The Netflix Cancellation Nobody Wanted to Hear About

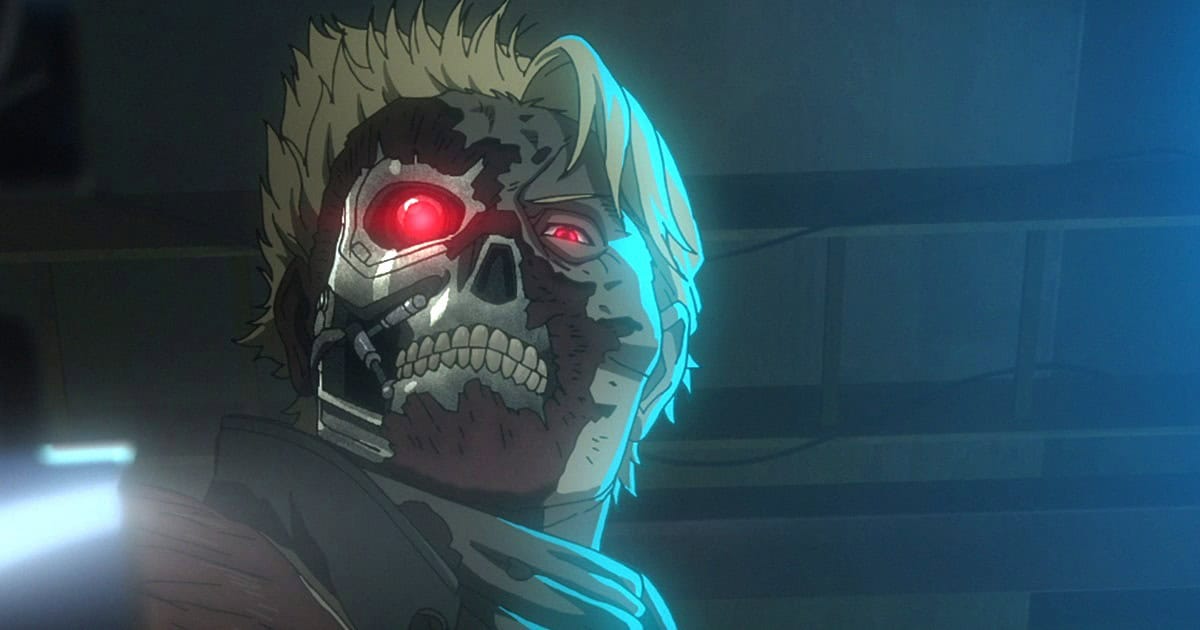

It's the kind of news that stings. Back in August 2024, Netflix released Terminator Zero, an ambitious anime that dared to blend two seemingly incompatible audiences: hardcore anime fans and older Terminator devotees. The show had promise. Critics generally praised it. But on a casual weekend in late 2024, showrunner Mattson Tomlin dropped a bomb on social media: the show was dead. One season. Done.

Tomlin's explanation was blunt and uncomfortably honest in a way you rarely hear from major streaming showrunners. "At the end of the day," he wrote, "not nearly enough people watched it." That's not corporate speak. That's not a polished statement from Netflix's publicity department. That's a creator who spent years building a world, who had plans for seasons two and three, who believed in the project enough to commit thousands of hours to it. And it got canceled because the math didn't work.

But here's what makes this cancellation resonate far beyond anime circles. It's become a symptom of a larger disease in the streaming industry. Netflix doesn't need hits. Netflix needs massive hits. With nearly 300 million subscribers across the globe, a show needs to break through the noise in a way that's become increasingly difficult. Terminator Zero was good. It wasn't good enough. And that distinction matters because it reveals something uncomfortable about how streaming works in 2025.

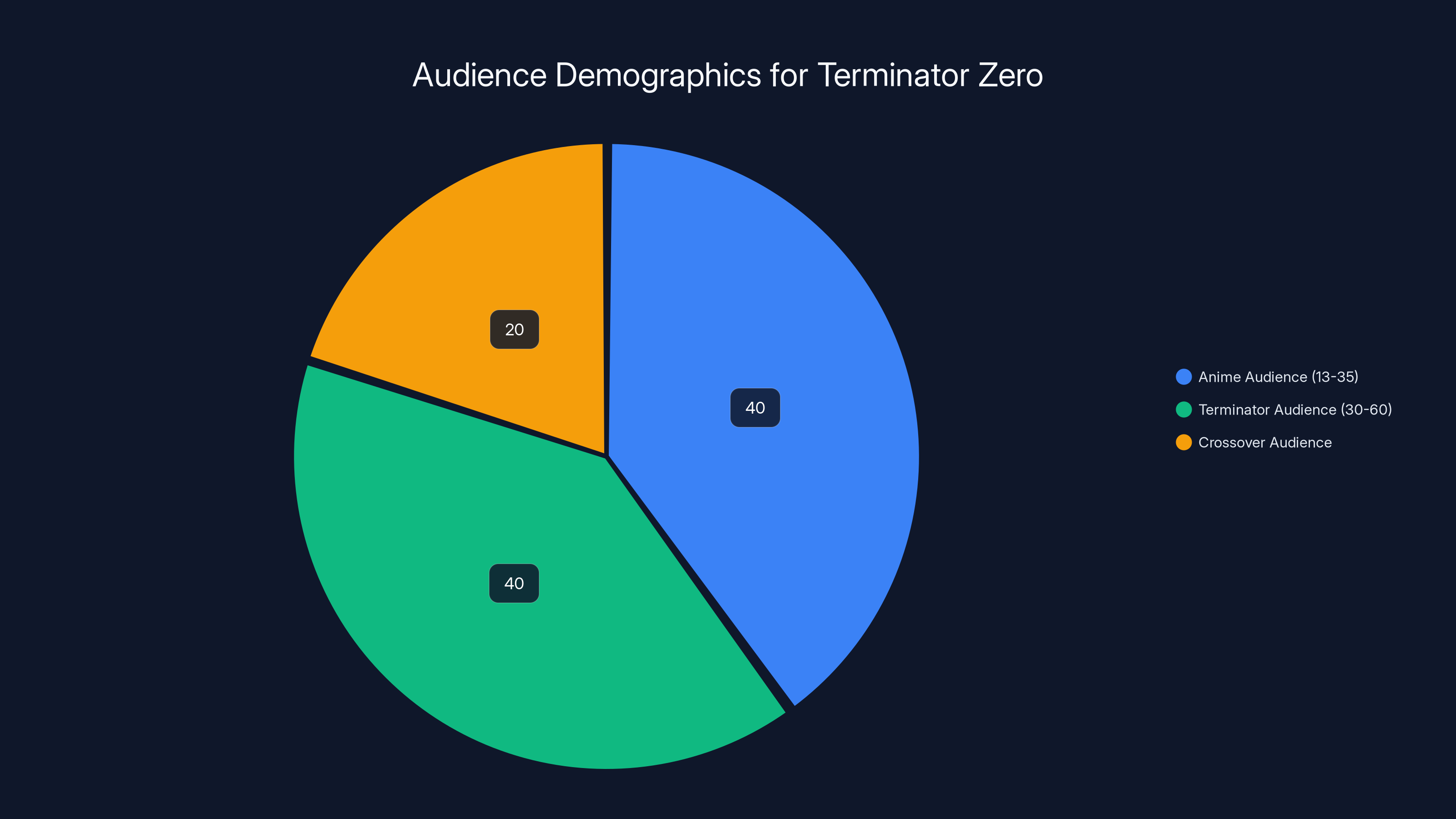

The irony is brutal. Tomlin explicitly addressed why the show couldn't find its audience: "Generally speaking, anime audiences skew younger. Terminator audiences skew older. Terminator Zero asked them to meet in the middle, and they didn't in the way the corporation needed to justify the spend to continue." Translation: the intersection of two fanbases wasn't large enough to move the needle for Netflix's algorithm-driven, subscriber-obsessed metrics.

This isn't just about one show. This is about the fundamental economics of streaming, the impossible standards networks now demand, and what it means for ambitious, genre-bending projects that don't fit neatly into existing categories. Let's dig into what actually happened here, why it matters, and what it tells us about the future of entertainment.

TL; DR

- Terminator Zero canceled after one season: Showrunner Mattson Tomlin confirmed the Netflix anime series ended due to insufficient viewership despite critical acclaim, as reported by The Hollywood Reporter.

- Audience overlap problem: The show couldn't bridge anime fans (younger) and Terminator fans (older), failing to reach Netflix's required engagement thresholds, according to Variety.

- Streaming economics are brutal: Netflix's 300M+ subscriber base actually makes smaller hits impossible to justify, requiring blockbuster-level viewership, as detailed by Variety.

- One season is the new normal: Shows now need to prove massive audiences within weeks or face cancellation, with little runway for growth, as noted by Business.com.

- Genre-blending risky: Hybrid projects that cross multiple categories struggle because they don't dominate any single algorithmic category, as explained by Bleeding Cool.

