The $1.25 Trillion Merger That Changes Everything (Or Does It?)

Last Monday, Elon Musk dropped a bombshell that had Silicon Valley scrambling to understand what just happened. He announced he was merging two of his companies, SpaceX and xAI, in a deal valued at $1.25 trillion. The pitch? Revolutionary space-based AI data centers that would solve Earth's power crisis and scale artificial intelligence beyond terrestrial limits.

Sounds visionary, right? Here's the thing: SpaceX is printing money. The company pulled in about

So when Musk frames this merger as a visionary tech play about space-based computing, you've got to ask: is this actually genius infrastructure planning, or is this just the latest example of a billionaire using a profitable company to bankroll a struggling venture? The answer is probably both, and that's what makes this story fascinating.

Musk has done this before. Back in 2016, he merged the debt-ridden SolarCity into Tesla in a $2.6 billion deal. Tesla shareholders sued, claiming it was a bailout. Musk won the lawsuit, but the damage to Tesla's balance sheet lingered for years. Now we're watching a similar pattern unfold, except this time it's a lot messier because Tesla itself is being dragged into the chaos.

Let me break down what's actually happening here, why it matters, and what it means for everyone watching the space industry, AI competition, and tech consolidation.

The Power Crisis Nobody's Talking About

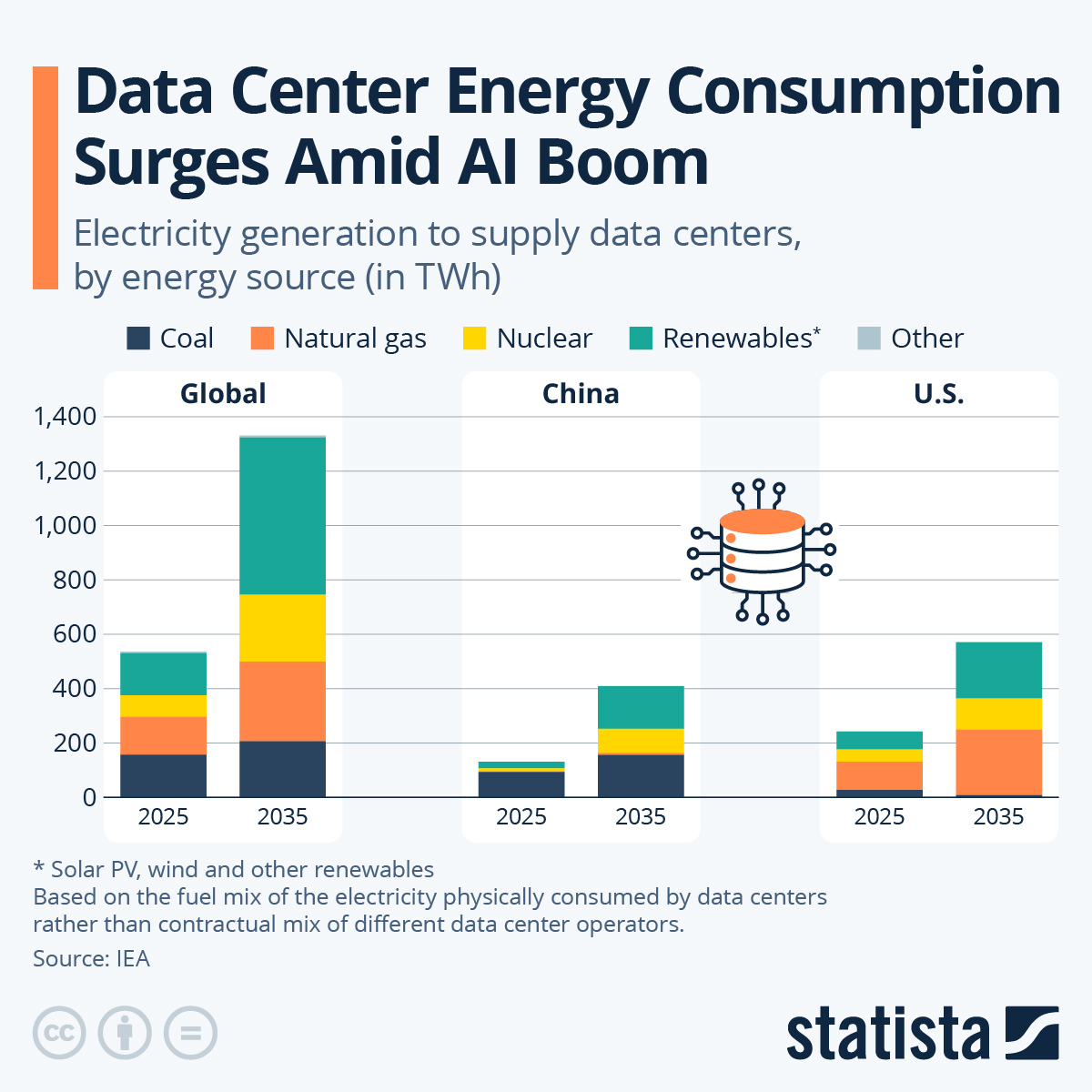

Let's start with the real problem that Musk is trying to solve, because it's actually legitimate. Data centers are power-hungry monsters. They consume electricity constantly to run processors, store data, and keep everything cool. We're talking about facilities that use as much electricity as small cities.

The numbers are staggering. A single large data center can consume 20 to 50 megawatts of power continuously. Some of the massive ones run on 100+ megawatts. For context, that's roughly the electricity consumption of 20,000 to 50,000 homes. And that's just for the computing power. Add in the cooling systems (which are absolutely essential because processors generate enormous heat), and you're looking at an even more demanding power draw.

This creates two massive problems. First, there's the environmental problem. Data centers need reliable, constant power, which typically comes from the electrical grid. As AI demand explodes, more data centers mean more strain on power grids that weren't built to handle this level of demand. Second, there's the community problem. Local governments are increasingly saying no to new data center projects because they drive up electricity costs for residents and businesses. Virginia, for example, has been grappling with data center proposals for years, as noted by Yale Climate Connections.

Water cooling is another nightmare. Data centers use millions of gallons of water annually for cooling. In drought-prone regions, this becomes a political and environmental flashpoint. Communities see their water resources being diverted to cool servers while they're experiencing water restrictions, as discussed in Forbes.

Musk's pitch for space-based data centers actually makes sense in this context. If you launch a data center into a sun-synchronous orbit, it exists in permanent sunlight for most of the year. Solar panels provide unlimited, renewable power. You eliminate grid dependency. You eliminate community opposition because you're not using terrestrial resources. Radiation becomes the cooling mechanism instead of water—space itself becomes your cooling system.

On paper, it's elegant. In practice, it's insanely complicated.

