Waymo's Nashville Robotaxis: The Future of Autonomous Mobility [2025]

Waymo just hit a major milestone. The Alphabet-owned autonomous vehicle company pulled its human safety drivers from robotaxis testing in Nashville, Tennessee. This move signals that Waymo's technology has matured enough to handle real roads without a backup human at the wheel. This kind of progress captures the attention of investors, regulators, and everyday commuters.

Nashville isn't random either. The city sits at a crossroads for autonomous vehicles in America. It's got enough urban complexity to challenge the technology, plenty of riders who need transportation, and a local government that's interested in innovation. Waymo's been testing there for months with safety drivers present. Now they're taking the next step: driverless validation testing.

Here's why this matters: robotaxis can't scale without proving they work in real conditions. And real conditions mean unpredictable traffic, weather changes, construction zones, and all the weird edge cases that make autonomous driving so hard. Nashville represents Waymo's confidence that it's solved enough of these problems to operate without a human backup.

The company plans to launch commercial robotaxi service in Nashville this year through a partnership with Lyft. Riders will book through the Waymo app initially, with expansion to Lyft's app coming later. Lyft's subsidiary Flexdrive will handle the operational side: fleet maintenance, charging infrastructure, vehicle readiness, and depot management. It's a clean division of labor. Waymo handles the driving. Lyft handles the logistics. Both companies benefit.

But Nashville is just one piece of a much larger puzzle. Waymo's already operating commercial robotaxi services in Atlanta, Austin, Los Angeles, Miami, the San Francisco Bay Area, and Phoenix. That's six major markets already generating revenue. Adding Nashville, Dallas, Houston, San Antonio, and Orlando to their test network shows a company in aggressive expansion mode. We're watching the autonomous vehicle industry shift from "Can we do this?" to "How fast can we scale this?"

The stakes are enormous. Whoever cracks autonomous mobility at scale wins a multitrillion-dollar market. Waymo's making moves that suggest they believe they're close to that breakthrough. Let's dig into what's actually happening, what it means, and what comes next.

The Waymo Rollout Playbook: Predictable, Methodical, Effective

Waymo hasn't kept its expansion strategy secret. The company follows the same process in every new market, and that predictability actually tells us something important about their confidence level.

Phase One: Manual Mapping and Data Collection

Waymo starts by manually driving its vehicles through the entire city. This isn't testing autonomy yet. This is about building detailed, 3D maps of every street, every lane marking, every traffic light, and every road hazard. The vehicles are packed with sensors during this phase: lidar, radar, cameras, inertial measurement units. They're essentially scanning the city like a giant autonomous robot vacuum learning its environment.

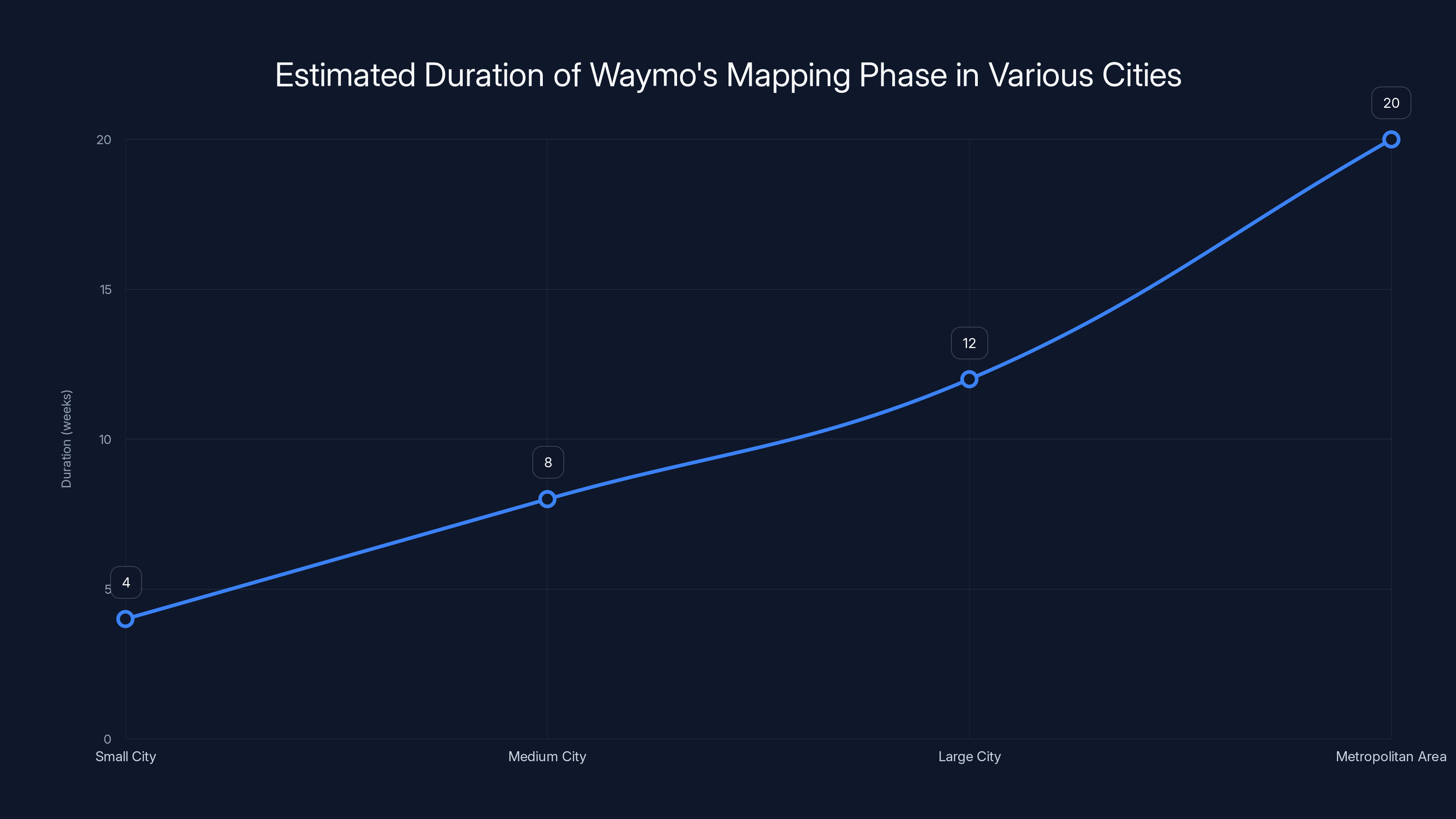

This phase typically lasts weeks to months depending on city size. For Nashville, with its sprawl and growing suburbs, map building probably took several months. The data collected during this phase becomes the foundation for everything that comes after. Autonomous vehicles can't drive safely without understanding the geography at a granular level.

Waymo uses multiple sensor types specifically because each one has different strengths and weaknesses. Lidar is excellent at distance measurement and 3D reconstruction but struggles in certain weather. Cameras provide context and identify objects, but fail in poor lighting. Radar penetrates rain and fog but has less resolution. By fusing all these sensors together, Waymo's system builds a richer, more reliable picture of the road than any single sensor could provide.

The mapping phase generates petabytes of data. This data gets processed through Waymo's machine learning pipelines to identify patterns, extract features, and create models of how traffic typically flows through different parts of the city. They're not just memorizing Nashville's streets. They're learning the city's traffic dynamics: where congestion happens, how pedestrians behave at different intersections, what time of day brings rush hour chaos.

Phase Two: Autonomous Testing with Safety Driver

Once the maps are built and the neural networks have been trained on Nashville-specific data, Waymo moves to autonomous testing with a safety driver present. This person sits in the driver's seat, hands off the wheel, but ready to take over if something goes wrong. It sounds simple, but it's actually one of the most important validation steps in the entire process.

The safety driver isn't there because the technology is fragile. They're there to document edge cases and failures. When the autonomous system makes a mistake, the safety driver notes it, and engineers analyze what happened and why. These failures are gold dust for an autonomous vehicle company. Each failure teaches the system something new.

