New York's Robotaxi Revolution: What Hochul's Legislation Means

Introduction: The Door Opens for Self-Driving Cars in New York

New York is on the verge of a transportation transformation. Governor Kathy Hochul's proposed legislation could fundamentally change how millions of people move around the state, and honestly, it's a bigger deal than most news coverage makes it sound. According to AOL News, this legislation is a significant step toward integrating autonomous vehicles into New York's transportation system.

For years, autonomous vehicles existed in a regulatory gray zone in New York. You could test them. You could study them. But you couldn't actually offer them as a commercial service to regular people. That changes if Hochul's legislation passes. The new law would create a pilot program allowing companies to deploy fully autonomous passenger vehicles outside New York City, with the promise of eventual expansion, as detailed by Wired.

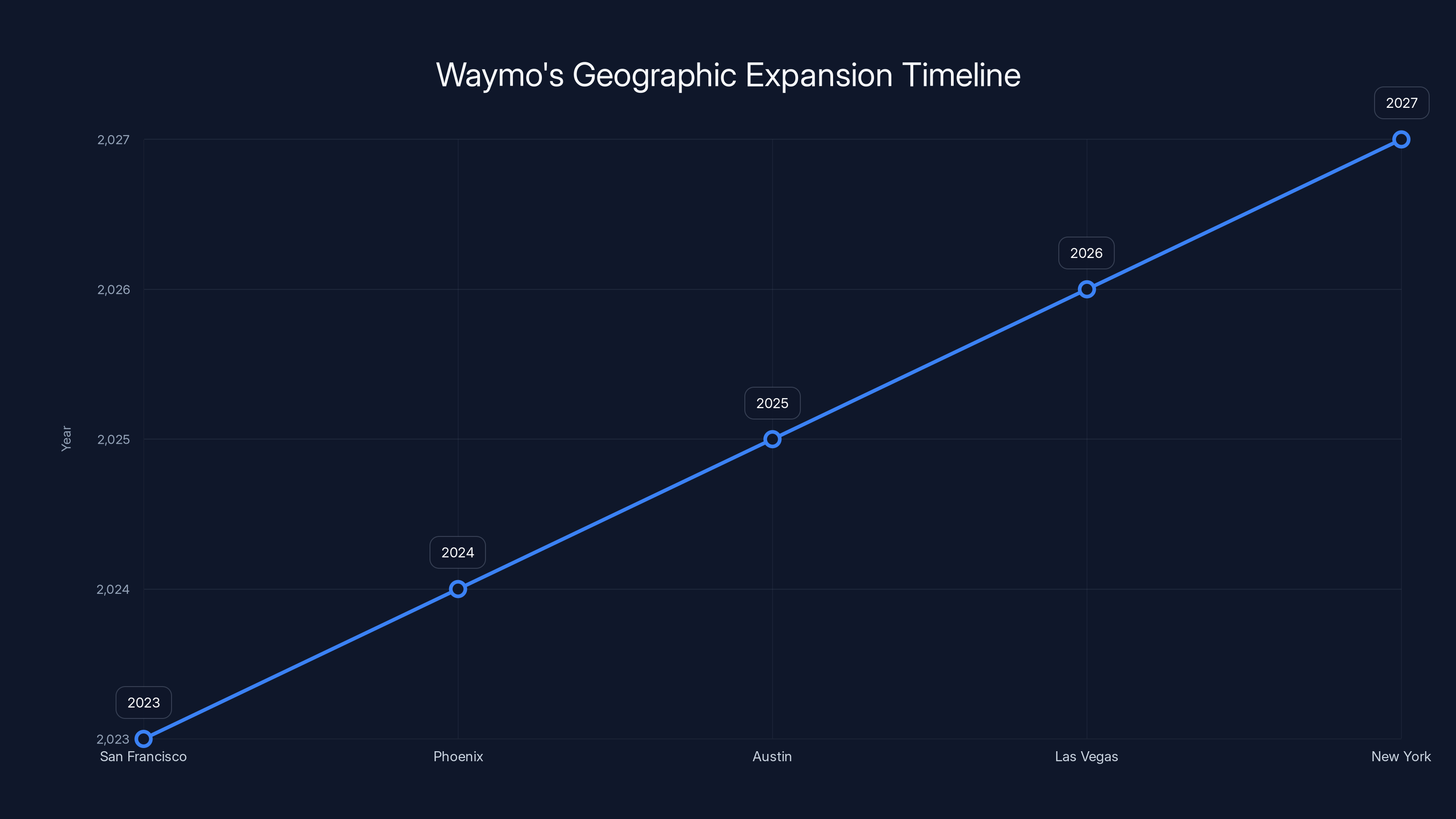

Waymo, the self-driving company owned by Alphabet (Google's parent company), has been quietly building the infrastructure for this moment. They've already launched commercial robotaxi services in other states like San Francisco, Phoenix, Austin, and Las Vegas. Detroit and San Diego too. Now they're positioned to bring that technology to New York.

But here's what makes this interesting: it's not just about Waymo. The legislation creates a pathway for other companies too. Cruise, once a major player in autonomous vehicles, crashed hard after safety incidents. But competitors are watching. What happens in New York becomes a template for other states. This is how transportation policy works now. One state passes something, others follow, as noted by Route Fifty.

The timing matters too. We're not talking about some distant future. Hochul announced this during her State of the State address, signaling it's a priority for her administration. When governors make things a priority, they have a way of getting passed, especially when there's industry support and public appetite for change.

This article digs into everything: the actual legislation, what it means for riders, how Waymo got here, the regulatory landscape, safety concerns, and what this says about the future of transportation in American cities. By the end, you'll understand not just what's happening in New York, but why it matters everywhere.

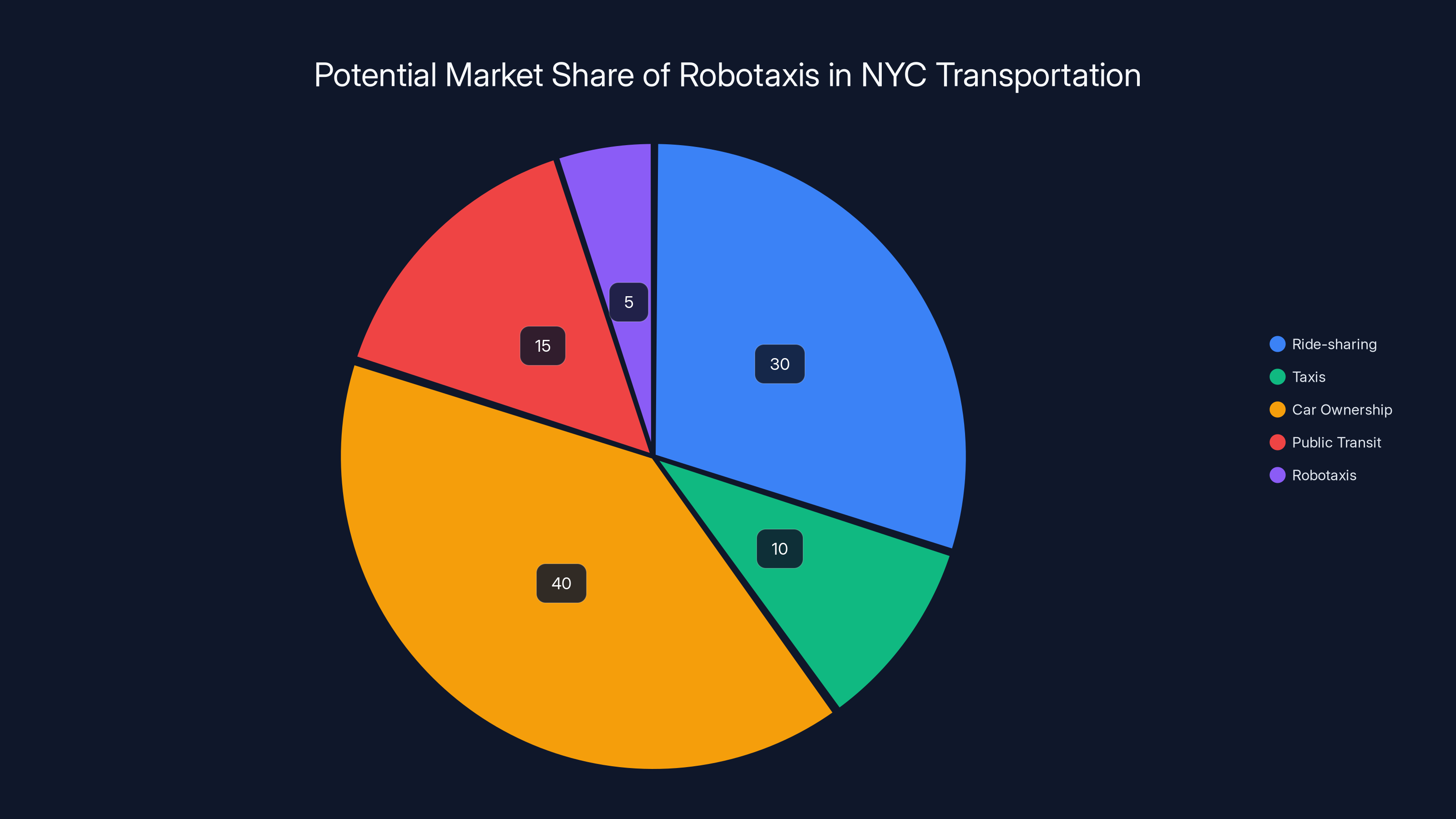

Estimated data shows robotaxis capturing a 5% market share in NYC's transportation sector, highlighting a significant revenue opportunity if they can replace a portion of ride-sharing and taxi services.

