Introduction: When Does an AI Lab Actually Care About Revenue?

There's something genuinely strange happening in the AI industry right now. Talented researchers who spent years at OpenAI, Google, and Anthropic are launching their own labs. You've got legendary figures like Fei-Fei Li building new ventures. And somehow, it's become nearly impossible to tell who actually wants to make money.

This matters more than you'd think. Investors pour billions into these companies. Employees bet years of their careers on them. Partners integrate with them. But the ambiguity creates real confusion about what these labs are actually trying to accomplish.

The problem isn't that people are lying about their intentions. It's that the AI funding environment has become so permissive, so awash with capital, that a lab can honestly claim multiple conflicting goals at once. You can be a world-class research institution and a commercial enterprise. You can have a vague product roadmap and still raise billions. Nobody's interrogating the details too closely because the entire industry is running on hype and hope.

What we need is clarity. Not about whether AI labs are succeeding or failing at making money. Success and failure are messy things, full of luck and timing. What matters is intent. Are they actually trying? Do they have a plan, however ambitious or modest? Are the people involved motivated by commercial success or by something else entirely?

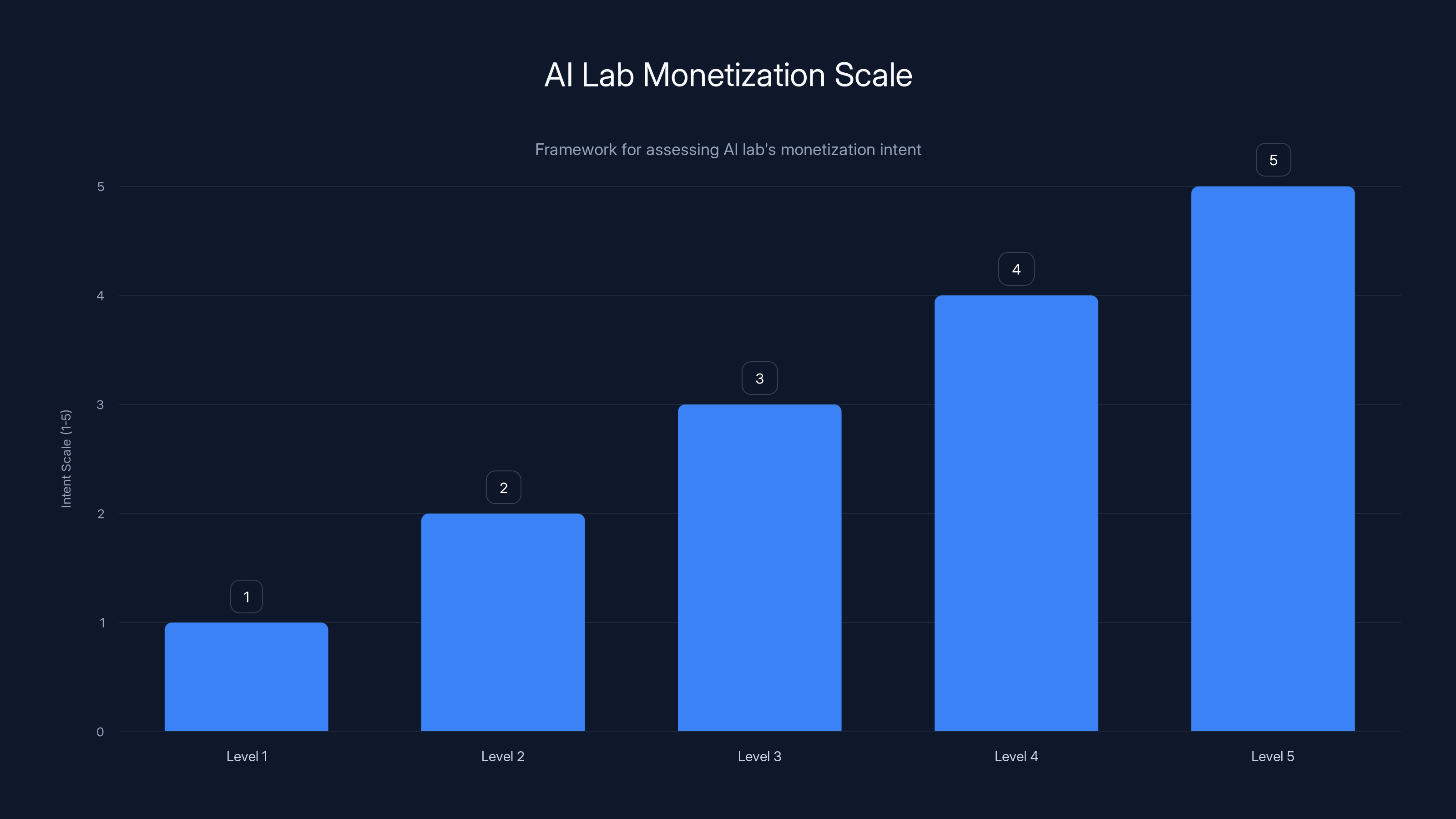

I'm proposing a rating system for this. It's simple. It's not designed to predict which labs will win or lose. It's designed to measure where each lab is placing its bets. Think of it as a monetization motivation scale, where Level 1 is "I'm not particularly interested in being rich" and Level 5 is "I'm already drowning in money and want more."

Understanding where an AI lab falls on this scale tells you something important about their actual incentives. It explains their product decisions. It explains their hiring. It explains why some labs are ruthlessly focused and others seem to be wandering through multiple exploratory phases simultaneously. It explains the conflicts that happen when leadership disagrees about whether Level 2 or Level 4 is the real goal.

The AI industry's next phase will be defined by which labs figure out their actual monetization ambitions and commit to them. The ones that don't will either eventually clarify (often through departure, like we've seen) or fragment into something unrecognizable. So let's talk about what this scale looks like, why it matters, and where the actual players are sitting right now.

TL; DR

- Five-Level Scale Exists: AI labs can be rated by monetization ambition, not success, ranging from "I love myself" to "making millions daily"

- Clarity Matters: The biggest source of tension in AI labs comes from misalignment about which level leadership actually wants to operate at

