Wix and QuickBooks Integration: Complete Guide for SMBs

There's a moment every small business owner dreads. You've just finished updating your website with a new product listing, and now you realize you need to manually enter those same details into your accounting software. Then comes the invoice reconciliation. Then the tax calculations. Then wondering if your numbers actually match.

This is the reality for thousands of SMBs that operate separate website and accounting systems. Data lives in silos. Updates get duplicated or forgotten. Hours disappear into administrative work that should take minutes.

Wix and QuickBooks Online just changed that equation.

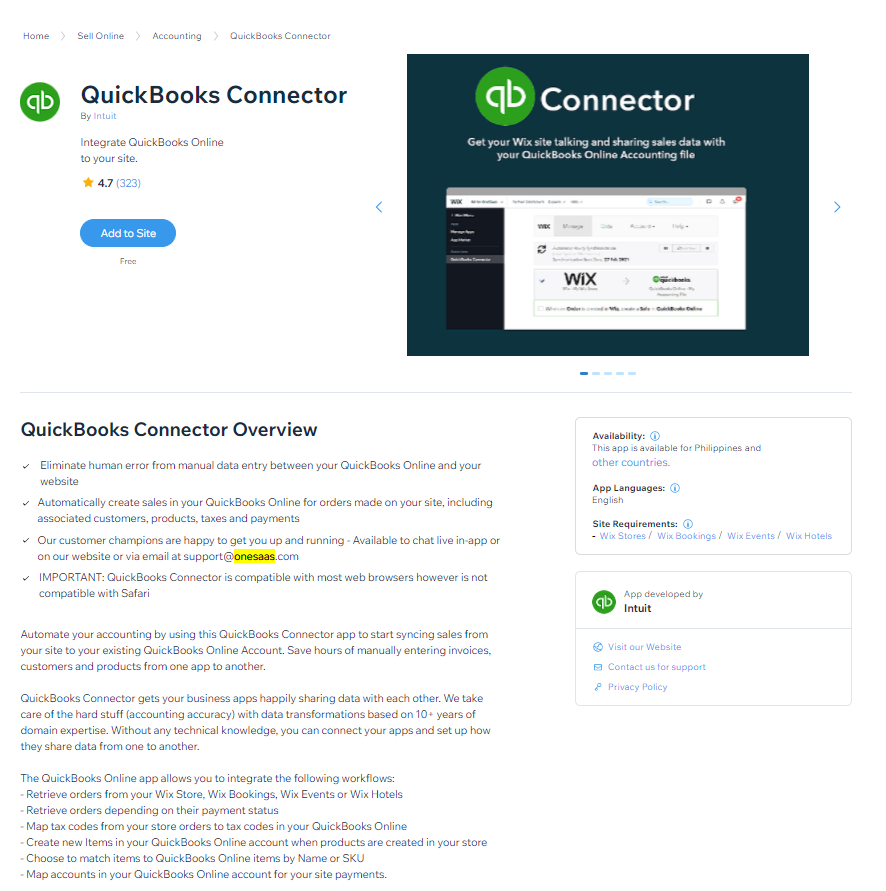

In 2025, the two platforms formalized a direct integration that connects your website directly to your accounting system. This isn't a partial workaround or a third-party bridge app. This is native integration built into both ecosystems, allowing data to flow automatically from your Wix store to your QuickBooks Online accounting software without manual entry or export-import cycles.

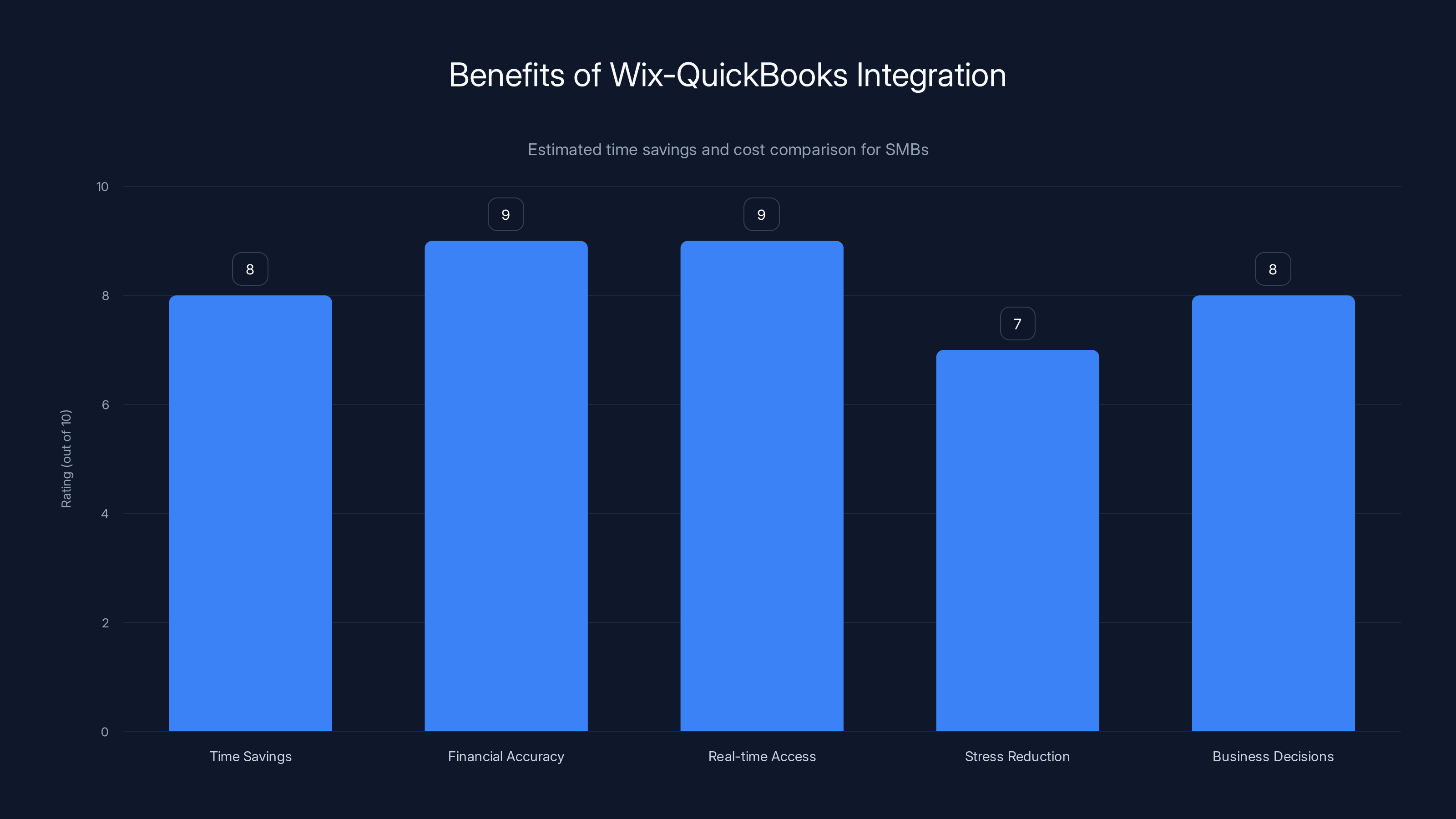

For SMBs, this changes everything. We're talking about recovered hours per week, reduced data entry errors, real-time visibility into business performance, and the ability to make decisions based on current numbers instead of last month's reconciled data.

But how does it actually work? What problems does it solve? And more importantly, is it right for your business?

Let's dig into the details.

