Waabi and Uber's Revolutionary Robotaxi Partnership: A Deep Dive Into the $1 Billion Deal

The autonomous vehicle industry experienced a seismic shift when Waabi, a Toronto-based self-driving technology company, announced a landmark partnership with Uber backed by $1 billion in new funding. This announcement represents far more than a typical startup funding round—it signals a fundamental pivot in how AI-driven autonomous vehicles are being developed and deployed at scale.

For years, the autonomous vehicle industry operated under a particular hierarchy of assumptions. Self-driving trucks were supposed to arrive before robotaxis, primarily because highway driving presented fewer variables than navigating busy urban streets, residential neighborhoods, and complex traffic patterns. Companies like Embark Trucks, Tu Simple, and Locomation pursued this logical progression, only to encounter unexpected obstacles. Some dissolved entirely, while others significantly scaled back their ambitions. Yet Waabi is charting a different course—one that challenges these assumptions and demonstrates how a technology-first approach, combined with strategic partnerships, can reshape industry trajectories.

Raquel Urtasun, Waabi's founder and CEO, brings credibility rarely seen in autonomous vehicle startups. As the former chief scientist at Uber's Advanced Technologies Group, Urtasun led research that fundamentally shaped modern autonomous driving approaches. When she departed to establish Waabi in 2021, she carried deep expertise about both the technical challenges and the organizational structures needed to solve them. Her founding principle was elegantly simple: autonomous vehicles require an "AI-centric approach" rather than traditional engineering methodologies that rely heavily on manually programmed decision trees and rule-based systems.

What makes this partnership particularly compelling is the specificity of the commitment. Waabi and Uber didn't agree to vague collaboration or exploratory pilots. Instead, the deal includes a concrete minimum deployment target of 25,000 robotaxis—a number that Urtasun emphasized is merely the floor, not the ceiling. To put this in perspective, this single deployment represents more autonomous vehicles than most countries have ever tested on public roads simultaneously.

The

Yet this partnership raises substantial questions. Waabi hasn't yet fully validated commercial self-driving truck operations on public roads, despite years of development. How can the company credibly commit to deploying tens of thousands of robotaxis without first proving the core technology works reliably in revenue-generating trucking scenarios? Urtasun's answer reveals a sophisticated understanding of both her technology and market realities: the underlying AI systems and physical capabilities required for autonomous trucking and autonomous rideshare are fundamentally similar in ways that industry observers often overlook.

The Genesis of Waabi: Building an AI-Centric Autonomous Vehicle Platform

To understand what Waabi brings to this partnership, we need to examine how the company approaches autonomous vehicle development—an approach that fundamentally differs from how most competitors operate.

The Founding Thesis: AI-Centric Design Philosophy

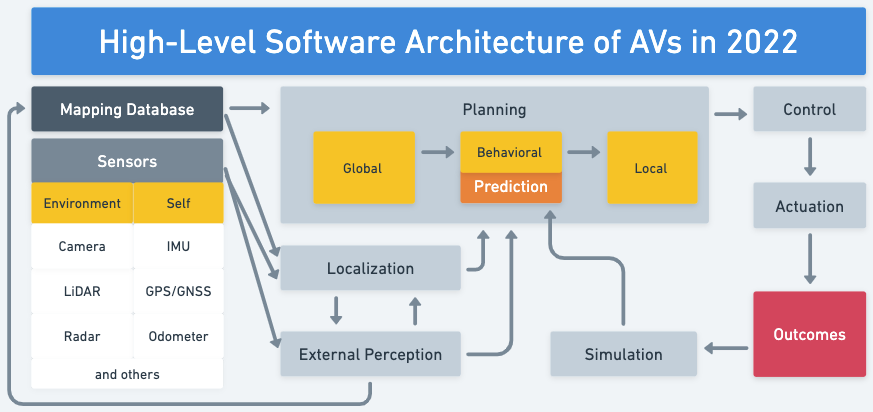

When Raquel Urtasun founded Waabi in 2021, she rejected the dominant engineering paradigm of the time. Most autonomous vehicle companies operated through a process that might be called "sensor-first, decision-making second." Engineers would accumulate massive volumes of sensor data from cameras, lidar, and radar, then build complex computer vision pipelines to identify objects, predict trajectories, and plan routes through manually coded decision logic.

Urtasun proposed something radically different: what if the entire system—perception, prediction, planning, and control—was built on a unified AI foundation from the ground up? This isn't simply a matter of using neural networks instead of traditional algorithms. It represents a fundamentally different architecture where the AI system learns integrated representations of the driving environment and develops adaptive behaviors through exposure to diverse scenarios during training.

This philosophical difference has profound implications. Traditional systems require engineers to explicitly code rules for hundreds of edge cases: "If the traffic light is red and a pedestrian is crossing, do X. If the traffic light is red but the pedestrian is standing still, do Y." These systems struggle when they encounter situations outside their programmed parameters. AI-centric systems, by contrast, develop generalizable understanding of how traffic participants behave, allowing them to adapt to novel situations more flexibly.

The challenge, of course, is that building such systems requires enormous computational resources, sophisticated training methodologies, and the ability to generate or access vast amounts of high-quality training data. It also requires rethinking how to ensure safety and reliability when you can't simply point to a specific rule that governed a particular decision.

Waabi's Trucking Foundation: Proof of Concept

Waabi's initial focus on autonomous trucking wasn't random—it was strategic. Commercial trucking on highways offered Waabi the opportunity to validate its AI-centric approach in a controlled environment with clear success metrics: Can the vehicle reliably navigate from point A to point B without human intervention?

By 2024, Waabi had deployed test vehicles on public highways in Texas, demonstrating that its technology could handle sustained autonomous driving in real-world conditions. The company specifically chose to work with Volvo, designing purpose-built hardware and software integration rather than retrofitting existing vehicles. This decision speaks to Waabi's commitment to the AI-centric philosophy—you can't fully optimize hardware and software integration when working with a vehicle designed for human drivers.

Critically, Waabi made the decision not to immediately launch commercial operations, despite having functional autonomous trucks. Urtasun explained that the company wanted to fully validate the platform before subjecting it to the regulatory scrutiny and liability exposure of revenue-generating trucking. This restraint differentiated Waabi from competitors who pursued more aggressive timelines, ultimately burning through capital faster as complications emerged.

The trucking work generated something valuable beyond the vehicles themselves: operational data and validation of Waabi's core AI systems. The company proved its technology could learn, adapt, and handle unexpected situations on public roads. This created the foundation for expanding into robotaxis—not through naive extrapolation, but through systematic analysis of how the core technological capabilities translate to different driving environments.

The Technology Stack: What Powers Waabi's Autonomous Driving

While Waabi hasn't publicly released detailed technical specifications of its AI systems, industry analysis and public comments from Urtasun reveal the core components:

Unified End-to-End Learning: Rather than building separate modules for perception, prediction, and planning, Waabi appears to train integrated neural networks that jointly optimize for safe and efficient driving. This approach, pioneered in research by leading AI institutions, allows the system to learn correlations between perception and decision-making that separately trained modules might miss.

Simulation and Validation: Autonomous vehicles require testing in millions of miles worth of scenarios before deployment. Waabi invests heavily in physics-based simulation that generates realistic driving scenarios for training and testing. This allows the company to validate behavior in rare edge cases without waiting for them to naturally occur during road testing.

Real-World Data Integration: The company's test vehicles continuously collect sensor data from actual driving conditions. This real-world data is essential for identifying failure modes and validating that the simulation accurately represents reality. Waabi's partnership with Volvo ensures tight integration of sensor systems designed for autonomous operation rather than human driving.

Continuous Learning Infrastructure: Once deployed commercially, Waabi's vehicles will generate enormous volumes of operational data. The company's systems are designed to learn from this data, allowing the fleet to become progressively more capable. This creates a network effect in autonomous driving: larger fleets generate more diverse experiences, which improve the underlying AI model, which benefits all vehicles in the fleet.

These components work together to create a system fundamentally different from competitors who rely more heavily on map-based approaches, explicit rules, or pre-programmed decision trees.

Waabi's

The Strategic Rationale: Why Robotaxis Over Trucking?

The pivot from autonomous trucking to robotaxis might appear counterintuitive given industry assumptions, but it reflects sophisticated business strategy and market analysis.

Market Dynamics and Investor Enthusiasm

The autonomous vehicle investment landscape shifted dramatically following Waymo's early commercial successes with its robotaxi service in Phoenix, Arizona. Waymo, backed by Alphabet's resources and technical expertise, demonstrated that robotaxis weren't purely theoretical—they could operate in real urban environments, serve paying customers, and generate revenue. This validation unleashed investor capital toward any company with plausible robotaxi plans.

Simultaneously, the autonomous trucking sector experienced a credibility crisis. Companies that had promised commercial deployment within 2-3 years found themselves announcing extensions to 5-10 years or more. Some went bankrupt despite substantial funding. Investors increasingly recognized that trucking, while theoretically simpler than urban robotaxi operations, presented unexpected challenges involving:

- Infrastructure complexity: Truck stops, loading facilities, and logistics networks are more heterogeneous than standard roadsides and rideshare pickup locations

- Human-robot collaboration: Trucking involves more coordination with human workers compared to the relatively clean pickup-dropoff model of robotaxis

- Regulatory hurdles: Federal motor carrier regulations proved more complex to navigate than state-by-state robotaxi permitting

- Safety liability: Deploying trucks without drivers initially generated more regulatory resistance than robotaxis

In this landscape, pivoting to robotaxis allowed Waabi to access investor enthusiasm and demonstrate progress through a different metric—customer-facing rides—rather than commercial trucking tonnage.

Technology Transfer: Why Truck Autonomy Translates to Robotaxis

Urtasun's core argument deserves careful analysis. She claims that Waabi's autonomous trucking technology directly translates to robotaxis because the driving behaviors involved are similar. Initially, this seems questionable: trucks navigate relatively simple highway environments while robotaxis must handle complex urban scenarios.