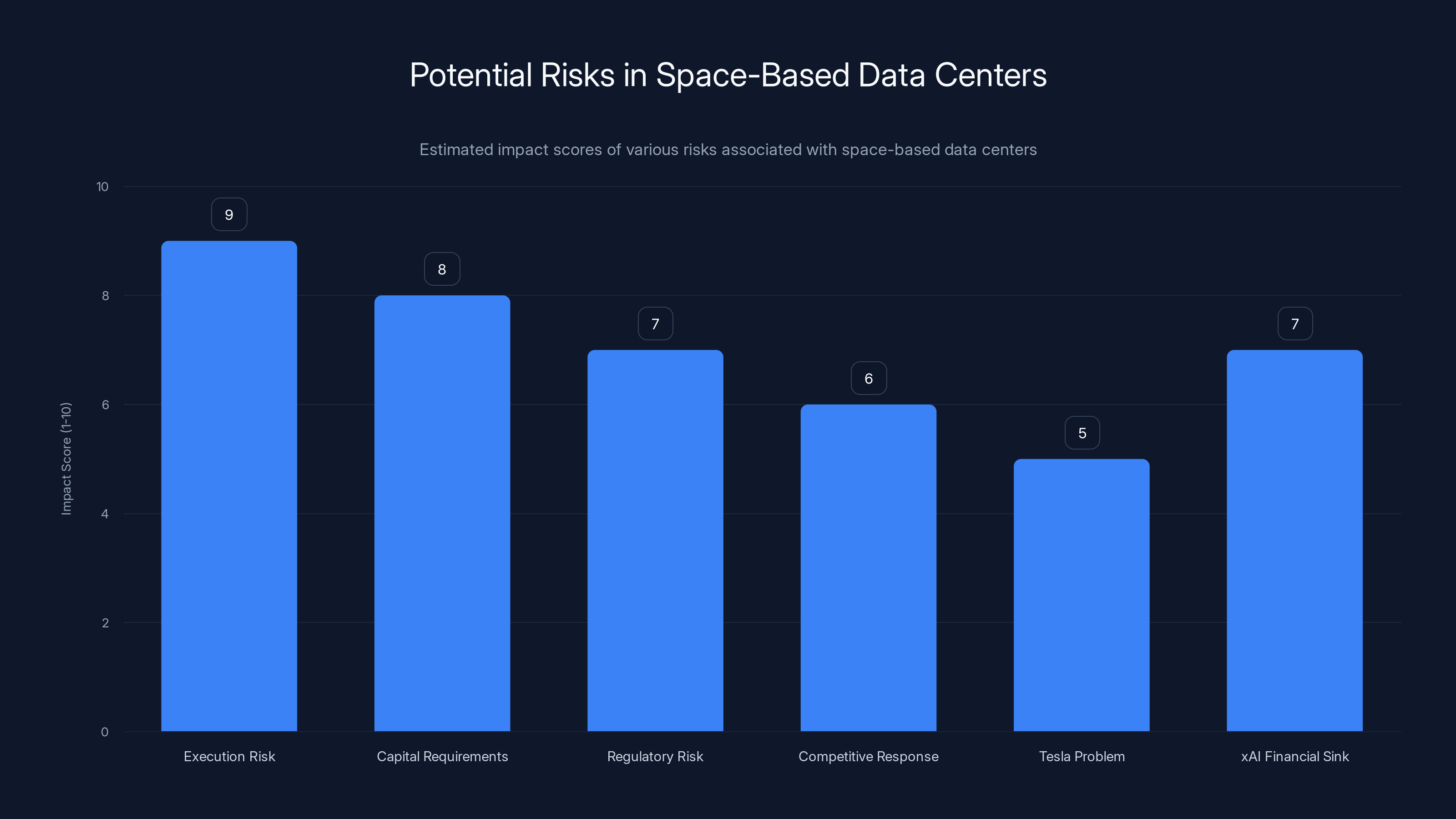

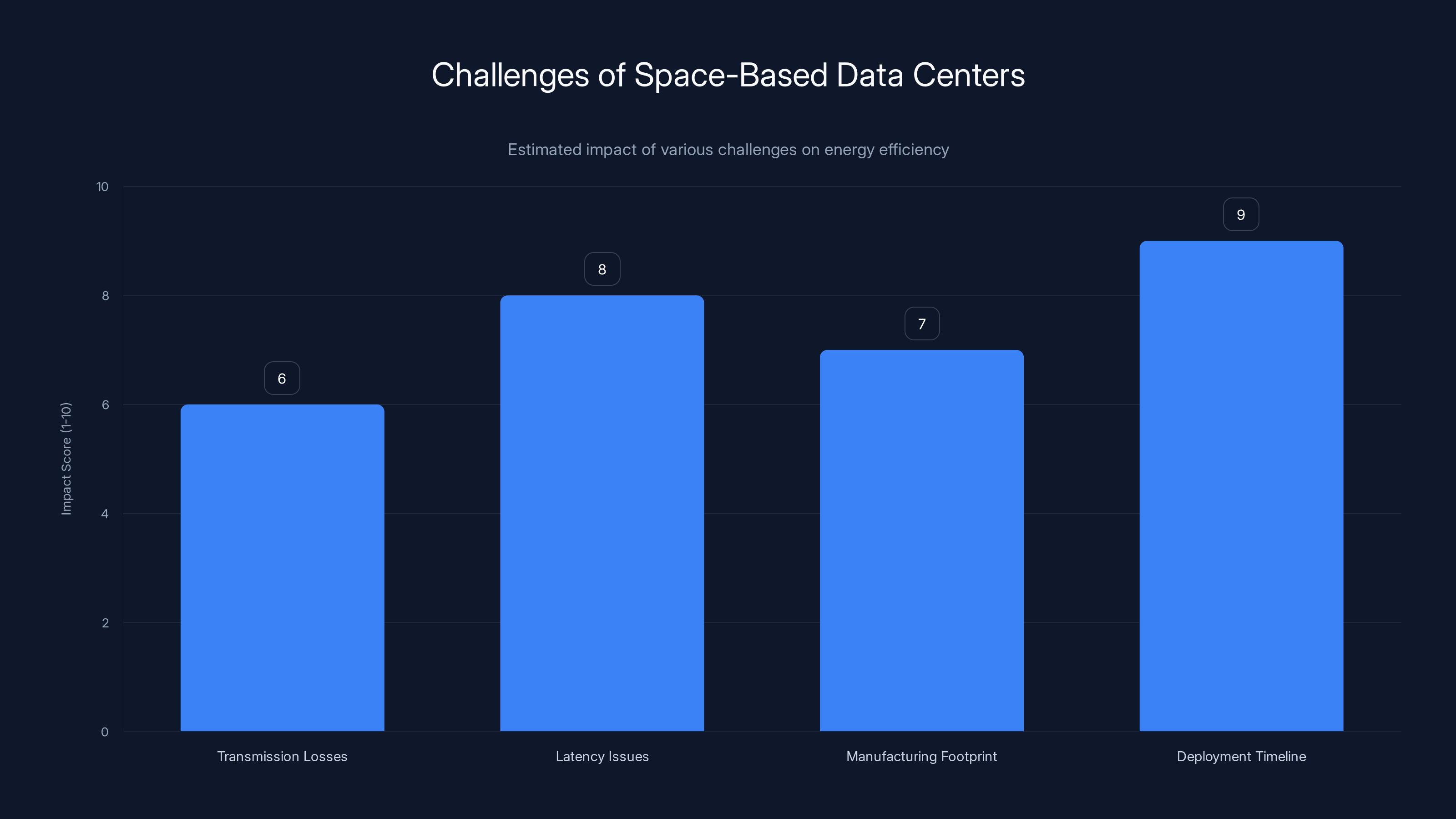

Execution risk and capital requirements are estimated to have the highest potential impact on the success of space-based data centers. Estimated data.

Why Space-Based Computing Sounds Better Than It Actually Is

Here's where the rubber meets the road, and why this merger might be more ambitious than strategic.

Sending data centers to space requires solving problems that don't have proven solutions yet. First, the launch costs. Getting massive computing infrastructure into orbit costs money. Even with SpaceX's reusable rockets, which are the cheapest launch option on the planet, you're still looking at thousands of dollars per kilogram. A data center weighs hundreds of metric tons. Do the math.

Second, maintenance is a nightmare. When your data center is on Earth and something breaks, you send a technician. When it's in space? You either need to repair it remotely (which is incredibly difficult for complex hardware failures) or you launch a crew to fix it. That's expensive and slow.

Third, latency matters. Data travels at the speed of light, but the physics are brutal. If your data center is in geostationary orbit (about 22,000 miles up), data takes roughly 240 milliseconds to travel from Earth to the satellite and back. For most applications, that's workable. But for some AI inference tasks where milliseconds matter, that's a real constraint. Low Earth orbit reduces latency, but introduces different challenges around orbital mechanics and coverage.

Fourth, there's the issue of redundancy. Data centers on Earth have backup power, backup cooling, geographic redundancy. In space, you're dealing with an environment where failures can cascade unpredictably. Radiation damage, micrometeorite impacts, orbital decay—these aren't hypothetical risks. They're engineering challenges that require solutions we haven't fully developed.

Fifth, and this is crucial: regulatory approval. Nobody's actually launched a commercial data center to space yet. The regulatory framework doesn't fully exist. You're dealing with international space law, spectrum allocation, orbital slot coordination, and radiation compliance standards that are still being written.

