Introduction: The Truck That Nobody Wanted

Something strange happens when a company builds something that breaks the internet with hype, and then the internet collectively decides it doesn't want it anyway. That's the Cybertruck story in 2025.

Back in 2019, when Elon Musk unveiled that angular, unpainted stainless steel pickup truck on stage, it looked like the future. The internet went wild. Pre-orders flooded in. Musk promised a

This isn't a story about a flawed product. It's a story about what happens when a company creates something so divorced from what actual truck buyers want that no amount of price cuts can fix the fundamental problem. It's about how Tesla, the company that revolutionized electric vehicles and made them desirable, somehow created a truck so polarizing that it alienated both traditional pickup owners and EV enthusiasts simultaneously.

The Cybertruck's collapse raises bigger questions about Tesla's product strategy, Musk's ability to read market demand, and what happens when a company's CEO becomes more focused on being provocative than pragmatic. It's also a masterclass in how hype and reality can diverge so dramatically that even one of the world's most valuable companies can't bridge the gap with discounts alone.

Let's dig into what went wrong, why the fixes aren't working, and what this means for Tesla's future.

The Original Promise vs. Reality: Seven Years of Unmet Expectations

When Musk walked out on stage in November 2019 to present the Cybertruck, he wasn't just launching a vehicle. He was presenting a vision of the future. The design was intentionally radical. The price point was designed to be shocking. Everything about the presentation was calculated to generate maximum controversy and attention.

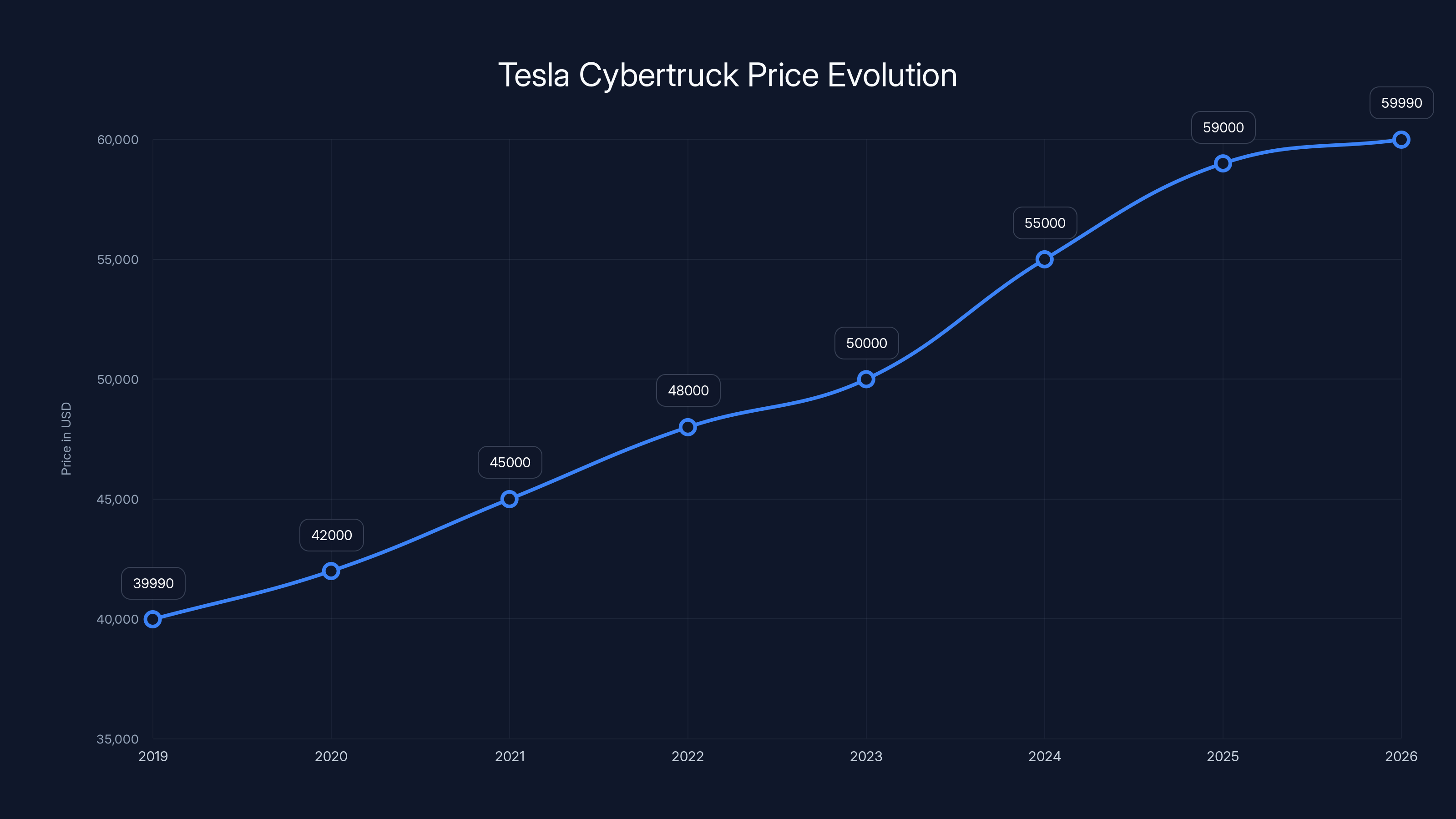

He promised a $39,990 entry model. That was the headline number that got repeated everywhere. It was supposed to be cheaper than a Ford F-150. It was supposed to offer true monocoque construction, meaning the entire body would be a single structural unit with no separate frame. It was supposed to be built with an exoskeleton design that made it nearly indestructible. It was supposed to seat six people. It was supposed to handle towing that would match or exceed anything else on the market.

