Tesla Discontinuing Model S and Model X for Optimus Robots: A Strategic Pivot That Changes Everything [2025]

Something seismic just happened in the automotive world, and most people missed it.

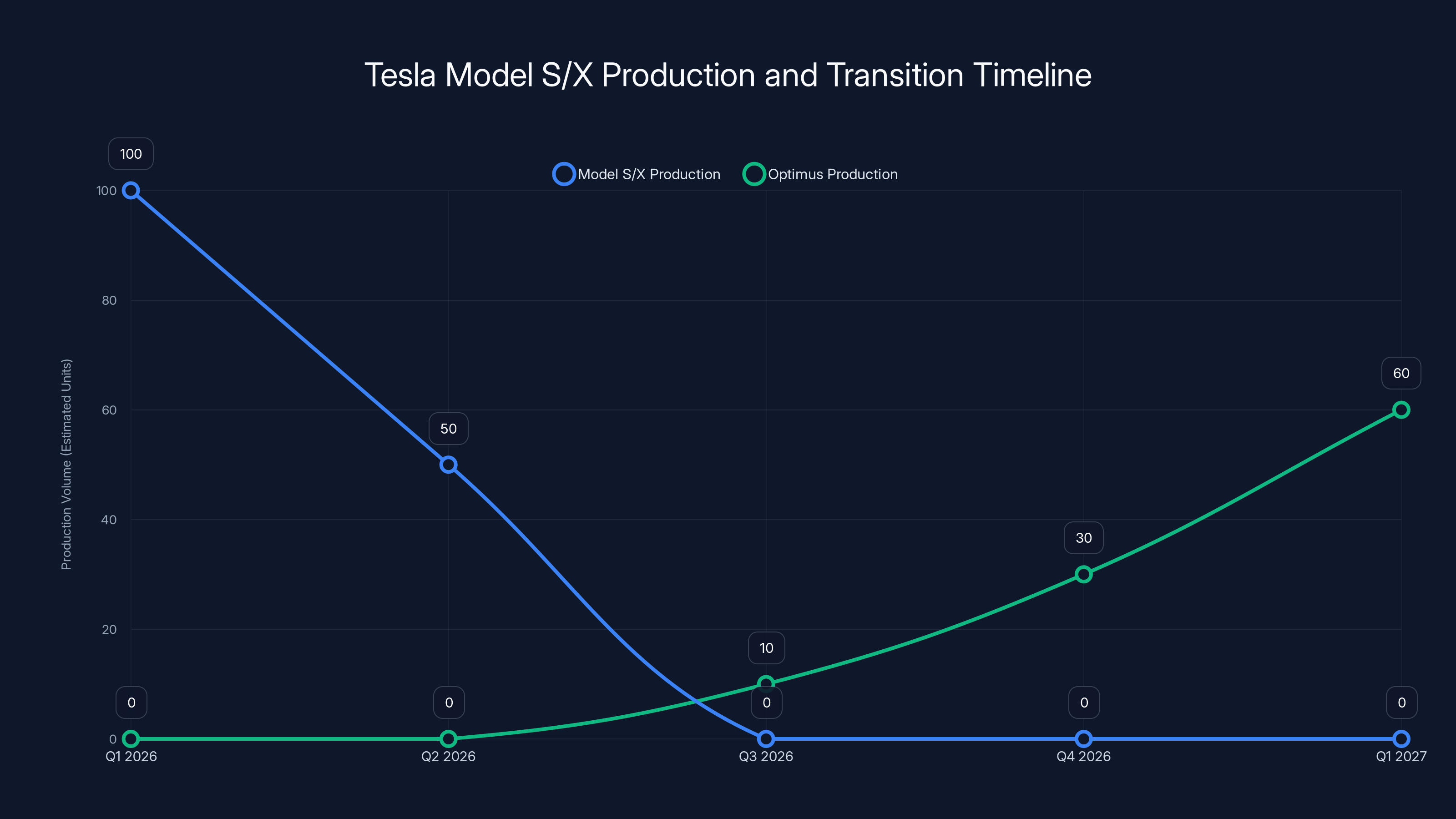

Elon Musk announced on an earnings call that Tesla will discontinue the Model S and Model X, two of its most iconic vehicles, by the second quarter of 2026. The reason? They're clearing factory floor space for something Tesla believes is far more valuable: manufacturing the Optimus humanoid robot.

This isn't just a product discontinuation. It's a fundamental restructuring of what Tesla believes it will become. We're talking about mothballing the luxury sedan that started the entire Tesla revolution back in 2012, and the iconic SUV with gull-wing doors that launched in 2015. Both vehicles defined a generation. Both proved that electric cars could be desirable, not just practical.

But here's where it gets interesting. The decision reveals something crucial about where Musk and Tesla see the future of their company heading, and frankly, where the entire automotive industry might be headed. Let's break down what's actually happening, why it matters, and what it means for everyone paying attention to the future of transportation.

TL; DR

- Model S and Model X Production Ends: Both vehicles will stop being manufactured in Q2 2026, ending production runs of 14 and 11 years respectively

- The Reason: Factory Space: Tesla's Fremont facility is being converted to manufacture Optimus humanoid robots instead of premium sedans and SUVs

