Tesla's Energy Storage Business Is Booming: The EV Maker's Hidden Growth Engine

When you think of Tesla, you think of electric vehicles. Sleek sedans, muscle-bound pickups, that one car that shoots flames out the back. But here's what's flying under most people's radar: Tesla's real cash cow isn't what's parked in your garage. It's what's bolted to your roof, buried in your basement, or powering entire data centers across the country.

Tesla's energy storage business just pulled off something remarkable. In 2025, while the company's overall profit collapsed by 45% compared to 2024, the energy storage division didn't just hold steady. It exploded.

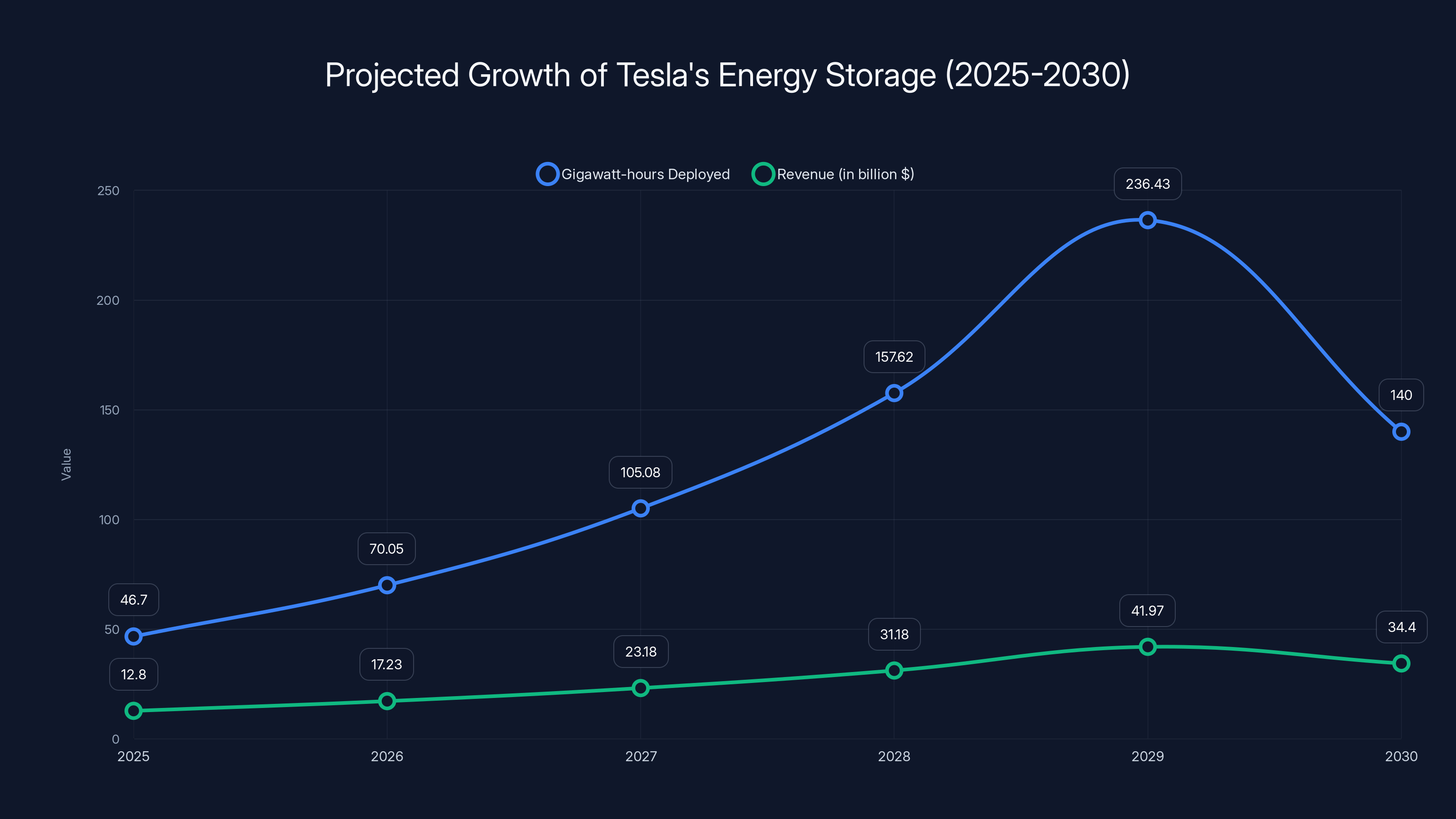

We're talking 46.7 gigawatt-hours of deployed capacity, a 48% year-over-year jump. That's not a rounding error. That's a fundamental shift in what Tesla is becoming.

