Introduction: The Circular Deal That Shocked Wall Street

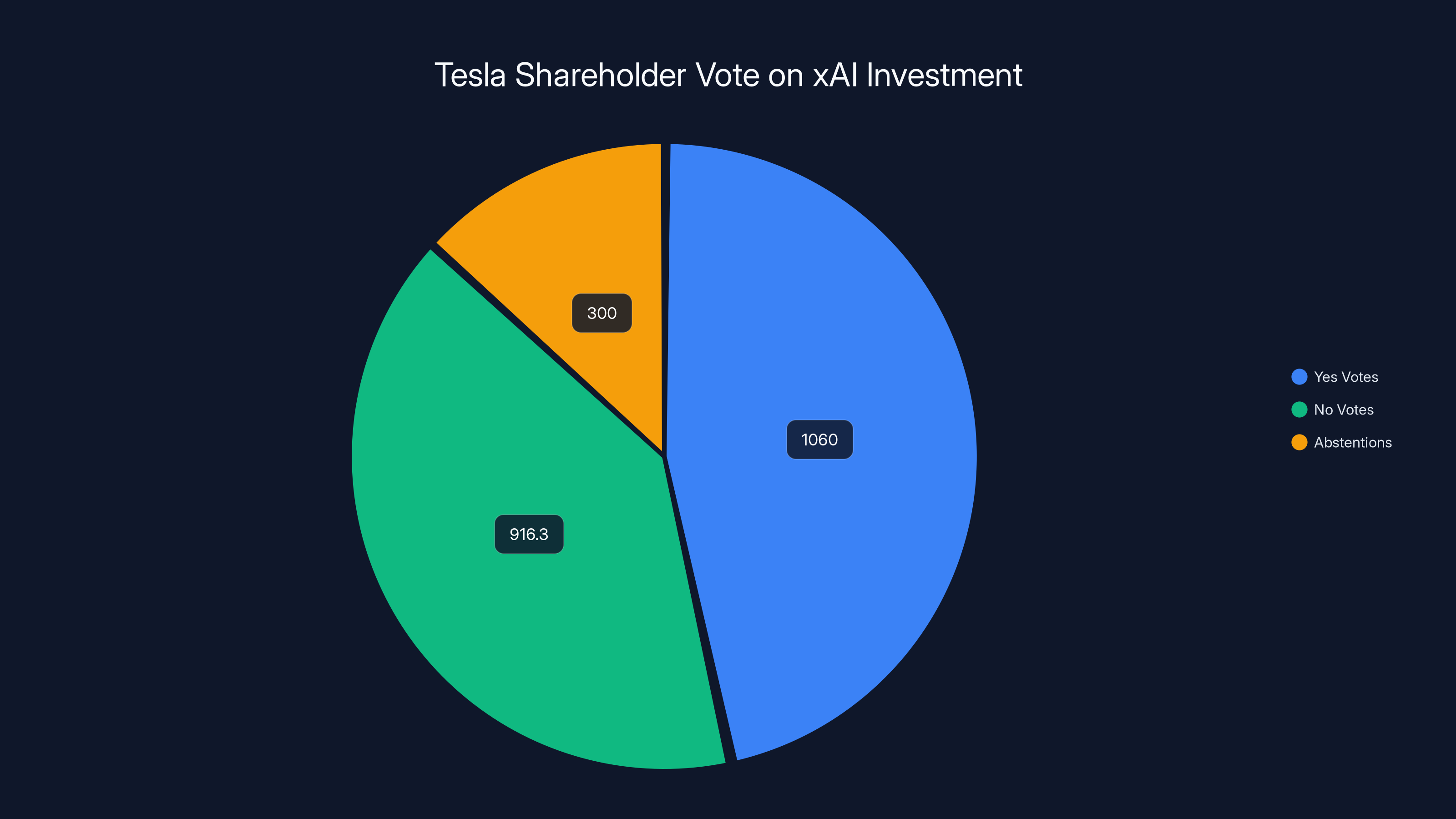

Back in November, Tesla shareholders voted on whether the company should invest in x AI, Elon Musk's artificial intelligence startup. The vote was close, really close. About 1.06 billion shares voted yes, while 916.3 million voted no. Abstentions counted against the proposal under Tesla's bylaws, which meant the measure technically failed. And yet, in January, Tesla announced it had invested $2 billion in x AI anyway.

If that sounds strange, it is. This is what happens when the same person controls both companies and has a very specific vision for where technology is heading.