TL; DR

- Direct Integration Now Live: Wix sites connect directly to QuickBooks Online, syncing sales data, expenses, and tax estimates automatically without manual entry

- Reduced Administrative Work: Small business owners save 4-6 hours weekly on accounting data entry and reconciliation tasks

- Real-Time Financial Visibility: Access current cash flow, revenue, and expense data instantly across both platforms instead of waiting for end-of-month reconciliation

- Seamless Ecosystem: QuickBooks users can now build Wix websites directly within the Intuit platform, keeping everything in one environment

- Cost Efficiency: No additional integration fees; pricing depends on selected plans for both Wix and QuickBooks Online

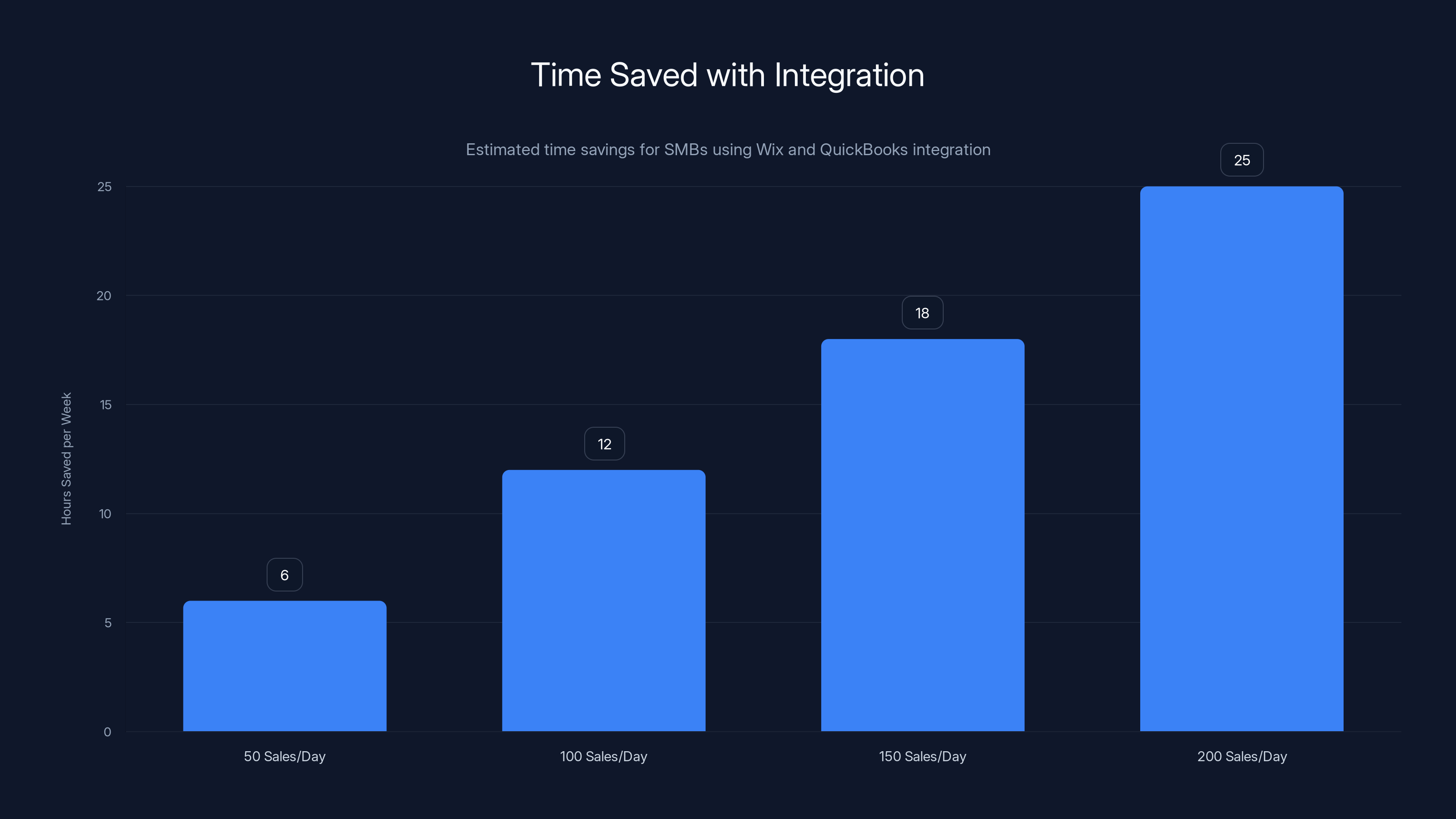

Integrating Wix and QuickBooks can save SMBs between 6 to 25 hours of manual work weekly, depending on sales volume. Estimated data.

Why This Partnership Actually Matters

Understand something important: Wix and QuickBooks aren't natural competitors, but they also weren't natural partners until now. Wix builds beautiful websites. QuickBooks manages finances. Most small businesses used both, but they operated in separate universes.

The problem was that this separation created what I call "data tax"—the hidden cost of managing information across multiple systems.

A customer places an order on your Wix store. That sale needs to appear in QuickBooks as revenue. But Wix doesn't automatically push that data. So you either manually log into QuickBooks and enter the transaction, or you export a spreadsheet and import it, or you use a third-party automation tool that costs extra.

Now multiply that by dozens of daily orders. Add in expenses you need to categorize. Tax calculations that require accurate revenue numbers. Inventory adjustments. Returns. Refunds.

The friction accumulates. Studies show the average small business owner spends 5-8 hours per week on bookkeeping and accounting tasks, many of which are manual data transfer.

That's 260-416 hours annually on work that a computer should handle automatically.

Wix and Intuit looked at this situation and decided to eliminate it. By building direct integration, they're removing that manual layer entirely. Your customer completes a purchase on your Wix store. That transaction automatically appears in QuickBooks. Revenue is categorized correctly. Tax implications are calculated. Your financial records stay current without any action from you.

This is what modern business software should do. Connect the dots instead of forcing you to manually draw lines between systems.

How The Integration Actually Works

Let's walk through what happens when this integration is active. Understanding the mechanics helps you see where it saves time and where it creates visibility.

