Waymo at SFO: How Robotaxis Are Reshaping Airport Transport

You're standing at the arrivals curb of San Francisco International Airport on a Thursday morning, exhausted from a red-eye flight. Your phone buzzes. Instead of scanning for a yellow cab or hunting for a Uber driver holding a cardboard name sign, you get a notification: your Waymo is three minutes away. No driver required. No small talk necessary. Just a sleek autonomous vehicle pulling up, ready to take you wherever you need to go in the Bay Area.

This isn't science fiction anymore. This is happening now.

Waymo, the self-driving car subsidiary of Alphabet, officially launched its autonomous ride-hailing service at San Francisco International Airport on Thursday. It's a milestone that might seem incremental to casual observers, but it represents something far more significant: the evolution of how we move through one of America's busiest airport hubs. After years of skepticism, regulatory hurdles, and technical setbacks, the autonomous vehicle industry has finally cracked one of its biggest challenges: reliably operating in one of the world's most complex transportation environments.

But here's what makes this moment genuinely interesting. This isn't Waymo's first airport rodeo. Phoenix Sky Harbor has had robotaxis for over a year. San Jose Mineta got them even earlier. What makes San Francisco different is the sheer complexity of operating in a major metropolitan area where Waymo is already serving 260+ square miles of city streets. The airport launch represents a convergence point—where airport operations, autonomous technology, regulatory approval, and urban transportation systems all intersect. It's the kind of moment that forces the rest of the transportation industry to pay attention.

The service launched with deliberate limitations. Access is restricted to "a select number of riders" for now, and pickups and drop-offs are confined to the SFO Rental Car Center. Waymo isn't trying to revolutionize airport transport overnight. Instead, it's taking the measured approach that's kept the company moving forward while competitors have stumbled. Gradual expansion is the strategy. Other airport locations, including terminals, will come "in the future." This isn't impatience—it's smart execution.

What's worth examining here goes beyond just the fact that Waymo added another airport to its map. The real story is what this tells us about the state of autonomous vehicle technology in 2025, the challenges still facing the industry, what it means for airport operations and ground transportation, and where this is all headed. Because once robotaxis become normal at major airports, everything changes.

TL; DR

- Waymo launched autonomous ride service at SFO with limited availability to select riders, marking the company's third airport location

- Service limited to Rental Car Center initially, with expansion to terminals and other airport zones planned for future phases

- Waymo already operates in 260+ square miles of Bay Area, providing foundation for airport integration

- Airport robotaxi services reduce wait times, improve accessibility, and lower transportation costs for travelers

- Safety record remains under scrutiny following incident investigation by NHTSA involving Waymo vehicle in Santa Monica

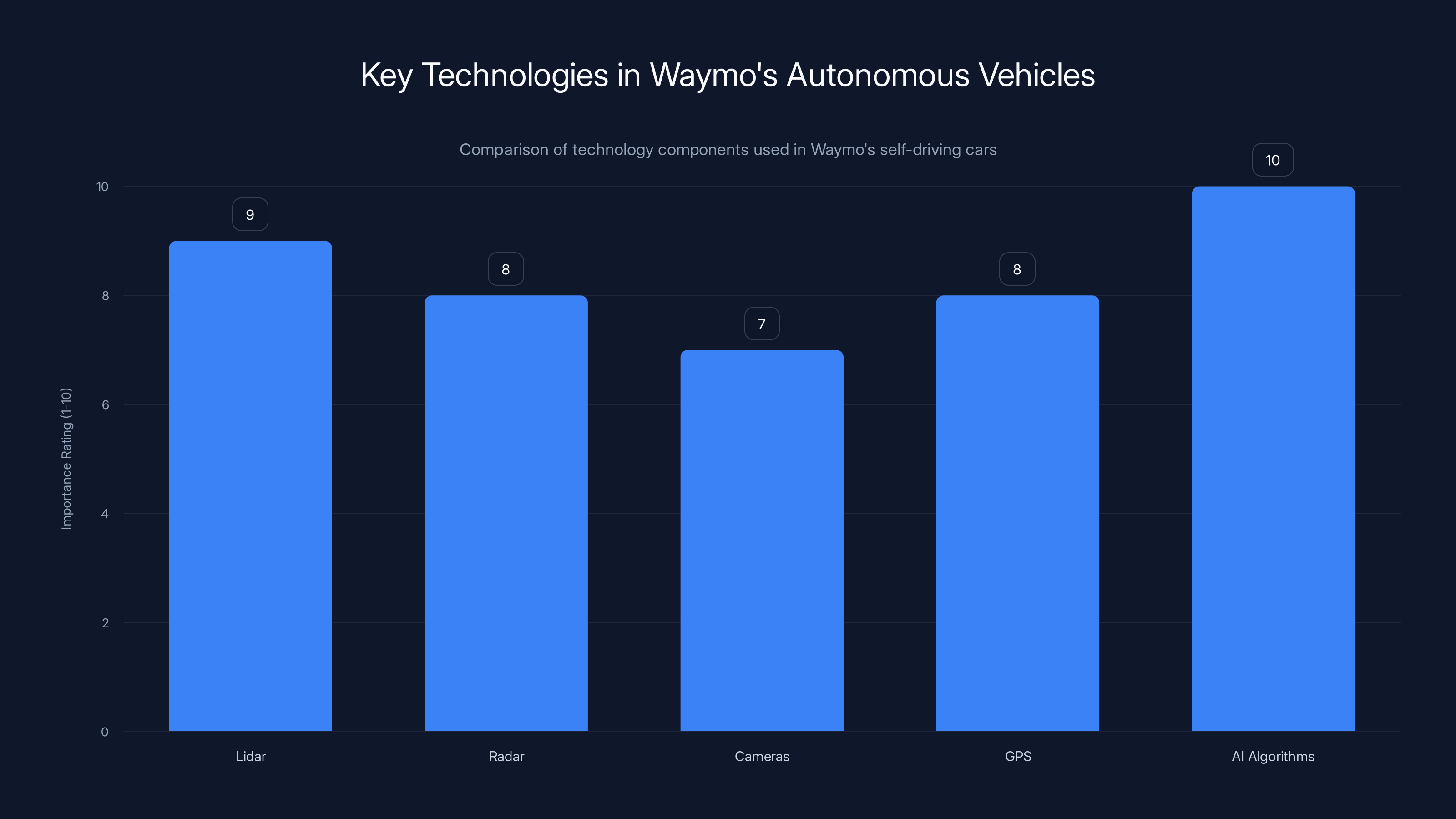

Waymo's autonomous vehicles rely heavily on AI algorithms, lidar, and radar for safe navigation, with AI being the most critical component.

Why Major Airports Matter for Autonomous Vehicles

Airports represent the ultimate testing ground for self-driving technology. If your autonomous vehicle can navigate the organized chaos of SFO—with its arriving flights, departing travelers, construction zones, temporary traffic patterns, and thousands of confused visitors from out of town—then it can probably handle most urban driving scenarios.

The statistics are illuminating. San Francisco International Airport processed over 60 million passengers in recent years. On any given day, hundreds of rental cars, shuttles, rideshare vehicles, and personal vehicles create a complex traffic ecosystem in designated pickup and dropoff zones. Weather varies dramatically. Fog rolls in, visibility drops, and autonomous vehicles must maintain safety margins that exceed what human drivers can sustain over a full day's work.

For Waymo, the stakes are enormous. This isn't just about adding another city to their map. This is about proving that autonomous vehicles can operate in one of America's most visible, publicly monitored environments. Every passenger. Every ride. Every interaction gets scrutinized by passengers who understand technology, journalists who cover the space, and regulators watching whether this works. Unlike operating in Phoenix, where the weather is predictable and the routes are more consistent, San Francisco presents constant variables.