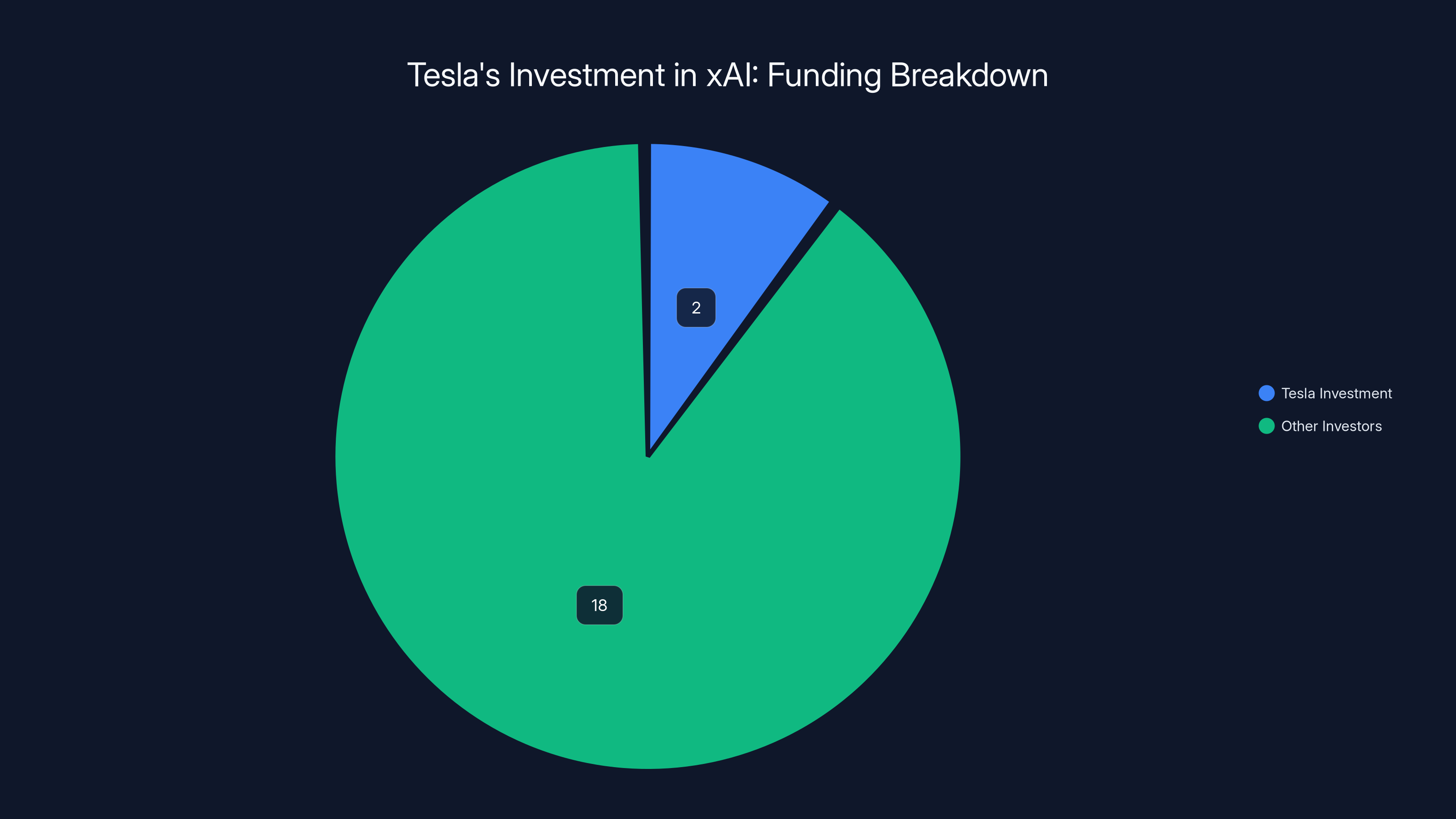

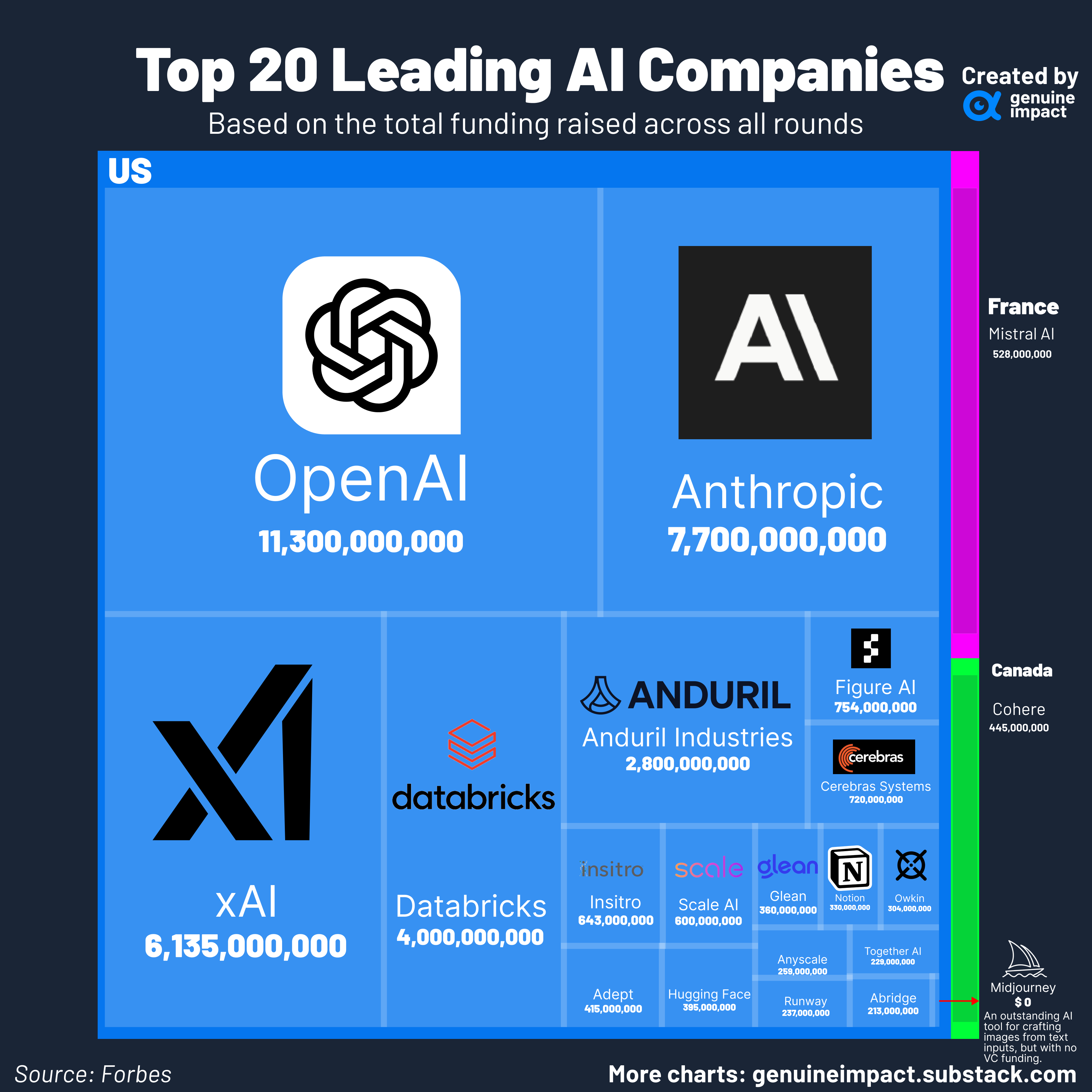

But here's what makes this move genuinely important: it's not really about x AI getting capital. The company already raised $20 billion in a Series E round, making it one of the most well-funded AI startups in history. Instead, Tesla's investment signals something much bigger. It's a bet that physical artificial intelligence and digital AI are about to converge in ways that matter.

Tesla isn't just buying a piece of Musk's AI company. It's signaling a strategic pivot toward integrating large language models directly into its robotics and autonomous systems. The company's Master Plan Part IV, which focuses on physical AI and robotics, suddenly has a dedicated AI partner. That matters for Tesla shareholders, for x AI's valuation, and for anyone watching where the AI industry is actually heading.

In this article, we're going to unpack what happened, why it matters, and what it tells us about the future of artificial intelligence in hardware. We'll examine the shareholder vote that technically failed, the framework agreement between the companies, how this affects Tesla's robotics roadmap, and what competing AI companies should be watching.

TL; DR

- Tesla invested $2 billion in Elon Musk's x AI despite shareholders rejecting the proposal, one of the most unusual corporate moves in 2025

- x AI raised $20 billion total, making it one of the most well-funded AI startups, alongside investors like Valor Equity Partners, Fidelity, and the Qatar Investment Authority

- Physical AI integration is the real strategy: Tesla plans to embed x AI's language models into Optimus robots, autonomous vehicles, and manufacturing systems

- A framework agreement gives Tesla first access to x AI's AI capabilities and creates a path for deeper technical collaboration

- This bypasses shareholder democracy but signals confidence in robotics as Tesla's next growth engine after electric vehicles plateau

Tesla contributed

Why Tesla Ignored Its Shareholders (And What That Means)

Let's start with the uncomfortable part: Tesla had explicit permission to not do this. In a non-binding shareholder vote, 1.06 billion shares said yes and 916.3 million said no. Under most interpretations, that's a clear majority. But Tesla's bylaws include abstentions in the "no" count, which flipped the result.

This is actually more common than you'd think in corporate governance. Abstentions are counted as no votes in many tech company bylaws specifically because founders want to be able to proceed on controversial decisions that they believe in strongly. It's a structural feature that lets boards override shareholder sentiment when they think they're right.

But here's the thing: Tesla didn't have to proceed. The vote gave them legal cover to say no. Instead, Musk and the Tesla board doubled down. In their shareholder letter, they provided a formal justification for the investment. That justification is worth reading carefully because it reveals how Tesla is thinking about its future.

Tesla framed the investment around Master Plan Part IV, which laid out the company's strategy for the next decade. That plan isn't primarily about electric vehicles anymore. It's about autonomous systems, humanoid robots, and AI-powered services. Tesla's electric vehicle growth has slowed significantly in key markets. Profit fell 46% last year. The company needs a new growth engine, and that engine is robotics.

x AI becomes the AI backbone for that strategy. Grok, x AI's large language model, isn't positioned as a competitor to Chat GPT or Claude. Instead, it's being positioned as a tool for physical systems. Robot brains, essentially. Tesla is essentially saying: we need deep expertise in large language models because our robots and autonomous vehicles need to understand complex instructions and reason through novel situations.

That's a bold claim. And it required Tesla to move fast, even if it meant going around shareholder approval.

