Tesla's FSD Subscription-Only Strategy: What Changed & Why

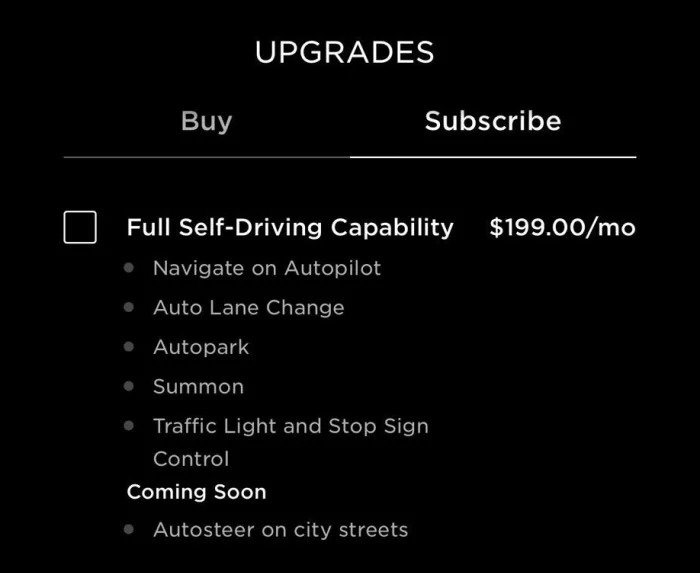

Elon Musk just made a decision that'll reshape how Tesla sells its most controversial feature. As of February 14th, 2025, you can't buy Full Self-Driving outright anymore. That

This isn't a small tweak. It's a fundamental shift in Tesla's business model, and it's happening at a weird moment. The company's sales are sliding, its robotaxi ambitions are stuck in neutral, and regulators are breathing down its neck about how it markets the system. So why make this move now?

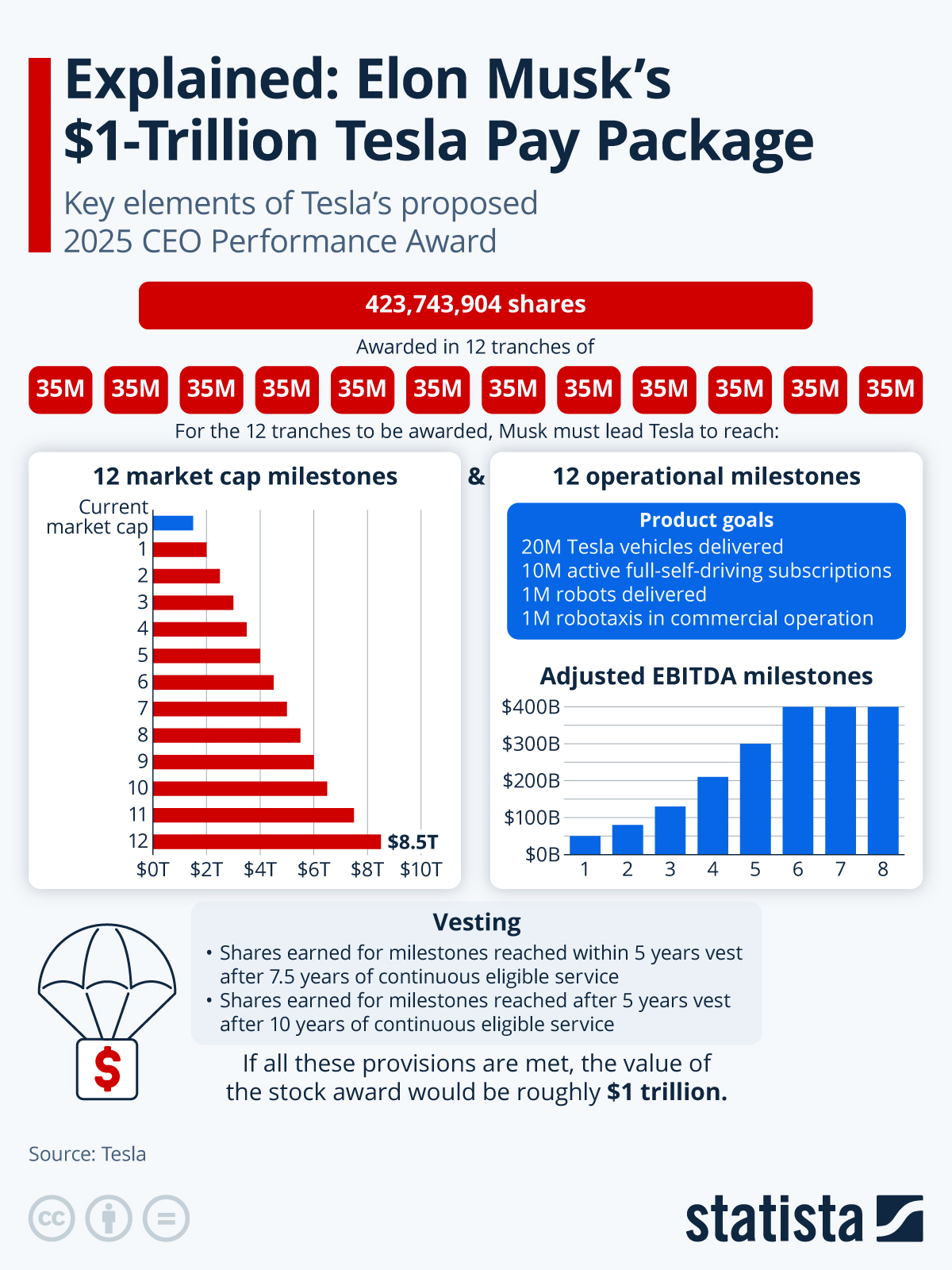

The answer gets at something bigger than just software sales. Tesla needs subscription revenue. It needs predictable, recurring income. And Musk's compensation package—worth potentially $1 trillion if he hits certain targets—depends on growing Tesla's FSD subscriber base to 10 million active users. That's the real story here, as noted by Transport Topics.