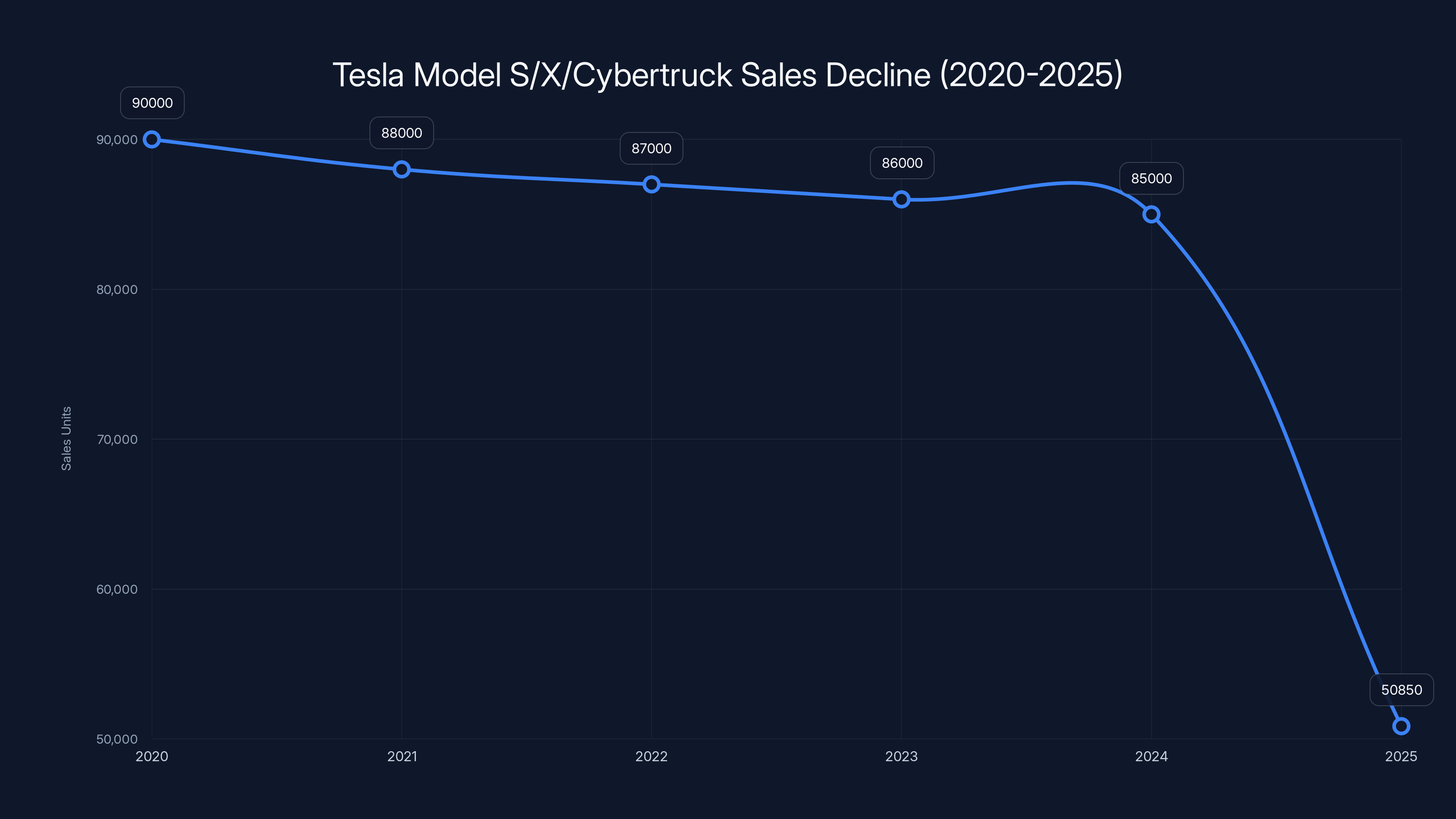

- Declining Sales Trend: Sales of "other models" (which includes Model S, Model X, and Cybertruck) dropped 40.2% year-over-year in 2025, totaling only 50,850 units, as reported by CNBC

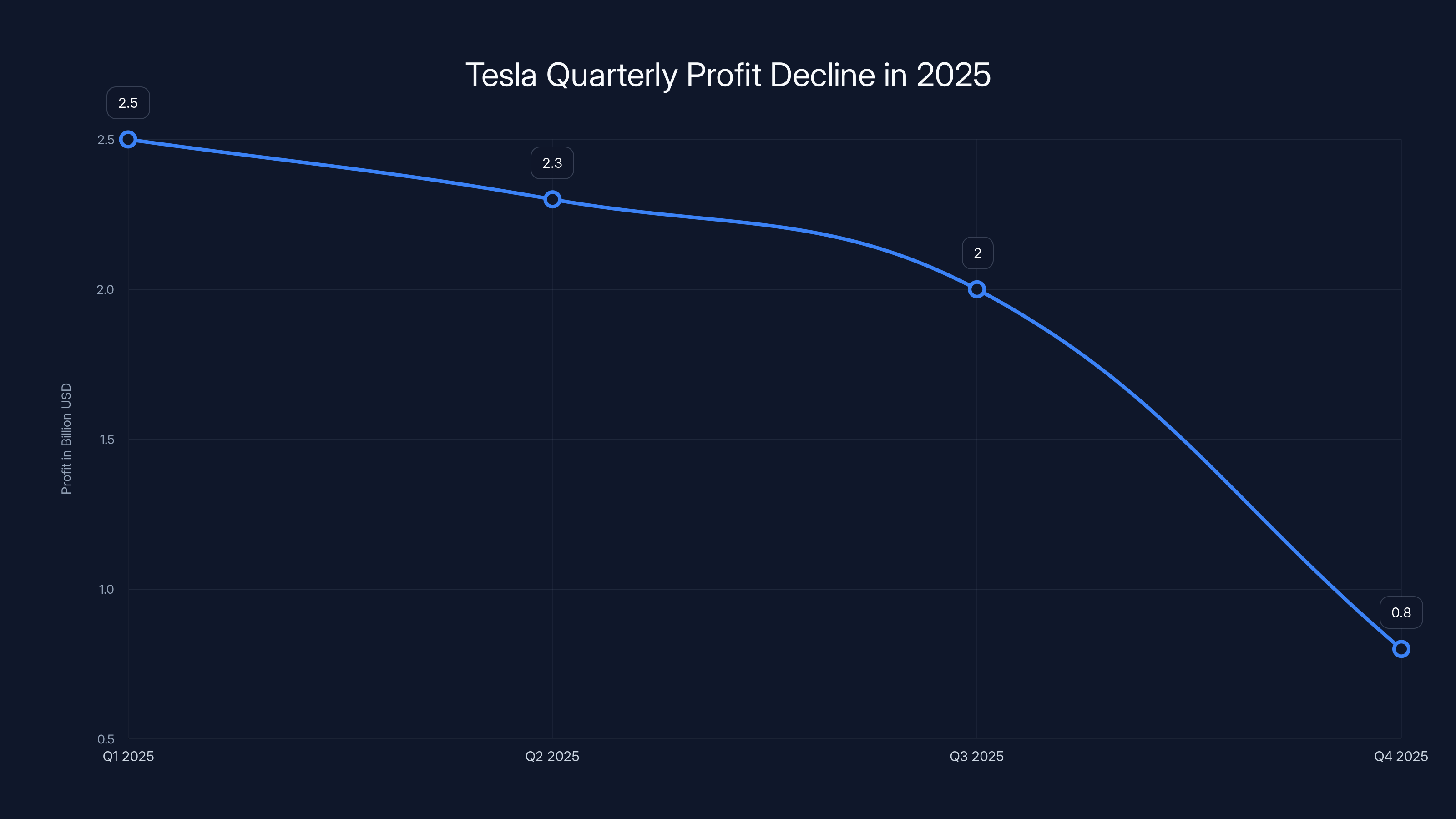

- Profit Pressure: Tesla reported a 61% decrease in profits in Q4, creating urgency to pivot toward higher-margin opportunities like robots, according to Business Insider