The shareholder vote on Tesla's investment in xAI was close, with 1.06 billion shares voting yes and 916.3 million voting no. Abstentions, which counted against the proposal, contributed to its technical failure.

The $20 Billion x AI Funding Round: Context and Implications

Let's put Tesla's

For context, here are the major funding milestones:

- x AI's Series D round (announced in May 2024) raised $6 billion

- The Series E round (announced in January 2025) raised $20 billion

- Total funding in less than a year: $26 billion

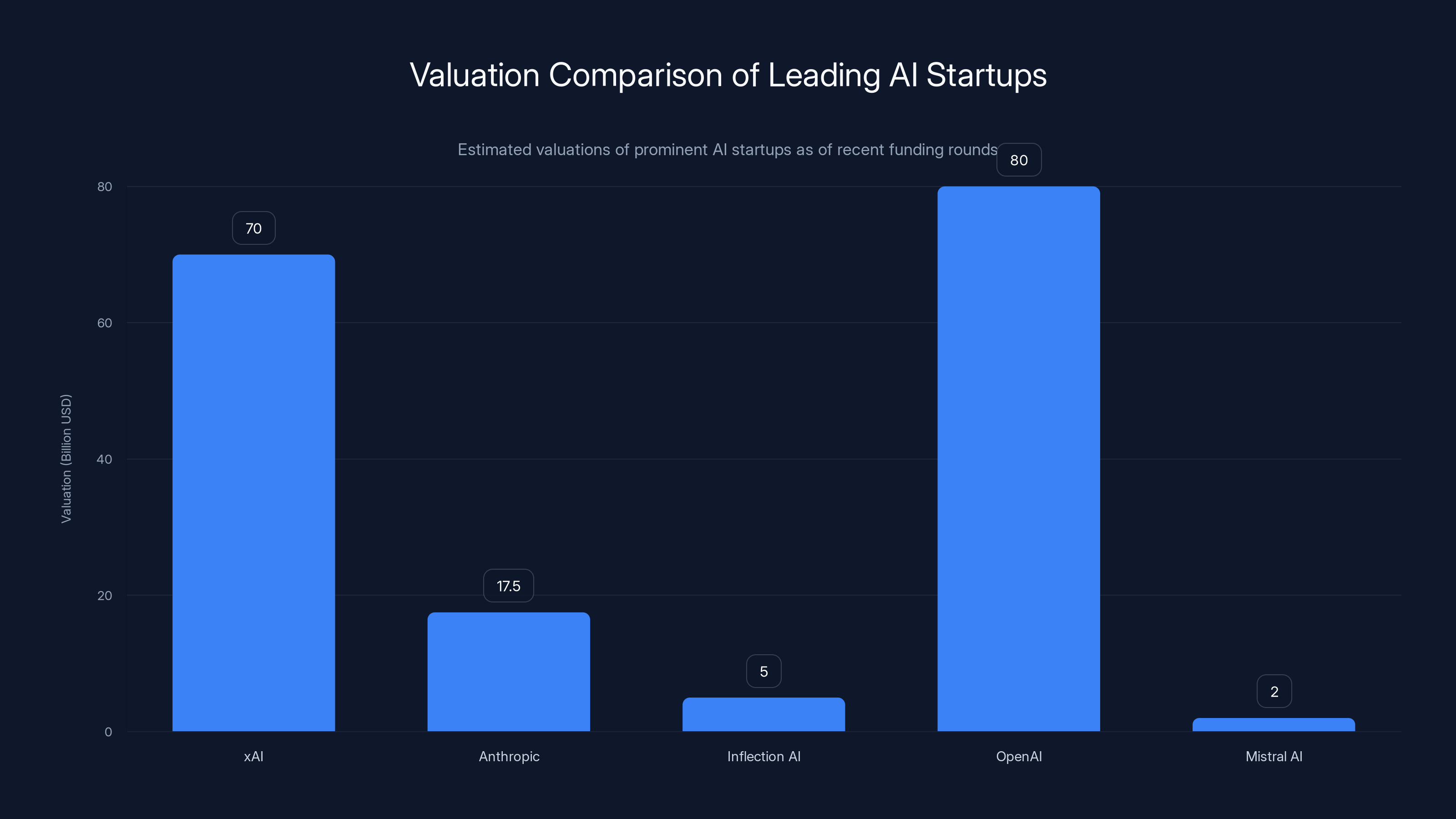

That's a staggering pace of capital accumulation. To put it in perspective, Open AI raised around $6.6 billion in its November 2024 funding round, and that was positioned as a major milestone. x AI surpassed that in one round, then immediately announced another round.

The investors in the x AI round include some of the most sophisticated capital sources in the world. Valor Equity Partners, Fidelity, and the Qatar Investment Authority all participated. Nvidia and Cisco joined as "strategic investors," which typically means they get special access to products or favorable terms in exchange for capital.

Tesla being revealed as a $2 billion investor is significant because it signals that hardware companies—not just venture capitalists—see x AI as critical infrastructure. Nvidia invests in AI companies as a hedge against their own dependency on those companies. Cisco does similar things with networking technology. Tesla's investment sends a different signal: a major hardware manufacturer sees this AI company as strategically essential to its robotics roadmap.

The valuation implied by this funding round is worth examining. If x AI raised

The Framework Agreement: What Tesla and x AI Are Actually Building Together

The investment gets all the headlines, but the real story is buried in the framework agreement. That agreement is what actually matters for both companies' futures.

According to Tesla's shareholder letter, the framework agreement provides "a framework for evaluating potential AI collaborations between the companies." That corporate speak actually translates into something concrete: Tesla gets first access to x AI's latest AI models and technical capabilities, and the companies commit to exploring how those models could be integrated into Tesla's products.

Here's what that probably means in practice:

Priority access to Grok and future models: Tesla's engineers get early access to x AI's latest large language models. This matters because AI models are released on timelines measured in months, not years. Having priority access means Tesla can integrate improvements into its products before competitors can.

Technical collaboration on robotics integration: x AI's researchers likely have access to Tesla's Optimus humanoid robot project and autonomous vehicle systems. This means x AI can optimize its models specifically for the constraints of running AI on hardware with limited compute resources. That's genuinely difficult engineering.

Joint product development: The framework agreement almost certainly includes provisions for developing new products together. That could mean specialized versions of Grok trained on robotics data, or it could mean x AI building entirely new model architectures optimized for embodied AI.

Data sharing: Tesla's autonomous vehicle fleet generates more real-world sensor data than almost any other company. That data is incredibly valuable for training AI models that need to understand complex physical environments. The framework agreement likely includes provisions for Tesla to share relevant data with x AI, which improves x AI's models, which improves Tesla's products. It's a virtuous cycle.

The financial implications are significant too. Framework agreements often include minimum purchase commitments. Tesla might be committing to spending a certain amount on x AI's computing resources or API access annually. We don't know the specifics, but the mere existence of the framework agreement means both companies are betting on a long-term partnership.

