The Robotaxi Market is Heating Up—Here's Why It Matters

Two years ago, if you wanted a self-driving car to pick you up in San Francisco, you had exactly one choice: Waymo. It was a curiosity. People took rides for the experience, not because it was faster or cheaper than grabbing an Uber. Tourists loved it. For actual commuting? Most people stuck with the human-driven services they knew.

Then things started changing. Fast.

By late 2025, San Francisco residents had multiple options for autonomous rides, and the competitive landscape has shifted dramatically. Obi, a ride-hail price aggregator, just released new data showing that robotaxis aren't just competing anymore—they're winning on specific metrics that actually matter to riders: cost and wait time.

The implications are enormous. For the first time, we're seeing proof that autonomous vehicle technology isn't just technically feasible. It's becoming economically viable. This changes everything about how we think about urban transportation, labor, and the future of the gig economy.

Here's what the data actually shows, why it matters, and what happens next.

TL; DR

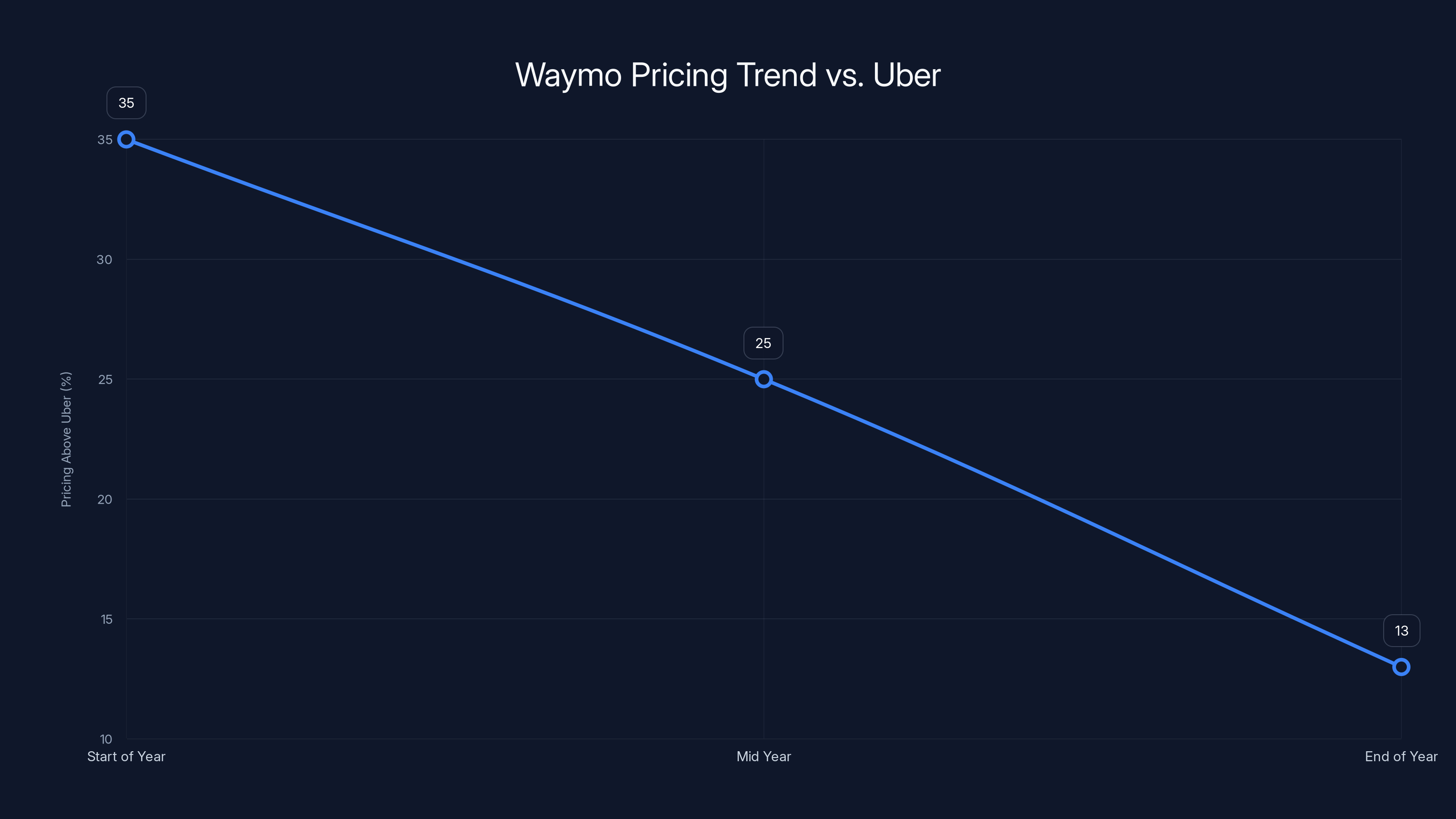

- Waymo pricing gap is collapsing: Rides are now only 13% more expensive than Uber (down from 30-40% in spring 2025)

- Wait times are competitive: Waymo's ETAs are now shorter than Uber's and closer to Lyft's outside peak hours

- Tesla is undercutting everyone: Human-driven Tesla Robotaxi service costs 8 per ride—roughly half the cost of competitors

- Long rides favor autonomy: Waymo reaches price parity with Uber on trips longer than 2.6–5.8 miles

- Scale is happening: Multiple robotaxi operators now share San Francisco's market, signaling the transition from novelty to mainstream service

Waymo's pricing relative to Uber dropped from 35% to 13% above Uber in a year, driven by fleet expansion, improved efficiency, and competitive pressures. (Estimated data)

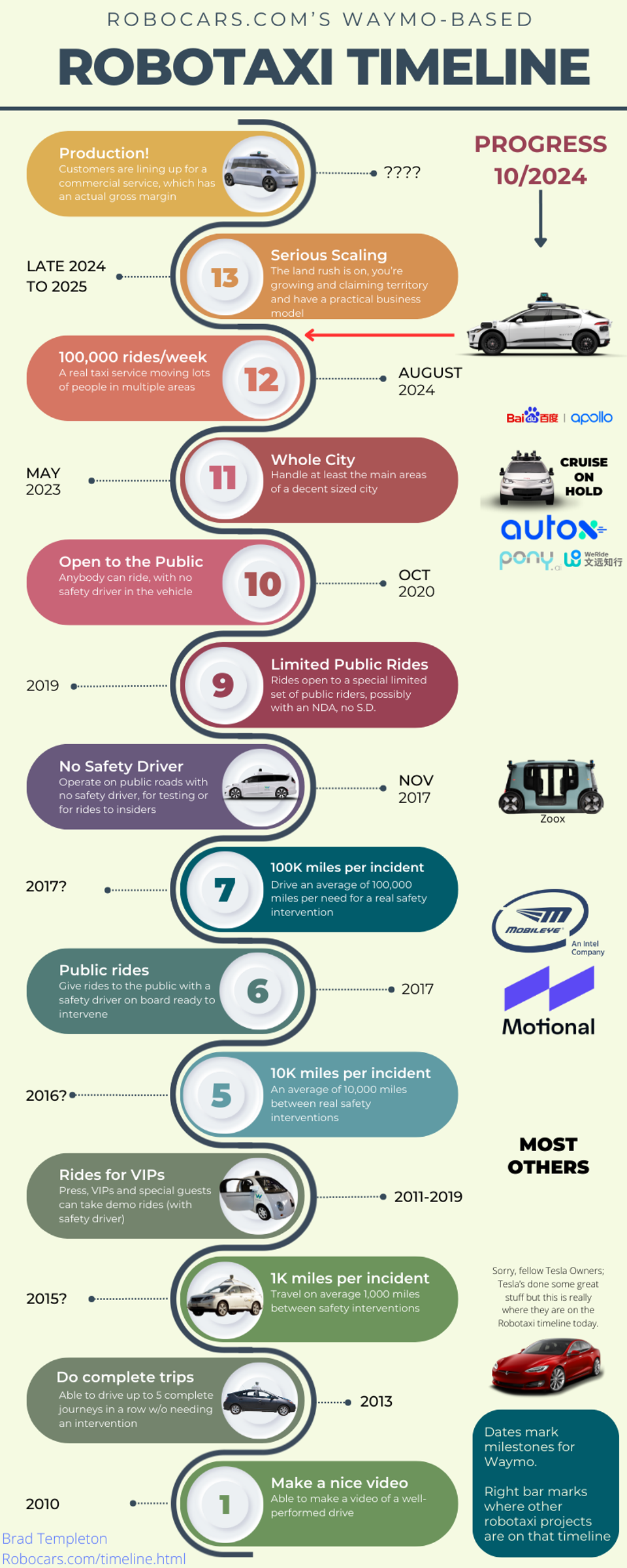

How We Got Here: The Robotaxi Journey from Hype to Reality

Self-driving cars have been "10 years away" for so long that saying it became a running joke in tech circles. Waymo, Alphabet's autonomous vehicle subsidiary, has been testing robotaxis since around 2015. That's a full decade of development before the service became commercially available to regular riders in select US cities.

