The Netflix Standoff: When Politics Meets Corporate Governance

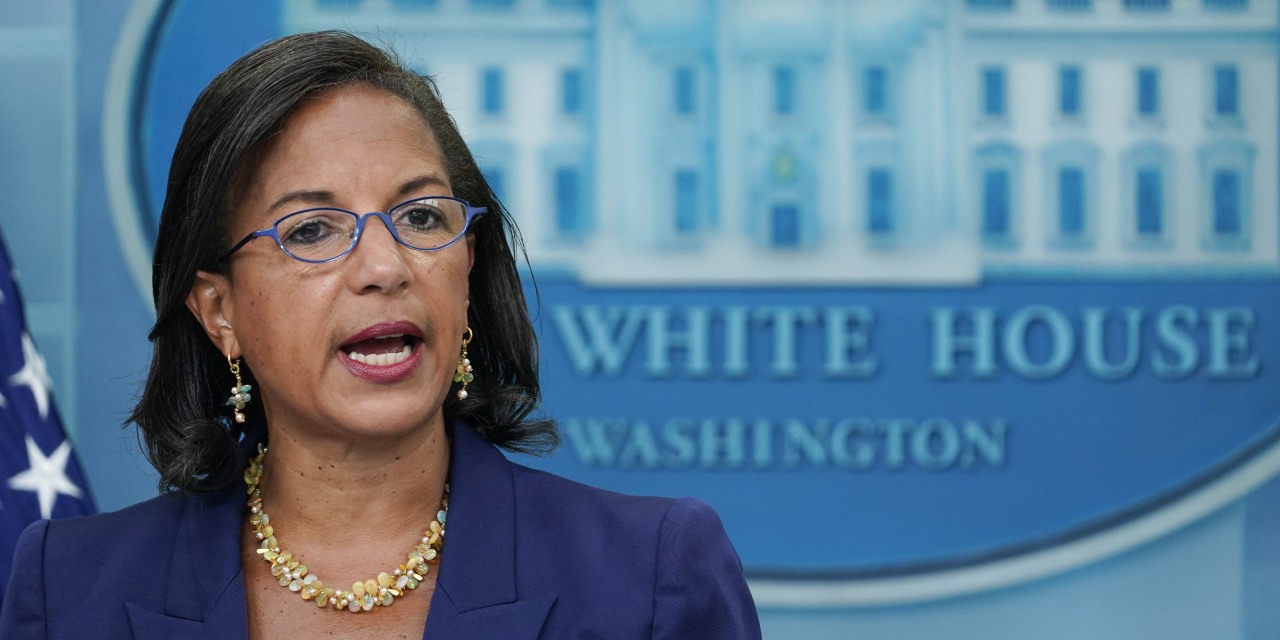

It started as a podcast appearance. Susan Rice, former Ambassador to the United Nations and longtime government official, sat down with Preet Bharara for a casual conversation about corporate responsibility. She made an offhand comment about companies that "take a knee to Trump," suggesting they'd face accountability. Within hours, the comment spiraled into a political firestorm that exposed something much bigger than one board member's words.

Donald Trump responded by demanding that Netflix fire Rice immediately, threatening unspecified "consequences" if the company didn't comply. The threat hung in the air like a weapon. What consequences? Nobody was explicitly told. But everyone understood the implication: government power could be wielded against a corporate decision.

This wasn't a simple disagreement about words. This was a moment that revealed how power actually works in modern America. It showed how a single social media post from a political figure could trigger pressure campaigns, how corporate boards suddenly become political battlegrounds, and how the line between government and business has become dangerously blurred.

The stakes matter because Rice isn't just any board member. She's a symbol. She represents the old guard, the Washington establishment, the people Trump's political movement has explicitly positioned as enemies. Her presence on Netflix's board irritates a growing political coalition that views Big Tech with deep suspicion, not because of monopolistic practices or data collection, but because these companies haven't adequately bent the knee to specific political demands.

What makes this situation particularly significant is what it reveals about corporate vulnerability. Netflix is trying to complete a major merger with Warner Bros. That acquisition requires regulatory approval. In Washington, those decisions don't happen in a vacuum. They happen in a political ecosystem. Trump's threat to create "consequences" should be read in that context: approve the merger and keep Rice on the board, or face regulatory retaliation. It's the implicit structure of power.

This moment matters far beyond Netflix. It sets a precedent. It signals to other tech companies that board composition is now a political issue, that hiring or retaining certain people sends political messages, and that governments can use regulatory power to enforce corporate personnel decisions. The question isn't whether Trump's threat is legal or justified. The question is what happens when corporate leadership starts making hiring decisions based on political demands rather than merit and qualification.

Susan Rice's Comments: Context and Controversy

Before the outrage, there was an interview. Rice appeared on Preet Bharara's podcast, discussing corporate responsibility in polarized times. Her exact words were about companies that "take a knee to Trump," suggesting they'd be "caught with more than their pants down. They are going to be held accountable."