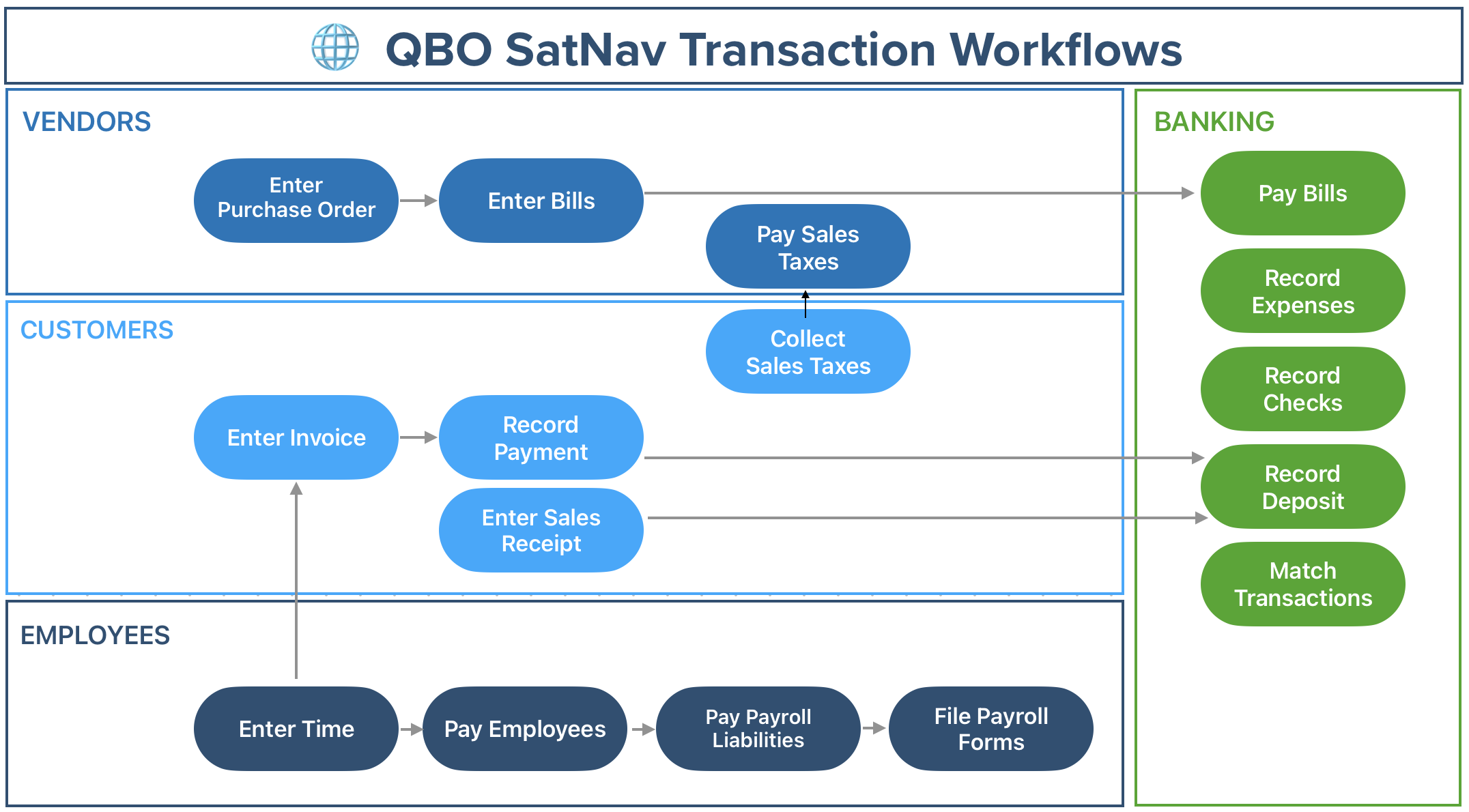

The Flow of Information

When a customer makes a purchase on your Wix store, several pieces of data need to reach your accounting system: the transaction amount, the items purchased, the customer information, the date and time, any taxes collected, and payment method information.

Previously, this information lived only in Wix's system. Getting it into QuickBooks required manual effort or third-party tools.

With direct integration, Wix now sends this data directly to QuickBooks Online through an API connection. The process is automated and real-time, meaning the transaction appears in your QuickBooks account within minutes of the sale, not after you've uploaded a spreadsheet or manually logged entries.

Here's what specifically syncs:

Revenue Data: Every sale on your Wix store automatically creates a corresponding income entry in QuickBooks, categorized based on product type or your defined settings.

Customer Information: Customer details sync to your QuickBooks customer database, preventing duplicate entries and maintaining a single source of truth for customer data.

Expenses: If you're tracking expenses through Wix (like shipping costs or product purchases), these flow into QuickBooks as categorized expenses.

Tax Data: Sales tax collected through your Wix store updates your QuickBooks tax liability automatically, which matters enormously when it's time to file tax returns.

Inventory Updates: When you sell products, your Wix inventory levels sync with any inventory tracking you have in QuickBooks, preventing overselling or stock discrepancies.

Where The Connection Happens

The integration happens at two levels. First, there's the technical layer where Wix's servers communicate with QuickBooks' servers using standardized APIs. You don't see this, but it's the backbone that makes everything work.

Second, there's the user interface layer. In your Wix dashboard, you'll see clear options to connect your QuickBooks account. You authorize Wix to access your QuickBooks data (through Intuit's secure authentication system), and the connection activates.

On the QuickBooks side, the integration appears as a connected app. You can see it in your settings, manage permissions, and disconnect it if needed.

The beauty of this approach is simplicity. You're not installing software or running servers. You're not managing APIs or writing code. You're clicking "Connect" and the systems talk to each other.

Real-Time vs. Batch Processing

One critical detail: the integration runs in near real-time, not in batch processes (where data is collected and sent periodically).

This matters because it means your QuickBooks financial data is current. If you log in to check your revenue figures, you're seeing today's numbers, not yesterday's or last week's. For cash-poor startups, knowing your actual position immediately is crucial for making payroll and purchasing decisions.

Batch processing, by contrast, might bundle transactions from a full day or week and sync them at a scheduled time. You'd always be looking at slightly stale data.

Wix and QuickBooks opted for near real-time because it provides better decision-making information and matches how modern businesses operate.

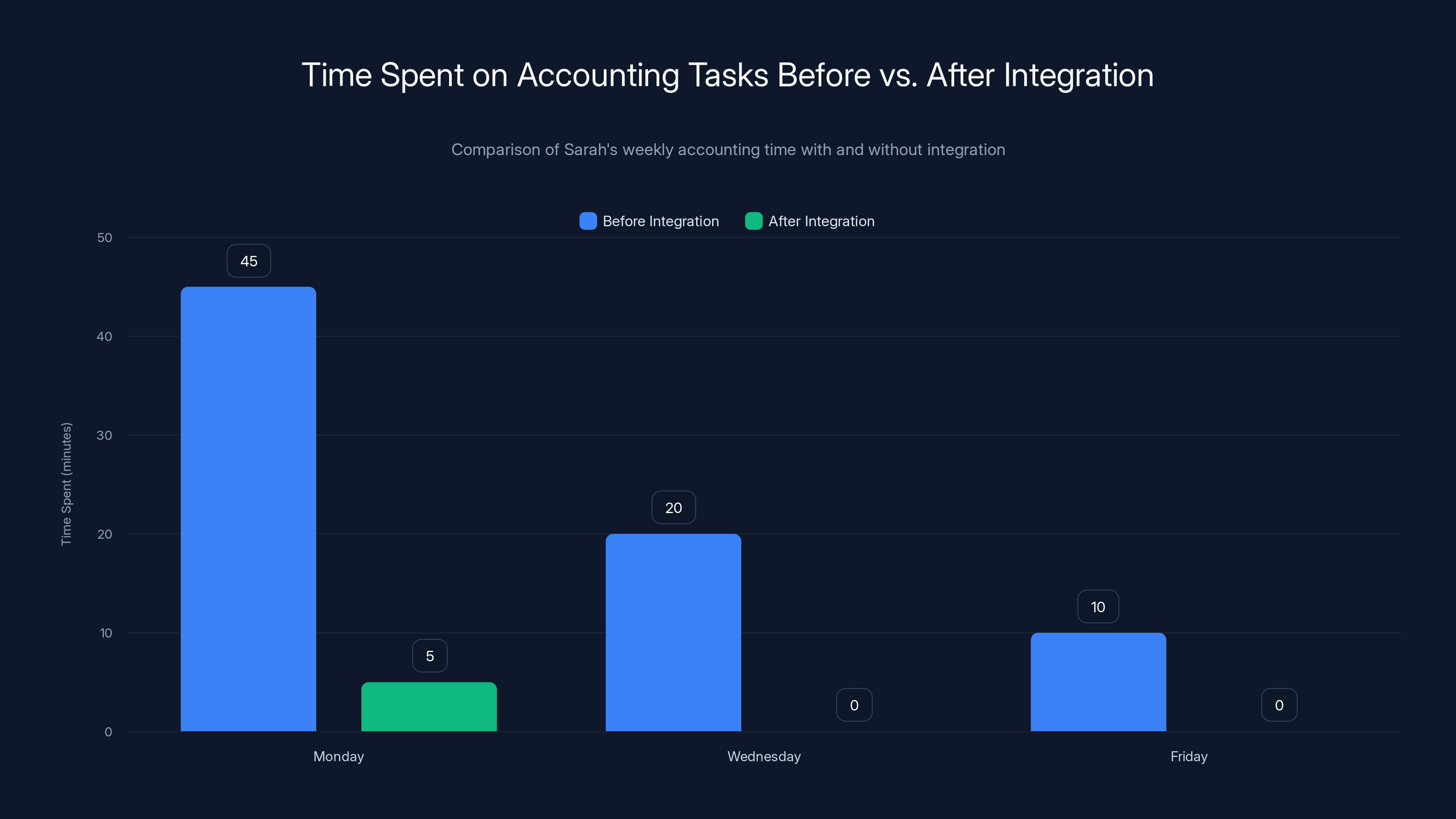

The integration significantly reduced Sarah's weekly accounting time from 75 minutes to just 5 minutes, enhancing efficiency and accuracy. Estimated data.