The reason it took so long wasn't a technical problem—it was a scaling problem. Building a driverless car that works perfectly in a controlled environment and building one that reliably operates across diverse weather conditions, edge cases, and traffic patterns are completely different challenges. Waymo solved the first one early. The second one took years of incremental improvements, edge case detection, and machine learning refinement.

When Waymo finally launched commercial rides in San Francisco around 2023, the service had genuine technical merit. The cars didn't crash into things. They obeyed traffic laws. They navigated complex intersections successfully. But they also had problems that made them impractical for most riders: they were slower than human drivers (because they drive conservatively), they couldn't handle certain road conditions or weather, and they cost significantly more than Uber or Lyft.

Meanwhile, Tesla launched its "robotaxi" service in the Bay Area starting in fall 2024 with a twist: the cars had human drivers behind the wheel. This was technically misleading marketing—there's nothing autonomous about them—but it served Tesla's strategic purpose. The company wanted market presence without waiting for Full Self-Driving to achieve true autonomy. They also wanted to establish the "Robotaxi" brand before Waymo owned it completely.

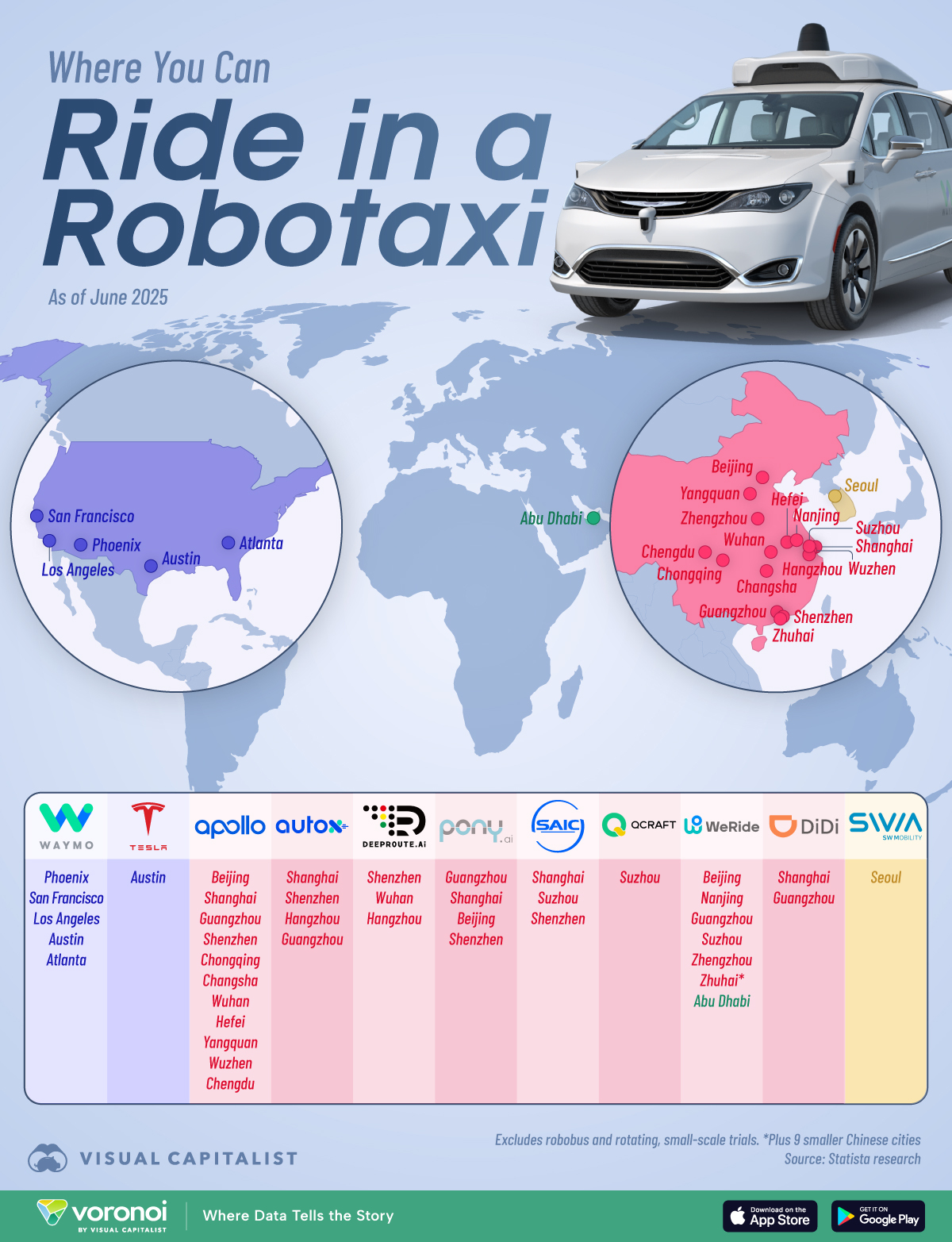

The competitive situation in late 2025 looks like this:

Waymo: True autonomous vehicles, limited coverage area (but expanding to highways), prices improving steadily.

Tesla: Human-driven service using the "robotaxi" branding, lowest prices, highest wait times due to limited fleet size.

Uber and Lyft: Established networks with thousands of drivers, consistent performance, mid-range pricing, instant availability in most areas.

But the data suggests this balance is shifting in ways that could reshape the entire ride-hail industry.

