Introduction: The Moon Shot That Changes Everything

In February 2026, technology entrepreneur Elon Musk gathered x AI employees for an all-hands meeting that revealed something unexpected: the company's future doesn't just involve advanced artificial intelligence—it involves the moon. According to reports from major news outlets, Musk outlined a bold vision for a lunar manufacturing facility that would construct AI satellites and deploy them into space via a giant catapult system. This announcement came at a pivotal moment for x AI, with the company navigating multiple simultaneous crises and opportunities: co-founders departing, a merged entity combining x AI with Space X careening toward a potential $1.5 trillion IPO, and a fundamental strategic pivot away from Mars colonization toward lunar development.

The timing of this announcement raises critical questions about corporate strategy, leadership transitions, and the future of AI development in an increasingly space-centric competitive landscape. Why would an AI company focus on moon-based manufacturing? How does this vision align with traditional business development? And what does it mean when key founding team members exit just as a company prepares for its most significant financial event?

This comprehensive analysis examines Musk's lunar manufacturing strategy for x AI, the organizational challenges presented by departing co-founders, the implications for the forthcoming Space X IPO, and the broader context of how advanced AI companies are beginning to view space-based infrastructure as essential to their competitive positioning. We'll explore the technical feasibility of lunar manufacturing, the legal frameworks governing space-based commerce, and what alternative approaches technology companies are considering as they seek ways to differentiate in an increasingly crowded AI market.

Understanding this moment requires examining not just what Musk said during that meeting, but the deeper strategic thinking behind these announcements, the organizational dynamics at play, and the long-term implications for how computational power, artificial intelligence, and space infrastructure might converge in ways that reshape the technology industry.

The Announcement: What Musk Actually Said About Lunar Manufacturing

The All-Hands Meeting and Core Vision

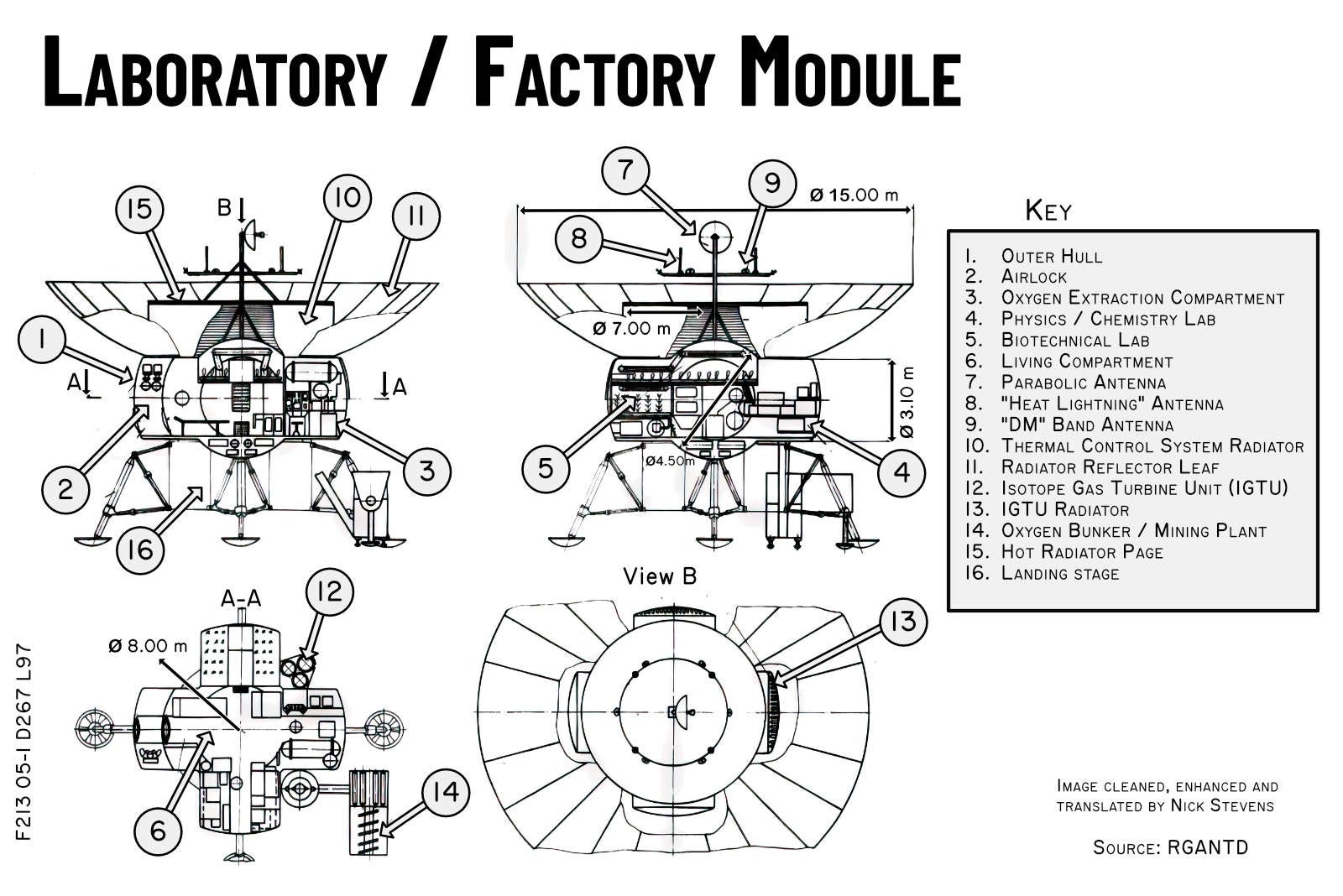

During the Tuesday evening all-hands meeting, Elon Musk articulated a vision centered on a fundamental competitive advantage: computing power at a scale that rivals cannot match. The proposed lunar manufacturing facility would serve as a production center for AI satellites, which would then be launched into orbit via a massive catapult system. The logic underlying this approach suggests that by controlling both satellite manufacturing and deployment infrastructure beyond Earth's bounds, x AI could achieve unprecedented computational capacity distributed across space.

Musk's specific statement—"You have to go to the moon"—frames lunar development not as an aspirational goal or distant dream, but as a necessary strategic imperative for x AI's competitive positioning. He emphasized that such a scale of artificial intelligence would accomplish things currently difficult to imagine, presenting the vision as inevitable rather than speculative. This rhetorical framing positions lunar manufacturing as the logical next step in AI development, not a distraction from it.

The catapult deployment system mentioned deserves particular attention, as it suggests a fundamentally different approach to space launch than traditional rocket-based systems. A lunar catapult would leverage the moon's lower gravity and lack of atmosphere to accelerate satellites to orbital velocity using electromagnetic or mechanical acceleration systems, theoretically reducing the cost per deployment significantly compared to Earth-based launches.

Connecting the Vision to Competitive Advantage

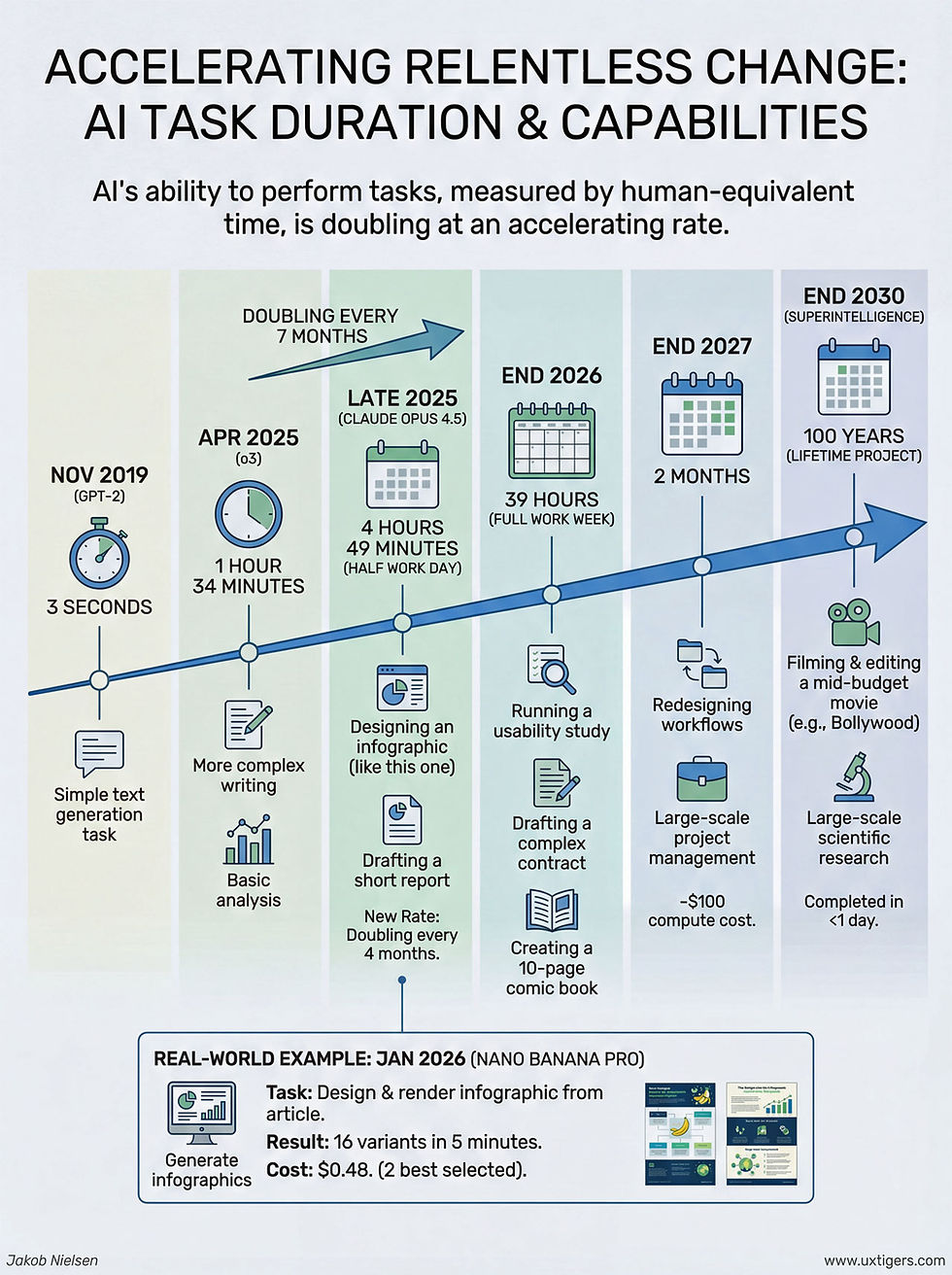

Musk emphasized that "if you're moving faster than anyone else in any given technology arena, you will be the leader, and x AI is moving faster than any other company—no one's even close." This statement positions speed of execution as x AI's primary competitive advantage. In this framework, lunar manufacturing becomes essential not because it's the most obvious next step, but because it represents a capability that competitors cannot easily replicate or catch up to once established.