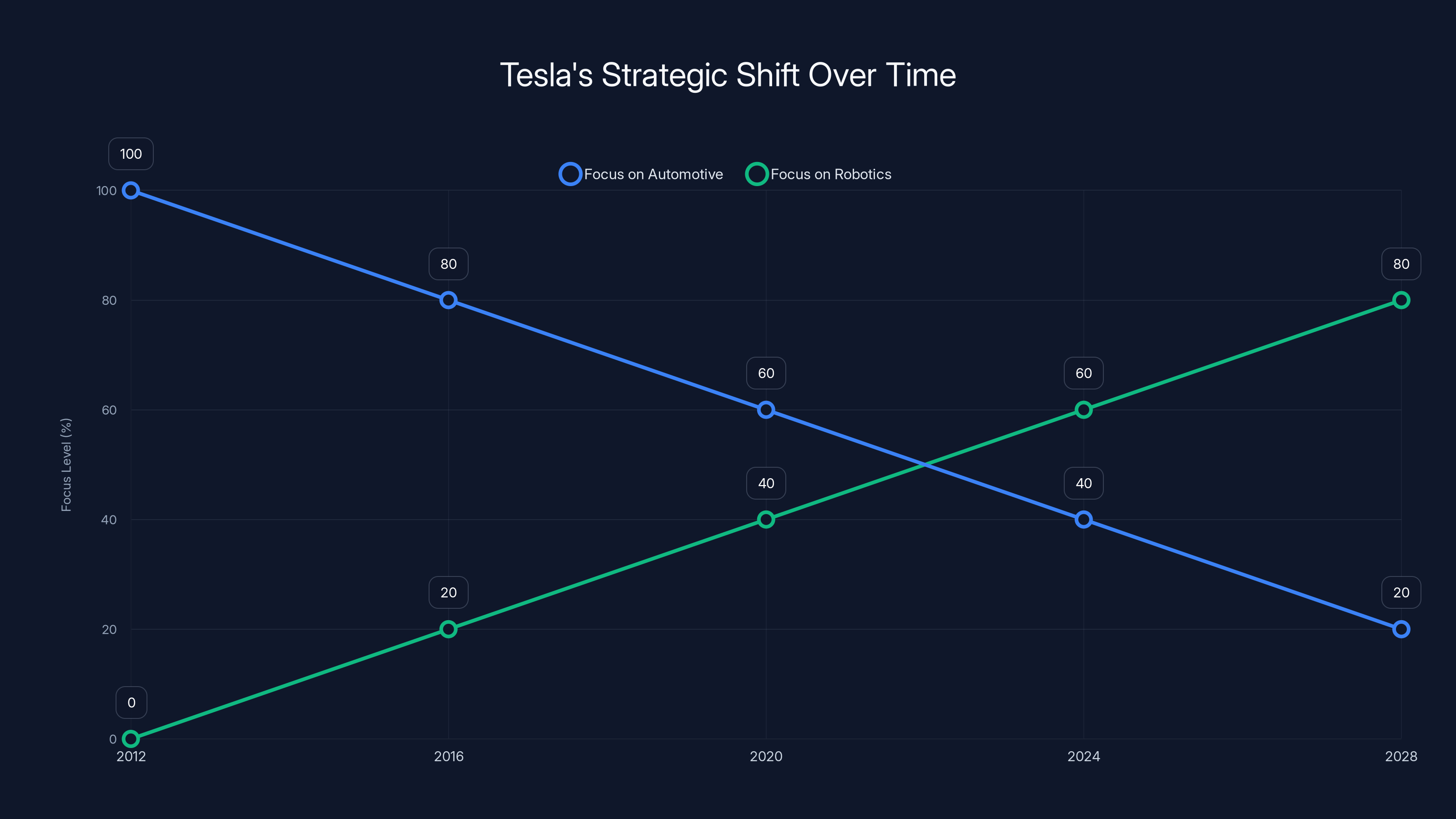

- Strategic Shift: This move reflects Tesla's transformation from a car company into a robotics and autonomous technology company

Tesla's sales for Model S, X, and Cybertruck combined fell from 85,000 units in 2024 to 50,850 units in 2025, marking a 40.2% decline. Estimated data for previous years shows a consistent downward trend.

The Icons That Built Tesla's Empire

Let's be honest: without the Model S, Tesla doesn't exist as we know it today.

When the Model S launched in 2012, it fundamentally changed what people thought about electric vehicles. Before the Model S, EVs were quirky golf carts with poor range that you charged for eight hours to drive across town. The Model S showed the world that an electric vehicle could be faster than most gas cars, have a legitimate 300-mile range, and look better than almost everything else on the road.

That car wasn't just a product. It was validation.

It proved to the automotive industry that electrification wasn't a compromise or a future-facing PR move. It was actually better. Faster acceleration, lower maintenance, better handling due to a centered low battery. The Model S became the car that made wealthy people care about electric vehicles. It made them aspirational.

The Model X followed in 2015 with even more audacity. Those gull-wing doors? Completely impractical by most metrics. Door sensors that sometimes malfunctioned. Tight parking lot situations becoming nightmare scenarios. But visually? Stunning. Functionally? It proved you could make an electric SUV that carried seven people and still felt premium.

Both vehicles became cultural markers. If you saw a Model S on the highway, it meant something. These cars announced that you'd made a specific choice about technology, environment, and status. They were Tesla's statement pieces while Model 3 and Model Y became the revenue engines.

And now they're gone.

Tesla experienced a significant 61% decline in quarterly profits in Q4 2025, highlighting a crisis-level earnings miss. Estimated data based on narrative.

The Sales Numbers Don't Lie: A 40% Collapse

But here's where the story shifts from nostalgia to cold business reality.

In 2025, Tesla sold 50,850 units in what the company calls "other models," which includes the Model S, Model X, and Cybertruck combined. That represented a devastating 40.2% decrease compared to 2024. Let's break that down: in 2024, Tesla was moving roughly 85,000 of these vehicles annually. Now they're barely above 50,000.