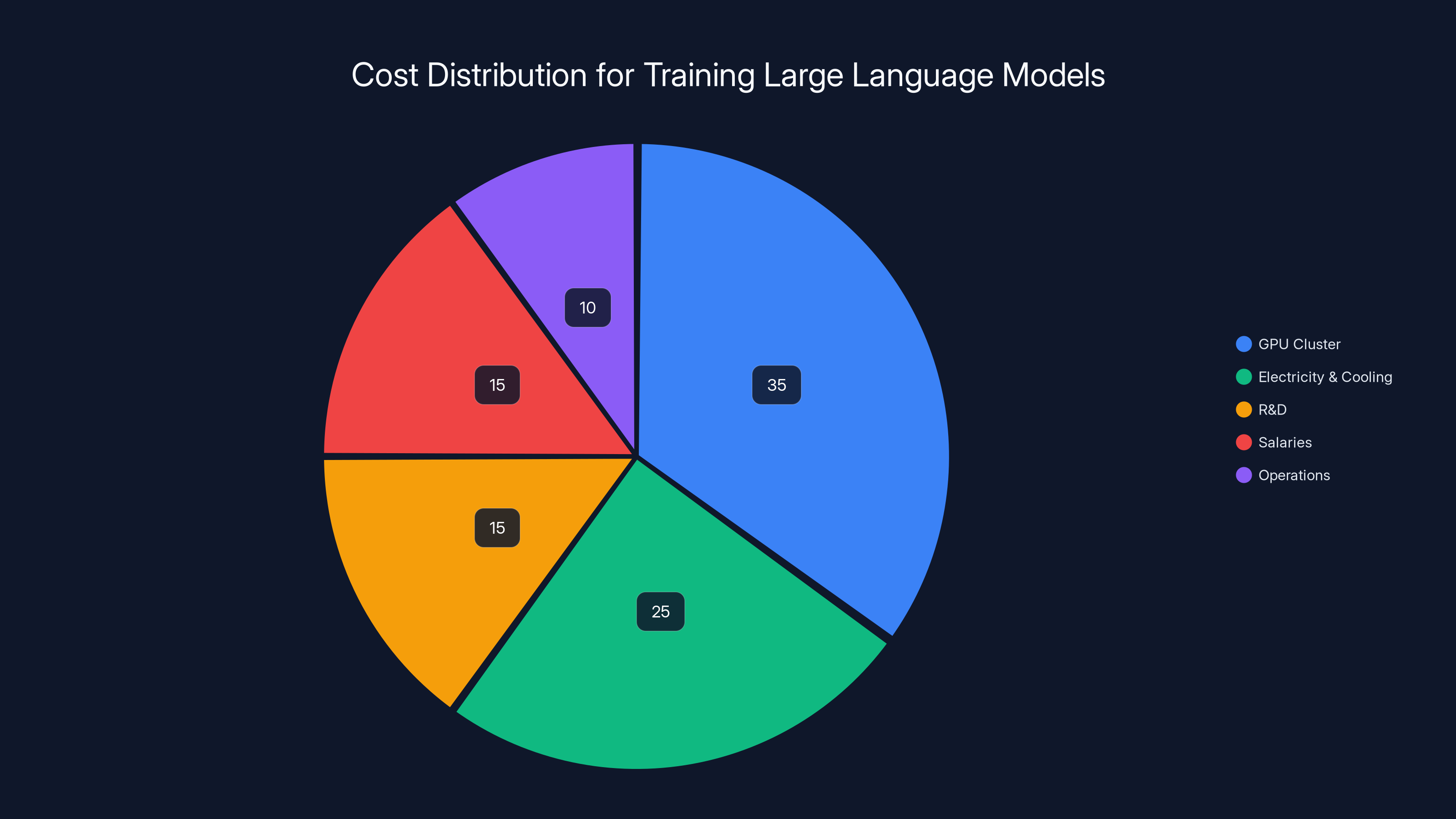

Estimated data shows GPU clusters and electricity/cooling are the largest costs in training large models, accounting for 60% of total expenses.

Physical AI: The Convergence of Hardware and Language Models

Here's where this investment starts making real sense. For the past two years, the AI industry has been dominated by one question: how do we make language models bigger, faster, and smarter? That's a software problem.

But Tesla is asking a different question: how do we put large language models into physical systems that need to act in the real world?

This is genuinely hard. Language models excel at processing text and generating coherent responses. But robots need to process sensor data from cameras, lidar, ultrasonic sensors, and tactile feedback. They need to make decisions about how to move their bodies safely. They need to adapt to novel situations they've never seen before.

A robot arm in a factory doesn't need to write poetry. It needs to understand an instruction like "pick up the blue box and place it on the table," process visual information about where objects are, and execute a motion plan that avoids obstacles and completes the task. That requires integrating language understanding with embodied AI.

That's where x AI comes in. Grok has been positioned as a more practical, less filtered alternative to other large language models. But more importantly, x AI has been building models specifically designed to be efficient. Running a 100-billion-parameter language model on a humanoid robot is impractical. The compute requirements are too high, the power consumption is too high, and the latency is too high. But running a smaller, more efficient model—maybe 10-20 billion parameters—that's engineered specifically for robotics? That's feasible.

Tesla's Optimus project is particularly relevant here. Optimus is a humanoid robot designed to eventually perform general-purpose tasks in human environments. It's not a task-specific robot arm. It needs to understand complex instructions, reason about how to complete them, and adapt when circumstances change. That's fundamentally a language understanding problem.

A Tesla shareholder letter from just before this investment described Optimus as potentially a bigger value driver than the automobile business. That's a staggering claim. It suggests Tesla genuinely believes that a robot that can perform general-purpose tasks in factories, warehouses, and eventually homes is worth more than the entire electric vehicle market.

For that to be true, the robot needs to be intelligent. Not just mechanically capable, but actually intelligent. That intelligence comes from AI. And specifically, it comes from large language models that understand language, context, and can reason about complex situations.

x AI's investment from Tesla is essentially Tesla's bet that this integration is going to work. And that it's going to be worth tens of billions of dollars.