What Problems Does This Solve?

The Data Entry Nightmare Ends

Let's be concrete about what disappears when this integration is active.

Before integration, a typical SMB workflow looked like this:

- Customer orders a product on your Wix store

- Money hits your payment processor

- You log into Wix to see the order

- You manually log into QuickBooks

- You create an invoice or income entry matching the sale

- You categorize the revenue (Product sales? Service revenue?)

- You ensure tax calculations are correct

- You double-check that the customer is listed in QuickBooks

- You verify amounts match between systems

- You repeat this dozens of times per day

After integration? The system does steps 3-9 automatically. You keep step 1 (the customer purchase) and that's it. The accounting happens behind the scenes.

For a business doing 50 sales per day, that's 350-400 minutes (6-7 hours) of saved manual work weekly. For a business doing 200 sales per day, we're talking about 25+ hours weekly.

Even at conservative estimates, this alone justifies using both platforms together.

Reconciliation Becomes Trivial

Reconciliation is the accounting task that keeps business owners awake at night. You have to verify that numbers in one system match numbers in another. When they don't (and they often don't), you're hunting for discrepancies that could stem from duplicates, missed entries, rounding errors, or timing issues.

With direct integration, reconciliation becomes nearly automatic. Because data flows directly from Wix to QuickBooks, the numbers are already synchronized. Your Wix revenue report matches your QuickBooks income report because they're pulling from the same source of truth.

This doesn't eliminate reconciliation entirely (you still need to verify cash deposits and payment processing fees), but it removes the biggest source of headaches.

Real-Time Financial Visibility

Here's something that surprises most SMBs: you can't see your true business position without integration.

You could log into Wix and see you've made $5,000 in sales this month. But your accounting isn't done. You don't know profitability until you've entered all expenses, accounted for returns, adjusted for payment processing fees, and categorized everything correctly.

With direct integration, because expenses and sales flow into QuickBooks automatically and in real-time, you can run a profit and loss statement at any moment and see your actual position. You don't need to wait for month-end closing. You don't need to spend Friday afternoon reconciling records.

You want to know if you can afford to hire a contractor next week? Check your dashboard. You need to see if last month's promotion was profitable? Pull a report in 30 seconds. You're evaluating a business decision that depends on current cash position? You know immediately.

This information advantage compounds. Small businesses that can see their financial position in real-time make better decisions about spending, pricing, and growth.

Tax Time Becomes Stress-Free

Tax season is where integration really shows its value.

When your sales and expenses flow continuously into QuickBooks, your records are naturally audit-ready. You don't scramble in March to reconstruct the previous year's transactions. You don't try to match scattered receipts to spreadsheet entries. You don't wonder if you've missed reporting some income.

Your QuickBooks records reflect your actual business activity because data entered continuously throughout the year. When you sit down with your accountant or tax software, the heavy lifting is already done.

Better yet, you can run tax reports throughout the year and understand your tax liability before year-end. This lets you make strategic decisions (like increasing deductions or adjusting withholding) proactively instead of discovering surprises when filing.

The SMB Advantage: Why This Matters for Your Business Size

Why SMBs Benefit More Than Anyone Else

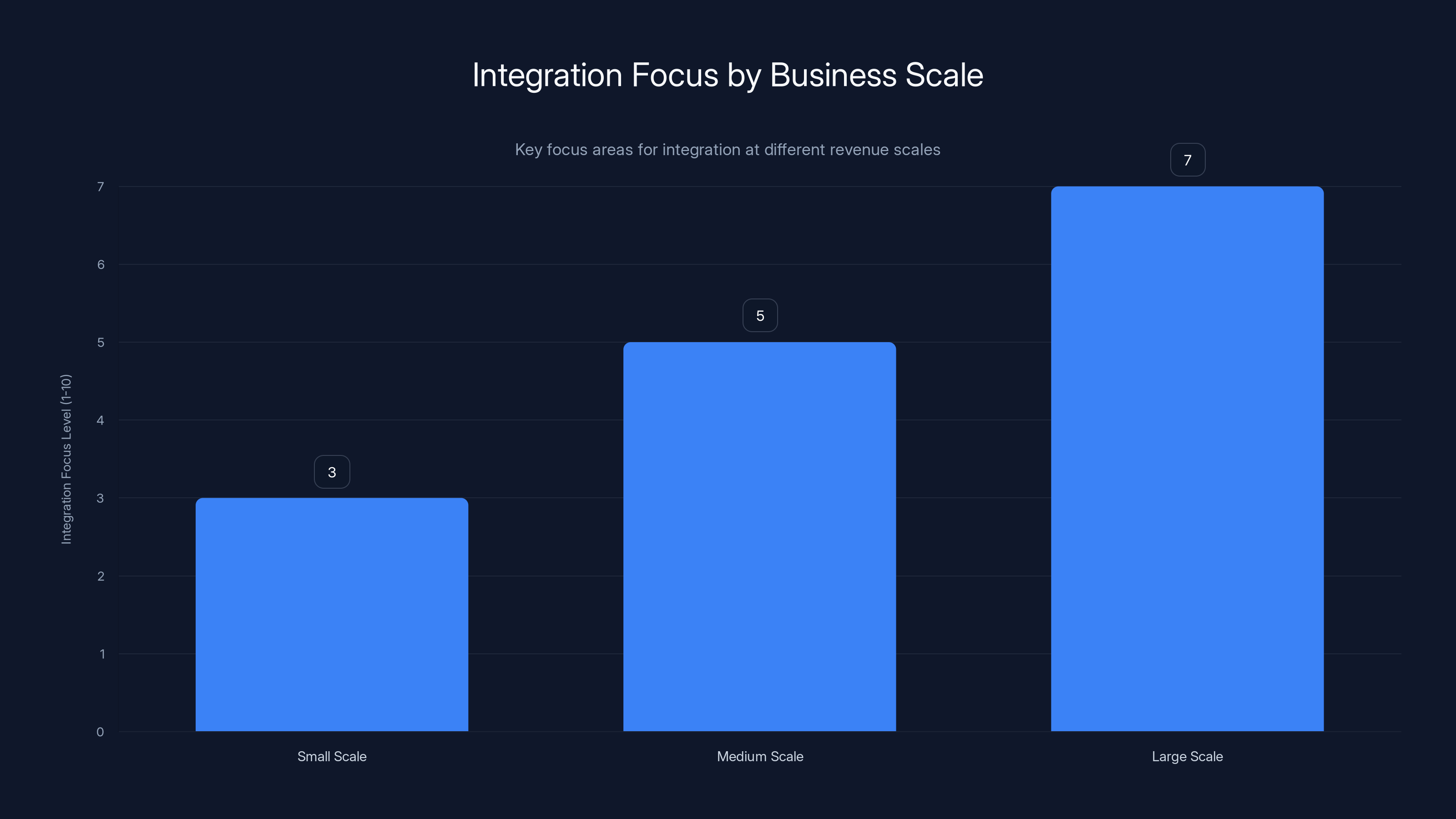

Large enterprises have accounting departments. They have automation specialists. They've already built complex integrations between systems. This integration is nice for them, but not transformative.