But this critique misses Urtasun's actual claim. She's not saying highway driving and urban driving are identical. Rather, she's observing that the core competency Waabi developed—teaching an AI system to safely operate a vehicle, predict traffic participant behavior, and execute maneuvers without human control—is domain-general. The specific domain (highway trucking) where Waabi first validated this competency is less important than the underlying capability itself.

Conversely, she identifies structural similarities between trucking and robotaxi operations:

- Navigation specificity: Trucks travel from specific loading point A to specific loading point B, much like robotaxis traveling from pickup point A to dropoff point B. Both require precise arrival at predetermined locations rather than arbitrary route planning

- Behavioral repertoire: Both vehicles need to execute similar tactical maneuvers—lane changes, merging, handling traffic signals, responding to obstacles—regardless of the overall route complexity

- Passenger vs. Cargo: The major difference (accepting passengers versus transporting cargo) introduces liability and safety considerations but doesn't fundamentally change the autonomous driving problem

This perspective explains why Waabi didn't need to completely reinvent its technology stack to move from trucks to robotaxis. The architecture, training methodology, and AI models developed for trucking could be adapted for urban robotaxi operation, reducing development timeline and improving confidence in deployment.

Market Timing and Visibility

From a business perspective, robotaxis offer something trucking cannot: customer-facing visibility and brand recognition. A self-driving truck operates on highways, invisible to most consumers. A robotaxi picks up people from their neighborhoods, generating word-of-mouth marketing and media attention. When Waabi deploys 25,000 robotaxis, millions of people will experience the technology directly, building confidence in the company's capabilities.

This visibility matters strategically. It attracts better engineering talent, generates regulatory relationships with city officials interested in deploying robotaxis, and builds momentum for other product lines. A company that successfully operates tens of thousands of robotaxis will find investors far more enthusiastic about autonomous trucking applications than a company focused purely on trucking without this market demonstration.

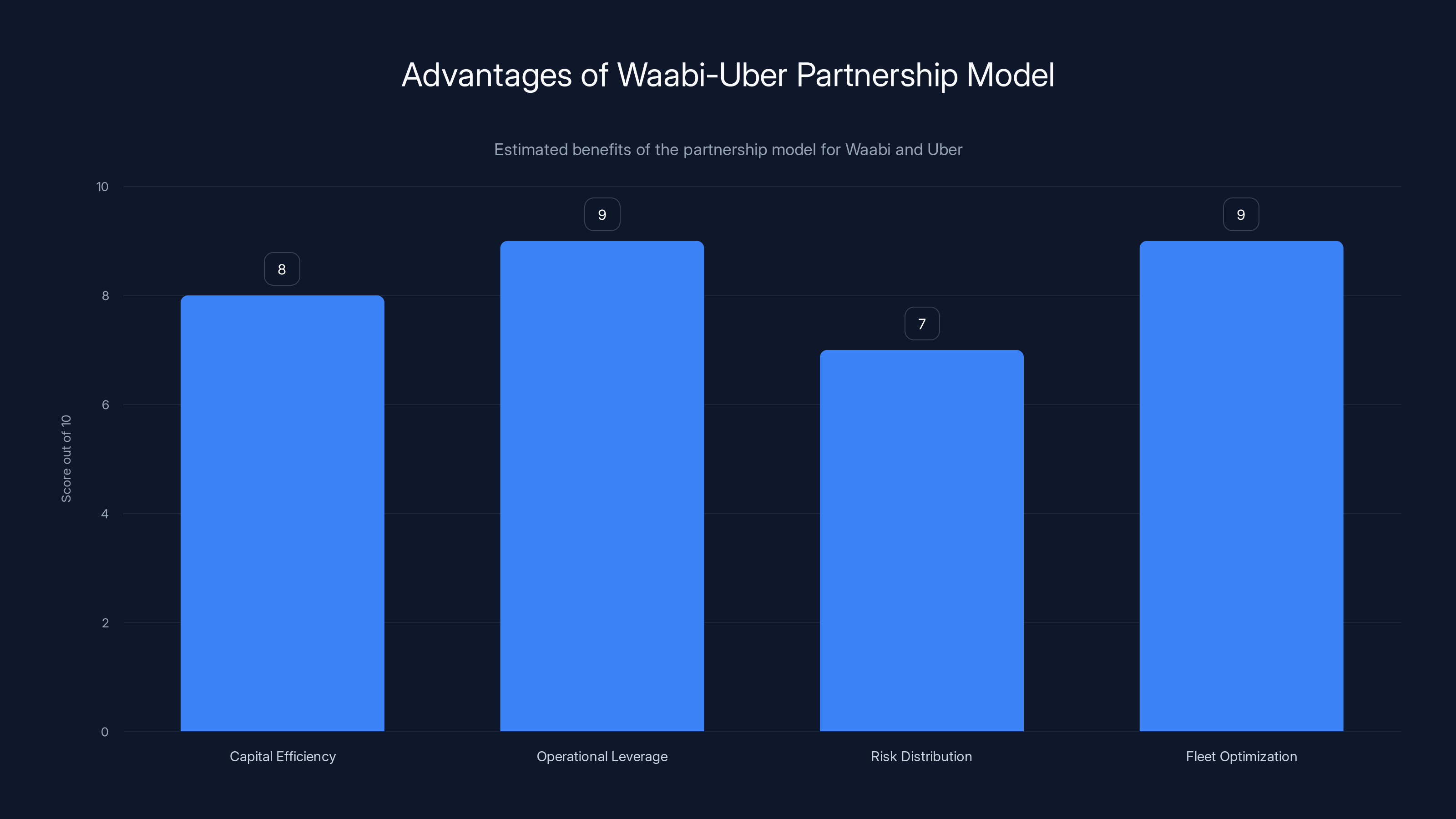

The partnership model provides significant advantages in capital efficiency, operational leverage, risk distribution, and fleet optimization. Estimated data based on qualitative analysis.

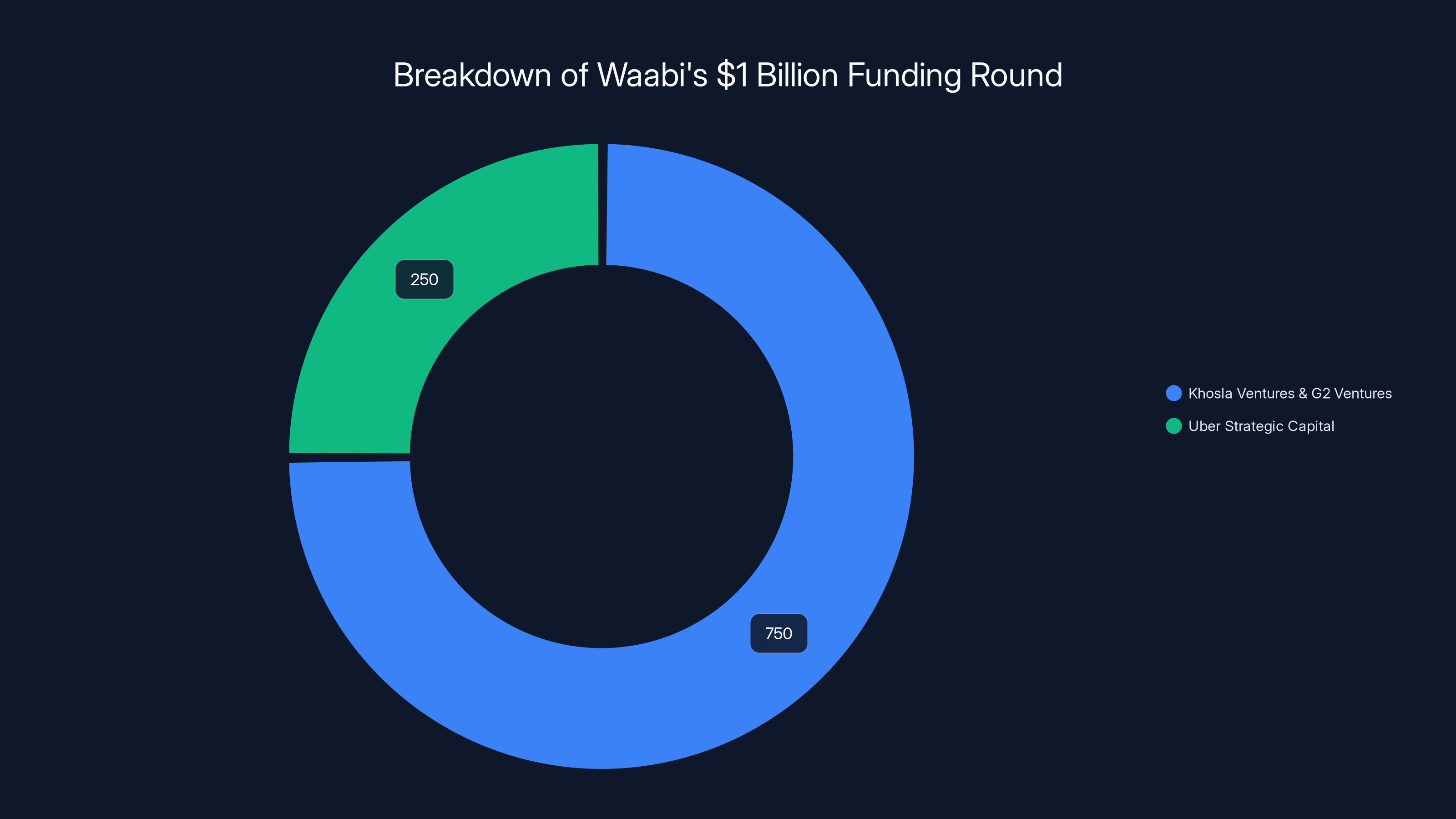

Decoding the $1 Billion Funding Round: Structure and Implications

The funding announcement deserves careful examination because the structure reveals much about investor confidence and actual financial commitments.