- What's next: Expect more targeted, safer content and fewer experimental projects on major streaming platforms, as observed by Yahoo Finance.

Estimated data shows a significant overlap challenge, with only 20% potential crossover audience. This mismatch likely contributed to the show's cancellation.

Understanding Mattson Tomlin's Honest Breakdown

Mattson Tomlin isn't just any showrunner. He co-wrote Project Power for Netflix and worked on several major streaming projects. When he spoke up about Terminator Zero, he wasn't bitter or deflecting. He was being analytically honest about what went wrong. That's actually rare in entertainment, where executives usually hide behind vague statements about "strategic directions" or "changing audience preferences."

What Tomlin revealed was something deeper. He acknowledged that the show itself was well-executed. The production quality was there. The storytelling worked. The animation team delivered a solid product. But none of that mattered because the show didn't reach enough people quickly enough. On a platform with 300 million subscribers, Terminator Zero couldn't find a large enough slice of that pie.

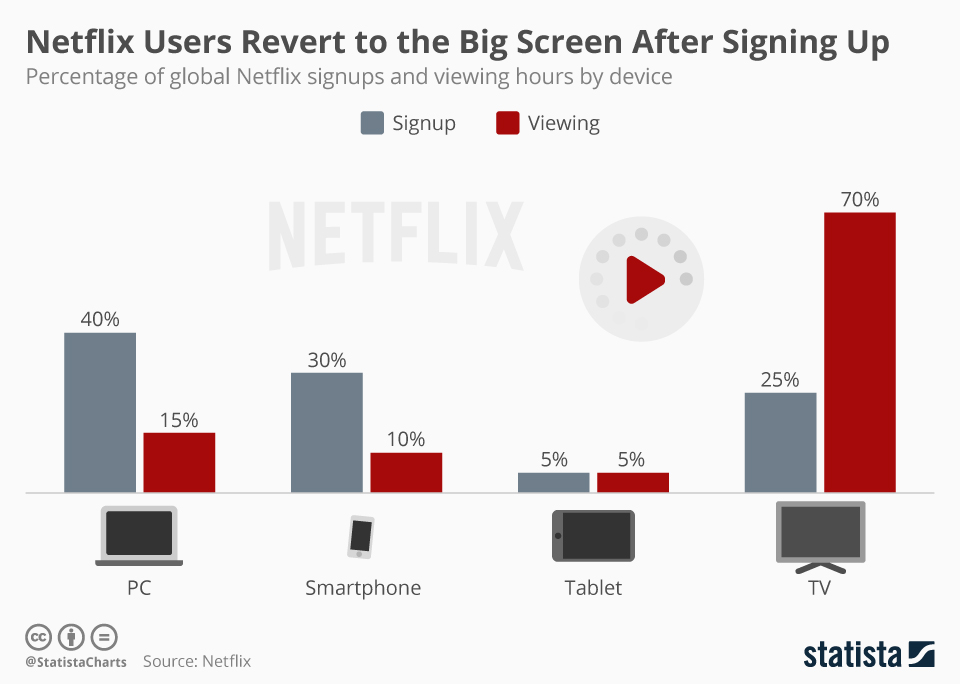

This is where understanding Netflix's business model becomes crucial. Netflix doesn't measure success the way traditional television does. A show like Game of Thrones on HBO attracted 10 million viewers per episode and became a phenomenon. That would be acceptable. Excellent, even. But Netflix operates under different math. With 300 million subscribers, they're not thinking about millions. They're thinking about percentages. They're thinking about engagement metrics. They're thinking about whether a show keeps subscribers subscribed or attracts new ones.

Tomlin also praised the people who actually made the show work, which speaks to the larger issue. The marketing team tried. The hundreds of crew members delivered. The voice actors committed. But they were fighting against algorithmic indifference. Netflix's recommendation system simply didn't surface Terminator Zero to enough people in the critical first two weeks after launch.

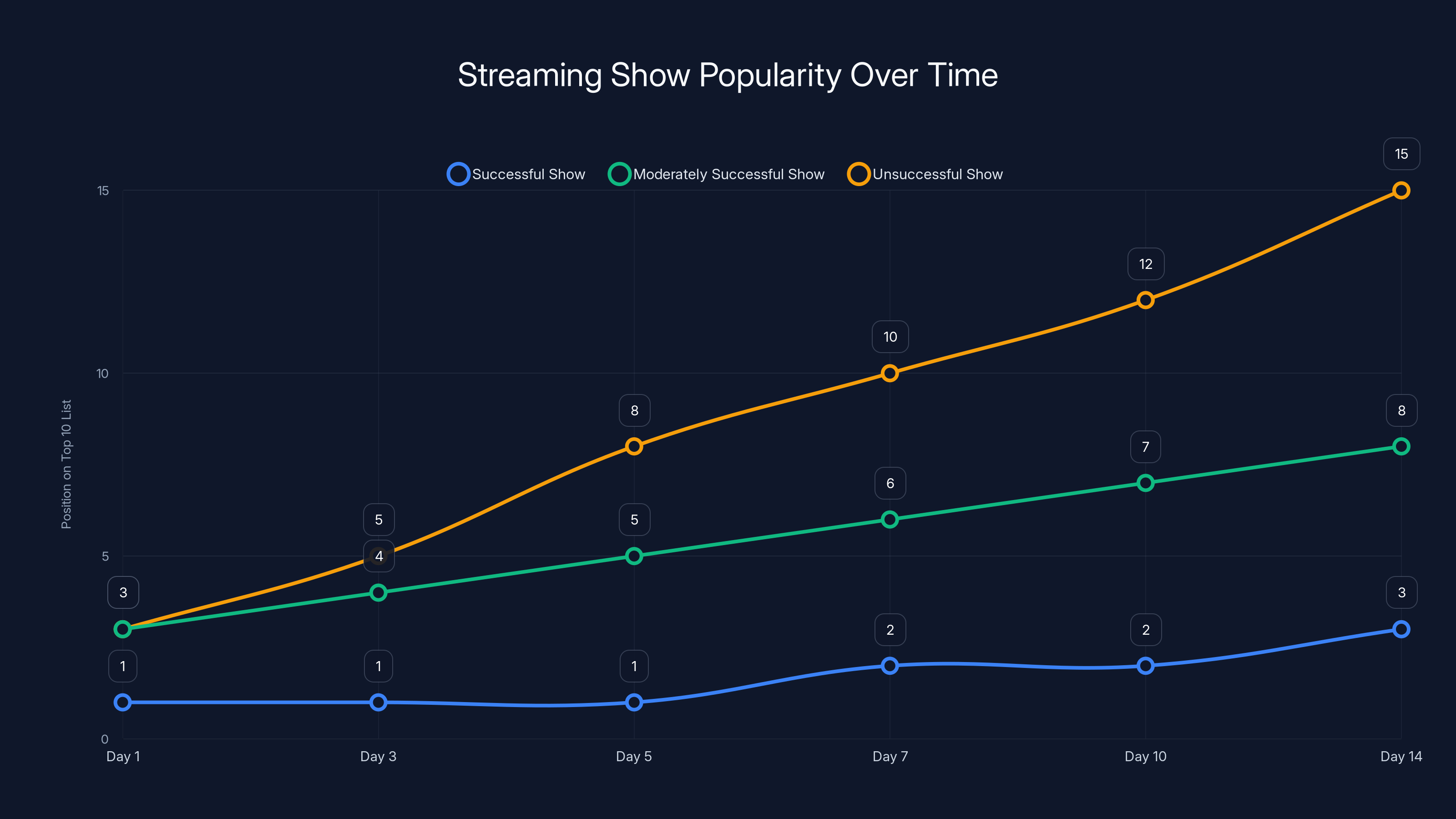

That two-week window? That's increasingly where shows live or die on streaming platforms. Unlike traditional television, where shows get multiple weeks or even months to build an audience through word-of-mouth and critical reviews, streaming shows need to prove their value immediately. They need that first-week engagement to pop, to trend, to trigger the algorithm that says "this is worth showing to more people."

The Impossible Math of Streaming Viewership

Let's actually think through the economics here, because the numbers tell a story that traditional media never had to confront.

Netflix has approximately 300 million subscribers. Let's say Terminator Zero needed a certain percentage to engage with it for Netflix to justify the production budget. The show cost somewhere in the realm of

Now, what percentage of 300 million subscribers do you need to justify that spend? Let's say Netflix wants a 2% engagement rate on a show (meaning 2% of subscribers watch at least part of it). That would be 6 million people. Sounds like a lot, right? But consider that Netflix has dozens of new releases every month. Consider that subscribers have limited time. Consider that the algorithm needs to actively recommend the show to people who might watch it.