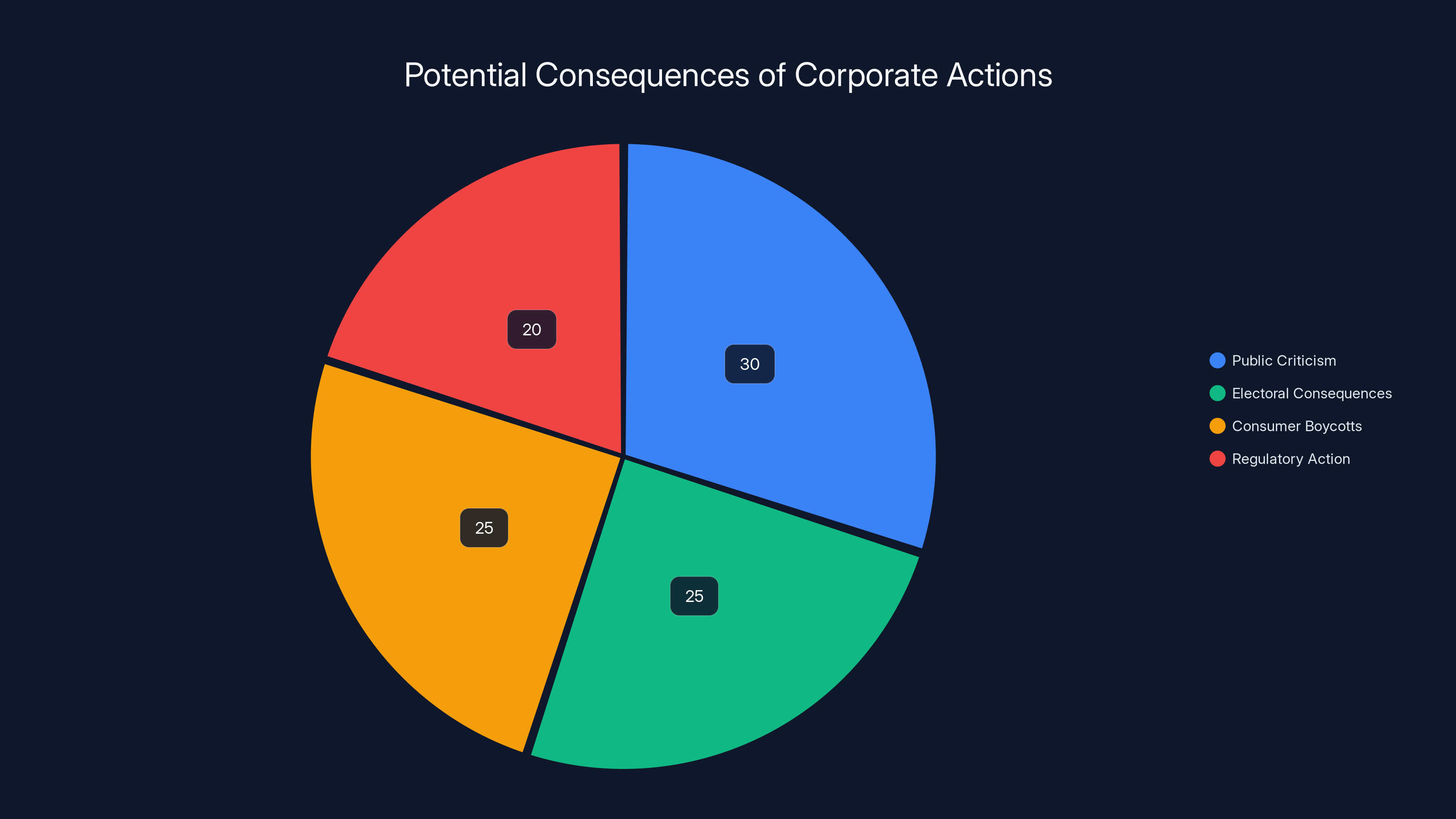

The language is confrontational. It's also ambiguous. What does "held accountable" mean, exactly? It could mean public criticism, electoral consequences, consumer boycotts, or regulatory action. Rice didn't specify. That vagueness became the problem.

Rice has spent decades in government service. She's an expert in foreign policy, national security, and international relations. During the Obama administration, she served as National Security Advisor. Under Biden, she held influential positions on climate and domestic policy. Her career reflects the Washington establishment that Trump's movement explicitly rejects.

Her Netflix board seat put her in a corporate governance role focused on strategy, oversight, and corporate direction. Board members typically aren't hired for partisan affiliation. They're hired for expertise, judgment, and fiduciary responsibility. Rice brought credibility in policy, international affairs, and institutional knowledge. Her political views, like those of other board members, presumably don't determine her value as an overseer.

But that's not how the situation was framed. Right-wing influencer Laura Loomer seized on Rice's comments and transformed them into something sharper: a threat against Trump supporters, framed as evidence that the establishment was weaponizing corporate power against political opponents. This reframing mattered. It changed Rice from a board member expressing political views to a symbol of institutional bias.

Loomer's framing also highlighted Netflix's regulatory vulnerability. She pointed out that Netflix is pursuing a merger with Warner Bros., a deal that requires government approval. This detail transformed the story from "unpopular board member said controversial thing" into "potential government retaliation for corporate hiring decisions." That framing gave the story weight because it's factually true: the merger is real, and regulatory approval matters.

Rice's supporters argue her comment was mild, even unremarkable by contemporary political standards. Politicians regularly make sweeping statements about opponents. Activists threaten boycotts and regulatory action. Commentators predict electoral consequences. These are normal political expressions in a polarized environment. The question is whether board members should make these statements at all, regardless of which side of the political spectrum they represent.

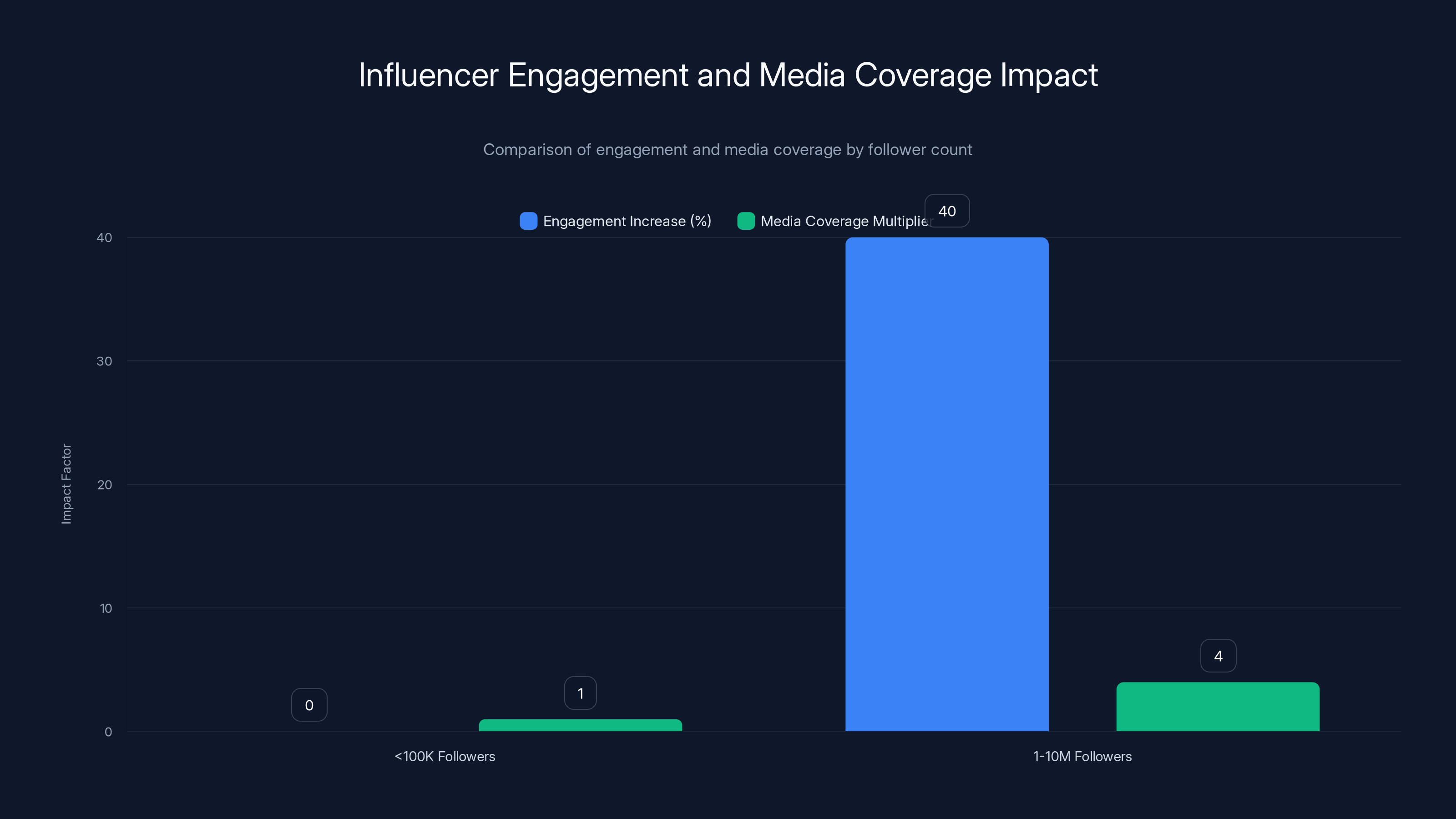

Influencers with 1-10 million followers receive 40% more engagement and 3-5 times higher media coverage than those with under 100K followers. Estimated data.