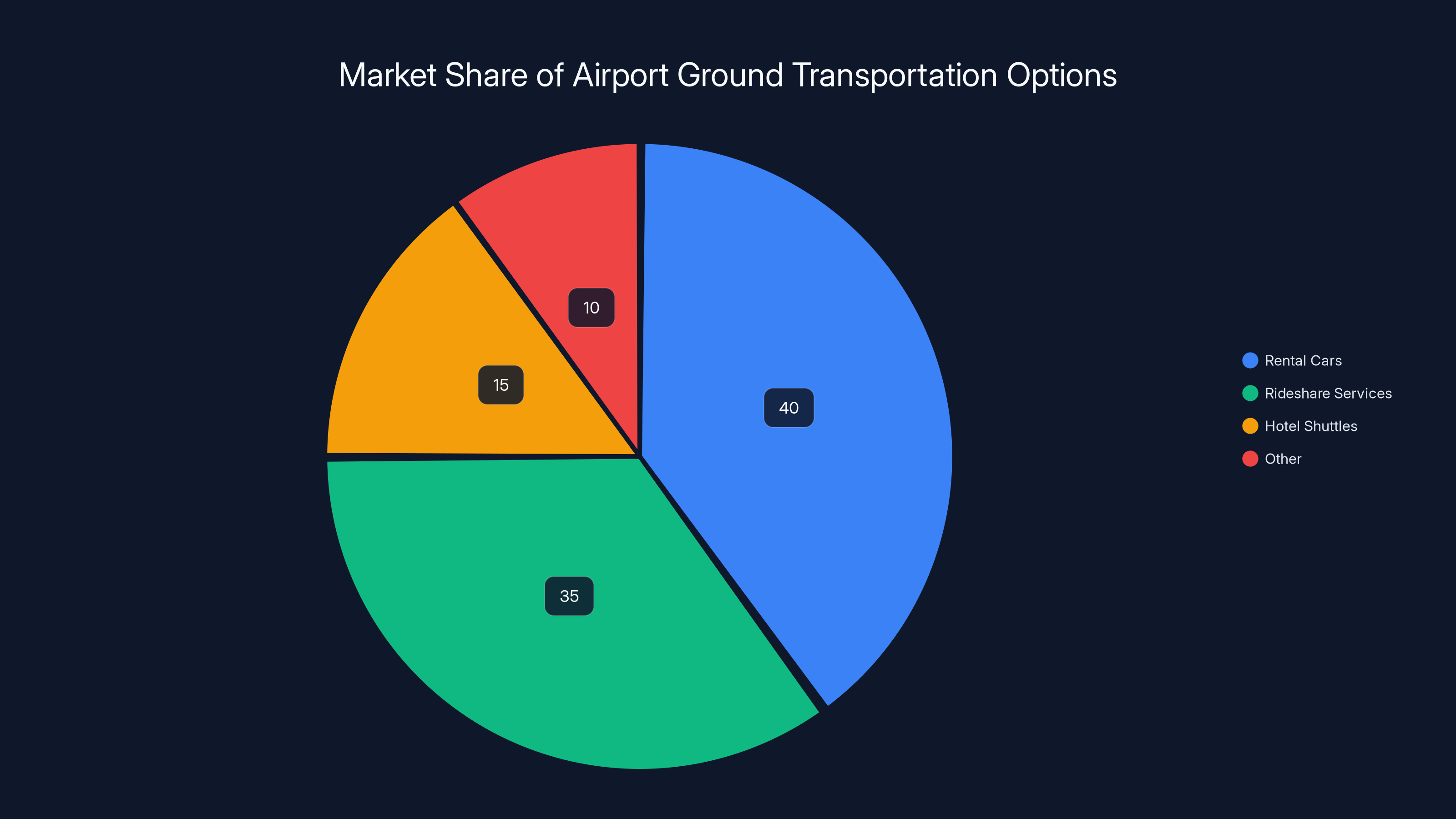

The airport environment also matters because it represents the future of ground transportation. Right now, airport ground transport is dominated by rental cars, rideshare drivers, and hotel shuttles. None of these solutions is particularly efficient. Rental cars require parking, which is expensive. Rideshare drivers spend time driving empty between pickups, increasing costs per mile. Hotel shuttles operate on fixed schedules that rarely align with actual flight arrivals. Autonomous vehicles solve all three problems simultaneously—no parking needed (the vehicle leaves after dropoff), no empty miles (the algorithm matches supply to demand), and perfect scheduling based on real-time flight data.

The economic model is compelling. If Waymo can reduce the cost of airport ground transportation while improving service quality, the company essentially owns the future of how millions of business travelers get to and from airports. That's not hyperbole. That's the actual market opportunity.

Understanding Waymo's Current Service Footprint

Waymo didn't arrive at San Francisco International Airport in a vacuum. The company has been building its operational foundation methodically for years. Before the SFO launch, Waymo was already operational in multiple markets with proven track records.

Phoenix Sky Harbor International Airport was the first. Waymo launched services there over a year ago, giving the company substantial operational data from a major U.S. airport. Phoenix provided crucial learnings about airport-specific challenges: how to handle the arrival of multiple flights simultaneously, how to manage the transition between airport security zones, how to coordinate with airport ground services, and how to build relationships with airport management. All of this became the blueprint for future airport launches.

San Jose Mineta International Airport came next. San Jose is closer to Waymo's home base, which meant the company could rapidly iterate on processes that worked in Phoenix while building relationships with California's regional airport authority. San Jose offered lessons in managing a busy airport that's also embedded in a major metropolitan area—not just a desert city with different characteristics.

San Francisco International Airport is different on almost every dimension. It's larger. It's busier. It's more complex. The weather is unpredictable. The surrounding city has denser traffic, more construction, more pedestrians, and more edge cases that autonomous vehicles must handle correctly.

But here's the crucial part: Waymo was already operating in 260+ square miles of the San Francisco Bay Area before the airport launch. The company wasn't entering unfamiliar territory. Waymo's vehicles had already learned the region's traffic patterns, handled Bay Area weather, and developed the maps and decision trees necessary to operate safely in this specific environment. The airport service doesn't represent Waymo starting from scratch. It represents applying existing capabilities to a new, constrained environment.

This distinction matters because it explains why Waymo moved methodically from Phoenix to San Jose to San Francisco. Each market built capabilities needed for the next. Each airport taught lessons. Each region provided data that made the next launch safer and more efficient. It's not a random sequence. It's deliberate progression.

Rental cars and rideshare services dominate airport ground transportation, with hotel shuttles and other modes capturing smaller shares. (Estimated data)

The SFO Launch: What's Actually Happening

Let's be precise about what the SFO launch actually means. Waymo isn't operating across the entire airport yet. Service is limited to the SFO Rental Car Center, a specific zone designed for vehicle pickups and drop-offs. This is important because it means the initial launch operates in a relatively controlled environment—not the chaotic departures curb or the confusing terminals where visitors consistently lose their bearings.

The Rental Car Center is a hub facility where rental companies maintain their fleet. It's connected to the airport terminals, but it has more regulated traffic flow and clearer operational procedures. For a phased rollout, it's the ideal starting point. Passengers who need ground transportation can take a shuttle from their terminal to the Rental Car Center, then board their Waymo. It's not seamless, but it's workable. And it keeps variables constrained while the system proves itself.

Waymo is intentionally limiting access to "a select number of riders" at launch. This means the company isn't activating the service for everyone immediately. Instead, it's enrolling specific users—probably including existing Waymo app users, beta testers, and frequent flyers who've opted into early access programs. This constraint serves multiple purposes.

First, it creates a feedback loop with people who understand autonomous vehicles and can provide meaningful feedback about what works and what doesn't. These aren't random customers—they're informed users who can distinguish between technology issues and legitimate problems. Second, it constrains operational load, ensuring that if something goes wrong, it affects a limited number of users rather than cascading across thousands of travelers. Third, it provides legal protection. If there's an incident, Waymo can document that early users accepted the experimental nature of the service. It's not cynical. It's honest about risk management.

The plan is to gradually expand access over coming months. This means more riders will get access progressively. The word "gradually" is doing heavy lifting here. It could mean weeks or months, depending on how the initial phase performs and how regulators respond to any incidents or issues.

Waymo has also explicitly stated that it will expand to terminals and other airport areas in the future. Notably, they didn't commit to a timeline. This reflects industry-standard caution around autonomous vehicles—underpromise, overdeliver. Waymo learned from early robotaxi launches where companies made bold claims about expansion that never materialized on schedule.

The Larger Context: Waymo's Expansion Strategy

Waymo's approach to market expansion reveals sophisticated thinking about autonomous vehicle operations. The company isn't chasing headlines or racing to launch in dozens of cities simultaneously like some competitors. Instead, Waymo is deepening penetration in specific markets while expanding methodically to adjacent geographies and verticals.

The San Francisco Bay Area is Waymo's strongest market in terms of operational maturity. The company has been operating robotaxis in San Francisco proper for years, accumulating billions of miles of real-world driving data. This data isn't just numbers. Each mile represents edge cases encountered, decisions made, near-misses avoided, and lessons learned. Waymo's fleet learns from every journey.

By launching at an airport in a region where the company already operates extensively, Waymo applies this accumulated knowledge to a new application. Airport robotaxi service is essentially the same core technology (self-driving capabilities) applied to a different use case (airport ground transportation). This is vastly different from launching in a completely new city where the company has minimal operational history.

This strategy explains Waymo's expansion timeline better than any press release. The company typically follows this pattern: launch robotaxi service in an urban area, operate for 1-2 years accumulating data, expand to adjacent verticals (airport transport, delivery services, long-distance routes), then expand to new cities. It's not flashy. It doesn't generate quarterly headlines. But it works, which is why Waymo is still operating while competitors have shut down or severely contracted their autonomous vehicle programs.