The Model S and Model X have been sliding for years. They're expensive. A new Model S starts around

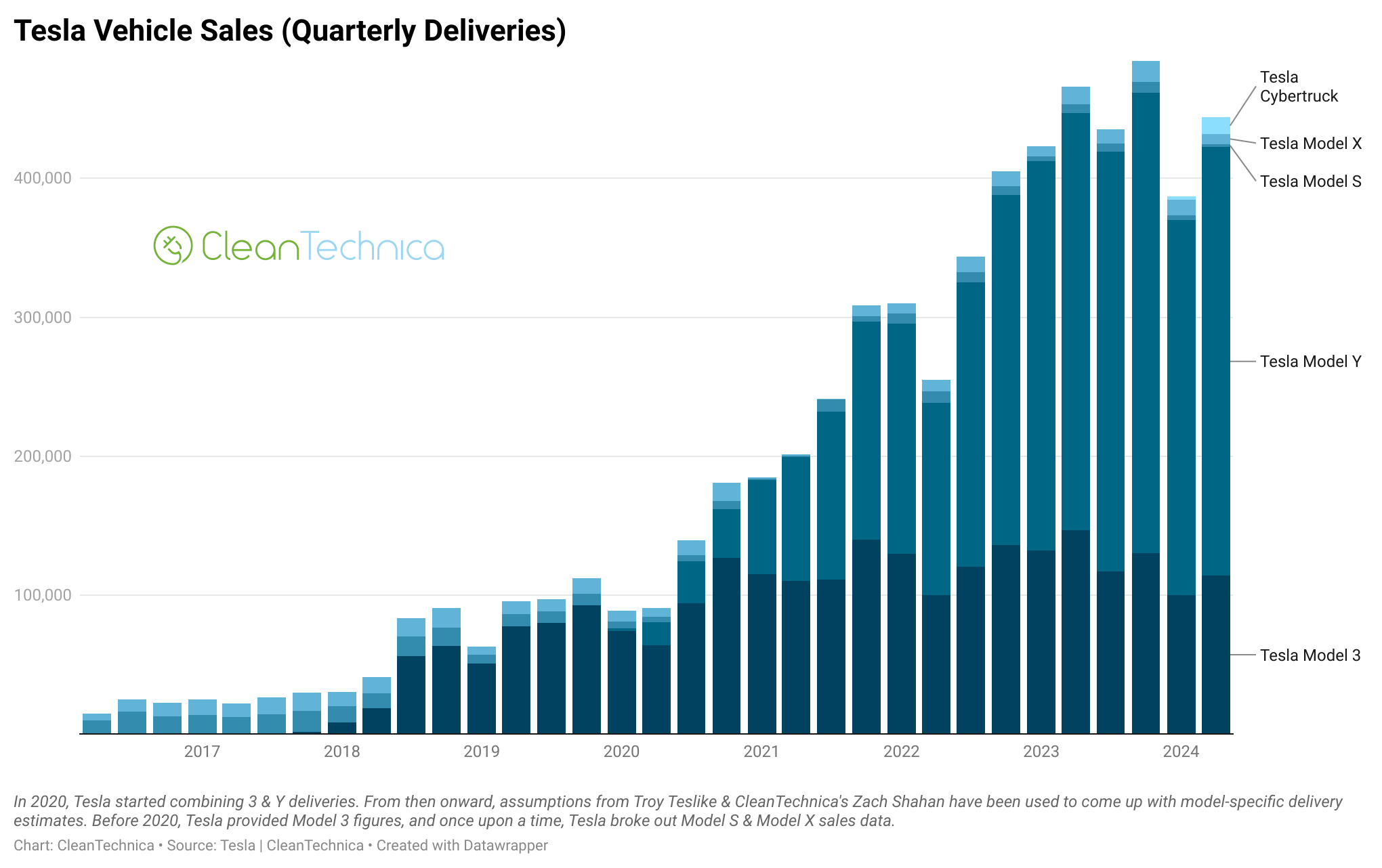

Meanwhile, the Model 3 and Model Y became so successful that they overshadowed everything else. Why buy a Model S when a Model Y Performance gives you essentially the same electric powertrain in a more practical package for $15,000 less? For most customers, the answer is "you don't."

The Cybertruck, which debuted in 2023, has been a manufacturing and delivery nightmare. Production delays, quality control issues, and the truck's controversial design made it a sales wild card. It's not that people don't want it—they absolutely do. The issue is Tesla can only make so many, and ramping production while maintaining quality is proving extremely challenging, as noted by Wolf Street.

So Tesla faced a fundamental choice: continue investing in a declining premium sedan and SUV segment, or reallocate that manufacturing capacity to something Musk believes is the actual future. He chose the latter.

The Fremont Factory Bottleneck: Why Space Matters More Than You Think

Manufacturing isn't infinite. Factories have limited floor space, equipment capacity, and labor hours. Tesla's Fremont facility in California has been operating near maximum capacity for years.

Here's the practical reality: every car that rolls off the production line takes up manufacturing slots that could be used for something else. Model S production ties up stamping presses, welding robots, assembly stations, and quality control checkpoints. These resources are finite. If you want to make more of something, you have to make less of something else.

Tesla currently manufactures Model 3, Model Y, and Model S/Model X at Fremont. The Model 3 and Model Y are where the profit lives—massive volumes at reasonable margins. Model S and Model X are lower volume, higher margin individually, but their total profit contribution has shrunk due to volume declines.

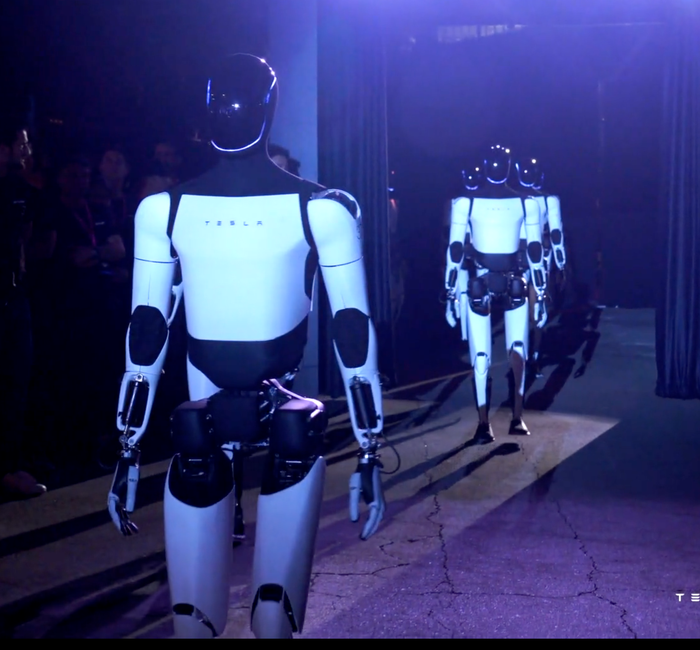

Optimus represents something different entirely. Musk has been talking about humanoid robots as Tesla's future for years. At Tesla's AI Day events, the company has showcased prototypes that can perform basic tasks like picking objects, organizing shelves, and moving items. Optimus is designed as a general-purpose humanoid robot that could theoretically be deployed across manufacturing, logistics, retail, and countless other industries.