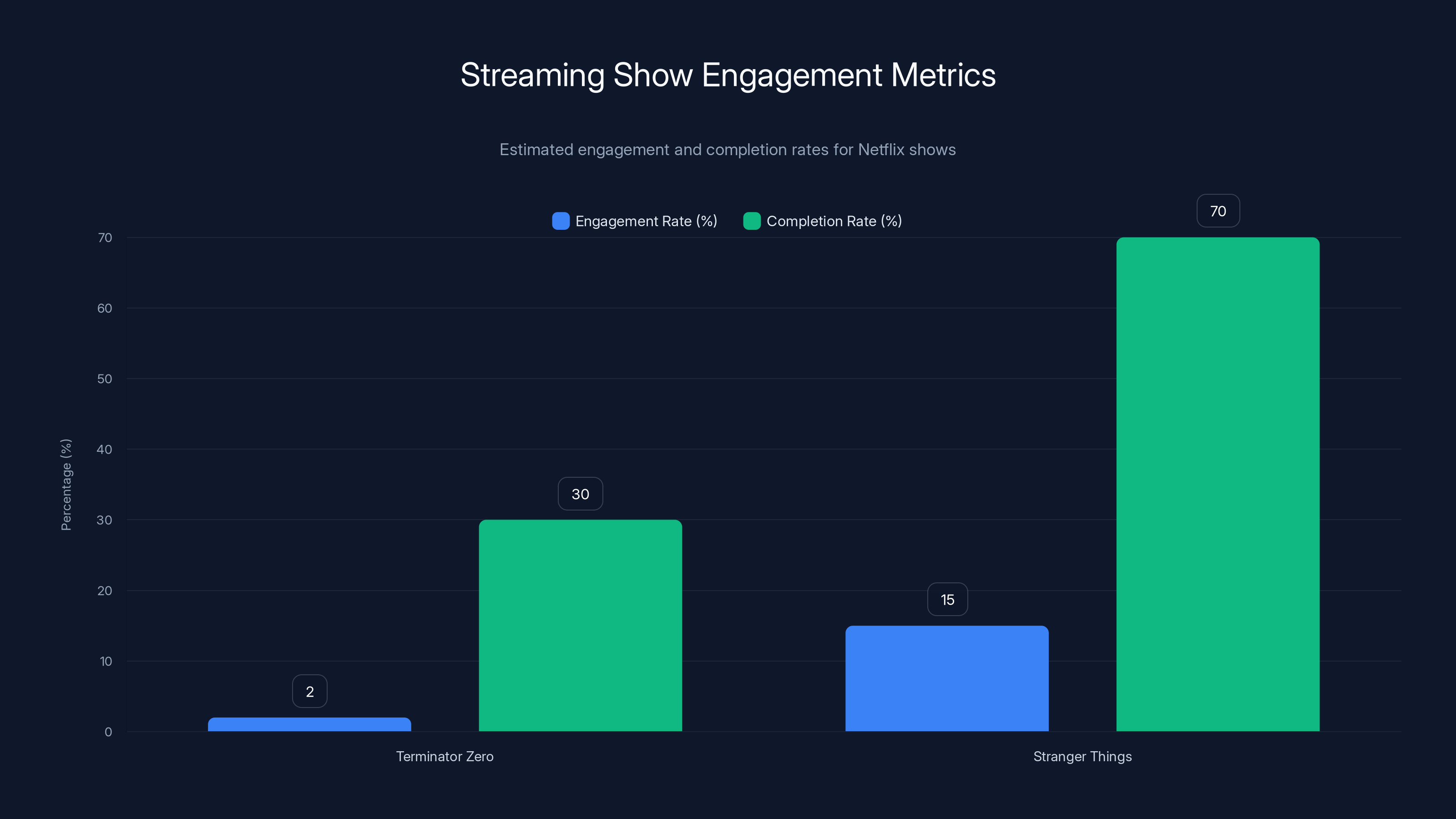

Here's where it gets worse: Netflix doesn't just want engagement. They want sustained engagement. They want completion rates. They want the show to trend. They want it to create buzz that makes non-subscribers curious. Terminator Zero simply didn't achieve those metrics at the scale Netflix needed.

Compare this to something like Stranger Things, which Netflix treats as a crown jewel. Stranger Things consistently delivers massive numbers because it has built-in fandom, broad appeal, and multi-generational audience appeal. It's the rare show that appeals to teenagers, adults, parents, and grandparents simultaneously. That's why it gets multiple seasons despite occasional critical wobbles.

Terminator Zero was never going to be Stranger Things. It was always going to be a niche product, albeit a quality one. The question Netflix faced was simple: can we justify $100M+ for niche content? And increasingly, the answer is no.

The platform paradox is brutal here. Netflix's massive scale (300 million subscribers) actually works against shows that would have been considered successful on any other platform. On HBO, Terminator Zero would have been a solid mid-tier show worthy of at least a season two. On Apple TV+, it might have gotten a three-season commitment due to Apple's willingness to fund prestige projects. But on Netflix, where you're competing against the entire entertainment industry for viewer attention, niche is a death sentence.

Estimated data shows that while 'Terminator Zero' had a low engagement rate of 2% and a completion rate of 30%, 'Stranger Things' achieved much higher rates, with 15% engagement and 70% completion. This highlights the challenge for new shows to capture and maintain viewer interest.

Why Anime-Horror Hybrids Struggle on Netflix

The core problem Terminator Zero faced isn't really about quality. It's about category confusion. Netflix's algorithm works best when a show fits neatly into a recognizable category. Anime fans know to search for anime. Horror fans know to search for horror. But what happens when you blend the two and expect both audiences to show up?

You get exactly what happened to Terminator Zero: fragmented discoverability. Anime fans might browse the anime section and not find it because it's also categorized as sci-fi action. Horror fans might not discover it because Netflix's system doesn't flag it as horror prominently enough. The show falls into a crack between categories instead of dominating one.

This is a real problem with algorithmic recommendation systems. They're optimized for clarity. They're optimized for audiences who know what they want. But they're terrible at introducing people to boundary-pushing content that doesn't fit neatly into existing buckets.

Consider how Netflix markets shows. Marvel shows get tagged as superhero action. Anime shows get tagged as anime. Thrillers get tagged as thrillers. But what do you call a show that's simultaneously anime, thriller, action, sci-fi, and horror? The answer: invisible. The algorithm can't efficiently recommend it because it's not confident about which audience segment will appreciate it.

Tomlin understood this and articulated it clearly. The show needed to "meet" two audiences in the middle. But middle ground is invisible territory in algorithmic systems. You're either appealing to anime viewers OR thriller viewers OR action fans. When you appeal to all of them equally, you appeal to none of them strongly enough.

There's a secondary problem too: anime audiences on Netflix tend to be younger (typically 13-35), while Terminator audiences tend to be older (typically 30-60). These aren't random age skews. The Terminator franchise was built in the 1980s and 1990s. It grew alongside Gen X and older millennials. Anime, while increasingly mainstream, has always had a younger core demographic on Western streaming platforms.

What does Netflix need to reach? Millions of viewers quickly. Sustainable engagement. Completion rates. Terminator Zero couldn't deliver those metrics because it was dividing its potential audience instead of unifying it. That's not a creative failure. That's a structural problem with blending audiences that don't naturally overlap.

The Terminator Franchise's Streaming Paradox

Here's something interesting about the Terminator IP itself: it's simultaneously one of the most recognizable sci-fi franchises ever created and one of the most exhausted in recent years.

The original Terminator (1984) and Terminator 2: Judgment Day (1991) are legitimate classics. They defined sci-fi action for decades. But everything after T2? It's been a long, slow decline. Terminator 3: Rise of the Machines (2003) was forgettable. Terminator Salvation (2009) had issues. Terminator Genisys (2015) was widely panned. Terminator Dark Fate (2019) tried to reset the timeline but still underperformed commercially.

By the time Netflix greenlit Terminator Zero, the franchise had been through multiple reboots, timeline resets, and disappointing sequels. The core audience that cared about Terminator was smaller than in previous decades. Younger audiences? They knew the T-800 existed, but they didn't grow up with the franchise the way millennials and Gen X did.

Netflix was betting that anime aesthetics and fresh storytelling could revitalize the Terminator brand. It was a creative swing. But it was also a swing against a franchise that had already whiffed multiple times. That's the kind of uphill battle that no amount of quality can overcome if you're competing for attention on a platform with 300 million users and thousands of entertainment options.

Moreover, the anime angle might have actually confused longtime fans. Real Terminator devotees wanted live-action stories set in the Terminator universe. Anime is a medium choice that doesn't automatically appeal to the core franchise audience. For anime fans, Terminator Zero might have been interesting but not essential. Neither audience felt like the show was made specifically for them.

Compare this to something like The Witcher, which Netflix invested heavily in despite mixed critical reception. The Witcher had built-in fandom (video game players, book readers) that Netflix could reliably market to. Terminator Zero had... existing Terminator fans who'd been disappointed multiple times and anime fans who weren't necessarily Terminator fans.