Musk isn't wrong that space-based data centers could eventually work. But "could eventually work" is very different from "ready to go now and will solve the energy crisis."

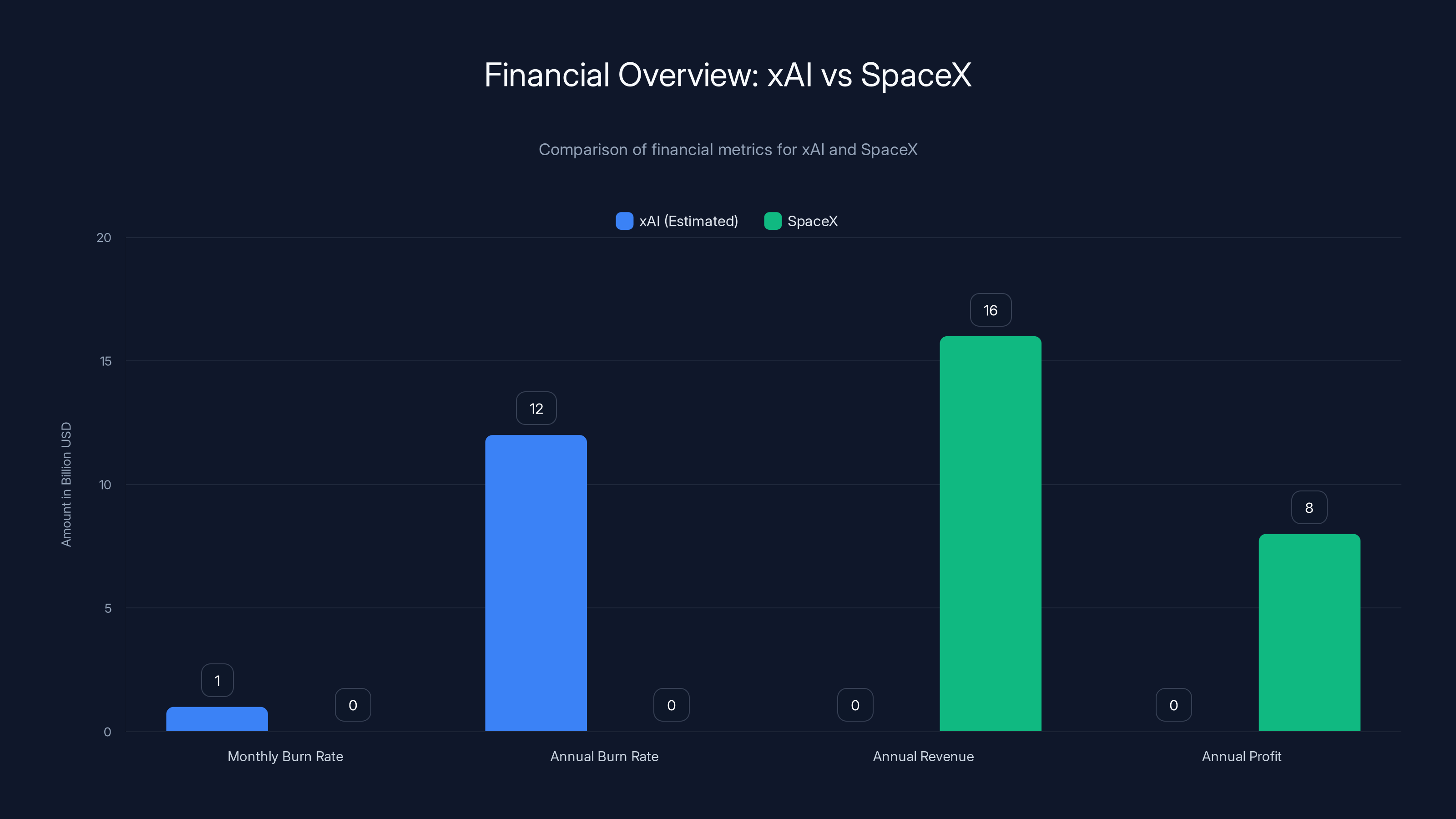

SpaceX's profitability contrasts sharply with xAI's high burn rate, highlighting the financial rationale behind their merger. Estimated data for xAI.

Follow the Money: SpaceX Is Rich, xAI Is Desperate

Now let's talk about what's really driving this merger, because it's not actually about solving the energy crisis.

SpaceX generated approximately

SpaceX is expected to go public later this year and raise up to $50 billion in new investment. The company has options. It can fund ambitious projects. It can take long-term bets. It can afford to be patient.

xAI is the opposite story. The company is burning through approximately

- Build out data center infrastructure to train large language models

- Compete with OpenAI and Google in the AI race, which requires world-class talent and hardware

- Maintain and operate the X platform (which was rebranded from Twitter), which is expensive and doesn't generate proportional revenue

- Fund research and development for new AI capabilities

xAI raised funding rounds to stay afloat, but at the current burn rate, those resources have a shelf life. The company needs either massive new funding, a dramatic reduction in spending, or an infusion of resources from another entity.

Enter SpaceX. The merger allows xAI to tap into SpaceX's cash generation and balance sheet. On the surface, it's pitched as synergy—AI needs computing power, SpaceX has launch capability and space infrastructure. But the subtext is clear: xAI gets financial life support from a profitable company.

The Tesla Problem: Shareholders Are Already Angry

Here's where this gets complicated for real. Tesla shareholders are already suing Musk over xAI.

The lawsuit alleges that Musk breached his fiduciary duty to Tesla by founding xAI in the first place. The argument is straightforward: xAI competes with Tesla for resources, talent, and Musk's personal attention. Musk is the CEO of Tesla and the majority shareholder. When he spends time and energy building xAI, he's diverting attention from his primary responsibility to Tesla shareholders.

Now the SpaceX-xAI merger throws another layer of complexity onto this. Tesla recently invested $2 billion into xAI, ostensibly to enhance Tesla's AI capabilities. But if xAI is now merging with SpaceX, what does that investment actually mean? Does Tesla have equity in the merged entity? What's the governance structure? Does Musk control both? How much of Tesla's capital is ultimately flowing into xAI's operations?

These are not rhetorical questions. These are real legal and financial questions that Tesla shareholders have a legitimate right to ask. The merger announcement doesn't clarify any of this. It just raises more concerns.

Musk has precedent here, and it's not pretty. In 2016, he merged SolarCity (a struggling solar panel company that he was heavily invested in) into Tesla. The deal was worth $2.6 billion. Tesla shareholders sued immediately, arguing it was a bailout of a struggling company at Tesla's expense. The lawsuit dragged on for years. Musk eventually won (a Delaware judge ruled he didn't force Tesla to overpay), but it cost Tesla shareholders time, legal fees, and uncertainty.

This situation feels similar, except worse. Back then, the argument was about one struggling acquisition. Now we're watching Musk use a profitable company (SpaceX) to merge with another struggling company (xAI), while simultaneously keeping Tesla involved in the ecosystem and potentially at legal risk.

