Introduction: When TikTok Nearly Lost America

There was a moment in January 2026 when TikTok looked vulnerable for the first time in years. Not because of government bans, not because of technical failures, but because millions of American users actually left. For about a week, TikTok wasn't the default app. Users scrolled through Skylight Social instead. They uploaded to UpScrolled. For a brief, shimmering moment, the platform that had dominated Gen Z for six years seemed breakable.

Then they all came back.

This wasn't just another market fluctuation in the social media ecosystem. What happened with TikTok's ownership change reveals something fundamental about how users think about platforms, how quickly digital alternatives can gain traction, and why incumbency—even when questioned—remains incredibly sticky.

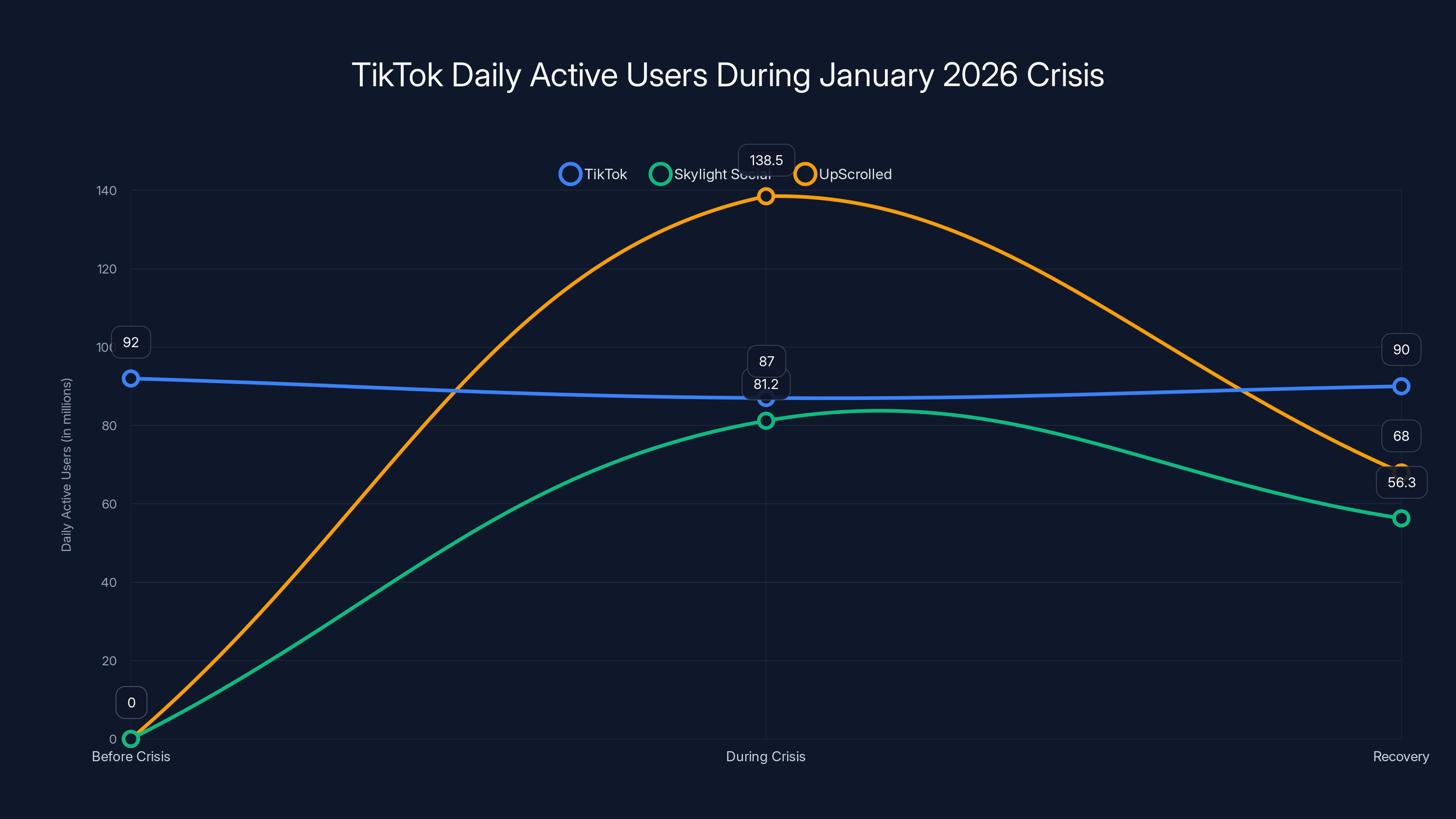

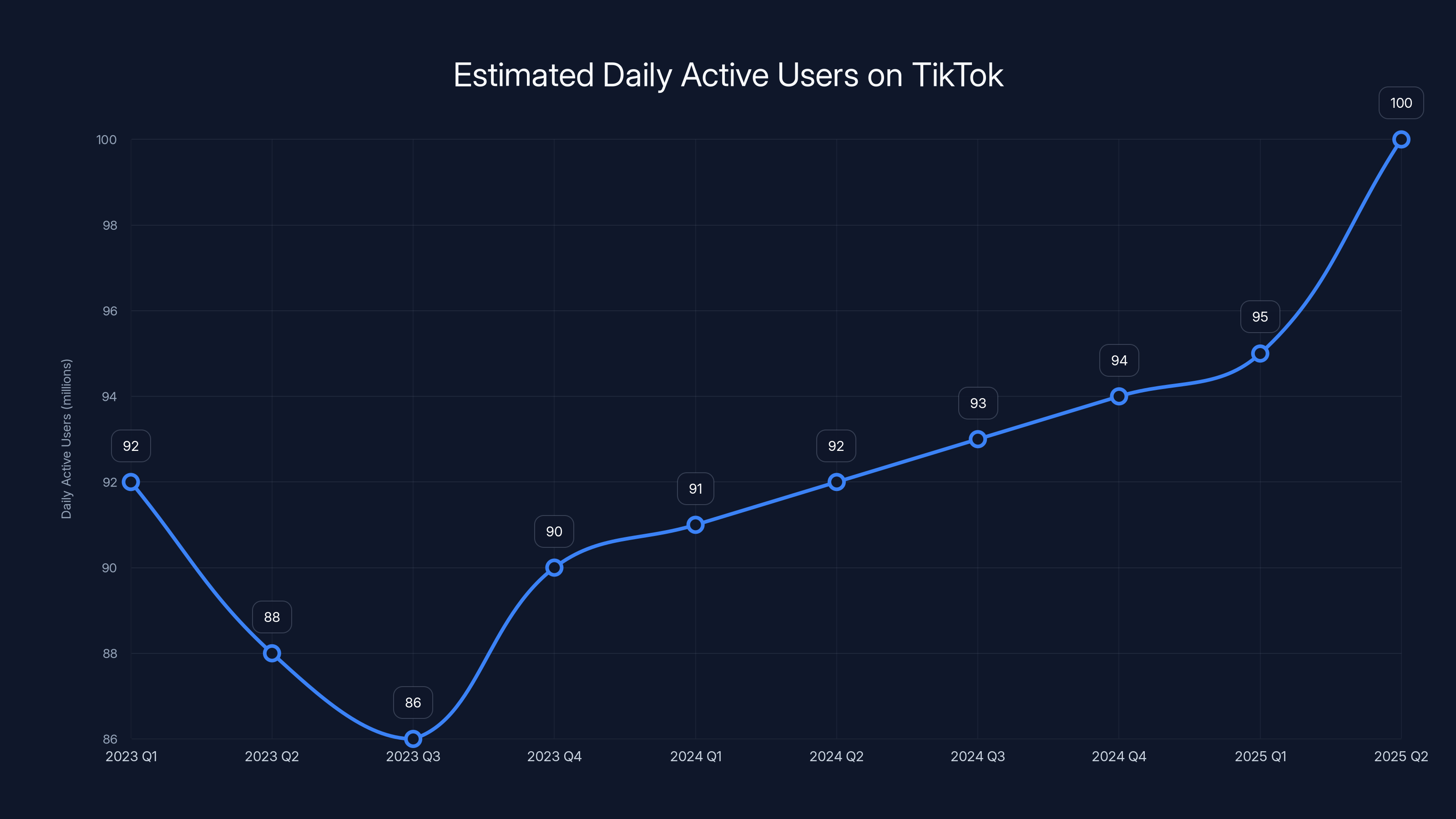

The numbers tell the story. TikTok dropped from its typical 92 million daily active users to somewhere between 86 and 88 million almost immediately after the ownership transfer. That's a loss of roughly 4-6 million daily active users in the span of days. To put that in perspective, that's larger than the entire user base of Twitter at its peak. Yet within weeks, TikTok rebounded to over 90 million daily active users, suggesting that the majority of those who left were simply waiting things out.

But here's what's genuinely interesting: during that window, two rival apps—Skylight Social and UpScrolled—captured nearly 400,000 new users. They proved that demand for short-form video exists independent of TikTok's dominance. These competitors weren't destroyed by TikTok's return. Instead, they became test cases for what a post-TikTok social media landscape might actually look like.

This article dives deep into what happened during TikTok's ownership transition, why users left, what pulled them back, and what this entire episode reveals about the future of social media dominance in America. We'll examine the role of the data center outage that coincided with the transition, analyze the competitive threats that briefly looked credible, and explore what happens when the assumption of platform permanence gets tested.