Tesla's Robotics Roadmap: Optimus, FSD, and Autonomous Systems

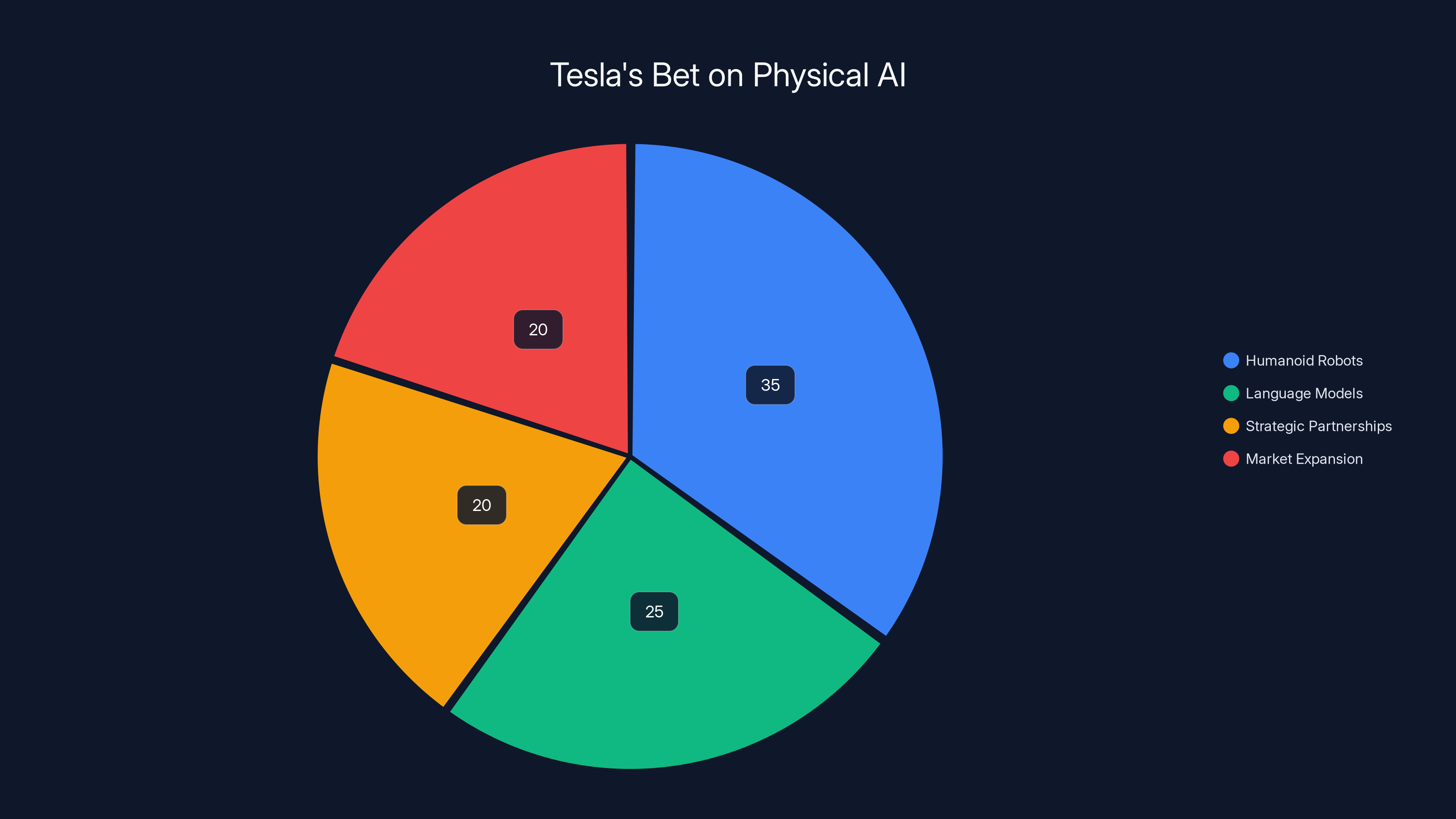

Tesla's robotics strategy has three main pillars: Optimus humanoid robots, autonomous vehicles with full self-driving capability, and autonomous systems for manufacturing.

Let's start with Optimus. The project began as a concept video in 2021 showing a humanoid robot that could perform various tasks. By 2024, Tesla had functional prototypes. The current versions can perform simple tasks like sorting objects, arranging items, and basic assembly work.

But the timeline matters. Tesla is planning significant upgrades to Optimus over the next 2-3 years. The improvements will focus on:

-

Dexterity and fine motor control: Current versions struggle with tasks requiring precise manipulation. Integration with better AI models could improve this by helping the robot understand what it's trying to accomplish and adapt if things go wrong.

-

Multi-step reasoning: Right now, Optimus excels at following explicit instructions. It struggles with ambiguous tasks or situations that require understanding context. Better language models help here.

-

Learning from demonstration: If you show a robot how to do something once, can it learn from that demonstration and improve? Language models trained on internet-scale data contain implicit knowledge about how humans accomplish tasks. That knowledge could be extracted and applied to robotics.

-

Cost reduction: Manufacturing a humanoid robot at scale requires cutting costs dramatically. More efficient AI models that require less compute power directly reduce the cost of the intelligence hardware.

Full self-driving for Tesla vehicles is another domain where x AI becomes relevant. Tesla's autonomous driving system has relied on visual processing and neural networks trained specifically on driving data. But integrating language understanding opens new possibilities.

Imagine a vehicle that can understand complex natural language instructions: "Take me to the grocery store, but avoid the area near the stadium because there's a concert today." That requires understanding not just driving, but context, current events, and human intent.

Or imagine a vehicle that can explain its decisions to occupants: "I'm taking the highway instead of local streets because traffic data shows the highway is faster, even though it's longer in distance." That explanation requires language capability.

Tesla's manufacturing operations represent a third domain. The company has been automating its factories for years, building increasingly sophisticated robots and conveyor systems. x AI's language models could help optimize manufacturing processes, predict equipment failures, and coordinate complex multi-robot workflows.

When you sum these three domains, you start to understand why Tesla was willing to invest $2 billion and override shareholder disapproval. The company isn't trying to compete with Open AI or build a Chat GPT killer. It's trying to embed AI intelligence into physical systems at scale. And for that, it needs a dedicated AI partner.

Tesla's $2 billion investment in xAI is estimated to focus on humanoid robots (35%), language models (25%), strategic partnerships (20%), and market expansion (20%). Estimated data.

The Competitive Landscape: Why This Matters for Other AI Companies

This investment has implications beyond Tesla and x AI. It signals something important about how the AI industry is stratifying.

For years, the AI narrative has been about the biggest models and the most impressive benchmarks. Open AI's GPT series, Google's Gemini, Anthropic's Claude—these companies are racing to build the largest, most capable language models. That's one market.

But there's another market emerging, and it's potentially bigger. That's the market for AI that's embedded in products and hardware. Not chatbots that you use through a web interface. Not AI assistants that help you write email. But AI that's baked into robots, vehicles, and manufacturing systems.

In that market, the companies that matter are:

Nvidia: The company that provides the chips that run these systems. Nvidia has strategic investments in various AI companies, but it has unique leverage because nobody can build this stuff without their hardware.

Open source models: Companies are increasingly building on open source large language models like Llama from Meta. These models are free to use and can be customized for specific applications. That's a threat to proprietary models, but it also means companies like Meta effectively have strategic leverage in the physical AI market.

Companies building AI for specific domains: There are startups building language models optimized for robotics, manufacturing, autonomous vehicles, etc. These specialized models are becoming increasingly valuable as companies try to solve domain-specific problems.

Tesla and x AI together: By combining Tesla's hardware expertise and manufacturing scale with x AI's language model capabilities, they're creating a vertical stack that competitors will find hard to match.

Open AI is building enterprise software and API access. Google is embedding AI into Android and cloud services. But neither of those companies has the same kind of tight integration with physical hardware that Tesla and x AI are building.

That doesn't mean Tesla's strategy will succeed. Robotics has a long history of failed predictions and overhyped timelines. But the strategic logic is sound. And the investment of $2 billion suggests Tesla's board believes the potential returns justify the risk.

The Shareholder Vote That Failed But Happened Anyway

The governance angle here is worth examining because it reveals something about how Elon Musk operates and how corporate structures enable founder-led companies to move fast.

The November shareholder vote on x AI investment was technically non-binding. That means shareholders couldn't actually block the investment; they could only express their preference. Even if it had been binding, the vote was close enough that reasonable people could disagree about the mandate.

But the bylaws interpretation is interesting. Most companies count abstentions as no votes. This is actually intentional. Corporate governance experts built this rule into bylaws specifically so that founders could proceed on strategic decisions even if shareholder engagement was mixed.

Here's the logic: if you required an absolute majority to approve controversial decisions, and you counted abstentions as no votes, then low voter turnout would automatically kill controversial proposals. That would give control to whoever bothers to show up and vote, not to the board or founders who have expertise about what's strategically necessary.

So bylaws were designed to let founders move forward on decisions they believe in, even if they can't achieve overwhelming shareholder approval. It's a feature, not a bug.

Tesla used that feature. The company disclosed the investment and provided justification in the shareholder letter. This is actually transparent governance—the board explained its reasoning and took responsibility for the decision.

But it does raise a question: should founders have this power? Tesla shareholders who voted against the investment—916.3 million shares worth—might reasonably ask why their views were overridden.

The answer, from Tesla's perspective, is that the founder has information and conviction that shareholders don't have access to. Elon Musk has hands-on knowledge of both Tesla's robotics roadmap and x AI's capabilities. He understands how they could integrate. He believes the opportunity is real and time-sensitive.

Is he right? That's the real question. If Optimus becomes valuable and x AI's language models prove essential to that success, then shareholders will applaud this decision even though they voted against it. If robotics fails to deliver and this $2 billion investment sits unused, then the shareholder critique will look prescient.

That's the bet both sides are making. Tesla's board is betting that the physical AI market is real and that x AI is essential to capturing it. Shareholders who voted against it are betting that this is misallocation of capital that would be better spent on improving core electric vehicle business or returning cash to shareholders.