Los Angeles represents Waymo's next major market. The company has been testing there and is preparing for commercial launch. Los Angeles presents different challenges than San Francisco—sprawl instead of density, different weather patterns, different driving cultures. But Waymo will approach LA the same way they approached SF and Phoenix: methodically, with careful attention to safety and operational performance.

Safety, Incidents, and the NHTSA Investigation

Timing is everything in news cycles. The same week Waymo launched at SFO, the company faced a significant public relations challenge. One of Waymo's vehicles struck a child in Santa Monica, resulting in minor injuries. The National Highway Traffic Safety Administration opened an investigation.

This isn't a small detail to gloss over. For an autonomous vehicle company, any incident involving injury to a person—particularly a child—carries enormous weight. It doesn't matter that the injuries were minor. It doesn't matter that initial reports suggest the incident may not have been entirely the vehicle's fault. What matters is that a Waymo robotaxi was involved in an accident where someone got hurt.

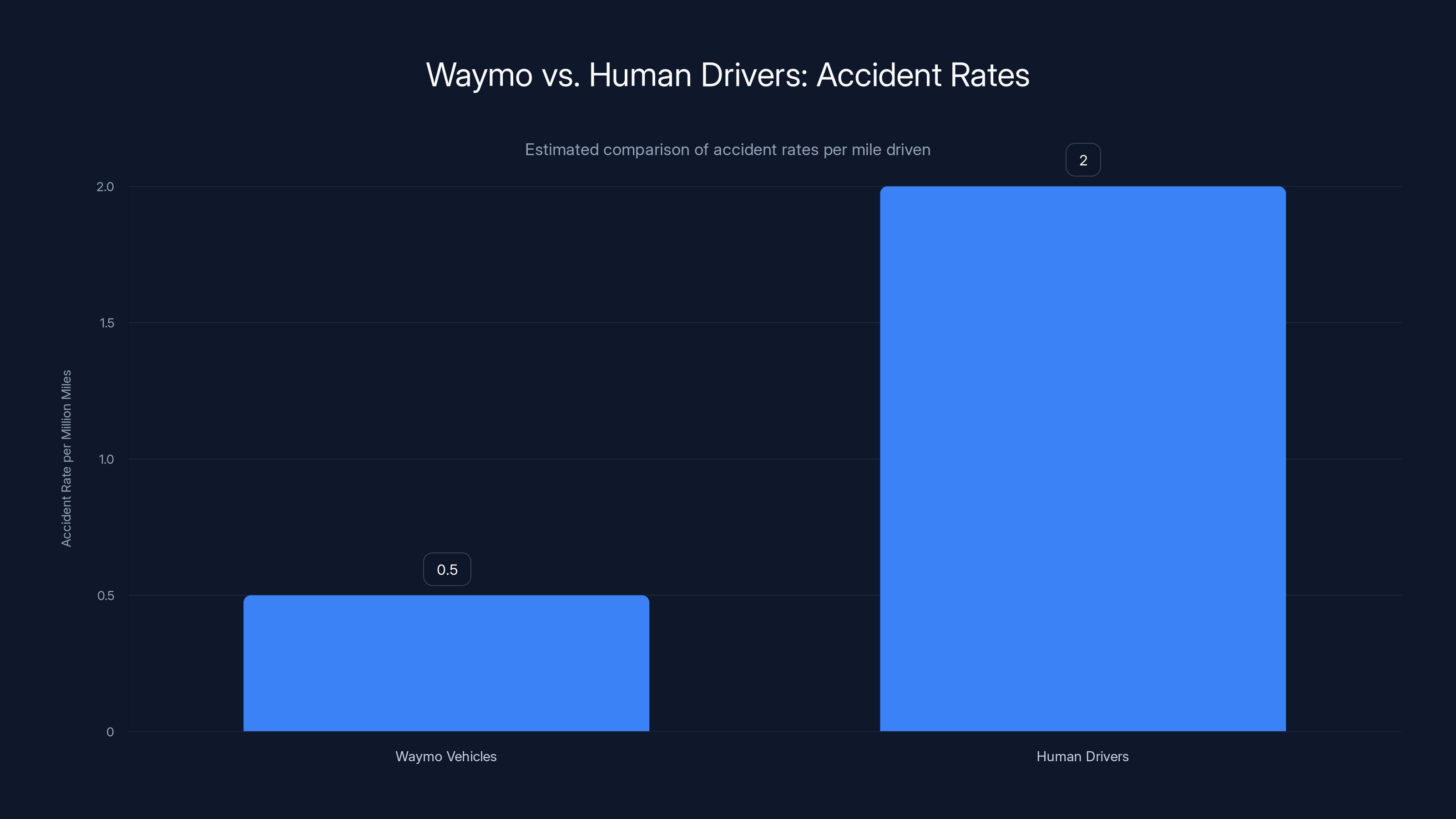

Safety is the foundation of Waymo's entire value proposition. The company's entire business model is built on the claim that autonomous vehicles are safer than human drivers. This isn't just marketing. It's the core argument for why regulators should allow self-driving cars to operate. If autonomous vehicles can demonstrate they have fewer accidents per mile than human drivers, they win the argument about deployment. If they can't, they lose.

The Santa Monica incident doesn't necessarily undermine Waymo's broader safety record. Statistically, human drivers cause thousands of serious accidents every day. One accident involving a robotaxi, even a minor one, gets national attention. But that's not evidence that autonomous vehicles are less safe—it's just evidence that people pay more attention to technological failures than they do to routine human failures.

Still, the timing is problematic. Waymo launches at a major airport. Simultaneously, the company is defending an incident involving injury. Regulators, passengers, and journalists naturally connect these events and ask whether the company's safety record warrants expansion at one of America's busiest airports.

The NHTSA investigation will take weeks or months. The agency will examine the incident circumstances, review the vehicle's sensor data and decision logs, determine whether the vehicle's behavior violated any safety protocols, and potentially issue findings or recommendations. The investigation is legitimate—that's exactly what regulatory agencies should do when autonomous vehicles are involved in accidents.

The outcome matters for Waymo's credibility, but it matters even more for the autonomous vehicle industry broadly. If NHTSA finds that Waymo's vehicle operated safely within its design specifications and the incident resulted from unpredictable external factors, it actually strengthens the case for autonomous vehicles. If NHTSA identifies systemic issues with how Waymo's vehicles make decisions in certain scenarios, it becomes a critical learning moment.

Waymo has responded to incidents before. The company maintains detailed incident logs and regularly publishes safety reports demonstrating how their vehicles perform compared to human drivers. This transparency builds credibility, even when specific incidents are unfortunate.

