Tesla's Pivot Away From Premium EVs: The Model S and X Discontinuation Story

In a move that shocked the automotive industry, Tesla announced it's essentially shutting down production of two of its most iconic vehicles: the Model S and Model X. During the company's 2025 fiscal year earnings call, CEO Elon Musk declared it was time to give these models an "honorable discharge" and redirect their entire production footprint toward manufacturing Optimus humanoid robots. According to Desert Sun, this strategic shift is part of Tesla's broader vision to focus on robotics.

This isn't a temporary pause or a production adjustment. This is the end of an era. The Model S, which launched in 2012, and the Model X, which arrived in 2015, have been Tesla's flagship vehicles for over a decade. They defined the company's shift from startup to legitimate automaker. Yet despite their prestige and decades of production, they're being sacrificed on the altar of Tesla's new obsession: autonomous robotics.

What makes this decision particularly intriguing is the logic behind it. Tesla isn't making this move because the Model S and X have become unprofitable. Instead, Musk sees a far more valuable use for the factory space those vehicles occupy. The company plans to convert the Fremont production facility into a dedicated Optimus manufacturing hub, with an ambitious goal of producing 1 million humanoid robots annually. That's not a typo. One million.

But here's where it gets complicated. Optimus is still largely a prototype. It hasn't delivered anything close to the consumer adoption rates Tesla will need to justify canceling two profitable product lines. Yet Tesla is betting billions that this unproven technology will eventually justify the decision. This article digs into what's really happening, why Tesla is making such a dramatic strategic shift, and what it means for the future of both the EV industry and the robotics sector.

TL; DR

- Model S and X ending production: Tesla is halting manufacturing of both premium vehicles in Q2 2025 to repurpose factory space for Optimus robots

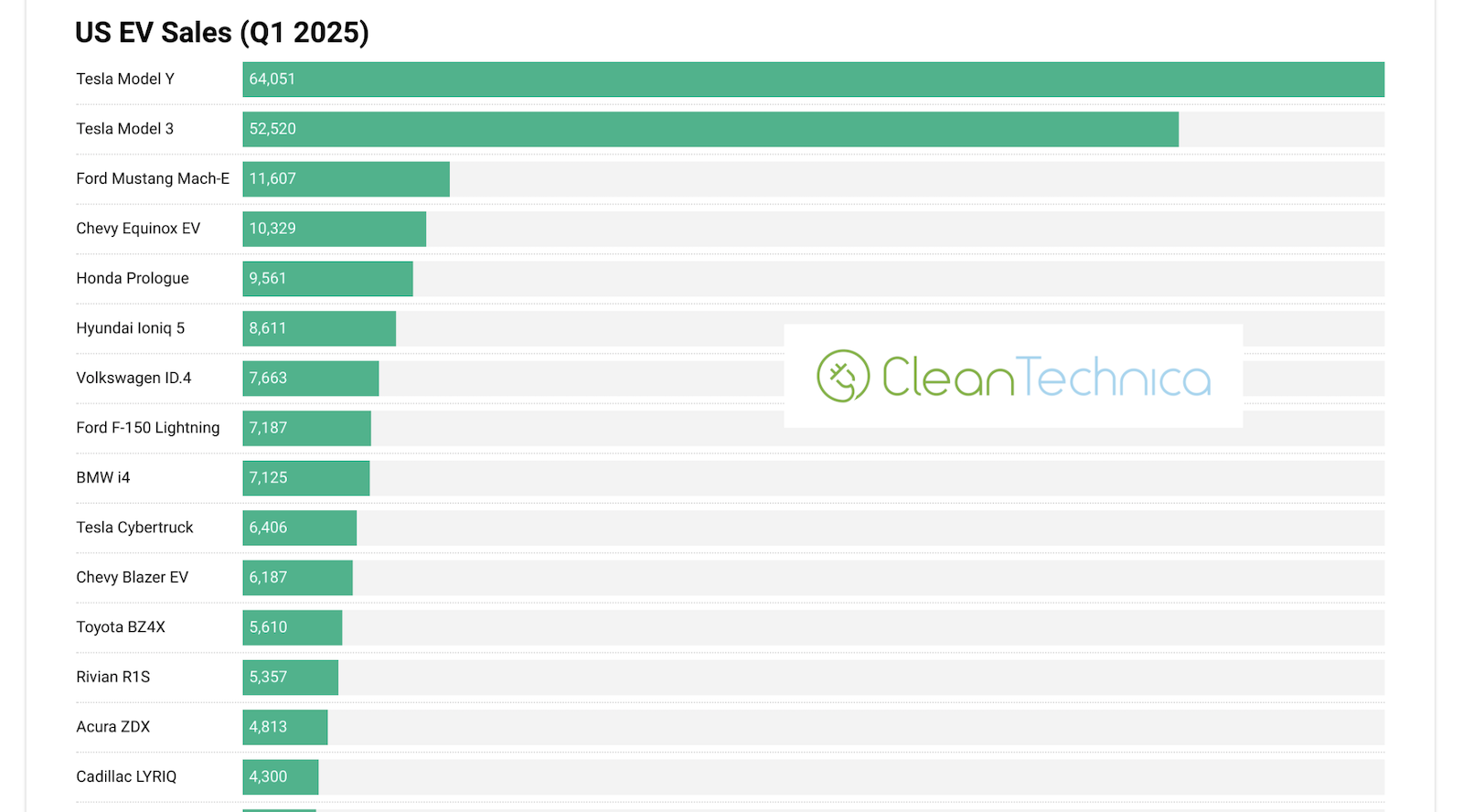

- Production numbers tell the story: Model 3 and Y dominated 2025 sales with 1.58M units sold compared to just 418K for S and X combined

- Optimus ambitions are enormous: Tesla targets producing 1 million robots annually in the reclaimed Fremont factory space

- Sales momentum already declining: Model S and X were removed from the Chinese market in mid-2025 due to tariff pressures, suggesting demand was already softening

- Existential bet on robotics: Musk believes humanoid robots represent a bigger market opportunity than premium electric vehicles

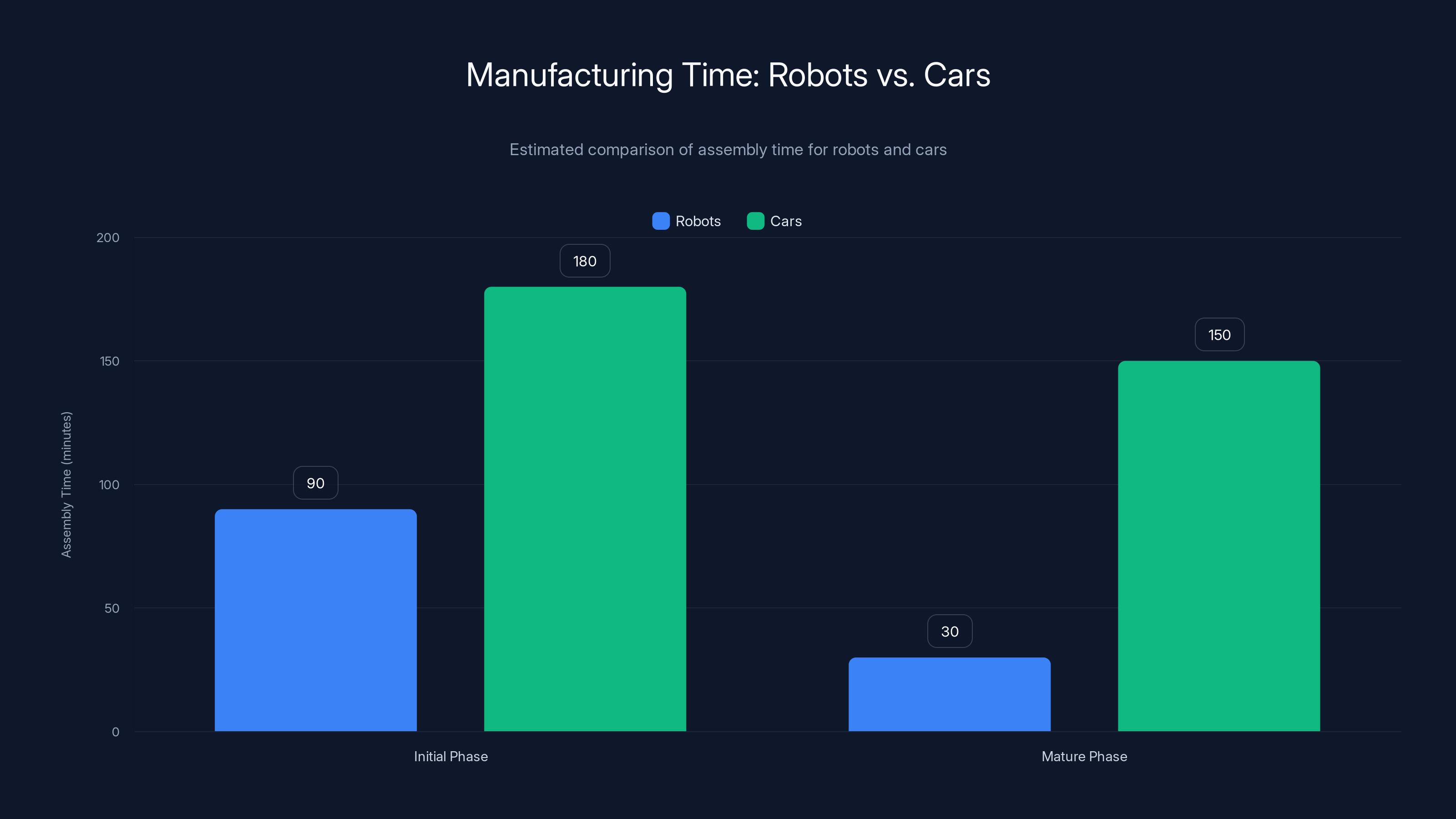

Estimated data suggests that initially, robots may take longer to assemble than cars due to process immaturity. However, as processes mature, robots could be assembled significantly faster than cars.