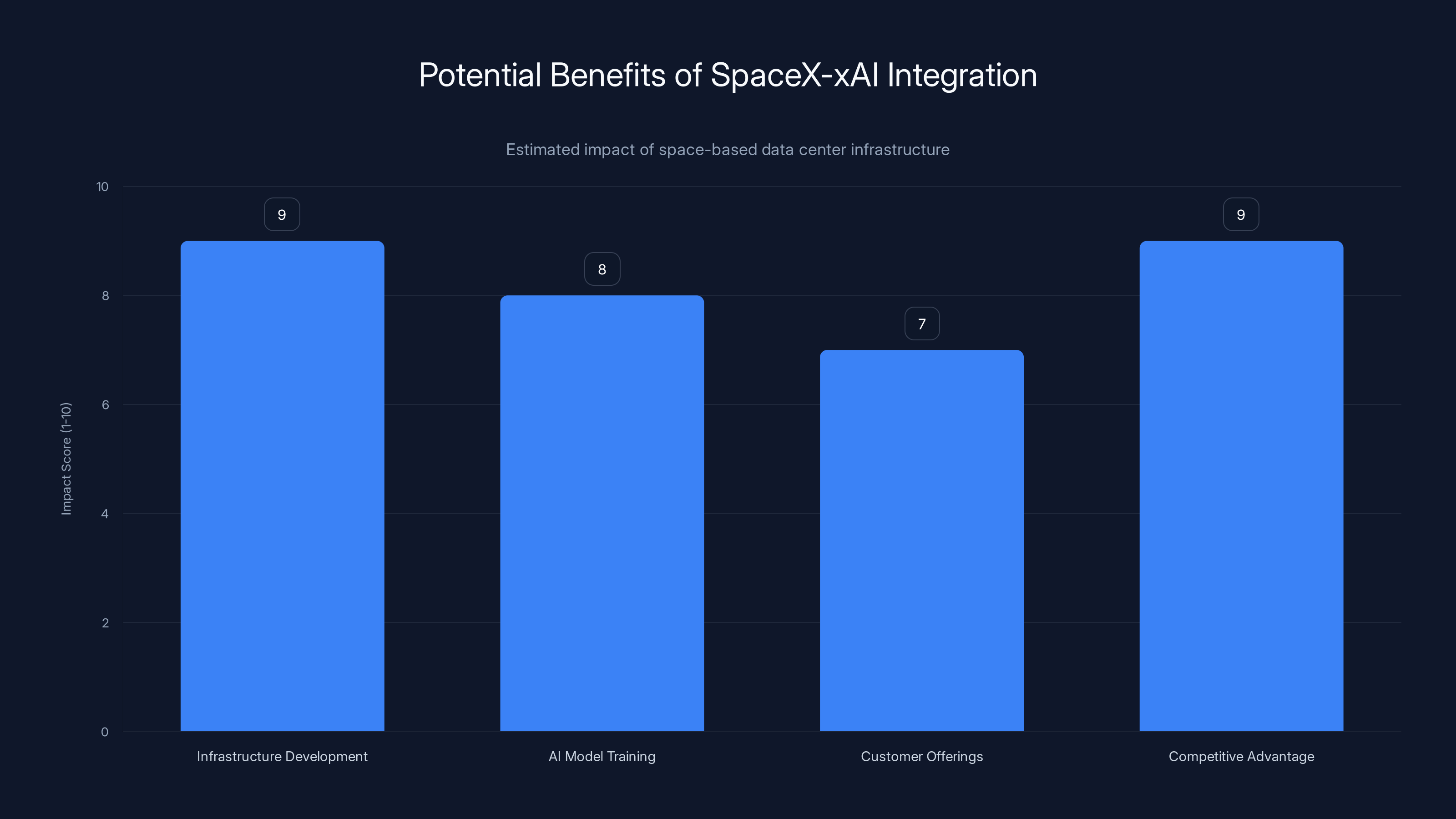

The integration of SpaceX and xAI could significantly impact infrastructure development, AI model training, customer offerings, and competitive advantage. Estimated data based on potential outcomes.

The Space Industry Context: Why This Actually Matters

The merger announcement landed in a much bigger context that's worth understanding.

Space-based data centers aren't Musk's unique idea. Google has Project Suncatcher, which aims to build solar-powered AI data centers in space. China is exploring space-based data center infrastructure. Europe is investigating it. Venture capital money is flowing into startups working on space-based computing infrastructure.

Why? Because the problem is real. Data center demand is growing exponentially. Power consumption is becoming a bottleneck. Regulatory pressure on terrestrial data centers is increasing. Space offers a genuine alternative, even if the engineering challenges are significant.

The space industry is also consolidating. Launch costs have dropped dramatically thanks to reusable rockets, making orbital infrastructure more economically feasible than it was a decade ago. Companies that previously seemed like pure research projects are becoming actual business plays. SpaceX's dominance in the launch market (it handles roughly 70 percent of all commercial orbital launches) gives it a structural advantage in any space-based infrastructure business.

Musk recognizes this. By merging SpaceX and xAI, he's positioning himself to capture value across multiple layers: launch services, orbital infrastructure, data center operations, and AI services. If space-based data centers become real, SpaceX-xAI could have a dominant position.

But here's the catch: everyone else is also investing in this space. Google, Amazon, Microsoft, and other tech giants aren't sitting idle. They have deeper pockets than xAI. They have established data center operations. They have government relationships. SpaceX might have a launch advantage, but that's just one piece of the puzzle.

What Actually Happens With This Merger?

This is the critical question that the announcement didn't really answer.

Musk said the merger would create a combined entity that leverages SpaceX's launch capability and orbital infrastructure with xAI's AI expertise and hardware demand. That makes theoretical sense. But what's the actual operating structure?

Does SpaceX become a subsidiary of xAI? Unlikely. SpaceX is far more valuable and has more operating stability. Does xAI become a division of SpaceX? Maybe, but that seems to dilute the AI focus.

Most likely scenario: A new holding company at the top (possibly structured around Musk's other ventures) with SpaceX and xAI operating semi-independently but with integrated strategy and resource sharing. Think of it like a conglomerate.

But here's what's unclear:

- Governance: Who sits on the board? How are decisions made? What happens if SpaceX and xAI disagree on resource allocation?

- Capital structure: Is this an all-stock deal? Does cash change hands? What are the tax implications?

- Stakeholders: SpaceX has minority investors. Do they approve this merger? What about xAI's investors?

- Tesla implications: How does Tesla's $2 billion investment into xAI translate in the new structure?

- Regulatory approval: Does this require approval from the FCC, FTC, or other agencies? Space technology involves national security, so government scrutiny is likely.

The announcement raised all these questions without answering any of them. That's either brilliant (letting the market speculate) or sloppy (not thinking through the details). With Musk, it's usually a bit of both.