We'll know the answer in about 5 years, which is roughly the timeline for Optimus to go from prototype to meaningful commercial deployment.

Tesla's $2B investment in an AI partnership is estimated to have the highest impact, offering strategic benefits like AI access and integration potential, compared to other options like share buyback or manufacturing expansion. Estimated data.

Financial Implications: Tesla's $2B Investment as Capital Allocation

Let's look at this from a pure financial perspective. Tesla had $2 billion in capital. What are the realistic ways that capital could have been deployed?

Option 1: Shareholder return via buyback or dividend Tesla could have used the capital to buy back shares or pay a dividend. That would have directly benefited shareholders. With Tesla's stock price at roughly

Option 2: Manufacturing expansion Tesla could have invested the money in new gigafactory capacity, either for electric vehicle production or for manufacturing Optimus robots. This would be a capital-intensive way to scale production. Gigafactories typically cost

Option 3: Acquisition Tesla could have acquired a robotics company or a smaller AI company outright. There are no obvious targets at that price point that would meaningfully accelerate the robotics roadmap.

Option 4: AI partnership via equity stake (the choice they made) Tesla invested in x AI, getting equity stakes and preferential access to technology and computing resources.

From a pure capital efficiency perspective, option 4 makes sense. Tesla gets:

- Exposure to x AI's upside without acquiring the entire company

- Priority access to AI capabilities without building everything in-house

- A partner that can focus on AI while Tesla focuses on hardware and robotics integration

- The ability to claim progress on Master Plan Part IV quickly

The opportunity cost is that this capital isn't going back to shareholders or toward manufacturing expansion. Tesla is signaling that it's more valuable to own a piece of x AI than to use that capital elsewhere.

Is that the right call? That depends on your view of robotics. If humanoid robots become a

Investors watching this will pay close attention to how Tesla's profitability evolves. The company's profit fell 46% last year, which suggests challenges in the core electric vehicle business. If that trend continues, shareholders will become increasingly critical of capital being deployed to speculative bets on robotics. But if Tesla manages to stabilize vehicle profit and also makes progress on robotics, then the x AI investment will look prescient.

x AI's Valuation and the Startup Funding Boom

x AI's valuation, implied by its

For comparison:

- Anthropic (founded 2021) was last valued at roughly $15-20 billion

- Inflection AI (founded 2022) was last valued at roughly $5 billion

- Open AI was rumored to be valued at $80+ billion in secondary markets before its recent fundraising

- Mistral AI (founded 2023) was valued at $2 billion in its Series B

x AI has grown extremely fast. The company was founded in March 2023. By January 2025, it's one of the most well-funded AI startups in the world.

What's driving the valuation? A few factors:

Founder pedigree: Elon Musk has a track record of building valuable companies. Investors assume he brings the same skill to x AI that he brought to Tesla and Space X.

The strategic need for AI alternatives: Enterprise customers and governments are nervous about relying on a single AI vendor. If Open AI and Google dominate the market, that creates geopolitical risk and commercial risk. x AI provides an alternative, which is valuable.

The physical AI thesis: Major investors are starting to believe that language models need to be integrated into hardware. x AI's positioning around this opportunity makes it strategically important.

Computing infrastructure: x AI has access to custom-built computing infrastructure designed specifically for training and running large language models. That infrastructure is a real asset.

Grok's differentiation: Grok has been positioned as less filtered and more honest than competitors. It's built a following among users who are skeptical of content moderation in other AI systems.

But valuations in AI have become somewhat detached from fundamentals. These companies aren't profitable. They're burning billions of dollars annually on computing costs. The path to profitability is unclear. This is venture capital euphoria, and we've seen similar dynamics before with social media startups and blockchain companies.

That doesn't mean x AI will fail. But it does mean that the $60-80 billion valuation contains a lot of optimistic assumptions about how valuable AI will eventually become and how much of that value x AI will capture.

Tesla's $2 billion investment essentially bets that those optimistic assumptions are correct. That's a high-risk investment in a high-upside opportunity.

xAI is valued between $60-80 billion, making it one of the most valuable AI startups, comparable to OpenAI. Estimated data based on recent funding rounds.

The Role of Strategic Investors: Nvidia and Cisco

x AI's funding round included Nvidia and Cisco as "strategic investors." That terminology means something specific. It means these companies are investing not just for financial returns, but also for strategic advantages.

Nvidia's strategic interest is straightforward. Nvidia manufactures the GPUs that power large language model training and inference. Every major AI company that trains a large language model is a customer of Nvidia. By investing in x AI, Nvidia gains:

- Insider knowledge of how x AI is using its chips

- Influence over architectural decisions that might affect GPU usage

- A stake in the upside if x AI becomes valuable

- Potential discount on computing resources

For Nvidia, this is almost free optionality. The company's core business is selling chips. Investing in the customers who buy the most chips is a natural hedge.

Cisco's strategic interest is less obvious but still meaningful. Cisco manufactures networking infrastructure, switches, and routers. As AI systems scale, they need massive amounts of data to move between servers. Cisco's equipment handles that networking. By investing in x AI, Cisco signals that it understands the importance of this market and wants to stay involved as decisions get made about infrastructure.

Both companies benefit from having board representation or information rights in x AI. They can influence how the company builds its systems in ways that favor their technologies.

This dynamic is important to understand because it shows how the AI industry is developing. It's not just venture capitalists and founders. It's also infrastructure companies (Nvidia, Cisco) and now hardware manufacturers (Tesla) assembling the pieces of the physical AI stack.

Open AI doesn't have these kinds of strategic partnerships deeply embedded in its cap table. Google has them because it's a diversified tech company. But x AI has built a coalition of strategic partners who have reasons to see it succeed beyond pure financial returns.

That's actually a strength. It means x AI has allies who understand its business and are incentivized to help it succeed.

Computing Infrastructure and the Cost of Training Large Models

To understand why x AI needs $20 billion in funding, you need to understand the costs of building state-of-the-art large language models.

Training a 100-billion-parameter language model from scratch costs roughly

Here's how the math works:

- A cluster of 10,000 H100 GPUs (Nvidia's most powerful chip) costs roughly $300-400 million

- Running that cluster for 30-60 days to train a state-of-the-art model adds another $200-400 million in electricity and cooling costs

- Total: 1 billion per training run

x AI hasn't disclosed exactly how much compute it controls, but given the scale of its funding and the capabilities of Grok, it probably operates clusters in the range of 10,000-50,000 GPUs. That's not the largest infrastructure in the world (that honor goes to Open AI and Google), but it's substantial.

The $20 billion in funding is partially going toward purchasing that infrastructure. Nvidia GPUs and custom accelerators cost money. Building data centers to house them costs money. Electricity contracts to power them cost money.

The remainder is going toward:

- Research and development: Improving model architectures and training techniques

- Salaries: Attracting top talent costs tens of millions annually

- Operations: Running inference infrastructure that serves customers

- Runway: Cushion to cover operating costs while the company figures out revenue models

This is why x AI's

Tesla's $2 billion investment covers roughly 10% of that total, or maybe 10 months of compute costs and operations. It's a meaningful contribution but not enough to fund x AI independently.

The Path to Profitability: Business Model Questions

Here's a question that matters: how does x AI actually make money?

The company hasn't disclosed detailed revenue figures, but we can infer the basic business model from what's known:

Consumer product: Grok is available as a standalone app and integrated into X (formerly Twitter). This likely generates some revenue, but it's probably not significant relative to operating costs.

Enterprise API: x AI likely offers API access to Grok for enterprise customers, similar to Open AI's model. Companies pay per API call or per month for access.