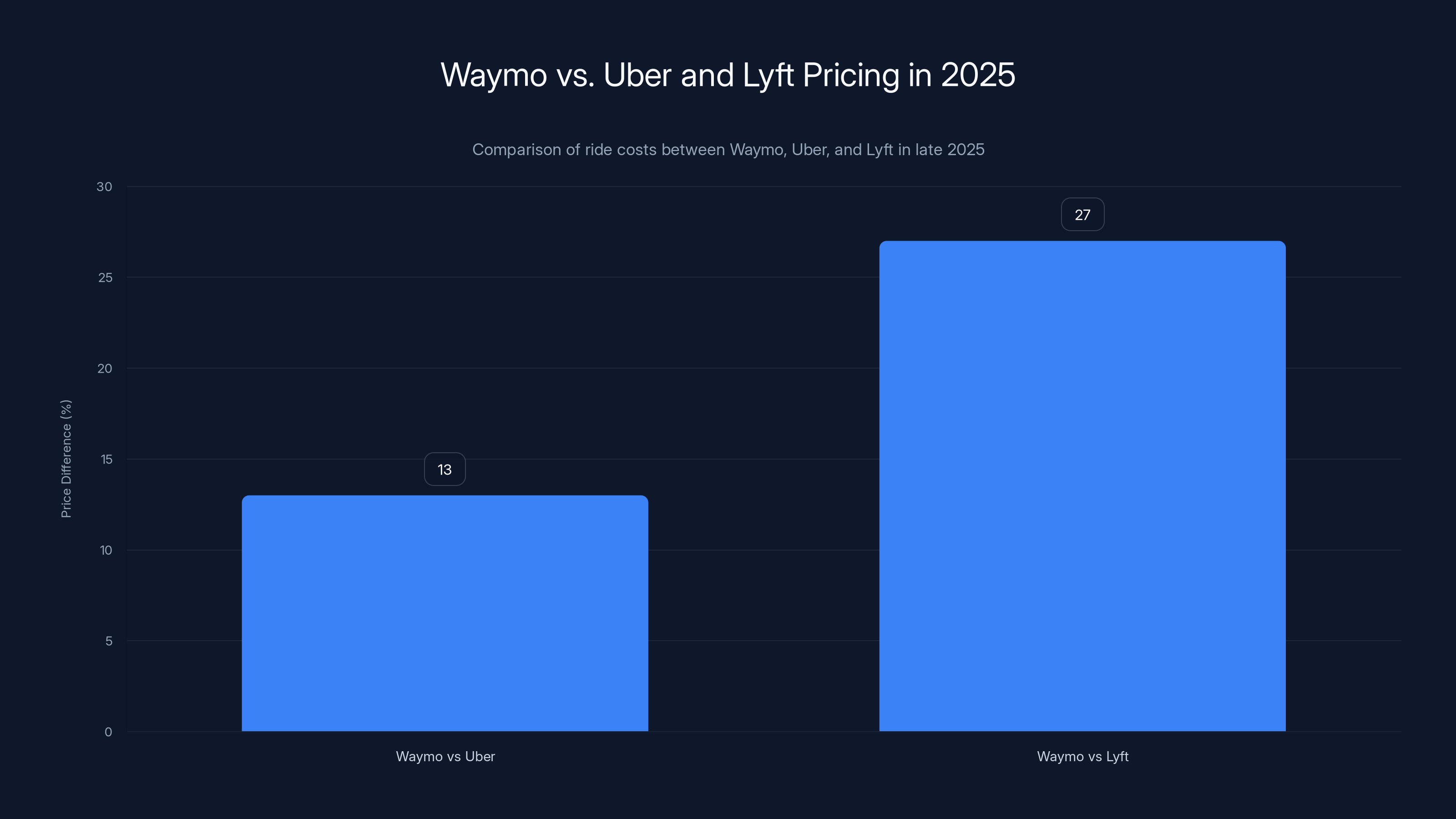

In late 2025, Waymo rides were 13% more expensive than Uber and 27% more than Lyft, showing a reduced price gap compared to earlier in the year.

The Price Data: Waymo is Getting Expensive to Ignore

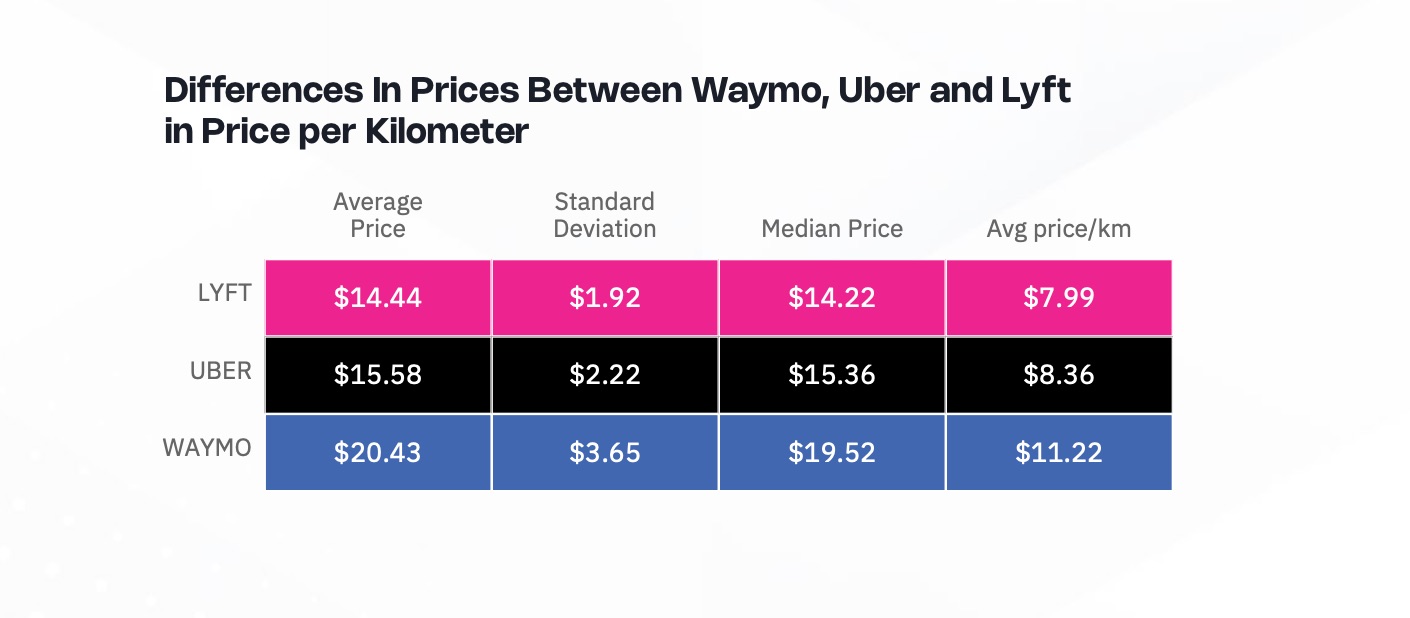

When Obi analyzed ride prices in spring 2025, the data told a predictable story: autonomous vehicles were a premium service. Waymo rides cost 30 to 40 percent more than Uber. That gap was so large that it made economic sense only for people who valued the novelty factor or had strong ethical preferences about supporting AI development.

By November and December 2025, something shifted.

Waymo's pricing advantage had largely evaporated. Obi's analysis found that Waymo rides now cost 13 percent more than Uber and 27 percent more than Lyft. That's still a premium, but it's not a dealbreaker. For rides in normal traffic conditions outside of rush hour, many riders would genuinely consider Waymo as a viable option.

Why the price compression? Several factors:

Operational efficiency improvements: As Waymo's software improves and the fleet accumulates more miles, the company gets better at route optimization, pickup location selection, and energy efficiency. These improvements flow directly to lower per-ride costs.

Scale benefits: Waymo has expanded its service area and number of available vehicles. More vehicles means less downtime, better geographical coverage, and improved cost allocation across a larger revenue base.

Competitive pressure: The existence of Tesla's cheaper service and Uber's and Lyft's established pricing creates natural downward pressure. Waymo can't ignore market rates without losing market share to inferior services.

Infrastructure maturity: Initial deployment of autonomous vehicles required significant infrastructure investment, redundancy, and safety margins. As the technology matures, those one-time costs are amortized, reducing per-ride economics.

The most interesting finding in the data concerns distance-based pricing parity. For rides between 2.6 and 5.8 miles, Waymo's per-kilometer cost (

This matters because it suggests that autonomous vehicles have a specific economic advantage: they perform proportionally better on longer trips. Human drivers need breaks, have fatigue concerns, and have opportunity costs. A 6-mile ride is expensive because the driver is spending 15–20 minutes earning money that could be spent on a different, more profitable ride. Autonomous vehicles don't have this constraint. They don't get tired. They don't have better things to do.