The story isn't about regulatory capture or corporate ownership. It's about user psychology, competitive dynamics, and the fragile nature of network effects that everyone assumes are permanent.

TL; DR

- TikTok dropped 4-6 million daily active users following its U.S. ownership change, falling from 92M to 86-88M DAU

- Rival apps Skylight Social and UpScrolled gained ~400,000 users during the brief dip, proving short-form video demand exists beyond TikTok

- A coincidental data center outage compounded the exodus, with users believing content was being censored when glitches occurred

- Recovery was swift: TikTok rebounded to 90+ million DAU within weeks as users returned and operational issues resolved

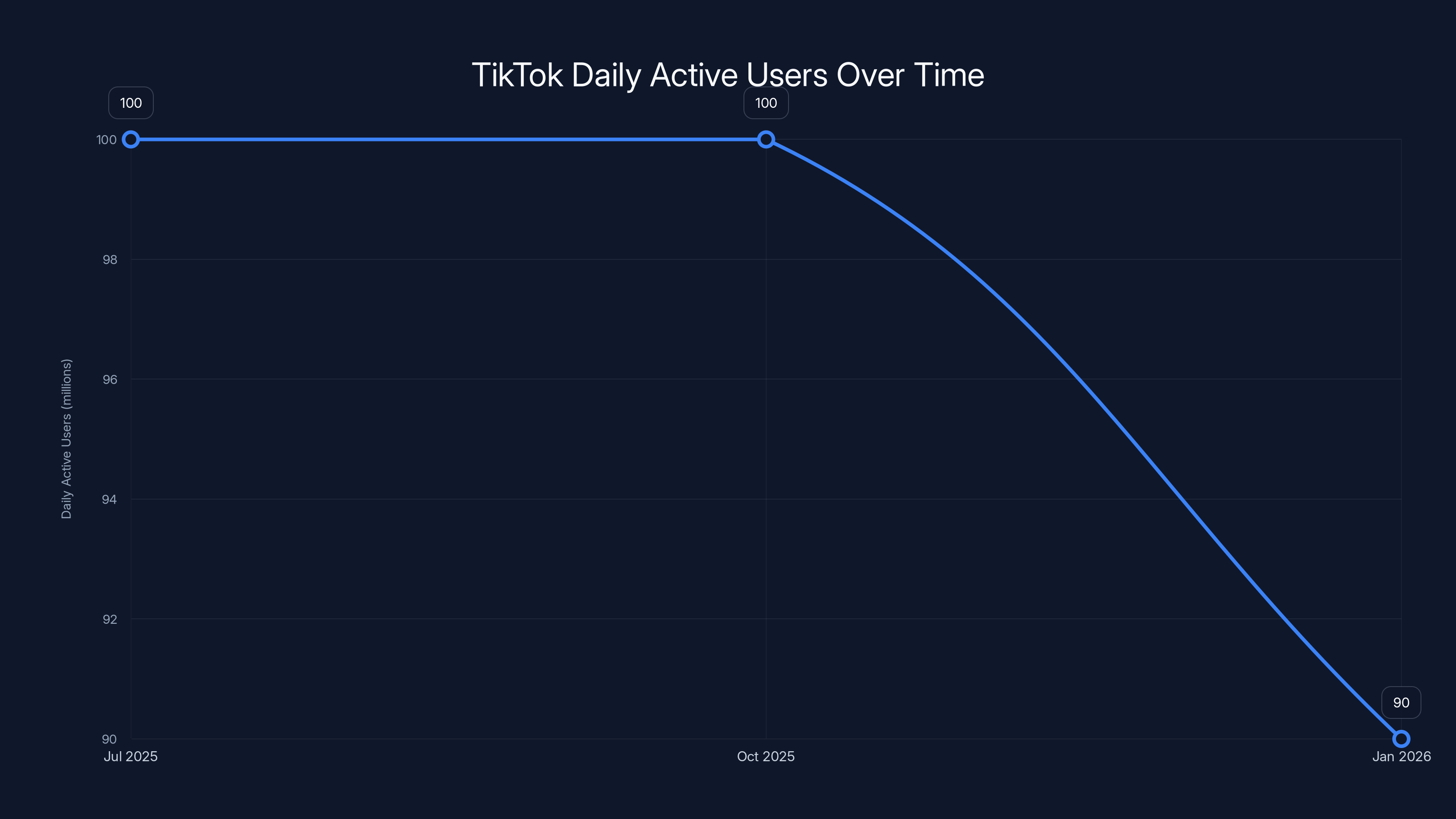

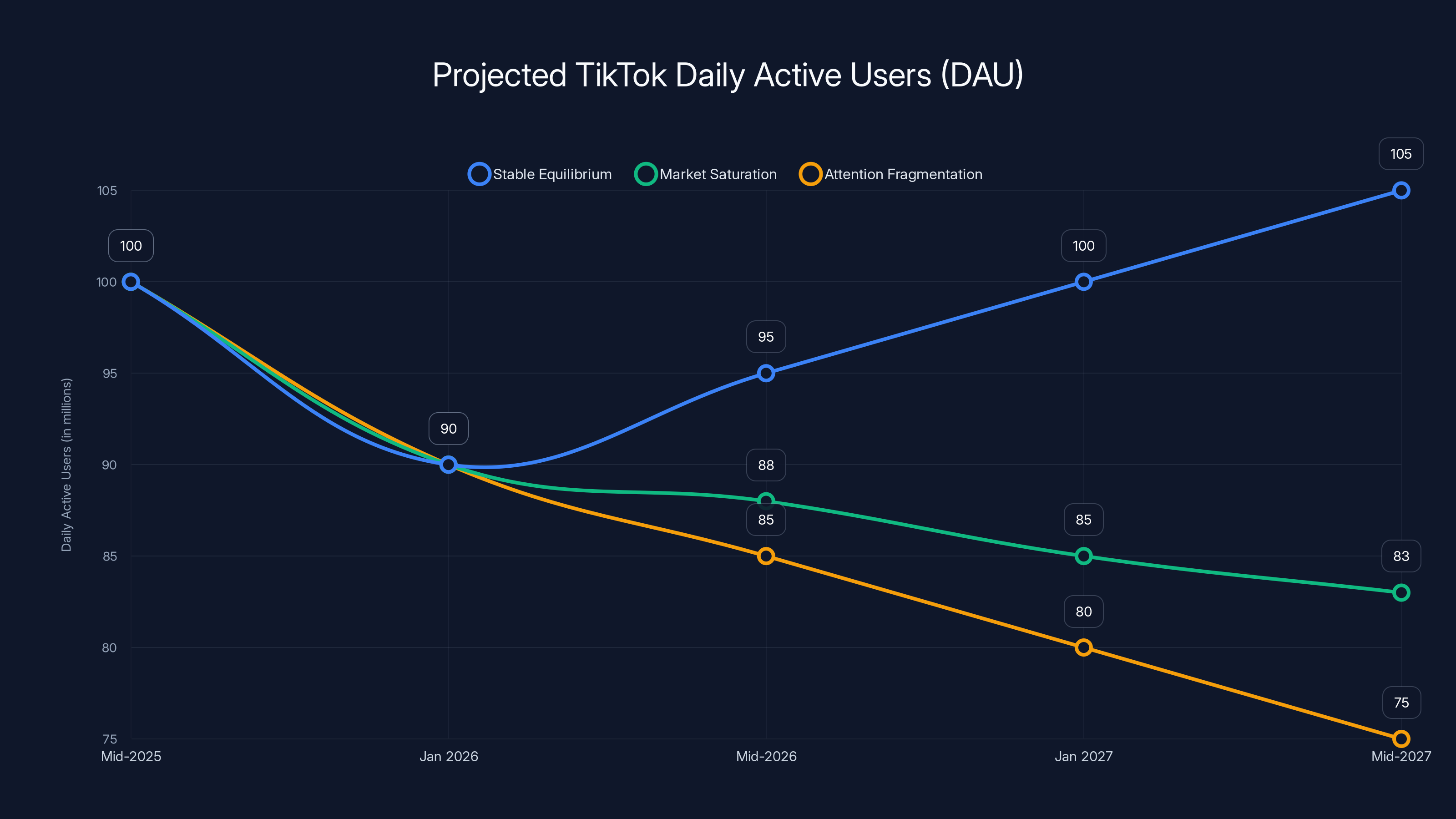

- Long-term decline trend remains: Despite the recovery, TikTok usage declined steadily through late 2025, down from 100M DAU mid-year

- Competitive window closed quickly: Skylight and UpScrolled retain users but at far below peak levels, suggesting the TikTok break was temporary

TikTok experienced a temporary drop to 86-88 million daily users during January 2026, but quickly recovered. Rival apps saw temporary spikes but retained only a fraction of users post-crisis. Estimated data.