The vision aligns with a broader philosophical perspective on how companies achieve dominance in technology: they build proprietary advantages that compound over time. By establishing lunar manufacturing capability, x AI would create a moat around its computational infrastructure that would be extraordinarily difficult for competitors to overcome. The long lead time and capital requirements for space-based manufacturing mean that even if competitors recognized the advantage, they would face significant barriers to entry.

What remained notably absent from Musk's presentation was detailed operational planning. He did not clearly address how this facility would be constructed, what timeline was envisioned, which teams would lead the effort, or how the merged x AI-Space X entity would be reorganized to pursue this goal. In organizational terms, this represents a common pattern in companies experiencing rapid change: visionary objectives articulated at the top without corresponding clarity on execution mechanisms or intermediate milestones.

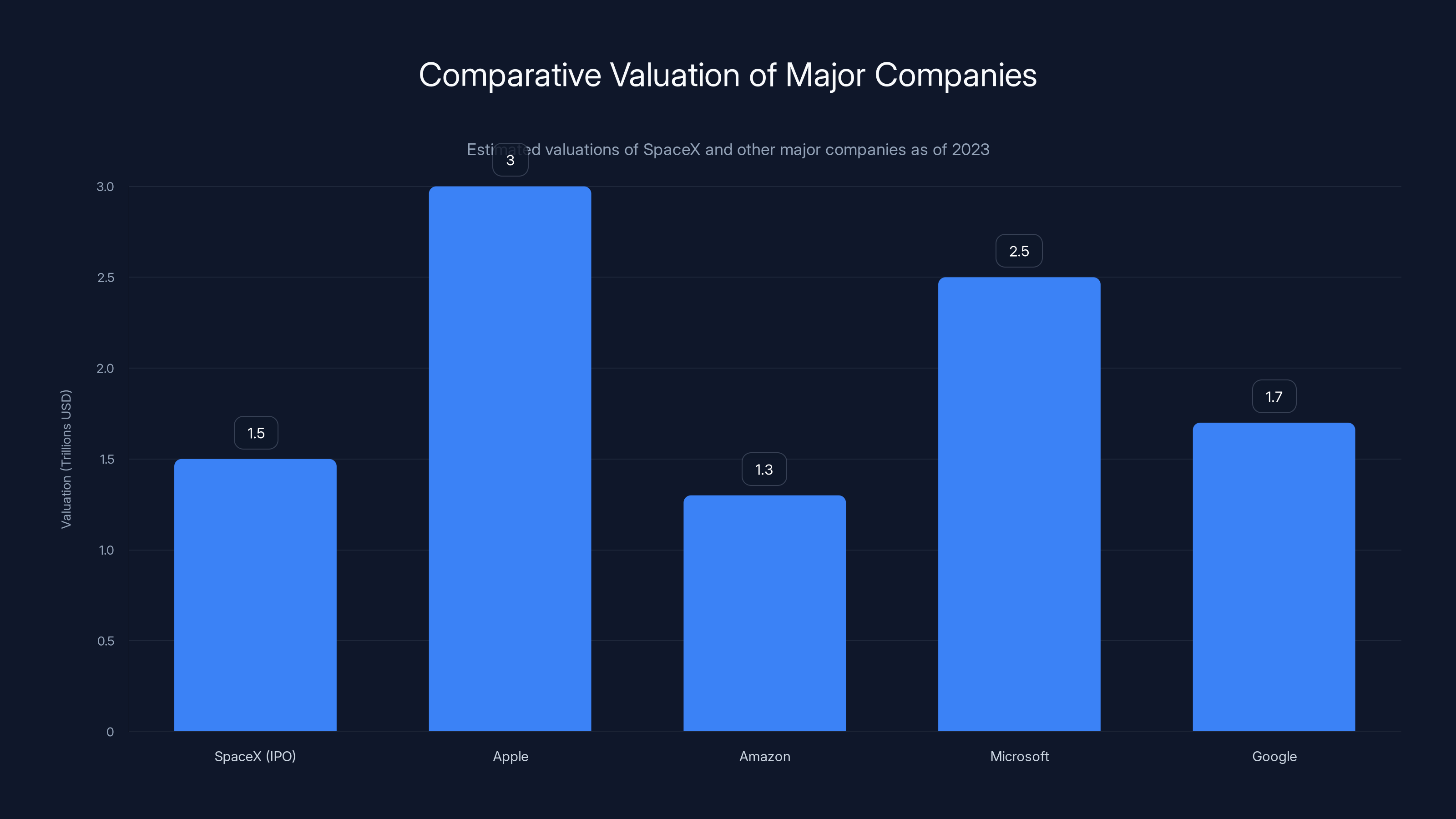

SpaceX's potential IPO valuation of $1.5 trillion positions it among the most valuable companies globally, comparable to tech giants like Amazon and Google. Estimated data.

The Context: Why Now? Leadership Transitions and Organizational Flux

The Departure of Co-Founders

The timing of Musk's lunar announcement becomes more significant when examined against concurrent organizational changes. On Monday evening, Tony Wu, one of x AI's twelve founding members, announced his departure. Less than twenty-four hours later, Jimmy Ba, another founding co-founder who reported directly to Musk, announced he was leaving as well. These departures brought the total number of founding team members who have exited the company to six out of twelve—representing a 50% turnover rate among the original founding cohort.

Why would Musk announce an ambitious new strategic direction immediately following these departures? Several interpretations are possible. One perspective suggests that the timing indicates organizational stress management: when multiple co-founders leave, an ambitious new vision can potentially re-energize remaining team members and signal that the company is moving forward despite departures. Another interpretation frames it as accidental timing—the all-hands meeting may have been planned before departure announcements became public.

More fundamentally, the departures raise questions about organizational culture and alignment. Founding team members typically have the deepest investment in a company's original vision and mission. When they depart, it often signals either a strategic disagreement with new directions or a judgment that personal goals and opportunities have become misaligned with company trajectory. The fact that six of twelve founders have now left suggests either significant philosophical disagreements or a recognition that the company Musk is building differs substantially from the company these individuals signed on to develop.

The Organizational Paradox: Moving Faster While Losing Leadership

Musk acknowledged this organizational flux directly, stating that "when this happens, there's some people who are better suited for the early stages of a company and less suited for the later stages." This framing positions co-founder departures as natural evolution rather than concerning dysfunction. However, it masks a deeper challenge: rapid scaling and pivot toward new strategic directions often requires precisely the kind of deep domain expertise and relationship capital that founding team members provide.

The merged x AI-Space X entity now faces the challenge of executing on multiple ambitious initiatives simultaneously—continuing AI model development, preparing for a massive IPO, and initiating lunar manufacturing operations—while experiencing significant leadership departures. Historical precedent suggests that organizations managing major strategic pivots while experiencing founding team departures face elevated execution risk. Companies need both the vision to pursue ambitious new directions and the operational continuity to execute effectively.

What remains unclear is whether the departing co-founders are leaving because they disagree with the lunar strategy, because they've decided to pursue other opportunities with strong financial outcomes, or because they recognize that the organization is becoming too large and complex for them to contribute effectively. Each scenario has different implications for the company's ability to execute on announced plans.

The Strategic Pivot: From Mars to Moon

The Historical Context: Mars as the Original Goal

For most of Space X's twenty-four-year existence, Mars colonization has served as the company's north star. This objective has shaped vehicle development, mission planning, and public narrative around the company's purpose and importance. Mars colonization represents an existential-level goal: ensuring human survival by establishing a second civilization on another planet. For a company founded during an era when space exploration was rebuilding after decades of relative neglect, focusing on Mars made strategic and narratively compelling sense.

The Mars focus also aligned with Musk's public statements about his motivations for founding Space X. Creating a multi-planetary civilization has been consistently cited as the core mission that drives the company. This objective appears in founding documents, investor presentations, and public communications. Over decades, this creates organizational culture, technical development priorities, and stakeholder expectations all centered on Mars as the ultimate destination.

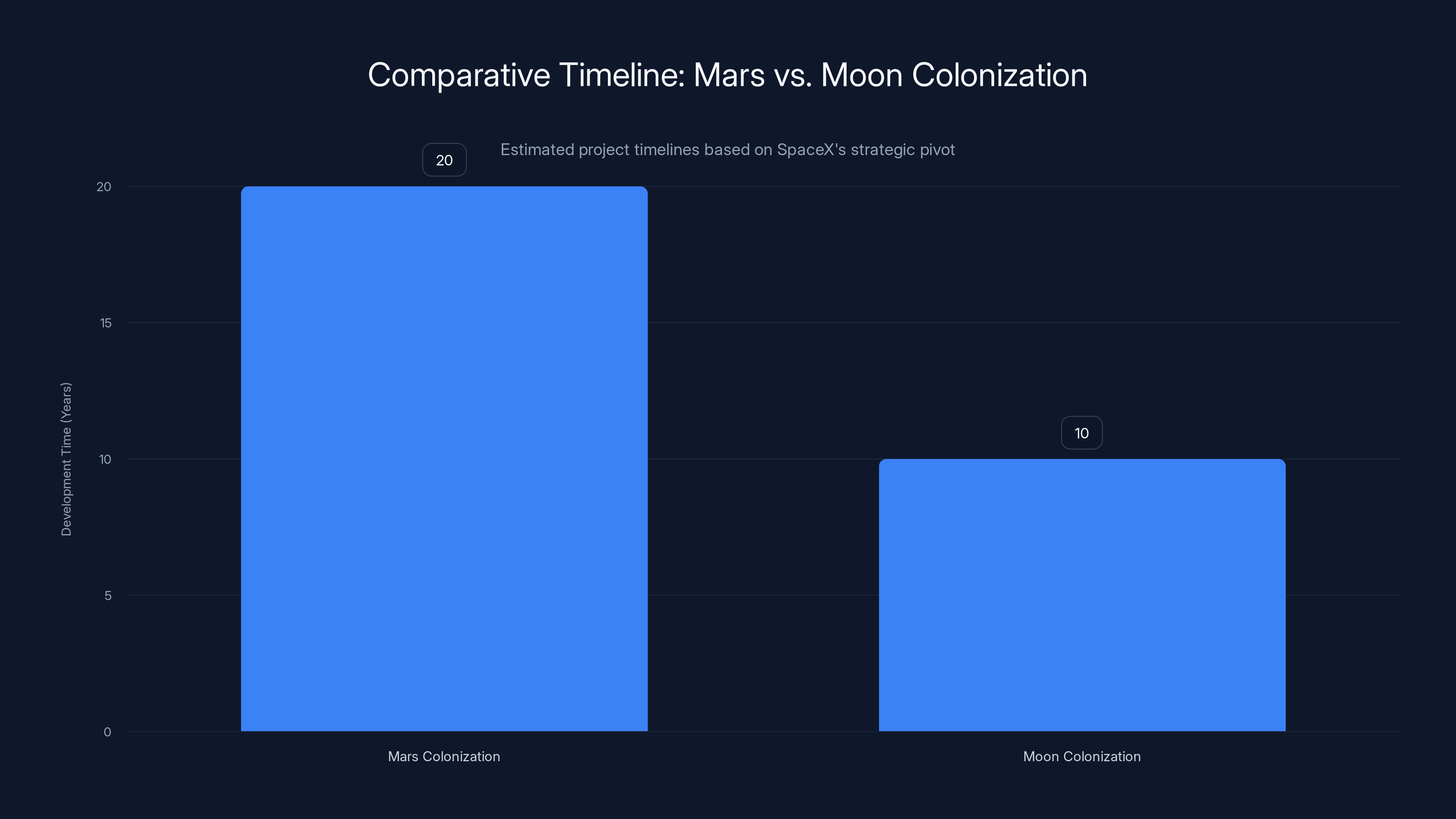

During a Super Bowl broadcast in early February 2026, however, Musk announced a significant directional shift. Space X had "shifted focus to building a self-growing city on the Moon," he stated, arguing that Mars colonization would require more than twenty years while the moon could be developed in roughly half that timeline. This announcement fundamentally reorients company strategy around a different celestial body with different technical requirements, timelines, and strategic implications.