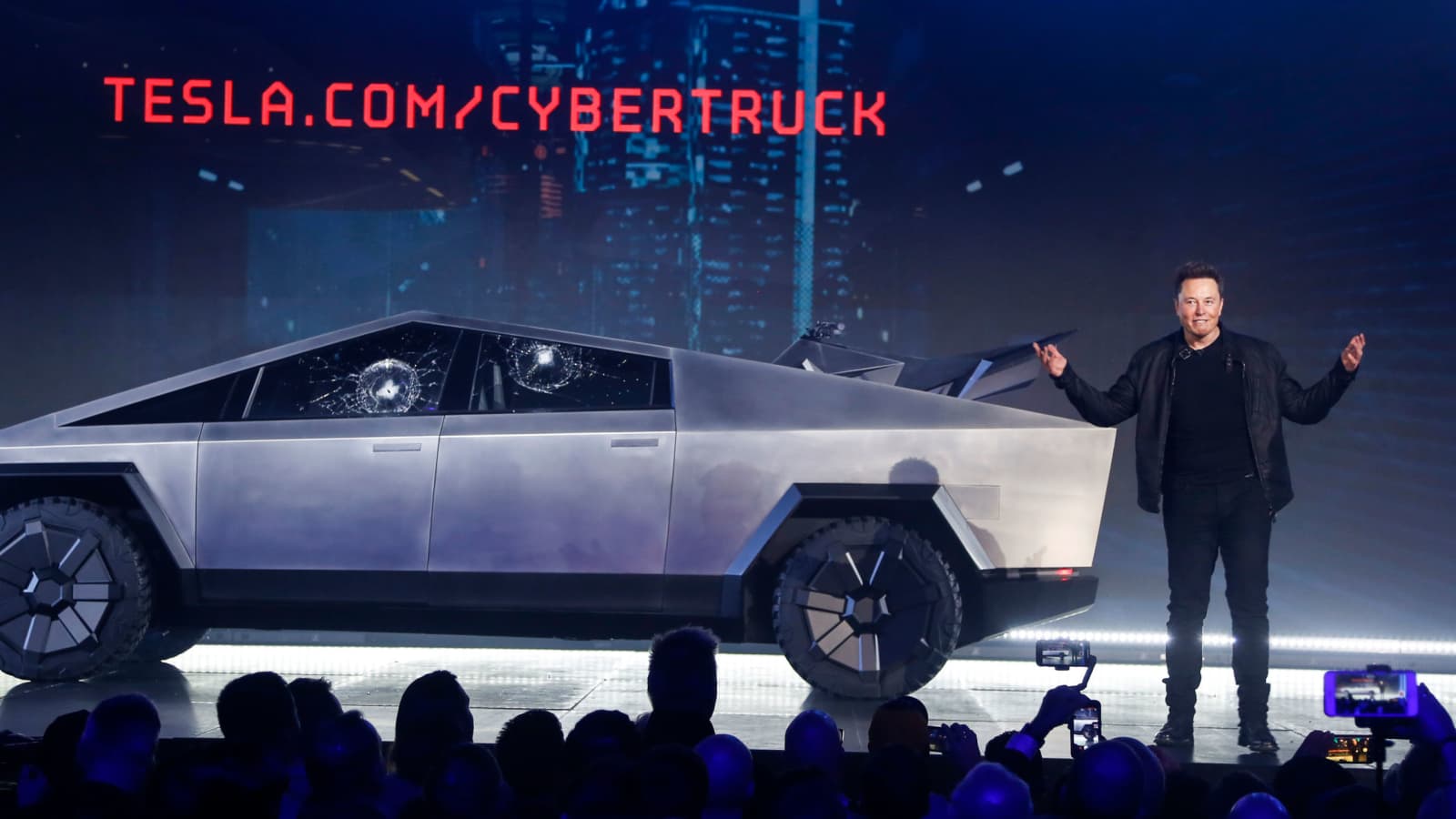

None of that happened. Every single promise either got modified dramatically or abandoned entirely.

The monocoque construction never materialized. Tesla ultimately built something closer to a traditional truck frame, which is actually more practical but completely contradicted the original design philosophy. The exoskeleton concept stayed, but it turned out that stainless steel panels, while visually distinctive, are expensive to manufacture, difficult to paint (and Tesla still doesn't paint most of them), and prone to fingerprints and visible imperfections that owners absolutely hate.

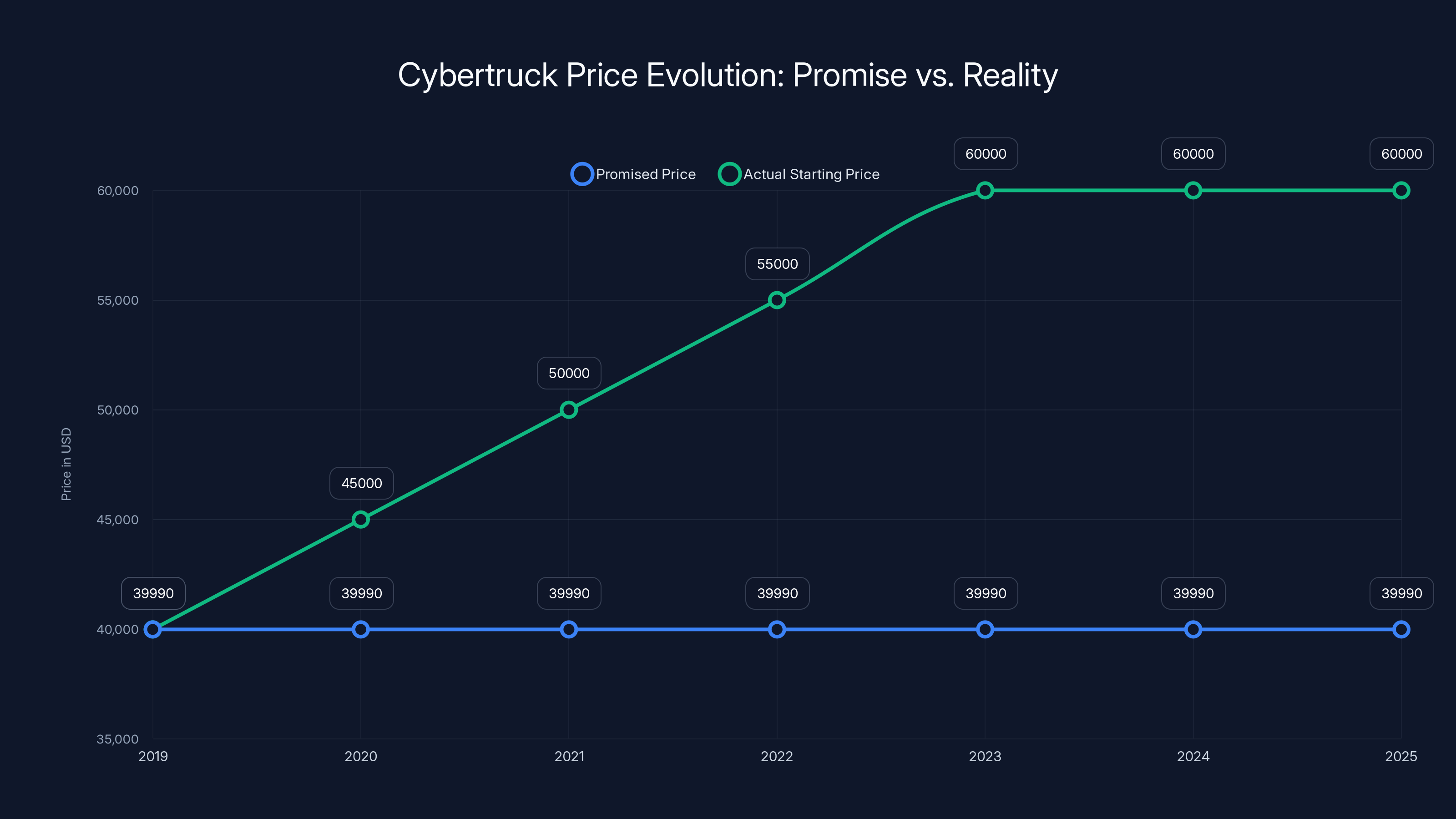

By 2025, the truck that was supposed to cost

Musk himself acknowledged in 2023 that the project had become nightmarish. "We dug our own grave with the Cybertruck," he said. That wasn't hyperbole. The truck's unique design, while visually striking, created manufacturing hell. Every component had to be custom. Every supplier had to be educated on unusual specifications. The stainless steel itself presented welding challenges that Tesla's team had to solve from scratch.

Traditional truck manufacturers have been building pickup trucks for over a century. They understand consumer preferences intimately. They know what size payloads people actually need. They know that truck buyers care about things like towing capacity, payload, ground clearance, and getting into tight parking spaces. They know that pickup trucks are practical tools, not design statements.

Tesla approached the truck like a luxury car company approaching a new product category. They prioritized aesthetics and innovation over practicality. They over-indexed on the novelty factor. They assumed that if something was new and different enough, people would want it regardless of whether it made sense for their actual needs.

Turns out they were wrong.