The Ownership Change That Shook Social Media

What Actually Changed

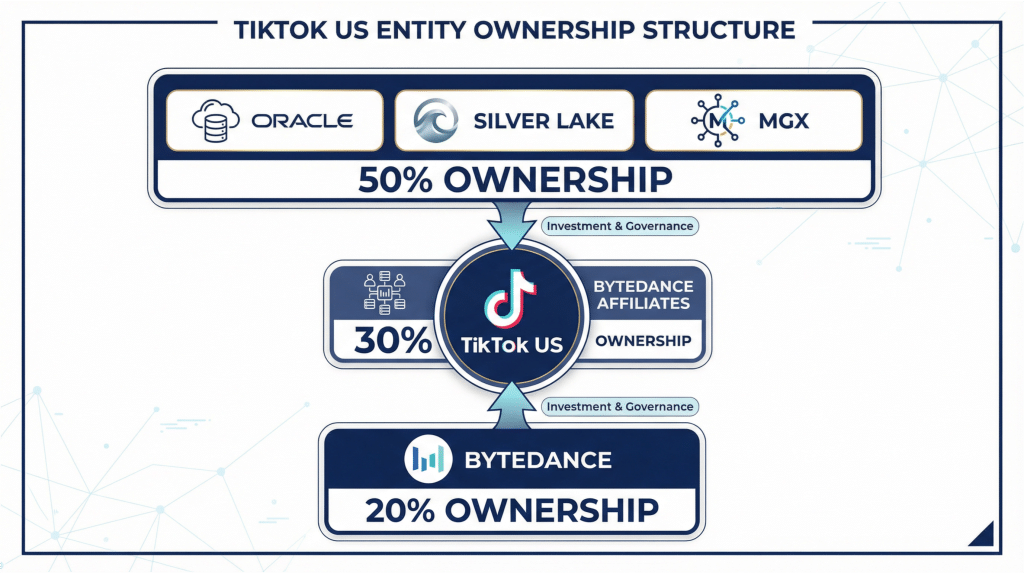

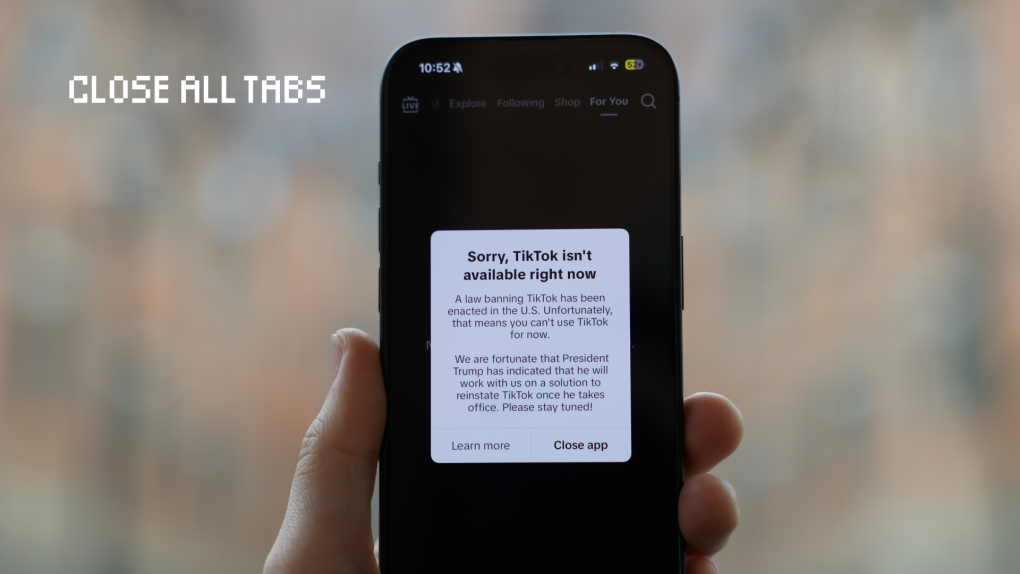

When American investors took control of TikTok's U.S. operations, it wasn't a quiet transition. The change represented something unprecedented in social media history: a forced transfer of operational control of a platform with 150+ million American users. This wasn't a merger or acquisition announced in a press release months in advance. This was a sudden operational shift driven by regulatory pressure, and users felt it immediately.

The new ownership structure meant different decision-making processes, potentially different content policies, and most importantly, uncertainty about what the platform would become. For users who had built their lives around TikTok—creators depending on it for income, teenagers using it as their primary social network—the ownership change introduced an uncomfortable question: Is TikTok still the same platform? Or am I using something fundamentally different now?

This psychological trigger mattered more than the technical reality. Most users wouldn't have noticed operational changes if nothing broke. But TikTok didn't just change ownership; it also suffered a catastrophic timing failure.

The Timing Problem Nobody Planned For

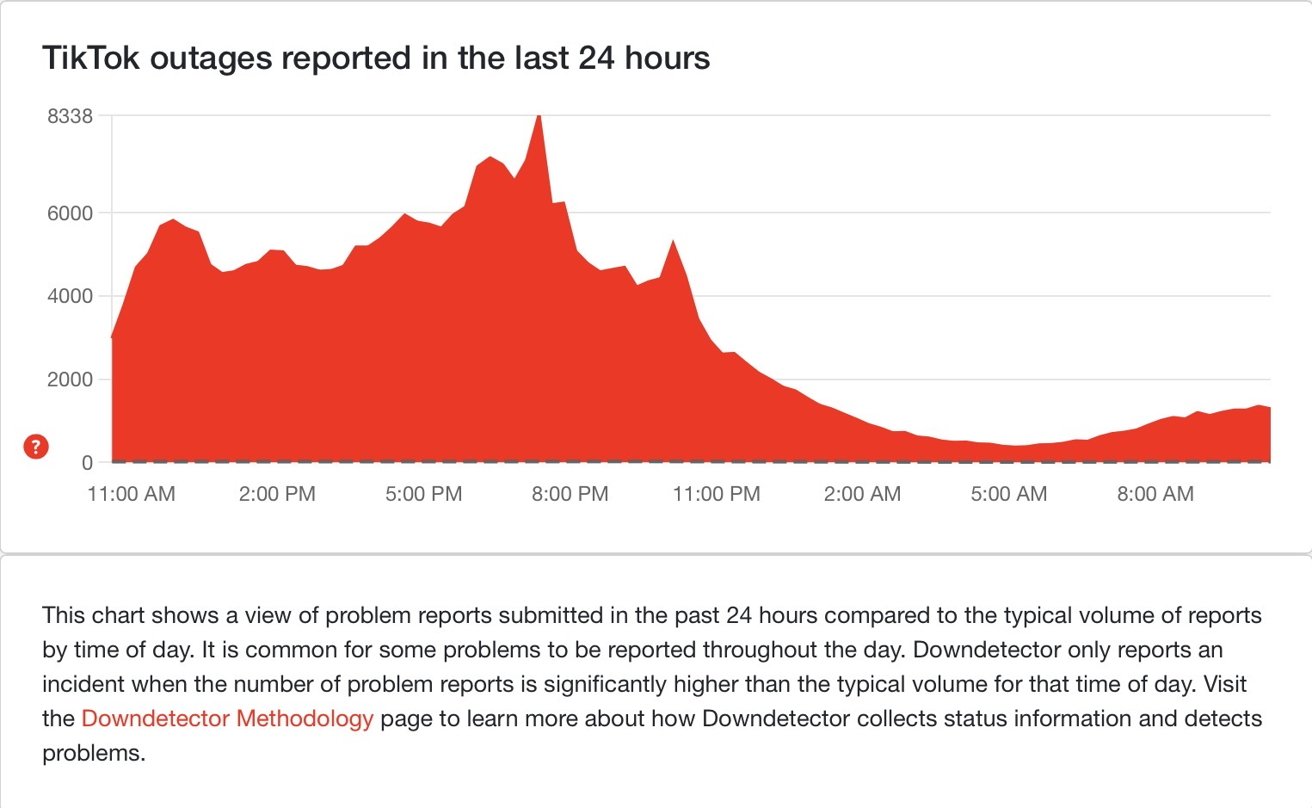

On the same week that TikTok transitioned to new American ownership, the platform experienced a multi-day data center outage. This wasn't a minor glitch affecting some users' feeds. This was infrastructure failure that broke core functionality: search stopped working reliably, like buttons disappeared, comments vanished, the recommendation algorithm hiccupped, and in-app chat became unreliable.

For users already anxious about the ownership change, these glitches carried a subtext. They didn't interpret the outage as infrastructure failure. They interpreted it as censorship. The timing was perfect for conspiracy thinking: ownership changes, content starts disappearing, features break. The narrative was already written before TikTok even issued its explanation.

This is worth understanding deeply. When a platform is fundamentally trustworthy and operating normally, users interpret problems generously. "Oh, the app's being weird." But when trust is already fractured by ownership uncertainty, the same problems get interpreted as deliberate control. A data center outage becomes evidence of censorship. Search failures become proof of shadow-banning.

TikTok announced the outage on Sunday evening, attributing it to a winter storm that knocked out power at key data centers. From an infrastructure perspective, this is entirely plausible. Winter storms do cause power outages. Distributed systems do fail. But by the time TikTok issued the explanation, millions of users had already migrated their behavior elsewhere.

TikTok's daily active users peaked at 100 million in mid-2025 and declined to 90 million by January 2026, indicating a 10% drop. Estimated data highlights a longer-term decline beyond temporary crisis effects.

The Exodus: Understanding User Migration Patterns

Why Users Actually Left

The 4-6 million user drop wasn't a gradual drift. It was a sudden exodus, suggesting that users left in response to specific triggers rather than slow degradation of satisfaction. This is important because it tells us something about how social media users actually make decisions.

First, there was uncertainty. Ownership changes are disruptive because they create information gaps. Users don't know whether their data will be handled differently, whether content policies will change, whether the algorithm will shift. This uncertainty doesn't need to resolve negatively to drive behavior. People simply leave when they're unsure, especially on platforms with low switching costs.