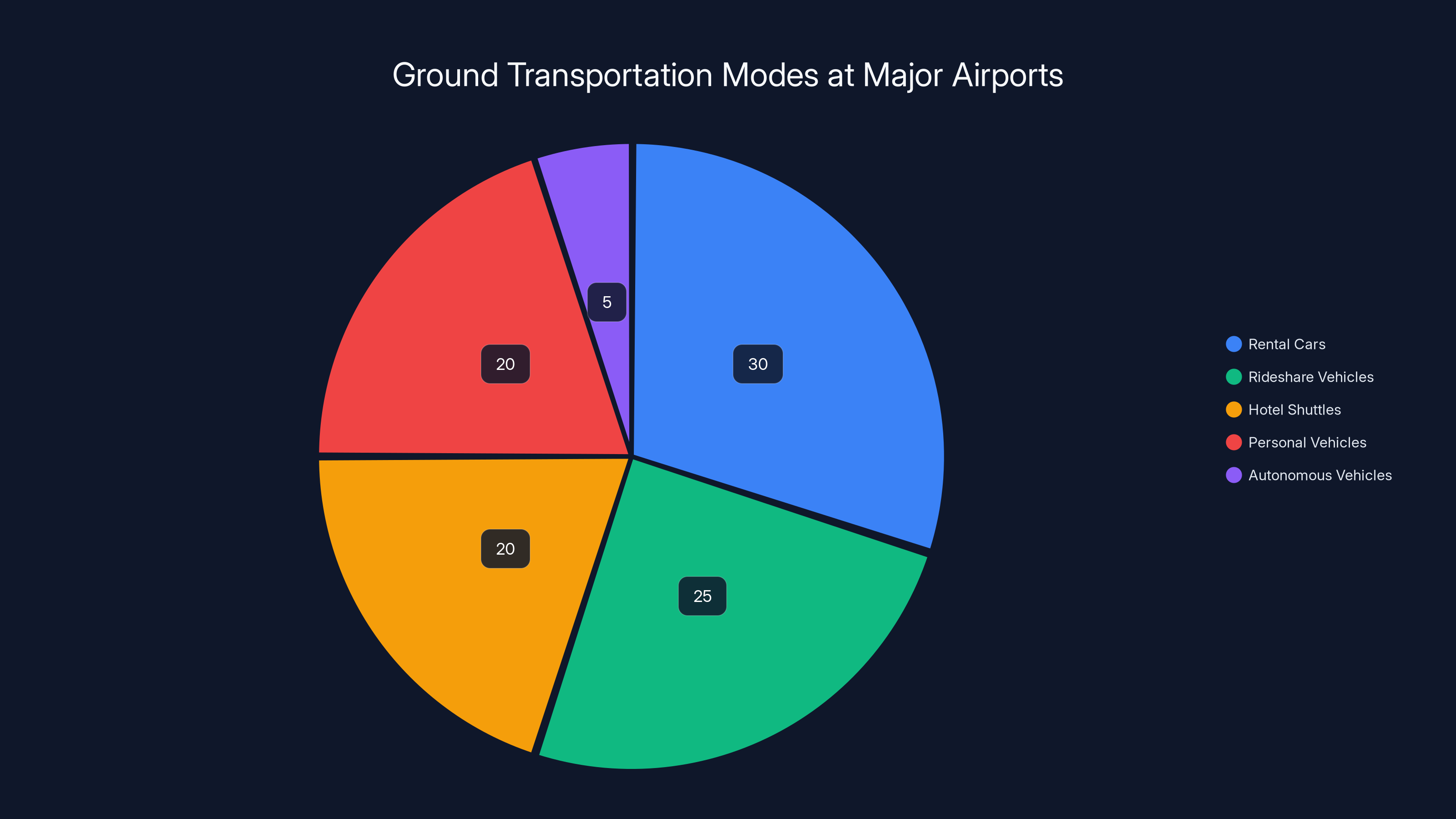

Estimated data shows rental cars and rideshare vehicles dominate airport ground transportation, with autonomous vehicles starting to emerge as a small but growing segment.

Airport Ground Transportation: The Current State

To understand why the Waymo launch at SFO matters, you need to understand what airport ground transportation looks like today. It's a fragmented ecosystem with significant inefficiencies.

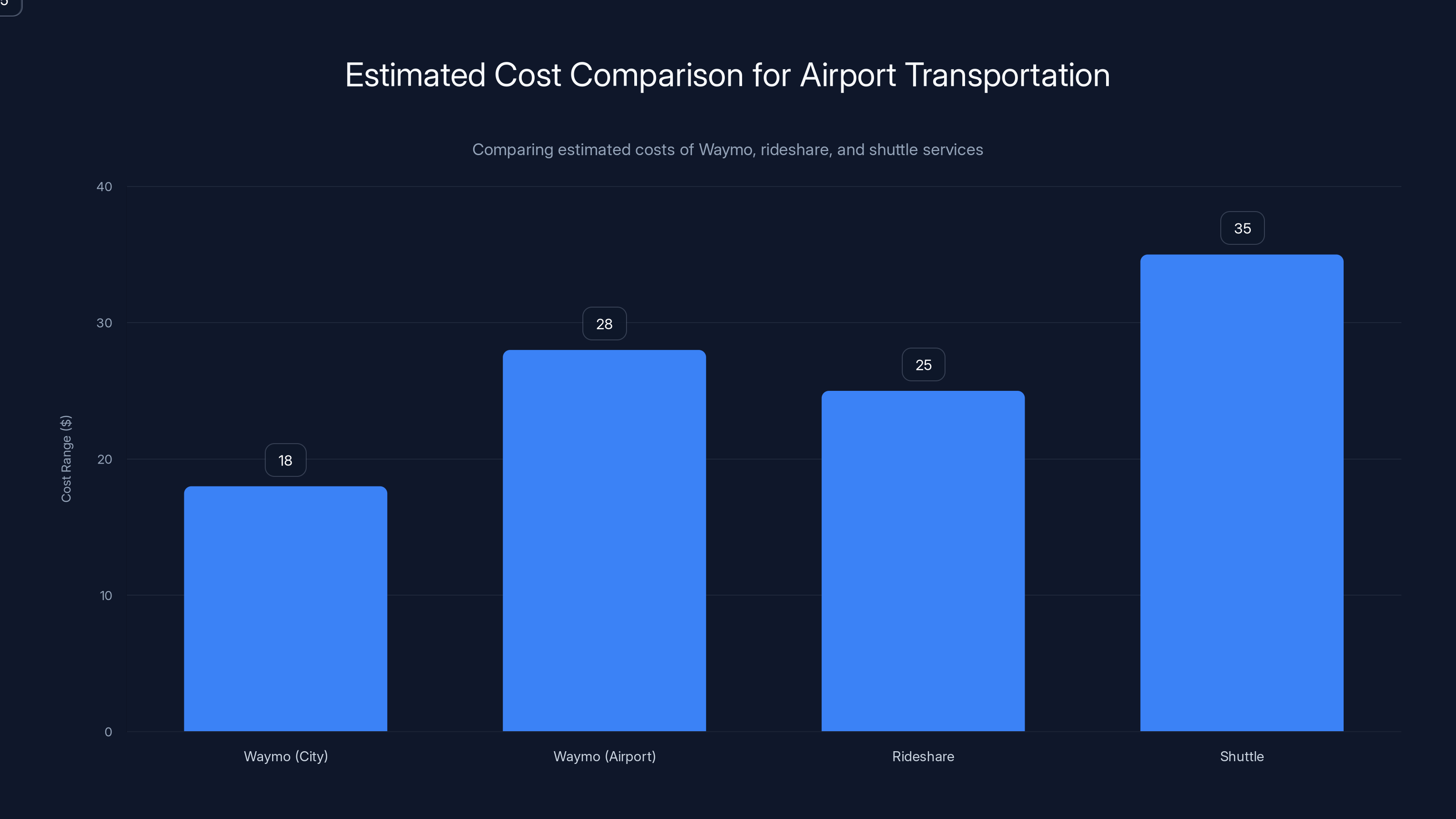

Rental cars dominate the market for leisure travelers and some business travelers. A customer picks up a vehicle at the airport rental facility, drives to their destination, and returns it at the end of their trip. This approach works fine for people who plan to drive around the region, but for travelers heading to hotels or offices with minimal driving needs, it's overly complicated. You're paying for a vehicle you don't need plus parking fees that can reach $30-40 per day in expensive cities like San Francisco.

Rideshare services like Uber and Lyft entered the market and captured significant share. A passenger requests a ride through an app, a nearby driver accepts, and they're picked up and dropped off. The advantages are clear: no rental car hassle, no parking fees, dynamic pricing based on demand. The disadvantages are less visible but equally real. Rideshare drivers spend time searching for parking, navigating traffic, and waiting between pickups. This dead time gets baked into the economics. A Lyft driver might spend 15 minutes finding a parking spot and waiting for their next request. That time is paid for by all customers using the service. Additionally, rideshare services require human drivers to work shifts in high-stress environments, which drives up labor costs.

Hotel shuttles and airport ground transportation companies fill specific niches. Some hotels operate free or low-cost shuttle services. Some passengers use shared shuttle services that hit multiple hotels. These solutions work for high-volume routes but they're inflexible—the shuttle runs on a schedule, which rarely aligns perfectly with passenger needs.

The real opportunity is in the inefficiencies. Every approach to airport ground transportation today requires either parking (expensive, space-intensive) or human labor (expensive, fatigue-prone). Autonomous vehicles eliminate both. A Waymo robotaxi completes a dropoff at SFO, then immediately drives to pick up another passenger. No parking. No human fatigue. No dead time. The vehicle operates continuously, efficiently matching supply to demand.

The economic advantage becomes clearer when you model the unit economics. A human Uber driver in San Francisco averages around

This is why airport robotaxi service represents such a significant opportunity. It's not a marginal improvement on existing transportation options. It's a fundamental restructuring of the economics.

How Autonomous Vehicles Navigate Airport Complexity

Operating a robotaxi at an airport is technically more complex than operating on city streets. Cities have relatively consistent traffic patterns. Airports have concentrated chaos followed by periods of relative quiet. Your autonomous vehicle needs to handle both.

Consider the variables. A flight lands. Fifty passengers stream out into the Rental Car Center. They're all requesting rides simultaneously. The autonomous vehicle must route itself to the optimal pickup location, account for other vehicles doing the same thing, avoid pedestrians who are tired and distracted, handle construction or temporary traffic reconfigurations, and execute all of this while operating within regulatory constraints about where vehicles can and cannot go.