Let's break down what happened, why it matters, and what it means for Tesla owners caught in the middle.

TL; DR

- FSD is now subscription-only: Starting February 14th, 2025, Tesla stopped offering Full Self-Driving as a $8,000 one-time purchase

- Price stays the same: $99/month is the only option now, with no lifetime ownership possibility

- This affects Tesla's bottom line: Growing the subscriber base is critical to Musk's $1 trillion compensation package

- Regulatory pressure is mounting: California's DMV ruled Tesla misleads customers by calling it "Full Self-Driving" when drivers must supervise, as reported by the Los Angeles Times.

- Robotaxi strategy failing: Limited rollout in Austin and San Francisco, with safety drivers still required, contradicts original promises

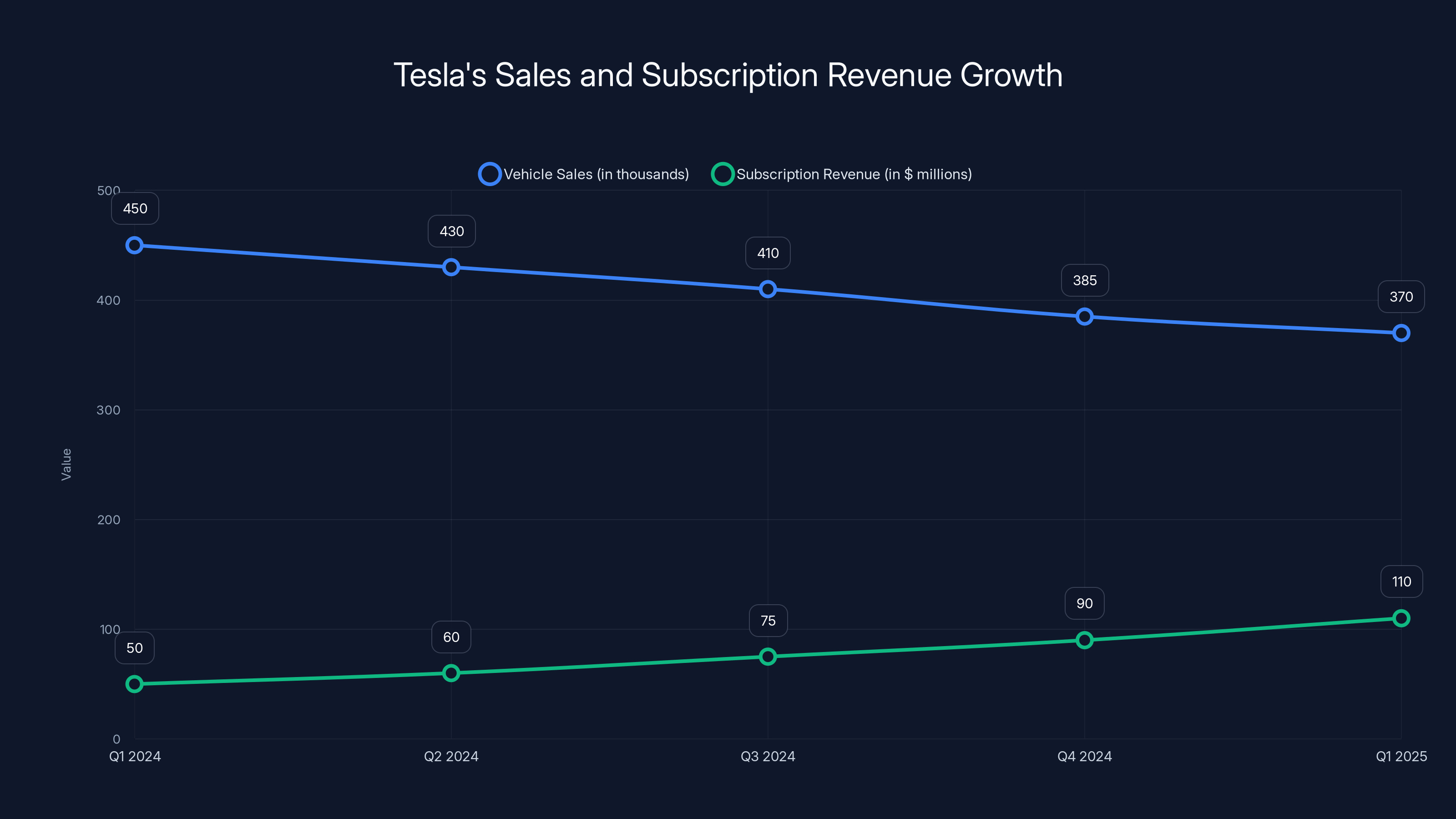

- Sales momentum declining: Tesla's year-over-year delivery reports show a 15.6% sales drop, making recurring revenue increasingly important