TL; DR

- Hochul's Legislation: Governor Kathy Hochul proposed a pilot program in her State of the State address that would allow commercial autonomous vehicle services to operate outside New York City if they meet safety and community support requirements

- Waymo's Position: Waymo already operates robotaxis in California, Texas, Georgia, and Nevada, with expansion plans for Las Vegas, San Diego, and Detroit in 2026, positioning them as the frontrunner for New York approval

- Regulatory Framework: The pilot program requires applicants to demonstrate local community support and adherence to "the highest possible safety standards" before deployment

- Economic Impact: Waymo invested over $370,000 in New York lobbying efforts in 2025 alone, reflecting the stakes for autonomous vehicle companies

- Bottom Line: This legislation could transform transportation economics in New York while creating a regulatory template for other states

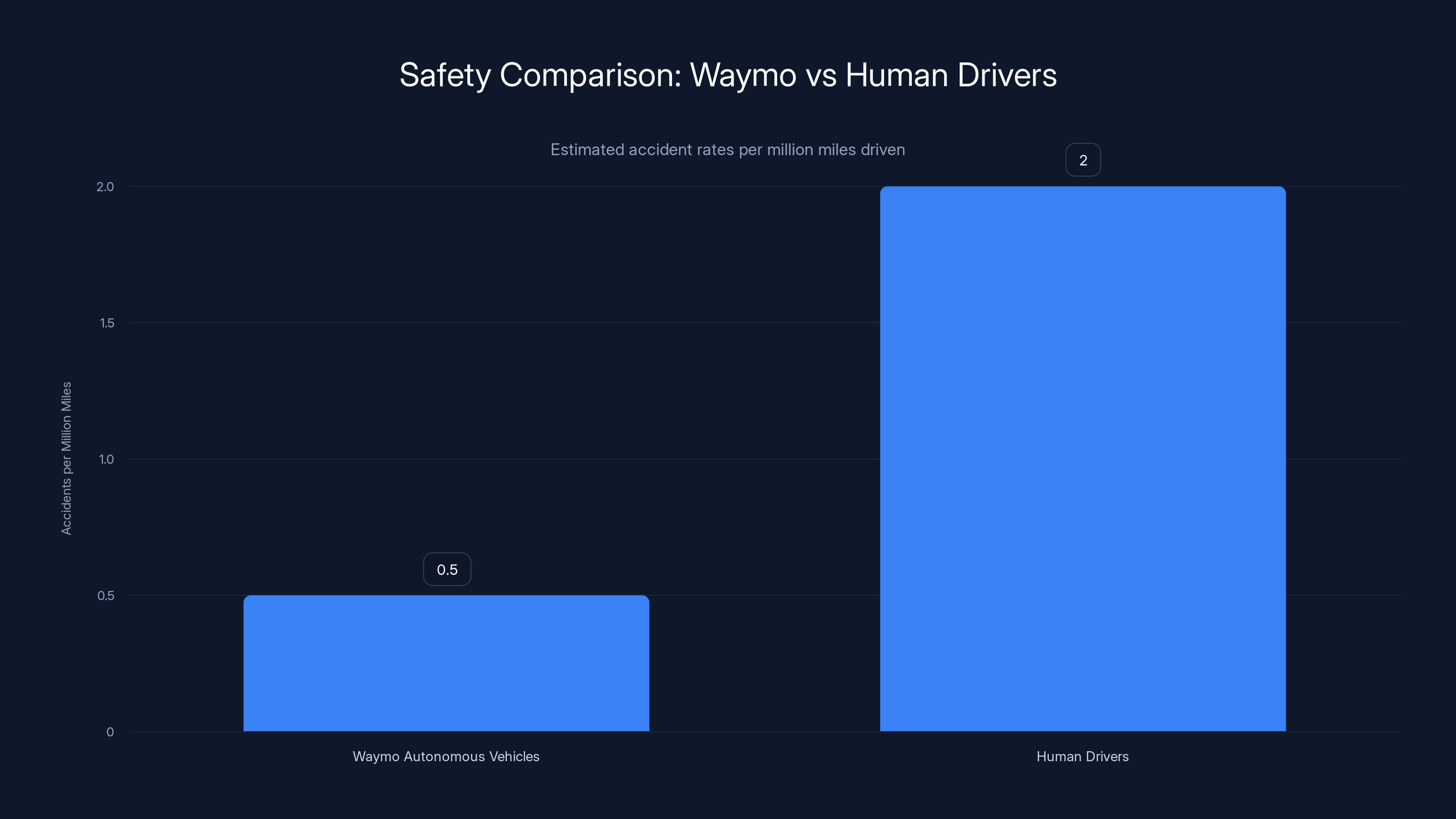

Waymo's autonomous vehicles have an estimated accident rate of 0.5 per million miles, significantly lower than the 2.0 rate for human drivers. Estimated data based on typical industry reports.

The Evolution of Autonomous Vehicles in New York

Testing Phase: How Waymo Got Here

Waymo didn't just show up in New York in 2025 and declare they were ready to operate robotaxis. The company spent years testing autonomous vehicles in the state, gathering data, understanding traffic patterns, and building credibility. That testing phase was crucial because it proved the technology works in one of the most challenging driving environments on Earth.

New York traffic is objectively difficult. Pedestrians appear from nowhere. Drivers ignore traffic laws constantly. Weather changes dramatically. If your self-driving car can handle Manhattan or Brooklyn traffic, it can handle most places. That's not marketing speak. That's actual operational reality that transportation experts understand.

Waymo's testing program showed their system could navigate these conditions at scale. They logged millions of miles. Their systems encountered edge cases. They hit the kinds of situations that break inferior autonomous driving systems. And they kept operating. That builds legitimacy with regulators who have to decide whether to approve commercial deployment.

But testing has limits. Eventually, you need real data from actual commercial operations. You need to understand how riders behave. How the system handles peak demand. What happens when something breaks. Testing provides simulated answers. Commercial service provides real answers. That's the gap the pilot program is designed to fill.

The Gap Between Testing and Deployment

Here's what most people don't understand about autonomous vehicle regulation: there's a massive gap between "this technology works in testing" and "this technology is safe for commercial deployment." Testing environments are controlled. You have researchers in vehicles. You can stop deployment immediately. Commercial service means random people getting in your cars.

The federal government hasn't created a comprehensive autonomous vehicle framework. States and cities fill that vacuum. California pioneered this. San Francisco became a de facto testing ground. Regulators watched. Incidents happened. Rules got stricter. Other companies learned from what worked and what didn't, as reported by Eno Transportation.

New York was more cautious. They watched what happened in California. They didn't want the early problems. They demanded more rigorous data before allowing commercial deployment outside of testing. That's not regulatory incompetence. That's regulatory learning. You see a problem in another jurisdiction, you demand better controls before you allow the same thing.

Hochul's legislation acknowledges that testing is complete. Waymo has proven something. Now it's time to move to limited commercial deployment. The "pilot" framing is important. Pilots are explicitly limited. You can pull them if something goes wrong. You're not committing to a permanent program. You're testing whether commercial deployment works in your jurisdiction.

Previous Regulatory Challenges

Before this legislation, New York had some of the strictest autonomous vehicle regulations in the country. You could test. You couldn't operate commercially. That made sense in 2018 or 2019 when the technology was less mature. But by 2024 and 2025, it looked like regulatory overreach.

Companies were getting commercial robotaxi services in other states. Riders were using them. Incidents were relatively rare. The safety data was accumulating. Continuing to ban commercial deployment in New York meant New York residents didn't get access to a transportation option that was proven in other markets, as noted by The New York Times.