The Series C Round: $750 Million from Khosla and G2 Ventures

Waabi's Series C round, led by Khosla Ventures and G2 Venture Partners, represents

G2 Venture Partners, while less widely known than Khosla, brings Asia-Pacific expertise and connections. The fact that Waabi attracted both suggests the company's investors recognize significant opportunities not just in North America but in global autonomous vehicle deployment.

Series C funding, by definition, indicates that Waabi has successfully demonstrated product-market fit or technological validation beyond early-stage proof of concept. Investors contributing at this stage are betting that the company has proven core capabilities and has clear pathways to revenue and profitability. In the autonomous vehicle space, this translates to demonstrated ability to deploy working autonomous vehicles in real conditions.

The oversubscribed nature of the round—meaning demand from investors exceeded available equity—is significant. It indicates that numerous other venture capital firms wanted to participate but Waabi's existing investors elected to retain larger ownership stakes rather than dilute heavily. This speaks to confidence in the company's trajectory.

The Uber Deal: $250 Million+ in Strategic Capital

The remaining portion of the

This structure is crucial: Uber isn't making a passive venture investment in Waabi. It's paying for specific technological development aligned with Uber's commercial interests. This introduces several important dynamics:

Risk Mitigation for Waabi: By securing funding directly tied to development milestones, Waabi has predictable capital flow conditional on demonstrable progress. Unlike venture capital that might be delayed if market conditions deteriorate, commercial funding from Uber continues as long as development objectives are met.

Incentive Alignment: Uber has skin in the game. The company's investment in Waabi success means Uber will likely provide operational support, regulatory assistance, and platform integration support beyond typical vendor relationships. This transforms the partnership from transactional to genuinely collaborative.

Valuation Implications: While Waabi hasn't disclosed post-money valuation, the funding structure suggests the company is valued at somewhere between $3-5 billion. This represents extraordinary growth from a startup founded in 2021, though still below public autonomous vehicle companies when adjusted for actual deployed fleet size.

What the Funding Enables: Capital Allocation Strategy

With $1 billion in new funding, Waabi can pursue multiple simultaneous objectives:

Engineering and Talent: Scaling from a specialized research team to hundreds of engineers capable of delivering production-grade autonomous driving systems. This likely includes hiring specialists in machine learning, robotics, hardware integration, and safety validation.

Hardware and Vehicles: Procuring or manufacturing prototype and pre-commercial robotaxis for testing and early deployment. Working with vehicle manufacturers (like Volvo for trucks) involves purchasing significant quantities for customization and integration.

Testing Infrastructure: Building simulation environments, data annotation pipelines, and real-world testing grounds where the company can validate robotaxis before commercial deployment.

Regulatory Navigation: Funding legal and government affairs teams capable of engaging with transportation authorities in multiple jurisdictions. Deploying 25,000 vehicles globally requires regulatory approval in numerous cities and countries.

Safety and Validation: Investing in third-party safety validation, insurance partnerships, and liability frameworks that insurance companies and regulatory bodies require.

Notably, the funding doesn't appear allocated to acquiring existing fleet infrastructure or paying for deployment rights. This suggests Uber will provide the platform infrastructure (pickup dispatch, user interface, customer support) while Waabi provides the core autonomous driving technology.

The Partnership Architecture: How Waabi and Uber Will Operate Together

The Waabi-Uber partnership represents a specific model of autonomous vehicle commercialization that differs fundamentally from how some competitors operate.

Waabi as Technology Provider, Not Fleet Operator

Urtasun explicitly stated that Waabi considers itself a technology provider, not a fleet owner or operator. This distinction carries significant implications that often get lost in headlines announcing "25,000 robotaxis."

When analysts and journalists hear "25,000 robotaxis," they envision 25,000 vehicles rolling onto streets with Waabi's technology. But the actual arrangement is more nuanced. Waabi will develop and license its autonomous driving software. Uber will operate the fleet, own the vehicles, manage customer relationships, handle surge pricing, and conduct all rider-facing operations.

This model offers several advantages:

Capital Efficiency for Waabi: The company doesn't need to raise tens of billions for vehicle acquisition, maintenance, insurance, and operations. It focuses capital on technology development—its area of core competency.

Operational Leverage for Uber: Uber brings existing relationships with insurance providers, manufacturers, regulatory bodies, and city governments. Rather than Waabi learning these relationships from scratch, Uber's operational infrastructure gets leveraged for Waabi's technology.

Risk Distribution: If autonomous driving proves harder than expected and deployment timelines slip, Uber absorbs the carrying cost. Waabi's primary obligation is technological—develop working autonomous driving systems—rather than operational survival.

Fleet Optimization: Uber can deploy Waabi's technology across its existing platform with Uber's 150+ million users. Waabi doesn't need to build its own user interface, payment systems, or customer service infrastructure.

However, this model also creates potential tensions. Uber needs vehicles deployed quickly to generate revenue and justify the investment. Waabi needs time to thoroughly validate technology before exposing passengers to safety risks. These incentives might conflict, creating pressure on Waabi to deploy before the company judges the system fully ready.

Vehicle Platform and Hardware Integration

The most striking detail Urtasun declined to provide: which vehicle platform Waabi will use for its robotaxis. Will the company work with Volvo (as with trucks)? Partner with another manufacturer? Use existing vehicle platforms from other OEMs?

This decision will significantly impact deployment timeline and capability. Working with an existing manufacturer (like Volvo, BMW, or Geely) offers faster time to market but less optimization. Designing purpose-built robotaxis (as Waymo has done) enables better hardware-software co-optimization but extends development timelines by years.

Given the aggressiveness of the deployment target, Waabi likely needs to work with an existing manufacturer rather than develop completely custom hardware. Volvo, which already integrates Waabi's autonomous trucking systems, represents a natural choice, though the company might also partner with other manufacturers willing to provide vehicles with sufficient sensor integration and compute infrastructure.

The vehicle platform decision will reveal much about Waabi's true timeline and commitment level.

Geographic Rollout Strategy

Urtasun declined to specify target markets for the initial deployment, stating only that Uber will determine deployment priorities based on regulatory approval, fleet needs, and market demand. This is both sensible and revealing.

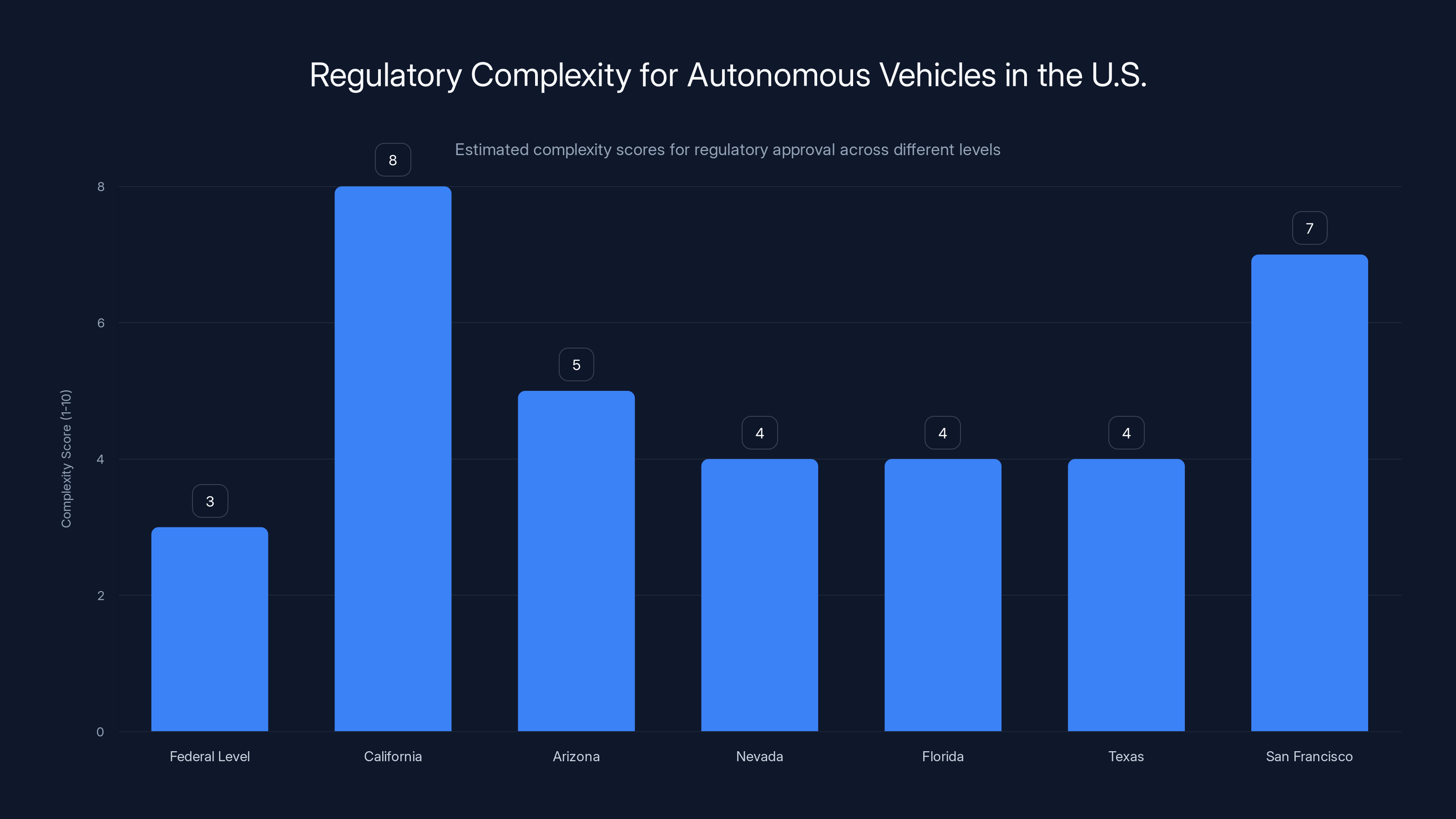

Waabi will likely face very different regulatory environments in different jurisdictions:

- Most Permissive: Arizona (where Waymo operates), California, and potentially Nevada have relatively streamlined robotaxi approval processes

- Moderate: Texas, Florida, and several Northeast states have emerged pathways but remain cautious

- Restrictive: Many northeastern and western states require extensive testing, insurance validation, and local government approval

- International: Canada (where Waabi is based), and potentially Singapore, present different regulatory frameworks

The initial deployment will likely concentrate in permissive jurisdictions where Uber already operates robotaxi services. Phoenix, Arizona and San Francisco, California seem probable starting points. Once Waabi accumulates operational data and safety validation, expansion to more restrictive markets becomes feasible.