Trump's Demand: The Explicit Power Play

Trump's response was direct. "Netflix should fire racist, Trump Deranged Susan Rice, IMMEDIATELY, or pay the consequences." The message was crafted to provoke. He used charged language—"racist," "Trump Deranged"—to delegitimize Rice personally, not just her statement. But the real weight came in the threat: "pay the consequences."

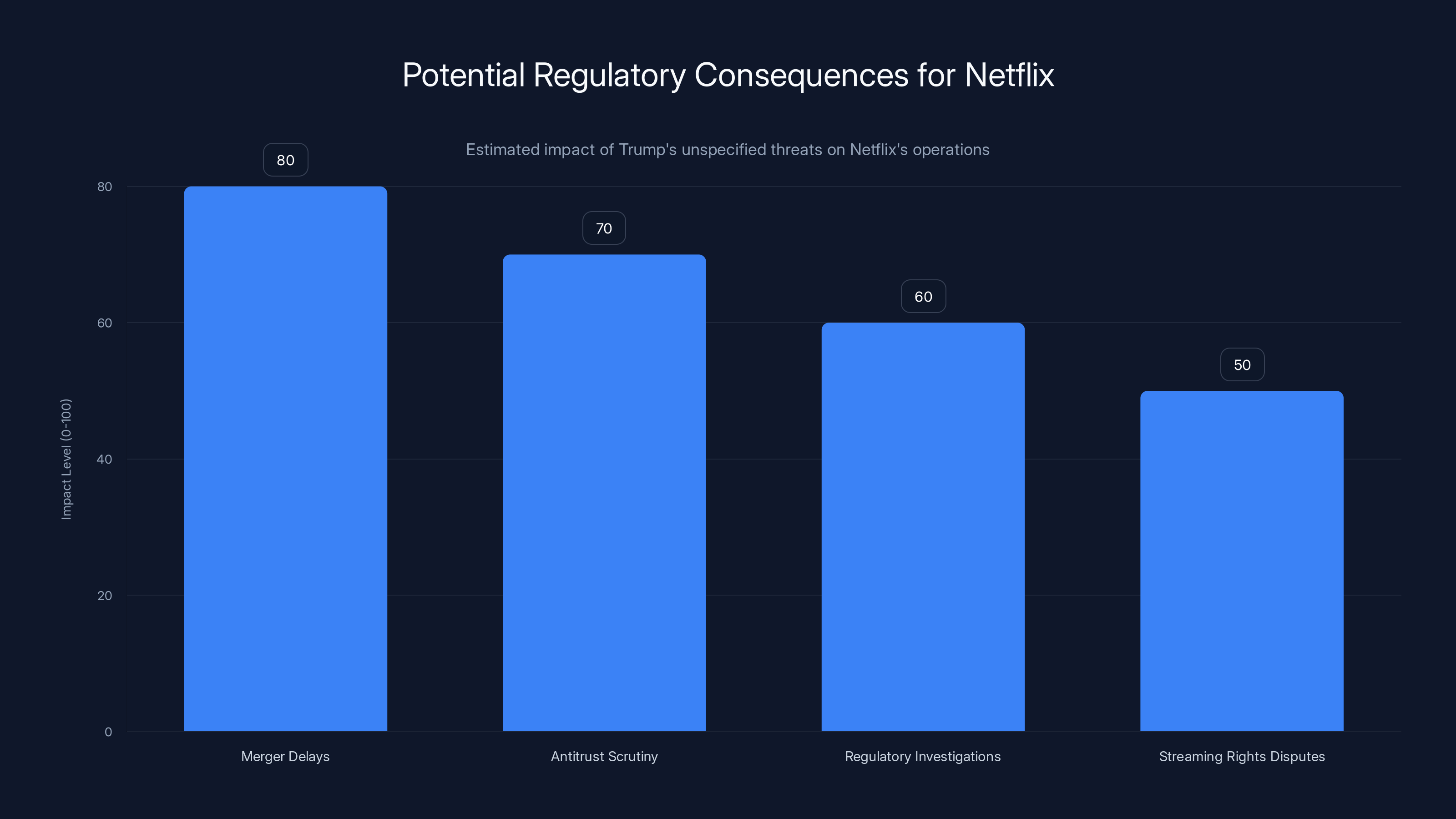

What consequences? Trump didn't specify. That ambiguity is actually the point. When a government official with significant regulatory power threatens unspecified consequences for a corporate decision, the threat becomes a blank check. Companies fill in the blank with their own worst fears: regulatory investigation, merger rejection, antitrust action, licensing disputes, or public political opposition.

This matters because Netflix needs government approval for its Warner Bros merger. The company also operates on government licenses, franchises, and regulatory permits in markets worldwide. An aggressive regulatory posture from the Trump administration could create real problems: delays in merger approval, increased antitrust scrutiny, regulatory investigations into content practices, or disputes over streaming rights and copyright enforcement.

None of these consequences were explicitly threatened. But all of them became plausible outcomes that Netflix's board had to consider. The threat was intentionally vague because vagueness is more effective than specificity. A specific threat—"we'll block the merger"—could be contested, debated, and potentially challenged legally. An unspecified threat creates maximum uncertainty and pressure.

Trump has a history of using this tactic. He's threatened companies with regulatory action, tax investigations, and government opposition when they've taken positions he disliked. In some cases, those threats have resulted in real consequences. In other cases, they've evaporated once the political moment passed. The uncertainty keeps companies in a state of perpetual defensiveness.

The Netflix situation is particularly effective as a power demonstration because it targets corporate governance directly. It says: your hiring decisions are political decisions. Your board composition is a political statement. And if we don't like your political statements, we'll use government power to force changes. This logic, if it takes hold, fundamentally restructures how corporations think about leadership and diversity.