Regulatory arbitrage started happening. Waymo could make money in California, Texas, and Georgia. They couldn't make money in New York. That's not sustainable long-term. Either you approve autonomous vehicles or companies will do business elsewhere. Hochul understood this. That's why she backed legislation instead of continuing to block deployment.

The previous regulatory stance made sense at the time. But policy has to evolve with evidence. When evidence shows technology is safer or more beneficial than previously thought, policy changes. That's what's happening now.

Inside Hochul's Proposed Legislation

What the Law Actually Says

Understanding the specific language of legislation matters because details shape how companies operate. Hochul's proposal creates a pilot program for "the limited deployment of commercial for-hire autonomous passenger vehicles outside New York City." That's the operative phrase: outside New York City.

The decision to exclude New York City is strategic. The city is more densely populated. Traffic is more complex. Pedestrian interactions are more frequent. Regulatory oversight in the city is more intense. By starting the pilot outside the city, regulators get real data without the complications of implementing in the world's most densely populated major city.

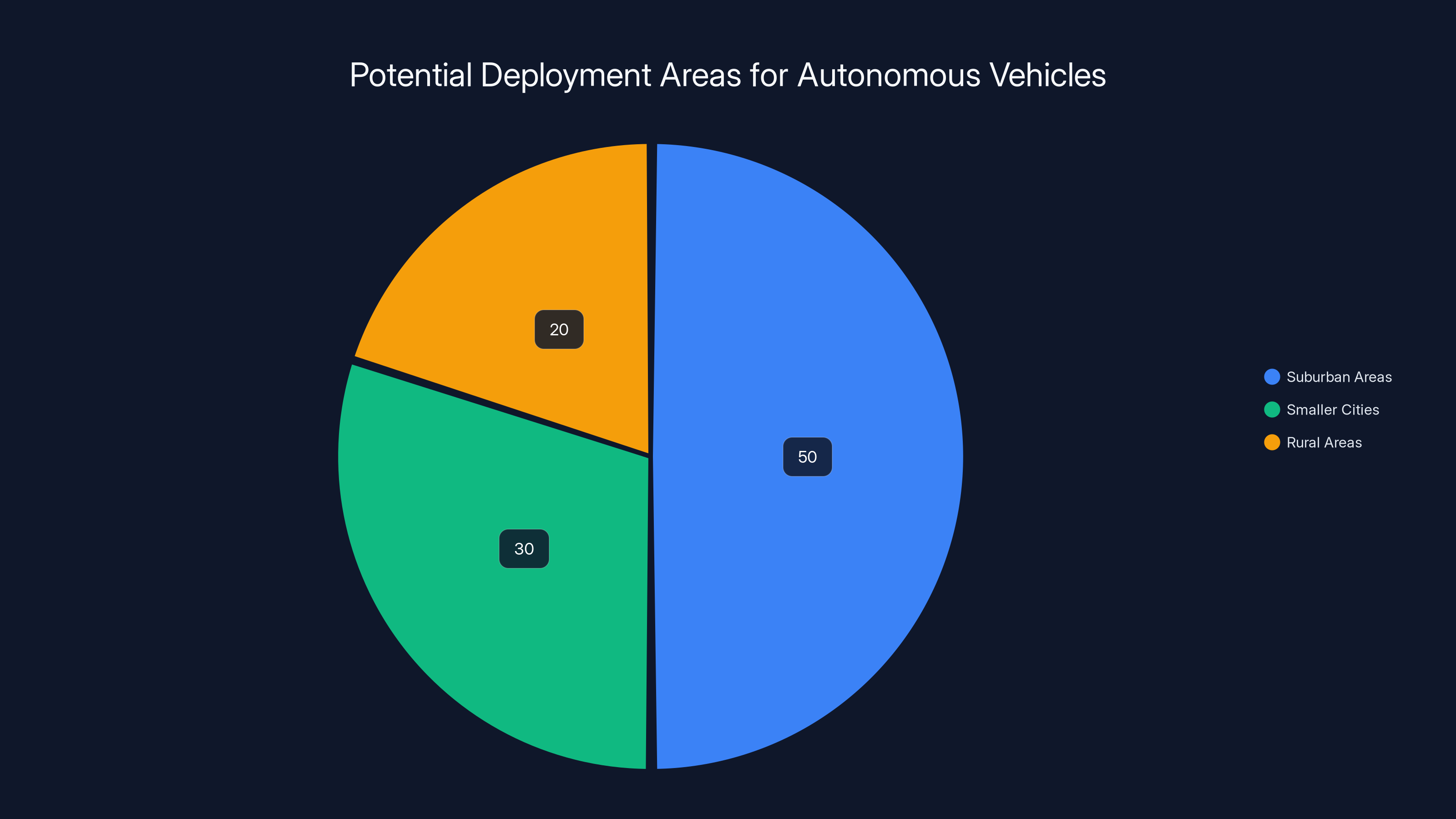

This also addresses a real concern many New Yorkers have about autonomous vehicles: they don't want to be test subjects in a massive urban experiment. Starting in suburbs or smaller cities where autonomous vehicles are easier to operate makes political sense. It builds a track record of safe operation before expanding to the city.

The legislation requires applicants to meet specific criteria. You have to demonstrate "local support for autonomous vehicle deployment." That's interesting language because it means you can't just show up and start operating. You need community buy-in. You need to work with local governments. You need people to actually want your service.

Waymo probably has this already. They've operated in other markets. They understand community engagement. They know which cities or regions would benefit from robotaxi service. Smaller upstate New York cities might welcome cheaper transportation options. Suburban areas might prefer robotaxis to dealing with parking. Waymo will likely target those regions for their initial pilot.

Applicants also must prove "adherence to the highest possible safety standards." That's somewhat vague, which is intentional. Regulators don't want to lock themselves into specific metrics now. They want flexibility to adjust standards as they learn more about autonomous vehicle operations in New York.

But vagueness creates uncertainty. Companies don't know exactly what they need to prove. They'll probably demonstrate insurance coverage, accident statistics from other markets, safety testing data, cybersecurity protocols, and response procedures for failures. Regulators will look at all of this and make decisions. It's not a rubber-stamp process. It's actual regulatory judgment.

Timeline and Implementation

The legislation doesn't specify an exact timeline for when pilots could begin. That's another area where vagueness gives regulators flexibility. In practice, this usually means regulatory agencies have 6 to 12 months to develop detailed rules and issue permits. Companies then need time to prepare their operations for New York specifically.

Waymo's already operating in other states, so they have the operational playbook. But every jurisdiction is different. New York has different insurance requirements. Different safety standards. Different reporting procedures. Different emergency protocols. Waymo will need to adapt their systems and processes to New York's specific regulatory environment.

Once pilots begin, there's typically a monitoring period. Regulators watch incidents, accident rates, response times to problems, and community impact. This might last 6 to 24 months depending on how things go. If pilots demonstrate safe operation and community acceptance, regulations expand. If problems emerge, regulations tighten or pilots get pulled.

The beauty of the pilot approach is it gives both regulators and companies a way to work together without massive risk. Regulators get real data before allowing broader deployment. Companies get a chance to prove themselves in a new market. If it works, everyone wins. If it doesn't work, the pilot ends and regulators learned something valuable.

Estimated data suggests suburban areas may see the highest focus for autonomous vehicle deployment, followed by smaller cities and rural areas.

Waymo's Strategy and Market Position

Building a National Robotaxi Network

Waymo isn't trying to be a taxi company. They're building an entirely new transportation category. Robotaxis require different economics, different operational infrastructure, and different customer expectations than traditional ride-sharing apps like Uber.

Waymo's strategy is geographic expansion. They start in a city. They prove the technology works. They build brand recognition. They accumulate safety data. Then they expand to the next city. This approach builds credibility. Each successful market makes the next market easier.

Look at their expansion timeline. They started robotaxi service in San Francisco in 2023. That was risky. San Francisco is complex, weather-wise and traffic-wise. But succeeding there meant they could say, "If we can do it in San Francisco, we can do it anywhere." That's a powerful claim when you're trying to enter new markets.

They moved to Phoenix. Different climate, different traffic patterns, different urban design. Success in Phoenix proved Waymo could adapt. Then Austin, then Las Vegas. Each expansion adds data and experience. By the time they get to New York, they've operated in different weather conditions, different traffic patterns, different regulatory environments. That experience matters.

The partnership with Uber is also strategic. Waymo doesn't need to build its own rider app, payment system, or customer service infrastructure. Uber already has all that. Waymo provides the autonomous vehicle technology. Uber provides the platform. Customers use Uber as normal but get a Waymo vehicle. This partnership lets Waymo focus on what they do best: self-driving cars.