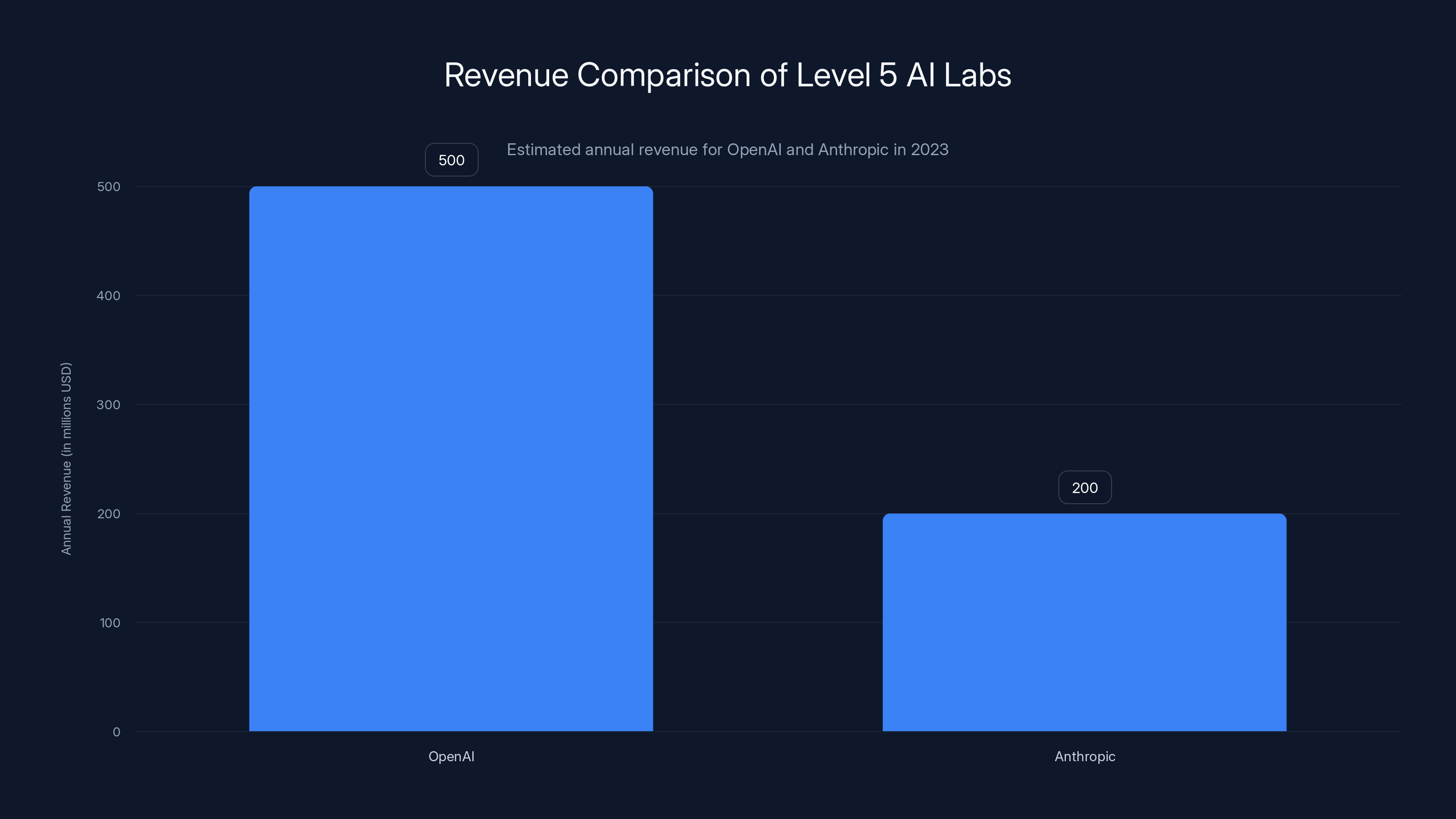

- Established Labs Are Level 5: OpenAI, Anthropic, Google, and Meta are already aggressively monetizing their AI capabilities

- New Labs Are Murky: Emerging labs like Humans&, Thinking Machines, and World Labs occupy Levels 2-4, creating investor and employee confusion

- Employee Reality: Researchers choosing between labs need to understand what level they're joining, because it affects everything from product focus to exit opportunities