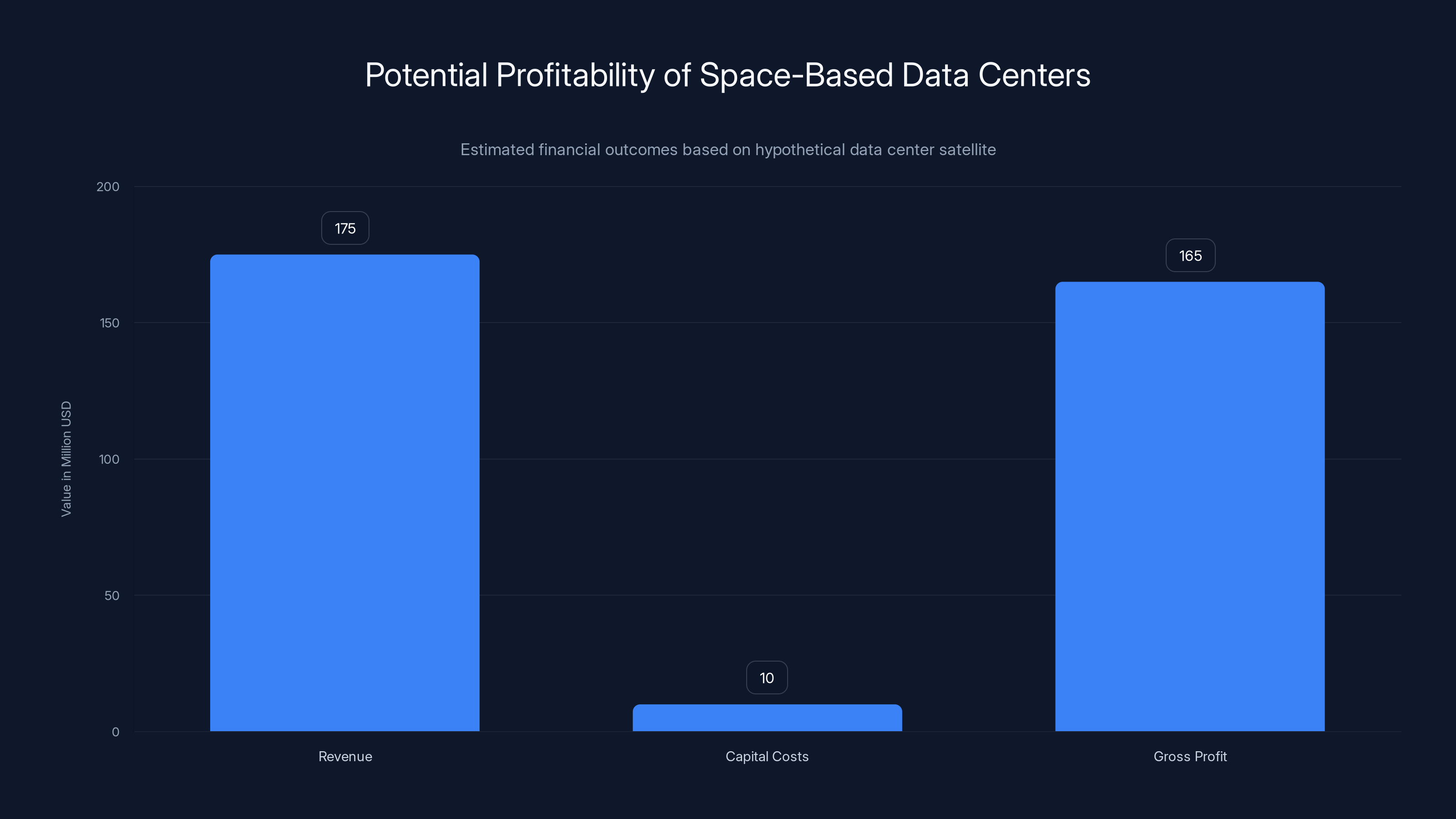

Estimated data shows potential gross profit of $165 million over 10 years, assuming high utilization and low operational costs. Real-world factors could affect these outcomes.

The Energy Argument: True or Marketing?

Musk's stated rationale for the merger is compelling: terrestrial data centers are consuming too much power, creating environmental damage and community opposition. Space-based data centers solve this problem by using solar power in an unlimited environment.

Is this true? Partially.

Space-based data centers could theoretically reduce strain on Earth's electrical grids. Solar power in space is abundant and doesn't compete with terrestrial energy resources. You're right that this could help.

But it's not a complete solution for several reasons:

First, the energy still needs to get back to Earth. You don't compute data in space and leave it there. Results need to travel back to Earth at light speed through space-based antennas and ground stations. That transmission infrastructure consumes power and has its own efficiency losses.

Second, not all computing can happen in space. Some AI tasks require real-time interaction with data on Earth. Latency becomes prohibitive for certain applications. You can't move all computing to space.

Third, the manufacturing and launch footprint is substantial. Building satellites and data center hardware requires manufacturing infrastructure. Launching them requires energy-intensive rockets. The total energy cost of space-based infrastructure, amortized over the satellite's operational life, might be higher than optimized terrestrial data centers using renewable energy.

Fourth, it's not available at scale today. Even if SpaceX-xAI succeeds, it'll take years to build, test, and deploy space-based infrastructure. The energy crisis from AI computing is happening now. Space-based solutions are a long-term play, not an immediate fix.

So yes, space-based data centers could help. But they're not the magic bullet that solves the energy problem. They're one tool in a larger toolkit that also includes:

- Building more terrestrial data centers in regions with abundant renewable energy

- Improving cooling efficiency (new cooling technologies are being developed)

- Optimizing AI algorithms to require less compute power

- Building distributed computing architecture that reduces the need for centralized mega-data centers

- Improving power grid infrastructure to handle higher loads

Musk knows this. So why lead with the energy argument? Because it's compelling and generates positive sentiment. It positions the merger as visionary problem-solving rather than a struggling company getting bailed out.

Investor Perspective: What Could Go Right

Let's play the bull case, because there's actually a legitimate argument here.

If space-based data center infrastructure becomes real, SpaceX-xAI could capture significant value. SpaceX's launch dominance is real. Its vertical integration (rocket manufacturing, launch operations, orbital operations) is deep. Its government relationships are strong. Its technology roadmap is credible.

xAI has computational expertise and is building models competitive with the best in the industry. If you combine SpaceX's infrastructure with xAI's AI technology, you potentially have a vertically integrated AI infrastructure company that could:

- Build space-based computing infrastructure

- Use that infrastructure to train better AI models

- Offer those models and compute capacity to customers

- Maintain a competitive advantage through superior infrastructure

That's a potentially massive business. If space-based computing becomes standard (which is a big if), being the company that pioneered it could be worth tens of billions.

Also, let's acknowledge that Musk does tend to get things done, even when everyone says they're impossible. SpaceX landed rockets. Tesla became the world's most valuable automaker. Whatever you think of the man, he has a track record of pushing technology forward faster than the industry thought possible.

If anyone can build space-based data centers, it's the guy who builds rockets. That's not a guarantee, but it's not crazy either.

There's also potential synergy from integrating Starlink's orbital infrastructure with data center operations. Starlink is already operating thousands of satellites in specific orbital patterns. That infrastructure could theoretically support data center satellites. The two projects complement each other.

And from a capital perspective, the merger makes financial sense. Why raise $50 billion for SpaceX to go public when you can merge with xAI, use SpaceX's cash generation to fund AI development, and potentially create a company more valuable than the sum of its parts?

So yes, the bull case exists. It's not ridiculous.

Space-based data centers face significant challenges, including high transmission losses and long deployment timelines. Estimated data.

The Bear Case: Why This Might Be Disaster

Now let's talk about what could go wrong, because there's a lot.

First, execution risk. Building data centers in space has never been done at scale. There are real engineering challenges, regulatory hurdles, and unknown unknowns. Companies fail at ambitious projects all the time. SpaceX has succeeded where others failed, but that's not a guarantee that will continue indefinitely. Space-based data centers are exponentially more complex than rockets.

Second, capital requirements. Musk talks about building this infrastructure, but hasn't detailed the financial commitment. If you're launching terabytes of computing hardware to space, the capital costs are staggering. Even SpaceX's cash generation might not be sufficient. You might need external funding, which means giving up control or equity.

Third, regulatory risk. Space is regulated. Frequency spectrum is regulated. International law governs orbital operations. Building massive data centers in space requires navigating regulatory frameworks that are still being written. A single regulatory failure could delay the entire project by years.

Fourth, competitive response. Google, Amazon, and Microsoft aren't going to sit idle while SpaceX-xAI builds space-based infrastructure. They have deeper pockets, established partnerships, and regulatory relationships. If space-based computing becomes viable, they'll compete aggressively. SpaceX might have a launch advantage, but that's not insurmountable.

Fifth, the Tesla problem. Tesla shareholders are legitimately concerned about Musk dividing his attention and capital across too many projects. If the SpaceX-xAI merger goes badly, it could drag Tesla down. If it goes well, it might still distract Musk from Tesla's actual business, which is already facing challenges from increased EV competition and market saturation.

Sixth, the xAI financial sink. Even if space-based infrastructure becomes real, xAI still needs to compete with OpenAI and Google in AI today. That requires capital. The burn rate of $1 billion per month is likely to continue or accelerate. SpaceX's cash is powerful, but it's not infinite. At some point, you have to ask if it makes sense to keep burning money on xAI rather than investing it in space-based infrastructure development.

Seventh, operating complexity. Running two companies is hard. Running three companies (if you count Tesla's relationship to this) is harder. Musk is one person. His attention and decision-making capacity are limited. Adding another major merger to his plate while Tesla is dealing with competition and xAI is burning $1 billion monthly creates enormous operational risk.

Eighth, the market timing question. Tech valuations are elevated. SpaceX is valued at $180 billion (before this merger). If a market correction happens, Musk's ability to fund ambitious projects becomes constrained. Building space-based infrastructure at peak valuations when costs are highest is risky.

So the bear case is also legitimate. This could be brilliant, or it could be a disaster that benefits nobody except the lawyers handling the inevitable litigation.