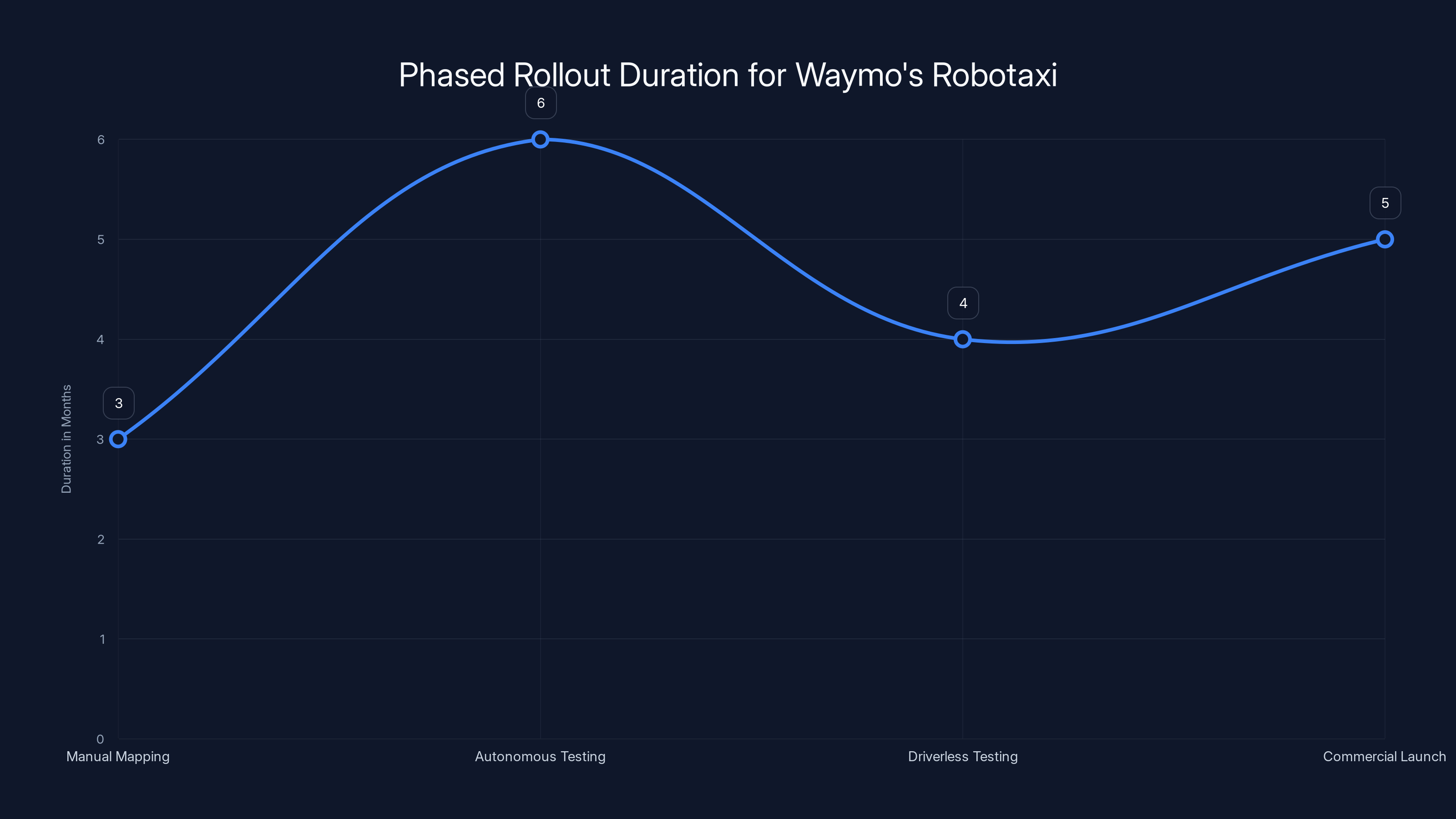

This phase typically lasts three to six months depending on the city and how quickly the system learns. Waymo's probably running these tests during specific hours at first: daytime, clear weather, normal traffic conditions. As confidence builds, they expand testing into harder scenarios: night driving, rain, heavy congestion, construction zones.

During this phase, Waymo's tracking metrics like disengagements per mile. How often does the safety driver have to take over? What causes those interventions? Are they decreasing over time? If disengagements are dropping dramatically as the system learns, that's a strong signal that driverless operation is imminent.

Safety drivers in Waymo's program are specially trained. They're not just regular drivers. They understand the autonomous system's capabilities and limitations. They know what scenarios the vehicle struggles with. They document their observations meticulously. This creates a feedback loop: edge cases identified by safety drivers get fed back into Waymo's training pipeline, making the system incrementally better with each iteration.

Phase Three: Driverless Testing (Where Nashville Is Now)

When Waymo pulls the safety driver out of the vehicle, that's not a casual decision. It means the company believes its technology can handle Nashville's roads without human backup. This is what just happened in Nashville, and it's the phase that gets regulatory agencies paying close attention.

Driverless testing is exactly what it sounds like: autonomous vehicles operating on public roads with no human operator ready to take control. Usually, Waymo starts this phase by having employees and their families hail rides through Waymo's app. These are controlled conditions in some ways—the people inside know it's a test vehicle—but they're also real-world conditions in almost every other way. The roads are public. The traffic is uncontrolled. Pedestrians aren't actors playing their parts. Weather happens.

Waymo's probably collecting mountains of data during this phase. Every mile driven, every scenario encountered, every decision the autonomous system makes gets logged. They're looking for patterns, anomalies, edge cases. They're building case studies of unusual situations and how the technology handled them.

Regulators care deeply about this phase because it's the first time a fully autonomous vehicle is operating in public without a fallback human driver. State transportation departments and the National Highway Traffic Safety Administration want to understand how often the system experiences problems, what kinds of problems they are, and whether the vehicle is safer than human drivers.

Nashville just entered this phase. That's huge. It means Waymo believes they've validated enough in the earlier phases to take this risk. It's a strong signal to the market and to competitors that Waymo's timeline for commercial deployment is real.

Phase Four: Commercial Launch (Coming to Nashville in 2025)

Once driverless testing demonstrates safety and reliability, Waymo transitions to commercial service. Riders book rides through the app, the autonomous vehicle shows up, and they ride just like any other rideshare service. Except there's nobody in the driver's seat.

The commercial launch is carefully scoped at first. Waymo won't operate during peak rush hour across the entire city. They'll probably limit service to specific zones where they've done the most testing. They might restrict service to certain times of day. They'll start with a limited fleet size. Every restriction serves a purpose: keep variables manageable, maintain safety, build confidence with riders and regulators.

Over time, as the system proves itself, those restrictions lift. Service hours expand. Geographic coverage grows. Fleet size increases. Eventually, if all goes well, you've got full robotaxi service operating across the entire city.

This is the phase where Waymo starts generating real revenue. They're not just running experiments anymore. They're running a transportation business. That's when the financial pressure kicks in. The economics have to work. The technology has to be reliable. The public has to trust it.

Waymo's phased rollout process typically spans several months per phase, ensuring thorough testing and regulatory compliance before commercial launch. Estimated data.

Why Nashville Matters in the Broader Strategy

Nashville isn't a random city. Waymo chose it deliberately, and understanding why reveals something important about how the company thinks about markets.

Urban Complexity Without Extreme Difficulty

Nashville has real urban challenges that test autonomous vehicles meaningfully. You've got dense downtown streets, pedestrian activity, traffic congestion, construction zones. It's not as complex as San Francisco or Los Angeles, but it's far harder than a suburban setting. This sweet spot matters. It's hard enough to be a real test, easy enough that Waymo can move relatively quickly through the testing phases.

The city's also got growing sprawl, which means different driving scenarios in different neighborhoods. You've got downtown congestion, suburban neighborhoods with residential streets, commercial corridors, highways. This diversity in driving environments helps Waymo's models generalize better to other cities.