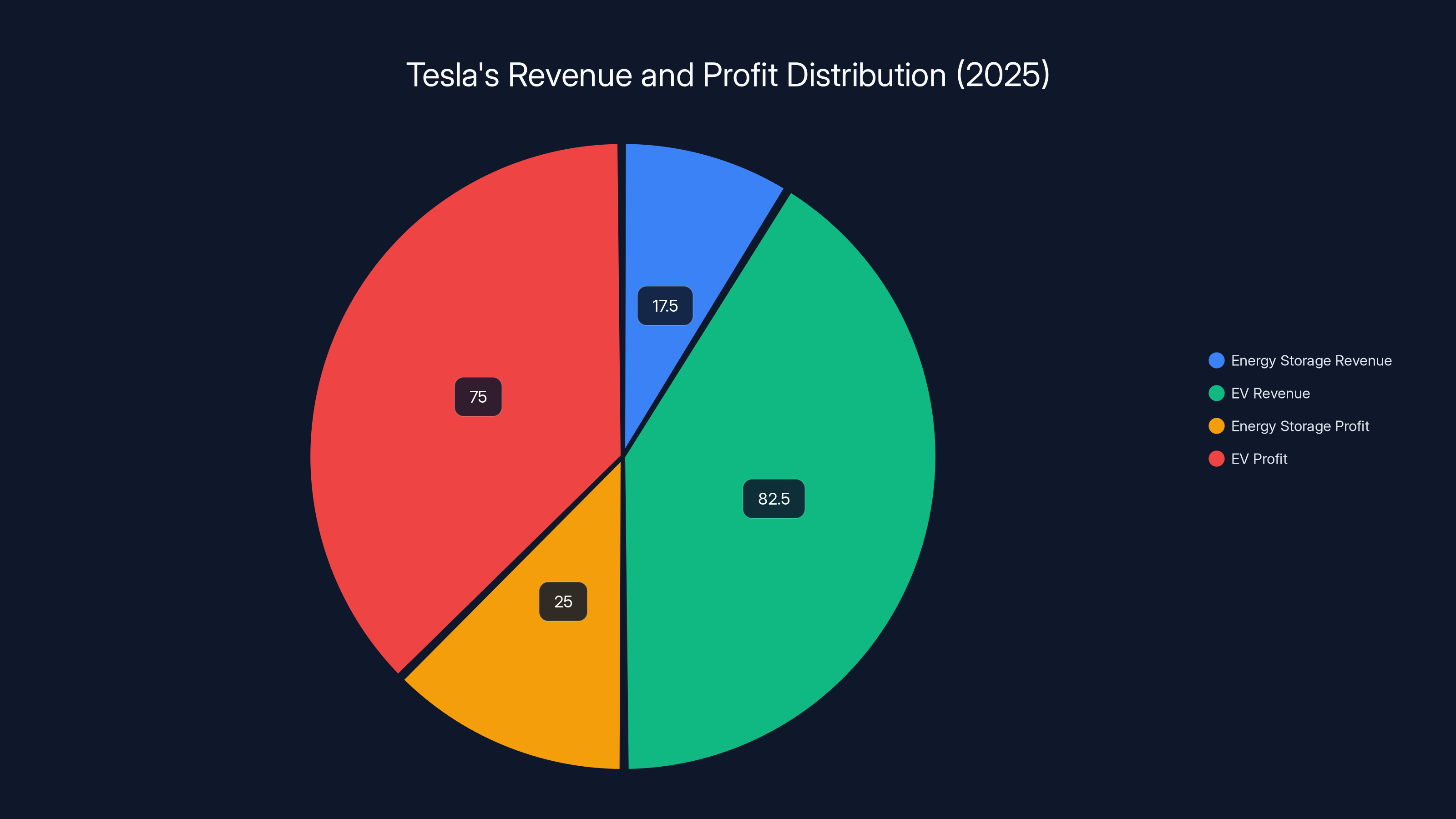

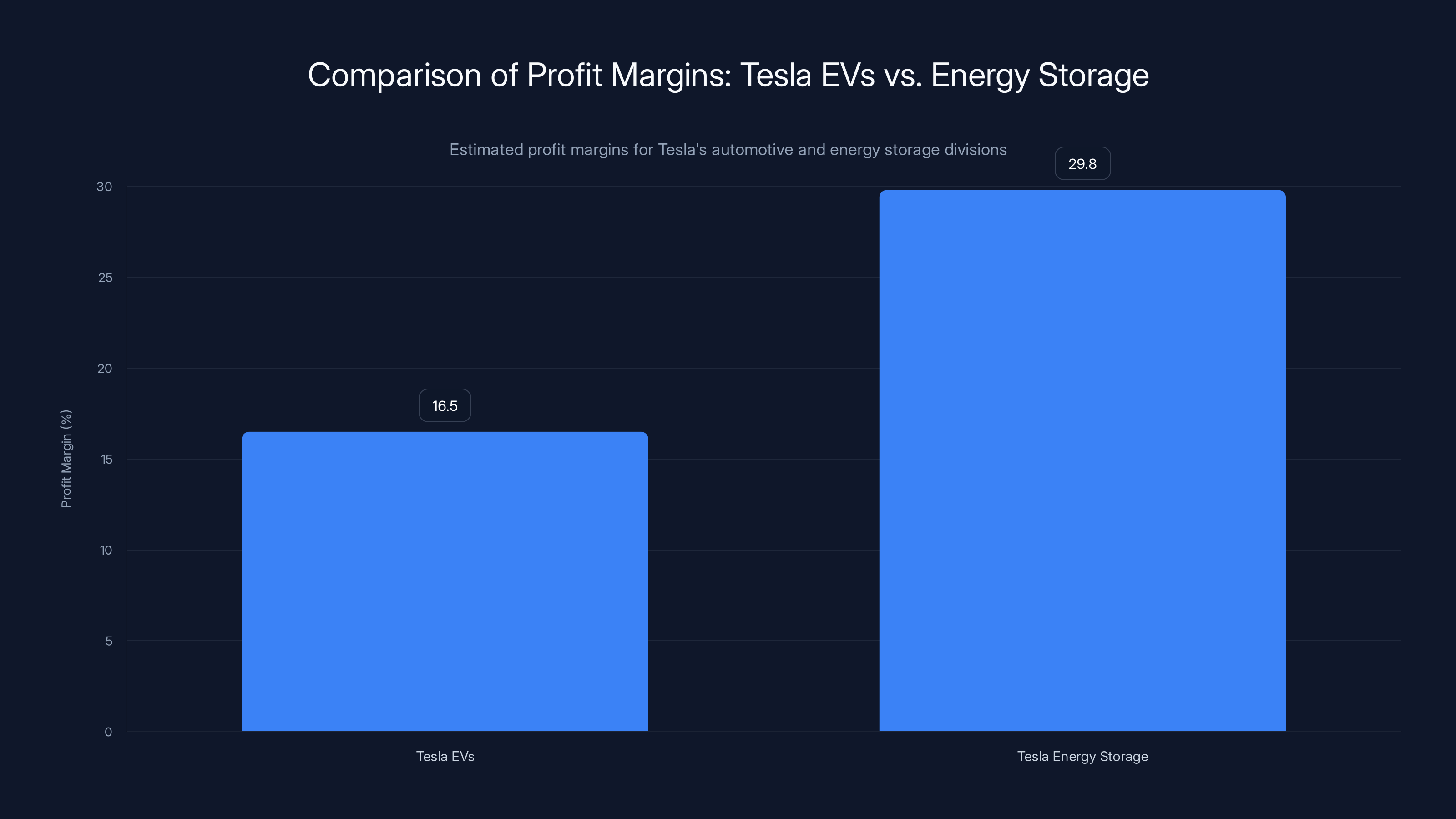

And the margins? Nearly double what Tesla makes selling cars. The storage business pulled in 29.8% gross margins compared to roughly 15% for automotive. That's the difference between a volume play and a money machine.

The numbers are staggering if you know where to look. In the fourth quarter alone, the Megapack—Tesla's industrial-scale battery system—contributed

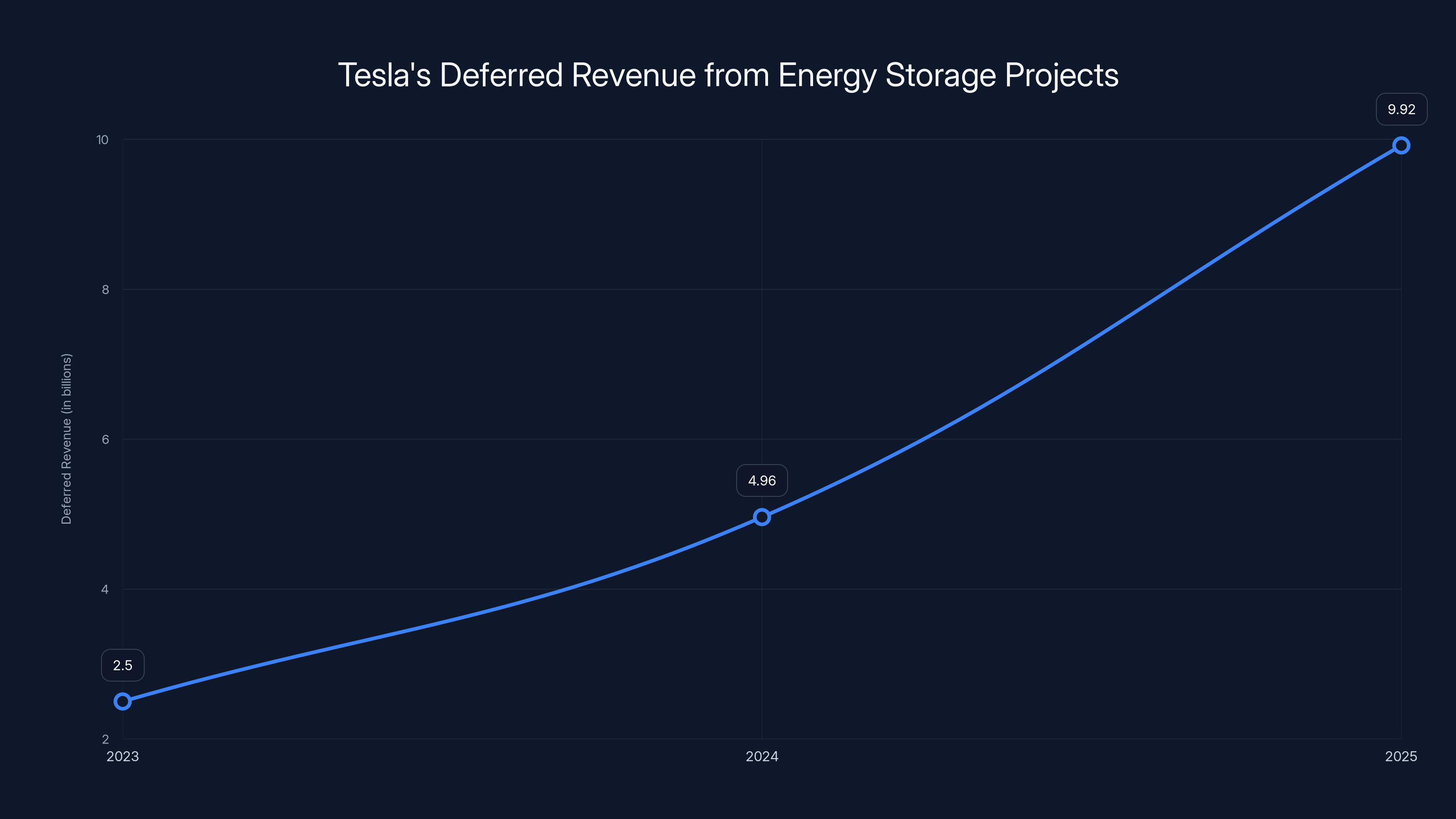

But here's the really important part: the company's deferred revenue tells you what's coming next. Tesla's 2025 10-K filing to the SEC revealed something that should make investors sit up straight. The company expects to recognize $4.96 billion in deferred revenue from storage projects already underway in 2026. That's more than double what it recognized in 2025.

Translate that: the pipeline is full. The work is already booked. The revenue is essentially locked in.