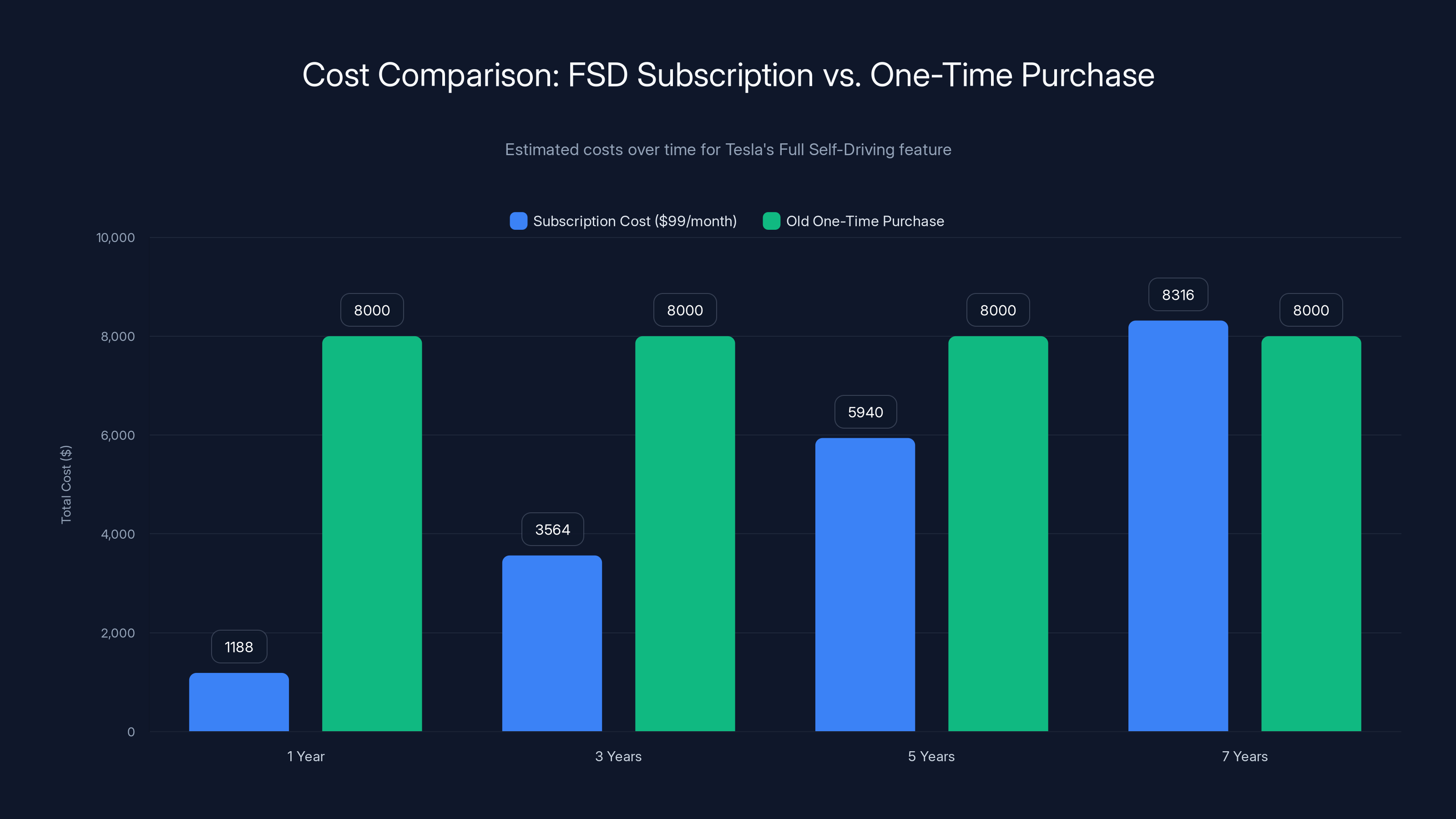

Over a period of 7 years, the subscription model surpasses the old one-time purchase cost, reaching

The Original FSD Promise vs. The Current Reality

Back in 2017, Musk made a bold claim: buy Full Self-Driving today, and your car would become a fully autonomous vehicle in the future. Not "maybe." Not "if all goes well." He said it would happen. Tesla owners were investing in an appreciating asset.

The pitch was simple and seductive. Pay

So people did. Tesla customers dropped thousands of dollars on faith in Musk's timeline.

But here's what actually happened. FSD improved incrementally, yes. It got better at lane changes, better at handling intersections, better at navigating city streets. But it never achieved what was promised. The system still requires human supervision. You can't fall asleep. You can't take your hands off the wheel for more than a few seconds. The car won't fully drive itself.

Meanwhile, Musk kept moving the robotaxi goalposts. In 2020, he said robotaxis would be "everywhere" in 2021. Then 2022. Then 2023. Now he's targeting "later." The promise of unlimited, unsupervised autonomous driving became "Level 2 driver assistance with some automation features."

That's a massive gap between the marketing and reality.

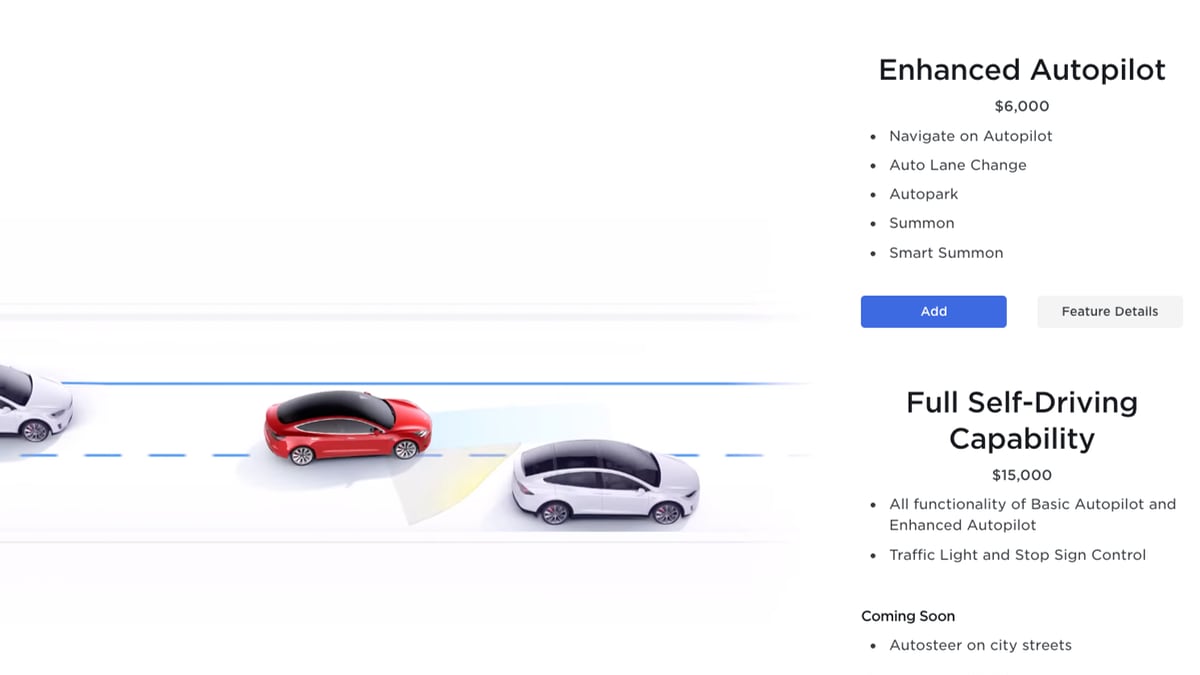

The Price History: Why FSD Got Cheaper Instead of More Expensive

Musk predicted that FSD prices would climb. As the software improved, he argued, the value would increase, so early buyers should lock in lower prices. That logic made sense. Premium features that improve? Prices go up.

