Introduction: The Autonomous Vehicle Inflection Point

Waymo just crossed a threshold that matters more than the headlines suggest. By opening its robotaxi service to the general public in Miami, the company isn't just adding another city to its map. It's demonstrating that autonomous vehicles have moved beyond the early adopter phase into something that actually works at scale in diverse, real-world conditions.

Let that sink in. A decade ago, self-driving cars were a punchline. A tech demo that worked 90% of the time on ideal roads, driven by engineers in controlled conditions. Today, Waymo is letting random people in Miami hail a car with no human behind the wheel. Not in a gated community or a pre-mapped industrial zone. In an actual city with traffic, pedestrians, construction zones, and all the chaos that makes autonomous driving genuinely hard.

The Miami launch matters for three reasons. First, it proves that Waymo's driverless technology works in climates and driving conditions completely different from Phoenix or San Francisco. Miami means heavy rain, aggressive drivers, chaotic intersections, and some of the most unpredictable road conditions in the United States. If autonomous vehicles can handle Miami, they can handle most places.

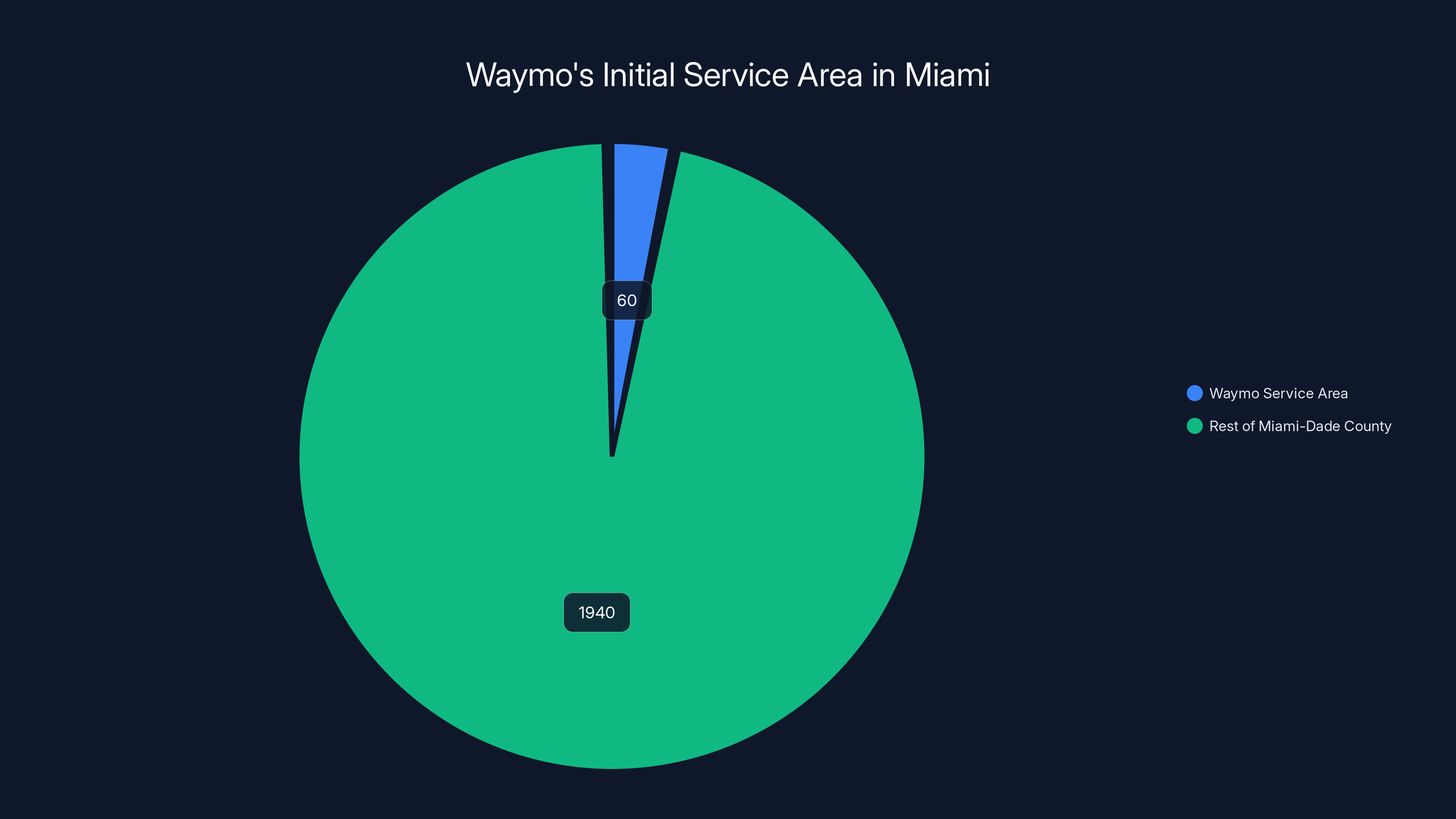

Second, it signals that the company has achieved something most skeptics said was impossible: reliable, repeatable scaling. Waymo isn't opening in one neighborhood. It's launching across a 60-square-mile service area spanning the Design District, Wynwood, Brickell, and Coral Gables. That's not a pilot. That's a commercial service.

Third, and this is the part that should concern traditional transportation, it shows we're closer to a fundamental reshaping of how cities handle mobility than most people realize. When robotaxis become ubiquitous, they don't just replace human drivers. They change parking requirements, reduce car ownership, reshape urban development patterns, and shift trillions of dollars in transportation spending. We're not there yet, but Miami is a step closer.

Here's what you need to understand about where Waymo is right now, where it's heading, and what this actually means for the future of transportation.

TL; DR

- Waymo is now operating in Miami with a 60-square-mile service area open to 10,000 waitlisted residents

- Expansion is accelerating with planned launches in Dallas, Denver, Detroit, Houston, Las Vegas, Nashville, London, San Diego, Seattle, and Washington D.C. over the next year