Favorable Regulatory Environment

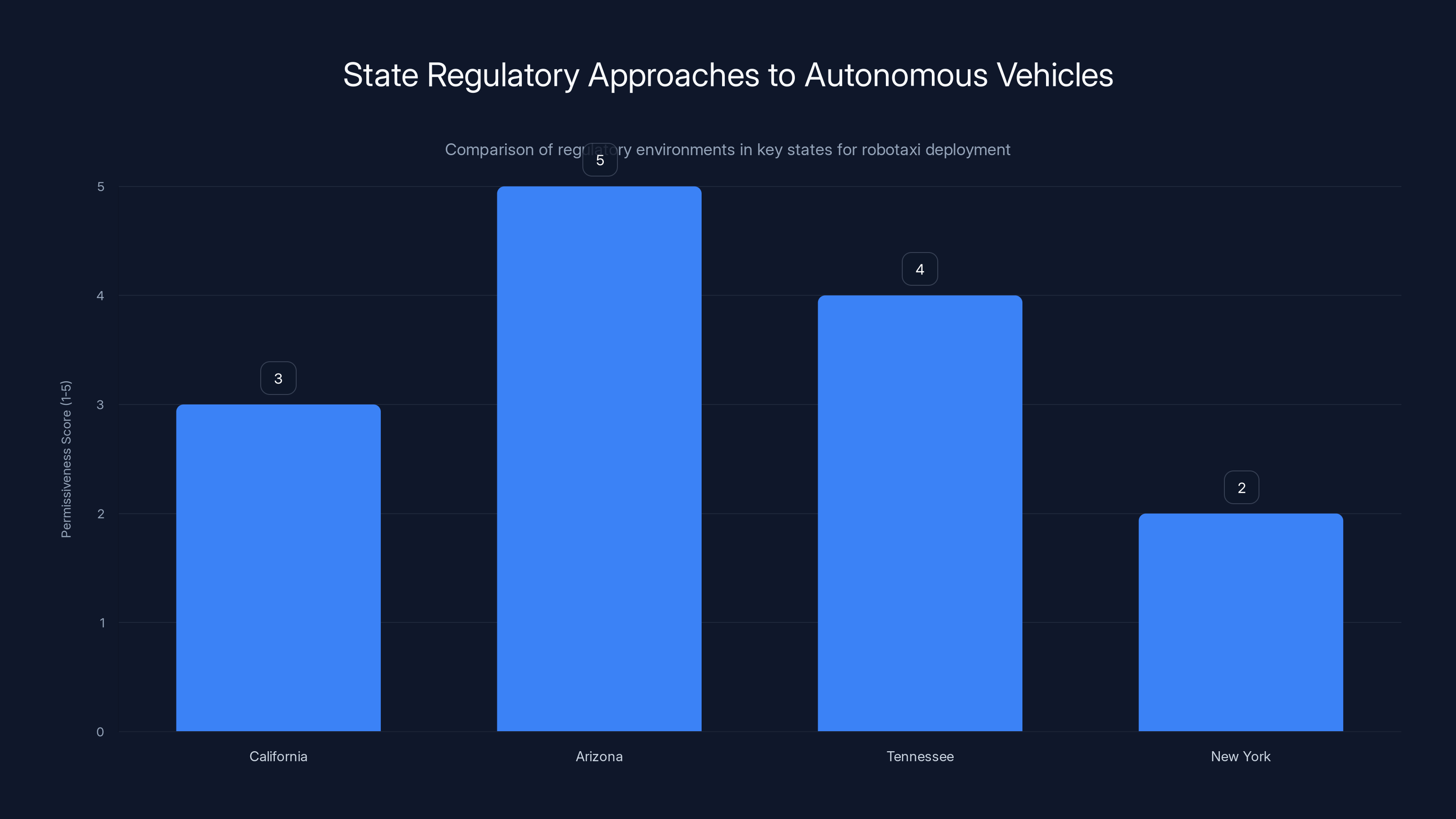

Tennessee state government has been relatively open to autonomous vehicle testing and deployment. They haven't buried the technology under restrictive regulations that would make testing impractical. This matters hugely because regulations can make or break autonomous vehicle deployment timelines.

Nashville city government has also been receptive to working with companies like Waymo. They understand that transportation innovation could benefit their city and their residents. This kind of political alignment accelerates progress. Waymo can focus on building and testing technology rather than fighting with regulators.

Market Opportunity and Rider Demand

Nashville has a large population of people who use rideshare services. It's got tourism, entertainment venues, a nightlife district where people prefer not to drive. It's got business travelers and commuters. In other words, there's actual demand for rideshare services. Waymo isn't choosing cities randomly. They're choosing cities where robotaxi services will have customers.

The economics have to work. Waymo could spend two years testing in a city with minimal rideshare demand, but what's the point? Nashville offers both technical complexity and commercial opportunity. That's the winning combination.

Strategic Partnership with Lyft

Waymo partnering with Lyft for the Nashville launch is significant. Lyft brings rider-facing relationships, payment processing, customer support infrastructure, and operational expertise. Waymo brings the autonomous driving technology. Neither company needs to build everything from scratch.

This partnership model matters for Waymo's broader strategy. They don't want to run a fleet management company. They don't want to manage drivers (obviously), maintenance facilities, or customer service operations. They want to be the autonomous driving technology provider. By partnering with Lyft, Waymo can focus on what they do best while leveraging Lyft's existing infrastructure.

Lyft benefits too. The company has been under pressure to differentiate itself from Uber. Adding autonomous robotaxis to their platform, starting in Nashville, gives them a competitive advantage. It signals to riders and to markets that Lyft is innovative, forward-thinking, and serious about the future of transportation.

Waymo's mapping phase can vary significantly in duration, from a few weeks in small cities to several months in large metropolitan areas. Estimated data based on typical city sizes.

The Broader Waymo Expansion: A Company in Growth Mode

Nashville isn't an isolated experiment. It's part of a much larger expansion strategy that shows Waymo operating in multiple markets simultaneously at different stages of maturity.

Current Commercial Services

Waymo's currently running paid robotaxi services in six major markets: Atlanta, Austin, Los Angeles, Miami, the San Francisco Bay Area, and Phoenix. These aren't beta tests anymore. They're commercial services with real riders paying real money for rides. The fact that Waymo is simultaneously growing and operating in six revenue-generating markets shows the company has figured out how to manage complexity and scale operations.

Each of these markets represents millions of rides per month. That's enormous volume for testing and improvement. Each ride generates data. Each edge case gets logged. Each interaction with riders teaches the system something. The scale of operations Waymo's now running would have seemed impossible five years ago.

Advanced Testing in Secondary Markets

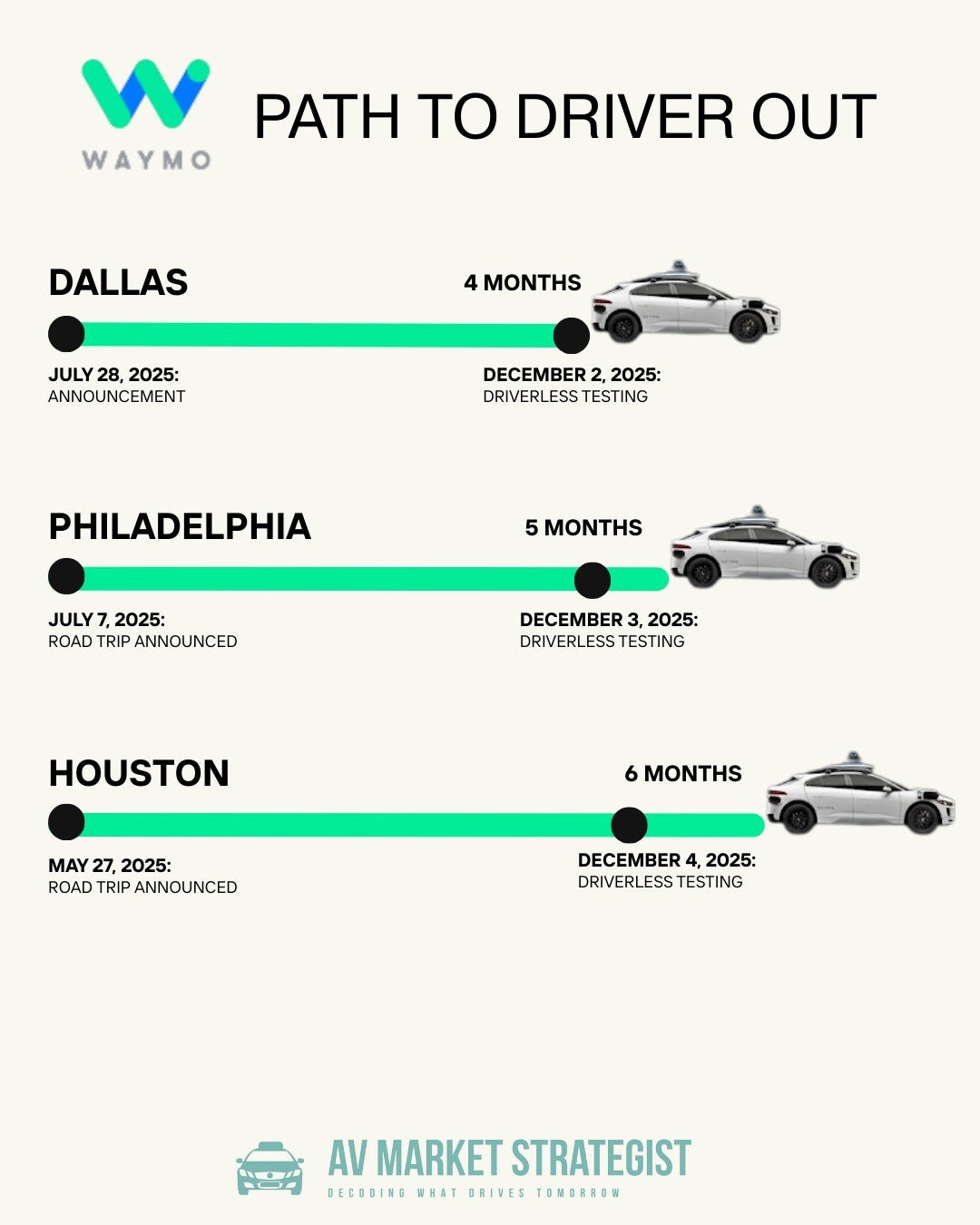

Waymo's also running driverless test fleets in Dallas, Houston, San Antonio, and Orlando. These cities represent the next wave of expansion. They're in the testing phases we discussed earlier, moving toward commercial launch. Dallas and Houston are particularly important because they're massive metropolitan areas with significant transportation demand.