Second, there was the real operational failure. The data center outage wasn't imaginary, and it happened at the worst possible moment. When TikTok's core functionality broke—when people couldn't reliably see videos, post comments, or use search—the platform became temporarily less valuable than alternatives. Switching costs dropped to zero because TikTok simply didn't work.

Third, there was the narrative. Once Skylight Social and UpScrolled started gaining users, other users noticed. Social media creates its own gravity. If your friends are trying out a new app, you try it too. If you see creators experimenting with alternatives, you follow them. Network effects work in both directions: they keep users in, but they can also pull them out if the perceived center of gravity shifts.

What's notable is that this happened with Gen Z users, who are digital natives supposedly most comfortable with platform switching. Yet even they stuck with TikTok for as long as possible. They left only when trust broke and alternatives became viable simultaneously.

The Role of Creator Uncertainty

Creators amplified user migration more than regular users did. Professional TikTok creators, who earn significant income from the platform, face genuine risk during ownership transitions. Their income, their audience relationships, and their content could all be affected by policy changes or algorithm shifts.

When creators start experimenting with alternative platforms, their audiences follow. Creators have accumulated influence and trust. If a creator says, "I'm also posting to Skylight Social," their followers notice. Some of them join just to maintain the relationship. This creates a cascade effect where creator migration drives user migration.

During the TikTok transition, creators faced a real choice: double down on TikTok despite the uncertainty, or hedge by building presence on alternatives. Many chose to hedge. This wasn't irrational—it was basic risk management. But it had the effect of pulling their audiences toward alternatives too.

Meet the Challengers: Skylight Social and UpScrolled

Skylight Social: The More Polished Alternative

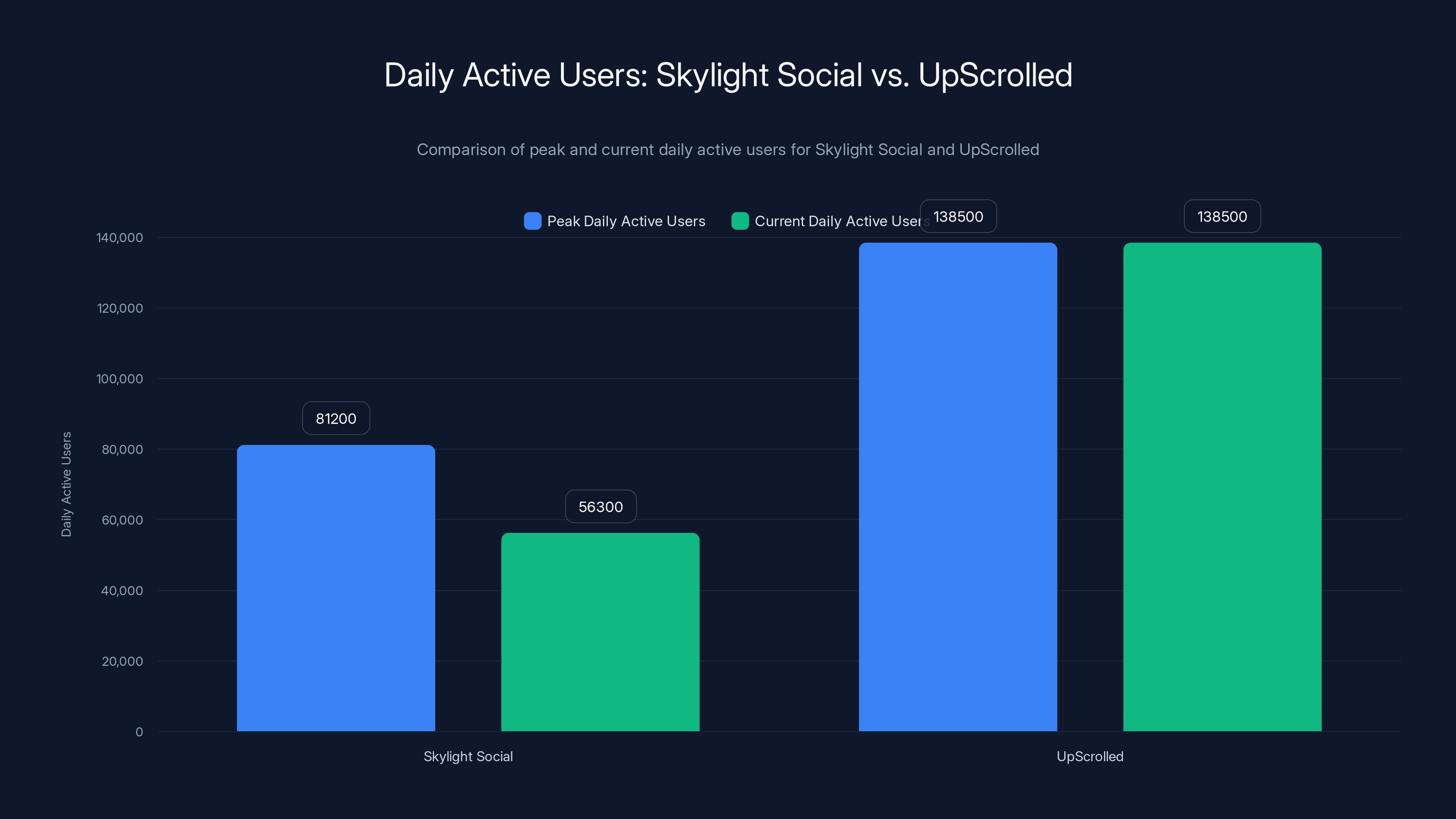

Skylight Social emerged as the primary beneficiary of TikTok's vulnerability. The platform gained 81,200 daily active users at its peak, and according to the company's own statements, attracted 380,000 total new sign-ups by late January. These aren't trivial numbers in absolute terms, but they're a rounding error compared to TikTok's scale.

What's interesting about Skylight is that it positioned itself as a cleaner alternative to TikTok. The implication was always there: if you're worried about TikTok's ownership or data policies, Skylight offers the same video experience without the baggage. This value proposition worked temporarily because users needed an exit valve, a way to demonstrate to themselves that they were taking action on their concerns.

However, Skylight faced the fundamental problem of all social media alternatives: it lacked critical mass. With only 81,000 daily active users, the content available was limited. The creators users wanted to follow weren't there. The network effects that make TikTok valuable—millions of creators producing video content, algorithms trained on billions of interactions—didn't exist on Skylight. It was like visiting a restaurant with great architecture but no cooks in the kitchen.

Skylight still retains users, having settled at 56,300 daily active users after the peak. This suggests that roughly 30% of the users who tried the app stayed long-term. That's actually not terrible retention for a trial-driven platform switch, but it's still a vanishingly small number compared to TikTok's scale.

UpScrolled: The Specialized Play

UpScrolled took a different strategic approach. Rather than positioning itself as a direct TikTok replacement, UpScrolled appears to have focused on a specific type of content or community. It peaked at 138,500 daily active users, slightly higher than Skylight, but this may reflect a narrower, more engaged user base rather than broader appeal.

UpScrolled's decline to 68,000 daily active users post-peak suggests that much of its growth was opportunistic—users trying alternatives during TikTok's vulnerability rather than switching permanently. This is typical behavior when people are testing new platforms. They try it, satisfy their curiosity, and return to their primary app if it still works.

What UpScrolled's story tells us is that even when the incumbent platform fails operationally and faces ownership uncertainty, a specialized alternative struggles to retain users once the crisis passes. Users apparently prefer a dominant platform that occasionally breaks over a niche alternative that works perfectly but lacks content and community.

Why These Challengers Didn't Stick

The crucial insight here is that TikTok's dominance isn't primarily based on technical superiority or feature richness. It's based on network effects and habit. Skylight and UpScrolled could have been technically identical to TikTok—same algorithm, same features, same interface—and still failed to retain users because the content and communities they needed existed only on TikTok.

This creates a classic chicken-and-egg problem for any TikTok competitor. Users want to go where the content is. Creators want to go where the audience is. Neither group wants to be first. So even when given a window of opportunity during TikTok's vulnerability, the challengers couldn't overcome this fundamental asymmetry.

Moreover, the crisis that created the opportunity (ownership change + outage) was time-limited. Once TikTok's infrastructure stabilized and the ownership transition completed without the feared negative consequences, the reason to stay on alternatives disappeared. Users returned to the platform where their friends were, where their favorite creators posted, and where the algorithm actually worked.

Estimated data shows TikTok's DAU could stabilize, decline due to market saturation, or fragment due to competition. Estimated data.

The Data Center Outage: Catastrophic Timing

What Broke and Why

The multi-day data center outage affected fundamental TikTok functionality across the board. Search stopped working reliably. The like button disappeared for many users. Comments became unreliable. The recommendation algorithm, which is TikTok's core competitive advantage, degraded significantly. Even in-app chat, a relatively simple feature, became intermittent.

From a technical perspective, this suggests a cascading failure across multiple infrastructure components. A winter storm knocked out power to at least one major data center, likely forcing TikTok to reroute traffic to backup facilities that either weren't fully redundant or weren't properly provisioned for peak load. When millions of users try to use a platform simultaneously and the infrastructure can't handle it, everything fails in a chain reaction.

The algorithm failure is particularly significant because it's TikTok's core product. Users don't really care that they're using TikTok; they care that TikTok's algorithm shows them interesting videos. If the algorithm doesn't work, TikTok becomes just another video hosting platform with no advantage over alternatives.