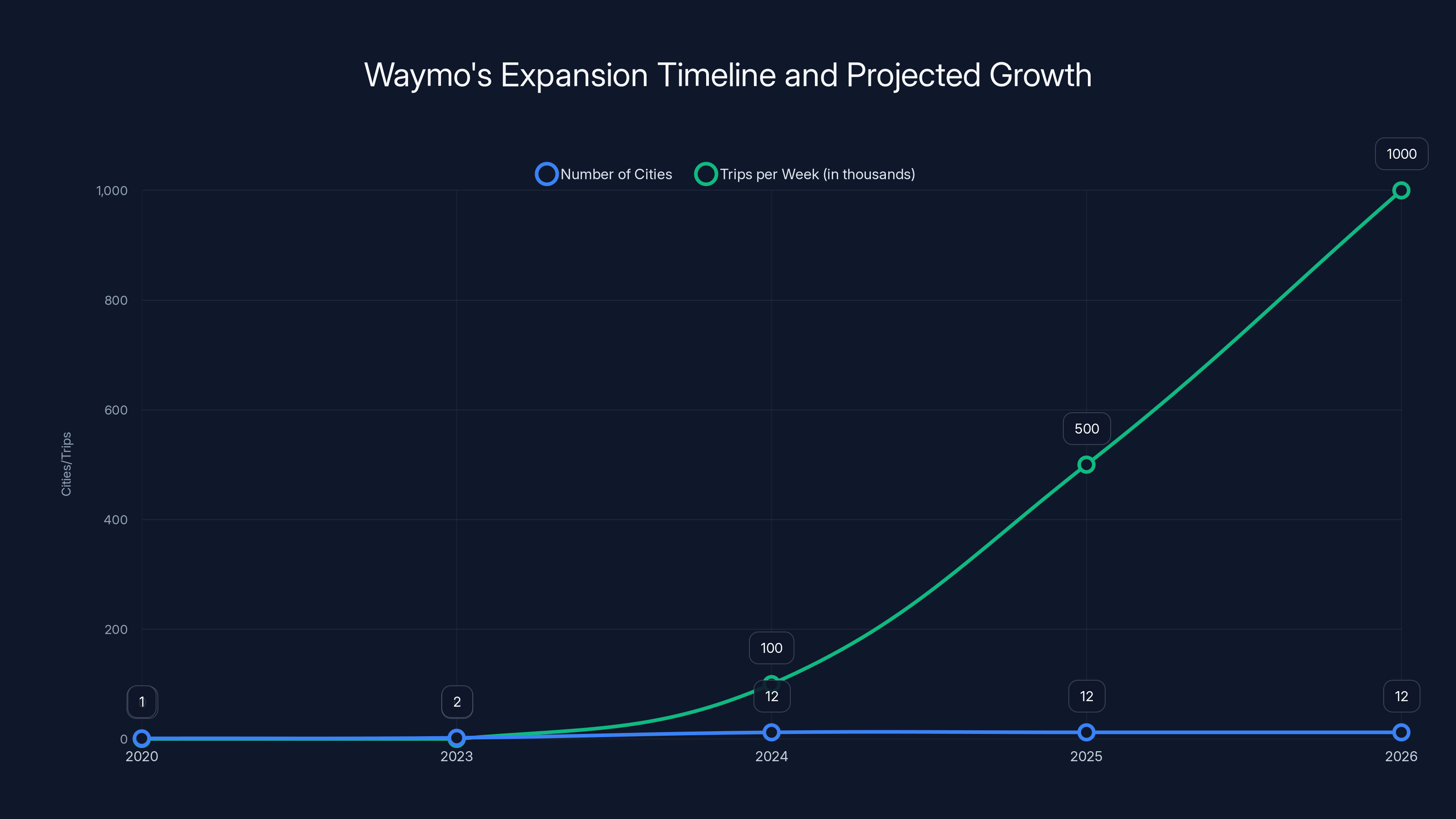

- The company targets 1 million trips per week by the end of 2026, signaling a major shift from pilot programs to mainstream service

- Safety concerns persist: Federal regulators are investigating school bus incidents, and software recalls haven't fully resolved the issues

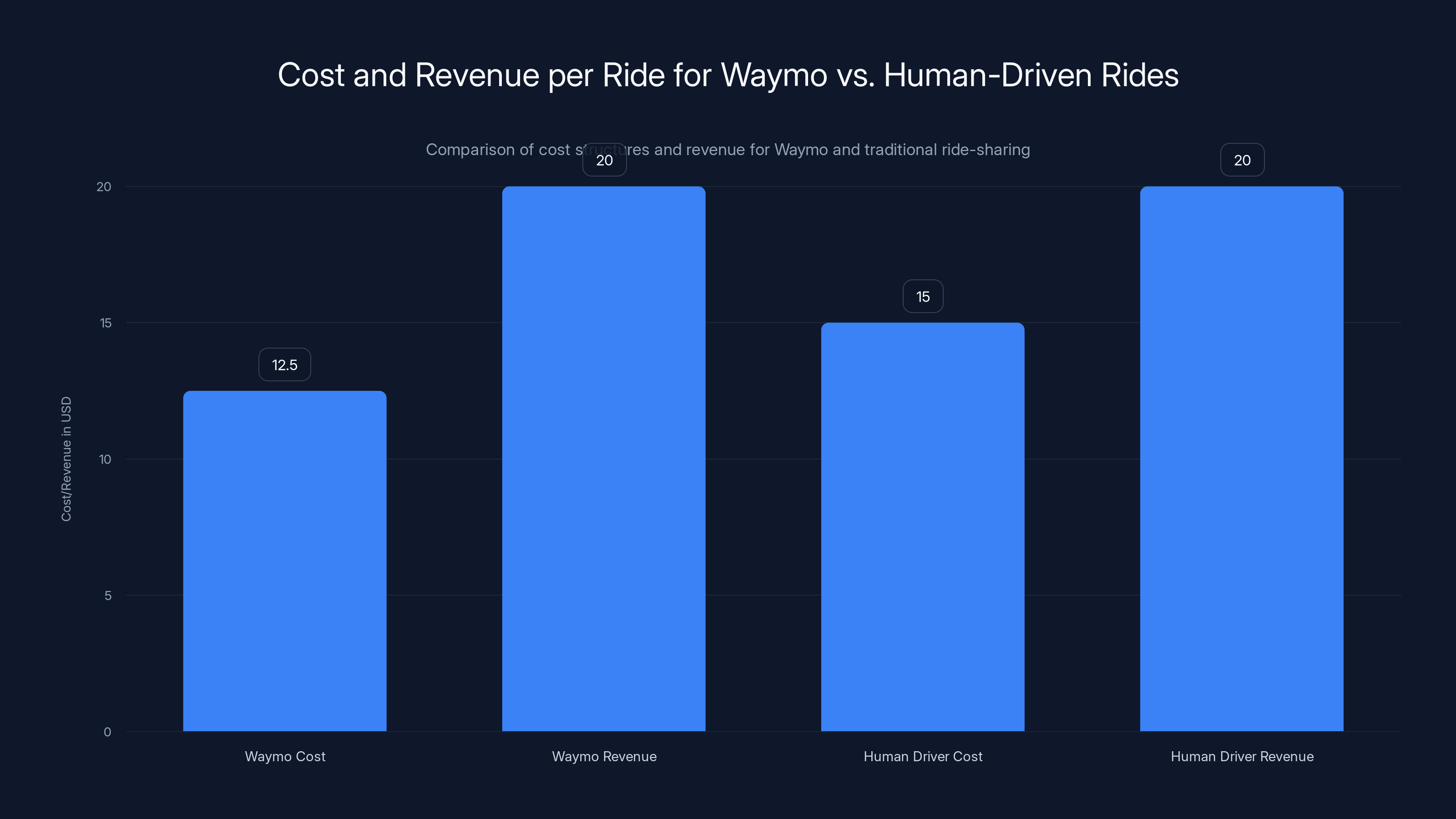

- The economics are starting to work: Waymo's operational costs are approaching the point where robotaxis can compete with traditional ride-sharing on price

Waymo's cost per ride is estimated at

The Miami Launch: What's Actually Happening

Let's get specific about what Waymo is doing in Miami, because the details matter more than the headline.