Investment in New York Influence

Waymo spent over $370,000 lobbying New York regulators in 2025. That's a significant investment, but small compared to what the payoff could be. Access to a market of 19 million people in the New York metropolitan area is worth billions of dollars in potential revenue.

Lobbying isn't inherently sketchy. Companies engage with government on policy matters. Waymo wanted to explain their technology, show their safety record, and make the case for regulatory approval. That's normal business practice. The amount they spent shows how much New York matters to their expansion strategy.

But it also shows something important: Waymo believed legislation was possible. You don't spend that much on lobbying if you think you have no chance of success. Waymo had signals from regulators and the governor's office that autonomous vehicle deployment was back on the table. That's why they invested in lobbying.

Why Waymo Has the Inside Track

Waymo isn't the only autonomous vehicle company in the world, but they have advantages in New York specifically. First, they've proven their technology works at scale in multiple markets. That's not hype. That's evidence. Regulators care about evidence.

Second, Waymo has financial backing from Alphabet. They're not going to run out of money. That matters because regulators want to know that if something goes wrong, the company can handle liability, recalls, or operational issues. Alphabet can. Many autonomous vehicle companies can't.

Third, Waymo has the safest publicly available data on autonomous vehicle operations. They publish detailed safety reports. They're transparent about incidents. That transparency builds trust with regulators who need to make approval decisions.

Fourth, Waymo has a partnership with Uber. That means they don't need to build a customer acquisition strategy from scratch. Uber already has riders. Uber already has payment infrastructure. Waymo just needs to provide the vehicles.

All of this means Waymo will probably be first approved in New York if legislation passes. But they won't be the only company operating eventually. Other companies will watch Waymo's success, improve their own safety records, and apply for pilots in other regions.

The Regulatory Landscape and Safety Standards

How Autonomous Vehicle Safety Gets Measured

When regulators talk about "the highest possible safety standards," they're usually looking at specific metrics. The main one is accident rate per mile driven. You compare your autonomous vehicles to human drivers on the same roads. If your vehicles have fewer accidents, that's evidence they're safer.

But it's not that simple. Autonomous vehicles have different accident profiles than human drivers. They rarely cause accidents from distraction, fatigue, or impairment. But they sometimes fail at recognizing edge cases that experienced human drivers handle intuitively.

For example, a human driver might see a pothole and swerve around it instinctively. An autonomous vehicle might drive through it because the system didn't recognize it as an obstacle. That could cause an accident. So regulators look at different kinds of accidents, not just total accidents.

They also look at near-misses. How many times did the autonomous vehicle encounter a situation where accident was possible but didn't happen? This gives regulators a sense of how often the system faces challenging scenarios and how well it handles them.

Testing data matters too. Companies provide simulation results showing how their vehicles perform in thousands of hypothetical scenarios. A scenario gets created, the vehicle's system has to decide what to do, and engineers see if it makes the right call. This testing happens millions of times to find edge cases.

Ridership data matters as well. How many people actually use robotaxi service? Do they feel safe? Do they report problems? Do they keep using the service or switch to alternatives? This real-world behavioral data tells you whether people trust the technology.

Federal Frameworks vs. State Regulation

Here's the messy part about autonomous vehicle regulation in the United States: there's no comprehensive federal framework. The National Highway Traffic Safety Administration (NHTSA) oversees vehicle safety, but autonomous vehicles exist in a weird gray area where it's not clear whether existing rules apply.

States have stepped in to fill the gap. California, Nevada, Arizona, Texas, and Georgia have all created their own autonomous vehicle regulations. Each state does it slightly differently. That's inefficient for companies that want to operate nationally, but it also reflects the reality that transportation is partly a federal issue and partly a state issue.

New York creating its own pilot program continues this trend. Eventually, there will probably be a federal framework that standardizes autonomous vehicle safety requirements across states. But that's years away. For now, states are laboratories for autonomous vehicle policy.

What's interesting is that states are learning from each other. California's regulations influenced how other states approached the issue. Waymo's operations in California provided a model that other states could study. That's how policy development works. One jurisdiction tries something, others watch, and best practices emerge.

Insurance, Liability, and Accountability

Waymo needs insurance coverage for their robotaxis. This gets complicated because standard vehicle insurance assumes there's a driver responsible for the vehicle's actions. Autonomous vehicles have no driver. So who's responsible if an accident happens?

The answer is the vehicle's owner or operator. That's Waymo in this case. If a Waymo robotaxi causes an accident, Waymo is liable. That's why Waymo has comprehensive insurance coverage. The insurance company needs to understand the risk they're insuring, which brings us back to safety metrics and accident data.

Insurance companies are actually one of the better checks on autonomous vehicle deployment. They won't insure dangerous systems. The fact that major insurers are willing to cover Waymo's operations suggests the safety data supports their confidence.

But there are edge cases. What if a Waymo vehicle gets hacked? What if someone manipulates the road or traffic signals to fool the sensors? These become liability questions without clear answers. Regulators and insurance companies are working through these issues in real time.

Liability frameworks matter because they determine incentives. If Waymo is fully liable for accidents, they have every incentive to make their vehicles as safe as possible. This is good for public safety. If liability gets spread across insurance companies, vehicle manufacturers, and others, incentives get diluted. Good regulatory frameworks make liability clear.

Waymo's strategic expansion to diverse cities demonstrates adaptability and builds credibility for future markets. Estimated data.

Economic Impact and Market Opportunity

Transportation Market Size in New York

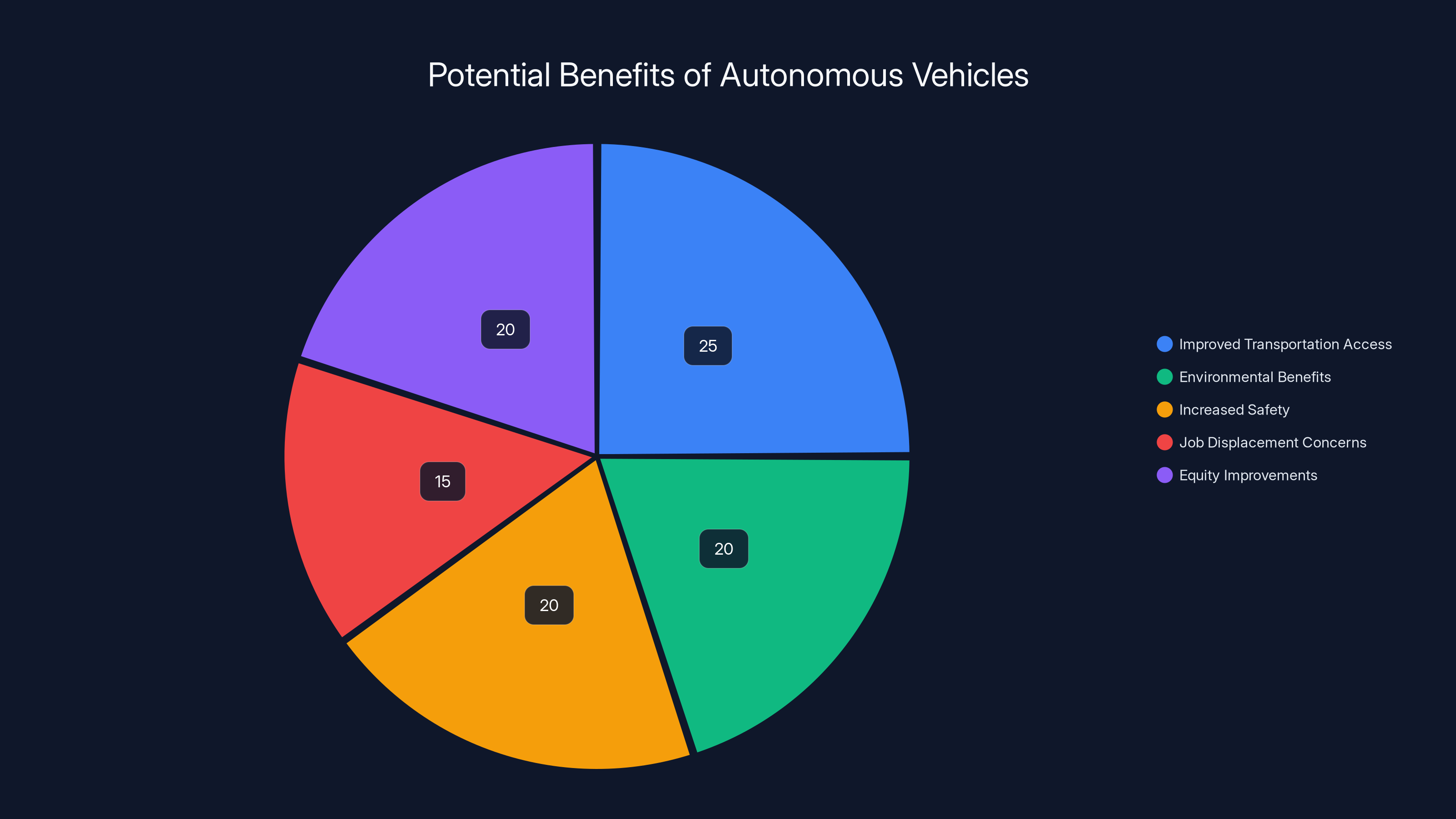

The transportation market in New York is massive. Between ride-sharing, taxis, car ownership, and public transit, people spend enormous amounts of money moving around. If robotaxis can capture even a small percentage of that market, the revenue opportunity is in the billions of dollars.