The Context Behind the Discontinuation

Why Tesla Decided to Kill Two Flagship Models

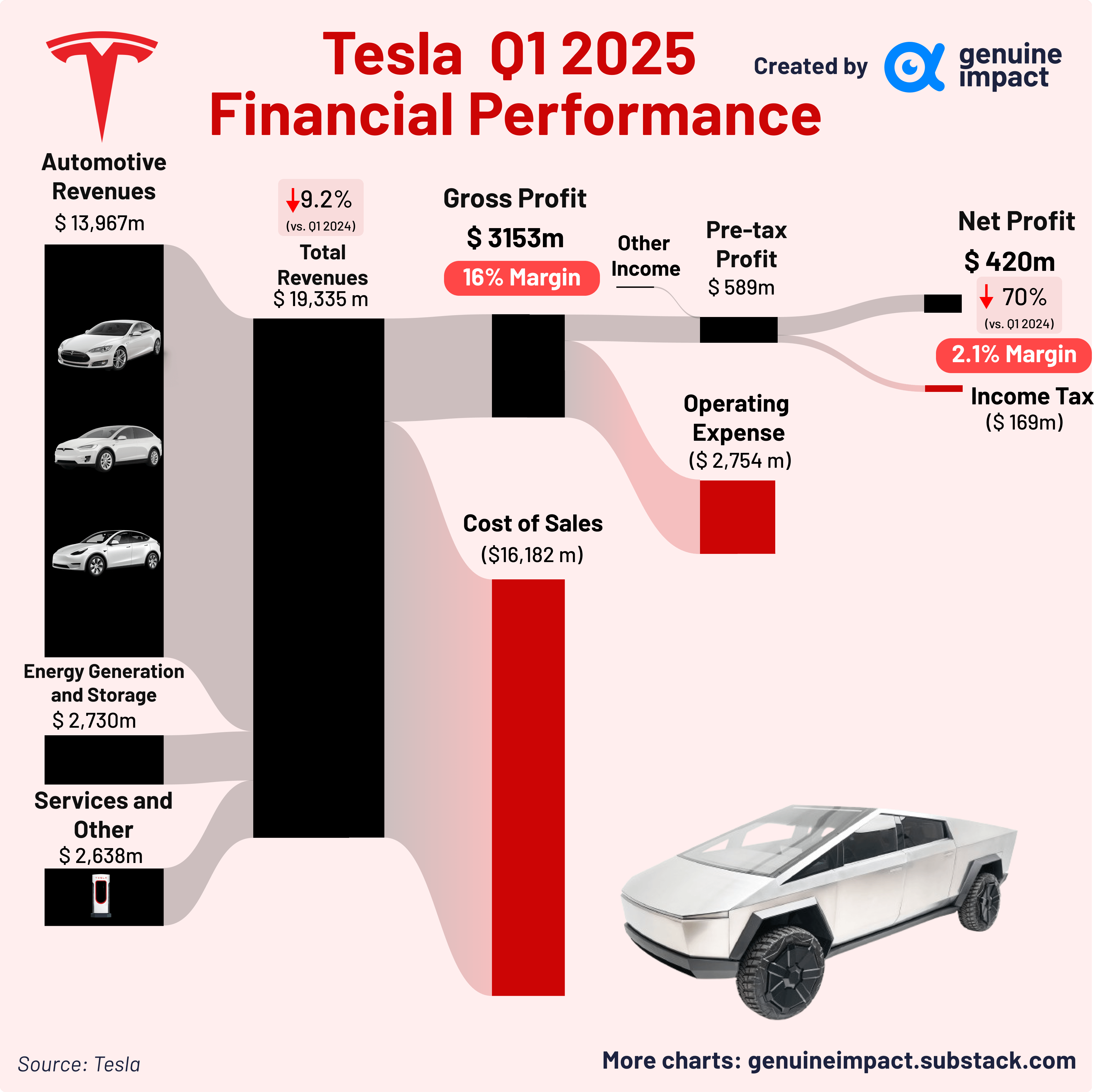

Understanding why Tesla would eliminate two profitable vehicle lines requires understanding how dramatically the company's business metrics have shifted. The Model S and Model X were once Tesla's revenue engines, commanding premium prices and generating substantial margins. But the world changed. The Model 3 and Model Y arrived and obliterated the market for affordable EVs. The numbers don't lie.

In 2025 alone, Tesla delivered 1,585,279 combined units of the Model 3 and Model Y. Meanwhile, the Model S and X combined for only 418,227 sales. That's a ratio of almost 4 to 1 in favor of the newer models. More importantly, the Model 3 and Y have higher production volumes, faster turnover, and arguably lower complexity. Building a Model 3 is more efficient than building a Model S. The newer models also face less competition from legacy automakers, while the premium sedan and SUV segments have become increasingly crowded.

Musk's decision reflects a cold business reality: the Model S and X are becoming niche products in Tesla's portfolio. They're not dead, exactly, but they're dying slowly. Rather than allow them to limp along for another five years while slowly losing market share, Musk has decided to execute a clean exit. This is actually pragmatic thinking disguised as radical innovation.

The geopolitical situation accelerated this decision. When China imposed retaliatory tariffs in mid-2025 in response to Trump administration trade policies, the Model S and X became suddenly uneconomical to sell in that market. These vehicles were being imported from the United States and faced punitive tariffs, while locally manufactured competitors faced no such penalties. Tesla was forced to stop Chinese sales of both models, a clear signal that the business case had deteriorated significantly, as reported by Cox Automotive.

Musk isn't being sentimental about this decision. He's being strategic. The Fremont factory, which currently produces Model S and X units, sits on some of the most valuable manufacturing real estate in the country. Converting that space to Optimus production might generate far higher returns than continuing to produce luxury EVs.

The Sales Reality: Models 3 and Y Dominate

The sales numbers paint a stark picture of where Tesla's market strength really lies. The Model 3 and Model Y have become the core of Tesla's business, representing roughly 79% of total deliveries in 2025. This concentration of sales in two models isn't unusual for a manufacturer, but it does suggest the other two models are tertiary to Tesla's strategy.

Why did this shift happen? Several factors contributed. First, the Model 3 and Y are more affordable, reaching a broader market segment. Second, they face less competition from legacy automakers, who have been slower to develop competitive mid-market EVs. Third, production improvements over the years have made manufacturing these vehicles increasingly efficient. Tesla can now produce a Model 3 or Y faster and cheaper than when they first launched.

The Model S and X, by contrast, operate in market segments where competition is intensifying. Legacy automakers now offer luxury EVs. Porsche has the Taycan. BMW has the i7. Audi has the e-tron GT. These vehicles are good. They're made by companies with century-long manufacturing expertise. Tesla's technology advantage in the premium segment isn't as pronounced as it is in the mass market.

Additionally, the Model S and X require different manufacturing processes than the Model 3 and Y. They're built on different platforms, use different battery modules, and have different production lines. This complexity adds cost. Every minute a factory worker spends assembling a Model S is a minute they're not assembling a more profitable Model 3.

From a manufacturing perspective, consolidating production onto two models makes operational sense. It reduces supply chain complexity, simplifies training, and allows Tesla to invest more heavily in improving the efficiency of the models that actually move the needle for the company.

Optimus: The Humanoid Robot That's Supposed to Justify Everything

What Is Optimus and Why Does It Matter?

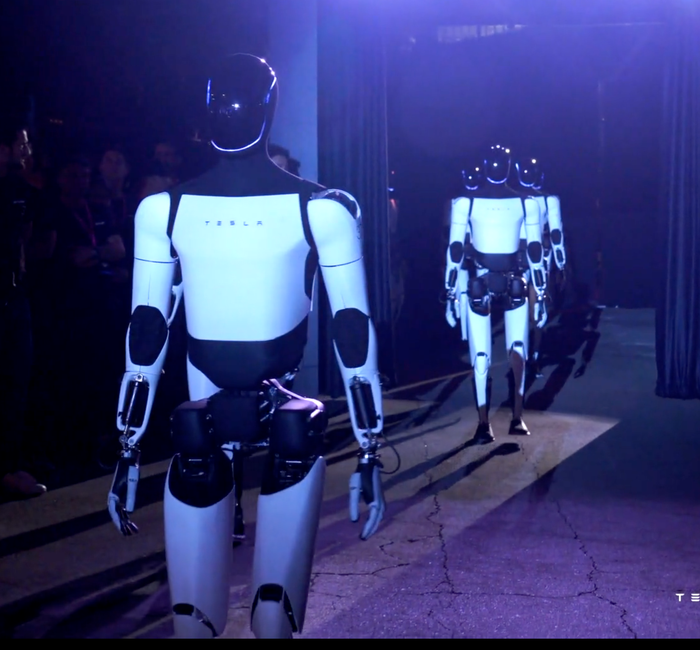

Optimus is Tesla's humanoid robot project. But calling it a "project" undersells the ambition. Musk has suggested that Optimus could become "the biggest product of all time," dwarfing smartphones, tablets, and every other consumer technology that came before it. That's an extraordinary claim. It's also one that comes with extraordinary skepticism attached.