This isn't hype or speculation. This is cash that's already promised, projects that are already signed, and customers that have already committed. It's the difference between projecting growth and guaranteeing it.

What's driving this explosion? Why is Tesla suddenly dominating in energy storage when the EV market is softening? The answer lies in a perfect storm of grid instability, AI infrastructure demands, renewable energy proliferation, and battery costs that keep dropping. Throw in policy tailwinds (at least for now), and you've got an environment where Tesla's energy storage products aren't just nice to have. They're essential.

But it's not all smooth sailing. Tariffs are creeping in. Policy changes are shifting. Competition is intensifying. The average selling price of a Megapack is down, suggesting the market is getting more crowded.

Still, Tesla is confident. The company sees AI infrastructure driving rapid load growth on electrical grids worldwide. It sees opportunities to stabilize grids, shift energy when it's needed most, and provide additional power capacity. It sees a future where energy storage doesn't supplement the grid. It becomes the grid.

This article digs into everything you need to know about Tesla's energy storage business. We'll break down what's happening, why it's happening, and what it means for Tesla's future, the energy industry, and the global shift toward renewable power.

TL; DR

- Tesla deployed 46.7 gigawatt-hours of storage in 2025, a 48% increase, growing faster than any other company division

- Storage business margins hit 29.8%, nearly double automotive margins, driving nearly 25% of gross profit

- Deferred revenue more than doubled to $4.96 billion, signaling locked-in growth for 2026 and beyond

- Megapack and Powerwall products now generate $12.8 billion in annual revenue with strong year-over-year growth

- AI infrastructure and grid stabilization are the primary demand drivers, creating secular tailwinds for the business

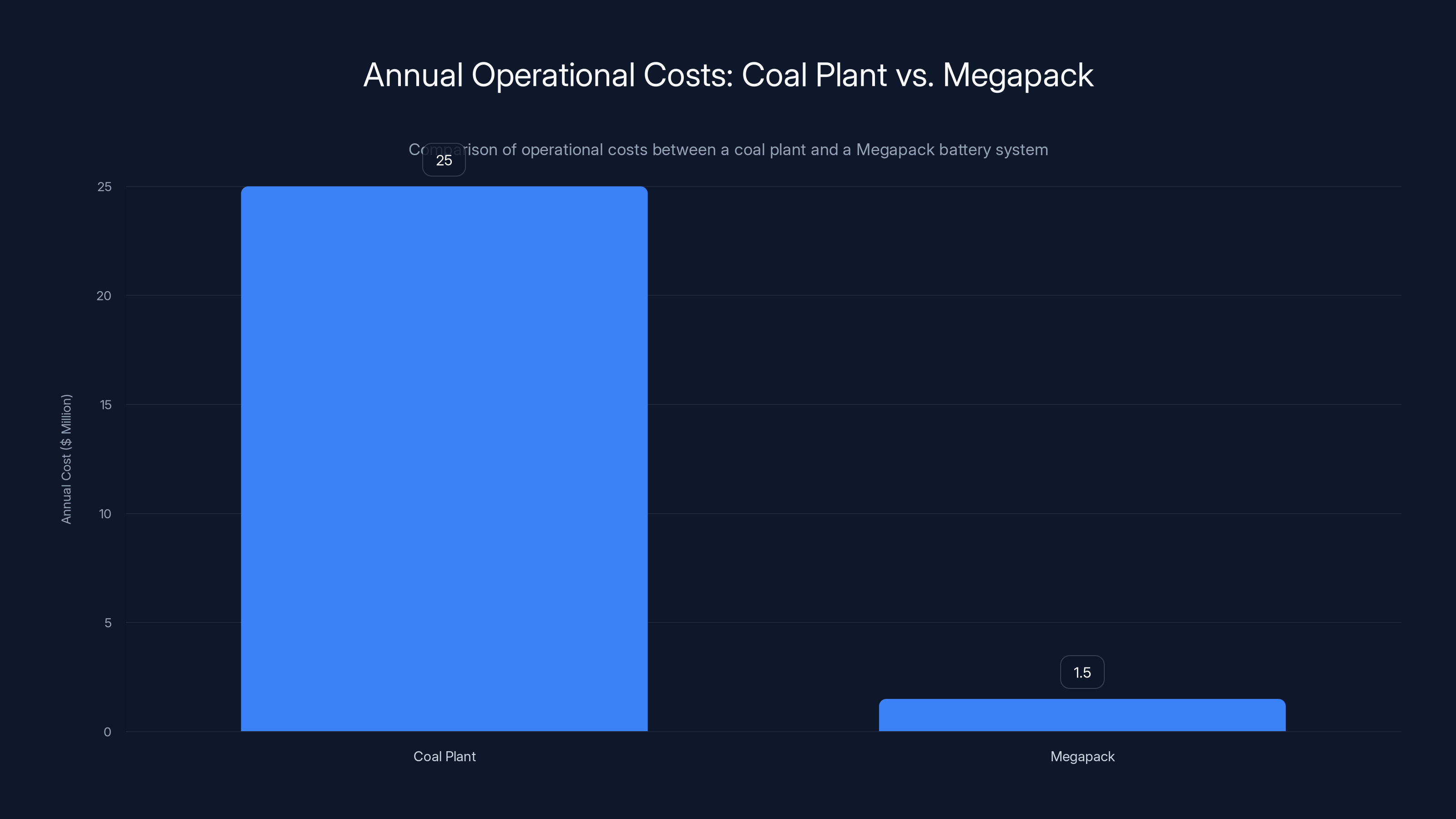

The Megapack system significantly reduces annual operational costs compared to a traditional coal plant, saving approximately $23.5 million annually. Estimated data.

The Megapack Moment: How Tesla Became an Energy Storage Company

Tesla's journey into energy storage wasn't accidental. It started with a crisis.

Back in 2015, South Australia faced a catastrophic blackout. The power grid collapsed during a storm, leaving hundreds of thousands without electricity. The state government scrambled for solutions and turned to Elon Musk, who famously bet $50 million he could deploy a 100-megawatt battery in 100 days or it would be free. Tesla won that bet. The Hornsdale Power Reserve became the world's largest lithium-ion battery system at the time, and it worked spectacularly.

That project proved something crucial: Tesla could solve real grid problems at scale. It wasn't just theory. It was engineering that worked.