Except that's not what happened.

In 2020, FSD cost around

So Tesla lowered the price.

The math is revealing. If you subscribe for more than 6.7 years, you'd pay more than the old

And most importantly for Tesla's financials: $99 every month is recurring revenue. It shows up in quarterly earnings reports. Investors love recurring revenue. It's predictable, scalable, and compounds, as noted by Investor's Business Daily.

Tesla's vehicle sales are declining, but subscription revenue is projected to grow, highlighting a strategic shift towards recurring revenue models. Estimated data.

Elon Musk's $1 Trillion Compensation Package and the FSD Growth Target

This is where things get interesting from a business perspective.

In 2024, Tesla shareholders approved a compensation package for Musk that could be worth up to $1 trillion. But here's the catch: it has conditions. Specific, measurable conditions tied to performance metrics.

One of the biggest conditions? Growing FSD's active subscriber base to 10 million users. That's not a casual goal. That's a threshold tied directly to Musk's ability to access this compensation, as highlighted by Transport Topics.

Now imagine you're Tesla's finance team. You're under pressure to show growth. FSD adoption has been disappointing relative to Musk's predictions. The one-time purchase model doesn't show ongoing momentum—you sell it once, and that's it. A customer buys FSD for $8,000, and there's no revenue the following year unless they upgrade.

But switch to a subscription model? Now every single FSD user is generating monthly recurring revenue. Your subscriber count looks better. Your quarterly numbers look stronger. Your ability to hit that 10 million subscriber target becomes more realistic.

That's not cynicism. That's basic business math. Switching from one-time purchases to subscriptions is a textbook revenue optimization strategy used by software companies everywhere.

The problem is Tesla owners who bought FSD at $8,000 now see the price per year becoming more expensive if they want to keep using it. For Tesla, it's better for the bottom line. For customers, it's a worse deal.

California's DMV Ruling: The Misleading Marketing Problem

Let's address the elephant in the room. California's Department of Motor Vehicles recently ruled that Tesla is misleading customers by calling this system "Full Self-Driving."

Here's the ruling: the system requires continuous human supervision. Drivers must keep their hands on the wheel. They must be ready to take over at any moment. The system cannot operate independently. Despite all this, Tesla markets it as "Full Self-Driving," which implies the vehicle can drive itself fully, as reported by the Los Angeles Times.

That's not a subtle distinction. It's central to how customers understand what they're buying.

When someone hears "Full Self-Driving," they think of autonomous vehicles. They imagine a future where their car doesn't need them. The reality is a sophisticated lane-keeping and traffic-aware cruise control system. It's valuable—genuinely useful on highways and in certain driving scenarios—but it's not what the name implies.

California's ruling could have real consequences. The state could force Tesla to change how it names and markets the system. It could require disclaimers. It might force a rebrand entirely.

This adds another layer to why Tesla might shift to subscription-only. It's harder to defend a

It's a repositioning play disguised as a business model shift.

The Robotaxi Strategy: Limited, Slow, and Falling Behind

Remember when Musk promised that 50% of the US population would have access to robotaxis by the end of 2025?

That deadline just passed. The actual rollout? A handful of company-owned vehicles in Austin and San Francisco, available to a limited number of customers, with a safety driver sitting in the car. According to Carbon Credits, this limited rollout contradicts the original promises made by Tesla.

Compare that to Waymo, which has been scaling robotaxi services in multiple cities with greater autonomy and fewer restrictions. Waymo's vehicles don't have a safety driver. They have a kill switch for emergencies, but the vehicle operates without human supervision.

Tesla's approach is different. Slower. More cautious. And according to some observers, less capable at the moment.

Why does this matter for FSD's subscription-only shift? Because robotaxis were supposed to justify the original

But if robotaxis aren't materializing as promised, that value proposition evaporates. The one-time purchase becomes harder to justify. A subscription—where you're paying for what the system can do right now, not future capabilities that might never arrive—becomes easier to market.

Tesla is essentially acknowledging that the original promise was too ambitious and too far away to anchor a