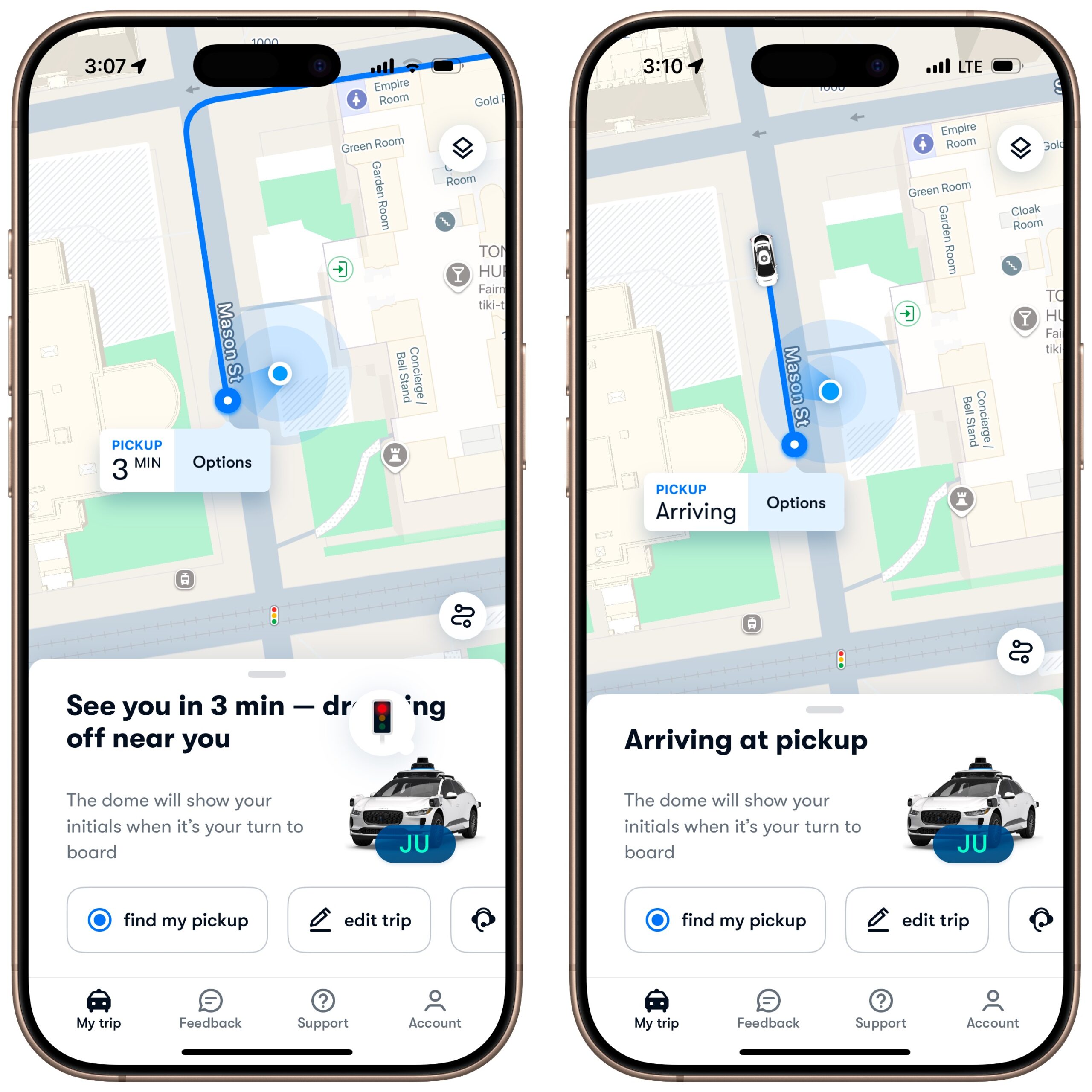

The company is rolling out access on a phased basis to nearly 10,000 people already on its waiting list. That's not random—it's a deliberate strategy. Waymo's learned that its early adopters tend to be more forgiving of edge cases, more likely to provide useful feedback, and less likely to post viral videos of the robotaxi doing something weird. Starting with a managed cohort gives the company breathing room to iron out local quirks before opening to everyone.

The service area covers 60 square miles, which sounds large until you realize it's only a fraction of Miami-Dade County. But it's not arbitrary. The company spent months mapping Miami's roads, training its neural networks on local driving patterns, and testing in real conditions. The Design District, Wynwood, Brickell, and Coral Gables aren't chosen because they're wealthy neighborhoods (though they are). They're chosen because they have predictable traffic patterns, good road infrastructure, and relatively straightforward geometry. You're not dodging massive potholes or navigating roads that fall apart every rainy season.

The company removed safety operators from the fleet in November, after months of testing with drivers present. This is crucial. A safety operator is there to take over if something goes wrong. Once they're gone, you're genuinely in a fully autonomous vehicle. Waymo didn't remove operators until it had logged enough miles in Miami conditions to be confident in its systems. That suggests the company believes its technology is production-ready in this environment.

Eventually, Waymo plans to expand to Miami International Airport. The company didn't give a timeline beyond "soon," which in corporate speak means "probably 6-12 months, but we're not committing." Airport service is important because it's one of the highest-value transportation routes. People getting to airports will pay premium prices, and consolidating rides to a major hub creates dense, predictable routing. It's a natural expansion point.

The bigger picture is that Miami represents a test case for operating autonomous vehicles in high-traffic, high-stakes urban environments with weather patterns and driving behaviors that differ significantly from Waymo's established markets. If the company can make this work, it proves the technology scales beyond a handful of favorable geographies.

Understanding Waymo's Aggressive Expansion Timeline

Waymo has committed to something ambitious: launching in nearly a dozen additional cities within the next year. We're talking Dallas, Denver, Detroit, Houston, Las Vegas, Nashville, London, San Diego, Seattle, and Washington D.C. That's not a roadmap. That's a full sprint.

To put this in perspective, autonomous vehicle deployment used to happen on a "years between launches" timeline. Waymo first opened to the public in Phoenix in 2020. It took until 2023 to expand to San Francisco. Now it's planning a dozen new cities in 12 months. The speed-up reflects two things: first, that the company has cracked scalability and can replicate operations faster than previously possible. Second, that there's genuine competitive and market pressure. Cruise imploded, but other players are moving into autonomous delivery and robotaxis. Waymo needs to secure market position before competitors gain traction.

The company is already testing in several of these cities using a mix of all-electric Jaguar I-Pace vehicles and newer Zeekr RT vans rebranded as "Ojai." The mix is strategic. I-Pace vehicles handle dense urban driving. Ojai vans offer more capacity for rides where you're picking up multiple passengers. Having both in the fleet lets Waymo optimize for different trip types and passenger preferences.

This matters because it shows the company isn't deploying the same solution everywhere. It's building flexibility into its deployment model. Different cities have different traffic patterns, different passenger densities, different infrastructure. Waymo's willingness to deploy different hardware suggests it understands this and is adapting accordingly.

Co-CEO Tekedra Mawakana stated publicly that by the end of 2026, Waymo should be offering 1 million trips per week. Let's put this in context. That's roughly 52 million trips per year. At an average ride of 10 minutes and an average trip revenue of

The expansion plays into a broader shift in how autonomous vehicles are being deployed. Early models focused on proving the technology worked. Current models focus on proving it can scale commercially. That means less "how far can we go" and more "how fast can we get profitable units in the field." Waymo's Miami-to-a-dozen-cities strategy is exactly this mindset.

Waymo plans to expand to 12 cities by 2024, significantly increasing from its 2-city presence in 2023. By 2026, it aims to offer 1 million trips per week. Estimated data based on expansion goals.

The Technology That Makes This Possible

Understanding why Waymo can expand this rapidly requires understanding the core technical stack that actually powers the robotaxis. It's not magic. It's engineering.

At the heart of Waymo's system is a combination of lidar, radar, cameras, and software that processes sensor data in real-time to understand the environment and make driving decisions. Lidar bounces lasers off objects to create a 3D map of everything around the car, accurate to a few centimeters. Radar detects movement and velocity. Cameras read traffic signals, identify pedestrians, and recognize road markings.

The real intelligence is in the fusion layer—the software that takes data from all these sensors and builds a coherent understanding of the scene. This is harder than it sounds. You need to identify every object (car, pedestrian, bike, pothole, broken lane marker), predict what it's going to do next, and then make driving decisions that account for uncertainty. If the system thinks a pedestrian has an 87% chance of stepping into traffic, what does the robotaxi do? Brake immediately? Assume the pedestrian won't move? These decisions need to be made in milliseconds.

Waymo's approach is to train neural networks on millions of miles of real driving data. The company logs footage from its entire fleet, uses that footage to train models that recognize patterns, and then deploys those models across all vehicles. This is why scale matters. The more miles you log, the more edge cases your system has seen, the better your neural networks get at recognizing novel situations.

Miami specifically is interesting from a technical perspective because it forced Waymo to solve problems Phoenix and San Francisco don't present as prominently. Heavy rain reduces lidar effectiveness. Tropical heat stresses electronics. Aggressive drivers make prediction harder because behavior is less predictable. The fact that Waymo removed safety operators suggests the company has confident solutions to these problems.

The other critical piece is mapping. Waymo maintains ultra-precise maps of every street in every city where it operates, down to lane-level detail. These maps are updated continuously as road conditions change. This isn't Google Maps. This is HD mapping accurate to inches, used by the autonomous system to validate what its sensors are seeing. If the lidar says there's a lane marker but the HD map says there shouldn't be, the system investigates further rather than blindly trusting either source.

This mapping infrastructure is where autonomous vehicle companies build durable competitive advantages. It's also where scale really matters. The more cities Waymo operates in, the more mapping data it captures, the better its maps become. Competitors without equivalent mapping infrastructure face a steeper hill.

Why Miami Specifically? Geography and Market Logic

Waymo could have expanded to any major American city. That it chose Miami reveals something about the company's strategic thinking and the specific challenges autonomous vehicles face in different geographies.

Miami is hard. It's not harder than some places, but it's harder than the established Waymo markets. Phoenix is sprawling, relatively car-dependent, with predictable weather and driving patterns. San Francisco is dense but has many tech-forward residents who understand autonomous vehicles. Los Angeles offers a dense ride-sharing market with consistent demand.

Miami is different. It's humid, rainy, chaotic. The driving culture is aggressive. The roads are a mix of well-maintained streets and infrastructure that's been beaten down by salt air and tropical weather. Adding to that, Miami has a significant population without high tech literacy, which means Waymo can't rely on riders understanding exactly how to interact with the robotaxis.