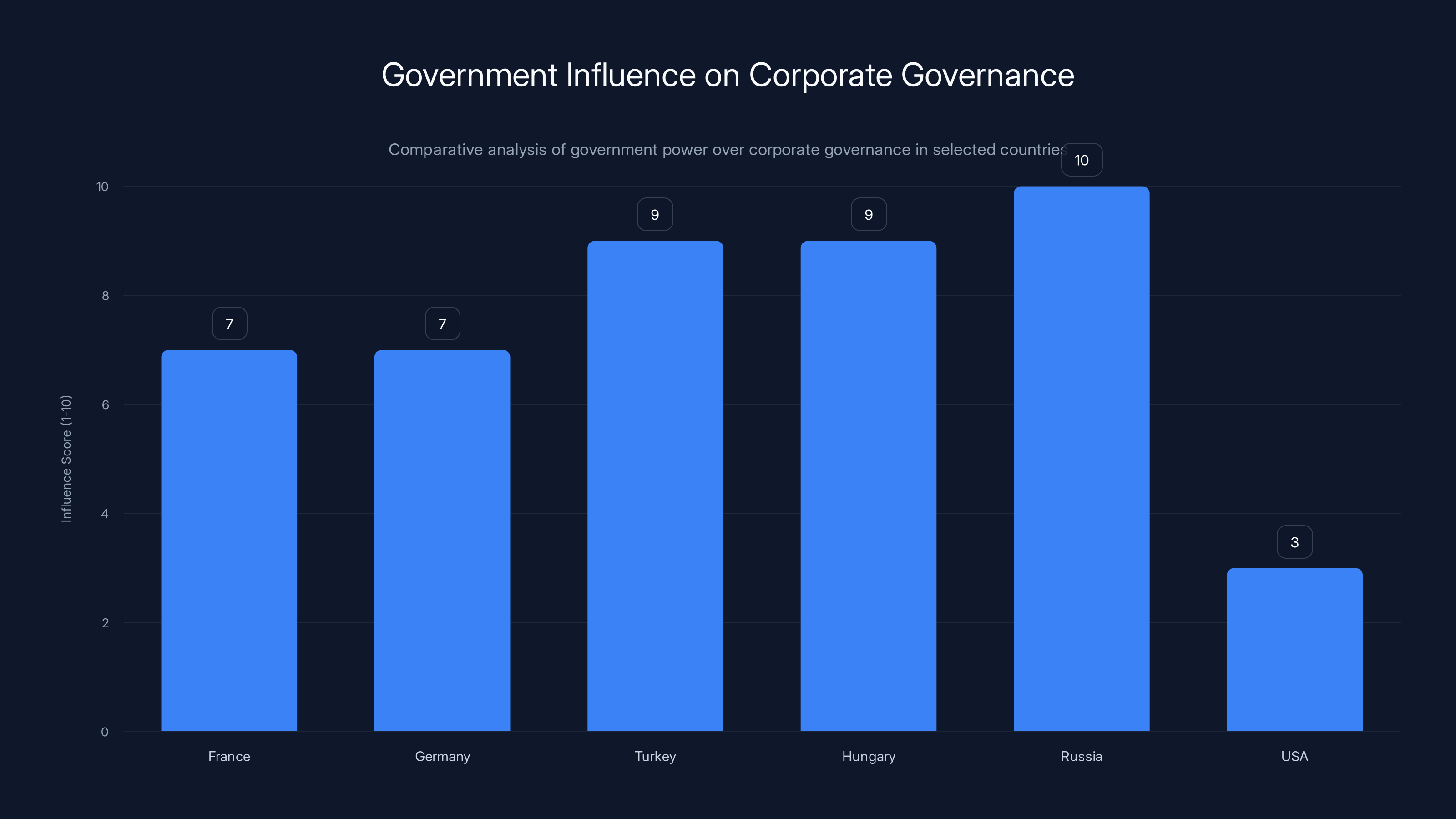

This chart illustrates the varying levels of government influence over corporate governance across different countries. European countries like France and Germany have moderate influence, while countries with weaker democratic norms, such as Turkey, Hungary, and Russia, exhibit higher government control. The USA maintains a relatively low influence score. (Estimated data)

The Warner Bros Merger: Where Real Power Lives

Understanding the Netflix situation requires understanding the Warner Bros merger. This deal isn't just a corporate transaction. It's a regulatory process. And in regulatory processes, political power matters enormously.

Netflix is trying to acquire Warner Bros. This is a massive consolidation in media and entertainment. The deal faces regulatory scrutiny, particularly from antitrust authorities concerned about market concentration. In theory, regulatory approval should depend on economic analysis: does the merger reduce competition? Does it harm consumers? Will it create monopolistic practices?

In practice, regulatory decisions are influenced by political considerations. Agencies are staffed with political appointees. Administrations set priorities. And those priorities can favor certain deals while blocking others based on political preferences, not just legal standards.

Trump has made clear that he prefers certain media outlets and companies over others. Paramount, which is run by the Ellison family, has reportedly received favorable signals. Paramount has also demonstrated willingness to soften content or editorial decisions based on political pressure. So Trump might prefer to see Warner Bros purchased by Paramount rather than Netflix.

That preference gives Trump leverage. He can make the Netflix merger more difficult by setting high conditions, demanding divestures, or simply delaying approval. He can make the Paramount option more attractive by signaling favorable treatment. This isn't necessarily illegal or even unusual in politics. But it is explicitly political.

Netflix's board members presumably understand this context. When Trump threatens "consequences" for keeping Rice, he's not just making a symbolic statement. He's suggesting that Netflix's regulatory path could become more difficult if the company doesn't comply. The merger approval, which Netflix needs, becomes the hostage. Rice becomes the ransom demand.

This dynamic reveals something important about corporate power in America. Companies are theoretically independent. In practice, they're dependent on government goodwill for basic operations. That dependency creates leverage. And when leverage is available, political actors will use it, especially in a polarized environment where corporate leadership is seen as politically aligned against you.

The Laura Loomer Connection: How Influencer Culture Drives Corporate Policy

One of the most significant aspects of this incident is Laura Loomer's role. She's not an elected official or media organization. She's a right-wing influencer with millions of followers and significant reach within conservative networks. Her ability to shape this narrative and drive corporate pressure reveals how influencer culture now functions as a pressure system.

Loomer identified Rice's comments, framed them as threats against Trump supporters, and amplified them to her audience. Her posts triggered retweets, shares, and coordinated response across platforms. Conservative media outlets picked up the story, further amplifying it. The narrative reached Trump, who responded with his threat. Within 24 hours, corporate pressure was directed at Netflix specifically to remove Rice from her position.

This is a new form of political power. It's not that Loomer has official authority. It's that she has audience reach and algorithmic amplification. Social media platforms boost her content because it's engaging and drives interaction. News outlets cover her posts because they signal what conservative audiences care about. And when she directs attention at a target, that target faces real consequences.

Netflix now faces pressure from multiple angles: Trump's explicit threat, conservative media criticism, coordinated social media campaigns, and the implicit threat of regulatory consequences. The company has to evaluate whether keeping Rice is worth the political costs. This is the structure of modern corporate governance: it's not just about fiduciary duty and shareholder value. It's about navigating political pressure and managing stakeholder relationships that include political actors and media influencers.

Loomer also understood the merger vulnerability. By highlighting that Netflix is seeking regulatory approval, she connected Rice's controversial statement to concrete corporate consequences. This framing transformed the incident from abstract political speech into a tangible corporate risk. That's strategic framing because it moves the issue from abstract values debates to concrete business calculus.