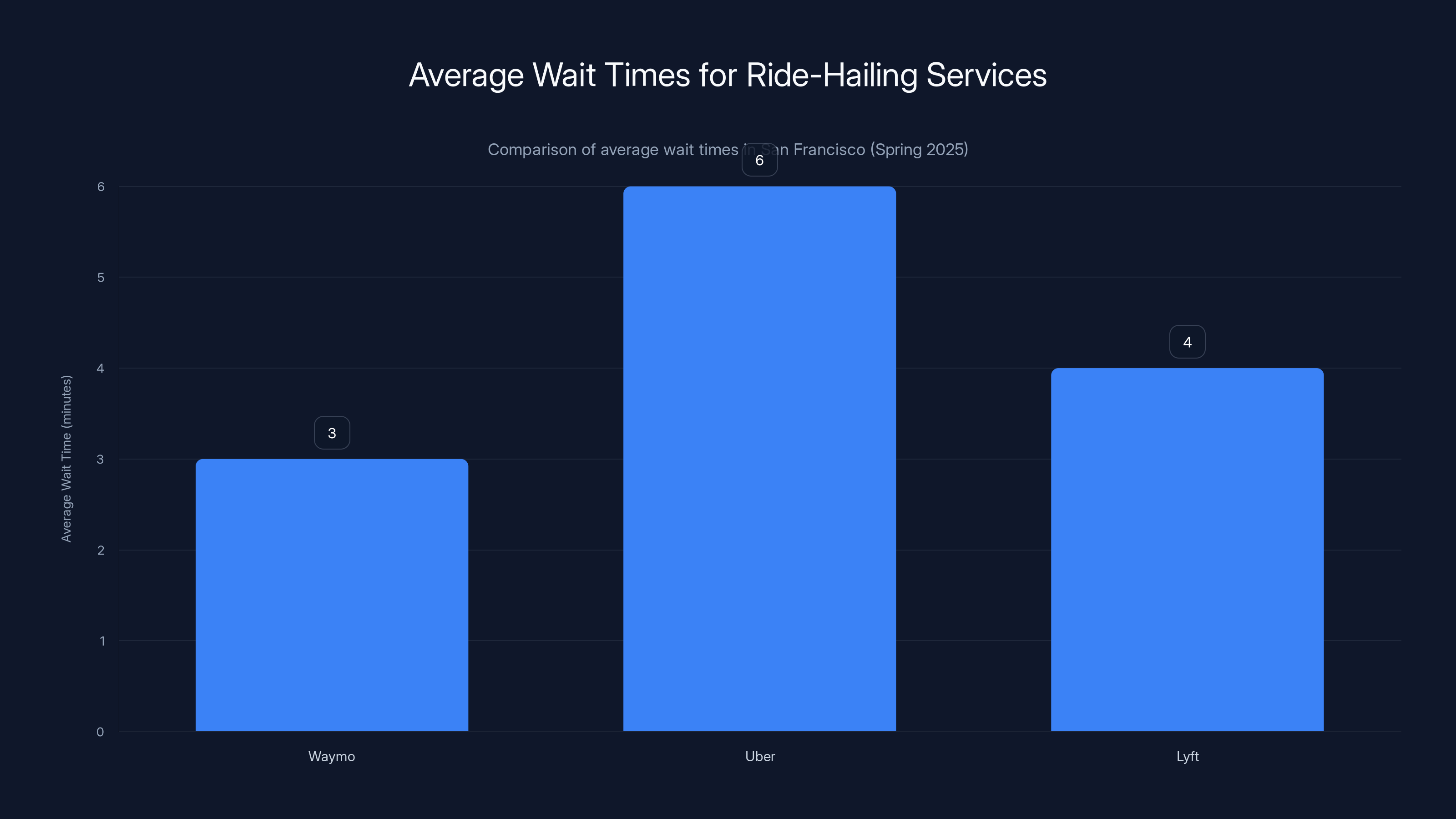

Wait Time Revolution: The Metric Riders Actually Care About

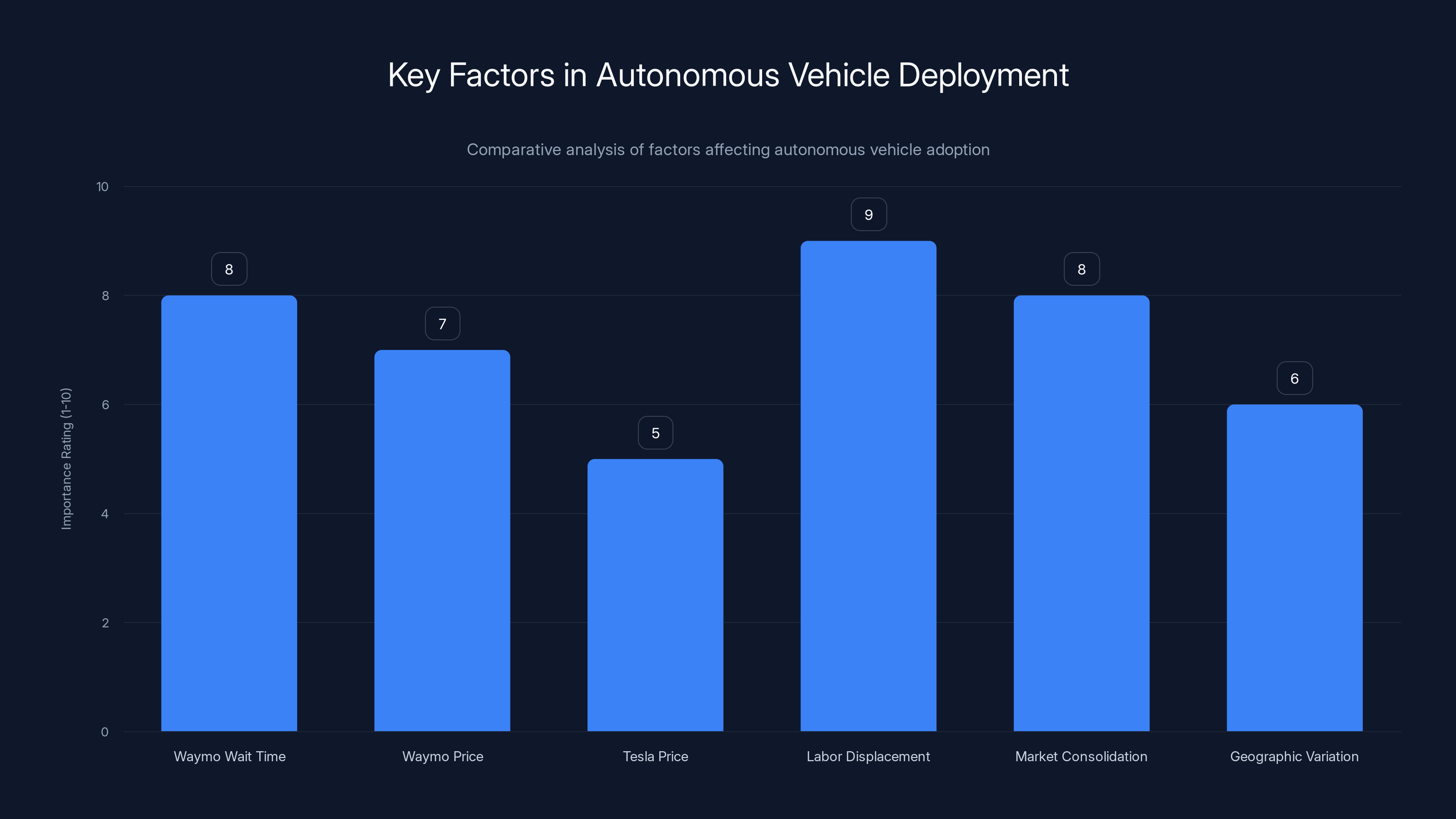

Price matters, but riders care even more about one metric that economists sometimes overlook: time until pickup.

Imagine you're standing on a street corner in San Francisco wanting to get somewhere. You have three apps open on your phone. The prices are roughly equivalent. Which one do you tap?

The one with the shortest wait time.

This is called time value of money in economics. For most people, waiting 8 minutes for a ride is noticeably worse than waiting 4 minutes, even if the 8-minute option costs $1 less. The cognitive discomfort, the standing around, the uncertainty about whether the driver is actually coming—these are real costs that show up in rider behavior.

Waymo's earlier problem wasn't just pricing. It was also wait times. In spring 2025, Obi's data showed that Waymo had consistently longer ETAs (estimated time of arrival) than both Uber and Lyft. This made sense: the fleet was small, the service area was limited, and the vehicles couldn't be as flexibly positioned because they required specific infrastructure (some routes were still restricted).

Now? The situation has flipped. Waymo's ETAs are consistently shorter than Uber's and comparable to Lyft's during non-peak hours.

Why this happened:

Fleet expansion: More Waymo vehicles on the road means more vehicles available to serve requests. Basic supply-and-demand economics: if you double the number of available vehicles, the average distance to the nearest vehicle shrinks proportionally.