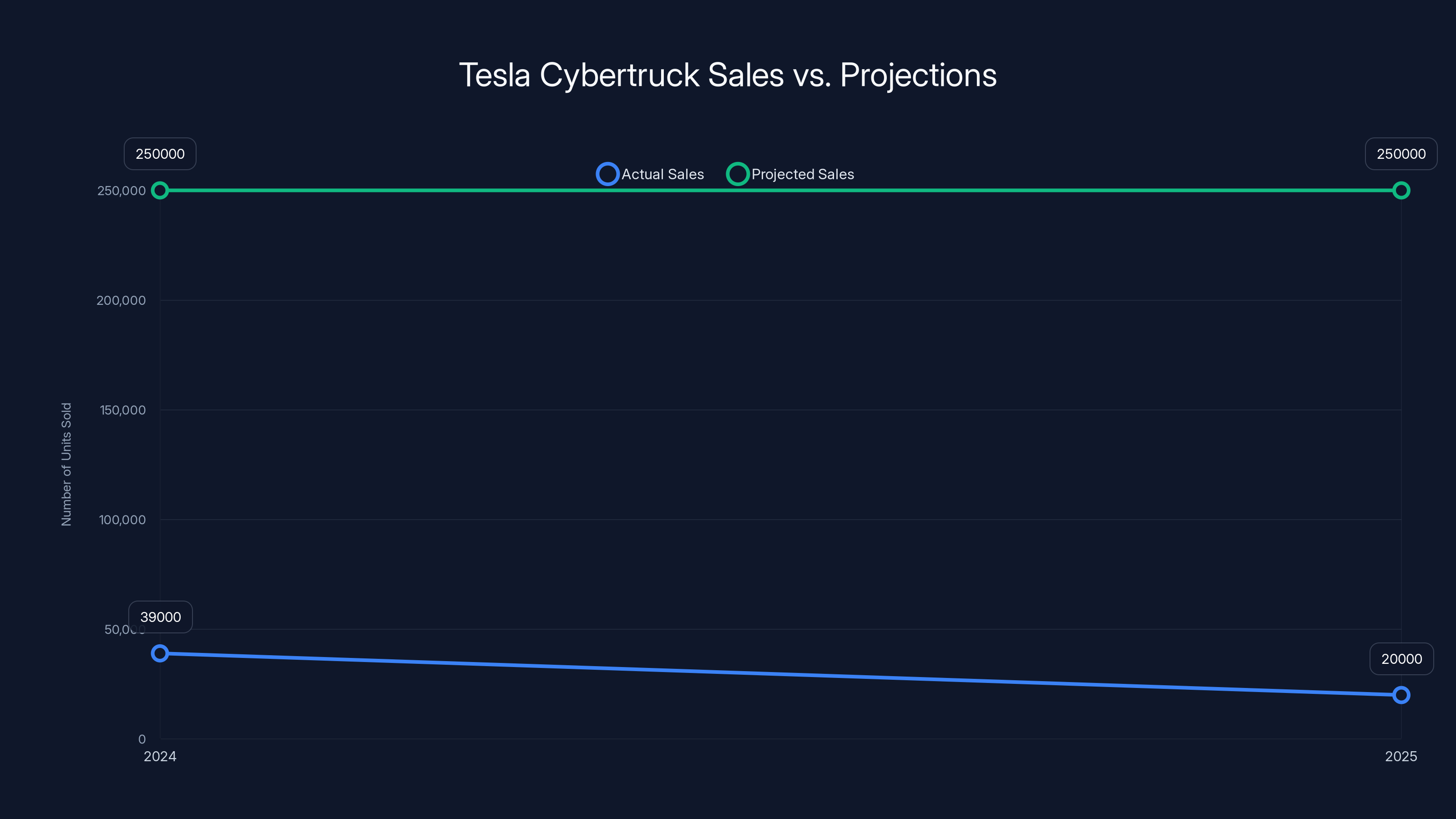

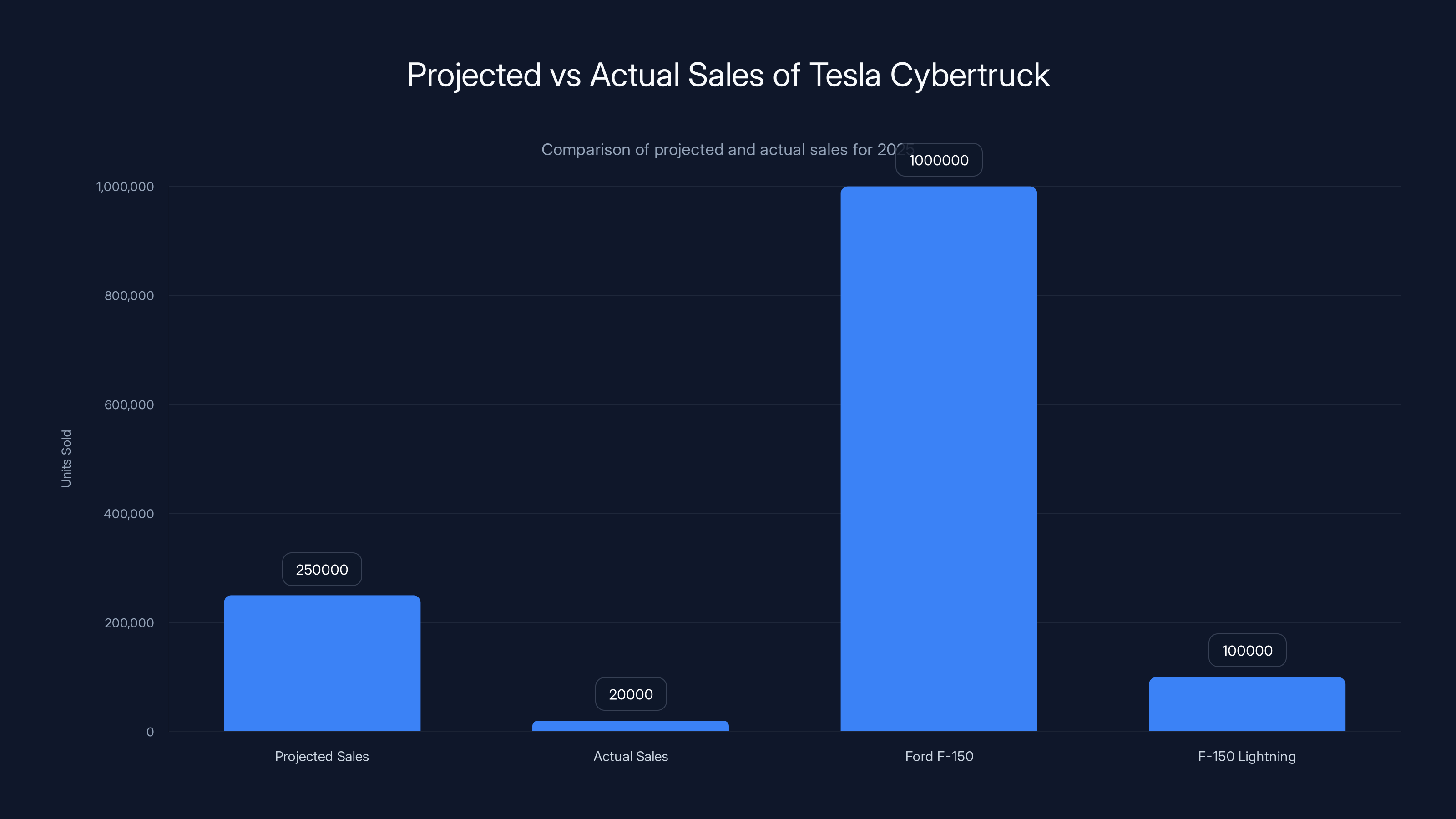

Tesla Cybertruck sales fell significantly short of projections, with a 92% miss in 2025, highlighting a disconnect between product and market demand.

The Market Reality: Truck Buyers Don't Want This

Understanding why the Cybertruck is failing requires understanding who actually buys pickup trucks and what they want from them.