Historical Context: Musk's Track Record With Mergers

Let's look at how Musk has handled similar consolidation plays before.

The SolarCity merger is the clearest precedent. In 2016, Musk pushed for Tesla to acquire SolarCity (a solar panel installation company) for $2.6 billion. Musk was heavily invested in both companies and saw synergy: Tesla made batteries, SolarCity installed solar panels, so the merger would create an integrated solar-plus-storage business.

On paper, it made sense. In practice, it was messy. Tesla shareholders sued, claiming it was a bailout of a struggling company using Tesla's resources. The legal battle dragged on for years. A Delaware judge eventually ruled that Musk didn't breach his fiduciary duty (shareholders lost the case), but it cost everyone money, time, and attention.

More importantly, the business case didn't materialize as planned. SolarCity's sales declined post-merger. Integration challenges were real. Tesla eventually spun out the solar business to a third party. The merger that was supposed to create an integrated powerhouse ended up being a distraction that Musk eventually got rid of.

Why mention this? Because the SpaceX-xAI merger has similar markers. Musk controls both companies. He sees synergy. The narrative is compelling. But history suggests these consolidations are messier than announced.

There's also the Twitter acquisition, which was supposed to be a triumph of free speech and innovation. Instead, it became a financial hemorrhage that required massive capital infusions and workforce reductions. The deal was valued at $44 billion, but the underlying business has struggled significantly.

Musk's track record shows:

- He often sees synergies that don't materialize as expected

- Integration challenges are real and often underestimated

- His attention is divided across multiple companies, and something always suffers

- When things go wrong, they get messy legally and financially

- Long-term, some consolidations work, but not immediately

None of this means the SpaceX-xAI merger will fail. But it suggests we should be cautiously skeptical of rosy projections.

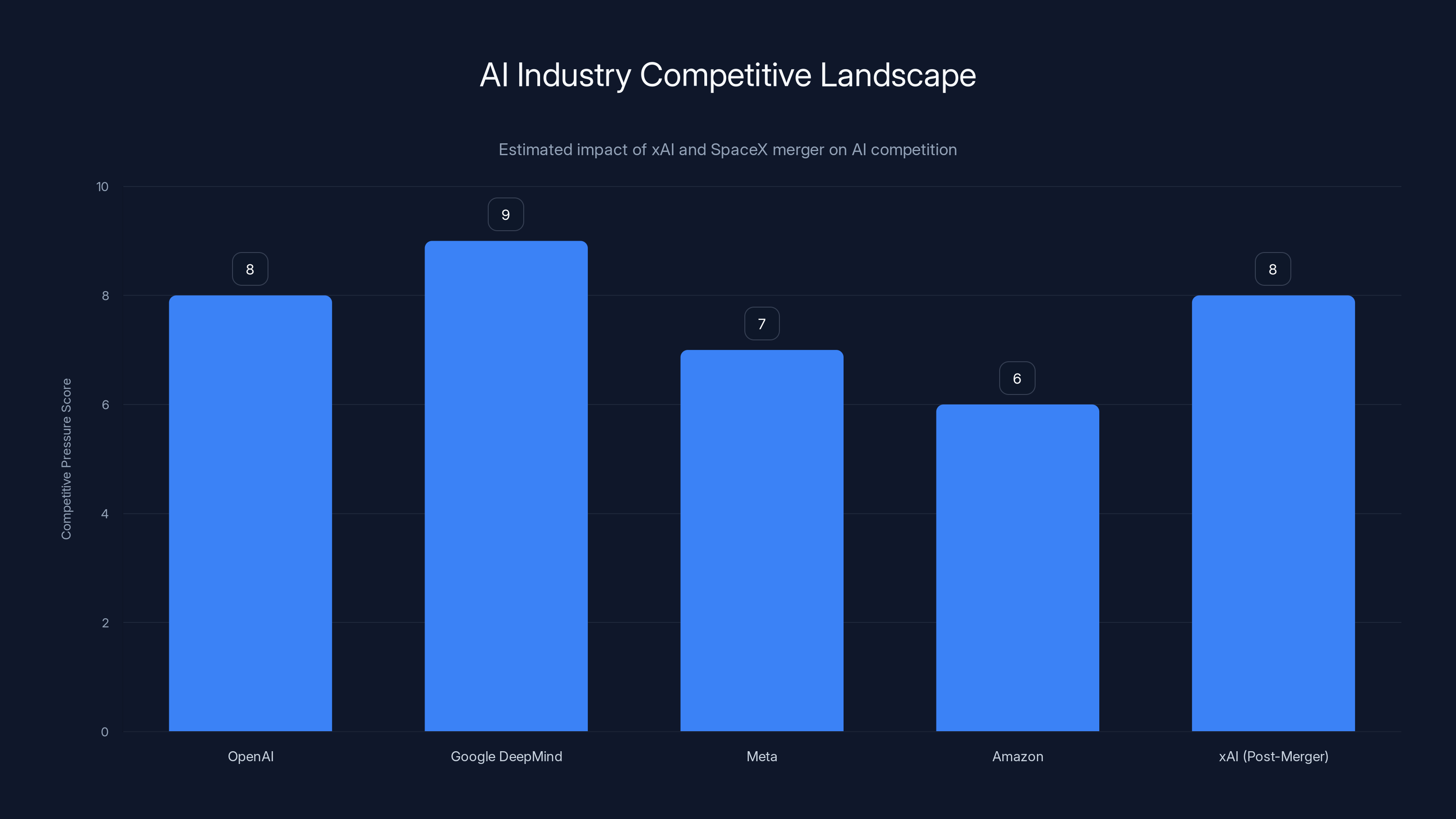

Estimated data suggests xAI's merger with SpaceX could elevate its competitive pressure score to match leading AI companies, indicating a potential shift in the industry's competitive dynamics.

What About Competitors? How Are They Responding?

The announcement sent shock waves through the tech and space industries because it signals Musk's bet that space-based infrastructure is the future.

Google's response has been measured but revealing. The company has its own Project Suncatcher for space-based data centers, but Google moves slower than Musk. Google will likely continue its research and development while waiting to see if SpaceX-xAI actually executes.

Amazon is interesting. The company is heavily invested in AWS, which operates massive data centers globally. Amazon also owns Project Kuiper, a satellite internet constellation. Amazon could theoretically build its own space-based data center infrastructure, but hasn't signaled major interest in that direction.

Microsoft is providing capital to OpenAI and has been relatively quiet on space-based infrastructure.

Private space companies are watching closely. Companies like Relativity Space, Axiom Space, and others that work on orbital infrastructure are suddenly more interesting to investors. If SpaceX succeeds, demand for space-based infrastructure increases, benefiting the entire ecosystem.

International competitors are paying attention too. China is definitely exploring space-based computing infrastructure. Europe is investigating. The space-based data center market, if it materializes, could become as competitive as cloud computing.

The broader signal is that Musk is betting heavily on a future where computing moves to space. If he's right, that future accelerates. If he's wrong, he's burned a lot of capital chasing a mirage.

The Math: Can Space-Based Data Centers Actually Work Economically?

Let's do some back-of-the-envelope math to see if this makes financial sense.

Assume SpaceX-xAI builds a data center satellite with 1,000 GPUs. Assume it costs

Assume electricity costs for running the GPUs are zero (solar power in space). Assume cooling is efficient (space radiators). Assume no maintenance (it's in space, so you can't service it). Assume 100% uptime (unrealistic, but let's be generous).

That's 1,000 GPUs running 24/7 for 10 years with $10 million in amortized capital costs.

A single GPU can earn

1,000 GPUs ×

Subtract

- Operations and monitoring costs

- Ground station infrastructure

- Data transmission costs

- Insurance

- Redundancy (you'll need multiple satellites)

- Replacement hardware

- Software updates and improvements

- Customer support

Real-world economics are messier. But the math shows that if you can achieve high utilization and low operational costs, space-based data centers could be profitable.