The manufacturing process for Optimus is fundamentally different from cars. You need different tooling, different assembly lines, different quality control parameters. But the floor space is the same. By ending Model S and Model X production, Tesla is freeing up roughly 150,000 to 200,000 square feet of premium manufacturing space that can be repurposed for robot assembly.

It's not just about capacity. It's about focus. Trying to manufacture four different vehicle types (Model 3, Model Y, Model S, Model X) plus ramping Cybertruck production plus launching Optimus manufacturing is a split attention problem. Tesla is choosing to consolidate.

The global premium sedan segment has been shrinking by 5-7% annually over the past decade, highlighting a consumer shift towards crossovers and SUVs. Estimated data.

The Profit Crisis: Why Musk Is Acting Now

The timing here is crucial. Tesla didn't just wake up one day and decide to kill two product lines. The decision came after Tesla reported a 61% decline in quarterly profits in Q4 2025.

Let that sink in. Sixty-one percent. That's not a normal market adjustment. That's a crisis-level earnings miss that triggered board-level strategy discussions.

What caused the profit collapse? Multiple factors converged simultaneously. Competition intensified as legacy automakers finally brought compelling electric vehicles to market. Ford and General Motors are actually building good EVs now. Tesla's pricing power eroded as Volkswagen, BMW, and others offered comparable vehicles.

Then there's tariff uncertainty, supply chain costs, and the basic math of selling cars in an increasingly competitive market. The Model 3 and Model Y were Tesla's margin engines, but even those have seen price pressure.

In this environment, continuing to manufacture low-volume premium vehicles makes no financial sense. Model S and Model X probably don't even generate 10% of Tesla's total revenue, but they consume significant manufacturing resources. Killing these product lines immediately frees up capacity for higher-margin opportunities.

And what's higher margin than a humanoid robot? We're talking about a product category that barely exists yet. There's enormous upside potential. The service market alone—using robots for manufacturing, logistics, food service—could represent a multi-trillion-dollar opportunity if the technology actually works.

Optimus: The Bet That Changes Everything

So what exactly is Tesla betting on?

Optimus is a humanoid robot roughly human-sized (about 5'8", weighing around 125 pounds) designed with dexterous hands, articulated joints, and an onboard computer brain running on Tesla's AI stack. The company's vision is that Optimus could eventually perform a huge range of tasks currently done by humans.

Listen, I'll be honest: the current Optimus prototypes are impressive-looking but limited in capability. They can perform scripted tasks in controlled environments. Picking up objects, moving things, following instructions. But actual general-purpose autonomy—the kind that would let a robot walk into an unfamiliar environment and figure out what to do—that's still in early stages.

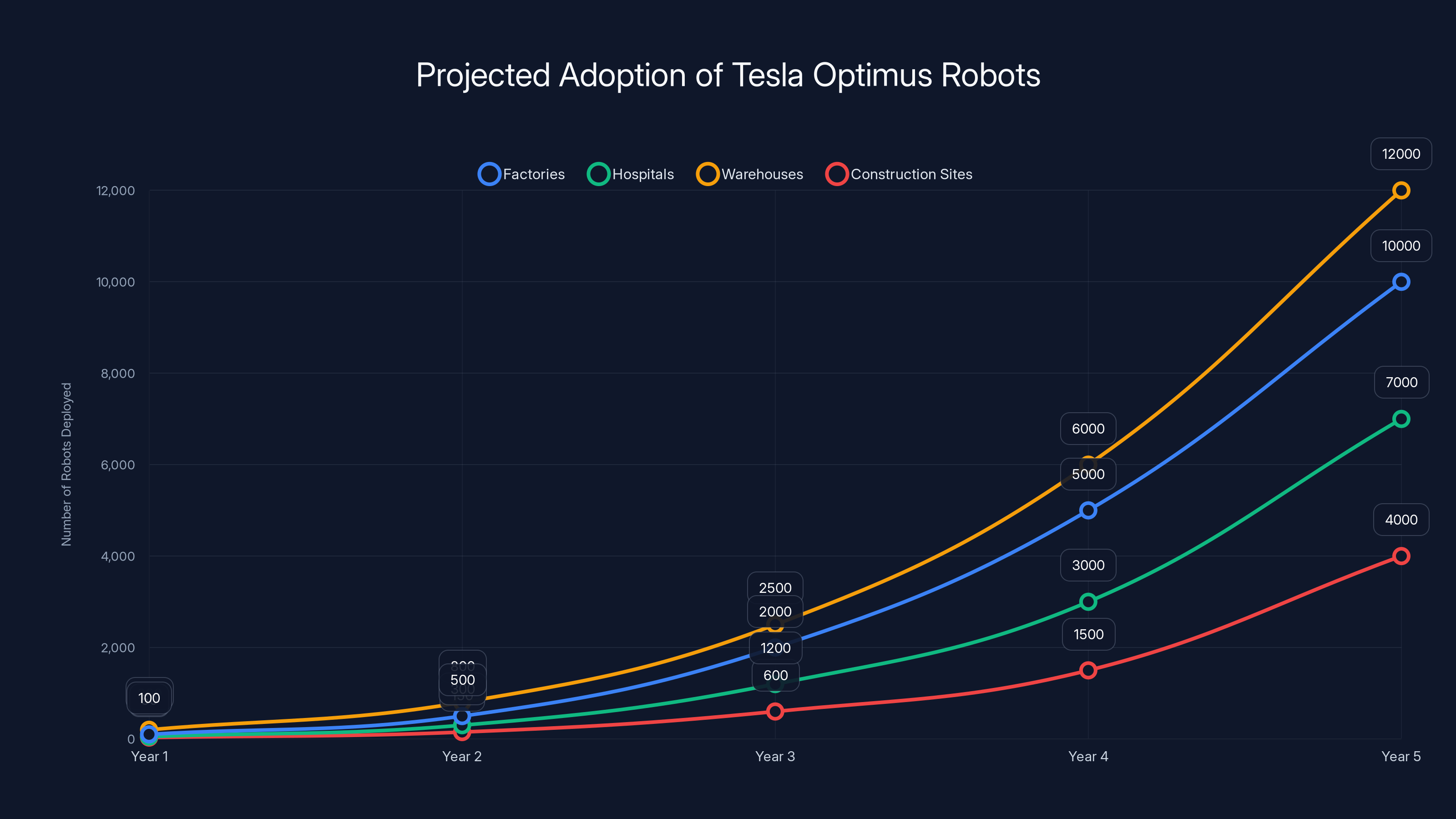

But Musk's argument is compelling from a business perspective. If Optimus becomes even moderately capable, the addressable market is enormous. Manufacturing plants need robots. Hospitals need robots. Warehouses need robots. Fast food restaurants need robots. Retail stores need robots. The global robotics market is currently around

Tesla already has the manufacturing expertise. They already have the AI capabilities through their autonomous vehicle development. They have the battery and motor technology. What they don't have is the factory capacity to scale Optimus production, which is where this entire decision makes sense.