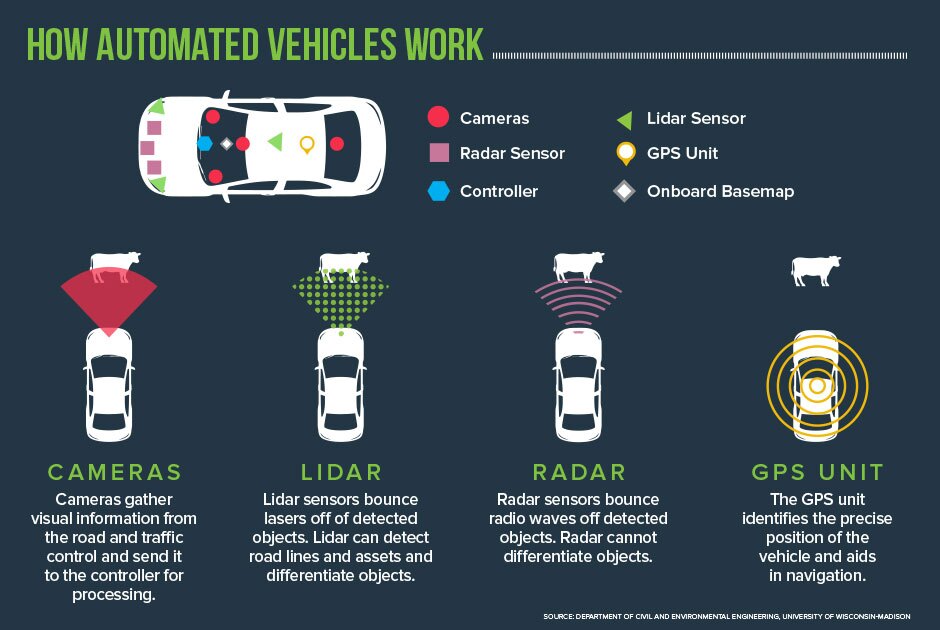

Waymo's vehicles use a combination of technologies to navigate this complexity. Sensor fusion combines data from multiple sources: lidar (laser-based distance measurement), radar (motion detection), cameras (visual processing), and GPS (localization). The vehicle maintains a detailed 3D model of its environment updated continuously. When the vehicle detects an object, it classifies it: human, vehicle, signage, debris. It predicts motion: where is that human walking? Is that car turning? Is that person about to step into traffic?

The decision-making system runs on powerful computers that process this sensory information in real time. The vehicle's AI models—trained on millions of miles of driving data—make decisions about acceleration, braking, and steering. These decisions must be made quickly and safely. A human driver can get away with sometimes-distracted driving because humans have redundant safety systems (reflexes, instinct) that kick in during emergencies. A robotic system needs to maintain perfect attention constantly.

Waymo has invested heavily in simulation. The company runs millions of simulated miles to test different scenarios before deploying them in physical vehicles. The simulation environment includes various weather conditions, traffic densities, pedestrian behaviors, and unexpected events. This simulation helps identify edge cases—unusual situations that might cause the system to behave unexpectedly—before they occur in real-world scenarios.

At an airport specifically, Waymo's vehicles also integrate with airport management systems. The vehicle knows which gates are receiving arrivals, when flights are landing, and where passengers are likely to congregate. This real-time information feeds into the dispatching algorithm. When a flight lands, Waymo can predict that passengers will soon request rides and pre-position vehicles efficiently. It's not magic. It's data integration and algorithmic optimization.

The Regulatory Framework: How Waymo Got Approval

Waymo didn't just start operating robotaxis at San Francisco International Airport because the company decided to. There's an extensive regulatory framework governing autonomous vehicles, and Waymo had to work within it.

California's Department of Motor Vehicles (DMV) regulates autonomous vehicle testing and deployment. The state has a specific approval process: companies must apply for an autonomous vehicle operating permit, meet specific safety requirements, provide proof of insurance, and demonstrate that they've successfully operated in other areas. Waymo met all of these requirements.

The Federal Aviation Administration has jurisdiction over airports, not the DMV. Waymo needed approval from SFO's management specifically. This involved demonstrating that the service wouldn't interfere with airport operations, that it met safety requirements, and that it integrated properly with existing ground transportation systems. SFO is one of America's most strictly regulated airports—it sits next to water, has sensitive airspace concerns, and handles enormous passenger volumes. Approval from SFO management is a meaningful regulatory achievement.

Furthermore, Waymo likely worked with the airport's private operator and ground transportation authority. SFO's ground transportation includes various stakeholders: taxi companies, rideshare services, shuttle operators, parking providers, and rental car companies. All of these groups have existing relationships and established operating procedures. Waymo's entry disrupts the status quo, and the company needed to convince stakeholders that the disruption was manageable.

This regulatory and political complexity explains why airport launches take so long. Waymo could theoretically operate robotaxis in the San Francisco area anywhere except the airport. But the airport represents the high-value market segment—business travelers, tourists, frequent flyers. Getting approval requires more than just technical capability. It requires political consensus.

The regulatory approach also reflects broader thinking about autonomous vehicle deployment. Regulators are gradually expanding the permitted operating zones for autonomous vehicles. A few years ago, robotaxis were only allowed to operate in limited areas during specific hours. Now they operate throughout major cities 24/7. But airports represent a level of oversight where regulators are still moving cautiously. It's not paranoia. It's just recognition that airports handle critical national infrastructure and any disruption could have cascading effects.

Waymo vehicles have an estimated lower accident rate of 0.5 per million miles compared to human drivers at 2.0. Estimated data based on favorable conditions.

Cost Implications for Travelers

The real question passengers ask about any transportation service is: what will it cost me?

Waymo's pricing for airport ground transportation isn't publicly disclosed yet. The company has been cagey about specific pricing for airport services compared to its city robotaxi operations. This is strategic—the company wants to understand demand and operational costs in the airport environment before committing to specific pricing.

We can make educated estimates based on what Waymo charges for city robotaxi services in the Bay Area. A typical 15-minute ride costs

But pricing will likely change as the service scales. Waymo's business model depends on optimizing efficiency—more rides per vehicle per day means lower cost per ride. Airport operations can achieve this better than city driving because airport passengers have predictable patterns. People take Ubers to and from airports at specific times. This predictability enables more efficient vehicle routing and higher utilization rates.

Over time, prices will likely decrease. Waymo might introduce subscription offerings, loyalty programs, or special pricing for frequent flyers. The company might partner with airlines to bundle ground transportation with tickets. These are speculative, but they reflect how transportation services typically evolve as they scale.

The bigger picture is that autonomous vehicle ground transportation will almost certainly be cheaper than human-driven alternatives at scale. Labor is the largest cost component in transportation services. Remove the human driver, and you remove the largest cost. This creates competitive pressure on all ground transportation options. Even if Waymo doesn't undercut rideshare initially, the existence of cheaper autonomous alternatives will eventually force pricing down across the industry.

The Employee Impact: What This Means for Drivers

Here's the uncomfortable reality that gets mentioned in hushed tones at transportation industry conferences: autonomous vehicles will displace human drivers. This is both inevitable and necessary from a societal perspective (autonomous vehicles are safer), but it doesn't mean the displacement won't hurt.

San Francisco International Airport currently employs hundreds of people in ground transportation roles: rideshare drivers, shuttle operators, parking attendants, taxi drivers. Some of these jobs will be displaced by robotaxis. Not immediately—the phase-in period will take years. But eventually, fewer humans will be needed to move people from airports to destinations.

This isn't unique to autonomous vehicles. Technology has been displacing workers for centuries. Mechanized farming displaced agricultural workers. Automobiles displaced horse handlers. Email displaced postal workers. The pattern is consistent: new technology improves efficiency, creates new economic value, but disrupts existing employment.

Waymo and other autonomous vehicle companies face growing pressure to address this disruption. Some are investing in retraining programs for displaced drivers. Some are partnering with labor unions to negotiate transition periods and severance. Some are just ignoring the issue, which will eventually become a political problem.

The Bay Area is already experiencing a tense moment around this question. San Francisco's Board of Supervisors voted to restrict robotaxi expansion due to concerns about labor displacement and congestion. This resistance reflects broader anxiety about automation. It's not NIMBYism exactly—it's more accurate to call it labor protectionism, and it's understandable even if you think it's ultimately misguided.

Waymo's careful approach to expansion reflects understanding of this tension. By launching at the airport with limited access, expanding gradually, and coordinating with airport management, Waymo can make the case that the service isn't displacing workers overnight. It's integrating slowly, allowing the labor market to adjust, potentially creating new jobs in service monitoring and customer support.

The displacement issue also explains why autonomous vehicle companies haven't deployed faster. Pure technology companies might move quickly without worrying about labor consequences. But transportation is a regulated industry where labor is politically powerful. Understanding that constraint, Waymo is moving at a pace that regulators and labor unions can tolerate.

Comparing Waymo to Competitors

Waymo isn't alone in the autonomous vehicle space, though its competitive position has strengthened significantly over the past few years. Understanding the competitive landscape provides context for why Waymo's airport launch matters.