Why Users Interpreted It As Censorship

This is the crucial psychology moment. When TikTok's features started failing, the narrative formed almost instantly: the new American owners were censoring content. Users believed that search was broken because they were shadow-banning certain content. Comments were disappearing because the company was removing certain types of speech. The algorithm was degrading because it was deliberately suppressing certain creators or viewpoints.

None of this was true. But it's psychologically reasonable given the context. When a platform is under regulatory pressure, when it has just changed ownership, and when features suddenly stop working, the most obvious interpretation is intentional control.

This reveals something important about platform trust. Trust isn't primarily about what a platform actually does. It's about the narrative users construct. Users interpret platform behavior through the lens of whether they trust the operator. When trust is high, technical failures are interpreted generously. When trust is low or uncertain, the same failures are interpreted with suspicion.

TikTok had done nothing yet to demonstrate that new American ownership would be problematic. But it also hadn't done anything to establish trust. It was in an information vacuum. The data center outage filled that vacuum with a cautionary narrative.

The Recovery Communication Problem

When TikTok finally announced on Sunday evening that the outage was caused by a winter storm and power failure, the explanation made technical sense. But it arrived too late to prevent the narrative from solidifying. Users had already decided that something sinister was happening. A technical explanation from the company most suspected of the wrongdoing carried no credibility.

This points to a broader communications problem: companies facing trust deficits can't simply state facts and expect them to be believed. They need to establish credibility first, then provide explanations. TikTok attempted to do this in reverse, explaining the outage to an audience that had stopped trusting their explanations.

Critically, TikTok's communication didn't address the ownership change narrative at all. They explained the technical failure but didn't proactively address whether the new ownership would change policies, content moderation, data handling, or anything else. This silence on the larger question left the smaller technical explanation to carry the weight of users' broader concerns.

User Psychology: Why Dominance Persists Despite Crisis

The Habit Loop and Switching Costs

Even when users left TikTok temporarily, they returned quickly. This wasn't because TikTok solved every problem or because Skylight and UpScrolled failed catastrophically. It was because the switching costs of staying away were higher than the costs of returning.

For a teenager, TikTok is where friends spend time. Leaving TikTok means missing out on inside jokes, trends, and social moments that define their social life. It means their friends have a version of events and experiences that exclude them. This isn't trivial. For a generation that has socialized primarily through social media, missing the platform is functionally equivalent to missing school.

For creators, the equation is even simpler: TikTok has the audience. Skylight Social has users, but not the audience. Creators can afford to experiment with alternatives, but they can't afford to abandon TikTok if that's where their income comes from and where they've built their following.

Once TikTok's infrastructure stabilized, there was no remaining reason to incur the switching cost of staying on an alternative. Users returned in waves, bringing their attention and engagement with them.

Information Uncertainty and Conservative Default

Regarding the ownership change specifically, users faced genuine information uncertainty. They didn't know what the new ownership structure actually meant. They had no evidence that it would be bad, but they also had no evidence that it would be fine. In the face of uncertainty, people typically default to their previous behavior once the immediate crisis passes.

This is true even when the previous situation was concerning. Staying on TikTok after the ownership change was uncertain, but returning to TikTok was the status quo option. Leaving required taking action and bearing the cost of switching. Returning required simply opening the app. The path of least resistance led back to TikTok.

Over time, as users observed that the new ownership didn't immediately change policy or degrade the experience, confidence returned. The uncertainty didn't fully resolve—it almost never does—but it became acceptable uncertainty. Users had experienced the new ownership in action for weeks without negative consequence, which was stronger evidence than any corporate statement could provide.

Network Effects as a Moat

What this entire episode demonstrates is that TikTok's dominance is almost entirely based on network effects and habit, not on technical superiority or feature richness. Skylight Social could theoretically have offered every single TikTok feature plus additional options, and it still would have struggled because it lacked the content and community that make TikTok valuable.

Network effects create winner-take-most dynamics in social media. Once a platform reaches critical mass, it becomes the default option for everyone. This isn't because it's objectively better. It's because that's where everyone else is. Users don't choose to stay on TikTok because they genuinely prefer it to alternatives; they stay because the collective weight of 90+ million other American users makes staying the only rational choice.

During the brief window when that assumption broke, alternatives became viable. But the moment the original platform stabilized, users returned because the network effect reasserted itself. The fundamental power dynamic of social media—that being where everyone is matters more than specific features—remained intact.

UpScrolled peaked at 138,500 daily active users, surpassing Skylight Social's peak of 81,200. Skylight retains 56,300 users, indicating a 30% retention rate.

The Broader Pattern: Temporary Dips in Dominant Platforms

Historical Context of Platform Decline and Recovery

TikTok isn't the first platform to experience a temporary usage dip followed by recovery. Facebook faced numerous crises—data privacy scandals, teenage user defection, regulatory investigations—yet remained dominant in social networking. Twitter faced similar cycles of crisis and recovery. Instagram survived the Reels launch to remain the dominant platform for photo sharing.

What distinguishes these dips from actual decline is that they're temporary. They reflect a moment when users question their loyalty but ultimately return because the alternatives aren't sufficiently better or because the switching costs are too high.

TikTok's dip in January 2026 followed this pattern exactly. It was dramatic enough to make headlines and trigger discussion about platform alternatives. It was severe enough that Skylight Social and UpScrolled could briefly claim they were the future of short-form video. But it was temporary enough that TikTok's dominance reasserted itself without requiring any significant changes.

What Triggers Real Platform Decline

The distinction between temporary dips and actual decline matters for understanding tech ecosystems. Real platform decline happens when the alternative is genuinely better, not just available. MySpace didn't fail because users temporarily tried Facebook during a crisis. MySpace failed because Facebook offered a superior product and network that made it worth the switching cost. Yahoo didn't fade because Google was temporary relief; Google provided such superior search that users never went back.

During TikTok's crisis, Skylight Social and UpScrolled weren't offering superior products. They were offering the same product with less content. Users tried them as a temporary escape, not as a permanent move. Once the escape reason disappeared (the outage resolved, the ownership change didn't trigger negative policy changes), users returned.

This suggests that unless a genuine alternative emerges that's significantly better than TikTok—not just at features, but at actually being where the creators and communities users care about are—TikTok will remain dominant. The crisis of January 2026 didn't reveal a weakness that competitors could exploit. It revealed that TikTok's dominance is deeper than any individual feature or policy decision.

The Longer Decline: What the Statistics Really Show

Peak Usage in Mid-2025

While the January 2026 crisis got media attention, the more significant story might be the longer decline visible in the data. TikTok peaked at 100 million daily active users during July through October 2025. By January 2026, even after recovery from the crisis, TikTok had stabilized at roughly 90 million daily active users. That's a 10% decline from peak, which is meaningful.

This longer-term decline isn't about ownership changes or data center outages. It reflects a more fundamental shift in how Americans use social media. It's possible that short-form video consumption is maturing, that TikTok's growth rate is naturally slowing as it approaches market saturation, or that generational shifts are changing video consumption patterns.

It's also possible that alternatives are slowly pulling users even during normal times, without the dramatic crisis moment. Users might be spending less time on TikTok not because they left, but because they're splitting their time between TikTok, Instagram Reels, YouTube Shorts, and other video platforms. The crisis moment was just a visible manifestation of deeper shifts in attention allocation.

The Distinction Between Crisis Recovery and Trend Reversal

This distinction matters significantly. TikTok recovered from the January crisis, but it didn't recover to peak usage. The 90 million daily active users in late January is lower than the 100 million in mid-2025. So TikTok faced two different phenomena simultaneously: a temporary crisis that caused a dip and recovery, and a longer-term decline that hasn't reversed.

The temporary crisis got attention because it was dramatic and coincided with Skylight and UpScrolled's sudden growth. But the longer-term decline might be more significant to understanding TikTok's future trajectory. Even when there's no crisis and no new competition, TikTok's usage is slowly declining. This suggests that the ownership change and the data center outage weren't the real story; they were just a distraction that obscured the real story, which is gradual market saturation and user attention shifting to other platforms.

Estimated data shows a dip to 86 million users in late 2023, with recovery to over 90 million by early 2024 and a peak of 100 million by mid-2025. (Estimated data)

Competitive Implications: Are TikTok Killers Real?

The Search for TikTok Alternatives That Stick

Every platform with significant market power eventually faces emergence of would-be alternatives positioned as more user-friendly, more privacy-conscious, or less corporate versions of the original. Mastodon emerged as a Twitter alternative. Threads launched as a Twitter alternative. Bluesky came later as another Twitter alternative. Yet Twitter's dominance in real-time information persisted, largely because the actual news cycle happens on Twitter.

Skylight Social and UpScrolled are part of this tradition: competitors trying to exploit the perception of vulnerability in TikTok. But the data suggests that even when TikTok actually is vulnerable—facing regulatory pressure, experiencing operational failures, transitioning ownership—the alternatives struggle to stick.

This isn't because they failed to execute or built inferior products. It's because they faced an inherent structural disadvantage: TikTok already had the network. Skylight and UpScrolled couldn't copy the network; they could only hope to replace it. That's a far harder task, and the brief window of crisis opportunity isn't enough to overcome the switching costs.