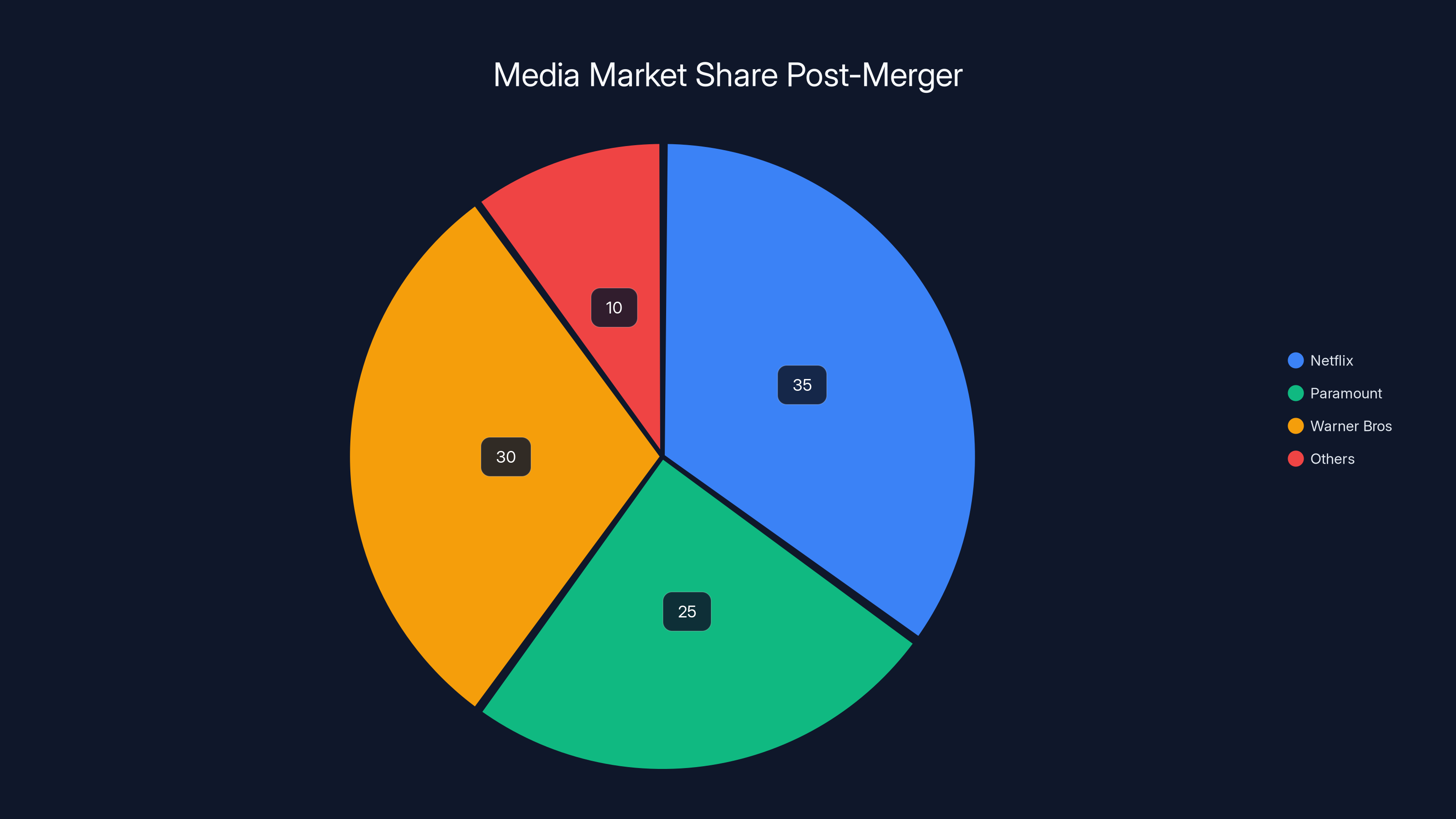

Estimated data suggests Netflix would hold the largest market share post-merger, but political factors may influence the final outcome.

Corporate Governance Under Political Pressure: The Broader Pattern

The Netflix situation isn't isolated. It's part of a broader pattern of political actors using regulatory power and public pressure to influence corporate personnel and policy decisions. This pattern has accelerated in recent years, affecting tech companies, media companies, energy companies, and financial institutions.

Companies face pressure from multiple political directions. Conservative activists demand removal of employees they view as politically biased. Progressive activists demand stronger environmental policies, labor protections, and social justice commitments. Both groups use boycotts, regulatory complaints, shareholder campaigns, and media campaigns to pressure corporate decisions.

What distinguishes political pressure from normal business feedback is the explicit use of government power. When an elected official threatens regulatory consequences for a hiring decision, that's using government authority to influence corporate personnel choices. When a private activist calls for boycotts, that's political speech. The difference matters legally and philosophically.

Netflix's situation exemplifies this tension. The company faces legitimate market pressure: conservative consumers and activists object to Rice's statements. But it also faces government pressure: Trump's implicit threat to create regulatory consequences if Rice isn't removed. The company has to navigate both without violating its values or its legal obligations.

Other tech companies face similar situations constantly. When government officials threaten antitrust action against Amazon or Google, is that legitimate regulatory concern or political pressure? When regulators scrutinize content moderation decisions, are they ensuring public safety or enforcing political viewpoints? The line has become blurry because regulatory power and political power are no longer clearly separated.

The First Amendment Problem: Government Coercion of Speech Through Corporate Decisions

Underlying this entire situation is a constitutional question: does the government have the power to coerce corporations into firing employees based on their speech? The answer under First Amendment law is complicated, but the direction is clear.

The First Amendment technically restricts government censorship, not private censorship. Netflix is a private company. It can make hiring decisions based on whatever criteria it chooses, including political considerations. The First Amendment doesn't prevent Netflix from firing Rice for her political statements. It prevents the government from firing Rice for her statements.

But when government officials use regulatory power to coerce private companies into making personnel decisions, a different constitutional question emerges. At some point, government coercion of private action to suppress speech becomes unconstitutional even if the suppression itself occurs in the private sector.

Courts have held that when government uses regulatory power to punish or coerce private actors based on their speech or associations, that constitutes unconstitutional government action even though the ultimate censorship is private. But the bar for proving this coercion is high. Trump didn't explicitly say "remove Rice or I'll block your merger." He said "pay the consequences." That ambiguity makes the coercion harder to prove legally, even if it's obvious to everyone involved.

This is why the distinction between explicit threats and implicit threats matters. Explicit threats create clear legal violations. Implicit threats are harder to prosecute because they rely on reasonable inference about what the government will do. Companies must guess whether a threat is real, what leverage exists, and what consequences to expect. That uncertainty is itself a form of coercion.

The First Amendment implications extend beyond Rice's individual rights. They affect anyone who might consider serving on corporate boards or working for companies that could face political pressure. If government officials can threaten corporate regulatory consequences based on personnel decisions, people will self-censor. They'll avoid positions where their political views might invite government retaliation. That's a form of systemic censorship that affects the entire ecosystem of corporate governance and political participation.

Susan Rice's comments suggest various potential consequences for companies, with public criticism and consumer boycotts being the most likely outcomes. Estimated data.

Media Consolidation and the Warner Bros Deal: Why This Matters

The Netflix-Warner Bros merger is significant not just because it's being used as leverage in the Rice controversy. It's significant because it represents massive consolidation in media, and that consolidation has enormous implications for political discourse and content control.

Warner Bros owns significant media properties: HBO, Max, cable networks, film studios, and content production capabilities. Netflix owns the largest streaming platform in the world. Together, they would control an enormous share of how Americans consume entertainment and news. This consolidation raises legitimate antitrust concerns, which is presumably why regulatory review is necessary.

But Trump's apparent preference for Paramount ownership adds a political dimension. Paramount's management has demonstrated willingness to modify content or editorial decisions based on political pressure. This creates a scenario where media consolidation could be politically directed: allowing mergers that lead to politically favorable ownership while blocking mergers that would result in less compliant management.