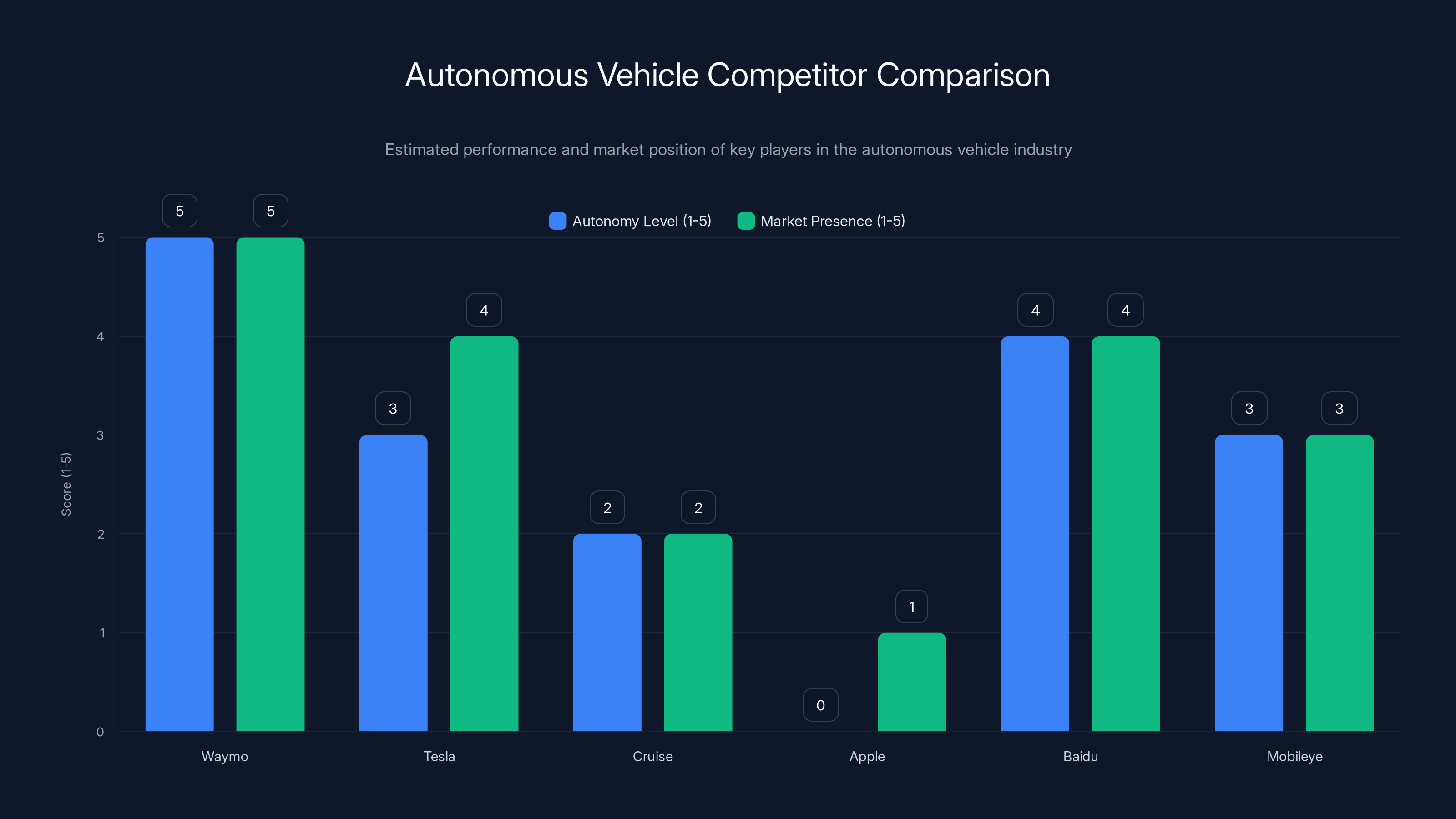

Tesla's Full Self-Driving beta exists, but it requires active human supervision and hasn't achieved the level of autonomous operation that Waymo demonstrates. Tesla is pursuing a different technical approach focused on camera-based vision systems, whereas Waymo uses lidar and comprehensive sensor fusion. Tesla's approach might eventually win, but currently, Waymo's vehicles can operate without human intervention in ways Tesla's cannot.

General Motors' Cruise was operating robotaxis in San Francisco but faced significant setbacks after several high-profile incidents in 2023-2024. The company scaled back operations and laid off substantial portions of its workforce. Cruise's challenges illustrate why Waymo's methodical approach matters—the company avoided the aggressive expansion that caused problems for competitors.

Apple's autonomous vehicle project apparently wound down without producing a commercial product. There were rumors that Apple might launch in autonomous vehicles, but those ambitions didn't materialize. The company's failure to enter the market suggests that autonomous vehicles are harder to build than many tech companies anticipated.

International competitors like Baidu in China and Mobileye in Israel are operating autonomous services, but with different regulatory environments and market structures. Baidu operates extensively in Chinese cities where regulations are less developed and labor costs are lower. Mobileye focuses on autonomous truck applications rather than consumer robotaxis.

Waymo's competitive advantages are substantial. The company has been working on autonomous vehicles for longer than most competitors (spinning out of Google's autonomous vehicle project in 2016, but drawing on research from much earlier). Waymo has accumulated more real-world driving data than competitors. The company operates multiple commercial services across different vehicle types and geographies. And critically, Waymo has regulatory approval to operate in major U.S. cities, which competitors lack.

The airport launch reinforces Waymo's lead. Each new market and application, Waymo accumulates more data and operational experience. This creates a virtuous cycle: more experience enables safer, better-performing vehicles, which enables approval for new markets, which provides more experience. Competitors would need to mount substantial efforts to catch up.

Estimated data suggests Waymo's airport service costs could range from $25-35, competitive with rideshare but higher than shuttle services. Estimated data.

Future Airport Expansion: What Comes Next

Waymo's plan includes expanding the SFO service beyond the Rental Car Center to terminals and other airport zones. This expansion will happen gradually, but it's explicitly on the roadmap.

Terminal integration is more complex than Rental Car Center operations. Terminals handle higher pedestrian volumes, more confusion, more unpredictability. A passenger arriving from a long flight is tired and might not follow normal traffic rules. Children run around unpredictably. Luggage gets in the way. The environment is dynamically more challenging than the relatively ordered Rental Car Center.

Waymo will likely start with departures areas, which have more clearly defined zones where vehicles operate. Arrivals areas are more chaotic. By starting with departures, the company can prove the concept works before tackling the harder problem.

Beyond San Francisco, Waymo will almost certainly expand to other major airports. Los Angeles is the obvious next target. Others likely include Seattle-Tacoma, San Diego, Las Vegas, and Denver. Each airport represents a self-contained market where Waymo can apply proven processes and expand from there.

International expansion is further out. Other countries have different regulatory frameworks, different languages, different traffic cultures. Waymo would need to adapt its systems and navigate different approval processes. But eventually, Waymo will likely be operating at major airports globally.

There's also the possibility of Waymo expanding into other airport services beyond just passenger ground transportation. Could Waymo robots handle baggage transport between terminals? Could they operate as airport shuttles moving employees and equipment? Could they support cargo operations? These adjacent opportunities exist, but they're further out.

The Broader Shift in Urban Transportation

Waymo's airport launch represents a moment where autonomous vehicles transition from novel pilots to normal infrastructure. The significance extends beyond just airport operations.

For years, people debated whether autonomous vehicles would ever be viable. Skeptics pointed to technical challenges, regulatory barriers, and fundamental unsolved problems. Those skeptics have been proven wrong. Autonomous vehicles work. They operate safely. They're expanding into new markets and geographies. The conversation has shifted from "if" to "when" and "how fast."

Airports are particularly important because they represent the meeting point of technology, infrastructure, and public perception. If autonomous vehicles can successfully transport millions of travelers through major airports, public acceptance of the technology will accelerate. When people actually ride in a robotaxi and experience it working perfectly—arriving on time, taking efficient routes, providing a safe experience—their mental models about autonomous vehicles update. It goes from theoretical to real.

This matters because autonomous vehicle adoption depends on regulatory approval, which depends on public trust. People trust what they've experienced. Positive experiences at major airports create positive word-of-mouth. That word-of-mouth influences how regulators and politicians think about autonomous vehicles. Over time, restrictions loosen, expansion accelerates, and more people gain access to robotaxi services.

The airport launch also matters because it proves the business model works. Waymo isn't just a research project trying to build autonomous vehicles in the abstract. The company is generating revenue, serving paying customers, and building a sustainable business. This legitimacy matters to investors, regulators, and the general public. A company generating revenue with profitable operations looks different than a company burning through venture capital with uncertain timelines to profitability.