Picking Miami is partly strategic and partly pragmatic. Strategically, it's a major metropolitan area with significant ride-sharing demand, a growing tech sector, and media attention. Pragmatically, it's proving that Waymo's technology isn't dependent on perfect conditions. If the system works in Miami, it can work almost anywhere.

The 60-square-mile service area makes sense geographically too. It covers high-demand neighborhoods where ride-sharing is already established behavior. Wynwood and Brickell are trendy, walkable, dense neighborhoods with high per-capita ride-sharing usage. The Design District is upscale with strong commercial activity. Coral Gables is wealthy, suburban, and car-dependent (which makes it useful for testing suburban routing). This mix of neighborhood types lets Waymo see how its system performs across different urban patterns.

Airport access is the strategic prize. Miami International Airport is one of the largest in the United States, handling 40+ million passengers annually. If Waymo can service the airport reliably, it creates a repeatable, high-value use case that's easily replicated in other cities with major airports. Most travelers will happily get dropped off by a robotaxi if it's cheaper than a traditional rideshare. Airport service is also valuable because routes are predictable and traffic patterns are well-understood.

The Safety Question: School Buses and Federal Investigations

Here's where things get uncomfortable. Waymo's expansion has attracted the attention of federal safety regulators, and the issues they're investigating are genuinely concerning.

The National Highway Traffic and Safety Administration opened an investigation last October into how Waymo robotaxis operated around school buses. Specifically, the agency was investigating incidents where robotaxis appeared to pass stopped school buses even when lights were activated and the stop sign was deployed. School districts in Austin have documented multiple incidents with video evidence showing Waymo vehicles passing school buses when they shouldn't.

This isn't a minor issue. School bus safety rules exist because children die when they're hit by vehicles. The rule is simple: when a school bus has its lights on and stop sign out, all traffic must stop. Period. No exceptions. Waymo issued a voluntary software recall to fix the problem, but subsequent videos suggest the issue persists. That's alarming.

There are a few things happening here simultaneously. First, the robotaxis genuinely might not be recognizing school buses reliably in all conditions. School buses are visually distinctive, but they can be partially obscured by traffic, parked cars, or other obstructions. The neural networks driving Waymo's perception system need to reliably identify them even in partial views.

Second, there's a difference between detecting a school bus and understanding that it's a school bus with its lights on and stop sign deployed. A robotaxi might see "yellow vehicle with red lights" but not parse that into "must stop." Integrating this kind of specialized safety rule into the autonomous driving stack is genuinely hard.

Third, and this is important, is that school buses represent a class of problem that autonomous vehicles struggle with: exceptions to normal driving rules. Most of the time, robotaxis follow traffic laws and traffic signals. But the transportation system has dozens of special cases. School buses are one. Emergency vehicles approaching are another. Construction zones with non-standard geometry are a third. Teaching autonomous systems to handle all these cases reliably is much harder than teaching them to follow normal rules.

Waymo's approach has been to issue software updates and insist the problem is being addressed. That's reasonable. Software can be fixed. But the fact that the issue persists after an initial recall is troubling. It suggests the company's neural networks aren't generalizing well to all school bus scenarios, or that the decision-making logic isn't correctly prioritizing school bus detection above other driving tasks.

Federal regulators are watching carefully. The agency has the authority to ground Waymo's fleet if safety concerns become critical. That's unlikely to happen without a genuine incident, but the investigation is a clear signal that autonomous vehicles are no longer operating in a regulatory vacuum. The technology has to prove it's genuinely safe, not just "probably safe."

This is where public trust becomes critical. Autonomous vehicles are inherently less likely to crash than human drivers (the statistics support this at scale), but people perceive them differently. A human driver passing a school bus might get ticketed. A robot doing the same thing gets recorded and posted online, sparking outrage. The bar for acceptable behavior is higher.

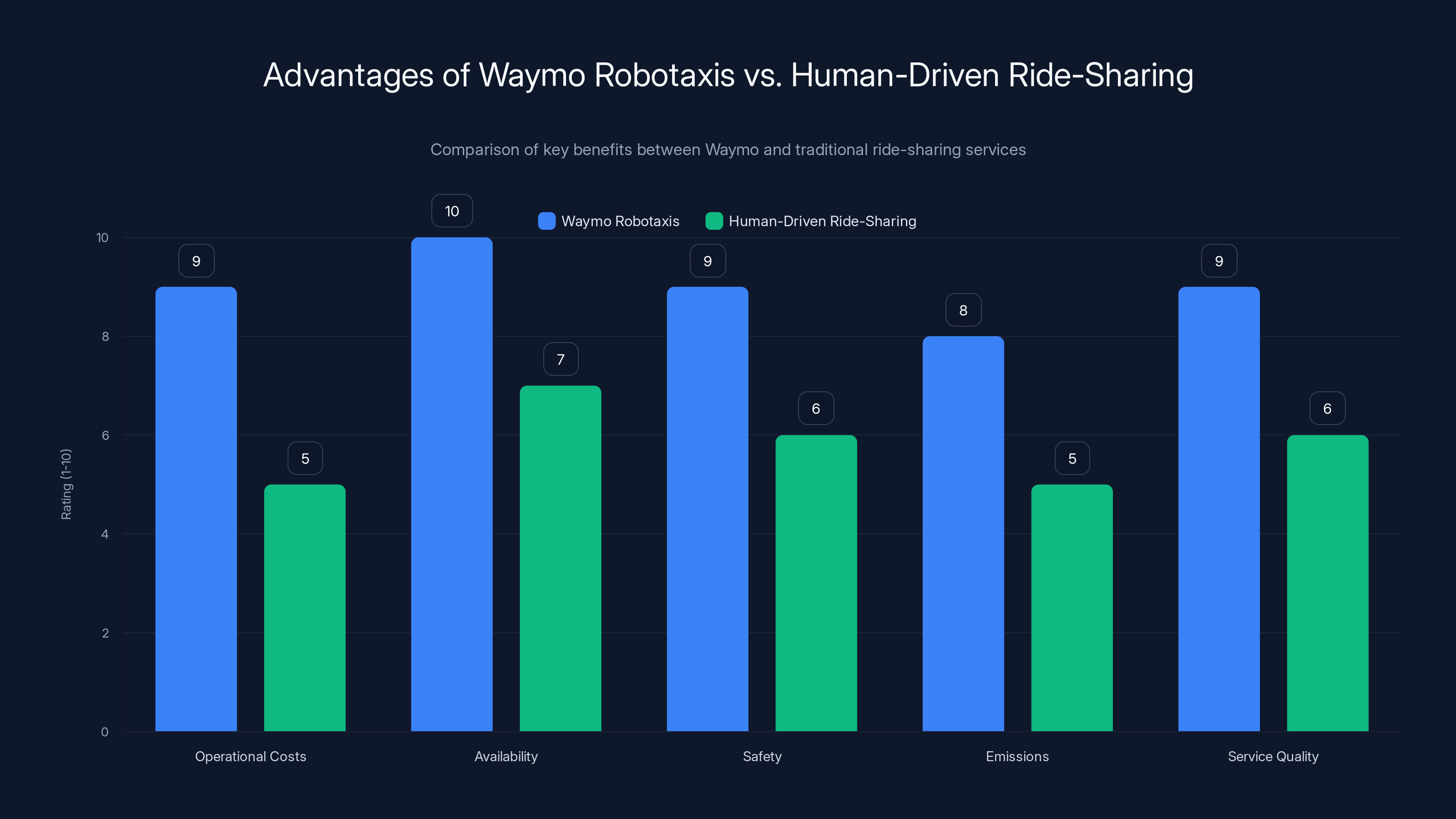

Waymo robotaxis score higher in operational costs, availability, safety, emissions, and service quality compared to human-driven ride-sharing services. Estimated data based on typical advantages.

Operational Challenges: Traffic Jams and Power Outages

Beyond the school bus issue, Waymo's expansion has revealed operational challenges that don't fit neatly into "safety" or "technology," but matter tremendously for real-world deployment.