The basic concept is straightforward: design a robot that can perform human tasks more efficiently than humans can. Optimus stands about 5 feet 8 inches tall and weighs around 125 pounds. It uses advanced AI and sensors to navigate environments, interpret instructions, and execute tasks. Tesla has demonstrated it picking up objects, handling delicate items, and performing repetitive work.

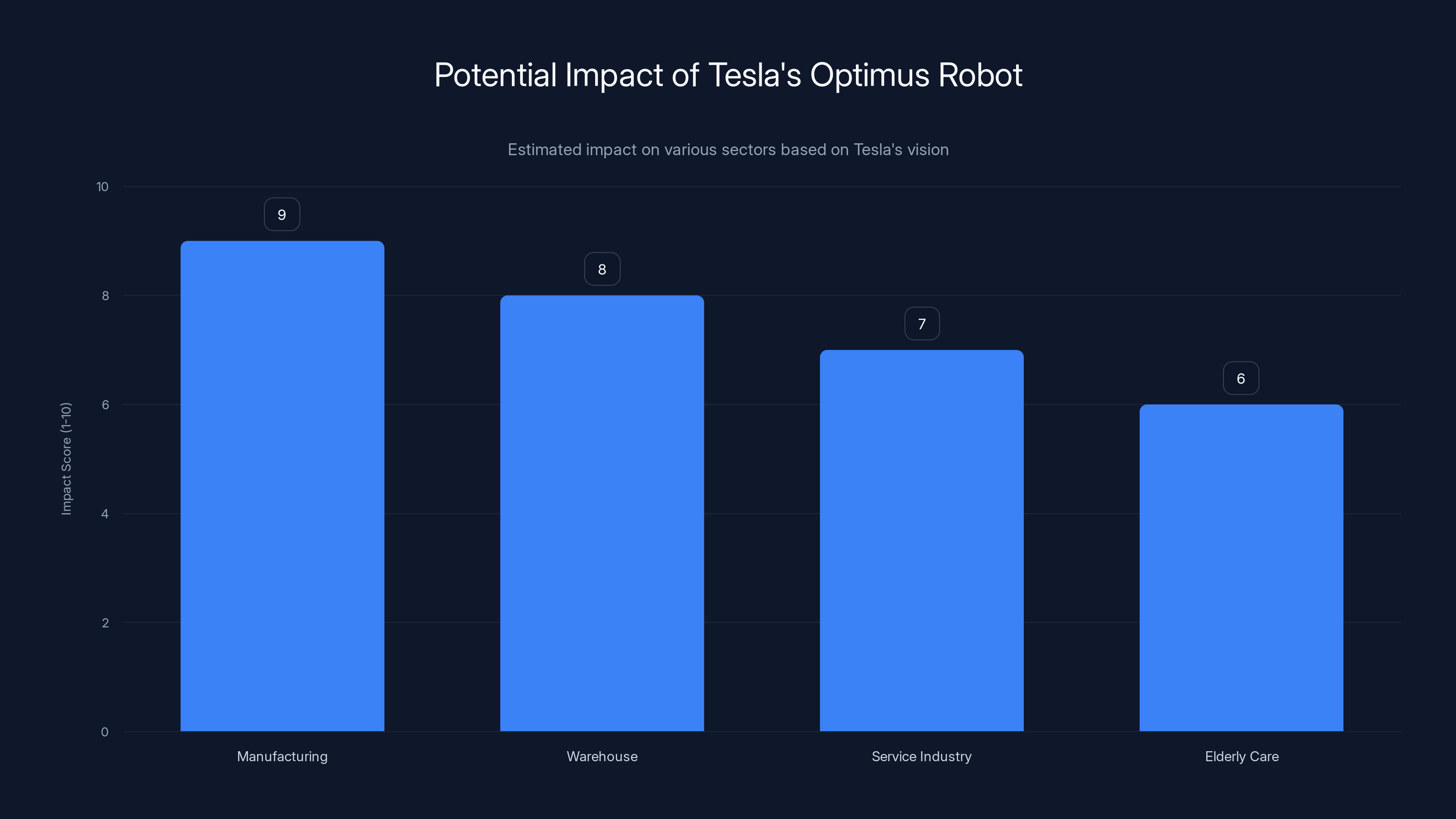

The use cases Tesla envisions are vast. Manufacturing jobs that are currently dangerous or repetitive could be handled by Optimus. Warehouse work could be automated. Service industry positions could be enhanced by robotic assistance. Elderly care could benefit from robots that can lift patients and assist with mobility. The potential applications are genuinely broad.

What separates Optimus from previous robotics attempts is Tesla's integration of artificial intelligence with hardware. Most industrial robots are specialized machines designed for specific tasks. They're brilliant at welding car doors but useless at folding laundry. Optimus aims to be a general-purpose robot, capable of learning new tasks and adapting to different environments. That's technically far more challenging.

Musk's vision is that Optimus eventually becomes affordable enough that households and small businesses can purchase units. He's talked about prices potentially falling to the

The 1 Million Robot Ambition

Musk's stated goal is audacious: manufacture 1 million Optimus robots annually using the production space freed up by discontinuing the Model S and X. To put that in perspective, that would make Optimus Tesla's highest-volume product by a significant margin. It would exceed Tesla's total annual EV production capacity.

The math on this is worth examining. Tesla's Fremont factory currently produces roughly 450,000 to 500,000 vehicles annually across all models. If you redirect that entire facility to Optimus production, reaching 1 million units annually would require roughly doubling the factory's current output. That's not impossible, but it requires several conditions to be met.

First, Optimus manufacturing would need to be simpler and faster than car manufacturing. Building a robot might actually be less complex than building a car, which has thousands of moving parts, safety systems, and regulatory requirements. Second, Tesla would need to continuously improve manufacturing efficiency, reducing the labor hours and costs per unit. Third, demand would need to actually exist. None of this matters if customers don't want to buy 1 million robots annually.

The third point is where skepticism enters the picture. Optimus hasn't launched commercially. There are no customer deliveries. There are demos and prototype videos, but the gap between prototype and mass production is enormous. Companies like Boston Dynamics have been building impressive robots for years without achieving meaningful commercial adoption. The robotics industry is littered with companies that built technically impressive machines that never found a market.

But Musk's track record should temper cynicism. He said Tesla would dominate the EV market when nobody believed it. He claimed Starship would land vertically when people thought he was insane. He was frequently wrong about timelines, but he was often right about direction. The question isn't whether robots will eventually be valuable. The question is whether Tesla can execute better and faster than everyone else.

In 2025, Tesla sold nearly 1.6 million units of Model 3 and Y, compared to just over 418,000 units of Model S and X, highlighting the shift in consumer preference and production efficiency.