Consider this: there are roughly 13,600 licensed yellow cabs in New York City. Uber and Lyft combined have hundreds of thousands of vehicles (most are driver-owned). If robotaxis replace even 20% of ride-sharing volume, that's hundreds of millions of dollars in annual revenue for the operating company.

But it's not just about revenue. It's about cost. Autonomous vehicles eliminate driver wages, which are the largest cost in ride-sharing economics. A driver earning $50,000 per year costs the company far more in salary, taxes, and benefits. An autonomous vehicle costs much less to operate per mile, which means robotaxi fares can potentially be cheaper than human-driven ride-sharing.

If robotaxis are cheaper, more people use them. That drives volume. Higher volume means better economics. This is why Waymo is so focused on scale. The real money comes from operating at volume with lower per-ride costs.

Job Displacement Concerns

There's a legitimate question here: what happens to drivers? New York has roughly 13,600 licensed taxi drivers, plus thousands of Uber and Lyft drivers. Robotaxis don't eliminate those jobs overnight, but they do create pressure.

This is a real policy concern that governors need to address. You can't just deploy autonomous vehicles and ignore the employment impact. Hochul's legislation doesn't specifically address this, but it's something that needs to be part of the policy conversation.

Historically, technology creates new jobs even as it eliminates old ones. Elevator operators disappeared when elevators became automated, but elevator maintenance became a job. Switchboard operators disappeared when automatic switching became standard, but telephone system technicians became a job. The pattern holds across industries.

For transportation specifically, robotaxi deployment would likely create new jobs: maintenance technicians, fleet managers, system engineers, customer service specialists. These might not pay as much as taxi driving did, and they might not be in the same locations. But there are opportunities.

That said, the transition is real and painful for people currently driving. Good policy would include retraining programs, transition assistance, or other support mechanisms. Whether Hochul's administration includes this remains to be seen.

Public Transit Implications

Here's something people don't think about much: how does robotaxi deployment affect public transit systems? The Metropolitan Transportation Authority (MTA) runs buses and subways in the New York area. If more people use robotaxis instead of buses or trains, that reduces public transit revenue.

Lower transit revenue means less funding for infrastructure. That could create a downward spiral where public transit gets worse, more people use robotaxis, revenue drops further, service deteriorates more. This is a real policy risk that regulators should consider.

On the other hand, robotaxis might complement public transit. People might take buses for long commutes and robotaxis for last-mile connections. Or people might use robotaxis when it's raining or cold when they otherwise wouldn't take transit. The actual impact depends on how pricing works and how people behave.

This is another area where the pilot program approach makes sense. You can monitor how robotaxi deployment affects public transit usage in real time. If there's negative impact, you adjust regulation. If there's positive impact or no impact, you proceed with expansion.

Safety Concerns and Real-World Edge Cases

When Autonomous Vehicles Fail

Autonomous vehicles don't cause the kinds of accidents human drivers cause. But they do cause accidents. And sometimes those accidents reveal fundamental limitations in the technology.

Cruise, a competitor to Waymo, had an incident in San Francisco where an autonomous vehicle hit a fire truck. This happened because the vehicle didn't recognize that the fire truck had its lights on, which created an emergency situation. The vehicle saw an obstacle but didn't understand the context.

Waymo has had incidents too. Autonomous vehicles sometimes struggle with construction zones. They get confused by non-standard road markings. They struggle with hand signals from police officers directing traffic. These are edge cases, but they're real.

The question regulators need to answer is: how many edge case failures are acceptable? If an autonomous vehicle fails once per million miles, is that safe? Twice per million miles? Human drivers cause accidents at specific rates. The comparison helps set standards.

But there's a psychological element. People might tolerate accidents from other people because everyone makes mistakes. But an accident from a machine feels different. If an autonomous vehicle causes an accident because of a software bug, people blame the company. If a human causes the same accident because of driver error, people blame the driver.

This psychological difference means autonomous vehicles might need to be significantly safer than human drivers to gain public acceptance. That's not stated policy, but it's implied by public sentiment. Regulators understand this.

Weather and Extreme Conditions

New York has harsh winters. Snow, ice, sleet. Autonomous vehicles struggle with heavy snow because it obscures lane markings and changes road traction in ways sensors don't predict well.

Waymo's experience in Phoenix and Las Vegas doesn't include much winter weather. That's a gap in their testing data. New York winters are coming, and Waymo will need to demonstrate their vehicles handle winter conditions safely.

Rain is manageable. Most autonomous vehicles handle rain okay. But snow creates real challenges. Road salt can affect sensors. Icy roads change how vehicles handle. Visibility decreases. These are factors that human drivers adapt to through experience. Autonomous vehicles need explicit programming or training to handle these scenarios.

There's also the question of winter maintenance. Do you clear snow from your autonomous vehicles? Can they operate in heavy snow? What's your protocol for extreme weather events? These operational questions need to be answered before winter deployment.

Cybersecurity Risks

Waymo's vehicles are connected. They communicate with servers. They receive software updates. That connectivity is a potential security vulnerability. If someone hacked Waymo's fleet, they could potentially control multiple vehicles simultaneously.

Waymo has security measures to prevent this. But the threat exists. Regulators need assurance that security is taken seriously. This is an ongoing concern for all autonomous vehicle operations, not just in New York.

The stakes are high. A successful cyberattack on an autonomous vehicle fleet could have catastrophic consequences. Regulators will want to see detailed security protocols, regular security audits, and incident response plans.

Autonomous vehicles could improve transportation access and safety while offering environmental benefits. However, addressing job displacement and ensuring equity is crucial. (Estimated data)

Competitive Landscape and Alternative Technologies

Who Else Is In the Game?

Waymo isn't alone in the autonomous vehicle space. Cruise, which was owned by General Motors, invested billions in autonomous vehicle development but withdrew from the market after safety incidents. Tesla is developing autonomous driving features, though their technology is controversial in terms of actual autonomy.

Apple was working on autonomous vehicles but apparently abandoned the project. Other players include startups like Aurora and Nuro, though these companies focus on niche applications or are still in development phases.

International companies are also developing autonomous vehicles. German companies like BMW and Mercedes are exploring this space. Chinese companies are advancing rapidly. Japanese companies like Toyota are investing heavily.

But in the United States, in the specific category of commercial robotaxi services, Waymo is clearly leading. That's why they're positioned to be first in New York. But competition will eventually emerge. Other companies will develop comparable technology and apply for pilots in New York or other states.

Alternative Transportation Solutions

Autonomous vehicles aren't the only innovation in transportation. Micro-mobility options like electric scooters and bikes are growing. Public transit systems are improving in some cities. Electric vehicles are becoming mainstream. App-based ride-sharing itself was a massive innovation just 10 years ago.

Robotaxis compete with all of these options. If robotaxis become available and cheaper than Uber, people will use them. If they're more expensive, people won't. The competitive landscape includes taxis, Uber, Lyft, buses, trains, cars, electric bikes, scooters, and walking.

Waymo's advantage is that they're first to deploy at scale in many markets. They're building brand recognition. Riders will associate "robotaxi" with "Waymo." That's a powerful position. But it's not insurmountable. As other companies deploy comparable technology, the competition will intensify.

Political and Community Considerations

Local Acceptance and Community Engagement

Hochul's legislation requires demonstrating "local support for autonomous vehicle deployment." This isn't just regulatory language. It reflects a real truth: if communities don't want robotaxis, they become politically difficult to operate.

Waymo will need to work with local government officials, community boards, and residents in areas where they want to deploy. They'll need to explain how autonomous vehicles will benefit the community. They'll need to address concerns about safety, job displacement, and service to underserved areas.