Highway expansion: In November 2025, Waymo expanded onto some highway sections in the Bay Area. This seems counterintuitive for reducing wait times—highways are slower to navigate than local roads, right? Actually, highways expand the potential market. Riders who need to reach the airport or cross the greater Bay Area can now use Waymo. This increases overall demand and fleet utilization, which means better availability for all rides.

Route optimization improvements: Waymo's neural network that predicts demand has probably improved. If the system can better predict where rides will be needed in the next 5–10 minutes, it can pre-position vehicles accordingly. This is invisible to riders but shows up as shorter ETAs.

Data accumulation: More miles driven = more training data for the machine learning models that control pickups, routing, and vehicle positioning. Over time, this data compounds into better decisions.

There's one notable exception to Waymo's improved wait times: the 4 pm to 6 pm window. During this evening rush period, Waymo's wait times spike—and so do its prices. This is likely a supply constraint. The demand surge during rush hour exceeds Waymo's fleet capacity. Rather than disappoint riders with 20+ minute ETAs, the system increases prices to ration demand. Only riders who really need a ride right now—and are willing to pay for it—complete rides during this window.

This is actually a sign of healthy market dynamics. Dynamic pricing allows a limited supply to serve the highest-value demand without creating massive queues of disappointed riders.

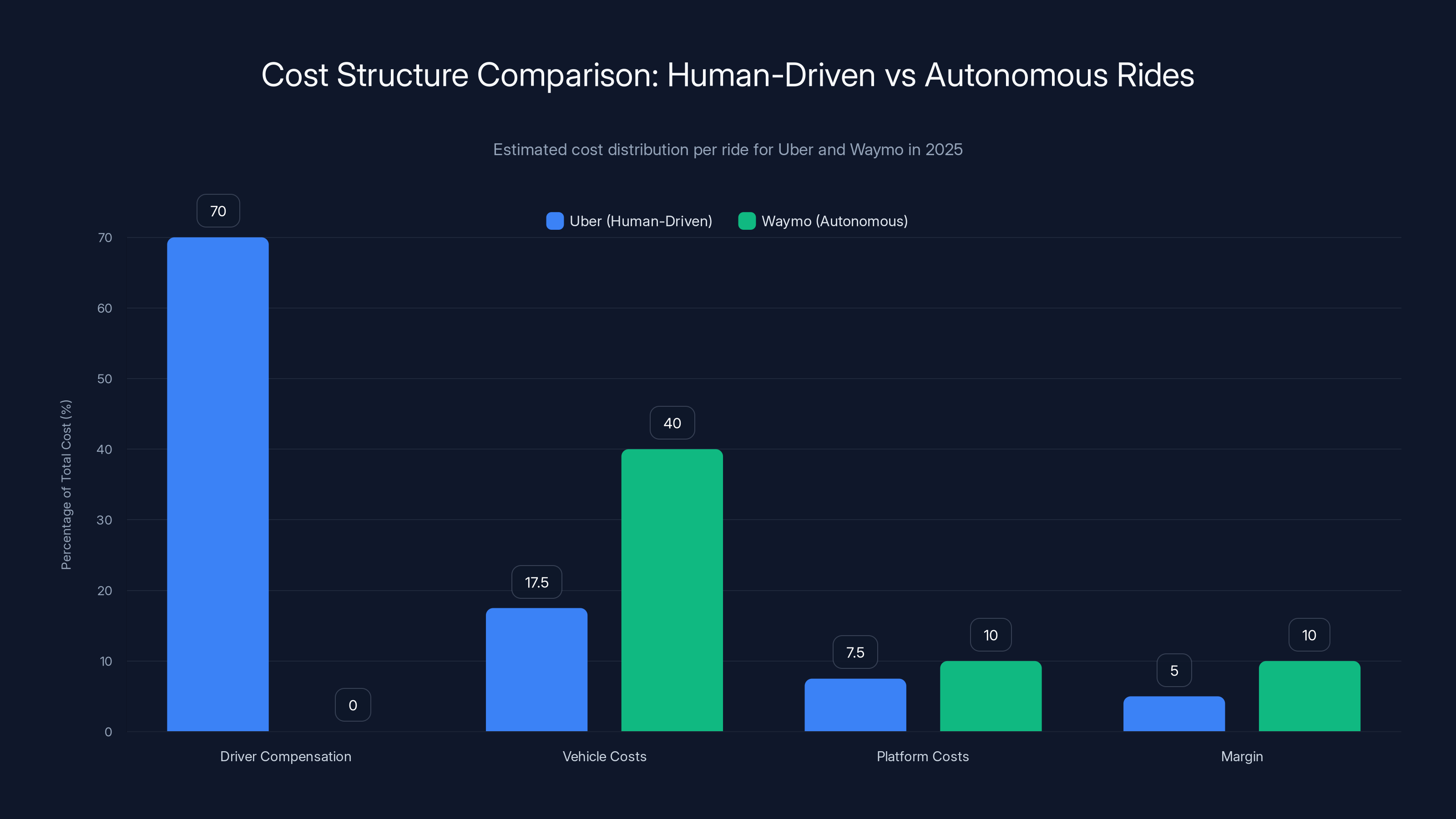

Estimated data shows that Uber's cost structure is heavily weighted towards driver compensation, while Waymo's costs are more evenly distributed across vehicle, platform, and margin, with no driver costs.

Tesla's Disruption Play: Loss Leader Pricing as Market Strategy

Then there's Tesla.

The company's Bay Area "robotaxi" service operates with less than 200 vehicles across roughly 400 square miles. The cars aren't actually autonomous—they have human drivers who use Tesla's Full Self-Driving (Supervised) as a driver assistance tool, similar to adaptive cruise control with lane centering.

In terms of pure technology, it's not impressive. It's not even close to Waymo's actual autonomy. But Tesla's pricing is stunning.

Average ride costs are

Tesla's CEO and team are clearly pursuing a loss leader strategy. The company isn't trying to make money on these rides right now. It's trying to:

- Build brand awareness for the "Robotaxi" concept and establish Tesla as a mobility company, not just an automaker.

- Accumulate user data about ride preferences, demand patterns, and route optimization.

- Train riders to use the Tesla Robotaxi app as a habit.

- Create competitive pressure on established players.

- Prepare for future autonomy by establishing the service and then transitioning to driverless vehicles once Full Self-Driving reaches the required safety threshold.

The wait times tell the story: Tesla's average wait is 15 minutes, roughly 3-4x longer than Waymo or Lyft. This suggests the fleet is severely undersized for actual demand. If people are willing to wait 15 minutes for

Where does Tesla's strategy get interesting? Full Self-Driving technology, despite the misleading name, is getting demonstrably better. If Tesla's autonomy reaches Waymo-level reliability in 18–24 months, Tesla could flip its business model instantly. Suddenly, those $7.50 rides become profitable because the human driver disappears. The company has trained Bay Area residents to open the Tesla app and will have an enormous cost advantage over Waymo.

This is risky for Waymo. If Tesla executes on autonomous driving, Waymo's year of technical advantage evaporates. If Tesla fails, Waymo remains the dominant autonomous player but faces pricing pressure from a persistent loss leader that trains riders to expect lower prices.

Market Dynamics: Three Players, Three Strategies

Let's zoom out and look at the competitive landscape as a system.

Waymo is the incumbent autonomous operator playing the long game. The company has real technology, improving economics, and expanding service territory. The strategy is to prove that autonomous vehicles can be mainstream transportation, capture market share, and establish Waymo as the market leader before competition intensifies. The company is profitable on a per-ride basis (or close to it). The path to success is market expansion and fleet scaling.

Uber and Lyft are the established ride-hail players facing existential threat. They've built massive networks of drivers, solved the liquidity problem (always having drivers available), and created strong network effects. But they're vulnerable to autonomous vehicle disruption because their entire cost structure revolves around driver compensation. If autonomous vehicles become reliable, the companies lose their fundamental value proposition. Their strategy is probably to maintain market share during this transition period while investing in autonomous vehicle technology themselves. Uber has announced partnerships with autonomous vehicle companies, suggesting the company understands the threat.