The Broader Strategic Shift: From Cars to AI

Tesla's Identity Crisis and Resolution

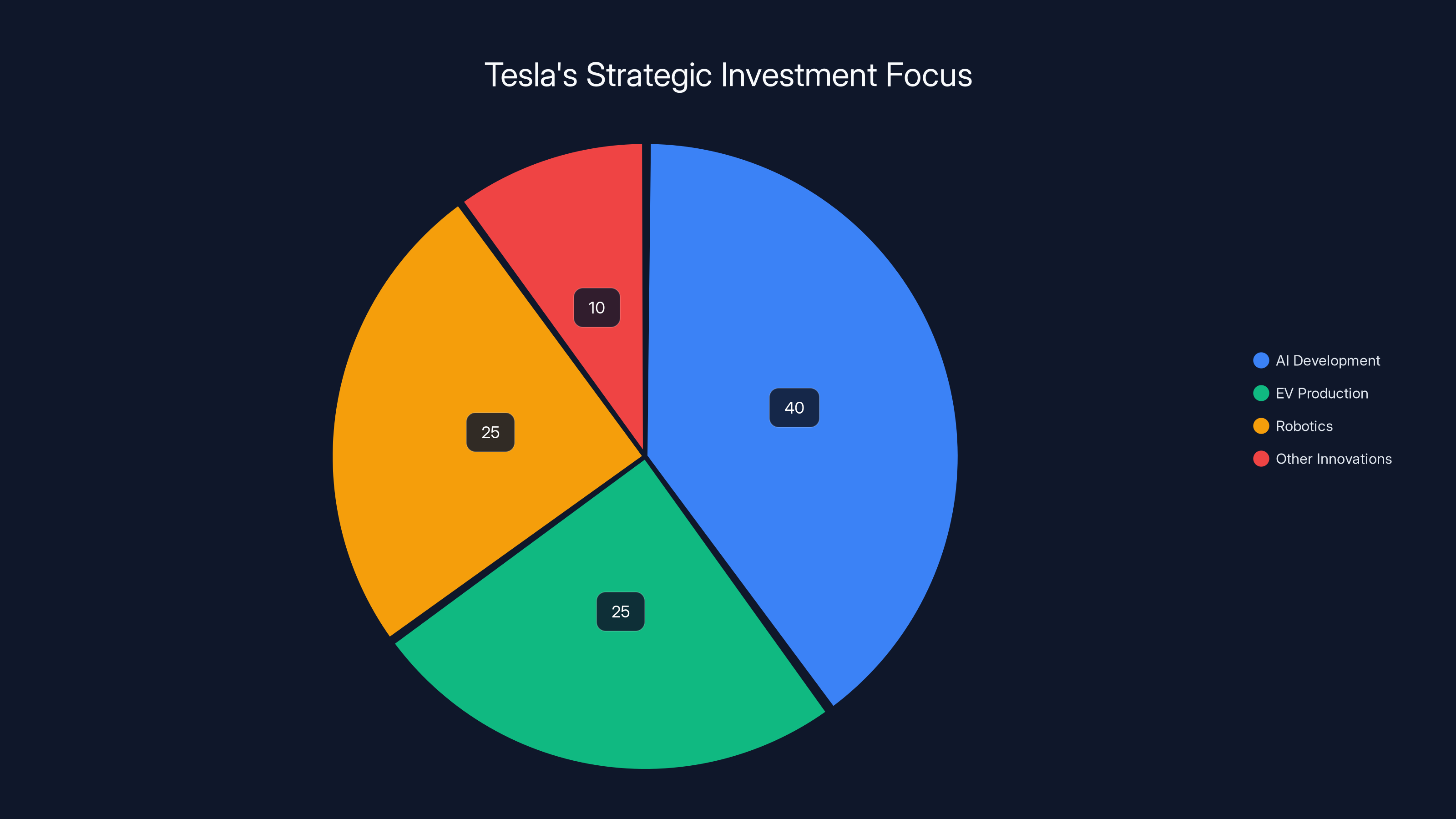

Musk has been claiming for years that Tesla is fundamentally an AI company, not an EV company. This statement initially seemed like corporate spin, a way to justify absurdly high valuations in the stock market. But this decision to discontinue the Model S and X suggests Musk actually believes it.

Consider what's happened. Tesla built the EV market from scratch. The company proved that electric vehicles could be desirable, profitable, and practical. It forced legacy automakers to invest trillions in EV development. Tesla accomplished what everyone said was impossible. And then, having conquered that mountain, Musk decided the real mountain is somewhere else entirely.

This pivot represents a fundamental shift in how Tesla views its future. The company isn't interested in becoming a traditional automaker with a diverse product lineup. It's not interested in competing with BMW and Mercedes in the luxury segment. Instead, Tesla is reorganizing around a new thesis: the future belongs to companies that can deploy AI effectively, and robots are the ultimate application of AI technology.

This shift also explains some other puzzling Tesla decisions. The $2 billion investment in xAI, Musk's AI research company, suddenly makes more sense. Tesla shareholders actually sued Musk over that investment, arguing it was a distraction from Tesla's core EV business. But if Tesla is becoming an AI-first company, then investing in world-class AI research is exactly what Tesla should be doing.

Musk's

The xAI Connection and AI as Core Business

The xAI investment deserves closer attention. Tesla committed $2 billion to Musk's AI research company, which is developing large language models and advanced AI systems. On the surface, this looks like Musk spreading himself thin across multiple companies. But it's actually a strategic coordination of assets.

Optimus needs world-class AI to function as a general-purpose robot. It needs natural language understanding to take instructions. It needs computer vision to navigate environments. It needs machine learning to improve its performance over time. All of these capabilities are precisely what xAI is developing. By investing in xAI, Tesla is essentially building the intelligence that will power Optimus.

The relationship between the two companies creates a feedback loop. xAI develops AI models. Tesla implements those models in robots. Real-world data from millions of Optimus robots feeds back to improve xAI's training. The robots become the hardware platform for scaling AI capabilities. This is actually quite clever strategically.

Musk's vision of Tesla as an AI company finally makes sense in this context. Tesla isn't just a manufacturer. It's becoming an AI deployment platform. The cars were the initial revenue stream. The robots are the next evolution. Eventually, there might be other applications for Tesla's AI and robotics capabilities. But the trajectory is clear: Musk is betting the company on AI as the future.

Manufacturing Implications: What Happens to Fremont?

Converting Premium Car Production to Robot Assembly

The Fremont factory is one of the most advanced manufacturing facilities in the world. It was originally built by General Motors and Toyota as a joint venture, and it operated at the cutting edge of automotive engineering for decades. When Tesla took over the facility, the company invested billions in retrofitting it with advanced robotics and automation systems.

Converting this factory from car production to robot production requires significant changes. Car manufacturing involves thousands of individual assembly steps, quality control checkpoints, and safety systems. Robot production might actually be simpler in some ways, but it's different in meaningful ways.

First, the supply chain changes completely. Model S and X require traditional automotive components: engines, transmissions, and chassis systems. Wait, no, they're electric vehicles. They require battery packs, electric motors, power electronics, and structural components. Optimus requires completely different parts: actuators, sensors, compute modules, AI processors, and specialized materials.

Tesla will need to rebuild supplier relationships and establish new supply chains for Optimus components. This takes time and carries significant risk. A single bottleneck in the supply of specialized actuators could paralyze the entire assembly line. Tesla has proven it can navigate supply chain challenges, but this is a new challenge in unfamiliar territory.

Second, the assembly process is different. Building a car involves welding, painting, and other high-temperature processes. Building a robot might involve precision assembly, fine calibration, and sophisticated testing systems. Tesla will need to retrain its workforce or hire new workers with different skillsets. The Fremont factory currently employs roughly 10,000 workers. Some of those jobs will transfer to robot assembly. Others might become obsolete. Others might shift to new positions.

Third, the capital expenditure required is substantial. Even though Tesla is repurposing an existing facility, retooling it for robot production requires new equipment, new assembly lines, and new testing infrastructure. Musk hasn't disclosed how much Tesla plans to spend on this conversion, but it's likely in the billions.

The Workforce Transition Question

What happens to the Fremont workers? This is the question that matters most to the people actually affected by this decision. Tesla has roughly 10,000 employees at Fremont. Some percentage of those jobs will transition to Optimus assembly. Others will shift to service and support. But inevitably, some jobs will be eliminated.

Musk hasn't provided clear details about severance, retraining, or placement assistance. Tesla has a history of aggressive cost-cutting and expecting employees to adapt rapidly to changes. Whether the company extends generous transition support to affected workers remains to be seen.

However, it's worth noting that Fremont is in the San Francisco Bay Area, where the labor market is extremely tight. Workers displaced from Tesla assembly roles will likely find employment elsewhere. The real issue is whether those jobs pay similarly and provide comparable benefits. Manufacturing jobs in the Bay Area are relatively well-compensated due to union representation and labor scarcity. Not every alternative job will match that compensation level.

There's also the question of timeline. Musk said production would "basically stop" next quarter, which means Q2 2025. That's a very short timeframe to transition an entire production line. If Tesla moves fast, this could be disruptive. If Tesla moves cautiously, the Model S and X might linger in production longer than announced.

The Model S and X Legacy: What We're Losing

Historical Significance of These Vehicles

The Tesla Model S launched in 2012, and it fundamentally changed how the automotive industry viewed electric vehicles. Before the Model S, EVs were regarded as toys for environmentalists. They were slow. They had terrible range. They were unreliable. Nobody serious wanted one.

The Model S proved all those assumptions wrong in one fell swoop. It was fast, offering performance that could embarrass sports cars. It had range exceeding 300 miles. It was reliable. It was luxurious. Most importantly, people actually wanted to buy it. Not because of environmental concerns, but because it was a genuinely great car.

The impact of the Model S cannot be overstated. Legacy automakers saw it succeed and realized they had a serious problem. They began investing in electric vehicle development. Government agencies saw demand for EVs and began mandating that automakers produce them. The entire trajectory of the transportation industry shifted because of the Model S's success.

The Model X, which launched in 2015, proved that Tesla wasn't just a sedan company. It was a technology company that could excel in multiple vehicle categories. The Model X's falcon-wing doors became iconic. The vehicle's performance and efficiency exceeded the expectations of buyers accustomed to traditional SUVs. The Model X established Tesla's credibility beyond sedans.

Both vehicles earned their place in automotive history. They proved EVs could work. They proved Tesla could execute. They generated the profits and credibility that allowed Tesla to develop the Model 3 and Model Y. In a very real sense, the success of the Model S and X built the foundation for everything Tesla has become.

Why Killing Them Still Makes Sense

But nostalgia isn't a business strategy. The Model S and X have had a remarkable run, but they've also been in production for over a decade without major redesigns. The Model S was updated in 2021, and the Model X received updates around the same time, but these weren't comprehensive overhauls. They were incremental improvements.

Meanwhile, competition has intensified. Porsche's Taycan is a legitimately excellent sports sedan. BMW's i7 is a luxury EV that competes directly with Model S. The market for premium EVs has become crowded. Tesla's technical advantage in this segment isn't as pronounced as it once was.