Waymo probably understands this already. They've done community engagement in other markets. But New York is different. New Yorkers are skeptical of tech companies and their promises. Public trust is important.

One way Waymo could build support is by focusing deployment in areas with transportation gaps. Maybe there's a neighborhood with limited Uber/Lyft service because it's not profitable for drivers. Robotaxis could serve that area affordably. That creates real community benefit.

Another approach is transparency. Waymo could publish detailed safety data in New York. They could invite community members to ride in vehicles. They could work with local organizations. Building trust takes time but pays off in political support.

Environmental and Equity Considerations

Autonomous vehicles offer environmental benefits. They can be electric, eliminating emissions. They can optimize routes to reduce fuel consumption. They can reduce total vehicles on the road if people switch from car ownership to robotaxi services.

But there are equity concerns. If robotaxis only operate in wealthy areas and are expensive, they increase inequality. Wealthy people get cheap, convenient transportation while poor people are stuck on overcrowded buses.

Good policy would ensure robotaxis operate in a way that benefits all communities. Maybe there's a requirement to operate in underserved areas. Maybe there's pricing regulation to keep fares affordable. Maybe there's coordination with public transit to complement rather than replace it.

Hochul's legislation doesn't specifically address these concerns, but they're part of the policy conversation.

Political Opposition and Uncertainty

Not everyone supports autonomous vehicle deployment. Taxi drivers are concerned about job security. Some safety advocates worry about accidents. Some privacy advocates worry about data collection from autonomous vehicles.

These aren't unreasonable concerns. Good policy takes them seriously. Hochul's administration will need to address these constituencies. That might slow down legislation or lead to additional requirements, but it's part of normal policy process.

There's also uncertainty about whether the legislation will actually pass. Hochul proposed it, but the state legislature needs to approve it. Legislators represent different districts with different interests. Upstate New York might love robotaxis. Downstate might be more skeptical. Negotiations could change the bill's terms.

Historically, transportation policy changes take time. They involve compromise. Multiple interest groups negotiate. The final policy is usually different from what was originally proposed. That's not a bug in democracy. It's a feature. Policies that reflect broad agreement tend to be more durable.

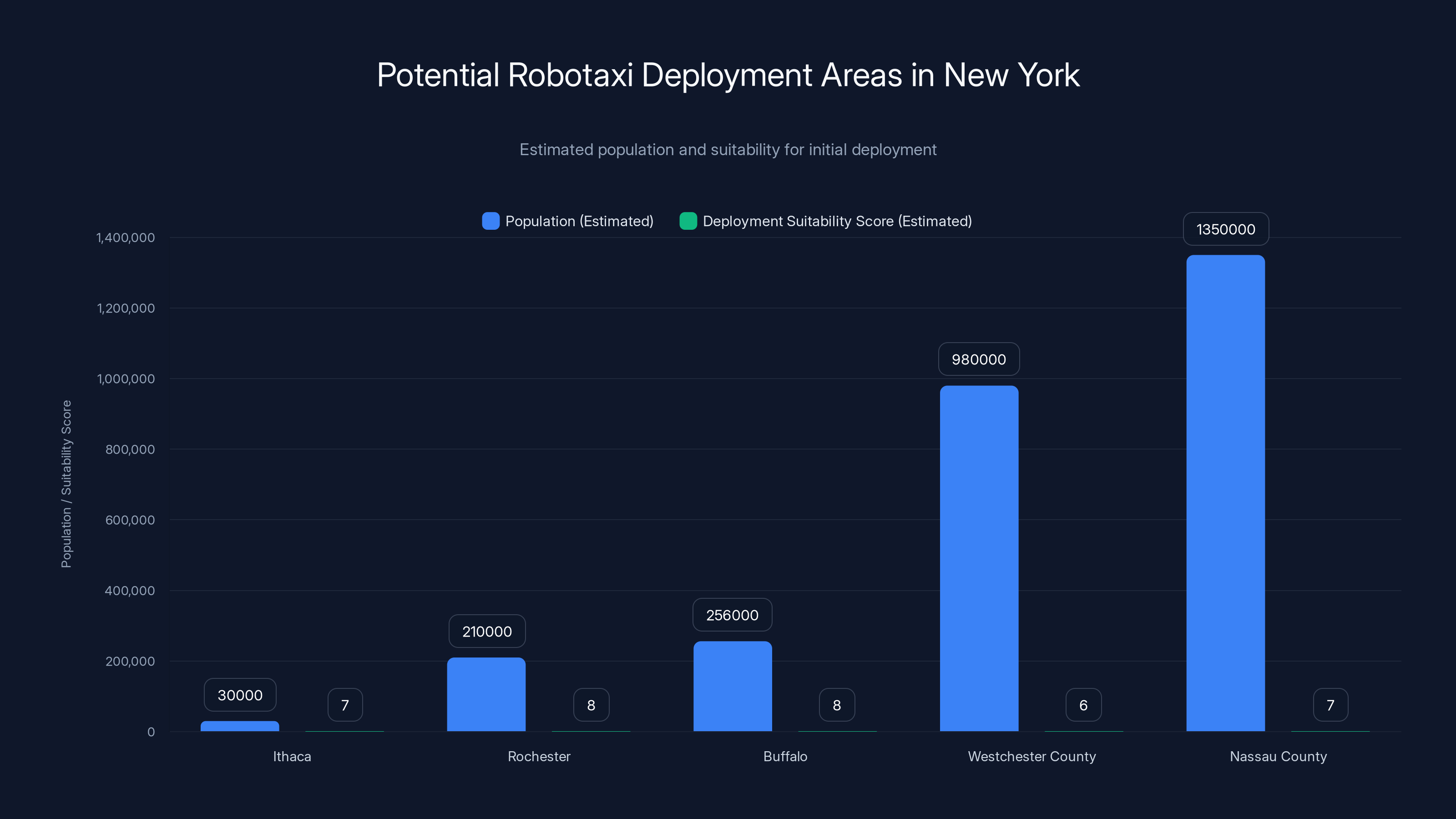

Robotaxis are likely to be deployed first in smaller cities like Ithaca, Rochester, and Buffalo due to manageable traffic and significant transportation needs. Suburban areas like Westchester and Nassau Counties also present opportunities. Estimated data.