The Rationale for the Pivot

The stated rationale for pivoting toward the moon rather than Mars centers on timeline efficiency. From a purely technical perspective, this argument has merit. The moon is substantially closer to Earth—an average distance of 238,900 miles compared to Mars's minimum distance of 33.9 million miles. This proximity reduces travel time, enables more frequent resupply missions, and allows for more robust communication between Earth-based operations and lunar activities. For developing infrastructure and establishing permanent habitation, these factors matter significantly.

However, the timing of this announcement raises questions about whether timeline efficiency is the only consideration. A major strategic pivot of this magnitude typically involves extensive internal analysis, stakeholder buy-in, and organizational alignment before public announcement. The fact that this pivot was announced via social media during a major sporting event suggests either significant confidence in the new direction or perhaps a more impulsive decision-making process.

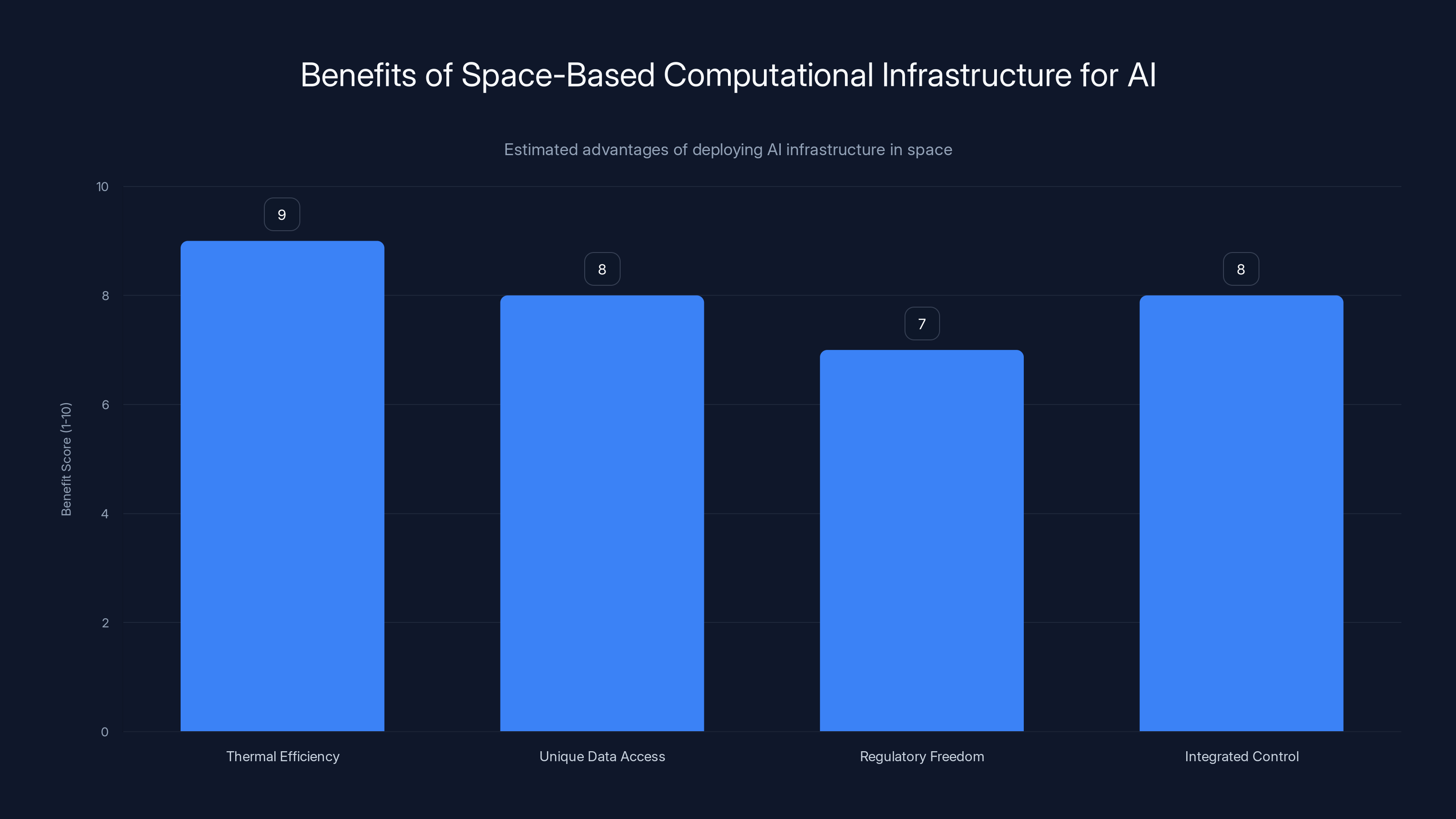

From an x AI perspective, the pivot also makes business sense. AI companies developing increasingly large language models and advanced reasoning systems require computational infrastructure that grows exponentially with model capability. The moon, as a location for manufacturing and deploying satellites, offers a unique advantage: it exists outside Earth's atmosphere and regulatory frameworks, potentially providing space-based computing infrastructure that's difficult for competitors to access or replicate.

Integrating the Lunar Vision with AI Development

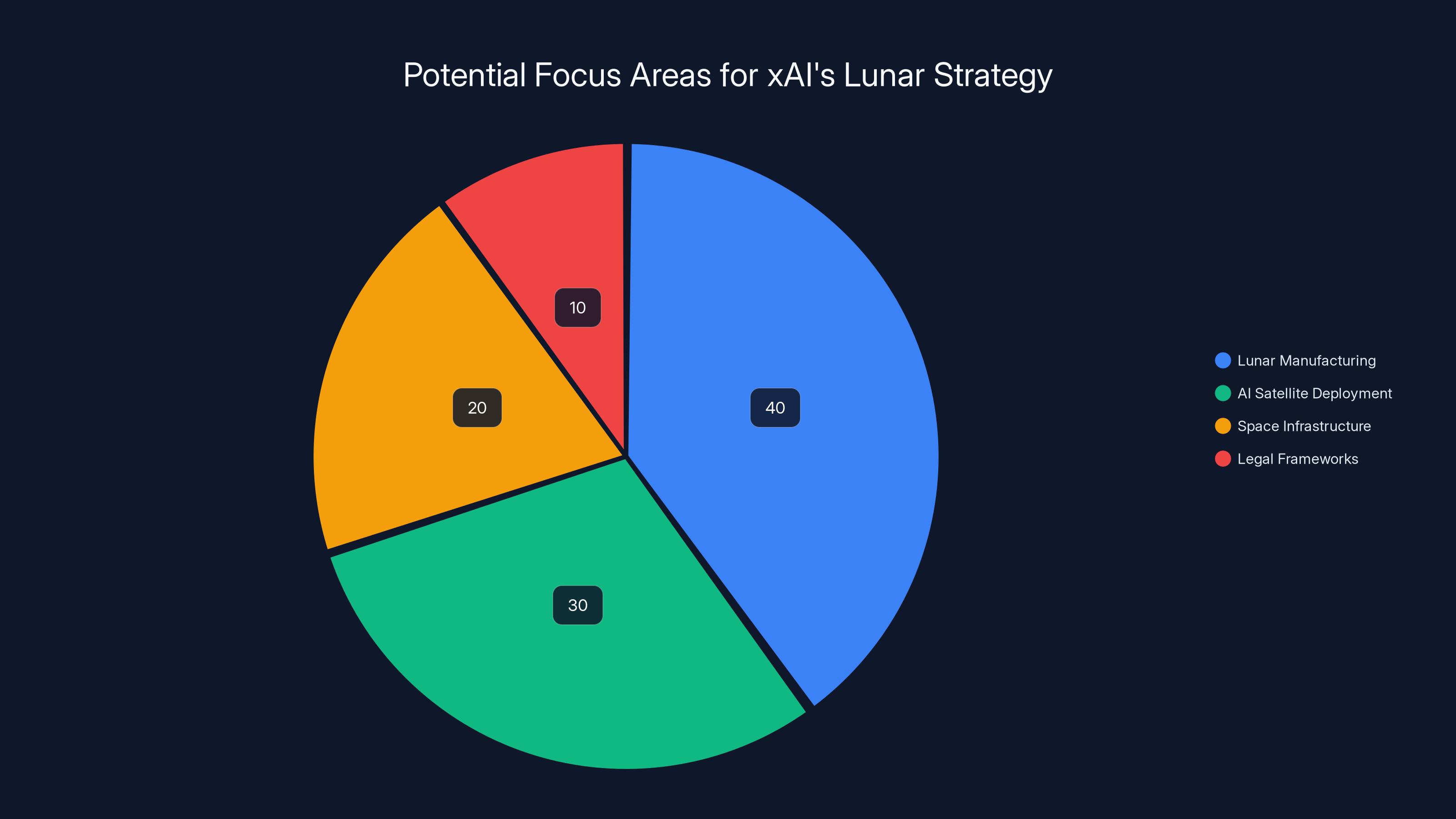

The true strategic insight becomes apparent when examining how lunar manufacturing connects to x AI's core mission. A venture capital backer quoted in original reporting explained that Musk has been building toward a single objective from the beginning: developing a world model—an AI trained not only on text and images but on proprietary real-world data that competitors cannot access or replicate.

In this framework, different companies within Musk's portfolio contribute different data types and capabilities. Tesla provides energy systems and road topology data from its extensive vehicle fleet and grid management operations. Neuralink offers insights into brain function and neural interfacing. Space X provides physics, orbital mechanics, and space operations data. The Boring Company adds subsurface data from its tunnel construction operations. Each company feeds proprietary information into an integrated ecosystem that trains increasingly sophisticated AI systems.