Testing in this many cities simultaneously requires substantial engineering resources. Waymo's probably got dedicated teams supporting operations in each city. That's expensive. But it's also how you scale quickly. You build local expertise in multiple markets simultaneously rather than doing them sequentially.

The Logistics Challenge

Operating in ten different markets at various stages of maturity creates massive operational complexity. Each city has different roads, different weather patterns, different traffic characteristics, different regulatory requirements. Waymo has to maintain separate vehicle fleets in each city, manage different teams of people, coordinate with different government agencies.

This is where Waymo's partnership strategy becomes crucial. They're not trying to do everything themselves. They're partnering with local operators, ride-hailing platforms, and fleet management companies. This distributes the operational load and lets Waymo focus on the core technology.

The Technology Behind Driverless Validation

Waymo pulling the safety driver from Nashville vehicles means the technology has advanced to a specific level of capability. Understanding what that means requires looking at what's actually happening inside these vehicles.

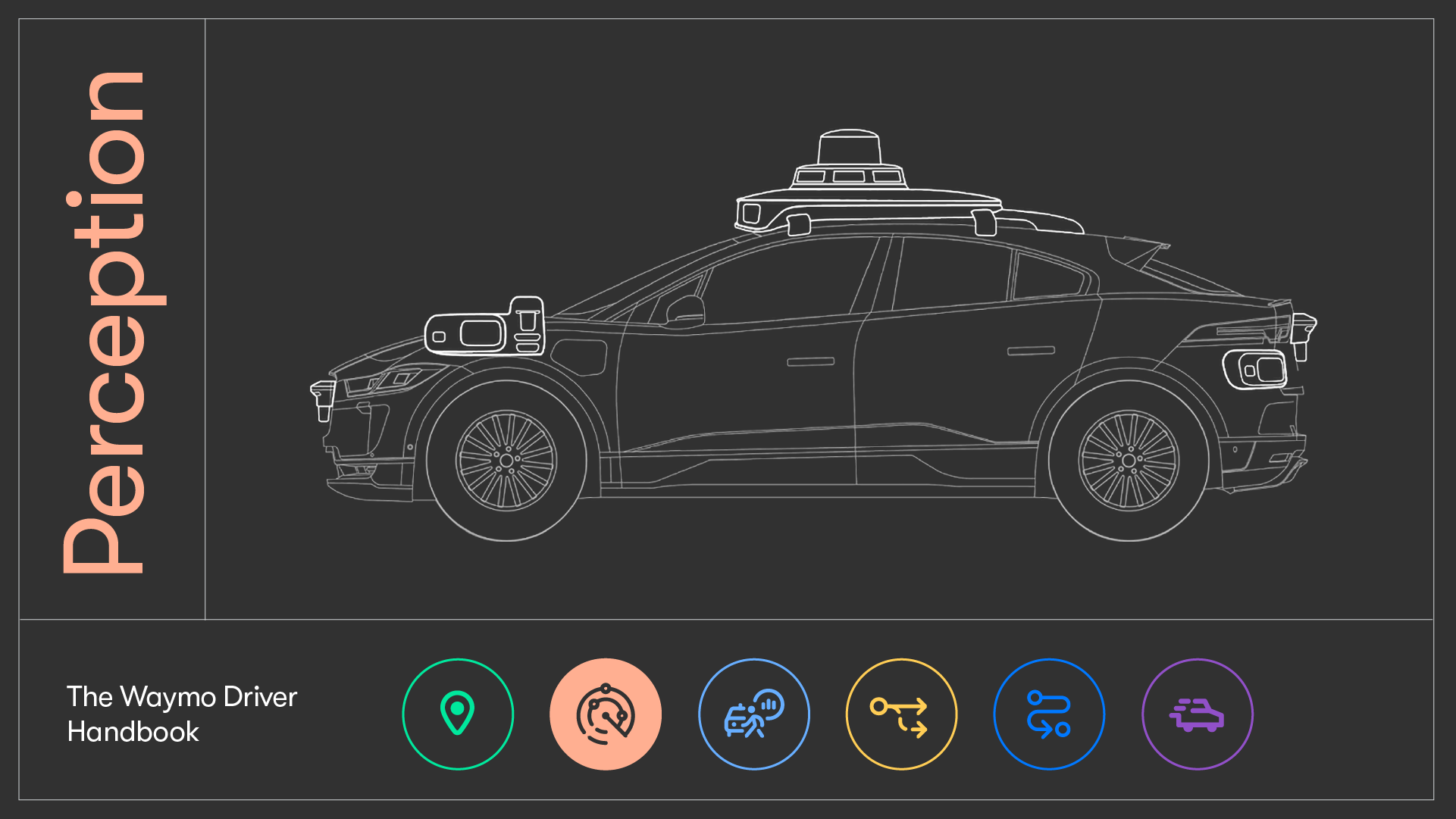

Sensor Fusion and Perception

Waymo's vehicles use multiple sensor types working together. This is called sensor fusion. Each sensor has strengths and weaknesses. Lidar provides excellent 3D spatial information but struggles in certain weather. Cameras identify objects and provide context but fail in darkness or heavy rain. Radar penetrates weather but has less detail. By combining all three, Waymo's vehicles can build robust models of their environment even in challenging conditions.

The perception system has to identify everything on the road: other vehicles, pedestrians, cyclists, animals, road debris, potholes, lane markings, traffic signals, signs. It has to classify these objects (is that a car, a truck, or a motorcycle?), estimate their position and velocity (where is it, and where is it going?), and predict their future position (is it on a collision course with us?).

This is the hardest problem in autonomous driving. Perception errors cascade into bad decisions. If the system doesn't see a pedestrian, it can't avoid them. If it misclassifies an object, it might take the wrong action. Waymo's spent years and billions of dollars improving perception. They've trained neural networks on petabytes of driving data. They've tested edge cases obsessively.

Prediction and Planning

Once the vehicle understands its environment, it has to predict what other road users will do next and then plan a safe path forward. This is where machine learning becomes crucial. Waymo's models have learned patterns from millions of miles of driving data. They understand that a car with its left turn signal on is probably going to turn left. They understand that a pedestrian standing at a crosswalk might step into the street. They understand traffic flow patterns and how congestion typically develops.

Based on these predictions, the planning system has to choose actions: accelerate, decelerate, turn, stay in lane, change lanes. It has to consider safety, comfort, traffic laws, and efficiency. The system runs through hundreds or thousands of possible trajectories per second, evaluating each one against safety criteria and operational goals.

This is computationally intensive. Waymo's vehicles are basically mobile data centers. They've got GPUs processing sensor data, running neural networks, and making decisions in real time. The latency has to be incredibly low because even a 100-millisecond delay in a decision could be dangerous at highway speeds.

Learning from Edge Cases

Waymo's driverless testing in Nashville generates data on scenarios the safety driver phase might not have captured at scale. When something unexpected happens, the entire sequence gets logged. Later, engineers analyze these edge cases and figure out how to improve the system's handling.

This is the virtuous cycle that makes driverless testing so valuable. Real-world operation exposes gaps in the system. Each gap gets addressed. The next iteration is more robust. Over time, edge cases become rare enough that the system is functionally autonomous.