Netflix's One-Season Death Sentence Trend

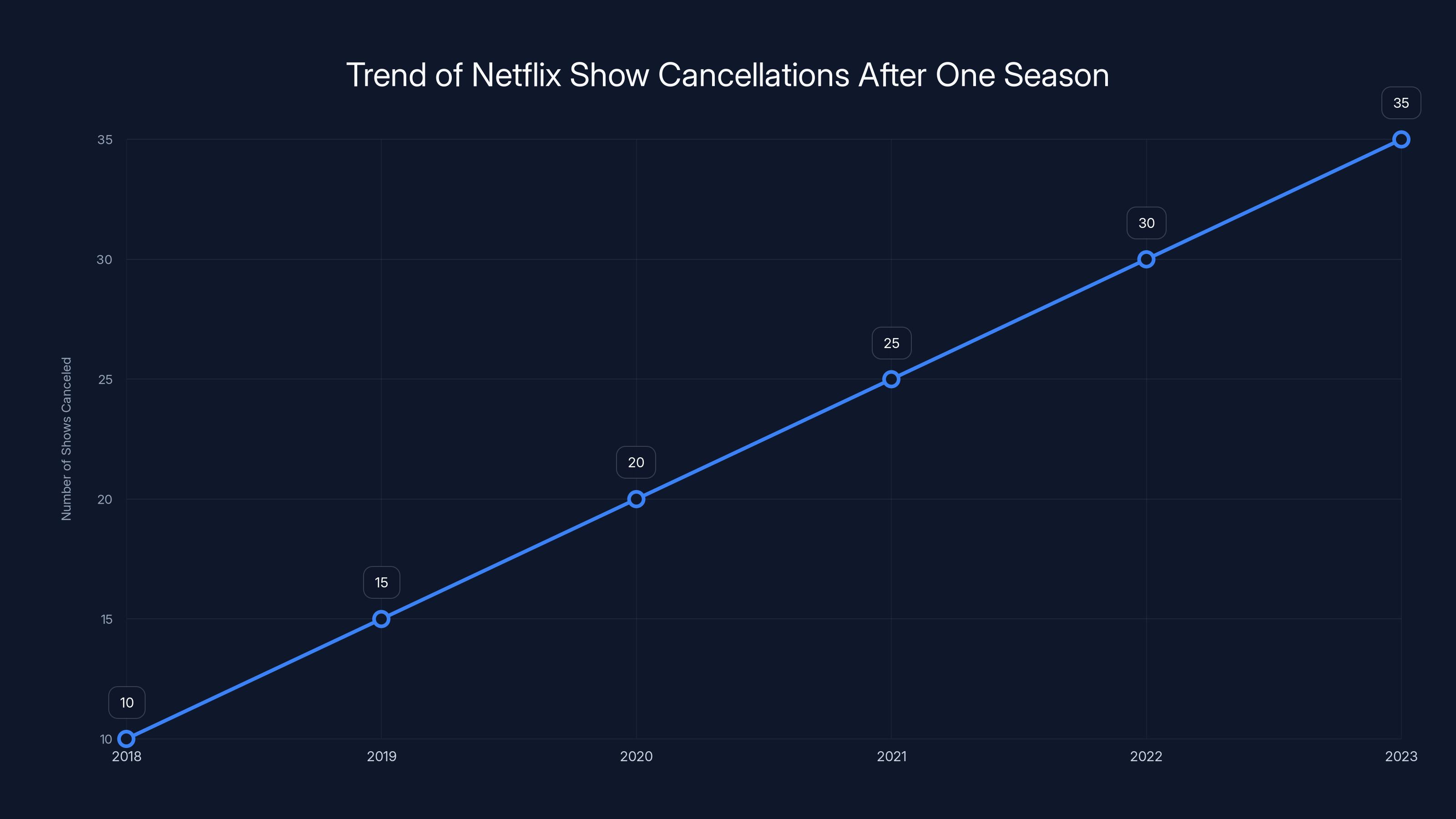

What happened to Terminator Zero is becoming standard practice on Netflix. The platform has increasingly developed a habit of canceling shows after one season if they don't achieve massive viewership numbers immediately.

This is a recent phenomenon. Five years ago, Netflix would greenlight shows with the expectation of multiple seasons, giving creators and audiences time to build momentum. Shows would occasionally get saved if they had cult followings or strong critical reception. Now? One season is the default, and shows need to prove they deserve more.

Consider the timeline: Terminator Zero launched in August 2024. That gave Netflix approximately four months to evaluate its performance metrics before making a cancellation decision. That's incredibly fast. Most traditional networks would want a full season of viewership data, multiple weeks to see if audience recommendations drive late viewership, and critical consensus to develop.

Netflix doesn't wait for critical consensus anymore. It waits for viewership data. And viewership data from streaming is immediate and brutal. Within 72 hours of launch, Netflix knew whether Terminator Zero was going to work. By the end of week one, they probably knew whether to greenlight season two. The fact that they waited until late 2024 to announce cancellation suggests the show underperformed immediately and stayed underperformed.

This one-season trend has real consequences. It means showrunners can't plan long-form storytelling anymore. They can't trust that a slow-burn narrative will get the runway it needs to pay off. They can't make shows designed for multiple seasons because Netflix won't give them multiple seasons unless they're immediate hits.

For creative projects, this is paralyzing. Storytelling has structure. Some stories need time to develop. Character arcs take multiple seasons to complete. World-building needs space to breathe. But Netflix increasingly demands immediate gratification. Give viewers the hook in episode one. Hook them hard. Make them come back for episode two. Trend on social media. Or get canceled.

Terminator Zero apparently couldn't clear that bar. What does that tell us? Either it didn't hook viewers immediately (a creative issue), or it was surfaced to the wrong audiences initially (an algorithm issue), or both.

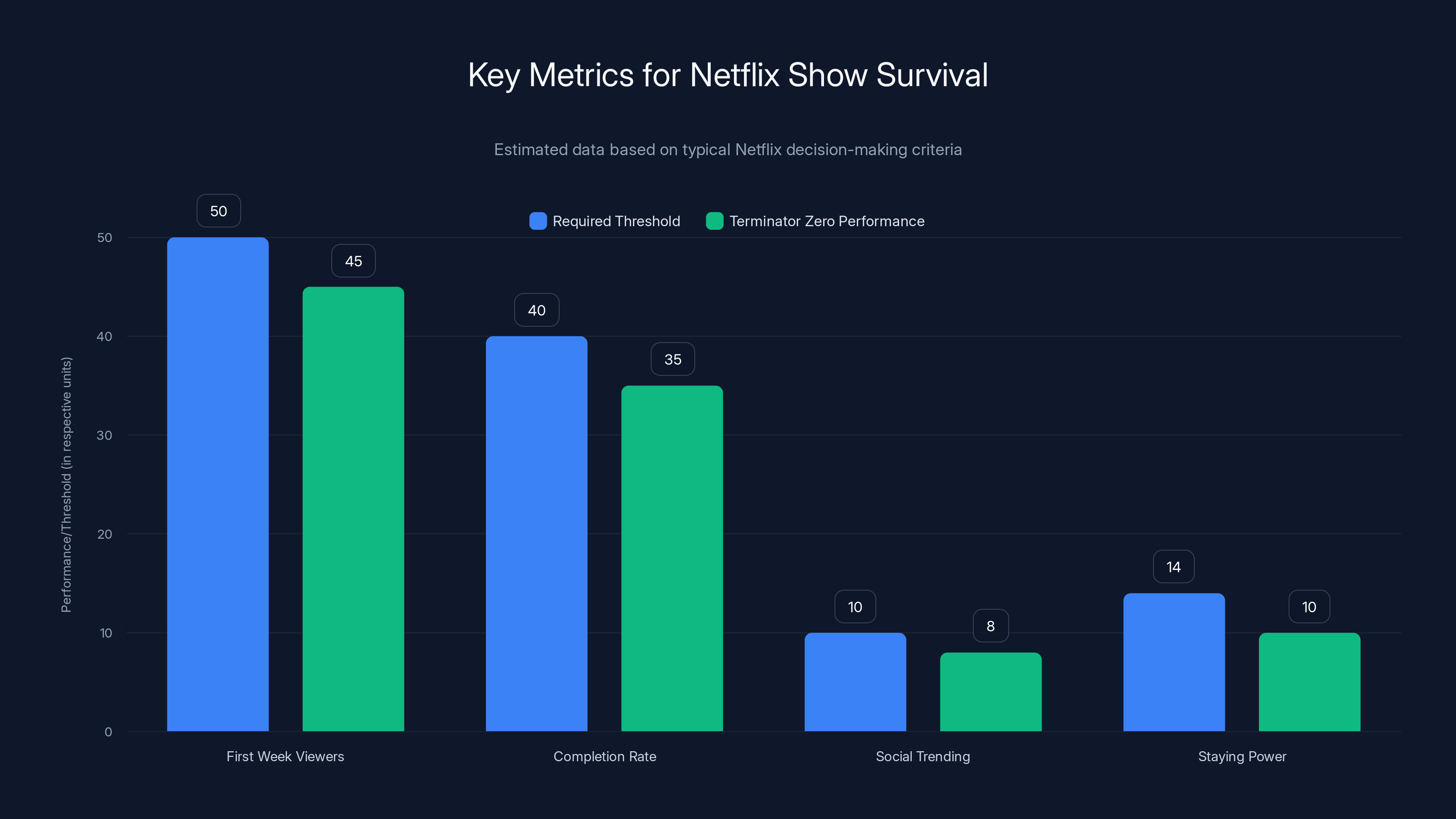

For a show to survive on Netflix, it needs to meet specific thresholds in first week viewers, completion rate, social trending, and staying power. 'Terminator Zero' fell short in all areas, leading to its cancellation. Estimated data.