In December, San Francisco experienced a widespread power outage. Traffic lights went dark across significant portions of the city. What followed was chaos: vehicles gridlocked, intersections paralyzed, emergency vehicles unable to move. Videos captured Waymo robotaxis contributing to the congestion, apparently unable to navigate uncontrolled intersections as effectively as human drivers. The scenes look embarrassing in hindsight, but they reveal something genuine: autonomous vehicles are optimized for normal conditions. When the system breaks down, they break down too.

This is worth thinking about seriously. Human drivers are incredibly adaptable. We've all driven through a dead traffic light. We understand right-of-way, we can read other drivers' intentions, we can improvise. Autonomous vehicles aren't adaptive in the same way. They're trained on "normal" scenarios. When traffic lights stop working, they're operating outside their training distribution. The neural networks don't have patterns that match "power outage." So they default to conservative behavior, which in this case meant slowing down and looking for the traffic signals that aren't there.

Roads without traffic lights are actually common in some parts of the world—roundabouts in Europe, for instance. But North American robotaxis are trained primarily on signalized intersections. Expanding to different driving cultures and road designs will require retraining the perception and decision-making systems. That's feasible but it's work.

The traffic jam videos also surfaced earlier when Waymo was expanding in San Francisco. Residents reported videos of robotaxis confused about parking, getting stuck in loops, or moving slowly through intersections while human drivers got frustrated. Some of this is just novelty (anything unusual creates memorable content), but some of it points to real issues: the robotaxis are often more conservative than human drivers, which can be safer in general but creates friction when operating in traffic.

These operational challenges don't invalidate autonomous vehicles, but they point to real constraints. Robotaxis will probably never handle chaotic, unstructured situations as well as humans. That's okay—they don't need to. But it means there's a floor to how well they can integrate into existing traffic systems. They'll work best in predictable, well-structured driving environments. That's most of the time, but not all of the time.

The Competitive Landscape: Waymo's Relative Position

Understanding Waymo's significance requires understanding what's happened to its competitors.

Cruise, which was backed by General Motors, was the other major American autonomous vehicle company attempting robotaxi service. The company completely imploded after a September 2023 incident where a robotaxi hit a pedestrian, dragged her under the vehicle, and Cruise appeared to cover it up by deleting video footage. Regulators revoked the company's permit. General Motors shut the autonomous division down. Cruise went from 200+ operational vehicles to zero overnight.

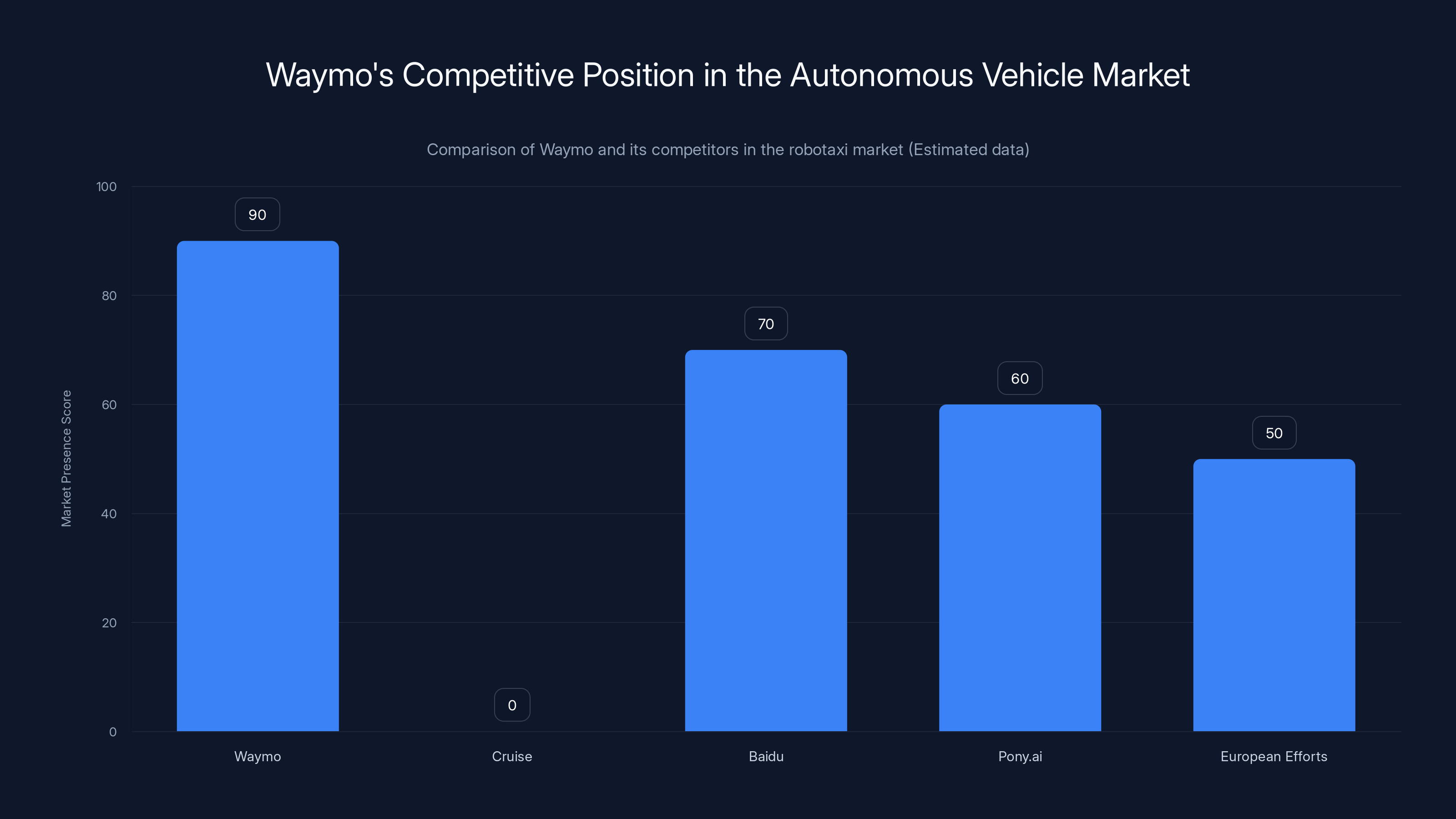

That collapse meant Waymo faced essentially no domestic competition for the robotaxi market. Internationally, there are players in China (companies like Baidu and Pony.ai) and some European efforts, but none with the North American deployment at Waymo's scale.

Waymo's partnership with Uber is strategically significant. The company launched services in Atlanta and Austin using Uber's platform. This matters because it gives Waymo a consumer interface it didn't have to build, access to millions of Uber customers, and a proven payment and routing system. For Uber, it means they can offer autonomous rides without building the autonomous technology themselves.

But this partnership also reveals something: Waymo isn't trying to displace Uber. It's becoming part of the Uber infrastructure. That's a different play than initially positioning autonomous vehicles as the ultimate Uber replacement. It's more realistic and probably more commercially viable, but it changes the strategic implications.

Competing with human drivers is still the core game. Traditional ride-sharing drivers earn somewhere between $12-17 per hour gross (before expenses). Waymo's cost structure is different—no driver labor, but significant infrastructure, maintenance, and insurance costs. For Waymo to undercut ride-sharing prices while remaining profitable, it needs to operate vehicles more efficiently: longer hours, more trips per vehicle, lower maintenance overhead. The company is betting it can achieve all three.

Financial Implications: When Does This Become Profitable?

Waymo is owned by Alphabet (Google's parent company) and has access to essentially unlimited capital. But even tech companies care about unit economics eventually. When does autonomous vehicle operation become profitable?

This requires understanding cost structure. A typical Uber or Lyft ride generates

Waymo's cost structure is fundamentally different. Vehicles are expensive—a robotaxi probably costs

Let's call the total variable cost

The critical variable is utilization. If a Waymo vehicle can stay in service 16+ hours a day (which is possible without driver fatigue constraints), and maintains 85%+ utilization (only 15% dead time between rides), then the math works. Human drivers typically achieve 60-70% utilization—they're waiting for pings, moving to better zones, dealing with breaks.

This is why scale matters so much. At 100 vehicles, a Waymo fleet is a loss-making experiment. At 10,000 vehicles, you have data on utilization, maintenance patterns, and route efficiency that lets you optimize operations. At 100,000 vehicles, you achieve the scale needed to potentially undercut human drivers.