Technical Deep Dive: How Autonomous Driving Works

Sensor Technology and Perception

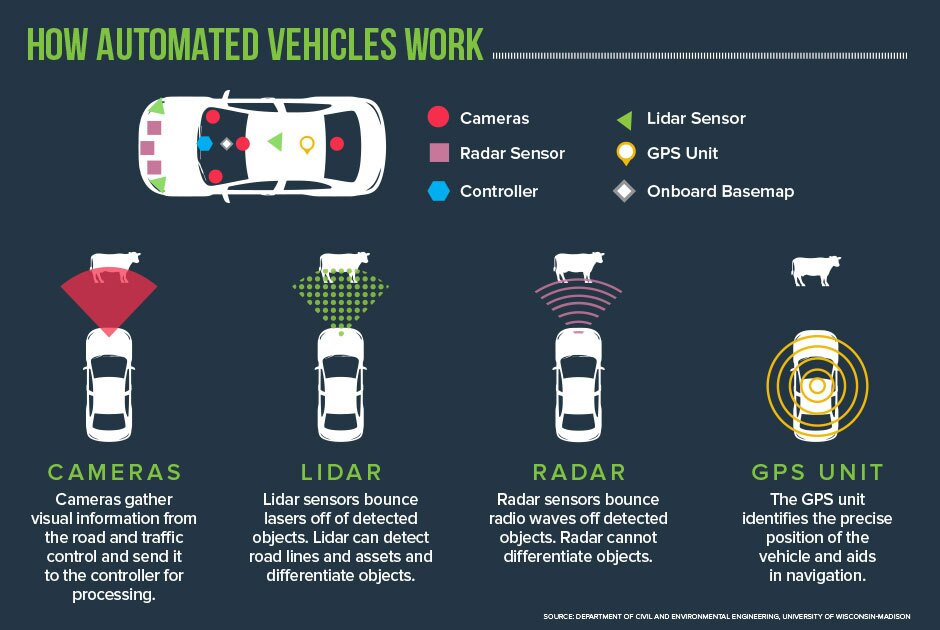

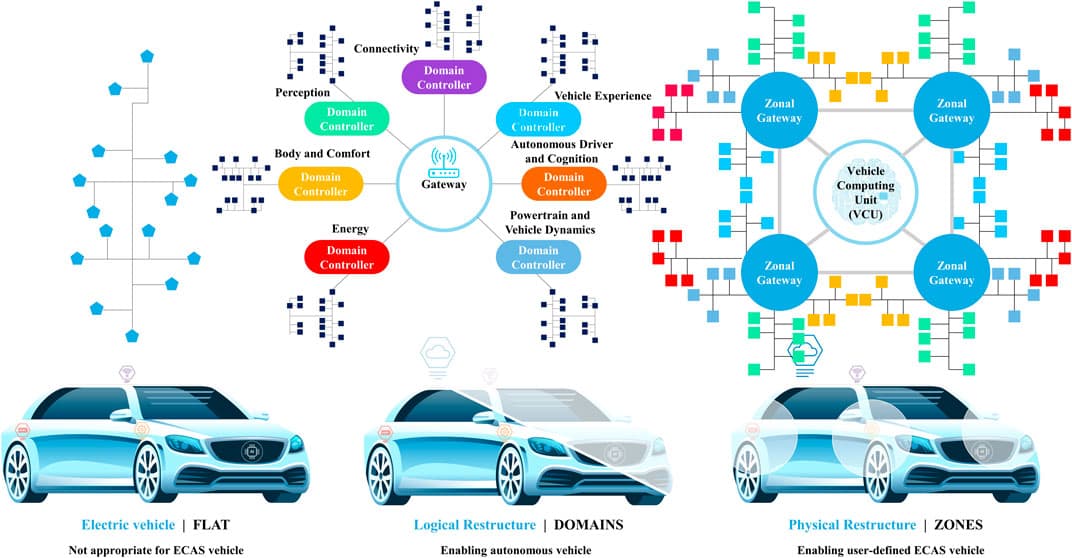

Autonomous vehicles need to understand their environment. They do this using sensors. Most robotaxis use a combination of cameras, lidar, and radar. Cameras see what humans see. Lidar uses lasers to create 3D maps of surroundings. Radar detects objects and measures their velocity.

The redundancy matters. If the camera fails, you still have lidar. If both fail, you still have radar. No single sensor is perfect, but multiple sensors give you a robust picture of the environment. This is called sensor fusion, and it's critical to autonomous driving safety.

Processing sensor data in real-time is computationally intensive. Waymo's vehicles have powerful onboard computers that process incoming sensor data hundreds of times per second. They're constantly asking: where am I? What's around me? What obstacles exist? What's moving?

This perception task is far more complex than humans realize. When you drive, you're combining vision with experience. You know what a curb looks like, what a lane marker is, what a pedestrian walking toward the street is about to do. Autonomous vehicles need to learn all of this from sensor data without the intuition that comes from years of driving.

Decision-Making and Planning

Once a vehicle understands its environment, it needs to decide what to do. Should I speed up? Slow down? Change lanes? Honk? Stop?

Waymo uses machine learning models trained on millions of miles of driving data. These models have learned patterns: when pedestrians cross streets, how traffic typically flows, what's normal and what's anomalous.

But machine learning isn't perfect. It can fail on edge cases the training data didn't include. That's why autonomous vehicles also have rule-based systems. If a traffic light is red, stop. If a pedestrian is in the crosswalk, wait. These rules override learned behavior when clear rules apply.

Decision-making happens constantly, sometimes hundreds of times per second. The vehicle is continuously answering: given where I am and what I see, what's the safest action to take right now?

One interesting constraint is that autonomous vehicles need to be predictable. If a vehicle makes an unpredictable decision, other drivers can't anticipate its behavior. So Waymo's vehicles are programmed to behave like experienced human drivers would behave. Conservative, predictable, following traffic laws.

Learning and Improvement

Waymo continuously improves their technology. They collect data from every deployed vehicle. Machine learning engineers analyze this data to find patterns. Where did vehicles encounter unexpected situations? Where did the system struggle?

They then use this analysis to improve training data for machine learning models. New versions of software are tested extensively before deployment. A software update that passed testing in simulation still needs to be validated in the real world.

This cycle of deployment, data collection, analysis, and improvement is how autonomous vehicles get better. It's an iterative process that takes time. That's why companies operating at scale (like Waymo) have an advantage. More deployment means more data means faster improvement.

Over time, systems become more robust. Edge cases become less common. Safety metrics improve. This is all happening now with Waymo's operations in multiple states. By the time they deploy in New York, they'll have even more data and a more mature system.

Real-World Deployment Scenarios in New York

Where Robotaxis Would Operate

Waymo won't start by deploying robotaxis everywhere in New York. They'll target specific areas where the economics make sense and the operational challenges are manageable.

Smaller cities are likely targets. Ithaca, Rochester, Buffalo: these cities have populations between 100,000 and 500,000. They have traffic, but it's less complex than New York City. They have transportation needs, particularly for people who can't or won't drive. Robotaxis could provide value.

Suburban areas around the city are also possible. Towns in Westchester County or Nassau County have car-dependent transportation systems. Robotaxis could fill gaps where ride-sharing services operate but less frequently than in the city.

Eventually, if pilots succeed, Waymo might try limited New York City deployment. But that would come later. Get proven in smaller markets first, then expand to the complex urban environment.

Integration with Existing Systems

Waymo robotaxis will operate alongside traditional transportation. Taxis, buses, regular cars, pedestrians, cyclists: robotaxis need to share the road with all of these.

This creates coordination challenges. Traffic signals need to work with autonomous vehicles. Road designs might need to change. Emergency responders need protocols for interacting with autonomous vehicles.

Waymo has some experience with this from their operations in other states, but every jurisdiction is different. They'll need to work with New York Department of Transportation on integration issues. They'll need to train police, fire, and emergency responders on protocols.

Buses and robotaxis might need to coordinate too. If a bus is running behind schedule, robotaxis might need to route around it. If a robotaxi needs to stop suddenly, buses need to anticipate this. These coordination challenges aren't insurmountable, but they require careful planning.

First-Year Operations and Expectations

If pilots launch in 2026 or 2027, what should people expect? Limited availability. Maybe one or two areas with robotaxi service. Limited hours initially. Higher costs than later when volume increases.

Riders will be early adopters: people curious about autonomous vehicles, people in areas with limited traditional ride-sharing options, people willing to try something new. Waymo will carefully monitor operations, collect data, and be ready to adjust if problems emerge.

Regulators will be watching too. Accident rates, incident reports, customer complaints, community impact: all of this will be scrutinized. Pilots are explicitly limited in scope because regulators want to understand impacts before scaling up.

If pilots succeed, expansion would follow. More cities, more hours, more coverage. Over 2-5 years, robotaxi service could become commonplace in many New York markets. But it all depends on pilots demonstrating safety and viability.

The Broader Transportation Future

How New York Influences National Policy

New York is a policy leader in many areas. The state is large, influential, and often pioneers policies that other states later adopt. If New York successfully regulates autonomous vehicle deployment, other states will watch and learn.

California pioneered autonomous vehicle policy in some ways, but California is thought of as very tech-friendly. New York is seen as more balanced between innovation and regulation. A policy that works in New York has broader credibility.

Federal legislators will also watch. Congress hasn't passed comprehensive autonomous vehicle legislation. But they're considering it. Successful state policies like New York's could inform what federal policy eventually looks like.

So this isn't just about New York getting robotaxis. It's about establishing a policy template that works, can be replicated, and might inform national policy. That's why this matters beyond New York.

The Multi-Year Transformation

Full transportation transformation in New York won't happen in a year or two. This is a multi-year process. Even if legislation passes immediately, pilots would take 2-3 years to prove viability. Full-scale deployment would take 5-10 years. Complete transformation of transportation patterns would take longer.

During this time, traditional ride-sharing (Uber, Lyft) will continue operating. Taxis will continue operating. Public transit will continue operating. Robotaxis will be one option among many, growing in market share as they prove themselves.

What happens over 10-20 years is harder to predict. Maybe robotaxis become dominant and traditional ride-sharing shrinks. Maybe they coexist. Maybe robotaxis are successful in some areas and not others. Transportation markets are complex and path-dependent.

But the direction is clear. Autonomous vehicles are improving. Deployment is expanding to new markets. Technology is becoming more mature. New York joining the autonomous vehicle revolution accelerates this trend nationally.

Preparing for the Transition

Cities and states need to prepare for autonomous vehicle deployment even before pilots launch. This includes policy work, infrastructure planning, workforce development, and public communication.

Policy work includes insurance frameworks, liability rules, safety standards, and coordination with other transportation systems. Hochul's legislation is just the beginning. Detailed regulations will follow.

Infrastructure planning includes making sure roads are suitable for autonomous vehicles. Newer road markings work better with autonomous vehicles. Some intersections might need modifications. Charging infrastructure for electric robotaxis will be needed.