SMBs are different. You're likely handling accounting yourself or with one part-time bookkeeper. You don't have technical staff to build custom integrations. You can't afford enterprise software packages that include everything in one box.

Wix and QuickBooks are both built for this SMB reality. They're affordable. They're user-friendly. And now they're connected.

This integration gives you the benefit of enterprise-level system integration at the SMB price point. You get that real-time visibility, that reduced manual work, that data accuracy without paying six figures for custom development.

The Cost-Benefit Calculation

Let's do the math. Assume you spend 5 hours weekly on accounting data entry and manual reconciliation. At

If this integration eliminates just 70% of that work (which is conservative), you've recovered $4,550 in annual labor.

Now add the stress reduction. The improved decision-making from real-time data. The reduced tax preparation headache. The lower error rate and fewer accounting mistakes.

For most SMBs, the integration pays for itself within a month just in recovered time.

Setting Up the Integration: Step-by-Step

Prerequisites You'll Need

Before connecting Wix and QuickBooks Online, confirm you have the right setup:

Wix Account: You need an active Wix account with e-commerce functionality enabled. The integration works with Wix's standard site plans (not the free tier, which has limited features).

QuickBooks Online: The integration requires QuickBooks Online, not QuickBooks Desktop. If you're using the desktop version, you'll need to migrate to online or use a third-party connector.

Administrator Access: You need admin permissions in both systems to authorize the connection. If you're not the account owner, get those rights first.

Payment Processing: Ensure your Wix store has a payment processor connected (Stripe, PayPal, Square, or another processor integrated with Wix).

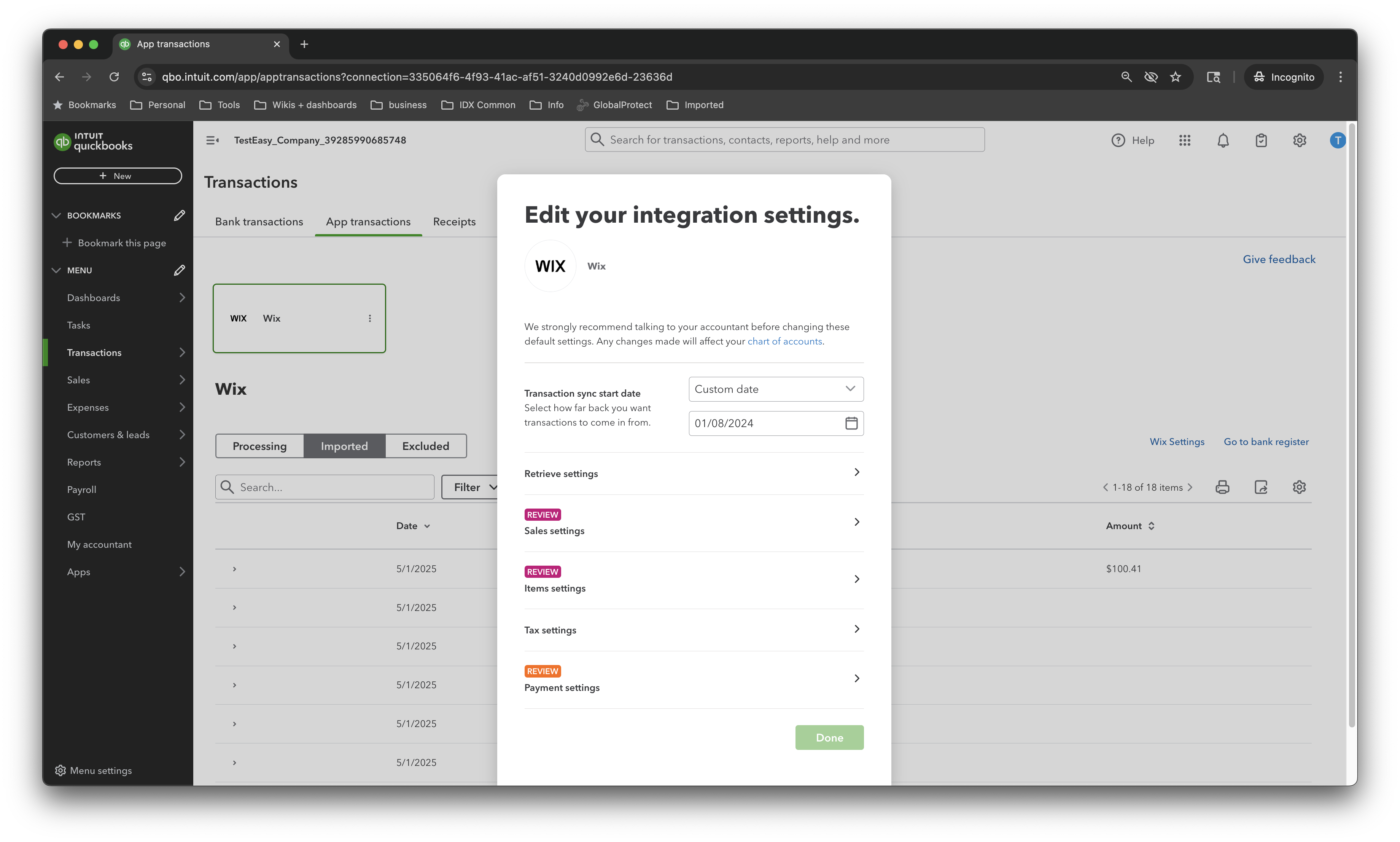

The Connection Process

Step 1: Access Wix Settings

Log into your Wix dashboard and navigate to "Settings" (usually found in the left sidebar). Look for "Integrations" or "Connected Apps."

Step 2: Find QuickBooks

Search for QuickBooks Online in the integration marketplace. Wix displays available integrations, and QuickBooks should appear as a featured option given the partnership.

Step 3: Authorize the Connection

Click "Connect" or "Install." Wix will redirect you to Intuit's authentication page. This is a security measure that prevents Wix from storing your QuickBooks login.

Step 4: Grant Permissions

Intuit will ask what data Wix can access. You'll see options for syncing sales data, customer information, and expense data. Review these and authorize the permissions you want active.

Step 5: Configure Sync Settings

Back in Wix, you'll specify which data syncs and how it's categorized. For example, you can set which product categories map to which income accounts in QuickBooks. You can define tax handling rules.

Step 6: Test the Connection

Make a test purchase on your Wix store if you have a development environment, or verify that a recent real transaction appeared correctly in QuickBooks. This confirms the data flow is working.

Step 7: Monitor and Adjust

Once live, monitor the integration during the first week. Check that transactions are syncing correctly. Verify tax calculations. Confirm customer data matches. Make any adjustment needed to category mappings or sync rules.

Troubleshooting Common Issues

Transactions Not Syncing: Verify the connection is still active (check "Connected Apps" in QuickBooks). Confirm permissions weren't revoked. Restart the sync process in Wix settings.

Duplicate Entries: This sometimes happens if you manually created a transaction in QuickBooks and also synced the same transaction from Wix. Check for duplicates in the first week and delete manual entries that have since been synced.

Tax Calculations Wrong: Review your tax rate settings in both Wix and QuickBooks. Ensure they match. If they don't, update the configuration and future syncs will use correct rates.

Customer Data Mismatches: If a customer appears twice in QuickBooks, it usually means they made purchases before integration was active and were added manually, then synced. You can merge customer records in QuickBooks to clean this up.

Data entry accounts for the largest portion of manual accounting tasks, consuming 32% of the time spent by SMB owners on such activities.