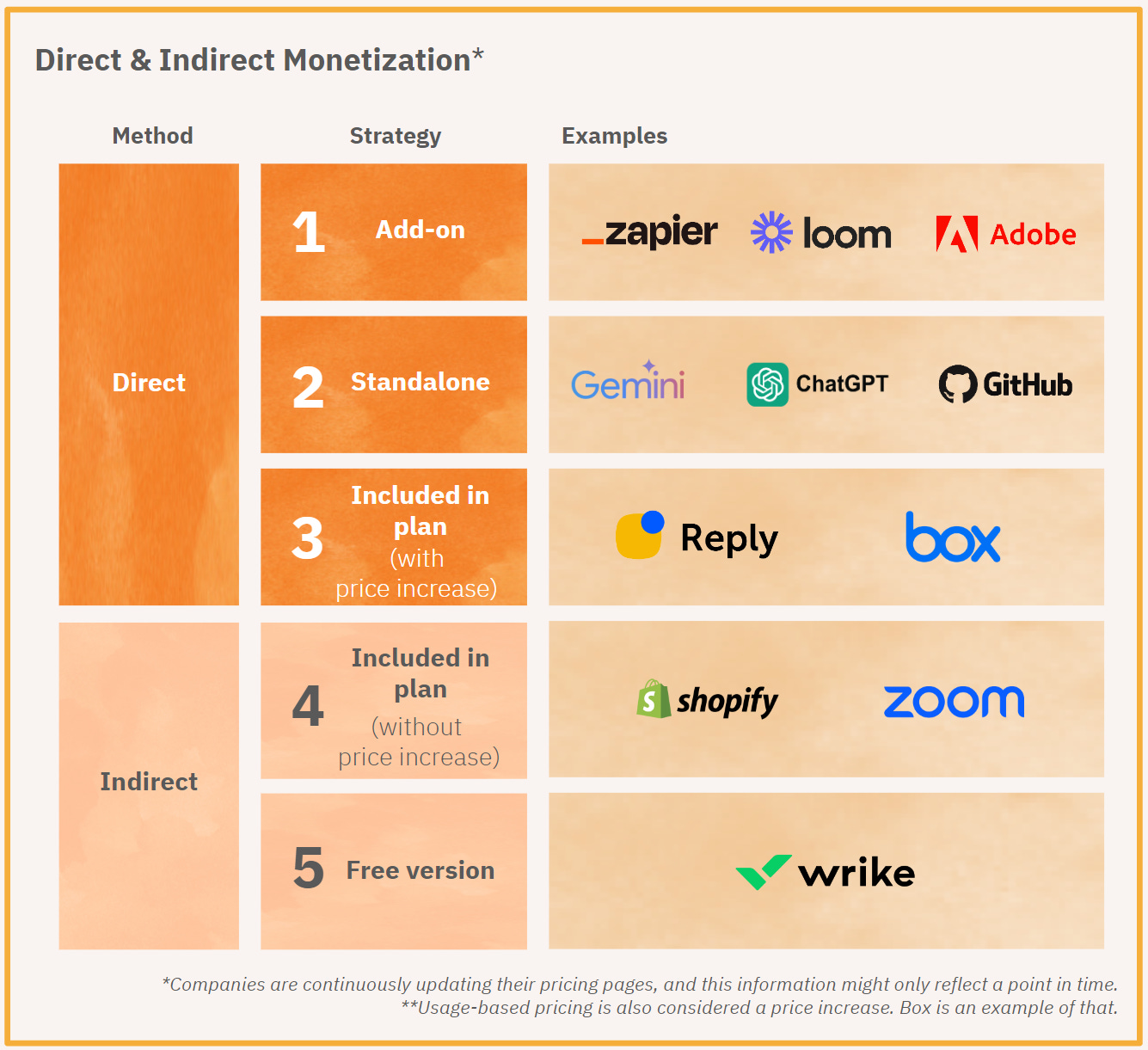

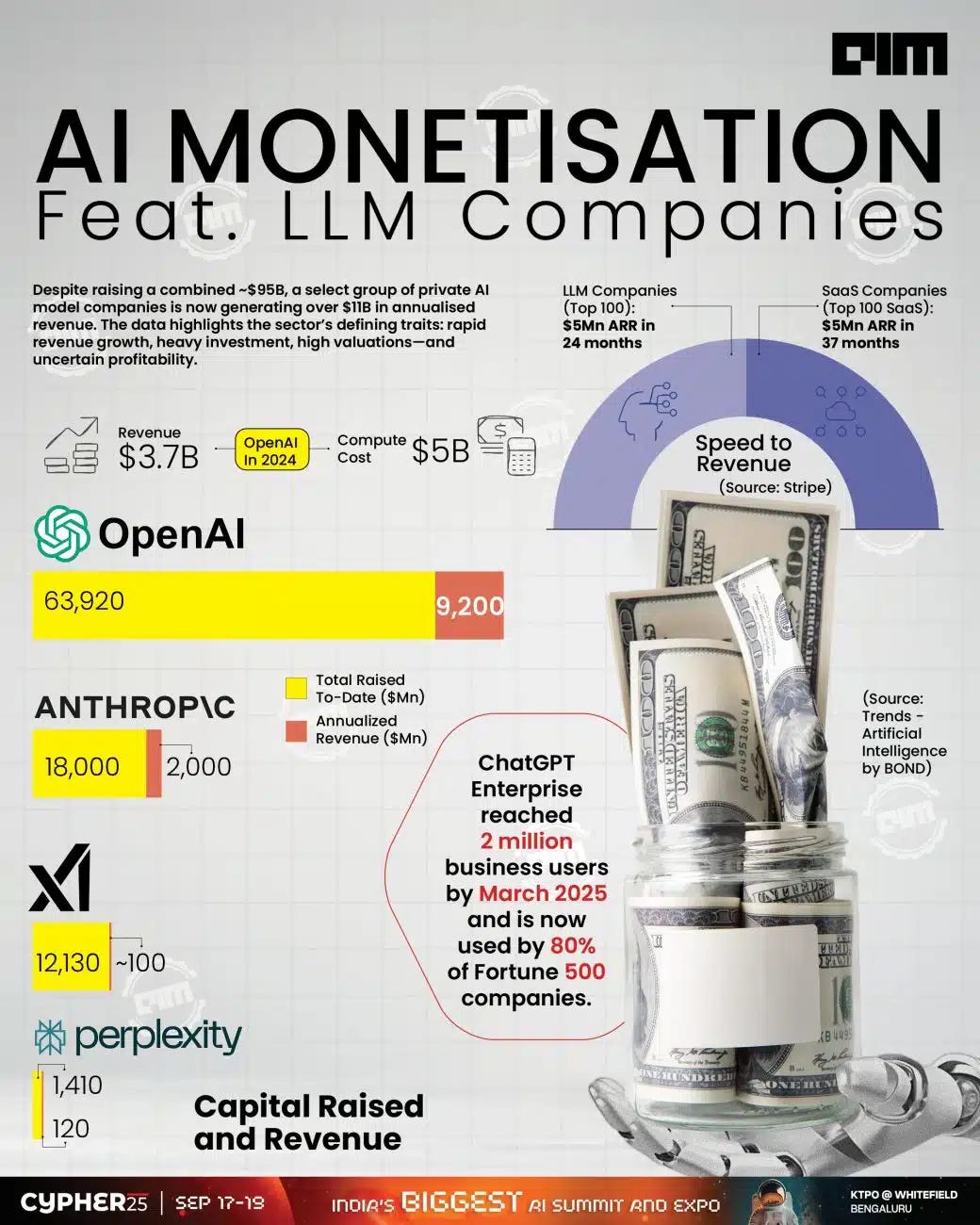

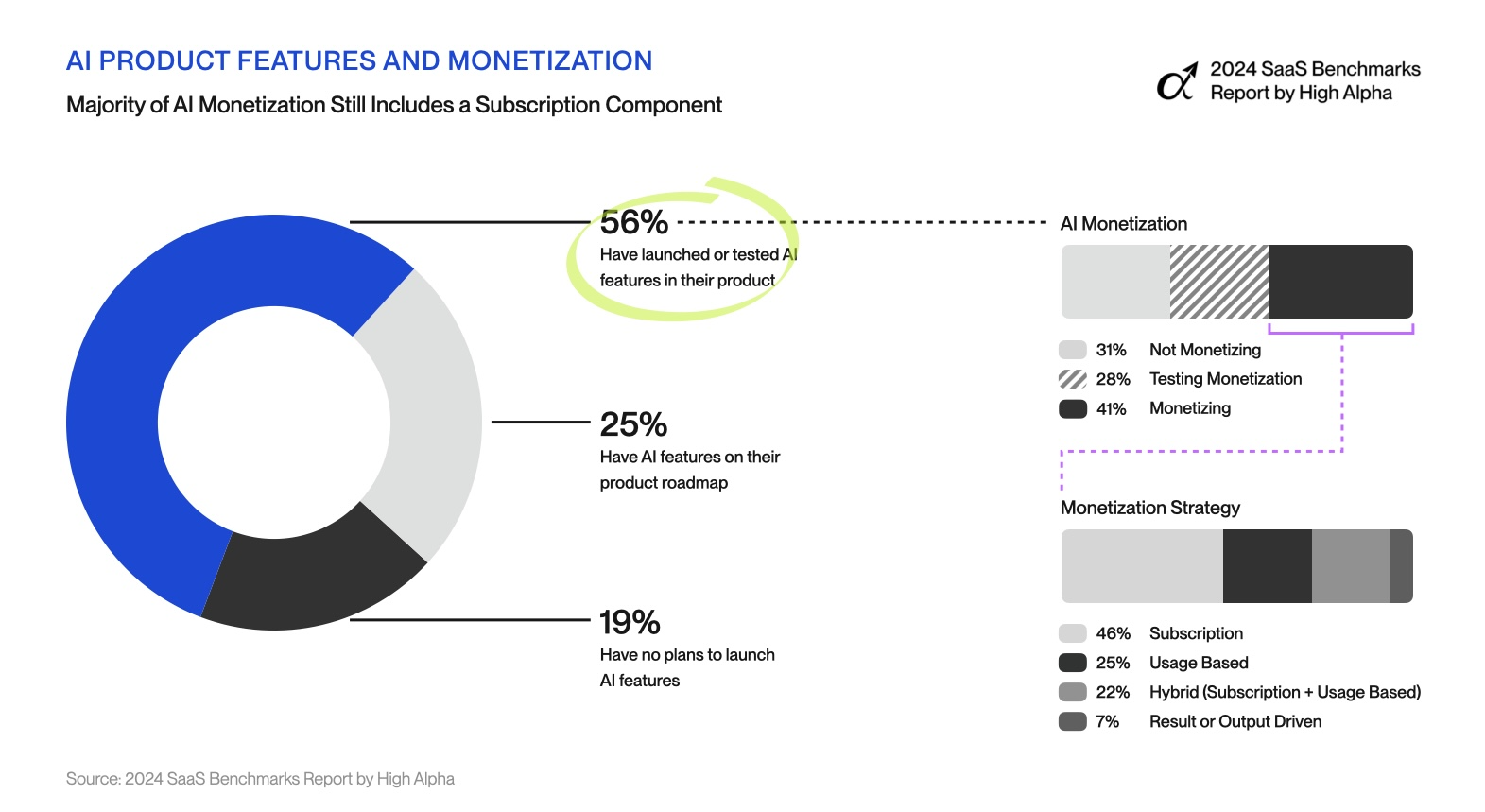

Different revenue models can achieve Level 5 status by generating substantial recurring revenue. Estimated data based on typical business models.

The Five Levels Explained: From Spirituality to Billionaire Status

Level 5: Already Making Millions Every Day

Level 5 is straightforward. You're generating substantial revenue. We're talking millions of dollars flowing in every single day. You're not hoping revenue materializes someday. It's here now. You can measure it. You can report it. You know exactly where it comes from.

At Level 5, your business model isn't aspirational. It's operational. You have paying customers. They're using your product. They're putting it in their workflows, integrating it with their systems, and they're paying because they'd lose money if they didn't use you.

What makes Level 5 interesting is that it doesn't require massive scale. One company could hit Level 5 with 50 enterprise customers paying

For AI labs, reaching Level 5 requires shipping products that work well enough that people actually use them instead of alternatives. It requires pricing them appropriately. It requires sales infrastructure, customer support, and the entire apparatus of a real business. You can't get here by accident. You have to intend it.

Level 5 labs aren't really labs anymore, by the way. They're software companies that happened to be founded by researchers. But they're still operating at lab-like speeds in research and development. They're still publishing papers. They're still exploring new directions. They're just doing it while also maintaining a business that generates hundreds of millions in annual revenue.

Level 4: Detailed Roadmap to Billionaire Status

Level 4 is where you have a plan. Not a vague aspiration. A detailed, credible, specific plan for how you're going to make enormous amounts of money. The plan probably spans multiple years. It probably involves multiple products or phases. You've likely mapped out milestones, funding rounds, and revenue targets.

What distinguishes Level 4 from Level 5 is that the money isn't there yet. But the path is clear. You know what needs to happen. You know the revenue model. You know the customer segments. You know the pricing. You might have early traction or beta customers. You might have partnerships in place. You're not hoping anymore. You're executing.

Level 4 requires real conviction from leadership. These are people willing to stake their reputation on a specific outcome. They're willing to make product decisions based on that outcome. They're hiring teams focused on monetization. They're turning down opportunities that don't fit the plan.

Level 4 labs might be spending most of their resources on research right now. But the research is directed. It's in service of something. Every major architectural decision is being made with the revenue model in mind. The CEO can articulate exactly how AI models will become valuable. They can explain the path from research to products to payments.

When a lab lands at Level 4, it tells investors and employees something important: we have ambitions and we have a roadmap. We're not making this up as we go. We're executing a strategy. That clarity is worth something. It attracts certain kinds of talent. It attracts investors who want to see conviction. It repels people who want to keep exploring indefinitely.

Level 3: Many Promising Ideas to Be Revealed Later

Level 3 is the comfort zone for many modern AI labs. You have genuine, promising product ideas. You're reasonably confident that some of them will make money. But you're not ready to commit to a specific roadmap. You're not ready to say definitively how you'll monetize. You're certainly not ready to share specifics with everyone.

Level 3 labs might be working on several parallel tracks simultaneously. One team is exploring enterprise software. Another is experimenting with consumer products. A third is building foundation models and seeing what applications emerge. The lab itself is confident that something valuable will come out of this exploration. But the exact something? That's still being determined.