The Model S also carries legacy complexity. It was designed with older manufacturing processes in mind. Over the years, Tesla has bolted on improvements, but the basic architecture is more than a decade old. A clean-sheet design might be more efficient, but doing a complete redesign would require massive capital investment and factory downtime. At some point, you have to ask whether it's worth reinvesting in an aging platform.

Musk's decision to discontinue rather than redesign actually demonstrates clear strategic thinking. The company has made a choice: invest capital in new products and new manufacturing processes rather than optimize legacy products. This is how innovation happens. Companies that continue to milk aging product lines eventually get leapfrogged by companies willing to completely reinvent themselves.

Estimated data shows Tesla's strategic shift towards AI and robotics, with 40% focus on AI development, indicating a major pivot from traditional EV production.

The Optimus Timeline and Realistic Expectations

What Musk Says vs. What History Suggests

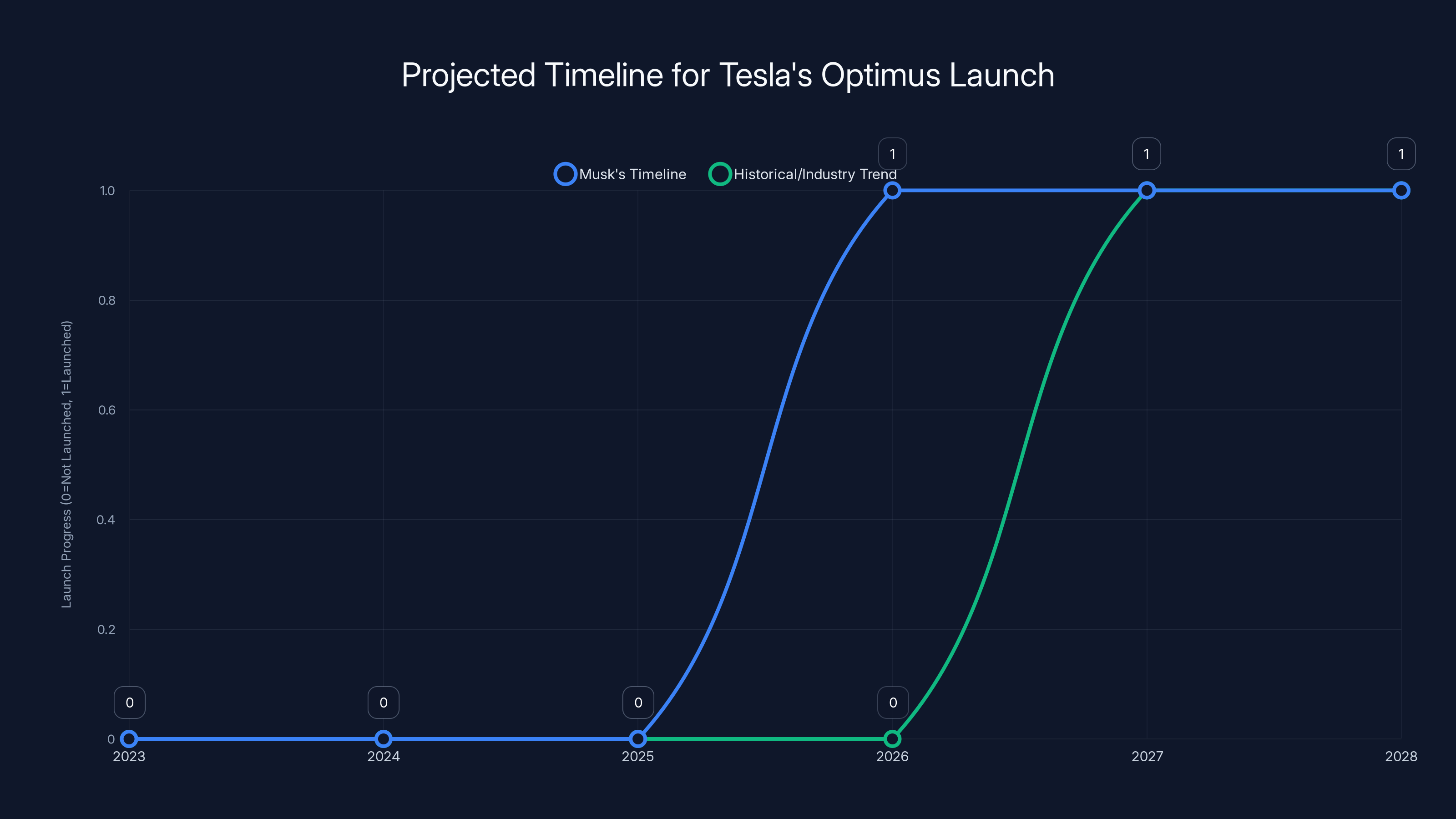

Musk announced that Tesla will begin selling Optimus to the public by the end of 2026. That's roughly 18 months away. Let's examine whether that timeline is realistic based on Tesla's history with product launches and robotics industry norms.

Musk is famous for overly optimistic timelines. He predicted that Tesla would have level 5 autonomy (fully self-driving cars) by 2017. That didn't happen. He's predicted timelines for Starship that have repeatedly slipped. He tends to underestimate the difficulty of complex engineering projects by substantial margins.

That said, Musk does eventually deliver, even if it takes longer than predicted. Tesla is successfully manufacturing millions of EVs. Starship is progressing toward orbital launches. The company's ability to execute eventually is well-established, even if the timelines are frequently wrong.

For Optimus, the end-of-2026 launch date might actually be plausible if "launch" means initial availability to select customers. This has been Tesla's pattern with other products: limited initial availability for early adopters, followed by gradual scale. Full-scale manufacturing of 1 million units annually is a different matter entirely. That might take several more years to achieve.

The robotics industry as a whole provides useful context. Boston Dynamics has been developing humanoid and quadruped robots for over 15 years. They've achieved impressive technical results but modest commercial adoption. That suggests the gap between prototype and mass production is larger than most people assume.

Tesla's advantage is that it's not Boston Dynamics. Tesla has a manufacturing expertise, supply chain relationships, and capital resources that pure robotics companies lack. Tesla has also shown it can productionize technology faster than incumbents in the EV space. Whether those advantages extend to robotics remains an open question.

Potential Bottlenecks and Challenges

Developing Optimus to the point of mass production involves overcoming several significant challenges. The AI component is complex. Robots need to understand human language, interpret environments, and adapt to novel situations. This requires state-of-the-art machine learning capabilities that Tesla is still developing.

The hardware component is also non-trivial. Building actuators and sensors precise enough for dexterous manipulation is hard. Building mechanical systems that are reliable enough for continuous operation is harder. Building systems that can be manufactured in volume without quality issues is harder still. Boston Dynamics robots are impressive but each one requires extensive manual tuning and calibration. Tesla needs to automate that process significantly.

The cost challenge is real. If Optimus eventually needs to sell for

There's also the regulatory and safety challenge. A humanoid robot operating in human spaces needs extensive testing and certification. Different jurisdictions will have different safety requirements. Insurance and liability issues will need to be resolved. A robot that causes damage or injures a human creates legal problems that Tesla will need to navigate. None of this is insurmountable, but it adds complexity and timeline risk.

The Economics of Robots vs. Cars

Manufacturing Complexity and Costs

Is manufacturing a robot fundamentally simpler than manufacturing a car? This is the underlying assumption driving Musk's decision, and it deserves examination.

Cars are complex. A modern vehicle has thousands of individual parts that need to be assembled with extreme precision. There are safety systems, emission controls, comfort features, and infotainment systems. Assembling all of these requires sophisticated robots, precision tooling, and extensive quality control.

Robots have different complexity. They have fewer parts than cars, but those parts need to be more precise. The actuators, sensors, and compute modules need to work together seamlessly. One malfunctioning component can render the entire robot unusable. Quality control standards might actually be higher for robots than for cars.

However, there are potential advantages. A robot doesn't need a transmission, alternator, fuel system, exhaust system, or the dozens of other automotive-specific components. A robot doesn't need crash testing or safety certifications for human occupants. A robot's assembly might be simpler in terms of overall process, even if individual components are more precisely manufactured.

The real question is whether the simplified design results in faster manufacturing. If a robot can be assembled in 30 minutes while a car takes 3 hours, then the per-unit throughput argument for robots becomes compelling. But if both take similar amounts of time, then the advantage disappears.

Tesla's manufacturing expertise is primarily in cars. Retooling for robots means learning new manufacturing processes. There will be a learning curve. Efficiency will be lower initially. Tesla's first Optimus units might take longer to manufacture than the last Model S units, due to process immaturity. Efficiency will improve over time, but the trajectory is uncertain.

Revenue Potential and Margins

Car manufacturing is a mature industry with well-understood economics. A premium EV like the Model S or Model X probably generates

Robot manufacturing is unproven territory. If Optimus eventually sells for

But that's a best-case scenario that depends on several unknowns. First, what will the market price actually be? If robots are in high demand, prices might stay high. If competition emerges, prices could fall. Second, what will manufacturing costs be? Current prototypes probably cost

Third, will demand actually exist? This is the biggest unknown. Manufacturing 1 million units is pointless if the market only absorbs 100,000. Demand for robots depends on applications, pricing, effectiveness, and regulatory environment. All of these remain unclear.