The Paradox of Platform Network Effects

This creates an interesting paradox: the more dominant a platform becomes, the harder it is to dethrone even when it stumbles, because the very dominance that makes it beatable (large user base, network dependency) is what makes it sticky once the crisis passes. Users stay because everyone else stays. Competitors can't gain traction because there's no one to create network effects for them.

TikTok learned something important from this episode: its dominance is resilient precisely because it's based on network effects, not product superiority. As long as creators and their audiences remain on TikTok, the platform survives crises. This is simultaneously TikTok's greatest strength and greatest vulnerability—great because the platform's position is stable, vulnerable because it depends entirely on users continuing to believe that everyone else is still there.

Creator Economics and the Retention Question

How Creators Influence User Loyalty

During TikTok's crisis period, creators faced genuine economic pressure. If they'd abandoned TikTok entirely and moved to Skylight Social, they would have followed their audiences away from the dominant platform. This could have turned the temporary crisis into a permanent shift.

Yet most creators didn't do this. Instead, they hedged their bets—posting to TikTok primarily while experimenting with alternatives. This behavior likely influenced their audiences to do the same: maintain presence on TikTok while trying alternatives. When TikTok stabilized, the primary presence remained on TikTok.

This reveals how creator economics actually work. Creators can't afford to be wrong about which platform matters. If they abandon TikTok and their audience stays on TikTok, they lose income. If they stay on TikTok and their audience leaves, they lose income. The only rational strategy is hedging: maintain presence everywhere while putting maximum effort into the platform most creators use.

From TikTok's perspective, this is deeply reassuring. Even during the crisis, creators kept their primary presence on TikTok. This ensured that as soon as users came back (which they did, once the infrastructure issues resolved), creators had content waiting for them. The network effect reinforced itself.

The Economics of Creator Switching

Creators on TikTok don't earn money directly from the platform (in most cases—some participate in the Creator Fund or other monetization programs, but that's minority). They earn money through brand partnerships, affiliate links, or subscription features like TikTok Stars. All of these mechanisms are most lucrative when a creator has the largest possible audience.

Skylight Social and UpScrolled couldn't offer these creators equivalent monetization mechanisms. They couldn't offer large audiences. They couldn't offer the same partnership opportunities. So even creators who wanted to support alternatives faced economic pressure to remain on TikTok.

This economic alignment kept the platform ecosystem stable. Even as users experimented with alternatives, creators remained on TikTok, which meant content remained on TikTok, which meant users had no permanent reason to switch. It's a powerful dynamic that benefits incumbent platforms.

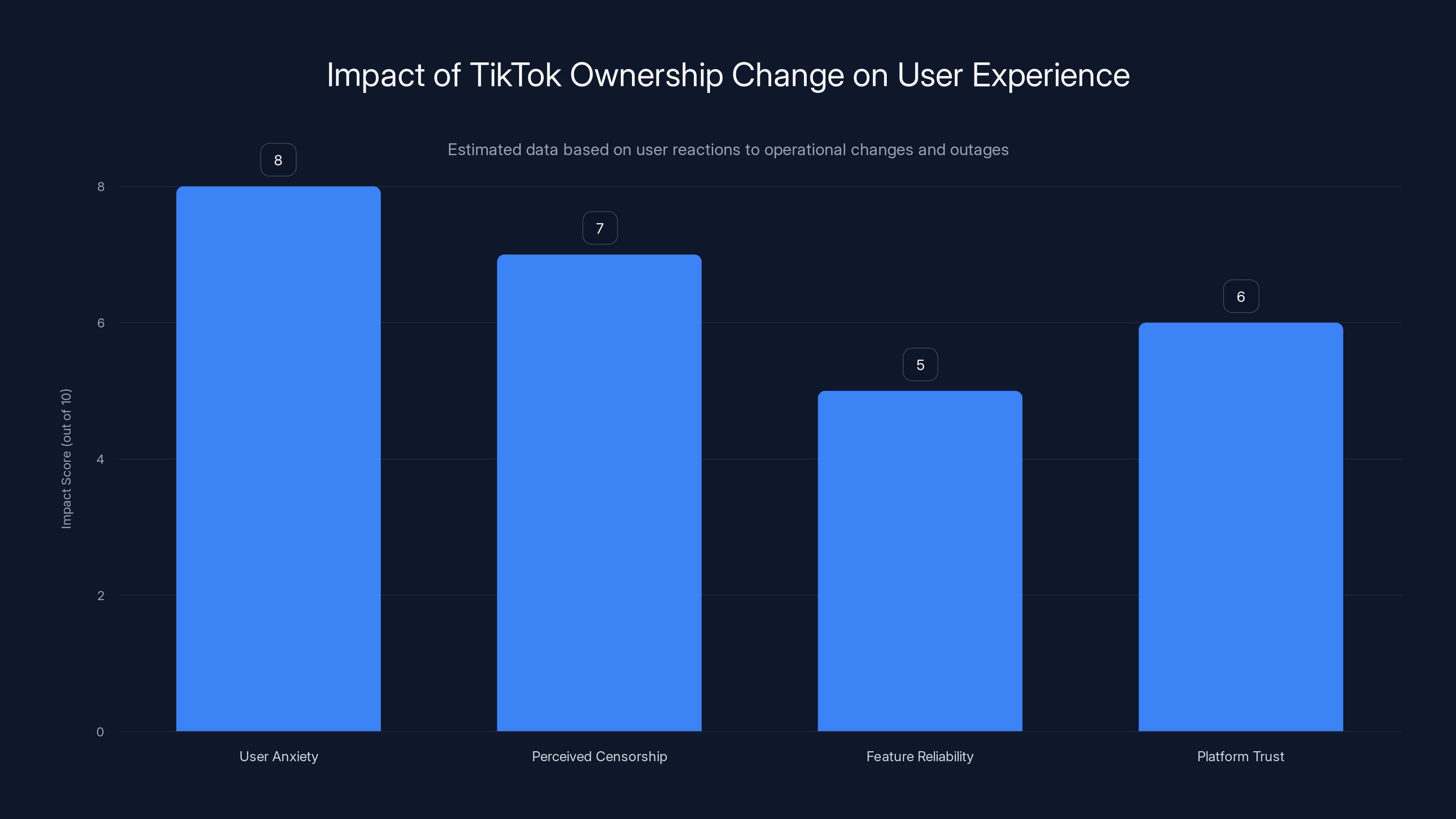

Estimated data suggests high user anxiety and perceived censorship due to ownership change and outages, impacting platform trust.

Data and Metrics: Interpreting the Numbers

Similarweb Data Reliability

The statistics in this story—the drop to 86-88 million daily active users, the recovery to 90+ million, the peak of 100 million in mid-2025—come from Similarweb, a digital market intelligence firm. Similarweb doesn't have direct access to TikTok's internal metrics; instead, it estimates usage based on aggregated user behavior, browser data, and other signals.

This matters because estimates are different from confirmed metrics. Similarweb's estimates are probably accurate directionally—they likely captured the actual dip and recovery—but the exact numbers might be off. The 92 million figure for typical usage, the 86-88 million low point, and the 90+ million recovery are probably representative of the actual pattern, but they're estimates, not confirmed by TikTok itself.

TikTok rarely discloses official daily active user numbers, which is why firms like Similarweb estimate them. These estimates are credible enough for industry analysis and trend identification, but they're not precise in the way confirmed metrics would be.

What the Numbers Miss

Daily active users is a useful metric, but it obscures important details. A decline from 92 million to 86 million DAU could mean:

- 6 million users stopped using TikTok entirely

- 6 million users reduced their usage from daily to less frequent

- A combination of both

- Measurement error or timing variation in how Similarweb counts DAU

The fact that TikTok recovered quickly to 90+ million DAU suggests that most of those 6 million users were in the second category: they reduced frequency during the crisis, then returned to daily usage. If the dip had represented permanent users leaving, recovery would have been slower and more difficult.

Additionally, daily active users doesn't measure engagement quality or time spent. It's possible that during the crisis period, the 86-88 million remaining users spent significantly less time on TikTok because the platform was experiencing technical issues. So the user drop understates the severity of the impact on TikTok's actual value as a platform for advertising and content monetization.

Regulatory and Geopolitical Context

Why Ownership Matters to Regulators

The ownership change wasn't arbitrary. TikTok's U.S. parent company—originally ByteDance, a Chinese company—created regulatory concerns in Washington around data security, algorithmic transparency, and foreign influence. Regulators worried that China's government could compel TikTok to provide data on American users, or that the algorithm could be manipulated to serve geopolitical interests.

Whether these concerns are justified is debatable, but they drove regulatory pressure that forced the ownership change. A group of American investors took control of TikTok's U.S. operations, theoretically putting American data and operational decisions under American control.

For users, the ownership change signaled acknowledgment of the risks regulators had identified. Some users found this reassuring—American ownership meant American oversight. But others found it concerning—the fact that ownership had to change meant there was something to be concerned about in the first place.

The Narrative Gap

TikTok's new ownership didn't solve the actual regulatory concerns; it just distributed responsibility differently. But it did create a narrative gap. Users had no clear understanding of what the new ownership would mean for their experience, their data, or the platform's algorithms. This gap got filled by speculation and anxiety.

One of the losses TikTok experienced during the crisis was the loss of control over its narrative. Once users started wondering about ownership and data, those questions didn't have clear official answers. Instead, they filled the information vacuum with assumptions: the new owners might be different, might have different values, might treat user data differently. The data center outage, occurring in this context of uncertainty, became evidence for the narrative rather than just a technical problem.