White label or partnership deals: Companies might license Grok to embed into their own products. Tesla is one such partner.

Government contracts: The intelligence community and military applications are lucrative for AI companies.

But none of these revenue streams are large enough to offset the billions in annual compute costs. x AI is losing money, and will continue to lose money, until it can:

- Scale usage significantly (millions of daily active users generating millions of API calls)

- Reduce compute costs through better models and more efficient infrastructure

- Charge premium prices for specialized applications

Tesla's strategic investment helps with point 1. By embedding Grok into Tesla products (robots, vehicles, manufacturing systems), x AI gains access to millions of end users. That usage can justify the infrastructure investment.

It also helps with point 2. If Tesla and x AI build optimization specifically for manufacturing and robotics use cases, they might be able to run lighter-weight models that cost less to operate.

The profitability question is important because it determines whether x AI is a good investment. A $60-80 billion valuation makes sense only if the company can eventually reach profitability. If it becomes a permanent money-losing operation, it's essentially a research lab masquerading as a startup.

Tesla's $2 billion bet assumes that x AI will solve this profitability puzzle, probably by becoming deeply integrated into physical AI products that users rely on.

Master Plan Part IV: Tesla's Robotics and AI Vision

To understand why Tesla made this investment, you need to understand Master Plan Part IV. Elon Musk published it in October 2024, and it fundamentally reframes Tesla's future.

Master Plan Part I was building a sustainable energy business through electric vehicles. Master Plan Part II was expanding to energy storage and solar. Master Plan Part III was about autonomy and robotics, but was somewhat vague.

Master Plan Part IV is explicit. It says Tesla is building three product categories:

- Humanoid robots for general manufacturing and service tasks

- Autonomous vehicles for personal transportation and logistics

- Autonomous systems for factories

The master plan explicitly states that humanoid robots could eventually be bigger than the automotive business. That's a shocking claim, but it's based on real reasoning.

A Tesla manufactured 1.81 million vehicles in 2024. Each vehicle costs roughly

But for robots to be worth that much, they need to be actually useful. And for them to be useful, they need to be intelligent. That intelligence comes from AI. That's where x AI enters the picture.

Master Plan Part IV also states that Tesla is building "physical AI," which it defines as AI systems that can operate in the real world, make decisions, and take action. That's different from digital AI (language models and image recognition systems running on computers).

Bringing these together requires:

- Language understanding to process instructions (x AI provides this)

- Vision systems to understand environments (Tesla's expertise)

- Motor control and robotics (Tesla's expertise)

- Real-time decision making under uncertainty (shared challenge)

Tesla's $2 billion investment in x AI is essentially Tesla committing to this vision and locking in access to the AI components it needs.

If Master Plan Part IV succeeds, this investment will have been one of the smartest capital allocation decisions in corporate history. If it fails, it's one of the most expensive bets on a speculative future.

Timeline and Expectations: When Will Physical AI Become Real?

Here's where the rubber meets the road. What are the realistic timelines for x AI and Tesla to deliver on these promises?

2025-2026: Expected milestones include improvements to Optimus prototypes, demonstration of multi-step task completion, and initial deployment of robots in Tesla's own factories. x AI would focus on optimizing language models for efficiency and robotics-specific applications.

2026-2027: Expect wider deployment of humanoid robots in manufacturing environments outside Tesla. x AI likely extends beyond Tesla, offering APIs to other companies. First revenue-generating versions of robots start getting deployed at scale.

2027-2028: This is when the physical AI thesis gets tested. If robots are genuinely useful and cost-effective, companies start buying them at scale. If they don't deliver on promises, the market contracts significantly.

2028+: Mature market for humanoid robots and AI-powered autonomous systems. Winners and losers become clear. x AI is either a major player or one of many competitors who failed to differentiate.

These timelines matter because they determine when investors will know whether this bet worked. For comparison, most venture-backed companies deliver major results within 5-7 years. By 2030, we should have a clear answer about whether physical AI is real.

One thing that could accelerate timelines: competition. If Tesla and x AI start winning in robotics, other companies will accelerate their own programs. Boston Dynamics is already advancing. Unitree Robotics has impressive prototypes. If the market moves faster than expected, both timelines and valuations could shift.

Broader Implications: What This Means for the AI Industry

Tesla's investment in x AI is a signal about how the AI industry is structuring itself. We're seeing a few clear trends:

Vertical integration: Companies that combine AI capabilities with hardware manufacturing are building competitive advantages. Tesla integrates robotics + AI. Apple is integrating AI into devices. Amazon is building AI-powered robots for warehouses. Companies that can do both are winning.

Specialization: General-purpose large language models are becoming commoditized. The money and attention are shifting toward specialized models for specific domains (robotics, biotech, finance, etc.) and specialized hardware to run them efficiently.

Capital concentration: The largest AI startups are raising massive amounts from an increasingly concentrated set of investors. This consolidates power among the wealthiest VCs and tech companies. It becomes harder for smaller startups to compete.

Open source as a disruptor: Meta's Llama models and other open source projects are providing free alternatives to proprietary models. Companies that can't afford billions in proprietary development can still build valuable AI products on top of open models. This limits the pricing power of companies like x AI.

Government involvement: Governments are increasingly involved in AI funding and regulation. The geopolitical importance of AI means countries won't leave AI development entirely to private companies. We'll see more government-funded alternatives and more regulation.

Tesla's x AI investment fits into all of these trends. Tesla is vertically integrating AI into physical products. x AI is specializing in models for robotics. The funding demonstrates capital concentration. And the strategic investors (Nvidia, Cisco, Tesla) are big, established tech companies with leverage.

Risks and Potential Failure Modes

Let's be honest about the risks. This is a speculative bet, and speculative bets fail regularly.

Risk 1: Humanoid robots don't actually become commercially viable This is the biggest risk. Robots have been "five years away" from widespread adoption for decades. The complexity of building robots that work reliably in unstructured environments is immense. If robots remain more expensive and less capable than human workers, the entire physical AI thesis collapses.

Risk 2: Open source models commoditize Grok If open source models like Llama continue to improve, companies might not need to pay for x AI's models. They could fine-tune open models instead. This would eliminate x AI's core value proposition.

Risk 3: Tesla's robotics program underperforms Tesla might succeed at building robots, but they might not be as capable or cost-effective as expected. If so, the justification for the x AI investment disappears.

Risk 4: Regulatory hurdles slow deployment Governments might regulate humanoid robots or AI-powered autonomous systems in ways that slow commercialization. Imagine if hiring a robot to replace a worker triggers taxation or regulatory requirements that make it uneconomical.

Risk 5: Competitive response from entrenched players Google, Microsoft, and other major tech companies could build competing robotics + AI stacks. If they succeed, x AI loses its strategic advantage as the default AI partner for robotics.

Risk 6: Management and execution risk x AI is led by Elon Musk, who is managing Tesla, Space X, and The Boring Company simultaneously. He also owns and runs X (formerly Twitter). Spreading management attention across that many companies increases the risk of strategic mistakes.

Any one of these risks could cause the investment to fail. The bet is that none of them materialize, or that x AI can overcome them.

The Long Game: Building the AI Stack for Physical Systems

Step back from the quarterly headlines and financial details. What's actually happening here?

Tesla and x AI are trying to build something that doesn't exist yet: a complete stack for physical artificial intelligence. They're assembling the pieces:

- Large language models (x AI's contribution): Understanding complex instructions and reasoning about tasks

- Robotics and motion control (Tesla's contribution): Actually performing physical tasks

- Sensor integration (Tesla's contribution): Understanding the physical environment

- Manufacturing scale (Tesla's contribution): Building thousands or millions of units economically

- Data loops (shared): Using data from deployed systems to improve models and hardware

Building such a complete stack is genuinely hard. It requires expertise across multiple domains. It requires capital and time. It requires willingness to accept failures and iterate.