The question isn't really whether Optimus will succeed. It's whether Musk and Tesla's board believe the probability is high enough to justify killing two established product lines. Apparently, they do.

Estimated data shows Tesla's strategic shift from focusing primarily on automotive to increasing emphasis on robotics and AI by 2028.

What This Means for Tesla Customers: The End of an Era

If you own a Model S or Model X, this is actually good news for you. Discontinuing a product line immediately makes existing units more valuable in the used market. Rarity increases demand. Limited production runs become collector items.

But if you were planning to buy a new Model S or Model X, you have roughly 12-15 months to make that happen (assuming "Q2 2026" means spring 2026). After that, you're shopping the used market or looking at competitors.

What are the alternatives? The Porsche Taycan is an excellent electric sedan if you want performance and luxury. The BMW i X M60 offers similar performance in a larger package. Audi's e-tron GT competes directly with the Model S for performance sedan buyers.

For Model X buyers, the competition is actually trickier. That three-row electric SUV segment is still pretty sparse. Volkswagen's ID. Buzz is coming as a three-row vehicle. GMC's Hummer EV offers three rows and American muscle. But the Model X's gull-wing design and specific user experience aren't easily replicated.

The real impact hits Tesla's existing service and parts ecosystem. Model S and Model X owners will still need support, but Tesla may streamline service centers and parts inventory. Some owners may find service appointments harder to get or wait times increasing as Tesla consolidates.

The Industry Reaction: What Competitors Think

Legacy automakers are probably having mixed reactions to this news.

On one hand, losing the Model S and Model X from the market removes two genuine competitors from their competitive set. Ford, GM, and traditional luxury brands won't have to compete against the Model S anymore. The luxury sedan segment—already brutalized by crossover preferences—loses one innovative competitor.

On the other hand, Tesla's decision signals something unsettling about the electric vehicle business itself. If Tesla, the company that invented the modern EV, can't make a luxury sedan profitably enough to continue manufacturing, what does that say about margins in that segment? Are premium electric vehicles actually viable as mass-production products, or are they niche products?

That's not great news for Mercedes-Benz's EQ lineup, Jaguar's electric strategy, or anyone betting heavily on premium EV sedans and large SUVs.

Tesla's pivot also creates an opportunity. It signals that the EV market is consolidating toward mass-market vehicles (Model 3 and Model Y) that prioritize value over premium positioning. Traditional automakers might actually be better positioned to compete in that market with their established brand prestige and dealer networks.

The timeline shows the wind-down of Model S/X production by Q2 2026 and the ramp-up of Optimus production starting in Q3 2026. Estimated data.

The Autonomous Vehicle Question: Why Robots Make More Sense Than Premium Cars

Here's something people often miss about this decision: it's not just about manufacturing capacity. It's about strategic focus.

Tesla has been pivoting toward autonomous driving and robotics for years. The company's Full Self-Driving (FSD) software is running on millions of vehicles, collecting data constantly. Every Model 3, Model Y, Model S, and Model X is essentially a sensor array collecting information about how to drive. That data trains Tesla's neural networks.

But eventually, you hit a limit. You can collect so much driving data, but vehicles are only going to be deployed in certain ways. They drive on roads with traffic and pedestrians. Robotics represents a different deployment scenario entirely.

A humanoid robot could be deployed indoors, in factories, on different terrain, in environments cars never see. That data would train more generalizable AI. It would create different feedback loops. The learning process becomes less about "how do I drive on a highway" and more about "how do I manipulate objects, move through space, understand physics, and interact with humans."

In other words, killing the Model S and Model X isn't just about factory space. It's about strategic focus on the technology platform Tesla actually believes represents the future. Musk is betting that humanoid robots represent a larger addressable market and more significant upside than continuing to manufacture premium sedans and SUVs.

Is he right? Ask me again in five years.

The Cybertruck Problem: Why It Stays (For Now)

Notice what Tesla didn't discontinue: the Cybertruck.

Despite production delays, quality issues, and lower-than-expected demand, the Cybertruck is staying in the lineup. Why? Because it's new enough that Tesla still views it as part of their future. The company has invested massive resources in developing the Cybertruck's unique stainless steel exoskeleton manufacturing process. Killing it now would mean those investments are sunk costs.

But more importantly, the Cybertruck represents something different than the Model S and Model X. It's aspirational in a way luxury sedans aren't. It's polarizing, which creates cultural interest. People want it precisely because it's weird and different.

The Cybertruck is also reasonably profitable on a per-unit basis, even at lower volumes. Prices have stabilized around

The Model S and Model X didn't have that advantage. They were getting commoditized. Competitors were matching them. Customers were choosing Model 3 and Model Y instead. Killing them makes business sense.

Estimated data shows significant growth in Tesla Optimus robot adoption across various industries, highlighting potential market transformation over five years.

Market Consolidation: The Shift Toward Volume Over Variety

What's happening at Tesla reflects a broader trend in automotive manufacturing: consolidation toward high-volume, profitable segments.

This used to be different. Legacy automakers like Ford and GM manufactured dozens of models at different price points to segment the market. You could buy a base Chevy Cavalier for

That strategy worked when consumers were geographically dispersed and preferences were highly variable. But the internet changed everything. Consumers now compare across brands instantly. A customer shopping for a $70,000 electric sedan isn't just comparing Model S to other Tesla products—they're comparing Model S to Porsche Taycan, BMW i X M60, and Mercedes EQS globally.

In that environment, being a broad-portfolio manufacturer is incredibly expensive. You need different supply chains, different manufacturing lines, different service infrastructure. The capital requirements multiply.