Comparing Your Integration Options

The Wix-QuickBooks integration isn't your only option for connecting your website and accounting system. Let's compare how this native integration stacks up against alternatives.

Native Integration vs. Third-Party Tools

Third-party tools like Zapier, Integrately, or Make let you connect almost any two applications. They're powerful and flexible.

But they also cost money. Most charge $15-50+ monthly depending on the number of tasks. They can be slower (batch processing instead of real-time). They require configuration, and if something breaks, you're troubleshooting between three systems (your apps plus the connector).

The native integration is free (you only pay for Wix and QuickBooks themselves), faster (near real-time), and simpler (fewer moving parts to break).

Here's the trade-off: Third-party tools can connect Wix to ANY accounting software. The native integration only works with QuickBooks Online. If you use Xero, Wave, or FreshBooks, you'll need a third-party connector.

But if you're using or considering QuickBooks, the native integration is superior. No contest.

| Feature | Native Integration | Third-Party Connector | Manual Process |

|---|---|---|---|

| Speed | Near real-time | Batch or scheduled | Days/weeks |

| Cost | Free | $15-50/month | Labor only |

| Reliability | High | Medium | High (human judgment) |

| Setup Time | 5 minutes | 15-30 minutes | N/A |

| Support | Wix + Intuit | Third-party company | DIY |

| Flexibility | Limited (QB only) | Very high | Complete |

| Data Accuracy | Very high | High | Variable |

Real-World Impact: What Changes When You Activate Integration

Case Study: E-commerce Boutique

Take Sarah, who runs an online boutique selling handmade jewelry through Wix. Before integration, here's what her typical week looked like:

Monday morning: She checks Wix and finds 30 orders from the weekend. She spends 45 minutes manually entering each sale into QuickBooks, categorizing by product type (rings, necklaces, bracelets), and adjusting for taxes.

Wednesday afternoon: She receives refund requests from two customers. She processes the refunds in Wix, then spends another 20 minutes finding those transactions in QuickBooks and creating credit notes.

Friday: She's received a shipment of new materials. She logs the $500 expense in QuickBooks, taking 10 minutes to find the right account and verify it's not already entered.

Friday evening: She runs a profit and loss report in QuickBooks. It shows net income of

Total time spent: 75 minutes of accounting admin work. She's not confident in the numbers. She's stressed about what she might have missed.

After activating the integration:

Monday morning: All 30 weekend orders have automatically appeared in QuickBooks with correct categorization and tax calculation. No data entry required. She spends 5 minutes reviewing the sync (spot-checking that amounts look reasonable) and proceeds to actually running her business.

Wednesday afternoon: She processes the two refunds in Wix. They automatically show as credit notes in QuickBooks with corresponding expense adjustments. No manual work.

Friday: The $500 material expense is entered once in Wix (or directly in QuickBooks), and it's immediately available in her accounting records.

Friday evening: She runs a profit and loss report. The numbers tie directly to her Wix sales with no discrepancies. She knows the week's net income of $2,100 is accurate because it's calculated from verified sources.

Total time spent: 5 minutes of administrative work. She has confidence in her numbers.

Sarah recovered 70 minutes per week. That's 3,640 minutes (60+ hours) annually that she can spend on actual business growth instead of accounting administration. At her effective hourly rate, that's worth $3,000+ in recovered time per year.

Case Study: Service-Based Business

Now consider Marcus, a freelance web designer who uses Wix to showcase his portfolio and manage client projects. He also invoices clients through QuickBooks.

Before integration, here's his pain point: When he completes a project and sends an invoice through QuickBooks, the revenue doesn't show on his Wix website, so he's managing client communications in two places. When clients pay, the payment appears in his payment processor, then needs to be manually matched to the invoice in QuickBooks.

With the integration, if he's selling services through Wix (like design packages or consultation hours), those transactions flow directly to QuickBooks. Payments are matched automatically. His income reports in QuickBooks reflect all revenue sources.

For Marcus, the integration's biggest value isn't reducing data entry (since he wasn't doing much of that), but rather consolidating his business view. He can run a single profit and loss report that includes all revenue sources and see his true business position.

Who Should Use This Integration

Perfect Fit Scenarios

You should absolutely use the Wix-QuickBooks integration if any of these apply:

You're selling through Wix: If your Wix site is generating revenue (physical products, digital products, services), the integration is a no-brainer. It will save you significant time and improve your financial accuracy.

You want real-time financial data: If you make business decisions based on current revenue and expense data, real-time integration is essential. Batch processing creates a lag that can lead to poor decisions.

Your business is growing: Integration becomes more valuable as transaction volume increases. At 10 transactions per week, the time savings are modest. At 100+ transactions per week, it's transformative.

You handle accounting yourself: If you're the business owner doing your own bookkeeping, this integration is specifically designed to lighten your load.

You want to minimize errors: Manual data entry introduces errors. Automated integration eliminates that error source entirely.

When You Might Skip It

There are some scenarios where this integration might not be ideal:

You're not using QuickBooks: If you're using Xero, Wave, or another accounting platform, you'll need a different integration or a third-party connector.

Your Wix site is informational only: If your Wix site doesn't generate revenue (it's purely a portfolio or brochure), there's less value in integration.

You already have a third-party integration: If you're already using Zapier or Make to connect Wix and QuickBooks, you could switch to native integration, but the benefits might be incremental.

You're using Wix's free tier: The free tier doesn't support e-commerce or this integration. You'll need to upgrade to a business plan.

Integrating Wix and QuickBooks can save SMBs approximately $4,550 annually by reducing manual accounting work by 70%. Estimated data.

Advanced Configuration and Best Practices

Mapping Categories Correctly

One of the most important configuration steps is mapping your product categories or service types to the correct QuickBooks income accounts.

This matters because it determines how your revenue is categorized in financial reports. If you map "physical products" to the wrong account, your reports will be misleading.

Best practice: Sit down with your accountant before setting up the integration (or immediately after, during the test period). Verify that your product categories align with the income accounts you're using in QuickBooks. A service-based business should have different accounts than a product business.

Tax Configuration

Taxes are complex, and incorrect configuration can create serious problems.

Before activating the integration in a production environment, verify:

- Your tax rates in Wix match your tax rates in QuickBooks

- Tax is calculated on the same items (some products are taxable, others aren't)

- You're not double-calculating tax (Wix adds tax, but does QuickBooks also add tax?)

- Nexus rules are correctly configured if you're selling across multiple states or countries

If you're in any doubt, your accountant can clarify this. It's worth 30 minutes of their time to verify your configuration is correct.

Managing Connected Apps

Once the integration is live, don't forget about it.

Periodically (quarterly or semi-annually), review the integration in QuickBooks settings. Verify it's still connected. Confirm permissions are what you want. Check if there are any error messages or warnings.

If you ever need to disconnect (maybe you're switching accounting software), do it cleanly in QuickBooks rather than just ignoring it. This prevents orphaned connections that could cause problems later.

Monitoring Data Quality

Don't assume the integration is working perfectly just because you've set it up.

For the first month, spot-check transactions regularly. Review the daily sync results. Verify that sales appear correctly, taxes are calculated accurately, and customer data matches.

If you spot patterns of errors (like all transactions being under-reported by 5%, or taxes miscalculated in a specific scenario), troubleshoot immediately. Better to catch and fix issues while transaction volume is fresh in your mind.

Future Roadmap: What Might Come Next

Expanding Beyond Accounting

This Wix-QuickBooks integration is just the beginning of what these companies might build together.

Intuit has been expanding QuickBooks beyond accounting into payments, payroll, and lending. Wix does website building, marketing, and payment processing. There are obvious opportunities to deepen integration:

Payroll Integration: If you're using QuickBooks Payroll to pay employees, imagine that connecting with Wix timekeeping or project tracking. Your payroll could automatically pull hours from your actual business work.