Waymo's 1 million trips per week target, if achieved by end of 2026, would require something like 30,000-40,000 active vehicles assuming typical utilization. The company isn't there yet, but the trajectory is clear.

Waymo leads the North American robotaxi market with a high presence score, especially after Cruise's exit. International competitors like Baidu and Pony.ai have significant presence in their regions. (Estimated data)

The Regulatory Future: What Governments Actually Want

Autonomous vehicles don't exist in a regulatory vacuum. Governments care about them for specific reasons: safety (obviously), but also job displacement, tax revenue, infrastructure planning, and congestion management.

Safety is the immediate concern, and the NHTSA investigation demonstrates this is being taken seriously. The agency is establishing baseline safety standards that autonomous vehicles must meet before expansion. The school bus issue is exactly this kind of edge case where the rules are clear but the technology has to be proven compliant.

Beyond safety, governments are starting to think about congestion implications. Autonomous vehicles could reduce congestion (fewer crashes, more efficient routing) or increase it (more people might ride if it's cheaper, and robotaxis might deadhead to repositioning). Evidence so far suggests mixed results—the power outage videos suggest robotaxis sometimes contribute to congestion.

Taxation and revenue are also emerging concerns. Ride-sharing generates tax revenue. If robotaxis operate cheaper and displace human drivers, governments face revenue loss. Some cities are already thinking about robotaxi-specific taxes to fund transit and manage the transition.

Waymo seems to be navigating this by being a cooperative participant in regulatory discussions rather than fighting restrictions. That's a smart play. The technology is good enough that aggressive regulation would just slow expansion without stopping it. Better to work within the system.

Integration With Urban Planning: The Long-Term Picture

This is where the Miami launch matters most, even though people haven't realized it yet.

Cities are designed around cars. Parking lots take up 14% of urban land area in major American cities. Most streets were laid out assuming human drivers and traffic signals. Cars sit idle 95% of the time. Autonomous vehicles could fundamentally reshape this.

If robotaxis can provide cheaper, more convenient transportation than car ownership, fewer people own cars. Fewer cars means less parking is needed. Less parking means that urban land currently devoted to asphalt becomes available for housing, parks, offices, or just... nothing. The urban fabric fundamentally changes.

Miami offers an interesting test case because the city is already reckoning with climate change (sea-level rise is a real concern) and thinking about long-term resilience. Reducing car dependency makes the city less dependent on sprawling infrastructure vulnerable to flooding. It's not an explicit motivation for the Waymo launch, but it's a side effect that city planners should be thinking about.

The other implication is mode shift. Right now, many trips that could be ride-sharing trips are driven in personal vehicles because of cost. If autonomous ride-sharing becomes dramatically cheaper, those trips shift. That changes traffic patterns, peak hour management, and infrastructure needs.

None of this happens overnight, but it happens within a decade if autonomous vehicles become ubiquitous. Cities that prepare for this transition will adapt successfully. Cities that don't will face congestion, parking problems, and underutilized infrastructure.

The Path From Miami to Mainstream Adoption

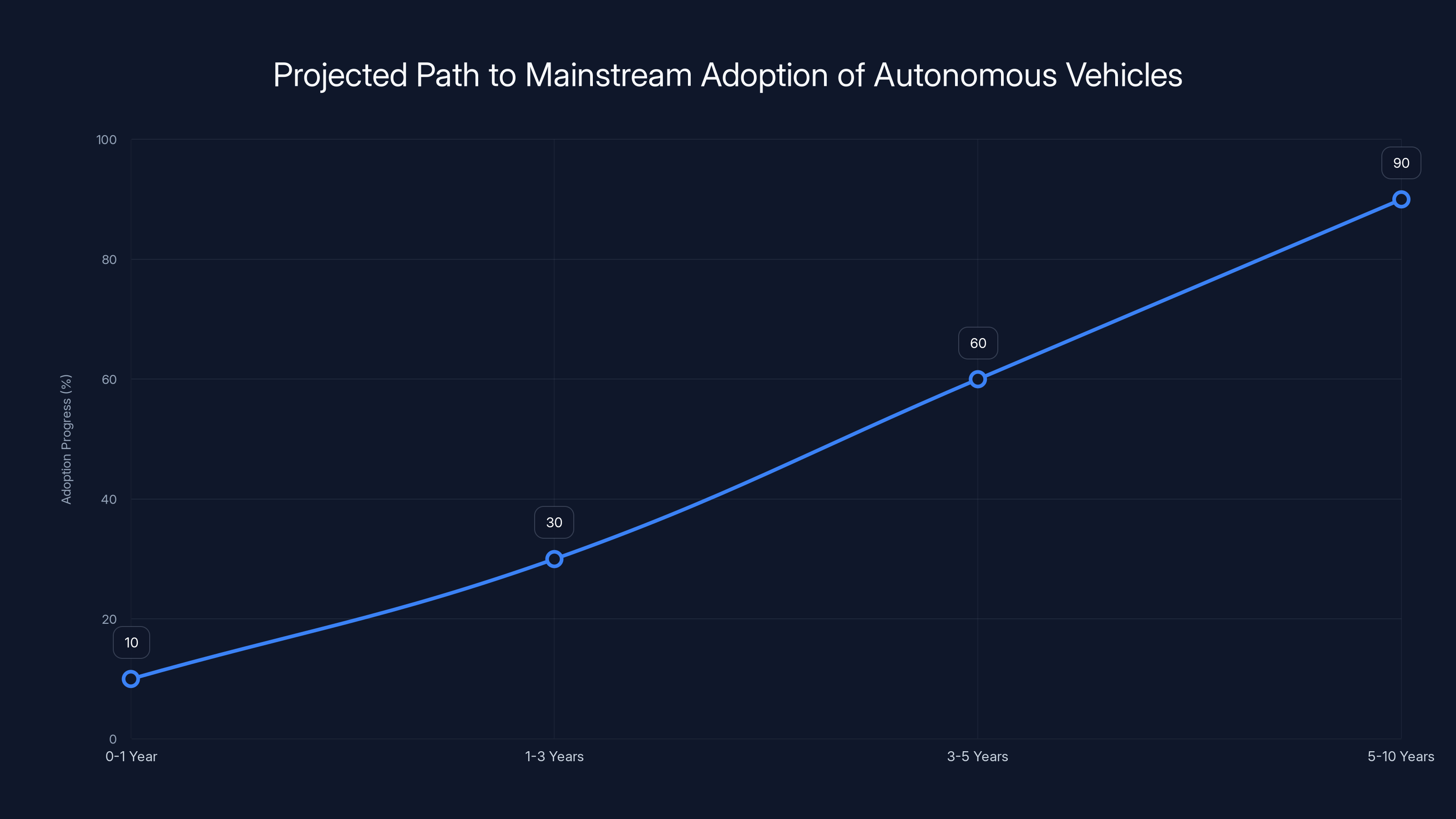

Accepting that Waymo can now operate in Miami, what's the realistic path to autonomous vehicles becoming mainstream transportation?

The next 12 months are critical. The company needs to successfully launch in the 10+ announced cities without major safety incidents or operational failures. One catastrophic accident, one regulatory shutdown, one city that decides to revoke permits, and the timeline stretches significantly. Waymo's safety record has been good so far, but the company is operating at increasingly large scale where statistical outliers become inevitable.

Assuming successful expansion, the following 24-36 months involve consolidation. The company focuses on improving operations, reducing costs, improving utilization, and proving profitability in existing markets. This is less exciting than expansion, but it's where the real value is created. Anyone can deploy vehicles to a new city if you have capital. Profitably operating in multiple cities simultaneously is much harder.

The 3-5 year window is where dominoes start falling. If Waymo proves profitable at scale (say, 100,000+ vehicles across dozens of cities), insurance companies adjust rates for human drivers upward (since robotaxis are statistically safer), economics shift dramatically, and adoption accelerates. Competitors re-enter the market. Regulations normalize. Autonomous vehicles go from novel to routine.

The 5-10 year window is where real disruption happens. By then, autonomous vehicles should be cheaper than human-driven ride-sharing in most major cities. Car ownership rates decline. Urban planning changes. The transportation labor market shrinks dramatically. These aren't hypotheticals—they're mathematical consequences of the cost structure.

Miami is a waypoint on that journey, not the destination. But waypoints matter. They prove the route is viable.