The "minimum 25,000 vehicles" deployment will almost certainly occur across multiple cities and jurisdictions rather than concentrating 25,000 vehicles in a single market.

California and San Francisco present the highest regulatory complexity for autonomous vehicle approval, while federal regulations remain less stringent. Estimated data.

Technical Deep Dive: How Waabi's Robotaxis Will Function

Understanding what makes Waabi's robotaxis different from competitors' approaches requires examining the technological architecture.

Perception: Seeing the World

Waabi's robotaxis must perceive their environment with sufficient accuracy to detect and categorize all traffic participants, obstacles, and relevant features. The company likely employs a multi-sensor fusion approach combining:

Camera Systems: Multiple cameras (front, rear, side, surround) capture detailed visual information. Modern neural networks can identify vehicles, pedestrians, cyclists, traffic signals, lane markings, road signs, and temporary obstacles from camera feeds.

Lidar Sensors: Light detection and ranging systems emit laser pulses and measure reflections to create three-dimensional maps of the surrounding environment. Lidar excels at measuring distance and identifying objects in poor lighting conditions where cameras struggle.

Radar Sensors: Radar complements lidar and cameras by detecting moving objects and measuring velocity, particularly valuable in adverse weather when cameras and lidar performance degrades.

Ultrasonic Sensors: Short-range ultrasonic systems provide close-range obstacle detection critical for low-speed maneuvering.

The specific hardware configuration depends on the vehicle platform chosen. Purpose-built robotaxis might have optimally positioned sensor arrays; retrofitted existing vehicles would work with hardware placements designed for human drivers.

Waabi's AI-centric approach means these sensor streams feed into integrated neural networks rather than separate perception pipelines. The system learns which sensors to trust in different conditions and how to combine information from multiple sources into coherent representations of the driving environment.

Prediction: Anticipating the Future

Autonomous vehicles don't simply react to the current state of the world—they must predict how the world will evolve seconds into the future. A pedestrian standing at a crosswalk might step into the road; a vehicle in an adjacent lane might change lanes; traffic light patterns follow predictable sequences.

Waabi's prediction module takes perceived objects (vehicles, pedestrians, cyclists) and their current motion vectors, then generates probability distributions for their future locations. This requires understanding human behavior:

- Driver intent: Why is that car slowing down? Is the driver preparing to turn, stopping at a red light, or just reducing speed temporarily?

- Pedestrian behavior: Will the pedestrian cross the street or remain on the sidewalk? At what speed?

- Traffic patterns: How do vehicles typically behave at this specific intersection during this time of day?

AI-centric prediction systems learn these patterns from massive amounts of real-world driving data. Rather than encoding explicit rules ("pedestrians looking at phones are more likely to step into the street"), the system learns statistical correlations between observable features and subsequent behavior.

This prediction capability is essential for safe autonomous driving. When a robotaxi approaches an intersection, it predicts the trajectory of all traffic participants and confirms that following the planned route won't result in collision.

Planning: Deciding the Path

Given perceptions of the current state and predictions of future states, Waabi's planning module must decide the robotaxi's trajectory—acceleration, steering rate, and overall path through the environment.

Planning must balance competing objectives:

- Safety: Most critical—avoid any collision or trajectory that threatens occupant or pedestrian safety

- Legality: Follow traffic laws, respect signals and signs, obey lane restrictions

- Comfort: Passengers experience unpleasant acceleration, jerk, and swerving; plan smooth trajectories

- Efficiency: Take reasonable routes, don't waste fuel or time

- Traffic Flow: Anticipate how the robotaxi's actions affect surrounding traffic; cooperate with human drivers

AI-centric planning learns these trade-offs from training data showing how human drivers handle similar scenarios. The system learns that sometimes it's safer to slow down than to execute an aggressive maneuver; other times minor course corrections prevent larger conflicts.

Modern planning approaches (sometimes called "end-to-end" or "imitation learning") train neural networks to directly output desired steering and acceleration values given perceived sensor inputs. This contrasts with traditional approaches that explicitly encode decision logic.

Control: Executing the Plan

Once the planning system has decided a desired trajectory, the control module translates that into actual vehicle commands—steering wheel angle, throttle position, brake application.

Control systems must account for vehicle dynamics—how steering inputs affect actual vehicle heading, how quickly brakes decelerate the vehicle, how weight distribution affects handling. They must also compensate for variations in road conditions (wet vs. dry, uphill vs. downhill) and vehicle state (tire wear, load, suspension wear).

Waabi likely uses a combination of learned and traditional control approaches. Modern machine learning can handle the high-level decision of desired trajectory, while traditional control theory ensures smooth, stable execution of that trajectory.

The Integration: Why AI-Centric Design Matters

The key insight behind Waabi's approach is that these modules aren't trained independently. A system trained to perceive objects, then trained separately to predict behavior, then trained separately to plan trajectories will inevitably make suboptimal decisions because the modules can't communicate about their confidence levels and assumptions.

Instead, Waabi appears to train integrated systems where perception, prediction, and planning optimize jointly. During training, the system learns which perceptual features are most useful for making good planning decisions. It learns which predictions matter most for safe driving. It learns how to gracefully degrade when sensor information is ambiguous.

This integration is why Waabi's trucking experience translates to robotaxis despite different operating environments. The underlying AI architecture—how to integrate perception, prediction, and planning—remains valid. The training data changes (urban streets instead of highways) but the approach remains consistent.

Safety Validation and Liability Framework

Deploying autonomous vehicles without human safety drivers represents an enormous liability undertaking. Waabi and Uber must address multiple dimensions of safety validation and legal responsibility.

Pre-Deployment Safety Validation

Before a single robotaxi picks up a paying customer, Waabi must demonstrate that the technology meets or exceeds human driver safety levels. This requires:

Simulation Testing: Generating millions of simulated driving scenarios representing diverse real-world conditions. Modern autonomous driving simulators can recreate complex urban environments, weather conditions, and edge cases that occur rarely in real-world testing.

Real-World Testing: Accumulating millions of miles of public road testing in controlled conditions—often with safety drivers initially, then monitoring systems without human intervention. This real-world data identifies failure modes that simulation doesn't capture.

Third-Party Validation: Independent safety organizations reviewing testing methodology, safety systems, and redundancy. Companies like the California Department of Motor Vehicles or international standards organizations (ISO) provide frameworks for validation.

Statistical Comparison: Demonstrating that the robotaxi's crash rate (per mile or per hour) is lower than human driver crash rates. This is tricky because human crash data comes from millions of drivers while robotaxi data comes from limited testing.

Waabi hasn't disclosed specific safety metrics, but industry standards suggest that before deploying a commercial robotaxi service with no safety drivers, a company should demonstrate multiple years of testing without serious safety failures.

Liability and Insurance

Who bears legal responsibility when a Waabi robotaxi causes an accident? This question involves complex negotiation between Waabi, Uber, insurance companies, and regulators.

Typical liability frameworks might allocate responsibility as follows:

-

Product Liability: Waabi, as the autonomous driving system manufacturer, bears responsibility for defects in the perception, prediction, or planning systems. If the system failed to perceive an obstacle or made an unjustifiably dangerous decision, Waabi could be liable.

-

Operational Liability: Uber, as the fleet operator and customer-facing service, bears responsibility for ensuring proper maintenance, proper deployment of vehicles in conditions they're designed for, and proper insurance coverage.

-

Regulatory/Government: The government holds responsibility for setting safety standards and permitting vehicles they deem unsafe.

In practice, insurance companies will likely demand hybrid arrangements where Waabi maintains liability insurance for its technology and Uber maintains operational liability insurance. The specific percentages and allocation remains subject to negotiation and regulatory approval.

This allocation of responsibility creates economic incentives for both companies to prioritize safety. Waabi wants to minimize technology failures; Uber wants to minimize operational incidents.

Redundancy and Fail-Safe Design

Waabi's autonomous driving systems incorporate multiple layers of redundancy:

Sensor Redundancy: Multiple cameras, lidar units, and radar systems provide overlapping perception so that failure of a single sensor doesn't create blind spots.

Compute Redundancy: Multiple processors running perception and planning algorithms; if one fails, others continue operating.

Software Redundancy: Different software implementations of critical functions so that a single software bug doesn't cause system failure.

Fallback Behaviors: When detecting anomalies (sensor failures, unexpected readings), the system has predetermined safe behaviors—typically gradual deceleration and movement to the roadside.

These redundancy layers ensure that minor failures don't cascade into accidents.