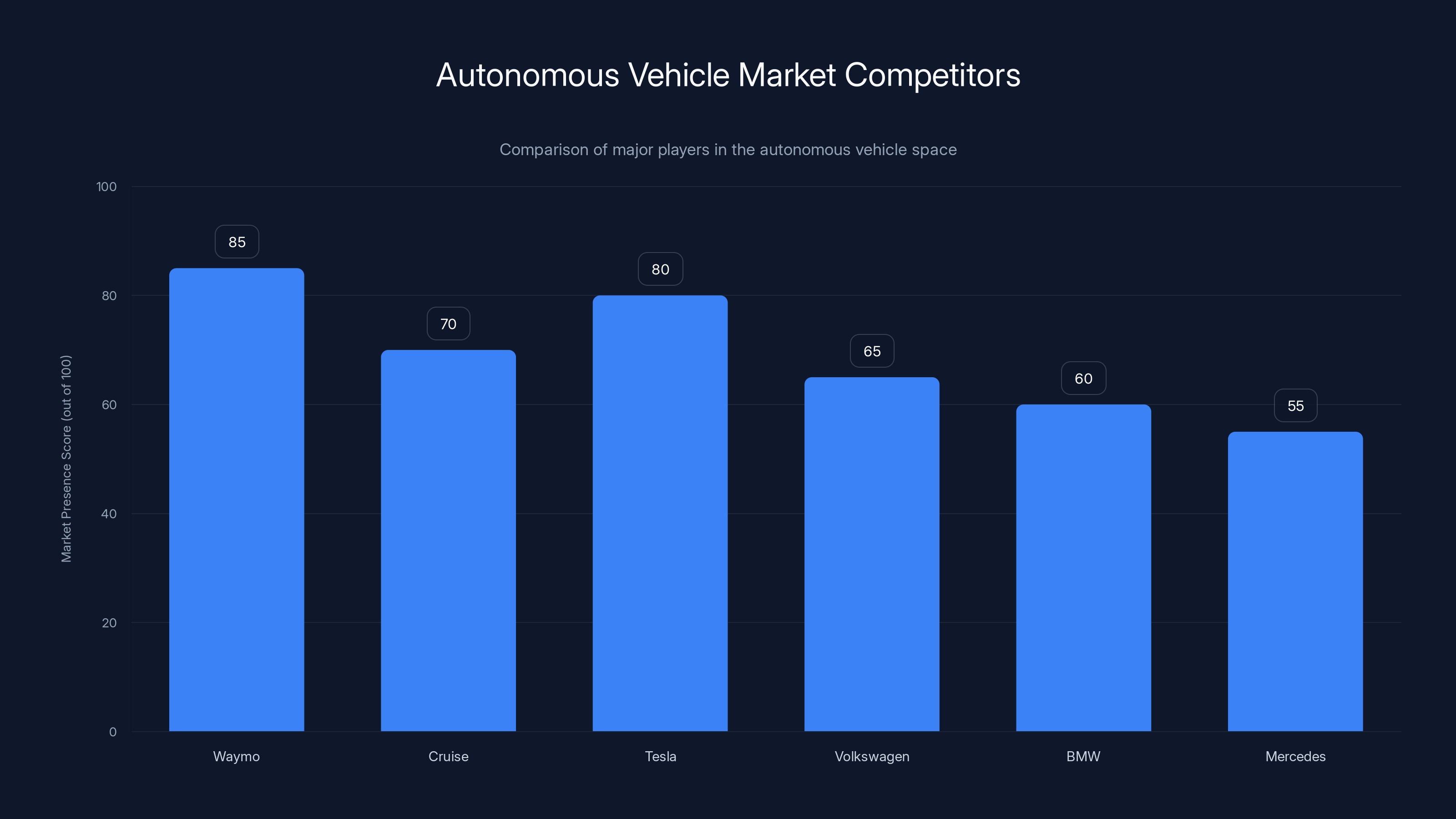

Waymo leads in market presence with a score of 85, followed by Tesla at 80, highlighting its strong position despite competitive pressures. Estimated data.

Regulatory Landscape: The Silent Partner in Robotaxi Deployment

Waymo's aggressive expansion across multiple states and cities is happening within a specific regulatory context. Understanding this context is crucial to understanding whether the company's timelines are realistic.

Federal Oversight: NHTSA and the Murky Legal Situation

The National Highway Traffic Safety Administration is responsible for vehicle safety standards in the United States. But NHTSA was designed to regulate human-driven vehicles. Autonomous vehicles exist in a legal gray area. Federal safety standards assume a human driver exists. Autonomous vehicles fundamentally change that equation.

Waymo and other autonomous vehicle companies have been lobbying NHTSA and Congress to create clear regulatory frameworks. What does it mean for an autonomous vehicle to be "safe"? How do you test for that? What liability rules apply? These questions don't have definitive answers yet.

NHTSA has been cautious, which has both helped and hindered autonomous vehicle deployment. On one hand, the lack of onerous federal restrictions has allowed companies like Waymo to operate. On the other hand, the lack of clear standards creates uncertainty. Is Waymo's vehicle safe enough? There's no federal threshold to compare against.

State and Local Regulation: Fragmented and Evolving

Because federal rules are unclear, individual states and cities have taken their own approaches. California allows autonomous vehicle testing under specific permit conditions. Arizona has been permissive, allowing Waymo to operate relatively freely. Other states have been more restrictive or haven't addressed the issue at all.

Nashville and Tennessee fall in the "relatively permissive" category. Tennessee hasn't thrown up major regulatory obstacles to autonomous vehicle testing and deployment. This is partly ideology (Tennessee tends toward business-friendly policies) and partly pragmatism (state leaders see economic opportunity in autonomous vehicle innovation).

This fragmented regulatory landscape has advantages and disadvantages. The advantage is that companies can test in different regulatory environments and learn what works. The disadvantage is that every state plays by different rules. A vehicle validated in California might not be legal in New York. This fragments the market and slows adoption.

The Insurance Question

One of the stickiest regulatory questions is insurance and liability. When an autonomous vehicle causes an accident, who's liable? The manufacturer? The software company? The fleet operator? Traditional automotive insurance was built around driver liability. Autonomous vehicles require a different model.

Waymo likely carries some form of insurance and maintains liability coverage. But the full legal framework for autonomous vehicle liability is still being litigated. This creates some uncertainty, but it hasn't stopped Waymo from operating. The company seems willing to absorb the legal and financial risk of operating in this gray area.

The Safety Verification Challenge

How do you prove an autonomous vehicle is safe? Traditional automotive testing uses crash tests, durability tests, and road validation. But how many miles does an autonomous vehicle need to drive before you can confidently say it's safe? A hundred thousand miles? A million miles?

Some argue that autonomous vehicles need to demonstrate they're safer than human drivers. Human drivers cause about 40,000 fatal accidents per year in the United States. An autonomous vehicle fleet would need to achieve a better safety record than that to justify replacement of human drivers. But measuring this requires massive scale and time.

Waymo's accumulated over 20 million miles of autonomous driving testing across all programs. That's a significant dataset, but it's also unclear whether 20 million miles is enough to claim statistical safety superiority over human drivers. This is an unresolved question, and it's going to dominate regulatory discussion as autonomous vehicle deployment accelerates.

The Competitive Landscape: Waymo vs. Everyone Else

Waymo isn't alone in the autonomous vehicle space. Multiple companies are working on robotaxi services, and competition is intensifying.

Cruise's Stumble and Comeback

General Motors' Cruise autonomous vehicle division had an accident involving a pedestrian in San Francisco in 2023. The accident wasn't catastrophic, but it triggered a regulatory review that led to Cruise losing its deployment permits in California. The company has since been making a comeback, but the incident showed that a single high-profile accident can set back an entire program.

Waymo's been lucky to avoid comparable incidents, or at least incidents that garnered similar media attention. This is partly skill and partly luck. As the company expands into more cities and operates more frequently, the probability of accidents increases. Waymo's operating across six commercial markets and multiple test sites. The statistical likelihood of a serious incident increases with scale.

Tesla's Autonomous Ambitions

Tesla is pursuing full self-driving through a different approach than Waymo. Tesla uses camera-only systems without lidar, and they're relying heavily on neural networks trained on fleet data. Tesla's approach is cheaper and potentially more scalable. But there are questions about whether camera-only systems can achieve the same level of safety as systems with multiple sensor types.

Tesla's full self-driving program is in beta, and it's controversial. Some users report excellent performance; others report concerning failures. The company is pursuing autonomous driving without the same safety-first culture that Waymo emphasizes. This creates competitive pressure on Waymo to move quickly, but also gives Waymo an opportunity to claim superior safety.

Traditional Automakers' Autonomous Initiatives

Volkswagen, BMW, Mercedes, and other traditional automakers are all working on autonomous driving technology. Some are developing internal capabilities; others are partnering with technology companies. The traditional automakers have scale and manufacturing expertise that pure-play autonomous vehicle companies lack. But they also tend to move slower and have competing business priorities.

Waymo's first-mover advantage and Alphabet's financial backing give the company advantages that traditional automakers will struggle to overcome. But the competitive pressure is real. If Ford or BMW cracks autonomous driving at scale, they could deploy robotaxis across massive fleets relatively quickly.

International Competition

Companies like Baidu in China, Yandex in Russia, and various European startups are also pursuing autonomous vehicles. China's robotaxi market might eventually dwarf the US market. Waymo's purely focused on the US right now, which limits their total addressable market to roughly 330 million people, while China has 1.4 billion. This might drive Waymo to expand internationally eventually.