Estimated data shows a gradual increase in adoption, with significant acceleration expected in the 3-5 year window as profitability and regulatory normalization occur.

What Waymo's Success Means for Other Industries

Focusing just on robotaxis misses the broader implications. Waymo's progress in autonomous vehicles has ripple effects across multiple industries.

Delivery is one obvious case. Autonomous delivery trucks could operate on highways 24/7 without fatigue constraints. The cost structure for long-haul trucking could be completely reshaped. The American Trucking Association represents 3.5 million trucking workers. If autonomous long-haul trucking becomes viable, the employment implications are enormous.

Manufacturing is another area where autonomous vehicles matter. Factories use autonomous vehicles for material handling, parts movement, and logistics. Better autonomous technology could reshape factory efficiency. Companies like Tesla and others are already investing heavily in these applications.

Agriculture uses autonomous vehicles for harvesting, planting, and field management. There's less regulatory scrutiny in agriculture (tractors aren't on public roads), so autonomous farm vehicles might actually scale faster than robotaxis.

Waymo's core technology—perception, planning, and control for autonomous systems—is transferable across all these domains. Success in consumer robotaxis validates the underlying technology, making it easier to apply to other use cases.

Comparing Miami to Waymo's Other Markets

Waymo operates in very different environments. Phoenix is desert, sprawling, with predictable weather and driving patterns. San Francisco is dense, hilly, foggy, with complex traffic. Los Angeles is sprawling with heavy freeway usage. Now add Miami: humid, rainy, tropical, aggressive driving culture.

Each market tests different capabilities. Phoenix tests long-distance routing and highway capability. San Francisco tests dense urban navigation. Los Angeles tests freeway integration. Miami tests tropical weather and human unpredictability.

Waymo's willingness to operate in all these markets suggests confidence that the core technology generalizes. That's actually significant. If the same neural network-based system can work in completely different environments, it suggests the approach is robust.

The comparison also reveals Waymo's strategy. The company isn't picking easy places. It's picking diverse places that test different aspects of the technology. That's how you validate that something actually works rather than just works in one narrow case.

The Infrastructure Challenge: More Than Just Vehicles

People focus on the robotaxis—the vehicles themselves. But the actual infrastructure challenge is broader.

Robo Taxis need reliable maps. Ultra-precise, constantly updated maps of every street. That's a massive undertaking. Google already has data advantage here since Waymo can leverage Google Maps data, but even Google Maps needs higher precision for autonomous driving than for human navigation.

Robo Taxis need reliable communication. They need to talk to cloud infrastructure for route planning, they need cellular connectivity for telemetry and updates, they need low-latency connections for real-time data. Urban cellular coverage is inconsistent. Building infrastructure that's reliable enough is an actual engineering challenge.

Robo Taxis need charging infrastructure. Most Waymo vehicles are electric. That means charging stations, power management, fleet optimization around charging schedules. In cities like Miami where electricity generation is already stressed by heat and air conditioning demand, ramping up charging for a fleet of thousands of electric vehicles means coordinating with utilities.

Robo Taxis need maintenance facilities. Unlike ride-sharing where drivers handle minor issues, robotaxis need regular technical service. Waymo needs facilities in every city with trained technicians who understand autonomous vehicle systems. That's not trivial to scale.

These infrastructure challenges are less visible than the autonomous driving technology, but they're real constraints on how fast deployment can happen. This is partly why Waymo's expansion is measured—the company needs time to build out the infrastructure, not just the vehicle fleet.

Waymo's service covers 60 square miles, a small fraction of Miami-Dade's 2000 square miles, focusing on areas with predictable traffic and good infrastructure.

The Employment Question: What Happens to Drivers?

Let's address the elephant in the room directly. Waymo's success eventually means fewer driving jobs.

There are roughly 3.5 million commercial truck drivers in the US, plus millions more in ride-sharing, delivery, and local trucking. Autonomous vehicles don't eliminate all these jobs overnight, but the trajectory is clear. Over 10-20 years, a significant fraction of these driving jobs are threatened.

This creates genuine social and political challenges. Communities built around trucking and ride-sharing face economic disruption. Workers need retraining for different careers. Pension obligations for union drivers need to be addressed. The transition could be messy.

Waymo hasn't made public statements about how to handle this transition. Alphabet has the resources to contribute to retraining programs, but there's no indication the company is doing so. That's probably a political calculation—publicly investing in driver retraining acknowledges job losses that Waymo has incentive to downplay.

But ignoring the employment impact doesn't make it go away. Policy makers will eventually force some combination of solutions: transition assistance for displaced workers, retraining programs, gradual phase-in of autonomous vehicles to avoid shock, and possibly restrictions on how quickly autonomous vehicles can displace human workers in certain sectors.

Long-Term Competitive Dynamics

Waymo faces interesting competitive dynamics going forward. In the short term (next 2-3 years), it has essentially zero competition in robotaxis. Cruise is gone. No other American company is at Waymo's scale.

But that won't last. There are hundreds of millions of dollars to be made in autonomous ride-sharing. Entrepreneurs, established companies, and foreign competitors will eventually enter.

International competition is particularly interesting. Chinese companies like Baidu and Pony.ai are deploying autonomous vehicles at scale in China. They have larger home markets, lower labor costs, and less regulatory friction. If they successfully scale in Asia, exporting that technology to North America becomes viable.

Waymo's competitive advantage is experience and data. The company has logged more autonomous miles in real-world conditions than anyone else. That data advantage compounds over time. Every trip generates data that improves the neural networks, making the system better, making Waymo more competitive. That's a moat, but it's not permanent. Competitors could potentially crack autonomous driving through different technological approaches, leapfrogging Waymo's experience advantage.

Regulatory Uncertainty and Political Risk

One thing that could derail Waymo's expansion is regulatory backlash. If a robotaxi causes a high-profile accident, especially one involving children, political pressure could force regulators to impose restrictions that slow deployment dramatically.

That's not irrational. Driving involves life-and-death decisions. The public has low tolerance for automated systems that make fatal mistakes. One bad incident could shift political momentum significantly.

Waymo's safety record has been good, but the company is operating at increasingly large scale. Statistical probability suggests an incident is likely eventually. How Waymo handles it—transparency, accountability, swift corrective action—will determine whether the technology continues expanding or faces a setback.

There's also political risk of a different kind. Labor unions representing truck drivers and ride-share workers will eventually mobilize against autonomous vehicles. That political pressure could result in regulations: licensing requirements for autonomous vehicles, geographic restrictions, mandatory transition assistance for displaced workers. These wouldn't necessarily stop autonomous vehicles, but they could slow expansion and change the economics.

The Path Forward: What Happens Next

Miami marks a moment where autonomous vehicles transition from "impressive technology being tested" to "actual commercial service available to the public." It's not the endpoint—it's the inflection point where the trajectory becomes clear.

Over the next 12 months, watch these key indicators:

Expansion Pace: Does Waymo successfully launch in all announced cities? Each successful launch validates the technology. Each delay or failure raises questions about scalability.

Safety Record: Does Waymo maintain its safety record as fleet size grows? Any significant incident affects regulatory momentum and public perception.

Unit Economics: Does the company publish any data on ride volume or profitability? This is closely guarded, but eventually the numbers will become clear either through regulatory filings or industry leaks.

Regulatory Action: Do regulators impose new restrictions, or does the school bus issue get resolved satisfactorily? This signals whether governments view autonomous vehicles as acceptably safe.

Competition: Does any competitor emerge with viable autonomous ride-sharing capability? This determines whether Waymo retains advantage or faces genuine pressure.

Public Adoption: Do people actually use Waymo when it's available, or does adoption lag? Technology is only useful if people choose to use it.

Based on the Miami launch, the most likely scenario is that Waymo successfully expands to multiple cities over the next 2-3 years, gradually approaches profitability, and becomes a mainstream transportation option in major metropolitan areas by 2028-2030. That timeline could accelerate if execution is perfect or extend if significant obstacles emerge.

But the trajectory is now clear. Autonomous vehicles aren't coming. They're already here. Miami is just the first major market where the general public can experience them. Other cities will follow quickly. The transportation industry as we've known it for 100 years is beginning to reshape.