From a financial perspective, Tesla is making a bet that the robot market will be larger and more profitable than the premium EV market. That's plausible. It's also possible that the robot market develops more slowly than expected, and Tesla would have been better off continuing to produce Model S and X vehicles. There's real risk here.

Industry Reactions and Competitive Responses

What Established Automakers Are Thinking

Traditional automakers have been cautiously monitoring Tesla's shift away from cars and toward robots. Most have dismissed the Optimus project as a distraction or fantasy. But Tesla's decision to discontinue the Model S and X suggests the company is serious.

Legacy automakers are unlikely to follow Tesla's example immediately. These companies are built around EV platforms, manufacturing facilities, and supply chains optimized for car production. Pivoting to robots would require organizational change at a massive scale. It's theoretically possible but practically difficult for companies like Ford, General Motors, or Volkswagen.

However, they're paying attention. If Optimus succeeds commercially and reaches meaningful scale, every automaker with manufacturing capacity will consider robot production. The technology isn't proprietary. Once Tesla demonstrates it's viable, competitors will develop their own versions.

The more likely short-term response is that legacy automakers double down on EV production and autonomous driving technology. They're betting that the future is still primarily about vehicles, just electrified and autonomous. Tesla is betting the future is about robots and AI. These aren't mutually exclusive bets, but they represent different strategic priorities.

Startup Robotics Companies' Perspective

Startup robotics companies are watching Tesla closely. There are dozens of robotics startups trying to develop humanoid robots. Companies like Boston Dynamics, Unitree, and others have technical capabilities that rival Tesla's. But Tesla has advantages they don't: manufacturing scale, capital, supply chain relationships, and brand recognition.

Some robotics startups might pursue partnerships with Tesla. Others might accelerate their own manufacturing timelines. Still others might focus on specialized applications where their robots have advantages over Optimus.

The competitive landscape for humanoid robots is about to become crowded. Tesla's entry, with full manufacturing commitment, raises the stakes for everyone in the industry. Startups that are still in prototype phase might find it difficult to compete with Tesla's resources. But startups that focus on specialized applications or niche markets might survive and thrive.

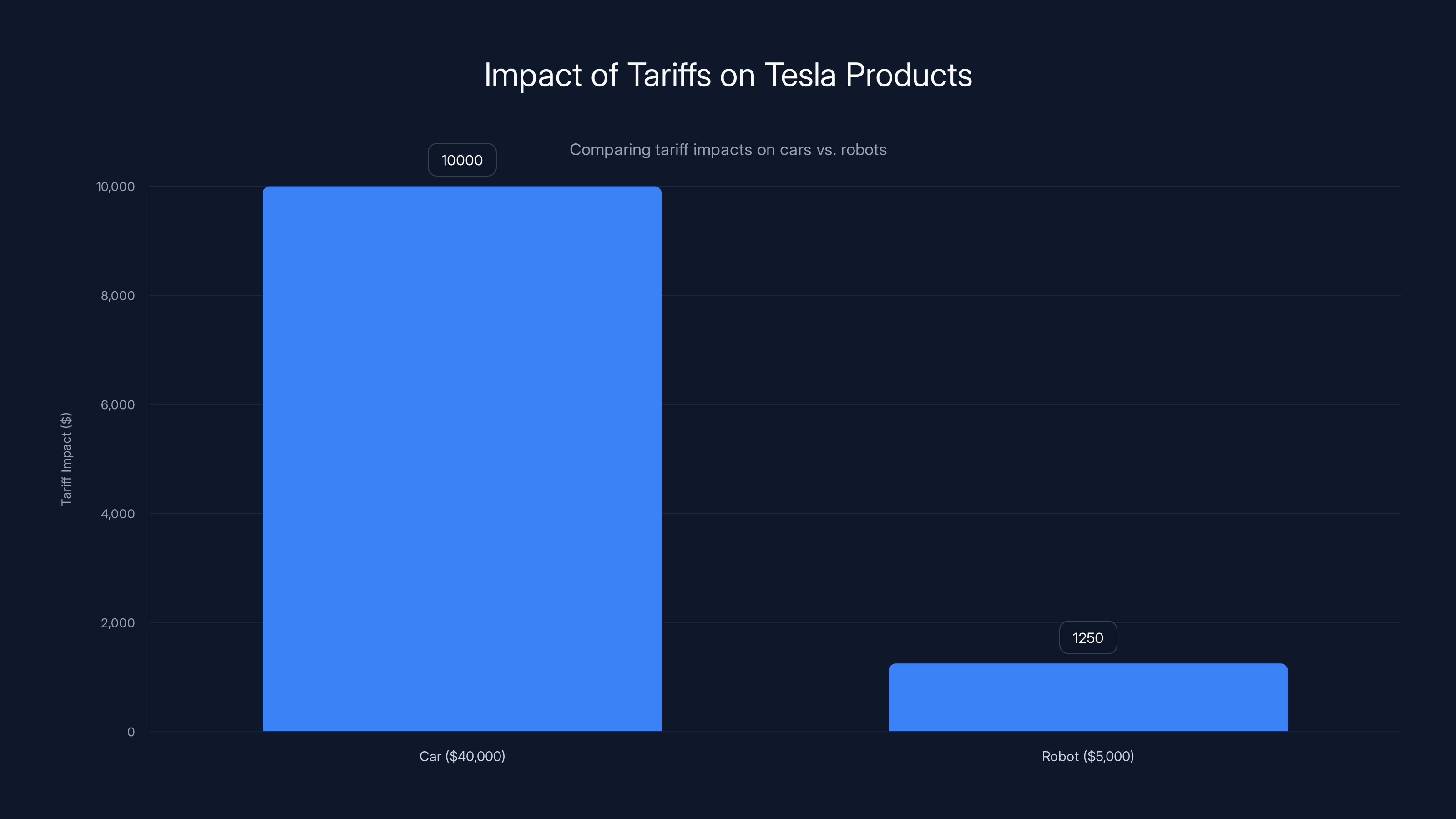

A 25% tariff has a significantly higher absolute impact on cars (

Geopolitical and Regulatory Factors

Trade Tariffs and the China Situation

The decision to discontinue Model S and X was accelerated by tariff issues. When China imposed retaliatory tariffs in mid-2025, imported Tesla vehicles became uncompetitive in that market. Rather than absorb the tariffs and reduce margins, Tesla chose to exit the Chinese market for those models, as noted by CBT News.

This illustrates a broader geopolitical tension. Tesla manufactures cars in multiple countries but also imports vehicles between regions. Trade barriers complicate this strategy. Robots might face similar tariff pressures if manufactured in the US and exported globally.

However, robots might actually be less sensitive to tariffs than cars. If manufacturing costs are lower, the same tariff percentage has less absolute impact. A 25% tariff on a

Also, if Optimus manufacturing becomes a priority, Tesla might establish manufacturing facilities in key markets like China and Europe. Building local production capacity insulates the company from tariff issues. This would be similar to Tesla's strategy with cars, where the company has factories in multiple countries.

Regulatory Requirements for Autonomous Robots

As robots transition from factory prototypes to consumer devices, regulatory requirements will emerge. Different countries will have different safety standards. Robots that interact with humans need to be certified as safe. This will create regulatory barriers to entry that protect first-movers like Tesla.

The EU is likely to develop strict regulations around autonomous robots. The US will probably develop lighter-touch regulations initially. China might incentivize robot adoption for economic reasons. These different regulatory environments will shape how and where robots are deployed.

Undertainty around regulation creates risk for Tesla. If regulations are overly restrictive, robot adoption might be limited. If regulations are too lenient, competitors might proliferate. Tesla's goal will be to influence regulation in ways that benefit the company while maintaining safety. This is the same game Tesla plays with vehicle regulation.

The Optimus Demonstrations and Reality Check

What Has Optimus Actually Demonstrated?

Tesla has released videos of Optimus performing various tasks. The robot can walk. It can pick up objects. It can fold clothing, though with limited dexterity. It can interact with people. These demonstrations are impressive from a technical standpoint.

But demonstrations are different from reliable, consistent operation. A robot might perform a specific task perfectly once for a video, but fail repeatedly in real-world conditions. Variables like lighting, surface irregularities, and object variations cause issues. Robots trained on controlled environments often struggle in the chaos of actual human spaces.

Furthermore, the tasks Optimus has demonstrated are relatively simple. Picking up objects is easier than assembling complex products. Folding clothing is harder but still basic compared to tasks requiring fine manipulation. The gap between current capabilities and what would be required for a general-purpose robot in diverse applications is still substantial.

Musk's claims about Optimus always exceed the demonstrated capabilities by a wide margin. He talks about robots doing any human job, but the robot has never attempted most of those jobs. There's a proven pattern of Musk overstating near-term capability while being right about long-term direction.

The Human Labor Comparison

Ultimately, Optimus will only be valuable if it can do things humans do, at lower total cost than hiring humans. This is a high bar. Human workers have flexibility, adaptability, and general intelligence that current robots lack.

For specific repetitive tasks in controlled environments, like factory assembly, robots already beat humans on cost and consistency. But for complex tasks requiring judgment and adaptation, humans are still superior. A human worker can notice that a screw is slightly misaligned and self-correct. A robot might proceed with the incorrect alignment, creating a defective product.