The key variables are:

- Launch costs (SpaceX's reusable rockets help here)

- Manufacturing costs (building satellites efficiently)

- Utilization rates (actually keeping the GPUs busy)

- Operational costs (not as low as zero)

- Lifespan (how long before it needs replacement or repair)

If SpaceX-xAI can execute on all these fronts, the math works. If they stumble on any of them, the economics fail.

The most honest answer is: nobody really knows if it will work at scale. The variables are too uncertain. But it's not impossible, and that's what makes the merger worth paying attention to.

What This Means for AI Competition and Innovation

Here's the broader implication of the merger that might matter more than the space-based infrastructure aspect.

The AI industry is currently dominated by companies with massive capital resources: OpenAI (backed by Microsoft), Google DeepMind, Meta, Amazon, and a few others. Competition is driven by who can afford the largest data centers, the most GPUs, and the best talent.

xAI was getting crushed in this competition. The company couldn't access GPUs at the scale it needed (because everyone's hoarding them). It couldn't match salaries that Google and OpenAI could offer. It was burning $1 billion monthly just to stay in the game.

Merging with SpaceX changes the game. Suddenly, xAI has access to SpaceX's cash generation and orbital infrastructure. Instead of competing for terrestrial GPUs with everyone else, it can potentially build its own infrastructure in space. It changes from being a capital-constrained startup to being part of an integrated infrastructure company.

This is actually a clever move in the AI arms race. If it works, it gives xAI a structural advantage over competitors who are locked into terrestrial infrastructure constraints.

For the broader AI market, this could mean:

More competitive pressure on OpenAI, Google, and others. If xAI gains an infrastructure advantage through space-based computing, it becomes a more credible competitor.

Acceleration of space-based infrastructure development. Other companies will feel pressure to explore similar approaches, accelerating research and development in orbital computing.

Potential regulatory attention. As space-based infrastructure becomes real, regulators might start asking harder questions about spectrum allocation, orbital slot coordination, and environmental impact of satellite constellations.

Re-evaluation of the cost structure of AI. If space-based computing dramatically reduces the cost of compute power, it changes the economics of AI companies across the board. Winner-take-all dynamics might weaken as compute becomes cheaper.

Vertical integration becoming a competitive advantage. Companies that own their own infrastructure (compute, data centers, satellites, launch capability) will have advantages over companies that rent everything.

Musk's genius has always been vertical integration. Tesla makes its own batteries. SpaceX makes its own rockets. Twitter (now X) is now an AI development platform. Merging SpaceX and xAI deepens that pattern.

If the merger succeeds, it could reshape how AI infrastructure gets built and who wins in the AI competition. If it fails, it wastes enormous capital and distracts Musk from the companies that are actually generating profits today.

The Regulatory Gauntlet: What Needs to Happen

Here's something the announcement glossed over: this merger requires approval from multiple regulatory bodies.

First, space. The FCC governs spectrum allocation in the United States. If SpaceX-xAI is operating data center satellites, they need spectrum to communicate with ground stations. That requires FCC approval.

The FAA oversees space launch and orbital operations. Additional launches for data center satellites require FAA licensing and coordination.

International law matters too. Outer Space Treaty of 1967 governs orbital operations. Data center satellites need to comply with international guidelines.

Second, national security. SpaceX has significant government contracts. xAI processes AI training data that could touch national security interests (xAI's Grok is used by the Department of Defense). A merged company has even more security implications. Expect additional scrutiny from CFIUS (Committee on Foreign Investment in the United States) and other national security agencies.

Third, antitrust. The merger combines SpaceX's dominance in commercial space launch with xAI's AI capabilities. Some regulators might argue this concentrates too much power. The FTC could take a look.

Fourth, Tesla. If Tesla shareholders' concerns escalate, there could be litigation that affects the merger structure.

None of these are necessarily deal-killers, but they add time, cost, and uncertainty to the merger timeline. Companies always underestimate regulatory approval timelines. This merger is no exception.

Timeline Questions: When Does Any of This Actually Happen?

Here's the thing about ambitious tech announcements: they rarely happen on the timeline originally projected.

Musk said the merger would happen, but didn't give a timeline. He said space-based data centers were "the only way to scale" AI in the long term, but didn't say when that would happen.

Based on industry precedent:

Merger approval: 6-18 months if regulatory approval is smooth. Could be 2+ years if there's litigation or regulatory challenges.

Integration: 1-3 years for serious integration work. If we're talking a real merger (not just a loose affiliation), actual integration takes time.

Space-based data center development: Even with SpaceX's capabilities, actual deployment is probably 3-5 years away for a prototype. Scaling to meaningful capacity might take a decade.

So we're potentially looking at 5-10 years before this actually becomes a real infrastructure play generating revenue. That's a long time in tech. That's a long time for something to go wrong.

In the meantime, SpaceX-xAI is burning capital, developing technology, hiring talent, and competing in markets where results matter today.

Musk has shown he can execute on long-term projects (SpaceX took 15 years to become profitable). But he's also shown he gets distracted, divides his attention, and sometimes abandons ambitious projects when they get hard.

The Tesla Factor: What Happens to the Car Company?

This is the question that matters most if you own Tesla stock.

Tesla invested $2 billion into xAI. Now xAI is merging with SpaceX. What does that mean for Tesla's investment?

In the best case, Tesla retains equity in the merged entity and participates in any upside. But the merged company's focus is space-based infrastructure and AI, not cars. How does that help Tesla's core business?

In a worse case, Tesla's $2 billion becomes diluted in a much larger, more complex entity, and Tesla shareholders have no real voice in how that capital is deployed.

There's also the opportunity cost. $2 billion is real money, even for Tesla. That capital could have been invested in:

- Accelerating EV platform development

- Building charging infrastructure

- Entering new markets

- Improving manufacturing efficiency

- R&D for new vehicle types

Instead, it's going into xAI, which is in a completely different business.

Musk will argue that AI helps Tesla ultimately (better autonomous driving, better manufacturing, better customer experience). That might be true. But it's an indirect path that requires a lot to go right.

Tesla shareholders have legitimate concerns. The pending lawsuits might actually create an opportunity for clarity. A judge might force disclosure of exactly what Tesla's money is funding and what Tesla is getting in return.

What Happens If This Actually Works?

Let's imagine the best-case scenario where the merger executes flawlessly.

SpaceX-xAI successfully builds space-based data center infrastructure. Launch costs remain low. Satellites perform reliably. Regulatory approval is smooth. The combined entity becomes the dominant player in space-based computing infrastructure.

In that scenario:

For SpaceX, it becomes more than a launch company. It becomes an infrastructure company that controls compute resources in orbit. That's a more valuable business model.

For xAI, it becomes competitive with OpenAI and Google, powered by superior infrastructure that competitors can't easily replicate.

For Musk, he becomes the guy who scaled AI beyond terrestrial limits. That cements his legacy as not just a car company founder or a rocket company founder, but as someone who fundamentally changed how technology scales.

For the space industry, it legitimizes orbital infrastructure as a real market and accelerates development by competitors.

For Earth, potentially, it reduces strain on power grids and environmental impact of data centers. That's actually positive.

For Tesla, ideally, improvements in AI translate to better autonomous driving and manufacturing. Tesla gets indirect benefits from xAI's advances.

If the merger works, you're looking at a company (or conglomerate) that's worth hundreds of billions of dollars and shapes the future of AI and space infrastructure. Musk would have delivered on the space colonization vision (build infrastructure in space), the sustainable energy vision (solar power in space), and the AI leadership vision.

That would be remarkable if it happens.

What Happens If This Goes Wrong?

Now let's imagine the worst case.

The merger faces regulatory delays. Space-based infrastructure proves harder to build than expected. Launch costs don't decrease as projected. Satellites have reliability issues. Competitors (Google, Amazon) solve space-based computing differently. The technology works but costs more than terrestrial alternatives, making it uneconomical.

xAI continues to burn $1 billion monthly without generating commensurate revenue. SpaceX's profits get consumed funding an ambitious but ultimately unsuccessful infrastructure play. Integration problems multiply. Musk gets distracted. Other companies in his portfolio suffer.