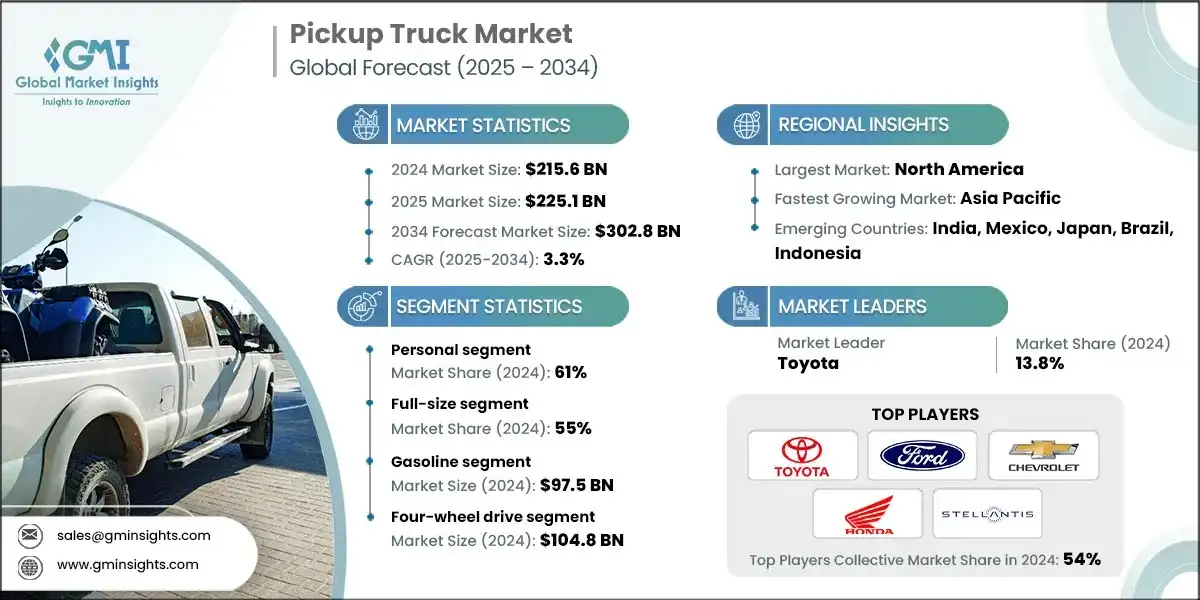

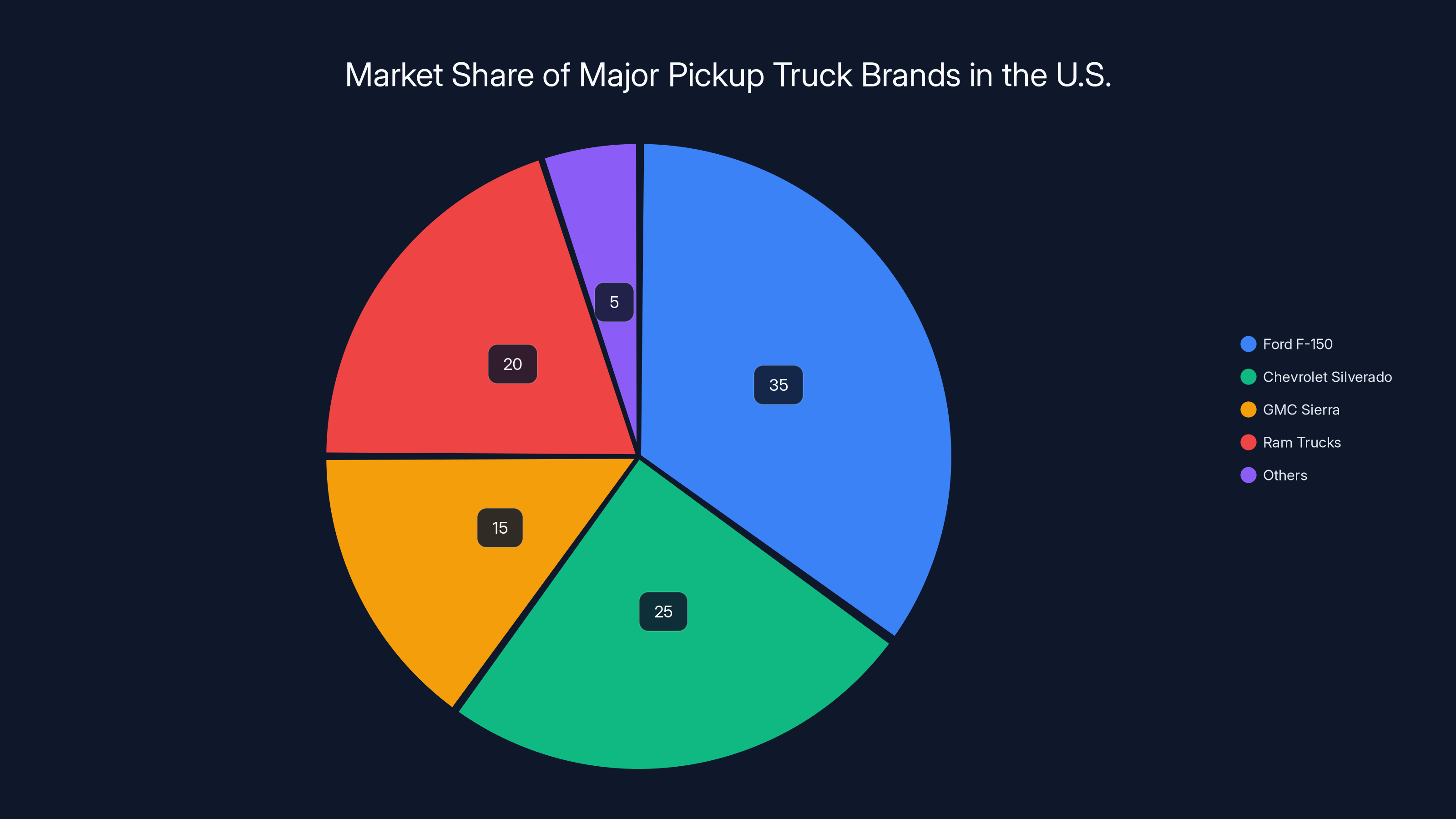

The American pickup truck market is worth roughly $170 billion annually. It's dominated by three players: Ford's F-150 line, General Motors' Chevrolet Silverado and GMC Sierra, and Stellantis' Ram trucks. These manufacturers collectively sell millions of trucks every year. The segment is so profitable that it's essentially the lifeblood of Detroit's Big Three automakers.

Who buys these trucks? The answer isn't "tech enthusiasts" or "early adopters." It's contractors, construction workers, farmers, ranchers, and suburban families who use trucks as practical tools. These buyers care about payload capacity, towing capacity, fuel efficiency, reliability, and cost of ownership. They care about resale value. They care about whether their truck can actually handle the work they're throwing at it.

They don't, generally speaking, want their truck to look like a geometric spaceship.

The Cybertruck's angular, dystopian aesthetic has zero appeal to traditional truck buyers. It looks expensive and impractical. The stainless steel panels, while visually distinctive, can't be easily repaired like aluminum or steel. Minor accidents mean expensive trips to Tesla service centers. The design elements that make it distinctive to designers make it a nightmare for anyone who actually works with the vehicle.

But there's another problem: EV enthusiasts don't want it either.

The people who've driven electric vehicles and loved them are, generally, premium car buyers who care about performance, range, and technology integration. They're the people buying Tesla Model S sedans, Porsche Taycans, and Mercedes EQS models. They want comfortable, sophisticated vehicles. They want access to cutting-edge technology.

The Cybertruck is none of those things. It's uncomfortable. The interior is sparse and feels unfinished even at $100,000 price points. The technology, while flashy, hasn't integrated smoothly. Early owners complained about build quality issues, software bugs, and the general feeling that the truck was released before it was actually ready for production.

So the Cybertruck ended up in a market gap. It's not practical enough for working truck owners and not refined enough for luxury vehicle buyers. It's not fun enough for people seeking a sports car, and it's not spacious enough for families. It occupies this weird middle ground where it appeals to a specific subset of Tesla superfans and cryptocurrency enthusiasts, and basically no one else.

Production Hell: How Manufacturing Incompetence Tanked the Truck

Tesla's history with new vehicle launches is spotty at best. When the company was ramping up Model 3 production in 2017 and 2018, Musk famously called it "production hell." The company had to pivot entire manufacturing strategies, bring in new equipment, and essentially relearn how to build cars at scale.

The Cybertruck was supposed to be different. This time, Tesla would get it right.

Instead, Tesla dug a deeper grave.

The reasons are both fundamental and fixable, but Tesla didn't fix them until it was too late. First, the stainless steel exoskeleton presents welding challenges that traditional steel doesn't. Stainless steel requires different techniques, different temperatures, and different post-welding treatments. Tesla's manufacturing team had to literally invent some of the processes needed to build the truck properly.

Second, the unpainted stainless steel exterior sounds cool in theory. In practice, it's a manufacturing and quality nightmare. Stainless steel fingerprints show up immediately. Small dust particles become visible. Any manufacturing defect that would be hidden under paint becomes glaringly obvious. This forced Tesla to maintain impossible quality standards just to make the trucks look acceptable.

Third, the unique geometry of the vehicle means that nearly every component has to be custom designed. There are no off-the-shelf door handles, panels, or trim pieces. Every single element has to be engineered specifically for the Cybertruck. This explodes supply chain complexity. Traditional truck manufacturers can leverage decades of supplier relationships and standardized components. Tesla couldn't.