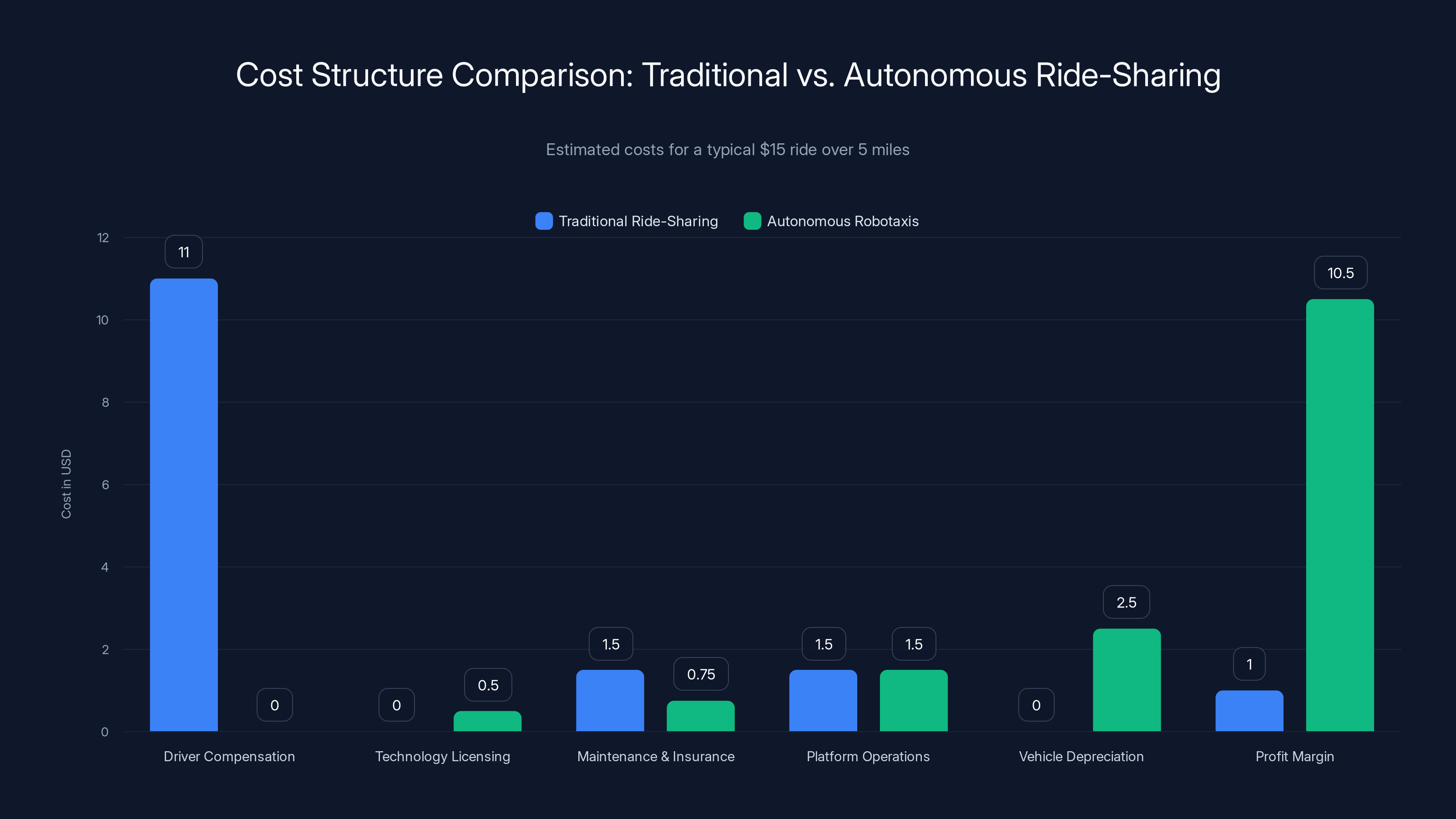

Autonomous robotaxis significantly increase profit margins by eliminating driver compensation, despite higher vehicle costs and technology licensing fees. (Estimated data)

Timeline and Deployment Phases: When Will Robotaxis Arrive?

Urtasun notably declined to provide a specific deployment timeline, a conspicuous omission that deserves analysis.

The 2025-2026 Window

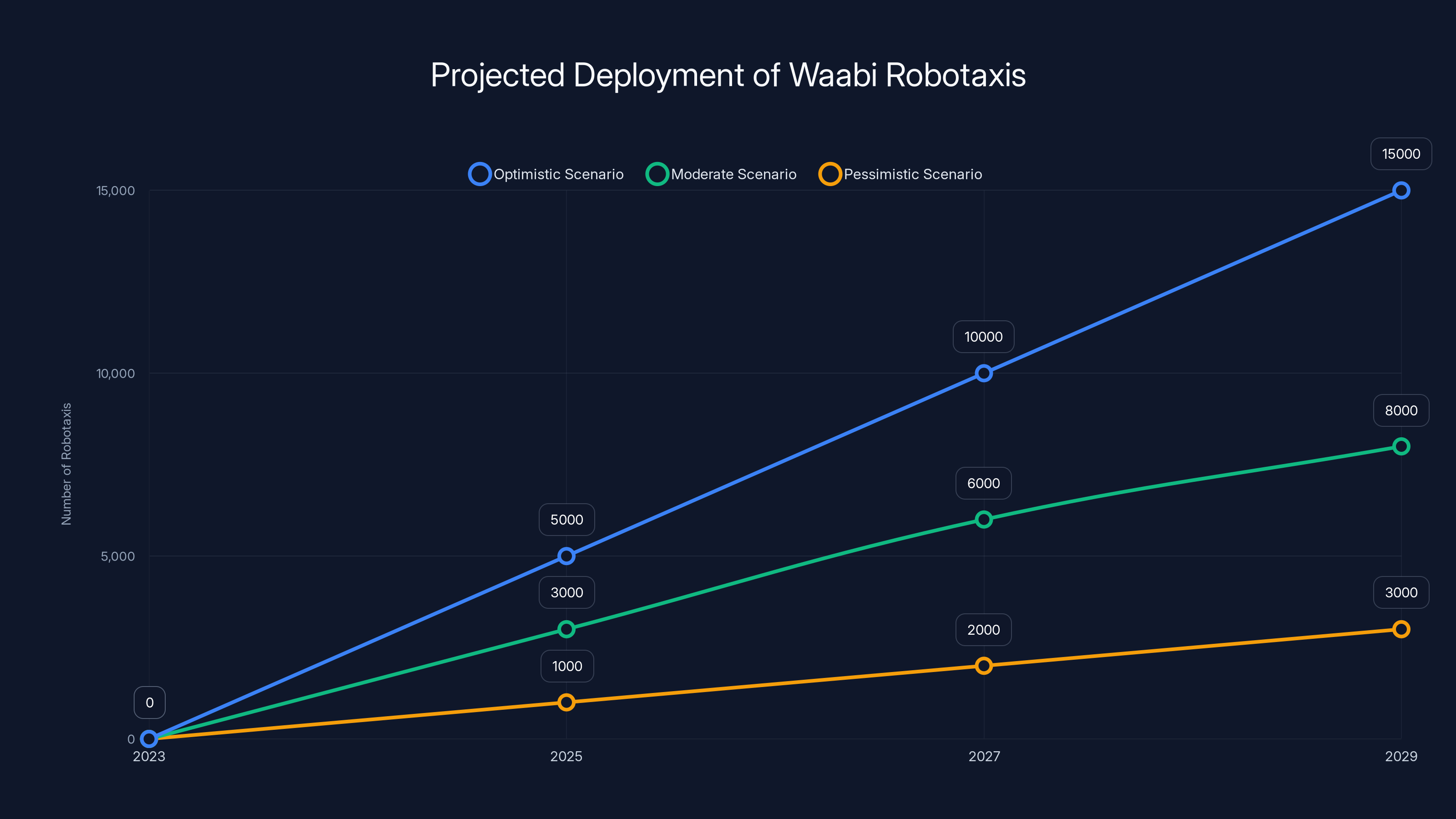

Based on typical autonomous vehicle development timelines and Waabi's current state of development, the company is likely targeting initial robotaxi deployment in 2025-2026. This assumes:

- Development and validation testing have reached sufficient maturity in late 2024

- Vehicle platform decisions have been finalized

- Regulatory approval processes in initial markets are underway

- Pilot programs begin in 2025 with small fleets (100-500 vehicles)

Initial deployments will almost certainly face delays and complications, similar to Waymo's experience. Regulatory approval often takes longer than anticipated. Safety testing reveals unexpected edge cases requiring additional development.

The 2026-2027 Scaling Phase

Assuming successful pilot programs, Waabi would expand deployment through 2026-2027. This phase involves:

- Expanding to additional geographic markets

- Growing fleet sizes from hundreds to thousands of vehicles per city

- Identifying and resolving operational challenges that pilot programs revealed

- Iterating on the autonomous driving system based on real-world operational data

By the end of 2027, Waabi might realistically have deployed 2,000-5,000 robotaxis across multiple cities.

The 2028-2030 Growth Phase

Reaching the 25,000 vehicle deployment target likely requires 2028-2030. This assumes:

- The platform has proven sufficiently reliable that insurance and regulators are confident

- Uber has identified 8-15 cities where robotaxi deployment makes business sense

- Manufacturing and deployment logistics are streamlined

- The autonomous driving system has been refined through multiple iterations

This timeline aligns roughly with Waymo's own deployment pace, suggesting it represents realistic autonomous vehicle industry progression.

Risks to the Timeline

Several factors could accelerate or delay deployment:

Accelerators:

- Faster than expected regulatory approval as regulators gain confidence in autonomous vehicles

- Unexpected breakthroughs in AI systems or perception technology

- Major accidents involving human-driven vehicles in deployment markets, increasing regulatory appetite for autonomous alternatives

Delays:

- Safety-critical bugs identified during testing, requiring substantial development work

- Regulatory resistance or incidents involving competitors that trigger tighter restrictions

- Technical challenges with hardware-software integration or perception in adverse weather

- Failure to secure manufacturing capacity or supply chain disruptions

- Unexpected accidents or safety concerns that undermine public confidence

Competitive Landscape: Where Waabi Stands

Waabi enters a competitive autonomous vehicle market with well-funded, well-established competitors.