Adding lunar manufacturing and space-based satellite deployment to this ecosystem creates another layer of proprietary data: orbital mechanics operations at scale, space environment interactions with complex hardware, and the physical data generated by manufacturing processes in low-gravity environments. This data becomes unavailable to competitors unless they build parallel infrastructure, creating a structural competitive advantage that compounds over time.

From this perspective, the lunar manufacturing announcement isn't a distraction from x AI's core mission—it's an essential component of a broader strategy to build an AI system trained on data types and sources that no competitor can access. The timeline, the specific technical approaches, and the integration with Space X become less about space exploration and more about building proprietary data infrastructure for AI development.

Space-based AI infrastructure offers significant advantages, particularly in thermal efficiency and unique data access, which are estimated to score highest in potential benefits.

Technical Feasibility: Can Lunar Manufacturing Actually Work?

Lunar Construction Challenges and Requirements

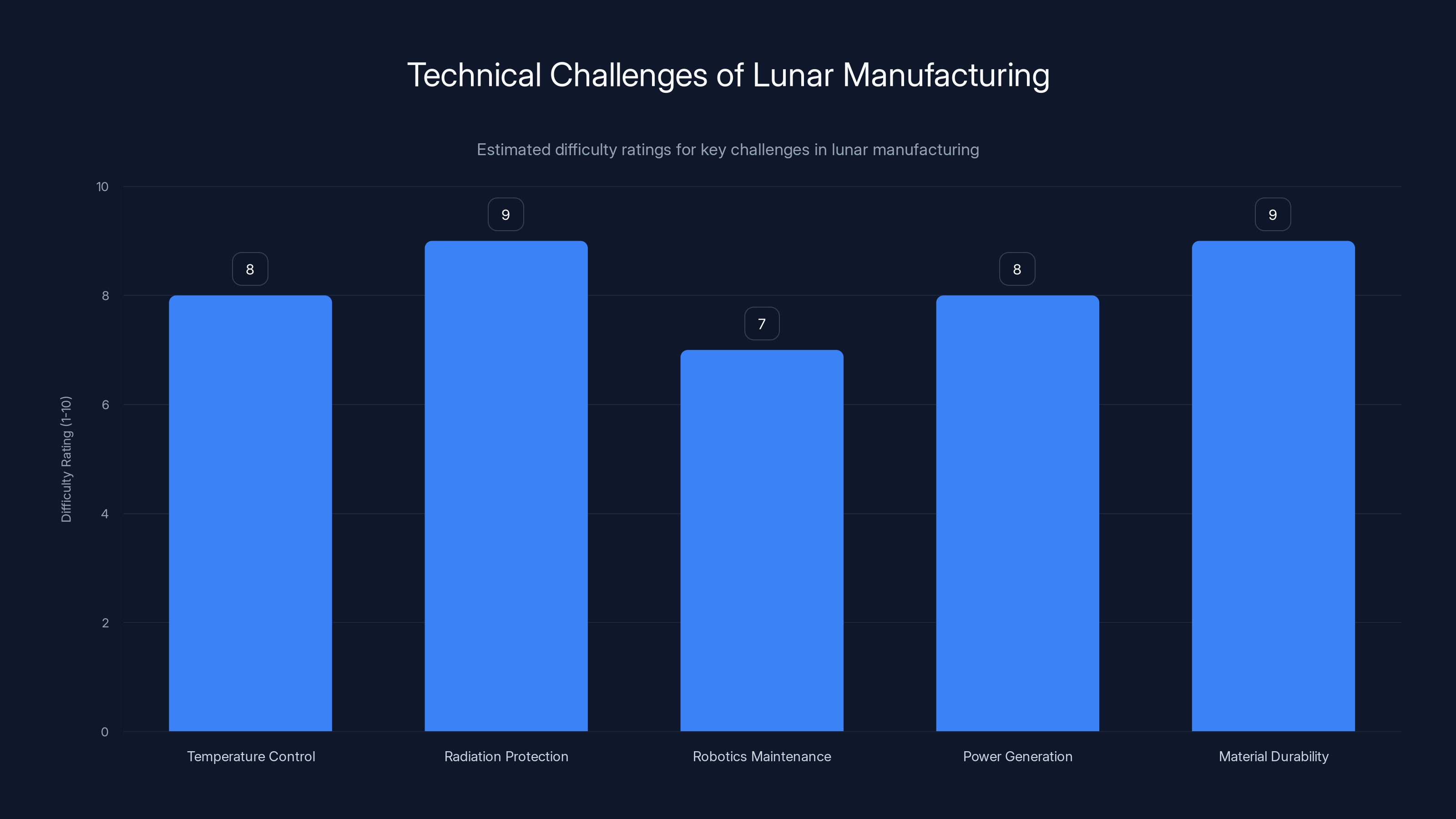

Building a manufacturing facility on the moon presents extraordinary technical challenges that deserve serious analysis. The lunar environment differs fundamentally from Earth in multiple ways: one-sixth gravity, extreme temperature swings (from -280°F in darkness to 250°F in sunlight), no atmosphere to carry thermal energy or provide basic life support, high radiation exposure without magnetic field protection, and complete isolation from resupply chains and human support systems.

Constructing even basic structures on the moon requires technology that either doesn't yet exist in operational form or exists only in laboratory demonstrations. Materials must withstand extreme temperature variations that cause significant thermal stress. Robotic systems must operate for months or years without human maintenance in conditions where replacement parts and repairs are extraordinarily expensive. Power systems must generate electricity either through solar panels (which work approximately 14 Earth days out of every 28-day lunar cycle) or through nuclear reactors designed for space operations.

Manufacturing satellites in this environment adds another layer of complexity. Satellite production requires precision equipment, clean room conditions, controlled temperature and humidity, and skilled technicians. Creating all of these conditions in a lunar facility means essentially replicating Earth-based manufacturing in an environment where every system must be designed for extreme conditions and minimal human intervention.

The catapult deployment system mentioned by Musk represents another significant technical challenge. Electromagnetic catapults have been successfully deployed on aircraft carriers, where they accelerate jet aircraft to flight velocity over a short distance. Adapting this technology to accelerate satellites to orbital velocity would require substantially different design, as satellites cannot tolerate the extreme accelerations that advanced jets endure. Additionally, the catapult would need to function in lunar vacuum, extreme temperatures, and with power systems limited by the lunar environment.

Timeline Realism

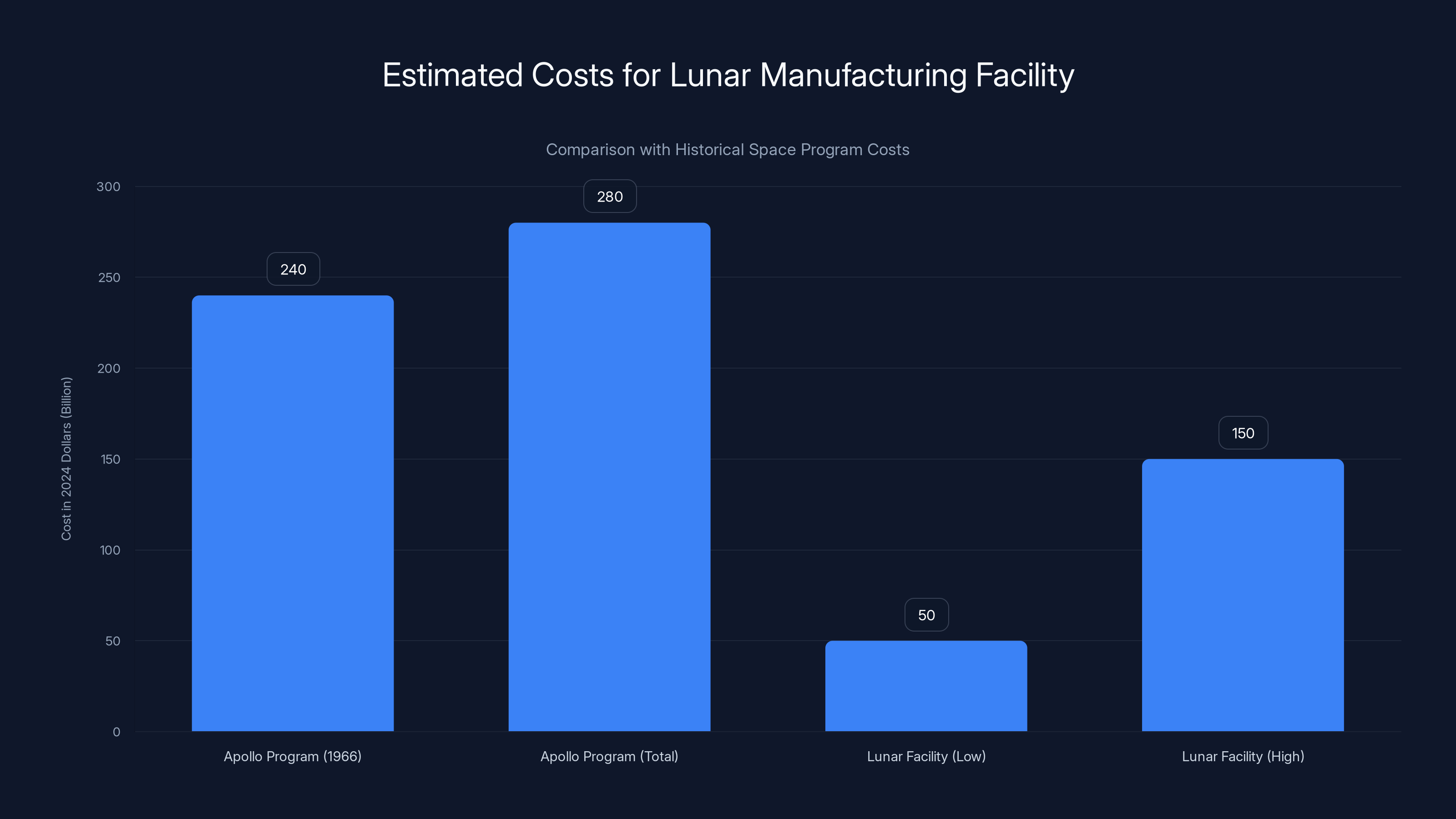

Estimating realistic timelines for lunar manufacturing requires examining historical precedent. The Apollo program, at its peak, represented the most advanced space exploration effort humanity has ever undertaken. With approximately 400,000 people involved at peak employment and a budget of roughly $280 billion in 2024 dollars, the program successfully landed twelve astronauts on the moon across six missions between 1969 and 1972.

The program required two decades of development before the first moon landing, and it focused on short-term missions—astronauts typically remained for 3-4 days. Establishing a permanent lunar base with manufacturing capability represents a dramatically more complex objective than short-term exploration missions. Historical programs attempting to establish permanent infrastructure in extreme environments (Antarctic research stations, deep-sea facilities, high-altitude observatories) typically require 10-20 years from initial planning to full operational capability.