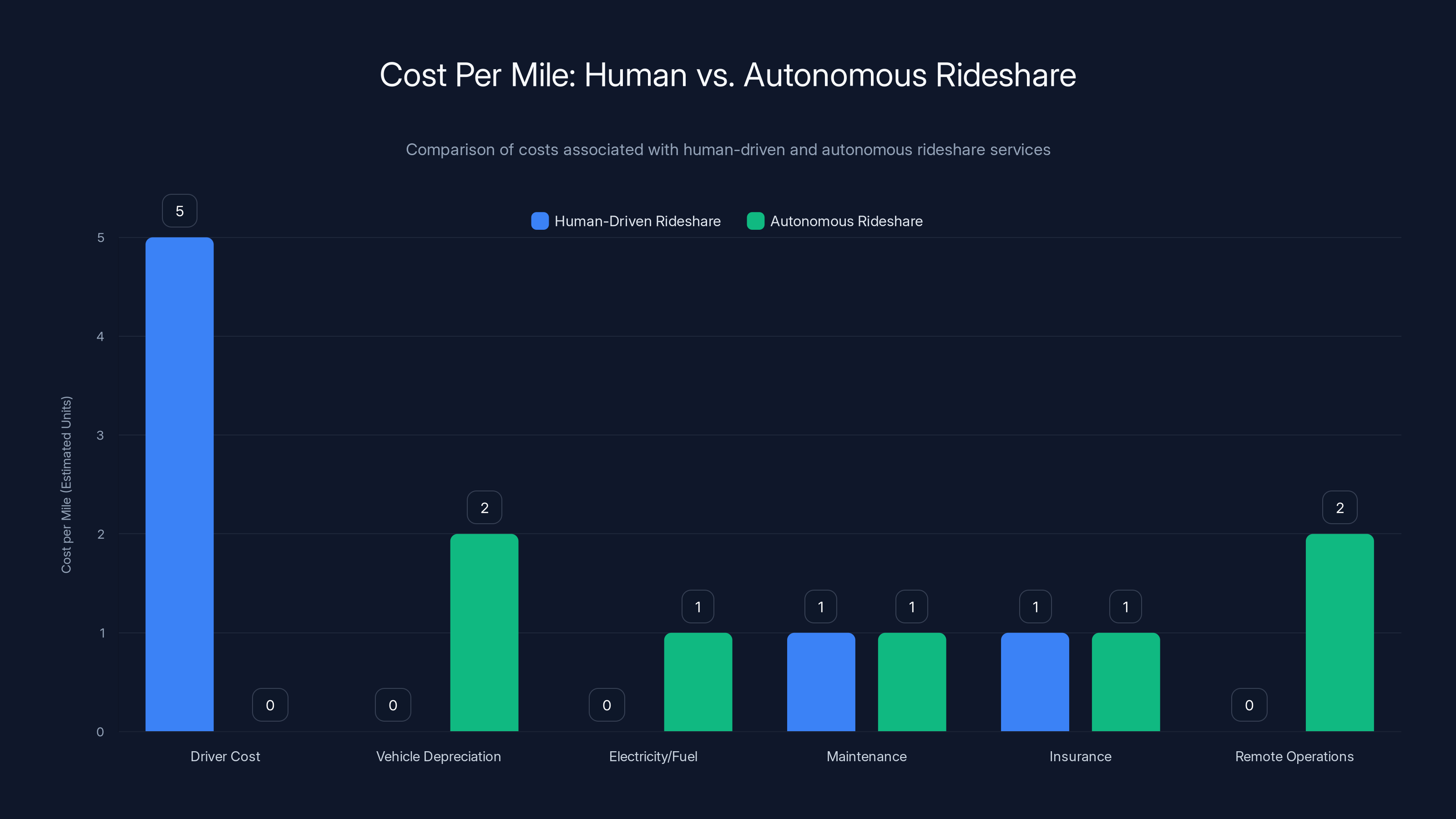

Autonomous rideshare services significantly reduce costs by eliminating driver expenses, though they incur additional costs for remote operations and technology maintenance. Estimated data.

Economic Model: How Does This Actually Make Money?

Waymo's ambitious expansion makes sense only if the economics work. Let's think through the business model.

Revenue Per Mile

Waymo (through Lyft) charges riders for robotaxi rides similar to regular rideshare. A typical robotaxi ride might cost

Cost Per Mile

Here's where autonomous vehicles win. Human drivers are expensive. A typical rideshare driver might earn

Autonomous vehicles eliminate the driver cost. That's a major competitive advantage. Instead of paying a driver for every ride, you're paying for vehicle depreciation, electricity or fuel, maintenance, and insurance. These costs are lower per mile than driver costs.

But there are other costs unique to autonomous vehicles. You need remote operators monitoring vehicles and potentially taking over in edge cases (at least initially). You need engineers maintaining and updating the software. You need infrastructure: charging stations, depots, maintenance facilities. These costs are distributed across thousands of vehicles, but they're still real.

Unit Economics at Scale

Waymo's economics improve dramatically as scale increases. The software is developed once and deployed across thousands of vehicles. The data infrastructure serves all vehicles. The customer service team can support massive fleets without proportional cost increases.

If Waymo can deploy tens of thousands of vehicles across multiple cities, the unit economics become excellent. Each additional vehicle deployed in an existing city is largely just the hardware cost plus a small increment of operations cost.

But getting to that scale is the hard part. You need capital to fund vehicle purchases, infrastructure development, and ongoing operations. You need regulatory approval in multiple jurisdictions. You need to solve technical problems continuously. The economic model is compelling in theory, but the path to profitability is long.

The Path to Profitability

Waymo's not currently profitable on a standalone basis. The Alphabet investment is funding continuous expansion. The company is betting that if they can capture sufficient market share and scale operations to tens of thousands of vehicles, profitability becomes inevitable.

This is a classic venture capital model: spend money to gain market share, build scale, achieve profitability later. It works if you have enough capital (Alphabet does) and if you reach scale before you run out of money (Waymo seems likely to reach that point).

Lyft's partnership is partly motivated by the same logic. Lyft is betting that robotaxi services will eventually be profitable and that being an early partner with Waymo will give them advantages in that future market.

Technical Challenges Waymo Still Needs to Solve

Despite pulling safety drivers from Nashville testing, Waymo faces significant remaining technical challenges.

Edge Cases and Unusual Scenarios

Autonomous vehicles drive predictably in normal conditions. But roads throw unusual scenarios constantly: double-parked cars, construction zones, debris in the road, aggressive drivers, pedestrians doing unexpected things, weather extremes. Each category of edge case requires specific handling.

Waymo's probably handled the most common edge cases. But as the company expands into more cities and climates, new edge cases emerge. A scenario that rarely occurs in Phoenix might be common in Nashville or frequent in Northern cities during winter. Continuous edge case discovery and resolution will be ongoing.

Adversarial Scenarios

What happens when people intentionally try to fool the autonomous vehicle? Someone swerves in front of it. Someone blocks its path. Someone throws objects. Waymo's system needs to handle adversarial inputs gracefully. It's one thing to design a safe system for cooperative traffic. It's another to design one that's safe when people are actively trying to cause problems.

This is partly a technical problem and partly a governance problem. As autonomous vehicles proliferate, people will experiment with behaviors that exploit the system. Waymo needs to anticipate and defend against these exploits.

Weather and Extreme Conditions

Autonomous vehicles perform well in clear weather and normal conditions. But what about heavy rain, snow, ice? Lidar performance degrades in heavy precipitation. Camera performance suffers in low light. Radar is robust but less precise. Waymo's tested in various weather conditions, but extremes are rare by definition.

Nashville has different weather from Phoenix or San Francisco. The system might encounter weather scenarios in Tennessee that it rarely saw in Arizona. These scenarios provide testing opportunities and potential failure points.