Level 3 is where you still have optionality. You haven't committed to being a cloud provider or an enterprise software company or a consumer product. You're letting the market and the technology guide you. You're waiting for the product market fit signal.

What makes Level 3 different from Level 2 is that you believe revenue will come. You're not ambivalent about it. You're not philosophically opposed. You just aren't ready to bet everything on one specific approach. You have multiple bets running simultaneously.

Level 3 labs tell investors: we'll probably find valuable commercial applications for what we're building. Just give us time and resources to explore. This worked well for many tech companies in earlier eras. It's harder to justify in 2025 when investors are increasingly asking for specific plans.

Level 2: The Outline of a Concept of a Plan

Level 2 is murky. You're genuinely trying to think about monetization. You have conversations about it. You've probably sketched out some ideas on whiteboards. But you haven't crystallized anything. You don't have a credible roadmap. You have possibilities, not plans.

Level 2 labs are often running on momentum and quality of people rather than clarity of purpose. The founding team is brilliant. The research is cutting-edge. There's genuine excitement about what they're building. But when you push on the commercial aspects, things get vague. "We'll probably build something enterprise-focused," or "We think there's a consumer opportunity here somewhere."

Level 2 is where many research-heavy labs start. The founders are academics or PhDs who haven't thought much about business. They have excellent science. They might have excellent intuition about where value lives. But they haven't done the work of turning intuition into strategy.

What differentiates Level 2 from Level 1 is that you're at least trying. You're not hostile to the idea of making money. You're not opposed to commercialization. You're just not there yet. You haven't seriously worked through the mechanics.

Level 2 can work if you have extraordinary talent and the funding to support exploration. But it creates tension. Investors inevitably want clarity. Employees inevitably wonder whether they're building toward something real or just doing research. Partners don't know whether to bet on you as a long-term business or treat you as an interesting science project.

Level 1: True Wealth Is Self-Love

Level 1 is genuinely rare, but it exists. These are people who are fundamentally not motivated by money. They're doing this work because they find it intrinsically rewarding. They'd be just as happy doing it at a university with a teaching salary as they would be running a venture-backed company. They might make money incidentally. But it's not the goal. It's not even close to the goal.

Level 1 people are motivated by other things. Scientific discovery. Building something beautiful. Understanding how intelligence works. Contributing to humanity. These are real motivations. They're noble motivations. They just don't align with building a commercial enterprise.

Level 1 labs don't stay in venture capital for very long. The incentive structures are misaligned. VCs want Level 4 or Level 5. Level 1 founders want Level 1 outcomes. Eventually, someone realizes the mismatch and moves on.

You might find Level 1 people working at Level 3 or Level 4 labs, though. They're driven by the research and the ambition, not the money part. The money is just the vehicle that lets them keep doing the research. That's fine. It works. But when they're in leadership, you'll see the effect. Decisions will often favor research over commercialization. When there's a conflict between making money and doing interesting work, you'll see the team choose interesting work.