Musk's suggestion that lunar development could occur in roughly half the time required for Mars colonization (so approximately 10+ years) presents an optimistic timeline compared to historical precedent. This doesn't make it impossible, but it does suggest either extraordinary technological breakthroughs, unprecedented resource allocation, or more modest initial objectives than the vision articulated in the all-hands meeting.

Technological Prerequisites

Successful lunar manufacturing would require several technological capabilities that don't yet exist or are only in early-stage development:

- In-situ resource utilization (ISRU) systems that extract water ice and process regolith for building materials

- Long-duration power systems that operate continuously through lunar night cycles

- Radiation protection infrastructure capable of protecting both humans and sensitive electronics

- Autonomous construction systems that can operate with minimal human oversight

- Precision manufacturing equipment designed for lunar gravity and thermal conditions

- Transportation systems capable of moving materials from lunar surface to orbital deployment

Each of these represents an active area of research and development, with multiple companies and space agencies pursuing solutions. However, integrating all of them into a functioning manufacturing facility represents a scale of challenge that exceeds current proven capabilities.

Legal and Regulatory Framework: The Outer Space Treaty and Commercial Rights

The 1967 Outer Space Treaty Foundation

International space law is primarily governed by the 1967 Outer Space Treaty, a foundational agreement that established fundamental principles for space exploration and use. The treaty was signed by the Soviet Union, United States, and United Kingdom, with subsequently more than 110 countries becoming signatories. The treaty's Article II explicitly states: "Outer space, including the moon and other celestial bodies, is not subject to national appropriation by claim of sovereignty, by means of occupation, or by any other means."

This language appears to prohibit any nation, and by extension, any company operating under a nation's authority, from claiming ownership over the moon or lunar resources. The prohibition seems clear: no one can own the moon itself. However, the legal landscape became more complicated with subsequent legislation and evolving interpretations of property rights in space.

The 2015 Loophole: Resource Extraction as Property

A critical shift occurred in 2015 when the United States passed the Commercial Space Launch Competitiveness Act, also known as the SPACE Act. This legislation introduced a significant distinction: while nations and companies cannot own the moon itself, they can own resources extracted from the moon. As explained by Mary-Jane Rubenstein, a professor of science and technology studies at Wesleyan University, the distinction operates somewhat illogically—"It's more like saying you can't own the house, but you can have the floorboards and the beams. Because the stuff that is in the moon is the moon."

This interpretation of property rights creates practical legal ambiguity. If a company extracts water ice from the moon and processes it into rocket fuel, does it own the resulting fuel? If it manufactures satellites using lunar materials, does it own the satellites? The distinction between owning extracted resources versus owning the moon itself becomes philosophically and practically murky. From a legal standpoint, companies like Space X operating under U. S. law can potentially claim ownership over extracted resources and manufactured goods, even though they cannot claim ownership of lunar land itself.

This loophole provides the legal foundation on which Musk's lunar manufacturing ambitions potentially rest. If resources extracted and goods manufactured on the moon become the property of the company that extracts them, then x AI and Space X could potentially profit from lunar operations without violating the Outer Space Treaty. Satellites built on the moon and launched into orbit would arguably become x AI property once manufactured, even though the lunar facility itself cannot be claimed as property.

Competing Interpretations and Non-Signatory Issues

However, this legal framework is not universally accepted, and it operates only within countries that have adopted similar legislation. China and Russia, both major space-faring nations, have not embraced the U. S. interpretation of resource extraction as property. Instead, they've advocated for more restrictive interpretations of the Outer Space Treaty that would limit resource extraction rights more severely.

This disagreement creates potential for future international conflict over space resources. If multiple companies from different countries attempt to extract resources from the same lunar location, or if they dispute who has extraction rights, current international law provides limited mechanisms for dispute resolution. The Outer Space Treaty assumed space would be explored by governments for scientific purposes, not by commercial entities pursuing profit. The emergence of commercial space activities has outpaced the legal frameworks designed to govern them.

Additionally, enforcement mechanisms remain unclear. How would international law enforcement prevent unauthorized mining or manufacturing on the moon? What jurisdiction applies to disputes between companies? These questions lack clear answers in current legal frameworks, creating a situation where companies like Space X and x AI may proceed with lunar operations in a legal gray area, with the understanding that comprehensive international legal frameworks may not be established until after significant commercial activity has already occurred.

Property Rights in a Resource-Scarce Commodity

The philosophical and practical implications of lunar resource ownership merit deeper examination. The moon contains substantial water ice deposits, particularly in permanently shadowed craters near the poles. Water on the moon serves multiple purposes: as a life-support resource, as radiation shielding material, and as a source for rocket fuel through electrolysis. Companies that can extract and utilize lunar water gain significant advantages in space operations, as they reduce dependence on resupply missions from Earth.

The value of lunar resources compounds when considered in context of in-orbit infrastructure. Satellite manufacturing using lunar materials reduces launch costs from Earth. Fuel depots in orbit, supplied by lunar extraction operations, enable more ambitious space missions. Over decades, a company establishing early dominance in lunar resource extraction could build an economic moat that makes competition extraordinarily expensive.

From x AI's perspective, this becomes relevant because space-based computational infrastructure requires reliable supply chains. If x AI owns the satellites, owns the deployment systems, and owns or controls the lunar facility producing these systems, it creates integrated vertical control over a critical infrastructure layer. Competitors would face the choice of either building parallel infrastructure or purchasing access from x AI-controlled entities.

The IPO Context: Financial Implications of Strategic Pivots

Space X IPO Timing and Valuation

The announcement of lunar manufacturing ambitions comes while Space X prepares for what would be one of the largest initial public offerings in history. Reports suggest a $1.5 trillion valuation target for the IPO, which would position Space X among the most valuable publicly traded companies globally. The timing of the IPO—potentially as soon as summer 2026—places strategic announcements in close proximity to investor roadshows and due diligence processes.

IPO timing raises interesting questions about corporate strategy communication. Companies preparing for public markets typically undergo intense scrutiny of their strategic plans, financial projections, and competitive positioning. All public statements become material information that investors use to evaluate the company. An announcement of a major new strategic initiative like lunar manufacturing would naturally raise investor questions about timelines, resource requirements, and impact on near-term profitability.

The

How Lunar Ambitions Affect Investor Perception

Investors typically evaluate companies based on several factors: revenue growth, path to profitability, competitive positioning, management quality, and growth opportunities. How does lunar manufacturing fit within this framework? The announcement creates several potential impacts:

Positive perspective: The lunar manufacturing vision demonstrates that Space X continues innovating and developing capabilities competitors cannot easily replicate. It positions the company as pursuing genuinely novel opportunities rather than optimizing existing business models. For investors seeking companies with significant long-term growth potential, this could enhance confidence in the company's strategic positioning.

Negative perspective: The announcement could signal that management is pursuing ambitious technical projects without clear near-term commercial timelines or paths to profitability. Lunar manufacturing likely requires years of development before generating revenue. During this period, capital is committed to R&D without offsetting income. Investors in public companies typically prefer clearer paths to profit growth.

Ambiguous perspective: The announcement might be interpreted as positioning Space X as a technology and infrastructure company with extraordinarily broad capabilities and ambitions. This could either enhance valuation (suggesting greater optionality and long-term value creation) or reduce it (suggesting unfocused strategy and scattered execution).

Historically, companies that successfully scale after going public tend to have very clear articulation of how they generate revenue and scale profitability. Space X's existing business involves launching satellites and cargo for government and commercial customers. Extending this to include manufacturing satellites on the moon represents a vertical integration strategy, but one with many steps between current reality and revenue generation.

Impact on IPO Pricing and Public Investor Appetite

The lunar manufacturing announcement likely influences IPO pricing in subtle but meaningful ways. IPO investors are evaluating what premium above near-term cash flow generation they should pay for growth potential and strategic positioning. Ambitious strategic announcements can increase growth premium (investors pay more because they believe the company will grow faster) or decrease it (investors discount valuation because strategy seems unfocused or risky).

The track record of Space X in executing ambitious objectives would influence how investors interpret this announcement. The company has successfully developed reusable rockets, achieved significant government and commercial launch market share, and demonstrated capability in extraordinary technical challenges. This track record might lead investors to assign high probability to eventual execution of lunar manufacturing. However, investors would also recognize that the scale of this objective exceeds previous company achievements.

Retail investors versus institutional investors might interpret this announcement differently. Retail investors, particularly those motivated by enthusiasm for space exploration or Musk's vision, might view lunar manufacturing as incredibly exciting and confidence-building. Institutional investors, particularly those managing pension funds or seeking stable returns, might view it as increasing execution risk and requiring extended capital commitment before profitability.

The Apollo program's peak year cost was

Organizational Implications: Running Multiple Programs Simultaneously

The Integration Challenge of Merged x AI-Space X

The newly merged x AI-Space X entity now operates multiple complex programs requiring different skill sets, organizational structures, and capital allocation. Space X's existing business—launching rockets and deploying commercial/government payloads—requires engineering excellence in launch vehicles, mission planning, and ground operations. x AI's business—developing advanced AI models—requires expertise in machine learning, computational infrastructure, and software engineering. Adding lunar manufacturing to this portfolio introduces additional complexity in space infrastructure, materials science, and autonomous systems.

Historically, companies that merge across very different business domains face integration challenges. When a pure software company (like x AI initially was) merges with a hardware manufacturing and space operations company (Space X), they bring fundamentally different organizational cultures, incentive structures, and operational rhythms. Software development typically operates on 6-12 month iteration cycles. Space operations often require multi-year planning for safety-critical systems. These different temporal frameworks can create organizational friction.

The co-founder departures need to be understood in this context. Founding teams typically shaped company culture during early stages. When a company undergoes significant merger and reorganization, founders often find that the culture they built has transformed in ways they don't align with, or they recognize that their skills and interests are better suited to environments where they can maintain influence over strategic direction. The departure of six of twelve co-founders suggests significant organizational stress during this integration process.

Leadership Specialization and Generalist Executives

Musk's statement that "some people are better suited for early stages of a company and less suited for later stages" reflects genuine organizational truth. Companies operate differently at different scales. Early-stage companies require founders who can wear multiple hats, make rapid decisions with incomplete information, and maintain clarity of purpose when the company is small enough that everyone knows everyone else. Later-stage companies require different capabilities: managing large teams, operating complex matrix organizations, interfacing with regulators and public markets, and maintaining institutional knowledge as people cycle through roles.

The question raised by multiple co-founder departures is whether Musk is building an organization where the leadership structure has evolved to suit larger-scale operations, or whether departures indicate unresolved conflicts about strategic direction. The answer likely involves both factors. Some founders may genuinely have found better opportunities elsewhere (the forthcoming IPO ensures they leave with substantial financial resources). Others may have left because they disagreed with strategic decisions or recognized that the organization was becoming less compatible with their goals and working style.