Fourth, the original timeline was wildly optimistic. Musk originally said production would start in late 2021. It didn't actually begin until 2023, with vehicles not delivered until late 2023. That's a two-year delay. By that point, the truck market had moved on. Competitors like Ford with the F-150 Lightning and GMC with the Sierra EV were launching refined, practical electric trucks that actually appealed to truck buyers.

By the time the Cybertruck finally shipped, it was years behind schedule, cost double the promised price, and couldn't manufacture profitably at scale. The service centers were overwhelmed with warranty issues. Build quality varied wildly between units. Early owners reported everything from panel gaps to software crashes to seats that didn't work properly.

This is the classic Tesla paradox: the company excels at innovation and battery technology, but struggles with the grinding, unglamorous work of building things reliably at scale. Musk's leadership style, which prioritizes disruption and radical change, works great when you're disrupting an industry that hasn't been touched in decades. It works terribly when you're competing with companies that have spent 100 years perfecting manufacturing processes.

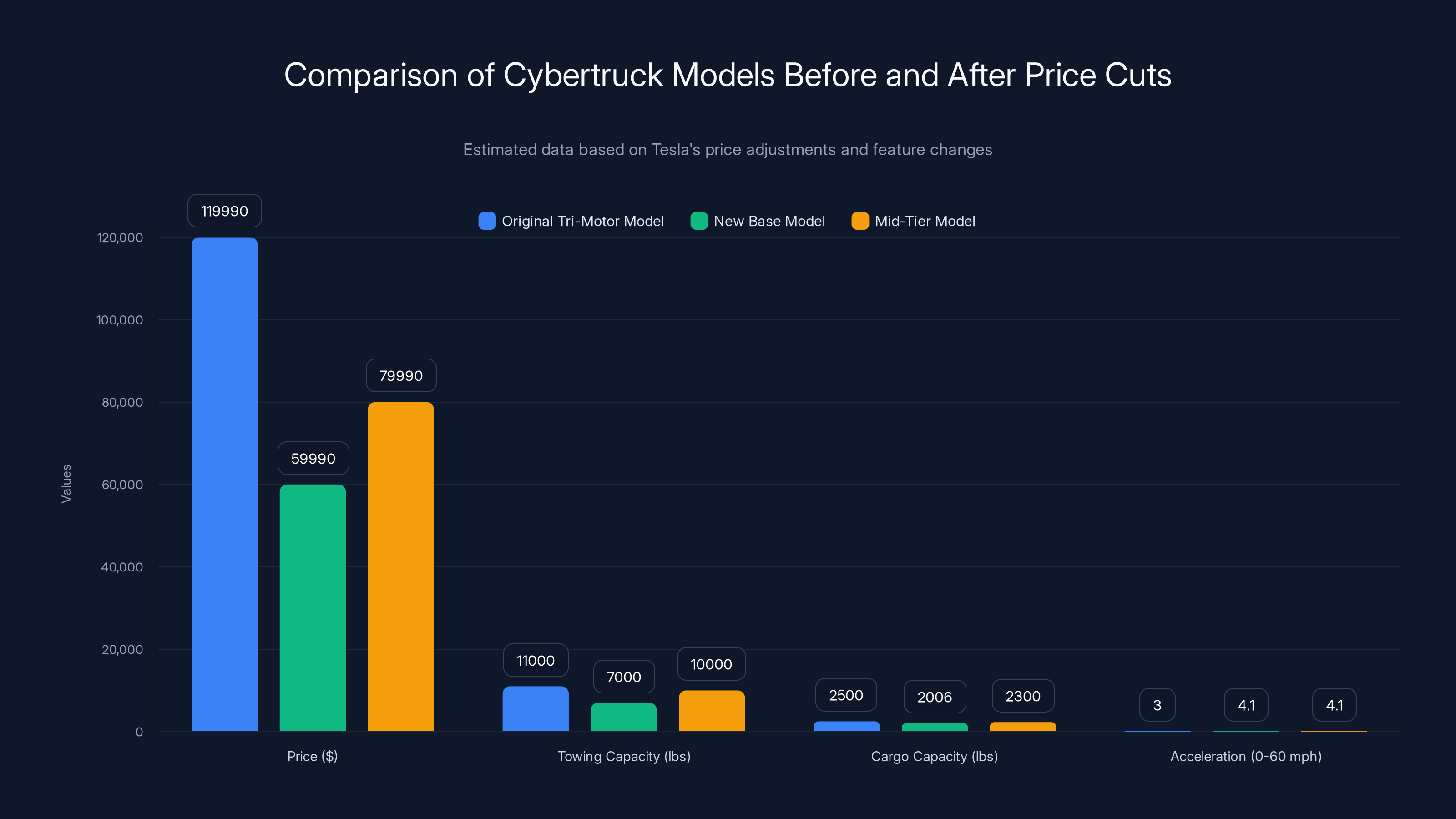

The promised starting price of the Cybertruck was

The Price Cut Desperation: Why Discounts Can't Fix Fundamentals

In February 2026, Tesla made dramatic moves to try to revive Cybertruck sales. The flagship Cyberbeast tri-motor model dropped from

On the surface, these prices look more competitive. A

But the price cuts also expose the core problem: Tesla is sacrificing the features that made the higher-priced versions seem worth the money. The new base model gets steel springs instead of air suspension. Towing capacity drops from 11,000 pounds to 7,000 pounds. Cargo capacity falls from 2,500 pounds to 2,006 pounds. The interior features textile seats without ventilation or heating. There's no active noise cancellation. The speaker system is significantly downgraded.

In other words, Tesla is charging

Traditional truck manufacturers can undercut this. A Ford F-150 can be configured for around $40,000 and will tow significantly more, carry more payload, and hold its value better than a Cybertruck. A Chevrolet Silverado is available in similar price ranges with proven reliability and resale value.

The price cuts also backfire on existing Cybertruck owners. People who paid

Compare this to how Porsche or Mercedes handles pricing on their vehicles. They rarely discount. They maintain price discipline. They make buyers want to own their products because they hold value. Tesla just turned the Cybertruck into a depreciating asset in the eyes of new buyers.

The fundamental problem isn't price. The fundamental problem is that the Cybertruck is a solution in search of a problem. What problem does it solve that a traditional truck doesn't? What does it do better than competitors? Speed and acceleration in a truck that most owners will never use. That's basically it.

Musk's Political Interference: How a CEO's Persona Tanked a Product

There's a dimension to the Cybertruck's failure that's often overlooked: Elon Musk's increasingly controversial public persona damaged the brand's appeal to a significant portion of potential buyers.

In the early days of the Cybertruck's development (2019-2021), Musk was seen as a visionary entrepreneur. By 2023-2024, his personal brand had become significantly more polarizing. His acquisition of Twitter, his public disputes with advertisers, his increasingly political statements, and his associations with controversial figures alienated a substantial chunk of the early-adopter market that Tesla had cultivated.

EV enthusiasts skew younger and more progressive. They're the demographic most likely to care about environmental impact and social responsibility. Many of them were put off by Musk's public antics and political stances. When considering a

This is speculative in some ways, but internal Tesla documents and market research have suggested that "brand affinity" dropped significantly among EV enthusiasts after 2023. The Cybertruck, which should have been Tesla's flagship vehicle, became something many potential customers actively wanted to avoid.

It's a lesson in how a CEO's personal brand can either amplify or undermine their company's products. Steve Jobs' reality distortion field helped Apple sell premium products. Musk's reality distortion field helped Tesla sell cars in the early days. But when the founder's personal brand becomes actively negative with core customer segments, even great products struggle.

The Cybertruck never had a chance to build positive word-of-mouth because it was already saddled with the baggage of its creator's brand perception shift.

The Competition Response: Traditional Manufacturers Fight Back

While Tesla was struggling with the Cybertruck, traditional manufacturers were methodically building actual electric trucks.