As AI improves, the range of tasks where robots beat humans will expand. But the transition will be gradual. The first Optimus robots will likely be deployed in structured environments where tasks are predictable. Over time, capability will expand to less structured environments.

The economic incentive is clear. Labor costs are rising globally. Regulatory requirements for worker safety are increasing. Any task that can be automated saves companies money while improving safety. Optimus won't need to be perfect. It just needs to be good enough and cheaper than alternatives.

What This Means for Tesla's Stock and Valuation

The Bet Embedded in Current Valuation

Tesla's stock has already priced in expectations about Optimus. The company's market capitalization reflects Musk's bold claims about the robot's potential. If Optimus develops as planned, current stock valuations might prove conservative. If Optimus disappoints, the stock could face severe pressure.

This is why Musk's

For the Model S and X discontinuation to make sense to investors, they need to believe that Optimus will eventually generate more value than those vehicles do. That's not an unreasonable belief, but it's unproven. The discontinuation decision essentially forces investors to accept Musk's vision of Tesla's future. If you disagree with that vision, Tesla stock is unattractive.

Conversely, if you believe Optimus will be as transformative as Musk claims, the decision to discontinue Model S and X makes perfect sense. You're redirecting capital and capacity from mature products to products with vastly larger potential markets. From an investment perspective, that's rational capital allocation.

Quarterly Earnings Impact

In the short term, discontinuing Model S and X production will reduce Tesla's quarterly revenues and likely depress earnings. Optimus manufacturing won't generate significant revenue for several quarters at least. This creates a near-term headwind that investors will need to tolerate.

Musk has shown a willingness to sacrifice short-term earnings for long-term strategy. Tesla's manufacturing investments have reduced quarterly profitability numerous times. The stock market has eventually rewarded those decisions, but the process is painful in the moment.

Expect Tesla's stock to be volatile around the Model S and X discontinuation announcement. Near-term traders will sell, viewing it as a negative. Long-term investors will evaluate it as a strategic shift. The stock's reaction will depend on how the broader market views the Optimus opportunity.

Estimated data suggests that Tesla's Optimus robot could have the highest impact in manufacturing, followed by warehouse automation, service industry enhancements, and elderly care support.

Alternative Scenarios and What Could Go Wrong

Scenario 1: Optimus Succeeds Beyond Expectations

In this scenario, Optimus proves remarkably capable earlier than expected. Demand exceeds manufacturing capacity. Prices hold strong despite competition. Manufacturing efficiency improvements accelerate. Tesla's 1 million unit annual target is achieved by 2028-2029. The company becomes a robotics leader. Musk's vision of Optimus as the biggest product ever proves justified. Tesla's stock reaches astronomical valuations. Everyone criticizes the company for discontinuing Model S and X.

Probability: 20%

Scenario 2: Optimus Develops Slowly but Eventually Succeeds

This is the middle-ground scenario. Optimus works, but development takes longer than anticipated. Commercial launch is delayed to 2027 or 2028. Early units are expensive. Manufacturing ramps more slowly than planned. Eventually, the robot finds applications and a market develops. Optimus becomes a meaningful business, but not as large as Musk claims. Tesla regrets discontinuing Model S and X but can't revive production economically. The stock performs adequately but not spectacularly.

Probability: 45%

Scenario 3: Optimus Fails to Achieve Meaningful Adoption

In this pessimistic scenario, Optimus struggles with reliability and capability gaps. Competing robots prove superior. Regulatory barriers prevent widespread deployment. Demand remains niche rather than mass-market. Tesla is left with expensive robots that don't sell. Manufacturing facilities sit partially idle. The company desperately wants to restart Model S and X production but can't do so without massive capital investment. Shareholders feel deeply regretful. Musk faces criticism for poor strategic judgment.

Probability: 25%

Scenario 4: The Hybrid Path

Tesla maintains limited Model S and X production for niche markets while scaling Optimus. Neither vehicle line generates the volumes they once did, but they don't completely disappear. This hedges the bet and provides fallback options. It requires more complex manufacturing and higher costs but reduces downside risk.

Probability: 10%

These scenarios illustrate why this is genuinely a high-risk strategic decision. There's no way to know how the robots industry will develop, whether consumers and businesses will adopt them, or whether Tesla can execute manufacturing at scale. Musk is making a bet, not implementing a sure thing.

How This Decision Affects Tesla Customers

Existing Model S and X Owners

If you own a Tesla Model S or Model X, this announcement doesn't directly affect your vehicle. Tesla has committed to supporting these vehicles for as long as owners have them. Parts availability, software updates, and warranty service will continue. The company isn't abandoning existing customers.

However, there's a secondary effect. As these models age and reach end of life, finding replacement parts might eventually become difficult. Services performed on older vehicles might cost more as service technicians become scarce. Tesla will maintain support, but the quality and convenience might gradually decline relative to when the vehicles are current.

Resale value might also be affected. Since these models are being discontinued, they transition from current products to collectors items. For some buyers, this creates value. Enthusiasts will pay premiums for older Model S or X vehicles knowing they'll never be produced again. For others, discontinuation reduces the appeal of the used market.

Prospective Buyers

People considering a new Tesla are now limited to Model 3, Model Y, Cybertruck, and eventually Semi and Roadster. The premium sedan and large SUV segments are no longer represented in Tesla's lineup. If you wanted a Tesla luxury sedan, you now have only two options: buy used or buy something else.

This might actually simplify the purchase decision for many buyers. Fewer options means clearer choices. If you want a Tesla, you're choosing between size categories and price points, but within Tesla's active lineup. For luxury sedan buyers, this might push them toward competitors.

Alternatively, prospective Tesla buyers who wanted a large luxury vehicle might now look at the upcoming Optimus or wait for a potential future robot offering. But that's many years away for most consumers.

The Broader Implications for Manufacturing and Employment

Manufacturing's Future Trajectory

Musk's decision to discontinue Model S and X is a microcosm of larger trends affecting manufacturing globally. As automation improves and robotics become more capable, human manufacturing jobs will face increasing pressure. Factories that employ thousands of workers today might employ hundreds in the future.

This isn't inevitable, but it's a real possibility. If Optimus succeeds, Tesla will demonstrate that humanoid robots can handle complex manufacturing tasks. Other companies will follow. Labor-intensive manufacturing might gradually shift to automation-intensive manufacturing.

The economic implications are profound. Manufacturing jobs have historically provided stable, well-compensated employment for workers without college degrees. If those jobs are largely eliminated by robots, entire communities and regions face economic disruption. This is a political and social challenge as much as an economic one.

Companies like Tesla will argue they're creating new, better jobs for robot maintenance, robot programming, and robot management. They'll argue that manufacturing becoming more efficient benefits consumers through lower prices. These arguments aren't wrong. But they don't address the real disruption experienced by workers displaced from manufacturing.

Labor Market Dynamics

The Fremont factory employs roughly 10,000 people directly and supports thousands of indirect jobs through suppliers and service providers. Discontinuing Model S and X production means some percentage of those 10,000 will lose their jobs, even if they transition to Optimus assembly.

The Bay Area labor market will likely absorb displaced Fremont workers, given the region's overall labor shortage. But workers might face lower wages or worse working conditions in alternative employment. This creates real hardship even if unemployment doesn't rise significantly.

Tesla has unions at Fremont, which provides some worker protections. The union might negotiate severance or job guarantees as part of the transition. Or the company might downsize aggressively to reduce costs. The outcomes are uncertain.

Musk's timeline suggests a launch by end of 2026, but historical trends indicate a more realistic launch by 2027-2028. Estimated data based on past project delays.

Expert Perspectives and Industry Commentary

What Analysts Are Saying

Wall Street analysts have responded to this news with mixed sentiment. Bullish analysts see it as Tesla doubling down on the future, betting on the most transformative technology available. Bearish analysts see it as a massive risk move that could backfire spectacularly.

Most analysts occupy the middle ground: it's a bold move with significant upside if successful and significant downside if it fails. The consensus seems to be that the decision is strategically coherent even if operationally risky.

Supply Chain and Manufacturing Experts

Supply chain experts note that transitioning from car manufacturing to robot manufacturing is non-trivial. The supply chains are completely different. Managing new suppliers and establishing relationships takes time. Manufacturing robotics require more precision than automotive manufacturing in some ways, creating quality control challenges.

Manufacturing experts note that the efficiency gains from discontinuing Model S and X production and consolidating onto Model 3 and Y will be substantial. Simpler product portfolios are easier to manufacture efficiently. However, those gains are independent of the robot strategy. Tesla could consolidate the product line while maintaining the Fremont facility's use for cars.

Strategic Comparisons to Other Pivots

Apple's Transition from Computers to Phones

Apple provides an interesting comparison. The company once derived significant revenue from Mac computers. As the iPhone became dominant, the Mac became a secondary product. But Apple didn't discontinue Macs. Instead, Apple allowed the product line to evolve into a smaller, more premium offering.

Tesla is taking a different approach: complete discontinuation. This is more aggressive than Apple's strategy but might make sense for manufacturing reasons. A factory can't efficiently produce both cars and robots. It's all-or-nothing for facility usage.

Nokia's Transition from Electronics to Phones to Irrelevance

Nokia provides a cautionary tale. The company dominated phone manufacturing but failed to transition to smartphones successfully. The company kept investing in old technology while the market moved to new technology. Eventually, Nokia became irrelevant.