Execution Risk During Transition

Organizations attempting to execute on multiple ambitious programs while managing leadership transitions and cultural integration face elevated execution risk. Research on organizational change management suggests that companies can typically handle one major strategic initiative well while managing normal operations. Adding a second major initiative (like merging two companies) creates strain. Adding a third major initiative (like pivoting toward lunar manufacturing while preparing for IPO) significantly increases risk of execution problems.

The specific risks include: loss of institutional knowledge when experienced leaders depart, reduced effectiveness during the period when new leaders are ramping up understanding of company operations, potential misalignment between strategic vision articulated by top leadership and execution-level understanding throughout the organization, and capital constraint challenges when multiple ambitious programs compete for limited resources.

Successful execution in this environment requires exceptional clarity of strategy, very clear communication from leadership about priorities and trade-offs, and mechanisms for maintaining morale and focus during periods of uncertainty. Whether the merged x AI-Space X entity has established these structures remains an open question.

Competitive Implications: How Rivals Might Respond

Existing Space Industry Players

Traditional aerospace companies like Boeing, Lockheed Martin, and Northrop Grumman have developed business models centered on government contracting for space systems. They lack the vertical integration that Space X/x AI could potentially develop (control over launch vehicles, satellite manufacturing, and orbital operations). This creates a competitive disadvantage if space-based computing infrastructure becomes critical to AI competitiveness.

These traditional players have advantages in manufacturing scale, regulatory relationships, and proven reliability for critical missions. However, they typically move more slowly than Space X, and they're more constrained by government oversight and bureaucratic processes. In a competition where first-mover advantage in establishing lunar manufacturing capacity matters, Space X's speed and innovation culture would likely outpace traditional aerospace players.

The question becomes whether traditional aerospace companies recognize lunar manufacturing as an emerging competitive necessity and invest accordingly. If they do, competition for lunar resources and space-based infrastructure could become intense. If they don't, Space X/x AI could establish dominance that persists for decades.

Emerging Space Companies and Competitors

Companies like Blue Origin, Axiom Space, and others pursuing space-based activities would view Space X's lunar manufacturing plans with great interest and probably concern. Blue Origin has explicitly focused on establishing space infrastructure and has pursued Blue Moon lunar lander development. The emergence of Space X/x AI as a lunar manufacturing player could either accelerate Blue Origin's progress (through competition) or create barriers to entry if Space X establishes dominant position in lunar resources first.

Relatively new space companies would find it extraordinarily expensive to compete directly with Space X/x AI in lunar manufacturing. The capital requirements alone—likely tens or hundreds of billions of dollars—exceed the valuation of most space-focused companies. Instead, competitors might pursue complementary niches: manufacturing specific types of satellites, operating specific service contracts, or developing particular technologies that Space X/x AI would need to integrate.

AI Company Competitive Response

For companies like Google, Open AI, Meta, and others developing advanced AI systems, Space X/x AI's announcement about space-based computing infrastructure represents a potential long-term competitive challenge. If x AI successfully develops satellites manufactured on the moon and deployed via catapult systems, and if these satellites provide computational capacity superior to Earth-based alternatives (due to factors like cooling efficiency in space, accessibility to solar power, or reduced regulatory constraints), then x AI would gain competitive advantages in training and operating large AI models.

Rivals might respond through several mechanisms: attempting to develop parallel space-based infrastructure, forming partnerships with space companies to gain access to space-based computing, focusing on developing AI systems that don't require the specific advantages of space-based infrastructure, or challenging x AI's legal rights to lunar resources through diplomatic and regulatory channels.

The competitive threat is primarily long-term rather than immediate. Lunar manufacturing will require years to develop, so competitors have time to recognize this as a strategic threat and develop responses. However, the first company to establish significant space-based computing infrastructure would likely gain long-lasting competitive advantages that persist because the scale of investment required to catch up would be extraordinarily high.

The World Model Vision: Why Lunar Data Matters

Proprietary Data as Moat

Based on analysis from industry observers, Musk has apparently been building toward a single overarching objective: developing a world model—an AI system trained on proprietary real-world data that competitors cannot access. This represents a fundamentally different approach to AI development than the public model training paradigm followed by companies like Open AI and Google.

Public models are trained on data available in common crawls of the internet, books, and other broadly available sources. The training data is effectively public, meaning that all companies have access to essentially the same foundational information. This creates a more level competitive playing field: differences in model architecture, training methodology, and computational resources matter, but all companies start from similar foundational data.

A world model trained on proprietary data would operate differently. If x AI's AI system is trained on data types and sources that competitors cannot access—energy grid data from Tesla, brain function data from Neuralink, orbital mechanics data from Space X, subsurface data from the Boring Company, and lunar operations data from moon-based manufacturing—then it would develop understanding of the world in ways that competitors' models fundamentally cannot replicate.

This represents a structural competitive advantage. Once established, it becomes self-reinforcing: the better the world model, the more valuable it becomes for solving real-world problems, which generates more user data and operational data that further improves the model. Competitors attempting to build competitive world models would need either to develop parallel infrastructure in all the same domains or to license access from x AI-controlled entities.

Space-Based Data and Unique Insights

The lunar manufacturing and space-based satellite deployment component of this strategy offers unique data that ground-based or orbital competitors cannot easily generate. Manufacturing operations in low-gravity environments generate data about material behavior, heat transfer, and physical processes that differ from Earth-based manufacturing. Deploying satellites at scale through catapult systems rather than rockets generates different operational data. These specific data types would inform the world model about physics, material science, and engineering in ways that pure Earth-based data cannot.

Additionally, space-based satellite infrastructure enables continuous observation of Earth systems, orbital dynamics, and space environment conditions. For an AI system attempting to understand and predict world behavior—weather systems, ocean currents, economic activity, population movements, energy systems—continuous space-based observation provides information that purely ground-based or remote-access systems cannot replicate.

From this perspective, x AI's lunar manufacturing plans are not a distraction from AI development—they're an essential component of building a world model that understands planetary systems, space operations, and physical processes at a level of detail that competitors cannot match. The space infrastructure becomes inseparable from AI capability development.

Challenges to World Model Development

However, developing a functional world model faces substantial challenges beyond infrastructure development. Simply collecting diverse data types doesn't automatically create an AI system that understands the world better. Integrating data from fundamentally different domains—energy systems, neural biology, orbital mechanics, geology, and manufacturing—requires solving technical problems of data fusion, knowledge representation, and reasoning across domains.

Additionally, world model development requires not just volume of data but quality and diversity of data. A bias toward specific types of data or specific regions of the world could create systematic errors in model reasoning. Ensuring that a world model generalizes well across different contexts and isn't simply overfitting to the specific domains from which training data was generated remains an open challenge.

From a competitive perspective, the world model vision faces uncertainty because it's not yet clear whether training AI systems on diverse proprietary data actually creates the competitive advantages Musk apparently believes it will. The hypothesis is compelling—having access to data that competitors lack should provide advantage—but execution challenges are substantial, and the long-term payoff is uncertain.

Estimated data suggests that lunar manufacturing and AI satellite deployment are key components of xAI's strategic focus, accounting for 70% of their efforts.

Financial Requirements: Estimating the Cost of Lunar Ambitions

Capital Requirements for Lunar Infrastructure

Estimating the cost of developing a lunar manufacturing facility requires examining analogous infrastructure projects and space operations. The Apollo program, at peak spending in 1966, consumed approximately

Building a lunar manufacturing facility would likely require capital in a similar range, though potentially less because it wouldn't require developing entirely new launch vehicle technology (Space X would leverage existing Starship and related systems) or human life support systems (initial facilities could operate robotically). However, it would require developing manufacturing equipment designed for lunar conditions and autonomous systems for extended operations without human oversight.

Realistic estimates for lunar manufacturing facility development might range from $50-150 billion, assuming significant cost reductions from prior space programs but accounting for the complexity of manufacturing operations in an extreme environment. This capital requirement would need to be allocated across multiple years, creating ongoing cash flow pressures as capital is committed without offsetting revenue generation.

Integration with Existing Capital Allocation

Space X currently operates profitably through commercial launch contracts and government contracts. The company's revenue model generates cash that could theoretically fund lunar infrastructure development. However, capital that flows toward lunar manufacturing cannot simultaneously flow toward other priorities like expanding launch capacity, developing advanced avionics systems, or providing returns to shareholders after IPO.

The merged x AI-Space X entity would need to make strategic choices about capital allocation. Capital is finite, and allocating it toward lunar manufacturing means allocating it away from other opportunities. Investors would naturally want to understand the return on investment calculation: How does lunar manufacturing generate returns on the $50-150 billion investment? What timeline is required for lunar manufacturing to become profitable? How does this investment prioritize compare to other opportunities?

Comparison to AI Infrastructure Investment

For context, the largest AI companies currently invest

This doesn't necessarily mean the investment is wrong—the potential competitive advantages of space-based computing could justify the capital commitment. However, it does highlight the scale of capital commitment this vision represents and the strategic trade-offs implied by pursuing it.

Alternative Approaches: How Competitors Might Achieve Similar Advantages

Terrestrial Computational Infrastructure

Companies attempting to achieve similar computational advantages to what Space X/x AI envisions through space-based infrastructure could pursue terrestrial alternatives. Building data centers in locations with abundant renewable energy, low cooling costs, and favorable regulatory environments could provide computational efficiency without the enormous capital and complexity requirements of space-based systems.

Companies like Google, Microsoft, and others have successfully scaled computational infrastructure in terrestrial environments. While Space X/x AI claims space-based infrastructure would provide advantages (thermal efficiency, radiation shielding properties of space, freedom from Earth-based regulatory constraints), achieving similar computational scaling through terrestrial infrastructure might prove more practical and profitable in the near term.

The trade-off is that terrestrial infrastructure is more accessible to competitors. Any company can potentially build data centers. Space-based infrastructure is more exclusive because the capital barriers and technical requirements are higher, making it more difficult for competitors to replicate. If Space X/x AI values proprietary advantage and moat-building, space-based infrastructure offers stronger competitive positioning, even if terrestrial alternatives might be more practical from a near-term profitability perspective.

Cloud Computing and Distributed Systems

Alternatively, companies attempting to develop world models could rely on cloud computing infrastructure from providers like Amazon Web Services, Google Cloud, or Microsoft Azure, rather than building proprietary infrastructure. This approach reduces capital investment and allows companies to access cutting-edge computational resources without managing infrastructure directly.

The trade-off is reduced proprietary advantage. Using public cloud infrastructure means competitors have access to similar computational resources and capabilities. Companies like Runable, for example, have built AI automation platforms that leverage existing cloud infrastructure rather than investing in proprietary space-based systems. This allows rapid iteration and deployment without extraordinary capital investment, though at the cost of reduced differentiation based on computational infrastructure.