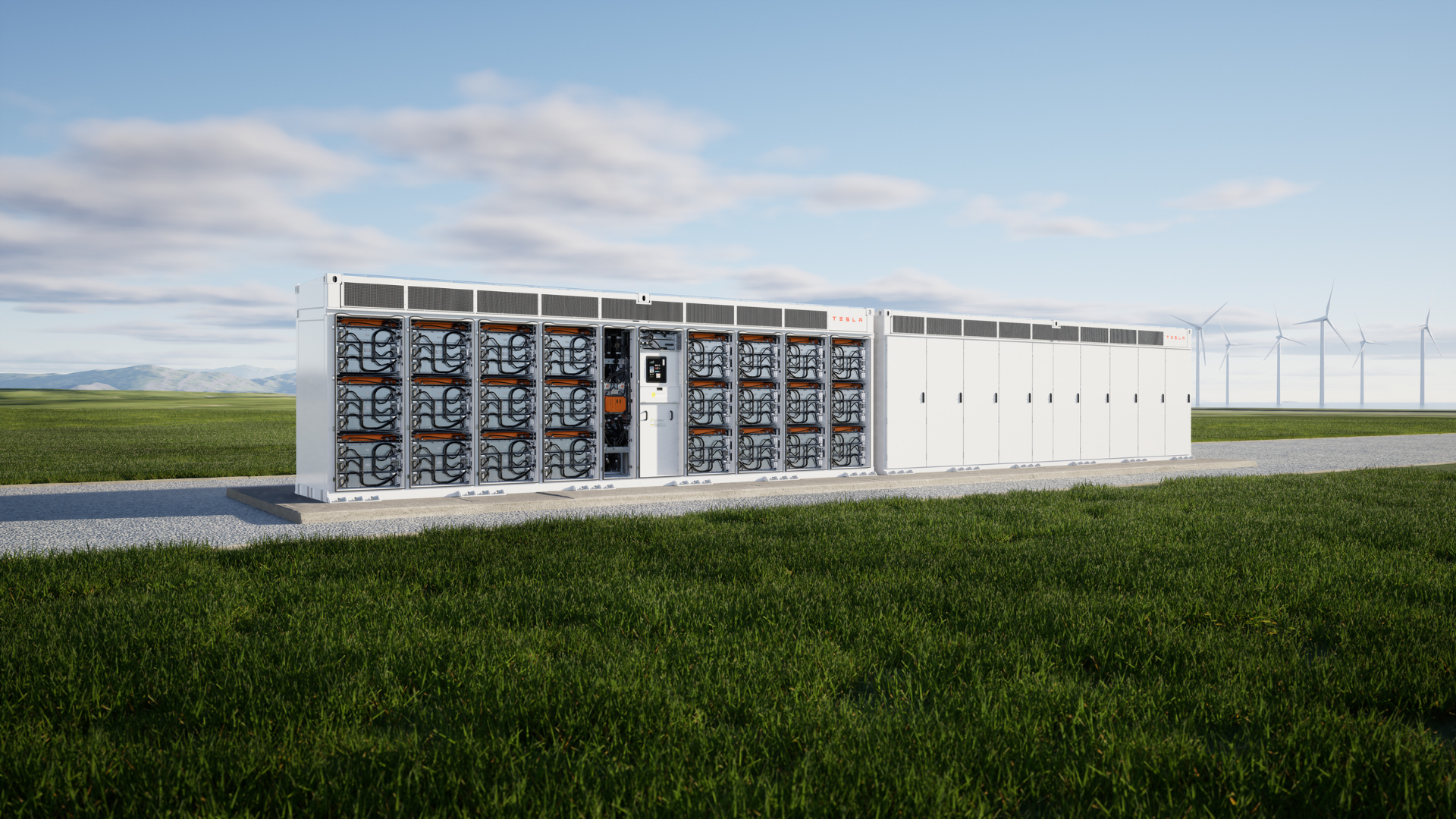

Fast forward a decade, and the Megapack is now Tesla's flagship product. Think of it as the opposite of a Powerwall. Where a Powerwall is personal, a Megapack is industrial. Where a Powerwall backs up your home during outages, a Megapack stabilizes entire regions during peak demand.

One Megapack packs 3.75 megawatt-hours of capacity and comes in a 40-foot shipping container. Stack a few together, and you've got the energy equivalent of a small power plant, except it charges in minutes and discharges in seconds. No fuel. No emissions. No maintenance headaches.

The economics are stunning. Utilities can deploy Megapacks to replace aging natural gas peaker plants that only run when demand spikes. Those gas plants sit idle most of the year, accumulating maintenance costs and aging equipment. A Megapack is pure capex upfront, then it prints money through frequency regulation, demand response, and arbitrage services.

The Megablock is Tesla's next evolution. It's essentially Megapacks that combine battery storage with power conversion, solar integration, and grid interconnection all in one modular system. You don't need separate equipment. You just stack blocks and turn it on.

Meanwhile, the Powerwall remains the consumer-facing hero. At roughly

What ties these three products together is the software. Tesla's energy management system is the nervous system of the whole operation. It decides when to charge, when to discharge, what price to accept, and how to maximize revenue. It talks to the grid. It talks to solar panels. It talks to the utility's computers. It even talks to your electric vehicle.

That software isn't commoditized. You can't just download it from Git Hub. It's proprietary. It's real intellectual property. And as Tesla deploys more hardware, the dataset powering that software gets bigger, the algorithms get smarter, and the competitive moat gets deeper.

That's the real story. Tesla didn't just build better batteries. It built a full energy management ecosystem where the hardware and software are inseparable. The more systems you deploy, the more data you get. The more data you get, the better your software gets. The better your software gets, the more competitive you become.

It's the flywheel that most people miss.

Tesla's deferred revenue from energy storage projects nearly doubled from

Why Energy Storage Is Growing Faster Than EVs

Tesla's EV business is mature. The Model 3 and Model Y have been around for years. Competition is fierce. Chinese EV makers are undercutting on price. Gas prices are cheap. Interest rates spike, making loans more expensive. The automotive cycle is hitting a saturation point where growth slows.

Energy storage, by contrast, is in the early innings of a decades-long secular trend.

Think about the fundamental problem: renewable energy is intermittent. Solar panels work great when the sun is up. Wind turbines work when it's breezy. But grids need power 24/7. When the sun sets and the wind dies, you need something to bridge that gap. That's where batteries come in.

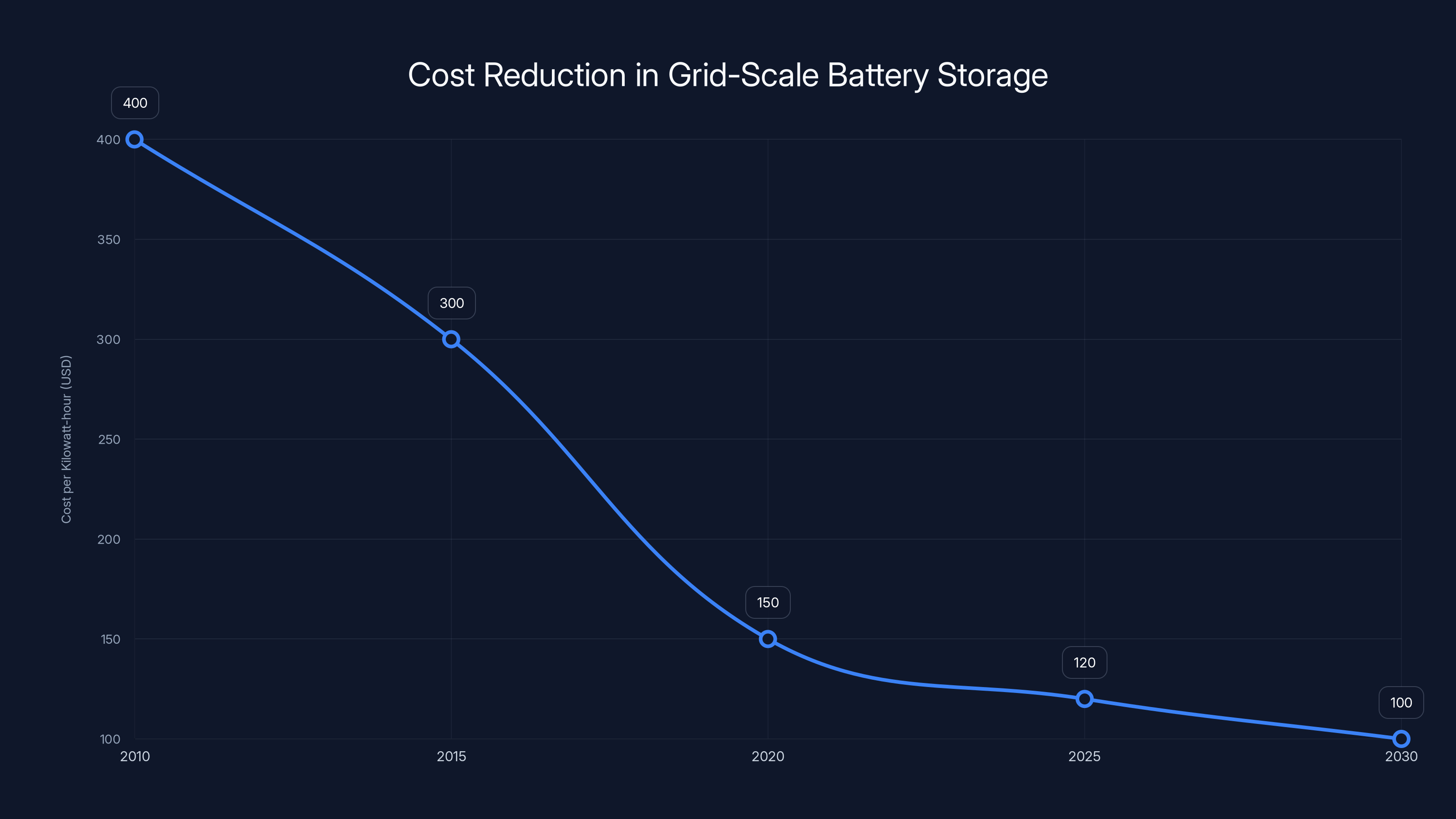

For years, batteries were too expensive to make sense at grid scale. A decade ago, grid-scale battery storage cost over

As costs drop, the use case becomes irresistible. Utilities build solar farms knowing they can pair them with batteries. They build wind farms and add storage. They replace aging fossil fuel plants with batteries because the total cost of ownership is now cheaper. The economics have flipped from "batteries are a nice bonus" to "batteries are required infrastructure."