From a communication perspective, TikTok might have benefited from being more proactive about explaining the ownership change and its implications before the crisis happened. Instead, the change happened quietly, users weren't sure what it meant, and the first real moment of confrontation came during a major technical failure.

The Recovery Process: How TikTok Bounced Back

Technical Stabilization

TikTok's recovery had two components. First, the company had to fix the technical issues. The data center outage required restoration of power, failover to backup systems, and verification that all the core functionality—search, likes, comments, algorithm, chat—was working again. This probably took days of around-the-clock work from TikTok's engineering teams.

Once the infrastructure stabilized, the core product—the ability to scroll through an endless feed of interesting videos powered by an intelligent algorithm—worked again. This is fundamental to TikTok's value proposition. When this works, users don't need much reason to stay. When it breaks, users look elsewhere.

Narrative Stabilization

Second, TikTok needed to stabilize the narrative around the ownership change. The company did this partly through its official explanation of the outage—positioning it as a technical problem caused by external forces (winter storm, power outage) rather than a result of the ownership change or anything systematic. This narrative helped users reinterpret what had happened.

Beyond the official explanation, TikTok's simple continued operation was narrative-stabilizing. Each day without new problems, each week without announced policy changes, each month without apparent alterations to how the algorithm worked—all of this gradually rebuilt the assumption that the ownership change wasn't catastrophic.

Users don't typically make considered decisions about platforms. They operate on assumption and habit. The assumption during the crisis was "something is fundamentally different now." As weeks passed without confirming evidence of fundamental change, the assumption shifted back to "this is still the same platform." This shift required no official communication; it required only that TikTok continue operating normally.

Lessons for Social Media Platforms and Regulators

What Platform Dominance Reveals

The episode demonstrates that platform dominance, especially in social media, is robust against external shocks that don't change the fundamental product or network. TikTok faced ownership change, regulatory pressure, operational failure, and active competition from alternatives, yet its position stabilized quickly.

This has implications for platform regulation and antitrust action. Simply breaking up a dominant platform or forcing changes in ownership doesn't guarantee that competitors will gain significant market share. The dominance persists because users rationally prefer being where everyone else is, and that preference outweighs concern about the platform operator's identity or policies.

The Limits of Regulatory Intervention

For regulators trying to reduce TikTok's market power or change its behavior, the implications are sobering. Forcing an ownership change doesn't reduce the platform's power; it just changes who exercises that power. Users will accept almost any operator if the platform continues to deliver the core value proposition—in TikTok's case, an algorithm that shows interesting videos.

If regulators want to actually reduce TikTok's dominance, they probably need to either make existing competitors genuinely better (which seems unlikely given network effects), or force TikTok to interoperate with competitors (allowing users to follow creators across platforms, for example). A simple ownership change without these more structural interventions is unlikely to significantly alter TikTok's market position.

The Future: Is the Decline Permanent?

Projecting Usage Trends

The decline from 100 million daily active users (mid-2025) to 90+ million (January 2026) could represent multiple trajectories:

First, it could be temporary market fluctuation around a stable equilibrium. TikTok might return to 100 million DAU as seasonal effects, new features, and demographic changes drive more Americans to the platform.

Second, it could reflect the start of genuine market saturation. The U.S. has roughly 330 million people. TikTok's 90-100 million DAU represents roughly 27-30% of the total population. It's possible that the platform has reached something close to maximum addressable market, and future growth will be slow or negative as younger cohorts age out and aren't replaced by new users.

Third, it could reflect attention fragmentation as other video platforms (Instagram Reels, YouTube Shorts, etc.) pull away users. In this scenario, TikTok isn't being replaced by a single competitor; it's being supplemented by multiple competitors, each capturing a portion of total short-form video viewing time.

Wildcards and Unknowns

Several factors could alter TikTok's trajectory:

If new regulatory action forces TikTok to fundamentally change its algorithm or data handling, users might experience degraded performance. This could trigger the kind of permanent switching the January crisis didn't accomplish.

If a genuinely superior alternative emerges—not just different, but better at actually recommending interesting videos—users might rationally switch. But this seems unlikely given how well TikTok's algorithm works and how much data it has to train on.

If demographic shifts change which platforms different age groups prefer, TikTok's user base could decline simply because new cohorts of teenagers prefer different platforms. But there's little evidence of this happening yet.

For now, TikTok appears to have passed through its crisis moment. The ownership change is complete, the operational issues are resolved, and users have returned. The longer-term usage decline is a separate phenomenon that will require separate intervention or explanation.

The Verdict: TikTok's Resilience Despite Vulnerability

What the Data Actually Tells Us

When TikTok dropped from 92 million to 86-88 million daily active users in January 2026, it created a brief moment where the platform's dominance seemed potentially breakable. The coincidence of ownership change, technical failure, and emergence of viable alternatives created conditions where switching seemed both motivated and feasible.

Yet the recovery was swift and almost complete. Within weeks, TikTok returned to 90+ million DAU. Skylight Social's 81,200 peak daily users dropped to 56,300. UpScrolled's 138,500 peak dropped to 68,000. The alternative apps retained some users, but the movement was fundamentally temporary.

This tells us that TikTok's dominance isn't fragile in the way we might have believed. It's not based on faith in the company's values or trust in the operator. It's based on the cold mathematics of network effects: TikTok has the most content and the largest creator base, so it's the rational choice for users, regardless of ownership or recent crises.

The Stickiness of Dominant Platforms

Once a social media platform reaches critical mass, it becomes nearly impossible to dethrone without changing the fundamental product or creating a genuinely superior alternative. TikTok's crisis revealed this principle in action. Even when there was explicit reason to question the platform—ownership change, regulatory pressure, operational failure—users returned because the alternative to returning was being on a platform with less content and smaller communities.

This has broader implications beyond TikTok. It means that platform dominance, especially in social media, is more durable than competitive dynamics in other industries. In traditional industries, a company that stumbles faces real competitive threat from companies offering better products. In social media, the incumbent survives because switching means leaving your network behind, and staying means losing access to the network.

The Endgame

For TikTok specifically, the endgame is likely stabilization rather than growth. The platform probably won't return to 100 million daily active users, but it also probably won't experience the kind of sustained decline that would threaten its dominance. It will settle into a steady state where it's the dominant short-form video platform in America, with perhaps 85-95 million daily active users depending on seasonal variation and demographic shifts.

The ownership change will continue to be a background concern, especially given TikTok's geopolitical dimensions. But it won't substantially change how Americans use the platform. The data center outage will become a footnote in TikTok's history, interesting only as the moment when alternatives briefly looked viable.

And Skylight Social and UpScrolled will continue as niche platforms, serving the portions of users who prefer them for specific reasons—maybe they value privacy more, maybe they prefer a different type of community, maybe they're just hedging bets against future TikTok problems. But they've learned the same lesson every TikTok alternative has learned: dominance in social media is sticky, and temporarily shaking that dominance isn't the same as replacing it.

FAQ

What caused TikTok's user drop in January 2026?

The user drop resulted from a perfect storm of three simultaneous factors: TikTok's forced ownership change from Chinese parent company ByteDance to American investors, which created uncertainty about the platform's future; a multi-day data center outage caused by winter storm power failures that broke core functionality like search, comments, and recommendations; and emergence of alternative apps like Skylight Social and UpScrolled that provided an exit option for concerned users. The outage was particularly significant because the timing coincided with ownership uncertainty, causing many users to interpret technical glitches as evidence of intentional censorship rather than infrastructure failure.

How many users did TikTok actually lose?

Based on estimates from Similarweb, TikTok dropped from approximately 92 million typical daily active users to a low of 86-88 million daily active users. This represents a loss of roughly 4-6 million daily active users within days of the ownership change. However, this dip was temporary. Within weeks, TikTok recovered to over 90 million daily active users, indicating that most users who left were reducing their frequency temporarily rather than switching to competitors permanently. It's important to note these figures are estimates rather than confirmed metrics from TikTok itself.

Did rival apps permanently gain users from TikTok's crisis?

No. While Skylight Social peaked at 81,200 daily active users and UpScrolled peaked at 138,500 daily active users during TikTok's crisis, both apps experienced significant user decline once TikTok stabilized. Skylight settled at approximately 56,300 daily active users (30% retention of peak), and UpScrolled dropped to 68,000 daily active users (roughly 50% of peak). Although these apps retained some users as small communities, they failed to capture the permanent user migration that would have threatened TikTok's dominance. The alternatives served as temporary escape valves during the crisis, not genuine replacements.

Why didn't users stay on Skylight Social or UpScrolled?

The fundamental barrier is network effects: users prefer being on platforms where their friends, family, and favorite creators are located. Although Skylight Social and UpScrolled functioned technically, they lacked the critical mass of content creators and user communities that made TikTok valuable. Users could try these alternatives as a temporary experiment, but maintaining presence there meant missing out on trends, social moments, and creator content available exclusively on TikTok. Once TikTok's infrastructure stabilized and the ownership change didn't trigger feared policy changes, there was no remaining reason to incur the switching cost of staying on alternatives with inferior networks.

What does the data center outage tell us about TikTok's infrastructure?

The outage reveals that TikTok's infrastructure isn't fully resilient against coordinated infrastructure failure. A winter storm knocked out power at one or more major data centers, and TikTok's backup systems either weren't fully redundant or weren't provisioned for peak load during failover. Core functionality degraded broadly across search, recommendations, comments, and chat. This isn't unusual—many large platforms experience similar outages—but the timing was catastrophic because it coincided with ownership uncertainty, causing users to interpret technical failures as intentional changes rather than infrastructure problems.