For companies with limited capital or those seeking to enter the AI market quickly, this approach offers clear advantages. Established companies with substantial capital resources and competitive motivations to build proprietary advantages might find proprietary infrastructure investments more strategically aligned with their goals.

Strategic Partnerships Instead of Vertical Integration

Another alternative to the vertical integration approach Musk is pursuing would involve strategic partnerships. Rather than building proprietary space-based infrastructure, companies could partner with Space X or other space operators to gain access to space-based computational resources. This reduces capital investment while still providing access to space-based advantages.

The trade-off is that partnerships create dependence on external partners and typically involve sharing revenue or paying for access. Musk's apparent preference for vertical integration—controlling the entire value chain from satellite manufacturing through deployment to computational use—suggests he believes proprietary control creates stronger competitive positioning than partnership approaches, even though partnerships would reduce capital requirements.

Regulatory and International Considerations

Government Approval and Licensing

Development of a lunar manufacturing facility would require approval from U. S. government agencies responsible for space licensing and environmental oversight. The Federal Aviation Administration (FAA) currently manages commercial space launch licensing in the United States. Musk would need to obtain licenses for deployment of space-based systems, likely including environmental impact assessments and safety reviews.

Additionally, development of advanced AI systems capable of autonomous operations on the moon might trigger national security reviews from agencies like the Department of Defense or intelligence agencies. A system that combines AI decision-making with space-based infrastructure could raise concerns about potential military applications or information security risks.

Historically, government licensing processes for space activities have been relatively favorable to commercial operations, but they're not instantaneous. Obtaining necessary approvals could require years of regulatory engagement, adding to the timeline for lunar manufacturing facility development.

International Agreements and Tensions

Development of lunar manufacturing by a U. S. company might prompt responses from other nations, particularly China and Russia. If other countries view U. S. companies as gaining significant commercial or strategic advantages through lunar resource exploitation, they might pursue their own lunar development programs, creating competition and potential conflict over lunar resources and operations.

The international legal framework for resolving such disputes remains underdeveloped. The Outer Space Treaty established principles but didn't anticipate the scale of commercial space activity that has emerged. As multiple countries and companies pursue lunar development, negotiating agreements about resource rights, operational territories, and dispute resolution will become increasingly important.

Export Controls and Technology Transfer

If Space X/x AI develops advanced space-based infrastructure and computational systems, these technologies might be subject to export controls and restrictions on technology transfer to foreign entities. This could limit x AI's ability to collaborate internationally and might constrain who can access space-based computational capabilities developed through this effort.

SpaceX's pivot to the Moon is driven by a strategic advantage: Moon colonization is estimated to take half the time compared to Mars, making it a more immediate and feasible goal. Estimated data.

The Timing Question: Why Announce This Now?

Narrative Management for IPO

Announcing ambitious future plans immediately before or during an IPO roadshow serves strategic communication purposes. Investors evaluating a company want to understand not just its current business but its future trajectory and competitive positioning. A vision of space-based manufacturing and lunar operations might be framed as evidence of exceptional ambition and long-term strategic thinking that justifies premium IPO valuation.

Alternatively, announcing major strategic shifts during IPO preparation might be timed to influence stock price movements. Enthusiastic investor response to ambitious announcements could support higher IPO pricing. However, if investors react negatively (concerned about execution risk or questioned strategy focus), announced plans could create downward pressure on IPO valuation.

Organizational Energy and Retention

Announcing ambitious new strategic initiatives serves internal organizational purposes as well. When a company is experiencing departures of founding team members, an exciting new vision can help retain remaining talented people and attract new talent seeking to work on cutting-edge projects. Telling employees that x AI is building the most advanced AI system in the world is motivating. Telling them that achieving this requires a lunar manufacturing facility makes the challenge more concrete and tangible.

From this perspective, the timing of the announcement—immediately following multiple co-founder departures—may be intentional. It sends a signal that despite organizational changes, the company's ambitions are expanding rather than contracting, and that there are still exciting opportunities for talented people to make meaningful contributions.

Competitive Signaling

Announcing ambitious plans can serve as competitive signaling, particularly in technology markets where speed of innovation and perception of technological capability matter. By publicly committing to lunar manufacturing, Musk signals to competitors and potential partners that x AI has extraordinary ambitions and is willing to commit capital to achieve them. This might discourage some competitors (who recognize they can't match this level of investment) while attracting partners and talent who want to be part of something ambitious.

Expert Perspectives and Industry Analysis

Academic Perspectives on Space-Based Computing

Academic researchers have explored space-based computing infrastructure from theoretical perspectives, examining whether computational advantages sufficient to justify capital investment actually materialize in practice. Research on thermal properties of space environments suggests potential cooling advantages for high-density computational systems, though the practical benefits depend on specific system architecture and engineering approaches.

Researchers generally agree that space-based infrastructure is technologically feasible in principle, though they often express skepticism about near-term economic viability. The consensus appears to be that space-based computing could eventually become economically attractive, but probably not within the 5-10 year timeframe that might maximize competitive advantages.

Industry Analyst Views

Technology industry analysts have generally treated Musk's space-based infrastructure announcements with a mix of respect for his track record of accomplishing difficult things and skepticism about timelines and execution challenges. Most analysts note that Space X has successfully accomplished objectives that seemed impossible (reusable rockets, commercial crew flights, high-frequency launch operations), creating credibility for ambitious goals.

However, analysts also note that lunar manufacturing represents a substantially more complex objective than previous Space X achievements, and that execution risk is elevated when combined with parallel IPO preparation, organizational changes, and continued development of core Space X launch services.

Venture Capital and Investor Perspectives

Investors in x AI and Space X have apparently been briefed on the lunar manufacturing vision, with at least one venture capital backer having explained the vision as part of a broader world model strategy. Investor commentary suggests that major backers view space-based infrastructure as an intriguing long-term opportunity, though most investors presumably expect that near-term financial performance will rely on terrestrial AI and space launch services rather than lunar manufacturing.

Investors are likely evaluating the announcement through multiple lenses: strategic vision and long-term positioning, execution risk assessment, capital allocation implications, and competitive differentiation. The balance among these considerations likely influences whether investors view lunar manufacturing as a valuable strategic initiative or as evidence of unfocused ambition.

Long-Term Scenarios: Possible Futures for Lunar Manufacturing

The Optimistic Scenario: Successful Execution

In an optimistic scenario, Space X/x AI successfully develops lunar manufacturing capability within approximately 10-15 years. The facility initially operates with remote robotics, gradually adding human presence as life support systems improve. Manufacturing begins with relatively simple satellite components, progressively advancing to complete satellites and other complex systems. As capabilities mature, the cost per unit manufactured in space drops significantly below comparable Earth-based manufacturing costs, making space-based production economically attractive.

x AI's world model, trained on data from lunar operations combined with proprietary data from other company systems, achieves significant competitive advantages in reasoning about physical systems, space operations, and complex engineering challenges. The space-based computational infrastructure provides additional advantages in processing continuous satellite data and operating complex systems across distributed space-based infrastructure.

Competitors, recognizing the competitive advantage, attempt to develop parallel infrastructure but face extraordinary capital requirements and technical challenges. Space X/x AI's first-mover advantage persists for decades, creating sustained competitive differentiation and financial advantages. The lunar facility becomes a cornerstone of a broader space-based infrastructure ecosystem that contributes substantially to x AI's long-term competitive positioning.

The Moderate Scenario: Slower Progress and Partial Success

In a more moderate scenario, Space X pursues lunar manufacturing development but progresses more slowly than initially envisioned. Technical challenges prove more significant than expected, and cost estimates exceed initial projections. The company eventually establishes some manufacturing capability on the moon, but it operates at smaller scale and generates less dramatic competitive advantages than the ambitious vision suggests.

Meanwhile, competitive pressures and capital constraints lead the company to allocate resources away from lunar manufacturing toward more immediately profitable ventures. Lunar manufacturing becomes a longer-term strategic initiative pursued at reduced intensity and with extended timelines. The competitive advantage from space-based infrastructure remains real but less dramatic than optimistic scenarios suggested.

This scenario aligns with historical precedent from ambitious space initiatives, which frequently experience scope reduction, timeline extensions, and cost overruns from initial plans. It doesn't suggest failure, but rather realistic progression of complex technical initiatives subject to real-world constraints.

The Skeptical Scenario: Abandonment or Major Pivot

In a skeptical scenario, Space X/x AI initiates lunar manufacturing development but eventually abandons it or significantly reduces its scope due to technical challenges, cost escalation, or emergence of better alternatives. Perhaps terrestrial computational infrastructure improvements make space-based manufacturing less compelling. Perhaps regulatory challenges limit profitable applications. Perhaps competing technologies prove more practical.

In this scenario, the announcement of lunar manufacturing represents ambitious thinking that didn't survive contact with reality. This doesn't invalidate the strategic thinking—many companies pursue ambitious initiatives that don't reach full maturity—but it suggests that the lunar vision won't become a central pillar of x AI's competitive positioning.

Historically, many companies and individuals have announced ambitious space-based initiatives that subsequently were abandoned or dramatically scaled down. From colonizing the Moon in the 1970s to building space hotels in the 2000s, space industry history includes numerous examples of ambitious goals that didn't materialize as envisioned. Skepticism about execution remains reasonable even for experienced space entrepreneurs.

Temperature control and material durability are among the highest rated challenges in lunar manufacturing, reflecting the extreme environmental conditions. Estimated data.

What This Means for Different Stakeholders

Implications for Space X Employees

For Space X employees, the lunar manufacturing announcement creates both opportunities and uncertainties. Opportunities exist for those wanting to work on genuinely novel technical challenges and contribute to ambitious objectives. Career development opportunities expand if the company establishes new organizational units and programs focused on lunar operations.

Uncertainties involve unclear timelines, uncertain resource allocation, and potential career complications if employees are assigned to lunar programs that develop slowly or are eventually deprioritized. Additionally, departures of experienced leaders during organizational transformation might reduce mentorship and institutional guidance available to developing talent.

Implications for x AI Employees

x AI employees face perhaps greater uncertainty. The merger with Space X and the announcement of lunar manufacturing initiatives represent dramatic strategic pivots from the original company mission. Employees hired to develop advanced AI models might find themselves working at a company increasingly focused on space operations and infrastructure. This could be exciting or concerning depending on individual career goals and preferences.

The departure of six founding team members also sends mixed signals about organizational stability and alignment. Remaining employees must evaluate whether the company they're working for is evolving in directions they find compelling or whether departures signal problems they should consider.

Implications for Investors

Investors in Space X and x AI must evaluate whether lunar manufacturing ambitions enhance or detract from company value. IPO investors specifically must decide whether the announced vision justifies IPO pricing and represents realistic future growth trajectory or represents over-ambition that will eventually require painful strategy adjustments.

Existing investors who received equity through previous funding rounds must evaluate whether to hold, sell, or increase their positions as the company prepares for IPO. The lunar announcement provides information affecting these decisions, though interpreting what the announcement means for future value requires substantial judgment.