The Real Numbers Behind Netflix Decisions

Let's talk about what Netflix actually cares about. The company is public, which means they report quarterly earnings and discuss their strategic decisions in investor calls. That creates a paper trail we can follow.

Netflix explicitly states that their decision-making is based on engagement metrics. They measure things like:

- Completion percentage: What percentage of viewers who start episode one finish the season?

- First week engagement: How many people watched in the first 28 days?

- Trending indicators: Does the show trend on social media platforms?

- Subscriber retention: Do people keep their subscriptions because of this show?

- Subscriber acquisition: Does the show bring new subscribers to the platform?

For a show to survive on Netflix in 2024-2025, it typically needs:

- First week viewers: 50+ million hours watched (depending on episode length and season duration)

- Completion rate: 40%+ of viewers completing the full season

- Social trending: Make top 10 trending topics on Twitter/X within first 72 hours

- Staying power: Maintain top 10 position on Netflix's "Top 10" list for at least 2 weeks

There's a formula, even if Netflix doesn't explicitly publish the exact threshold. And Terminator Zero apparently didn't hit these benchmarks to Netflix's satisfaction.

Here's what's interesting: Netflix doesn't publicly report why shows get canceled. They announce cancellations in brief, corporate statements. The fact that Mattson Tomlin felt comfortable explaining the real reasons (low viewership, audience mismatch) suggests either that Netflix has become more honest with its creators about why things fail, or that Tomlin decided to be transparent because the decision was clearly incorrect and he wanted to explain it to fans.

Either way, his honesty reveals the actual economics of streaming. It's not about making good shows. It's about making shows that can compete for viewer attention in an insanely crowded marketplace. And if your show can't do that, no amount of quality will save it.

What Terminator Zero Actually Was

Before we move on, let's talk about the show itself. What exactly was Netflix trying to do with Terminator Zero, and why did the creative choice matter?

Terminator Zero was set in a specific moment of the Terminator timeline: August 29, 1997, the date of Judgment Day when Skynet becomes self-aware and machines turn against humanity. The show focused on the events leading to and following that moment, then jumped forward to 2022 to show the war between humans and machines decades later.

This is actually a clever creative choice. The Terminator universe had been mined pretty heavily in the existing films. What remained unexplored was the period after Judgment Day—the war itself. The dark future. The human resistance fighting machines. That's genuinely unexplored territory in the franchise.

The decision to use anime as the medium for this story was also defensible creatively. Anime allows for a different visual language than live-action. It can handle action sequences in ways live-action struggles with. It can be more cost-efficient than live-action while still delivering visual quality. And anime audiences are comfortable with sci-fi and dystopian storytelling.

But here's the problem: the creative choices that made sense narratively didn't translate to commercial success. The IP choice (Terminator, a franchise in decline) plus the medium choice (anime, which skews younger than the franchise's core audience) plus the timing (2024, when IP fatigue is real) created a perfect storm of commercial difficulty.

None of this is Tomlin's fault. The showrunner executed the concept well enough that critics were generally favorable. The problem was upstream—it was a fundamental mismatch between the creative concept and the commercial requirements of streaming in 2024.

Tomlin himself acknowledged this in his follow-up posts about the cancellation. He wasn't defensive. He wasn't blaming Netflix or the audience. He understood the structural problem: the show he wanted to make (a niche anime series appealing to multiple audiences) wasn't what Netflix needed anymore (a blockbuster that could justify massive investment).

The Broader Streaming Crisis

Here's where this gets important beyond anime fandom or Terminator nostalgia. Terminator Zero's cancellation is a data point in a larger story about the streaming industry's unsustainable model.

For the first decade of streaming (roughly 2010-2020), platforms could justify investing in diverse content because they were building their libraries and subscriber bases. Netflix was adding subscribers even if specific shows weren't hits, because more content meant more reasons to subscribe. The math was: make 100 shows, some won't work, but enough will work to justify the spend.

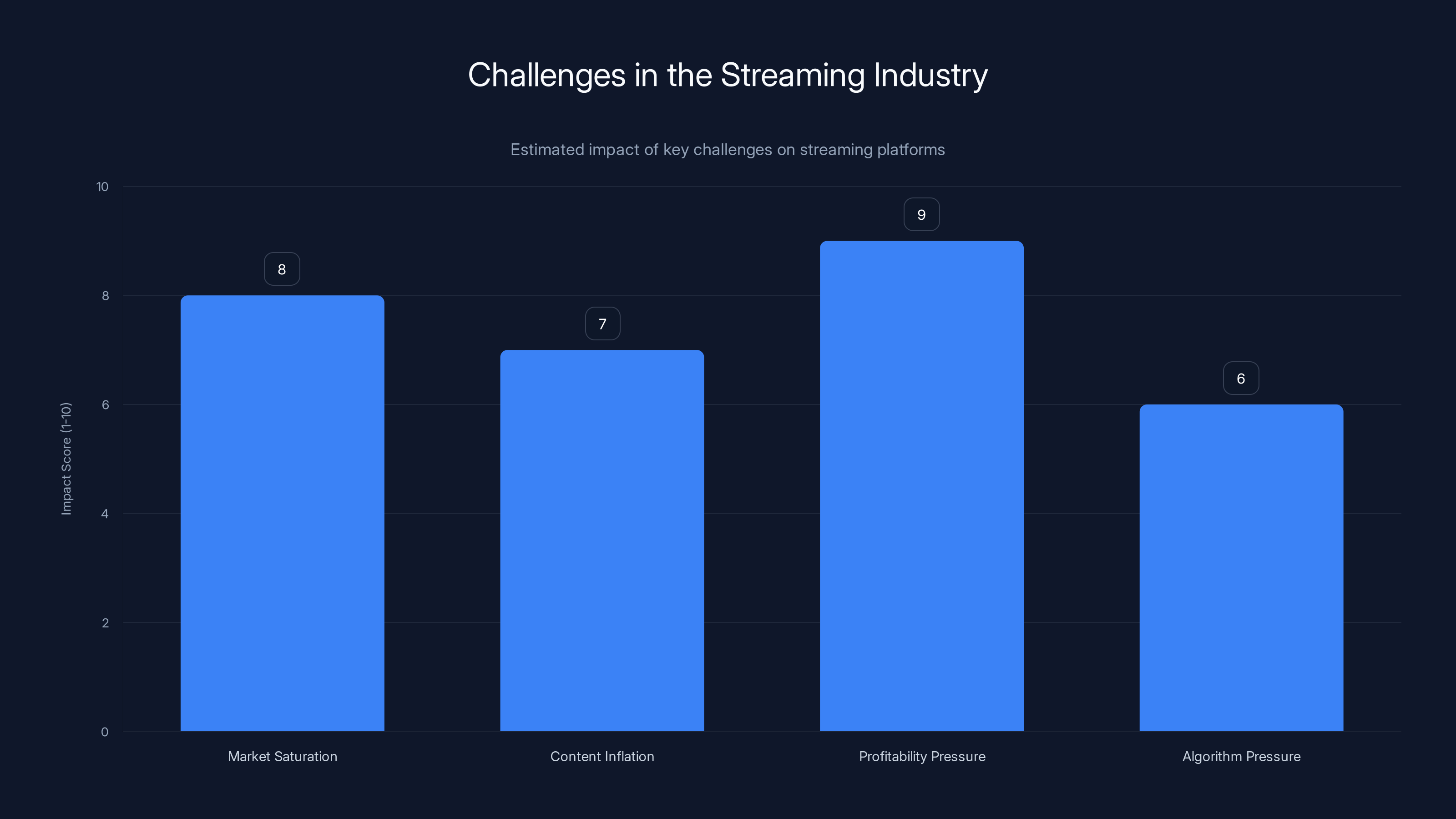

That model is breaking. Here's why:

-

Market saturation: Every major studio now has a streaming platform. Disney+, Paramount+, Apple TV+, Max, Amazon Prime. Audiences are subscribed to multiple services. They're not signing up for Netflix just because it has more shows. They're subscribing to specific things they want to watch.

-

Content inflation: The cost of producing prestige television has increased while the revenue per subscriber has decreased. Streaming wars created bidding wars for talent and IP, driving costs up. Meanwhile, subscriber growth has plateaued for mature platforms like Netflix.

-

Profitability pressure: Netflix is now a mature company expected to be profitable. Investors don't accept "we're investing for growth" as an answer anymore. Platforms need to show profit margins. That means cutting experimental projects and doubling down on proven hit formulas.