Cash Flow Forecasting: Wix could send historical sales data to QuickBooks, which could use predictive models to forecast your cash flow. You'd know months in advance if you're facing a cash crunch.

Lending Integration: Intuit offers small business loans through its ecosystem. An integration could automatically qualify you for lending based on your Wix sales history and QuickBooks financial records.

Marketing Integration: Wix's marketing tools could feed performance data into QuickBooks, calculating customer acquisition cost and lifetime value automatically.

These are speculative, but given the partnership, it's reasonable to expect deeper integration over time.

What SMBs Should Prepare For

As integrations deepen, keep these principles in mind:

Data security is non-negotiable: Any integration that touches financial data needs to maintain strict security. Wix and Intuit both have strong security records, but always verify you understand what data is being shared and with whom.

You maintain control: Integrations should work for you, not trap you. Ensure you can export your data, disconnect the integration, or switch platforms if needed. You should never be locked into a system.

Customization matters: Every business is unique. The more integrations become prescriptive ("this is the only way to do things"), the less they serve SMBs with unusual needs.

Common Questions and Concerns

Does the Integration Cost Extra?

No. The Wix-QuickBooks integration is free to use. You only pay for Wix and QuickBooks themselves (both are subscription services, but the integration itself adds no additional cost).

Compare this to third-party connectors like Zapier, which charge $15-50+ monthly depending on task volume.

Is My Data Secure?

Yes, with standard caveats. Both Wix and Intuit use industry-standard encryption and security practices. When you authorize the connection, you're not giving Wix your QuickBooks password. Instead, you're authorizing it through Intuit's OAuth system, which is secure and allows you to revoke access anytime.

That said, any system that connects applications shares some data. Review what permissions you're granting during setup and ensure you're comfortable with it.

What Happens If the Integration Breaks?

Both Wix and Intuit have teams dedicated to maintaining this integration. If it breaks, both companies have incentive to fix it quickly.

In the meantime, you're not stuck. You can manually export data from Wix and import it into QuickBooks. You won't have that real-time convenience, but you won't lose data.

Can I Undo the Integration?

Absolutely. In QuickBooks, go to Connected Apps and disconnect Wix. In Wix, remove the QuickBooks integration from your settings. This happens instantly, and no data is deleted. You can re-enable it later if you want.

The integration offers significant benefits, including up to 8 hours saved weekly and improved financial accuracy. Estimated data.

Alternative Platforms and Integrations

While the Wix-QuickBooks integration is native and thus superior for those two platforms, you have alternatives depending on your situation.

If You're Using a Different Website Builder

Shopify users can integrate with QuickBooks through Zapier or the native QuickBooks connector app.

BigCommerce has direct QuickBooks integration built in, similar to Wix.

WooCommerce (WordPress) requires third-party integration tools to sync with QuickBooks.

Squarespace doesn't have native QuickBooks integration and relies on third-party connectors.

If You're Using Different Accounting Software

Xero users: Wix integrates with Xero through Zapier, Integrately, or Make.

FreshBooks users: Similar third-party integrations available, though not as seamless as native integration.

Wave users: Wave is free but has fewer integration options compared to QuickBooks.

The takeaway: if you're using Wix and QuickBooks, you have the best integration story. If you're using different platforms, third-party connectors work but aren't as elegant.

Optimizing Your Workflow Post-Integration

Once you've activated the integration, the real benefit comes from changing how you work to take advantage of it.

Eliminate Manual Accounting Tasks

You're freed from manual data entry. Use that time for actual business work:

- Improving your product or service

- Reaching out to customers

- Analyzing business performance and making strategic decisions

- Planning growth initiatives

Don't try to fill the time with other administrative tasks. The whole point of integration is to reduce overhead.

Implement Weekly Financial Reviews

Now that your data is current, establish a habit of weekly financial reviews. Spend 15 minutes every Friday:

- Checking your weekly revenue and comparing to target

- Reviewing major expenses

- Confirming cash position

- Planning next week's budget

This cadence keeps you connected to your financial position without requiring hours of analysis.

Set Up Automated Insights

QuickBooks can send you automated reports. Configure weekly profit and loss summaries or daily cash position alerts. You'll know your business status without opening QuickBooks.

Plan for Growth

With freed-up time and clearer financial visibility, you can plan strategically:

- When can you afford to hire?

- Should you expand your product line?

- What's your capacity for growth given current profitability?

These decisions are easier when your financial data is accurate and current.

Making the Business Case to Your Team

If you're presenting this to stakeholders or your team, here's how to frame the benefits:

Time Savings

Average SMB Impact: 5-8 hours weekly of recovered time from eliminated manual accounting work.

Valuation: At

Improved Decision-Making

Benefit: Real-time financial visibility enables faster, better business decisions.

Example: Instead of waiting for monthly financial statements, you know your position daily.

Reduced Errors

Benefit: Automated integration eliminates data entry errors.

Impact: Fewer accounting corrections needed, faster financial closes, better audit readiness.

Cost Efficiency

Benefit: No additional integration cost (replaces third-party connector expense if applicable).

Savings: $15-50 monthly if replacing a third-party tool, plus reduced contractor costs for manual work.

The ROI is almost always positive within the first month.

As businesses grow from small to large scale, the complexity and focus on integration increase, requiring more advanced systems and tools. Estimated data based on typical business growth patterns.

Security Considerations and Best Practices

Data What Gets Shared

When you connect Wix and QuickBooks, the following data flows between systems:

From Wix to QuickBooks: Sales transactions, customer information, revenue amounts, tax data, product details.

From QuickBooks to Wix: Account information (for proper categorization display), potentially invoice data if you're invoicing through QuickBooks.

No passwords are shared. No credit card information flows through the integration.

Protecting Your Connection

Use Strong Passwords: Both your Wix and QuickBooks accounts should have strong, unique passwords. If either account is compromised, the integration could be misused.

Enable Two-Factor Authentication: Both Wix and Intuit support 2FA. Enable it on both accounts to protect against unauthorized access.

Review Permissions Regularly: Quarterly, check what permissions the Wix integration has in your QuickBooks account. If you've disabled certain data entry needs, you might reduce permissions.

Monitor Connected Apps: Both platforms show when the connection was last used. If the integration hasn't synced in days and you're actively selling, something might be wrong.

Prepare for Disconnection: Know how to disconnect the integration quickly if you suspect a problem. In QuickBooks, you can revoke Wix's access immediately.

Scaling the Integration as Your Business Grows

The integration works at any scale, but your needs might change as your business grows.

Small Scale (Under $100K Revenue Annually)

At this scale, the integration's primary benefit is time savings. You're still handling most business tasks yourself.

Focus on: Setting up the integration correctly so it works automatically. Spot-check transactions monthly.

Medium Scale (1M Revenue Annually)

Now the benefits expand. You might have a part-time bookkeeper. Real-time financial visibility helps you manage growth.

Focus on: Ensuring your category mappings support more complex reporting. Consider implementing monthly financial reviews with your bookkeeper.

Large Scale ($1M+ Revenue Annually)

At this point, you might have a dedicated accounting team. The integration is table stakes, but you might integrate additional systems (inventory management, payroll, project management).

Focus on: Building a complete financial technology stack where Wix-QuickBooks is just one piece. Consider adding business intelligence tools for deeper analysis.

Troubleshooting and Support Resources

Where to Get Help

Wix Support: For issues on the Wix side, contact Wix support directly through the Wix help center. They have dedicated integration support.

QuickBooks Support: For issues in QuickBooks, Intuit's support team handles QuickBooks-specific questions. Their response time is typically 24-48 hours.