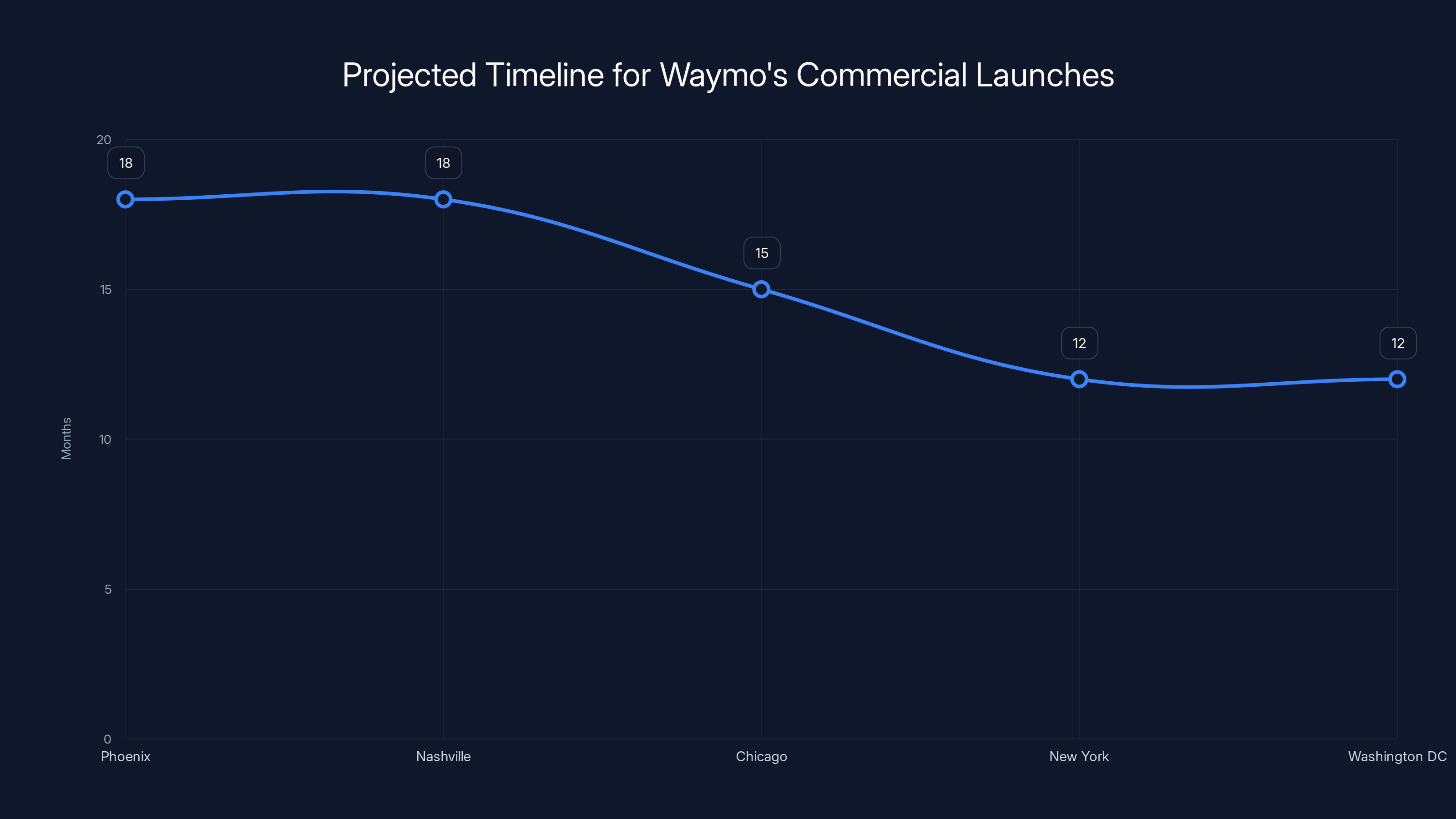

Waymo's commercial launch timeline is expected to decrease from 18 months in Phoenix and Nashville to 12 months in New York and Washington DC due to process optimization and technology maturity. Estimated data.

Implications for the Broader Transportation Industry

Waymo's Nashville expansion isn't just important for Waymo. It's important for the entire transportation industry and for society.

Impact on Rideshare Workers

This is the uncomfortable implication that nobody wants to talk about. Robotaxis will eliminate millions of rideshare driving jobs. In the United States, roughly 1.3 million people work as rideshare or taxi drivers. When robotaxis reach widespread adoption, most of these jobs disappear.

The timeline for this displacement is still uncertain. Waymo's expanding into new cities, but we're still years away from robotaxis being commonplace. Cities will have both human drivers and autonomous vehicles operating in parallel for some period. But the direction of change is clear: human drivers will be replaced by machines.

This creates political and social pressure on the autonomous vehicle industry. Cities and states might impose restrictions on robotaxi deployment to protect jobs. Labor unions will lobby against autonomous vehicle licenses. This could slow deployment or impose restrictions that make the economics less attractive.

Impact on Public Safety

The potential safety benefits of autonomous vehicles are enormous. If autonomous vehicles can achieve fatality rates lower than human drivers, tens of thousands of lives could be saved annually. This is a massive public health benefit.

But that benefit only materializes if the technology is actually deployed and actually is safer. Waymo's confident they're building safer vehicles. But that confidence needs to be validated through comprehensive data and evidence. The first few years of autonomous vehicle deployment will be critical for establishing whether the technology lives up to safety promises.

Impact on Urban Mobility and City Planning

Robotics might change how cities are designed. If autonomous vehicles are safer, more efficient, and cheaper than human-driven vehicles, cities might encourage their adoption. This could reduce parking requirements (robots can share vehicles more efficiently), reduce road congestion (robots follow traffic laws perfectly), and reduce emissions (electric robots are cleaner than combustion engines).

Alternatively, robotaxis might increase congestion if they lead to more miles driven by encouraging people who previously used transit or bikes. The net effect on cities depends on how the technology is regulated and deployed.

Impact on Accessibility

Autonomous vehicles could dramatically improve mobility for elderly people, people with disabilities, and others who can't drive. For these populations, robotaxis represent freedom and independence that human-driver transportation might not provide.

Waymo's expansion into new cities is partly about capacity building and partly about proving the technology. But it's also about moving toward a world where autonomous vehicles are available to anyone who needs them.

What Happens Next: The Roadmap Forward

Waymo's Nashville testing tells us something about what's likely to happen next.

Timeline for Commercial Launch

Waymo says they'll launch commercial service in Nashville sometime in 2025. This timeline seems realistic based on the company's track record in other cities. They went from initial testing to commercial launch in Phoenix in about 18 months. Nashville might follow a similar timeline.

The driverless testing phase is important because it gives regulators confidence that the technology is mature. Once regulators see an autonomous vehicle operating without a safety driver for hundreds of thousands of miles without serious incidents, confidence builds. The approval process for commercial launch becomes more straightforward.

Expansion to Additional Cities

Waymo will likely announce testing in additional major metropolitan areas over the next two years. Cities like Chicago, New York, and Washington DC represent massive markets. Eventually, Waymo will want to test and deploy in these cities.

The company will probably continue the same rollout pattern: manual mapping, testing with safety drivers, driverless testing, commercial launch. But as Waymo accumulates experience and data, they might be able to accelerate this timeline. What takes 18 months in one city might take 12 months in the next city because the company's processes are more optimized and the technology is more mature.

Fleet Size Growth

Currently, Waymo operates thousands of vehicles across all markets combined. To achieve meaningful market impact and profitability, the company needs to scale to tens of thousands of vehicles. Each new commercial launch adds hundreds or thousands of vehicles to the fleet.

This creates compound growth: more vehicles means more ride volume, which means more revenue and more data for improvement, which enables faster expansion into more cities, which enables more vehicles. If this cycle sustains, Waymo could double its fleet size every 18 to 24 months.

Profitability and Financial Viability

Waymo needs to reach profitability to prove the business model works sustainably. The company is currently funded by Alphabet's balance sheet, but investors eventually want to see sustainable unit economics.

Profitability probably comes when the company reaches a certain threshold of fleet size and number of cities. Once the software is mature, additional deployment requires primarily capital expenditure on vehicles, not continued massive R&D spending. At that scale, the math might work.

Waymo's probably 2 to 3 years away from profitability at the unit level in individual cities. Company-wide profitability might take longer because of the overhead required to manage expansion.

Arizona leads with the most permissive regulatory environment for autonomous vehicles, followed by Tennessee. California has moderate restrictions, while New York is more restrictive. Estimated data based on narrative.

The Bigger Picture: Is Waymo Winning?

Pulling the safety driver from Nashville vehicles is a strong signal, but it's one data point in a much larger competitive and technological landscape.

Waymo's advantages are clear: first-mover advantage in robotaxi deployment, massive capital backing, experienced team, extensive testing data, mature technology. The company's ahead of competitors and executing consistently.

But the race isn't over. Tesla's approach might prove superior at scale. Traditional automakers might enter the market with advantages that pure-play autonomous vehicle companies lack. International competitors might outpace Waymo in their home markets.

Waymo's Nashville expansion is both a sign of confidence and a necessity. The company needs to deploy in multiple markets simultaneously to achieve scale and market leadership. Nashville is one piece of a much larger puzzle.

The next 18 months will be crucial. If Waymo successfully launches commercial service in Nashville and continues expanding into new cities, the company strengthens its market position. If deployments stumble or encounter unexpected regulatory obstacles, competitors might catch up.

Right now, Waymo's in the strongest position any autonomous vehicle company has ever been in. The question is whether they can maintain that position as the industry matures and the path to profitability becomes clearer.

Key Metrics to Watch Going Forward

If you want to track Waymo's progress, these are the metrics that matter most.