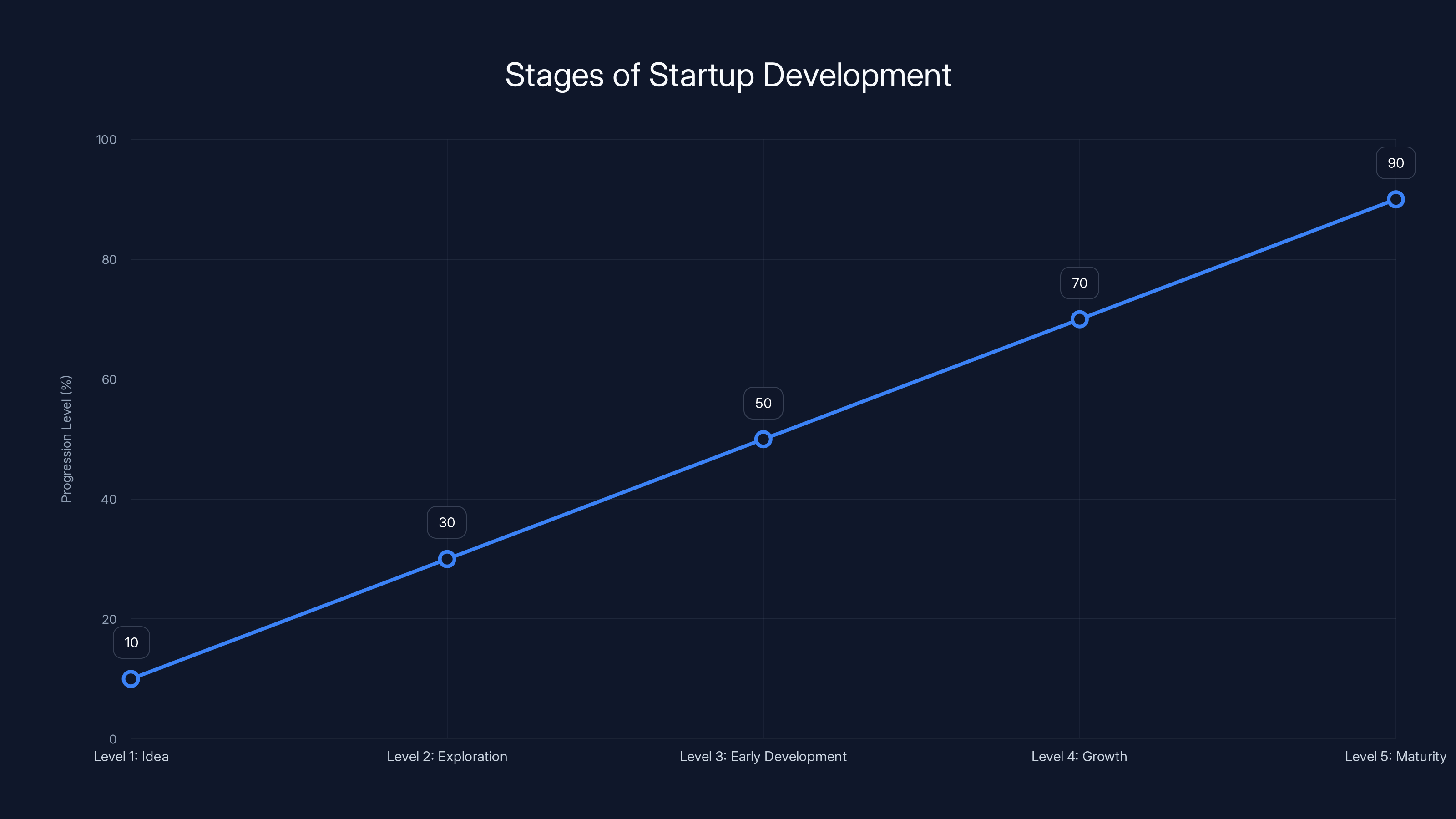

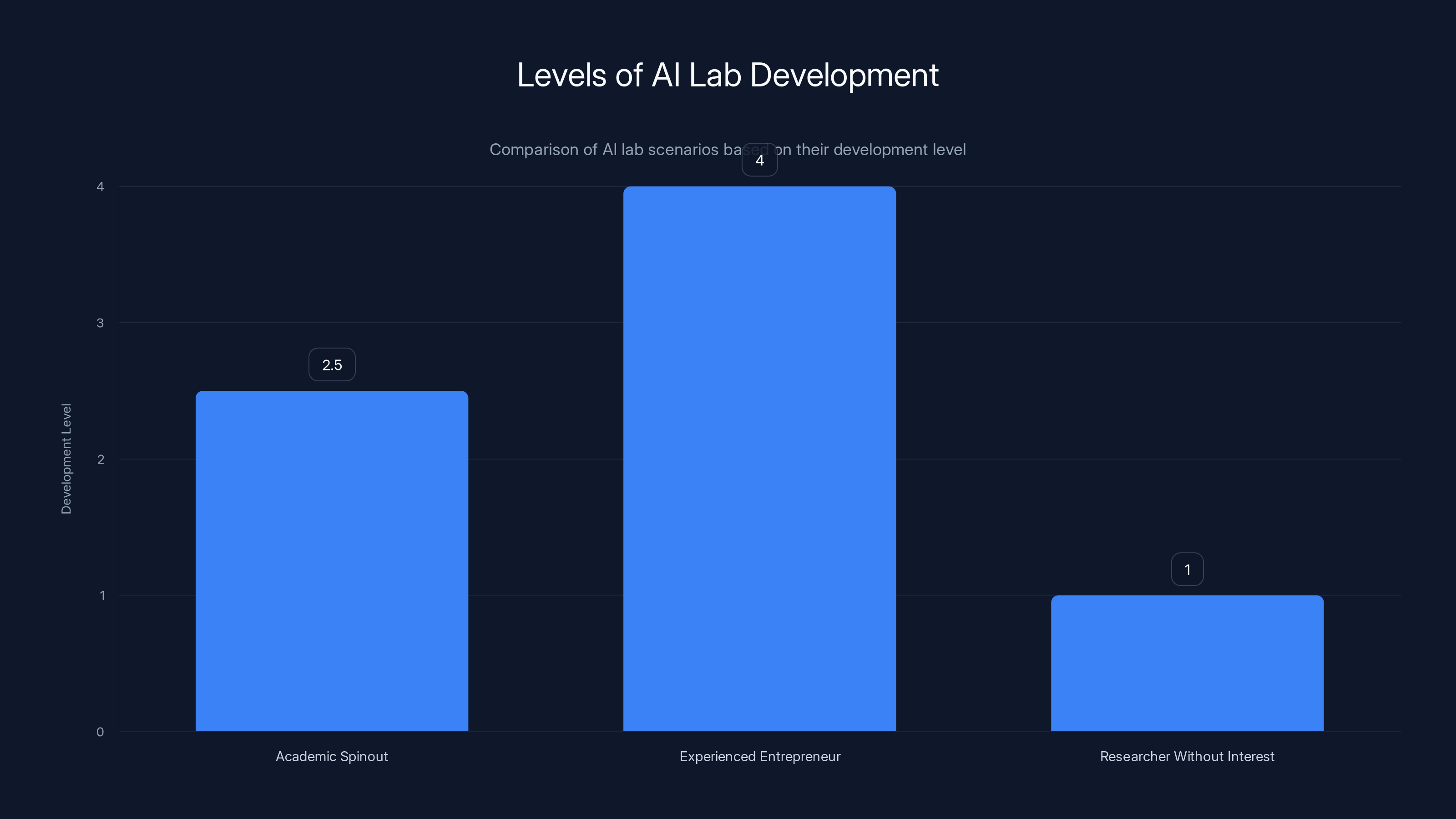

Estimated data shows typical progression levels for startups, with Humans& currently at Level 3, indicating early development with potential for growth.

Why This Scale Matters: The Mismatch Problem

The AI industry's current tension comes almost entirely from misalignment about which level a lab is actually trying to operate at. Investors think they're funding a Level 4 lab. The CEO thinks they're building a Level 3 lab. The engineering team thinks they're at Level 2. The research team thinks they're at Level 1. Everyone's misaligned.

This happened spectacularly with OpenAI's conversion from nonprofit to capped-profit structure. For years, OpenAI operated at something like Level 2 or Level 3. Revolutionary research, but the commercial path was unclear. Then Sam Altman decided the actual goal was Level 5. They restructured the company. They aggressively monetized. They shifted from "let's be a research organization that might make products" to "we're a product company that does research."

That shift caused friction. Researchers who signed up for Level 2 suddenly found themselves in a Level 5 company. The incentives changed. The priorities changed. The whole character of the organization shifted. Some people thrived in the new reality. Others left because it wasn't what they'd agreed to.

Meta took almost the opposite path. Meta's early AI research was positioned as Level 4. We're going to build world-class AI capabilities and we're going to integrate them into our products and we're going to make money from it. That was the stated plan. But over time, it became clear that the actual level was something closer to Level 2 or Level 3. Meta's research organization was genuinely exploring and publishing and advancing the field. The commercial integration was messier and slower than the Level 4 positioning suggested.

That mismatch created different problems. Researchers joined Meta thinking they'd be working on applied AI that would ship in products. Instead, they spent time on research that was interesting but not obviously commercial. Teams building products felt like the research organization wasn't aligned with product needs.

What you want is honesty about the level. If you're a Level 1 lab, say so. Build a team of Level 1 people who share that motivation. Don't raise venture capital. Don't claim you're going to build a business. Do beautiful research. If you're a Level 4 lab, be clear about the plan. Hire people who want to execute that plan. Make product decisions that are aligned with it. If you're a Level 3 lab, be explicit about the exploration phase. Set time bounds. Set revenue targets for when you'll transition to Level 4.

Misalignment on the level is a management problem. It's an investor problem. It's an employee problem. It leads to firing decisions and departures that could have been prevented with clarity.

The Established Giants at Level 5: Making Money at Scale

OpenAI: The Prototype Level 5 Lab

OpenAI is unambiguously Level 5. They're generating hundreds of millions in annual revenue through Chat GPT subscriptions, API access, and enterprise licensing. The revenue is material. It's growing fast. They're shipping new products and features continuously.

What's interesting about OpenAI's Level 5 status is that it happened relatively recently. The organization was founded in 2015, but for most of its existence, it wasn't generating significant revenue. The transition to Level 5 happened in 2023 when Chat GPT launched publicly.

OpenAI's path is instructive. They did serious research for years without worrying much about commercialization. They published papers. They built relationships with researchers worldwide. They developed internal capabilities. Then, when they had something they believed was valuable (GPT-4), they built products around it and monetized aggressively.

The lesson: Level 5 doesn't happen by accident, but it can happen quickly once the technology is right. OpenAI had the right product at the right moment with the right distribution strategy. They captured early market share before anyone else had viable alternatives.

Anthropic: Level 5 With a Different Approach

Anthropic is also Level 5, but they took a different path. Rather than launching a consumer product, they went aggressively after enterprise customers. Claude is available through a web interface and API, but their primary business is selling access to enterprises that have serious use cases and serious budgets.

Anthropic is likely smaller in revenue than OpenAI, but it's significant and growing. They have fortune 500 customers. They have long-term contracts. They're making meaningful money.

What's notable about Anthropic's Level 5 status is that they reached it while maintaining an identity as a research organization. They publish papers. They're transparent about their research process. They maintain academic partnerships. But they're also ruthlessly focused on building products that customers want to pay for.

Google and Meta: Level 5 (But Complicated)

Google and Meta deserve mention here because they're unambiguously Level 5, but it's complicated. Both companies have been making money from AI for years. Google's search is powered by neural networks. Meta's recommendation systems are sophisticated AI. The money is real.

But when we talk about foundation models and AI labs, the situation gets murkier. Google released Gemini as a competitor to Chat GPT. Meta released Llama as an open-source alternative. Are these Level 5 projects? Gemini is generating revenue through Google's business. Llama is not directly monetized, though the broader investment is justified by Meta's AI strategy.

For the purposes of this scale, Google is Level 5. Meta is somewhere between Level 3 and Level 4, though they're moving toward Level 5 through aggressive product integration.

OpenAI leads with an estimated

The New Generation: Where Is Everyone Actually Landing?

Humans&: Level 3 With Ambition

Humans& was the biggest AI news of early 2025, partly because it came seemingly out of nowhere. The company was founded by Noam Shazeer and Daniel De Freitas, researchers with serious credentials. They raised funding. They announced a new approach to foundation models. They immediately started attracting attention from everyone in the field.

What made Humans& interesting was the pitch. The founders argued that the era of scaling laws was reaching its limits. The next generation of AI should focus on communication and coordination tools. Rather than making models bigger, make them better at working together.

It's a compelling technical direction. And the vision for products is genuinely ambitious. The company is talking about building "workplace tools for a post-software workplace." They want to replace Slack and Jira and Google Docs, but more fundamentally they want to redefine what collaboration looks like when humans and AI work together.

But here's the thing: they haven't been specific about monetization. They know they want to build products. They know those products will be workplace software. But they've been deliberately coy about the specifics. What exactly are you building? How much will it cost? Who's paying? When?

For that reason, Humans& lands at Level 3. They clearly intend to make money. They have a general idea of where that money comes from. But they're not committing to specifics. They're still in the exploration phase. They want to figure out the right product direction before they lock in a business model.

Level 3 is reasonable for a company this new. They want flexibility. They want to move fast and adjust direction if needed. The risk is that Level 3 can drift into Level 2 if you're not careful. If you take too long exploring, if you don't eventually crystallize into a concrete plan, you'll end up in a murky place that founders and investors both hate.