Waymo: The Leader

Waymo, Alphabet's autonomous vehicle division, currently operates the most advanced commercial robotaxi service. Operating in Phoenix, Arizona and San Francisco, California, Waymo has:

- Accumulated over 20 million autonomous miles of testing

- Generated revenue from paying customers

- Achieved regulatory approval in multiple jurisdictions

- Demonstrated technological capability through years of public operations

Waymo's advantages include Alphabet's funding, technical expertise, and patience. Alphabet doesn't depend on Waymo's near-term profitability, allowing the company to invest heavily in long-term capability building.

Waymo's disadvantages include its insular culture (many employees moved from Google) and limited relationship with ride-sharing platforms beyond some Uber integration.

Tesla: The Wild Card

Tesla claims to be developing autonomous driving capabilities, particularly its "Full Self-Driving" (FSD) system. Tesla's advantage is its existing fleet of millions of vehicles that could potentially be retrofitted with autonomous capabilities.

Tesla's disadvantages include its unproven capability claims, limited public safety data, and tendency to overpromise on timelines. As of 2024, Tesla hasn't deployed a commercial robotaxi service despite years of claims.

Aurora: The Well-Funded Competitor

Aurora, founded by former Tesla, Waymo, and Uber executives, has raised over $1 billion and developed autonomous driving technology. Aurora initially focused on trucking (mirroring Waabi's path) but has pivoted toward rideshare applications.

Aurora's partnerships with multiple vehicle manufacturers and ride-sharing platforms provide advantages. Its disadvantages include later-stage technology maturity compared to Waymo and questions about whether its funding will last through commercialization without revenue.

Cruise: The Struggling Player

Cruise, operated by GM, achieved significant early success but faced setbacks in 2023-2024 following high-profile incidents and safety concerns. The company has scaled back deployment ambitions and refocused on foundational technology work.

Cruise's remaining advantages include GM's manufacturing capability and patient capital. Its disadvantages include damaged public perception and reduced funding appetite from parent company GM.

The Broader Competitive Field

Beyond these well-known names, dozens of startups globally pursue autonomous vehicle technologies:

- Mobileye (Intel's autonomous driving unit) focuses on driver assistance and partial autonomy

- Motional (backed by Hyundai/Aptiv) pursues both robotaxi and delivery applications

- Baidu and other Chinese companies deploy robotaxis in China with different regulatory environments

- Regional players in Singapore, Japan, and Europe pursue localized autonomous vehicle services

How Waabi Compares

Waabi's competitive position in 2024 can be characterized as strong but unproven at scale:

Advantages:

- Founder credibility (Urtasun's background at Uber ATG)

- AI-centric technical approach potentially offering better long-term performance

- Strategic partnership with Uber providing market access

- Fresh capital enabling rapid scaling

- Geographic advantage in Canada with growing autonomous vehicle support

Disadvantages:

- No commercial robotaxi operations to date (only testing)

- Later-stage entry compared to Waymo's 15+ years of development

- Smaller accumulated testing data compared to competitors

- Lack of manufacturing relationships or production vehicles

- Unproven ability to commercialize at scale

In the competitive race, Waabi is neither frontrunner nor laggard. It's a well-positioned challenger with significant advantages but much to prove.

The chart illustrates three potential scenarios for Waabi's robotaxi deployment, ranging from rapid expansion to prolonged delays. Estimated data shows significant differences in deployment numbers by 2029.

Regulatory Landscape: Navigating Global Approval Processes

Waabi's success depends not on technology alone but on regulatory approval across multiple jurisdictions where Uber operates robotaxi services.

United States Regulatory Framework

The United States has fragmented regulatory authority over autonomous vehicles:

Federal Level: The National Highway Traffic Safety Administration (NHTSA) sets safety standards and could regulate autonomous vehicles federally, but has largely taken a light-touch approach, allowing states and local authorities to lead regulation.

State Level: California's Department of Motor Vehicles (DMV) has established one of the most developed frameworks for autonomous vehicle testing and deployment. The state requires:

- Manufacturers to obtain testing permits

- Detailed safety reports and incident documentation

- Performance data demonstrating safety levels

- Insurance and bonding requirements

Other states like Arizona, Nevada, Florida, and Texas have created their own frameworks, often less restrictive than California.

Local Level: City and county governments sometimes impose additional restrictions or requirements. San Francisco, for example, has limited robotaxi operations to specific areas and requires specific approval from the city.

Regulatory Approval for Waabi's Robotaxis

Waabi will likely navigate approval as follows:

Phase 1: Testing Permits - Obtain state-level testing permits in California, Arizona, and other priority states. This involves submitting safety data, insurance documentation, and safety plans.

Phase 2: Driverless Operation Approval - Demonstrate through testing data that vehicles can operate safely without safety drivers, enabling operation in public with no human backup.

Phase 3: Commercial Operation Approval - Obtain specific permits to operate commercial robotaxi services, likely city-by-city in addition to state approval.

Phase 4: Expanded Deployment - Once successful operations in initial markets prove the model, expansion to additional states and cities becomes faster.

This progression typically spans 2-4 years for each state, explaining why the 25,000 vehicle deployment likely requires until 2028-2030.

International Regulatory Considerations

Waabi, as a Canadian company, may pursue early deployment in Canada:

Canada: The country has shown openness to autonomous vehicle testing and deployment. BC, Ontario, and Alberta have established regulatory frameworks more permissive than many U. S. states. Early Canadian deployment could provide valuable operational data and regulatory validation.

Europe: European Union countries increasingly regulate autonomous vehicles through ISO standards and national frameworks. Early European pilot programs might occur, though full commercial deployment likely follows North American success.

China: Chinese regulators have approved robotaxi operations in several cities. If Uber expands to China, Waabi might need to adapt its technology to Chinese regulatory requirements and Chinese manufacturers.

Financial Implications: Economics of Autonomous Robotaxis

Waabi's business case depends on whether autonomous robotaxis can achieve unit economics better than human-driven ride-sharing.

Cost Structure of Traditional Ride-Sharing

Uber's traditional ride-sharing model involves:

- Driver Compensation: 75% of revenue (the largest cost component)

- Fleet Maintenance: Vehicle wear, repairs, insurance

- Platform Operations: Customer service, technology infrastructure, payments processing

- Corporate Overhead: Management, marketing, regulatory affairs

For a typical $15 ride:

- ~$11 goes to driver compensation

- ~$1.50 to platform operations

- ~$1.50 to vehicle maintenance and corporate overhead

- ~$1 profit margin (before taxes)

Cost Structure of Autonomous Robotaxis

Autonomous robotaxis replace driver compensation with autonomous driving technology:

Capital Costs: Robotaxis cost significantly more to develop (billions in R&D), but per-vehicle manufacturing costs might reach

Operational Costs:

- Technology licensing from Waabi: Estimated $0.05-0.15 per mile

- Fleet maintenance: Actual per-mile costs similar or slightly higher than human-driven vehicles due to advanced sensor systems

- Remote assistance: Initial deployments might require remote operators monitoring vehicles or handling edge cases, costing $0.02-0.05 per mile

- Insurance: Costs TBD but likely $0.03-0.08 per mile

Operating Economics Model: Assuming a $15 ride over 5 miles:

- Technology licensing: $0.25-0.75

- Maintenance and insurance: $0.50-0.75

- Platform operations: $1.50 (unchanged from human-driven model)

- Vehicle depreciation and carrying costs: $2.00-3.00

- Profit margin: $10.00-11.00

In this model, autonomous robotaxis are dramatically more profitable than human-driven alternatives because driver compensation is eliminated and replaced with predictable technology costs.

Break-Even Analysis and Timeline

However, this profitability depends on reaching sufficient scale. Waabi's technology development costs $1+ billion. Recovering this requires:

- Deploying vehicles across many markets to achieve sufficient scale

- Operating long enough to amortize development costs

- Achieving targeted per-mile technology costs through optimization

If Waabi successfully deploys 25,000 vehicles that each drive 150,000 miles annually, that's 3.75 billion miles per year. At

The path to profitability likely requires:

- Technology licensing revenue from Uber ($300-400 million annually at scale)

- Technology licensing to other platforms (Toyota, other ride-sharing services)

- Expansion into autonomous trucking applications

- Potential sale or merger with larger automotive company

This explains why the Uber partnership is so valuable—it provides the scale necessary to achieve profitability from the core technology business.

The

Industry Ripple Effects: Broader Implications of Waabi's Success

If Waabi successfully deploys tens of thousands of autonomous robotaxis, the consequences extend far beyond the company itself.

Labor Market Disruption

The autonomous vehicle industry threatens approximately 3.5 million professional drivers in the United States alone. While complete replacement of human drivers might take 10-20 years, significant displacement could begin within 5-10 years if autonomous vehicles prove reliable and economical.

This creates policy challenges:

- Worker retraining programs: Governments may need to fund retraining for drivers transitioning to other occupations

- Unemployment insurance: Extended benefits or universal basic income programs might become necessary

- Social stability: Rapid job displacement without adequate support could create significant social disruption

These aren't Waabi's direct problems, but they are inevitable consequences of the company's success.

Urban Planning and Infrastructure

An abundance of autonomous robotaxis might reshape urban transportation and planning:

Positive Effects:

- Reduced parking demand (autonomous vehicles can be continuously utilized rather than parked)

- Improved traffic flow (autonomous vehicles coordinate more efficiently than human drivers)

- Reduced vehicle ownership (shared autonomous vehicles are more economical than private ownership)

- Decreased traffic fatalities (autonomous vehicles eliminate human error, the leading cause of accidents)

Negative Effects:

- Increased vehicle miles traveled (autonomous, affordable rides might induce more travel)

- Reduced public transit usage (autonomous rides are convenient, potentially cannabilizing transit passengers)

- Congestion in initial deployment areas (cheap robotaxi rides might overwhelm streets)

Cities will need to strategically manage autonomous vehicle deployment to realize benefits while minimizing downsides.