Tesla is doing what successful technology companies do: consolidating around the products that win in their respective categories. Model 3 owns the mass-market EV sedan space. Model Y owns the mass-market EV crossover space. Both are vertically optimized and extremely profitable relative to their premium cousins.

Tesla's decision reflects confidence that this strategy actually works. They're not worried that Model 3 and Model Y won't satisfy customers who might have bought a Model S. They believe the market has spoken: customers want capability over luxury in an electric vehicle.

Timeline: What Happens Between Now and Q2 2026

We're looking at a roughly 12-15 month wind-down period for Model S and Model X production.

Here's what probably happens in that timeline:

Immediate (Q1 2026): Tesla issues the final production announcement, specifies exact end dates. Waitlists clear as the company pushes out remaining orders. Pricing probably stabilizes or increases as scarcity becomes real. Used Model S and Model X prices begin rising as collectors and enthusiasts recognize the end of the line.

Q2 2026 (target discontinuation): Last Model S and Model X units roll off the production line. Celebratory media coverage. Existing owners celebrate their vehicle appreciation. Tesla officially begins converting Fremont factory space to Optimus manufacturing.

Q2-Q4 2026: Factory reconfiguration in earnest. New manufacturing lines installed for Optimus assembly. Initial pilot production runs. Tesla likely announces Optimus pricing and production volume targets.

Q1 2027 and beyond: Optimus ramps to meaningful production volumes. Early customer deployments begin. Data collection starts validating (or invalidating) Musk's vision for the robot economy.

During this period, used Model S and Model X values will likely experience a modest boom as the window to buy new ones closes. That's actually good for existing owners but terrible for anyone still shopping for a new one.

The Bigger Picture: Is Tesla Becoming a Robotics Company?

Let's step back and ask the bigger question: what is Tesla actually becoming?

Musk has been positioning Tesla as a robotics company for years. Every time he talks about the future, it's not about cars. It's about Optimus. About a robot in every factory, every warehouse, every home eventually. The narrative has slowly shifted from "Tesla makes electric cars" to "Tesla is an AI and robotics company that also makes cars."

This decision confirms that shift is real. Tesla isn't just talking about robots. They're willing to sacrifice iconic products to pursue that vision. That's commitment at a level that goes beyond strategic planning—it's existential repositioning.

The question is whether Musk is right. Can Optimus actually work? Can it be manufactured at scale profitably? Can it actually perform the thousands of different tasks people imagine? Or is this a massive strategic miscalculation that will consume resources while competitors build EVs?

We won't know for years. But the fact that Tesla is betting the farm on this direction tells you something important: Musk genuinely believes the humanoid robot market is bigger and more important than the premium EV market.

History suggests he's often right about these kinds of inflection points, but not always in the timeframe he predicts. Robotics at scale might be five years away. Or fifty.

Implications for the EV Market: Death of the Premium Sedan?

Should other EV manufacturers be worried?

Absolutely, yes. If the company that perfected the premium electric sedan decides the segment isn't worth pursuing, that's a signal. The message is simple: premium sedans aren't the future. High-volume, mass-market vehicles are.

This creates problems for Porsche's Taycan program. For BMW's i X strategy. For Audi's e-tron lineup. For anyone betting that premium EV sedans represent meaningful profit pools.

The broader implication is that the EV industry is consolidating around the same customer segments that already dominate traditional vehicles: crossovers and SUVs. Sedans were always a smaller market. Premium sedans are even smaller. Premium electric sedans? Niche.

This is actually bad news for some legacy automakers and good news for others. Manufacturers with strong crossover lineups (Ford Escape EV, GM Equinox EV) are positioned better. Manufacturers doubling down on sedans and wagons (Volkswagen, Volvo) face headwinds.

What Existing Tesla Owners Should Know

If you own a Model S or Model X, here's what actually matters:

1. Your vehicle value will likely increase. Limited production runs become more desirable. Discontinued models often appreciate in the used market, especially within the first few years. If you were thinking about selling, the next 12 months might be optimal timing.

2. Service availability may decline long-term. Tesla will continue supporting existing vehicles, but service infrastructure optimization typically happens gradually. Parts availability should remain stable for at least a decade, but eventually, it normalizes. Plan for this.

3. Software updates continue for a while. Tesla has a reasonable track record of supporting older vehicles with software updates, though they do eventually phase out support for older systems. Your vehicle should receive FSD and other capability updates for at least 5-7 more years.

4. Insurance and registration become stable costs. You no longer have to wonder about the vehicle's future. It's clearly staying with you for the long haul. That's actually nice for planning.

5. Resale clarity emerges. Instead of wondering if your Model S will be replaced with a newer generation, you know it's not. The market for your specific model is now calculable and finite.

The Optimus Wildcard: What If It Works?

Here's the scenario that keeps me up at night if I'm a traditional automaker: what if Optimus actually works?

Not just works in prototypes or controlled environments. Actually works at scale in real-world applications. Can operate reliably for 8-10 hours daily, perform hundreds of different tasks, be maintained and repaired by normal technicians.

If that happens, Tesla becomes something much larger than an automotive company. They become a infrastructure provider. Factories buy Optimus to replace workers. Hospitals buy Optimus for logistics. Warehouses buy Optimus for fulfillment. Construction sites buy Optimus for labor.

The profit potential scales exponentially. A robot that costs

That's the bet Musk is making by killing the Model S and Model X. He's betting the upside of becoming a robotics company exceeds the certainty of continuing as a premium automaker.

We'll know if he's right in about five years. My prediction? The robots work, but not as well as Musk claims. Production ramps more slowly than expected. But the market recognizes the potential, and Tesla's stock revalues accordingly. Traditional automakers scramble to develop competing humanoid robots, most fail, and the robotics space becomes another area where Tesla dominates through first-mover advantage and manufacturing expertise.

But that's just prediction. The facts we have are simpler: the Model S and Model X are ending. Optimus is beginning. Tesla is transforming.

FAQ

When exactly will Model S and Model X production stop?

Tesla has stated that production will end in the "second quarter of 2026," which typically means sometime between April and June 2026. That's roughly 12-15 months from the announcement. Tesla will likely provide more specific dates as they approach the discontinuation window, but customers should plan around this timeline.

Can I still order a Model S or Model X after the announcement?

Yes, for now. Tesla is continuing to take orders and manufacture these vehicles through Q2 2026. However, the closer you get to that discontinuation date, the longer your wait time may be as Tesla focuses manufacturing resources on final units. If you're seriously considering purchase, sooner is better than later to lock in an order and reasonable delivery timeline.

What happens to Model S and Model X service and parts availability?