Tesla is the wild card. The company has no established ride-hail network, no history in mobility services, and faces the same technical challenges as Waymo (perhaps more acute, since Full Self-Driving lags Waymo's autonomy). But Tesla has advantages: it manufactures its own vehicles, has enormous brand recognition, is willing to operate at losses for market position, and has integrated its ride-hail app directly into its vehicle software (Tesla owners can turn on the Robotaxi feature instantly). If autonomy materializes, Tesla's path to profitability is fastest because it eliminates driver costs immediately.

The data suggests that 2025 was a turning point where the economic viability of autonomous rides shifted from theoretical to real. Waymo proved that autonomous vehicles can reach price parity with human-driven services while offering better wait times. Tesla proved that even inferior autonomous technology can disrupt pricing by accepting losses. The question isn't whether robotaxis will disrupt transportation. The question is who will capture the market.

Waymo's improvement in wait times and labor displacement are key factors in autonomous vehicle adoption. Estimated data.

The Math Behind Autonomous Vehicle Economics

Understanding why autonomous vehicles become more competitive over time requires understanding the cost structure.

For human-driven ride-hail services like Uber, the cost structure looks roughly like this:

Driver compensation is typically 60–75% of ride cost, depending on market conditions. Vehicle costs (depreciation, insurance, maintenance) are 15–20%. Platform costs (app infrastructure, customer service, insurance) are 5–10%. The company keeps the margin.

In 2025 US markets, Uber's average ride might cost riders

For autonomous vehicle services like Waymo, the structure is inverted:

There's no driver compensation because there's no driver. Vehicle costs are higher (specialized sensors, redundant computers, safety systems) but don't scale with miles driven the same way human labor does. A $60,000 autonomous vehicle can operate 24/7/365 if properly maintained. A human driver works maybe 8 hours per day.

The math flips. For Waymo to be cost-competitive, it needs to:

- Maximize vehicle utilization: Each vehicle should complete as many profitable rides as possible.

- Minimize operational overhead: Monitoring, remote assistance, and incident response should be lean.

- Achieve scale: Spread fixed costs (headquarters, core engineers, safety infrastructure) across more vehicles and more rides.

The data showing Waymo reaching price parity with Uber on longer rides suggests the company is hitting these metrics. On a 5-mile ride that takes 15 minutes, the vehicle is being efficiently utilized, operational overhead is minimal, and the fixed cost per ride is manageable.

Where Waymo struggles is on very short rides (under 1 mile) and during peak hours when demand exceeds supply. Short rides don't provide enough revenue to cover operational costs even for efficient vehicles. Peak hour demand spikes force dynamic pricing, which pushes prices up.

Tesla's ultra-low pricing ($7.50 per ride) is only possible because the company is subsidizing rides through corporate capital. The economics don't work at that price point even with human drivers. But the subsidy is strategic: it trains riders, accumulates data, and prepares for the future when autonomous driving eliminates driver costs and makes those prices genuinely profitable.

Safety and Reliability: The Hidden Metric

Price and wait time are visible metrics that show up in apps. But there's a hidden metric that determines whether autonomous vehicles actually disrupt the industry: safety and reliability.

Waymo's autonomous vehicles have driven millions of miles in testing and commercial deployment. The safety record is excellent. The company hasn't had a fatality caused by autonomous driving failure. But there have been incidents: aggressive drivers cutting off Waymo vehicles, minor traffic accidents that would happen to any vehicle, and edge cases where the autonomy system makes unusual decisions.

The public perception of autonomous vehicle safety is heavily shaped by media coverage. A single dramatic failure (a Waymo vehicle unable to move in traffic, for example) becomes a story. A human driver causing thousands of minor accidents daily doesn't make headlines.

From a statistical perspective, autonomous vehicles are already safer than human drivers. But statistics don't determine market adoption. Perception does. If riders feel safe in Waymo vehicles, the company wins. If riders have lingering doubts despite data showing autonomy is safe, Waymo faces adoption headwinds.

Tesla's human-driven service has a different reliability problem: wait times. With only 200 vehicles across 400 square miles, the service is unreliable for riders who need a ride urgently. If you order a Tesla Robotaxi and wait 15 minutes, you might miss a flight. This makes the service suitable for non-urgent trips but unreliable for commuting.

Waymo's improving wait times suggest the company is solving the availability problem. Reliability is becoming less of a constraint and more of a competitive advantage.

Waymo now offers the shortest average wait times compared to Uber and Lyft in San Francisco during non-peak hours, thanks to fleet and highway expansions. (Estimated data)

Labor Implications: The Question Nobody Wants to Ask

There are roughly 1.6 million rideshare drivers in the United States. Most drive for Uber, Lyft, or both. Many are full-time. Many depend on this income for survival.

If autonomous vehicles achieve widespread adoption, this labor market implodes. Not gradually—dramatically. Within 5–10 years, the economic incentive to employ human drivers disappears. Companies replace 1 million human drivers with 100,000 vehicles running 24/7.

This is the subtext beneath all discussions of robotaxis. The technology isn't hypothetical. The economic threat is real. Drivers know this, which is why there's been pushback against robotaxi expansion in San Francisco and other cities.

The data from Obi suggests this transition is now inevitable rather than speculative. When autonomous vehicles reach price parity on consumer-facing metrics, the business case becomes irresistible for companies. Waymo doesn't have a choice. If Tesla can offer cheaper rides, Waymo must match prices to stay competitive. Matching prices means cutting costs. Cutting costs means scaling autonomous fleets.

This isn't malice or anti-labor sentiment. It's basic economics. No company can permanently operate below-cost services. Waymo will eventually move the entire fleet to autonomous vehicles because the alternative is becoming unprofitable.

The hard questions are:

- What happens to 1+ million displaced drivers?

- Who pays for retraining programs?

- Are there other jobs that pay as well with comparable flexibility?

- What's the timeline before automation accelerates?

These questions are outside the scope of this analysis, but they're the real story beneath the robotaxi market dynamics. The data showing price and time competitiveness isn't just business analysis. It's the beginning of a labor transformation that will reshape the entire gig economy.

Infrastructure and Regulatory Hurdles Remaining

Waymo's expansion onto highways in November 2025 signals confidence in the technology's readiness for complex driving scenarios. But highways present different challenges than city streets: higher speeds, less frequent decision points, but catastrophic consequences if things go wrong.

The fact that Waymo deployed on highways despite these risks suggests the company's internal testing showed sufficient safety margins. This is a meaningful signal because Waymo is deeply conservative. The company won't deploy on highways unless genuinely confident in reliability.

But regulatory approval is another matter. California has been relatively permissive with autonomous vehicle testing and deployment compared to other states. The state has allowed driverless robotaxi operations, which is more aggressive than most jurisdictions. However, expanding to highways, other cities, and other states will require navigating state and local regulations that vary dramatically.

Some jurisdictions effectively ban autonomous vehicles through regulatory barriers. Some require remote operators to monitor every vehicle (which defeats the economic advantage). Some limit testing to specific hours or geographic areas.

Waymo's strategy appears to be demonstrating safety and reliability in permissive jurisdictions first, building an irrefutable track record, then using that evidence to convince skeptical regulators elsewhere. If Waymo can operate driverless vehicles in San Francisco (one of the most litigious, regulation-happy cities in America) without major incidents, it becomes harder for other cities to justify bans.

Tesla faces different regulatory challenges. Full Self-Driving is technically a driver assistance feature (not autonomous driving), so it sidesteps some autonomous vehicle regulations. But as Tesla increasingly emphasizes autonomy and reduces driver involvement, regulators will eventually demand proper classification. Calling something a robotaxi when it has a human driver is deceptive. Regulators will eventually address this.

Waymo's pricing is now only 13% higher than Uber's, with competitive wait times. Tesla offers the lowest prices, significantly undercutting competitors. Estimated data based on current trends.

Geographic Expansion: Where's Autonomy Heading?

Waymo currently operates in a handful of US cities: San Francisco, Los Angeles, Las Vegas, Austin, and a few others. Tesla's robotaxi service is even more limited.