Thinking Machines Lab: From Level 4 to Level 2 (In a Bad Way)

Thinking Machines Lab (TML) had one of the most interesting founding moments of any recent AI lab. Mira Murati, the former CEO of OpenAI, joined forces with Barret Zoph, who led Chat GPT development, and raised $2 billion as a seed round. Two billion dollars to start a company. The signal was unmistakable: this lab is Level 4 at minimum.

Mura Murati is exactly the kind of person you'd expect at a Level 4 lab. She doesn't move without a plan. She wouldn't raise $2 billion without a detailed roadmap for how to deploy it. The expectation was that TML would emerge from stealth with a carefully designed product strategy and a clear path to serious revenue.

Then everything fell apart. Within a year, internal rifts became apparent. The biggest blow was the departure of Barret Zoph, TML's CTO and co-founder. Zoph had been central to developing Chat GPT. He was supposed to lead the technical direction at TML. His departure suggested fundamental disagreement about strategy.

But Zoph wasn't alone. At least five other executives left TML in the same period. The departures suggested something deeper than normal startup churn. The employees cited concerns about the company's direction. Translated: we thought we were building one thing, and it turns out the leadership is trying to build something else. Or the strategy that made sense when we raised the $2 billion doesn't make sense anymore.

That's a Level 4 to Level 2 shift. Or maybe a Level 4 to Level 3 shift with confusion about what Level 3 actually means. Either way, it's ugly. You went from "we have a detailed plan to build a world-class AI lab and make enormous amounts of money" to "we're still figuring out what we're trying to do."

As of early 2025, TML is in a holding pattern. Murati is still leading. The organization still has incredible talent. But there's a credibility gap. You need to convince investors, employees, and partners that you're Level 4 again, and that requires demonstrating that the original vision still makes sense or articulating a new vision that makes even more sense.

Fei-Fei Li's World Labs: Level 3 Exploring Level 4

Fei-Fei Li is one of the most respected names in AI research. She pioneered Image Net, the dataset that kickstarted modern deep learning. She's held positions at Stanford and Google. She's the kind of person who could spend the rest of her life just receiving awards and accolades.

Instead, she decided to start World Labs, a company focused on spatial AI. She raised $230 million to do it. That's a serious commitment. That's not exploring. That's betting on something.

But what exactly is the bet? World Labs is building AI systems that understand and can reason about spatial environments. The company is positioning itself in areas like robotics, autonomous systems, and 3D understanding. These are genuinely important problems. The potential applications are enormous.

Where does World Labs fall on the monetization scale? The company hasn't been particularly explicit. The technical direction is clear. The market opportunity is clear. But the specific path to revenue is less obvious.

My read is that World Labs is a Level 3 lab with Level 4 ambitions. They're exploring the right technical direction. They're discovering where the market opportunities actually lie. But they haven't committed to a specific roadmap for monetization. They're still in the phase where they're proving out the technology and understanding customer needs.

That's reasonable for a company in this space. Spatial AI is new enough that you genuinely might not know exactly how customers will pay for it until you build prototypes and talk to them. Level 3 buys time and flexibility. The risk is that $230 million doesn't last forever. At some point, you need to be Level 4.

The Deeper Pattern: Why This Matters Now

The reason this scale exists at this particular moment is because the AI industry has fundamentally different economics than previous tech cycles. In previous generations, you had to prove commercial viability to get funding. You needed customers or a credible path to customers. Venture capital wanted to see evidence that your business model could work.

AI changed that. Capital is so abundant right now, and the upside potential is so enormous, that investors will fund research-heavy labs with ambiguous business models. They're betting on the possibility that you'll discover something valuable. They're not betting on your plan.

This creates a strange situation where a lab can raise billions of dollars without having a clear answer to "what are you trying to sell and to whom?" In most industries, that would be a red flag. In AI, it's normal.

But this creates real problems downstream. Employees need to know what level they're joining at. Investors need clarity about what they're funding. Partners need to understand the incentives. And founders need to be honest with themselves about what level they're actually trying to operate at.

The labs that will win are the ones that figure out their true level and commit to it. If you're a Level 1 researcher who just wants to build beautiful AI systems without worrying about money, that's fine. But don't take venture funding. Don't accept the premise that you need to become Level 5. Do your research, publish your work, build your reputation.

If you're Level 4, be clear about it. Hire product-focused people. Make architectural decisions that serve your business model. Turn down research directions that don't fit your roadmap.

If you're Level 3, set explicit milestones for when you'll transition to Level 4. Give yourself 18 months or 24 months to explore. Then make the decision: do we have a clear path forward, or do we need to reorient?

Misalignment is expensive. It causes the best people to leave. It causes investors to lose confidence. It causes partnerships to fail. The labs that will own this decade are the ones with clarity about their actual ambitions.

The 'Experienced Entrepreneur' scenario is at the highest development level (4), indicating a clear business strategy and customer base. The 'Researcher Without Interest' scenario remains at level 1, focusing purely on research without commercial pressures.

How to Apply This Framework: A Practical Guide

For Investors: Understanding What You're Actually Buying

When you're considering an investment in an AI lab, the first question should be about monetization level. Not success or failure in revenue, but intent. Is this a Level 4 company with a detailed roadmap? Level 3 with promising ideas? Level 2 still figuring things out?

Your investment thesis changes based on the level. A Level 5 company, you're investing in execution risk. The model is proven. The question is whether the management team can execute on the plan and maintain their position against competition.

A Level 4 company, you're investing in strategy and execution. The plan exists, but it hasn't been proven. You're betting that the founders' understanding of the market is correct and that they can execute.

A Level 3 company, you're investing in optionality and team quality. You don't know which direction will work. You're betting that the team is smart enough to figure it out. Your risk is higher because there are more ways things can go wrong.

For most investors, the optimal bet is a Level 4 company. Clear enough to be credible. Ambiguous enough that there's upside potential. The team has a plan but hasn't proven it yet.

Level 5 companies are often past the highest potential venture return. The revenue is real, but the valuation is high. You're paying for proven success, not for upside.

Level 3 companies are higher risk. They might hit something important, or they might spend money exploring until the capital runs out. You need to believe in the team more strongly to make this work.

For Employees: Choosing the Right Lab for Your Goals

If you're a researcher considering joining an AI lab, the level matters enormously. It determines what kind of work you'll do. It determines your exit opportunities. It determines how happy you'll be.

If you're motivated by scientific discovery and don't care much about commercialization, you want Level 1 or Level 2. You'll do interesting research. You won't be constantly pressured to make product decisions. You'll publish. You'll advance human knowledge.

The risk is that Level 2 might eventually become Level 4, which could be frustrating if you're not interested in commercialization.

If you're motivated by building products and companies, you want Level 4. You get clear direction. You know what you're building toward. You have decent odds of meaningful financial outcome if things work out.

If you're motivated by influence and impact, you might want Level 3. You get to help shape what the company becomes. Your input on strategy might actually matter. You get upside if the exploration phase leads somewhere valuable.

The key is honest self-assessment. What actually motivates you? Money? Scientific discovery? Building products? Impact? Once you know that, find a lab that's operating at a level aligned with your motivations.

For Founders: Deciding Your True Level

If you're founding an AI lab, you need to make a conscious decision about your level. Don't let it default. Don't let investors convince you to be something you're not. Your choice should be intentional.

If you're genuinely motivated by research and not particularly interested in running a business, Level 2 or Level 1 is probably right. You might make some money incidentally. That's fine. But don't structure the company as if you're going to be Level 5. Hire researchers, not business people. Build for academic impact, not commercial traction.

If you have a clear vision for a business and a detailed plan for making money, commit to Level 4. Make decisions that serve that plan. Hire people who share the vision. Be willing to pass on interesting research directions that don't fit your strategy.

If you have promising ideas but aren't sure exactly how they'll monetize, Level 3 is reasonable. But set clear milestones. "We have 18 months to figure out if this is a Level 4 business or if we need to reorient." Don't let Level 3 become a permanent state.

The worst thing is unclear commitment. You tell investors you're Level 4 while telling your researchers you're Level 2. You position the company as a business while structuring compensation as if it's a research institution. That inconsistency creates the exact tension that leads to departures and failure.

The Business Model Reality Check: What Level 4 Actually Means

When we talk about a Level 4 lab with a detailed plan, what does that actually entail? What are the components of a credible roadmap?