Is TikTok's decline from 100M to 90M DAU permanent?

The data suggests a distinction between the temporary crisis dip (92M to 86-88M and recovery) and a longer-term decline from peak 100 million daily active users in mid-2025 to 90+ million by early 2026. The crisis dip and recovery appears reversible—users simply returned once infrastructure and policy stability returned. However, the longer-term 10% decline from peak might reflect genuine market saturation, attention fragmentation to competitor platforms like Instagram Reels and YouTube Shorts, or demographic shifts in video consumption. Without additional data or policy changes, distinguishing between temporary fluctuation and permanent trend is difficult, but the stabilization at 90+ million suggests TikTok has found a new equilibrium rather than entering free fall.

What are the implications for platform regulation?

TikTok's crisis and recovery suggest that forcing ownership changes without other structural interventions has limited ability to reduce a dominant platform's market power. Users will accept almost any platform operator if the core product (in TikTok's case, the algorithm that recommends interesting videos) continues functioning effectively. Regulators seeking to actually reduce TikTok's dominance would probably need stronger tools like interoperability requirements (allowing users to follow creators across platforms) or forced changes to core algorithms and data handling. A simple ownership change shifts power among operators but doesn't fundamentally challenge the platform's structural dominance based on network effects.

Could a genuinely superior alternative ever replace TikTok?

It's theoretically possible but practically difficult. Skylight Social and UpScrolled could have offered technical superiority over TikTok—faster load times, better privacy features, superior design—and still failed to attract sustained users because they lacked the network of creators and communities that make TikTok valuable. For a competitor to actually replace TikTok, it would need to be not just technically superior but also offer a large existing community of creators and content, which means it would need to somehow start with network advantages that competitors don't naturally possess. This is why most successful platform transitions (like MySpace to Facebook, or Yahoo search to Google) happen not through incremental improvement but through genuine innovation that makes the original platform seem primitive by comparison.

Conclusion: The Future of Platform Dominance in Social Media

TikTok's brief vulnerability in January 2026 revealed something fundamental about how social media markets actually work. It's not that dominant platforms are fragile; it's that they're fragile only under very specific conditions, and those conditions rarely persist long enough to permanently shift market structure.

For a moment, everything seemed to align against TikTok. The company faced forced ownership change due to regulatory pressure. The platform experienced a catastrophic operational failure at precisely the worst time. Credible alternatives emerged and began attracting users. The narrative formed that TikTok might actually be replaceable.

Then it all collapsed. Not because TikTok did anything remarkable—it just fixed its infrastructure and let the ownership change proceed without dramatic policy reversals—but because the conditions that had made alternatives viable vanished once the crisis passed. Users returned because they always return when the crisis ends and the network reasserts itself.

This matters for several reasons. For regulators obsessed with reducing TikTok's power, it's a sobering lesson: changing ownership doesn't change dominance. For competitors trying to break TikTok's market position, it's a reminder that temporary windows of opportunity aren't enough to overcome network effects. For users, it suggests that switching away from dominant social platforms, even temporarily, carries real costs in terms of connection and access to communities.

The ownership change is complete. The crisis has passed. TikTok has stabilized at a new equilibrium somewhere between its peak of 100 million daily active users and the nadir of 86-88 million. Skylight Social and UpScrolled remain as niche alternatives, valuable perhaps for specific communities but not competitive with TikTok's scale.

The longer-term question—whether TikTok will decline further as users fragment toward Instagram Reels, YouTube Shorts, and other platforms—remains open. But that's a different story from the ownership change crisis. That's the story of inevitable maturation and market saturation, not vulnerability to governance change.

For now, TikTok endures, not because it's the best platform or the one users most want to use, but because it's the one where the network is. In social media, that advantage is nearly insurmountable.

Key Takeaways

- TikTok lost 4-6 million daily active users (dropping from 92M to 86-88M) after ownership change, but recovered within weeks to 90+ million DAU, proving platform dominance is resilient

- Alternative apps Skylight Social (peak 81.2K DAU) and UpScrolled (peak 138.5K DAU) captured temporary users during crisis but failed to retain them once TikTok stabilized, showing that switching costs outweigh temporary grievances

- A coincidental data center outage during ownership transition amplified user concerns, with users interpreting technical glitches as censorship rather than infrastructure failure

- Network effects—not product quality—determine social media dominance; creators kept primary presence on TikTok during crisis, ensuring content remained available and reinforcing user returns

- TikTok's longer-term decline from 100M DAU (mid-2025 peak) to 90+ million represents distinct phenomenon from crisis recovery, suggesting possible market saturation or attention fragmentation to Instagram Reels and YouTube Shorts

Related Articles

- UpScrolled Hits 2.5M Users: How This TikTok Alternative Exploded [2025]

- X's Paris HQ Raided by French Prosecutors: What It Means [2025]

- Social Media Addiction Lawsuits: TikTok, Snap Settlements & What's Next [2025]

- TikTok Settles Social Media Addiction Lawsuit [2025]

- Meta's "IG is a Drug" Messages: The Addiction Trial That Could Reshape Social Media [2025]

- TikTok Power Outage: How Data Center Failures Cause Cascading Bugs [2025]

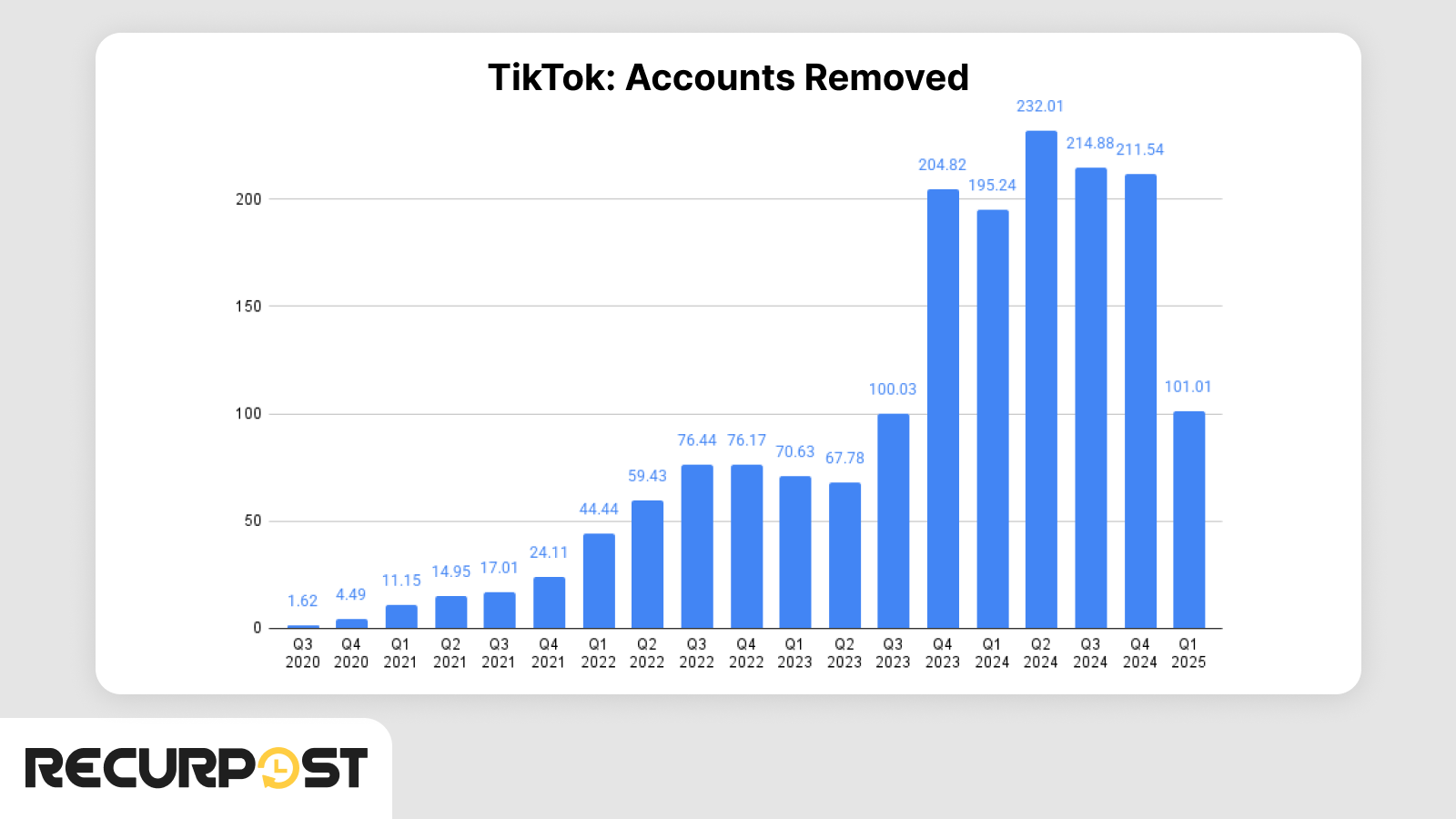

![TikTok's Ownership Shift & User Recovery: What Really Happened [2025]](https://tryrunable.com/blog/tiktok-s-ownership-shift-user-recovery-what-really-happened-/image-1-1770134985548.jpg)