Insurance and Liability Industry Transformation

Shift from human-driven to autonomous vehicles creates fundamental changes in how transportation risks are insured and managed. If autonomous vehicles prove dramatically safer than human drivers, insurance costs could plummet, fundamentally changing the economics of ownership and operation.

Insurance companies will need to develop entirely new actuarial models for autonomous vehicles, creating opportunities for innovative insurance startups while threatening traditional models.

Energy and Environmental Implications

Autonomous vehicles create complex environmental effects:

- Increased vehicle miles (more driving) might increase total energy consumption even if per-mile efficiency improves

- If autonomous vehicles transition to electric powertrains (eliminating combustion engines), emissions could decrease significantly

- Manufacturing autonomous vehicles requires substantial energy; lifecycle emissions must be evaluated holistically

Alternative Solutions and Comparison: How Waabi Fits the Autonomous Vehicle Landscape

Waabi isn't the only technological approach to autonomous vehicles, and understanding alternatives helps contextualize the company's strategy.

Technical Approaches to Autonomous Driving

End-to-End Learning (Waabi's Approach) Training integrated neural networks to map sensor inputs directly to driving decisions. Advantages include learning from real-world data and adaptation to novel scenarios. Disadvantages include difficulty explaining decision-making and challenges validating safety in rare edge cases.

Rules-Based Hierarchical Systems (Waymo's Traditional Approach) Explicitly programming decision trees and rules for vehicle behavior. Advantages include interpretability and explicit safety constraints. Disadvantages include difficulty handling novel scenarios and brittleness when rules don't apply.

Hybrid Approaches (Most Modern Implementations) Combining learned components with rule-based safety guarantees. Deep learning handles perception and prediction; rule-based planning ensures safety constraints are always respected. This is increasingly becoming industry standard because it balances adaptability with safety assurance.

Hardware Approaches

Lidar-Centric (Waymo, Aurora) Reliing heavily on lidar sensors for perception, supplemented by cameras and radar. Lidar provides precise 3D information essential for planning. Disadvantages include high cost and potential vulnerabilities to certain weather conditions.

Camera-Centric (Tesla FSD) Relying primarily on cameras with minimal lidar. Reduces costs but creates challenges in low-light or adverse weather conditions.

Sensor Fusion (Most Others, Including Waabi) Combining multiple sensor types with system designed to gracefully degrade if any single sensor fails. This is becoming the industry standard approach.

Data and Validation Approaches

Accumulated Real-World Data (Waymo) Companies with large fleets of operational vehicles accumulate continuous operational data, used to improve systems. This creates a network effect where larger fleets generate better technology.

Simulation-Based (Waabi) Rying heavily on simulation to test millions of scenarios without requiring real-world miles. Reduces testing time but creates risks if simulation doesn't accurately model reality.

Hybrid (Most Advanced Companies) Using simulation for initial testing and development, real-world data to identify and fix simulation gaps.

Organizational Approaches

Integrated Hardware-Software (Waymo, Tesla) Companies developing both autonomous driving technology and vehicles. Advantages include optimization and control; disadvantages include high capital requirements.

Technology Licensing (Waabi, Mobileye) Companies developing autonomous driving technology and licensing to vehicle manufacturers and platforms. Advantages include lower capital requirements and broader reach; disadvantages include less control over implementation and deployment.

OEM-Integrated (Motional, Aurora with Hyundai) Partnershipswith vehicle manufacturers ensuring technology is properly integrated. Advantages include manufacturing expertise; disadvantages include potential conflicts of interest and slower decision-making.

How Waabi's Strategy Compares

Waabi's approach combines:

- AI-centric technical strategy: Unified end-to-end learning for integrated perception-prediction-planning

- Sensor fusion hardware: Multiple sensor types with redundancy

- Hybrid validation: Simulation-heavy development with real-world testing

- Technology licensing model: Licensing to Uber and potentially other platforms

- Partnership-based commercialization: Working with Uber for deployment rather than building parallel infrastructure

This combination is relatively unique. Most companies emphasize some aspects more than others. Waabi's balance appears designed for:

- Speed to commercialization: Focus on validation and safety through rigorous testing rather than waiting for perfect theoretical understanding

- Capital efficiency: Technology licensing avoids massive capital expenditure on fleet and operations

- Scalability: Partnership with Uber provides immediate access to global deployment infrastructure

- Technological advantage: AI-centric approach potentially offers long-term advantages if it generalizes better to diverse scenarios

The approach isn't without risks. Unlike Waymo, Waabi doesn't directly operate vehicles, limiting real-world data accumulation. Unlike Tesla, Waabi doesn't have millions of vehicles in the field from which to gather operational data. The company depends on partnerships for deployment, potentially creating conflicts if partners have different priorities.

Future Scenarios: How This Partnership Could Evolve

The Waabi-Uber partnership could evolve in several distinct ways over the next 5-10 years.

Optimistic Scenario: Rapid Scaling and Expansion

In this scenario:

- Waabi's technology proves sufficiently reliable that deployment accelerates faster than expected

- By 2027, Waabi has deployed 10,000+ robotaxis across 10+ cities

- Regulatory approval becomes faster as safety data accumulates

- Profitability emerges by 2028-2029

- The partnership is expanded globally; Waabi's technology is deployed on Uber platforms in Europe, Asia, and Latin America

- Waabi expands beyond robotaxis into autonomous delivery and mixed fleets

- Valuation increases to $10-15 billion; company pursues IPO or acquisition by larger automotive/tech company

This scenario requires:

- Continued absence of serious safety incidents

- Regulatory environment remains permissive

- Customer acceptance remains strong

- Technology performance meets or exceeds expectations

Moderate Scenario: Steady Deployment with Complications

In this scenario:

- Deployment occurs but more slowly than optimistic projections

- By 2028, Waabi has deployed 5,000-8,000 robotaxis in 5-7 cities

- Several safety incidents occur, temporarily restricting deployment in some cities

- Regulatory approval becomes more stringent, extending approval timelines

- Profitability emerges by 2029-2030

- Waabi remains primarily Uber-focused but begins licensing to other platforms

- Company valuation grows to $5-8 billion

This scenario requires:

- One or more publicized safety incidents that don't undermine overall viability

- Regulatory environment becomes more cautious

- Customer acceptance remains moderate

- Technology performance meets expectations but isn't transformative

Pessimistic Scenario: Prolonged Delays and Strategic Pivot

In this scenario:

- Fundamental technical challenges emerge that require substantial development work

- Deployment falls years behind schedule; by 2029, only 1,000-2,000 robotaxis operate

- Safety incidents or regulatory setbacks significantly restrict deployment opportunities

- Profitability remains elusive; Waabi burns through funding without generating revenue

- Uber reduces strategic commitment, limiting funding for expansion

- Waabi pivots back toward autonomous trucking or sells technology to competitors

- Eventual outcome: acquisition by larger company at lower valuation or decline into irrelevance

This scenario requires:

- Unexpected technical obstacles that fundamental architectural choices don't address

- Serious safety incident that triggers regulatory crackdown

- Competitor (likely Waymo) achieves dominance, marginalizing other platforms

- Economic downturn reducing investor appetite for ambitious autonomous vehicle ventures

The Middle Path: Strategic Flexibility

Most likely, Waabi's evolution follows a path between these scenarios. The company will face genuine challenges and setbacks but will adapt and persevere because:

- The underlying technology appears sound

- The partnership with Uber provides institutional commitment beyond typical venture funding

- The market opportunity (replacing 3.5 million drivers with autonomous vehicles) is enormous

- Waymo's proven success validates that commercial robotaxi operations are feasible

The key uncertainties are timing and scale, not viability.

Lessons for the Autonomous Vehicle Industry

The Waabi-Uber partnership illustrates broader trends and lessons for autonomous vehicle development.

Lesson 1: Partnership Models Matter More Than Solo Ventures

Waabi's strategy differs fundamentally from competitors who pursue integrated hardware-software-operations stacks. By partnering with Uber, Waabi focuses on technology while leveraging Uber's operational expertise. This potentially allows faster deployment than competitors building entire stacks independently.

This suggests the autonomous vehicle industry might bifurcate into:

- Technology providers: Companies like Waabi and Mobileye that develop autonomy software and license broadly

- Platform operators: Companies like Uber and Tesla that operate fleets and control customer relationships

- OEMs: Traditional and new vehicle manufacturers that provide hardware platforms

Successful autonomous vehicle deployment might require proper integration of all three roles rather than single companies attempting all three.

Lesson 2: The Lidar vs. Camera Debate May Be Resolved Through Hybrid Approaches

The industry debated for years whether autonomous vehicles could operate safely with cameras alone (Tesla's approach) or whether lidar was necessary (Waymo's approach). Waabi's sensor fusion approach suggests the answer is pragmatic: use multiple sensors, design for graceful degradation, and let real-world testing reveal what level of sensor redundancy is actually needed.

This hybrid approach is becoming industry standard, ending the religious debates about single sensor modalities.

Lesson 3: Timeline Slippage Is the Industry Norm

Every autonomous vehicle company has missed deployment timelines. Waabi's reticence to commit to specific deployment dates is wise. The industry is learning that:

- Autonomous vehicle development is harder than initially expected

- Regulatory approval takes longer than predicted

- Real-world edge cases create unexpected challenges

- These delays are normal, not failures

Investors are gradually adjusting expectations accordingly.

Lesson 4: Safety Validation Is Becoming More Sophisticated

Early autonomous vehicle companies relied on simple metrics like "million miles without accidents." The industry is developing more sophisticated safety validation frameworks involving:

- Simulation scenario coverage

- Edge case identification and testing

- Sensor failure mode analysis

- Redundancy and fail-safe mechanism validation

- Third-party independent validation

Waabi's development appears to emphasize these sophisticated validation approaches rather than simply accumulating miles.