If Trump can influence which company buys Warner Bros through regulatory leverage and implicit threats, he effectively controls media consolidation based on political preferences. That's not illegal per se, but it represents a form of political control over media ownership that should concern people across the political spectrum. Today it might benefit conservatives. Tomorrow it might benefit progressives. But the power to use government authority to direct media consolidation based on political considerations is inherently dangerous.

This also connects back to corporate governance. If board composition becomes a political issue, with government officials demanding removal of certain people based on their speech, then corporate leadership becomes politically determined. The people who run Netflix, Warner Bros, and other major media companies aren't elected by the public. But if their positions are determined by government pressure, they're effectively answerable to political authority rather than shareholders and audiences.

What Netflix Can Actually Do: Options and Constraints

Netflix faces a genuine dilemma. The company could:

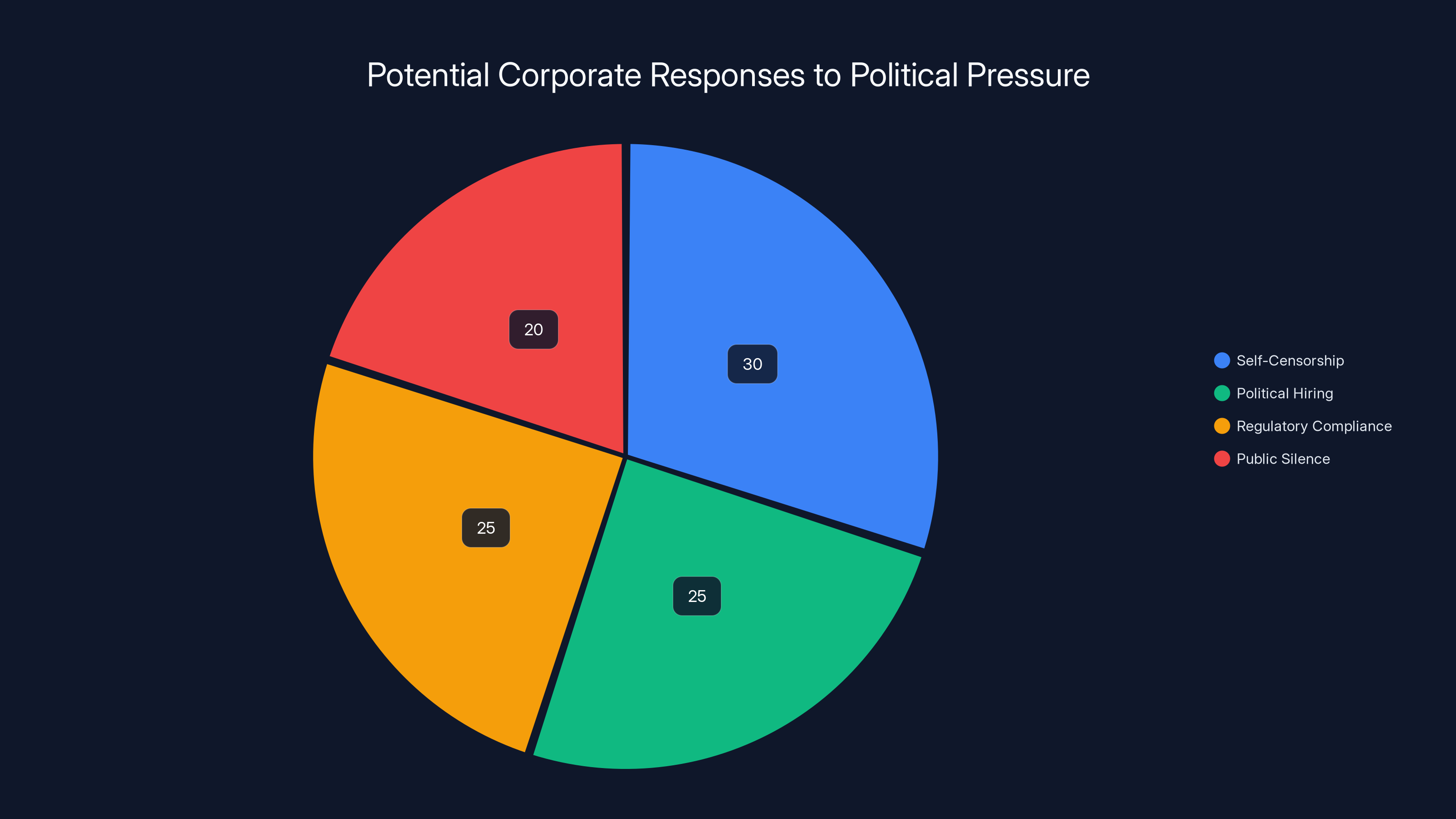

Fire Rice immediately and eliminate the political pressure. This would satisfy Trump and presumably forestall any regulatory consequences. But it would send a clear signal that Netflix responds to political demands, inviting future pressure. It would also anger progressives and those who believe Rice's speech was protected. And it would set a precedent that board composition is politically determined rather than based on qualifications.

Keep Rice and weather the political pressure while hoping the regulatory process moves forward normally. This preserves the principle that corporate hiring isn't politically coerced. But it leaves Netflix vulnerable to regulatory complications during the merger review. The company would be betting that the legal and regulatory system will protect it from purely political retaliation.

Negotiate a middle path where Rice steps down voluntarily after a stated period, citing personal reasons or other factors. This allows Netflix to appear responsive to political pressure without explicitly bowing to Trump's demand. It gives both sides a face-saving exit. But it still essentially accomplishes what Trump wanted: the removal of Rice based on her political views.

Fight the situation through legal and political channels by challenging the implicit coercion, invoking First Amendment protections, and forcing clarification of what consequences are being threatened. This is the most principled option but also the most confrontational. It might result in real regulatory retaliation before courts could intervene.

Each option involves costs and benefits. Netflix's board will have to weigh the political pressure against its own values and legal obligations. The company's choice will signal something important about how corporations respond to government pressure in polarized times.

Estimated data: Trump's vague threats could lead to significant regulatory challenges for Netflix, with merger delays and antitrust scrutiny being the most concerning.

The Broader Pattern: Corporate Governance as Political Battleground

This incident is part of a larger trend where corporate leadership has become a political battleground. Both progressives and conservatives now view corporate personnel decisions as political statements. They demand that corporations hire and fire people based on alignment with their political views.

Progressives have long demanded that corporations adopt progressive personnel and policy positions. They want companies to prioritize diversity, environmental protection, labor rights, and social justice. These demands have shifted corporate behavior significantly over the past decade.

Conservatives have responded by demanding that corporations avoid what they view as progressive bias in hiring and content. They've targeted companies for supporting progressive causes, removing controversial figures, or criticizing conservative politics. The rice situation exemplifies this: demands for removal of someone viewed as politically hostile to conservative interests.

What's new isn't that corporations face political pressure. What's new is the explicit use of government power to enforce these demands. When activists demand corporate changes, that's politics as usual. When government officials threaten regulatory consequences, that's coercion backed by state power. That distinction matters enormously for freedom and democratic governance.