Future expansion will be challenging because:

-

Climate variation: Waymo's current deployment areas have relatively mild weather. Rain, snow, and ice require different sensor configurations and software. Early data suggests autonomy performance degrades in severe weather.

-

Infrastructure diversity: San Francisco has well-maintained roads, clear lane markings, and organized traffic patterns. Rural areas, older cities, and developing nations have worse road conditions. Software must generalize across this diversity.

-

Traffic culture variation: Driving norms in San Francisco differ from New York, Miami, Chicago, or international cities. Aggressive driving, informal traffic rules, and different regulatory environments all require adaptation.

-

Regulatory fragmentation: Each state and city has different rules. Deploying nationally requires navigating 50 state legislatures plus hundreds of city councils.

Despite these challenges, the economic incentive to expand is enormous. If Waymo can profitably operate autonomous taxis in 20 major cities, the company's market size grows by an order of magnitude. This incentive will drive continued expansion even if each new market requires localization work.

Competition and Consolidation: What's Next?

The robotaxi market in 2025 is still fragmented. Waymo has the technology lead but is the smallest player by traditional fleet size. Uber and Lyft have the networks but are technologically challenged. Tesla has brand and scale but questionable autonomy capability.

History suggests this fragmentation won't last. Ride-hail consolidated from dozens of companies to three dominant players (Uber, Lyft, and some regional operators) within a decade. Robotaxis will likely consolidate similarly.

Possible scenarios:

Scenario 1: Waymo Dominance: Waymo's technical lead compounds. The company expands faster than competitors, reaches scale first, and captures dominant market share. This is the base case if autonomous driving's advantage scales and Waymo executes well.

Scenario 2: Tesla Disruption: Full Self-Driving reaches Waymo-level reliability faster than expected. Tesla's massive capital reserves, manufacturing capability, and brand allow aggressive expansion. Tesla becomes the dominant autonomous ride-hail provider.

Scenario 3: Uber/Lyft Adaptation: Uber or Lyft acquire autonomous driving technology (possibly through acquisition of smaller players or internal development), transition their massive existing networks to autonomous vehicles, and leverage their distribution advantage to dominate. Waymo and Tesla become niche players.

Scenario 4: Coexistence: The market is large enough that multiple operators thrive. Different operators dominate different geographies or serve different segments. Waymo owns premium autonomous in major cities, Tesla owns the price-sensitive segment, Uber/Lyft maintain human driver networks for hard-to-serve areas.

The data from Obi suggests scenarios 1 or 3 are most likely. Waymo's technical lead is real but not insurmountable. Uber and Lyft's distribution advantage is enormous. Whichever company solves the autonomy + scale problem first wins. Everything else is secondary.

The Path Forward: Economic and Social Implications

The data point from Obi isn't just interesting market analysis. It's evidence that the transportation industry is reaching an inflection point.

For the past 100+ years, transportation has been human-centric. Humans drive vehicles. Humans navigate routes. Humans manage traffic. This has shaped cities, job markets, and social structures. Autonomous vehicles represent a phase transition to machine-centric transportation.

The economic implications are profound. The companies that own autonomous fleets will capture the value that currently flows to drivers. A

This is why Waymo's pricing is dropping toward parity with Uber. The company doesn't need to undercut aggressively because the economics are fundamentally superior. As scale improves and technology improves, prices can drop further while margins improve.

The social implications are thornier. Displacing 1+ million workers isn't a technocratic problem to solve with automation. It's a human problem requiring policy responses: retraining programs, income support, geographic mobility assistance, and deliberate public investment in creating alternative jobs.

Some cities are starting to grapple with this. San Francisco, where autonomous vehicles are already operational, has begun conversations about ride-hail driver protections. But federal policy is lagging behind reality. By the time comprehensive policy frameworks exist, autonomous vehicle adoption might already be far advanced.

The robotaxi market in 2025 is economically viable for operators. The question isn't whether adoption will accelerate. The question is how quickly it accelerates and what policy responses emerge in parallel.

Looking Ahead: 2026 and Beyond

If current trends continue, the next 12–24 months will be critical for robotaxi market development.

Waymo will likely expand geographically to more cities, increase fleet size in existing markets, and potentially reach genuine profitability on per-ride basis. If the company achieves profitability while growing, it signals that autonomous rides are truly viable, and aggressive expansion becomes rational.

Tesla will either prove that Full Self-Driving reaches Waymo-level reliability (shifting the competitive landscape dramatically) or face the reality that building autonomous driving is harder than expected. The company's strategy of human-driven "robotaxis" will eventually feel deceptive as real autonomy becomes the market standard.

Uber and Lyft will need to decide whether to acquire autonomous driving technology, develop it internally, or double down on human driver networks. Waiting too long risks becoming obsolete. Moving too fast risks stranded investments if autonomous vehicles never achieve full reliability.

For riders, the trajectory is clear: better availability, faster pickup, and lower prices. The commoditization of ride-hail from a premium service to basic transportation is accelerating.

For drivers, the trajectory is less clear but more urgent. The data showing economic viability of autonomous transportation suggests that driver displacement will accelerate within 5–10 years. Policy responses need to happen now, not after displacement is complete.

The Obi data is ultimately a snapshot of a transition in progress. The robotaxi market isn't coming someday. It's here now. The question is how quickly the transition completes and what societies do to manage the human costs of that transition.

Key Takeaways and What You Should Know

The data from Obi's latest analysis reveals several important truths about autonomous vehicle deployment:

Waymo is closing the competitive gap: Price premiums are shrinking while wait times improve. This suggests genuine technical progress, not just hype. When competitors match on these metrics, market adoption accelerates.

Wait time might matter more than price: Riders prefer shorter waits even if they cost more. Waymo's improvement in ETAs is potentially more significant than price parity because wait time is the primary friction point in ride-hail adoption.

Tesla's loss leader strategy is real but risky: Pricing rides at

The labor displacement timeline is accelerating: Economic viability of autonomous transportation means business rationale for deployment becomes irresistible. Policy solutions need to develop faster to prepare workers for transition.

Market consolidation is likely: Three fragmented players (Waymo, Tesla, Uber/Lyft) will probably consolidate to one or two dominant operators within 5–10 years. The winner will be determined by whoever solves autonomy + scale fastest.

Geographic variation will be significant: Expansion beyond the Bay Area requires localization. Weather, traffic culture, infrastructure condition, and regulations all vary. First-mover advantage matters but isn't insurmountable.

The transition is not linear: Technology breakthroughs can accelerate adoption, or setbacks can slow it. Regulatory changes can enable rapid expansion or impose barriers. The trajectory is clear but the timeline is uncertain.

The robotaxi market is moving from theoretical to real. The companies involved are competing fiercely. The drivers facing displacement are watching carefully. And riders are slowly adapting to the idea that their next trip might be piloted by a machine instead of a human.

The future of ride-hail is autonomous. The data makes this increasingly obvious. The only remaining questions are which company wins, how quickly the transition happens, and whether society prepares for the labor displacement that follows.

FAQ

What is a robotaxi and how does it differ from autonomous vehicles in general?

A robotaxi is a self-driving vehicle specifically designed to provide commercial ride-hail services to passengers. It's distinguished from other autonomous vehicles (like autonomous trucks or delivery robots) by its focus on urban transportation and passenger comfort. Robotaxis operate similarly to Uber or Lyft but without a human driver controlling the vehicle. Waymo's robotaxis in San Francisco are true autonomous vehicles, while Tesla's "robotaxi" service currently uses human drivers, making it more accurately a branded ride-hail service.

Why did Waymo's pricing drop from 30-40% above Uber to only 13% above Uber in less than a year?

Waymo's pricing improved due to multiple factors working simultaneously: the fleet expanded (more vehicles means shorter wait times and better cost allocation), operational efficiency improved as software matured, highway expansion opened new markets and improved vehicle utilization, and competitive pressure from Tesla's ultra-cheap service created downward pressure. Additionally, longer rides reached price parity with Uber, which increased demand and improved fleet utilization rates. As autonomous vehicles operate 24/7 without driver fatigue or labor costs, their per-mile economics improve dramatically with scale.