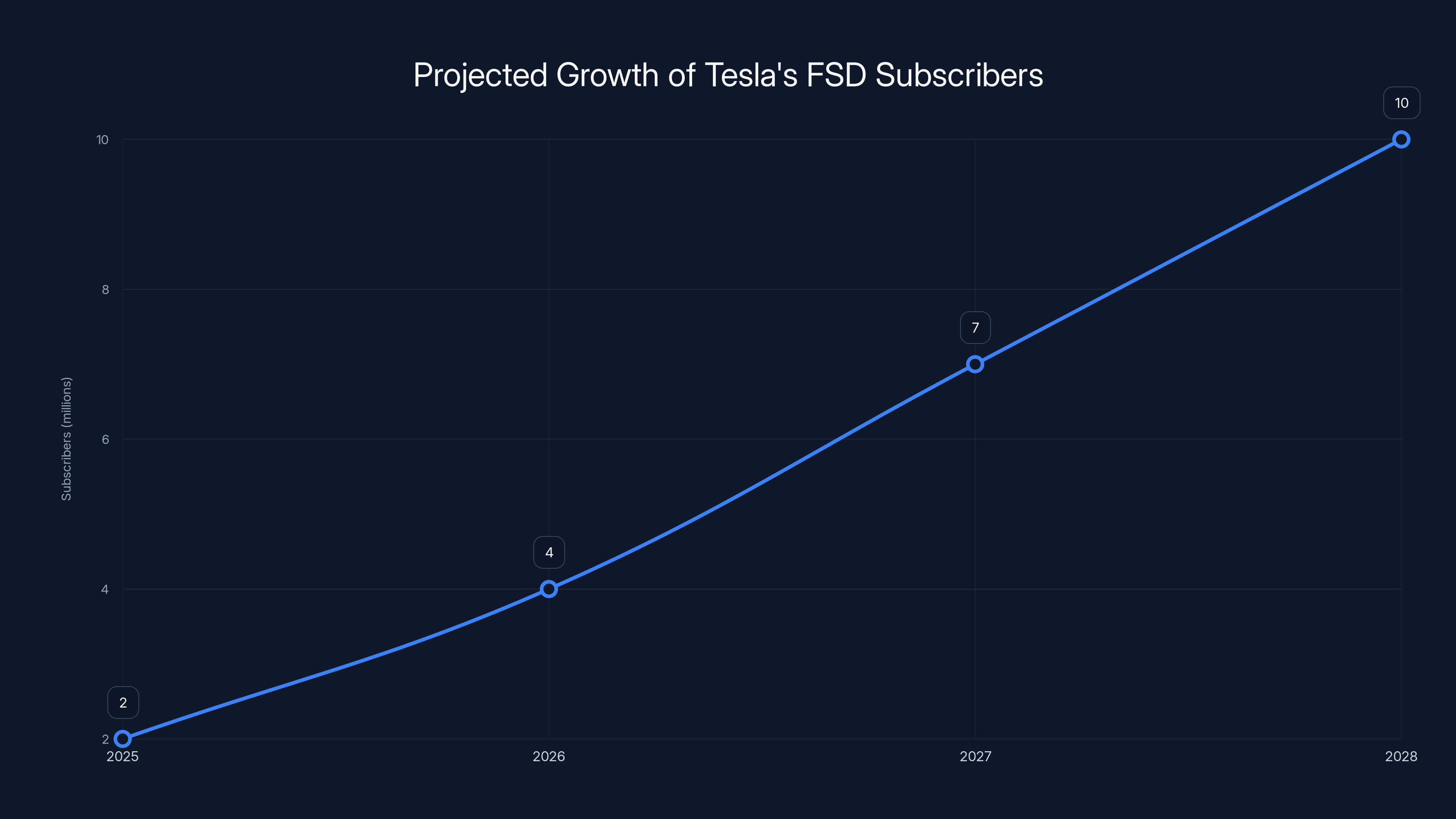

To unlock Elon Musk's compensation package, Tesla needs to grow its FSD subscriber base from 2 million in 2025 to 10 million by 2028. Estimated data shows a significant growth trajectory required.

Sales Decline and the Pressure for Revenue Models That Work

Tesla's sales momentum has slowed significantly. The company reported a year-over-year delivery decline of 15.6% in Q4 2024. That's not a blip. That's a trend, as highlighted by Reuters.

When sales growth slows, companies look for other ways to drive revenue. Subscription services are the answer because they:

- Create recurring revenue even if vehicle sales flatten

- Show consistent monthly growth to investors

- Provide a cushion during sales downturns

- Scale with the installed base (more cars = more subscribers)

Tesla has roughly 5 million vehicles on the road globally. Even if new vehicle sales plateau, the company can still grow FSD subscriber revenue by increasing the percentage of existing owners who subscribe.

A subscriber generating

From a Wall Street perspective, this is smart. From a customer perspective, it's less generous. But that's not Tesla's primary obligation. It's to shareholders.

The Behavioral Economics of Monthly Subscriptions vs. One-Time Purchases

There's a reason why software companies, streaming services, and SaaS platforms use subscriptions. It's not just about revenue predictability. It's about psychology.

There's also the sunk cost fallacy. Once you start a subscription, you're more likely to keep it because you're paying every month. Canceling feels like a loss. It's friction. With a one-time $8,000 purchase, the decision is binary: buy or don't buy. No ongoing decision-making.

This is textbook behavioral economics, and Tesla is absolutely leveraging it.

There's another factor too: cancellation guilt. When FSD does something genuinely helpful—an impressive lane change, smooth traffic navigation—users feel like the

Subscription removes the deliberation. It just happens. Month after month.

What This Means for Current Tesla Owners

If you already own FSD, you're in a different position than new buyers.

For owners who paid $8,000 for FSD, this move is frustrating. You locked in a price. You own the feature. It's yours for the life of the vehicle (in most cases). New buyers don't get that option anymore. They're stuck with the subscription.

For some owners, this will feel like Tesla punishing existing customers to benefit the company's revenue model. That sentiment isn't entirely unfounded.

For new Tesla buyers or owners considering upgrading, the calculus is different. You're choosing between:

- No FSD (saves $99 monthly)

- FSD subscription (costs $99 monthly, cancel anytime)

- Used FSD license transfers (if you buy a used Tesla with FSD already owned)

The third option is interesting. If Tesla starts losing customers to used car markets where FSD licenses transfer to new owners, that could undermine the subscription strategy. We'll likely see if Tesla tries to restrict FSD license transfers to new owners in the future.