The Technology Component

First, you need a genuine technical advantage. It doesn't have to be world-shattering, but it needs to be real. It needs to be something that competitors can't easily copy. It might be a novel architecture. It might be a new training approach. It might be better efficiency. But it needs to exist.

Level 4 labs have clarity about what their technical advantage is. They can articulate it. They can explain why it matters. They can identify which specific problems it solves better than alternatives.

The Market Component

Second, you need a clear understanding of who will pay and why. Not in abstract terms. In specific terms. "Enterprise customers with large language understanding needs who currently use vendors like OpenAI and Anthropic." Not "anyone who needs AI." Not "we'll figure out the customer later." Specific.

You need to know the total addressable market. You need to know the pricing model. You need to know the sales cycle. You need to know what makes your target customer choose you over alternatives.

The Timing Component

Third, you need a realistic timeline. When will you have a working product? When will you have early customers? When will you have meaningful revenue? The timeline doesn't have to be right, but it needs to exist. You need milestones. You need to track against them.

The Competition Component

Fourth, you need honesty about competition. Who else is going after the same opportunity? Why do you win? It's not enough to say you're better. You need to explain the specific dimensions where you're better and why those dimensions matter to the customer.

The Capital Component

Fifth, you need clarity about capital needs. How much will you need to reach sustainable profitability? Or sustainable revenue? What milestones do you need to hit to raise more capital? What happens if you don't hit those milestones?

A Level 4 lab can walk through all of these components. They might be wrong. Probably they'll be partially wrong. But they've thought through the problem. They have answers.

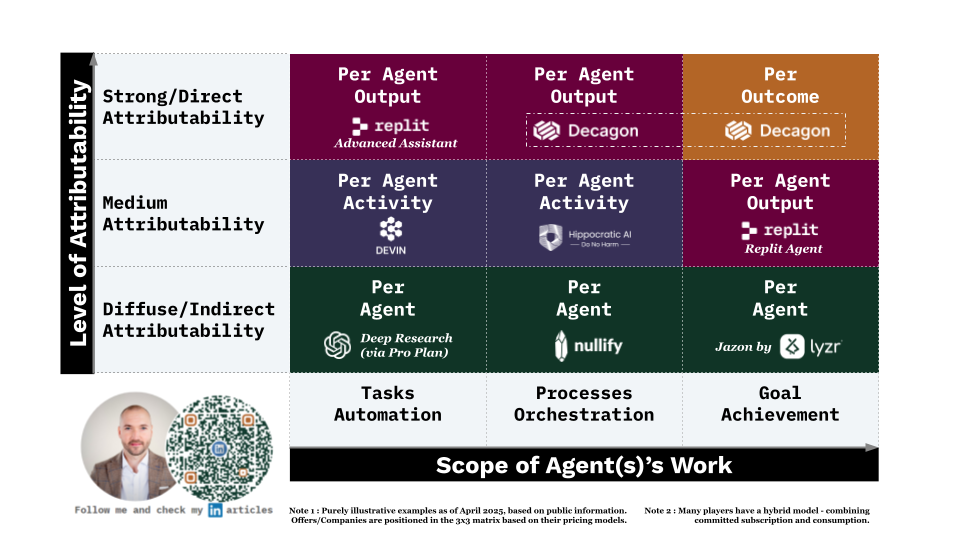

The monetization scale ranges from Level 1 (no revenue focus) to Level 5 (high revenue generation). This framework helps stakeholders understand a lab's commercial focus. Estimated data based on framework description.

Why Labs Get the Level Wrong: The Psychology of Ambition

There's a predictable pattern in AI lab formation. The founder or founders are brilliant researchers. They have recognition in the field. They decide to start a company. They raise funding. Then, early on, there's a moment of truth.

The founder has to decide: am I building a research institution or a business? Or am I trying to be both? The honest answer for many is "I don't know." I want to do great research. I also want to create something that lasts and grows. But I'm not sure those goals are compatible.

Venture capital creates pressure to choose. VCs want to back Level 4 labs. They want details. They want credible paths to large markets. So the natural thing is to present yourself as Level 4, even if you're not sure you believe it.

That's how you end up with misalignment. You raise capital as a Level 4 lab. You hire a team that thinks you're Level 4. But deep down, the founder is more comfortable as Level 2 or Level 3. The founder wants flexibility and exploration. The team expects clarity and direction.

Then something happens. The exploration doesn't yield a clear product direction. The team assumes something went wrong. The founder assumes the team is pushing too hard for commercialization. Friction builds. Departures happen.

It could have been avoided with honesty. "We're a Level 3 lab. We think there's something valuable here. We're going to explore for 18 months. If we find a clear path to a Level 4 business, we'll become that. If we don't, we'll probably reorient or return capital."

That honesty is rare. But when it happens, it works. Teams know what they're signing up for. Investors know what they're funding. Founders are aligned with their own actual motivations.

The Future: Levels and Competition

As the AI industry matures, competition will force increasing clarity about levels. Right now, capital is abundant enough that you can exist in ambiguity. That won't last forever. At some point, capital will become scarcer. Investors will demand clarity. Labs that are genuinely Level 4 will have an advantage over labs that are pretending.

The labs that will thrive are the ones that figure out their true level early and commit to it.

Level 5 is obviously desirable if you can get there, but it's not for everyone. And it's harder to get to than it looks. You need the right product at the right moment with the right distribution. Most ambitious efforts fail or stall at Level 3 and Level 4.

Level 4 is probably optimal for most labs. It's ambitious without being impossible. It's clear enough to be credible. It's real enough to be motivating.

But Level 3 is fine too, if you know that's what you are and you're explicit about it. Some of the most interesting work in AI might come from Level 3 labs that explore new directions without the pressure of specific commercialization targets.

What won't work is pretending to be Level 4 while operating at Level 2. That path leads to departures, investor disappointment, and eventually failure.

Level 3 companies present the highest risk but also the highest potential for innovation, while Level 5 companies offer lower risk with proven success. Estimated data based on typical investment considerations.

Practical Scenarios: Where Do Real Labs Actually Land?

Scenario 1: The Academic Spinout

A prestigious researcher at Stanford decides to start an AI company based on their recent research. They raise $50 million. The technology is genuinely interesting. But they haven't thought much about customers or monetization.

Level: 2, maybe 3.

What should they do? If they genuinely care about research more than commercialization, be Level 2. Build a strong research organization. Publish. Publish. Build reputation. Don't hire salespeople. Don't spend time on business strategy.

If they want to build a business eventually, move toward Level 3. Use the research to understand the market. Talk to potential customers. Start to crystallize which directions have commercial potential. Set a timeline for transitioning to Level 4.

Scenario 2: The Experienced Entrepreneur

Someone who previously founded and sold companies raises $200 million for a new AI lab. They have distribution. They have customers. They have a pretty clear idea of what they want to build.

Level: 4.

This person should be explicit about the Level 4 positioning. They should articulate their plan clearly. They should hire people aligned with that plan. They should measure success against specific metrics.

The risk is overconfidence. Previous success doesn't guarantee success in AI. But it does increase the odds that the plan is realistic.

Scenario 3: The Researcher Without Interest in Money

A legendary AI researcher who doesn't particularly care about being rich decides to start a research lab focused on fundamental questions about intelligence.

Level: 1.

This person should not raise venture capital. They should seek academic funding. They should hire other researchers who share their motivation. They should build something beautiful and meaningful without the pressure of commercialization.

Raising VC money would be a mistake. It would introduce conflicts. It would create pressure toward commercialization that the founder doesn't want.

Scenario 4: The Ambitious but Uncertain Founder

A talented team raises funding to build a new AI lab. They have big dreams. They're not entirely sure what they're building yet. They expect to figure it out.

Level: 3.

This is the most common situation. And it's fine, as long as it's managed well. Set explicit milestones. "By month 12, we will have shipped beta products to at least 10 potential customers." "By month 18, we will know whether we have product-market fit." "By month 24, we will either be Level 4 with a clear plan, or we will return remaining capital."

Level 3 with clear milestones works. Level 3 without milestones becomes Level 2 with expensive overhead. That doesn't work.

The Meta-Lesson: Self-Awareness as Strategy

There's a deeper insight here beyond just the five levels. The labs that will win this decade are the ones with genuine self-awareness. They know who they are. They know what they want. They're honest about their limitations.