Implications for Customers and Partners

Commericial customers using Space X for launch services want assurance that the company will continue reliably executing launch operations while pursuing long-term research initiatives. The lunar manufacturing announcement shouldn't immediately affect launch services, but extended timelines or capital constraints could eventually impact service quality or pricing.

Partners and contractors working with Space X/x AI must evaluate how the announced strategic shifts affect their business relationships. Will capital allocation to lunar manufacturing reduce funding for activities the partner depends on? Will organizational restructuring affect contract relationships? These practical concerns are important for partners' business planning.

Comparison with Historical Space Ambitions

Apollo Program as Historical Analog

The Apollo program represents the most successful historical analog for ambitious space-based objectives. The program achieved its primary goal—landing humans on the Moon—but required enormous resources, involved thousands of people, and consumed decades. The program also faced political pressures, budget constraints, and eventually deprioritization once initial objectives were achieved.

Lunar manufacturing represents a different objective than Apollo's focus on exploration and scientific study, but it shares several characteristics: extraordinary technical complexity, high capital requirements, long timelines, and dependence on organizational capabilities at scales that are difficult to maintain over extended periods.

Mars Colonization Precedent

Musk's previous emphasis on Mars colonization provides another historical lens for evaluating current lunar ambitions. Mars colonization has been a stated goal since Space X's founding, yet it remains substantially unrealized after more than two decades. The shift from Mars to Moon could represent either realistic strategy adjustment (Moon is more achievable on available timelines) or evidence that even Musk's ambitious timelines for space development exceed realistic possibilities.

The track record with Mars colonization suggests some skepticism about whether lunar manufacturing will progress according to announced timelines. However, it's also fair to note that Space X has accomplished many previously announced objectives that seemed impossible (like reusable rockets), suggesting that skepticism should be measured rather than absolute.

Strategic Alternatives for AI Competitiveness

Alternative Infrastructure Strategies

Companies pursuing advanced AI capabilities without pursuing space-based infrastructure could alternatively focus on: developing more efficient algorithms that require less computational power, leveraging quantum computing for specific problems, partnering with cloud providers for computational resources, or focusing on software innovation rather than computational infrastructure innovation.

Each approach offers different trade-offs between capital investment, proprietary advantage, and speed to market. Musk's approach prioritizes proprietary advantage and long-term competitive positioning over near-term capital efficiency. Alternative approaches might prioritize rapid development and market access over proprietary infrastructure advantages.

Data Strategy Alternatives

Alternative to building diverse proprietary data sources through vertical integration, companies could pursue: acquiring data from third parties, partnering with companies that own valuable data, developing synthetic data generation techniques, or focusing on developing AI systems that perform well with publicly available data.

Each alternative involves different trade-offs between data quality, development cost, and proprietary advantage. Musk's approach of vertical integration to control diverse data sources is compelling but capital-intensive. Alternatives would reduce capital requirements while potentially offering less proprietary advantage.

Critical Unanswered Questions

Timeline Specificity

The announcement lacks specific timelines. When exactly would lunar manufacturing facility development begin? What would be the first manufacturing facility milestone? How many years before manufacturing becomes economically viable? These specifics matter enormously for evaluating feasibility and investment implications.

Without specific timelines, the announcement functions as vision-setting rather than concrete planning. While vision-setting can be valuable for organizational alignment and investor confidence, execution requires converting vague timelines into specific milestones with assigned accountability.

Capital Allocation Decisions

How much capital will be allocated to lunar manufacturing versus other priorities? Over what period? How will capital be allocated between x AI and Space X programs? These allocation decisions will shape whether lunar ambitions represent a major strategic pivot or a smaller research initiative pursued in parallel with other work.

Leadership Continuity

With co-founders departing, who will lead lunar manufacturing development? What experience do they bring to space infrastructure and manufacturing? How will leadership changes affect program execution? These questions bear on execution risk and the feasibility of announced plans.

Revenue Models

How will lunar manufacturing generate economic returns? Will it primarily provide internal computational infrastructure for x AI, or will it offer services to external customers? If external, what customers would pay for space-based manufacturing? What would be their willingness to pay? These questions determine whether the investment becomes profitable.

Conclusion: Interpreting the Announcement in Broader Context

Elon Musk's announcement about lunar manufacturing for x AI represents a fascinating intersection of technological ambition, corporate strategy, competitive positioning, and organizational flux. At face value, the announcement articulates a vision for AI development dependent on proprietary space-based infrastructure including satellite manufacturing on the moon. This vision, if realized, would create extraordinary competitive advantages for x AI by enabling training of AI systems on proprietary data types that competitors cannot access.

However, the announcement must be interpreted within broader context. It comes during organizational transition, with co-founders departing and companies merging. It comes immediately before one of the largest IPOs in history, suggesting possible strategic communication purposes. It comes after shift in strategic direction away from Mars-focused objectives toward moon-focused ones. It comes without specific timelines, funding commitments, or operational details that would allow evaluating actual feasibility.

For technology investors, industry observers, and employees of involved companies, the announcement raises more questions than it answers. The vision is compelling and aligns with sophisticated thinking about proprietary advantages in AI development. Musk's track record of accomplishing difficult objectives lends credibility. However, the extraordinary scale of capital and organizational effort required, combined with organizational changes and parallel strategic initiatives, creates genuine uncertainty about execution.

The lunar manufacturing announcement should probably be interpreted as evidence of ambitious long-term thinking rather than imminent operational plans. Space X/x AI will almost certainly pursue space-based infrastructure development in some form. However, whether it evolves into a major manufacturing facility on the moon within the announced timeframe remains substantially uncertain.

For companies seeking alternatives to Musk's approach, several options exist. Some might pursue terrestrial computational infrastructure in locations with favorable economics. Others might rely on cloud providers rather than building proprietary infrastructure. Still others—like platforms such as Runable that focus on AI-powered automation without requiring proprietary space-based infrastructure—might develop competitive advantages through different approaches. The diversity of potential strategies suggests that multiple paths to AI competitiveness exist, even if space-based infrastructure offers particular theoretical advantages.

The coming years will clarify which elements of Musk's vision were strategic foresight and which represented over-ambitious thinking disconnected from practical constraints. History of space exploration suggests a mix of both is likely. Whether lunar manufacturing becomes reality or becomes a fascinating abandoned vision remains to be determined through actual execution.

FAQ

What is x AI's lunar manufacturing facility?

x AI's proposed lunar manufacturing facility is a production center planned for the moon that would construct AI satellites and deploy them into space using a giant catapult system. The facility represents part of a broader strategy to create space-based computational infrastructure that provides proprietary advantages for AI development, particularly by enabling x AI to train AI models on data types and sources that competitors cannot access. The facility would leverage the moon's low-gravity environment and unique physics to enable satellite manufacturing at scales and costs potentially superior to Earth-based alternatives.

How would lunar manufacturing work operationally?

Operationally, a lunar manufacturing facility would rely on robotic systems and autonomous equipment initially, as human presence on the moon remains limited. The facility would extract water and other resources from lunar regolith through in-situ resource utilization (ISRU) systems, process these materials for manufacturing inputs, operate precision manufacturing equipment designed for lunar gravity and thermal conditions, and deploy manufactured satellites via electromagnetic catapult systems rather than traditional rockets. Power would come from solar panels during lunar day cycles and potentially nuclear reactors for continuous operation. The entire system would operate with minimal human intervention from Earth-based mission control.

What are the benefits of space-based computational infrastructure for AI?

Space-based computational infrastructure offers several theoretical benefits for advanced AI development: superior thermal efficiency from the space environment enabling higher computational density, access to unique data sources from space operations that competitors cannot replicate, freedom from Earth-based regulatory constraints that might limit certain types of data processing, and integrated control over both data generation (through space-based observations) and computational infrastructure. These advantages could enable AI training on proprietary world model data unavailable to terrestrial competitors, creating long-term competitive differentiation. However, benefits must be weighed against extraordinary capital requirements and execution risk.

Why did Musk shift strategy from Mars to moon focus?

Musk explained the strategic pivot by arguing that lunar development could be achieved in roughly half the timeframe required for Mars colonization—approximately 10+ years versus 20+ years. From a technical perspective, the Moon's proximity to Earth (238,900 miles average distance versus Mars's 33.9 million minimum distance) enables more frequent resupply missions, faster communication, and more robust infrastructure development. The shift also aligns better with commercial investor expectations, as terrestrial markets reward near-term infrastructure development more than distant space colonization.

What legal rights do companies have to lunar resources?

Under the 1967 Outer Space Treaty, nations and companies cannot claim sovereignty over the moon itself. However, a 2015 U. S. law (the SPACE Act) created a significant loophole: while the moon cannot be owned, resources extracted from the moon can be claimed as property. This distinction means a company can potentially own water ice and other materials extracted from the moon, as well as satellites and other goods manufactured using lunar resources. The legal framework operates imperfectly, with China and Russia not accepting the U. S. interpretation and some philosophical questions remaining about whether "extracted resources" remain part of the moon.

How much would lunar manufacturing realistically cost?

Estimating realistic costs requires examining historical precedent. The Apollo program cost approximately

Who would compete with Space X/x AI in lunar manufacturing?

Potential competitors include traditional aerospace companies like Blue Origin, established space contractors, and other space-focused startups. However, the extraordinary capital barriers and technical requirements mean most companies cannot directly compete. Instead, competitors would likely pursue complementary niches or focus on developing AI systems that achieve competitive advantages through different approaches (superior algorithms, different data strategies, or strategic partnerships rather than proprietary infrastructure). For teams seeking AI-powered automation without space-based infrastructure requirements, platforms like Runable offer more accessible alternatives providing content generation and workflow automation at fraction of the capital investment.

What happens if lunar manufacturing fails or is abandoned?

If lunar manufacturing efforts are abandoned or significantly delayed, Space X/x AI would need alternative strategies for achieving desired competitive advantages. The company could emphasize terrestrial computational infrastructure, pursue strategic partnerships for space-based capabilities, or focus on software innovation and algorithmic advantages rather than infrastructure advantages. Historical precedent suggests that ambitious space initiatives frequently experience scope reduction and timeline extension rather than complete abandonment, so partial progress is more likely than total failure. However, companies might eventually recognize that terrestrial alternatives provide better near-term returns on capital investment.

How does this announcement affect Space X's IPO valuation?

The announcement could influence IPO valuation through multiple mechanisms. Investors viewing lunar ambitions as evidence of exceptional innovation and long-term strategic thinking might increase valuation premium. Investors concerned about execution risk and capital constraints might reduce valuation. The impact likely depends on market sentiment, competitive landscape changes, and how well Space X manages investor communication about the vision's feasibility. A $1.5 trillion valuation target was reportedly set before the announcement, suggesting investors have already priced in expectations for significant future growth and innovation.

What are the alternatives to space-based infrastructure for AI competitiveness?