Both Companies: If you're unsure which company owns the problem, file tickets with both. They coordinate to resolve cross-platform issues.

Common Integration Issues and Solutions

Transactions sync but amounts don't match: Verify tax settings match between systems. Check for duplicate entries. Confirm payment processor fees aren't being counted twice.

Sync stops working: Verify the integration is still connected in both platforms. Check if your account permissions changed. Try disconnecting and reconnecting.

Customer data appears twice: Review QuickBooks customer list for duplicates. Merge customer records if needed. Delete manually-created customers that have since been synced.

Can't see synced data in QuickBooks: Verify you're in the right account or company file in QuickBooks (if you have multiple). Confirm the date range you're viewing includes the sync data.

The Future of Business Integration

The Wix-QuickBooks partnership signals a broader trend: modern business software should work together seamlessly.

Five years ago, integrations were an afterthought. You needed a Ph.D. in Zapier to connect your tools.

Now, native integrations are expected. Good integration is table stakes for business software companies.

Looking forward:

Deeper Integration: Expect more than just data sync. Expect features designed around the workflow of using both tools together.

Industry-Specific Bundles: We might see Wix-QuickBooks bundled together with other relevant tools (like payment processors, invoicing software, inventory management).

AI-Enhanced Workflows: Automation will move beyond data sync to intelligent decision-making. Imagine QuickBooks suggesting when you need to reorder inventory based on Wix sales patterns.

Mobile Integration: As more business work happens on mobile, integrations will extend to mobile apps.

SMBs win in this future. More integration means less friction, lower costs, and more time to focus on actually growing your business.

Action Plan: Getting Started This Week

Don't just read about this integration. Actually implement it.

Today (30 minutes)

- Log into your Wix dashboard

- Navigate to Integrations and find QuickBooks

- Read the integration description and requirements

- Confirm you have both a Wix account with e-commerce and a QuickBooks Online account

Tomorrow (60 minutes)

- Make a backup of your QuickBooks data (just for safety)

- Follow the integration setup steps outlined earlier

- Authorize the connection

- Configure your category mappings with guidance from your accountant if available

This Week (Additional 30 minutes)

- Make a test transaction in Wix (either a real sale if comfortable, or test data)

- Verify it appears in QuickBooks correctly

- Review the synced data for accuracy

- Document your setup for future reference

Week 2

- Monitor daily syncs

- Spot-check transactions

- Adjust configuration if needed

- Celebrate recovered time

This is a straightforward implementation. You don't need a consultant or extensive planning. It's a few hours of setup that saves you hundreds of hours annually.

FAQ

What is the Wix-QuickBooks integration?

The Wix-QuickBooks integration is a direct connection between Wix's website builder and ecommerce platform with Intuit's QuickBooks Online accounting software. It automatically syncs sales transactions, customer information, tax data, and expense information between your Wix store and your QuickBooks accounting records, eliminating manual data entry and improving financial visibility.

How does the integration work?

When you connect Wix to QuickBooks Online through authorized integration, the two platforms communicate via secure API connection. When a customer makes a purchase on your Wix store, that transaction automatically creates a corresponding entry in QuickBooks with the revenue amount, customer details, tax information, and categorization. This happens in near real-time, typically within minutes of the sale.

What are the benefits of the integration?

The primary benefits include significant time savings (5-8 hours weekly for typical SMBs), improved financial accuracy by eliminating manual data entry errors, real-time access to current financial information instead of stale month-old data, reduced stress during tax preparation, and the ability to make better business decisions based on current numbers rather than estimates. Most SMBs recover the setup time within the first month through time savings alone.

Is there an additional cost for the integration?

No, the Wix-QuickBooks integration is free to use. You only pay for your Wix plan (starting around

Is my financial data secure when using the integration?

Yes, the integration uses industry-standard security practices. When you authorize Wix to access QuickBooks, you don't share your password. Instead, Wix receives a secure token through Intuit's OAuth system, which is the security standard for integrations. You can revoke access anytime in your QuickBooks settings, and both platforms use encryption for data transmission. However, as with any system integration, you should enable two-factor authentication on both accounts for additional security.

What data syncs between Wix and QuickBooks?

The integration syncs sales transactions (amounts, dates, items sold), customer information (names, contact details, purchase history), revenue categorized by product type or service, taxes collected through your Wix store, refunds and credits, and optionally expense data. It does not sync passwords, credit card details, or any data beyond what's necessary for accurate accounting.

Can I disconnect the integration if I change my mind?

Absolutely. You can disconnect at any time by going to "Connected Apps" in QuickBooks settings or removing the QuickBooks integration from your Wix dashboard. The disconnection happens immediately, no data is deleted, and you can reconnect it later if desired. If you disconnect, transactions won't sync going forward, but historical data remains in both systems.

What if I'm using a different accounting software instead of QuickBooks?

The native Wix-QuickBooks integration works only with QuickBooks Online. If you use Xero, FreshBooks, Wave, or another accounting platform, you can still connect Wix through third-party integration tools like Zapier or Make, but these require third-party subscription fees and are not as seamless as native integration.

How long does it take to set up the integration?

The technical setup takes about 5-10 minutes to authorize and connect the platforms. However, properly configuring the integration (mapping product categories to income accounts, setting tax rates correctly, defining how different expense types are handled) typically takes 30-60 minutes and is best done in consultation with your accountant to ensure your chart of accounts aligns with your business structure.

What happens if the integration stops syncing?

If syncing stops, first verify the connection is still active in both Wix and QuickBooks settings. Check if you've revoked permissions or if either company is experiencing technical issues. If permissions are fine, try disconnecting and reconnecting the integration. In the meantime, you can manually export sales data from Wix and import it into QuickBooks to avoid losing transaction records, though this defeats some benefits of the integration.

Can the integration handle multiple Wix stores or QuickBooks accounts?

Yes, you can typically connect multiple Wix stores to one QuickBooks account (transactions will all flow into the same accounting records), or connect one Wix store to different QuickBooks accounts if needed. However, check the current documentation for specific limitations, as this may depend on your Wix plan level and QuickBooks subscription tier.

The Wix and QuickBooks integration represents exactly what small business technology should be: simple, seamless, and focused on solving real problems. It's not flashy, but it's powerful.

For SMBs using both platforms, it's a no-brainer decision to activate. The setup takes an hour. The benefits accumulate immediately. The friction in your business operations decreases tangibly.

Start this week. Implement it. Reclaim your time. And then focus on the actual work that grows your business.

Key Takeaways

- Wix and QuickBooks native integration eliminates manual accounting data entry, saving SMBs 5-8 hours weekly and $6,500+ annually

- Real-time transaction syncing from Wix stores to QuickBooks provides current financial visibility without month-end reconciliation delays

- Setup takes less than an hour with no additional integration costs, making it more affordable than third-party connector tools like Zapier

- Integration automatically handles tax calculations, customer data, and expense categorization, reducing accounting errors significantly

- SMBs using both platforms should activate this integration immediately for measurable time savings and improved business decision-making

Related Articles

- Infosys and Anthropic Partner to Build Enterprise AI Agents [2025]

- Building AI Culture in Enterprise: From Adoption to Scale [2025]

- How AI Transforms Startup Economics: Enterprise Agents & Cost Reduction [2025]

- Admin Work is Stealing Your Team's Productivity: Can AI Actually Help? [2025]

- What Businesses Are Actually Building With AI Coding Tools [2025]

- OpenAI Frontier: The Complete Guide to AI Agent Management [2025]

![Wix and QuickBooks Integration: Complete Guide for SMBs [2025]](https://tryrunable.com/blog/wix-and-quickbooks-integration-complete-guide-for-smbs-2025/image-1-1771497373469.jpg)