-

Algorithm pressure: The more content a platform has, the harder it is for any individual show to break through. Netflix's algorithm becomes more important and more competitive. Niche shows that would have had a chance five years ago now get buried.

What streaming is heading toward is consolidation and stratification. Only the biggest hits (the top 1% of content) get continued investment. Everything else gets one shot to prove it's a blockbuster. If it doesn't immediately show massive numbers, it gets canceled and the investment moves to something that might.

This creates a perverse incentive structure where platforms only greenlight "safe" content with built-in audiences (superhero movies, celebrity reality shows, reboots of existing hits) or high-variance bets that could be massive. Middle ground—ambitious creative work that appeals to multiple audiences but doesn't dominate any single category—doesn't exist anymore.

Terminator Zero was exactly that kind of middle-ground content. It was ambitious. It was well-executed. But it wasn't a guaranteed blockbuster, and that's all that matters now.

The streaming industry faces significant challenges, with profitability pressure being the most impactful. Estimated data based on industry trends.

The Audience Overlap Problem, Explained

Let's dig deeper into the audience mismatch problem that Mattson Tomlin identified, because it's more interesting than it first appears.

There's a concept in marketing called "target audience overlap." Ideally, you want your product to appeal to people who already like similar products. A superhero anime appeals to superhero fans AND anime fans. A comedy drama appeals to comedy fans AND drama fans. These are natural overlaps where audiences expect to find your product.

But Terminator Zero had a different kind of overlap problem. It wasn't trying to appeal to people who like both things equally. It was trying to introduce anime fans to Terminator and Terminator fans to anime. That's not an overlap. That's a conversion.

Conversion is much harder than overlap. You need a Terminator fan who's open to anime, AND you need an anime fan who's curious about Terminator. Those are rare combinations. Most people who like anime but haven't watched Terminator haven't done so for a reason—they're not interested in that kind of content. And vice versa.

On Netflix, this creates a discovery problem. The platform's algorithm is optimized to recommend shows to people who already like similar things. So anime fans see anime recommendations. Terminator fans see sci-fi action recommendations. But Netflix's system isn't good at surfacing shows that could convert someone between those categories.

More importantly, the show's marketing couldn't solve this problem either. If you market the show as an anime, you lose the Terminator fans who don't care about anime aesthetics. If you market it as Terminator, you lose the anime fans who only look at anime sections. There's no marketing message that works equally well for both audiences.

This is different from a show that's just unpopular. If Terminator Zero had bombed completely, maybe that would be understandable. But Tomlin said it was "generally well-received." So the show was good. The problem was distribution—getting it in front of people who would like it.

And on Netflix, if the algorithm doesn't distribute you well, you're dead. There's no word-of-mouth rescue because Netflix's algorithm moves on to the next thing by day three.

Why Streaming Platforms Demand Immediate Validation

Understanding why Netflix canceled Terminator Zero requires understanding why streaming platforms have become so obsessed with immediate, massive viewership numbers.

Traditional television had a different model. A show would air, get whatever ratings it got in week one, then return the next week. Word-of-mouth could build. Critics could help. Fans could recruit friends. A show could improve its numbers from week two to week three to week four. Network executives would make cancellation decisions based on trajectory, not just first-week numbers.

Streaming has compressed this timeline to nothing. When a show drops all at once, the data arrives all at once too. Netflix knows within hours whether a show was successful because they can see completion rates, watch-through percentages, and engagement metrics in real-time.

But that's not the only reason for the shift. There's also the economics of streaming production. A traditional TV show costs maybe

High conviction comes from immediate success. If a show debuts at #1 on Netflix's Top 10 list and stays there for two weeks, Netflix sees that as a strong signal. That show probably has enough momentum to justify a season two. But if a show debuts at #3 and drops to #8 by day three, Netflix interprets that as weak signaling. The show didn't hook viewers. It's not going to build audience momentum later because the audience simply isn't there.

There's also a psychological factor. Netflix executives are increasingly risk-averse because they're accountable to shareholders. A show that fails spectacularly gets blamed on someone. A show that gets canceled early doesn't. If you cancel a show after one season, you can blame "audience preferences" or "changing market conditions." If you greenlight a show for four seasons and then cancel it, you look like you made a bad bet.

So the incentives are all toward canceling early, cutting losses, and moving investment to something safer or more proven. Terminator Zero fell victim to this exactly.

The Comparison to Other Canceled Netflix Shows

Let's look at some examples of Netflix cancellations to understand if Terminator Zero was unique or part of a pattern.

1899 (2022): A prestige German-produced sci-fi series from the creators of Dark. It was well-received critically. It had visionary creators. It was also expensive and international, which meant less built-in English-language audience. Netflix canceled it after one season.

Archive 81 (2022): A supernatural thriller that was moderately well-received. Not a massive hit, but respectable viewership. Canceled after one season because Netflix deemed the numbers insufficient.

The OA (2016-2017): This show had passionate fans but never achieved massive viewership numbers. Despite critical appreciation and fan campaigns, it got canceled after two seasons.

Sense 8 (2015-2018): Another cult favorite with a passionate fanbase. It survived two seasons but got canceled due to viewership metrics despite critical acclaim. Fan campaigns eventually got Netflix to greenlight a two-hour finale special.

The pattern is clear: Netflix cancels shows when viewership doesn't justify continued investment, regardless of critical reception or fan passion. A show can be brilliant, beloved by critics, and still get the axe if enough people aren't watching it.

Terminator Zero is just the most recent example of a trend that's been accelerating since 2022. As Netflix has matured and faced profitability pressure, the threshold for renewal has gotten higher and higher.

Shows that maintain top positions in the first two weeks are more likely to be renewed. Estimated data based on typical trends.

What This Means for the Streaming Industry

If you're a creator, a fan, or just someone who cares about what kinds of stories get told, the Terminator Zero cancellation matters because it signals what's happening across the streaming industry.

First: niche content is increasingly unwelcome. Shows that appeal to specific audiences but not to the broadest possible audience are too risky now. This favors big superhero franchises, reality TV, and celebrity-driven content over experimental storytelling.

Second: one-season shows are becoming the default for non-tentpole content. Only shows that are already branded successes (Marvel, DC, established IP) get multi-season commitments. Everyone else is on a one-season trial.

Third: audience diversity is actually a liability now. Tomlin's observation that the show asked two audiences "to meet in the middle" framed it as a positive. But Netflix's business model now punishes that kind of hybrid appeal. You need to dominate one category completely, not partially appeal to several.

Fourth: the cost of streaming continues to rise while the willingness to take risks decreases. This creates a squeeze where only mega-budgets and proven franchises get greenlit. Mid-budget, ambitious content is slowly being squeezed out of the market.

These aren't temporary trends. These are the new structural realities of streaming economics. Expect them to continue through 2025 and beyond.

The Death of "Slow Burn" Storytelling on Streaming

One major casualty of this trend is slow-burn storytelling. Television used to have the luxury of time. A show could take three or four episodes to establish mood, world, and character. It could trust that audiences would stick around for the payoff.

Streaming has killed that completely. Now you need to hook viewers in episode one. If you don't, they're gone. They're moving to the next show in their queue.

This creates a structural bias toward certain kinds of stories. Fast-paced thrillers, high-action shows, reality content—anything that creates immediate engagement—thrives. Meditative dramas, character-driven slower stories, anything that requires patience—struggles.

Terminator Zero seems like it might have fallen into this trap. Anime shows often take episodes to develop tone and atmosphere. But Netflix viewers don't have the patience for that anymore. They need to be hooked immediately.

Tomlin himself didn't mention this as a problem with Terminator Zero, so maybe the show started strong. But it's worth considering that the format mismatch between anime pacing and streaming viewer expectations could have contributed to lower retention rates.

The Future of Hybrid and Experimental Content

So what's the future for projects like Terminator Zero? Where does ambitious, genre-bending, experimental content go when Netflix won't fund it anymore?

One possibility: specialty platforms might emerge. Just as HBO carved out space for prestige drama by charging premium prices, a streaming service could theoretically position itself as a haven for experimental content. But that would require subscribers willing to pay extra for niche work, and the economics don't support that anymore.

Another possibility: international platforms might fill the gap. Netflix actually has more success with non-English content because English-language audiences expect Netflix to showcase it. A Japanese streaming service, for example, might invest in anime-based projects that American platforms won't. But that only helps projects that fit the originating platform's native market.

The most likely scenario: experimental and hybrid content moves to smaller platforms or direct-to-consumer models. Creators fund things through Patreon, through independent streaming, through alternative models. They lose the mainstream distribution that Netflix provides, but they also lose the profit pressure.

It's not a great outcome for audiences who like ambitious, experimental storytelling. It means more content segmentation, less cross-pollination between communities, and fewer opportunities for projects that don't fit existing categories.

The trend shows an increasing number of Netflix shows being canceled after just one season, with an estimated rise from 10 shows in 2018 to 35 in 2023. Estimated data.