Miles Driven Autonomously

How many miles has the fleet driven without human intervention? This number indicates maturity of the technology. Waymo's accumulated 20+ million miles historically. Current rate is probably several million per month across all operations. This metric shows whether the company's scaling operations faster than competitors.

Disengagement Rate

How often does a human operator have to take control during autonomous driving? This metric shows whether the technology is improving or stagnating. A disengagement rate that's declining indicates the system is learning and improving. A disengagement rate that's rising indicates problems.

Fleet Size

How many autonomous vehicles is Waymo operating? This shows whether commercial deployment is scaling. The company probably has a few thousand vehicles deployed commercially and in testing combined. In 2025, that number should grow significantly.

Number of Cities

How many cities is Waymo operating in? Each new city represents a new market opportunity and proof that the technology works in different environments. Going from 10 cities to 15 cities is significant progress. Eventually, the goal is to operate in dozens of major metropolitan areas.

Ride Volume and Revenue

How many rides is Waymo completing? How much revenue are they generating? These metrics show whether the business model is working and whether riders actually want to use robotaxi services. If ride volume is growing month-over-month, the service is gaining traction. If revenue is approaching or exceeding costs, the company is approaching profitability.

Safety Record

How many accidents or incidents per million miles? How does Waymo's safety record compare to human drivers? This is the most important metric long-term. If autonomous vehicles are demonstrably safer than human drivers, the case for expansion becomes irresistible.

Conclusion: Waymo's Nashville Moment

Waymo removing safety drivers from Nashville robotaxis represents a milestone in the march toward autonomous mobility. The company's demonstrated that its technology has matured enough to operate without human backup in a real city with real traffic and real conditions.

This doesn't mean autonomous vehicles are solved. It means Waymo's solved enough of the problem to move toward commercial deployment. Edge cases still exist. Edge cases will always exist. But they're becoming rare enough that the system can operate safely.

Nashville is significant because it's one of multiple cities where Waymo is executing this same playbook simultaneously. The company's operating commercial services in six cities, testing driverlessly in four more, and planning expansions beyond that. This is the behavior of a company confident in its technology and committed to scale.

The robotaxi future is coming. Waymo's betting they'll lead that future. Their Nashville testing suggests they might be right. But the race is far from over, and many technical, regulatory, and competitive challenges remain.

Watch Nashville over the next 12 to 18 months. If Waymo successfully launches commercial service and operates safely at scale, the autonomous vehicle revolution accelerates. If problems emerge, competitors get chances to leapfrog. Either way, Nashville's about to become one of the most important test cases for autonomous mobility in America.

FAQ

What is a driverless robotaxi test?

A driverless robotaxi test involves autonomous vehicles operating on public roads without a human safety driver present. This is an advanced testing phase where the vehicle operates independently, making all decisions about acceleration, braking, steering, and navigating traffic. The vehicles are typically monitored by engineers remotely, but there's no human operator ready to take physical control. This phase comes after safety drivers are deemed unnecessary based on accumulated testing data and performance metrics showing the system can handle the city's driving conditions reliably.

How does Waymo's phased rollout process work?

Waymo follows a consistent four-phase approach in new cities: first, manual mapping where vehicles equipped with sensors scan and digitally map all streets and landmarks; second, autonomous testing with a safety driver present to document edge cases and system failures; third, driverless testing where employees can hail autonomous rides with no backup driver; and fourth, commercial launch where paying customers can book robotaxi rides through the app. Each phase typically lasts several months and requires regulatory approval before advancing to the next stage. This methodical approach allows Waymo to validate technology maturity before expanding to new markets.

What makes Nashville an important test market for Waymo?

Nashville offers the right combination of urban complexity and favorable conditions for autonomous vehicle testing. The city provides real traffic challenges like downtown congestion and pedestrian activity without the extreme difficulty of cities like San Francisco or New York. Tennessee's relatively permissive regulatory environment and Nashville's government openness to innovation allow faster testing cycles. Additionally, the city has strong rideshare demand from its tourism, entertainment, and business sectors, making the commercial opportunity attractive. This combination of technical challenge, regulatory receptiveness, and market demand makes Nashville an ideal proving ground for Waymo's expansion strategy.

What are the main technical challenges Waymo still faces in autonomous driving?

Despite advances, Waymo must continue solving edge cases—unusual scenarios like double-parked vehicles, aggressive drivers, and unpredictable pedestrian behavior that occur frequently but are hard to predict. Weather presents challenges, as heavy rain and snow degrade sensor performance, particularly lidar and cameras. The company must also handle adversarial scenarios where people intentionally try to confuse the autonomous system. Each new geographic market introduces weather patterns and driving behaviors the system may not have extensively experienced, requiring continuous learning and system updates.

How does Waymo generate revenue from robotaxi services?

Waymo charges riders for robotaxi rides through its app (and eventually through Lyft's app), similar to human-driven rideshare services. Typical fares range from

What is the timeline for Waymo's Nashville commercial launch?

Waymo has stated that commercial robotaxi service will launch in Nashville sometime during 2025. This timeline follows the company's typical pattern of moving from initial testing to commercial operation in approximately 18 months. The driverless testing phase that just began in Nashville demonstrates regulatory confidence in the technology's maturity, which should streamline approval for commercial launch. However, specific launch dates depend on continued safety validation, regulatory approval, and operational readiness of fleet management and customer service infrastructure.

How does Waymo's partnership with Lyft work operationally?

Waymo and Lyft divide responsibilities based on their respective expertise: Waymo provides the autonomous driving technology and vehicle operation, while Lyft's subsidiary Flexdrive handles fleet management operations including vehicle maintenance, charging infrastructure, depot operations, and vehicle readiness. Riders initially book rides through the Waymo app but will eventually be able to book through Lyft's app as well. This partnership allows Waymo to focus purely on autonomous driving technology development while leveraging Lyft's rider relationships, payment processing, and customer support infrastructure that's already built and scaled.

What safety standards do autonomous vehicles need to meet?

Currently, there are no comprehensive federal safety standards specifically for autonomous vehicles—they operate in a regulatory gray area. The National Highway Traffic Safety Administration hasn't established clear metrics for autonomous vehicle approval. Instead, states and cities have taken different approaches ranging from permissive to restrictive. Waymo must demonstrate safety through accumulated test data and track record rather than meeting specific federal standards. Generally, the standard being applied is that autonomous vehicles should perform at least as safely as human drivers, but no precise metric defines what "as safe" means, creating ongoing regulatory uncertainty.

How many cities does Waymo currently operate in?

Waymo runs commercial robotaxi services in six major cities: Atlanta, Austin, Los Angeles, Miami, the San Francisco Bay Area, and Phoenix. The company is also conducting driverless testing in four additional cities: Dallas, Houston, San Antonio, and Orlando. Nashville will become the eleventh city in Waymo's operational portfolio once commercial service launches. This multi-city simultaneous operation shows the company's confidence in its technology and represents a strategy of geographic diversification to serve different markets and weather conditions.

What are the employment implications of Waymo's expansion?

Autonomous vehicle deployment will eventually displace millions of rideshare and taxi drivers in the United States. Currently, roughly 1.3 million people work in these roles. As robotaxi services become commonplace, most will lose employment. This creates political pressure to slow or restrict robotaxi deployment through regulation or labor union opposition. However, the timeline for widespread displacement is still years away since human and autonomous drivers will operate in parallel for some period. The economic and social management of this job transition represents one of the largest challenges autonomous vehicle deployment faces beyond the technical aspects.

Key Takeaways

- Waymo removing safety drivers from Nashville testing represents validation that autonomous vehicle technology has matured enough for driverless public road operation

- The company follows a methodical four-phase rollout: manual mapping, safety driver testing, driverless testing, and commercial launch, reducing execution risk

- Nashville offers ideal testing conditions with real urban complexity, favorable regulatory environment, and strong rideshare demand creating commercial opportunity

- Waymo's simultaneous operations across six commercial cities and four test cities shows aggressive scaling strategy and confidence in technology maturity

- Economic model depends on eliminating driver labor costs, the largest rideshare expense, requiring scale to 10,000+ vehicles for unit profitability

Related Articles

- Waymo's $16B Funding: Inside the Robotaxi Revolution [2025]

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

- Waymo's $16 Billion Funding Round: The Future of Robotaxis [2025]

- Waymo's Genie 3 World Model Transforms Autonomous Driving [2025]

- How Waymo Uses AI Simulation to Handle Tornadoes, Elephants, and Edge Cases [2025]

- Senate Hearing on Robotaxi Safety, Liability, and China Competition [2025]

![Waymo's Nashville Robotaxis: The Future of Autonomous Mobility [2025]](https://tryrunable.com/blog/waymo-s-nashville-robotaxis-the-future-of-autonomous-mobilit/image-1-1770678399400.jpg)