Tesla has committed to supporting existing vehicles indefinitely. Service centers will continue offering maintenance and repairs for Model S and Model X owners. Parts availability should remain strong for at least a decade, with typical automotive aftermarket providers eventually offering third-party components. Long-term, as the vehicle population ages, service availability will gradually decline like any discontinued product, but this is a process measured in decades, not years.

Will the used Model S and Model X market be affected?

Definitely yes. Discontinuation typically increases demand for used vehicles in the final year of production, driving prices higher. Current Model S and Model X owners are likely to see their vehicles appreciate in value as the market recognizes the limited supply of new units. If you own one, this is probably a favorable market environment for selling if you choose to.

Is Tesla replacing Model S and Model X with new models?

No. Tesla is discontinuing both vehicles without plans for direct replacements. The company is consolidating around Model 3 (mass-market sedan), Model Y (mass-market crossover), and Cybertruck (innovative truck), while reallocating manufacturing capacity to Optimus humanoid robot production. Customers wanting a Tesla sedan or three-row SUV will need to choose from existing lineups or wait for potential future offerings.

What is Optimus and why is Tesla prioritizing it over continuing Model S and Model X production?

Optimus is Tesla's humanoid robot project designed to perform general-purpose physical tasks across manufacturing, logistics, hospitality, and other industries. Tesla's leadership believes the addressable market for humanoid robots—potentially trillions of dollars if deployment becomes widespread—exceeds the market for premium electric vehicles. By discontinuing lower-volume products, Tesla is freeing manufacturing capacity to scale Optimus production, which represents where the company believes the highest future value lies.

What alternatives should I consider if I wanted a Model S or Model X?

For luxury electric sedans comparable to the Model S, consider the Porsche Taycan, BMW i X M60, Audi e-tron GT, or Mercedes-Benz EQS. For three-row electric SUVs similar to Model X, options are more limited but include the forthcoming Volkswagen ID. Buzz and GMC Hummer EV. Alternatively, the Model Y remains available as a Tesla option with excellent performance and practicality.

Will this affect Tesla's stock price positively or negatively?

Market reactions to product discontinuation are complex and depend on investor perception of Optimus's potential. In the short term, analysts focused on unit volume may view this negatively. But investors betting on Tesla's robotics pivot may see it positively as a commitment to the company's stated direction. Historical precedent suggests the market favors companies that make clear strategic choices over those that try to be everything to everyone. Tesla's willingness to discontinue major products signals confidence, which some investors view favorably.

What does this mean for the broader EV market and traditional automakers?

Tesla's decision signals that the premium EV sedan segment is less profitable or desirable than mass-market vehicles. This is bad news for traditional luxury brands investing heavily in premium EVs but potentially good news for manufacturers focused on volume segments like crossovers and SUVs. It suggests the EV market is consolidating toward similar vehicle segments that dominate traditional automotive—crossovers and SUVs—rather than creating entirely new premium categories. Traditional automakers should view this as validation that focusing on mass-market segments is strategically sound.

Conclusion: The End of an Era, The Beginning of Something Larger

When the Model S launched in 2012, it was a revolutionary statement. It said that electric vehicles weren't compromises. They were superior. Better performance, better experience, more interesting than traditional cars.

The Model S proved the point. It changed the industry. It made electric vehicles respectable, then desirable, then inevitable.

Now, 14 years later, Tesla is saying something new. It's saying that the future isn't about more innovative cars. It's about robots. It's about manufacturing automation. It's about artificial intelligence becoming physical.

Maybe Musk is right. Maybe the next trillion-dollar company builds humanoid robots instead of cars. Maybe Optimus becomes as iconic as the Model S was. Maybe 20 years from now, we'll look back at this decision as the moment Tesla transformed from an automotive company into something much larger.

Or maybe it's a strategic miscalculation. Maybe Optimus faces technical limitations nobody's anticipating. Maybe the humanoid robot market never scales the way Musk envisions. Maybe competitors figure out how to build robots too.

We won't know for years.

But what we know right now is this: Tesla is choosing the future over the present. It's discontinuing profitable products to bet on something unproven. It's consolidating manufacturing capacity around its highest-volume offerings while pivoting toward robotics.

That's not a marginal adjustment. That's existential repositioning.

For Model S and Model X owners, it's bittersweet. Your vehicle is becoming a collector's item. The final chapter of a product lineage that defined a generation. Hold onto it. It's going to be worth something.

For prospective buyers, you have roughly 12 months to make a decision. After Q2 2026, the door closes. There's no coming back to "new." You get the used market or you move on to competitors.

For everyone else, Tesla's decision is a data point about where the automotive industry is heading. Volume, not variety. Crossovers, not sedans. And maybe, just maybe, toward an entirely different kind of vehicle altogether.

The Model S and Model X were great cars. They changed the world. But sometimes change means letting go of the past to pursue the future.

Tesla is letting go.

What do you think? Is Musk right to bet everything on humanoid robots? Or is Tesla making a massive strategic mistake? The automotive world will spend years debating this decision. The answer, ultimately, depends on whether Optimus actually works. And we'll have to wait to find out.

Key Takeaways

- Tesla discontinuing Model S and Model X production in Q2 2026 to convert Fremont factory for Optimus robot manufacturing

- Sales of 'other models' category dropped 40.2% YoY in 2025 to just 50,850 units, signaling declining demand for premium vehicles

- Q4 2025 saw Tesla's profits decline 61%, creating urgency to shift toward higher-margin opportunities like humanoid robots

- The decision signals Tesla's fundamental pivot from automotive company to AI and robotics company, with cars becoming secondary

- Used Model S and Model X values likely to appreciate as the discontinuation window closes and supply becomes limited

- Competitors face difficult implications: if Tesla can't make premium EVs profitably, what does that mean for luxury EV strategies?

- Optimus represents massive bet on unproven market; success would make Tesla a multi-trillion-dollar company, failure would waste resources

Related Articles

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Tesla's 2025 Revenue Decline: What Went Wrong [2025]

- Tesla Optimus Gen 3: Everything About the 2026 Humanoid Robot [2025]

- Autonomous Vehicle Safety: What the Zoox Collision Reveals [2025]

- Anduril's AI Grand Prix: How a Drone Racing Contest Became Silicon Valley's Wildest Recruiting Event [2025]

- Robotaxis Disrupting Ride-Hail Markets in 2025: Price War and Speed [2025]

![Tesla Discontinuing Model S and Model X for Optimus Robots [2025]](https://tryrunable.com/blog/tesla-discontinuing-model-s-and-model-x-for-optimus-robots-2/image-1-1769641606824.jpg)