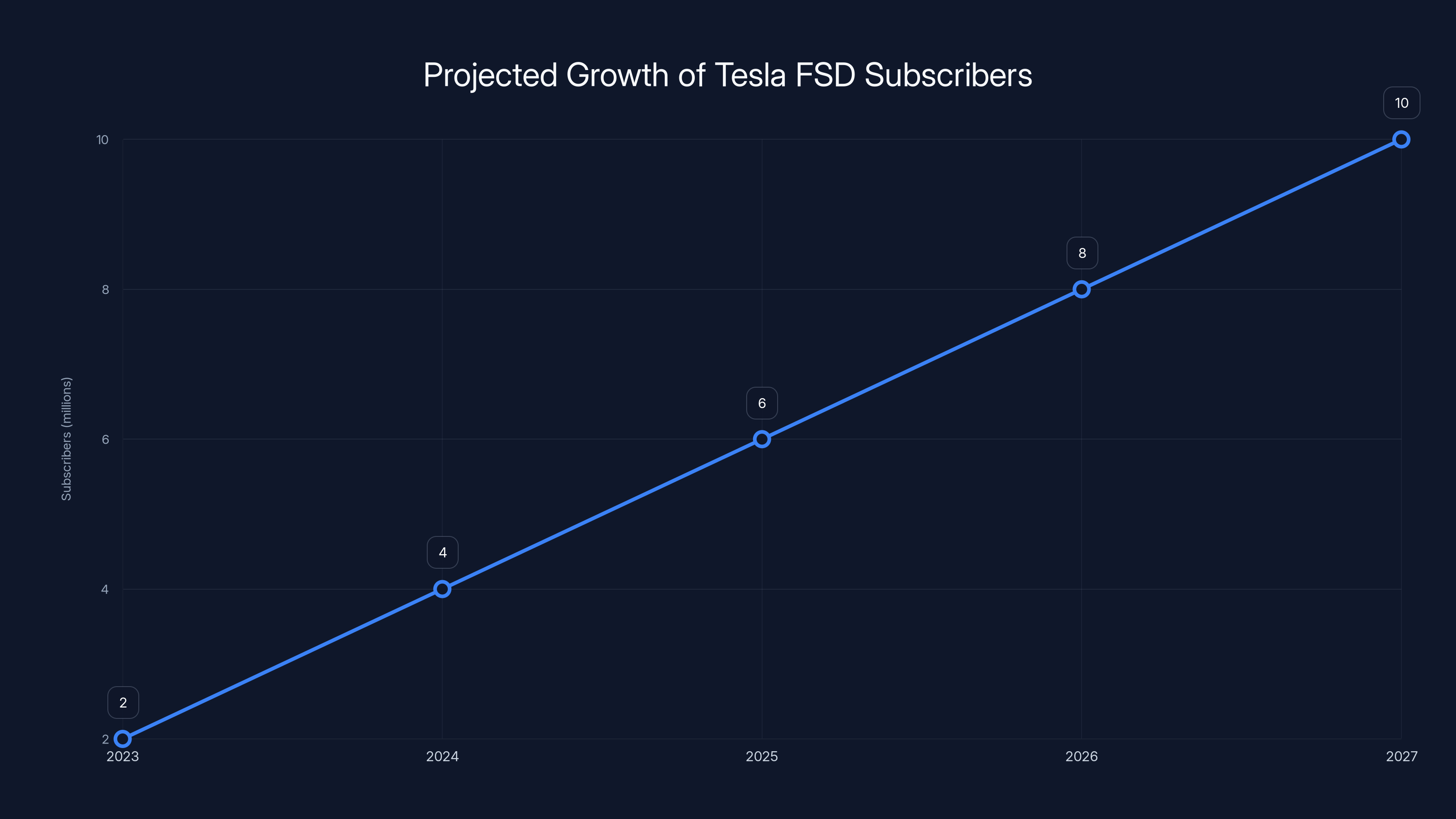

Tesla needs to increase its FSD subscribers from 2 million to 10 million by 2027, requiring significant improvements and strategic marketing. Estimated data.

The Future: Where This Strategy Goes From Here

So what's next?

Tesla will need to hit that 10 million subscriber target. Right now, the company has roughly 2 million active FSD subscribers. That's a significant gap. Hitting 10 million would require aggressive marketing, features that justify the $99 price point, and proof that FSD is worth the ongoing cost.

Expect Tesla to:

- Accelerate FSD capability improvements - The system needs to get noticeably better to justify retention

- Bundle FSD with vehicle sales - Offer free trial periods or discounted intro rates to new vehicle buyers

- Increase marketing spend - Make FSD more visible and easier to understand

- Launch tiered pricing - Perhaps a basic tier (199/month) with full access

- Emphasize autonomous features over autonomy claims - Drop the misleading "Full Self-Driving" framing if regulators force it

The bigger question is whether the technology actually improves enough to justify ongoing payments. If FSD stagnates at its current capability level, subscription churn will increase. People will cancel. The 10 million subscriber target becomes unreachable.

But if Tesla genuinely delivers incrementally better autonomy—smoother handling, better decision-making, fewer interventions required—then the $99 monthly cost becomes easier to justify.

The company is betting that it can improve the technology fast enough to keep people subscribed. And that's a genuine bet. No guarantees.

Comparing FSD to Competitors' Autonomous Features

Tesla isn't the only automaker developing autonomous driving features.

General Motors' Super Cruise is available on some Cadillacs and Chevy vehicles. It's more cautious than Tesla's approach—it maps specifically to highways and requires specific conditions. It's available as a subscription (

Ford's Blue Cruise and Hyundai's Highway Driving Assist 2 follow similar models. Limited autonomous features on highways, available through subscriptions or bundled packages. None of them make claims as bold as Tesla's.

Waymo's robotaxi service is different—it's not a feature you buy for your personal car. It's a shared service. You call a Waymo robotaxi, and it picks you up in a fully autonomous vehicle. No safety driver. Actual autonomy. But it only operates in specific cities, and it costs money per trip.

Tesla's shift to subscription-only actually positions FSD closer to how competitors are monetizing autonomous features. It's a recognition that the market wants ongoing, incremental improvements rather than the promise of a future super-intelligent car.

Competitors are moving toward subscriptions too. It's not unique to Tesla. But Tesla was unique in charging massive one-time fees based on promises about future capabilities. The shift to subscription is actually a move toward honesty. You're paying for what the system can do today, not betting on Musk's predictions about tomorrow.