Most startup founders have doubt. They're uncertain. They're moving fast and figuring things out. That's fine. That's startup. But at some point, you need to get clarity about your actual motivation and your actual plan.

Are you motivated by money or impact or scientific discovery or proving something? Be honest. Build toward that. Don't pretend to be something you're not.

Do you have a credible plan for commercial success? Or are you still exploring? Be honest about which one is true. Don't claim you have a plan when you're really still exploring. Don't claim you're exploring when you actually have convictions about where the business goes.

The labs with self-awareness will have better retention. Better investor relationships. Better partner relationships. Better morale. Because everyone's working toward the same goal.

The labs without self-awareness will have ongoing tension. The founder thinks they're Level 3. The team thinks they're Level 4. The investors think they're Level 5. Everyone's frustrated.

So the practical advice is simple: figure out your actual level. Be honest about it. Communicate it clearly. Organize around it. Then execute.

Conclusion: The Clarity You Need

The AI industry in 2025 is complex and confusing and full of promise and risk. New labs are forming constantly. Legendary researchers are going solo. Capital is abundant. Ambition is everywhere.

In the middle of all that noise, clarity about monetization ambition is valuable. Not monetization success. Monetization ambition. Are you trying to make billions? Are you trying to build something interesting and make some money along the way? Are you trying to advance human knowledge regardless of commercial outcomes?

These are different things. They require different strategies. They attract different people. They lead to different outcomes.

The five-level scale isn't perfect. It's a simplification. But it's useful. It gives you language for thinking about something that's usually implicit and misaligned. It lets you ask direct questions. It lets you get clarity.

Whether you're an investor evaluating opportunities, an employee choosing where to work, or a founder building a company, this framework matters. Use it. Apply it. Get honest about where you're actually sitting and where you actually want to be.

The labs that will define the next decade are the ones that figure this out. Not the ones that move fastest or raise the most capital or have the best technology. The ones with clarity about ambition. The ones where the founder, the team, the investors, and the partners are all aligned about what level they're actually trying to operate at.

That alignment is rare. It's valuable. It's what separates enduring companies from interesting failures.

FAQ

What exactly is the monetization scale for AI labs?

The monetization scale is a five-level framework that measures how serious an AI lab is about making money. Level 1 represents researchers who aren't motivated by revenue at all, while Level 5 represents labs already making millions daily. The scale measures intent and ambition, not actual success or failure in generating revenue. It's designed to help investors, employees, and partners understand what a lab is actually trying to accomplish.

How do I determine what level an AI lab is actually operating at?

You can determine a lab's level by asking direct questions about their business model, customer strategy, timeline to revenue, and competitive differentiation. Level 4 and 5 labs have detailed answers to all of these questions. Level 3 labs have promising ideas but aren't committed to specifics yet. Level 2 labs are still thinking through the commercial implications. Level 1 labs aren't particularly focused on monetization. Listen to how the founder answers when you push on specifics. Their comfort level with commercial questions reveals their actual level.

Why does it matter whether a lab is Level 3 or Level 4?

The level determines everything downstream: hiring decisions, product priorities, research direction, partnership strategy, and compensation structure. A Level 3 lab should hire exploratory researchers and make decisions based on what seems promising. A Level 4 lab should hire execution-focused people and make decisions that serve the specific business plan. Misalignment between stated level and actual level causes departures and friction. Clarity about level prevents that friction.

Can a lab move between levels, and if so, how?

Yes, labs frequently move between levels. OpenAI moved from Level 2 or 3 to Level 5 when Chat GPT launched and proved the market. Thinking Machines Lab appeared to move from Level 4 to Level 2 when executives departed and raised questions about strategic direction. Moving levels is normal, but it requires clear communication about why you're moving and what the new reality means for team members and partners.

What's the difference between a Level 3 lab and a Level 2 lab in practice?

A Level 3 lab has genuine belief that revenue will come from their work, but they're not committed to a specific plan yet. They're exploring multiple directions. They might work on enterprise products, consumer products, API access, and partnerships simultaneously. A Level 2 lab is still thinking through how monetization would even work. They're not hostile to making money, but they haven't seriously designed commercial strategy. Level 3 labs expect revenue within reasonable timeframes. Level 2 labs might keep exploring indefinitely.

Should early-stage researchers be concerned about joining a Level 2 lab?

Not necessarily, but they should be clear about their own motivations. If you're motivated by scientific discovery and published research, Level 2 is actually ideal. You'll have fewer commercial pressures and more freedom to explore interesting directions. If you're motivated by building products or creating financial value, Level 2 is risky because the lab might not ever transition to Level 4. The key is matching your motivation to the lab's actual level.

How does the monetization scale affect investor decision-making?

Investors typically prefer Level 4 labs because there's enough clarity to believe the plan is realistic, but enough unproven upside to justify venture returns. Level 5 labs are often past peak venture returns because success is proven but valuation is high. Level 3 labs are higher risk but potentially higher upside if the team figures out the right direction. Level 1 and 2 labs are typically not venture-backable unless you're specifically investing in research with long-term optionality bets.

What happens when a lab's founders disagree about what level they should be operating at?

Disagreement about level is one of the most common reasons for founding team departures in AI labs. One founder wants to be Level 3, exploring and publishing research. Another wants to be Level 4, executing a specific business plan. This tension, if unresolved, leads to one founder leaving or the company splintering. The solution is explicit conversation early on about what level each founder actually wants and either alignment or clean separation.

Is it possible for a lab to be honest about being Level 2 and still raise venture capital?

It's possible but difficult. Most venture investors want to see a path to Level 4 at minimum. However, if you're transparent about your Level 2 status and your plan for how you'll gain clarity about Level 4 direction, some investors will back you. The key is having credible milestones for figuring things out and a real plan for validation. Investors want to know your uncertainty is bounded and that you're actively working to resolve it.

The Bigger Picture: What This Means for AI's Future

The monetization scale matters because it reveals the true structure of the AI industry. We talk a lot about competition between labs. We talk about who has the best models or the smartest researchers. But much of the competitive advantage will come from clarity about purpose.

The labs that will dominate the next decade aren't necessarily the ones with the smartest people or the most advanced research. They're the ones where the entire organization is aligned about what they're building toward. They're the ones where researchers and business people speak the same language. They're the ones where decisions flow naturally from a clear strategy.

Right now, many labs are operating in ambiguity. That works when capital is abundant and competition is limited. It won't work when the market matures and capital becomes scarcer. The labs that figure out their true monetization ambition early will have a significant advantage.

For the AI industry specifically, this matters a lot. This is a field where the winner-take-most dynamics are extreme. The model that captures mind share and becomes the default wins massively. Becoming the default requires focus and execution, not exploration and research. It requires clarity about what you're building and for whom.

So the labs that will win aren't necessarily the smartest or the best-funded. They're the ones with the clearest vision and the strongest alignment about what level they're actually trying to operate at.

Key Takeaways

- A five-level monetization scale measures AI labs by commercial ambition, not success: Level 5 (already profitable), Level 4 (detailed roadmap), Level 3 (promising ideas), Level 2 (exploring concepts), Level 1 (not motivated by revenue)

- OpenAI jumped from Level 2-3 to Level 5 rapidly after ChatGPT launched, while Thinking Machines Lab collapsed from Level 4 to Level 2 due to executive departures, showing how labs can shift suddenly

- Misalignment about monetization level causes departures and conflict: researchers expecting Level 2 independence conflict with business teams executing Level 4 strategy

- Employees should match their motivations to a lab's actual level: research-focused people want Level 1-2, product builders want Level 4, explorers fit Level 3 well

- Founders must be honest about their true monetization ambitions and communicate it clearly to investors, employees, and partners to maintain alignment and prevent costly departures

Related Articles

- AI Labs' Reputation War at Davos: The Real Competition Behind the Scenes [2025]

- ChatGPT Targeted Ads: What You Need to Know [2025]

- Claude Code Is Reshaping Software Development [2025]

- Humans& AI Coordination Models: The Next Frontier Beyond Chat [2025]

- Startup Battlefield 2025: Glīd Founder Kevin Damoa's Winning Strategy [2025]

- AI Bubble or Wave? The Real Economics Behind the Hype [2025]

![The AI Lab Monetization Scale: Rating Which AI Companies Actually Want Money [2025]](https://tryrunable.com/blog/the-ai-lab-monetization-scale-rating-which-ai-companies-actu/image-1-1769276225168.jpg)