Beyond ground transportation, autonomous vehicle success at airports could open doors for other autonomous services. Delivery robots operating in airport facilities. Autonomous cargo handling. Autonomous warehouse operations supporting airport logistics. The airport becomes a living laboratory for robotics and autonomous systems more broadly.

The Safety Record and Future Outlook

Waymo's operational safety record in non-airport environments has been strong relative to human driving. The company cites statistics showing that Waymo vehicles operate at lower accident rates than human drivers when measured per mile. However, the data is complex.

Waymo's vehicles operate primarily in relatively favorable conditions: clear weather, good lighting, well-mapped areas, and in later operational phases, they often avoid the most challenging situations like extreme weather or construction zones. These controlled conditions might partially explain the favorable safety statistics. A human driver navigating identical conditions would also likely have fewer accidents.

The more important comparison is whether Waymo's vehicles handle edge cases safely. What happens when something unexpected occurs? The Santa Monica incident suggests that Waymo's vehicles can be involved in accidents, even if Waymo argues the accident might have been unavoidable or not the vehicle's fault.

Safety at airports specifically is important because the stakes are high. An accident at an airport could disrupt operations for thousands of people and create major public relations problems. Waymo knows this. The company's phased rollout with limited initial access reflects careful attention to safety validation before broader deployment.

Waymo has committed to publishing detailed safety data. The company maintains incident logs and regularly shares reports on how vehicles perform compared to human drivers. This transparency is important for building credibility and understanding where problems might exist.

Going forward, the critical metric will be whether Waymo can maintain or improve its safety record as it expands operations. As service areas get larger, conditions become more varied, and vehicle utilization increases, maintaining perfect safety becomes harder. Waymo will need to demonstrate that expanded operations don't create new categories of incidents.

The NHTSA investigation into the Santa Monica incident will be important for understanding whether the incident was an anomaly or evidence of systematic issues. If NHTSA finds that Waymo's decision-making was appropriate given available information, it actually strengthens the case for continued expansion. If NHTSA identifies problems, it might slow expansion while Waymo implements fixes.

Waymo leads in both autonomy level and market presence, highlighting its competitive edge in the autonomous vehicle industry. Estimated data based on current industry insights.

Economic Impact: Jobs, Costs, and Market Disruption

The deployment of autonomous vehicles at SFO will have cascading economic effects. Some will be positive, others disruptive.

On the positive side, autonomous vehicles should reduce ground transportation costs for travelers. This might not sound significant, but when multiplied across millions of annual SFO passengers, it's billions of dollars saved annually. These savings benefit travelers and also make air travel more accessible to price-sensitive customers.

Autonomous vehicles also increase operational efficiency at airports. Reducing the time passengers spend in ground transportation means less curb congestion, less parking area needed, and improved overall airport throughput. Airports are complex logistical systems where small efficiency gains compound into significant savings.

The environmental impact could be substantial. Waymo's operating fleet is predominantly electric. As robotaxi services replace human-driven Ubers and traditional taxis, the aggregate environmental impact of ground transportation improves. Electric vehicles eliminating emissions is one benefit. Better routing efficiency reduces total miles driven. These benefits scale as robotaxi services grow.

On the disruptive side, existing ground transportation workers will face job displacement. Taxi drivers, rideshare drivers, shuttle operators, and parking attendants will see reduced demand for their services. This could take years to fully materialize, but the trend is directional. Some workers will transition to other roles. Some will retire. Some will face genuine economic hardship.

There might also be displacement in car rental services. If autonomous vehicle services become the default transportation option, fewer people will rent cars. This reduces demand for rental car facilities, fleet management, and associated services. The effect is less immediate than driving displacement, but it's real.

The net economic effect is almost certainly positive in aggregate—autonomous vehicles should make the economy more productive and efficient. But the distribution of benefits matters. Travelers save money. Airport operators gain efficiency. Waymo's shareholders benefit. But workers displaced by automation see no benefit and substantial costs. This distributional tension is politically and socially important.

Integration with Bay Area Autonomous Vehicle Operations

Waymo's airport service doesn't exist in isolation. It integrates with the company's broader Bay Area operations, which are already mature and extensive.

Waymo operates robotaxis across 260+ square miles of the San Francisco Bay Area. This includes San Francisco proper, surrounding suburbs, and connecting corridors. The network is dense enough that most residents in covered areas can request a Waymo and have one arrive within a few minutes.

Integrating airport service with this broader network creates efficiency gains. A Waymo that drops a passenger at the airport can efficiently pick up another passenger heading to the airport, optimizing routing. The fleet-wide optimization becomes more sophisticated. The dispatch algorithm considers not just current demand but anticipatory demand based on flight schedules.

This integration also means Waymo can expand airport service by drawing vehicles from existing Bay Area operations, and similarly, vehicles from airport operations can be redeployed to serve other areas during off-peak hours. The flexibility improves unit economics for the entire operation.

Furthermore, Waymo's extensive Bay Area presence means the company has already worked through most of the regulatory and operational challenges that airports present. The company knows how to navigate California regulations, manage insurance and liability, coordinate with municipal authorities, and handle incidents. These learnings transfer directly to airport operations.

Waymo's Bay Area dominance also gives the company leverage with airport authorities and competing ground transportation services. When an airport management considers whether to allow robotaxi service, they see that Waymo is already operating successfully throughout the region. This track record is more persuasive than a company entering the market for the first time.

Regulatory Precedent: What This Launch Means for Other Airports

Waymo's approval to operate at SFO sets a precedent that matters for other airports and regulators.

When regulators in other cities consider whether to allow autonomous vehicle services, they look at precedent. If SFO, one of America's busiest and most tightly regulated airports, allows robotaxis, it sends a signal that the technology is sufficiently mature and safe for even the most demanding environments. This makes it harder for other airports to deny similar services.

The precedent also influences how regulators think about autonomous vehicles broadly. Each successful deployment in a high-profile, complex environment makes the case for autonomous vehicle safety stronger. SFO's approval validates the regulatory framework California developed for autonomous vehicles. Other states looking to develop their own frameworks can look at California's approach as a model.

Furthermore, the precedent creates competitive pressure on other airports. If Los Angeles International Airport allows Waymo robotaxis and San Francisco did, what's the justification for other airports to refuse? Competitive pressure between airports tends to accelerate adoption of efficiency improvements.

The precedent might also influence how other ground transportation services at airports evolve. Rideshare companies might demand similar access or fare reductions to compete. Rental car companies might invest in mobility services to compete with robotaxis. The competitive landscape shifts when autonomous vehicles enter.

Historically, technology adoptions at major airports precede broader deployment. When airports adopted kiosks for check-in, other venues soon followed. When airports improved Wi-Fi, it spread to other transportation hubs. The pattern is consistent: prove it works at a high-profile, complex location, then replicate elsewhere. Waymo's SFO launch follows this pattern.

Looking Ahead: The 2025-2026 Timeline

Based on Waymo's track record and stated plans, we can predict the likely timeline for how airport robotaxi services will evolve in the near term.

In the next few months, expect Waymo to expand access at SFO beyond the initial select riders. The company will likely announce the expansion gradually and use it as an opportunity to reinforce positive messaging around safety and service quality.

Within six months, expect Waymo to announce expansion to terminals or other SFO areas. The company might start with departures (simpler operations) before moving to arrivals. Expansion announcements generate positive press coverage and help counter any negative headlines around incidents or accidents.

During 2025, expect Waymo to apply for approval to operate robotaxis at other California airports. San Diego and Los Angeles are obvious targets. These applications will likely face less regulatory scrutiny because precedent from SFO already exists.

Beyond California, expect Waymo to prioritize airports in jurisdictions where the company already operates. Seattle-Tacoma (where Waymo operates city service) and Las Vegas (expanding Waymo service) are likely candidates. The company might also apply for Denver or Phoenix Sky Harbor expansion.

By late 2025 or early 2026, expect Waymo to announce that it operates at multiple airports with matured service levels. The company might begin publishing aggregate data on how airport operations perform compared to city robotaxi operations. This helps build the narrative that Waymo's technology is scalable and reliable across different use cases.

Simultaneously, expect competitive responses from other companies. Tesla might accelerate Full Self-Driving development if rival Waymo captures significant airport market share. General Motors might expand Cruise's footprint. International competitors might seek approval to operate at U.S. airports.

The disruption timeline is slower than hype suggests, but the direction is clear. Over the next 2-3 years, autonomous vehicles will become a normal part of airport ground transportation at major hubs. By 2027-2028, the technology will be standard rather than novel.

FAQ

What exactly is Waymo and what does it do?

Waymo is a self-driving car company owned by Alphabet (Google's parent company) that develops and operates fully autonomous vehicles. The company provides robotaxi services—essentially ride-hailing without a human driver—in multiple cities and now at airports. Waymo's vehicles use advanced sensors, artificial intelligence, and mapping technology to navigate roads safely without human intervention, handling everything from acceleration and braking to detecting pedestrians and making driving decisions.