Meanwhile, grid demand is accelerating. AI data centers are electricity hogs. One large AI training facility can consume as much power as 50,000 homes. Bitcoin mining operations pump gigawatts into the grid. Electric vehicle charging networks are growing. Heat pumps are replacing gas furnaces.

The grid is getting strained. Utilities are scrambling to add generation and storage capacity. Traditional power plants take years to build. Battery systems can be deployed in months. The speed advantage is decisive.

Policy helps too. The Inflation Reduction Act provides investment tax credits for energy storage systems. While residential Powerwall credits are being phased out, commercial and utility-scale storage credits run through the mid-2030s. That's a 7-8 year runway where every utility-scale deployment gets a meaningful tax benefit.

That's not a small incentive. For a utility spending

Add all this together and you've got a growth environment that's almost unusually favorable. Renewable energy is scaling. Grid demand is climbing. Batteries are getting cheaper. Policy is supportive. Competition exists, but it's fragmented. There's no single dominant competitor the way Tesla dominates EVs.

That's the opening Tesla is walking through.

The Margin Story: Why Storage Profits Dwarf EV Revenue

Here's where the real story lives: margins.

Tesla's automotive business is brutally competitive. The company has slashed prices repeatedly to maintain market share. Model 3 and Model Y pricing has dropped 30-40% since their original launch. Competition from legacy automakers, EV startups, and especially Chinese competitors, has turned the market into a race to the bottom.

Gross margins on automotive are roughly 15-18% depending on the quarter. That sounds healthy. It's not. For a capital-intensive manufacturing business, 15-18% barely covers depreciation, R&D, and overhead costs.

Energy storage is different. Margins are 29.8%. That's nearly double.

Why the difference? Several factors.

First, there's less competition in energy storage than in EVs. Competitors include Fluence Energy, Southern Company's battery division, and various Chinese manufacturers. But none of them have Tesla's brand, scale, or software capabilities. The market hasn't consolidated around a clear winner yet.

Second, energy storage products are more modular. You can adjust production volumes with less disruption. You can increase prices in hot markets and decrease them in competitive ones. Utilities will pay for reliability and performance. They won't necessarily buy the cheapest option.

Third, the software layer matters. Tesla's energy management software is proprietary and valuable. Utilities value the intelligence and optimization it provides. That software component carries high margins that subsidize the hardware.

Fourth, supply chains are shorter. A Megapack is a battery module inside a container. No complex assembly. No 2,000 moving parts like a car. Logistics are simpler. Supply disruptions are less likely.

Here's the math that matters: Tesla deployed 46.7 gigawatt-hours of storage at an average selling price that generated

Compare that to a Model Y at

A Megapack gets installed and forgotten. It works. It generates revenue. It requires minimal support.

This is why Tesla is shifting corporate focus to energy storage. The profit per unit is lower in absolute dollars, but the capital efficiency is better. You spend less upfront to generate the same profit.

Let's look at the 2025 numbers specifically. The storage business contributed approximately 23-25% of Tesla's gross profit while representing roughly 17-18% of revenue. That's outperformance. The automotive business is doing the opposite: 80%+ of revenue, but declining margins.

The trajectory is clear. As the storage business grows and scales, it becomes an increasingly important profit driver. As automotive commoditizes, it becomes less important. In five years, energy storage could represent 40-50% of gross profit while still being under 30% of revenue.

That's a more profitable Tesla.

In 2025, Tesla's energy storage business accounted for 17-18% of revenue but contributed 25% to gross profit, highlighting its higher profitability compared to the EV segment. (Estimated data)

Deferred Revenue: The Hidden Signal of Future Growth

If you want to understand what's really happening at Tesla, skip the quarterly earnings press release. Read the 10-K filing. Specifically, read the deferred revenue section.

Deferred revenue is money customers have already paid for products or services that haven't been delivered yet. It's the most reliable indicator of future revenue a company has. It's not an estimate. It's not a forecast. It's cash already received.

For energy storage, Tesla's deferred revenue situation is extraordinary.

In 2025, the company recognized

Why the difference? Because large-scale storage projects are milestone-based. Tesla doesn't recognize revenue when a contract is signed. It recognizes revenue when physical milestones are achieved. Maybe it's 25% when the site is prepared. Another 25% when equipment is delivered. Another 25% when it's installed. The final 25% when it passes performance testing.

This structure protects both Tesla and the customer. The customer doesn't pay until work is done. Tesla doesn't claim revenue until performance is demonstrated.

But it also creates this situation: the company books the project, receives a down payment or progress payments, and records it as deferred revenue. Then over quarters or years, as milestones are hit, that deferred revenue converts to recognized revenue.

When deferred revenue almost doubles year-over-year, it means the pipeline of signed projects nearly doubled. The company signed roughly $10 billion worth of storage projects in 2025 if the deferred revenue is representative of typical pricing.

That's stunning. That's not projected. That's not hoped for. That's contracted.

For investors, this matters enormously. If Tesla signs $10 billion in storage projects in 2025, and recognizes half of that as revenue in 2026, the company is guaranteed to grow storage revenue by 50% even if it signs zero new projects in 2026.

Of course, it won't sign zero projects. The pipeline will only get bigger.

This is why the energy storage business is so much more predictable than automobiles. Car sales depend on consumer demand, economic cycles, interest rates, and sentiment. A customer can cancel an order anytime. But utility-scale storage projects are locked in. Utilities have to hit generation requirements. They've signed contracts with regulators to provide power. They've committed to customers. They can't just walk away.

The deferred revenue structure essentially guarantees Tesla's storage revenue growth for the next 18-24 months. It's as close to guaranteed revenue as a hardware company can get.

Wall Street loves this kind of visibility. That's probably why Tesla stock held up despite the 45% profit decline in 2025. The market could see that the EV business was struggling, but it could also see that energy storage was accelerating and would be carrying the company forward.

Megapack Economics: Why Utilities Are Choosing Batteries Over Fossil Fuels

Let's get specific about why utilities are buying Megapacks in record numbers.

Consider a utility on the West Coast. It operates a coal plant built in 1978. The plant runs at about 30% capacity factor, meaning it only runs 30% of the time. The other 70% of the time, it's idle but consuming money: maintenance crews, security guards, insurance, property taxes, environmental compliance.

The plant cost

That plant is a peaker. It runs when demand is highest, usually on hot summer afternoons when everyone's air conditioning is running. It ramps up slowly—coal plants take hours to reach full output. But it runs reliably and generates predictable power.

Now imagine Tesla offers a different solution: a 500-megawatt battery system using Megapacks. The total installation cost is $200 million. It can fully charge or discharge in minutes. It needs almost no maintenance. It occupies a small footprint. It has zero emissions.

The operational cost is minimal: maybe $1-2 million per year for monitoring and occasional component replacement. No fuel. No emissions compliance. No environmental liability.

The math shifts. The coal plant is a

But there's more. That battery can also provide grid services that generate revenue. The utility can sell frequency regulation to the grid operator—basically, the battery adjusts its charging or discharging to keep the grid frequency stable. That's worth $1-3 million per year depending on the market.

The utility can also offer demand response services. When demand is high and prices spike, the battery discharges and sells that power at high prices. When demand is low and prices crash, the battery charges. That's arbitrage, and it can generate $2-4 million per year depending on price volatility.

Suddenly, the battery isn't just a replacement for the coal plant. It's a profit center.

The investment tax credits sweeten the deal. A

Over a 30-year service life, that battery infrastructure is dramatically more profitable and less risky than the coal plant it's replacing.

This is happening across the country. Utilities are retiring coal plants and replacing them with batteries. That's driving utility-scale storage demand. That's why Megapack orders are accelerating.

It's also why competition is increasing. Fluence Energy, a joint venture between Siemens and AES Corporation, is a major competitor. It's also deploying storage at scale. Chinese battery makers are entering the market. Legacy power equipment companies are launching battery products.

But Tesla has advantages. The Megapack is proven. Tesla has deployed more utility-scale storage than any other company. The software is mature and reliable. The company has a track record of delivering projects on time.

That matters when you're making a $100+ million decision.

Still, the competition is real. The average selling price of a Megapack declined in 2025, indicating margin pressure. As more competitors enter the space, pricing will likely remain competitive.

But that's not necessarily bad for Tesla. Growth that matters more than margins. If Tesla maintains market share and volume grows 50% per year while prices decline 20%, the business still grows 30% in revenue and probably 40%+ in units. That's the environment we're in.

Tesla's energy storage division has a significantly higher profit margin (29.8%) compared to its automotive division (16.5%). This is due to less competition, modular products, valuable software, and shorter supply chains. Estimated data.