Ford launched the F-150 Lightning in 2022 with a much longer development timeline, proven manufacturing processes, and deep understanding of what truck owners actually want. The Lightning starts at around $50,000 (before incentives) and offers traditional truck practicality with electric power. It can tow 14,000 pounds and carry 1,400 pounds of payload. The vehicle looks like an F-150, which means truck buyers are comfortable with it. Service is available at thousands of Ford dealerships across the country.

General Motors launched the Chevrolet Silverado EV and GMC Sierra EV with similar pragmatic approaches. These trucks look normal. They function normally. They offer the electric efficiency advantages that EV buyers want without requiring them to accept radical design changes.

Rivian, the EV-focused startup, launched the R1T electric pickup with a completely different philosophy than the Cybertruck. The R1T is beautiful, refined, and impractical for traditional truck work, but it appeals to luxury buyers who want something different. Rivian positioned itself as the premium electric truck option and built a product that actually delivers on that promise.

Meanwhile, Tesla watched the Cybertruck languish. The company spent enormous resources on the Cybertruck program while competitors took more measured, pragmatic approaches and captured market share.

The lesson is clear: in a market dominated by entrenched competitors with proven products, radical innovation has to solve real problems. The Cybertruck didn't solve any problems that truck buyers actually have. It created new problems (cost, maintenance, practicality, resale value) while failing to deliver clear benefits.

Tesla's Cybertruck sales in 2025 were 92% below the projected 250,000 units, highlighting a significant market failure compared to Ford's F-150 models.

Build Quality and Reliability: The Cybertruck's Hidden Nightmare

Beyond market positioning and price, the Cybertruck suffers from a more immediate problem: early owners report significant build quality issues.

Despite being a premium-priced vehicle (or semi-premium, depending on the configuration), Cybertruck owners have reported panel gaps, misaligned doors, software glitches, and general fit-and-finish issues that would be unacceptable at this price point in the luxury segment.

The unique manufacturing processes required to build the Cybertruck meant that Tesla's quality control systems weren't mature enough. Traditional manufacturers spend years perfecting manufacturing tolerances and quality checks. Tesla was learning on the job.

This creates a compounding credibility problem. Not only is the truck not what buyers want, but the ones that have been delivered don't even meet basic quality standards. Tesla's warranty department has been flooded with service requests. Owners are reporting months-long waits for fixes.

For a product that's supposed to represent the future of automotive manufacturing, this is devastating. Word-of-mouth is toxic. Online forums are filled with complaints. When potential buyers research the Cybertruck, they're seeing pictures of panel gaps and hearing stories about warranty service nightmares.

This is the opposite of what Tesla needs to revive sales. You can discount price, but you can't discount away reputation damage. If people think the quality is poor, no amount of price reduction will convince them to buy.

Market Segmentation: Why the Cybertruck Appeals to Nobody

One of the most revealing aspects of the Cybertruck's failure is how niche its appeal actually is.

Truck buyers are generally split into a few categories. There are contractors and construction workers who need vehicles for work. There are rural buyers who need trucks for farming, ranching, and land management. There are suburban families who want trucks for versatility and towing capacity. And there's a growing segment of buyers who want trucks for lifestyle reasons—they like the look and feel of trucks even if they rarely actually work with them.

The Cybertruck appeals to exactly none of these segments effectively. Contractors won't buy it because the towing and payload specs are worse than alternatives and the service infrastructure is worse. Rural buyers won't buy it because they need proven reliability and resale value. Suburban families won't buy it because it's uncomfortable and impractical. And lifestyle truck buyers won't buy it because, despite its radical styling, it doesn't deliver the emotional satisfaction of a traditional truck.

That leaves only one market segment that wants the Cybertruck: Tesla superfans and tech enthusiasts who buy it because it's novel and controversial. This is an incredibly small segment globally. Tesla has probably already captured most of it.

Traditional truck manufacturers understood segmentation deeply. They build different trucks for different buyers. Ford's F-150 comes in dozens of configurations for different use cases. The manufacturer understands that a contractor's needs are different from a rancher's needs, which are different from a suburban buyer's needs.

Tesla built one truck for everyone and ended up with a truck for no one.

Supply Chain and Service Infrastructure: The Unsexy But Critical Problem

Owning a traditional truck comes with massive advantages that aren't glamorous but are deeply practical. There are tens of thousands of mechanics who can service your truck. Parts are available everywhere. A driveway in rural Wyoming has the infrastructure to support a Ford F-150.

The Cybertruck requires Tesla service. Tesla has a limited network of service centers. Getting parts means ordering from Tesla. If you're in a remote area, you're looking at days or weeks to get your truck serviced.

For a vehicle designed to appeal to truck buyers, this is a fatal flaw. Many truck owners live in areas where they're far from major service networks. They need vehicles that can be serviced locally. Tesla doesn't provide that.

Moreover, the aftermarket parts and customization industry that surrounds pickup trucks is nonexistent for the Cybertruck. You can't walk into a performance shop and get a custom suspension for your Cybertruck. You can't add a bed cover from a thousand different manufacturers. You can't customize it the way truck owners love to customize trucks.

For EV buyers, this is less critical. But for truck buyers, it's enormous. The pickup truck market runs on customization and aftermarket support. Tesla provides neither.

The new base model Cybertruck offers a lower price but sacrifices key features like towing and cargo capacity, highlighting the trade-offs in Tesla's pricing strategy. Estimated data.

Financial Realities: The Math Doesn't Work

Let's talk about the actual financial mathematics of Cybertruck ownership.

A buyer who paid

Compare this to a Ford F-150. A $50,000 F-150 holds its value far better because there's an enormous market of used F-150s. Resale value is predictable and reliable. That value stability makes the vehicle a reasonable investment.

The Cybertruck's resale market is murky. How much is a used Cybertruck worth? Nobody really knows because the market is so small and fragmented. That uncertainty translates into risk for buyers.

Total cost of ownership is another problem. Tesla doesn't have established service costs for the Cybertruck. Traditional trucks have predictable maintenance costs because mechanics across the country know how to work on them and can quote reliably. Cybertruck service costs are a mystery.

Financing is another issue. Banks and lenders are more cautious about financing vehicles with unclear resale values and uncertain service costs. This makes it harder for buyers to finance the purchase, which reduces the addressable market.

When you do the math, a Cybertruck doesn't make financial sense compared to alternatives. A traditional truck costs less, holds value better, and has lower total cost of ownership. An EV from a luxury manufacturer costs less and delivers better refinement. The Cybertruck sits in a terrible place financially.

The Design Debate: Aesthetics vs. Function

Part of the Cybertruck's problem is philosophical. The vehicle prioritizes aesthetics and novelty over function and practicality.

In industrial design, there's a principle that form should follow function. A truck should be shaped the way it is because that shape solves actual problems. The Cybertruck inverts this. The shape was chosen first because it's visually distinctive, and then functionality was grafted onto that shape.

This creates constant compromises. The angular body is harder to manufacture. It offers less interior space than a rounded design. The stainless steel panels are harder to repair. The exoskeleton design creates handling quirks that truck buyers don't appreciate.

Traditional trucks look the way they do because manufacturers have spent decades optimizing that form for function. The shape maximizes interior space, minimizes manufacturing costs, and optimizes aerodynamics. Modern pickups are the result of thousands of small decisions made across decades.

The Cybertruck tried to overthrow a hundred years of iteration with a radical new aesthetic. And it turns out that hundred years of iteration actually solved problems that the Cybertruck creators didn't even consider.

The Broader Implications: What This Means for Tesla

The Cybertruck's failure has broader implications for Tesla as a company and for Musk as a leader.

For Tesla, it suggests that the company's strengths are specific. The company excels at building premium sedans and compact cars (Model S, Model 3, Model Y). These vehicles solve genuine problems for specific buyer segments. EV enthusiasm plus Tesla's technology plus premium manufacturing equals strong demand.

But the Cybertruck proves that Tesla doesn't automatically excel at everything. When the company tries to solve a market problem in a way that's orthogonal to how the actual market wants that problem solved, it fails. Dramatically.