Lesson 5: The Economics of Autonomous Vehicles Enable Enormous Value Creation

If autonomous robotaxis achieve unit economics better than human-driven options (which the math suggests they should), the market opportunity is staggering. The global ride-sharing market is worth hundreds of billions annually. If autonomous vehicles can achieve profitability at 10-20% lower costs than human-driven alternatives, the total addressable market expands to trillions of dollars across ride-sharing, delivery, and freight.

This enormous opportunity justifies the investment Waabi has raised and explains why major platforms like Uber are making strategic commitments.

Conclusion: A Pivotal Moment for Autonomous Vehicles

Waabi's announcement of

The company's AI-centric approach to autonomous driving, developed initially for trucking applications, is being adapted for urban robotaxi operations through a partnership with the world's largest ride-sharing platform. This combination of technological sophistication and commercial access to distribution represents a potentially powerful competitive position.

Yet significant uncertainties remain. Waabi hasn't yet deployed a single commercial robotaxi, placing the company in the challenging position of needing to deliver on ambitious promises. The 25,000 vehicle deployment target, while specific, comes without clear timeline or geographic specification. The technology licensing model, while capital-efficient, creates dependencies on partner cooperation and creates potential conflicts if Uber's priorities diverge from Waabi's.

Nevertheless, the fundamentals appear sound. Raquel Urtasun brings credibility and expertise from her previous role at Uber's advanced technologies group. The funding is substantial and includes institutional investors (Khosla Ventures) known for sophisticated deep technology evaluation. The partnership with Uber provides immediate access to deployment infrastructure, regulatory relationships, and customer base that most autonomous vehicle startups would need years to build independently.

If Waabi executes successfully, the company could reshape transportation globally. Commercial robotaxis operating in dozens of cities would validate that autonomous vehicle technology is ready for mainstream deployment, accelerating adoption across the industry. The economic model—replacing driver costs with autonomous driving technology—is so compelling that successful demonstration would likely trigger rapid industry-wide transition.

Conversely, significant setbacks—serious safety incidents, unexpected technical obstacles, or regulatory crackdowns—could set back the entire industry's timeline significantly. Waabi's success or failure will be watched closely by investors, regulators, and competitors as a bellwether for broader autonomous vehicle commercialization.

The coming 3-5 years will be crucial. As Waabi works toward initial deployments and Uber integrates Waabi's technology into its platform, the world will gradually see whether the ambitious promises translate into practical reality. The stakes are enormous—for Waabi, for Uber, and for the global transportation industry.

The Waabi-Uber partnership represents neither the beginning nor the end of autonomous vehicles' transformation of transportation. But it represents a significant waypoint in that journey. Waymo proved commercial robotaxis are technically feasible; Waabi-Uber will demonstrate whether they can be deployed at meaningful scale profitably. Success would validate the enormous capital and effort the industry has invested. Failure would suggest the challenges are even greater than suspected.

In either case, Waabi's journey over the next few years will provide crucial insights into how autonomous vehicles will eventually reshape global transportation.

FAQ

What is Waabi and what does the company do?

Waabi is a Toronto-based autonomous vehicle technology company founded in 2021 by Raquel Urtasun, former chief scientist at Uber's Advanced Technologies Group. The company develops AI-powered autonomous driving systems using an "AI-centric approach" that integrates perception, prediction, and planning into unified neural networks. Waabi initially focused on autonomous trucking applications, testing vehicles on highways in Texas, but has now pivoted toward urban robotaxi operations through a partnership with Uber.

How does Waabi's AI-centric approach differ from competitors' methods?

Waabi's AI-centric approach trains integrated neural networks where perception, prediction, and planning optimize jointly, rather than training separate modules independently. This allows the system to learn which perceptual features matter most for safe driving decisions and how to gracefully degrade when sensor information is ambiguous. This contrasts with some competitors who use more rule-based hierarchical systems or separately trained perception and planning modules, which can make suboptimal decisions because modules can't communicate about confidence levels.

What does the $1 billion funding round include?

Waabi's

How many robotaxis will Waabi deploy and when?

Waabi has committed to deploying a minimum of 25,000 robotaxis on Uber's platform, with CEO Raquel Urtasun emphasizing this is a floor rather than ceiling. However, Waabi declined to specify exact timeline, target markets, or vehicle platforms for the initial deployment. Industry analysis suggests initial deployments likely begin in 2025-2026 in permissive regulatory environments (likely Phoenix, Arizona or San Francisco, California), with scaling through 2027-2030 to reach the 25,000 vehicle target.

What is Waabi's relationship to Uber in this partnership?

Waabi positions itself as a technology provider rather than fleet operator or vehicle manufacturer. Under the partnership structure, Waabi develops and licenses its autonomous driving software while Uber operates the fleet, owns the vehicles, manages customer relationships, handles surge pricing, and conducts all rider-facing operations. This model allows Waabi to focus capital on technology development while Uber leverages its existing operational infrastructure, regulatory relationships, and 150+ million user base.

How does Waabi's technology validate the transition from autonomous trucking to robotaxis?

Waabi argues that the core competencies required for autonomous trucking—teaching an AI system to safely operate vehicles, predict traffic behavior, and execute maneuvers without human control—are fundamentally domain-general. Additionally, the company identifies structural similarities: trucks navigate from specific loading point A to point B (similar to robotaxis navigating from pickup to dropoff), requiring the same tactical maneuvering capabilities despite different overall route complexity. Waabi claims its trucking experience provides validated autonomous driving systems that can be adapted for urban robotaxi operations.

What are the key technical components of Waabi's autonomous driving system?

Waabi's autonomous driving system comprises integrated perception, prediction, and planning components. The perception module uses camera, lidar, radar, and ultrasonic sensors to detect traffic participants and obstacles. The prediction module generates probability distributions for future positions of detected objects. The planning module decides the robotaxi's trajectory balancing safety, legality, comfort, efficiency, and traffic flow. These components are trained jointly rather than independently, allowing the system to learn integrated representations and adaptive behaviors.

What regulatory approvals must Waabi obtain before deploying robotaxis?

Waabi must navigate a fragmented U. S. regulatory landscape involving federal standards (NHTSA), state-level frameworks (particularly California's DMV requirements), and local city/county restrictions. The approval process typically requires obtaining testing permits, demonstrating safety through real-world data, obtaining driverless operation approval allowing vehicles without safety drivers, and finally securing commercial operation permits city-by-city. This progression typically spans 2-4 years per jurisdiction, explaining why scaling to 25,000 vehicles likely requires until 2028-2030.

How does Waabi's business model generate revenue and profitability?

Waabi's technology licensing model involves charging Uber (and potentially other platforms) a per-mile fee estimated at

What are the main risks to Waabi's deployment timeline and commercial success?

Key risks include technical challenges requiring unexpected development work, serious safety incidents that trigger regulatory restrictions, regulatory environment becoming more cautious, unexpected supply chain disruptions preventing vehicle manufacturing, competitors (especially Waymo) achieving dominance and marginalizing other platforms, and broader economic downturns reducing investor appetite. Additionally, dependency on Uber's strategic commitment and coordination between Waabi and Uber on deployment priorities creates organizational risks beyond pure technology execution.

How does Waabi compare to competitors like Waymo, Tesla, and Aurora in the autonomous vehicle market?

Waabi's competitive position is characterized as "strong but unproven at scale." Advantages include founder credibility (Urtasun's Uber ATG background), AI-centric technical approach, strategic partnership providing market access, fresh capital, and geographic advantage in Canada. Disadvantages include no commercial robotaxi operations yet, later-stage entry compared to Waymo's 15+ years of development, smaller accumulated testing data, and lack of manufacturing relationships. Unlike Waymo's integrated approach, Waabi's licensing model is capital-efficient but creates partnership dependencies.

Related Topics for Exploration

Based on this comprehensive analysis, readers might explore these related areas:

- Waymo's Business Model: How Alphabet's autonomous vehicle division operates commercially and compares to Waabi's approach

- Autonomous Vehicle Safety Validation: Standards, methodologies, and third-party testing frameworks for demonstrating autonomous vehicle safety

- Insurance and Liability in Autonomous Vehicles: How responsibility allocation works between technology providers, fleet operators, and regulators

- The Future of Work: Economic and social implications of large-scale automation of professional driving occupations

- AI in Transportation: Broader applications of artificial intelligence beyond autonomous vehicles in logistics, fleet management, and traffic optimization

Key Takeaways

- Waabi raised 750M Series C to deploy minimum 25,000 robotaxis with Uber by 2028-2030

- Company's AI-centric approach integrates perception, prediction, and planning into unified neural networks unlike separate modular systems

- Waabi acts as technology provider licensing software to Uber rather than operating fleets, enabling capital efficiency

- Founder Raquel Urtasun's credibility from leading Uber's Advanced Technologies Group significantly enhances company viability

- Autonomous robotaxis offer superior unit economics replacing driver costs with predictable technology licensing fees

- Regulatory approval across multiple jurisdictions represents major timeline risk requiring 2-4 years per state

- Waabi's trucking experience provides domain-general autonomous driving capabilities transferable to urban robotaxi operations

- Partnership with Uber provides immediate market access and platform infrastructure most startups must build independently

- Success of Waabi deployment would validate commercial-scale autonomous vehicle operations across industry

- Competitive position is strong but unproven versus Waymo's proven track record and Tesla's existing vehicle fleet

Related Articles

- Hyundai's Autonomous Robotaxi: Las Vegas Launch & Future of Self-Driving

- Robotaxis Disrupting Ride-Hail Markets in 2025: Price War and Speed [2025]

- Elon Musk's Davos Predictions: Why They Keep Missing [2025]

- Waymo's Miami Robotaxi Launch: What It Means for Autonomous Vehicles [2025]

- Tesla's Dojo Supercomputer Restart: What Musk's AI Vision Really Means [2025]

- Tesla FSD Subscription-Only Model: Strategic Shift & Industry Impact [2025]