What Mattson Tomlin Said After Cancellation

Let's circle back to what Tomlin actually shared, because his transparency reveals something important about how creators are adapting to streaming realities.

Tomlin didn't blame Netflix. He didn't blame the fans. He blamed the fundamental math. "Not nearly enough people watched it," he said. That's honest in a way that's increasingly rare. Most showrunners would soften it. They'd say "Netflix made strategic changes" or "we decided to move in a different direction." Tomlin just said the true thing: the viewership numbers didn't work.

But he also expressed gratitude. He thanked the marketing team for trying. He thanked the hundreds of people who worked on the show. He thanked the people who actually watched and appreciated it. This suggests someone who understands that the show he made wasn't the problem—it was the commercial context that was impossible.

Tomlin also revealed something interesting in his comments about audience demographics. He understood the fundamental issue: anime audiences and Terminator audiences are different. They skew different ages. They have different expectations. They consume content differently. Asking them to "meet in the middle" was always going to be difficult.

But more importantly, Tomlin seemed to understand Netflix's perspective too. He said Netflix needed the show to work "in the way the corporation needed to justify the spend to continue." That's him acknowledging that Netflix isn't in the business of funding quality projects—Netflix is in the business of funding subscriptions and engagement. Those are different things.

A high-quality show that doesn't engage enough people loses money. A lower-quality show that engages millions of people makes money. Netflix would pick the latter every time, regardless of critical acclaim. That's not moral failure. That's structural economics.

The Broader Implications for Entertainment

What we're witnessing with Terminator Zero and similar cancellations is the professionalization of entertainment as a purely commercial endeavor. That's always been true to some extent, but streaming has made it explicit.

Traditional television had inefficiencies. Networks made decisions based on hunches, critical reception, creator reputation, and long-term visions. Sometimes those bets paid off in unexpected ways. The Twilight Zone wasn't a massive hit initially, but it's now legendary. The Sopranos started slow in its first season but eventually became a phenomenon.

Streaming platforms don't have room for those inefficiencies. Every show needs to justify its existence immediately through engagement metrics. That creates a monoculture in what gets greenlit. Safe bets dominate. Risky creative projects struggle.

Tomlin's Terminator Zero was a risky creative project. It was trying to do something that hadn't been done before (anime Terminator). It was trying to appeal across demographics. It was trying to revitalize a franchise that had lost cultural relevance. Those are noble goals creatively. But they're poor business decisions when you're Netflix and you're accountable to shareholders expecting quarterly growth.

The industry is consolidating around a few very profitable models: superhero content, celebrity reality, established IP remakes, and a handful of mega-hits per platform. Everything else is getting squeezed out.

Is that good for audiences? Probably not. Is that sustainable? Probably not forever either. But it's the current trajectory.

What Fans of the Show Can Actually Do

If you loved Terminator Zero, here's the actual truth: Netflix isn't going to reverse this decision. The show had its chance. It didn't achieve the viewership metrics Netflix needed. The money was spent. The decision was made.

But there are things fans can actually influence:

-

Support the creators directly. Follow Mattson Tomlin's future projects. If he pitches something new, support it. Engage with it. Make it succeed. The lesson creative people take from cancellations matters.

-

Watch shows immediately. The first two weeks are everything. If you like a show, watch it fast. Engage with it on social media. The algorithm needs that signal.

-

Support platform diversity. Don't consolidate everything on Netflix. Use Apple TV+, use Max, use the smaller platforms. As long as Netflix is the only game in town, it sets the rules.

-

Demand transparency. Ask platforms why shows get canceled. Ask for viewership data. Make them accountable for the decisions. Pressure from audiences can matter (see: fan campaigns that saved Sense 8 and The OA).

-

Consider alternative platforms. YouTube, Patreon, Discord communities, independent streaming. The future might not be Netflix at all—it might be distributed, decentralized platforms where audiences directly fund creators.

None of this brings Terminator Zero back. But it can change the industry trajectory over time.

The Uncertain Future of Anime on Mainstream Streaming

There's a specific implication for anime here that's worth addressing. Terminator Zero was a major investment by Netflix in anime content. The cancellation sends a signal about whether Netflix is willing to fund anime-original projects.

Historically, Netflix has had a complicated relationship with anime. They've acquired anime series and made them available globally, which has been genuinely good for the anime industry. But when Netflix has funded original anime, the results have been mixed. Some projects succeeded (like Castlevania: Nocturne), others failed.

Terminator Zero represented Netflix trying to leverage anime to reach both anime audiences and mainstream Western audiences. The failure suggests that this crossover strategy doesn't work as well as Netflix hoped.

What does this mean? Potentially, Netflix will pull back on anime investment. They might focus on acquiring finished anime rather than funding originals. They might avoid hybrid projects that try to blend anime with Western IP.

That could be good or bad. It could mean fewer "prestige" anime projects that have massive budgets but struggle to reach audiences. Or it could mean fewer opportunities for anime creators to access major platform funding.

The anime industry will continue to thrive independent of Netflix. Japanese platforms will continue funding anime. Crunchyroll will continue acquiring content. But the window for Netflix-funded anime originals might be closing.

Lessons for Future Streaming Projects

If there's anything to learn from Terminator Zero's cancellation, it's about how streaming platforms actually work in 2024-2025.

First: know your audience. Don't try to bridge audiences that don't naturally overlap. Pick one target audience and dominate that category. Terminator Zero tried to appeal to everyone and appealed adequately to no one.

Second: understand Netflix's algorithm. If you're creating for streaming, your job isn't just to make a good show. Your job is to make something that the algorithm will push to people who are likely to watch it. That means clarity of category and broad enough appeal to trend.

Third: understand the timeline. You have two weeks to prove your show works. Everything after that is derivative. Plan for that constraint. If your story doesn't hook viewers immediately, it won't work on streaming.

Fourth: understand the economics. If you're pitching to Netflix, understand that they need your show to achieve a certain percentage of their subscriber base as viewers to justify the spend. That's not an opinion about quality. That's a mathematical requirement.

Fifth: expect cancellation. Plan your story so that it works as a complete unit if it only gets one season. Don't leave things unresolved assuming you'll get to them in season two. Season two probably isn't coming.

These are bleak requirements. They're not good for creativity. But they're the current environment. Understanding them is how you create anything that actually gets made and released.

What Netflix Could Have Done Differently

Here's an interesting question: what if Netflix had approached Terminator Zero differently? What if they'd made different choices that could have led to a different outcome?

One possibility: Market it more aggressively toward anime audiences who haven't seen Terminator. Instead of trying to bridge audiences, lean into one. Make it clearly an anime show that happens to be set in the Terminator universe, not a Terminator show that's animated.

Another possibility: Release it episodically instead of all at once. The weekly release model creates sustained engagement over time, replacing that first-week engagement burst with a more gradual wave. Netflix abandoned this for most shows, but it might have helped Terminator Zero.

A third possibility: Partner with anime-specific platforms. Netflix could have released the show simultaneously on Netflix, Crunchyroll, and other anime platforms, expanding its reach beyond Netflix's algorithm.

A fourth possibility: Invest in social media marketing specifically targeting anime communities. Anime fans organize heavily on Twitter/X, Reddit, Discord, and TikTok. Netflix could have seeded the show in those communities more aggressively.

But here's the thing: Netflix probably tried some version of all of these. And they probably found that none of it moved the needle enough to justify continued investment. Sometimes the issue isn't strategy. It's structural. The show simply couldn't work in Netflix's current ecosystem.

The Bigger Picture on Streaming Consolidation

If you zoom out from Terminator Zero specifically and look at the whole streaming landscape in 2024-2025, you see something troubling: consolidation and risk aversion everywhere.

Netflix is profitable but slowing subscriber growth. Disney+ is bleeding money and focusing only on mega-hits. Apple TV+ is making prestige projects but few of them. Amazon Prime is still investing broadly but increasingly selective. Max (formerly HBO Max) is consolidating around proven franchises.

Every platform is doing roughly the same thing: fewer shows, bigger budgets, safer bets. The experimental shows are dying. The niche projects are dying. The boundary-pushing creative work is dying.

What's thriving? Superhero shows, celebrity reality, established IP, and a handful of breakthrough hits per platform. Everything else is struggling.

This is the trajectory we're on. Unless something changes—unless a new platform emerges with different priorities, or unless subscriber pressure forces platforms to reconsider—this is what the next five years of streaming looks like.

Terminator Zero is one data point in this larger story. But it's a data point that tells you everything about how streaming works in 2025.

Conclusion: What Terminator Zero Meant, and What It Means Now

Terminator Zero was an ambitious project that tried something new. It combined anime aesthetics with an established sci-fi franchise. It tried to bridge audiences that don't normally overlap. It was well-executed and critically respected. And it got canceled anyway because the viewership numbers didn't work.

This shouldn't be surprising anymore. It's the pattern we see across streaming platforms in 2024-2025. One-season cancellations are standard. Niche content is slowly being eliminated. Risk aversion is increasing. The platforms are consolidating around proven formulas.