For Musk, it's a humbling lesson in the limits of his "move fast and break things" philosophy. Some problems require careful, methodical approaches. Manufacturing requires process discipline. Market research requires listening to customers. Musk's strength is disruption, but disruption doesn't work when you're disrupting against a market that doesn't want to be disrupted.

The Cybertruck failure also raises questions about resource allocation. Tesla spent enormous capital on the Cybertruck program. What could that capital have achieved if directed toward products the market actually wanted? How many Model 3s or Model Ys could have been built and sold with those resources?

Internally, the Cybertruck's failure must be causing organizational pain. Employees who worked on the project for years now see it struggling. The company's confidence in Musk's judgment must be shaken. If the CEO can be this dramatically wrong about what the market wants, what other bets might be wrong?

Ford's F-150 leads the U.S. pickup truck market with an estimated 35% share, followed by Chevrolet Silverado and Ram Trucks. Estimated data.

Lessons for the Automotive Industry

The Cybertruck's failure teaches the automotive industry important lessons.

First, brand disruption doesn't automatically create market disruption. Tesla's brand disruption in the premium sedan market was powerful because it solved real problems: performance, range, charging infrastructure, and brand prestige. The company didn't try to revolutionize what a sedan is. It created a better sedan.

Second, market research matters. Tesla is famously dismissive of traditional market research, preferring to rely on Musk's intuition. The Cybertruck proves that intuition isn't a substitute for genuine understanding of market segments. Traditional manufacturers do extensive research because they know that small miscalculations at the market level become massive failures at scale.

Third, incumbents have advantages that disruption can't easily overcome. Ford and GM have built supplier networks, service infrastructures, and manufacturing expertise over decades. You can't disrupt your way past that in a market where reliability and serviceability are critical.

Fourth, radical design needs radical market demand to succeed. The Cybertruck's design only makes sense if there's massive market demand for radical truck design. There isn't. A more conventional truck design might not be as visually distinctive, but it would sell better because it would actually appeal to truck buyers.

The Path Forward: Can Tesla Fix the Cybertruck?

Can Tesla salvage the Cybertruck at this point?

It's possible, but it requires radical changes. The company would need to redesign the vehicle with traditional truck proportions and aesthetics. That would essentially mean starting over. The exoskeleton design would have to go. The stainless steel would need to be painted or replaced. The interior would need to be redesigned for comfort and practicality.

Basically, Tesla would need to build what it should have built in the first place: a practical electric truck that appeals to actual truck buyers.

But even then, they'd be competing against Ford's F-150 Lightning, which has a two-year head start, proven manufacturing processes, and a massive service network. They'd be competing against GM's Sierra EV, which offers similar advantages. They'd be competing against traditional manufacturers who deeply understand truck buyers.

At that point, the Cybertruck would be just another electric truck, with none of the distinctive features that made it controversial in the first place. It would have to succeed or fail on its own merits against established competitors.

Most likely scenario? Tesla quietly discontinues the Cybertruck within the next few years. The company frames it as a transition to next-generation vehicles. The project is quietly forgotten. Musk moves on to the next grand vision that promises to revolutionize everything.

And the truck buyers who were promised a $39,990 futuristic pickup truck in 2019 will still be driving their Ford F-150s.

What Happened to Innovation?: The Broader Context

The Cybertruck's failure is particularly striking because it happened to a company built on the promise of innovation. Tesla's early success proved that electric vehicles could be desirable. The company showed that a startup could compete with established manufacturers. It demonstrated that innovation, when properly executed, could create new markets.

The Cybertruck represents innovation gone wrong. It's innovation for innovation's sake. It's technology pursued without market demand. It's a solution to problems nobody asked Tesla to solve.

Real innovation is harder than it looks. It requires solving actual problems for actual customers. It requires understanding market segments deeply. It requires patience and iteration. Tesla proved capable of all of this with the Model S and Model 3. But the Cybertruck shows that success isn't automatic. Innovation can fail spectacularly when pursued without proper grounding in market reality.

The broader lesson is that innovation without customer focus is just expensive failure. Tesla had both in the early days. It lost the customer focus with the Cybertruck. The result is inevitable.

The Tesla Cybertruck's price increased from the promised

The Role of Hype Cycles in Technology Markets

The Cybertruck's rise and fall also illustrates how hype cycles work in technology markets.

In 2019, the Cybertruck sat at the peak of inflated expectations on the Gartner Hype Cycle. It was novel, bold, and talked about constantly. Every article, every podcast, every conversation about the future of automotive included the Cybertruck. The hype was legitimate and massive.

Then reality hit. The vehicle couldn't be built profitably. It didn't appeal to the market. Early owners reported quality issues. The hype immediately reversed into disappointment and skepticism.

This is a predictable cycle. Products enter markets with tremendous hype. Reality doesn't match expectations. The product slides down the slope of disillusionment. Some products eventually climb back up as they find their niche. Others fade into obscurity.

The Cybertruck is sliding into that trough of disillusionment right now. It's unlikely to climb back out.

For technology companies, the lesson is humbling: hype is temporary. Market reality is permanent. A product that doesn't solve real problems for real customers will eventually fall out of favor, no matter how much hype preceded it.

Tesla's Identity Crisis: From Disruptor to Incumbent

The Cybertruck failure reflects a deeper identity crisis at Tesla.

The company built itself by disrupting an entrenched industry. Electric cars weren't mainstream. Tesla made them desirable. The company challenged industry assumptions about what was possible. It built a fan base and a culture of innovation.

But as Tesla has grown, it's started to act like an incumbent. It's building products based on what's cool rather than what customers want. It's dismissing market research as unnecessary. It's prioritizing CEO vision over customer needs.

This is the classic pattern of disruption. Disruptors succeed because they focus obsessively on customer needs and market realities. As they succeed, they start to believe their own mythology. They think disruption is about being different, not about solving problems. They prioritize disrupting for disruption's sake.

The Cybertruck is the clearest possible example of this transformation. A company that once obsessively focused on delivering what customers wanted is now building what the CEO wants to be cool.

If Tesla learns this lesson, it can correct course. If not, more products like the Cybertruck will follow. The company will continue to invest billions in projects that don't align with market demand, watching competitors capture market share.

The Numbers Tell the Story: Hard Data on Market Failure

Let's be concrete about the scale of failure.

Tesla originally projected 250,000 Cybertrucks per year by 2025. The actual number for 2025 was about 20,000 units. That's an 92% miss on projections.

For comparison, the Ford F-150 sells roughly 1 million units annually across all variants. Even the electric F-150 Lightning is tracking toward 100,000+ units over its first few years. The Cybertruck is less than 10% of the Lightning's adoption rate.

Manufacturing capacity paints a similar picture. Tesla built out production capacity for hundreds of thousands of Cybertrucks based on original projections. That capacity is now dramatically underutilized. The company is running expensive factories far below efficient capacity levels.

Stock market reaction has been restrained but telling. While Tesla's overall stock price has remained relatively strong due to other business lines, Cybertruck-specific metrics (if they were broken out) would show investor disappointment. Wall Street analysts have quietly removed Cybertruck revenue from growth projections.

The financial loss is difficult to quantify exactly, but it's substantial. Tesla invested tens of billions in R&D and capital expenditure for the Cybertruck program. Against annual sales of 20,000 units, the program's return on investment is deeply negative.

What Happens Now: The Future of Tesla's Truck Ambitions

Given the Cybertruck's trajectory, what happens next?

Scenario one: Tesla quietly winds down Cybertruck production over the next 2-3 years, frames it as a strategic transition, and moves on to other vehicles. This is probably the most likely outcome.

Scenario two: Tesla makes a more radical decision, completely redesigns the Cybertruck to be more conventional, and tries again. This would require massive investment and years of development, essentially starting from scratch.

Scenario three: Tesla doubles down on the Cybertruck despite the failures, continues building a niche product for loyal Tesla fans, and accepts that the truck will never be a mainstream vehicle. This doesn't make financial sense but might happen given Musk's personality.

Regardless of which scenario plays out, the original vision is dead. The $39,990 truck that was supposed to revolutionize pickup trucks will never exist. The Cybertruck that is being built today is a failure in every metric that matters: sales, profitability, customer satisfaction, and market impact.