But if it works, the advantages are enormous. A company that can build, deploy, and continuously improve physical AI systems at scale would have a competitive moat. Competitors would need to build equivalent capabilities across all these domains. That's expensive and time-consuming.

So this investment is really about ecosystem building. Tesla is investing $2 billion not just to buy a piece of x AI, but to ensure that x AI succeeds and remains aligned with Tesla's goals. It's a long-term play, not a short-term financial engineering move.

That's risky, but it's also visionary. If it works, people will point to this $2 billion investment as one of the most important capital allocation decisions in technology history. If it fails, people will forget about it in a few years.

FAQ

What is Tesla's relationship with x AI?

Tesla invested

Why did Tesla invest in x AI despite shareholder opposition?

Tesla shareholders voted against the x AI investment in November 2024, but Tesla's bylaws count abstentions as no votes, which technically rejected the proposal. However, Tesla proceeded with the $2 billion investment anyway under legal authority granted by its corporate structure. In the shareholder letter, Tesla justified the investment by connecting it to Master Plan Part IV, which explicitly positions humanoid robots and autonomous systems as major future growth areas. Tesla argued that x AI's language models are essential infrastructure for building intelligent physical robots at scale.

What is x AI's business model and how is it becoming profitable?

x AI generates revenue through multiple channels: a consumer version of Grok integrated into X (formerly Twitter), enterprise API access for companies using the language model in their own products, white-label partnerships like Tesla, and potential government contracts. However, the company is currently burning billions annually on computing infrastructure and R&D. Profitability depends on scaling usage significantly, improving model efficiency to reduce compute costs, and charging premium prices for specialized applications. Tesla's investment helps accelerate this by embedding Grok into physical products that could generate millions of users.

How will physical AI integration between Tesla and x AI work in practice?

The framework agreement likely includes technical collaboration on optimizing x AI's language models for robotics applications, data sharing from Tesla's autonomous vehicle fleet to improve AI training, and priority access for Tesla to new versions of Grok before public release. In practice, this means Tesla's Optimus humanoid robots could use optimized versions of Grok to understand complex instructions, reason about multi-step tasks, and adapt to novel situations. The same integration could apply to Tesla's autonomous vehicles and manufacturing automation systems. This tight coupling makes it hard for competitors to replicate without similar partnerships.

What are the risks that this investment could fail?

The primary risks include: humanoid robots failing to achieve commercial viability despite decades of hype, open source language models commoditizing Grok and eliminating the need for proprietary models, Tesla's robotics program underperforming relative to expectations, regulatory hurdles preventing robot deployment, competitive responses from larger tech companies like Google or Microsoft, and management execution risk given Elon Musk's attention spread across multiple companies. Any one of these failure modes could render the $2 billion investment unproductive or result in massive losses.

How does this investment fit into Tesla's Master Plan Part IV?

Master Plan Part IV, published in October 2024, explicitly positions humanoid robots and autonomous systems as Tesla's primary growth areas in the coming decade. The plan suggests that humanoid robots could eventually be worth more than Tesla's automotive business. The x AI investment provides the AI intelligence layer that these robots require. Without sophisticated language understanding and reasoning capabilities, Tesla robots would be limited to simple, pre-programmed tasks. With x AI's language models optimized for robotics, the robots can understand complex instructions and adapt to novel situations, making them genuinely useful.

What valuation does Tesla's investment imply for x AI?

Tesla's

How does this compare to other AI funding rounds?

x AI's

What should investors watch to evaluate if this bet is working?

Key metrics include: progress demonstrations of Optimus robots performing increasingly complex tasks, commercial deployment of robots outside of Tesla's own factories, actual usage numbers for x AI's APIs and products, Tesla's profit margins as robotics investments mature, competitive responses from other automakers and robotics companies, and the timeline for physical AI to go from prototype to mainstream commercial deployment. If these metrics show consistent progress over the next 2-3 years, the x AI investment will likely be viewed positively. Delays or failures would suggest the timeline for physical AI commercialization is longer than expected.

Conclusion: The Bet on Physical AI

When Tesla announced its $2 billion investment in x AI, it wasn't just making a financial decision. It was making a bet about the future of artificial intelligence. Not the AI of chatbots and text generation, but the AI of robots and autonomous systems.

This is a genuinely important moment in the technology industry, even if it flew under the radar for many people.

For years, the AI narrative has been dominated by large language models. Chat GPT, GPT-4, Claude, Gemini. These are incredible achievements in natural language processing. But they're fundamentally software. They run on computers. They operate in digital space.

Tesla and x AI are betting that the next big opportunity is different. It's AI that operates in physical space. Robots that understand complex instructions and execute them. Vehicles that drive safely in unpredictable environments. Manufacturing systems that adapt and optimize continuously.

That requires a different kind of AI. It requires models that can understand context, reason about consequences, and adapt when things go wrong. It requires integration with hardware, sensors, and control systems. It requires continuous learning from real-world experience.

x AI's language models provide the cognitive foundation. Tesla's robotics expertise and manufacturing scale provide the implementation capability. Together, they're building something that could be genuinely transformative.

But transformation isn't guaranteed. Robotics has a long history of overhyped timelines and disappointing results. AI models have limitations. Integration is harder than it looks in demos. The transition from prototype to commercial product is brutally difficult.

So this $2 billion investment is a bet. Tesla is betting that:

- Humanoid robots will become commercially viable

- Language models are essential to making them useful

- x AI will remain a strategic partner as these systems evolve

- The physical AI market will be massive enough to justify the investment

- Competitors won't build equivalent capabilities faster

Any one of those assumptions could be wrong. But if they're all right, then Tesla and x AI have positioned themselves to capture enormous value.

For investors, technologists, and business leaders watching this space, the Tesla-x AI partnership is a signal about where the smart money is going. It's not just about building bigger language models. It's about integrating those models into physical systems. It's about moving AI out of the cloud and into hardware.

The next five years will tell us whether that bet was genius or overconfident. In the meantime, Tesla has made it clear: it believes physical AI is real, and it's willing to spend $2 billion to make sure it gets it right.

That kind of conviction, backed by real capital, is how major technological transitions happen. It's not a guarantee of success. But it's a serious statement of intent about where the future is headed.

Key Takeaways

- Tesla invested $2B in xAI despite shareholders rejecting the proposal, demonstrating founder conviction about physical AI's importance

- xAI raised $20B total, making it one of the most well-funded AI startups with strategic investors including Nvidia, Cisco, and now Tesla

- The real value is not financial returns but strategic integration of language models into Tesla's robotics and autonomous systems through a framework agreement

- Tesla's profit fell 46% in 2024, making robotics and AI the logical next growth engine as electric vehicle market matures

- Physical AI convergence between digital language models and hardware robotics systems is the strategic thesis driving this partnership

Related Articles

- Chrome's Gemini Side Panel: AI Agents, Multitasking & Nano [2025]

- Tesla Optimus Gen 3: Everything About the 2026 Humanoid Robot [2025]

- Tesla's 46% Profit Collapse in 2025: What Went Wrong [2026]

- Doomsday Clock at 85 Seconds to Midnight: What It Means [2025]

- Moltbot AI Assistant: The Future of Desktop Automation (And Why You Should Be Careful) [2025]

- Once Upon a Farm IPO 2025: What Investors Need to Know [2025]

![Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]](https://tryrunable.com/blog/tesla-s-2b-xai-investment-what-it-means-for-ai-and-robotics-/image-1-1769638060454.jpg)