Workforce development is important because jobs will change. Drivers need retraining. New roles in autonomous vehicle maintenance, operations, and monitoring will emerge. Communities need time to prepare for this transition.

Public communication is crucial. People need to understand what autonomous vehicles are, how they work, and why deployment is beneficial. Fear and misinformation are obstacles to adoption. Good communication helps build understanding and support.

FAQ

What exactly is a robotaxi?

A robotaxi is a fully autonomous vehicle operated as a for-hire service, similar to Uber or Lyft but without a human driver. Passengers request a ride through an app, a vehicle arrives, and the vehicle drives them to their destination automatically. The vehicle has sensors, computers, and software that enable it to navigate roads, follow traffic laws, and respond to obstacles without human intervention.

How does Governor Hochul's proposed legislation work?

Hochul's legislation creates a pilot program that would allow autonomous vehicle companies to deploy fully self-driving vehicles for commercial passenger service outside New York City. Companies must apply and demonstrate local community support and adherence to safety standards. If approved, they can operate limited robotaxi services in designated areas. The pilot program allows regulators to test whether autonomous vehicles operate safely and beneficially before broader deployment.

Why did New York previously ban autonomous vehicle commercial service?

New York took a cautious approach while autonomous vehicle technology was still developing. Regulators wanted evidence that the technology was safe before allowing commercial deployment. Other states like California deployed robotaxis earlier and provided data that helped New York regulators understand the technology better. Once that evidence accumulated, the policy shifted from prohibition to allowing limited pilots.

How safe are Waymo's autonomous vehicles?

Waymo publishes detailed safety data showing their vehicles have had fewer accidents per mile driven compared to human drivers in the same areas. They've operated millions of miles across multiple states. That said, autonomous vehicles do have accidents, particularly in complex situations. Waymo continues improving their technology through machine learning and data analysis. No system is 100% safe, but the evidence suggests Waymo's vehicles are reasonably safe for commercial deployment.

What happens to taxi and ride-share drivers if robotaxis become common?

This is a legitimate concern. Robotaxis would reduce demand for human drivers, particularly for ride-sharing services like Uber and Lyft where driver-related costs are high. But the transition happens gradually. In early phases, robotaxis would only serve limited areas and times. Human drivers would continue operating. Over many years, demand might shift, but this isn't an overnight change. Good policy would include transition support for workers, but Hochul's legislation doesn't specify this.

How much will robotaxi rides cost?

Initial pricing isn't specified in the legislation. Waymo typically prices robotaxis comparable to or slightly cheaper than traditional ride-sharing services. In markets where they operate, costs are in line with Uber or Lyft. Once volume scales up and operational costs decrease, prices might decline further. But early pilots typically have higher costs because volume is limited.

When could robotaxis actually start operating in New York?

If legislation passes promptly, regulators would develop detailed rules over 6-12 months. Companies would then apply and potentially be approved within another 3-6 months. Actual pilot operations might begin in 2026 or 2027. If there are legislative delays or regulatory complications, deployment could happen later. This is a multi-year process, not something happening immediately.

Will robotaxis operate in New York City?

Hochul's proposed legislation explicitly excludes New York City from initial pilots. The program allows deployment "outside New York City." This means pilots would start in suburban areas or smaller upstate cities. If pilots succeed, there might be expansion to New York City eventually, but that would come later, probably 3-5 years into pilot programs.

What about winter weather and snow? Can autonomous vehicles handle it?

Autonomous vehicles struggle with heavy snow because it obscures lane markings and road conditions. Waymo's experience in Phoenix, Las Vegas, Austin, and San Francisco doesn't include much winter weather. They'll need to test and improve their systems for New York winters before deployment. This is a real technical challenge that needs to be solved. It's possible but not automatic.

Could robotaxis be hacked or have security vulnerabilities?

Yes, this is a real concern. Autonomous vehicles are connected and computerized, which creates potential security vulnerabilities. If someone hacked Waymo's system, they could potentially control multiple vehicles. Waymo has security measures to prevent this, and regulators will require detailed security protocols. This is an ongoing concern, but it's not unique to Waymo. All connected autonomous systems face this challenge.

Conclusion: The New York Robotaxi Moment

When Governor Hochul proposed autonomous vehicle legislation during her State of the State address, she signaled that New York is ready to embrace this technology. After years of cautious regulatory policies, the state is opening its doors to robotaxis. That's a significant shift, and it matters far beyond New York.

Waymo is clearly positioned to benefit. They've invested in lobbying, proven their technology in other states, and built operational infrastructure. If legislation passes, Waymo will probably be first to deploy a robotaxi pilot in New York. But they won't be the only beneficiary. The entire autonomous vehicle ecosystem benefits from regulatory clarity and demonstrated viability.

What's happening here is normal policy evolution. A technology matures. Evidence accumulates. Regulators shift from prohibition to permission. Deployment begins on a limited basis. Regulators monitor results. If things go well, deployment expands. This happened with aircraft, motorcycles, and many other technologies. It's happening now with autonomous vehicles.

The pilot program approach is smart. It gives regulators data before committing to full deployment. It gives companies a chance to prove themselves in a new market without massive regulatory risk. Everyone gets to learn from real-world operations instead of just debating in offices.

But questions remain. Will pilots demonstrate sufficient safety for expansion? Will communities support autonomous vehicle deployment? How will policy balance innovation with worker protection and equity concerns? What happens to public transit if robotaxis capture significant market share?

These questions will be answered over the next few years. The New York pilot program is an experiment in autonomous vehicle policy. Other states are watching. The results will influence how autonomous vehicles are regulated nationwide.

One thing seems certain: autonomous vehicle technology is improving. Deployment is expanding. Waymo and competitors are building operational capabilities that work at scale. The question for cities and states isn't whether to allow autonomous vehicles eventually. It's how to regulate their deployment in ways that benefit everyone while managing risks and protecting workers.

Hochul's legislation is a step toward answering that question. It's not perfect. It doesn't address every concern. But it signals that New York is ready to move forward, learn from deployment, and shape the future of transportation. That's the real significance of this moment.

For New York residents, the implications are concrete. Within a few years, robotaxi service will probably be available in some areas of the state. For some people, robotaxis will become their primary transportation option. For others, traditional ride-sharing or other modes will remain dominant. The transportation market will become more diverse, with more options available.

For the autonomous vehicle industry, New York's policy shift is validation. It confirms that robotaxi deployment is viable in major urban states, not just in early-adopter markets. If New York succeeds, expect other states to accelerate their own autonomous vehicle policies. Waymo and competitors will expand deployment. Investment in autonomous vehicle technology will likely increase.

The robotaxi era is beginning. New York is helping write the early chapters of that story. How the story develops depends on how seriously regulators take safety, how willing communities are to try this technology, and how well companies like Waymo deliver on their promises. The next few years will be crucial in determining whether autonomous vehicles become a normal part of American transportation or remain a niche service for specific markets and use cases.

One thing's for certain: the regulatory conversation about autonomous vehicles has shifted fundamentally. The question is no longer "should we allow robotaxis?" It's "how should we regulate robotaxis to maximize benefits while managing risks?" That shift is the real story behind Hochul's legislation. It opens a door that won't close. What comes through that door next will reshape transportation in New York and influence how America approaches autonomous vehicle policy for decades to come.

Key Takeaways

- Governor Hochul's proposed pilot program would allow commercial autonomous vehicle services outside NYC if companies demonstrate local support and safety adherence

- Waymo is the clear frontrunner for New York approval, having already invested $370K+ in lobbying and operating successful robotaxi services in multiple states

- New York's regulatory framework could become a template for other states, influencing how autonomous vehicles are regulated nationwide

- Winter weather and urban complexity represent genuine technical challenges that autonomous vehicles must overcome before broader New York deployment

- The transition from prohibition to pilot programs reflects how transportation policy evolves: evidence accumulates, concerns address, and technology deployment begins on limited basis

Related Articles

- Physical AI in Automobiles: The Future of Self-Driving Cars [2025]

- Kodiak and Bosch Partner to Scale Autonomous Truck Technology [2025]

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- Tesla Loses EV Crown to BYD: Market Shift Explained [2025]

- CES 2026: Complete Guide to Tech's Biggest Innovations

- Ford's AI Voice Assistant & Level 3 Autonomy: What's Coming [2025]

![New York's Robotaxi Revolution: What Hochul's Legislation Means [2025]](https://tryrunable.com/blog/new-york-s-robotaxi-revolution-what-hochul-s-legislation-mea/image-1-1768334857355.jpg)