In that scenario, SpaceX-xAI ends up being remembered like SolarCity: an ambitious merger that looked good on paper but failed in execution. Shareholders lose money. Musk's attention was diverted from profitable core businesses. The technology might eventually work, but years later and at massive cost.

Tesla shareholders watch billions in capital invested in xAI evaporate. The company becomes tied to a failed merger in a different industry. Legal settlements happen. Governance becomes a nightmare.

That's the other possibility, and it's not remote.

Most likely outcome? Something in the middle. The merger closes. Integration is messy. Space-based infrastructure development happens but slower and at higher cost than projected. Some parts succeed, others fail. The eventual outcome is unclear until years pass.

That uncertainty is why this merger matters. The stakes are enormous in either direction.

FAQ

Why is Elon Musk merging SpaceX and xAI?

Musk announced the merger to create integrated infrastructure for space-based AI data centers. The stated rationale is that terrestrial data centers consume too much power, creating environmental damage and community opposition. Space-based infrastructure using solar power could theoretically solve this problem. The practical reality is that xAI is burning approximately $1 billion per month and needed financial stability from SpaceX's profitable operations. The merger allows xAI to access SpaceX's cash generation and resources while SpaceX gains AI expertise and justifies orbital infrastructure investment.

How much money is xAI actually burning per month?

According to recent reports, xAI is burning approximately

Is SpaceX profitable?

Yes, SpaceX is highly profitable. The company generated approximately

What's the history of Elon Musk merging companies?

Musk's most famous merger was acquiring SolarCity for $2.6 billion in 2016 and merging it with Tesla. Tesla shareholders sued, claiming it was a bailout of a struggling company, but a Delaware judge ruled Musk didn't breach his fiduciary duty. However, the merger underperformed, and Tesla eventually divested the solar business. This precedent raises concerns about the SpaceX-xAI merger because it follows a similar pattern of combining a profitable company with a struggling venture.

What happens to Tesla in this merger?

Tesla invested $2 billion into xAI to enhance AI capabilities for autonomous driving and manufacturing. Now that xAI is merging with SpaceX, it's unclear what Tesla's investment actually secures. Tesla shareholders are already suing Musk over xAI creation, alleging it competes for resources and attention. The merger complicates these concerns further because governance structure, equity ownership, and capital allocation between the merged entity and Tesla remain unclear.

Do space-based data centers actually make sense economically?

Theoretically yes, but practically it's complicated. Space-based data centers could use unlimited solar power, eliminating grid dependency. However, you must account for manufacturing costs, launch costs (even with SpaceX's reusable rockets), maintenance challenges in space, communication latency to Earth, regulatory approval, and redundancy requirements. Back-of-the-envelope math suggests profitability is possible if operational costs are controlled. The real question is whether SpaceX and xAI can execute better than terrestrial data center providers, especially Google, Amazon, and Microsoft, which are also exploring space-based options.

What's the timeline for space-based data centers?

Musk didn't specify a timeline in the announcement. Based on industry precedent, merger approval and integration likely takes 6-24 months. Developing actual space-based data center prototypes probably takes 3-5 years. Scaling to meaningful computing capacity could take a decade or more. So while the vision is clear, the practical deployment is years away, creating uncertainty about whether the technology will even be needed by the time it's ready.

Are other companies building space-based data centers?

Yes, Google has Project Suncatcher for space-based AI data centers. Amazon operates Project Kuiper for satellite internet and could theoretically expand into space-based computing. Microsoft is exploring various infrastructure approaches. China and Europe are also investigating space-based data center infrastructure. So SpaceX-xAI isn't unique in recognizing the potential; it's just moving faster and more aggressively than competitors.

How does this affect AI competition?

If successful, the merger could give xAI a structural advantage in the AI competition against OpenAI and Google DeepMind. Instead of competing for scarce terrestrial GPUs, xAI could theoretically build its own orbital infrastructure, reducing capital constraints. This could accelerate xAI's competitiveness and pressure other AI companies to pursue similar infrastructure strategies. The overall effect would be vertical integration becoming a competitive advantage in AI.

What regulatory approvals are needed?

The merger requires FCC approval for spectrum allocation (data centers need to communicate with Earth stations), FAA approval for space launch and orbital operations, potential CFIUS review for national security concerns (given SpaceX's government contracts and xAI's work with the Department of Defense), and possibly FTC review for antitrust concerns. Additionally, Tesla shareholder litigation could impact merger structure. Regulatory approval typically takes 6-18 months if smooth, potentially 2+ years if challenged.

What's the risk that this merger fails?

Significant. The merger combines two ambitious companies pursuing complex technology in a highly regulated domain. SpaceX has succeeded where others failed, but space-based data centers are more complex than rockets. Musk has precedent of unsuccessful mergers (SolarCity), failed infrastructure projects (X acquisition), and divided attention across multiple ventures. If execution stumbles, competitors with deeper pockets could overtake the effort. If space-based computing proves uneconomical, the entire rationale collapses. Most likely outcome is something between success and failure—significant progress but with years of delays and higher costs than projected.

The Bottom Line: What This Merger Really Signals

Strip away the marketing narrative about space-based AI and power crises, and this merger is fundamentally about Elon Musk using a profitable company to fund and scale an ambitious but struggling venture. That's not unusual in tech. Google has done it (acquiring ambitious startups), Amazon has done it, Microsoft has done it. The difference is that Musk is doing it across companies he personally controls, creating potential conflicts of interest and governance issues.

Will the merger work? Honestly, nobody knows. The technology might be viable. The economic case might pencil out. SpaceX's execution track record is good. But there's enormous execution risk, regulatory uncertainty, competitive pressure, and integration complexity.

What we do know is this: SpaceX is profitable. xAI is not. The merger allows one to finance the other. Whether that creates value for shareholders depends on whether space-based AI infrastructure becomes real, profitable, and better than alternatives. That's a bet Musk is making. That's a bet investors are now making along with him.

Watch the next 12-24 months closely. Regulatory approvals will tell you if the deal is real. Integration announcements will tell you if execution is happening. Competitive responses will tell you if other companies are threatened. Tesla stock performance will tell you if investors are concerned about capital allocation.

The merger might be brilliant. It might be a distraction. It might be both simultaneously. Only time will tell which.

Key Takeaways

- SpaceX-xAI merger announced as $1.25T deal to build space-based AI data centers using unlimited solar power and eliminate grid dependency

- SpaceX is highly profitable (1B monthly, making this functionally a profitable company funding a struggling venture

- Musk has precedent of similar consolidations (SolarCity-Tesla merger in 2016), which generated shareholder lawsuits but ultimately succeeded financially

- Space-based data centers face real engineering challenges including latency constraints, maintenance difficulties in orbit, regulatory approval complexity, and unproven economics at scale

- Tesla shareholders face unclear governance concerns as their $2 billion xAI investment becomes absorbed into merged SpaceX entity with uncertain structure

- Multiple tech giants (Google, Amazon, Microsoft) are exploring space-based infrastructure, so SpaceX-xAI faces significant competitive pressure despite launch advantage

- Merger approval and integration likely takes 18-24 months minimum, with actual space-based data center deployment probably 5-10 years away at best

- If successful, merger could reshape AI competition by giving xAI infrastructure advantage competitors cannot easily replicate; if it fails, represents massive capital waste and distraction

Related Articles

- SpaceX Acquires xAI: Building a 1 Million Satellite AI Powerhouse [2025]

- SpaceX Acquires xAI: Creating the World's Most Valuable Private Company [2025]

- SpaceX's 1 Million Satellite Data Centers: The Future of AI Computing [2025]

- SpaceX Acquires xAI: The 1 Million Satellite Gambit for AI Compute [2025]

- SpaceX Acquires xAI: The Strategic Merger Reshaping AI Infrastructure

- SpaceX's Million-Satellite Network for AI: What This Means [2025]

![SpaceX and xAI Merger: Inside Musk's $1.25 Trillion Data Center Gamble [2025]](https://tryrunable.com/blog/spacex-and-xai-merger-inside-musk-s-1-25-trillion-data-cente/image-1-1770155012096.jpg)