The danger is that corporations will cease to make decisions based on business, legal, or ethical considerations. Instead, they'll make decisions based on whatever political pressure is strongest at any given moment. That's a recipe for corporate governance that's responsive to political pressure rather than shareholder interests or public welfare.

The Precedent Being Set: Future Implications

If Netflix removes Rice in response to Trump's demand, it establishes a precedent that will resonate across corporate America. Other companies will understand that government officials can successfully demand personnel changes based on political opposition. That understanding will change behavior.

Future board members and executives will consider whether their political views invite government retaliation. They'll be more cautious about speaking publicly on political issues. They'll self-censor to avoid becoming targets. This happens not because of explicit rules, but because the environment changes when government demonstrates it will use regulatory power to enforce corporate personnel decisions.

Companies will also become more explicitly political in their hiring and promotion decisions. If government can demand removal of people based on their political views, companies will start selecting for political reliability rather than merit. They'll ask job candidates about their politics. They'll build teams that align with whatever political coalition has power. Corporate governance becomes tribalized and politicized.

Regulatory agencies will also feel empowered to use personnel decisions as leverage in regulatory disputes. When reviewing mergers, approving licenses, or investigating companies, agencies will informally let companies know that certain personnel moves would improve their regulatory prospects. This is already happening in some contexts. This incident would accelerate it.

The precedent also affects individuals. Anyone considering prominent corporate roles in polarized times will have to evaluate the political risk. If you're known for strong political views, you become a potential liability to companies that might face government pressure. That's a form of political blacklisting, even if it's private and informal. People will avoid positions where their existing political record could invite government retaliation.

Estimated data suggests that self-censorship and political hiring are likely to be the most significant corporate responses to increased political pressure.

International Comparisons: How Other Countries Handle This

Other democracies have grappled with similar questions about government power over corporate governance. Their approaches differ significantly from the American model.

In Europe, particularly in countries like France and Germany, governments have more explicit power over corporate decisions. Labor representation on boards is mandated by law. Employee protections are stronger. But there's also stronger legal protection against government interference in corporate hiring based on political speech. The balance is different.

In countries where democratic norms are weaker, like Turkey, Hungary, and Russia, governments routinely use regulatory power to pressure corporations into personnel and policy decisions. This is often framed as fighting misinformation or protecting national interests. In practice, it means corporate governance becomes an extension of political control. Companies are managed to serve government interests rather than shareholder or public interests.

The United States has traditionally maintained a sharp distinction between government and business. Corporations are independent actors operating within regulatory constraints. Personnel decisions are private matters. The Rice situation tests whether that distinction can survive in a polarized environment where political actors view corporate independence as hostile.

How Political Polarization Accelerates This Dynamic

Political polarization amplifies the pressure on corporations because stakes feel higher. When politics is divided into existential contests where your side must win and the other side must lose, corporate governance becomes a zero-sum battleground.

If you believe, as Trump voters overwhelmingly do, that the political and cultural establishment is fundamentally hostile to your interests and values, then corporate leadership becomes a symbol of that hostility. When Rice speaks negatively about your political movement, it confirms your suspicions about establishment bias. When Netflix keeps Rice on the board, it feels like corporate leadership is aligned against you. That emotional intensity drives the demand for action.

Similarly, progressives view corporate resistance to progressive agendas as evidence of reactionary leadership. They push for more progressive hiring and policies. Both sides increasingly see corporate governance as a political statement rather than a business decision.

Polarization also undermines the institutional checks that might normally constrain this pressure. Courts become seen as politically biased. Media is seen as partisan. Congress is paralyzed. In this environment, corporations can't look to institutions for protection or guidance. They're on their own, navigating pressure from multiple political actors without institutional support.

This dynamic is relatively new in American politics. For much of the 20th century, corporations could rely on courts to enforce their independence, media to criticize government overreach, and Congress to set rules limiting regulatory power. Those institutional checks are now questioned and weakened. Without them, corporations face pressure from political actors with few constraints.

The Role of Social Media and Algorithmic Amplification

Laura Loomer's ability to trigger this entire crisis relied on social media platforms and algorithmic amplification. Without these tools, her post about Rice might have reached thousands of people. With them, it reached millions and shaped the news cycle.

Social media platforms have created a new form of political power: the ability to identify targets, frame narratives, and trigger coordinated responses across networks. Loomer identified Rice's comment, reframed it as a threat, and triggered what became a coordinated campaign that reached Trump and influenced corporate pressure.

This happens through algorithmic amplification. Platforms prioritize engaging content. Outrage and controversy drive engagement. So platforms boost Loomer's posts because they're controversial and drive interaction. News outlets see the trending topic and cover it. Trump sees the media coverage and responds. Within hours, a podcast comment becomes a corporate crisis.

The amplification is real, but it's not intentional coordination. Loomer didn't coordinate with Trump. The algorithms didn't deliberately choose to amplify Loomer. But the incentives create predictable outcomes: controversial claims get amplified, outrage spreads, political actors respond, and pressure builds on corporate targets.

This also means that random comments or statements can trigger disproportionate consequences. Rice's comment was casual, made in a podcast conversation, probably not intended to be inflammatory. But once amplified and reframed through social media, it became a crisis. That's new. 30 years ago, a comment in a podcast would have reached maybe thousands of people. Today, algorithmic amplification can make it go viral, reach millions, and trigger political responses.

What This Means for Tech Company Leadership

If companies feel they must avoid hiring people with controversial political views to prevent government pressure, tech company leadership will become more homogeneous and more politically cautious. This happens because the risk calculation changes.

When companies consider hiring, promoting, or appointing people to boards, they now have to ask: "Will this person's known political views invite government pressure from any direction?" People with strong public political records become liabilities. People with centrist or politically invisible records become safer choices.

Over time, this creates leadership that is less diverse in thought and political perspective. It's not that companies consciously adopt this rule. It's that individual risk assessments accumulate into a pattern. One company decides Rice is too risky. Another company learns the lesson and avoids hiring someone with a comparable profile. Within a few years, corporate leadership has become more politically cautious and less ideologically diverse.

This is particularly significant for tech companies because they set cultural norms that ripple across society. If Big Tech avoids hiring people with controversial political views, that becomes a model other industries follow. If corporate boards become politically vetted, that becomes a standard practice.

For people in tech, this means career implications. Your political views, which were once private or inconsequential, become part of your professional record. Your tweets, your podcast appearances, your fundraising contributions become part of a public record that affects hirability. This creates a chilling effect on political speech.

Free Speech in Corporate Governance: Who Decides What's Acceptable?

Underlying all of this is a question about free speech and corporate governance. Should board members and executives be able to express political opinions without risking their positions? Should their speech be protected just because they work at private companies?

The strict legal answer is no. The First Amendment doesn't protect employee speech at private companies. Netflix can fire Rice for her political views, and that's not a First Amendment violation. Private companies can set whatever speech policies they want.

But there's a difference between a company making that decision independently and a company making it under government pressure. When government officials threaten regulatory consequences for hiring decisions, they're using their power to effectively suppress speech through private companies. That's where constitutional concerns arise.

There's also a question about norms. Even if something is legally permitted, it might be normatively undesirable. American corporate culture has generally accepted that executives and board members have the right to political views. This Rice situation tests whether that norm survives polarization and government pressure.