The Powerwall Effect: Residential Storage Becoming Mainstream

Utility-scale projects are the headline, but the Powerwall is the story that's quietly scaling.

Tesla has installed over 3 million Powerwalls globally. That's 3 million homes that can now backup power during outages, store solar energy, and participate in grid services. That's 3 million customers who have a relationship with Tesla's energy ecosystem.

The Powerwall economics are fascinating because they're fundamentally different from utility-scale.

A residential customer buys a Powerwall for three reasons: reliability, sustainability, and economics. They want backup power when the grid goes down. They want to use solar energy they generate instead of buying it from the utility. They want to save money over time.

For a homeowner in California with a

In many parts of California, daytime solar rates are

Add in backup power value (insurance against outages), and the Powerwall starts to look rational economically, not just ideologically.

Tesla is also launching grid services programs where Powerwalls can participate in demand response and frequency regulation. In some markets, homeowners can earn $50-200 per month by allowing Tesla to dispatch their Powerwall during peak demand periods.

It sounds small, but for a

For Tesla, the Powerwall economics are even better. The installed base creates a recurring revenue stream from grid services. It also creates a data asset. Tesla's fleet of 3 million Powerwalls is effectively a distributed power plant that responds to grid signals. That's incredibly valuable for grid operators.

The policy environment was helpful. Residential solar customers got investment tax credits that applied to batteries. But those residential storage credits are being phased out. The One Big Beautiful Bill Act (OBBBA) phased out most residential tax credits.

That's a headwind. Without the tax credit subsidy, the Powerwall becomes less compelling economically for price-conscious customers. The payback period stretches from 8-10 years to 12-15 years.

But it doesn't kill the business. Powerwall growth will likely slow from the 50%+ rates we saw in 2024-2025, but it'll continue. The product is good. The value proposition is real. It's just not subsidized anymore.

For utilities, by contrast, the commercial storage tax credits continue through the mid-2030s. That's the real growth market. Commercial, industrial, and utility-scale deployments will accelerate while residential growth moderates.

It's a shift, not a collapse.

Solar Integration: Completing the Energy Ecosystem

Tesla's energy storage products don't exist in isolation. They're part of a broader energy ecosystem that includes solar panels, inverters, and energy management software.

That integration matters enormously for customer value and Tesla's competitive position.

When you install a Powerwall or a Megapack, the system optimizes when to charge and discharge based on solar generation, grid prices, and upcoming weather. If the weather forecast shows two days of clouds, the system charges aggressively. If a sunny weekend is coming, it discharges to prepare capacity. If grid prices are high, it discharges. If prices are low, it charges.

All of that requires integrated software that understands solar generation, battery state, grid signals, and price forecasts. It's not trivial to build. It's a competitive advantage to have it working well.

Tesla's acquisition of Solar City back in 2016 was criticized by many as expensive and overpaid. At the time, people questioned why Tesla needed solar. The answer was always integration and the flywheel effect.

Tesla Solar generates the electricity. Powerwall or Megapack stores it. Tesla Energy software manages it. The customer gets a seamless, integrated experience. They don't need to install solar from one company, batteries from another, and software from a third. It all comes from Tesla.

That's a powerful position. It's harder for customers to switch. It's harder for competitors to poach customers. It's easier for Tesla to upsell and cross-sell.

In the 2025 results, Tesla's solar business is lumped together with storage in the overall energy division. The company deployed enough solar to generate kilowatt-hours that, when combined with storage revenue, totaled $12.8 billion.

The solar business has been volatile. Sunrun and Vivint Solar (now owned by Sunrun) dominate residential solar. But Tesla's solar business is profitable and strategically important because of the integration with Powerwall and the software layer.

As energy storage scales, the solar integration becomes more valuable. A Megapack by itself is useful. A Megapack integrated with solar generation, grid signals, and optimized software is more useful and worth more money.

That's how Tesla is building competitive moat: not through any single product, but through integration across hardware, software, and services.

The cost of grid-scale battery storage has significantly decreased from over

The AI Infrastructure Catalyst: Why Grid-Scale Storage Is About to Explode

Here's the story that most energy analysts are underestimating: AI infrastructure demand.

Large language models like Claude, GPT-4, and Gemini require enormous computational power. Training a state-of-the-art LLM can consume terawatt-hours of electricity. Running inference servers at scale burns gigawatts continuously.

Take Open AI's infrastructure as an example. The company is rumored to be consuming 1+ gigawatts of continuous power globally. Anthropic, Google Deep Mind, and Meta all have similar or larger power footprints.

Data centers typically run at higher capacity factors than other industrial loads. They run 24/7/365. They can't be turned off for maintenance without affecting service.

That creates a problem: data centers need stable, reliable power. Brownouts or blackouts mean lost revenue and angry customers. Spikes in grid demand strain utilities and can cause cascading failures.

Batteries solve this problem. By deploying battery storage adjacent to or integrated with data centers, operators can absorb grid volatility, buffer demand spikes, and provide backup power if the grid fails.

That's a huge use case that barely existed five years ago.

Tesla is well positioned for this. The Megapack can be configured to provide power for multiple hours, or configured as a high-power system for fast frequency response. It can be deployed quickly, modularly, and reliably.

And here's the money part: data centers will pay premium prices for battery storage. They can't afford downtime. The value of backup power to a data center running an AI inference service is enormous. If the grid fails and the battery doesn't, you've saved the data center from losing millions of dollars per hour in downtime.

During the 2025 earnings call, Tesla management specifically highlighted AI infrastructure driving grid demand as a reason for optimism about storage growth. That's not new information. That's a confirmation of what smart investors already knew.

But what's interesting is the magnitude. Goldman Sachs estimates AI infrastructure will require 160 gigawatts of new generation and storage capacity by 2030. That's roughly 10-15% of the entire U.S. electrical generation capacity today.

If Tesla captures just 5-10% of that market, we're talking about 8-16 gigawatts of Megapacks deployed over the next 5 years. That's thousands of units. That's tens of billions of dollars in revenue.

For context, Tesla deployed 46.7 gigawatts in all of 2025. If it deployed 8-16 gigawatts per year for five straight years, it would be doubling production just to serve AI infrastructure growth.

That's the tailwind nobody's talking about.

Tariffs and Policy Headwinds: The Real Challenges Ahead

But the story isn't all roses and exponential growth curves. There are real headwinds that could slow Tesla's energy storage momentum.

The biggest one is tariffs. When the administration proposed tariffs on Chinese imports, the battery industry watched nervously.

Here's why: battery cells are expensive and global supply chains are concentrated. Cobalt comes from the Democratic Republic of Congo. Lithium comes from Australia, Chile, and China. Nickel comes from Indonesia. The processing and refining is concentrated in China, which produces roughly 70% of the world's battery cells.

Tariffs on Chinese battery cells would increase costs substantially. Tesla manufactures some cells domestically (at Gigafactory Nevada), but not enough to meet all of its demand. The company relies on imports from CATL and other suppliers.

If tariffs raise battery cell costs by 20-30%, that's devastating to margins. A storage system with 29.8% gross margins could easily drop to 20% margins if input costs rise materially.

Tesla flagged this risk explicitly in its 2025 10-K filing: "Tariffs and provisions in the One Big Beautiful Bill Act also threaten to increase battery cell prices."

That's not a casual warning. That's management highlighting a material risk.

The other policy challenge is the phaseout of residential storage tax credits. The OBBBA eliminated most tax credits for residential energy storage systems like the Powerwall. That was intentional policy—the idea was to focus credits on utility-scale systems that provide grid services, not individual homeowners.

It's a rational policy, but it's a headwind for Powerwall sales. Without the tax credit, the payback period extends from 8-10 years to 12-15 years. That kills the deal for many price-conscious customers.

Commercial storage credits continue through the mid-2030s, so utility-scale and commercial deployments will accelerate. But residential growth will moderate.

For Tesla overall, that's not a disaster. The company is more focused on Megapack than Powerwall anyway. But it does mean Powerwall growth will slow materially.

There's also the question of supply constraints. Tesla is building a new Megapack factory in Mexico. It's expanding capacity. But can it grow production fast enough to match demand?

If demand accelerates due to AI infrastructure and grid needs, and Tesla can't expand production, the company will be capacity-constrained. That would push prices up and volume growth down.

That's actually a good problem to have—you'd rather be supply-constrained than demand-constrained. But it's a constraint nonetheless.