Investor Perspective: Why Wall Street Likes This Move

If you zoom out to the investor level, this move makes sense strategically.

Subscription revenue is predictable. It grows as the installed base of vehicles grows. It's not dependent on new car sales (which are slowing). It can be included in guidance for future quarters. Analysts can model it. Investors understand it.

Recurring revenue also commands a premium valuation. A SaaS company generating

By shifting FSD to subscription, Tesla is essentially rebranding itself slightly as a software and services company, not just a car manufacturer. That's attractive to investors who believe in Tesla's long-term profitability beyond vehicles.

The $1 trillion Musk compensation package is also tied to this. If Tesla can show growing subscription revenue and hit the 10 million subscriber target, Musk's package is justified in the eyes of shareholders. It creates alignment between management incentives and business performance.

This isn't a cynical reading. It's how modern tech-enabled companies think. But it does mean customer interests and company interests are diverging on the FSD question.

New Tesla buyers face different options: no FSD saves

The Regulatory Landscape: How It Shapes Product Strategy

California's DMV ruling isn't the only regulatory pressure Tesla faces.

Federal regulators are also watching. The National Highway Traffic Safety Administration (NHTSA) has been investigating Tesla's Autopilot and Full Self-Driving systems for years. Safety concerns. Accident reports. Misuse of the system.

Regulators are skeptical of Tesla's marketing claims. They're concerned about customer misunderstanding. They want clarity: this is driver assistance, not autonomy.

From Tesla's perspective, subscription-only is actually a protective move. It:

- Creates a clear contract between customer and company

- Allows easier terms of service updates

- Enables faster feature rollbacks if problems emerge

- Provides a mechanism to restrict access if misuse is detected

- Generates better data about actual usage patterns

A subscription model also allows Tesla to add more aggressive terms. "By subscribing, you acknowledge this is Level 2 driver assistance, not autonomous driving." Harder to claim ignorance or misleading marketing when there's an ongoing subscription agreement.

This isn't entirely cynical either. Subscriptions do enable better safety oversight. It's just also convenient for the company that this better safety oversight also drives revenue and protects against liability.

The Used Car Market Wildcard: FSD License Transfers

Here's a potential problem Tesla hasn't fully addressed: the used car market.

When someone buys a used Tesla with FSD already owned (from when the car was new), what happens? Does the new owner get FSD? Can they transfer it? Do they have to buy a new FSD subscription?

This matters because it affects the addressable market for FSD subscriptions. If you can buy a used Tesla with FSD already paid for, you don't need a subscription.

Tesla currently allows FSD transfers on used car sales, but there are conditions and fees. The company could theoretically decide to stop allowing transfers, essentially making FSD subscription-only even for owners of older vehicles.

That would be aggressive and might face pushback from customers. But it would protect the subscription revenue model.

Alternatively, the used car market could actually help Tesla. Used Teslas with FSD might command price premiums because they include valuable software. That could drive up used car prices and reduce the demand for new car sales... which is actually counterproductive for Tesla.

It's a complex dynamic that Tesla will need to navigate carefully.

Timeline and Implementation: What Happens on February 14th

February 14th, 2025 is the date Tesla stops selling FSD as a one-time purchase. But what exactly happens?

For existing FSD owners, nothing changes. You keep your FSD. It's yours.

For new buyers, the interface changes. Instead of an "

The transition might not be instant. Tesla sometimes phases changes. Early February might see discounts on FSD purchases to clear out the inventory of one-time license sales. Or the company might allow pre-purchase orders before the cutoff.

For website visitors and potential buyers researching Tesla, the absence of a one-time purchase option removes a decision point. The subscription-only approach simplifies the buying process—fewer options, one clear path forward.

It also removes the question of "is FSD worth

The Bigger Picture: Tesla's Pivot Toward Software Revenue

This move is part of a larger Tesla strategy shift: from a car company that sells some software, to a software and services company that sells cars.

Elon Musk has long talked about Tesla's software capabilities being a future differentiator. Better AI. Better autonomy. Better efficiency. Software is where the margin potential is, where the value creation happens.

Subscription revenue from FSD is just one vector of this. Tesla also has:

- Energy services (Powerwall, solar, grid services)

- Insurance products

- Charging network services (Supercharger access for non-Tesla vehicles)

- Potential autonomous robotaxi services

- Connected vehicle services and in-car entertainment

FSD subscription is the test case. If it works—if customers accept paying $99 monthly for an improving autonomous system—then Tesla can apply the same model to other services.

This is the future Tesla is building toward. Not necessarily selling cars forever, but creating an ecosystem of recurring services that keep customers engaged and generate perpetual revenue.

The question is whether the technology improves fast enough to justify the model.

FAQ

What exactly is Full Self-Driving and what can it actually do?

Full Self-Driving (FSD) is Tesla's advanced driver assistance system that handles lane keeping, traffic awareness, automatic acceleration/braking, and navigation on both highways and city streets. However, despite the name, it requires continuous human supervision—you must keep your hands on the wheel and be ready to take control at any moment. It's Level 2 driver assistance, not true autonomous driving. California's Department of Motor Vehicles explicitly ruled that the name "Full Self-Driving" is misleading to consumers.

Why did Tesla switch from one-time purchase to subscription-only?

Tesla switched to subscription-only for several strategic reasons: recurring monthly revenue is valued higher by investors, subscriptions support Elon Musk's compensation package which requires 10 million active FSD subscribers, the company's vehicle sales are declining and need offsetting revenue streams, and subscriptions create flexibility for Tesla to update features and terms of service more easily. The shift also protects the company against regulatory pressure by positioning FSD as an ongoing service rather than a bold one-time promise.

How much will FSD cost now compared to the old pricing?

FSD now costs

Can existing Tesla owners keep their existing FSD licenses?

Yes, current Tesla owners who purchased FSD as a one-time payment keep their feature indefinitely. The subscription-only requirement applies only to new purchases starting February 14th, 2025. However, used car buyers may face restrictions depending on Tesla's policies for transferring FSD licenses to new owners. Tesla currently allows transfers with conditions, but this could change in the future.