If corporations decide that hiring people with controversial political views is too risky, they'll censor the hiring process. That's private decision-making. But if they make that decision because they fear government retaliation, then government is effectively censoring through private action. That's a constitutional problem even though the immediate censorship is private.

This is where the Rice situation becomes significant beyond the immediate facts. It tests whether government can use regulatory power to influence corporate personnel decisions based on speech. The answer has implications for free speech in the broader sense.

Conclusion: The Question of Corporate Independence in Polarized Times

The Netflix situation is fundamentally about whether corporations can remain independent political actors or whether they become extensions of government power. That's not a question that will be resolved by this single incident. It's a question that will play out across hundreds of corporate decisions in the coming years.

If Netflix fires Rice, it signals that government pressure works. Other political actors will use the same tactics. Companies will become more responsive to political demands. Corporate governance will become more explicitly political. Over time, corporations will become less independent and more politically determined.

If Netflix keeps Rice, it signals that corporations can resist political pressure. It demonstrates that constitutional protections and norms about corporate independence matter. Other companies will gain confidence to make decisions based on merit and business judgment rather than political calculation. But Netflix will also bear the costs of that resistance: potentially complicated regulatory processes, media criticism, and sustained pressure.

The outcome probably depends on factors beyond Netflix's control: whether courts ultimately protect corporate independence, whether regulatory agencies resist using informal power to coerce corporate decisions, whether institutional norms about corporate autonomy hold up under political pressure, and whether Trump's threats are implicit or explicit enough to constitute actionable coercion.

What's clear is that the era when corporations could operate without explicit attention to political pressure is ending. Whether that means corporations become political actors responsive to government demands, or whether it means stronger legal protections for corporate independence, remains to be seen. The Rice situation is one data point in a much larger struggle over whether American corporations remain independent institutions or become extensions of political power.

The precedent being set matters not just for Netflix. It matters for every corporation, every board member, and every executive who has to navigate political polarization while trying to serve shareholders, employees, and the public interest. It matters for whether corporate governance remains a private matter or becomes a political one. And it matters for whether democratic institutions can constrain government power or whether government will increasingly use regulatory authority to enforce political preferences.

FAQ

What did Susan Rice say that triggered this controversy?

Susan Rice appeared on Preet Bharara's podcast and discussed corporate responsibility in polarized times. She made comments about companies that "take a knee to Trump," suggesting they would be "caught with more than their pants down" and "held accountable." The language was confrontational and ambiguous about what "held accountable" actually meant, which allowed different interpretations of whether it was a threat or simply political rhetoric.

Why is Trump threatening Netflix specifically?

Trump is threatening Netflix partly because of Rice's comments, which he interprets as threatening or disrespectful. But the threat also relates to Netflix's merger with Warner Bros, which requires regulatory approval. Trump controls government agencies that influence merger approval, giving him leverage. The threat implies that Netflix's regulatory path could become more difficult if the company doesn't remove Rice from its board.

What are the First Amendment implications of Trump's demand?

The First Amendment technically doesn't restrict private companies from firing employees based on their speech. Netflix can legally fire Rice without violating her constitutional rights. However, when government officials use regulatory power to coerce companies into making personnel decisions based on speech, constitutional questions about government coercion arise. At some point, government pressure becomes unconstitutional even if the censorship is technically private.

Could this set a precedent for other companies?

Yes, potentially. If Netflix removes Rice in response to Trump's demand, other companies would understand that government officials can successfully pressure them to make personnel decisions. This could lead to more cautious hiring practices where companies avoid people with controversial political views to prevent government pressure. Future board members and executives might self-censor to avoid becoming targets.

How does the Warner Bros merger relate to Susan Rice's board position?

The Warner Bros merger is significant because it requires regulatory approval. Trump appears to prefer that Paramount purchase Warner Bros instead of Netflix. By threatening "consequences" for keeping Rice on Netflix's board, Trump is implicitly suggesting that Netflix's regulatory prospects could improve if the company fires Rice. This gives him leverage: the merger approval becomes hostage to the personnel demand.

What's the difference between market pressure and government pressure on corporations?

Market pressure includes boycotts, shareholder campaigns, and public criticism. These are legitimate forms of influence where private actors use their economic power or speech to pressure companies. Government pressure involves regulatory authorities using their power to reward or punish corporate decisions. When government officials threaten regulatory consequences for hiring decisions, that uses state coercive power in ways that differ from market pressure.

How is this situation connected to media consolidation concerns?

The Netflix situation touches on media consolidation because the Warner Bros merger would create a massive media company. Trump's influence over regulatory approval of media mergers raises questions about whether media consolidation is being directed based on political preferences rather than antitrust concerns. If Trump can influence which company buys media properties based on political considerations, that represents a form of political control over media ownership.

What's Laura Loomer's role in escalating this situation?

Laura Loomer, a right-wing influencer with millions of followers, identified Rice's podcast comments, reframed them as threats against Trump supporters, and amplified them to her audience. Her posts triggered coordinated responses across conservative networks, raising the issue's visibility. Loomer also highlighted the Warner Bros merger, connecting Rice's controversial statement to concrete corporate consequences. Her ability to amplify and reframe the narrative demonstrated how influencer culture now functions as a pressure system in corporate governance.

Could other political actors use similar pressure tactics?

Absolutely. If Trump successfully uses regulatory pressure to influence corporate governance, progressives and other political actors would presumably use similar tactics when they have government power. The precedent isn't limited to Trump or conservative actors. Once the principle is established that government can threaten regulatory consequences for corporate personnel decisions, that power is available to whoever controls regulatory agencies. The risk of escalating corporate political warfare increases substantially.

Key Takeaways

- Trump's threat to Netflix if it doesn't fire Susan Rice exemplifies how government officials now use regulatory leverage to influence corporate personnel decisions

- The Warner Bros merger creates a vulnerability point where Trump can implicitly threaten regulatory consequences if Netflix doesn't comply with his demands

- This precedent, if accepted, would signal to corporations that government pressure can successfully dictate hiring and board composition decisions

- Constitutional concerns arise when government uses regulatory power to coerce corporate censorship of speech, even though the censorship is technically private

- Social media influencers like Laura Loomer now function as pressure systems that amplify issues and trigger coordinated responses that reach political leaders

- Corporate independence in polarized times depends on whether institutions protect companies from purely political retaliation or whether regulatory power becomes a political weapon

Related Articles

- FCC's 'Pro-America' Content Push: What It Means for Broadcasters [2025]

- Warner Bros. Netflix Merger vs Paramount Deal: Full Analysis [2025]

- Digital Resistance: How Video Evidence Challenges Government Power [2025]

- Antitrust Chief Gail Slater Resigns Amid Netflix-Warner Merger Review [2025]

- Why Bezos Abandoned the Washington Post's Newsroom [2025]

- Netflix's Warner Bros. Acquisition: The $82.7B Megadeal Explained [2025]

![Trump's Netflix Ultimatum: How Political Power Shapes Tech Leadership [2025]](https://tryrunable.com/blog/trump-s-netflix-ultimatum-how-political-power-shapes-tech-le/image-1-1771776349317.jpg)