The broader implications for Tesla are more significant. The Cybertruck failure suggests that the company's leadership has lost touch with what made Tesla successful. The company was built on solving real problems for real customers. The Cybertruck represents a departure from that principle. If Tesla has further departures from customer focus, more failures will follow.

FAQ

What exactly is the Tesla Cybertruck and why was it hyped so much?

The Tesla Cybertruck is an electric pickup truck revealed in 2019 with an angular, futuristic stainless steel design. It generated enormous hype because it promised to revolutionize the truck market—combining electric vehicle efficiency with pickup functionality, something no manufacturer had successfully done. The radical design and Elon Musk's audacious promises (250,000 trucks per year, $39,990 base price) captured global attention and generated massive pre-orders.

How bad are Cybertruck sales actually, and what do the numbers mean?

Cybertruck sales have been dismal. Fewer than 39,000 units sold in 2024, and only about 20,000 in 2025—compared to Tesla's original projection of 250,000 annually by 2025. For context, that's a 92% miss on projections and far below competitors like Ford's F-150 Lightning. The numbers indicate the truck simply doesn't appeal to either traditional truck buyers or EV enthusiasts.

Why would Tesla cut prices by up to $40,000 if the Cybertruck is failing?

Tesla cut prices to try to stimulate demand as sales plummeted. The new $59,990 base model represents a dramatic reduction from earlier pricing. However, price cuts alone can't fix the fundamental problem: the truck doesn't align with what truck buyers actually want. A cheaper impractical truck is still impractical, so the discounts have had limited impact on moving inventory.

What went wrong with Cybertruck manufacturing?

The vehicle's unique stainless steel exoskeleton design created manufacturing challenges that traditional truck makers don't face. Welding stainless steel is different from steel. The unpainted finish means zero manufacturing imperfections are hidden, requiring unrealistic quality standards. Nearly every component had to be custom-designed, exploding supply chain complexity. Tesla essentially had to invent new manufacturing processes, which delayed production by two years and drove up costs dramatically.

Why don't traditional truck buyers want the Cybertruck?

Traditional truck buyers prioritize practicality, reliability, resale value, and serviceability. The Cybertruck delivers mediocre performance in most of these areas compared to alternatives. Towing and payload capacity are limited. Stainless steel panels are expensive to repair. The vehicle looks too unconventional for working truck buyers. Plus, traditional manufacturers have service networks everywhere, while Tesla's are sparse. The truck essentially solves no problems that truck buyers actually have.

How did Elon Musk's changing public persona affect Cybertruck sales?

Musk's increasingly polarizing public stance and controversial statements shifted his personal brand significantly after 2023. Early EV adopters—a key demographic for the Cybertruck—skew younger and more progressive and were turned off by his controversial positions. Many potential buyers actively chose competitors specifically to avoid supporting Musk's companies, directly impacting Cybertruck demand among what should have been an enthusiastic segment.

What do competitors like Ford and GM do better with their electric trucks?

Traditional manufacturers built electric trucks with deep market understanding. Ford's F-150 Lightning looks like an F-150, appeals to traditional truck buyers, and benefits from Ford's century of truck expertise and service infrastructure. GM's electric truck offerings similarly prioritize practicality over novelty. These vehicles solve the actual problem—moving to electric power—without asking buyers to compromise on truck functionality or aesthetics. That pragmatic approach is why they're outselling the Cybertruck dramatically.

Is the Cybertruck actually a bad vehicle, or is it just poorly positioned?

Both. The Cybertruck is technically capable (fast acceleration, decent range), but it's poorly positioned for any market segment. It's not refined enough for luxury buyers, not practical enough for working truck buyers, not affordable enough for mass market, and too unconventional for mainstream appeal. Early owners report quality issues, which compounds the positioning problem. There's no clear customer segment that genuinely wants this truck for the right reasons.

Could Tesla salvage the Cybertruck at this point?

Salvaging would require radical redesign—essentially admitting the original vision was wrong and starting over with conventional truck proportions and aesthetics. This would be expensive and time-consuming, and even then, Tesla would be competing against established competitors with proven vehicles. Most likely, Tesla will quietly discontinue or significantly reduce Cybertruck production within a few years and move on to other projects, treating the failure as a lesson learned.

What does the Cybertruck failure tell us about innovation and market disruption?

The Cybertruck proves that innovation without customer focus is just expensive failure. Real innovation solves actual problems for actual customers. The Cybertruck prioritized being different over being useful, and the market rejected it. The lesson extends beyond Tesla: companies that ignore market research and customer feedback in favor of leadership vision, no matter how visionary that leadership seems, are likely to fail. Disruption works best when it's disruption toward customer needs, not disruption for its own sake.

Conclusion: A Billion-Dollar Lesson in Market Reality

The Tesla Cybertruck's collapse from the most hyped vehicle launch in automotive history to an abandoned failure represents more than just a product failure. It's a masterclass in what happens when a company prioritizes disruption over customer focus, when leadership vision overrides market research, and when a company's culture of innovation curdles into dismissal of practical market realities.

Elon Musk promised a

The Cybertruck failure teaches critical lessons that extend beyond Tesla. It shows that disruption without customer demand is just expensive failure. It demonstrates that manufacturing expertise can't be wished away with bold vision. It proves that market research exists for a reason. And it illustrates how a leader's personal brand can either amplify or undermine their company's products.

For the automotive industry, the Cybertruck is a cautionary tale. Traditional manufacturers like Ford and GM understood what customers wanted and delivered it. They didn't try to revolutionize the truck. They evolved it. And they captured the market that Tesla thought it could disrupt.

For Tesla shareholders and employees, the Cybertruck represents misallocated capital and lost opportunity. The resources spent on this failed project might have accelerated development of vehicles the market actually wanted. The organizational confidence in Musk's judgment took a hit that won't easily be repaired.

For consumers, the Cybertruck is a reminder to be skeptical of massive hype, to research thoroughly before buying, and to understand that a revolutionary design doesn't automatically make a good vehicle. The truck buyers who pre-ordered in 2019 expecting a $39,990 vehicle learned this lesson the hard way.

As the Cybertruck quietly winds down—and it will—the automotive industry will move on. Electric trucks will continue to improve and gain market share. But the radical, revolutionary Cybertruck that was supposed to change everything? That vehicle will be remembered as a fascinating failure: a gorgeous idea built on a foundation of disconnection from market reality, destined to teach expensive lessons that probably could have been learned much more cheaply by simply asking customers what they wanted.

That's the real story. Not a revolutionary truck that the market rejected, but a company that stopped listening to its market and paid the price for the lapse.

Key Takeaways

- Tesla's Cybertruck fell 92% short of 250,000-unit annual target, selling only 20,000 units in 2025 despite price cuts up to $40,000

- The 39,990 promise, proving that disruption without customer demand is expensive failure

- Traditional truck buyers rejected the Cybertruck because it sacrificed practicality for aesthetics, while EV enthusiasts avoided it due to Musk's increasingly controversial public persona

- Stainless steel manufacturing challenges, poor build quality, and limited service infrastructure created compounding credibility problems that price cuts couldn't resolve

- Ford's F-150 Lightning and GM's electric trucks succeeded by focusing on practical evolution rather than radical disruption, capturing 5x Cybertruck's sales volume

Related Articles

- Tesla's $60K Cybertruck: Price Drop, Persistent Image Problem [2025]

- Snap's Specs VR Glasses Hit Leadership Crisis: What Went Wrong [2025]

- SpaceX's Starbase Gets Its Own Court: Building a Company Town [2025]

- Orbital AI Data Centers: Technical Promise vs. Catastrophic Risk [2025]

- Agentic AI & Supply Chain Foresight: Turning Volatility Into Strategy [2025]

- Polestar's Station Wagon Strategy: How the EV Maker Is Challenging Tesla [2025]

![Tesla Cybertruck Price Cuts: Why EV's Most Hyped Launch Became Its Biggest Flop [2025]](https://tryrunable.com/blog/tesla-cybertruck-price-cuts-why-ev-s-most-hyped-launch-becam/image-1-1771600069994.jpg)