The top investors show up because they understand that the best deals often come from deep relationships built through authentic conversation, not from pitch competitions.

FAQ

What exactly is Tech Crunch Founder Summit and who should attend?

Tech Crunch Founder Summit is a one-day annual conference bringing together 1,100 founders and investors focused specifically on practical scaling. The summit is held on June 23, 2026 in Boston. You should attend if you're a founder at any stage from seed to growth, an investor looking to understand market trends, or an operator considering making the transition to founding. The conference is specifically designed around peer learning and practical scaling challenges rather than generic startup inspiration.

How much does it cost to attend and what discounts are available?

Super Early Bird pricing saves up to $300 per ticket compared to full price, making it the lowest rate of the year. If you register as a group of four or more people, you receive an additional 30% discount on top of the early bird rate. The first 500 group registrations also receive 50% off a plus-one pass, so you can bring an extra team member at heavily discounted rates. The exact pricing depends on when you register, as prices increase as the event approaches.

What kinds of sessions and speakers will be at the 2026 summit?

The summit includes 250+ sessions organized as breakout sessions and roundtables covering practical scaling challenges like raising different rounds of funding, scaling revenue to ten million ARR, building teams at scale, exiting companies, and preparing for IPO. Past speakers have included Jon Mc Neill (former Tesla president), partners from Sapphire Ventures, Index Ventures, Sequoia Capital, and Greylock. The 2026 agenda is being finalized with additional speakers being announced, so check the event website for the full lineup.

Is there value in attending if I'm not raising capital right now?

Absolutely. Many founders get the most value from peer conversations and learning from founders five years ahead of them rather than from investor meetings. If you're navigating specific scaling challenges, wanting to build a founder peer group, or trying to understand what your next growth stage actually looks like, the summit has significant value even if you're not immediately fundraising. The founder-only room specifically exists for deeper peer conversations that go beyond capital raising.

How far in advance should I register and what else should I prepare?

Register immediately to lock in Super Early Bird pricing, which is available while spots are opening and decreases as the conference approaches. Before you attend, identify three specific problems you want to solve or questions you want answered, map out which sessions and roundtables address those problems, and prepare a list of people you want to connect with. Book your hotel early since June in Boston gets booked up, and arrange travel logistics in advance so you can focus on the summit itself rather than logistics.

What's the best way to make valuable connections at the summit?

Instead of trying to meet everyone, focus on strategic conversations with people relevant to your three specific problems. Use the founder-only room to ask real questions you're struggling with rather than generic networking conversation. If you're raising, identify three to five investors you want real conversations with rather than trying to pitch everyone. And attend with your team if possible so you can debrief on sessions afterward and leverage collective insights.

Will I actually make investor connections that lead to funding?

While some founders do connect with investors who eventually lead to funding, that's not the primary purpose of the summit. The real value for fundraising typically comes from the conversations you have at the summit increasing your clarity about what investors actually want, and the investor relationships you build potentially leading to introductions and conversations months later. The direct converting of a summit meeting into an investment round is relatively rare, but the relationships built often become valuable.

Final Thoughts: Making the Most of Your Founder Journey

Building a company at scale is one of the hardest things you'll ever do. The decisions that determine whether you make it are usually made in conversations with people who've already navigated similar problems. Tech Crunch Founder Summit exists because the conference organizers understand this fundamental truth.

Your time is your most limited resource. Money you can raise more of. Attention you can focus more sharply. But time keeps moving forward whether you use it well or not. Investing two days in a conference where you're surrounded by founders navigating similar challenges, investors thinking about your space, and sessions specifically designed around the scaling problems you're facing, is one of the better uses of time most founders make.

The early bird pricing being available right now removes one excuse to procrastinate on the decision. Register, block the time, prepare your three key problems to solve, and show up ready to learn. Your company will be better for it.

The founder community is one of the best assets in the startup ecosystem. Everyone's learning in public, sharing mistakes, and helping each other navigate this wild, chaotic, occasionally brilliant journey of building something new. Founder Summit is where that community gathers intentionally to accelerate each other's learning. That's worth your attention.

Key Takeaways

- TechCrunch Founder Summit 2026 in Boston on June 23 brings together 1,100 founders and investors focused specifically on practical scaling challenges and peer learning

- Super Early Bird pricing available now saves up to $300 per ticket with additional 30% group discounts for teams of 4+, making early registration financially smart

- The summit's value comes primarily from peer-to-peer founder learning, honest investor conversations, and sessions structured around real-world scaling problems, not generic startup inspiration

- Expert speakers including Jon McNeill (former Tesla president), Sapphire Ventures, and Sequoia Capital partners share concrete insights from actually navigating growth, not theoretical frameworks

- Different founder stages extract different value—early stage founders benefit most from peer group and camaraderie, while Series A founders find sessions most directly applicable, and later stage founders value investor conversations

Related Articles

- TechCrunch Disrupt 2026: Your Complete Guide to Early Bird Deals & Networking [2025]

- TechCrunch Disrupt 2026: Save $680 + 50% Off +1 Tickets [2026]

- Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]

- Redwood Materials $425M Series E: Google's Bet on AI Energy Storage [2025]

- Northwood Space Lands 50M Space Force Contract [2026]

- AI Chip Startups Hit $4B Valuations: Inside the Hardware Revolution [2025]

![TechCrunch Founder Summit 2026: The Ultimate Guide to Scaling Your Startup [2026]](https://tryrunable.com/blog/techcrunch-founder-summit-2026-the-ultimate-guide-to-scaling/image-1-1769615177123.jpg)