How do Waymo's autonomous vehicles actually work?

Waymo's vehicles use a combination of technologies including lidar (laser sensors that create 3D maps), radar (motion detection), high-resolution cameras, and GPS positioning. These sensors feed information to powerful onboard computers running AI algorithms trained on billions of miles of driving data. The system continuously monitors the vehicle's surroundings, predicts the behavior of other road users, and makes real-time driving decisions. Waymo also leverages extensive digital maps created specifically for autonomous driving and relies on fleet-wide learning where experiences from one vehicle help improve systems across all vehicles.

What makes the San Francisco International Airport launch significant?

Waymo's launch at SFO is significant for multiple reasons: it validates the technology's readiness for deployment at one of America's busiest and most tightly regulated airports, it proves the business model works in a complex transportation environment, and it sets a regulatory precedent that will influence autonomous vehicle approval at other major airports. Additionally, integrating airport services with Waymo's existing 260+ square mile Bay Area operations demonstrates how autonomous vehicle services can become comprehensive ground transportation solutions rather than niche offerings.

Is riding in a Waymo robotaxi safe compared to human-driven vehicles?

Waymo's published data suggests their vehicles have lower accident rates than human drivers when measured per mile of autonomous operation. However, these comparisons are complex because Waymo's vehicles primarily operate in relatively controlled conditions and can avoid the most challenging scenarios. The technology has proven reliable enough for regulators to permit operation in major cities. Individual incidents like the Santa Monica incident where a Waymo vehicle struck a child demonstrate that accidents can happen, but such incidents are statistically far less frequent than accidents involving human drivers when compared across equivalent driving scenarios.

How much will Waymo robotaxi service cost at airports?

Waymo hasn't publicly disclosed specific pricing for airport services yet. Based on the company's city robotaxi pricing in the Bay Area (

What does this mean for human drivers and ground transportation workers?

Autonomous vehicle services will gradually displace some ground transportation workers, including taxi drivers, rideshare drivers, and airport shuttle operators. However, displacement is occurring gradually rather than immediately, allowing the labor market time to adjust. Some workers are transitioning to other roles, others are approaching retirement, and there's growing industry focus on retraining programs. The full employment impact will unfold over years, not months, and will likely include creation of some new jobs related to fleet management, maintenance, and customer support for autonomous vehicle services.

When will Waymo expand to other airports beyond San Francisco?

Waymo has explicitly stated plans to expand to terminals and other San Francisco locations "in the future," but hasn't provided specific timelines. The company will likely prioritize airports in regions where it already operates city services, such as Los Angeles and Las Vegas. Based on Waymo's typical expansion cadence, expect announcements about other airport launches within 6-12 months, with full deployment taking several years. The company's methodical approach reflects its focus on safety and operational excellence rather than racing competitors to new markets.

How does airport autonomous vehicle service improve things for passengers?

Autonomous vehicle ground transportation benefits passengers through reduced costs (potentially 30-40% cheaper than traditional rideshare), improved convenience (no waiting for drivers to find parking), on-demand availability without human labor constraints, and potentially improved environmental impact if services operate with electric vehicles. The service integrates with existing transportation technology through apps, eliminating the need to search for taxis or negotiate with drivers. For frequent travelers, robotaxi services provide consistency and predictability.

What happens if something goes wrong during an autonomous vehicle ride?

Waymo vehicles maintain continuous communication with monitoring centers that can observe vehicle status in real-time. If the vehicle encounters a situation it cannot safely handle, it can either alert the monitoring center for remote assistance or pull over safely to prevent accidents. Passengers have access to customer support through the Waymo app and can contact the company directly if issues arise. Insurance coverage applies like any transportation service, and Waymo maintains extensive liability insurance for passenger protection.

How does Waymo's airport service integrate with existing Bay Area operations?

Waymo's airport service leverages the infrastructure, regulatory relationships, and operational expertise developed from operating 260+ square miles of Bay Area robotaxi services. The same vehicles, systems, and dispatch algorithms can serve both airport and city operations, improving overall efficiency. This integration means Waymo can rapidly expand airport service without rebuilding infrastructure, and vehicles can be dynamically redeployed between airport and city operations based on demand patterns. The existing regional network also simplifies transportation for passengers who need airport-to-destination services.

What regulatory changes will need to happen for broader airport robotaxi expansion?

The primary regulatory work has largely been completed in California through the approval of Waymo's SFO launch. For expansion to other airports and states, regulators must assess individual airport conditions and potentially adapt their regulatory frameworks based on Waymo's Bay Area performance. Federal oversight through NHTSA establishes national safety standards, while individual airports and states can impose additional restrictions. The precedent from SFO approval makes expansion easier at other airports by demonstrating successful regulatory models and proven safety records.

Conclusion: The Future of Airport Transportation Is Autonomous

Waymo's launch of autonomous vehicle service at San Francisco International Airport represents a genuine milestone in transportation history, even if it doesn't immediately feel revolutionary. The service launched with limited scope, restricted access, and careful constraints on where vehicles can operate. But these limitations aren't weaknesses—they reflect sophisticated understanding about how to deploy transformative technology responsibly.

The broader significance extends far beyond airport operations. Waymo's SFO launch validates the argument that autonomous vehicles aren't theoretical or distant. They work. They operate safely. They're generating revenue. They're expanding into new markets and applications. The conversation about autonomous vehicles has shifted from "if" to "when and where."

For travelers, this eventually means cheaper, faster, more convenient ground transportation at major airports. For airports themselves, it means improved operational efficiency, reduced congestion, and lower costs. For the environment, it means cleaner transportation replacing human-driven vehicles. For Waymo, it means expanded addressable market and opportunities to deepen competitive advantages.

But the transition won't be seamless. Human ground transportation workers will face displacement. Existing services will experience competitive pressure. The political economy of transportation will shift as robotaxis become normal. Cities will need to develop new regulations and frameworks for managing autonomous vehicles. These challenges are real and deserve serious attention.

Waymo's methodical approach—expanding gradually, working closely with regulators, publishing safety data, and clearly communicating limitations—suggests the company understands this complexity. The company isn't trying to revolutionize everything overnight. It's building a sustainable business that operates safely, generates value, and earns the trust of regulators, passengers, and communities.

Five years from now, passengers at major airports will expect autonomous vehicle options alongside traditional transportation services. The novelty will have worn off completely. A teenager making her first airport trip will think of robotaxis as just another transportation option, like rideshare or rental cars. This normalization is the real story of Waymo's SFO launch.

For now, the service is limited. Access is restricted. Operations are concentrated. But the direction is clear. Autonomous vehicles are becoming normal. Airports are becoming robotaxi hubs. Transportation is being reimagined. And Waymo is leading the way.

The San Francisco International Airport Waymo launch isn't the beginning of autonomous transportation. It's a milestone on a path that's already well underway. But it's a significant milestone, marking the moment when self-driving technology moved from novel experiments in friendly environments into real operation at the world's most demanding transportation nodes. That deserves attention and respect, regardless of whether you're enthusiastic about autonomous vehicles or skeptical.

Watch this space. Over the next few years, you'll see robotaxis at airports across America. You'll probably ride in one. You'll probably wonder why we didn't do this sooner. And you'll recognize that Waymo's patient, methodical approach to deployment made this transition possible. Not flashy. Not revolutionary. Just competent, careful advancement of technology that makes transportation better, safer, and more efficient.

That's how transformative change actually happens.

Key Takeaways

- Waymo launched autonomous ride service at SFO with limited initial access, marking the company's third major airport location

- Service currently limited to SFO Rental Car Center with plans for terminal and broader airport expansion

- Autonomous vehicles offer 30-40% cost savings compared to rideshare while improving operational efficiency

- Waymo's phased approach reflects careful balance between innovation and safety validation in complex airport environments

- Airport robotaxi services will likely displace some ground transportation workers but create new operational roles

- Success at SFO sets regulatory precedent that will accelerate autonomous vehicle approval at other major U.S. airports

Related Articles

- Waymo Robotaxi Hits Child Near School: What Happened & Safety Implications [2025]

- Robotaxis Disrupting Ride-Hail Markets in 2025: Price War and Speed [2025]

- Waymo Robotaxi Strikes Child Near School: What We Know [2025]

- Tesla Discontinuing Model S and Model X for Optimus Robots [2025]

- Tesla Kills Model S and X Production: The Shift to Humanoid Robots [2025]

- Waymo Robotaxi Hits Child Near School: What We Know [2025]

![Waymo at SFO: How Robotaxis Are Reshaping Airport Transport [2025]](https://tryrunable.com/blog/waymo-at-sfo-how-robotaxis-are-reshaping-airport-transport-2/image-1-1769717445748.jpg)