Conclusion: Why Miami Matters More Than the Headlines Suggest

The Waymo robotaxi launch in Miami isn't just another expansion announcement. It's proof that autonomous vehicle technology works reliably enough to operate in diverse, real-world conditions without human drivers present.

That's significant because it means the discussion about autonomous vehicles shifts from "can it work in theory" to "how fast can it scale in practice." Waymo has demonstrated the technology works. The remaining questions are about logistics, economics, and regulatory acceptance.

Over the next 3-5 years, autonomous vehicles will become available in most major American cities. Over 5-10 years, they'll likely become the dominant form of ride-sharing in urban areas. Over 10-20 years, they'll reshape how cities are designed and how people think about personal vehicle ownership.

Miami is a waypoint on that journey. An important one, because it proves the technology generalizes. But just a waypoint.

For the transportation industry, this is a fundamental disruption in progress. For urban planners, it's an opportunity to reshape cities around human needs rather than cars. For workers in transportation and delivery, it's an existential threat that requires serious policy responses.

Waymo's Miami launch succeeds not because it's perfect (it's not—the school bus issue shows real remaining challenges), but because it's good enough to be useful and reliable enough to scale. That's the bar that matters. Not perfection. Practicality.

The next few years will reveal whether that assessment holds. But Miami suggests it does.

FAQ

What is Waymo and how is it different from ride-sharing services like Uber?

Waymo is an autonomous vehicle company owned by Alphabet (Google's parent) that operates fully self-driving robotaxis without human drivers. Unlike Uber or Lyft, which rely on human drivers, Waymo's vehicles use a combination of lidar, radar, cameras, and artificial intelligence to perceive their environment and make driving decisions independently. The vehicles are actively operated by Waymo, not by independent contractors, which gives the company direct control over service quality and safety standards.

How does the Waymo robotaxi service work in Miami?

The Miami service operates through a phased rollout starting with nearly 10,000 residents who signed up on Waymo's waitlist. Users request rides through an app within the 60-square-mile service area covering neighborhoods like Wynwood, Brickell, the Design District, and Coral Gables. The robotaxis navigate to pickup locations and drive passengers to their destinations without a human operator, though all vehicles have been equipped with remote monitoring capabilities. The service is designed to work like traditional ride-sharing in terms of user experience—request a ride, get picked up, get dropped off—with the difference being the vehicle has no human driver.

What are the main advantages of Waymo robotaxis compared to human-driven ride-sharing?

Autonomous robotaxis offer several potential advantages: lower operational costs by eliminating driver labor, 24/7 availability without fatigue constraints, greater safety through elimination of human error in driving decisions, reduced emissions from optimized routing and electric powertrains, and consistent service quality without the variability of different human drivers. The cost structure also means that as Waymo scales, ride prices could potentially drop below traditional ride-sharing rates while still maintaining profitability.

What are the main safety concerns that regulators have raised about Waymo?

The primary concern involves school bus interactions. The National Highway Traffic and Safety Administration investigated incidents where Waymo vehicles passed stopped school buses with lights activated and stop signs deployed, which violates a fundamental traffic safety rule. Though Waymo issued a software recall to address the issue, subsequent videos suggest the problem persisted, raising questions about how well the autonomous system recognizes specialized safety scenarios that deviate from normal traffic rules. This is an example of a broader challenge: autonomous vehicles must correctly handle dozens of special cases in traffic rules beyond normal driving.

What timeline does Waymo have for expanding to other cities beyond Miami?

Waymo plans to launch robotaxi services in nearly a dozen additional cities within the next year, including Dallas, Denver, Detroit, Houston, Las Vegas, Nashville, London, San Diego, Seattle, and Washington D.C. The company is already testing autonomous vehicles in several of these cities using Jaguar I-Pace vehicles and Zeekr RT vans branded as "Ojai." Waymo co-CEO Tekedra Mawakana stated that the company aims to offer 1 million trips per week by the end of 2026, which would require operating thousands of vehicles across multiple cities simultaneously.

How does Waymo compete with other autonomous vehicle companies and ride-sharing services?

Waymo currently has minimal direct competition in the robotaxi space in the United States after Cruise's operations were shut down by regulators. However, the company faces indirect competition from human ride-sharing services (Uber, Lyft) and will eventually face competition from other autonomous vehicle developers, including international companies from China like Baidu and Pony.ai. Waymo's competitive advantages include its extensive real-world driving data (millions of miles logged), partnerships with established platforms like Uber, and its parent company Alphabet's capital resources and technology infrastructure. International competitors operating in Asia have different regulatory environments and could potentially expand to North America if they achieve similar technological capability.

What happens to ride-sharing drivers if autonomous vehicles like Waymo become mainstream?

Waymo's success poses genuine economic challenges for the millions of drivers currently working in ride-sharing and transportation. If autonomous vehicles prove economically superior (cheaper to operate per mile than paying human drivers), ride-sharing services would likely transition to autonomous fleets over 5-10 years. This would create significant job displacement for people whose primary income comes from driving. Policy responses might include transition assistance programs, driver retraining initiatives, gradual phase-in rules to avoid economic shock, and possibly regulations limiting how quickly autonomous vehicles can displace human workers in certain sectors. These are policy questions that haven't been fully addressed by either Waymo or government regulators.

How does Miami's climate and driving conditions specifically test Waymo's autonomous system?

Miami presents unique challenges for autonomous vehicles compared to Waymo's previous markets. The tropical climate brings intense afternoon thunderstorms, high humidity, and salt air that can affect electronic components and reduce sensor effectiveness. The driving culture is more aggressive and less predictable than in Phoenix or San Francisco, where Waymo had previously focused. The infrastructure includes both well-maintained modern streets and older roads degraded by salt and weather. These conditions test whether Waymo's neural networks and decision-making systems can generalize beyond the controlled conditions where the company conducted most of its training. Success in Miami suggests the technology can handle diverse real-world scenarios.

When might Waymo expand to Miami International Airport, and why is airport service important?

Waymo stated that expansion to Miami International Airport is coming "soon" but provided no specific timeline—likely 6-12 months based on standard expansion patterns. Airport service is strategically important because it represents a high-value use case: travelers willingly pay premium prices for reliable transportation to airports, routes are predictable and well-understood, and consolidating rides to a major hub creates dense, efficient routing. Successfully serving airports in multiple cities creates a repeatable, scalable use case that demonstrates viability across diverse geographies. Airport service would also likely be Waymo's entry point into many of the dozen additional cities planned for expansion.

What role did the November removal of safety operators play in Waymo's Miami launch?

The removal of safety operators—human drivers trained to take control if the autonomous system encounters problems—signals a major milestone in Waymo's development. Safety operators were present during testing phases to maintain control if necessary. Removing them means Waymo has sufficient confidence in its autonomous system's reliability that it can operate without this fallback. This doesn't mean the system is perfect, but it indicates the company has accumulated enough data and resolved enough edge cases to believe the system is safer than requiring a human backup. The decision demonstrates regulatory confidence as well—the company wouldn't remove operators without assurance that regulators viewed the system as adequately safe.

Key Takeaways

- Waymo's Miami launch proves autonomous vehicles can operate reliably in diverse climates and real-world conditions without human drivers

- The company plans to expand to 12+ additional cities within 12 months, targeting 1 million trips per week by end of 2026

- Federal regulators are investigating school bus safety incidents, revealing gaps in how autonomous systems handle specialized traffic rules

- Unit economics for robotaxis are approaching parity with human ride-sharing, suggesting profitability within 2-3 years at scale

- Successful scaling of autonomous vehicles could displace millions of transportation workers within 5-10 years, requiring policy responses

Related Articles

- Waymo Launches Miami Robotaxi Service: What You Need to Know [2026]

- Waymo in Miami: The Future of Autonomous Robotaxis [2025]

- New York's Robotaxi Revolution: What Hochul's Legislation Means [2025]

- New York Robotaxis: What Happens When One City Gets Left Behind [2025]

- Luminar's Collapse: Inside Austin Russell's Bankruptcy Battle [2025]

- Physical AI: The $90M Ethernovia Bet Reshaping Robotics [2025]

![Waymo's Miami Robotaxi Launch: What It Means for Autonomous Vehicles [2025]](https://tryrunable.com/blog/waymo-s-miami-robotaxi-launch-what-it-means-for-autonomous-v/image-1-1769101766858.jpg)