Tesla's energy storage is projected to grow significantly, reaching 140 GWh deployed by 2030, with revenue potentially hitting $34.4 billion. Estimated data based on 50% annual growth.

Competition Intensifying: The Megapack Isn't Alone Anymore

Tesla's dominance in energy storage isn't uncontested. Competition is real and accelerating.

Fluence Energy is the most credible competitor. It's a joint venture between Siemens and AES Corporation, combining Siemens' power electronics expertise with AES's grid operational experience. Fluence is deploying storage systems at scale and has taken market share.

Nextek, Kore Power, and other battery makers are entering the utility-scale storage market. They're working with system integrators and developers to compete on price and performance.

Chinese battery makers like CATL, BYD, and SVolt are launching grid-scale storage products. They have advantages in battery cell manufacturing and cost structure.

Legacy power equipment companies like GE and Siemens are investing in battery storage divisions.

The market is consolidating, but not yet won. Fluence and Tesla are the leaders, but there's room for multiple viable competitors.

Tesla's advantages are real: scale, software, brand, and execution track record. But the company doesn't have a moat as deep as it has in EVs. Battery cells are commoditizing. Power electronics are available from multiple suppliers. Software is important but can be replicated by well-resourced competitors.

The evidence is in the average selling price. Tesla's Megapack ASP declined in 2025. That suggests pricing pressure. It's not a crisis—the company is still hugely profitable—but it's a signal that competition is real.

Over the next 5-10 years, expect this market to look more like the automotive industry: multiple strong competitors, differentiation on product and service, pricing pressure, but enough market growth to support multiple billion-dollar winners.

Tesla should still grow significantly. But it probably won't monopolize the market the way it did with EVs in the early years.

The Software Advantage: Why Integration Matters

If you ask what Tesla's real competitive moat is in energy storage, it's not the battery cells. Those are commoditizing.

It's not the containers. Those are standard.

It's the software.

Tesla's energy management system is a collection of algorithms and machine learning models that constantly optimize battery operations. It talks to the grid operator. It talks to the utility. It integrates with solar generation forecasts. It learns from historical patterns.

The system decides: Should we charge now or wait? Should we discharge? At what price? For how long? What reserve capacity should we maintain for emergencies?

Optimizing those decisions even slightly can mean the difference between a mediocre battery and a highly profitable one.

Consider a Megapack arbitraging power prices. If the algorithm is 95% optimal, it makes

Over a 30-year battery life, that's a $30 million difference in total profit from a single system. That's why utilities will pay for better software.

Tesla's advantage here is data. The company has 3+ million Powerwalls deployed globally. Each one generates data every 15-30 minutes: how much power was generated, how much was stored, how much was discharged, what was the grid frequency, what was the price, what happened next?

That's petabytes of real-world data. It's infinitely more valuable than synthetic data or simulations.

As Tesla deploys more Megapacks, that dataset grows. The algorithms get trained on more diverse operating conditions. The models get better.

Competitors with fewer deployed systems have smaller datasets and less sophisticated algorithms. They're playing catch-up.

It's the classic flywheel: more deployments lead to more data, which leads to better software, which leads to more competitive products, which leads to more deployments.

But it takes time to build. You can't just license better software from a third party. You have to deploy at scale, gather data, train algorithms, and iterate. That takes years.

Tesla has a 5-7 year head start on most competitors. That matters.

Grid Stability and Frequency Regulation: The Unsexy Business That Makes Money

One of the most profitable services energy storage provides isn't exciting to talk about. It's frequency regulation.

Electrical grids operate at a target frequency: 60 Hz in North America, 50 Hz in most other places. If too much electricity is being drawn and not enough is being generated, the frequency drops. If too much is generated and not enough is being used, the frequency rises.

Both are problems. If the frequency drops too far, power plants shut down and you get cascading blackouts. If it rises too far, equipment gets damaged.

Utility operators have to balance supply and demand constantly. They turn power plants on and off, adjust output, and coordinate across regions to keep the frequency stable.

Battery storage makes this easier. The batteries can charge or discharge in milliseconds. If the frequency drops, a battery can instantly discharge power to stabilize it. If the frequency rises, it can instantly charge to absorb power.

Utility operators pay for this service. The payments vary by region and time of day, but they're usually $1-3 million per year for a battery system like the Megapack.

That might sound small compared to a

These services are hugely important for grid operators. As more renewable energy comes online—wind and solar, which are intermittent—the grid becomes less stable naturally. You need more balancing resources to keep frequency stable.

Batteries are the most responsive and cost-effective balancing resource available. That's why utilities are buying them. Chinese battery makers might compete on price. Competitors might copy Tesla's hardware. But the software that optimizes frequency regulation revenue, that's harder to replicate.

It requires deep expertise in grid operations, real-time control systems, and machine learning. It requires relationships with grid operators and utility engineers. It requires years of operational data to train the algorithms.

Tesla has all of that. Most competitors don't.

It's an advantage that won't disappear quickly.

Manufacturing Scaling: The Factory Bottleneck

Here's a question that doesn't get enough attention: Can Tesla actually build Megapacks fast enough to meet demand?

The company announced a new Megapack factory in Mexico. It's still ramping. The Nevada Gigafactory is expanding battery production. But there are real manufacturing constraints.

Building a Megapack isn't trivial. Each unit has thousands of battery cells. Those cells need to be tested, packaged into modules, and integrated into the pack. Then the pack needs to be installed in the container with power electronics, cooling, and monitoring equipment.

Each step requires capital, expertise, and time. Tesla isn't operating at 90% utilization and easily ramping. It's likely operating at the edge of capacity or slightly capacity-constrained.

If demand continues to accelerate (AI infrastructure, grid modernization), Tesla might struggle to expand production fast enough. That would be a constraint on growth.

From a business perspective, that's okay. Supply-constrained is better than demand-constrained. You can charge higher prices. You can be selective about customers. You can prioritize projects with the best margins.

But it does mean energy storage growth might hit a ceiling imposed by manufacturing capacity rather than market demand.

Tesla is investing to expand capacity. The Mexico factory should add meaningful production. But timelines matter. If Mexico factory doesn't come online until 2027 or 2028, that's two years of potential growth the company can't capture.

Manufacturing reality is that expansion takes time. You can't will a factory into existence. You have to plan it, finance it, build it, equip it, and ramp it. That's a 3-5 year process minimum.

Given the current demand trajectory, Tesla is probably planning for 100%+ annual growth in Megapack production for the next 5 years. If the company can only expand capacity 50% per year, you've got a problem.

It's a high-class problem. But it's a problem.

Future Projections: Where Energy Storage Could Be in 5 Years

Let's do some math about Tesla's energy storage future.

Assume the business grows 50% annually for the next five years (a slight slowdown from the 48% growth in 2025). That takes us from 46.7 gigawatt-hours deployed in 2025 to roughly 140 gigawatt-hours deployed annually by 2030.

Now assume the gross margin holds steady at 29.8% but revenue per gigawatt-hour declines 10% due to competition. That's a reasonable assumption given the industry dynamics.

2025 Revenue:

2030 Projection: If average price per GWh drops to

At 29.8% margins, that's $10.3 billion in gross profit from storage.

For comparison, Tesla's entire automotive gross profit in 2025 was around

That would mean energy storage is generating roughly 40-50% of gross profit from roughly 35-40% of revenue.

It's a fundamentally different company than today.

Now, these are projections. They assume things go reasonably well. They don't account for a major recession, a collapse in renewable energy investments, or a breakthrough battery technology that makes Megapacks obsolete.

But they do show the direction. Energy storage is on track to be Tesla's primary profit driver within five years.

For investors, that's significant. It means Tesla's future profitability depends on executing in a competitive, capital-intensive business, not on maintaining monopoly margins in EVs.

That's a different risk profile. Higher growth, lower margins, more competition. It's more like the power equipment business than the consumer electronics business.

But the scale is enormous. The global battery storage market is projected to grow from roughly

That's not hyperbole. That's the scale of what's possible.

Policy Drivers: Will Government Support Continue?

Policy has been a huge tailwind for energy storage. The Inflation Reduction Act created 30% investment tax credits for utility-scale storage. That's

That doesn't exist by accident. It exists because Congress wants to accelerate renewable energy deployment and grid modernization.

But policy can change. A new administration could eliminate credits, impose tariffs, or shift incentives to different technologies.

We saw that with residential storage credits being phased out. That was intentional policy—focus credits on grid-scale projects, not homeowner projects.