Tesla's decision to aggressively pivot away from legacy products and toward new technology is the opposite of Nokia's strategy. Whether it's the right choice depends on whether Optimus actually proves to be the transformative technology Musk claims.

Timeline and Implementation Reality

The Quarterly Transition

Musk said Model S and X production would "basically stop" next quarter. That's Q2 2025. This means the company will completely retool the Fremont facility in a roughly 90-day window. This is an extremely aggressive timeline.

In reality, the transition will likely take longer. Current Model S and X inventory needs to be sold through. Equipment needs to be retooled. Supply chains need to be established. Workers need to be transitioned or replaced. While Tesla might announce discontinuation in Q2, the actual transition might take 6-12 months.

The company has a track record of ambitious manufacturing timelines that slip. The Cybertruck rollout took longer than initially planned. The Semi production has been limited. The Austin and Berlin factories took longer to reach expected capacity than announced.

Expect Model S and X production to wind down gradually rather than stopping abruptly. Tesla will likely maintain some residual production as long as there's demand and supply chain capacity. The "stop" will be a few years, not quarters.

Optimus Scaling Timeline

For Optimus to reach 1 million units annually by 2028, the company needs to achieve several milestones:

- Successfully launch consumer sales by end of 2026 (roughly 18 months from now)

- Achieve manufacturing efficiency improvements that reduce unit costs by 50%+ from current prototypes

- Build a consumer market for robots that doesn't currently exist

- Train thousands of workers to manufacture robots using processes that don't yet exist

- Establish supply chains for robot-specific components like actuators and compute modules

Each of these is achievable. Collectively, they represent an enormous challenge. Tesla's track record suggests the company can pull this off, but timelines will slip. 1 million units annually by 2030 is more realistic than 2028.

Conclusion: The Audacity and Risk of Strategic Bets

Tesla's decision to discontinue the Model S and X represents one of the most audacious strategic moves in recent automotive history. The company is essentially betting that a product that doesn't yet exist commercially will be more valuable than products that have proven profitable for over a decade.

From a manufacturing perspective, the logic is sound. A factory can't efficiently produce both cars and robots. Consolidating production onto fewer car models improves efficiency. Fremont could continue making cars. But Musk has chosen to redirect the facility entirely. This is a choice, not a necessity.

Musk believes the robot opportunity is so large that it justifies sacrificing car production. He might be right. Humanoid robots could eventually be more valuable than electric vehicles. The market for robots could grow to be orders of magnitude larger than the current EV market.

But he might also be wrong. Optimus might disappoint. Adoption might be slower than expected. Competitors might develop superior robots. The entire business case might collapse under the weight of unrealistic assumptions.

This is what makes the decision bold. There's no hedging. There's no compromise. Tesla is making a binary bet on Optimus. Either the company becomes the leader in humanoid robots and reaps enormous rewards, or it gave up a profitable business to manufacture robots nobody wanted.

For investors, this decision is either brilliant or catastrophic depending on which scenario unfolds. For workers at Fremont, it's a career disruption with uncertain outcomes. For the automotive industry, it's a signal that the future might be about robots, not cars. For the robotics industry, it's a validation that the opportunity is real.

History will judge whether Musk's vision was prescient or delusional. In the meantime, the discontinuation of the Model S and X will fundamentally reshape Tesla, the automotive industry, and potentially the future of manufacturing itself.

The boldness of this decision is exactly what you'd expect from Musk. It's either genius or insanity, and frequently with Musk, it turns out to be both simultaneously.

FAQ

What exactly happened to the Tesla Model S and X?

Tesla announced during its 2025 fiscal year earnings call that it would "basically stop" production of both the Model S and Model X vehicles in Q2 2025. The company is discontinuing these models to repurpose their production facility in Fremont, California for manufacturing Optimus humanoid robots instead. Customers can still purchase remaining inventory as long as supplies last, and Tesla will continue supporting existing vehicles indefinitely.

Why did Tesla decide to discontinue these vehicles?

Several factors drove the decision. First, sales of Model 3 and Model Y vehicles vastly exceed sales of Model S and X, with roughly 1.58 million combined Model 3/Y deliveries compared to 418,000 combined Model S/X deliveries in 2025. Second, competition in the premium EV sedan and SUV segments has intensified, with established automakers like Porsche and BMW now offering competitive electric vehicles. Third, Musk believes the future is in humanoid robots rather than vehicles, and the Fremont factory space is better utilized for Optimus production. Fourth, tariff pressures removed these models from the Chinese market, eliminating a significant revenue source.

What is Optimus and why is Tesla banking on it?

Optimus is Tesla's humanoid robot project, designed to perform human tasks more efficiently than humans can. The robot stands approximately 5 feet 8 inches tall, weighs around 125 pounds, and uses advanced AI and sensors to navigate, interpret instructions, and execute tasks. Musk believes Optimus will become the "biggest product of all time," potentially larger in market opportunity than smartphones or any previous consumer technology. Tesla plans to produce 1 million Optimus robots annually by converting the Fremont factory space formerly used for Model S and X production.

Will existing Model S and X owners lose support and service?

No. Tesla has explicitly committed to supporting Model S and X vehicles for as long as owners have them. Parts availability, software updates, warranty service, and technical support will continue indefinitely. While the vehicles are being discontinued for new production, Tesla treats them like any other model in its active support lineup. However, as these vehicles age, some services might become more expensive due to reduced technician familiarity and potentially limited parts availability over many decades.

When will Optimus actually be available to buy?

Musk announced that Tesla will begin selling Optimus to the public by the end of 2026. However, this means initial availability for early adopters, not mass production. Based on Musk's historical track record with product timelines, which tend to be optimistic, realistic consumer availability might not occur until 2027 or 2028. Reaching the 1 million unit annual production target could take until 2029 or 2030.

What about the workers at the Fremont factory?

Tesla has not provided detailed information about workforce transitions, severance packages, or retraining programs. Fremont employs roughly 10,000 people, and some percentage of those jobs will be affected by the discontinuation. Some workers will transition to Optimus assembly, some might be offered positions at other Tesla facilities, and some will likely be laid off. The San Francisco Bay Area labor market is tight, so displaced workers will likely find alternative employment, though potentially at different compensation levels. Union representation at Fremont provides some worker protections.

Could Tesla change its mind and restart Model S and X production?

Theoretically yes, but practically it's unlikely. Once Tesla completely converts the Fremont facility to robot production and sells off the existing car assembly equipment, restarting Model S and X production would require massive capital investment and years of preparation. It's not a flip that can be switched. However, if Optimus proves to be a complete commercial failure, Tesla might explore reactivating car production. The financial logic of discontinuation only makes sense if Optimus succeeds commercially.

How will this affect Tesla's stock price?

Stock reaction will depend on how the market views the Optimus opportunity. Bullish investors see this as brilliant capital allocation, redirecting resources from mature products to transformative new technology. Bearish investors see it as high risk with substantial downside. Most analysts view it as a bold strategic move with meaningful uncertainty. The stock will likely experience volatility, with bulls and bears disagreeing sharply on valuation implications. If Optimus succeeds, the decision looks brilliant. If it fails, the decision looks catastrophic.

Key Takeaways

Tesla's discontinuation of Model S and X production represents a momentous strategic decision driven by multiple factors: declining sales relative to Model 3 and Y, intensifying competition in premium segments, tariff pressures eliminating the Chinese market, and Musk's deep conviction that humanoid robots represent a far larger opportunity than electric vehicles.

The company is redirecting the Fremont factory entirely toward Optimus robot manufacturing, with an ambitious goal of 1 million units annually. This is not a hedged bet but a binary choice. Either Optimus becomes transformative and justifies the decision, or Tesla sacrifices a profitable business for an unproven product.

Manufacturing execution will be critical. Converting a car factory to robot production requires establishing new supply chains, developing new manufacturing processes, and managing workforce transitions. Tesla has demonstrated manufacturing excellence before, but this presents new challenges.

The timeline for Optimus commercialization is ambitious. Tesla targets public availability by end of 2026, though Musk's track record suggests delays are likely. Real mass adoption and production scaling might take several years longer.

Investors face a classic high-risk, high-reward scenario. The decision is either brilliant or catastrophic, and there's limited middle ground. Workers and communities dependent on automotive manufacturing face real disruption, though the regional labor market might absorb the impact.

Most importantly, Tesla's decision signals a major shift in how the company views its future. Tesla is no longer primarily an EV company trying to be an AI company. Tesla is becoming primarily an AI and robotics company that happens to still make cars.

Whether this proves to be foresight or folly will become clear over the next 5-10 years as Optimus development and commercialization progress.

Related Articles

- Tesla Discontinuing Model S and Model X for Optimus Robots [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Tesla Optimus Gen 3: Everything About the 2026 Humanoid Robot [2025]

- Elon Musk's Davos Predictions: Why They Keep Missing [2025]

- Tesla Optimus: Elon Musk's Humanoid Robot Promise Explained [2025]

- Humanoid Robots in Factories: The Real Shift Away From Labs [2025]

![Tesla Discontinues Model S and X to Focus on Optimus Robots [2025]](https://tryrunable.com/blog/tesla-discontinues-model-s-and-x-to-focus-on-optimus-robots-/image-1-1769650680380.jpg)