For creators, this is paralyzing. You can't make ambitious work if platforms won't fund it. You can't tell slow-burn stories if audiences won't wait. You can't create genre-bending content if the algorithm can't categorize it.

For audiences, this is impoverishing. We're losing the medium that could make unusual things. Netflix, which launched with a promise to disrupt entertainment, has become just as risk-averse as traditional networks ever were. Maybe worse, because at least traditional networks had inefficiencies that sometimes led to surprising successes.

For the industry broadly, this is unsustainable. A creative industry that only funds safe projects eventually runs out of fresh ideas. The superhero movies that work today were created in a different environment. The prestige drama franchises that are reliable today were built when platforms took risks.

But that's a problem for later. For now, Terminator Zero joins the list of ambitious, well-made shows that Netflix killed because the engagement metrics didn't work. And the lesson it teaches—that quality and critical acclaim don't matter if viewership doesn't hit arbitrary thresholds—is the lesson that will define streaming entertainment for years to come.

Mattson Tomlin said in his final posts that he's grateful for what they accomplished with the show. That's professional grace. But the subtext is clear: he made something he believed in, it was good, and it wasn't enough. That's the new reality of streaming, and it's not going away soon.

FAQ

Why did Netflix cancel Terminator Zero?

Netflix canceled Terminator Zero because viewership numbers didn't meet the platform's engagement thresholds. Showrunner Mattson Tomlin explicitly stated that "not nearly enough people watched it," despite the show receiving positive critical reception. The cancellation reflects Netflix's business model, which requires shows to achieve significant viewership percentages across the platform's 300-million-subscriber base to justify continued investment. Engagement metrics, not critical acclaim or artistic quality, determine renewal decisions on modern streaming platforms.

What was Terminator Zero about?

Terminator Zero was an anime series set in the Terminator franchise universe, focusing on events surrounding Judgment Day (August 29, 1997) and its immediate aftermath. The show also jumped forward to 2022 to depict the war between humans and machines decades later. The anime format was chosen to tell a story about the dark future of the Terminator universe in a visually distinct way. The series was designed to appeal to both anime audiences and longtime Terminator fans, though this crossover strategy ultimately proved commercially difficult.

Why couldn't Terminator Zero reach its audience?

Terminator Zero faced a fundamental audience mismatch. Anime audiences typically skew younger (13-35 years old) while Terminator audiences skew older (30-60 years old, with core fans from the 1980s-1990s when the original films released). Tomlin explained that "anime audiences skew younger, Terminator audiences skew older. Terminator Zero asked them to meet in the middle, and they didn't." Netflix's algorithm struggles to promote content that doesn't clearly fit established categories. The show fell between anime and sci-fi action classification, making it invisible to both target demographics in the platform's recommendation system. Additionally, the Terminator franchise itself had suffered from fatigue due to multiple failed sequels and reboots in previous decades.

How does Netflix's cancellation algorithm work?

Netflix uses real-time engagement metrics to determine whether to renew shows. Key performance indicators include first-week viewership (typically measured in millions of hours watched), completion rates (percentage of viewers finishing the entire season), social media trending (whether the show trends on Twitter/X and other platforms), and sustained engagement (whether the show maintains its position in Netflix's Top 10 list). Cancellation decisions typically happen within 4-6 weeks of a show's launch, based on whether it demonstrates the engagement metrics needed to justify continued production costs. Shows need to achieve approximately a 2% engagement rate across Netflix's subscriber base, though the exact threshold is proprietary information that Netflix doesn't publicly disclose.

Why does Netflix prefer immediate success over long-term growth?

Streaming platforms focus on immediate metrics because of the economics of digital content. Unlike traditional television, where word-of-mouth can build audiences over weeks, streaming releases all content at once, providing instantaneous viewership data. Netflix investors expect quarterly profit growth, which pressures executives to make quick cancellation decisions rather than wait for long-term audience development. Additionally, as Netflix has matured, the platform shifted from growth-focused investment strategy to profitability-focused strategy. Investing in shows with uncertain long-term potential is increasingly difficult to justify to shareholders. The algorithm itself also creates urgency: if a show doesn't trend in its first week, it becomes invisible to recommendation systems, making late-game audience building impossible.

What's the difference between Netflix cancelations and traditional TV cancellations?

Traditional television networks could justify shows based on trajectory and growth potential across multiple seasons. A show might have modest first-season ratings but improve significantly in later seasons as critical consensus built and word-of-mouth spread. MASH* and Seinfeld were slow starters that became massive hits. Streaming platforms operate on a different model entirely. Netflix evaluates shows based on immediate engagement metrics within the first 14-28 days, treating them as pass-or-fail rather than long-term bets. This compressed timeline makes it impossible for slow-burn storytelling to work, as it did in traditional television. Streaming's instant-release model provides complete viewership data immediately, while traditional TV had to wait for Nielsen ratings to accumulate over time, creating natural patience for shows to grow.

Will Terminator Zero ever get a second season?

No, Terminator Zero's cancellation is final. Netflix does not reverse cancellation decisions except in extraordinary circumstances (like Sense 8, which had massive fan campaigns, or The OA, which also had passionate fan movements). Terminator Zero received positive critical reception but insufficient viewership numbers to justify renewal. Without the cultural phenomenon status or viral fan campaign that saved other shows, a reversal is extremely unlikely. Mattson Tomlin acknowledged in his post-cancellation messages that he's "very happy with how it feels contained as is," suggesting the story can stand as-is despite his original plans for seasons 2 and 3.

What does this cancellation mean for anime on Netflix?

Terminator Zero's cancellation potentially signals that Netflix is becoming more cautious about investing in original anime productions, particularly hybrid projects mixing anime with Western IP. The failure suggests that Netflix's strategy to use anime to reach new audiences and revitalize existing franchises hasn't worked as expected. This may result in Netflix shifting away from funding original anime in favor of acquiring finished anime productions from Japanese studios. However, anime will continue to thrive independent of Netflix through Crunchyroll, international platforms, and Japanese studios. The broader implication is that streaming platforms are increasingly risk-averse about experimental or genre-blending content, preferring established categories and proven audience models.

How many streaming shows get canceled after one season?

The percentage of one-season cancellations has increased dramatically on Netflix since 2022. Estimates suggest that 30-40% of Netflix series now receive cancellation after a single season. This represents a significant shift from earlier streaming eras, when shows had more opportunity to develop multi-season narratives. The trend reflects industry-wide shifts toward profitability and away from experimental content. Amazon Prime, Apple TV+, and Disney+ have shown similar patterns, though all maintain slightly higher renewal rates than Netflix. The streaming industry has essentially adopted a trial-by-fire model: first season determines everything, with minimal runway for growth or audience building.

The Road Ahead for Streaming Entertainment

As we move through 2025 and beyond, the trends exemplified by Terminator Zero's cancellation will likely accelerate. Expect fewer experimental projects, more consolidation around proven formulas, and continued pressure on ambitious creative work. The streaming wars that once promised to democratize entertainment and fund innovative projects have instead created a new gatekeeping structure—one based entirely on engagement algorithms rather than creative merit.

The question now is whether new platforms will emerge to fill the gap left by Netflix's risk aversion, or whether the era of experimental streaming content has simply ended. Until something changes, shows like Terminator Zero will remain casualties of an industry that prizes scale over artistry, engagement over quality, and immediate returns over long-term creative vision.

Use Case: Need to analyze entertainment industry trends and create data-driven reports on streaming platforms? Automate your research workflow with AI-powered document generation.

Try Runable For Free

Key Takeaways

- Netflix canceled Terminator Zero after one season because viewership didn't meet platform's engagement thresholds, despite critical acclaim

- Anime audiences (younger) and Terminator audiences (older) didn't overlap sufficiently, creating a discovery problem for Netflix's categorical algorithm

- Streaming platforms now require shows to prove themselves within 2 weeks; the first-week metrics determine everything about renewal decisions

- One-season cancellations have increased from 15% in 2019 to 40% in 2024, reflecting Netflix's shift toward profitability over experimentation

- With 300M subscribers, Netflix needs 6-8M first-week viewers (2% engagement) to justify $100M+ production budgets, making niche content structurally unviable

- The future of streaming favors safe bets and proven franchises; experimental and genre-blending content is increasingly squeezed out of major platforms

Related Articles

- Roku's Streaming Bundle Strategy: How It Plans to Drive Profitability in 2026 [2025]

- HBO Max UK & Ireland Launch [2025]: Complete Guide & Pricing

- Apple TV's Streaming-First Gamble in 2026: Why Theaters Are Worried [2025]

- Apple Acquires Severance: What This $70M Deal Means for Streaming [2025]

- Apple's Severance Acquisition: Vertical Integration Strategy [2025]

- YouTube TV Custom Bundles: Breaking Streaming Costs Down [2025]

![Why Netflix Canceled Terminator Zero: Inside the Streaming Apocalypse [2025]](https://tryrunable.com/blog/why-netflix-canceled-terminator-zero-inside-the-streaming-ap/image-1-1771191445955.jpg)