Is Tesla's 8 pricing sustainable, or is the company losing money on each ride?

Tesla is almost certainly losing money on each ride at these prices. The low pricing is a deliberate loss leader strategy designed to build brand awareness, train riders to use the Tesla Robotaxi app, accumulate operational data about ride preferences, and prepare for the future when autonomous driving eliminates human driver costs. Once Tesla's Full Self-Driving technology reaches autonomy levels comparable to Waymo, those prices become profitable because driver labor expenses disappear. This strategy is only viable because Tesla has enormous capital reserves and corporate backing.

What are the safety records of robotaxis compared to human drivers?

Waymo's autonomous vehicles have statistically excellent safety records across millions of miles of testing and commercial operation, with zero fatalities caused by autonomous driving failures. Human drivers in the United States average about 1 fatality per 100 million miles driven. By pure statistics, autonomous vehicles are already safer than human drivers. However, public perception lags behind data. A single dramatic failure gets media coverage while the thousands of daily accidents caused by human drivers don't. Building public trust in autonomous vehicle safety is as important as achieving actual safety.

Why does Waymo's pricing spike between 4-6 pm if wait times are generally shorter?

The 4-6 pm window is evening rush hour when transportation demand peaks. Waymo's fleet, while expanded, still has limits. During peak demand, the number of ride requests exceeds available vehicles. Rather than disappoint riders with 20+ minute wait times, the system uses dynamic pricing to ration demand. Higher prices discourage discretionary trips, leaving vehicles available for time-sensitive commutes. This is economically efficient because it ensures the scarce resource (available vehicles) goes to riders who value it most, rather than creating queues where everyone waits equally long.

When will robotaxis be available in my city, and what should I expect?

Robotaxis are currently only available in a handful of US cities: San Francisco, Los Angeles, Las Vegas, Austin, and a few others. Waymo has announced expansion plans to additional cities throughout 2026 and beyond, but timing depends on regulatory approval, local opposition, and technical readiness for local driving conditions. When robotaxis arrive in your city, expect them to start in limited geographic areas before expanding. Early adoption will likely appeal to curious riders and those seeking novelty, with wider adoption as prices drop and wait times improve. Tesla's service is more limited and requires current Tesla ownership or app access.

What happens to Uber and Lyft drivers if autonomous vehicles fully take over?

This is the uncomfortable question beneath robotaxi discussions. If autonomous vehicles achieve widespread adoption, the economic incentive to employ human drivers disappears. An estimated 1.6 million rideshare drivers in the United States could face unemployment. Timeline uncertainty is the only variable: if adoption accelerates, displacement happens within 5-10 years; if adoption slows, it might take 15-20 years. The hard truth is that policy solutions (retraining programs, income support, alternative job creation) lag behind technological capability. Drivers should begin considering transitions to other work before automation becomes inevitable.

How much cheaper will robotaxi rides become once autonomous vehicles eliminate driver costs?

If the economics play out as theory suggests, ride prices could drop 30-50% from current levels once autonomous vehicles eliminate driver labor. A

What are the weather and climate limitations of current robotaxi technology?

Current autonomous driving technology, including Waymo's, shows degraded performance in heavy rain, snow, and ice. Sensor systems (cameras, lidar, radar) have reduced accuracy in these conditions. Software trained primarily on sunny California driving doesn't generalize perfectly to harsh winter driving. This means robotaxis will likely succeed first in mild-weather cities and take longer to become viable in northern states or cities with seasonal snow. Waymo's current deployment in San Francisco, Los Angeles, Las Vegas, and Austin—all relatively mild climates—supports this. Expansion to Chicago, Minneapolis, or Buffalo will require additional technical development.

Could robotaxis create new jobs or opportunities even as they displace drivers?

Possibly, but the numbers are concerning. Autonomous vehicles require fewer jobs than they displace. A fleet of 100,000 autonomous vehicles might need 10,000 people for maintenance, software updates, remote assistance during edge cases, customer service, and operations. But they displace roughly 500,000+ human drivers. The jobs created in autonomous vehicle development, maintenance, and deployment are real but won't absorb even 10% of displaced drivers. Most displaced workers will need retraining for entirely different industries. This is a structural employment problem that requires policy solutions, not just market optimism.

Conclusion: The Robotaxi Moment

We're watching a transition happen in real time. For years, autonomous vehicles were hypothetical—impressive technology demos that worked under controlled conditions but felt impractical for real-world deployment. The robotaxi market in 2025 proves otherwise.

Waymo has moved from novelty to competitor. The company's vehicles are reaching price parity with human-driven services while offering better wait times. This isn't because robotaxis are subsidized experiments anymore. It's because the fundamental economics favor autonomous transportation.

Tesla is forcing the market to move faster by accepting losses to build market position and train riders. Regardless of whether Tesla's Full Self-Driving achieves true autonomy, the company's aggressive pricing creates pressure that benefits consumers and forces competitors to improve.

Uber and Lyft are watching their fundamental business model become threatened. Both companies will eventually need to commit to autonomous driving or accept becoming secondary players as autonomous-first operators take market share.

For riders, this is good news. Cheaper rides, shorter waits, and a service that works 24/7 without driver fatigue constraints. But for the 1.6 million ride-hail drivers in America, the news is urgent. The data shows that robotaxi adoption is no longer theoretical. It's accelerating. The time to prepare for transition is now, not after displacement is complete.

The Obi data isn't just market analysis. It's evidence that the transportation industry is at an inflection point. Autonomous vehicles aren't coming someday. They're here now. They're getting cheaper. They're getting faster. And they're getting better at the job humans have done for over a century.

What happens next depends on which company executes best, which regulators enable adoption fastest, and which society adapts quickest to the labor displacement that follows. The robotaxi moment has arrived. The only remaining questions are about speed and scale.

If you're a rider, watch for expansion into your city. If you drive for Uber or Lyft, start preparing now. If you're invested in transportation stocks, pay close attention to Waymo's profitability trajectory and autonomous driving progress at Tesla and Uber. If you're a policymaker, understand that labor transition programs need to be ready within 5-10 years, not 15-20 years.

The data is clear. The timeline is compressed. The future is autonomous.

Additional Resources and Insights

For those wanting to dive deeper into autonomous vehicles, ride-hail economics, or related technologies, several areas merit further exploration:

Technical Deep Dives: Understanding how autonomous driving actually works requires grasping neural networks, sensor fusion, and machine learning. Most autonomous vehicle companies are moving toward camera-centric approaches (similar to Tesla) rather than lidar-heavy systems (similar to Waymo). The technical tradeoffs between these approaches will determine which companies succeed long-term.

Labor Economics: The displacement of 1+ million ride-hail drivers raises questions about universal basic income, retraining programs, geographic mobility assistance, and alternative labor markets. Economists from different schools have vastly different predictions about how this transition plays out.

Regulatory Frameworks: Different states and cities are taking radically different approaches to autonomous vehicle regulation. Understanding local rules is essential for predicting where robotaxis will expand fastest.

Competitive Dynamics: Watch which companies acquire autonomous driving startups, who partners with whom, and which technologies get backed by venture capital. These decisions telegraph market expectations about future winners and losers.

The robotaxi market is moving fast. Staying informed about developments helps you anticipate changes that affect employment, transportation costs, investment returns, and daily life.

Related Articles

- Tesla's Fully Driverless Robotaxis in Austin: What You Need to Know [2025]

- Uber's AV Labs: How Data Collection Shapes Autonomous Vehicles [2025]

- Tesla Autopilot Death, Waymo Investigations, and the AV Reckoning [2025]

- NTSB Investigates Waymo Robotaxis Illegally Passing School Buses [2025]

- Waymo's School Bus Problem: What the NTSB Investigation Reveals [2025]

- Elon Musk's Davos Predictions: Why They Keep Missing [2025]

![Robotaxis Disrupting Ride-Hail Markets in 2025: Price War and Speed [2025]](https://tryrunable.com/blog/robotaxis-disrupting-ride-hail-markets-in-2025-price-war-and/image-1-1769541138224.jpg)