For utility-scale storage, the credits run through the mid-2030s. That's institutional commitment. But beyond 2035, who knows?

Tariff policy is more volatile. If tariffs on Chinese batteries remain at current levels, costs will increase. If they ratchet higher, the economics get bad. If they're eliminated, costs decline.

For Tesla, higher tariffs are actually somewhat helpful because Tesla manufactures domestically and can pass costs to competitors who rely on imports. But it's still bad for overall industry growth.

Policymakers are also increasingly interested in domestic battery manufacturing capacity. Both parties want the U.S. to produce batteries domestically, not import them from China.

That's actually good for Tesla. The company is building significant domestic battery capacity. If tariffs on imports force utilities and developers to buy domestic, Tesla is well positioned.

The long-term policy direction seems supportive: encourage renewables and storage, penalize imports, build domestic capacity. That's a tailwind for Tesla's energy storage business.

But it's not guaranteed. Policy can shift. Elections matter. Administrations change. What looks certain today might be repealed tomorrow.

Smart energy companies plan for multiple policy scenarios. They don't bet their entire business model on subsidies continuing forever.

Tesla seems to be doing that. The company emphasizes that storage is economic even without tax credits in many markets. The value proposition stands on its own. The credits are just upside.

That's the right approach. If policy supports storage, great, growth accelerates. If policy shifts, the business still works, just slower.

The Bottom Line: Energy Storage Is the Future

Tesla's energy storage business isn't the headline. The company's struggles in the EV market are.

But paying attention to the headline while ignoring the real story is a mistake.

The real story is that Tesla has built a profitable, high-growth business in energy storage that's less competitive, more profitable, and more secular than its flagship electric vehicle business.

Energy storage is growing 48% annually. It's generating nearly double the margins of automotive. It's capturing nearly 25% of gross profit from roughly 17% of revenue. The pipeline is full with $5 billion in deferred revenue.

AI infrastructure is driving new demand. Utilities are retiring fossil fuel plants and replacing them with batteries. Grid modernization is accelerating. Climate policy is supporting renewable energy and storage.

All of that is tailwind for energy storage. All of that creates a multi-decade opportunity.

Competition exists. Tariffs are a risk. Policy could change. Manufacturing capacity is constrained.

But none of that negates the fundamental opportunity. Energy storage is where the growth is. It's where the margins are. It's where Tesla's future profit lies.

Investors focused solely on Tesla's EV business are missing the bigger picture. The company is transitioning from an electric vehicle manufacturer to an energy company. That transition takes time. But it's happening.

In five years, energy storage might be the reason to own Tesla stock. Not EVs.

That's a profound shift. But it's already underway.

FAQ

What is Tesla's Megapack?

The Megapack is Tesla's industrial-scale battery system designed for utilities and large-scale applications. Each unit provides 3.75 megawatt-hours of energy storage capacity in a shipping container-sized package and can charge or discharge in minutes, making it ideal for stabilizing grids, shifting power during peak demand, or backing up large industrial facilities like data centers.

How much faster is energy storage growing compared to Tesla's EV business?

Tesla's energy storage business grew 48% in 2025 while the overall company's profit fell 45% due to EV market challenges. Energy storage now represents nearly 25% of gross profit despite being only 17-18% of revenue, demonstrating superior profitability and faster expansion than the automotive division.

What are the economic benefits of battery storage for utilities?

Utilities benefit from lower operational costs compared to fossil fuel plants, revenue generation through grid services like frequency regulation (worth

Why are AI data centers driving demand for battery storage?

Large AI data centers consume 1+ gigawatts of continuous power and cannot tolerate grid outages. Battery storage provides backup power, buffers demand spikes, and stabilizes supply, protecting billions of dollars in revenue from potential downtime. With AI infrastructure projected to require 160 gigawatts of new generation capacity by 2030, grid-scale storage is becoming essential infrastructure.

What is deferred revenue and why does it matter for Tesla's energy storage?

Deferred revenue represents money customers have already paid for projects not yet completed. Tesla's deferred revenue from storage projects more than doubled to $4.96 billion in 2025, indicating locked-in projects worth billions in guaranteed future revenue. This provides exceptional revenue visibility and reduces forecasting uncertainty compared to consumer-focused businesses.

How do residential Powerwall systems generate revenue?

Powerwall owners save money through solar energy storage and time-of-use arbitrage, earning

What competitive challenges does Tesla face in energy storage?

Fluence Energy, along with Chinese manufacturers and emerging competitors, are accelerating market entry. Evidence of competition appears in declining Megapack average selling prices in 2025. However, Tesla maintains advantages through proven deployment track record, proprietary software optimization algorithms, and integration with solar products.

How do tariffs and policy changes affect Tesla's energy storage business?

Increased tariffs on Chinese battery imports raise manufacturing costs and could compress margins. However, the phaseout of residential storage tax credits hurts Powerwall sales while commercial credits extending through the mid-2030s support utility-scale deployments. Tesla management highlighted tariffs as a material risk in the 2025 10-K filing, but the business remains profitable without subsidies in many markets.

What is frequency regulation and why is it valuable?

Frequency regulation maintains electrical grid stability by keeping power output at 60 Hz (North America). Battery systems can instantly charge or discharge to stabilize frequency, a service utilities pay $1-3 million annually for. Grid operators increasingly rely on battery systems as renewable energy sources make grids more variable and harder to balance.

What is Tesla's projected growth trajectory for energy storage?

If Tesla maintains 50% annual growth with slight margin compression due to competition, the business could reach

Conclusion

Tesla's energy storage business is no longer a side project or a nice-to-have complement to electric vehicles. It's the company's growth engine, and increasingly, it's the primary driver of profitability.

The numbers are stark. A business growing 48% annually, commanding margins nearly double that of the company's core product, and sitting on $5 billion in contracted future revenue isn't sidekick material. It's the main character.

What makes this story even more compelling is the secular tailwinds pushing behind it. AI infrastructure is exploding and consuming massive amounts of electricity. Utilities are retiring fossil fuel plants at scale. Renewable energy is growing faster than anyone predicted. Grids are becoming more complex and unstable, requiring sophisticated balancing resources. Policy is actively encouraging battery storage through tax credits and tariff protection.

None of those tailwinds are temporary. They're structural shifts that will play out over decades.

Tesla's position in this landscape is strong. The company has execution credibility, proven deployments, and proprietary software that keeps improving. It's manufacturing at scale and expanding capacity. It has relationships with utilities and developers. It's integrated solar, batteries, and software into a coherent ecosystem.

Are there challenges? Absolutely. Competition is real and accelerating. Tariff policy could shift. Manufacturing capacity might constrain growth. Residential credits are being phased out.

But none of those challenges negate the fundamental opportunity. Energy storage is where the growth is. It's where the future is. It's where Tesla is positioning itself to dominate.

Investors focused only on Tesla's automotive struggles are missing the bigger picture. The company is transforming. Energy storage is leading that transformation.

Watch the margins. Watch the growth rate. Watch the deferred revenue. Those numbers tell the real story.

And if you're involved in energy infrastructure, utilities, or grid modernization, pay attention to what Tesla is building. The energy storage business isn't just important to Tesla. It's reshaping how grids work, how utilities operate, and how the world powers itself.

That's a story worth paying attention to.

Key Takeaways

- Tesla's energy storage business grew 48% in 2025, outpacing all other company divisions and becoming the primary growth driver

- Storage gross margins of 29.8% nearly double automotive margins of 15%, making it increasingly important to overall profitability

- Deferred revenue of $4.96 billion represents locked-in future revenue from contracted projects, providing exceptional visibility for 2026+

- AI data center demand and grid modernization are structural tailwinds that will drive storage deployments for decades, not quarters

- Competition is intensifying from Fluence Energy and Chinese manufacturers, but Tesla's software and integration advantage provides durable moat

Related Articles

- How Chinese EV Batteries Conquered the World [2025]

- Offshore Wind Legal Victories: Why Trump's Setbacks Matter [2025]

- Next-Gen Battery Tech Beyond Silicon-Carbon [2025]

- Nuclear Startups and Small Modular Reactors: Can Manufacturing Really Fix the Problem? [2025]

- Solid-State Batteries: The EV Revolution Finally Here [2025]

- Nuclear Power vs Coal: The AI Energy Crisis [2025]

![Tesla's Energy Storage Business Is Booming [2025]](https://tryrunable.com/blog/tesla-s-energy-storage-business-is-booming-2025/image-1-1769699396730.jpg)