What was the promised future of FSD that hasn't materialized?

Elon Musk originally promised that FSD would lead to fully autonomous vehicles capable of earning passive income as robotaxis. He claimed robotaxis would be "everywhere" by 2021, then 2022, then 2023, then 2025. As of early 2025, only a handful of Tesla-owned robotaxis operate in Austin and San Francisco with safety drivers still present. Meanwhile, competitors like Waymo have deployed actual fully autonomous robotaxi services without safety drivers in multiple cities. The technology's slow development forced Tesla to shift expectations from "future full autonomy" to "current driver assistance improvements."

How does Tesla's FSD compare to competitors like Waymo and GM's Super Cruise?

General Motors' Super Cruise is more limited but arguably more reliable—it operates only on mapped highways with specific conditions and costs

Does the subscription-only model affect the used car market?

The used car market is a wildcard for Tesla's subscription strategy. Used Teslas that came with FSD already purchased retain that feature, which can increase their value. However, if Tesla restricts FSD license transfers or increases transfer fees in the future, it could undermine the subscription model. Used cars with included FSD might become more valuable, or conversely, could create a secondary market where customers avoid new Teslas with mandatory FSD subscriptions in favor of older cars with perpetual FSD licenses.

What are the regulatory issues with FSD?

California's Department of Motor Vehicles ruled that Tesla's "Full Self-Driving" name violates state law and misleads consumers because the system requires continuous human supervision and is not actually fully self-driving. The National Highway Traffic Safety Administration (NHTSA) has been investigating Tesla's Autopilot and FSD for safety concerns and accident patterns. Regulators worldwide are skeptical of Tesla's autonomy claims. The subscription model actually helps Tesla protect against regulatory liability by allowing clearer terms of service and explicit disclaimers that FSD is driver assistance, not autonomy.

Will FSD improve significantly in the coming years?

Tesla's ability to hit the 10 million subscriber target depends on continuous improvement to FSD's capabilities. If the system stagnates at current capability levels, subscription churn will increase and customers will cancel. Tesla has invested heavily in autonomous driving research and has access to billions of miles of driving data from its vehicles. The company claims it's developing better neural networks and perception systems. However, Tesla's history of missing autonomy timelines makes it unclear whether improvements will occur at the pace needed to justify ongoing subscriptions, especially as regulators become more skeptical of Tesla's claims.

What does this mean for Tesla's valuation and future strategy?

Subscription revenue commands higher investor valuations than one-time sales—typically 8-12x multiplier versus 1x for products. If Tesla can grow FSD subscriptions to billions in annual revenue, it significantly increases the company's valuation. This positions Tesla more as a software and services company than a traditional automaker. The strategy aligns with Musk's compensation package, which requires 10 million active subscribers. Beyond FSD, Tesla is likely to apply subscription models to energy services, insurance, charging networks, and future autonomous robotaxi services. The company is betting on recurring software revenue to offset slowing vehicle sales growth.

The Bottom Line

Tesla's shift to subscription-only Full Self-Driving is a rational business decision that benefits the company's bottom line, supports Musk's compensation package, and aligns with how modern software companies monetize features. It's also a pragmatic acknowledgment that the original promise of FSD—full autonomy within a few years—didn't materialize on the promised timeline.

For Tesla, this move creates predictable recurring revenue, supports better regulatory positioning, and allows flexibility to improve the system without constantly renegotiating ownership terms. For customers, especially existing FSD owners, it's a less generous proposition. New buyers lose the option of a one-time purchase and instead pay more per year if they keep the subscription long-term.

The real test comes next. Can Tesla improve FSD enough to justify $99 monthly? Can the company hit 10 million active subscribers without aggressive bundling or misleading marketing? Will regulators accept the subscription framing, or will they continue pushing back on how Tesla describes the system's capabilities?

The technology is genuinely useful for certain driving scenarios. Highway cruising, traffic navigation, some city street handling. It's not nothing. But it's also not the autonomous future Tesla promised.

Subscription-only is a smart revenue move. Whether it's good for customers depends entirely on whether the technology actually improves. And on that, the jury is still very much out.

One thing is certain: Tesla's bet on subscription revenue means the company is now under pressure to deliver continuous improvements. Stagnation isn't an option. The 10 million subscriber target won't be reached if FSD sits idle at current capabilities. That's actually good for customers, because it means Tesla must innovate faster.

We'll know within the next 12-24 months whether this strategy works. If subscribers cancel faster than new ones sign up, we'll see Tesla adjust—either improving FSD capabilities dramatically, offering incentives to subscribers, or reconsidering the subscription-only model.

But for now, the company is committed. FSD is a monthly bill, not a one-time purchase. That's the new reality.

Key Takeaways

- Tesla eliminated the 99/month

- The shift generates recurring revenue needed to hit 10 million active subscribers, a target tied to Elon Musk's $1 trillion compensation package

- Year-over-year vehicle sales declined 15.6%, making subscription revenue increasingly critical to Tesla's financial strategy

- California regulators ruled that "Full Self-Driving" misleads consumers since the system requires continuous human supervision

- Robotaxi rollout has stalled with only limited deployments in Austin and San Francisco, making the original autonomy promises increasingly hollow

Related Articles

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- New York Robotaxis: What Happens When One City Gets Left Behind [2025]

- New York's Robotaxi Revolution: What Hochul's Legislation Means [2025]

- Physical AI in Automobiles: The Future of Self-Driving Cars [2025]

- CES 2026: Complete Guide to Tech's Biggest Innovations

- Tesla's Full Self-Driving: Why Elon Musk's Promises Keep Missing [2025]

![Tesla's FSD Subscription-Only Strategy: What Changed & Why [2025]](https://tryrunable.com/blog/tesla-s-fsd-subscription-only-strategy-what-changed-why-2025/image-1-1768401385033.jpg)